Written by KP, Jehn, CH, Ponyo, TraceØ, Crypto_Gang, JiSung Jung, Hyewon Jeong, Jinuk Hwang, nerdsuh, YoungWook Cho, Jaewook Lee

Table of Contents

Intro

1. Tightening Continues, Don’t Fight the Fed

1-1. Bitcoin as a Financial Asset

1-2. Institutional Adoption Drives Bitcoin to Become More Mainstream

1-3. Recession Predictions Mount – Here’s How to Prepare

2. In the End, Blockchain Will Become Faster and Cheaper

2-1. 2022 L1 War Claims the Battlefield Full of Scars with Ethereum as the Sole Survivors

2-2. A Full-Blown L2 War to Scale Up Ethereum

2-3. Modular Is the Mainstream! Projects Take After Ethereum

2-4. Monolithic Blockchains Gearing Up for Counterattacks

2-5. In the End, Resolving the “Blockchain Trilemma” Is the Key

3. The Evolving Blockchain Ecosystem Infrastructure

3-1. Native Verification: Solution to Lock-and-Mint Bridge Exploits

3-2. Chainlink Maintains the Largest Blockchain Oracle

3-3. Chainlink to Serve as Secure Blockchain Middleware Beyond Oracle

3-4. Decentralized Data Storage: Challenges and Prospects

3-5. Crypto Custody Wallet: Improving the Drawbacks for Mass Crypto Adoption

3-6. MEV: Network Activity is Key to Boost Validator Rewards

3-7. DAO, A New Structure to Keep Governance Decentralized

4. Blockchain Content Never Ceases to Evolve

4-1. Despite the Brimming Potential, Anticipation Should Be Kept Low Key at Least Until the End of Next Year

4-2. DeFi: Locking the Barn and Finding the Next Meta

4-3. Web 2.0 Companies Spearheading NFT Adoption

5. Inevitably Introduced, Regulations Will Support Mass Adoption in Long-Term

5-1. Introduction of Crypto Regulations Can No Longer Be Opposed

5-2. Difficult Time for Exchanges as Well: Every Exchange for Itself

Closing Thoughts

Intro

The year 2022 will be marked as one of the most turbulent in the history of the crypto industry. The global macroeconomic conditions worsened when the U.S. Federal Reserve began shrinking its balance sheet starting in Mar 2022, and the Luna-Terra crisis is believed to have fueled the start of a long crypto winter. Then a string of failures followed as Celsius, Three Arrows Capital (3AC), and BlockFi went bankrupt, and FTX joined the list as another crypto giant going under after devising a scheme to defraud investors, completely shattering investor confidence. After the FTX collapse, fears have centered around the Digital Currency Group (DCG) and its subsidiaries, Genesis and Grayscale. The downfall of many top crypto companies heralded a mass exodus from crypto, and as a result, the total market cap of crypto assets has fallen to one-third compared to the beginning of 2022. While it is unclear what the Luna-Terra collapse and FTX fallout would mean for the wider market, a new year is upon us.

Looking ahead to 2023, the Xangle research team expects the crypto market to bottom out, while it remains uncertain when we might see a “dovish pivot.” The Fed is still on a hawkish path to maintain a restrictive policy stance, and the adverse macroeconomic conditions are likely to continue, but we believe the following trends are heading into 2023: i) The impact of tightening on the real economy is likely to be relatively modest as the unemployment rate is expected to remain low, ii) the blockchain ecosystem infrastructure continues to steadily develop regardless of market conditions, and iii) Web2 companies like Meta, Nike, and Reddit are lining up for the Metaverse race, which, in turn, would accelerate the mass adoption of the blockchain technology. In this 2023 outlook, the Xangle research team shares diverse views on where the crypto market is headed. We hope you find this outlook informative in understanding the latest crypto market movements.

1. Tightening Continues, Don’t Fight the Fed

1-1. Bitcoin as a Financial Asset

Despite a crash in the value of cryptocurrencies in 2022, Bitcoin has been noticeably linked to risk assets such as real estate, high-yield bonds, and stock price index, indicating that Bitcoin has begun to establish itself as a "financial asset class."

For the past year, crypto and equity markets have traded tightly together, experiencing record-high correlations with benchmark stock indices for the U.S., S&P 500, and Nasdaq. Correlation between crypto and equity markets increased notably as central banks around the world lowered interest rates, expanding liquidity and driving demand for high-risk assets. Compared to pre-pandemic years, Bitcoin prices have become increasingly linked with equities as retail and institutional investors holding both traditional assets and Bitcoin piled into the crypto space.

However, high liquidity alone cannot explain the tight correlation between Bitcoin and other risk assets for the following reasons: i) Decoupling periods were observed in 2021 when both assets encountered strong rallies, and ii) correlations strengthened even after the Federal Reserve raised rates in 2022. With retail investors anchoring to the sidelines and institutional investors sinking money into the crypto space, Bitcoin has become increasingly correlated with the stock market. We believe this is largely due to institutional investors who often execute funds simultaneously across all asset classes according to macroeconomic variables, resulting in a greater correlation between Bitcoin and risky assets.

We notice that Coinbase deposits by retail and institutional investors plunged by more than 50% in 2Q 2022 as Terra Luna crashed and the Federal Reserve began tapering. On the other hand, the trading volume of institutional investors increased steadily, reaching 85% in 3Q 2022. Although the steady increase in the number of institutional investors is because a large number of retail investors moved to Binance and FTX, it is undeniable that more and more institutions are ramping up their exposure to the cryptocurrency sector.

According to the Institutional Demand for Cryptocurrencies Global Survey 2022 by Cointelegraph Research, which had 84 responses from institutional investors across the world, 45% of the professional investors have exposure to cryptocurrencies and are primarily holding Bitcoin (94%). Interestingly, 44% of respondents said that the most important consideration for investing in digital assets is their risk-return ratio, while responses to “diversification” and “my company is convinced that the technology will be important in the future” are clustered in the middle, meaning that these factors are moderately important. The responses indicate that many institutional investors are leveraging Bitcoin as a risk asset and a portfolio booster, not as an independent asset without any links to traditional finance. There are three main reasons why Bitcoin is being recognized as a risk asset by institutional investors and driving institutional demand.

1-2. Institutional Adoption Drives Bitcoin to Become More Mainstream

A. Infrastructure Improvements Lead to Greater Accessibility of Bitcoin

Bitcoin became more accessible as large traditional financial institutions began actively engaging in financial infrastructure projects to support crypto assets starting in 2H 2021. In Aug 2022, BlackRock partnered with Coinbase Prime to allow its clients to access Bitcoin via its Aladdin platform, and in Oct 2022, BNY Mellon launched a new digital asset custody platform to support Bitcoin and Ethereum. As such, the world’s largest asset managers and banks are offering solutions for digital asset technology by tapping TradFi infrastructure that includes risk management, accounting, and research (Table 2). The launch of these “all-in-one solutions” could perhaps attract more institutional investors who are not familiar with digital assets to trade.

B. Emergence of Use Cases

The crypto bull market in 2017 was highly speculative. Initial Coin Offerings (ICOs) took 2017’s crypto market by surprise, and countless crypto projects jumped on the bandwagon of this new form of crowdfunding to list tokens. According to ICO Rating, an ICO research and rating provider, 314 projects raised $5.9712B through ICOs in 2017, but about 30% of the tokens were delisted within a year. To institutional investors, the 2017 crypto market was a retail-driven speculative frenzy, and they would have thought themselves fortunate for not having been lured by market momentums in 2017.

However, the crypto bull market from 2020 to 2021 was different. As the previous crypto winter eliminated scam coins and weaker players, Bitcoin stood strong as the largest cryptocurrency by market cap. Ethereum's fee steadily increased as numerous smart contracts were onboarded on its network, and with its transition into a Proof-of-Stake (PoS) network following the Merge upgrade, it succeeded in generating organic revenue. Following the "DeFi Summer" in 2020 and the "NFT Boom" in 2021, numerous projects with actual use cases have emerged, achieving exponential growth. The increasing use cases and public interest naturally attracted institutional investors to invest in Bitcoin, the undisputed leader of cryptocurrencies. Digital assets and blockchain are gradually becoming mainstream technologies – DeFi market's TVL has grown to $291B at the end of 2021, comparable to the market cap of the top 30 U.S. companies, and large Web 2 companies like Starbucks and Disney have begun entering the NFT space. The increasing number of use cases and public interest naturally attracted institutional investors and, in turn, led to Bitcoin investment.

Consensus 2022, the world's largest blockchain gathering, was held in Jun 2022, bringing together many institutional investors in the traditional financial sector from Wall Street. Even after the Luna-Terra crash, many predicted the continued growth of the blockchain industry. As if to represent this, Fidelity's CEO Abigail Johnson said, "There were voices of concern that the crypto industry might disappear during the 2018 bear market. But the situation is different this time in 2022, as investors are asking when and how much to invest." It means that many institutional investors want to continue investing in the market despite entering the bear market.

C. Navigating Market Volatility

Institutional investors are sensitive to volatility. Assets with high volatility hinder the predictability of future profits and losses, making it difficult for investors to invest a large percentage of their portfolio in volatile assets. The S&P 500’s annual realized volatility from 2014 to 2019 is 12.7%, which means that the actual return for a year deviates ±6.4% from the expected return. On the other hand, Bitcoin’s volatility over the same period is 77.1%, roughly six times that of the S&P 500; from the institutional investor’s point of view, Bitcoin’s high volatility is a huge obstacle to investing, even considering its high risk-return rate.

However, a lot has changed over the past 20 years. Since 2020, the S&P’s annual realized volatility has increased significantly to 23.5%, while Bitcoin’s volatility has decreased to 71.6%. As a result, the volatility ratio between the two assets has also been halved. Over the past three years, institutional investors were able to build a tolerance to volatility after witnessing usually stable TradFi assets riding a painful roller-coaster – with the NASDAQ Composite falling more than 12.3% in a day and WTI oil prices going negative. Furthermore, Bitcoin’s high volatility has relatively settled, which could be an incentive for investors to allot percentage of their portfolio to cryptocurrency.

As Bitcoin has begun to establish itself as a financial asset, its price is increasingly affected by macro-financial factors. As Fed’s tightening monetary policy hit risky assets in 2022, Bitcoin was no exception. The US 10-year interest rate and price of Bitcoin, which did not display much correlation until last year, began to move opposite from each other since 2022.

Bitcoin will continue to mature and evolve as a financial asset in 2023. In light of the Terra Luna catastrophe and the collapse of Three Arrows Capital (3AC) and FTX, regulators will likely use these as grounds to push for more stringent rules around cryptocurrency. Regulatory policies that would drive away investors – setting a leveraging limit, requiring crypto businesses to implement KYC procedures, and securitizing digital assets – are highly likely to be introduced to ensure investor protection. However, more regulations could mean more stability in a volatile crypto market, which could draw more investment from TradFi institutions that abide by stringent regulations.

There also appears to be plenty of room for institutional investors to increase their Bitcoin holdings, which account for only 7.8% of the maximum supply; a relatively low percentage compared to common traditional financial assets such as gold and the S&P 500. What is noteworthy is that even though Bitcoin spot-based ETFs are yet to be listed in the U.S., the fund's share is 3.9%. Of the 3.9%, Grayscale Bitcoin Trust accounts for 3%; however, there will be a significant number of institutional investors who are reluctant to invest as Grayscale products are subject to significant limitations on resales and transfers with a statutory holding period of six months, and liquidity in the market is also insufficient. If the U.S. Securities and Exchange Commission (SEC) approves the spot Bitcoin ETF, a major influx of new institutional investments is expected to be injected. Meanwhile, ARK 21Shares submitted an application to the SEC for a spot Bitcoin ETF to be listed on an exchange. The continued attempts to list spot Bitcoin ETFs showcase investment commitments from institutional investors who will continue investing in Bitcoin in 2023.

1-3. Recession Predictions Mount – Here’s How to Prepare

The bottom line is that Bitcoin prices are unlikely to make a dramatic comeback in 2023. As the influx of institutional investors strengthens Bitcoin’s characteristic as a macro-influenced risk asset, the much-foretold recession of 2023 will dent investor confidence while the Fed is likely to continue raising interest rates, draining liquidity from the market.

As U.S. inflation slowed recently, Bitcoin prices rebounded, reflecting the expectations that the Fed will slow down its tightening measures. Bitcoin prices soared even when the Consumer Price Index (CPI) print for October and November came in below expectations and when the Chair of the Federal Reserve Jerome Powell suggested that the Fed may ease off interest rate hikes in a speech at the Brookings Institute. Now all that remains is the Fed’s interest rate hike, as forewarned by many experts. The Fed projected a terminal rate of a 5.0-5.25% range in Q2 2023 and will continue to remove liquidity throughout 1H 2023 to tame inflation. While interest rate rises, Bitcoin prices will remain flat in general as it is unlikely for the prices to fall sharply and cause a surprise rally.

Even after the Fed halts interest rate hikes, a similar trend is expected to continue in the second half. For Bitcoin prices to hike even during an economic recession, investors should hope for a “Dovish Pivot,” in which the Fed lowers the interest rate to stimulate the economy. However, given that the severity of the 2023 recession is expected to be significantly lower than that of the 2008 financial crisis and the 2020 pandemic recession, we deem that it is unlikely that the Fed will cut interest rates prematurely in 2023. Rather, the Fed is expected to maintain interest rates on hold until inflation is fully tamed. As the end of the year approaches, expectations for interest rate cuts in 2024 may rise, and the price of bitcoin may rise again, but considering that the interest rates will be adjusted slowly and cautiously, we will not experience a crypto surge similar to 2020-2021’s bull markets.

A. Battle Against Inflation to Continue in 2023

Inflation is reflected in the prices of goods and services in an economy. Commodity prices are stabilizing – food and energy price shocks from the Ukraine war began to ease. WTI oil prices, which once exceeded $120 per barrel, settled at $80 per barrel, and wheat prices slumped 20% from their peak to pre-Ukraine crisis levels. Global supply chains suffered severe challenges during the pandemic, and we are starting to see easing pressures, especially in shipping and transportation. Shipments from North America to China remained at around $21,000/FEU (forty-foot equivalent unit) in Sep 2022, but as of writing, rates are pushed back to 2,500/FEU with much faster transit time. The Fed’s Global Supply Chain Pressure Index (GSCPI) also indicates that global supply chain pressures have begun to moderate, improving to within one standard deviation by historical standards.

On the other hand, service prices show no sign of slowing down. Although new sales of homes are on the decline, rental vacancy rates did not increase significantly until 3Q 2022. In particular, shelter inflation is likely to stay elevated for a while. As mortgage rates rise, a growing number of people who can’t afford to buy homes are instead turning to rent, which drives up rent fees.

The U.S. labor market remains tight, indicating that wage growth will remain high. Data shows the job market is holding up despite widespread predictions about a recession, with the unemployment rate at a historic low of 3.7%. Wages are up sharply in the U.S. – The annual wage growth in the Atlanta Fed wage growth data was more than 6%. According to the U.S. NFIB Small Business Survey, the percentage of businesses planning to increase wages in the next three months remained elevated at 32%, and as demand is outpacing supply in the labor market, upward pressure on wages remains. The labor market is keeping the Fed on its toes as the latest nonfarm payrolls report (published on Dec 2, 2022) and the wage growth rate blew out expectations.

Although inflation dipped in August, price levels will not go down dramatically as they remain well above the Fed’s goal of 2%. Inflation is expected to decline in 2023, with most investment banks predicting it to reach around 3-4% towards the end of December and ease to around 2% by the end of 2023.

Despite being widely panned for using the term, “Inflation is Transitory,” the Fed has insisted on the narrative for over six months. In an effort to tame inflation, the Fed is likely to tighten the monetary policy further through more interest rate hikes and is willing to sacrifice the U.S. economy to ensure stability. The Fed is under pressure to back up its hawkish stance. Every Federal Open Market Committee (FOMC) meeting is making headlines around the world, even pointing out how many times the word “inflation” has been mentioned during the meeting, and the world is watching whether the Fed’s credibility as an inflation fighter can be kept.

The Fed’s effort to bring inflation under control is to ward off the threat of stagflation similar to that of the 1970s, during which the Federal Reserve policymakers decided to ease the monetary policy early and pulled back on rate hikes too soon to blunt the risks of a recession. Against this backdrop, even if the Fed decides to pause interest rates around 2Q 2023 under less recession fear, the Fed will lower rates only after the data provides confidence that inflation is moving down to its target goal in a sustained way. Since it took five months for the CPI to peak and enter a downward trend after the first rate hike since the pandemic in Mar 2022, the Fed will monitor the inflation indicators for at least five months or longer before deciding whether to cut interest rates. For this reason, it is unlikely for the Fed to become dovish again until at least the year's end, and so will the rise of Bitcoin prices.

B. Economists Predict “Mild Recession” in 2023

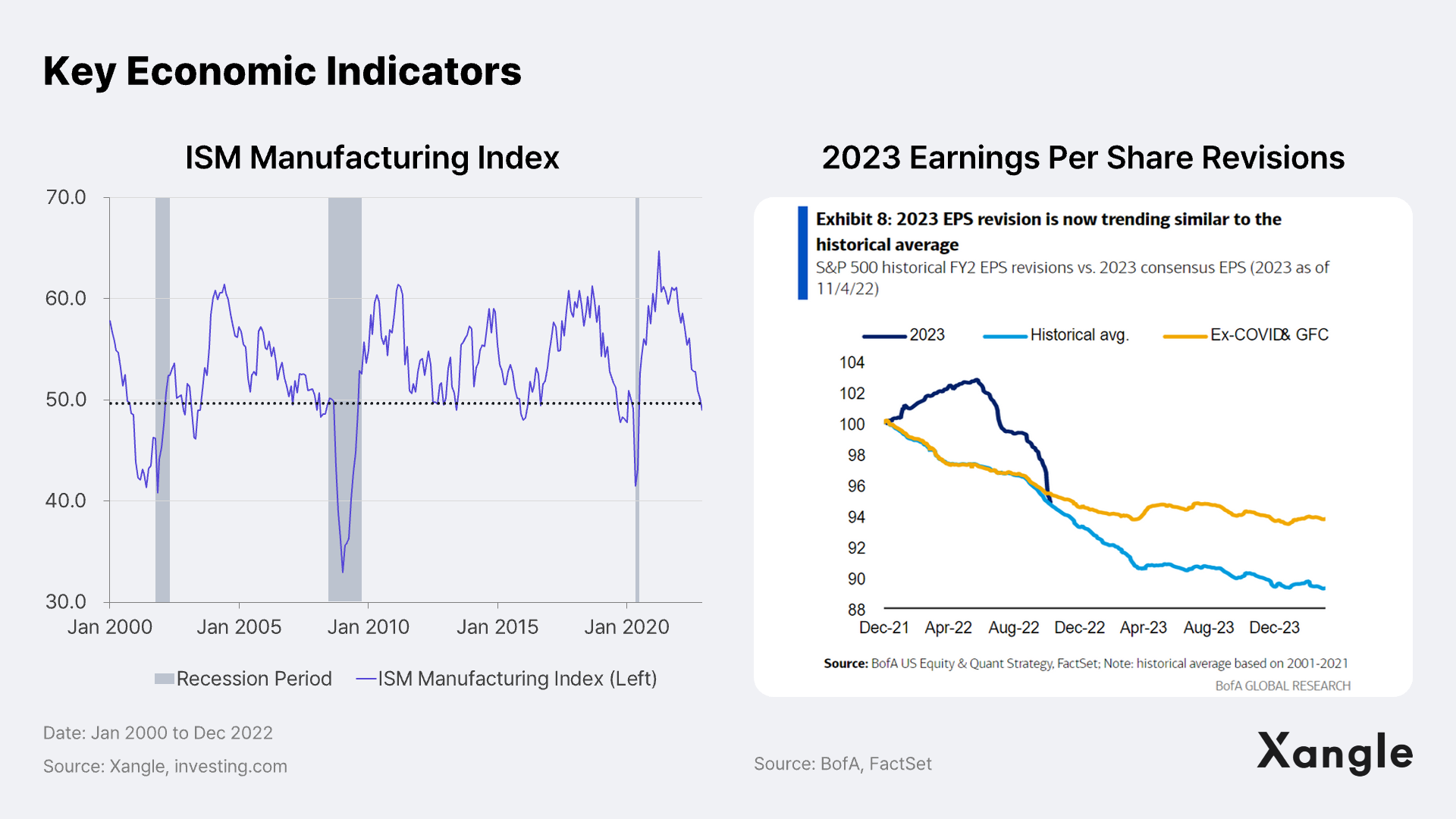

Key economic indicators have already implied that a U.S. recession is on the way in 2023. The long-term and short-term government borrowing rates have been inverted (10 year-3 month treasury yield spread), and the ISM manufacturing index also fell to 48.4% in December, falling below 50% for the first time since the pandemic broke out. The 2023 earnings guidance of companies is also being revised. Though a recession will likely hit in 2023, predictions say it could be “mild.”

In 2023, as prices become more stable and interest income rises, especially among high-income households, we expect consumer spending to remain relatively strong. Although real disposable income for each household has decreased sharply after the suspension of the Covid-19 relief funds and as inflation exceeded wage growth, the pace of decline is gradually slowing starting in 2H 2022. Goldman Sachs expects a consumption growth of roughly 1.5% in 2023. Black Friday online sales hit $9B despite fears over an economic recession from high inflation. Considering most sales came from electronics and apparel, durables that have stayed stable in price or declined compared to other durables, we see that the rise in sales figures was driven by real demand, and not inflation, a promising indicator of the spending power of U.S. households.

The unemployment rate remained essentially unchanged at a historic low of 3.7%, well below the natural rate of unemployment. According to the National Bureau of Economic Research (NBER), the natural rate of unemployment spiked in the U.S. at the onset of the Covid-19 pandemic, from 4.5% at the end of 2019 to 5.9% at the end of 2021 - the rate rose as the pandemic contributed to a boost in remote working and as the number of freelancers with multi jobs increased. The natural rate of unemployment is a useful construct for the Fed to gauge the unemployment-inflation trade-off as it is consistent with full employment and stable inflation, meaning that it can be an indicator to keep the interest rate unchanged. It also means that if the unemployment rate rises, downward pressure is placed on prices.

Given that the Fed underwent insurance cuts twice by 75 basis points in late 2019 in response to growing concerns over an economic downturn, there is a possibility that the Fed could cut rates in 2023. But circumstances are different in 2023. Inflation will remain above the Fed’s target, and recession will likely be shallow and mild. As the end of the year approaches, attention will turn to 2024, and expectations for rate cuts could potentially boost Bitcoin prices; however, the Fed will not be comfortable cutting rates until inflation declines close to its 2% target. Unlike in 2020, it will require some time to lower interest rates as the Fed does not want to overtight the economy. For this reason, it is unlikely for market liquidity to undergo dramatic expansion and Bitcoin prices to rebound drastically.

2. In the End, Blockchain Will Become Faster and Cheaper

2-1. 2022 L1 War Claims the Battlefield Full of Scars with Ethereum as the Sole Survivors

A. The Brutal L1 War of 2022

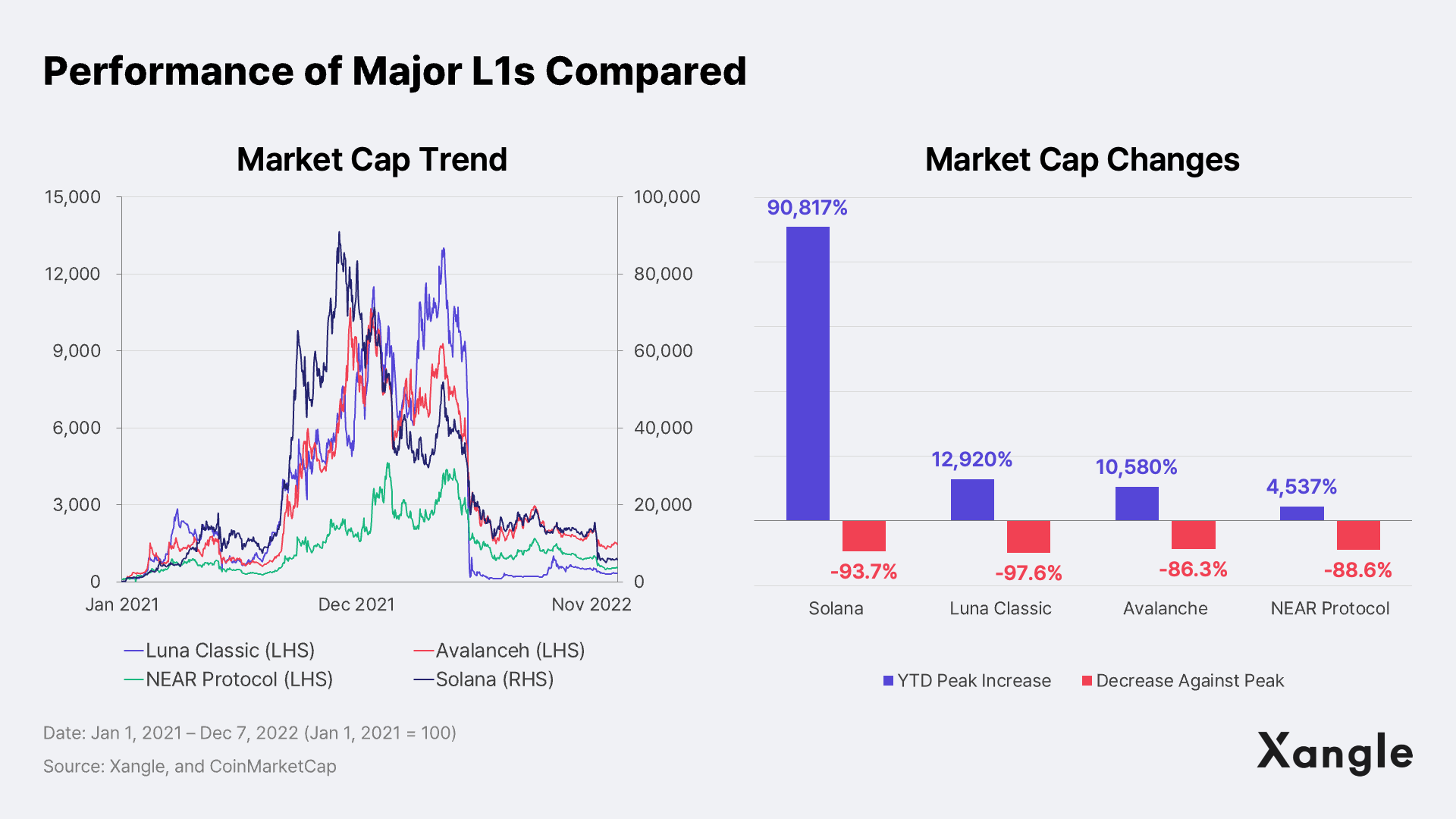

No one would question the Layer 1 (L1) War as the keyword that generated the most buzz in the bull market of 2021. The cut-throat competition to determine the survival of L1s was just that fierce. That heat was carried well over to the first half of 2022, pushing up the market cap of Solana, one of the major L1s, with over a remarkable 130-fold growth during that period.

However, the L1 war was brought to its gruesome end after only one year due to the unfavorable macro environment coupled with the fall of two major L1s, Terra in early 2022 (refer to the Xangle report, “Terra Becomes the Battlefield for the Layer 1 War” available in Korean) and Solana at 2022 end (refer to the Xangle report, “A Vitals Check on Solana and Layer 1 Ecosystem since the FTX Debacle”) brought on by their lax risk management.

The L1 tokens that dominated the top market cap, raking in the first half of 2022, handed their seats over to stablecoins and dApp tokens in the latter half of the year as the L1 war came to a close. Ironically, the only L1 left standing after the war – dubbed the “Ethereum Killer” – was none other than Ethereum itself. Interestingly, while Ethereum formidably held its position with the second largest market cap, other assets related to Ethereum 2.0, such as USDC, DAI, and stETH, also rose to the top of the cream in terms of market cap ranking.

B. Ethereum Finally Merges after Achieving Their Milestones in Wartime

A Successful Merge and Its Significance

While most projects were left tattered with only scars from the L1 War, Ethereum victoriously accomplished its long-awaited goal and ambition. In mid-September 2022, Ethereum completed its transition from the PoW (Proof-of-Work) to the PoS (Proof-of-Stake) consensus algorithm. The key to the Ethereum Merge is changing the consensus algorithm to PoS and enabling stable network operation by securing enough validators through staking.

The impact of the Merge may seem minimal from the mainnet infrastructure perspective. However, it boosts up the attractiveness of Ethereum from an investment point of view. A cryptocurrency data platform, Messari, claimed that the Merge ultimately changed the tokenomics of Ethereum to “Staking Economics” in its Ethereum 2.0 report published in 2020. It determined that the nature of the assets will be upgraded once more as Ethereum officially changes its structure to enable its users to earn interest through staking.

On the PoW chain of the past, Ethereum was an asset with some value storage functionality and characteristics of commodities. It was used as the key currency in its ecosystem and the gas fee to execute smart contracts. However, after the switch to PoS, Ethereum will have added characteristics as follows:

- Deflation can be expected as issuance volume is reduced and burn volume increases as per the network activity level.

- Interests can be earned through staking, and the staked Ethereum can be liquidated.

This means that Ethereum can further pad its attractiveness as a store of value as well as have an additional characteristic as a capital asset, similar to a hybrid perpetual bond, as staking interests can be earned. Ethereum has secured various ingredients for price increase as below. Let us explore how each of them is doing now, three months into the Merge.

Deflation Due to Issuance Reduction and Burns → Role as Store of Value Asset

As of December 11, 2022, about three months after the Merge, Ethereum is showing a +0.004% p. a. inflation rate according to ultrasound.money, which was expected to be about +3.579% p. a. if the network maintained its PoW-based operation as before. In summary, the inflation rate decreased by almost 99.9% after the Merge.

On top of issuance volume reduction after the switch to PoS, the network’s burn mechanism from EIP-1559adopted with the “London Hard Fork” in August 2020, preceding the Merge, is also considered to have acted as the cause for the decrease of Ethereum inflation. In other words, Ethereum is more likely to become a deflationary asset as network activity increases.

In fact, Ethereum recorded deflation for about 25% of the period since the Merge. The momentary hype for Xen Coin made by Jack Levin, one of the early Google founders, in October and the surge in demand for decentralized exchanges and stablecoins since the FTX incident in November are identified to be the causes driving up the network activities and burn volume.

If the volume of staked Ethereum on the network is maintained at 30 million ETH and gas fees at 60 gwei, Ethereum supply is expected to continue downward for the next two years. A decrease in Ethereum supply increases its attractiveness from the relative scarcity and provides a footing to view Ethereum as a means to store value. It would be like Bitcoin rising up as a store value asset through its contract enforcing the 21-million-coin supply cap.

Staking Yield and Asset Liquidation → Rising as a Capital Asset

As of December 12, 2022, the total deposit in Ethereum is recorded at around 16 million ETH, about 13.5% of the total supply issued and equaling 21 billion in U.S. dollars.

When users stake Ethereum, they will also get about 20% interest in ETH in five years as of now. Such yield calculation is before considering the increase in Ethereum price.

Moreover, the staked ETH can be liquidated through a wide range of protocols, such as Lido, Binance, and Rocket Pool, which currently offers Ethereum staking derivatives.

- Lido: Lido is a DeFi platform offering liquidation staking services based on stETH tokens based on the Ethereum blockchain. Currently, the total ETH deposited via Lido takes up about 29% of total ETH deposits to Beacon Chain.

- Binance: Binance offers an Ethereum staking derivative products from centralized exchanged. Like Lido, Binance uses BETH (Binance wrapped token - ETH). Currently, the total ETH deposited via Binance takes up about 6% of total ETH deposits to Beacon Chain.

- Rocket Pool: Rocket Pool is a platform that provides Ethereum staking liquidation services and node operation services. It offers rETH and only requires a deposit of 16 ETH to create a new Ethereum validator via an Ethereum staking pool called a “minipool.” Currently, the total ETH deposited via Rocket Pool takes up about 2% of total ETH deposits to Beacon Chain.

As of December 15, 2022, stETH, a liquid asset offered by Lido, which has the highest market share among the examples above, has USD 61 billion in market cap and is ranked 11th in the market.

Some claim that it is only natural that the scale of staked Ethereum is growing since there is no technical support for redeeming the ETH deposits yet. However, the derivatives that can liquidate ETH deposits are showing high activity.

Suppose asset liquidation were to remain as easy as such. In that case, Ethereum’s attractiveness as a capital asset will only increase since users can earn interest from staking Ethereum and leverage the liquid asset for other opportunities. This not only makes Ethereum a more attractive investment asset but, at the same time, also reminds us that there are various types of services and infrastructures already established in the Ethereum ecosystem.

2-2. A Full-Blown L2 War to Scale Up Ethereum

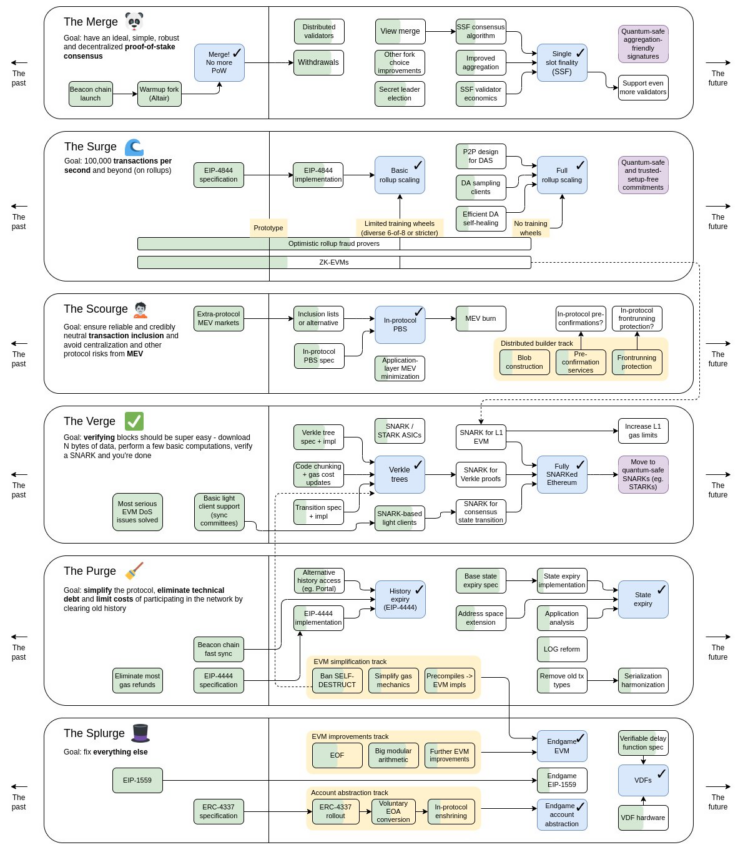

Ethereum’s true competitive edge may shine as it secures scalability through L2 solutions and sharding. While it is expected to take some time to adopt sharding which changes the structure of the Ethereum chain to enable parallel transaction processing, the market’s focus naturally shifts to Layer 2 (L2) solutions.

With Ethereum’s utility improved after the DeFi Summer of 2020 and NFT Summer of 2021, the interest in L2 that can enhance Ethereum’s scalability has continued since early 2022. The chart below displays the outstanding performances of major L2 projects in terms of token price, TVL trend, and investment. In particular, rollups – specifically Optimistic Rollups (ORs) based on fraud proof, such as Arbitrum and Optimism – have achieved significant growth.

ZK-rollups based on validity proof have also been very much talked about. However, with a few exceptions of app-specific ZKR solutions like StarkEx, most of the general-purpose ZK rollups remain at a testnet phase or require significant improvements. In this regard, StarkNet launched an alpha version in November 2021, and zkSync launched a baby alpha mainnet in late October 2022. Other promising ZKR solutions, such as Scroll and zkEVM, are also scheduled to launch their own mainnets in 1Q 2023. Considering the development progress of ZKR, it will be some time before ZKR reaches mass adoption. However, since it is emerging as the endgame of rollups, ZRK solutions’ mainnet launch and other movements are some of the key points to watch out for in 2023.

With the full-fledged growth of the L2 ecosystem anticipated in 2023 and many different L2s planned to launch their mainnets, the competition among L2s to claim their portion of the Ethereum pie will only get fiercer. Since they all have their own strategy and tokenomics, the game will get even more interesting.

A. OR to Have an Upper Hand over ZKR for the Time Being In 2023

In 2023, it may be advisable to look to Optimistic Rollups (ORs) such as Arbitrum and Optimism rather than ZKRs. Although it is true that ZKRs will have a stronger competitive advantage as the technology develops, ORs look more promising in the mid-to-long-term for the following three reasons (Please refer to the Xangle research article, “Would Optimistic Rollup Remain as a Viable Candidate Even After ZK Rollup Is Fully Developed?”):

- Closing the Technology Gap: While ZKR takes a definite upper hand in scalability, OR is determined to have a good chance to claim the win considering the actual processing speed of Optimism and Arbitrum is currently at around 3-4 TPS. The gap in cost between the two rollups is likely to narrow down as time passes, with Optimism introducing Bedrock technology and using blobs instead of calldata for data availability after the Surge. In terms of trust, OR assuming at least one out of N number of nodes to act honestly cannot take an advantageous position over ZKR, guaranteeing the trustworthiness of each batch via mathematical computation. However, the structure of OR that utilizes the game theory does not pose many issues either, which is evident in the fact that there has not been a single hacking incident in the one-year period that Arbitrum and Optimism have been operating their mainnets. Moreover, what had often been dubbed OR’s critical pain point and a disincentive for users – the seven-day DTD (Dispute Time Delay) – can be circumvented by using quick withdrawal services offered by market makers (MMs), making it unlikely for the end-users to feel much inconvenience.

- OR’s First-Mover Advantage: While Optimistic Rollups have been maintaining a stable operation of their mainnets and growing their ecosystem for over a year, most of the Zero-Knowledge Rollups have not yet launched their mainnets. Of course, the OR ecosystem is much larger. According to L2Beat, the total TVL of L2s is about USD 4.5 billion as of December 5, 2022, of which Arbitrum takes up 53% of the L2 market share with USD 2.35 billion and Optimism takes up 27% with USD 1.2 billion. Even if the TVL of all the app-specific ZKRs were to be combined, it would not amount to USD 1 billion. In terms of UAW (Unique Active Wallets) number, Arbitrum and Optimism reached 1.1 million and 1.4 million respectively, with their daily transactions also rising to exceed 400,000 recently. The market cap for stablecoins of Arbitrum and Optimism also reached USD 1 billion and USD 500 million each, with many competitive dApps onboarded, such as GMX, Uniswap, Aave, and Stargate Finance. On the other hand, most of the ZKRs have not even launched their mainnets and the ones launched are not ready for public use. In the meanwhile, ORs will get a first pic of the users and major dApps, getting on track to fully advance in their growth. The first-mover advantage will make it difficult for ZKR to narrow the gap in a short period of time. ZKRs will require more time to win over the trust of users and make meaningful growth in terms of network activity. For ZKRs, the year 2023 would be the time to lay a firm foundation, as 2022 was for ORs.

- EVM-Compatibility: Optimism and Arbitrum are already offering general-purpose rollup solutions with very high EVM-compatibility and well-established development libraries. Equipped with a development environment that makes it easy to onboard rollups, it is also relatively easy for projects to develop dApps on or migrate to OR, which is a formidable advantage, especially when considering Ethereum’s vast pool of developers. On the other hand, Polygon, ZKSync, and Scroll, which have declared the launch of their ZKEVM, fall under the category of Type 4 systems from the various types of ZKEVM that Vitalic Buterinproposed. The Type 4 ZKEVMs work by compiling smart contract source codes written in high-level languages into languages that can be used in the ZK-SNARK environment, having the upside of quickly generating validity proof at a relatively low cost but also with the downside of lowest EVM-compatibility. The fact that EVM was never designed with ZK technology in consideration makes it that much harder for development.

B. Polygon with an Ambition to Put an End to the L2 War

Although Arbitrum and Optimism do have high potential and are showing great performances lately, the L2 project emerging as the favorite to win is actually Polygon. The expectations are riding high for Polygon because it has i) the most global Web2 companies, such as Meta (former Facebook), Starbucks, and Nike, and ii) established a rollup pipeline that can fulfill various enterprise needs from PoS chain to ZK solutions. Some point out the fact that the Polygon PoS chain has its own validator and consensus algorithm and claim that Polygon is not L2. However, considering how Polygon is using Ethereum as the DA (Data Availability) Layer via checkpoints and is planning to evolve as an all-in-one comprehensive L2 solution in the future, we at the Xangle team expect such claims will die down soon enough.

C. StarkNet Aiming for the Win with Cairo: Ecosystem Growth Is the Key

StarkNet and its moves stand out from the many ZKRs. The most remarkable feature of StarkWare would be that it broke away from EVM by establishing its own development environment, Cairo, despite being an L2 project. In fact, major ZKRs other than StarkWare, such as Polygon, Scroll, and zkSync are developing ZKEVMs that mimic the EVM environment. This is an extremely valid strategy considering that it can easily attract Ethereum developers, of which there is a whopping number in the Web3 ecosystem. However, StarkWare stands out like a sore thumb and does not consider ZKEVM to be its ultimate goal because it believes that i) we need to build languages and VMs optimized to ZKRs rather than advocating EVM compatibility in order to reach high scalability, and ii) the importance and influence of EVM would fade as time passes since all the dApps will be run on L2 in five years’ time anyways.

Of course, StarkWare cannot completely look over the EVM developer ecosystem in mind, and is getting ready to offer Warp, a service to transpile Solidity codes to Cairo codes on StarkNet, as a part of its consideration for such consideration. However, it is much more focused on advancing Cairo, and even having released Cairo 1.0, optimized for STARK technology, as an open-source recently. Only time will tell if the winning move by StarkWare will indeed get them the win they seek. However, there is a good chance that Cairo might claim the position as the standard language for Ethereum developers in the future. (Refer to the Xangle report, "StarkNet Sheds a Light on a New Direction for ZK Rollups.") In this aspect, it is a positive sign that over 100 projects have already been onboarded on StarkNet.

D. zkSync and Scroll Forewarned Their Part in the Competition

On top of Polygon, Arbitrum, Optimism, and StarkNet – the projects aforementioned to watch out for the new year- zkSync and Scroll deserve our attention in 2023. zkSync is a ZK rollup being developed by Matter Labs, a Series C investment round startup, having attracted a hefty sum of USD 258 million from major investors, including a16z, Lightspeed Ventures, and Consensys. zkSync boasts of having the largest ecosystem among ZK rollups, along with StarkNet, which undoubtedly makes it one of the more promising ZKRs. However, considering it has been little over two months since zkSync launched the zkSync 2.0 baby alpha mainnet, and only to be used within the team, it will take some time until the project gains the trust of its users, launch its service, and increase the network activity to a significant level.

Scroll is developing EVM-equivalent ZK rollups based on its superb technological capabilities. However, unlike other projects that have already launched their mainnets or whose launch is imminent, such as StarkNet, zkSync, or Polygon, Scroll is still in the pre-alpha testnet phase. We could put a pin on this project and keep a close eye.

E. Level of Decentralization to Emerge as Critical Metrics in L2 Assessment

Today, all the L2 solutions are run in a centralized structure. The biggest issue with the centralized sequencer is that it has a single point of failure (SPOF) that can cause the whole network to shut down. This was proven true in January 2022 when Arbitrum went offline due to sequencer problems. The industry had looked the other way when it came to L2’s centralized operation, citing various practical issues. However, as the L2 market grows, they are likely to start considering decentralization of the rollups as one of the key factors in 2023. The foundation of L2 network decentralization is the L2 tokens, which can contribute to network decentralization in two aspects as below:

First is governance. Token holders will be able to participate in the decision-making process for key agendas regarding the protocol. Take a look at the structure of $OP that came into the market in May 2022, for example. Optimism took a two-house governance system comprised of the Token House and the Citizens’ House. $OP holders can participate in the Token House, where major financial decisions are made, including the ones on protocol upgrades, grant programs, $OP inflation, key personnel changes, and usage of the treasury. The members of the Citizens’ House are selected with $SBT and will be handling matters regarding the Retroactive Public Goods Funding (RPGF).

Second is the decentralization of the sequencer. OR uses the concept called slashing, much like the PoS blockchains. For anyone to participate as the sequencer to the rollup, they must deposit the fidelity bond as a sort of collateral, which is slashed as a penalty if they ever commit any malicious behavior such as double payment. Today, the OR solutions, including Arbitrum and Optimism, are operating their own sequencers. When tokens are issued, other players would also be able to participate as the rollups’ sequencers by depositing the L2 native tokens as the fidelity bond.

However, in 2023, many L2 projects are scheduled to release their tokens, including Arbitrum (4Q 2022 or 1Q 2023 expected), zkSync (2023 expected), and StarkNet (already deployed on November 17, but distribution and transaction support expected to take place in early 2023). Since most protocols use the newly issued tokens as a strong marketing tool to boost ecosystem activities, we may also want to keep a close eye on the trend of performance indices such as the network TVL post token issuance and how the token economics unfold after the initial distribution.

2-3. Modular Is the Mainstream! Projects Take After Ethereum

A. BNB Chain Is Following the Ethereum L2 Strategy

After the successful Merge, Ethereum is charging on to become a full-fledged modular blockchain with various L2 solutions also joining. Not only that, but other Layer 1 protocols are also actively adopting the modular blockchain format by benchmarking Ethereum or in their own way.

Binance Smart Chain (BNB Chain)

Binance Smart Chain, launched by Binance, the world’s number one cryptocurrency exchange, made fast growth by leveraging Binance’s wealth of human resources and capital. Binance Smart Chain is one of the few chains producing significant results after the Ethereum chain today. As of December 19, its TVL remains around USD 7.08 billion, about 10% of the total market share. Its cumulative revenue is recorded at USD 54 million, the third largest after Ethereum and Avalanche.

The chain also announced last September that it would launch a zk-SNARK-based ZK rollup. It completed the testnet launch in November and is targeting its mainnet launch within 1Q 2023. zkBNB was also designed to resolve BSC’s scalability issue and is expected to provide the following functions:

- Same Security as That of L1: The zkBNB shares the same security as BSC does. The security is also guaranteed cryptographically via the use of zkSNARK.

- Seamless L1-L2 Communication: BNB and BEP tokens created on BSC or zkBNB can be moved freely between the two chains.

- Fast Transaction Speed, Fast Finality, and Low Fees: zkBNB, putting BSC performance improvement as its first priority, showed off its ability to support 100 million addresses and up to 10,000 TPS. Also, zkBNB fees are paid in BEP20 or BNB at as low as 10-fold lower price.

With detailed plans about technical specifications undisclosed so far, the visibility into the specifics of the increase in TPS and reduction in gas fees after the launch is limited. However, it is evident that they expect the same impact as Ethereum’s L2 rollups. The key is whether Binance Smart Chain could keep up its competitive advantage going forward by adopting Layer 2 and securing scalability via zkBNB.

Binance is not alone on this journey. There are many other Layer 1s also striving to transform themselves into modular blockchains. For example, TRON acquired the Peer-to-Peer (P2P) file-sharing service, BitTorrent, last year and made an attempt to charge into the battleground of the L2 War. BitTorrent paved its way to evolve as a comprehensive Layer 2 solution with the launch of its BitTorrent Chain (BTTC) in December 2021.

Klaytn and Wemix have also announced their plans to improve scalability via L2 solutions. Although there are no updates on specific progress made so far, the fact that many projects are declaring their intentions to adopt Layer 2 chains left and right as a means to secure scalability reminds us that the modular blockchain is the way to go right now.

B. Cosmos Seeks to Set Itself Apart with Appchains

The Cosmos network is structured into a Hub and Zones. App-specific chains or Appchains, which are “zones” in Cosmos, are interconnected thanks to the Inter-Blockchain Communication (IBC) protocol officially live since April 2021. A total of 53 zones are connected via IBC today, with 49 of these zones activated and IBC’s cumulative transaction amount for the last month reaching USD 834 million.

Major players within the Cosmos ecosystem today can be briefly summarized below:

- Osmosis: The first Cosmos DEX launched in 2021. Osmosis acts as a liquidity hub that is connected to the assets across the entire ecosystem. Osmosis sets itself apart from other DEXs as it offers i) customized Automated Market Maker (AMM) algorithms and ii) superfluid staking. Users can make decisions and design their own AMM algorithms customized to their needs, selecting the type and ratio of tokens they want when creating a pool.

- Axelar Network: A cross-chain messaging protocol based on the Cosmos SDK. Axelar’s strong point is its superb scalability. Axelar Network supports around 30 major chains, including Ethereum, BNB Chain, Polygon, and Avalanche, and recorded a cumulative transaction amount of USD 1.6 billion.

- Juno: A Layer 1 based on the Cosmos SDK. Juno is an application-building platform equipped with interoperability between different chains. The mainnet was launched on October 1, 2021, providing a multi-chain smart contract environment by adopting CosmWasm. Over 30 projects are onboarded currently.

- Sei: A decentralized orderbook protocol based on the Cosmos SDK. Sei aims to become a DeFi hub within the Cosmos ecosystem as a DeFi-specialized Layer 1 that not only provides various features for dApps (such as its own order matching engine and its own price oracle) but also enables the use of both a virtual machine, CosmWasm, and a communication protocol, IBC.

It is also worth noting that there were barely any security breaches within the IBC ecosystem, considering the numerous bridge-related incidences that continued throughout 2021 (to be discussed further in the section below on bridges). In addition, Cosmos is preparing Interchain Security (ICS) to improve appchain security and token economics. This system involves a certain chain (mainly the Cosmos Hub at the moment) acting as a provider chain and providing security to consumer chains, who would then pay back with native tokens as rewards.

Although the attempt to introduce interchain security and staking liquidity system at the same time with ATOM 2.0 was dismissed by the community, unfortunately, various attempts to improve the ecosystem are continuing. After Ethermint and EVMOS, the idea that is gaining the most interest as of late is inspired by ZK rollups and proposes connecting IBC to Ethereum.

The Cosmos camp is deemed not only to have a competitive edge over the connectivity between blockchains but also with Web2. The market witnessed many existing Web2 players with the ability to secure their own users and security choosing Cosmos for their fast speed and scalability, such as Com2us, a major Korean gaming company (with KRW 800 billion market cap as of December 19); and Line, a messenger service by NAVER (with KRW 29.8 trillion market cap as of December 19) announcing their plans to launch their mainnets on Cosmos last August and December, respectively, following the footsteps of dYdX, a futures exchange previously based on Ethereum Layer 2.

2-4. Monolithic Blockchains Gearing Up for Counterattacks

Though the landscape looks like the modular blockchain camp, led by Ethereum, has won the L1 War of 2022, the monolithic blockchain camp still bears the torch to retaliate. The rivalry between Aptos and Sui emerged as the hot potato of the second half of 2022, and the eyes are on Solana to see if it would be able to reclaim its reputation after the struggle it endured in regard to the FTX debacle.

A. Monolithic 2.0: Aptos and Sui

Aptos and Sui projects are both new L1 blockchains derived from Meta’s blockchain endeavors that drew keen attention from all over the globe. The two blockchains are similar in that they both are ultra-high TPS L1 blockchains that seek to find scalability solutions on their base layer chains. However, their vision and approach to scalability enhancement, such as consensus algorithms and architectural design differ greatly. While Aptos is closer to an orthodox L1 per se, Sui brands itself as an object-centric blockchain with a development environment with much more freedom. For further exploration into the analyses and comparison of the two, please refer to the Xangle report, “Aptos vs. Sui Comparison: Similarities and Differences.”

In the year 2022, Aptos and Sui each achieved various milestones, as below. Both projects are highly competitive as the new monolithic L1 blockchains equipped with a high level of security, scalability, and convenience, based on outstanding developers, ample resources, and technological prowess. What is crucial is how the dynamic will unfold in the full-fledged competition for ecosystem expansion after their mainnets are launched. In this regard, both projects are showing great interest in the Korean market, as Aptos successfully secured a partnership with NPIXEL to build on its network, and Sui with Netmarble. All in all, it looks like Aptos is slightly ahead of Sui in the race. However, the game has only just begun.

B. Will Solana Be Able to Bounce Back?Will Solana Be Able to Bounce Back?

In the meanwhile, there is no argument the recent fall of FTX has cost Solana, the most representative monolithic chain of them all, its strongest supporters and left it in a lurch. FTX and Alameda Research under its wings have strongly driven the growth of Solana’s ecosystem, having participated in multiple funding rounds for Solana and actively investing in other Solana-based projects. FTX also gave much direct and indirect help in support of the Solana ecosystem’s growth as an exchange that most actively and enthusiastically listed Solana-based tokens, and operating Serum, a Central Limit Orderbook (CLOB) exchange as well as an NFT marketplace and Solana’s representative DeFi project. With FTX gone, Solana projects will face more difficulty attracting new investments and getting listed on major CEXs, and there is much less of an appeal for dApps to get onboarded on Solana.

Against this backdrop, Solana is embarking on its journey to stand on its own. In the past, Solana had been jeered at as a “VC Chain” in the crypto world for their close to 50% token distribution carved out for its team and investors for the initial funding round. So, the recent crisis could be a blessing in disguise as it serves as an opportunity to build decentralized governance and put more focus on the fundamentals. What the market can expect from Solana sans the VC support are as follows:

Strong Developer Community

Solana has a strong and firm developer community. What used to be a group of only 2,400 developers in August 2021 has rapidly grown 761% in a matter of one year to become an army of 20,717 by November 2022. Solana has the largest group of developers among Layer 1 blockchains, next to Ethereum right now. Such popularity is evident in the fact that the Solana Hacker House has risen to become one of the most sought-after blockchain events (with a total of about 64,000 participating in Solana conferences in 2022).

Remarkable Achievements in NFT Market

Solana achieved a remarkable performance in the NFT sector. Solana’s NFT market share is currently at the number two position among Layer 1 blockchains by transaction amount, having produced many of the highly recognized NFT projects, such as DeGods, y00ts, Okay Bears, Solana Monkey Business, and Degenerate Ape Academy (DAA). With Instagram recently announcing that it would support Solana NFTs, anticipation is rising for Solana to continue its growth in the NFT market in the future.

Continuous Improvements in Technology and Usability

It is also encouraging that Solana continues to make improvements in its technology and usability. For example, Solana recently successfully adopted QUIC (Quick UDP Internet Connection) and QoS (Stake Weighted Quality of Service) from the three ways to stabilize its network (QUIC, QoS, and local fee market) as announced in 1Q this year, and Solana’s smartphone, Saga, is well on its track for the launch in 1Q 2023. After Saga is launched, Solana is likely to overcome the limitations of having to offer Web3 services under the existing hardware and operating system and be able to offer a mobile-friendly Web3 environment.

It is also worth noting that there may be significant progress made in terms of network stability and decentralization once Firedancer is launched. Firedancer is a Solana validator client developed by Jump Crypto, with fewer bugs and faster transactions than existing clients. Lastly, the partnership Solana recently forged with Google Cloud on the blockchain node engine development will enable anyone to participate as a Solana node without having to go through all the complicated hoops and hurdles.

Creating a Modular Ecosystem with SVM (Sealevel Virtual Machine)

It is also an interesting development that L2 solutions, once thought of as mere relics of Ethereum, are being built on top of Solana. Solana’s Sealevel Virtual Machine (SVM) is quickly rising as the favorite choice for dApps demanding fast speed, with the ability to process transactions in parallel. Catering to such needs, SVM-based L2 solutions such as Nitro (a Sei Network-based Optimistic Rollup with SVM-compatibility) and Eclipse(an L2 solution enabling users to build SVM-based customized rollups) are also gaining attention.

2-5. In the End, Resolving the “Blockchain Trilemma” Is the Key

The modular method – increasing transaction speed and lowering gas fees by dividing blockchain functions to be handled by different chains – and the monolithic method – maximizing the blockchain’s performance to solve the scalability issue are not mutually exclusive concepts. Ultimately, they are simply different approaches to solving the same problem: the blockchain trilemma.

The blockchain trilemma refers to the impossible position we are in where the three main issues of blockchain – scalability, decentralization, and security – cannot be solved at the same time. While sacrifices would need to be made within the trilemma, and such sacrificial relationships among these three characteristics would not be changed by scaling up the triangle that makes up the trilemma, it would indeed increase the maximum size itself. In fact, this is the direction many of the chains are taking on.

In this regard, what makes or breaks the next L1 War would, of course, be which project can secure lower cost and high speed as well as security and decentralization. It seems that the modular blockchain camp, spearheaded by Ethereum to come out on top of the first L1 War and to forge alliances with the L2 camp, would dominate the market for the time being. For the year 2023, we would have to wait and see how other projects, each with their unique advantages and characteristics, such as Binance, Cosmos, and other monolithic blockchains, would secure scalability.

3. The Evolving Blockchain Ecosystem Infrastructure

The blockchain infrastructure sector struggled in 2022 due to the overall market downturn. Some sectors contributed to the market's downturn, while others have shown signs of aligning with the slump. 2022 was a record year for crypto hacks, bridges – in particular, Lock-and-Mint bridges* – being the prime target, accelerating the market downturn. The lock-and-mint bridges suffered the most from malicious attacks, exposing security risks as four of the five largest exploits during the year were bridge exploits. On the other hand, Oracle and storage networks are amongst the sectors affected by the market's decline. Oracle's TVS plunged amidst the overall industry deleveraging across DeFi, one of the major Oracle customers. Data storage networks are also on a steady decline, putting the narrative of decentralized NFT storage to shame. While MetaMask continues to attract more users, being one of the most popular wallets, Reddit surprised the crypto scene in 2022 as it launched an NFT-based marketplace that attracted millions of users to open the company's wallet. Though emerged as the meta to lead in 2022, DAOs failed to attract meaningful use participation and did not produce practical results.

*Lock-and-Mint bridges lock the original assets inside a smart contract on the sending side (A) while the receiving network (B) mints a replica of the original token on the other side.

3-1. Native Verification: Solution to Lock-and-Mint Bridge Exploits

Demand for cross-chain bridges is expected to slow down in 2023 – not only are Ethereum and Ethereum Layer 2 adoption booming but also the increasing number of Lock-and-Mint bridge exploits are exposing the bridges’ vulnerabilities. Blockchain bridges deployed today lack the strenuous testing necessary to ensure the technology’s stability and security. The demand for cross-chain asset transfers has risen sharply with the growth of alternative Layer 1 solutions called SoLunAvax. As a result, Lock-and-Mint bridges became immensely popular since they were simple, cheap, and did not require additional liquidity. However, since Lock-and-Mint bridges utilize a set of external verifiers, they are vulnerable to attacks. In the Ronin Network hack, five of the bridge’s nine validators had been compromised, and in the Wormhole hack, a flaw in the digital signature validation was exploited. The two incidents caused damage that amounted to over $2B.

In 2023, we expect that the native verification of cross-chain transactions will provide solutions to eliminate the structural risks of Lock-and-Mint bridges. Native verification requires each blockchain to create custom validators working within the other chain’s consensus mechanism. This approach could prevent exploits that the Lock-and-Mint bridges experienced as no external verifier set was introduced. As such, the crypto community has turned their attention to the natively verified blockchain bridge solution, and developers are putting hard efforts into developing the solution.

Near’s Rainbow Bridge and Cosmos IBC use native verification. As for Cosmos IBC, 53 independent blockchains are connected to Cosmos’s ecosystem, allowing increased customization and interoperability, and approaches have been introduced to bring Cosmos IBC to Ethereum. However, it will take some time for native verification of cross-chain transactions to be widely adopted for the following reasons: i) the number of users of Near and Cosmos, of which ecosystems use native verification, is less than that of Ethereum, and ii) the cost is high, and the transaction speed is low to run the solution.

3-2. Chainlink Maintains the Largest Blockchain Oracle

Total Value Secured (TVS) is a measuring stick of the adoption of price oracles. Chainlink has secured more than $70B TVS in early 2022, but the value has fallen 85% to $10B as of writing as the DeFi market suffered heavily from market volatility. However, the most popular oracle network Chainlink saw its market share increase even during the bear market. Oracle business tends to determine the growth of the oracle project depending on the growth potential of the ecosystem of the underlying mainnet. In 2022, Cosmos Oracle Band Protocol and Solana Oracle Pyth Network took a big hit, and as a result, the TVS of Chainlink, which is based on Ethereum-compatible EVM mainnets, has risen from a 79% at the beginning of 2022 to 90% as of writing.

In 2023, global companies chose the Ethereum ecosystem, particularly Polygon, for its security and stability. For this reason, we are looking forward to Chainlink’s further growth. It remains to be seen whether the publicly accepted equation of "Oracle = Chainlink" will stay unchanged in 2023.

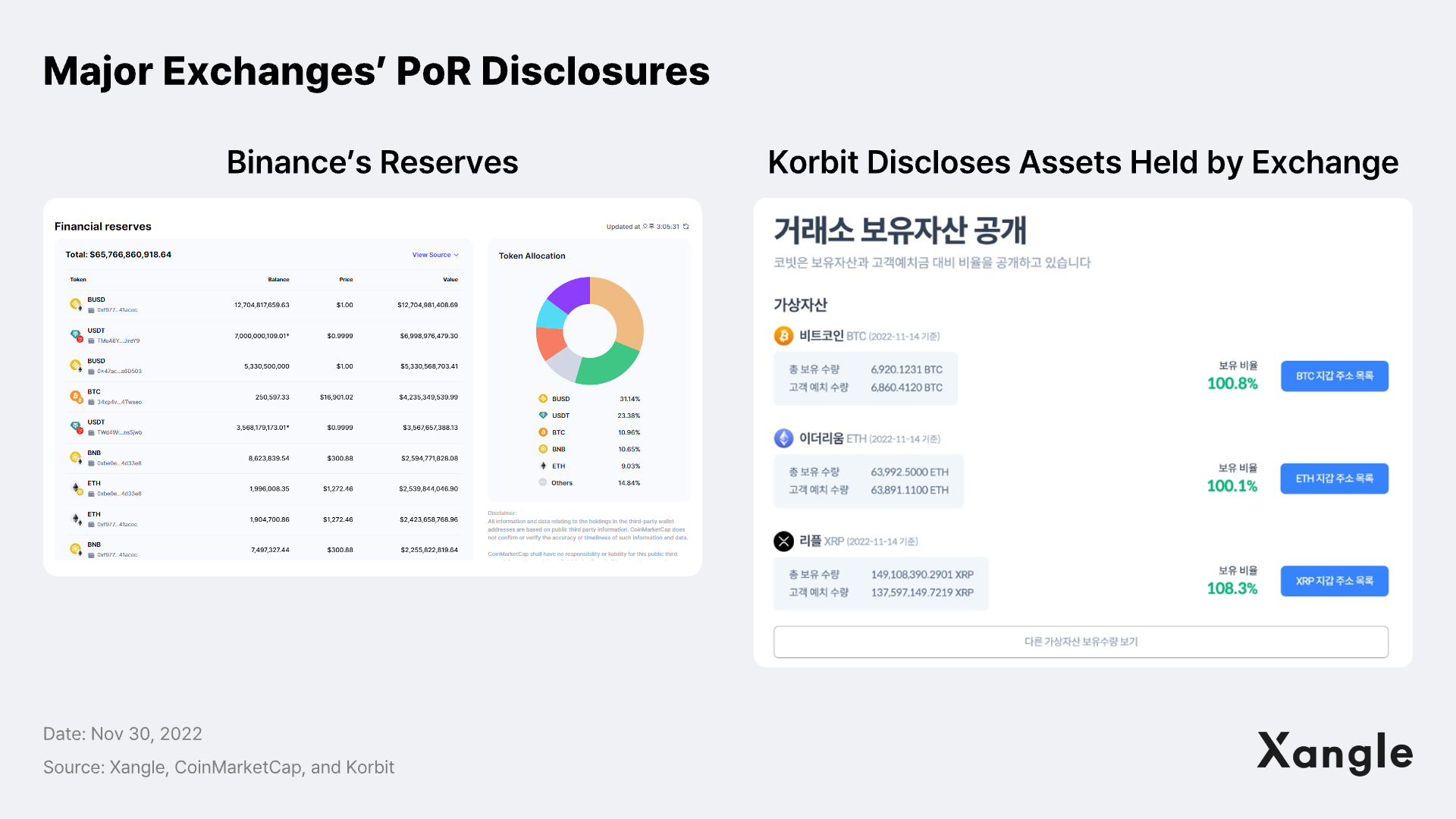

3-3. Chainlink to Serve as Secure Blockchain Middleware Beyond Oracle

Despite a severe market contraction of the oracle market in 2022, Chainlink managed to diversify its services, which drove the network’s growth amidst the bear market. Chainlink’s Verifiable Random Function (VRF), which can be utilized in dApps including NFTs and gaming, and the smart contract automation solution Chainlink Automation(previously “Keepers”), which relies on Chainlink’s Decentralized Oracle Networks (DON), are popular among dApps. Chainlink is pushing a new system called Proof-of-Reserve (PoR) to dApps, CeFi, and exchanges as a solution to crises like the FTX collapse. Aave DAO recently approved Chainlink’s PoR, specifically covering Aave v2 and v3 on Avalanche. The recent activity on Chainlink’s VRF requests rose sharply when the NFT-based strategy game Planet IX got released on the Polygon network, indicating that Chainlink is likely to expand further if the game’s usage continues to increase.

Chainlink is also preparing to release solutions such as Cross-Chain Interoperability Protocol (CCIP), a cross-chain bridge solution based on a decentralized oracle network, and Fair Sequencing Service (FSS), a Layer 2 sequencer decentralized service, in 2023. Chainlink is also continuing its research into DECO, a novel privacy-preserving oracle protocol. The roadmap and milestones indicate that Chainlink is broadening its services beyond oracle, and its expansion into comprehensive middleware infrastructure services is also expected to accelerate in 2023.

3-4. Decentralized Data Storage: Challenges and Prospects

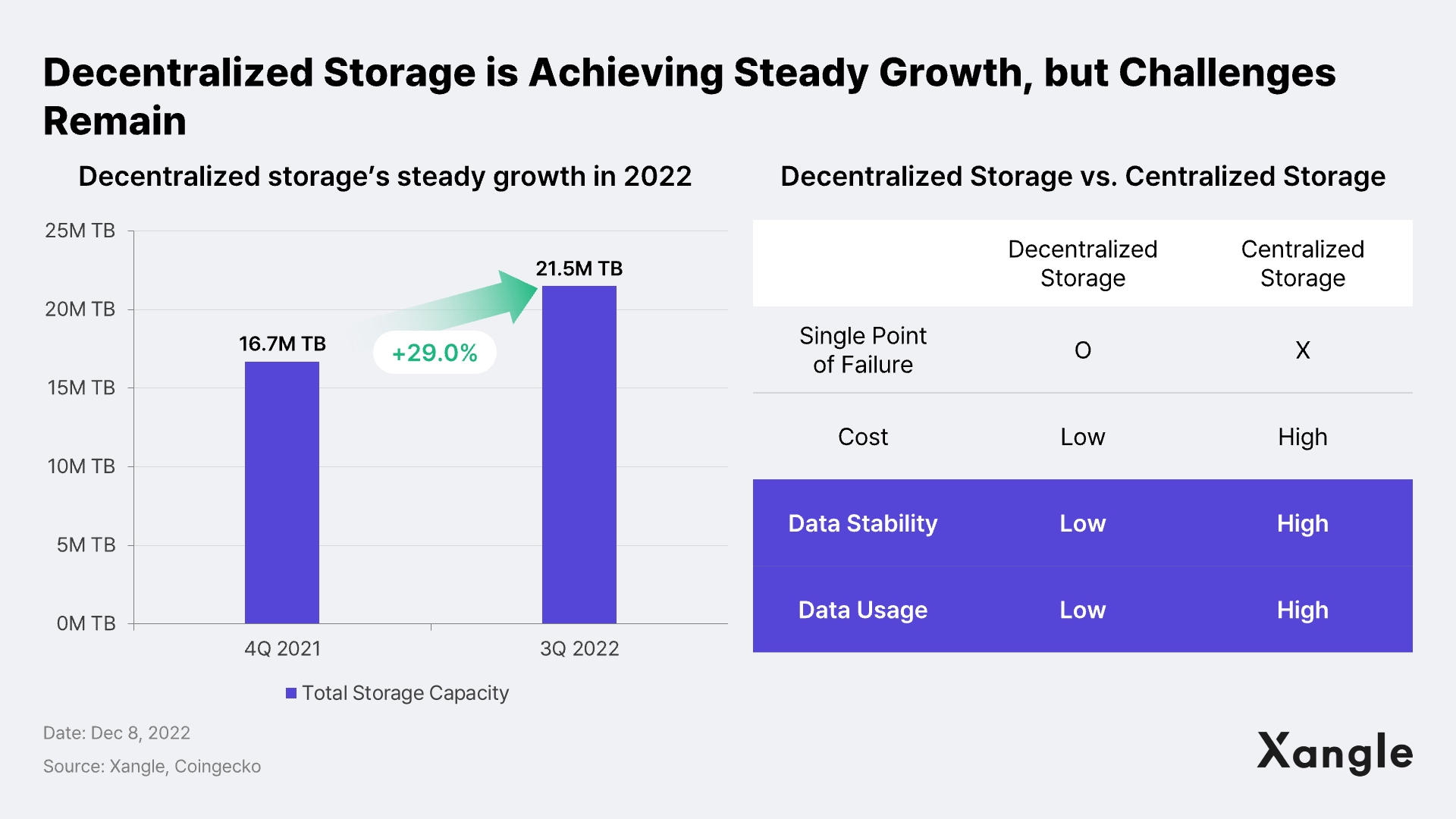

Though it fell short of delivering the narrative of decentralized NFT storage in 2022, the storage section made some progress this year. Decentralized storage does not have a single point of failure and does have low cost compared to centralized storage. Storage usage increased from 16.7M TB in 4Q 2021 to 21.5M TB in 3Q 2022, showing a growth rate of about 29%.

However, decentralized storage still presents two major challenges compared to centralized storage: the need for more stability and data utilization. For example, IPFS, on which the majority of NFTs are stored, is similar to BitTorrent – if the person who stores the file finds it not valuable enough to store a copy, the file will no longer be retained. Also, in terms of data utilization, centralized hosting services such as AWS and Azure store data and provide their own APIs to provide data analysis and machine learning. However, decentralized storage can only store data presently.

To tackle the technical obstacles, decentralized storages are working to apply data computing and programming, but it still needs to mature. Thus, the decentralized storage industry is unlikely to deliver what’s been promised in 2023. Filecoin, a leader in the sector, previously announced in 2022 that it would launch the Filecoin Virtual Machine (FVM) to bring smart contract programmability to the Filecoin storage network. FVM is expected to be officially launched in 2024 as the technology is in its nascent stages of development and has not yet been fully established. In this respect, the storage sector is unlikely to outperform the entire crypto market in 2023.

3-5. Crypto Custody Wallet: Improving the Drawbacks for Mass Crypto Adoption

Self-custody wallet, which allows users to take sole possession of their wallet’s private keys, has certain advantages. While a self-custody wallet presents clear benefits, the top non-custodial wallet Metamask did not enter the mainstream for the following reasons: i) UX issues, ii) web-based, and iii) management of independent seed phrases. For mass crypto adoption to take place in 2023, crypto wallets should work on improving their drawbacks, as new commers often find it difficult to navigate through them.

Multi-Party Computation (MPC) technology, most of which are semi-custodial, presents a solution to vulnerabilities of non-custodial wallets. MPC is a cryptography tool that allows multiple parties to make calculations using their combined data without revealing their individual input. MPC wallet divides a single private key among multiple parties, and more than n number of parties must agree for a transaction to complete. MPC wallets offer higher security as a hacker would need to attack multiple parties across systems. For this reason, BitGo, Coinbase Study, and other digital asset trust companies adopted MPC to reduce security risks. While MPC is mainly used by custodians that manage crypto wallets of institutional investors, the technology is likely to be used by various applications as it does not require seed phrases. The primary feature of MPC wallets like ZenGo is that they do not require long seed phrases but rather use facial recognition or email verification to further secure the user’s account. The aforementioned benefits of using MPC wallets indicate that it has the necessary elements for mass adoption, such as frictionless UX and password recovery functions.

Another wallet type that does not require a seed phrase is a smart contract wallet. This method has the advantage of excellent security in that the smart contract serves as a wallet, manages assets based on the smart contract, and supports compatibility with dApps. However, it is expensive to create and execute smart contracts, and an external wallet account (EOA, e.g., MetaMask) is required on the current Ethereum blockchain structure. The industry sees the smart contract wallet as the ultimate solution going forward but predicts it will take at least a year as the Ethereum design must be changed.

As mentioned earlier, many global companies are preparing to launch crypto asset services to deliver seamless UX backed by top-quality services in 2023. The integration strategy of crypto wallet services provides a glimpse into the future direction of the services – Nike and Meta will likely use the existing crypto wallet, whereas Reddit and Starbucks unveiled Reddit Vault and Starbucks Odyssey custodial wallets, respectively. While Nike and Meta non-custodial wallets place value in the ownership of users, Starbucks seems to have taken into account user convenience.

3-6. MEV: Network Activity is Key to Boost Validator Rewards

Ethereum’s transition to Proof-of-Stake (PoS) replaced crypto miners with Ethereum validators, reducing rewards for miners. This change has resulted in a 90% reduction in ETH incentives for miners, and as EIP-1559 always burns the base fee, block producers’ share further decreased. With less incentive, block producers naturally turned their attention to Maximal Extractable Value (MEV), and more and more validators adopted MEV-boosted blocks to receiving higher rewards. The graph below indicates that there has been a significant increase in cumulative MEV rewards on Ethereum in 2021.

Flashbots, a company that provides solutions to potential harms of MEV, claims that MEV will significantly boost validator rewards up to 60%. Block producers are expected to continue to execute MEV opportunities in the future as they can earn additional income through it. However, since 80% of all blocks are already using MEV solutions, it is unlikely that the size of the MEV market will increase rapidly, and it is expected that MEV profits will increase or decrease depending on the activity of the Ethereum network.

Flashbots make up the majority of the MEV-boost activity, followed by Flashbots, BloXroute, and Blocknative. As of writing, Flashbots accounts for 54.4% of the overall block production and 61.8% of MEV-boost block production. The numbers indicate that many of the Ethereum block proposed as of present used Flashbots’ MEV-boost. By censoring transactions, Flashbots complies with the Office of Foreign Assets Control (OFAC) sanctions, and many have raised concerns over such censorship and the potential risk of undermining censorship resistance. According to MEVwatch.info (as of Dec 20, 2022), 66% of all Ethereum blocks comply with OFAC sanctions. Flashbots appears to be complying with OFAC sanctions by censoring transactions associated with Tornato Cash. To mitigate MEV-driven validation centralization risk, the Ethereum Foundation has designed Proposer/Builder Separation (PBS), where block construction and block proposing are assigned to different roles, allowing everyone to validate regardless of their ability (less computing power or resources) to capture MEV.

Today, nearly all of the current MEV activity is Priority Gas Auction (PGA)-style and less than 10% of block producers extract MEV themselves. However, a small portion of the hash rate has been observed exploiting MEV themselves, revenue-sharing with traders, and selling access to private memory pools. As network activity increases, more block producers will participate in the MEV competition.

3-7. DAO, A New Structure to Keep Governance Decentralized

Decentralized Autonomous Organization, or DAO, seemed to garner the industry’s attention towards the end of 2021 amid the growing P2E market, but the price of almost all P2E games fell in 2022 as the bear market crisis hit the blockchain gaming industry hard. 2023 is expected to be the year of DAO centered on P2E with the introduction of more sophisticated forms of DAO backed by significant advancement in software and tools in various sectors.

P2E DAO: Fostering Sustainability and Community-Building

Approximately 30,000 YGG quarterly scholarship players were registered in the first quarter, growing nearly three times compared to the previous quarter. YGG still had 20,000 scholarship players in 3Q and recorded only -30% from its peak, which is considered a sound performance during the crypto bear market.

In addition, Merit Circle and GuildFi are also maintaining their value as game DAOs through continuous business expansion and partnerships. In particular, Merit Circle is taking the lead in the business model research on gaming guilds through active governance and working hard to build a durable game DAO in the crypto market. Given that both projects remain at a similar level in terms of AUM, DAOs will serve as an important infrastructure to secure the sustainability of the project from a P2E perspective.

DAOs are Becoming the Structure of Choice for DeFi and Web2 Organizations

1) SubDAO

number of SubDAOs skyrocketed at the end of 2022, and projects are expected to continue to take advantage of the new system in 2023. In Jan 2022, Bankless defined subDAOs as a way for a superDAO to localize an experiment with sufficient autonomy while keeping them aligned with the super DAO. P2E gamers have been actively forming subDAOs since the introduction of its concept, and some of the most popular DeFi solutions have been introducing more sophisticatedly designed subDAOs to operate more efficiently.

- MakerDAO’s Endgame v3: MakerDAO’s Endgame proposal focuses on creating MetaDAOs to ensure decentralization and stability. In Oct 2022, the community voted in support of the proposal, and this move will diversify MakerDAO’s stablecoin DAI reserves.

- dYdX DAO roadmap: In Nov 2022, prior to releasing the mainnet V4, the dYdX Foundation shared with the community the short-term roadmap for the dYdX DAO. The roadmap was proposed for the dYdX community to discuss and support the introduction of subDAOs. The proposal will be voted for on-chain to provide $DYDX as financial resources for each subDAO. dYdX intends to empower the community to launch additional subDAOs in the future for treasury and other areas.

Although the views of the two projects on subDAOs are different, it is worth noting that they have proposed their respective answers to ways to increase efficiency while maintaining a decentralized form of operation amid the growing size of each project. In MakerDAO's Endgame plan, the protocol proposed to split the DAO into subDAOs, each with its own governance token, which would enable MakerDAO to achieve maximal growth at the risk of price instability. Against this backdrop, the DeFi protocols' search for the ideal subDAO will continue in 2023.

2) Tools

Meanwhile, DAOs are becoming the structure of consideration for many traditional Web2 companies – in this context, lowering the entry barrier for mass DAO adoption has become critical. There are several DAO tools built to address needs within the DAO ecosystem.

Let's take a look at some of the representative DAO tools.

- Aragon: Aragon provides a full end-to-end framework to build DAOs. Its governance model supports tools for on-chain/off-chain decision-making, tokenomics, dispute resolution, voting, and governance on a chosen blockchain. Aragon is an easy-to-use open-source software used to maintain and create DAOs.

- Gnosis Safe: Gnosis Safe is a smart contract wallet that allows users to store, manage, and transfer digital assets and tokens on Ethereum. It is a multisig wallet that guarantees asset security. DAO organizations can easily manage private keys through Gnosis Safe.

- Snapshot: Snapshot is a decentralized voting system. Snapshot supports various voting types to cater to the needs of DAOs. Creating proposals and voting on Snapshot is free as the process is performed off-chain. Voting power can be calculated with ERC20s, NFTs, and others.

- Commonwealth: Commonwealth is an all-in-one governance platform for on-chain communities to make proposals, discuss, Snapshot, on-chain voting, and network analysis.

- Tally: Tally is a platform that builds governance infrastructure for Ethereum-based DAOs. The platform offers governance tools and services, including spending and correcting budgets.

- Pol.is: Pol.is is a real-time system for gathering and analyzing data. It is an open-source software using an algorithm designed to analyze participants' opinions and interests and visualize the group dynamics. It is a helpful tool for communities to better understand each other.

4. Blockchain Content Never Ceases to Evolve

Despite the macroeconomic headwinds, content available on the blockchain has constantly pushed its boundaries along with the advancements introduced in the blockchain infrastructure. In particular, most notable use cases were found in gaming, DeFi, and NFT segments with NFT being at the forefront in the quest for mass adoption. Web3 social media platforms, e.g., Lens Protocol, Mirror, and Minds, also have potential to grow into a bigger market, but will likely take some time before they are finally able to replace existing social networking services. On a more positive note though, there has been an increased interest in Web3 social media since Elon Musk banned links promoting other platforms, including Facebook, Instagram, Mastodon, and linktre.ee, on Twitter.

4-1. Despite the Brimming Potential, Anticipation Should Be Kept Low Key at Least Until the End of Next Year

Given the hype about the blockchain games, it may not be an overstatement to say that the first half of 2022 was the year of metaverse and P2E. The craze has calmed down before long though as the public who looked for a Ready-Player-One like future were disillusioned, and P2E games like Axie Infinity and Mir4 began to suffer structural limitations. The short-lived Axie Infinity’s glory, however, inspired many mid-to-large game companies to tap their strength and IP resources to jump start blockchain game development. Web3 game companies, regardless of the market environment, keep pushing ahead with gaming initiatives with enough runways. Although lower than 4Q21, the blockchain gaming & metaverse sector raised $7B up until 3Q this year, representing more than 50% in the entire crypto market. This apparently indicates that the institutional interest in the sector is holding up strong.

So yes, the potential of this market is obvious: blockchain technology is widely applicable in games, high quality games will soon be released, and there is even a steady stream of investments. Yet, it seems prudent to keep our reaction low key and take a more conservative approach at least until the end of next year. Not to mention the blockchain gaming market is an uncharted wilderness that came into the spotlight only less than 2 years ago (development of an AAA level game takes 24-36 months), the games have not been able to strike a balance to satisfy all key stakeholders in this business—investors, gamers, and developers—since the fall of P2E games. Given a seemingly endless testing and market’s judgement that always precede a successful game, the blockchain gaming market needs time to bloom.

A. Overseas: Web3-Native Game Companies Leading the Market