<Image source: Spider-Man: Across the Spider-Verse>

Table of Contents

1. Introduction

2. CCIP, Chainlink's Ambitious Project

3. Both CCIP and LayerZero Aim to Solve the Bridging Trilemma

4. CCIP and LayerZero Technologies: Similarities and Differences

5. CCIP’s Potential to Surpass LayerZero

6. Final Thoughts

1. Introduction

In the realm of numerous layer 1 and 2 blockchains, the issue of fragmented liquidity persists. For instance, consider multi-chain dApps like Uniswap and SushiSwap, where assets are confined within each respective blockchain. Transferring these assets seamlessly across chains remains a challenge. To draw a relatable analogy, it's akin to users needing to switch between different networks to use KakaoTalk and Naver due to the absence of the TCP/IP protocol on the internet.

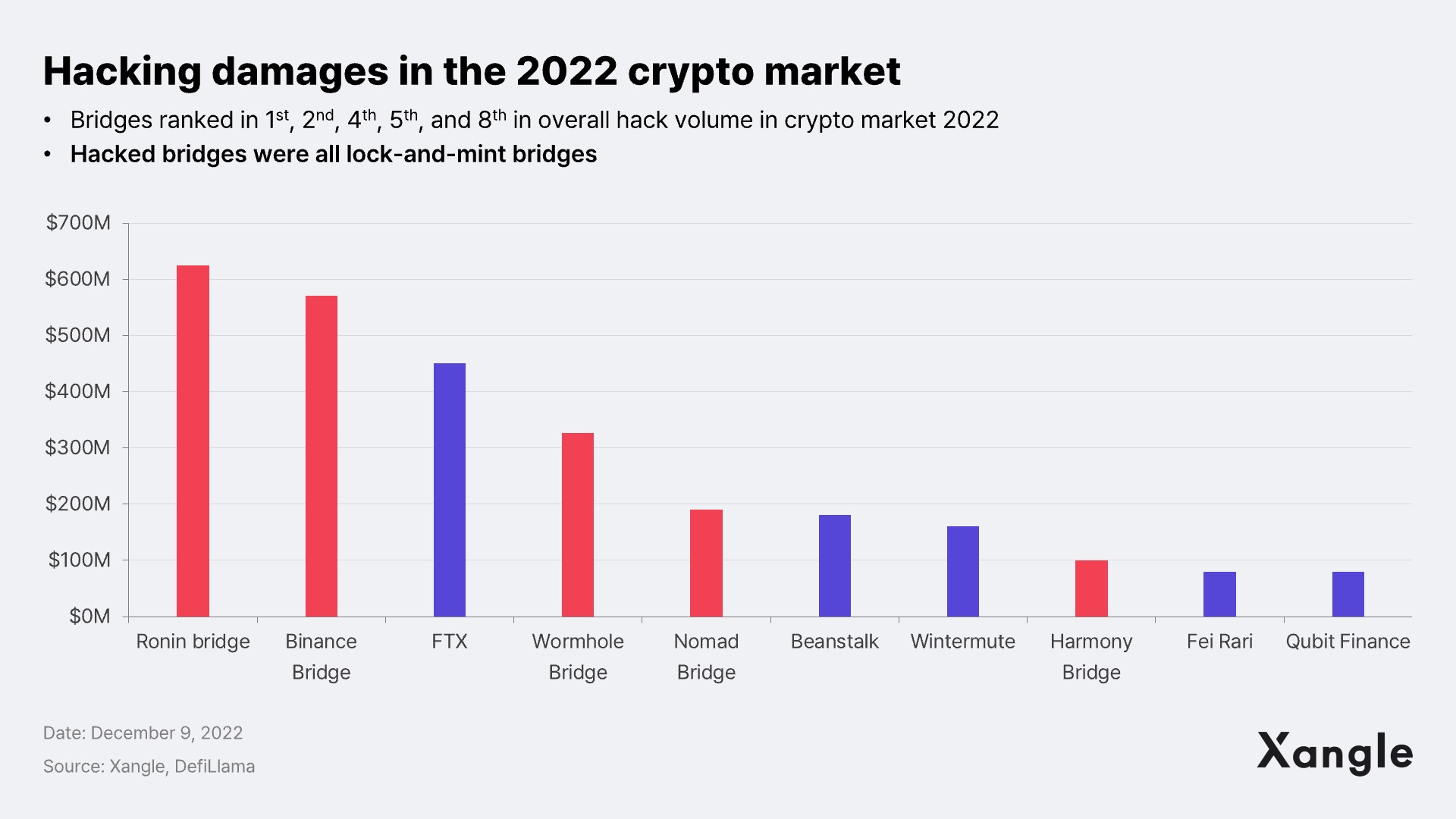

Several cross-chain technologies have emerged to address the segregation of liquidity across various chains. Among these, bridge technology garnered substantial attention, yet also faced criticism for its inefficiency and centralization. Then starting in 2021, bridges encountered significant issues when popular lock-and-mint bridges fell victim to multiple hacks (see 2023 Crypto Outlook: Antifragile).

Several cross-chain technologies have emerged to address the segregation of liquidity across various chains. Among these, bridge technology garnered substantial attention, yet also faced criticism for its inefficiency and centralization. Then starting in 2021, bridges encountered significant issues when popular lock-and-mint bridges fell victim to multiple hacks (see 2023 Crypto Outlook: Antifragile).

Swiftly stepping into the disrupted bridge ecosystem, LayerZero emerged as a robust solution. It solved the problems of existing inefficiencies bridges by combining ULNs (Ultra Light Nodes), Oracle, and the dual security of relayers. And although LayerZero currently only focuses solely on asset transfers, it's gearing up to make the leap to cross-chain messaging protocols in the future (See Xangle's "LayerZero Research").

In July of this year, at the EthCC event, Chainlink unveiled the CrossChain Interoperability Protocol (CCIP) testnet. This cross-chain solution, developed by Chainlink Labs in collaboration with SWIFT, the global organization of financial standard communications, is poised to stand as a formidable contender against LayerZero. In this article, we will first briefly introduce the technology behind CCIP, compare it with the technologies of LayerZero, and speculate on the trajectory of the standardization race.

2. CCIP, Chainlink's Ambitious Project

CCIP serves as a standardized protocol fostering communication amidst segregated blockchains. Sergey Nazarov, the founder of Chainlink, draws parallels between CCIP and the internet's TCP/IP. If TCP/IP orchestrated the standardization of the nascent, disjointed internet landscape, CCIP is poised to achieve a similar feat by unifying fragmented blockchains.

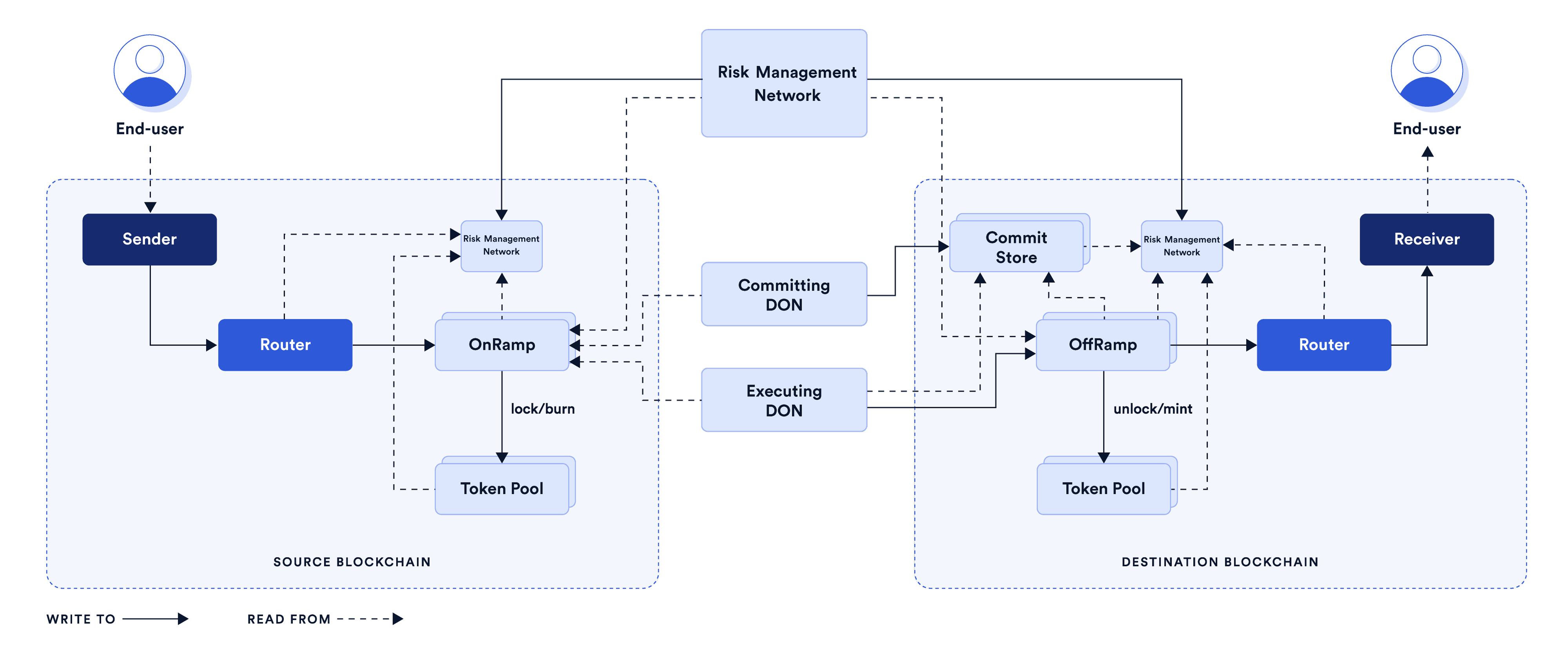

CCIP encompasses both on-chain and off-chain elements. So let's look at the components of CCIP as we follow the message delivery process:

Source Chain

1. In the source chain, there is a Router, which is the main contract for users to transfer assets and use smart contracts. Users only need to utilize the router to send messages on the source chain.

2. Messages sent to the router are then forwarded to the OnRamp. OnRamp validates cross-chain transactions and messages. Once validated, the transactions and messages are sent to the token pool.

3. Based on the transactions and messages received, the token pool locks or burns the corresponding tokens in the source chain.

Off-chain

1. The Execution DON (Execution Decentralized Oracle Node) of the off-chain performs the role of validating and executing transactions and messages recorded on the OnRamp.

2. The Commit DON monitors transactions and messages and sends them to the commit store of the destination chain in the form of the Merkle root.

3. In CCIP, an independent risk management network called RMN (Risk Management Network) exists for cross-chain security. In this network, nodes verify the identity of Merkle roots to ensure the message is true.

Destination Chain

1. When a message passes through the Execution DON and reaches the OffRamp, it validates the transaction again at the OffRamp stage.

2. At the same time, the Commit DON stores the Merkle root in the Commit Store that exists in the destination chain.

3. The destination chain's token pool mints new tokens based on the message sent by the OffRamp.

4. The final message is sent to the Router of the destination chain, and the user confirms the sent message.

CCIP fees are paid on the source chain, and it includes the gas fee of the source chain, plus some amount for insurance. The payment can be made using LINK or the source chain's native token.

3. Both CCIP and LayerZero Aim to Solve the Bridging Trilemma

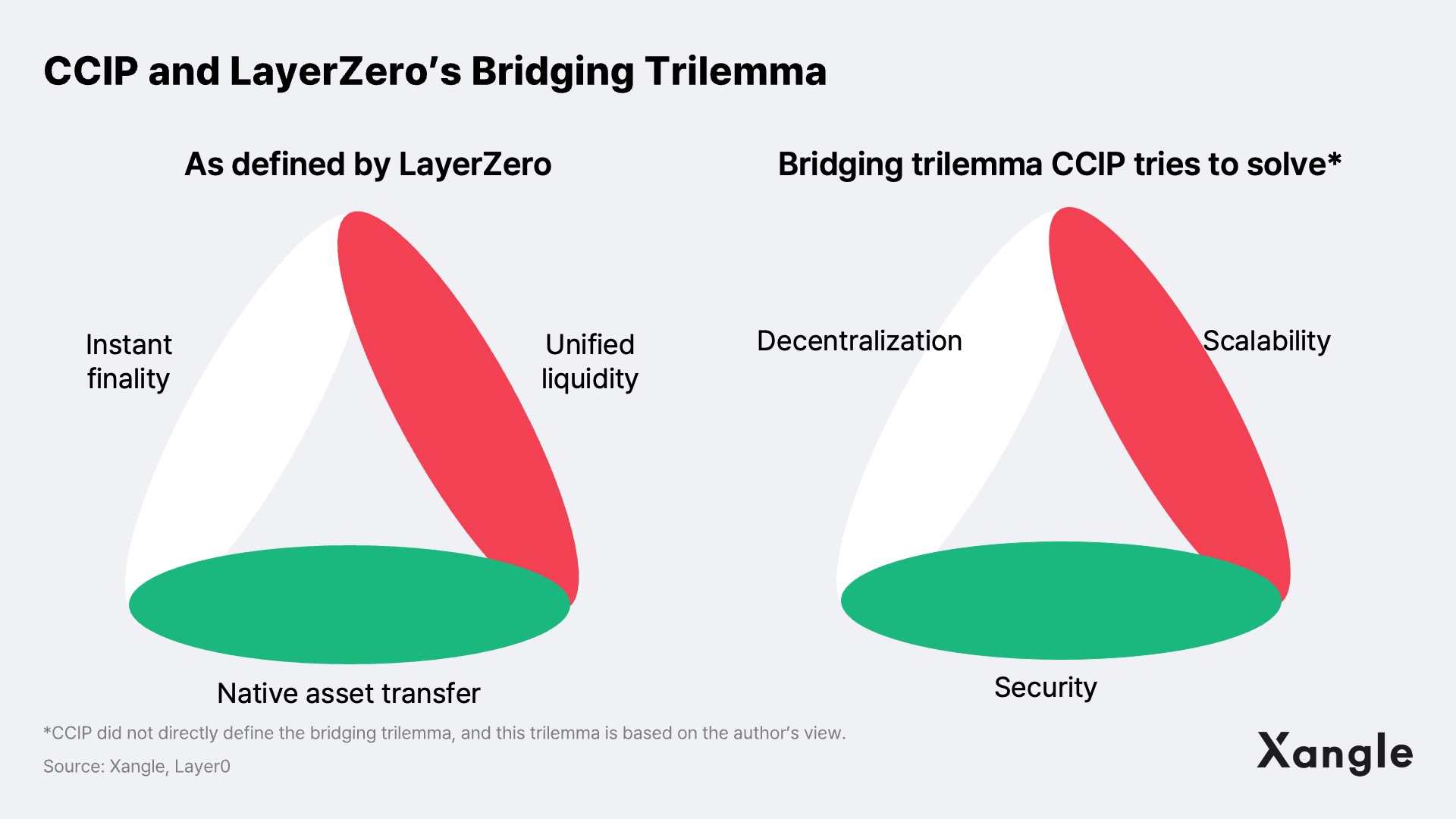

CCIP and LayerZero both aim to solve the bridging trilemma, but they have different interpretations of it. First, when LayerZero launched Stargate Finance, it defined the bridging trilemma as shown above. LayerZero identified unified liquidity, instant finality, and native asset transfer as the problems of existing bridges, and resolved these challenges with its Ultra Light Node (ULN) and delta algorithm.

So, what version of the bridging trilemma is CCIP addressing? While CCIP doesn't explicitly define the bridging trilemma, it aims to tackle the following problems commonly encountered with traditional bridges. In comparison to traditional solutions, CCIP is expected to be more: 1) decentralized (trustless), 2) secure, and 3) universal and scalable.

First, let's explore the aspect of decentralization. Many current bridge solutions are structured in a centralized manner. Consequently, a single entity or a small number of nodes are responsible for confirming transactions on these bridges. This creates a single point of failure, often leading to security breaches. On the other hand, CCIP does not have a single entity running the commit and execute DONs, and requires a quorum of affirmative votes on the DONs before a transfer can be made. And such a design makes CCIP more decentralized than existing bridge solutions.

Next, security. CCIP is expected to offer heightened security compared to traditional bridges. Most conventional bridges lack dedicated security units. In contrast, CCIP incorporates an independent security network known as RMN (Risk Management Network). Within RMN, risk management nodes play a crucial role by independently reconstructing Merkle trees from messages sent from the source chain. They then verify that this Merkle root aligns with the one from the message being sent. If the verification succeeds, the RMN forwards a blessing signature to the RMC, enabling normal message transfer. In cases where verification fails, the RMN sends a cursing sign to the RMC, effectively pausing CCIP. Consequently, CCIP's messaging technology is anticipated to offer greater security compared to other bridge solutions.

Lastly, in terms of universality and scalability, CCIP is expected to outperform traditional bridges. Existing bridges often require the development of separate smart contracts to scale to new chains, limiting their universality and scalability. On the contrary, CCIP can seamlessly connect to a new chain by adding only OnRamps, OffRamps, and RMC. Therefore, if a chain only possesses DONs for message transfer and verification, it can readily integrate with CCIP without the need for an additional smart contract. Consequently, CCIP is poised to excel in universality and scalability

4. CCIP and LayerZero Technologies: Similarities and Differences

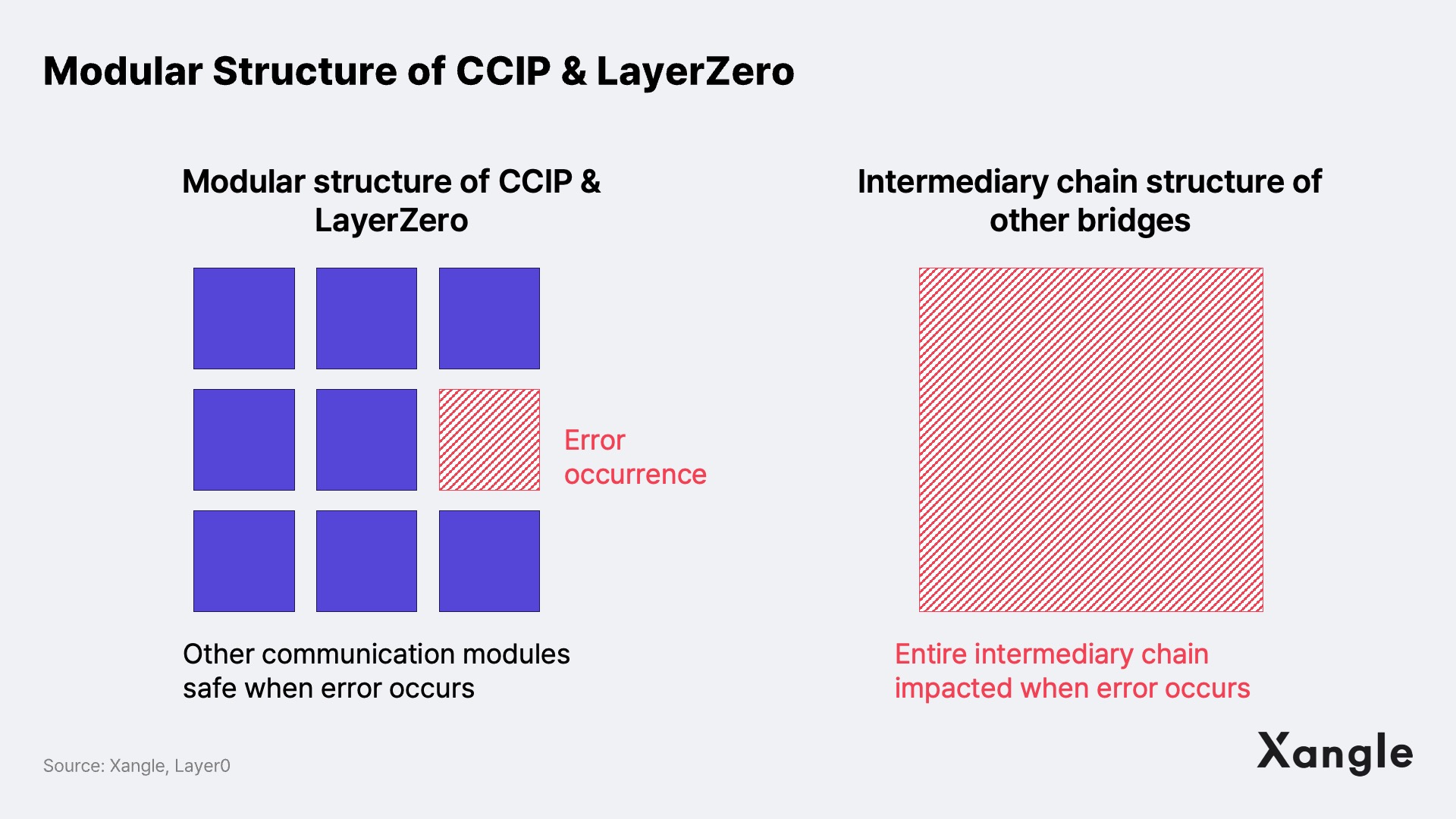

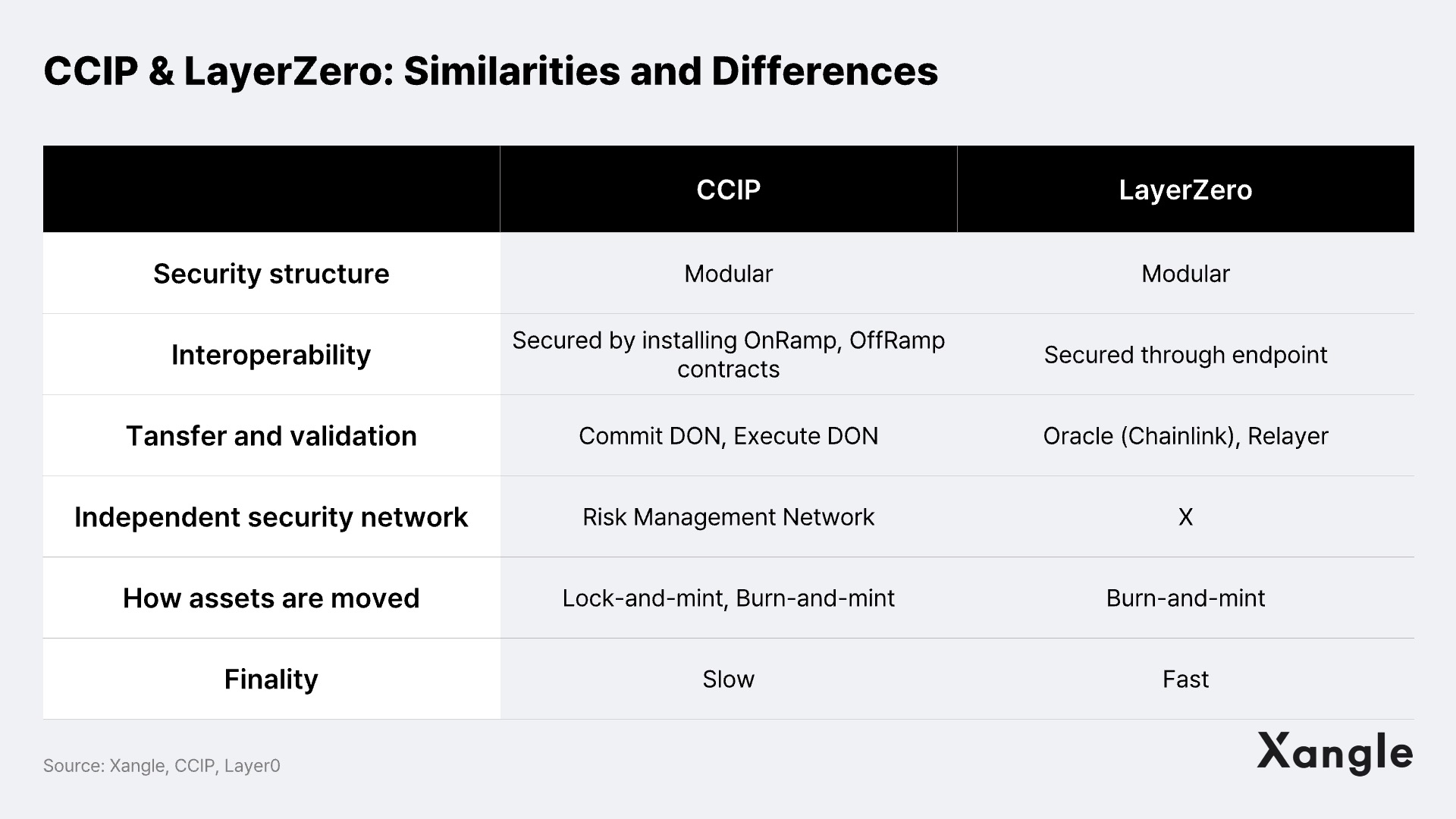

CCIP and LayerZero exhibit significant technological similarities. Firstly, both CCIP and LayerZero employ a modular approach, where each aspect of communication functions independently. This means that even in a worst-case scenario, such as a bridge hack, the integrity of the broader CCIP and LayerZero protocols' cross-chain operations remains unaffected. Moreover, this modular nature equips both protocols with the flexibility to swiftly expand to various other blockchains.

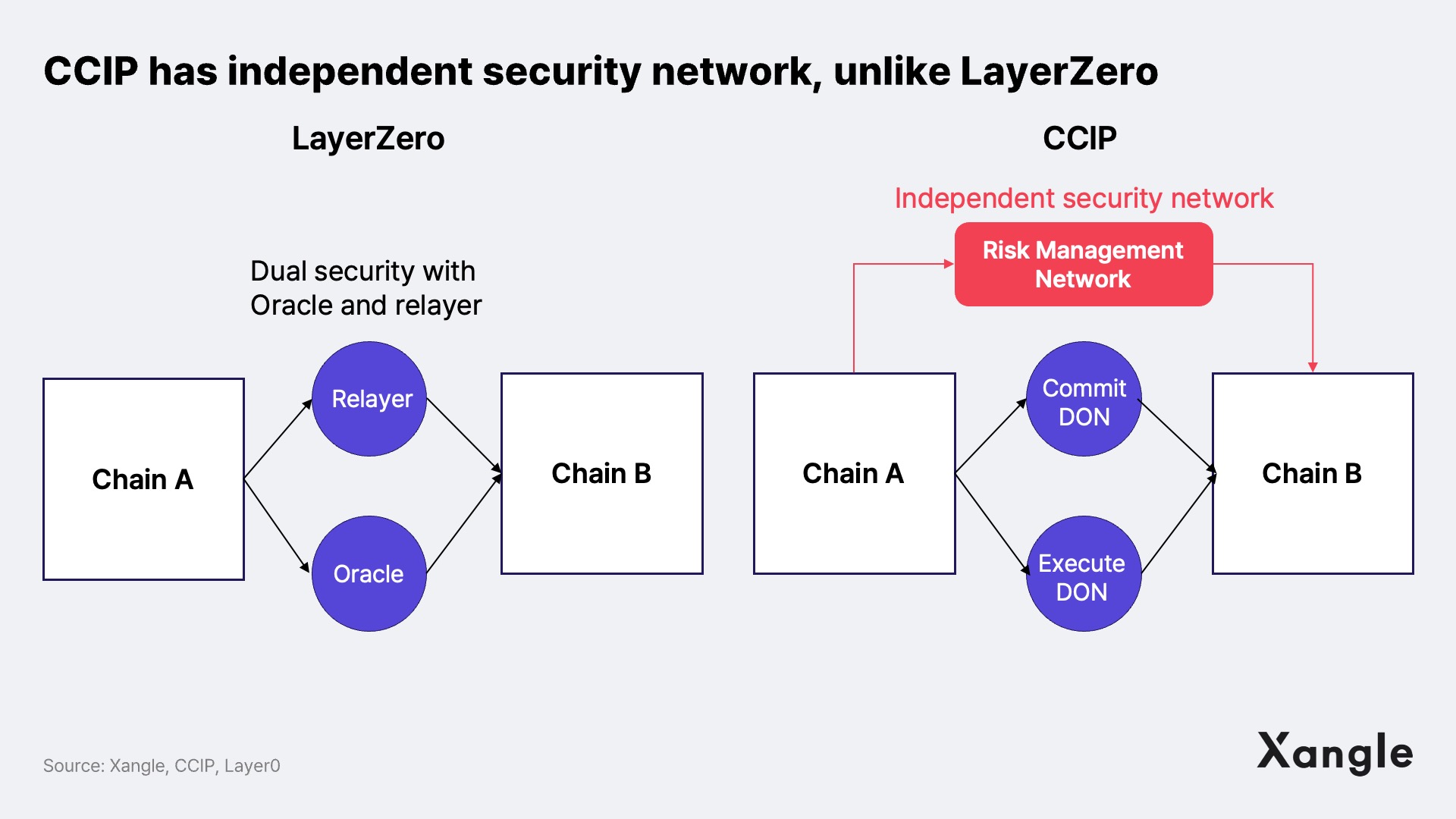

Furthermore, both protocols utilize a pair of middleware components for transfer and verification (CCIP: commit DON, execute DON; LayerZero: relayers, Oracle). Nonetheless, a key distinction arises: CCIP boasts its independent security network. LayerZero, on the other hand, guarantees the independence of relayers and Oracle to bolster security, making it exceptionally challenging to compromise the bridge unless both middleware elements collude. In contrast, CCIP not only assigns the roles of LayerZero’s Oracle and relayer to the commit DON and execute DON but goes an extra mile by establishing a separate security network, RMN.

However, when considering finality, LayerZero is to outperform CCIP. LayerZero has already demonstrated fast finality with Stargate. On the other hand, CCIP's transaction speed hinges on the finality of the source chain. If the source chain is Ethereum, then the transaction will take 10 minutes to finalize. Therefore, we expect CCIP to be somewhat slower.

To summarize, both protocols share universality as a common trait, but CCIP excels in security, whereas LayerZero takes the lead in terms of finality. In the foreseeable future, CCIP is expected to cater to larger transactions demanding heightened security, whereas LayerZero is poised to serve smaller transactions necessitating swift finality.

5. CCIP’s Potential to Surpass LayerZero

So, what does the future hold for the cross-chain standardization race between CCIP and LayerZero? I think the current cross-chain market is dominated by LayerZero, but CCIP has enough potential to surpass LayerZero.

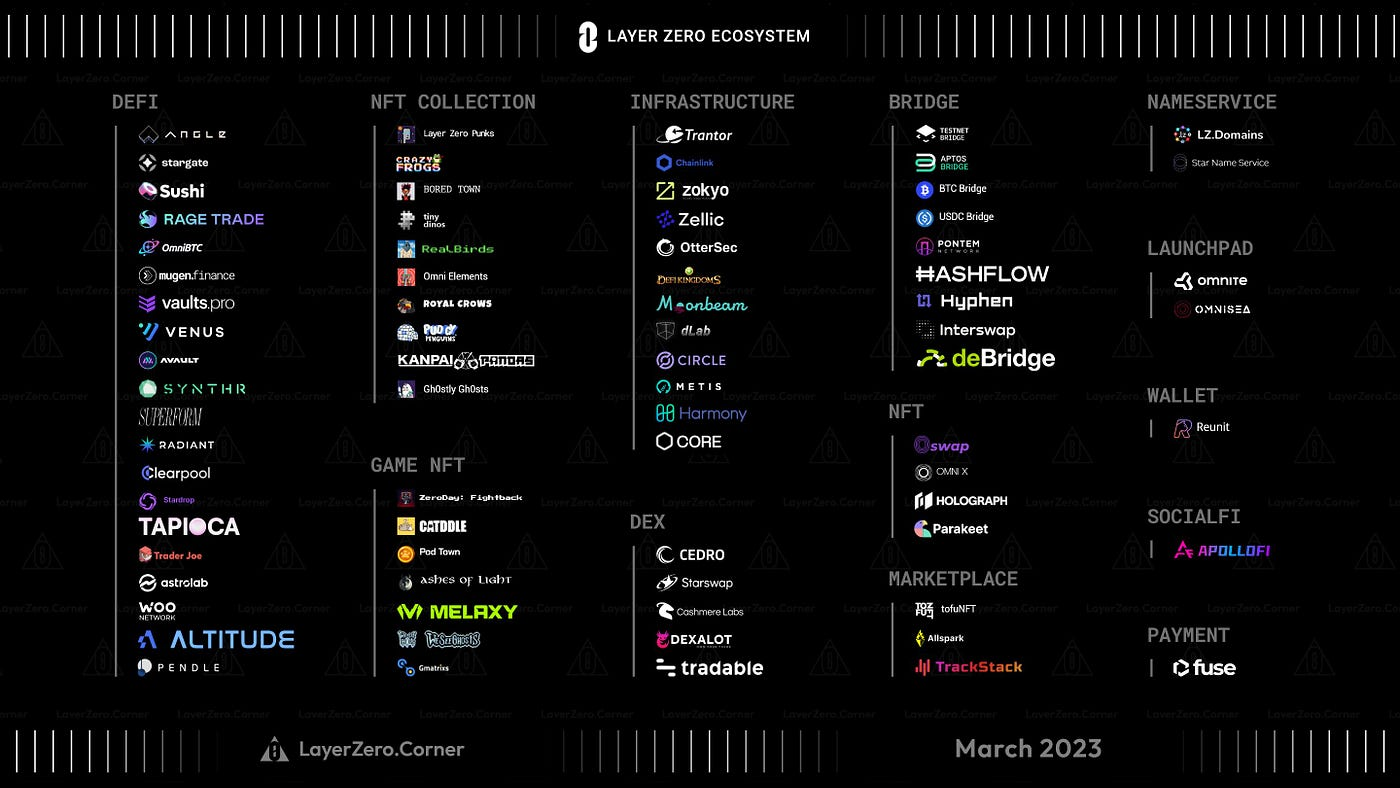

<Layerzero Ecosystem, Source: Layerzero.corner>

LayerZero already commands a significant presence in the bridge ecosystem, accounting for 36% of the total bridge trading volume in the past month (Source: DefiLlama). It has also secured over 80 dApps and boasts a bridge protocol called Stargate Finance.

Nevertheless, I think CCIP has a lot of potential because 1) it can leverage the existing Oracle network to rapidly expand its services, and 2) it has the potential to become a standard cross-chain solution by working closely with traditional financial institutions such as SWIFT.

First, regarding the already established Oracle network, Chainlink has already locked in a number of mainnet and dApps as customers through various products such as Oracle, VRF, Automation, etc. and already has over 992 DON networks. So when CCIP is officially released, it will be possible to quickly build a CCIP ecosystem by leveraging existing customer projects and DONs. For example, multi-chain dApps like Aave and Synthetix are already piloting cross-chain solutions on testnets.

<Article announcing that SWIFT and traditional financial institutions including banks will utilize CCIP, Source: Coindesk>

Secondly, CCIP's collaboration with traditional financial institutions is a significant factor that increases the likelihood of standardization. CCIP has already been announced through POC with SWIFT five years ago, and recently, major banks such as BNY Mellon, BNP Paribas, and Citi, as well as the U.S. financial intermediary DTCC, announced their intention to collaborate with SWIFT for blockchain connectivity testing through CCIP. This implies that public blockchains such as Ethereum and Polygon, as well as the private blockchains that banks have been experimenting with, are likely to be interconnected via CCIP.

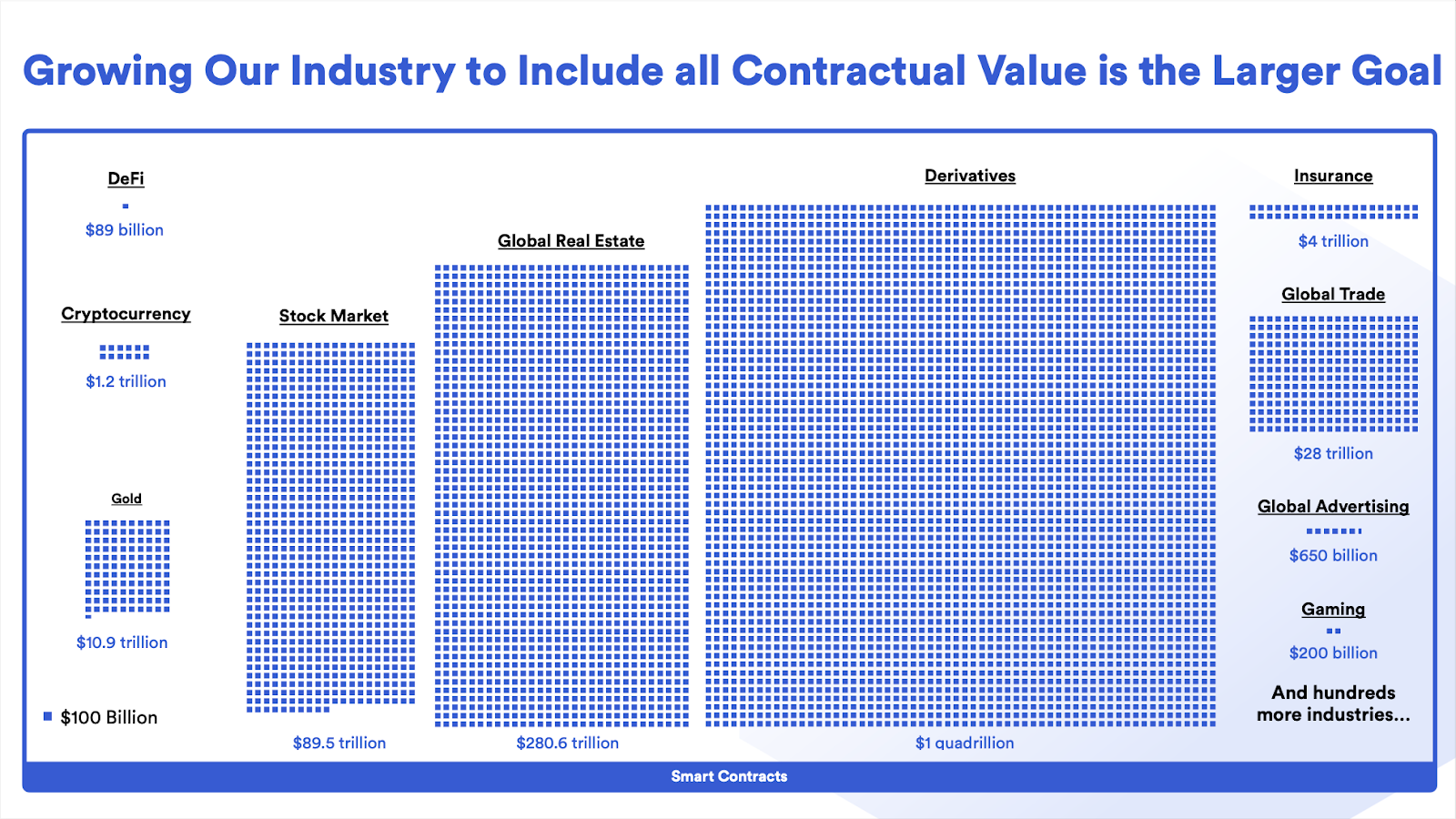

While LayerZero aims to become the standard for communication in the $1.2 trillion Web3 market, CCIP aspires to establish itself as the standard for communication in the much larger Web2 and Web3 markets, as illustrated below. In addition to the fact that CCIP is to have a competitive edge based on the customers and DONs it already acquired, the connection to the existing Web2 is a factor that further increases the potential for the standardization of CCIP.

6. Final Thoughts

CCIP still has a long journey ahead. It is still in the testnet stage, and the reward and punishment system for node operation has not yet been established. Furthermore, the CCIP ecosystem comprises only Aave and Synthetix protocols, which creates concerns that traditional financial institutions may opt to revert to their existing processes at any time.

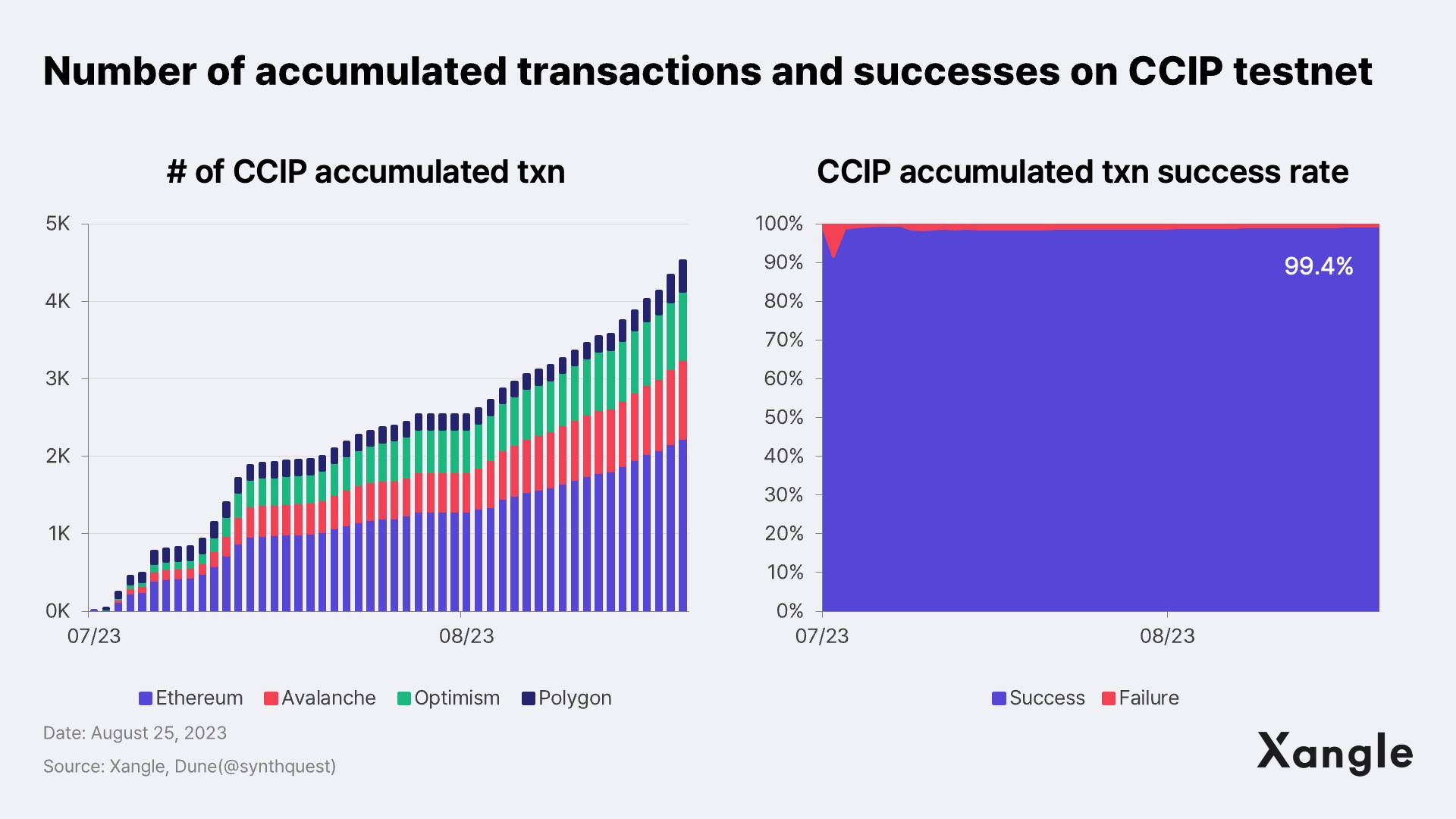

Nonetheless, CCIP is making steady progress. It has four mainnets running on its testnet and has processed over 4,500 transactions in just two months. Impressively, the transaction success rate stands at 99.4%, with no transaction failures for over a month, except for the initial phase of the testnet launch.

Therefore, it's anticipated that CCIP will emerge as a strong contender in the standardization race with LayerZero, especially when CCIP's mainnet is officially launched in the future. Furthermore, given the traditional financial sector's emphasis on security, CCIP is poised to introduce blockchain technology to Web2 financial markets rather than Web3, post-official launch.