Table of Contents

1. Chainlink: Driving the Core Data Infrastructure for Blockchain Networks

2. Unpacking Chainlink’s Data Infrastructure

2-1. Data services - Bringing all financial data on-chain via Chainlink

2-2. Interoperability Services - Bridging fragmented data and assets across blockchains

2-3. Privacy oracle services - Bringing Web2 identity to Web3 while safeguarding privacy

2-4. Computing services - Reducing costs and enhancing operational efficiency

3. Expanding Use Cases for Chainlink in Web3

3-1. Accelerating stablecoin regulations are driving the need for Chainlink PoR

3-2. As the Bitcoin ecosystem expands, Chainlink is establishing itself as the standard infrastructure solution

4. Why Traditional Financial Institutions Need Chainlink

4-1. Chainlink seamlessly connects legacy financial infrastructure with Web3, boosting efficiency

4-2. Chainlink is the optimal choice for institutions prioritizing regulation and security

4-3. Chainlink expands financial services and drives industry innovation

5. Closing Remarks - Why Chainlink Is the One to Watch in 2025

1. Chainlink: Driving the Core Data Infrastructure for Blockchain Networks

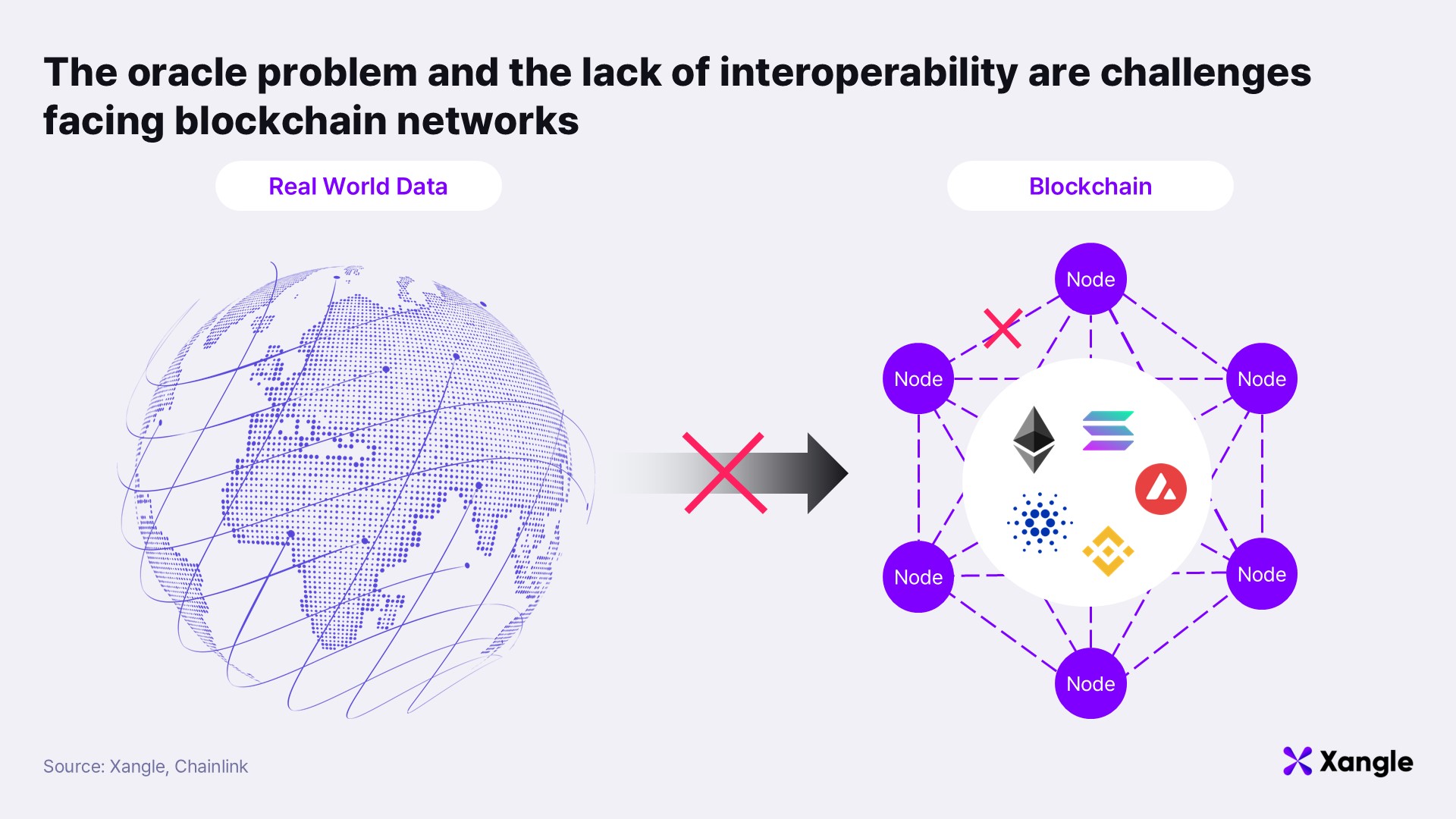

Blockchain networks that store data in a decentralized manner offer significant advantages, including integrity, transparency, and resistance to censorship. However, these networks also suffer from a notable limitation: they are inherently isolated from external data environments. Although data recorded on a blockchain can be freely utilized, fetching off-chain data or interacting seamlessly with other blockchain networks is challenging. In essence, obtaining reliable external data in a trustworthy manner is difficult, and as various blockchain networks operate independently, issues of data fragmentation and resource siloing arise. The disconnection from off-chain data is commonly referred to as the oracle problem, while the fragmentation among blockchains is seen as a deficiency in interoperability.

To overcome these challenges, the concept of blockchain data infrastructure has emerged. Such infrastructure not only enables blockchain networks to incorporate external data reliably but also enhances interoperability across different blockchains, thereby mitigating inherent limitations. As DeFi and on-chain financial systems continue to expand, robust data infrastructure becomes increasingly indispensable.

Within today’s blockchain ecosystem, a variety of data infrastructures—ranging from oracles to cross-chain solutions and data indexing services—are under development. Among these, Chainlink stands out as the clear industry leader. Chainlink’s contributions extend beyond simple data provisioning; it offers comprehensive solutions for cross-chain interoperability and proof-of-reserve mechanisms, effectively managing the entire spectrum of blockchain data infrastructure.

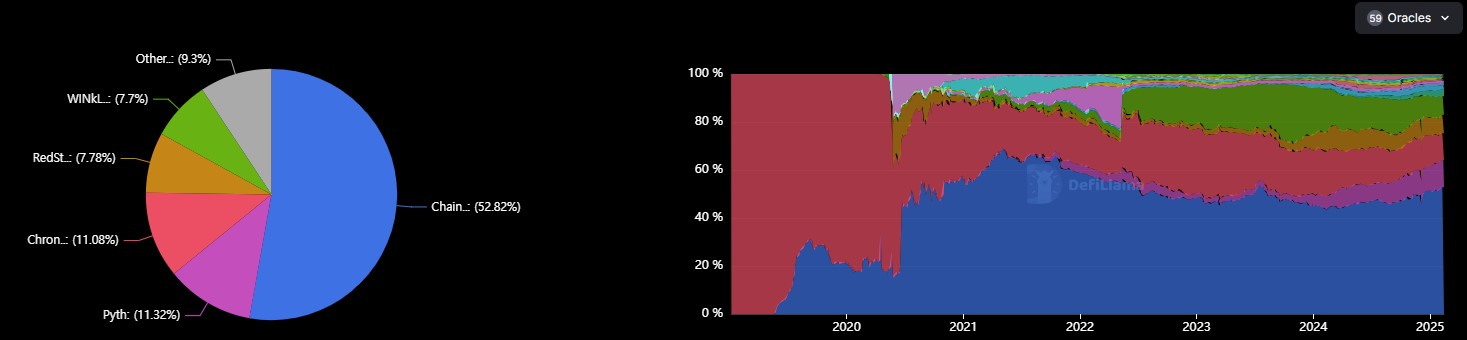

Chainlink’s oracle network has demonstrated its security and reliability over years of live operation. Since 2019, its market share has grown rapidly, and by mid-2020, it had established itself as the leader in the field. As of February 13, 2025, Chainlink commands a market share of 52.8%.

This report delves into Chainlink’s pivotal role as an essential element of blockchain data infrastructure. We examine the specific functions and mechanisms that Chainlink provides and, based on these insights, offer a forward-looking perspective on its future.

2. Unpacking Chainlink’s Data Infrastructure

2-1. Data services - Bringing all financial data on-chain via Chainlink

Data Feeds

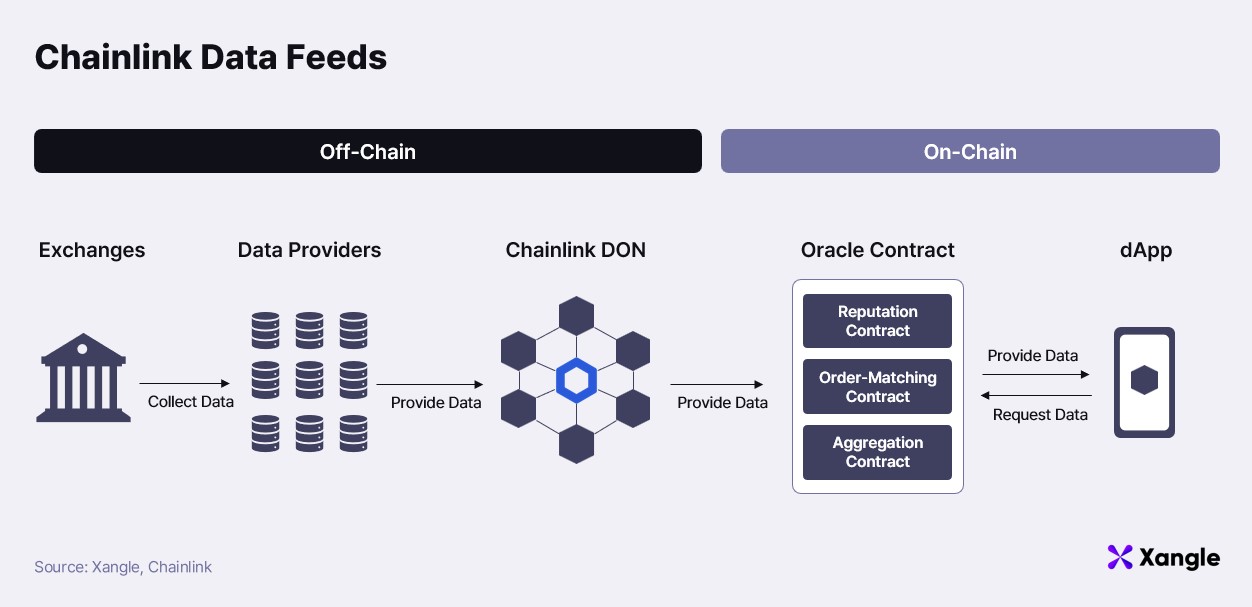

Chainlink’s Data Feeds is instrumental in delivering reliable external data onto the blockchain via its Decentralized Oracle Network (DON). Given that blockchains are inherently incapable of directly accessing external data, Chainlink securely aggregates, verifies, and supplies the necessary data for smart contracts.

The Data Feeds is composed of both on-chain and off-chain elements. On the blockchain, when a smart contract requests specific data, Chainlink’s oracle contract processes this request through a structured mechanism designed to ensure data integrity. Three core components are involved:

- Reputation Contract: Assesses the historical performance of oracle nodes to determine their trustworthiness.

- Order-Matching Contract: Connects data requests with suitable oracle nodes.

- Aggregation Contract: Consolidates and verifies data provided by multiple oracle nodes—often using techniques such as calculating the median—to produce a final, reliable value.

Off-chain, external financial and other data are aggregated from various exchanges and data providers, then processed by the DON. Each oracle node operates independently, fetching data from off-chain sources and transmitting it to the blockchain. The DON’s architecture is designed to manage simultaneous requests from numerous nodes, comparing and consolidating their outputs to maintain high reliability. Once verified on-chain, this refined data is made available for use by Web3 projects and smart contracts.

This dual-layer structure greatly enhances the stability and trustworthiness of the Chainlink network. To date, Chainlink supplies Data Feeds to 1,174 blockchain projects, solidifying its dominant position in the market.

Data Streams

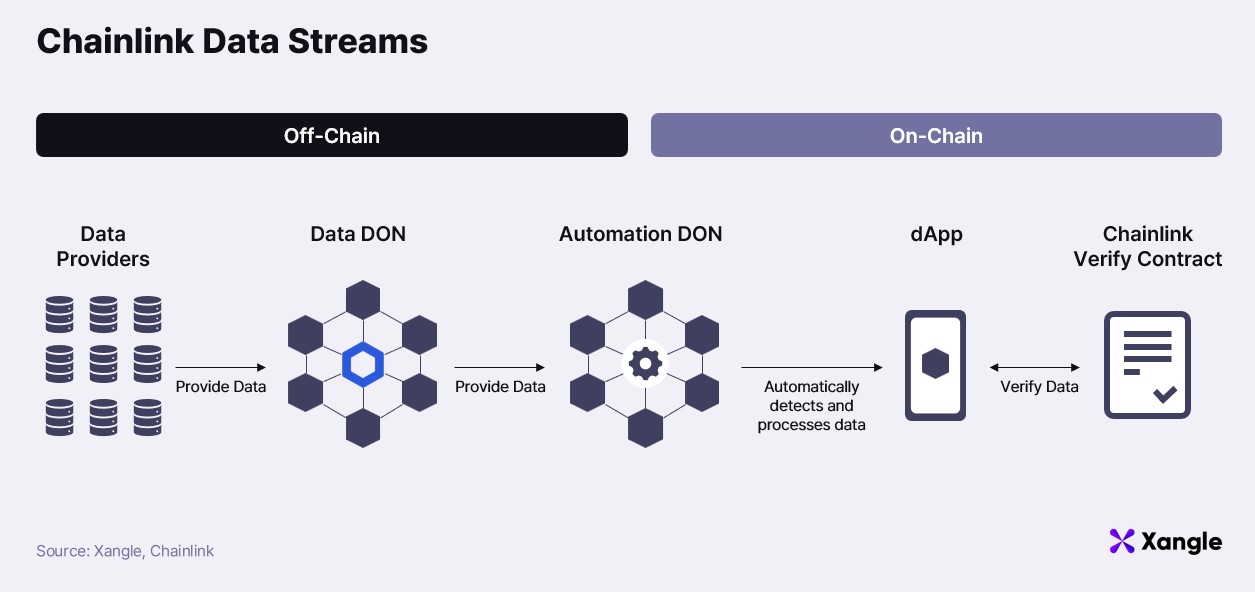

Chainlink Data Streams represent a high-speed oracle solution that delivers real-time market data on-chain with millisecond-level latency. In contrast to the traditional push-based method of Chainlink Data Feeds—which aggregates data from multiple sources and posts prices at fixed intervals—Data Streams employ a hybrid approach. Data is streamed off-chain in real time and then validated on-chain as needed.

This innovative system relies on key components: the Automation DON, which autonomously detects and processes data requests, and the Chainlink Verify Contract, which confirms data integrity on-chain. Automation DON minimizes on-chain execution costs by performing necessary computations off-chain, while the Verify Contract ensures that only authenticated data is passed on for smart contract utilization. As a result, smart contracts can access the latest price data immediately, reducing unnecessary gas fees from frequent updates.

Additionally, Data Streams offer granular market data that reflects both liquidity and volatility. Where conventional oracles may provide merely a median price, Data Streams incorporate liquidity-weighted bid and ask (LWBA) prices to capture market depth. This enhanced data provision improves trade precision, fortifies on-chain risk management, and allows for dynamic adjustments to margins or settlement terms in response to real-time market conditions. This capability is especially valued by on-chain derivatives platforms such as GMX and Synthetix, which leverage Data Streams to recreate trading environments comparable to those of centralized exchanges.

Proof of Reserve (PoR)

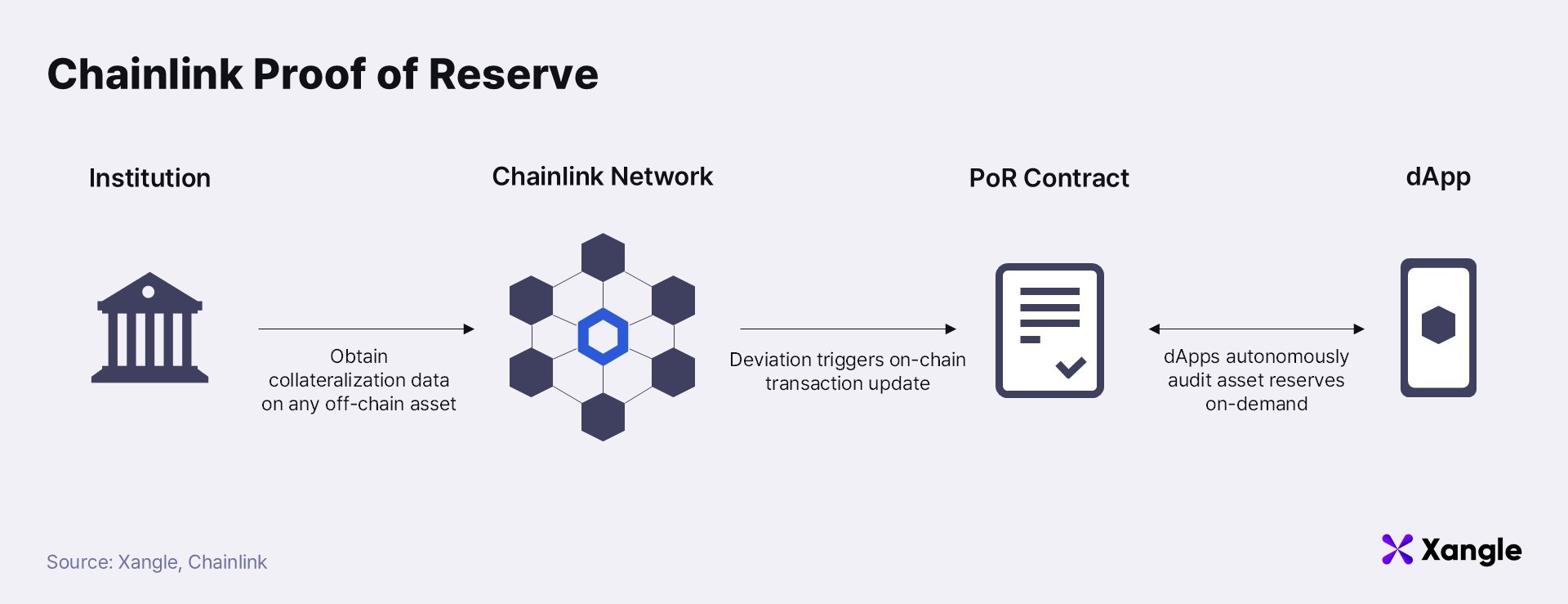

Chainlink’s Proof of Reserve (PoR) solution empowers smart contracts to verify, in real time, the reserve status of off-chain and cross-chain assets through a decentralized framework. Traditional centralized systems typically rely on independent auditing bodies to verify reserves and publish reports—a process that is both opaque and time-consuming. In contrast, Chainlink PoR employs the decentralized oracle network (DON) to automatically post reserve data on-chain, thereby ensuring both transparency and reliability.

Moreover, PoR incorporates a Secure Mint function that mandates new tokens to be backed by reserves exceeding the actual collateral. In conjunction with Chainlink Automation, this mechanism can automatically suspend token issuance if reserve levels fall below a required threshold (see section 2-4 for further details).

PoR is utilized to verify the reserve statuses of various asset classes, including stablecoins, wrapped assets, and tokenized real-world assets (RWA). For example, it ensures that stablecoins are backed 1:1 by bank deposits, and it guarantees that Bitcoin ETFs or wrapped assets (e.g., WBTC) have sufficient collateral on-chain. Several projects—such as TUSD, PoundToken, and CACHE Gold—are employing PoR to enhance the transparency of stablecoin operations and asset tokenization.

Smart Data

Chainlink SmartData is an on-chain data infrastructure designed to enhance the reliability, accessibility, and quality of tokenized real-world assets (RWA). As blockchain technology penetrates financial markets, digital financial products such as funds, stablecoins, and wrapped assets increasingly require on-chain evaluation and management. Chainlink SmartData addresses this need by securely providing critical metrics on-chain, including: 1) Proof of Reserve, 2) Net Asset Value (NAV), and 3) Total Assets Under Management (AUM).

Unlike standard price feeds that merely report token prices, SmartData is distinguished by its focus on essential financial indicators. The NAVLink feed, for example, publishes the net asset values of investment products like mutual funds and ETFs in real time, while the SmartAUM feed tracks the total assets managed by financial institutions and asset managers. This data is invaluable for constructing investment strategies and performing risk assessments, enabling DeFi and on-chain financial applications to automate fund management, asset rebalancing, and smart contract-based investment strategies with reliable, real-time data.

The potential of Chainlink SmartData is further validated by collaborations with prominent global financial institutions. For instance, a U.S.-based traditional financial infrastructure firm—comparable to Korea’s Korea Securities Depository—has conducted a Smart NAV pilot using Chainlink CCIP. This pilot successfully disseminated mutual fund NAV data across multiple blockchains, marking a significant step in bridging traditional finance with on-chain solutions. This case underscores the possibility that more institutions will adopt Chainlink SmartData in the future.

2-2. Interoperability Services - Bridging fragmented data and assets across blockchains

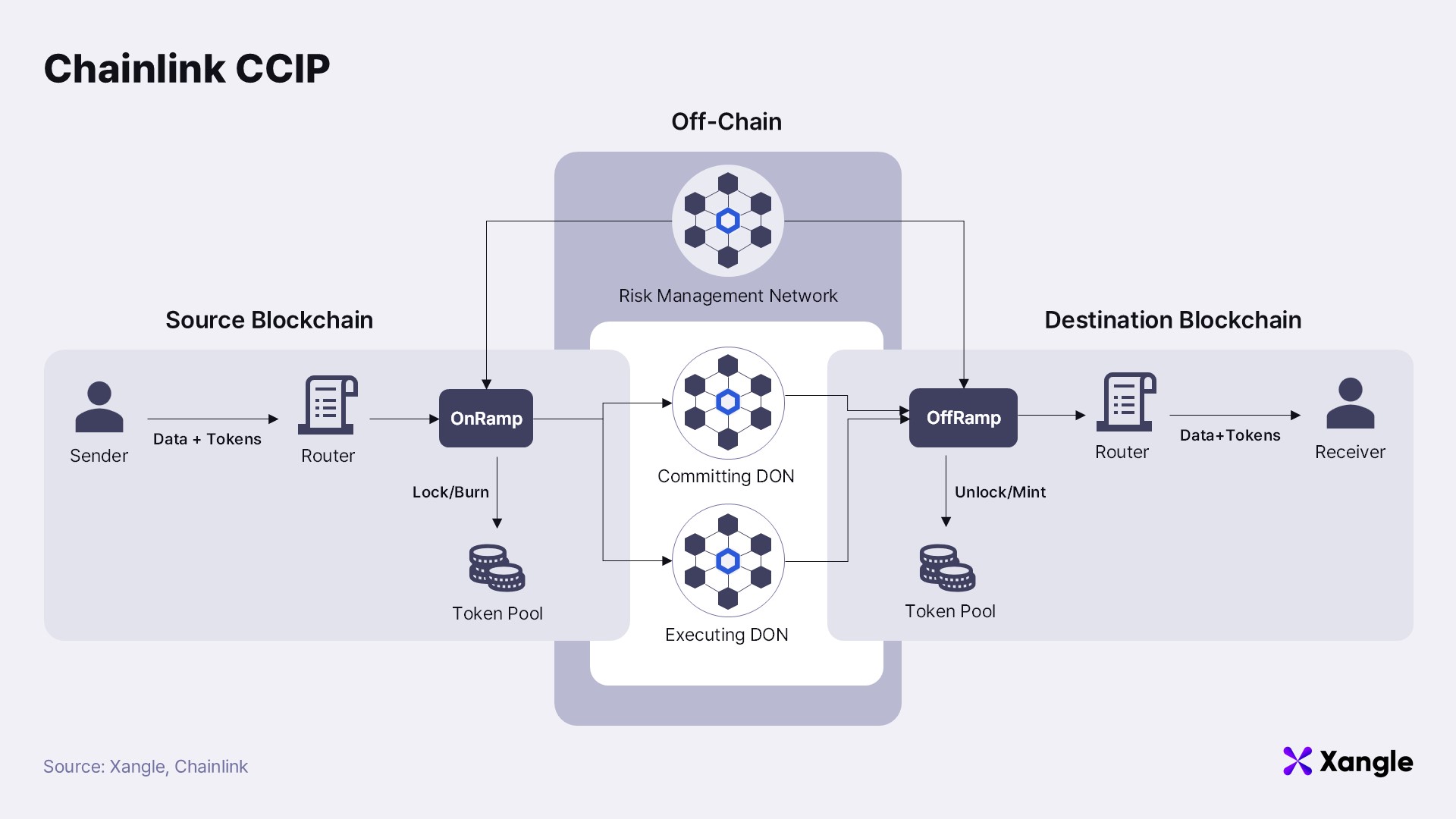

CCIP (Cross-Chain Interoperability Protocol)

Chainlink CCIP is a universal cross-chain protocol that enables secure data and asset transfers between disparate blockchains. Traditional cross-chain solutions have often relied on multi-signature bridges or centralized validator structures, which left them vulnerable to security breaches—as evidenced by the large-scale fund thefts in incidents like the Ronin Bridge and Nomad Bridge hacks. In contrast, CCIP employs a security-centric design that addresses these vulnerabilities while providing a stable cross-chain connection. Notably, it operates an independent Risk Management Network (RMN) that continuously monitors transactions; if any anomalous activity is detected, the system can block specific transactions or temporarily suspend cross-chain messaging across the network.

CCIP offers three core functionalities. First, the Arbitrary Messaging feature allows smart contracts on different blockchains to exchange data and react automatically, paving the way for the creation of intelligent financial products based on on-chain assets. Second, the Token Transfer function enables the transfer of tokens to smart contracts or directly to externally owned accounts (EOAs) on other blockchains. Finally, the Programmable Token Transfer feature combines cross-chain asset transfers with smart contract execution in a single transaction—making it possible, for instance, to automate collateral deposits in lending protocols. As of February 24, CCIP is already being utilized by 287 projects and teams.

Moreover, CCIP is not limited to Web3; it is also being adopted by traditional financial systems. In 2023, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) partnered with Chainlink, along with global financial institutions including Citi, BNY Mellon, and BNP Paribas, to test CCIP. Using the existing SWIFT network, they successfully executed simultaneous payments of tokenized assets across multiple blockchains—a milestone that is viewed as a crucial first step in bridging conventional finance with blockchain networks.

For more detailed insights on CCIP, please refer to Xangle’s “Can Chainlink’s CCIP Become a Standard Over LayerZero?” report.

2-3. Privacy oracle services - Bringing Web2 identity to Web3 while safeguarding privacy

DECO Sandbox

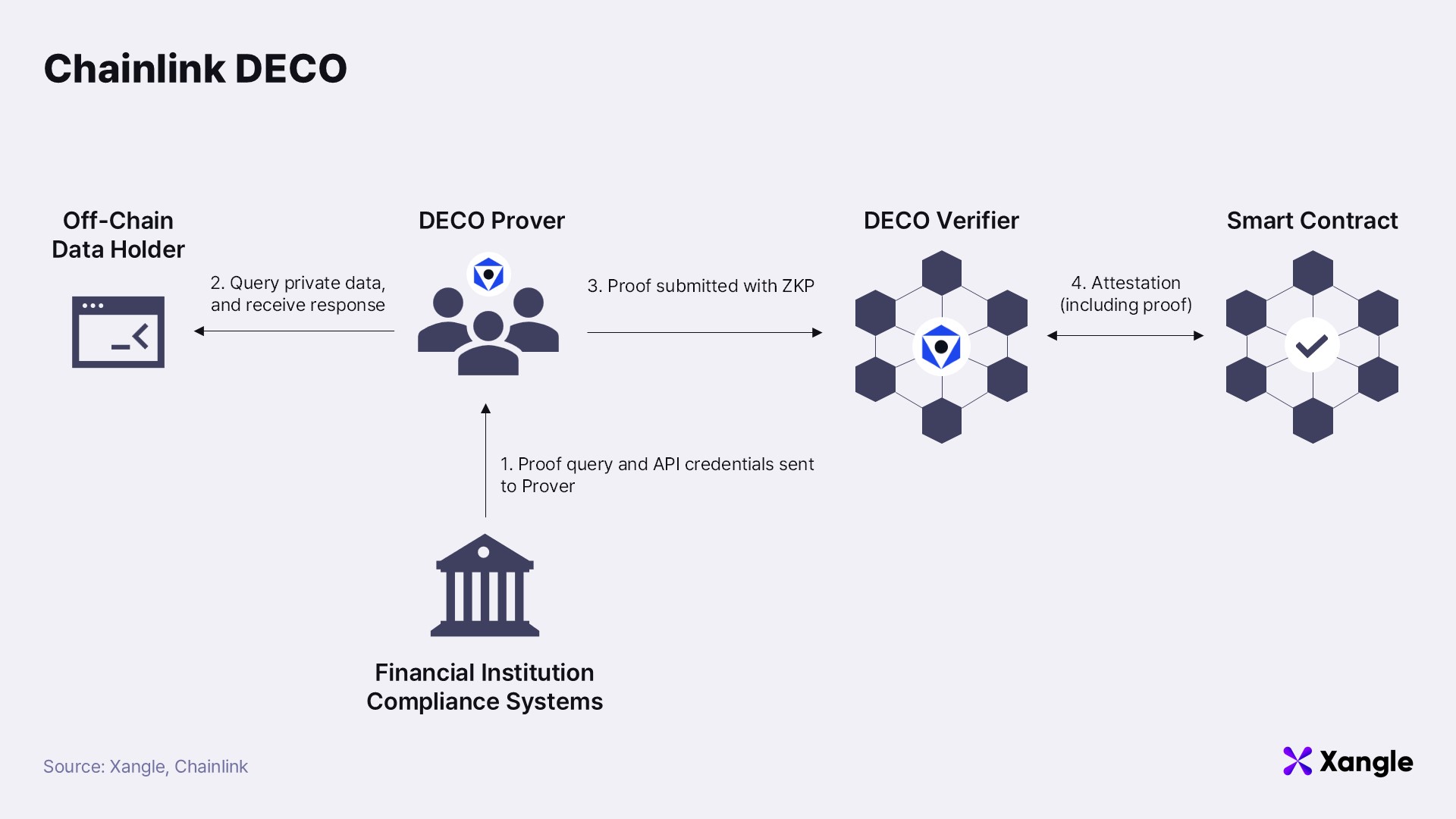

As blockchain technology becomes more widespread in the financial market, the issues of data privacy and regulatory compliance have come to the forefront. Traditional financial systems require rigorous authentication processes such as KYC and AML, but in a decentralized blockchain environment, striking a balance between identity verification and privacy protection is challenging. To address this, Chainlink has developed privacy-enhancing technologies and regulation-friendly on-chain data verification solutions.

A flagship solution is DECO, which enables users to prove that they meet certain conditions without having to disclose their personal information. For example, it can verify that a bank account’s balance exceeds a specified threshold without exposing the actual account number or exact balance. DECO leverages Zero-Knowledge Proofs (ZKP) to authenticate data while protecting sensitive information. Since it operates on existing web server protocols (TLS), financial institutions and enterprises can adopt it without needing to overhaul their infrastructure. This allows organizations to meet regulatory requirements without compromising on privacy, while Web3 projects can achieve secure on-chain identity verification and fund validation.

An illustrative case is Coinbase’s Project Diamond, which utilizes Chainlink’s infrastructure to enable institutional investors to manage on-chain assets in compliance with regulatory standards. Chainlink’s technology thus supports financial institutions in smoothly meeting regulatory obligations by leveraging decentralized IDs (DIDs) and verified credentials.

2-4. Computing services - Reducing costs and enhancing operational efficiency

Automation

Chainlink Automation is a service that enables the automatic execution of smart contracts. Traditionally, smart contracts require external transactions to trigger their execution, resulting in a lack of automatic response when specific conditions are met. By leveraging Chainlink’s DON, Automation facilitates periodic task execution, automated liquidations upon price triggers, interest rate adjustments, and more—all without manual intervention. Utilizing a network of high-uptime nodes ensures that these operations remain reliable, eliminating the need for centralized management and enhancing overall operational stability. With Automation, various on-chain systems—from DeFi protocols and NFT marketplaces to gaming platforms and DAO governance structures—can realize significant cost savings and efficiency improvements.

Functions

Chainlink Functions is a service that empowers smart contracts to access external APIs and Web2 data. Prior to this, smart contracts were limited to on-chain data, making real-time interaction with off-chain information challenging. Functions utilizes the Chainlink oracle network to fetch a wide array of Web2 data—ranging from weather information and sports results to financial data and IoT sensor readings—and bring it on-chain. This integration enables the creation of complex smart contracts that combine on-chain and off-chain data in industries such as insurance, supply chain management, decentralized finance, and gaming. Additionally, Functions offers a custom code execution feature, allowing developers to process specific computations off-chain and then transfer the results to the blockchain.

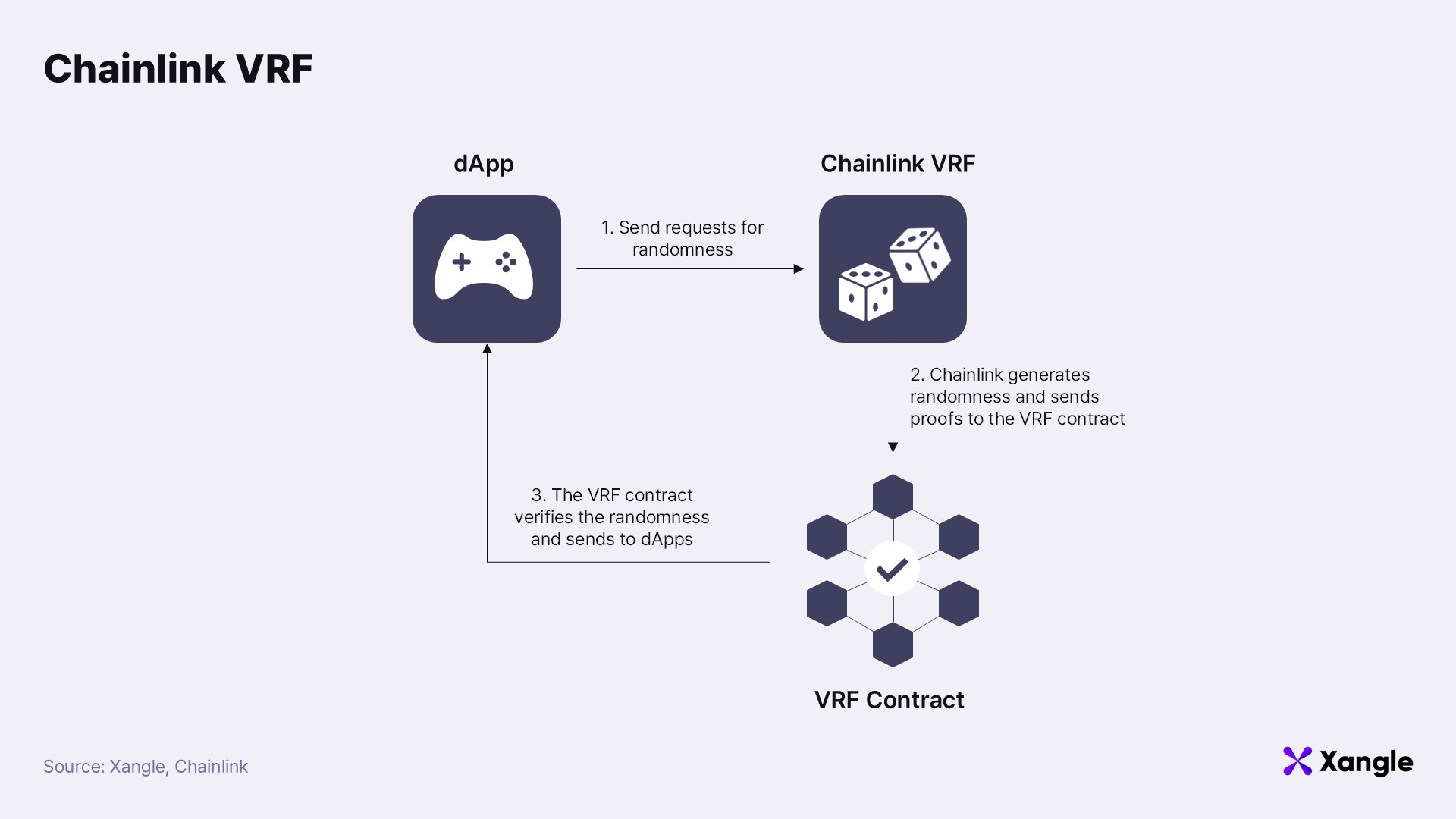

VRF(Verifiable Random Function)

Chainlink VRF is an on-chain solution designed to generate fair and verifiable random numbers. Traditional methods that rely on on-chain variables like timestamps or block hashes were susceptible to manipulation—where block producers could potentially alter outcomes by influencing block creation times or selectively submitting blocks. In contrast, VRF generates random numbers accompanied by cryptographic proofs that validate their integrity, thereby eliminating the possibility of tampering.

In practice, when a user requests a random number, VRF generates both the number and an accompanying cryptographic proof. This proof is then transmitted to the VRF smart contract, which verifies it to ensure that the randomness has not been manipulated. Once verified, the random number is made available for use in various blockchain applications. Thanks to this robust structure, projects utilizing VRF can effectively neutralize any possibility of block producer manipulation, ensuring transparent and trustworthy random number generation on-chain.

Currently, VRF is employed across a range of applications including blockchain gaming, NFT minting, and randomized reward systems. A recent noteworthy example is Nexon’s forthcoming blockchain-based game, MapleStory Universe, which has integrated Chainlink VRF to ensure fairness in aspects such as in-game item drops. This example underscores how VRF is being adopted not only in financial sectors but also across major gaming IPs and various other industries as a trusted infrastructure solution.

3. Expanding Use Cases for Chainlink in Web3

3-1. Accelerating stablecoin regulations are driving the need for Chainlink PoR

The value of stablecoins hinges on the trust that the collateral assets (such as U.S. dollars) are fully reserved to back the issued tokens. However, in the wake of events like the FTX collapse at the end of 2022, trust in centralized platforms has eroded, sparking widespread calls for transparent reserve disclosures. Whereas stablecoin issuers once relied solely on publicly released reserve reports or bank guarantees to build confidence, there is now a growing consensus that only on-chain data—with cryptographic proofs—can ensure sufficient trust.

In line with these developments, regulatory efforts targeting stablecoins have recently accelerated in the United States. In February 2025, Senator Bill Hagerty introduced the “GENIUS Act,” a bill that defines stablecoins as digital assets pegged 1:1 to the U.S. dollar and imposes federal regulations—including stringent reserve reporting requirements—on issuers with a market capitalization exceeding $10 billion. In addition, the U.S. Securities and Exchange Commission (SEC) approved interest-bearing stablecoins as securities for the first time. With these regulatory measures moving forward, the importance of Chainlink’s Proof of Reserve (PoR) is expected to increase significantly.

3-2. As the Bitcoin ecosystem expands, Chainlink is establishing itself as the standard infrastructure solution

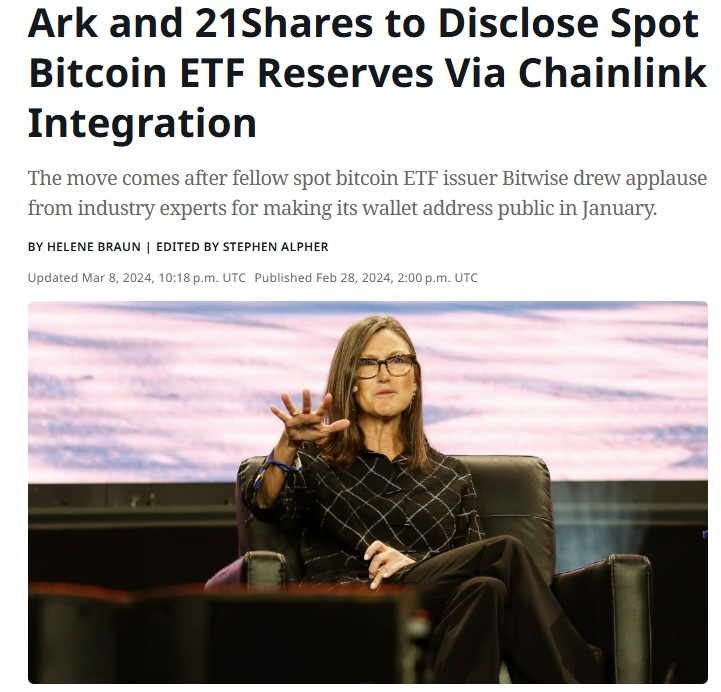

Following the approval of Bitcoin spot ETFs, transparent disclosure of the underlying asset holdings has emerged as a critical issue. While traditional financial systems rely on daily reporting or third-party custodial audits to verify collateral, on-chain verification of reserves significantly bolsters investor confidence. For instance, ARK Invest and 21Shares have integrated Chainlink PoR to validate and publicly display the Bitcoin holdings of the ARKB Bitcoin ETF in real time. As the adoption of Bitcoin ETFs grows, the demand for on-chain PoR has surged, positioning Chainlink as the de facto standard solution.

Source: CoinDesk

Source: CoinDesk

Bitcoin-based Layer 2 projects are also enabling direct on-chain utilization of Bitcoin by providing smart contract environments. In these ecosystems, Chainlink serves as the critical infrastructure that ensures data reliability and cross-chain connectivity. For example, Spiderchain—currently under development by Botanix Labs—integrates Chainlink Data Feeds to offer decentralized pricing data similar to that on Ethereum. Moreover, through CCIP, Spiderchain facilitates the use of locked-up BTC in Ethereum-based DeFi protocols, and vice versa, thereby securing robust cross-chain interoperability.

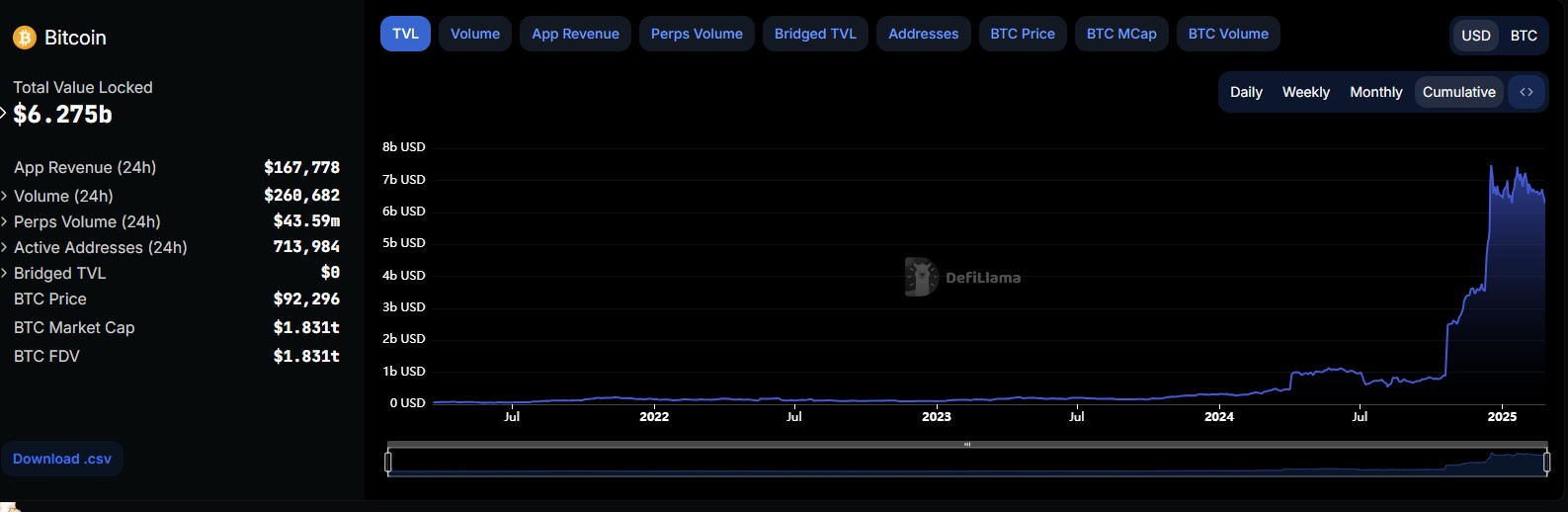

As the Bitcoin DeFi market continues to grow, diverse methods for utilizing BTC on-chain are emerging. The Solv protocol, for instance, operates a model where users deposit BTC and receive a 1:1 pegged token, SolvBTC, backed by over $2 billion in collateral. By adopting Chainlink’s CCIP as its official bridge, Solv ensures seamless asset transfers across multiple chains. This integration allows users to leverage SolvBTC across various platforms while enabling secure cross-chain transactions via CCIP.

Source: DefiLlama

Source: DefiLlama

Driven by the approval of ETFs, Layer 2 scalability, and the burgeoning DeFi ecosystem, the Bitcoin landscape is expanding rapidly. In this dynamic environment, Chainlink has emerged as the critical infrastructure provider delivering reliability and interoperability. Based on the reference cases mentioned above, Chainlink is poised to cement its role as a key infrastructure solution within the Bitcoin ecosystem.

4. Why Traditional Financial Institutions Need Chainlink

Chainlink’s role is not confined to the Web3-native space; it is increasingly emerging as an essential bridge for traditional financial institutions as well. This growing importance is driven by the unique advantages Chainlink offers in integrating legacy financial systems with blockchain technology and Web3. The key reasons can be summarized as follows:

4-1. Chainlink seamlessly connects legacy financial infrastructure with Web3, boosting efficiency

Major financial institutions are attracted to the efficiency and transparency of blockchain technology while preferring to integrate new solutions without completely overhauling their existing systems. Chainlink offers these institutions a familiar interface to access blockchain functionalities, making it an attractive solution with multiple proven use cases.

For example, the collaboration between SWIFT and Chainlink demonstrated the movement of tokenized assets by leveraging existing banking networks to connect with both public and private blockchains. In this experiment, several financial institutions—including Citi, BNP Paribas, and BNY Mellon—successfully integrated SWIFT messaging with Chainlink’s CCIP, enabling smart contracts across disparate networks to communicate seamlessly.

In addition, Chainlink has partnered with Euroclear and SWIFT alongside global financial giants such as UBS, Franklin Templeton, and Wellington Management to drive an industry initiative that combines AI, oracles, and blockchain technology. This project showcased how Chainlink’s oracles, integrated with AI models, can automatically aggregate and verify corporate action data (such as dividend payments or stock splits) and convert it for on-chain use. Moreover, by leveraging CCIP, the solution ensures the secure transfer of data between various public and private blockchains. As a result, corporate action data is standardized and delivered in real time, allowing investors and financial institutions to access accurate information swiftly and without additional verification.

In summary, Chainlink enables financial institutions to adopt blockchain technology in a manner that preserves the continuity of their existing infrastructure while enhancing automation and operational efficiency. This is the primary reason why traditional financial entities increasingly require Chainlink.

4-2. Chainlink is the optimal choice for institutions prioritizing regulation and security

When financial institutions consider adopting blockchain technology, regulatory compliance and security are paramount concerns. Chainlink plays a critical role in addressing these concerns.

For instance, Coinbase adopted Chainlink’s standards for its tokenization platform, Project Diamond, which is tailored for institutional investors. This platform supports the issuance, trading, and redemption of tokenized private market assets and integrates Chainlink’s CCIP to facilitate the secure movement of assets between public and private blockchains. This design not only meets regulatory requirements but also ensures interoperability across various blockchain networks. Reflecting on this, Coinbase Asset Management’s CIO Marcel Kasumovich stated in an official announcement that “Chainlink is the indispensable infrastructure that enables asset issuers, banks, and financial institutions to comply with regulations, secure their data with verified information, and build tokenization solutions that operate seamlessly across public and private blockchains.”

Chainlink’s network upholds the integrity of oracle data through multi-node and multi-signature structures, while its staking-based economic model further enhances security. These attributes make Chainlink the premier choice for financial institutions.

4-3. Chainlink expands financial services and drives industry innovation

By leveraging Chainlink, traditional financial firms gain a platform to introduce new financial products and services. In sectors where processes have historically been cumbersome—such as trade finance or international remittances—Chainlink is catalyzing process innovation. In the second phase of Brazil’s Central Bank’s Drex CBDC pilot, a consortium comprising Banco Inter, Microsoft Brazil, 7COMm, and Chainlink is developing a blockchain-based trade finance solution. This project aims to automate cross-border agricultural transactions and improve supply chain management. Utilizing Chainlink’s CCIP, the solution secures interoperability between Brazil’s Drex CBDC and digital currencies issued by foreign central banks, while also tokenizing electronic bills of lading (eBoL) to enable automatic payments to exporters during transportation. Angela Walker, Head of Financial Markets at Chainlink Labs, remarked, “Chainlink CCIP is the core enabler for secure, cross-border, multi-currency, and multi-chain transactions, and this pilot will validate the potential of tokenized assets.”

In addition, Chainlink has collaborated with BYMA—Latin America’s largest stock exchange—to develop a securities token issuance and clearing system, conducted stablecoin-compatible payment trials with Australia’s ANZ Bank, and participated in innovation projects such as ADGM’s RegLab Sandbox. These examples demonstrate how Chainlink is accelerating the digital transformation of financial services and enabling previously unfeasible products—such as stock-based instant settlements and real-time international trade payments. Chainlink is rapidly becoming the essential technological backbone for blockchain adoption across various industries.

5. Closing Remarks - Why Chainlink Is the One to Watch in 2025

Despite its revolutionary potential, blockchain technology historically faced significant barriers to mass adoption due to stringent regulatory constraints. Landmark regulations such as Chokepoint 2.0 and SAB121 limited financial institutions’ interactions with virtual asset companies, and the SEC’s rigorous oversight of major crypto entities further hindered market expansion. Such institutional constraints were significant obstacles to the adoption of blockchain infrastructure.

However, following shifts in regulatory policy during the Trump administration, a more relaxed approach to virtual asset regulations is anticipated, accelerating the transition of traditional finance to Web3. President Trump recognized digital assets as strategic assets and promised regulatory easing, thereby creating an environment conducive to blockchain adoption by financial institutions. In fact, shortly after taking office, Trump signed an executive order aimed at “Strengthening U.S. Leadership in Digital Financial Technology,” and since then, various initiatives have emerged in the United States to facilitate both regulatory adaptation and the adoption of blockchain technology.

A notable development is the ‘World Liberty Financial (WLF)’ project, led by the Trump family, which has adopted Chainlink as its infrastructure. WLF aims to promote the use of U.S. dollar-based stablecoins within the global financial system and to popularize decentralized finance (DeFi). Built on an Aave v3 instance that utilizes Chainlink Data Feeds and CCIP, WLF is set to offer lending services that exemplify the synergy of traditional finance and blockchain.

In conclusion, Chainlink is positioned to be one of the primary beneficiaries of U.S. regulatory changes and projects like WLF. This convergence of regulatory reform and technological innovation is the most compelling reason to keep a close watch on Chainlink in 2025.