1. The Growing Wealth Gap: A Crisis at the Threshold

2. Web3, A Promising Solution to the Wealth Gap

3. Hyperliquid: The Ultimate Champion of Community Distribution

4. Addressing Key Challenges: Expanding Services and Lowering Entry Barriers

1. The Growing Wealth Gap: A Crisis at the Threshold

Conversations about the expanding wealth gap are now commonplace, and the data suggests these concerns are well-founded. Various indicators show that the narrowing of economic disparities observed after World War II—particularly throughout the 1960s and 1970s—has reversed course. Today, inequality has surged back to levels comparable to those of the world war era. For instance, in the United States, the proportion of total wealth held by the top 0.1% of households dropped to as low as 8% during the 1970s but has since skyrocketed to over 20% in the 2010s.

Wage inequality, the very foundation of wealth creation, has similarly reached historic peaks, exceeding levels seen in 1928, just before World War II. According to the latest publicly available data from 2018, it is highly probable that these gaps have widened even further as we approach 2025.

This issue isn’t confined to wealth and wages. The gap between industries is also deepening. Today, the top 10 companies by market capitalization—names like Microsoft, Apple, Google, Amazon, and NVIDIA—have concentrated unprecedented levels of economic power. This exceeds even the concentrated market dominance of the “Nifty Fifty” era in the late 1960s and the monopolistic markets of the 1920s. Of particular note, nine of these top 10 companies, with the exception of Saudi Aramco, are all Big Tech firms. This dominance highlights the vast economic value generated by these companies compared to traditional industries, as well as their elevated status in the marketplace. With the advent of the AI era, this trend is widely expected to accelerate further.

As inequality deepens across society, social conflicts are also becoming more pronounced. In South Korea and elsewhere, far-right and far-left political factions are emerging, eroding the possibility of political and societal consensus. Debates over issues like refugee acceptance have become fiercely polarized, leading to a growing number of nations closing their borders. Around the globe, the adverse effects of widening inequality are becoming increasingly evident, with little sign of reversal. Historically, such severe economic disparities have often culminated in revolutions or wars—a reflection of humanity's cyclical history. When centralized powers (the “towers” such as monarchies, governments, or large corporations) become overbearing, decentralized networks (the “squares” representing the masses and individuals) inevitably rise in opposition.

Looking ahead, demands for more equitable “redistribution” across all areas—wealth, wages, and industries—are likely to intensify. How can we address these challenges? During the Renaissance, Gutenberg’s printing press revolutionized communication and empowered the “square.” Could we see a similar turning point in the 21st century? Might Web3 offer a solution to these issues?

2. Web3, A Promising Solution to the Wealth Gap

Web3 is has the potential to become an indispensable element of our political and social fabric. Its potential to address the widening wealth gap discussed earlier positions it as a modern zeitgeist for equitable solutions. Surprisingly, Web3’s mainstream adoption might occur more seamlessly than one might expect. For most people, abstract industry debates—like decentralization or the blockchain trilemma—are secondary. What truly matters to the average user is whether a service offers tangible benefits or simplifies daily life. In this regard, Web3 holds significant potential to tackle pressing livelihood challenges—what we might call the practicalities of "Everyday Survival Dynamics."

The defining characteristic of Web3 is its fundamentally different approach to “distribution,” which sets it apart from its Web1 and Web2 predecessors. While the journey will take time, if Web3 aligns itself with the spirit of a new era, it could ensure the fairer distribution of value created within its ecosystem. The following examples demonstrate just how different Web3’s stance on distribution is compared to Web2.

The promise of fairer distribution through Web3

A breakthrough case of Web3’s promise was Axie Infinity, a game that three years ago exemplified how blockchain technology could transform economic participation. For the first time, people realized they could earn real income and sustain a livelihood by engaging with a Web3 service. Axie players reported monthly earnings ranging from hundreds to thousands of USD, drawing over 2 million users, particularly from Southeast Asia.

While traditional games had similar earning opportunities through grinding or "farming," Axie’s combination of blockchain technology and tokenization created a new paradigm: Play-to-Earn (P2E). This innovative model became a compelling draw for users. Although the subsequent downturn in the metaverse and crypto markets reduced Axie’s user base, the game established Web3 services as platforms where users could generate income—a landmark moment for the ecosystem.

Another pivotal case that solidified Web3's position as a “distribution-friendly” alternative was the rise of the NFT marketplace Blur. During the NFT boom in 2021, OpenSea dominated the market, accounting for over 90% of transactions and establishing itself as a near-monopoly. Many investors believed OpenSea’s business model, which thrived on network effects as a platform connecting NFT creators and holders, would make its dominance unshakable. Fueled by this confidence, OpenSea secured a valuation of approximately $13.3 billion in January 2022, successfully raising significant funding.

However, the seemingly unassailable NFT marketplace landscape was disrupted by none other than Blur. While OpenSea followed the traditional Web2 platform model, imposing a 2.5% transaction fee and generating significant profits, Blur adopted an entirely different strategy. It first attracted creators and users by offering a 0% fee structure. Then, it launched its own token, distributing 50% of the total supply to users via airdrops. This approach mirrored the Web3 formula demonstrated by Axie Infinity: “use the platform, earn rewards,” which once again proved effective in driving user acquisition—this time in the NFT marketplace sector.

As a result, OpenSea’s market share steadily declined from its peak in January 2022 to just 20% by late 2024. Blur initiated its token distribution in February 2023 and has since completed three seasons, with a fourth currently underway. To date, over 25% of Blur’s total token supply has reportedly been distributed.

Blur’s rise has prompted some users to migrate to other platforms like Magic Eden, seeking fresh airdrop rewards. This has resulted in a competitive landscape where Blur and Magic Eden now dominate. Meanwhile, OpenSea, under pressure, is expected to launch its own token and reward system to retain users.

Blur’s success illustrates how a Web3 approach can outperform a Web2 model, even within the same service category. A cornerstone of this success was the allocation of 50% of Blur’s tokens (valued at approximately $375M) to its users and community.

Had OpenSea maintained its dominance, the resulting benefits would have been concentrated among its founders and venture capitalists, who collectively funded its $13.3B valuation. In contrast, Blur’s model distributed its success across a vast community of users, embodying Web3’s ethos of equitable distribution. This shift not only showcases Web3’s ability to attract users but also sets a clear industry precedent for prioritizing fairness and inclusivity in value creation.

Tokenomics: Advancing toward greater distribution

The principle that communities should own tokens and partake in a project’s growth predates the emergence of Web3 as a formal concept. Ethereum’s public sale serves as a landmark example. At the time, ICOs (Initial Coin Offerings) were the preferred method over airdrops. Ethereum distributed 80% of its tokens through public sales, while EOS went even further, allocating 90%. This approach enabled early investors to reap substantial benefits as token prices appreciated.

However, while ICOs initially gained attention for democratizing investment access for retail participants, they quickly became problematic during bull markets. The proliferation of fraudulent projects created widespread losses, tarnishing the model’s reputation. The global, minimally regulated nature of ICOs made them a breeding ground for scams, crossing jurisdictions and exploiting unwary investors. Consequently, regulators like the SEC in the U.S. and South Korea’s Financial Services Commission implemented outright bans on ICOs.

With ICO-based public sales no longer viable, token projects turned to venture capital (VC) funding and listings on major centralized exchanges (CEXs) to build and grow their initiatives. This method was praised for introducing more stringent vetting processes, ensuring healthier market practices. Yet, it also meant that only 20–30% of tokens were typically allocated to the community, limiting the benefits available to users and contributors.

In recent years, a concerning trend has emerged: projects releasing tokens and securing CEX listings before launching fully developed services. This practice disproportionately allocates tokens to early investors and exchanges, further shrinking the community's share. This imbalance has drawn substantial criticism and highlights a pressing challenge for the Web3 ecosystem to resolve.

(For an in-depth exploration of tokenomics’ evolution, see Xangle’s article, “The Tokenomics Chronicle”)

3. Hyperliquid: The Ultimate Champion of Community Distribution

As the share of tokens allocated to VCs and centralized exchanges (CEXs) during the early stages of product development increased, the Web3 community grew increasingly vocal in its criticism. Binance and other exchanges demanding over 5% of total token supplies at listing, coupled with VCs flipping tokens purchased at low valuations to retail investors at higher prices, sparked self-reflection across the industry. Then, seemingly out of nowhere, Hyperliquid—the ultimate champion of community distribution—made its entrance.

** (Note: This article will focus on Hyperliquid from the perspective of “Why Web3?” and distribution. For insights into Hyperliquid’s role in the Perp DEX and its ecosystem, refer to the excellent analyses by Populus and Dispread: FOUR PILLARS – “How Can You Not Love Hyperliquid?” and DeSpread – “The Perpetual DEX Endgame.”)*

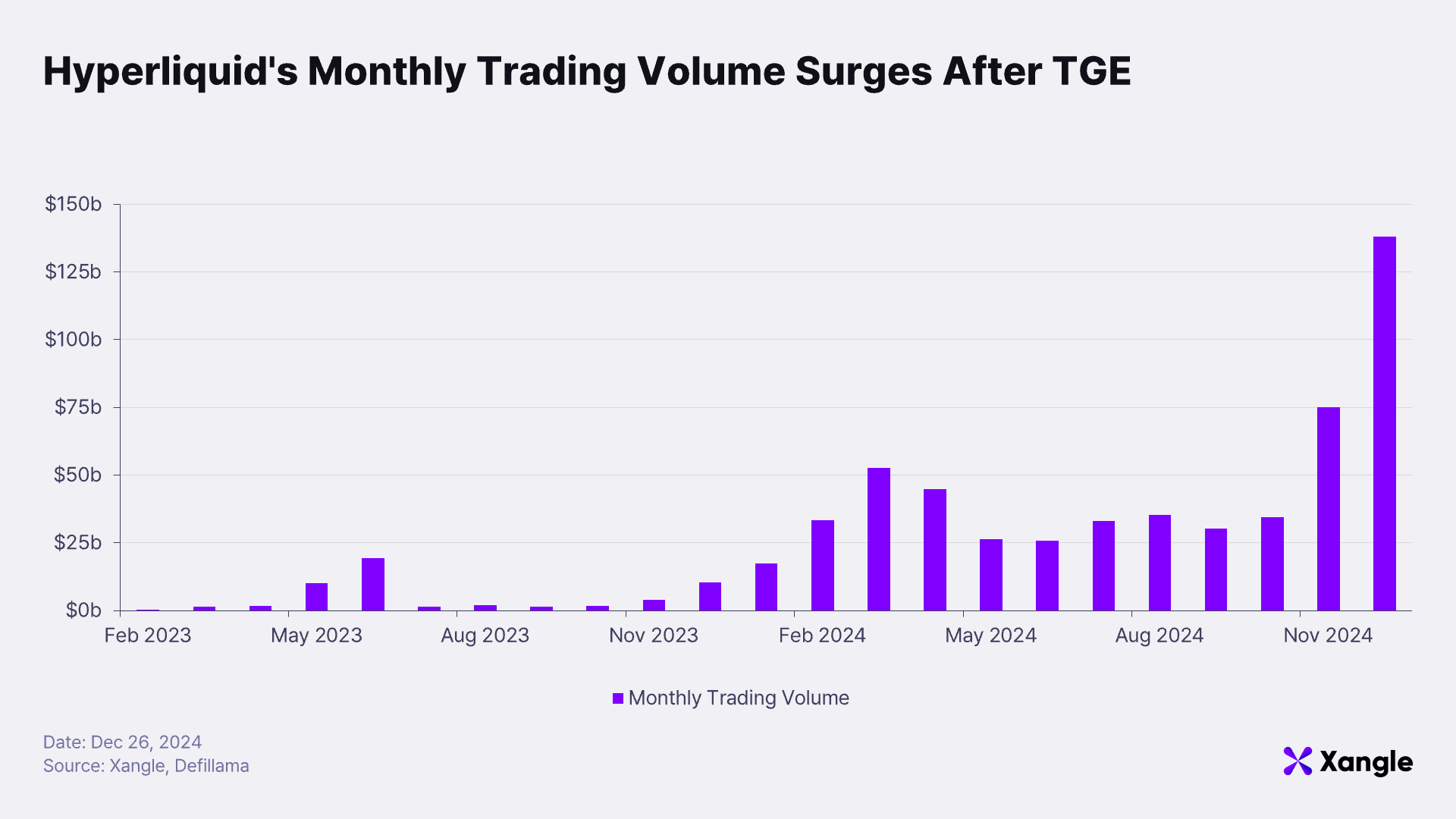

This year, Hyperliquid, a perpetual decentralized exchange (Perpetual DEX) operating quietly in the background, captured industry attention with its groundbreaking approach: on-chain order book processing, a highly competitive product, and unprecedented levels of token distribution to the community. During its Token Generation Event (TGE), Hyperliquid allocated 30% of its tokens to the community, with plans to distribute an extraordinary 70% of the total token supply to users. Moreover, the project opted to forgo VC funding and announced no plans to list on any CEX. These moves sent shockwaves through the industry, breaking traditional norms and generating immense anticipation around the project. Since its TGE, the token’s value has soared nearly tenfold, reaching a market cap of $30B. Of the 70% community allocation, the remaining 40% is valued at over $12B (₩16.5T). This has created a virtuous cycle where users engage more with the service to qualify for their share of the tokens.

What personally caught my attention was not Hyperliquid’s product itself but its massive 70% community token allocation. Unlike the Web2 paradigm—where founders and early investors claim the lion’s share—Hyperliquid is distributing 70% of ownership to ’users of the service.’ Such an approach is unprecedented in Web2. Consider Robinhood, which aimed to democratize finance and disrupt the traditional financial industry. During its IPO, Robinhood allocated only 1–2% of its equity to retail investors. While this was hailed as a bold step within traditional finance, from a Web3 perspective, 1–2% seems negligible. In the U.S., institutional investors typically claim most of the shares during IPOs, leaving retail investors with less than 1%. Now compare this to Hyperliquid, which offers 70% of its total tokens to users for free, versus Robinhood, which sold just 2% of its shares to retail investors. If Hyperliquid were to expand into both stock and crypto trading, which platform would users choose? Which would contribute more to alleviating inequality from a wealth distribution perspective? Given that much of today’s ultra-high-net-worth wealth is concentrated in equities, the answer seems clear.

Hyperliquid’s disruptive token distribution model is poised to prompt the Web3 industry to rethink its trajectory. The post-ICO era formula of VC funding followed by CEX listing now demands reevaluation. I believe that extensive user and community allocation—on a scale rarely seen in Web2—will be a critical factor in Web3’s success.Over time, this approach could help narrow the widening wealth gap, not as a direct goal but as a natural byproduct. Just as Web3 users increasingly expect to be rewarded for their contributions to services and communities, the broader public may soon start asking why they aren’t entitled to a share of the stocks (or tokens) of the platforms they use. In this context, Hyperliquid represents a project that was long overdue.

One Hyperliquid user reportedly earned enough from its airdrops to buy a house in California—a testament to the transformative power of equitable distribution in Web3.

4. Addressing Key Challenges: Expanding Services and Lowering Entry Barriers

The DEX market, led by platforms like Hyperliquid, has seen remarkable growth. This month, DEX trading volumes surpassed $700B for the first time, reaching 12% of centralized exchange (CEX) volumes. As DEX platforms continue to enhance their user experience, the gap with CEXs is expected to narrow rapidly. This trend hints at a future where Web3 services may gradually replace traditional online services.

However, outside of DEXs and NFT marketplaces, the Web3 space still lacks services that genuinely threaten their Web2 counterparts. The most promising sectors for disruption appear to be social media platforms and video streaming services—two areas generating immense value in the Web2 economy. While past Web3 social platforms like Steemit failed to achieve network effects beyond niche audiences, new initiatives like Farcaster signal continued innovation in this space. Similarly, while no platform currently rivals YouTube, Rumble—a video platform backed by Tether's $700M investment—offers hope. Its potential integration of tokenomics to reward viewers could mark a significant shift, challenging platforms like YouTube that profit disproportionately from user data while offering little in return.

Artificial intelligence (AI) is poised to accelerate this Web3 transition, albeit paradoxically. As AI advances, it amplifies efficiency but also deepens wealth disparities. Dominated by big tech, which monopolizes NVIDIA chips and user-generated data, the current AI landscape heavily favors centralized platforms. These companies have developed algorithms that increase user dependency and created innovations like autonomous driving, further centralizing wealth and power. Web3 projects, however, are emerging to counteract this trend. Decentralized GPU rendering services reward users for sharing computational resources, while privacy-preserving data monetization platforms empower individuals to benefit from their own data. These innovations aim to redistribute the value that big tech currently hoards.

To rival Web2 giants like YouTube, Web3 services must address infrastructure limitations and enhance user interfaces. Hyperliquid, for instance, boasts a community-driven token distribution worth $12B, yet its user base remains limited to 300,000. This highlights the need for improvements in accessibility and scalability. Encouragingly, the blockchain ecosystem has evolved significantly in recent years. Seven years ago, Ethereum struggled to support a single CryptoKitties application; today, on-chain infrastructure can handle complex trading orders efficiently. Additionally, crypto wallets have become more user-friendly, allowing social ID-based creation without requiring users to memorize seed phrases, a task that once involved physically writing them down for safekeeping.

Web3's value proposition lies in redistributing wealth from venture capitalists and major shareholders to everyday users. As service quality improves, Web3 platforms will become increasingly attractive to mainstream audiences. With more accessible and sophisticated solutions, Web3 could usher in an era of democratized value, much like Gutenberg's printing press revolutionized knowledge sharing. It is this potential that inspires optimism for the future of decentralized services.