Translated by Rhea

Table of Contents

1. DAXA Announces Delisting of WEMIX

2. WEMIX Platform Business to Inevitably Suffer from the Delisting

3. Korean Gaming Companies’ Blockchain Adoption to Be Stunted as Well

4. Heightened Need for Clear Regulatory Guidelines and Real-Time Surveillance System for Circulating Supply

1. DAXA Announces Delisting of WEMIX

Last evening, on November 24, the Digital Asset eXchange Alliance (DAXA) announced that they have come to a final decision to delist WEMIX, operated by WEMADE. Since being flagged with an “Investment Warning,” WEMIX had successfully pulled its price up momentarily by securing investments from Microsoft. However, since the decision to delist was announced, the price of WEMIX tokens has taken a nosedive by over 70% compared to the day before.

The reasons for WEMIX delisting disclosed by DAXA and the analysis by the Xangle Research team are as follows:

1) WEMIX's Contravention of Its Circulation Plan

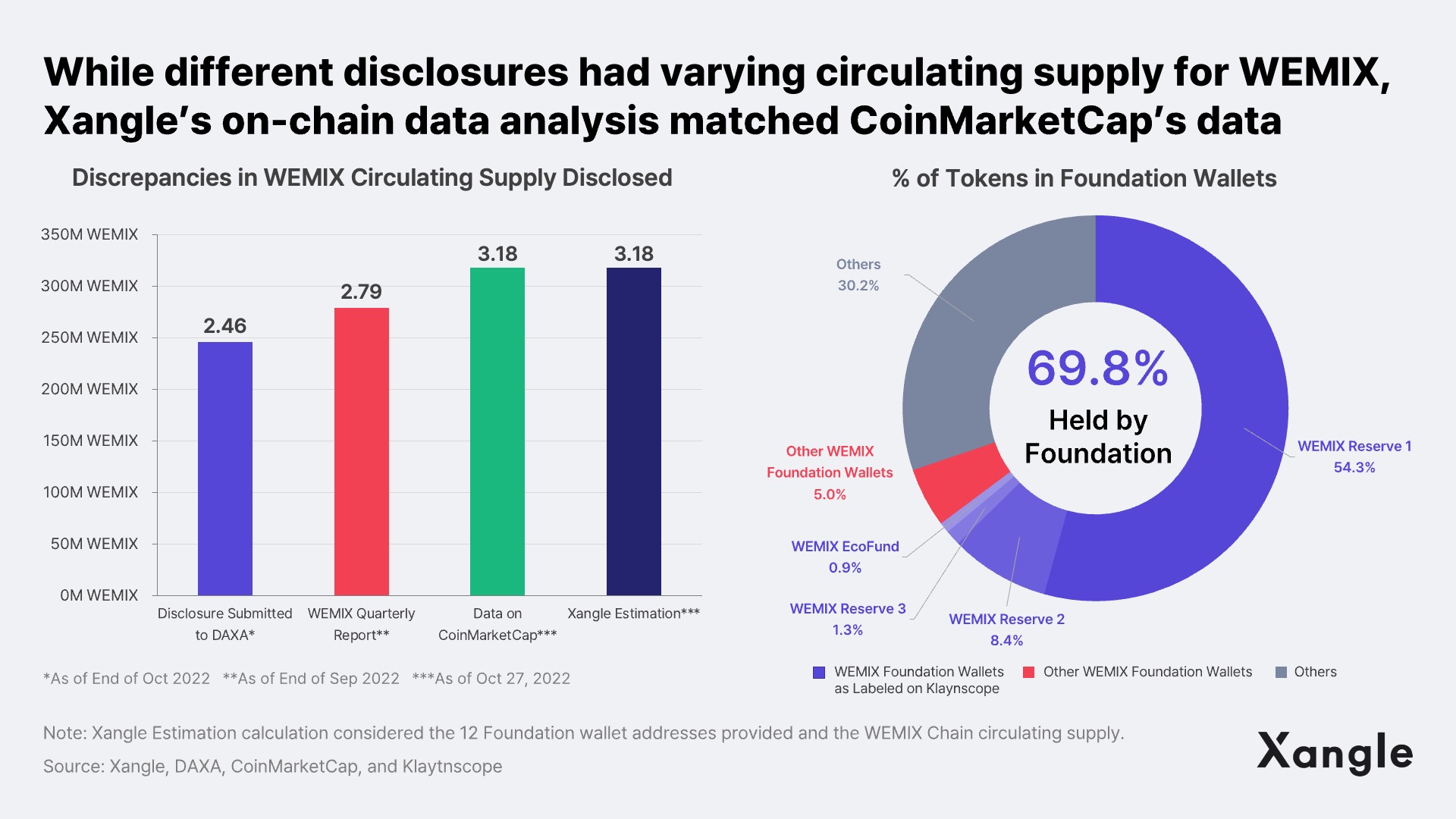

DAXA determined that the amount in excess of what was stipulated in the circulation plan submitted by WEMIX to DAXA member companies was significant as of when WEMIX was flagged with an Investment Warning, and that it amounts to a serious issue. As mentioned in the Xangle research article, "Issue Comments - WEMIX Flagged with an Investment Warning" (avaiable in Korean) published last October 28, discrepancies were found regarding the circulating supply of WEMIX as in the disclosure submitted to DAXA, WEMIX’s quarterly reports, and the Xangle analysis. (Please refer to the data below.)

The amount of circulating supply stated on the disclosure submitted to DAXA and the actual supply differed by about 70 million tokens. The main reason for such discrepancies was that 68.5 million WEMIX tokens – 6.5% of the total supply – were withdrawn in the month of October from WEMIX Reserve 1, the wallet which held the most WEMIX tokens. Of this amount, 35.8 million WEMIX tokens were used as collaterals to the KSD (a stablecoin) loan from Kokoa Finance, a DeFi service. WEMIX swapped the 16 million KSD borrowed to oUSDC, and converted them to KLAY via KLAYswap, another DeFi service. And, finally, the amount was transferred to a Binance account.

WEMIX also may have thought that further clarification and recovery to the original figure were needed in this aspect. Such can be construed from WEMIX’s effort to align its view on its circulating supply with the exchanges’ since it was flagged with the investment warning, by repaying the KSD loan from Kokoa Finance over three rounds of payment, which include 1) 4.5 million KSD from the resources obtained by AQX investment secured on November 4, 2) 2.2 million KSD financed from investments secured on November 8, and 3) 9.4 million KSD from collecting some of the liquidity provided to the DeFi protocols on the WEMIX mainnet. Then, a total of 63.4 million WEMIX tokens – including 27.6 million WEMIX set aside in case of liquidation and 35.8 million WEMIX collateral repayment – were retrieved to WEMIX Reserve 1.

In fact, in the WEMIX statement to recent investment warning from DAXA issued on October 30, WEMIX stated that “the WEMIX Team thought that the deposited amount was not included in the circulating supply calculation because it was not circulating in the market” and that “since then, [WEMIX] have confirmed that there is a disagreement with the exchanges, and [WEMIX] updated the […] figure […] by actively reflecting the exchanges’ opinion that this should be viewed as a circulating supply.”

2) Providing Inadequate or Misleading Information to Investors

As its second reason, DAXA mentioned that WEMIX had provided misleading information to the investors through medium and DART notices, and caused confusion among investors by publishing unconfirmed information about whether DAXA will terminate support for the trade on multiple occasions via press releases.

Although it has not been disclosed which part of the information released was specifically “misleading,” applying different sets of rules in defining what constitutes liquidation on Medium and DART could have been the primary issue. In its Medium posting on 3Q 2022, WEMADE announced that no WEMIX was liquidated in 2022. However, in the 3Q 2022 Quarterly Report disclosed on DART, KRW 146 billion was recognized as cumulative unearned revenue from the “liquidation” of WEMIX tokens. When a controversy arose, questioning if what was on the DART report signified that WEMIX tokens were liquidated, WEMIX changed the footnote to stipulate that the unearned revenue was as per “liquidation and payment” in its corrective disclosure announcement. This is to mean that the liquidation was not from direct sales of the tokens but from indirect “payments” of WEMIX to its investees in the form of investment. However, considering that the unearned revenue accounts for “what was received in advance before providing services” and that the WEMIX tokens the investor companies received will eventually be unloaded into the market, DAXA is likely to have taken this disclosure into consideration when making their decision.

The “publishing unconfirmed information about whether DAXA will terminate support for the trade” may be referring to the comments made by Chang, Hyun Guk, CEO of WEMADE, where he stated that “[he] thinks there is no possibility of WEMIX being delisted.” Chang even held an online press conference on November 2 where he confidently stated that “Since the first and foremost duty of DAXA is to protect good investors, I find it difficult to imagine they would delist [WEMIX] and do not think there is even a possibility of it.” Moreover, he even revealed what he was thinking inside, which was that it would be hard for Korean cryptocurrency exchanges to delist such a sizable project like WEMIX since exchanges get most of their revenues from transaction fees. Unlike MovieBloc, which immediately made an apology statement on the token’s circulating supply disclosure and bought back the excess supply, WEMIX had previously expressed there were no material concerns regarding delisting via press coverage. Such actions were deemed to have caused confusion for the investors.

3) Undermined Confidence on WEMIX Due to the Submission of Inaccurate Data during Vindication Period

Last on the list of reasons DAXA gave was that several inaccuracies were found in the data submitted during the vindication or clarification period and that unprecedented events and situations took place, such as multiple corrections or changes made to vital information about the circulating supply, which made it very difficult to recover the trust in the project’s ability to identify and manage important internal information.

When WEMIX updtated its circulating supply figure on CoinMarketCap, it was discovered that even the project itself failed to properly manage the circulating supply data either, as 1) tokens burnt and 2) the movement between wallets owned by the Foundation were also erroneously calculated as a part of its circulating supply, on top of the tokens provided to Kokoa Finance as collateral. While it can be presumed that an extensive vindication or justification process was undertaken, having extended the Investment Warning period two times, DAXA seems to have determined that the process did not go smoothly.

2. WEMIX Platform Business to Inevitably Suffer from the Delisting

As the delisting furthers uncertainties about the WEMIX platform business, it is expected to stunt the growth of various blockchain businesses. WEMIX has been fueling its growth by liquidating or getting a loan with the WEMIX tokens to finance its investments into gaming companies to be onboarded on the WEMIX platform or projects that can generate great synergy with the WEMIX ecosystem. WEMIX secured about KRW 289 billion by liquidating WEMIX tokens in 1Q, which has been used in full to expand its ecosystem, such as funding various partnerships and investments. Included in such partnerships and investments are gaming companies such as WEMADE PLAY (former SundayToz) and NDREAM, and metaverse companies such as Metascale and Envisible.

However, the recent delisting is expected to put the brakes on such a growth strategy. Over 90% of WEMIX tokens are traded through Korean exchanges, and its price plummeted over 60% yesterday alone, severely limiting its market liquidity. Of course, the delisting from Korean exchanges will also likely influence its listing status in overseas exchanges that value token management rules. In fact, Bybit has even posted a warning that “WEMIX didn't meet the requirements of Bybit Token Management Rules and it may be delisted” after WEMIX was delisted from the Korean exchanges. Right off the bat, it will likely cripple the plans to onboard 100 gaming companies in 1Q 2022.

3. Korean Gaming Companies’ Blockchain Adoption to Be Stunted as Well

Korean blockchain gaming companies can also expect to take a blow from the WEMIX delisting. Unlike other Korean gaming companies that had been adopting blockchain piecemeal on a test level, WEMADE had been pouring in massive capital and human resources and working hard toward developing the blockchain ecosystem. The recent mayhem with the delisting can impact the gaming companies gearing up to adopt blockchain. Furthermore, the confidence in the overall blockchain P2E game market may also drop if crypto investors leave the scene, hit with the WEMIX delisting. Since the incident, the prices of other gaming coins issued by gaming companies such as Netmarble’s MarbleX (MBX) and Kakao Games’ Bora (BORA) have also immediately dropped 5 to 15%, reflecting the market reaction to such concerns.

4. Heightened Need for Clear Regulatory Guidelines and Real-Time Surveillance System for Circulating Supply

While the issue with WEMIX tokens was concluded with the decision to delist the asset from the exchanges, something like this could happen again at any given time. To avoid going down the same road again, a clear standard for circulating supply has to be established, guidelines for disclosures and such need to be proposed, and a surveillance system must be set up to monitor the circulating supply in real-time. Currently, there is no standard commonly used for the circulating supply in the crypto asset market. [Please refer to a Xangle Academy article, "Coin Issuance Volume and Coin Circulating Supply" (available in Korean.)] There is no mandatory disclosure system as with the stock market either. This allows circulating supply volume to increase and decrease freely as the wind blows, and for too frequent unfair trading practices to take place due to the information gap.

The market is likely to highlight the importance of having a definition of circulating supply and transparent disclosure, as well as the on-chain tools that can check these data. If people did not have to simply rely on the information disclosed by the projects but could also verify the facts on the chain themselves, it would build stronger trust between investors and projects. To aid in such endeavors, Xangle prepared its own on-chain service – Live Watch – that monitors the data concerning the circulating supply on the chain in real-time, scheduled to launch at the end of the year or early next year. We hope this service will help alleviate information asymmetry and protect crypto investors by increasing data transparency.

Since the Terra-Luna crisis last May, the government is also leading the way in setting up conditions where investors can safely make their investments in crypto markets, in addition to its efforts to solve the taxation issues. While the Act on Reporting and Using Specified Financial Transaction Information was focused on preventing money laundering, the legislation bills currently in discussion in the National Assembly are concerned with preventing unfair trading in the crypto market and protecting investors. As the crypto market grows in its scale, regulatory adoption is also on a steep rise. Interests are high to see whether the regulations will be established in a rational and reasonable manner and serve as a momentum for the crypto market to take another leap.