Table of Contents

1. A Lending Market Lacking Interoperability — Can Cross-Chain Lending Be the Answer?

2. How Does Folks Finance Implement Cross-Chain Lending?

2-1. From the top DeFi app in the Algorand ecosystem

2-2. xPools: Cross-chain lending pools for liquidity consolidation and enhanced UX

3. Advantages in Capital Efficiency and User Experience Compared to Competing Projects

4. How to Strategically Use Folks Finance

5. Closing Remarks — Folks Finance at the Forefront of the Cross-Chain Asset Management Era

1. A Lending Market Lacking Interoperability — Can Cross-Chain Lending Be the Answer?

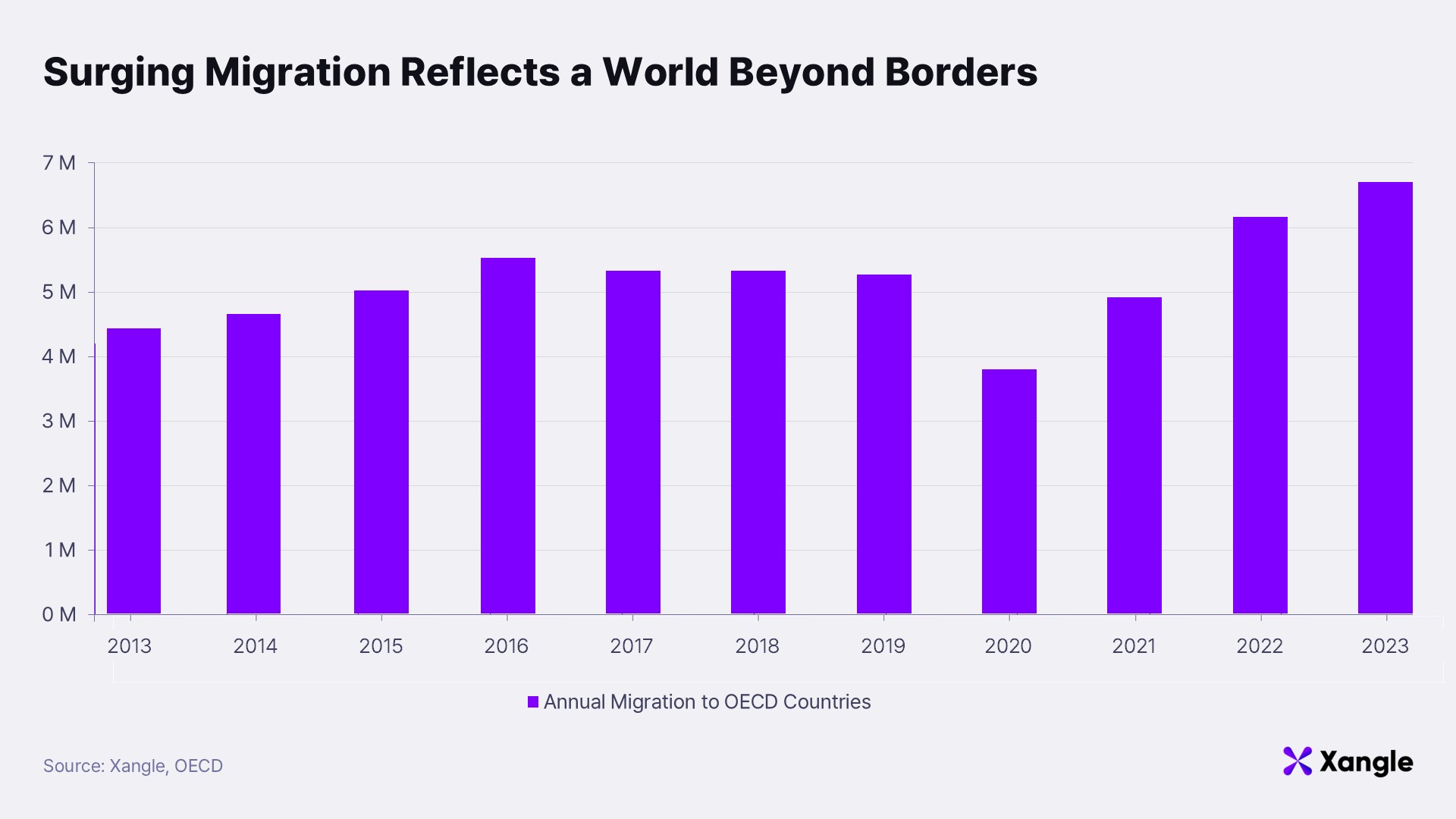

In 2023, approximately 6.7 million people migrated to OECD countries — the highest number ever recorded. Excluding the steep drop in mobility caused by the COVID-19 pandemic in 2020 and 2021, the trend has shown steady growth over the past decade. National and racial boundaries are gradually dissolving, and the flow of people and capital is becoming increasingly unrestrained.

However, in stark contrast to this trend, the financial system remains complicated and fragmented. To utilize assets across borders, one must navigate complex regulations, stringent foreign exchange controls, and rigorous screenings by financial institutions in each country — a process that incurs significant time and cost. Since national financial systems remain siloed, using assets held in Country A as collateral to borrow funds in Country B is practically impossible. If these barriers were dismantled, and assets could be freely leveraged regardless of location or nationality, not only would asset management become more flexible, but the entry barriers for global migration and investment would also be substantially lowered.

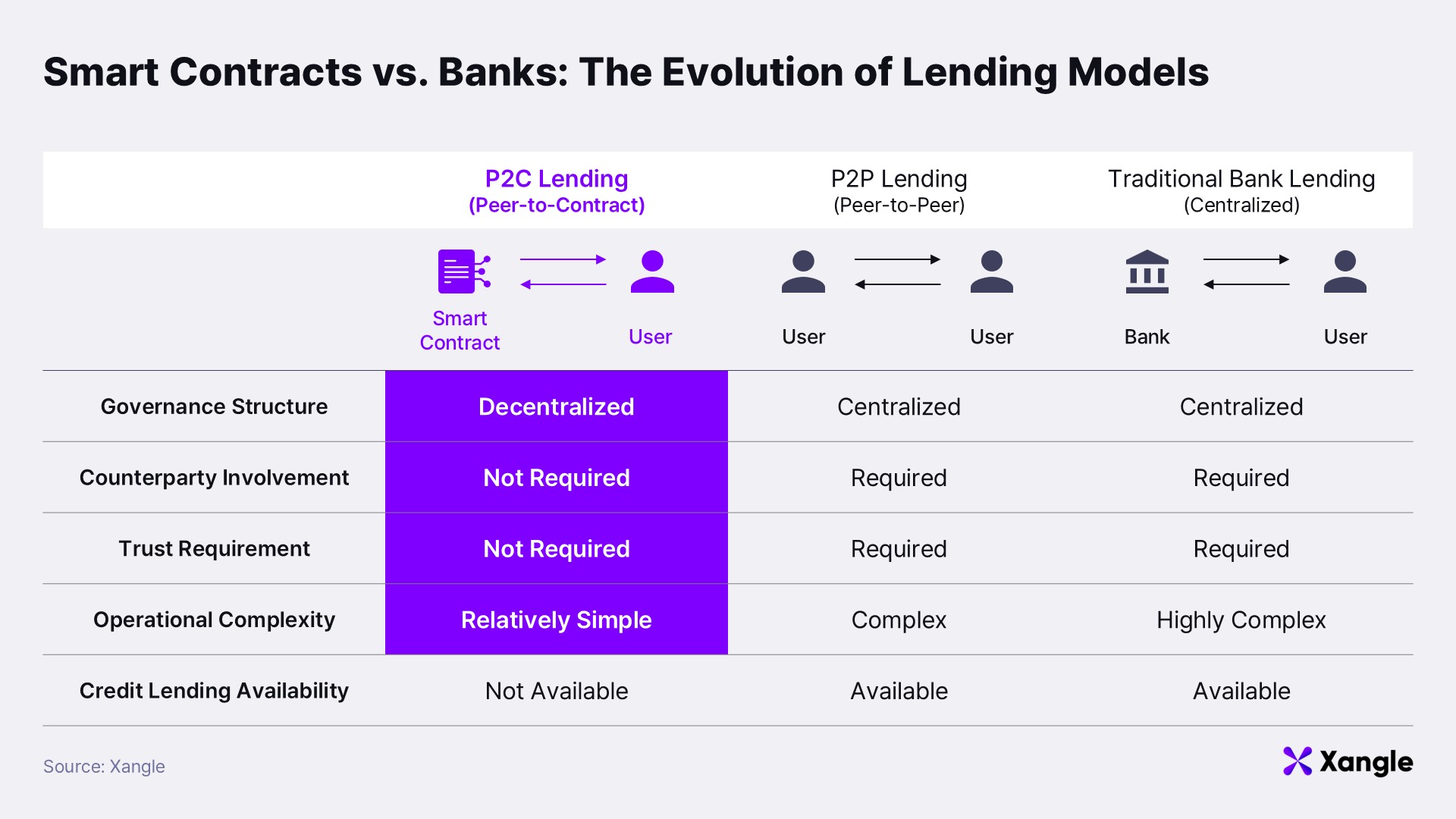

The blockchain-based lending market emerged as a response to these challenges. Leveraging the decentralization of blockchain networks, it provides trustless lending services. Anyone who holds assets can deposit them as collateral through smart contracts and borrow funds without undergoing complex procedures.

The lending sector has drawn significant attention for lowering entry barriers and maximizing capital efficiency. Starting with MakerDAO in 2017, followed by major players like Aave and Compound, lending has become one of the most active sectors in decentralized finance (DeFi). Yet interestingly, even the blockchain lending market has not fully solved the issue of interoperability and continues to exhibit problems similar to those of the Web2 lending system.

Current lending protocols operate within a single blockchain and face limitations when it comes to asset usage across different chains. Even if a user holds collateral assets on Chain A, borrowing or accessing liquidity on Chain B is difficult. This is more than a poor user experience — it results in asset isolation by chain and ultimately lowers the capital efficiency of the entire DeFi ecosystem.

To address these limitations, the concept of cross-chain lending has emerged. Cross-chain lending aims to build a lending infrastructure that transcends individual chains, encompassing multiple blockchain ecosystems to maximize asset utility and liquidity. For example, if a user can deposit collateral on Ethereum, borrow funds on Solana, and use them to purchase meme coins or establish LP positions — it would dramatically improve both asset management flexibility and capital efficiency.

This report focuses on Folks Finance, one of the key players in the cross-chain lending space. As its name "Folks" implies, Folks Finance aims to connect users and assets scattered across various networks into a unified experience.

We will explore the specific cross-chain lending structure proposed by Folks Finance, assess whether it can usher in a new era for the Web3 lending market, and examine the potential and challenges that lie ahead.

2. How Does Folks Finance Implement Cross-Chain Lending?

2-1. From the top DeFi app in the Algorand ecosystem

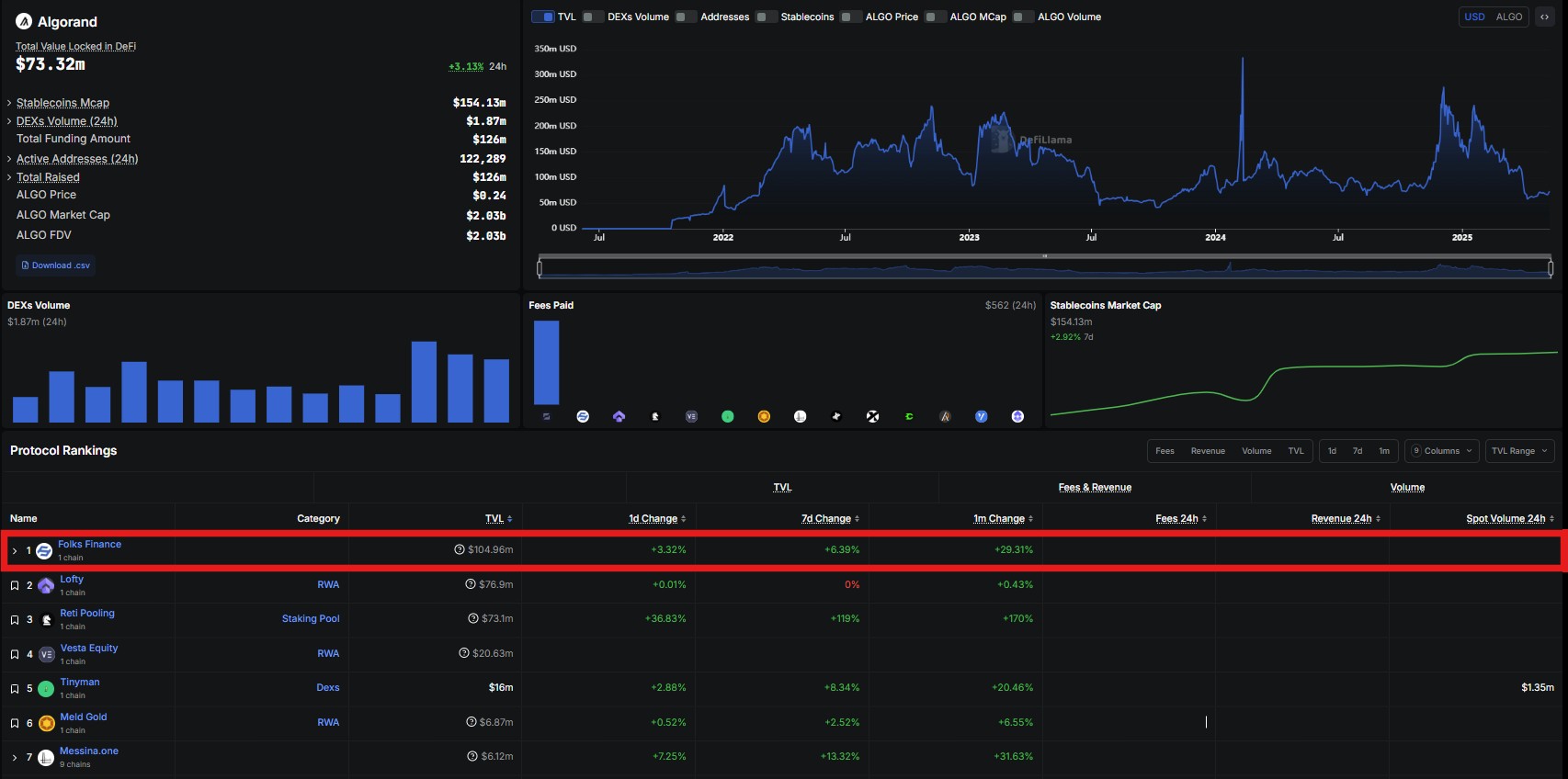

Folks Finance is a lending protocol officially launched in April 2022 on the Algorand network. The project has raised approximately $6 million in funding from notable investors such as Borderless Capital, Coinbase Ventures, and OKX Ventures. Leveraging its advanced technology and robust security, Folks Finance has grown to become the largest DeFi application within the Algorand ecosystem. Currently, it operates the ecosystem’s largest lending, liquid staking, and swapping services. As of January this year, the protocol’s TVL (Total Value Locked) exceeded $300 million, and as of May 14 (the time of writing), it still maintains a TVL of approximately $130 million.

Algorand is a blockchain network founded by Silvio Micali, a renowned cryptographer who was awarded the Turing Award in 2012 for his research in Verifiable Random Functions (VRF) and zero-knowledge proofs. The network employs a Pure Proof of Stake (PPoS) consensus algorithm, enabling high-speed processing (up to 10,000 TPS), low fees, instant transaction finality, and carbon neutrality — all aimed at solving the blockchain trilemma (scalability, security, and decentralization). For readers who wish to learn more about Algorand, we recommend Xangle’s “Will Algorand Pick Up Momentum Again?”

Folks Finance, the largest DeFi app on Algorand (Source: DefiLlama)

Folks Finance, the largest DeFi app on Algorand (Source: DefiLlama)

Recently, Folks Finance has begun expanding beyond Algorand to multiple blockchains. In 2024, the protocol launched a cross-chain lending protocol under the name xChain. With xChain, Folks Finance is establishing a new positioning as a “Cross-Chain DeFi Hub” and “Cross-Chain Lending Market,” with its key differentiator being the ability to lend across various chains without using a bridge. For instance, a user can deposit assets on Ethereum mainnet and immediately borrow assets on the Base chain — no bridging process required. Another notable feature is the platform’s account structure, which allows users to link wallets across different chains under a single Folks account, enabling unified portfolio management.

2-2. xPools: Cross-chain lending pools for liquidity consolidation and enhanced UX

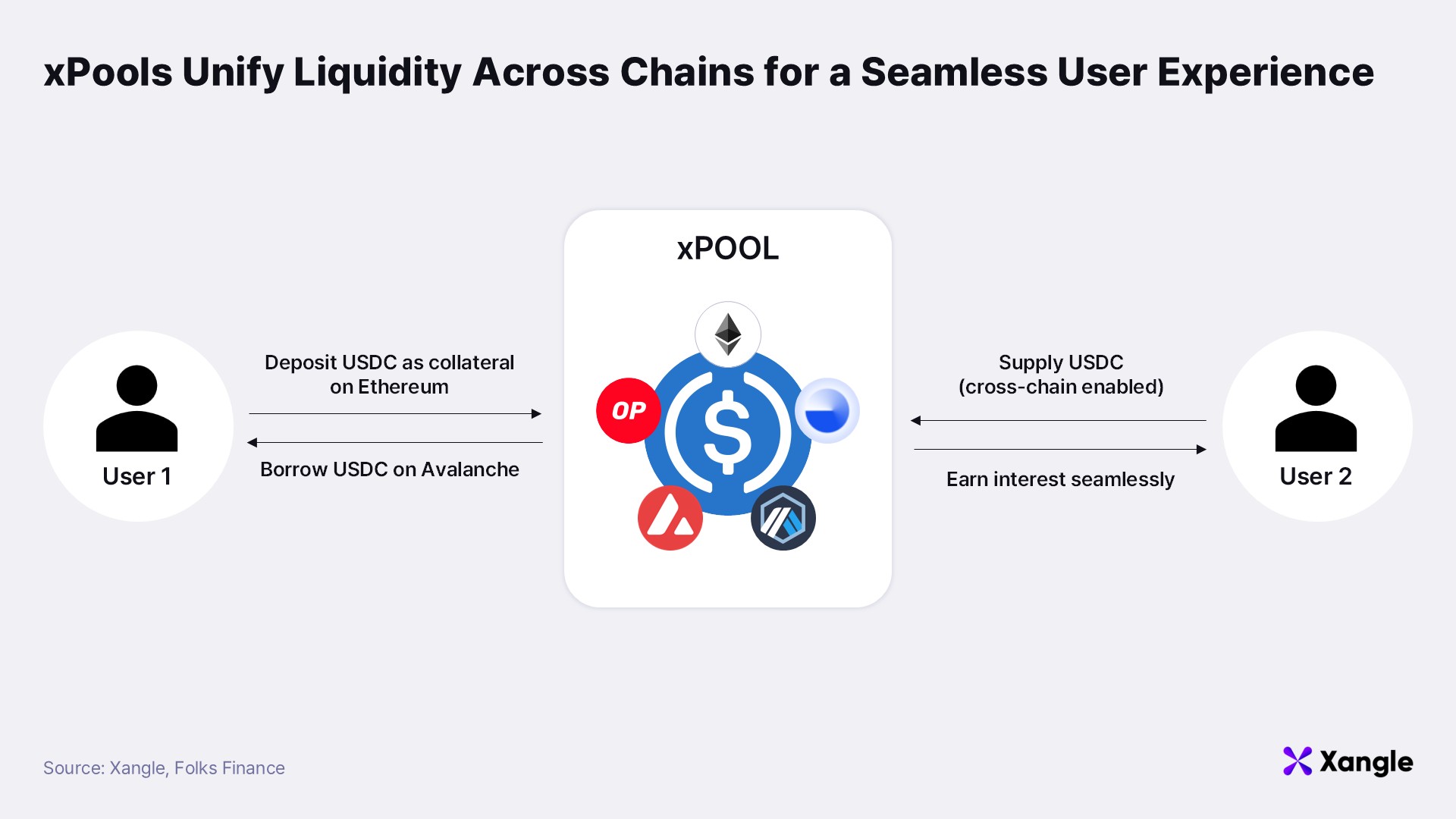

To deliver large-scale liquidity, flexible asset management, and a seamless user experience without bridges in a cross-chain DeFi environment, Folks Finance has implemented its proprietary unified liquidity architecture called xPools. xPools is a cross-chain liquidity system designed to handle deposit and borrowing requests across multiple chains through a single consolidated liquidity pool.

In this structure, regardless of which chain a user deposits their assets on, the assets are automatically aggregated into a central liquidity pool. Similarly, borrow requests on any chain are processed against this same pool. As a result, liquidity that was previously fragmented across chains is now unified, and interest rates are applied uniformly, without regard to chain-specific distinctions.

xPools currently support USDC and SolvBTC and plan to integrate additional assets using technologies such as Circle’s CCTP (Cross-Chain Transfer Protocol) and Chainlink’s CCIP (Cross-Chain Interoperability Protocol). Beyond technical implementation, xPools function as a next-generation liquidity infrastructure that redefines the structure of cross-chain DeFi, addressing inefficiencies and fragmentation through seamless technological integration.

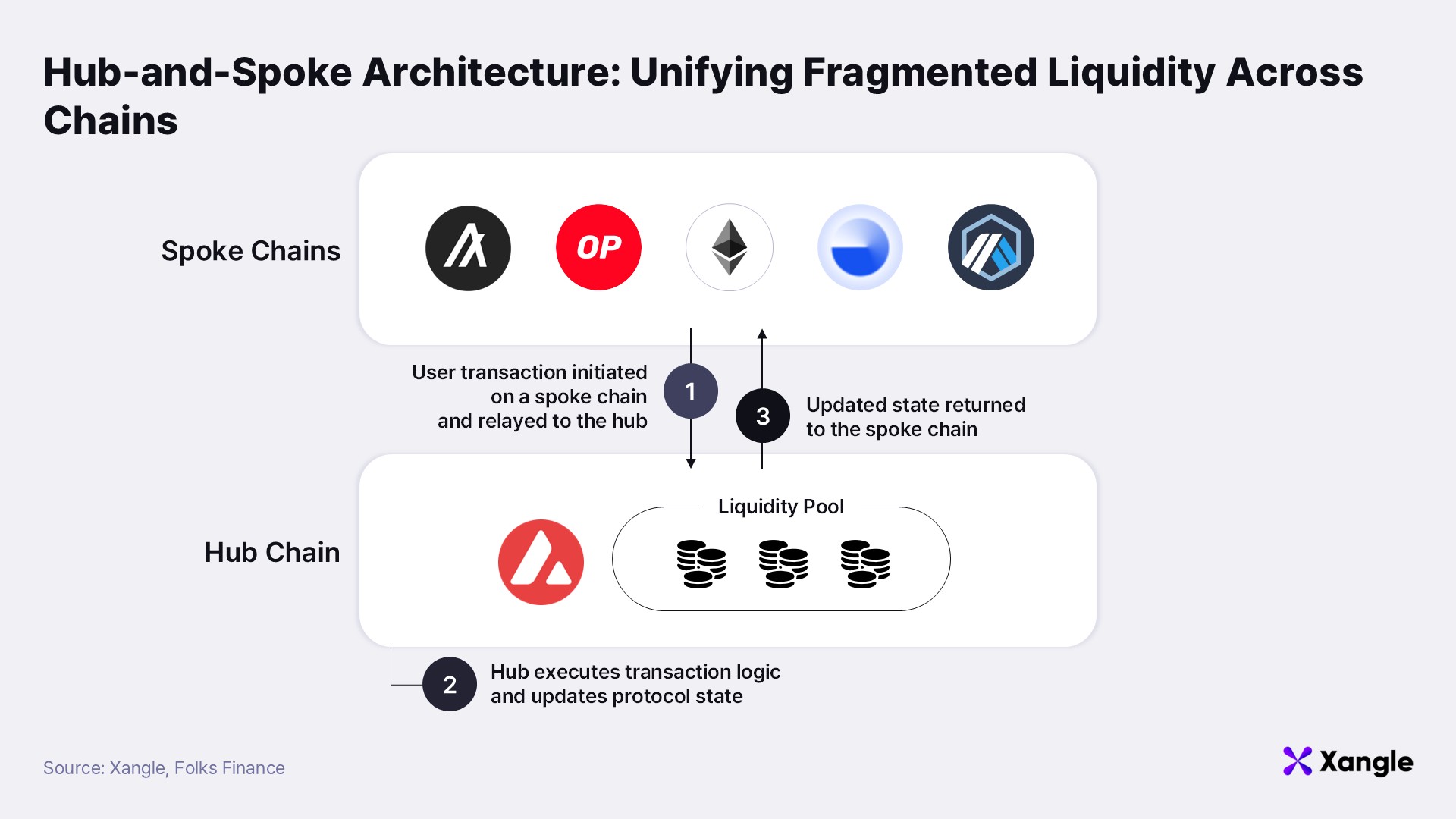

Technically, xPools are implemented based on a hub-and-spoke architecture and a multi-messaging layer.

Implementing efficient and seamless liquidity pools via a Hub-and-Spoke architecture

The unified liquidity structure of xPools is not merely a surface-level interface or messaging feature; it is realized through a structurally foundational hub-and-spoke architecture. To maintain consistent liquidity and state management across multiple chains, Folks Finance has designated Avalanche as its central hub chain, while other chains such as Ethereum, Base, Arbitrum, BNB Chain, and Polygon serve as spoke (connected) chains. Avalanche was chosen due to its high throughput, fast finality, low transaction fees, and EVM compatibility — all of which make it highly suitable for a DeFi environment and well-connected with other chains.

In this architecture, the hub chain stores the overall protocol state and handles core logic such as lending, borrowing, collateral status, interest rate calculations, and liquidations. Specifically, when a user initiates a deposit or borrowing request on a spoke chain, that request is transmitted to the hub chain, which processes it and then reflects the result back on the respective spoke chain.

In the hub-and-spoke model, liquidity from multiple chains is consolidated into a single hub chain, enabling the formation of a deep and unified liquidity pool without fragmentation. This setup expands the borrowing capacity for each asset and ensures a stable income structure by eliminating discrepancies in interest rates between chains.

There are also significant advantages in terms of user experience. For example, if a user deposits USDC on Ethereum or requests a loan on Base, the spoke chain receives the transaction and sends it as a message to the hub chain. The hub processes the request, updates the state, and sends the result back to the spoke chain. Thanks to this design, users can execute deposits and loans directly within their native chain environments without needing to undergo any complicated bridging process.

However, the hub-and-spoke structure carries a trade-off: dependence on the hub chain. If Avalanche experiences downtime or delays, the entire protocol could be affected — making it a potential Single Point of Failure (SPoF). Recognizing this, Folks Finance continuously reinforces its protocol security through regular smart contract audits and a bug bounty program.

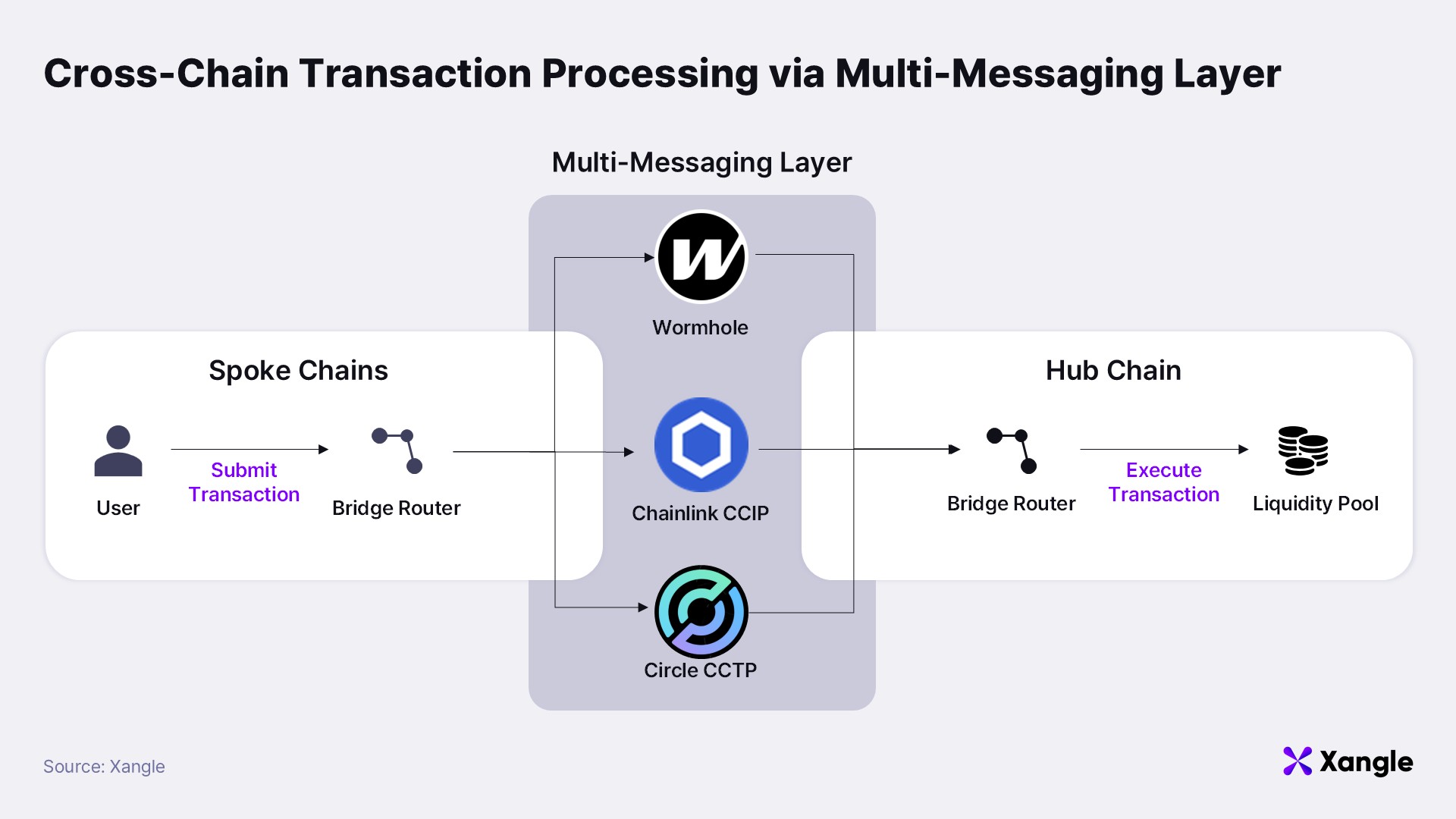

Ensuring security and scalability via a multi-messaging layer for cross-chain communication

For xPools and the hub-and-spoke structure to operate reliably, a trustworthy messaging infrastructure is essential for conveying state information between different blockchains. If a message transmitting a deposit or loan request between chains is interrupted or tampered with, the entire protocol could fall into an inconsistent or erroneous state.

To mitigate this, Folks Finance adopts a multi-messaging layer strategy. Rather than relying on a single bridge or messaging protocol, the system is designed to run multiple messaging routes in parallel, allowing for flexible responses under various conditions. Currently, Folks Finance supports messaging protocols including Wormhole, Chainlink’s CCIP, and Circle’s CCTP. These protocols are centrally managed via a module called the BridgeRouter. Specifically, the BridgeRouter acts as a routing hub that integrates different messaging protocols within a single system and forwards messages through the most appropriate protocol.

This architecture enhances both security and chain coverage, making the system more robust and scalable. For example, it distributes risks such as a single bridge hack or failure of a specific protocol. In the case of assets like USDC that support CCTP, cross-chain liquidity can be achieved without wrapping tokens, further boosting operational efficiency. Ultimately, the multi-messaging architecture serves as a foundational layer for xPools to effectively connect assets across chains and enhance the universality and reliability of cross-chain DeFi. That said, this structure does introduce additional complexity — including higher implementation difficulty, transaction fees, and potential message latency.

3. Advantages in Capital Efficiency and User Experience Compared to Competing Projects

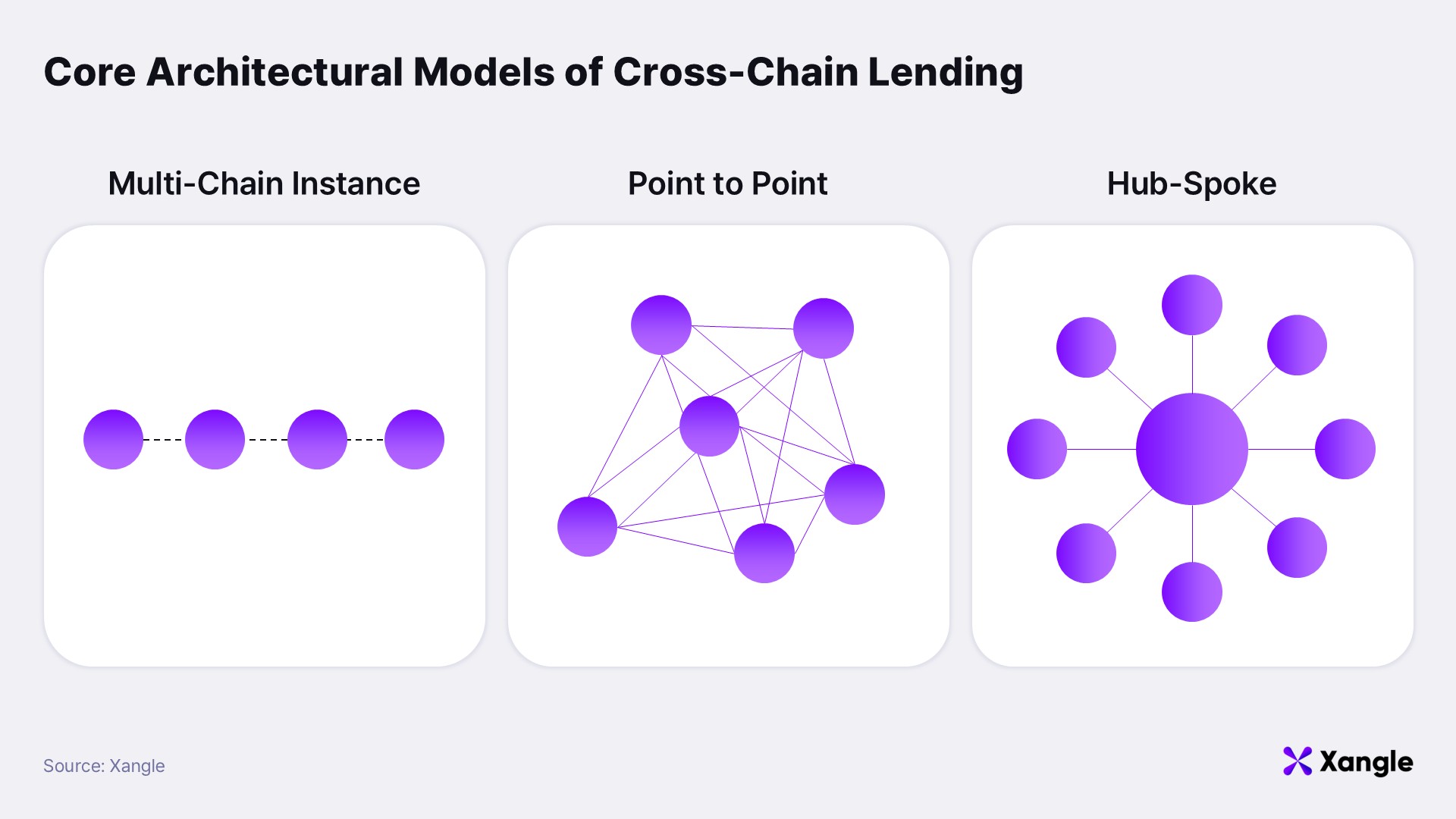

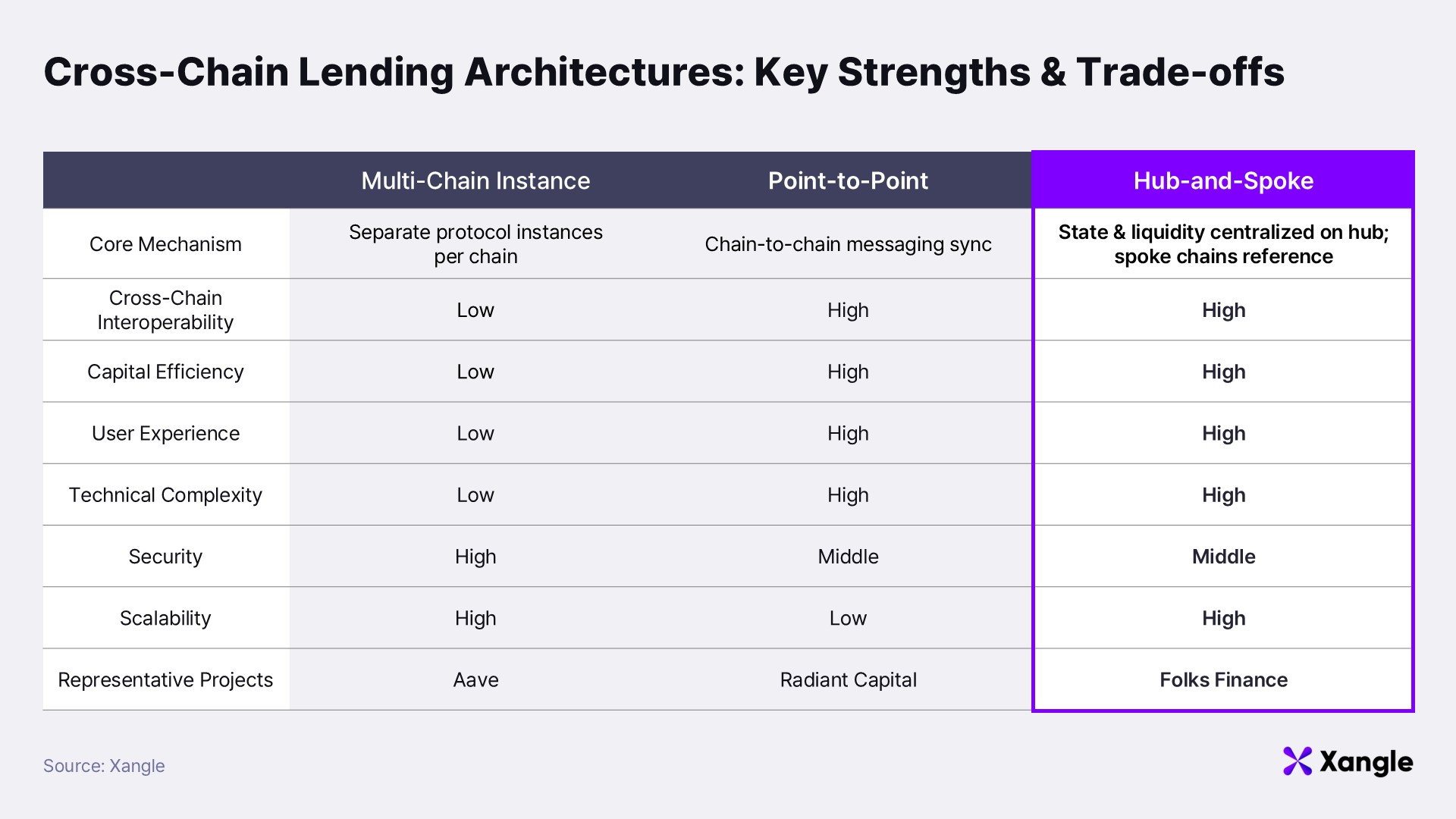

To implement cross-chain lending, protocols have explored various technical approaches, which can largely be categorized into three core architectural models:

Multi-Chain Instance Model

This model involves deploying separate protocol instances on each blockchain, each operating its own independent liquidity pool. Assets deposited on Ethereum, for example, can only be utilized within Ethereum. To borrow on another chain, users must bridge their assets and deposit them again. While this model technically supports multiple chains, it lacks actual interoperability—liquidity and state are not shared between chains. As a result, users face the inconvenience of manually moving assets across networks. That said, this approach does offer some benefits: it allows chain-specific optimization and retains the native user experience of each chain. Additionally, because no separate messaging infrastructure is required, implementation is simpler and more stable. Aave is a representative example of a protocol that follows this model

Point-to-Point Messaging Model

This model uses direct message synchronization between chains. It’s designed to enable real-time sharing of a user’s position state across multiple networks. It typically relies on messaging protocols to connect the collateral chain with the borrowing chain. Users can deposit assets on one chain and borrow on another—without needing to move the assets themselves. This model offers high flexibility in executing strategies across chains. However, as the number of supported chains grows, the messaging pathways become increasingly complex, and the system grows more reliant on relayers or oracles—raising security concerns. Furthermore, because each chain still maintains its own liquidity pool, liquidity fragmentation remains an issue. Radiant Capital utilizes this approach.

Hub-and-Spoke Model

This model concentrates both state and liquidity on a central hub chain, with other chains functioning as spoke chains that refer to the hub. With this setup, borrowing can be executed against a single liquidity pool regardless of where the assets are deposited, significantly improving cross-chain asset utility and capital efficiency. It is also more scalable across multiple chains. However, by centralizing all state on the hub chain, it introduces a potential Single Point of Failure (SPoF). If the hub chain goes down or message transmission fails or delays, the protocol as a whole may be impacted. Folks Finance has adopted this model.

As seen above, the three architectures vary in how they address interoperability and liquidity usage. Each presents trade-offs in terms of liquidity integration, messaging complexity, user experience, and security design.

4. How to Strategically Use Folks Finance

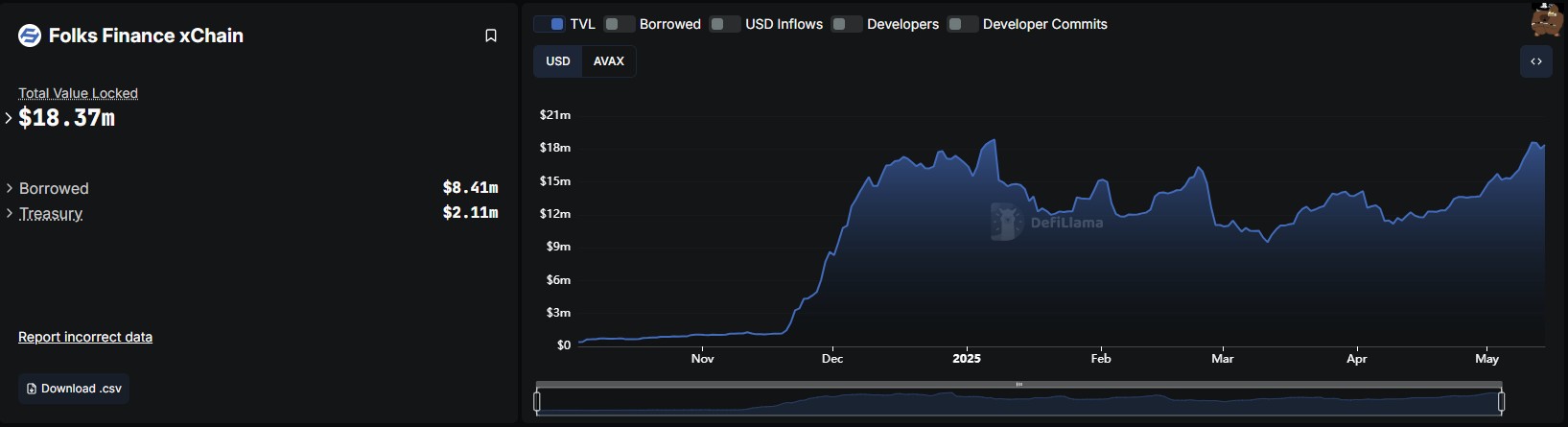

Currently, Folks Finance’s xPools has around $18 million in deposits. The primary motivations for depositors are to earn interest on stablecoins and Bitcoin, and to leverage their positions. As of May 14, approximately $7.9 million in USDC and $3.9 million in BTC have been deposited. These funds can be deployed in various DeFi strategies. One common approach involves using SolvBTC for cross-chain lending, allowing users to maintain Bitcoin exposure while earning additional DeFi yields.

Source: DefiLlama

Source: DefiLlama

How to Maximize Returns on Folks Finance 🪄

- Use SolvBTC in cross-chain lending to gain exposure to BTC price appreciation, earn deposit interest, farm points, and collect DeFi yields—all in a single strategy.

- Folks Finance currently operates a point reward program. Users who deposit or borrow with SolvBTC receive 5x points. In addition, Solv Protocol also runs its own point system and rewards users holding SolvBTC. (There’s speculation that these points may be redeemable for an airdrop upon TGE.)

- Sample strategy using Folks Finance:

- Deposit BTC or wrapped BTC into Solv Protocol to mint SolvBTC (and earn Solv points)

- Deposit SolvBTC into Folks Finance (earn ~2.86% APY + Folks Finance points)

- Use deposited SolvBTC as collateral to borrow more SolvBTC (pay ~0.21% APY interest, earn more points)

- Deploy the borrowed SolvBTC in other DeFi platforms for additional yield

⚠ Caution: If the collateral value falls below a certain threshold, liquidation risk arises. Also, APY rates and point reward structures are subject to change.

Disclaimer

This content is intended solely to inform readers about the point accumulation and strategic usage models of the Folks Finance platform. It does not constitute investment advice or recommendations of any kind. The strategies described here are only one of many possible approaches and may carry risks such as liquidation when using excessive leverage. All users should exercise their own judgment and proceed with caution.

5. Closing Remarks — Folks Finance at the Forefront of the Cross-Chain Asset Management Era

Folks Finance presents a differentiated cross-chain lending infrastructure through three core architectural designs: a hub-and-spoke unified liquidity model, a multi-messaging layer structure, and a bridge-free user experience. Notably, by anchoring its architecture around the Avalanche hub chain and connecting asset operations seamlessly across chains, while leveraging diverse messaging protocols such as Circle, Chainlink, and Wormhole, the protocol demonstrates a high level of structural sophistication in both stability and scalability.

The DeFi strategies enabled by Folks Finance’s cross-chain lending infrastructure are also worth highlighting. A multi-layered strategy—depositing and borrowing SolvBTC to gain exposure to Bitcoin price appreciation, farm points, and earn DeFi yields—exemplifies the new opportunities that cross-chain lending can offer. Folks Finance is more than just a protocol that “lets you borrow on different chains.” It is a user-centric platform designed to make complex asset strategies accessible and executable for all users.

That said, there are still challenges to overcome. Folks Finance has recorded over 50,000 cumulative users and around 3,000–4,000 weekly active users. While this indicates a certain level of early adoption, broader user acquisition and strategic initiatives to sustain engagement will be critical for true mainstream growth. Additionally, the reliance on Avalanche as the central hub chain introduces a structural Single Point of Failure risk.

Nevertheless, Folks Finance stands out as a key example of a cross-chain lending market player that integrates technical architecture, user experience, and ecosystem expansion strategy into a cohesive whole. Its intention to solve pain points in the traditional DeFi market and meet real user needs is evident and meaningful. Of particular note are the roadmap plans: launching a mobile app, enhancing accessibility through KYC integration, and implementing a debit card system that allows users to make payments using their deposited assets as collateral. These initiatives clearly reflect the project’s goal of building a user-friendly lending experience and extending cross-chain asset utilization into everyday life.