Table of contents

1. Introduction

2. Opportunities and Possibilities Brought by the Introduction of dTAO in Bittensor

2-1. The more $TAO staked in a subnet, the higher the subnet token price

2-2. The introduction of dTAO is expected to trigger a massive shift of $TAO into subnets

2-3. Validator activity as a guide to predicting $TAO movement

3. How the introduction of dTAO lowered the entry barriers to the Bittensor ecosystem

4. Final Remarks

1. Introduction

In February, Bittensor introduced dTAO, fundamentally restructuring its tokenomics framework. In the three months following this implementation, over 60 new subnets have emerged within the Bittensor ecosystem, accompanied by significant volatility in subnet token prices. This report seeks to examine the specific changes brought about by dTAO and to explore the resulting opportunities and potential implications for the ecosystem.

The analysis presented here primarily revolves around dTAO. While readers interested solely in grasping the foundational concepts of dTAO and its associated opportunities may find this article sufficient, we recommend first reviewing our earlier piece, “Bittensor Makes a Fundamental Shift in Tokenomics with dTAO,” for a more comprehensive understanding of the broader Bittensor ecosystem.

2. Opportunities and Possibilities Brought by the Introduction of dTAO in Bittensor

2-1. The more $TAO staked in a subnet, the higher the subnet token price

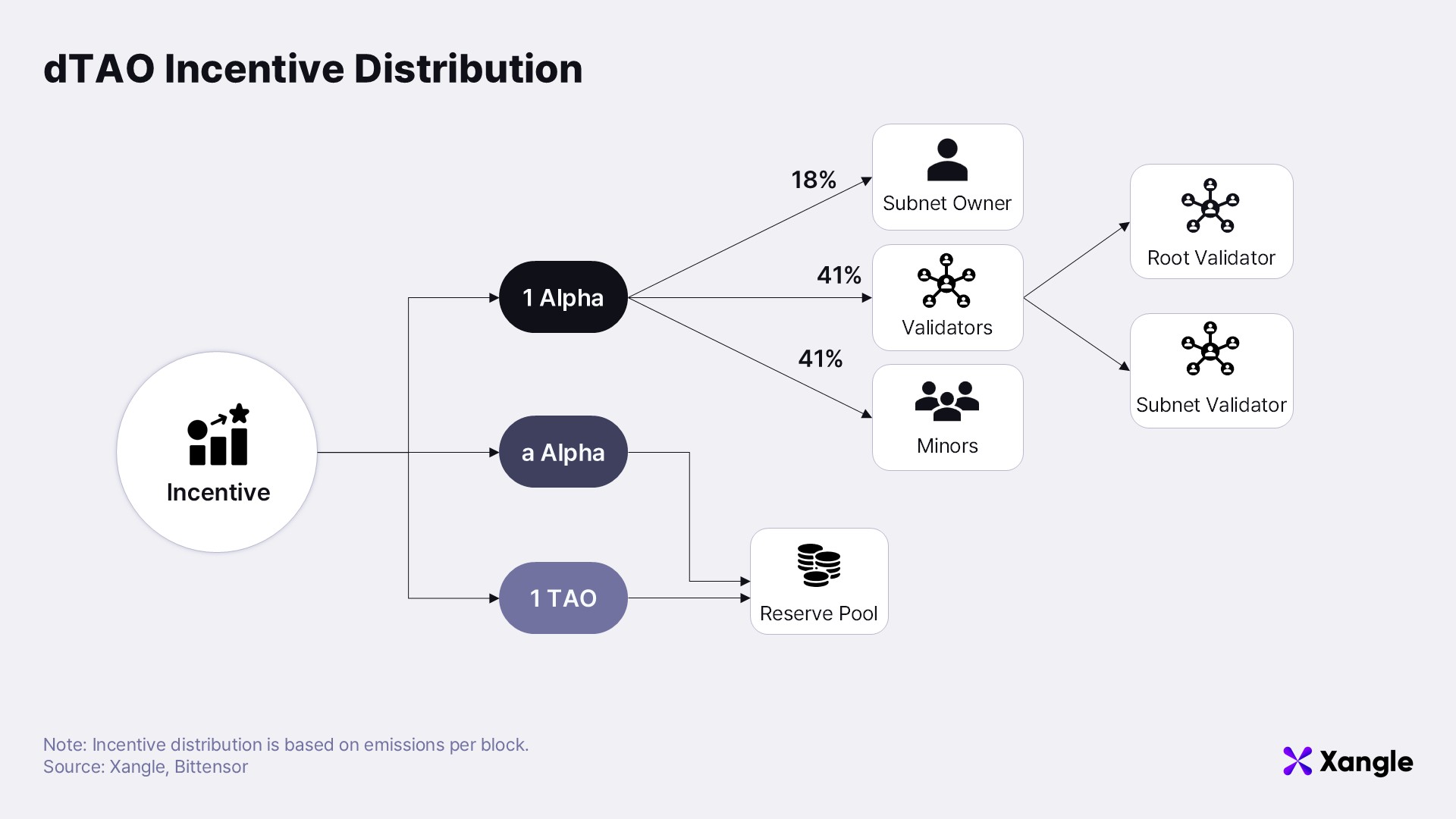

dTAO was introduced to make subnet validation more scalable and equitable. Prior to its implementation, validators directly assessed and validated subnets, thereby controlling the distribution of incentives. Under the dTAO model, however, each subnet issues a unique token called *Alpha, and the volume of incentives is now determined solely based on the market price of that token.

*"Alpha is a generic term referring to all subnet tokens, although each subnet maintains its own distinct Alpha variant.

A central mechanism within this model is the method by which Alpha token prices are determined. To facilitate this, Bittensor has established a reserve pool for each subnet, consisting of a $TAO–Alpha pair. Validators and users (i.e., stakers) can acquire a subnet’s Alpha tokens by staking $TAO into its respective reserve pool.

The price of each Alpha token is defined as:

Price = (Staked $TAO) / (Staked Alpha)

This means Alpha’s price increases as more TAO is staked and decreases when TAO is unstaked.

This creates a mechanism similar to an automated market maker (AMM) DEX, where “staking” acts as the functional equivalent of a token “buy.” It effectively combines DeFi staking mechanics with price discovery through liquidity bonding.

Incentives under this model are paid out in both TAO and Alpha. The total supply of each token is capped at 21 million, with periodic halvings built into the emission schedule. As of May 26, no halving has occurred. Currently, each block emits 1 TAO and (a + 1) Alpha tokens.

The newly minted TAO is deposited into the subnet’s reserve pool in accordance with an incentive ratio derived from the current Alpha price. To prevent artificial inflation of Alpha prices due to this injection of TAO, a corresponding amount of Alpha tokens (denoted ‘a’) is also deposited into the reserve. The remaining 1 Alpha token is distributed to ecosystem participants as follows:

- Subnet miners: 41%

- Validators: 41%

- Subnet operators: 18%

The 41% allocated to validators is further split between root validators and subnet validators, which will be discussed in more detail in Section 2-2.

2-2. The introduction of dTAO is expected to trigger a massive shift of $TAO into subnets

To preserve protocol stability, Bittensor adopted a phased implementation strategy for dTAO. During the initial rollout, Alpha token liquidity remained limited. Under such conditions, a rapid migration of staked TAO into subnets could trigger severe price volatility—ironically undermining the equitable incentive model that dTAO was intended to establish.

To manage this risk, Bittensor structured the incentive distribution to initially favor Root* stakers, with a gradual reallocation toward subnet stakers over time. The graph above depicts the shifting ratio of incentives distributed to Root versus subnet participants across various subnets.

*Root refers to the legacy subnet responsible for incentive distribution prior to dTAO. It is no longer active following the update.

For example, Bitcast—a subnet launched less than 100 days ago—still allocates a significant portion of its incentives to Root. In contrast, Sturdy, which has been active for over 100 days, now channels more incentives to subnet stakers than to Root. This trend of decreasing Root allocations over time is becoming more common across subnets. As this shift continues, rewards distributed to Root validators will decline considerably, while those directed to subnet validators will increase. This structural evolution offers a clear incentive for TAO liquidity to move into subnets. If such a migration occurs, it is expected to reinforce the previously described dynamic: increased TAO staking → rising Alpha token prices.

The chart below confirms this trend: over the course of three months, the proportion of TAO staked in Root fell from 72% to 62%. As of May 26, Root’s APY remains relatively high at 21%, so the overall concentration of TAO in Root is still substantial. However, the steady reduction in incentives allocated to Root has made it less attractive to stakers, prompting a gradual liquidity shift toward subnets. This movement is expected to accelerate as Root continues to lose its share of emission rewards.

As of May 26, approximately $2.73 billion worth of TAO remains staked in Root. Should this capital migrate into subnets, significant volatility in Alpha token prices is likely to follow.

It is important to note, however, that if a given subnet lacks genuine user demand, unstaked TAO may not be reallocated to subnet pools. Moreover, newly launched subnets are particularly vulnerable to downward pressure on Alpha prices, as a large share of their incentives must still be directed to Root. These Alpha tokens are converted into $TAO from the respective subnet’s reserve pool prior to distribution, effectively creating consistent sell-side pressure. This mechanism largely explains the common trend of early-stage Alpha price declines. As Root allocations diminish, this pressure is expected to ease. Until then, staking in low-demand or newly launched subnets should be approached with caution.

2-3. Validator activity as a guide to predicting $TAO movement

An analysis of Bittensor’s validator list offers useful insight into where TAO liquidity is likely to flow within the ecosystem.

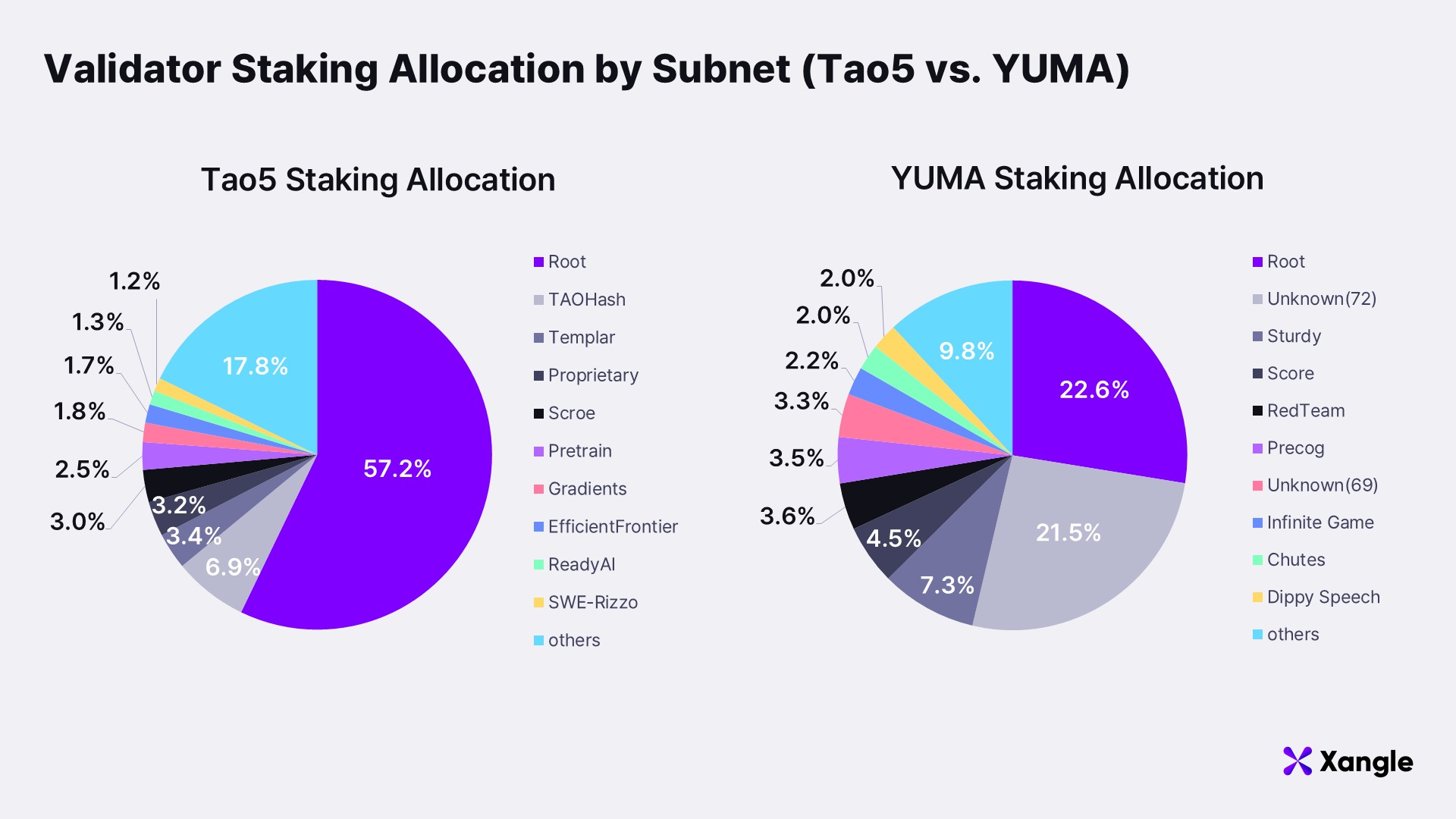

As of May 26, Tao5—the 8th largest validator by stake—also serves as a subnet incubator, while YUMA—the 6th largest validator—functions as a subnet accelerator. In the dTAO framework, where incentive distribution is determined exclusively by token price, capital concentration equates to influence. Validators with significant financial resources can drive up the price of Alpha tokens and, in doing so, capture a disproportionately large share of incentives. Tao5 and YUMA collectively hold over 10% of all TAO staked in the Bittensor ecosystem. As such, the subnets these validators support may serve as valuable indicators when assessing capital flow or forming investment hypotheses.

On X (formerly Twitter), Tao5 frequently references Rayon Labs, one of the ecosystem’s most prominent development teams. Rayon Labs operates several leading subnets—including Chutes (SN64), Gradients (SN56), and Nineteen (SN19)—which collectively account for approximately 25% of total network emissions.

YUMA is a subsidiary of Digital Currency Group (DCG), a well-known crypto venture capital firm, and plays a central role in accelerating a wide range of subnets. On May 2, YUMA publicly disclosed its backing of the following subnet projects: Precog (SN55), Infinite Games (SN6), Sturdy (SN10), Real-Time Data (SN42), Score (SN44), Dippy Speech (SN58), Agent Arena (SN59), Bitsec (SN60), RedTeam (SN61), Vericore (SN70), and FLock (SN96).

Examining the staking portfolios of Tao5 and YUMA can provide further insight. The chart below displays the subnet staking distributions associated with the official wallet addresses registered by each validator.

Although the majority of TAO liquidity remains concentrated in Root, early signs of capital aggregation are already emerging across select subnets. For example, in Tao5’s main wallet, the subnet with the highest allocation outside of Root is Taohash, which has experienced a remarkable 280x increase in price. Gradients—frequently referenced by Tao5 on X—has posted a 14x price increase. Notably, both of these subnets allocate 54% of their emissions directly to subnet stakers, surpassing the default incentive rate assigned to Root.

That said, this may also be indicative of a liquidity concentration phenomenon. Despite offering more than 50% of emissions to subnet stakers, many subnets have yet to demonstrate significant price appreciation—and in some cases, prices have continued to decline. These discrepancies underscore the importance of evaluating not only emission structures but also actual staking demand. Careful consideration of both factors is essential when making allocation decisions in the dTAO environment.

3. How the introduction of dTAO lowered the entry barriers to the Bittensor ecosystem

Prior to the introduction of dTAO, validators played a dominant role in subjectively evaluating subnets, effectively excluding users from participating in decisions related to incentive allocation within the Bittensor ecosystem. The launch of dTAO fundamentally changed this dynamic. Users can now actively participate in shaping incentive outcomes by staking TAO and acquiring Alpha tokens.

The current process for participating in the Bittensor ecosystem is as follows:

- Download and register a Bittensor Wallet, the protocol’s native wallet

- Connect the wallet to the official explorer

- Select a subnet for staking

- Use the Buy/Sell interface to stake TAO and receive Alpha, or to re-deposit Alpha and unstake TAO

Subnet List (Source: Taostats)

Subnet List (Source: Taostats)

Subnet Staking Interface (Source: Taostats)

Subnet Staking Interface (Source: Taostats)

While the system now offers a more open structure for user participation, there are technical limitations that still need to be addressed. Wallet support remains limited, and the ecosystem operates in relative isolation from other blockchain networks. In response, Bittensor has recently begun integrating EVM compatibility and formalized a partnership with LayerZero. These developments signal a strategic move toward greater cross-chain interoperability.

If successful, such integration could significantly enhance the accessibility of Alpha tokens—potentially opening the door to exchange listings on external platforms. This would not only increase Alpha’s liquidity but also broaden the user base beyond the current ecosystem boundaries.

4. Final Remarks

This report has examined the structural and economic transformations unfolding in the Bittensor ecosystem following the introduction of dTAO. Far from being a routine protocol update, dTAO marks a pivotal shift—redefining both the incentive distribution model and the mechanisms of ecosystem participation. By replacing a centrally governed framework with a price-driven incentive structure anchored in Alpha tokens, Bittensor has created a more accessible and decentralized foundation for user contribution.

One of the most immediate consequences of this shift is the anticipated large-scale migration of staked TAO from Root into individual subnets. This realignment is likely to induce pronounced fluctuations in Alpha token prices across subnets. During such a liquidity transition phase, the outcomes for different subnets may vary significantly, depending on factors such as network quality, initial incentive structures, and validator support. From an investment standpoint, these dynamics could present a range of new opportunities. Going forward, the ability to identify high-quality subnets and interpret validator behavior will likely serve as a strategic advantage for ecosystem participants. Close monitoring of capital flows and incentive shifts will be essential.

It should be noted, however, that this report is not intended as investment advice. Actual outcomes may differ considerably depending on the technical maturity of each subnet, the level of user demand, and the availability of sustainable liquidity.