Table of contents

1. Why the Aptos Ecosystem Deserves Renewed Attention

2. DeFi

2-1. Echo Protocol - Bitcoin liquidity protocol

2-2. Hyperion - The high performance DEX powering Aptos

2-3. Kana Labs - A seamless on chain perpetuals exchange

2-4. Kofi Finance - Liquid staking for APT

3. Game

3-1. Cattos - Telegram based GameFi on Aptos

4. Social

4-1. Rewardy - The social wallet that introduced Quest to Earn

1. Why the Aptos Ecosystem Deserves Renewed Attention

The Aptos ecosystem is once again drawing renewed attention from the market, propelled by a series of upcoming Token Generation Events (TGEs) from leading projects and the strategic debut of Shelby, Aptos Labs’ own decentralized storage protocol.

A key milestone came on July 2, when Echo Protocol, a Bitcoin liquidity and bridging solution, successfully completed its TGE becoming the first Aptos-based project to be listed on Binance’s Alpha program. The momentum has since continued to build, with major Aptos native DeFi protocols such as Hyperion and Kana Labs preparing for their own token launches, further amplifying market anticipation.

The recent unveiling of Shelby by the Aptos Foundation also marks a notable pivot toward long-term infrastructure expansion. Shelby is more than a file storage layer it introduces differentiated technical features, including a read based incentive mechanism, micropayment channels, and Clay Code based erasure coding. These design choices hint at the protocol’s ambition to go beyond storage utility and embed itself into the economics of the Aptos ecosystem. Market speculation has already begun around a potential token launch, with comparisons drawn to other decentralized storage projects that command substantial fully diluted valuations. As of July 3, Filecoin’s FDV stood at $5 billion and Walrus’s at $2 billion suggesting that Shelby could hold similar economic significance within Aptos.

For a deeper dive into Shelby, see Xangle’s report, “Shelby Drives New Momentum for the Aptos Ecosystem.”

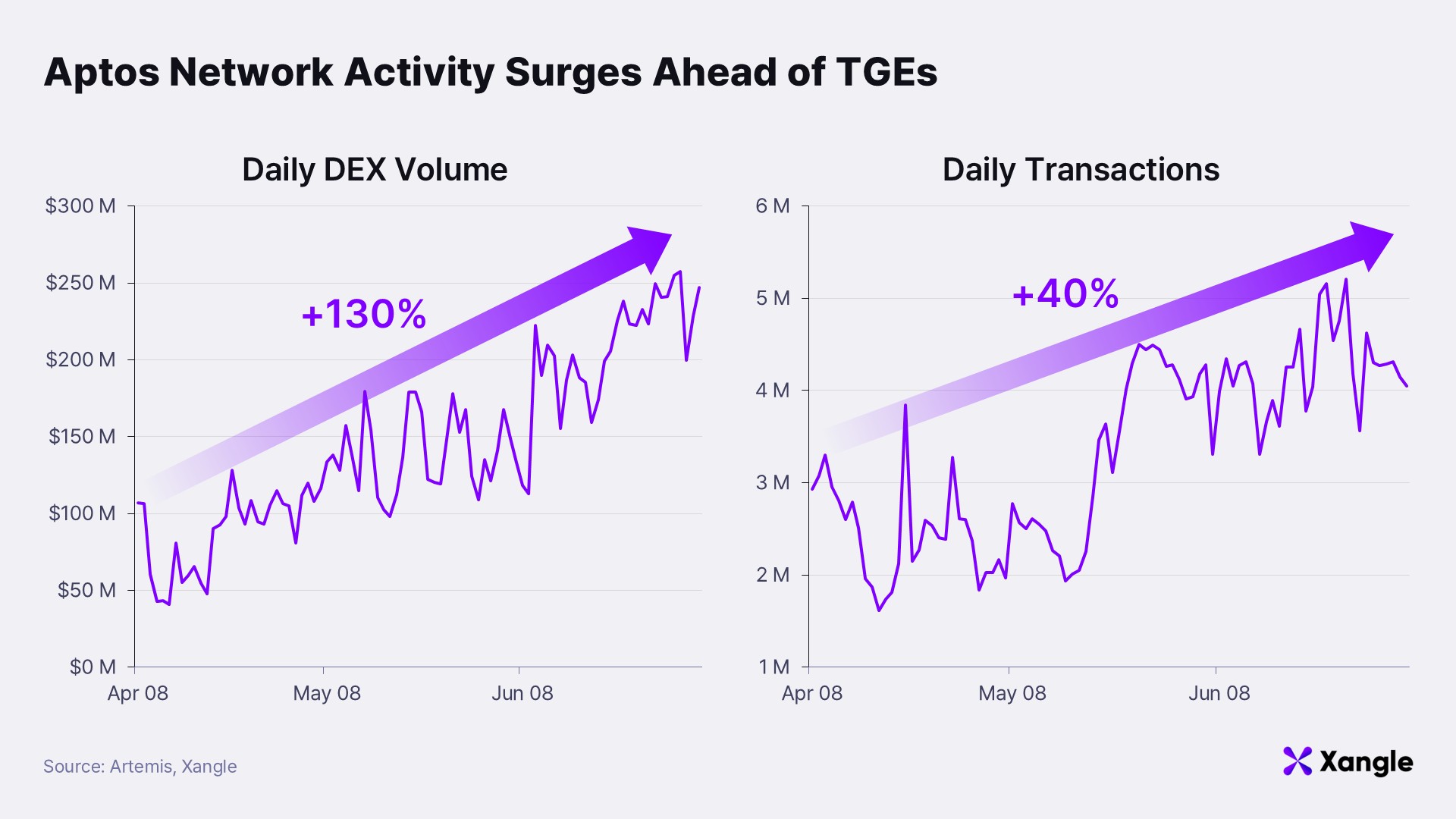

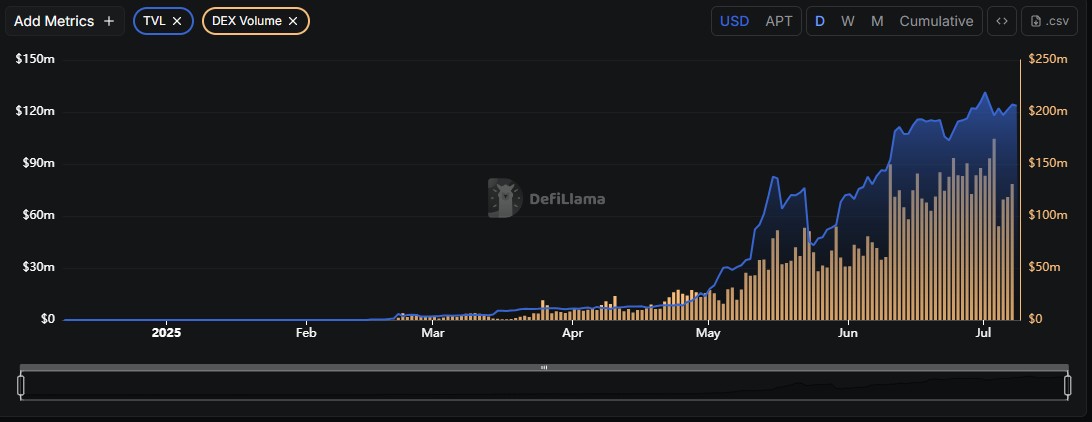

TGEs represent more than isolated token releases. They act as structural triggers that stimulate user acquisition, capital inflow, on chain activity, and network fee generation all of which compound to accelerate ecosystem growth. Aptos is already exhibiting signs of this pattern. As of July 8, daily DEX trading volume on the network reached approximately $250 million up 130% over the prior three months. During the same period, daily transaction counts climbed to around 4 million, representing a 40% increase. When measured from the lowest point within that timeframe, the rise exceeds 100%.

These metrics illustrate that on-chain activity within Aptos is materially increasing, coinciding with the wave of TGEs from major ecosystem dApps. Against this backdrop, the following sections spotlight key projects driving Aptos’s next growth phase along with the network effects and opportunities that may emerge in the process.

2. DeFi

2-1. Echo Protocol - Bitcoin liquidity protocol

TGE completed / Airdrop distributed

Echo Protocol Strategy 🪄

- Users who deposit BTC receive aBTC at a 1:1 ratio. Echo provides both lending and liquid staking services, enabling multiple yield streams and point farming opportunities.

- The Echo Points program is live, alongside a campaign offering up to 5× bonus rewards.

- Suggested strategy:

- Deposit BTC on Echo → 1.7% APY + points

- Stake the received aBTC into Echo Lend → 0.004% APY + points

- Use the staked aBTC as collateral to borrow more aBTC, then re deposit or deploy in DeFi to maximize returns

⚠ Note: Leveraged positions carry liquidation risk in the event of significant price drops. APYs are subject to change depending on protocol conditions.

About Echo Protocol

Echo Protocol is the first Bitcoin bridge and liquid staking platform within the Aptos and Move ecosystem, offering yield opportunities on both BTC and APT. Users can onboard BTC to Aptos and immediately earn a base APY of 1.7% simply by depositing. As of now, aBTC accounts for around 60% of all bridged assets on Aptos, with Echo’s total value locked (TVL) reaching approximately $650 million.

Echo successfully completed its Token Generation Event (TGE) for the native token $ECHO on July 2, becoming the first Aptos project listed on Binance’s Alpha program. The protocol achieved a fully diluted valuation (FDV) exceeding $70 million, reflecting strong market validation. Echo’s success lies in offering more than just a bridge. it enhances Bitcoin’s DeFi utility within Aptos by unlocking meaningful on chain use cases.

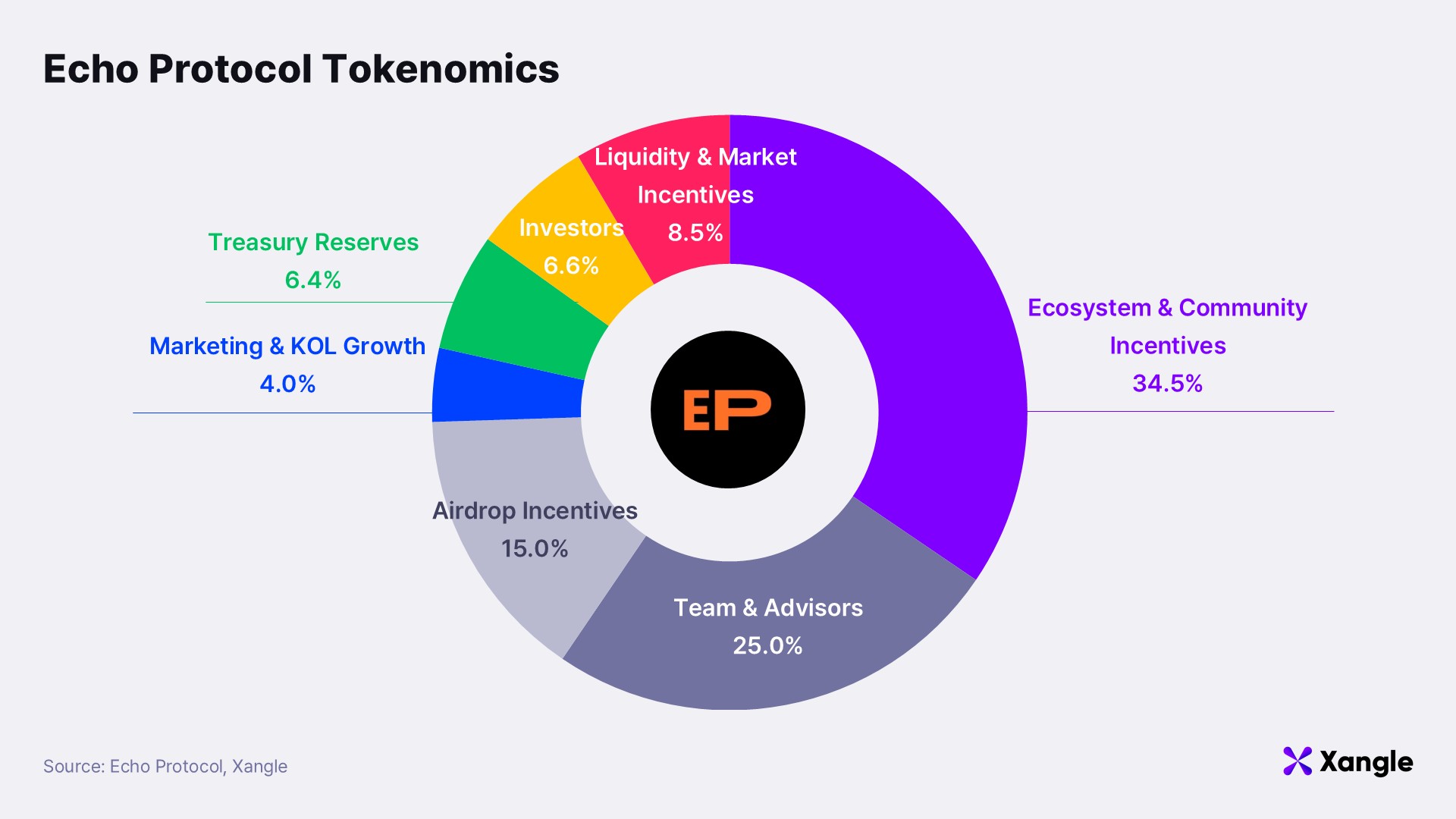

The project’s tokenomics further strengthen its long term viability. Echo employs a lock based model in which users who stake $ECHO receive $twECHO, a time weighted utility token that serves as the basis for revenue sharing. Those who lock $twECHO for an extended period can convert it into $vetwECHO, which grants governance rights and control over lending pool incentive allocations.

Echo’s token allocation also reflects its ecosystem focused growth strategy: 34.5% of the 1 billion total supply is dedicated to ecosystem and community incentives, while 15% is reserved for airdrops. Other portions are allocated for liquidity, investors, treasury, and marketing. With a sizable allocation toward growth, Echo is well positioned to further scale within Aptos.

2-2. Hyperion - The high performance DEX powering Aptos

TGE and Airdrop Upcoming 🔥

Hyperion Strategy 🪄

- Users can accumulate Drip points through trading and liquidity provision likely qualifying them for future airdrops.

- Liquidity providers earn 5 Drips per $100 per day. Traders earn 1 Drip per $0.01 in swap fees.

- Example:

- Deposit $500 in the APT–USDC pool with a 0.05% fee tier → 25 Drips/day

- Execute swaps that generate $0.01 in fees → 1 Drip earned per swap

- The pool currently offers an APR of 182.6%, making it highly attractive for yield seekers

⚠ Current APRs include Hyperion’s incentive rewards and are subject to change.

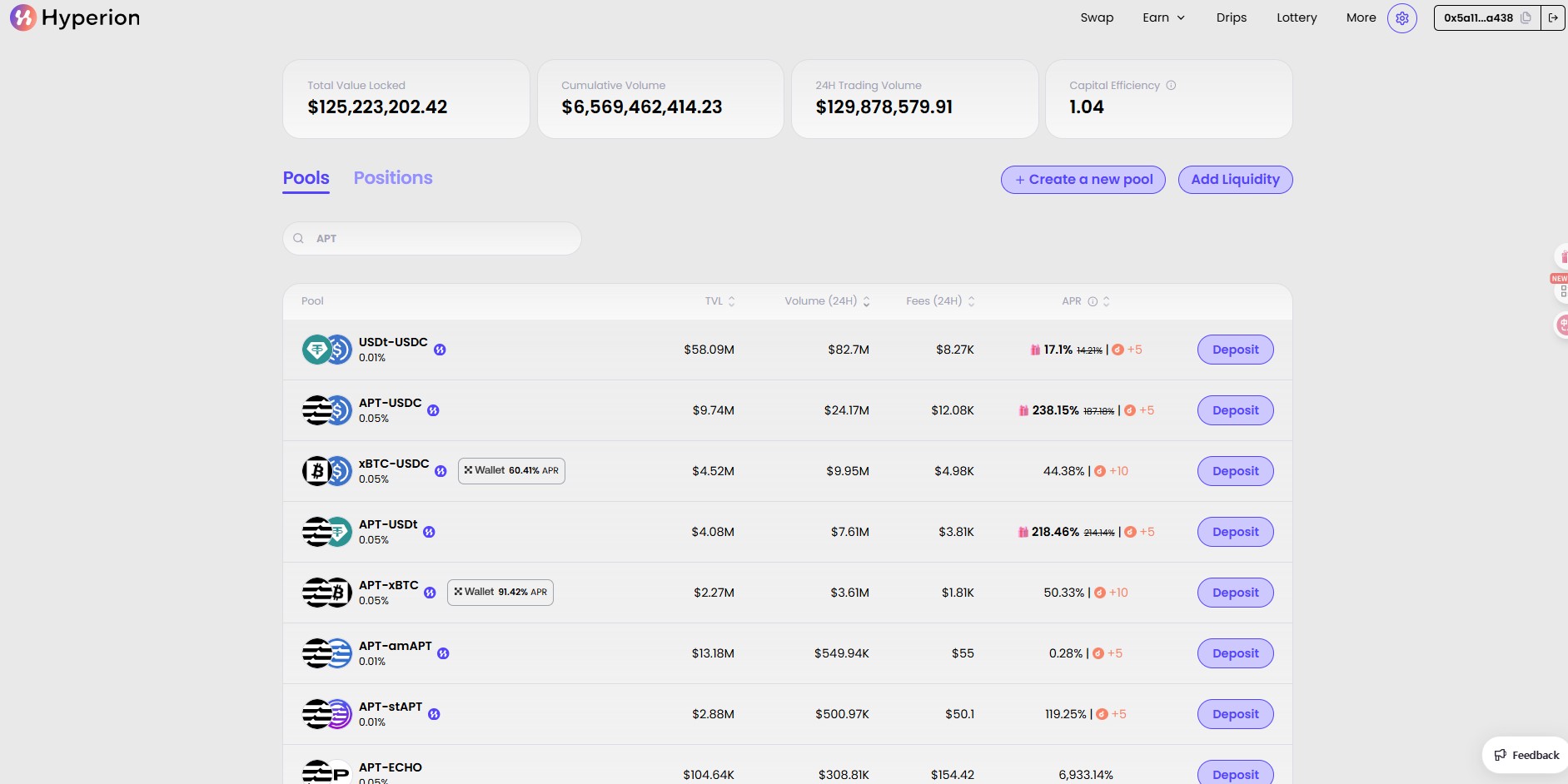

About Hyperion

Hyperion is a next generation decentralized exchange (DEX) on Aptos that merges an order book model with a concentrated liquidity AMM (CLMM), delivering a highly optimized trading environment for both retail users and professional traders.

The order book infrastructure allows for precise order placement and execution priority, while the AMM component simplifies liquidity provisioning and swaps. Under the CLMM architecture, liquidity providers can target specific price ranges, enhancing capital efficiency and maximizing fee capture. This dual mechanism effectively mitigates issues commonly faced by legacy DEXs, such as high slippage and underutilized liquidity.

Since its launch, Hyperion has quickly established itself as a core trading venue within the Aptos ecosystem. As of July 3, the platform had achieved $174 million in daily trading volume, while its TVL surpassed $130 million within just seven months underscoring both user traction and capital inflow. Hyperion’s emergence adds a critical layer of high performance infrastructure to the Aptos on chain economy.

Part of this growth is attributed to direct backing from the Aptos Foundation’s LFM program an accelerator initiative supporting real-use projects ahead of their TGEs. LFM provides resources spanning ecosystem integration, growth strategy, and launch execution. Echo Protocol’s earlier success in securing a Binance Alpha listing and defending its FDV under LFM guidance suggests Hyperion may follow a similar trajectory, particularly regarding major exchange listings and sustainable Tokenomics.

2-3. Kana Perps - A seamless on-chain perpetuals exchange

TGE and Airdrop Upcoming 🔥

Kana Perps Strategy 🪄

- Developed by Kana Labs, Kana Perps is a perpetual futures exchange designed to make trading accessible to everyone, with a smooth onboarding experience.

- How to get started:

- Click "Connect Wallet" on the homepage and link your Petra Wallet

- Deposit USDT into the Kana Perps Trading Account

- Click "Enable Trading" and approve the wallet signature request to activate trading

- Begin trading with up to 20× leverage

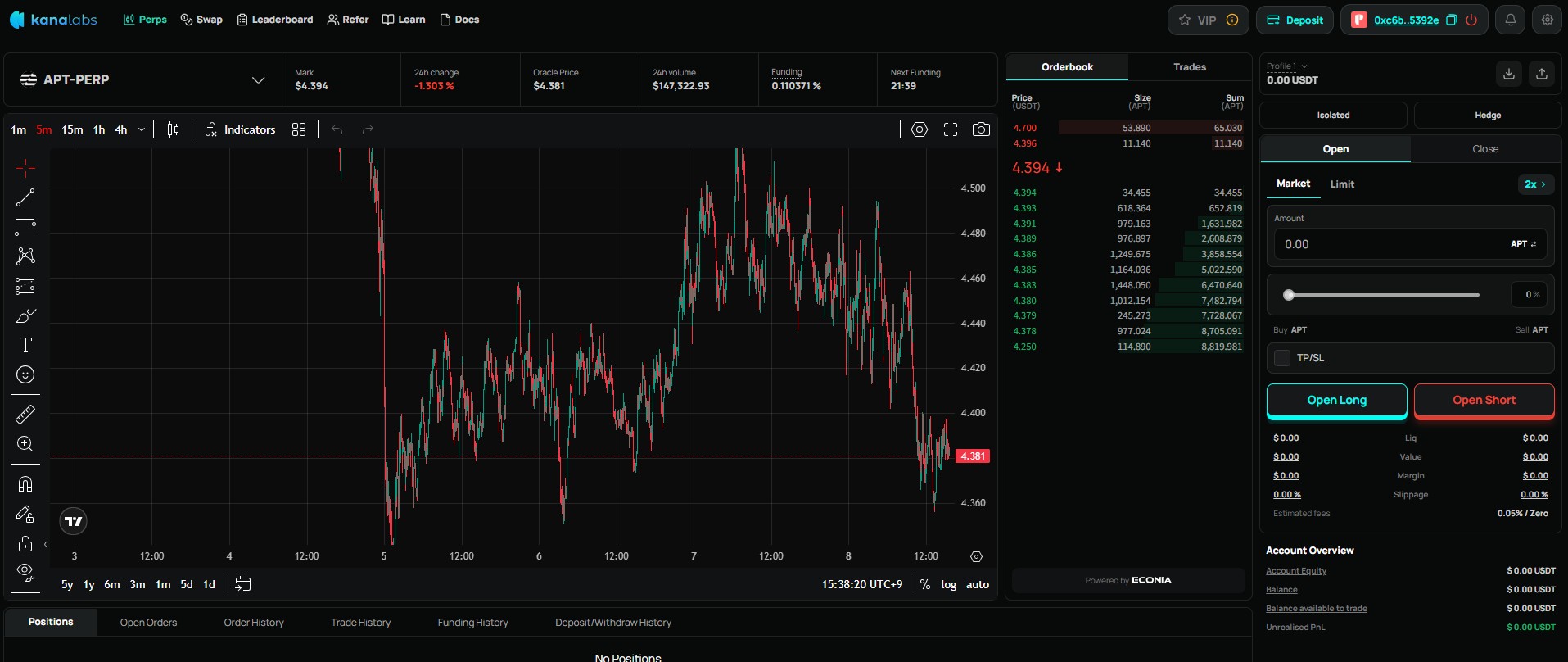

About Kana Perps

Kana Perps is a fully on chain perpetual futures exchange built on the Aptos blockchain. It features an order book–based architecture, offering low slippage and high-precision execution. All trades are settled via smart contracts, and the exchange currently operates with USDT based markets. What sets Kana Perps apart is its Web2 friendly design: keyless wallet integration, gasless market orders, and intuitive UI/UX enable effortless onboarding making it accessible even for DeFi newcomers.

The platform is also equipped with an insurance fund for liquidation protection and a funding fee mechanism to maintain price stability underscoring a dual focus on user safety and protocol sustainability. While current trading is limited to USDT markets, expansion into other asset classes is planned.

Kana Perps is quickly establishing itself as a key player in Aptos on chain trading. In under two months since launch, it has recorded $162 million in cumulative volume and a peak daily volume of $18 million. This rapid growth reflects strong demand from both seasoned DeFi traders and new entrants. Its combination of intuitive usability and institutional grade execution positions Kana Perps as a future benchmark in decentralized perpetual trading.

2-4. Kofi Finance - Liquid staking for APT

TGE and Airdrop Upcoming 🔥

Kofi Finance Strategy 🪄

- Kofi Finance enables users to stake APT and receive liquid staking tokens that can be deployed across the Aptos DeFi ecosystem.

- How to get started:

- Stake APT to receive kAPT

- Stake kAPT to receive stkAPT, which accrues auto-compounding yield

- Use stkAPT in lending, liquidity, or other DeFi protocols on Aptos to maximize rewards

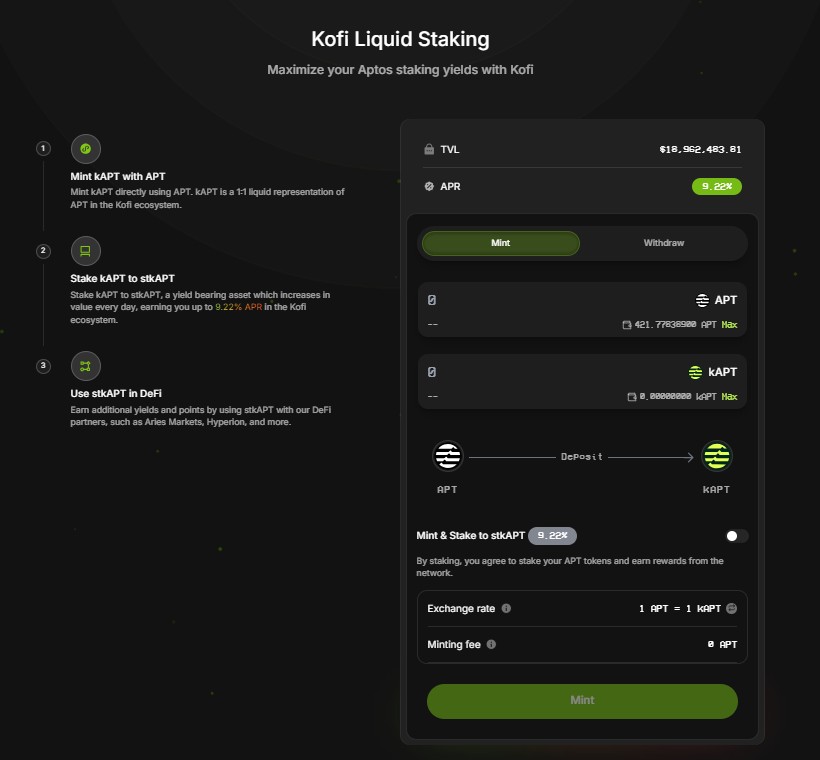

About Kofi Finance

Kofi is a liquid staking platform built on Aptos that expands on the traditional staking model by introducing stkAPT, a yield-bearing, auto-compounding token. This structure allows users to earn not only the baseline staking rewards but also additional yield across DeFi applications. Despite being less than two months old, the protocol has already attracted approximately $19 million in TVL.

When APT is staked, users receive kAPT at a 1:1 ratio, which can be redeemed for APT at any time. Staking kAPT then mints stkAPT, which accumulates rewards automatically over time without requiring manual claims. As of July 8, stkAPT offers an APR of 9.49%, and it is compatible with various DeFi strategies such as lending, collateralization, and liquidity provision. Kofi is actively integrating stkAPT with key Aptos-native protocols like Aries and Hyperion to expand its real-world utility.

The Aptos liquid staking market is currently dominated by Amnis, raising concerns over centralization. In this context, Kofi has emerged as a viable alternative, offering a higher APR (9.49%) compared to Amnis (7.25%) and a more decentralized trajectory. Given that Kofi has yet to conduct its TGE, there is significant room for future growth in user adoption and capital inflows. As a potential alternative to dominant players like Amnis, Kofi is well positioned to rebalance the liquid staking space on Aptos.

3. Game

3-1. Cattos - Telegram-based GameFi on Aptos

TGE and Airdrop Upcoming 🔥

Cattos Strategy 🪄

- Launch the Cattos bot directly in Telegram to begin gameplay

- Create a new wallet or link an existing one to deposit or withdraw APT or $CATTOS

- Level up your hero, defeat monsters, and earn $CATTOS tokens in real time

- Use $CATTOS to purchase in game upgrades, unlock auto-mining, and eventually swap on DEXs

About Cattos

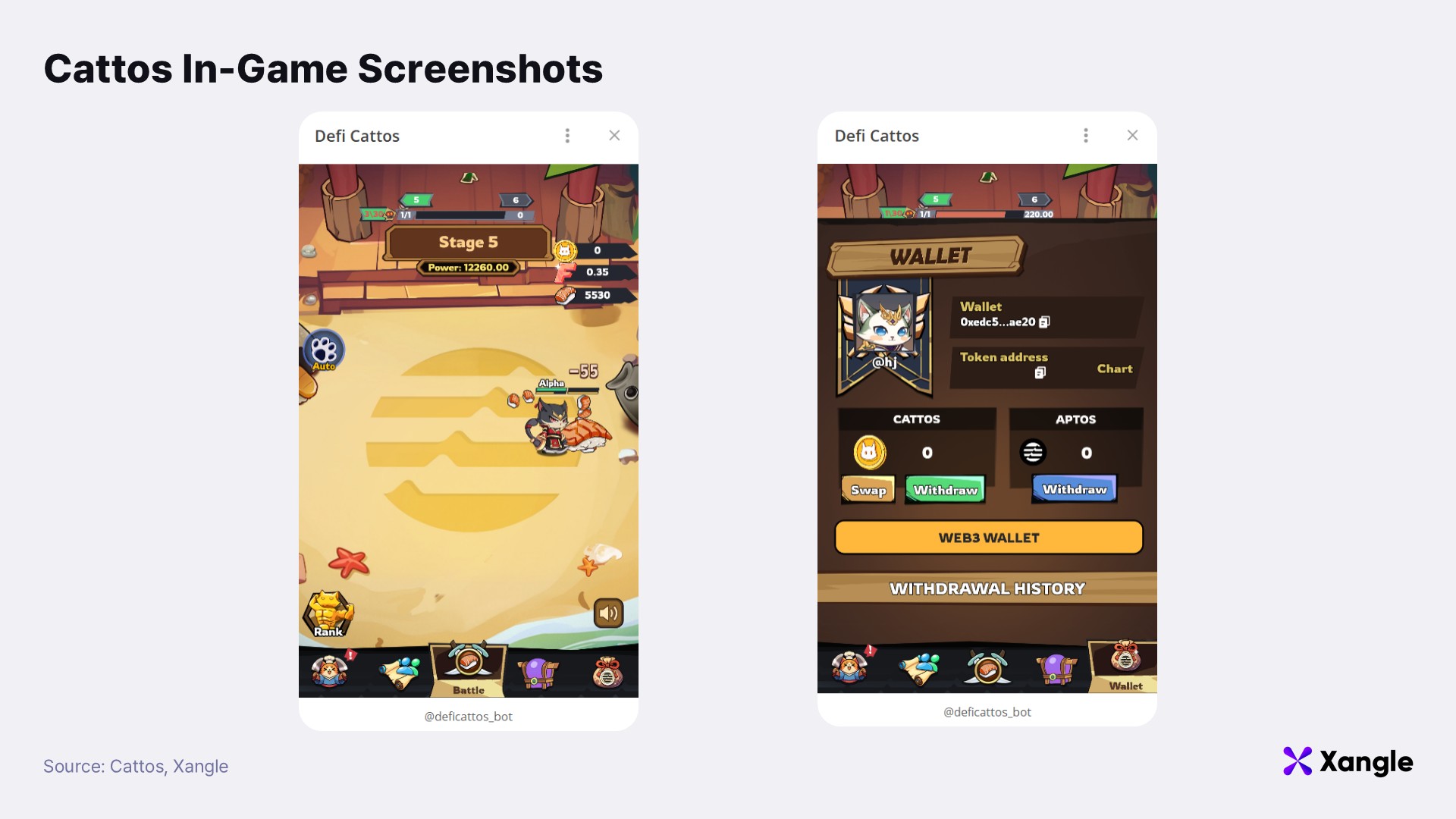

Cattos is a Telegram native GameFi project built on Aptos, offering a frictionless Play and Earn experience with ultra-simple gameplay mechanics. Players engage in battles, level up their characters, and earn $CATTOS tokens directly within Telegram without needing to install a separate app or wallet. The onboarding experience is designed for accessibility: wallets are auto-generated, seed phrases are skipped, and all transactions are handled on-chain in the background. With Aptos Foundation's gas sponsorship, users can interact on-chain without holding any APT lowering the barrier to entry for Web2-native users.

Earnings are generated by defeating monsters. The earned $CATTOS tokens can be used for hero upgrades, star level enhancements, and purchasing auto income features. Looking ahead, the ecosystem plans to expand utility into PvP tournaments, NFT purchases, and staking. From a tokenomics standpoint, 70% of the total supply is allocated to in game rewards, with the rest distributed across Hyperion liquidity (20%), CEX listings (5%), ecosystem development (3%), and marketing (2%). This structure positions $CATTOS as a decentralized, utility driven asset that can circulate freely within both gaming and DeFi contexts on Aptos.

Cattos has demonstrated strong early traction thanks to its accessible design. Over 120,000 users participated during the airdrop campaign, with 10,000 daily active users on average. Cumulative on-chain transactions have exceeded 55 million, and the 3,000 Genesis NFTs sold out within just 30 minutes, signaling strong community enthusiasm and viral momentum.

4. Social

4-1. Rewardy - The social wallet that introduced Quest-to-Earn

TGE completed / Airdrop distributed

Rewardy Strategy 🪄

- Participate in quests to earn points, which can be converted into RWD tokens

- How to get started:

- Download the Rewardy app and log in using a social account

- Complete daily check-ins, posts, and quizzes to earn points

- Convert points to RWD at a fixed rate of 1 point = 0.23 RWD

- Spend RWD in a random reward draw for gift cards, fried chicken, coffee, and more

- Future exchange listings may allow cash redemption

About Rewardy

Rewardy is a Web3 rewards wallet that connects everyday digital actions such as listening to music, gaming, and watching ads to token-based incentives. Users can create a wallet using only a social login, with no need for seed phrases or gas fees. On chain activities occur seamlessly within the app, lowering the barrier to entry for non crypto users. The product is structured around a Quest-to-Earn model: users earn points by posting, liking, commenting, or completing other in-app tasks. These points are automatically converted to RWD tokens via Rewardy’s core P2T (Point-to-Token) system. The conversion process is handled entirely in the background, delivering immediate and frictionless rewards.

A newly launched random draw feature allows users to spend RWD tokens to win real-world items such as coffee, gift cards, or fried chicken bridging the gap between digital activity and tangible benefits.

Rewardy has seen rapid adoption, with over 450,000 users and more than 1 million cumulative transactions to date. The app has been downloaded over 130,000 times, with 30,000 monthly active users, making it Korea’s most widely adopted non-custodial wallet. Monthly transaction volumes consistently exceed 1 million, signaling sustained user engagement.

Currently, Rewardy is running large scale onboarding campaigns in partnership with the Aptos Foundation, targeting Web2-heavy regions including Korea, Japan, and Southeast Asia. These efforts are tightly aligned with Aptos’s broader mass adoption strategy, positioning Rewardy as a flagship example of real-world Web3 integration via intuitive and reward-centric infrastructure.