Table of Contents

1. Circulating Supply Controversies

2. Compilation of Circulating Supply Issues

3. Causes Behind Ongoing Circulating Supply Issues

4. The Need for Clear Standards and Regulatory Guidelines for Circulating Supply

Appendix. Analysis of Inconsistencies in Circulating Supply

1. Circulating Supply Controversies

During the parliamentary audit of the Financial Supervisory Service on October 17, crypto assets were once again brought to attention, following discussions from the previous year. Representative Min Byung-deok of the Democratic Party expressed concerns to Chairman Lee Bok-hyun of the Financial Supervisory Service, noting that SUI tokens listed on domestic exchanges are increasing their circulating supply by staking tokens that should remain non-circulating. He highlighted criticism towards the Digital Asset eXchange Alliance (DAXA), a digital asset exchange consortium, for neglecting token circulating supply management. This marks the second consecutive year that issues related to the circulating supply of crypto assets have undergone scrutiny during the parliamentary audit, following last year's Terra-Luna incident caused by the exponentially increasing issuance of Luna tokens.

With incidents like the Terra-Luna incident from the previous year and the subsequent WEMIX circulating supply incident, Korean investors' interest in the circulating supply of crypto assets has reached unprecedented levels. As a result, discussions on circulating supply are more actively occurring domestically compared to international markets. In the first part of the circulating supply series, titled "[Circulating Supply Series#1] Circulating Supply: The Canary in the Crypto Mine," we delved into the origin and importance of the concept of circulating supply, considering it as the “canary in the coal mine” of the crypto asset market. In the second part of this circulating supply series, we aim to analyze the facts surrounding incidents that led to circulating supply controversies and discuss why incidents related to circulating supply continue to persist. For a detailed analysis of individual cases, please refer to the Appendix at the end of the article.

2. Compilation of Circulating Supply Issues

2-1. SUI: Inadequate disclosure of circulating supply and ambiguous criteria for non-circulating supply

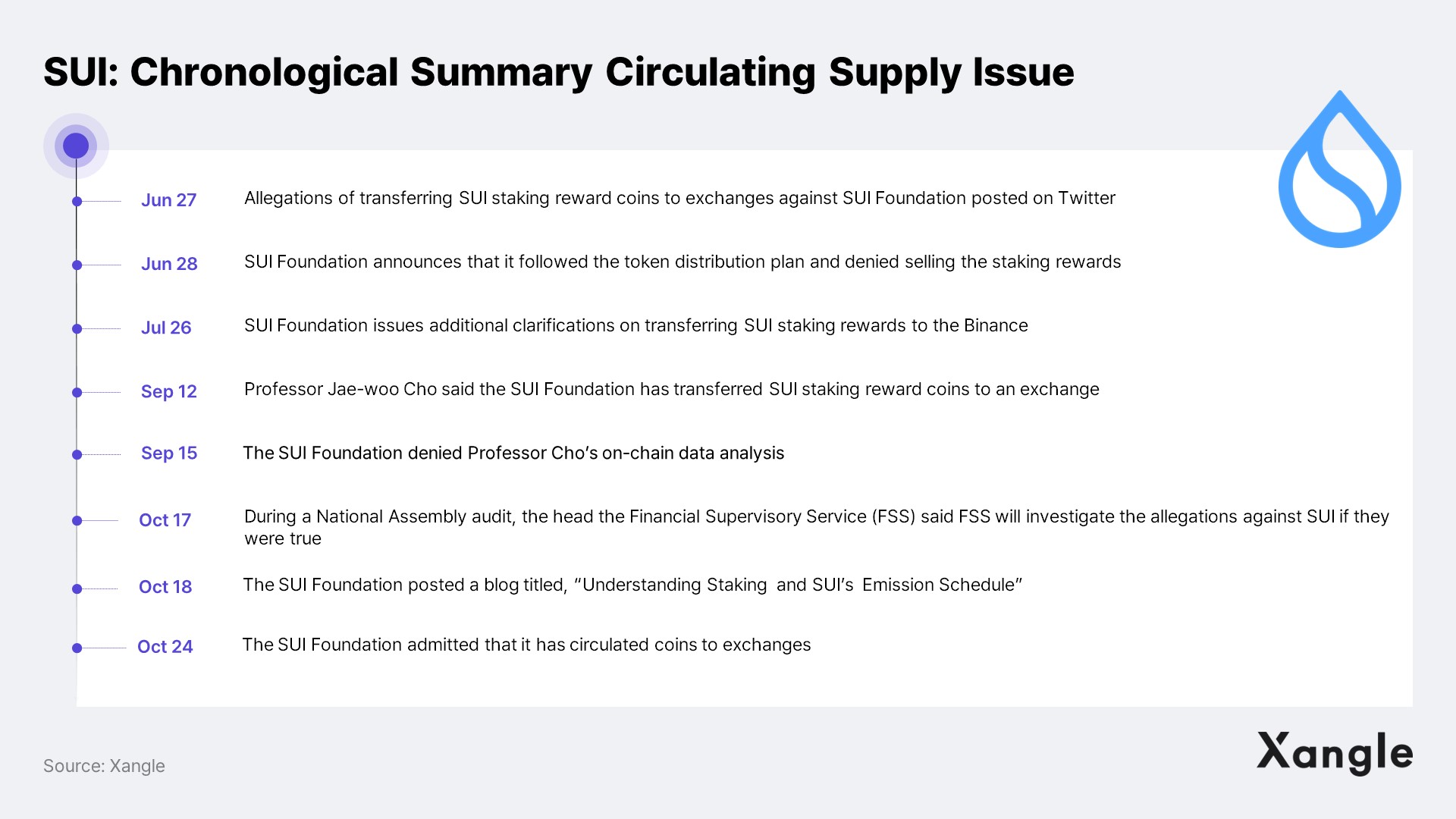

On June 27, a Twitter user raised suspicions that the SUI Foundation was staking locked-up tokens and dumping the staking rewards on exchanges. Despite the foundation's assertion that it follows its circulating supply plan and has not sold staking rewards, community suspicions persisted. Concerns also emerged regarding the potential further liquidation of SUI tokens. These allegations were even discussed during parliamentary audits led by Representative Min Byung-deok, prompting the foundation to issue additional clarifications regarding the liquidation of SUI tokens. The timeline of suspicions related to the circulating supply of SUI tokens is detailed below.

Concerning the circulating supply of the SUI token, suspicions against the SUIFoundation can be categorized into three issues: 1) inadequate disclosure of circulating supply, 2) staking of locked-up tokens and the circulation of staking rewards, and 3) suspicions of the foundation transferring staking rewards to exchanges. Although the SUI Foundation has provided clarifications for all three concerns, the community continues to raise questions regarding these explanations.

- Inadequate disclosure of circulating supply

- The SUI Foundation did not officially disclose its circulating supply plan until suspicions of SUI token dumping arose.

- Following the allegations, the foundation officially published its circulating supply plan through a blog post.

- Staking of locked-up tokens and circulation of staking rewards

- Allegations were made that the foundation staked locked-up SUI tokens, exceeding the stipulated circulation plan.

- The foundation clarified that all staking rewards for SUI tokens are carried out within the outlined circulation plan.

- However, negative opinions persist regarding the staking of locked-up tokens.

- Suspicions of the foundation transferring staking rewards to exchanges

- Allegations were raised that the foundation is sending staking rewards to exchanges for sale.

- The foundation clarified that while staking rewards were indeed transferred to exchanges, it was done to 1) address the MovEx team's contract violation tokens and 2) support the Education Grant Program.

*For a detailed analysis of suspicions and explanations related to SUI token dumping, please refer to Appendix 1.

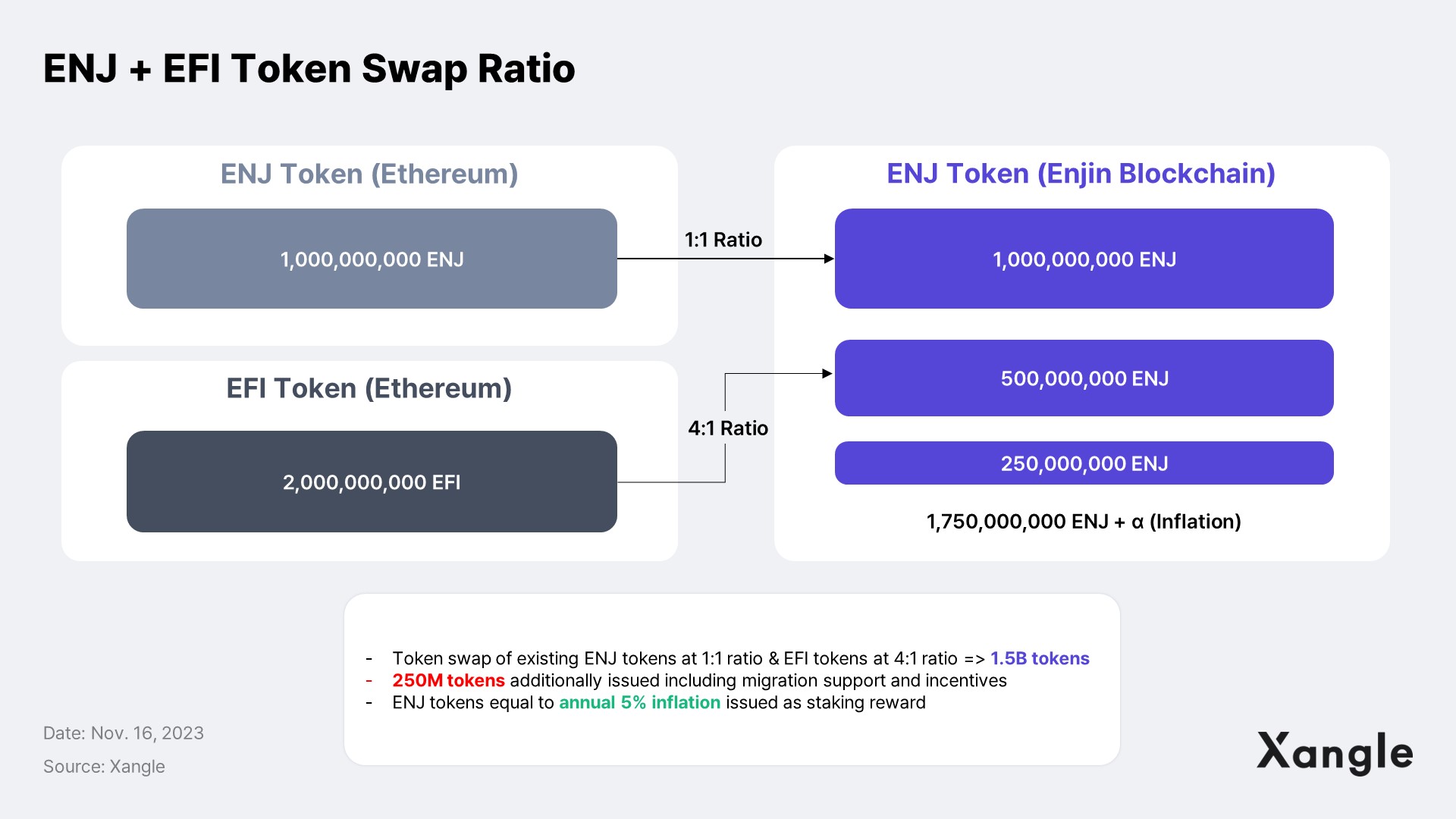

2-2. ENJIN: Substantial shifts in circulating supply due to mainnet launch

On September 26, 2023, UPbit, South Korea's largest crypto asset exchange, made the decision to delist ENJ tokens issued by Enjin Coin from the Korean won (KRW) market and chose to facilitate trading exclusively on the BTC market. Considering that the average daily trading volume in the first half of 2023 in the KRW market was approximately KRW 2.9 trillion, significantly surpassing the approximately KRW 1 billion in the BTC market, Upbit found it problematic to sustain ENJ Coin trading in the KRW market. Upbit provided four reasons for the delisting, highlighting significant changes in circulating supply due to the mainnet launch. The analysis of the debate surrounding the substantial change in the circulating supply of ENJ tokens is outlined below:

Significant changes in circulating supply due to mainnet launch:

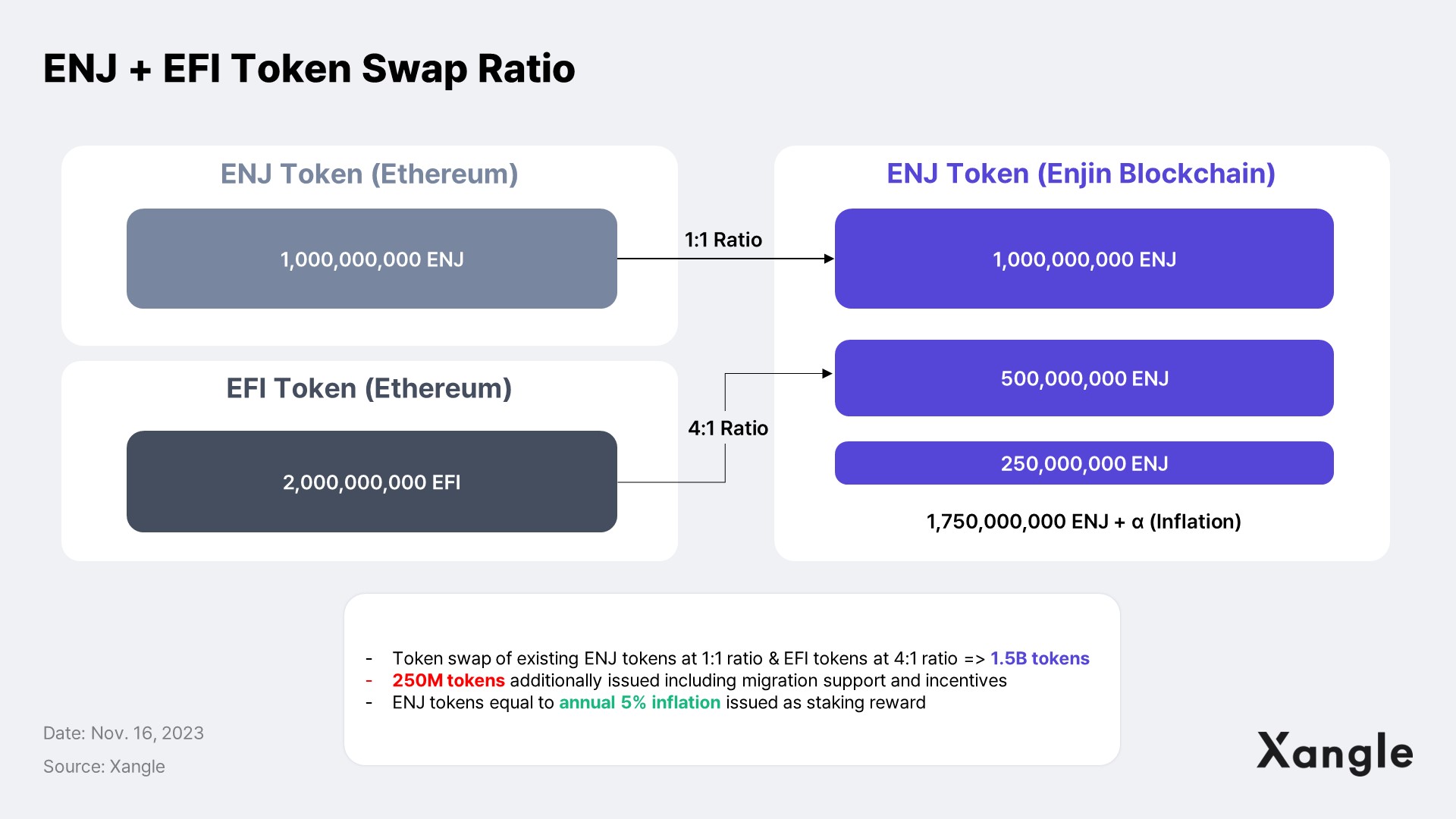

- Enjin Coin integrated the existing ENJ token and the EFI token they had issued, introducing a new ENJ token on the Enjin Blockchain.

- The existing ENJ tokens underwent a token swap at a 1:1 ratio, and EFI tokens underwent a swap at a 4:1 ratio, resulting in the issuance of 1.5 billion ENJ tokens.

- An additional 250 million ENJ tokens were issued, incorporating initial migration support and other incentives, introducing an inflationary structure, with a total of 17.5 billion + α ENJ tokens.

*For an in-depth analysis of the significant changes in the circulating supply of ENJ tokens, please refer to Appendix 2.

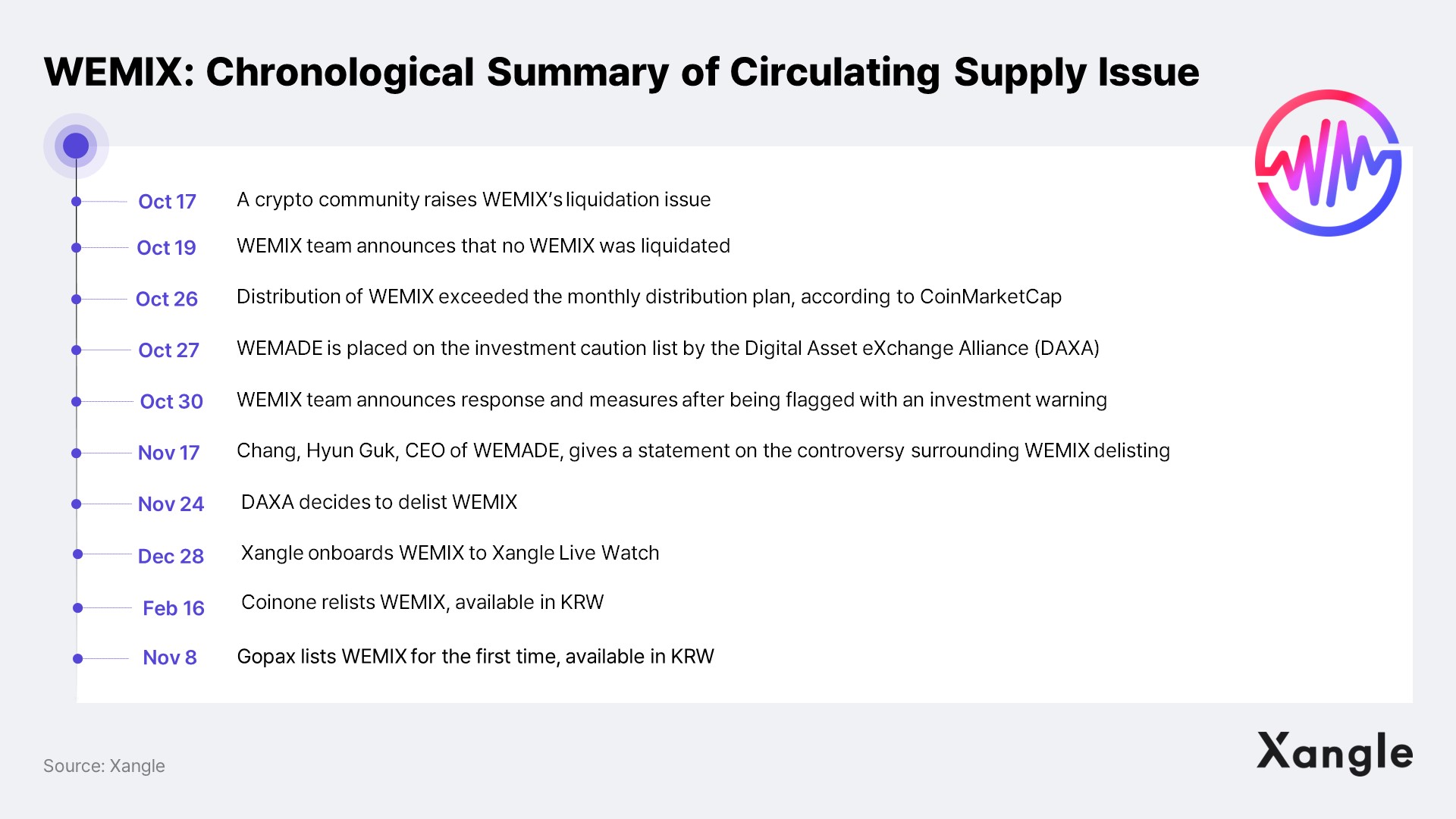

2-3. WEMIX: Delisted as distribution of WEMIX exceeds distribution plan

In 2022, WEMADE’s WEMIX token navigated a challenging year. On October 17, 2022, concerns emerged within the community regarding the liquidity of the WEMIX token. In response, WEMIX officially asserted that they had not participated in the liquidity adjustments of the WEMIX token and provided detailed explanations. Nevertheless, on October 27, DAXA flagged the WEMIX token as a cautionary trading asset. The WEMIX team underwent a clarification process for about four weeks. However, on November 24, DAXA made the decision to delist the WEMIX token, attributing it to inaccuracies between the distribution plan and actual circulating supply. The timeline of concerns related to the WEMIX circulating supply is as follows.

DAXA outlined three reasons for delisting the WEMIX token: 1) significant discrepancy between the actual circulation supply of WEMIX and distribution plan, 2) provision of inadequate or incorrect information to investors, and 3) errors in the documents submitted during the clarification period, resulting in a loss of trust. A summary of these reasons is provided below:

- Significant discrepancy between the actual circulation supply of WEMIX and distribution plan:

- The disclosed circulation of the WEMIX token, as indicated in the documents submitted to DAXA, demonstrated a discrepancy of approximately 70 million tokens compared to the actual circulation.

- To address this issue, WEMIX reclaimed 63.4 million WEMIX tokens, which were taken out of WEMIX Reserve 1.

- Inadequate or incorrect information provided to investors:

- DAXA highlighted that WEMIX disseminated misinformation to investors via Medium and DART disclosures, causing confusion by sharing unverified information about the potential termination of DAXA's trading support.

- Potential issues were identified concerning inconsistencies in the criteria applied to liquidity on Medium and DART.

- Errors in submitted documents and damage to trust during the grace period:

- Various errors were detected in the documents submitted during the grace period.

- Multiple corrections or revisions were made after the submission, particularly in crucial information related to circulation, leading to a loss of trust.

*For a more in-depth analysis of the WEMIX delisting, please refer to Comments on the WEMADE Issue – WEMIX Delisted.

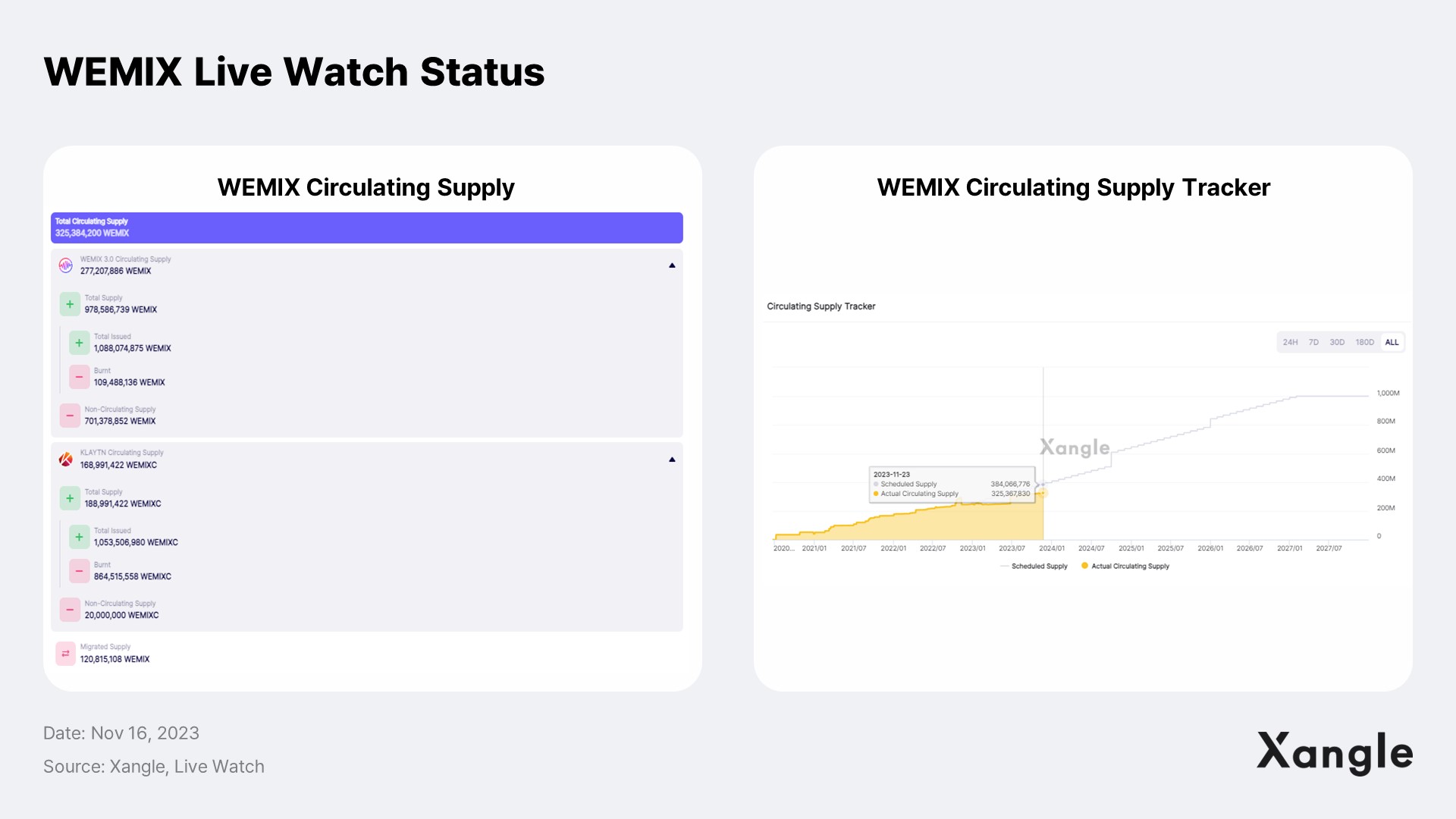

Three months after the delisting decision, Coinone, a member exchange of DAXA, announced the reintegration of WEMIX into its KRW market. Coinone justified the relisting based on various actions taken by WEMIX, which included 1) resolving the issue of excessive circulation, 2) improving investor access to information about token issuance and circulation through real-time monitoring services on external platforms, and 3) implementing a dedicated management system for WEMIX to provide transparent information to investors and exchanges. Additionally, on November 8, Gopax, another member exchange of DAXA, also proceeded with the new listing of WEMIX on its KRW market.

3. Causes Behind Ongoing Circulating Supply Issues

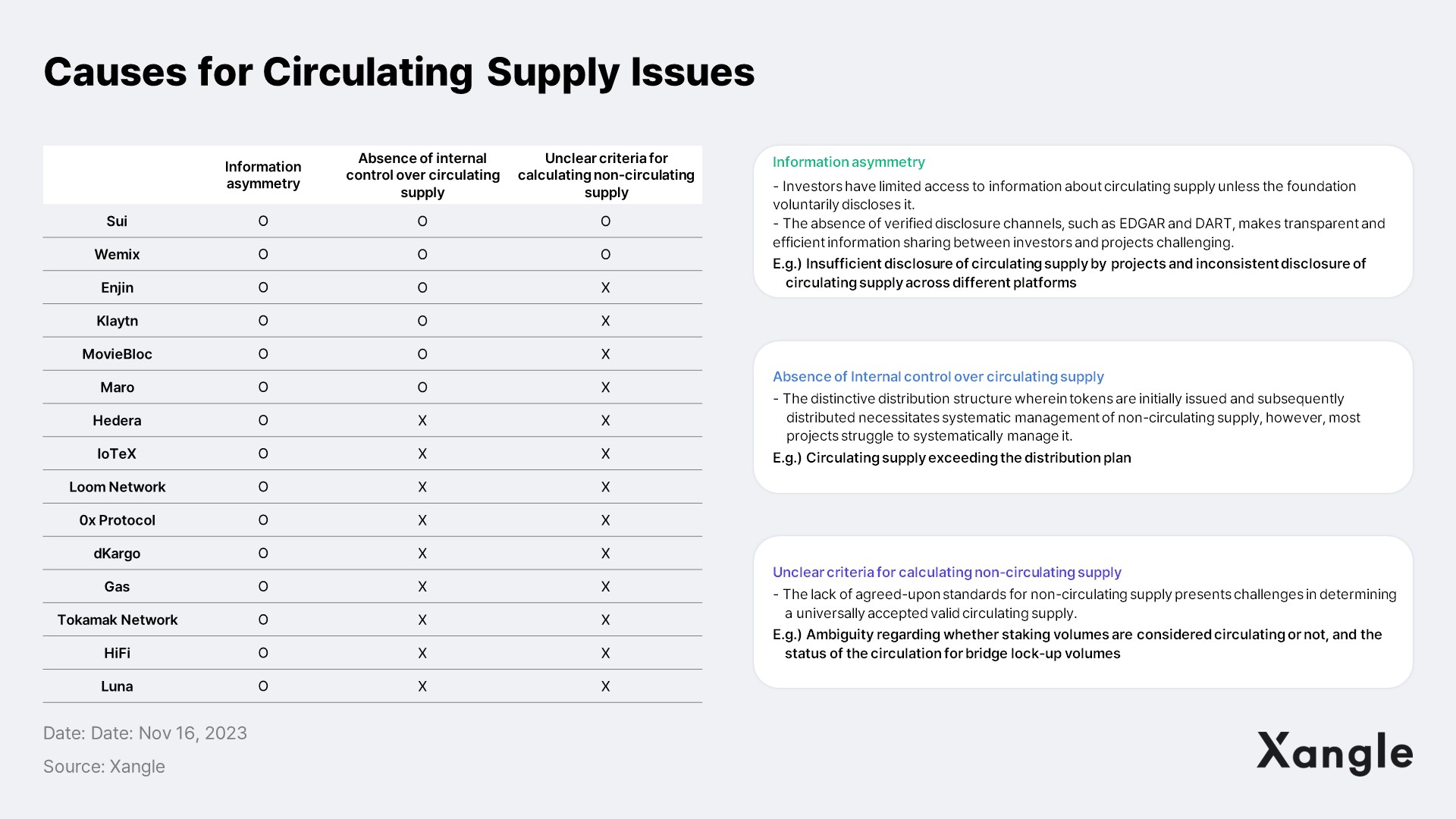

Several projects, including those mentioned earlier such as SUI, WEMIX, ENJIN, continue to face recurring issues related to circulating supply. Despite the frequency of incidents tied to circulating supply, the lack of effective responses and solutions raises the question of why these incidents persist. Xangle identifies three primary causes for current circulating supply incidents: (1) information asymmetry, (2) the absence of internal control over circulating supply, and (3) unclear criteria for calculating non-circulating supply.

3-1. Causes of circulating supply issues (1): Information asymmetry

To mitigate further incidents related to circulating supply, it is imperative to address the information imbalance between investors and projects. In the current crypto asset market, investors often face challenges in accessing crucial information about a token's circulating supply unless projects willingly disclose it. The primary sources of information available to investors regarding circulating supply are typically data aggregators like CoinMarketCap and CoinGecko, or exchanges where crypto assets are listed. However, these platforms rely on tokenomics with disclaimers provided by projects. Additionally, the lack of verification in circulating supply plans results in various entities offering inconsistent information, contributing to investor confusion. To rectify this situation, there is an urgent need for the swift implementation of transparent disclosure regulations, ensuring that each project assumes responsibility and discloses comprehensive information, covering all relevant aspects.

Moreover, the implementation of verified and centralized disclosure channels, akin to traditional financial markets' tools like DART and EDGAR, is essential for delivering precise information to investors. The aim is to reduce information asymmetry by enhancing investor access to transparent project information through a verified and unified disclosure channel. The adoption of such a disclosure channel can also facilitate effective communication from projects to investors regarding changes in circulating supply, encompassing modifications in tokenomics, adjustments in distribution plans, and shifts in project volumes throughout the project's lifecycle. Hence, it becomes imperative to promptly enforce a regulated disclosure system that ensures the provision of transparent information and safeguards against malicious behavior.

3-2. Causes of circulating supply issues (2): Absence of internal control over circulating supply

Many projects, following Ethereum, adopt a distinctive distribution structure wherein tokens are initially issued and subsequently distributed. This approach adds complexity to the management of each project's circulating supply. Typically, tokens are distributed by implementing lock-ups on selected tokens, gradually unlocking them over several years. Foundations manage this locked-up volume across dozens to hundreds of wallets. Presently, it is evident that a significant number of projects in the cryptocurrency market lack a robust internal control system for handling circulating and non-circulating supplies. Consequently, many projects face challenges in carefully managing their distribution plans. The absence of an internal control system for distribution volume often results in recurring instances where specific volumes are diverted from their intended purpose or used for alternative purposes. Additionally, excess volumes are distributed in the market due to negligence in managing the distribution plan.

On June 22, Upbit flagged MovieBloc as a trading watchlist due to disparities between the distribution plan submitted to Upbit and the plan published on other platforms, raising concerns about the reliability of MovieBloc's distribution plan. MovieBloc explained the distribution error by stating that the demand for MBL tokens through KMPlayer, where MBL tokens are utilized, exceeded initial expectations. The foundation did not anticipate the overspending of tokens held by the foundation, attributing the excess distribution to a communication error between the MovieBloc and KMPlayer teams during this process. This incident highlights the prevalent issue of weak or absent internal control systems for managing the quantity of unsold and distributed tokens among many projects. It underscores the necessity to develop a systematic plan for the comprehensive management of tokenomics.

3-3. Causes of circulating supply issues (3): Unclear calculation standards for non-circulating supply

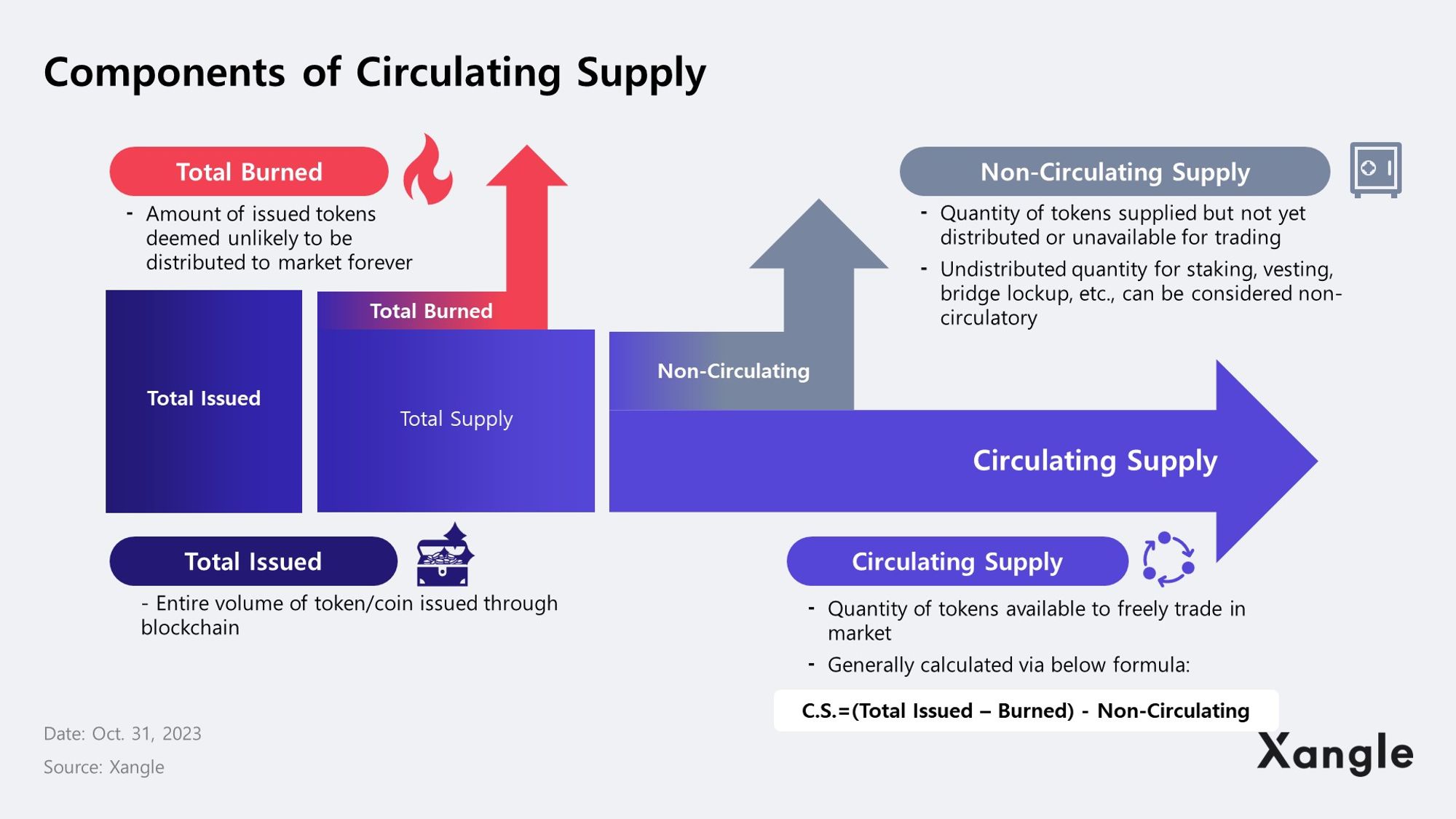

As mentioned in the “[Circulating Supply Series #1] Circulating Supply: Canary in the Crypto Mine” report, the circulating supply of tokens are commonly calculated by subtracting the burned amount and the non-circulating amount from the total issued amount in the current market.

For this method of calculation to be effective, there needs to be a consensus among all market participants on the calculation method for the non-circulating supply. However, such consensus does not currently exist. There are variations in tokenomics for each project, which means managing supply from the lock-up format, storage method, to usage purposes can all vary. Therefore, supplies for identical purposes can both be considered circulating or non-circulating. In order to propose a universal standard for calculating the non-circulating supply, a thorough analysis of each project based on a high level of understanding in crypto assets is required. However, selecting such a standard is a practical challenge for regulatory authorities. Therefore, regulatory authorities should provide a clearer framework based on the frameworks used by entities providing circulating supply, considering the actual nature of each amount to determine whether it is circulatory or non-circulatory.

4. The Need for Clear Standards and Regulatory Guidelines for Circulating Supply

In a nutshell, the recurring inaccuracies in circulating supplies are due to a combination of unclear standards for calculating non-circulating supply, information asymmetry, and the absence of internal control systems for circulating supply. Thus, an introduction of clear standards for calculating circulating supply and the adoption of verified disclosure system for monitoring are essential in order to prevent similar incidents. As mentioned in Part 1 of this series, it’s expected that clearer standards and related regulations will be established next year in South Korea through the “Digital Asset Accounting Guidelines” and follow-up measures of “Virtual Asset User Protection Act.”

Continuing with: Comparing circulating supply: TradFi vs. Crypto

In Part 2, we briefly explored incidents related to circulating supply, analyzed them, and discussed the reasons behind the recurring inaccuracies in circulating supplies. There must be appropriate regulations to prevent such inaccuracies and given that many systems regarding circulating supplies in the crypto asset market benchmark traditional financial markets, it’s highly likely that the circulating supply standards and disclosure regulations for crypto assets to be introduced in the coming year will also reference the regulatory frameworks of TradFi markets. So, in Part 3, we will delve into how the concept of circulating supply in the cryptocurrency market is utilized and regulated in TradFi. And we hope that our analysis of incidents related to inconsistencies in circulating supply has enhanced your understanding.

Appendix. Analysis of Inconsistencies in Circulating Supply

Appendix 1: Analysis of alleged SUI token dumping and explanation

1) Inadequate Disclosure of Circulating Supply

Prior to the suspicions were raised about SUI tokens, the Sui Foundation presented inadequacies in disclosing their circulating supply. Before the suspicions, the plans for circulating supply available for investors were limited to two estimates: the Until suspicions were raised about SUI tokens, the circulating supply plans accessible to investors were limited to two estimates: the estimate of circulating supply plan by Binance Research and the SUI digital asset report by Upbit for listing. However, the Sui Foundation did not verify the above plans. Plans were only disclosed via the Foundation’s blog on June 28, after suspicions were raised, which means that investors had no channel to obtain information regarding SUI’s circulation plans for about two months since the tokens were issued early May.

2) Staking of Locked-up Supply and Distribution of Staking Rewards

The Sui mainnet adopts PoS and allows the staking of locked-up amounts to ensure network security. The staking rewards generated are paid through 1) stake subsidies and 2) gas fees. Stake subsidies allocate 1B tokens among the total 10B SUI tokens, and approximately 1M SUI tokens are unlocked daily and distributed to validators as staking rewards based on the token’s circulation plan. Since token circulation supply increases from the unlocked amount, validators selling or circulating the SUI tokens they received as staking rewards do not impact the circulating supply. And gas fees also don’t affect the circulating supply since they are paid with already circulating SUI tokens. Therefore, the inflation caused by staking rewards from locked-up amounts, as explained by the foundation, is within the existing distribution plan and does not have additional impact.

However, despite the foundation's explanation, there is still negative sentiment in the community regarding SUI staking. And such divergence in perspectives stems from the debate about whether allowing staking of locked-up tokens and receiving rewards is justified. While many projects adopting PoS are sacrificing inflation rates for network security by allowing staking of locked-up tokens, this is generally deemed acceptable in the market. Thus, while it is hard to criticize establishing tokenomics that fit the characteristics of each network in the absence of clear legal standards for calculating circulating and non-circulating supply, eyebrows will continue to be raised without clear guidelines.

3) Selling Foundation-owned Staking Rewards

As previously mentioned, questions were raised about SUI tokens moving from the foundation-owned wallet to wallets associated with exchanges such as Binance, CoinList, OKX, among others. The Sui Foundation acknowledged that there were transferences in question but asserted that these were not token sales by the foundation.

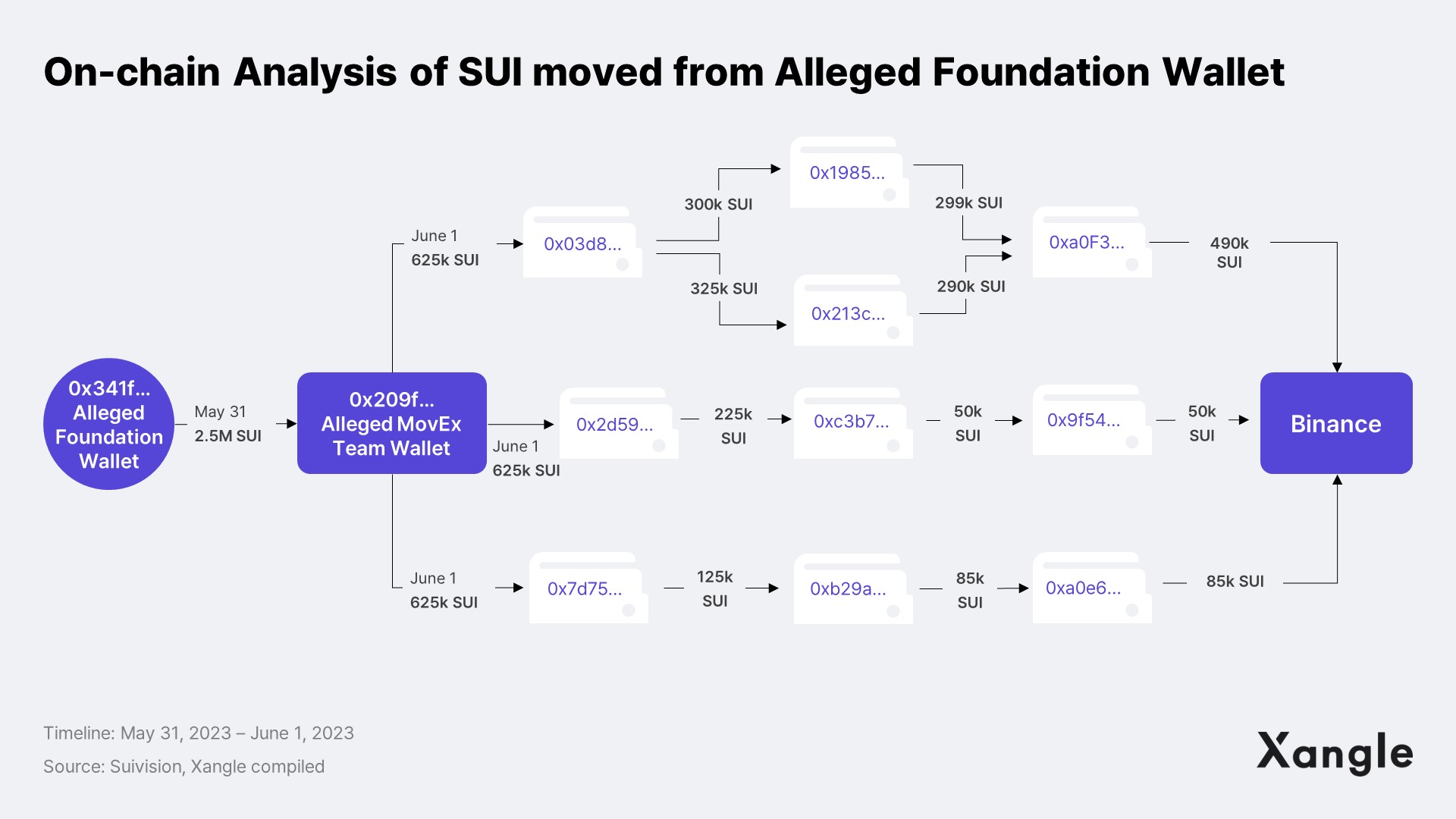

Let's examine the suspicion raised on June 27, where 625k SUI tokens were transferred to what is assumed to be a Binance wallet (0x9350...). About 2.5M SUI tokens from what was assumed to be a Foundation wallet (0x341f…), which was staking approximately 2.9B tokens at the time, moved to a specific wallet (0x209f…). Subsequently, that wallet transferred approximately 625k SUI tokens to three different addresses, and these tokens were eventually sent to Binance's wallet (0x9350...) through other wallets.

The Sui Foundation explained that the transactions in question did occur, they were due to a violation of contract by the MovEx team. The Foundation further explained that the transferred SUI tokens were recovered and that the lock-up amount of 2.5M SUI tokens have been transferred to an external custodian to be unlocked in the future according to the lock-up plan. Next up, let's examine the alleged transference of 3M SUI tokens from what is assumed to be a foundation wallet to the CoinList wallet (0x7fb5...). Initially, the alleged foundation wallet (0x341f...) sent 1.5M SUI tokens to a specific wallet (0x9267...) over three transactions, and the transferred SUI tokens eventually moved to CoinList's exchange wallet (0x7df6...). The Sui Foundation explained that these transactions were also not token sales by the foundation. The Foundation designated CoinList as a vendor to facilitate the operation of the Education Grant Program and explained that there are no issues regarding the transactions in question as they were part of the grant payment within the distribution plan. Unlike on-chain transactions, those that occur within CEXs are not externally verifiable unless the exchange publicly discloses the transaction details. Therefore, if a specific quantity is sent to an exchange-owned wallet without the foundation's disclosure, the current cryptocurrency industry perceives it as token sales. Thus, despite the consistent rebuttals from the Foundation, without legal binding and sufficient evidence, suspicions about the transferred SUI tokens to exchanges are unlikely to dissipate.

Appendix 2: Significant change to ENJ token circulating supply

Upbit determined that there was a significant change in the circulating supply of ENJ tokens due to the launch of a new mainnet by the operating company, Enjin Coin. Enjin Coin announced the launch of its proprietary mainnet, the Enjin Blockchain, that integrated the NFT platform ENJ token ecosystem issued on Ethereum in 2017 and the Polkadot-based parachain, Efinity Chain, to support it. According to Enjin Coin's plan, the new ENJ tokens on the mainnet will issue 1.75B ENJ tokens at the time of the Token Generation Event (TGE) and begin token supply. The existing ENJ tokens will be swapped at a 1:1 ratio for the migration to the new mainnet, and the EFI tokens on the Efinity Chain will be swapped at 4:1 ratio. Accordingly, the max supply of 1B ENJ tokens on Ethereum will be swapped at a 1:1 ratio, issuing 1B ENJ tokens on the Enjin Blockchain mainnet. For EFI tokens of which the max issuance is 2B, the token swap will be at 4:1 ratio, issuing a total of 500M additional ENJ tokens on the mainnet, as well as 250M additional tokens that includes support for initial migration and other incentives. Moreover, additional ENJ tokens will be issued, equal to the annual 5% inflation, as staking rewards for validators.

As of November 2023, 17.59B ENJ tokens were issued on the Enjin Blockchain mainnet, among which 490M are circulating. Considering each swap ratio from the burning of ENJ tokens and EFI tokens on the Ethereum, which are 140M and 200M, respectively, it can be considered that each are in circulation after being swapped to 140M and 50M ENJ tokens, respectively. Therefore, excluding the 140M ENJ tokens swapped at 1:1 ratio, an additional 350M ENJ tokens, equivalent to 35% of the total issuance, have been issued and are circulating in the market within two months of the mainnet launch. If the swap for EFI tokens is completed and staking rewards are distributed in the future, ENJ token holders may face high token inflation of approximately 75% in a short period of time. And it seems Upbit has attributed such sudden increase in circulating supply as major reason for delisting ENJ tokens from the Korean won market.