Table of Contents

Introduction

1. When Will the Era of Blockchain Gaming Begin?

2. Which Blockchain Games Deserve Attention?

3. What Does It Take for Blockchain Games to Succeed?

4. Closing Thoughts

Introduction

Blockchain gaming has been around for six years now. It started with the introduction of the first blockchain game, CryptoKitties, and the concept of Play-to-Earn (P2E) that was introduced by Axie Infinity, followed by global gaming giants like Ubisoft, SEGA, and Nexon joining the blockchain gaming market. However, the mainstream adoption of blockchain gaming still seems elusive. Many gamers hold a negative view of coins and NFTs, and even games based on popular IPs have received disappointing reviews. When will the era of blockchain gaming truly arrive? Why do gamers remain skeptical of it? What does blockchain gaming need to establish itself? This article aims to address these fundamental questions and provide insights into the future direction of the blockchain gaming market.

1. When Will the Era of Blockchain Gaming Begin?

It's been only a couple years since significant capital began flowing into the blockchain gaming market.

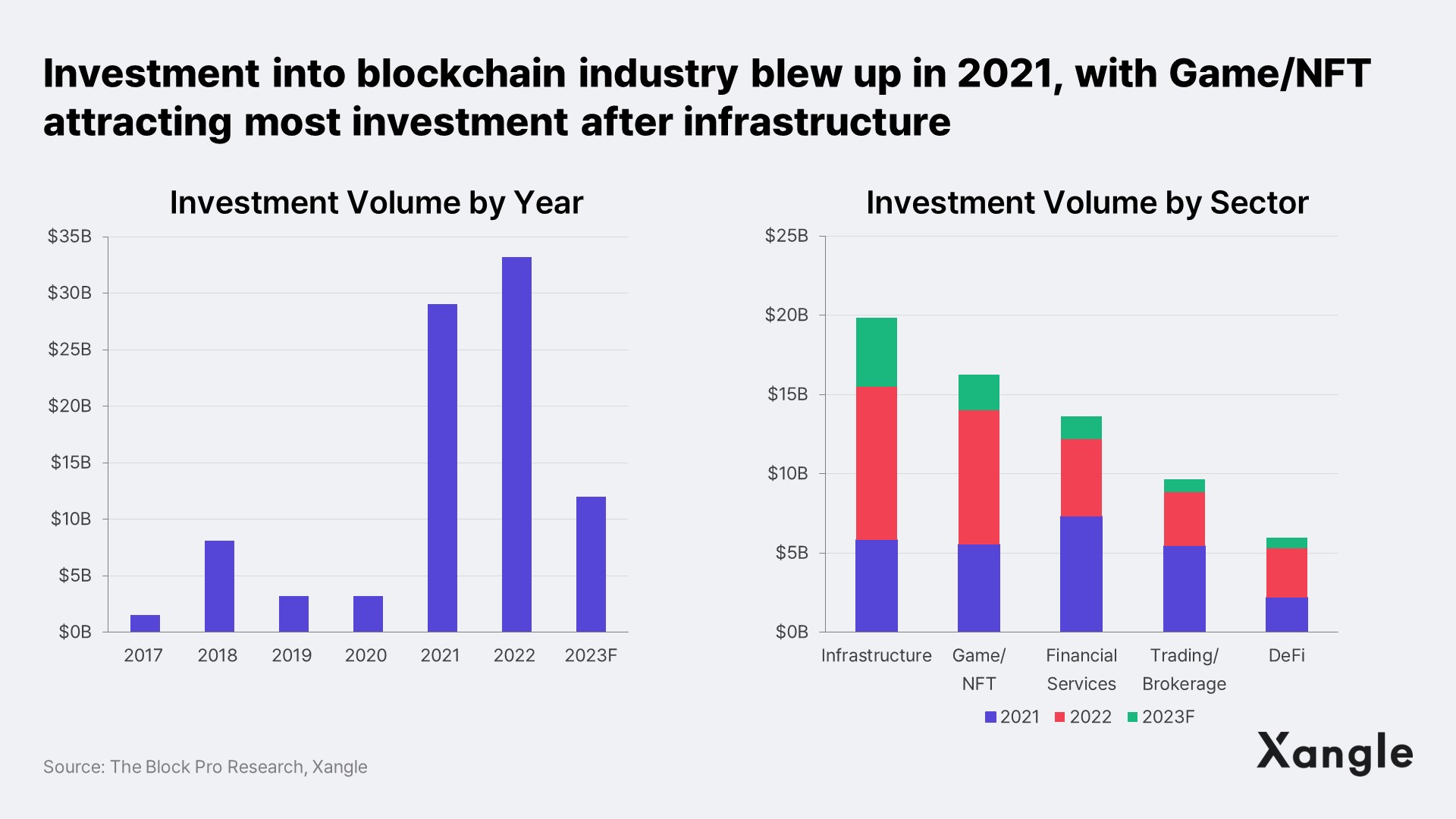

Gaming is one of the areas where blockchain technology has seen substantial investment, following infrastructure. Investment in blockchain gaming gained momentum in 2021 with the emergence of successful cases like Axie Infinity and MIR4. The investment, which was a mere $151.6 million in 2020, expanded significantly to $5.5 billion in 2021 and further to $8.5 billion in 2022. While it is expected that the investment in 2023 will decrease to around $2.3 billion due to the overall downturn in the crypto market, the cumulative investment from 2021 to 2023 amounts to a staggering $16.3 billion.

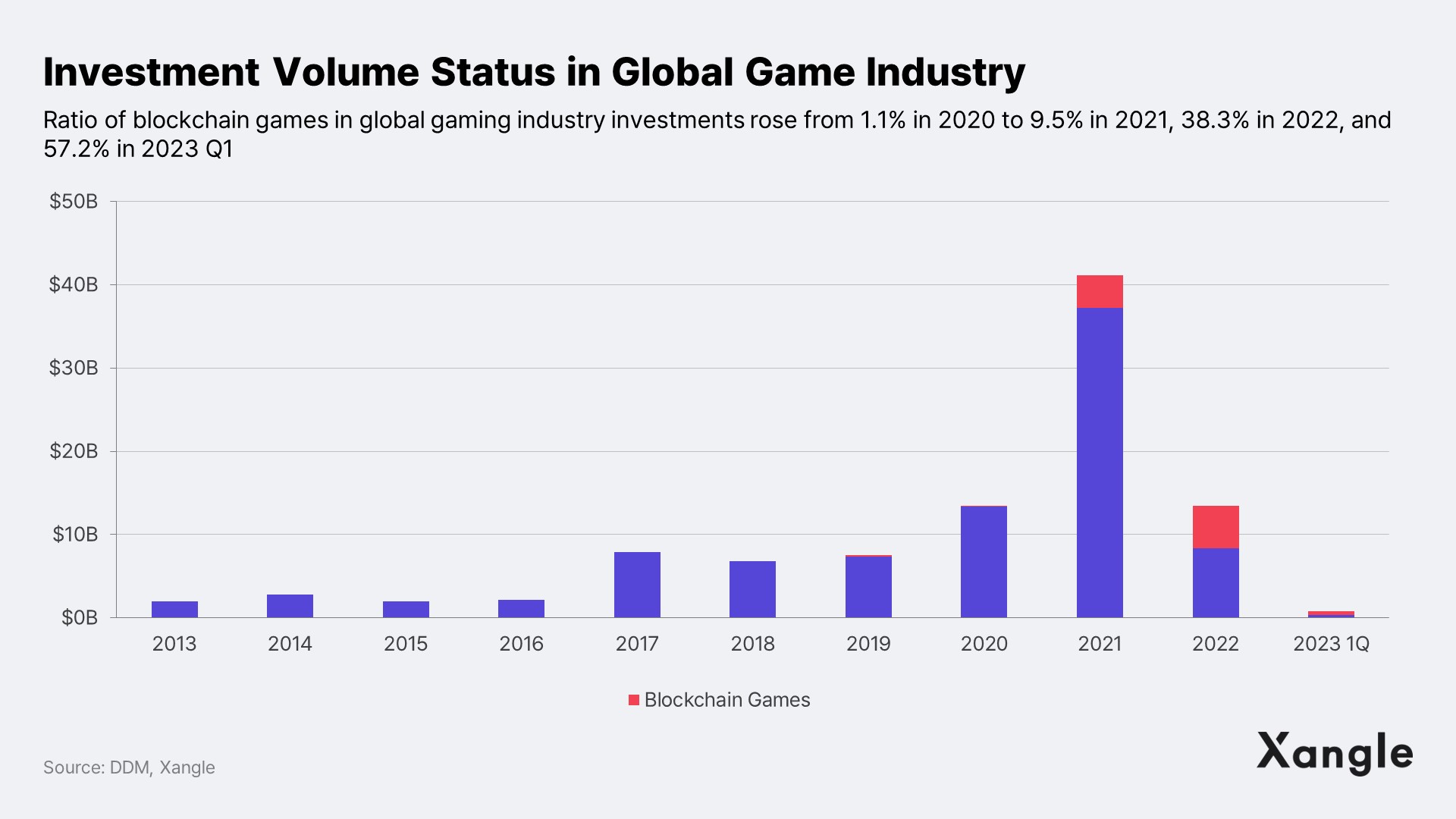

This level of investment is comparable to the traditional gaming industry. Annual investments in the global gaming industry have typically remained around $10 billion, with 2021 being an exceptional year due to factors like the COVID-19 pandemic and the metaverse trend. Considering that, in 2019, 2020, and 2022, the non-blockchain gaming industry received funding of $7.3 billion, $13.3 billion, and $8.3 billion, respectively, the significance of blockchain gaming investment becomes evident. The proportion of blockchain gaming investment within the overall gaming industry has steadily increased, going from 1.1% in 2020 to 9.5% in 2021, 38.3% in 2022, and a striking 57.2% in the first quarter of 2023.

However, despite the substantial influx of funds into the blockchain gaming market, it has not yet become the dominant force. Why is blockchain gaming struggling to gain a foothold, and how will it evolve in the future when compared to the progression of traditional PC and mobile gaming?

While PC and mobile gaming have been direct beneficiaries of technological advances…

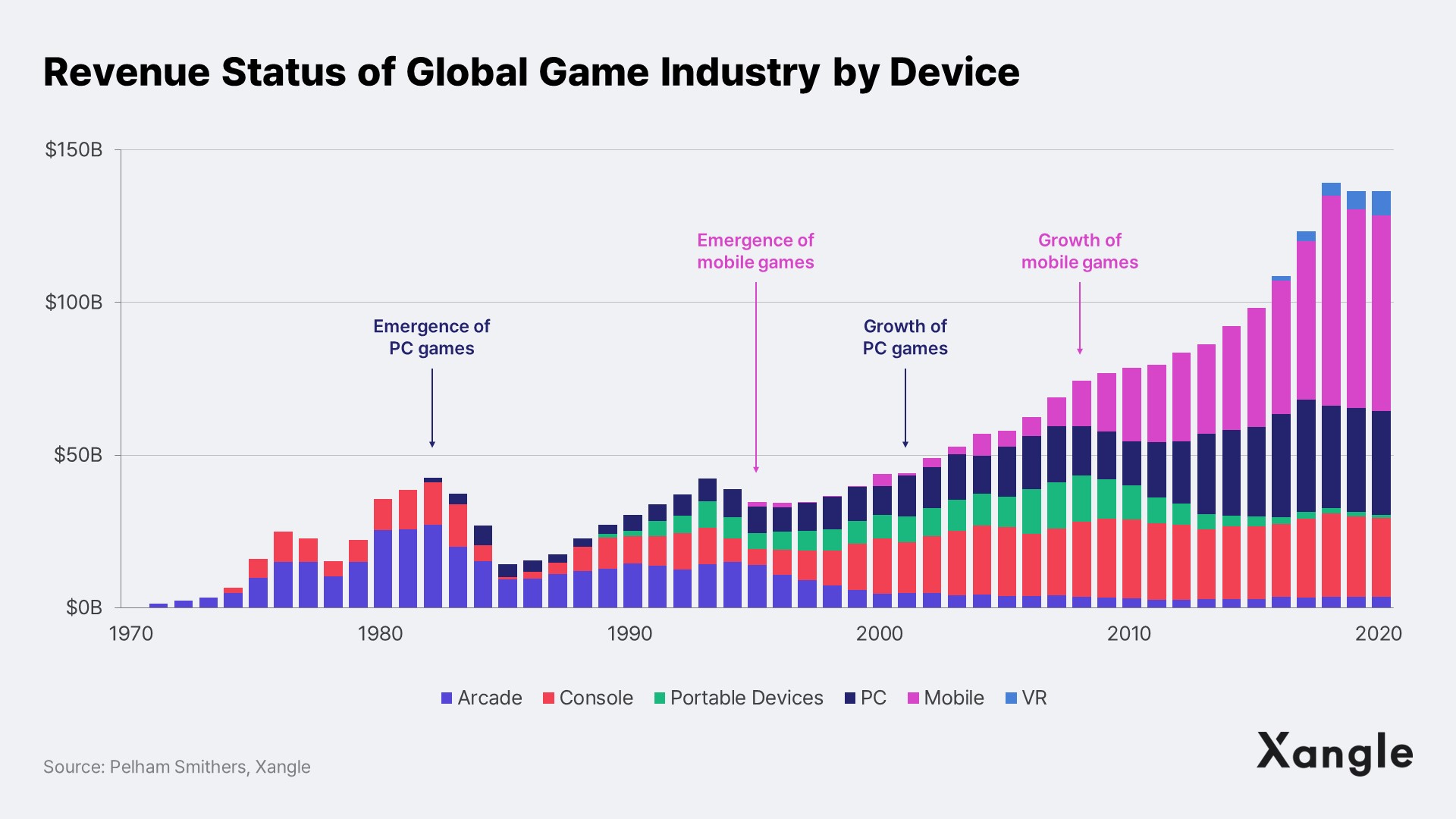

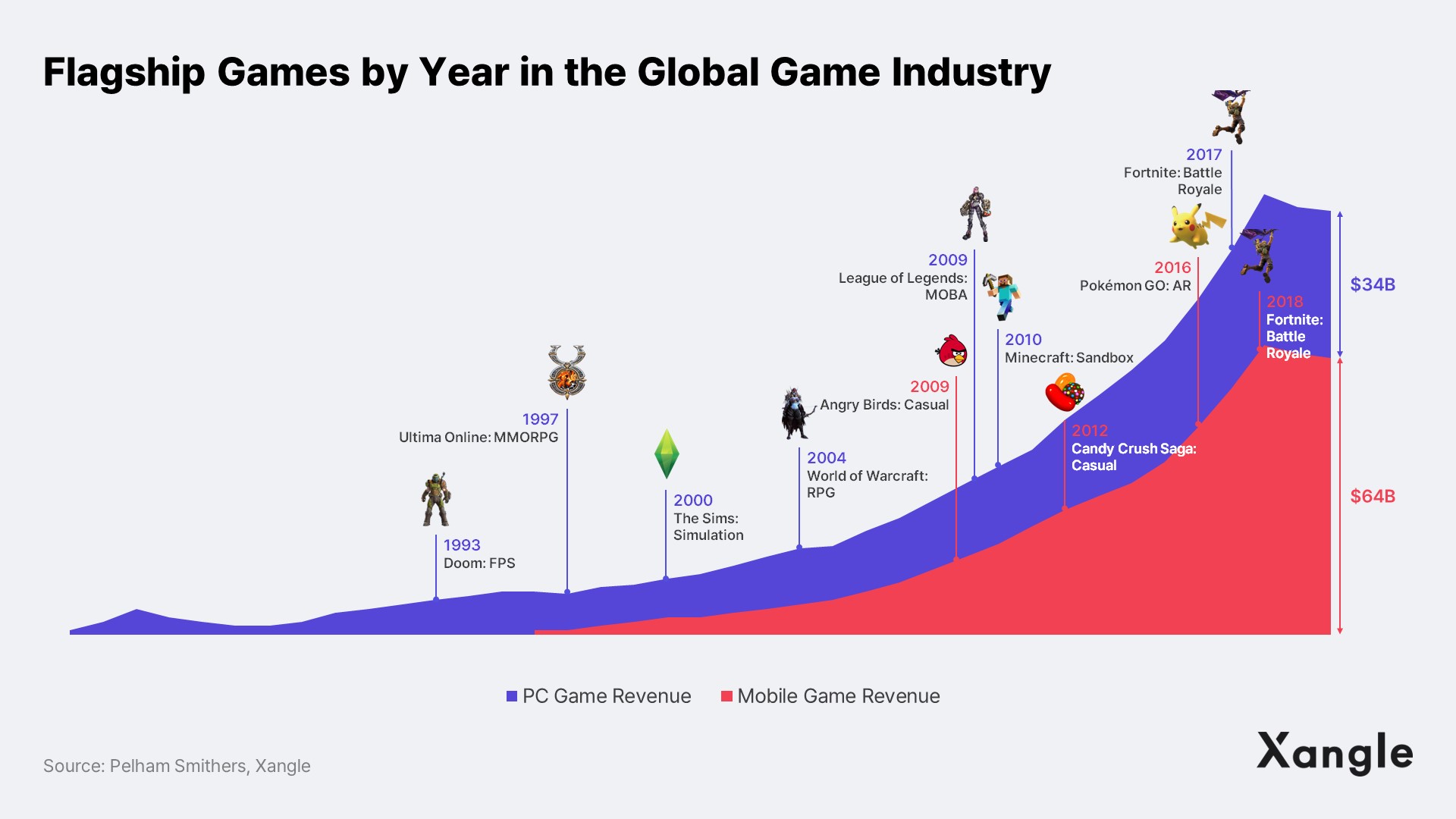

The growth of the gaming industry can be understood through three major inflection points. The gaming industry, which was initially revolutionized with the introduction of arcade games in the 1970s, went through three more significant shifts in the 1980s (console gaming), 2000s (PC gaming), and 2010s (mobile gaming). The revenue generated by the gaming industry increased significantly at each of these stages, with the industry's earnings rising from less than $5 billion in the early 1970s to approximately $45 billion in the 1980s, $80 billion in the 2000s, and $140 billion in the 2010s.

As of 2022, PC gaming accounted for $40.5 billion, and mobile gaming reached $92.6 billion, representing 22% and 55% of the entire gaming industry, respectively. Nevertheless, neither PC gaming nor mobile gaming achieved their current substantial revenue levels right from the start. The gap between the emergence of PC/mobile gaming and their accelerated revenue growth is noticeable in the figure below.

When PC gaming was first recognized, its revenue was only $1.0 billion, accounting for just 2.4% of the entire gaming industry at the time. It took 13 years for PC gaming revenue to grow to $10 billion (29.4%) and an additional 25 years to reach $15 billion (22.1%). Mobile gaming followed a similar trajectory, with its revenue starting at $1.0 billion, or 2.9% of the total gaming industry when initially recognized. It took 10 years for mobile gaming revenue to reach $10 billion (16.1%) and 12 years to reach $15 billion (20.4%). Although mobile gaming showed faster revenue growth than PC gaming, it still took a considerable amount of time for these segments to gain significant traction. In other words, both PC and mobile gaming did not establish and grow their markets quickly.

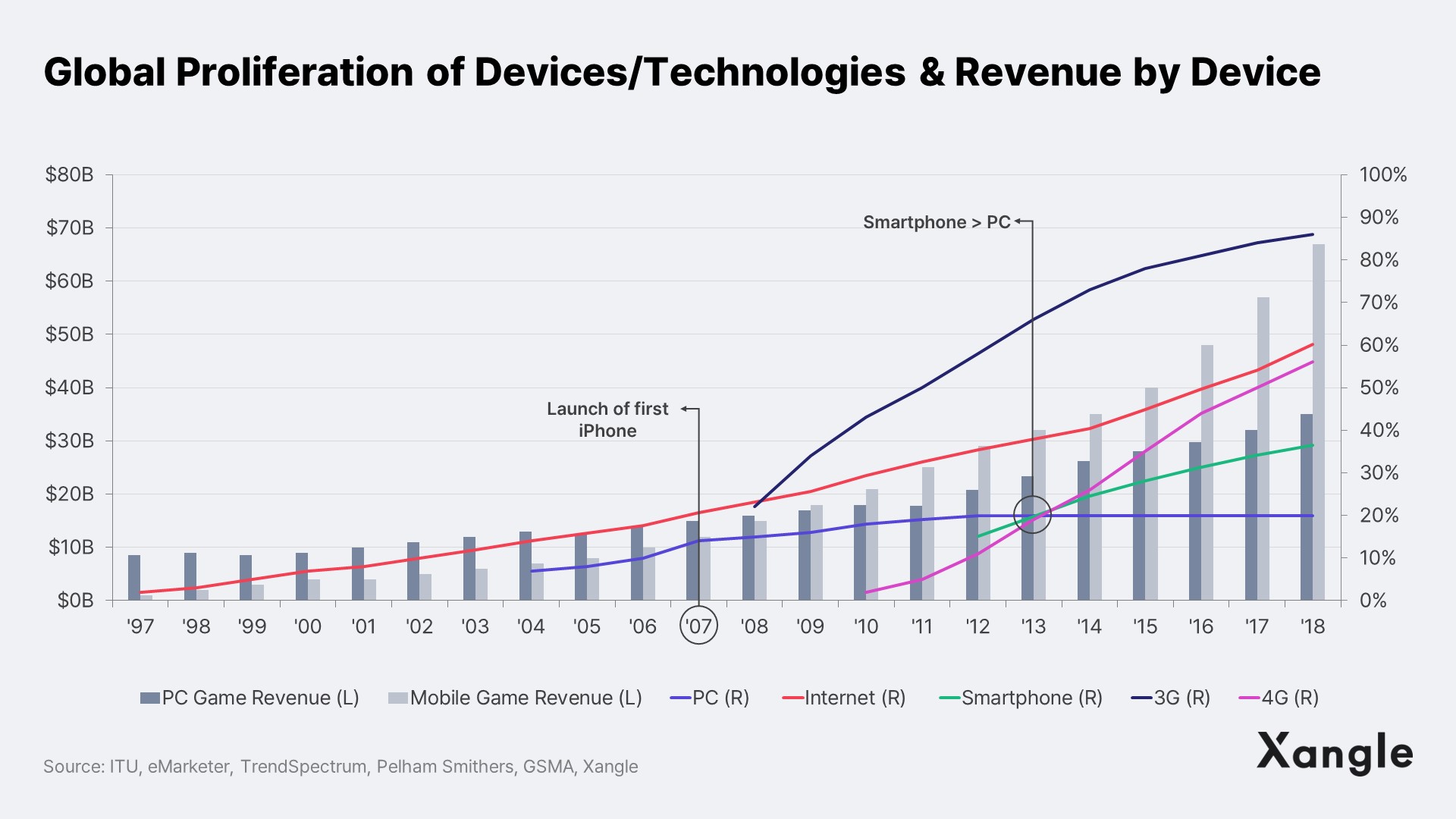

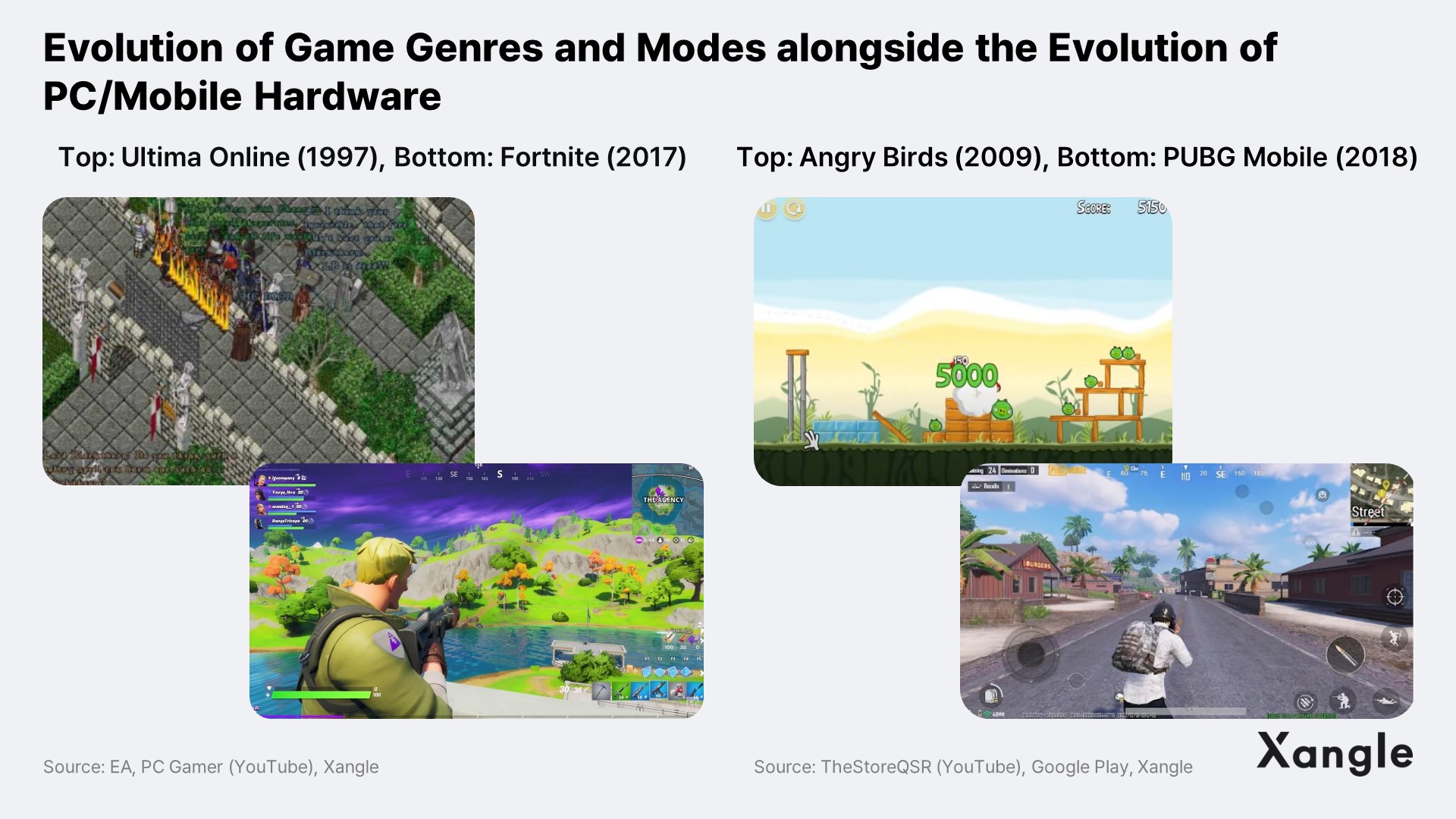

So, what were the key factors that fueled the growth of PC and mobile gaming markets? First, it was the widespread availability of hardware and technological advancements. The growth of PC gaming was fueled by the proliferation of PCs and the development of internet technology. Similarly, mobile gaming saw its expansion coincide with the proliferation of smartphones and the development of mobile communication technologies such as WiFi, 3G, and 4G. As seen in the figure below, both PC and mobile gaming revenues grew alongside with their related technologies. PCs and the internet transformed the gaming landscape by enabling players to enjoy games simultaneously with countless other gamers, breaking free from the constraints of playing alone. On the other hand, smartphones and mobile communications transcended the existing time and space limitations associated with gaming, making it possible for players to connect to games anytime and anywhere. This evolution in gaming hardware created a more convenient and enjoyable gaming environment, attracting new groups of gamers and contributing to the expansion of the PC and mobile gaming markets.

Next, the development of new game genres played a significant role. The history of PC and mobile gaming is a continuous process of successful games pioneering new genres and expanding them. As successes emerged for new genres, game developers dedicated themselves to developing games within those genres, which, in turn, led to market growth and activation. For example, Ultima Online (1997) was not the first MMO (Massively Multiplayer Online) game, but it played a crucial role in shaping the MMORPG (Massively Multiplayer Online Role-Playing Game) genre. The success of Ultima Online paved the way for various MMORPGs like EverQuest (1999), Runescape (2001), and World of Warcraft (2004). DotA (2003) similarly acted as a precursor to the MOBA (Multiplayer Online Battle Arena) genre, giving rise to games like League of Legends (2009) and Dota 2 (2013). Looking at mobile gaming, after the rapid growth of the market in the late 2000s with the introduction of smartphones, the industry saw an influx of casual games following the success of Angry Birds in 2009, and games like Cut the Rope (2010) and Candy Crush Saga (2012) marked the era of casual gaming. Then, the success of multiplayer mid-core strategy games like Clash of Clans (2012) expanded the market further along with mid-core/hard-core multiplayer genre such as MMO strategy games like Game of War: Fire Age (2013) and MOBA games like Honor of Kings (2015). The success of PUBG Mobile (2018) also showed that the battle royale genre could thrive on mobile devices, paving the way for the mobile adaptation of PC game Fortnite Battle Royale (2017), being the vehicle for the growth of the battle royale genre along with PUBG Mobile.

In summary, the growth of PC and mobile gaming can be attributed to 1) technological advancements and 2) the exploration of new game genres. Among these factors, technology played a more significant role in driving market growth. When we examine the revenue scale, the PC gaming market expanded with the advent of internet connectivity services, while the mobile gaming market took off with the widespread adoption of smartphones. The increase in internet speed, along with improvements in PC and smartphone specifications, led to enhanced graphics and faster frame rates. This, in turn, created an environment that could accommodate more gamers and offer a smoother gaming experience. As a result, multiplayer modes like MMORPG, MOBA, and battle royale emerged, allowing for more immersive gaming genres. In the end, the growth of PC and mobile gaming was dependent on the prior widespread availability of hardware and technological advancements, which is why it took a considerable amount of time.

It's recommended to approach blockchain gaming from a long-term perspective.

So, how should we view blockchain gaming? When examining market size and growth rate, short-term market size may not seem significant, but the current growth rate is considered to be promising.

Firstly, the short-term market size of blockchain games is expected to be small due to the fact that blockchain gaming didn't emerge with new hardware. PC and mobile games naturally became a major content on the platform alongside the proliferation of new hardware, benefiting from advancements in technology such as the internet, mobile communications, and semiconductor development. As a result, they occupied a significant portion of the expanding market with wider spread of hardware.

On the other hand, blockchain games run on already popular and widely used PC and mobile devices. This means that blockchain games must compete with existing games in the saturated market of PC and mobile games. They need to contend for a limited share of the market in an environment where the upside is restricted. In other words, unlike PC and mobile games that directly benefited from the growth of the hardware industry, blockchain games face difficulties in reaping the same benefits in the short term, which is why it is hard to view blockchain games on the same level of PC or mobile games.

Although the short-term market size might not be substantial, it is anticipated that a full-fledged blockchain gaming market will evolve as new hardware, where blockchain games can thrive, becomes more widespread. Hence, it's recommended to consider the growth potential of blockchain games from a more long-term perspective, as will be elaborated further.

So, is the growth rate of the blockchain gaming market truly slow? Not necessarily. The blockchain gaming market is projected to grow from the $746.1 million in 2018 to an estimated $7.4 billion in 2023, showing an average annual growth rate of 58.1%. While the initial five-year market size might be smaller compared to PC or mobile games, the absolute growth rate shows a promising trend, even demonstrating a higher growth trajectory.

In the short term, we anticipate the emergence of successful cases.

Therefore, the question we should be asking isn't about how fast the blockchain gaming market will grow, but rather, what to expect in the short term and which technologies will accelerate the long-term growth of blockchain gaming. Short-term expectations include the creation of initial successful cases, while long-term prospects involve the benefits from the growth of AR/VR hardware markets.

From a short-term perspective, just as in the past where the PC and mobile game market saw success in new genres that led to the development of more games in that genre, creating a cycle of success, we expect a similar pattern for blockchain games. Through initial success cases, more game developers will participate, further creating additional successes. This process will involve diverse attempts as well as trial and error, leading to improvements that could offer gamers a new gaming experience beyond P2E.

On a positive note, more game developers are increasingly getting involved in the blockchain gaming market. Korean game companies in particular are taking a leading role in blockchain game development. Most game giants are adopting an affirmative stance toward blockchain gaming apart from NCSoft. Their approaches vary, from releasing major titles as blockchain games to creating original IPs and utilizing blockchain technology in platforms other than gaming.

* To read more on blockchain game development by Korean game companies: “Asia Blockchain Gaming Deepdive”

Many international game companies tend to hold a more conservative stance regarding this market compared to Korean companies. Still, there is a growing trend where major game companies, such as Japan's Bandai Namco, Square Enix, Konami, and SEGA, as well as Western companies like Ubisoft and Take-Two Interactive, are gradually entering the blockchain gaming market. While they have not reached the game release stage as Korean game companies have, it seems like the rough outlines for their first games are beginning to take shape.

Perhaps WEMADE’s Night Crows Global will be the game that can achieve global success in the shortest time. Based on the proven gameplay in the South Korean market, it is believed that it could match MIR4’s global success. And there is high anticipation that Night Crows Global’s success will be the incentive for more game companies to enter the blockchain gaming market and improve gamers' perception of blockchain games. More on this topic later.

Will blockchain gaming benefit from the AR/VR industry in the long run?

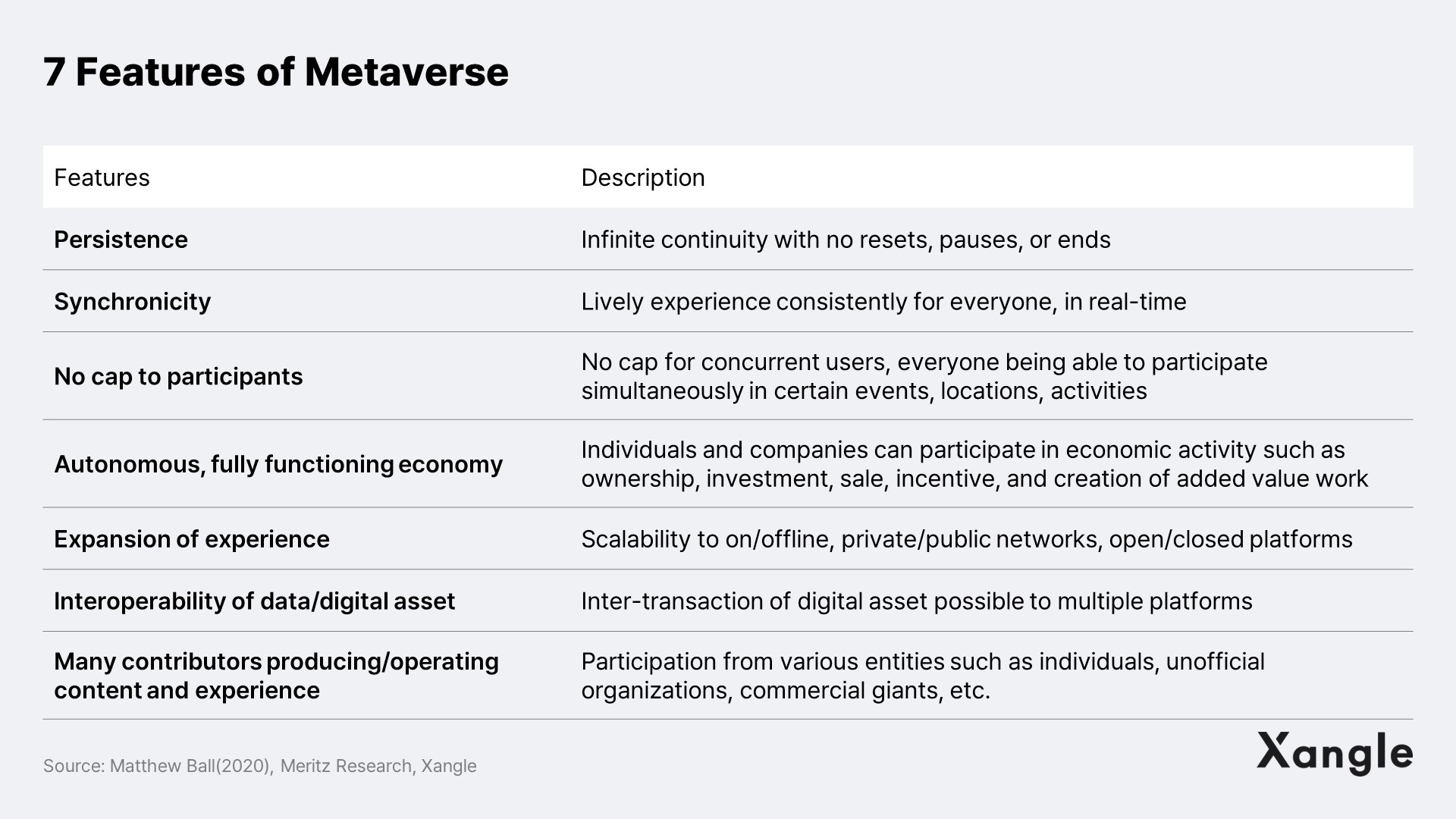

In the long term, blockchain gaming is poised to become a major content provider for AR/VR hardware, and is expected to grow in tandem with the AR/VR hardware industry. This anticipation arises from the belief that blockchain technology will play a pivotal role in the metaverse space implemented through AR/VR hardware.

The metaverse is an abstract concept without a concrete definition. However, when we examine the core attributes of the metaverse model presented by Matthew Ball, which is considered to be the closest to a perfect metaverse, the potential for using blockchain technology becomes evident in two key areas: 1) the interoperability of data and digital assets and 2) the creation and operation of content by various participants.

To ensure that digital assets maintain the same value across various platforms within the metaverse, they need to be designed and issued under a unified standard of blockchain. This allows digital assets to move freely between different metaverse platforms, ensuring interoperability. The concept of mods will be discussed in connection with content created and operated by various participants.

Just as PC and mobile games evolved and fully embraced the expanding market alongside hardware proliferation, it is expected that blockchain games will do the same with AR/VR hardware.

2. Which Blockchain Games Deserve Attention?

One blockchain game that deserves mention in today's blockchain gaming market is Night Crows Global by WEMADE, which is planned to be launched by the end of the year. Its gameplay has already been validated through its success in the Korean game market, and with the potential to reach global success levels similar to MIR4, Night Crows is making a strong case for itself.

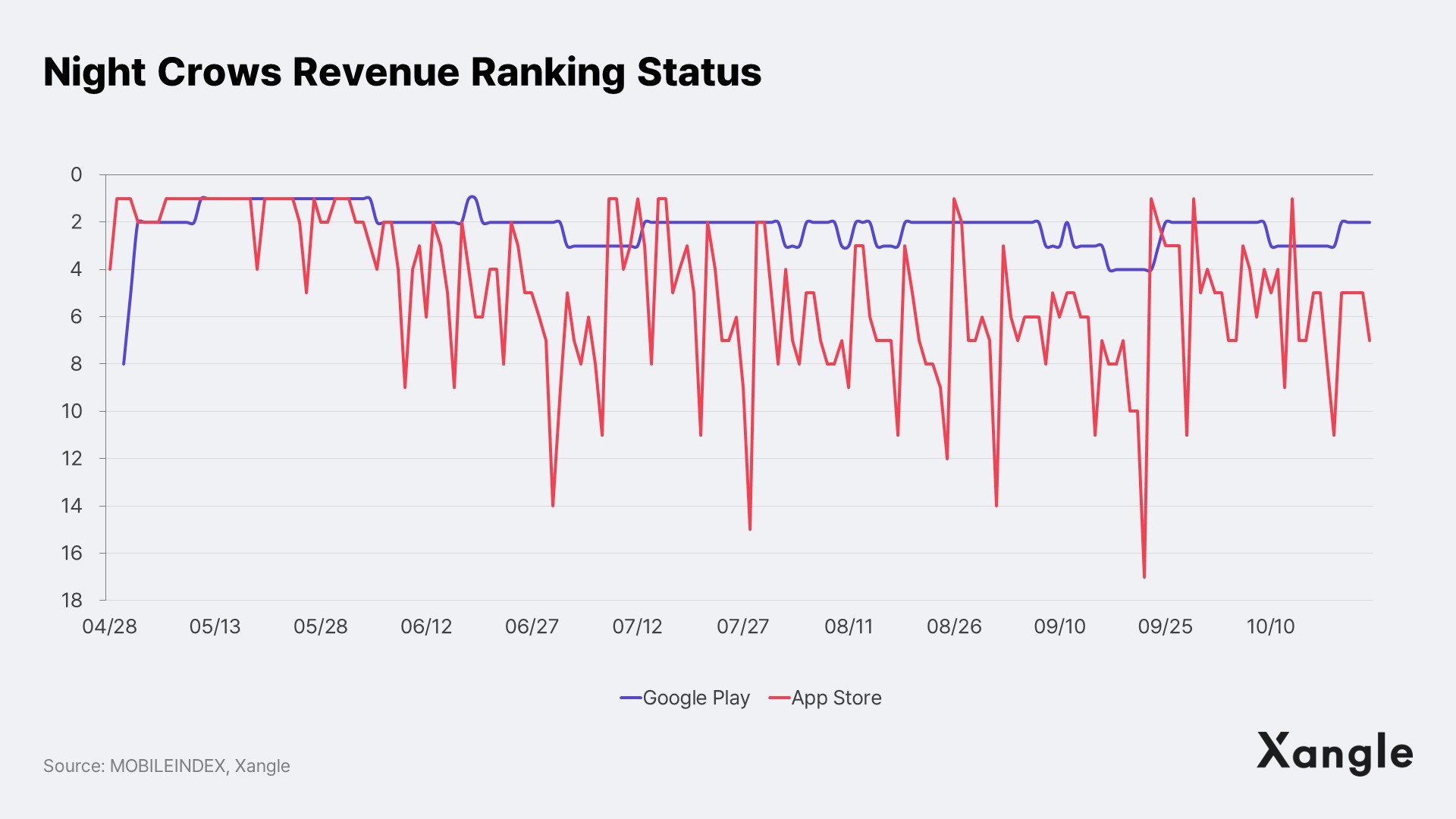

Night Crows’ Proven Success in the Domestic Market

Night Crows is a PC and mobile MMORPG developed by MADNGINE, with support from the developers of V4, HIT, and OverHit, and published by WEMADE. Night Crows entered the South Korean mobile gaming market, which basically been overtaken by the Lineage series (Lineage M, Lineage W, Lineage 2M) and Odin, alongside several new RPG titles such as ArcheAge War (3/21), Wars of Prasia (3/30), and Honkai: Star Rail (4/26). Despite the competition, it secured the top spot in Google Play's daily revenue ranking (5/10) and Apple's App Store daily revenue ranking (4/28), earning positive feedback from the market. It has since continued to maintain a strong position in the top revenue rankings on both app markets, currently ranking 2nd on Google Play and 5th on the App Store.

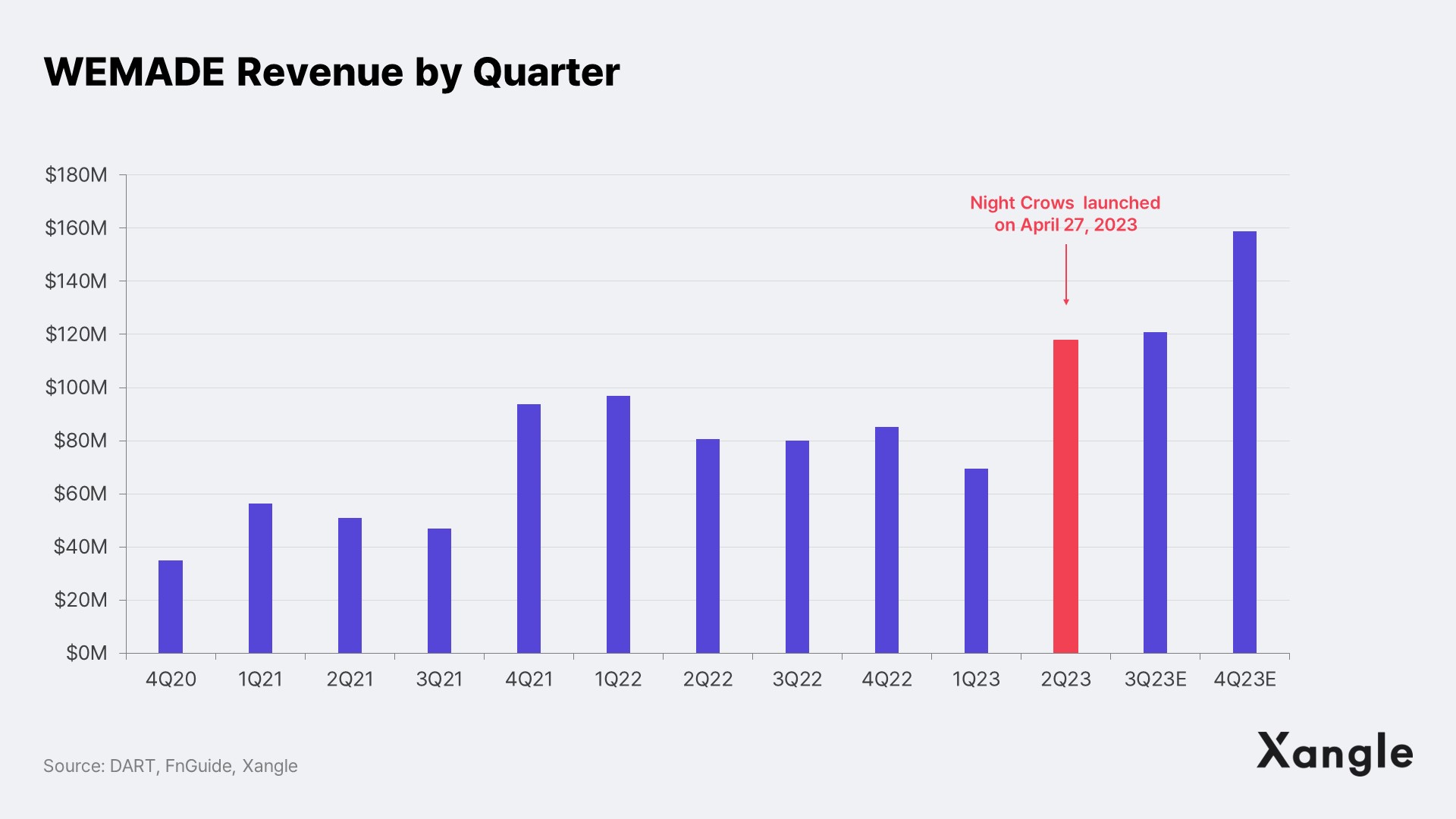

WEMADE, thanks to the success of Night Crows, achieved its highest quarterly revenue in history, recording approximately 120 million dollars in the second quarter. Despite the game being released at the end of April and the success not being immediately reflected, revenue increased by 46.1% year-on-year and 69.6% quarter-on-quarter. With cumulative revenue surpassing 100 million dollars and daily revenue estimated to be around 670k dollars, Night Crows has solidified its position as a new cash cow following MIR IP.

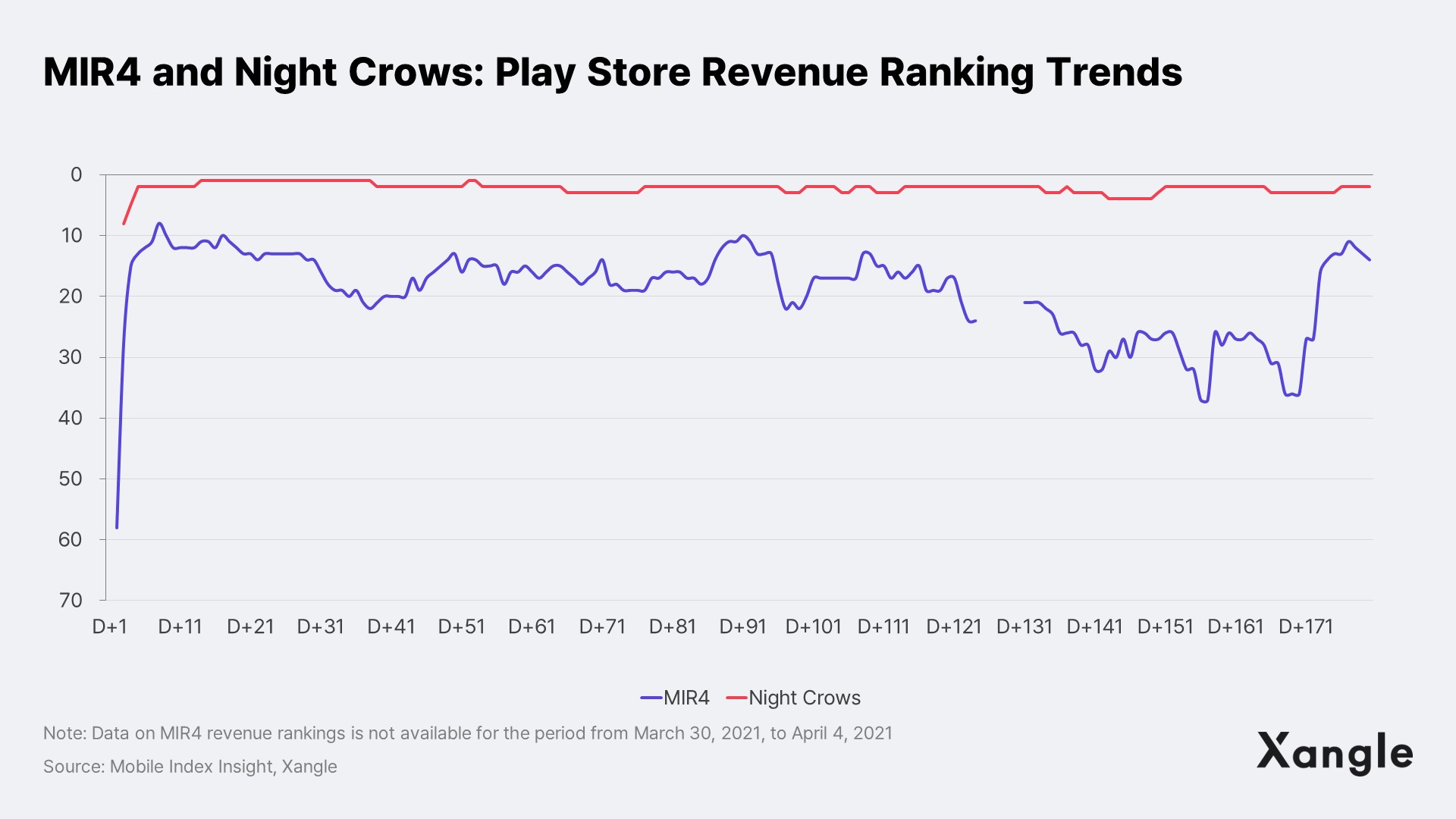

Night Crows’ domestic box office performance is superior to MIR4

When comparing the box office performance of Night Crows and MIR4, Night Crows takes the lead by a large margin. The difference is quite clear when comparing the first six-month revenues after launch on the two app markets. MIR4 peaked at 8th on Google Play and 4th on the App Store, ending up at 14th on Google Play and 42nd on the App Store after six months. In contrast, Night Crows reached 1st on both app markets and still holds 2nd place on Google Play and 5th place on the App Store after six months.

2021-1Q, 2021-4Q, and 2023-3Q revenues for MIR4, MIR4 Global, and Night Crows, are about 57 million dollars, 95 million dollars, and 122 million dollars, respectively. The estimated 2023-3Q revenue is expected to increase by 115.0% and 29.0% compared to 2021-1Q and 2021-4Q, respectively. Notably, Night Crows' domestic revenue has already surpassed MIR4 Global's, and MIR4 Global's revenue is 66.7% higher than the revenue from its domestic release.

But there’s more to blockchain games than just gameplay.

If we only consider the gameplay, Night Crows Global seems promising. Its impressive revenue and long-term success outshine MIR4 Global by all standards. However, predicting the success of blockchain games based solely on gameplay is overly simplistic. In contrast to the traditional PC and mobile gaming market, where fun and addictiveness are key to success, blockchain games have various other factors that influence success.

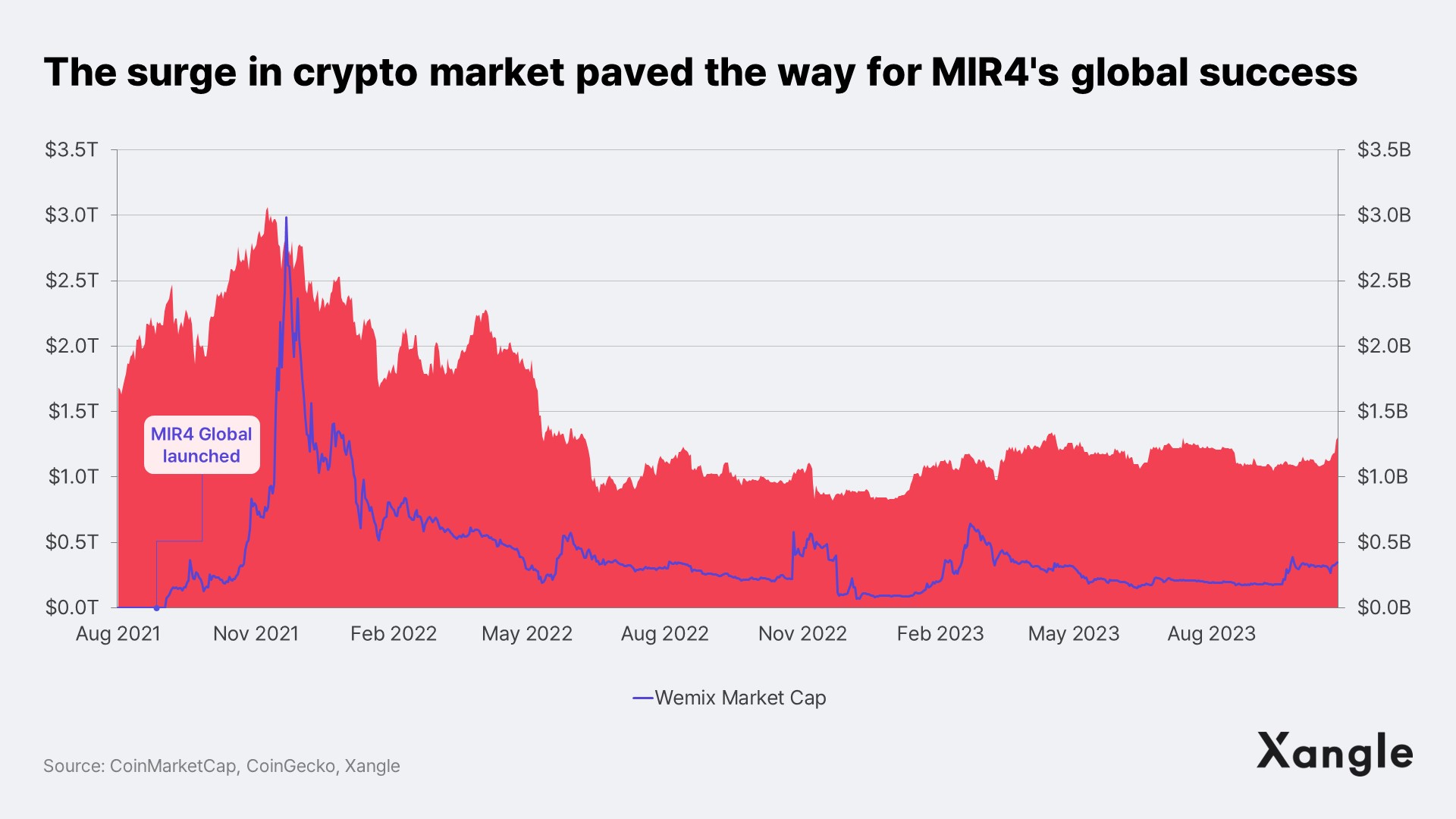

Blockchain games involve a complex network of stakeholders, including gamers, token investors, and token issuers (game companies), all tied to token prices. Thus, the flow of token prices plays a crucial role in the success of blockchain games. In the case of MIR4 Global's release in August 2021, it coincided with the boom in cryptocurrency, leading to an increase in token prices, P2E profits, number of users, and upward cycle of token prices. Although the excitement for the recent potential for spot Bitcoin ETF has contributed to the Bitcoin-oriented rebound, the overall market capitalization of the crypto asset market remains at around 40% of its previous levels.

Considering that Night Crows Global partially incorporates the P2E model, it is hard to expect the same robust market conditions as when MIR4 Global was released. Nevertheless, if the launch of Night Crows Global is delayed until the first quarter of next year, it could coincide with major events such as the expected approval of a spot Bitcoin ETF and the Bitcoin halving (expected in April), leading to a more favorable market situation.

If the market conditions open up the path for higher token prices, the tokenomics should support price stability. MIR4 Global introduced a straightforward tokenomics system involving the exchange of in-game assets with tokens. However, the absence of a mechanism to maintain token value led to a shortened game lifespan. Although MIR M introduced the staking feature and exhibited a more sophisticated tokenomics design, it still struggled to maintain token value.

* To read more on MIR4 Global and MIR M’s tokenomics: “Web3 Game Tokenomics: Extrapolating the Future From the Past”

Night Crows Global plans to introduce a brand new tokenomics system that is based on the lessons learned from MIR4 Global and MIR M. Operating under the name "Multi-Utility Token Economy" (MUTE), Night Crows Global supports one base token and six utility tokens. The base token, $CROW, pegs itself to $1 and features its own Peg Stability Module (PSM) to halt issuance if the price falls below $0.7. The six utility tokens are exchanged for prominent in-game items and are paired exclusively with $CROW on the in-house DEX (e.g., $TEAR-$CROW).

Night Crows Global has introduced multiple features to protect token value. However, it remains uncertain whether these features will work as intended when faced with a sudden influx of users. Games have always grappled with issues of bots that automatically collect in-game items, and blockchain games are no exception. Night Crows Global could potentially face a price fall in $CROW and utility tokens due to large-scale sell-offs. Also, if a significant amount of time is required to resume issuing $CROW, it could lead to a substantial exodus of users who joined for profit purposes.

Apart from token prices, the complex tokenomics of the game itself could also hinder success. In the case of MIR4 Global and MIR M, MIR M had a more evolved tokenomics that could defend token value, but MIR4 Global’s number of concurrent connected users was about five times that of MIR M. Note that MIR M’s hasty launch to continue MIR4 Global’s success is likely the biggest factor in this less-than-satisfactory performance. However, it is also possible that MIR M’s tokenomics system that introduced novel Web3 elements that were unfamiliar to existing gamers may have been a contributing factor. Given that Night Crows Global's intricate tokenomics system could also be a barrier, it is crucial to consider the large-scale user influx and sustained play by existing gamers, not just Web3 users, to ensure the success of blockchain games.

Expected to be a catalyst for global game companies

There are certainly concerns about Night Crows Global's tokenomics. It's a whole new approach that hasn't been tried in any game, so predicting the outcomes in the actual gaming environment is tough. And since tokenomics plays a vital role in keeping token prices stable, it affects the long-term success of blockchain games.

Still, despite these concerns, Night Crows Global has substantial potential for success. MIR4 Global's tokenomics might be seen as a failure in terms of price stability, but it managed to attract a whopping 1.3 million concurrent users. Even now, it holds the record with 240,000 concurrent users among blockchain games. Much like how MIR4 Global motivated significant domestic game companies to enter the blockchain game market, it is hoped that Night Crows Global will serve as a catalyst for global game companies, potentially surpassing MIR4 Global's success.

3. What Does It Take for Blockchain Games to Succeed?

Why games based on popular IPs receive disappointing reviews

In the blockchain gaming landscape, apart from pioneers like Axie Infinity, which introduced the Play-to-Earn (P2E) concept, and MIR4, which has pushed the completeness of P2E games to new heights, it's challenging to find standout games. But why is this the case, and why do games based on popular IPs sometimes fall short?

As mentioned earlier, when we talk about the success of blockchain games, it's not just about game quality but also about attracting and retaining existing gamers, alongside the Web3 users. Games that prioritize Web3 philosophy over overall quality can fall short of traditional gamers' expectations. Games using established IPs strive to maintain traditional game quality while integrating blockchain features. However, these features can sometimes act as barriers for gamers.

Games featuring well-known intellectual properties (IPs) in the existing gaming market have usually seen great success. This is because they naturally draw in a devoted fan base associated with the IP when a new game is launched. Some notable examples include Blizzard's Diablo series and Nintendo's The Legend of Zelda series.

- Diablo series: Blizzard's Diablo series, initially introduced in 1996, recently unveiled its fourth installment, Diablo 4, which achieved record-breaking sales. It raked in $666 million in just one week after its release, making it one of the fastest-selling titles in Blizzard's history.

- The Legend of Zelda series: Nintendo's The Legend of Zelda series, which made its debut in 1986, recently launched its 20th installment, The Legend of Zelda: Tears of the Kingdom. This title also made history in the series by selling over 10 million copies within a mere three days, becoming the quickest-selling game in The Legend of Zelda series.

However, it's challenging to anticipate a seamless transition of such a dedicated fan base to blockchain games that rely on existing IPs. From the perspective of gamers who enjoyed the original IP, there may not be strong motivation to engage with blockchain games for several reasons: 1) the absence of new content, 2) the high entry barrier, and 3) a lack of meaningful Play-to-Earn (P2E) rewards, as initially seen when P2E games were introduced. Consequently, there isn't much incentive for them to play blockchain games. On the other hand, these games can capture the interest of Web3 gamers and token investors. They offer a rare blockchain game with guaranteed quality for Web3 gamers and cultivate a user base that can absorb initial selling pressure, making them more robust compared to other blockchain games for token investors. To attract Web2 gamers, these games utilize familiar game IPs. However, games that merely recycle aging IPs without careful consideration of game design end up primarily attracting Web3 gamers and token investors to the game ecosystem. This is why rehashed blockchain games without thorough planning often fail to succeed.

Current blockchain games do not attract traditional gamers

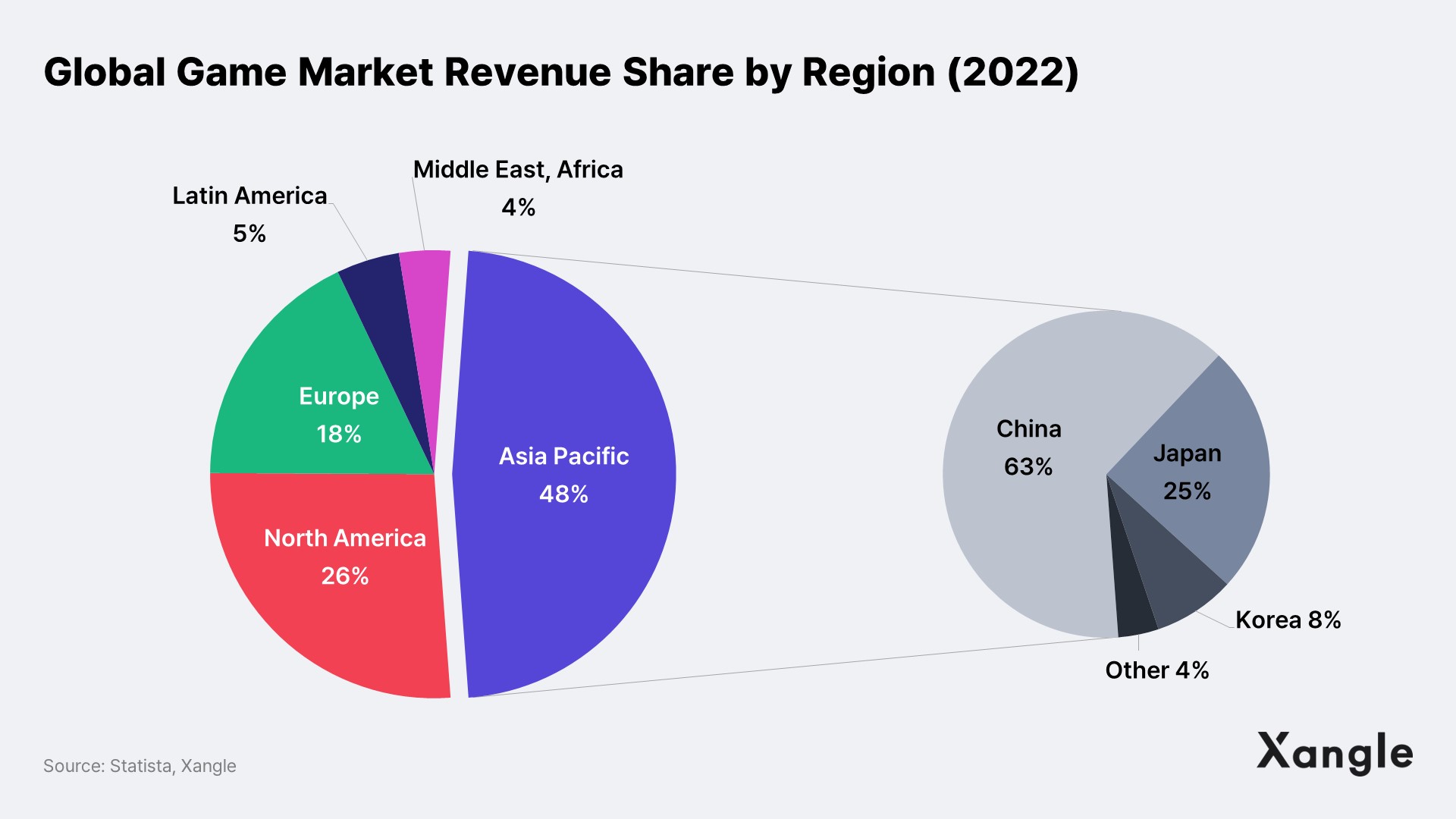

So, how can we smoothly transition Web2 gamers into the world of blockchain games? When we examine the regional revenue distribution in the global gaming market, we observe that the Asia-Pacific region claims the largest share at 48%, followed by North America at 26%, and Europe at 18%. Notably, the Asia-Pacific region is primarily dominated by three countries: China (63%), Japan (25%), and South Korea (8%), collectively representing over 95% of the market.

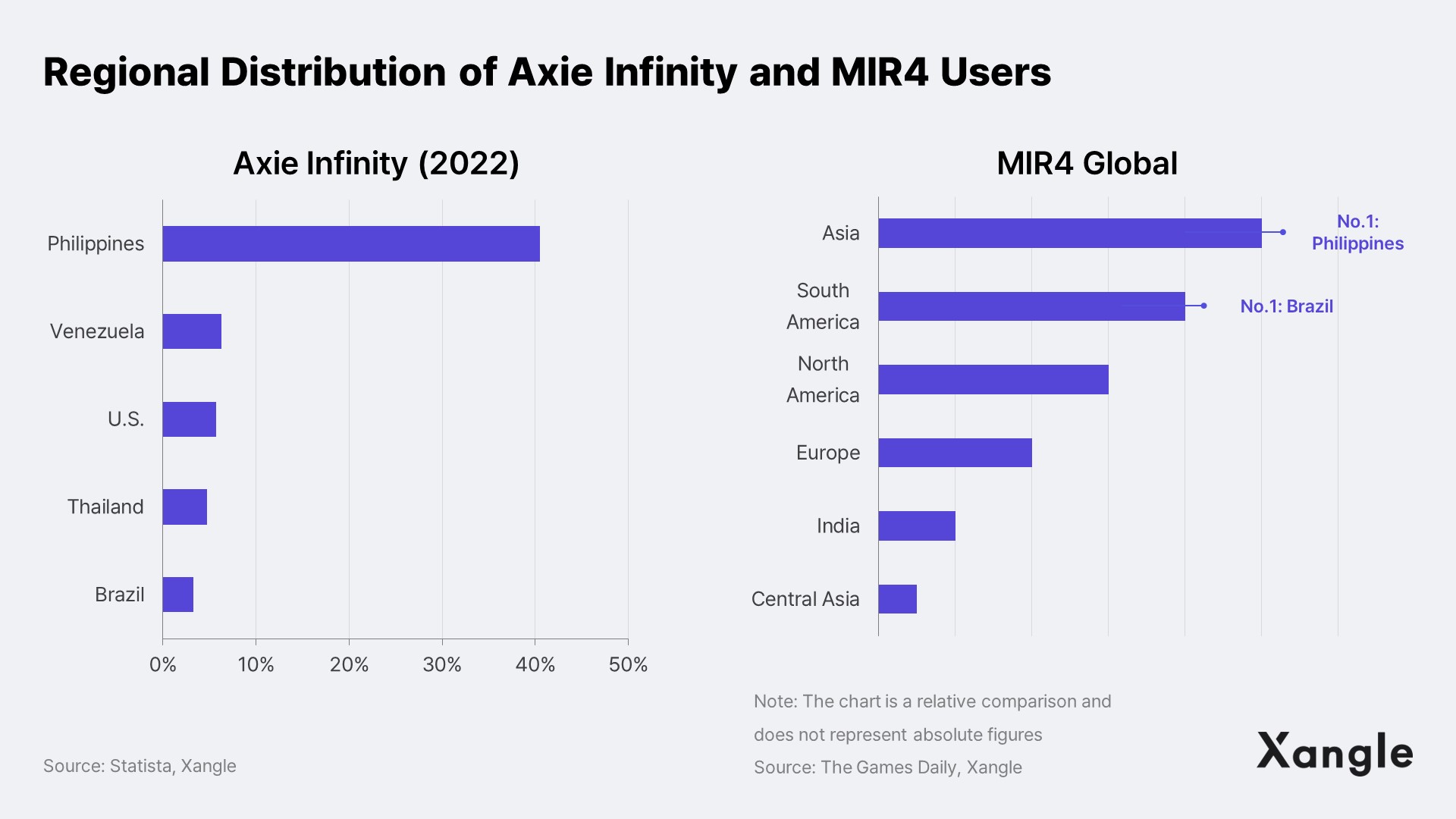

Conversely, a leading blockchain game like Axie Infinity has its user base spread across the Philippines (41%), Venezuela (6%), the United States (6%), Thailand (5%), and Brazil (3%). The majority of its users originate from Southeast Asia and South America, regions with relatively modest market shares of 4% and 5%, respectively, in the global gaming market. As for MIR4 Global, it boasts a substantial user base spanning Asia, South America, North America, Europe, India, and Central Asia. The Philippines emerges as a standout location in Asia, while Brazil hosts the largest number of users in South America.

This suggests that the blockchain games do not hold significant appeal for gamers in the three major gaming regions: East Asia (China, Japan, South Korea), North America, and Europe. It's crucial to note that obtaining a license is mandatory to offer games in China, and South Korea's restrictions on blockchain game services mean they are not reflected in statistics. Japan is actively pursuing the blockchain gaming market, following South Korea, hinting at a potential distinct path for Japan and South Korea in the future.

In Western regions, higher average incomes mean gamers find blockchain games with "earn while you play" models less appealing. Moreover, the Western gaming market primarily revolves around single-player console games, making it challenging to incorporate tokenomics and NFTs. Unlike Asian gamers who are accustomed to freemium models (Free-to-Play, F2P), Western gamers have historically resisted payment-driven content, resulting in strong opposition to tokens and NFTs. When Ubisoft announced its NFT plans in a YouTube video, it received an overwhelming 95% dislike ratio. Ultimately, Ubisoft had to remove the video.

* For more information on the blockchain gaming market in the West, please refer to “4-1-A. A. Overseas: Web3-Native Game Companies Leading the Market” in the “2023 Crypto Outlook: Antifragile” report.

Let's Shift Our Focus to “Mod”

To attract traditional gamers to blockchain games, we must present them with game formats they are comfortable with, while also offering a distinct gaming experience unique to blockchain. Overcoming challenges like wallet setup, transaction execution, and bridge utilization, which may initially appear complex, is vital for enhancing the user experience. The blockchain industry is well aware of these issues and actively researching methods to improve the UI/UX of blockchain services. It's anticipated that these issues will naturally be resolved with the advancement of blockchain technology, so we will not delve into this matter further. Now, what are the essential characteristics that games should possess to be both recognizable to existing gamers and capable of delivering the unique value that only blockchain can offer?

* For more insights on improving the UI/UX of blockchain services, please refer to the Xangle Original article, “ERC4337, the Epicenter of UX Innovation.”

When blockchain meets gaming, it offers gamers more than just tradable tokens. The true potential of blockchain lies in giving gamers the freedom to create and profit from their own unique modifications, often referred to as "mods." Even in traditional games, mods are a common phenomenon, where gamers tweak various elements of the game to create something new. For instance, the popular game "PlayerUnknown's Battlegrounds" (PUBG), created by South Korean company Krafton, draws its roots from ARMA 2 modding, specifically the "DayZ" mod, and the subsequent "DayZ: Battle Royale" mod. "DayZ" brought modifications to the ARMA 2 universe, while "DayZ: Battle Royale" tweaked game rules built upon the DayZ game system. Additionally, League of Legends was born from DOTA, a mod for Warcraft 3, and Counter-Strike began as a mod of Half-Life.

While some mods, like Battlegrounds, League of Legends, and Counter-Strike, have evolved into independent, successful games, most game companies either limit or prohibit mod creation. In practice, the rights of gamers to develop secondary content are solely decided by the discretion of these companies. From the game companies' viewpoint, this is a sensible choice. Unrestricted modding can alter the original game's vision, impact the profitability of paid Downloadable Content (DLC), and even pose risks to a company's intangible assets, such as the game's code. Nevertheless, despite these concerns, there are several benefits we can expect from integrating blockchain as elaborated below.

Game companies: The Quest for Sustainability

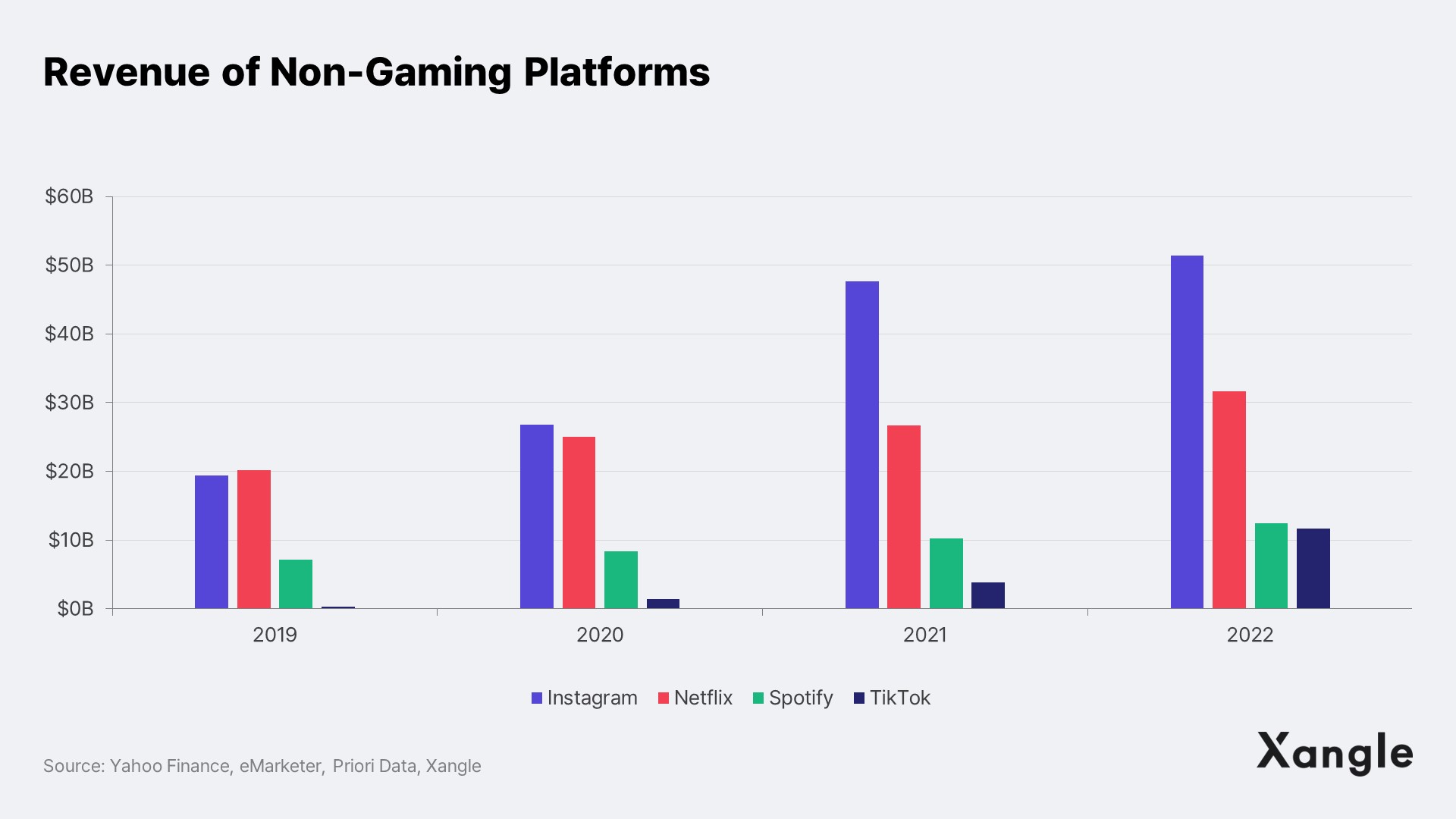

Game companies continuously update their content to attract and retain gamers. However, no matter how financially robust a game company is or how enjoyable their game is, ensuring a consistent influx of new gamers and keeping them engaged through updates are not easy tasks. Furthermore, in contrast to the past, there has been an explosive surge in non-gaming content options, such as YouTube, Instagram, TikTok, Netflix, Webcomics, and more. These platforms generate content tirelessly, while our leisure time remains limited. Game companies find it challenging to compete with the volume and speed of user-generated content on these platforms, which corresponds with the global gaming industry's transition to a more challenging phase.

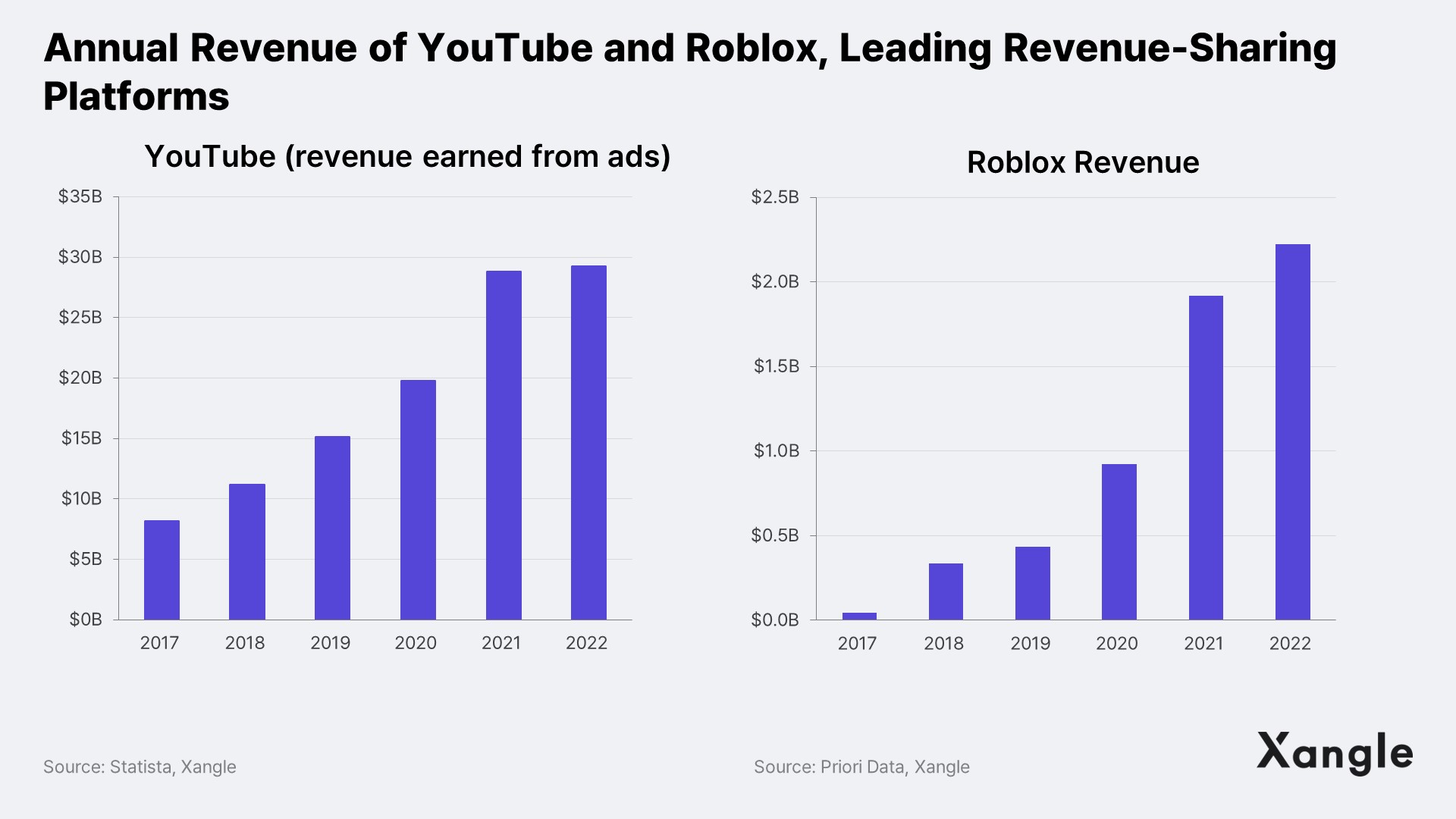

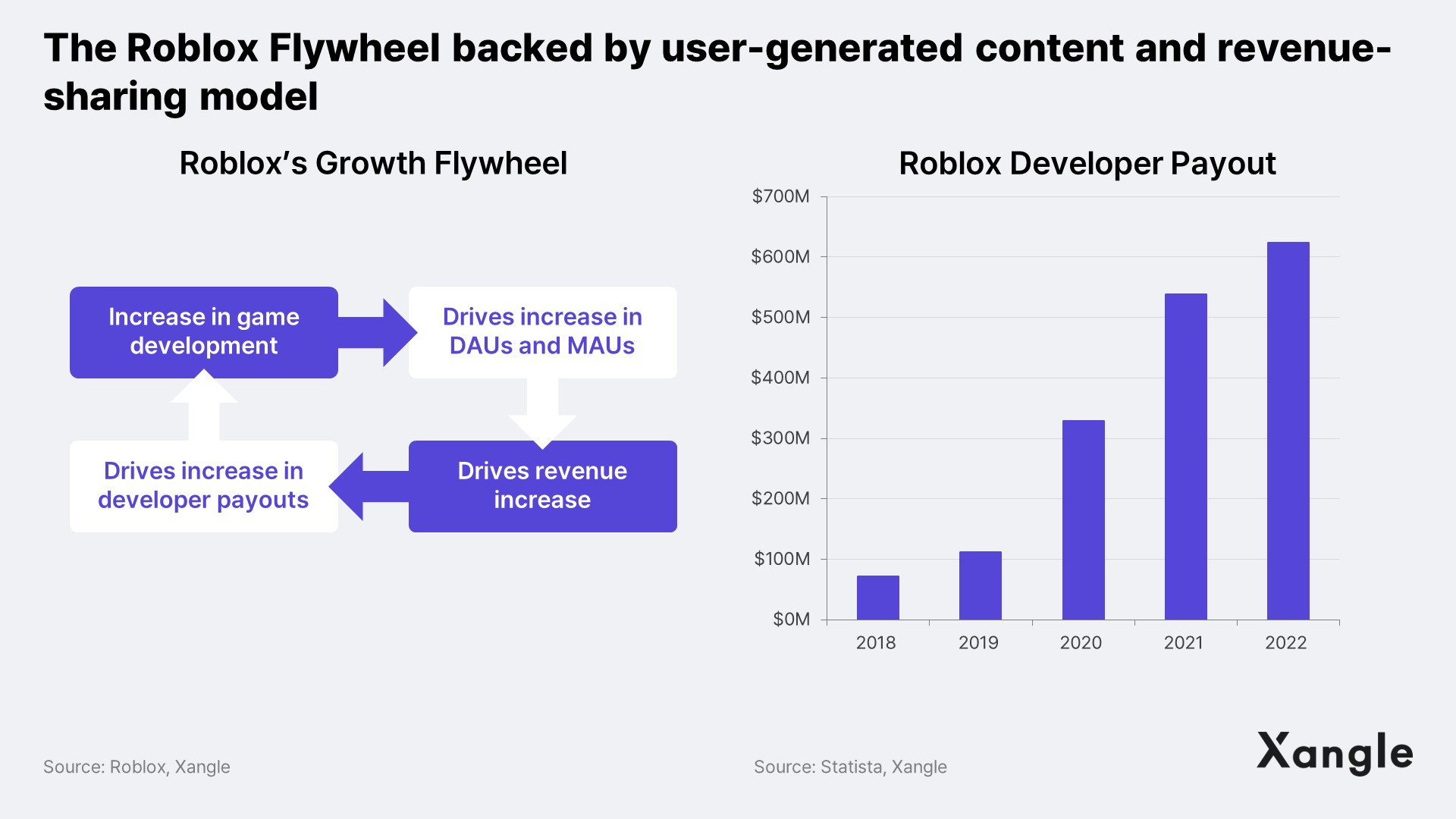

Game mods present a solution to address the inherent limitations of game sustainability. Allowing game mods enables game companies to share the responsibility of continuous content updates with gamers. This leads to quicker and more extensive updates, broadening the game's scope and prolonging its lifespan by reducing the rate at which gamers exhaust available content. In the end, this approach alleviates the sustainability burden on game companies. Gamers who create mods frequently have a better grasp of gamer preferences and demands than game companies. The efficacy of this user-focused content creation and its associated revenue-sharing models has already been demonstrated on platforms like YouTube and Roblox.

Modders: Earning profit!

In traditional gaming, gamers invested their time and effort in creating mods out of their love for the game, often sharing them freely. While a few mods eventually turned into independent, profitable games, most remained accessible for free. Since modders lacked proper reward mechanisms, they sometimes abandoned their development midway or left mods unattended after completion due to the absence of incentives. In blockchain gaming, we have the opportunity to reward modders economically through tokens, depending on their level of activity and engagement with their mods. This approach ensures that contributors to the gaming ecosystem receive fair recognition, fostering their continued involvement in the gaming community. As the number of modders grows, a more extensive variety of content becomes available, resulting in an expanded user base. Consequently, this leads to increased revenue, offering even more substantial rewards to creators.

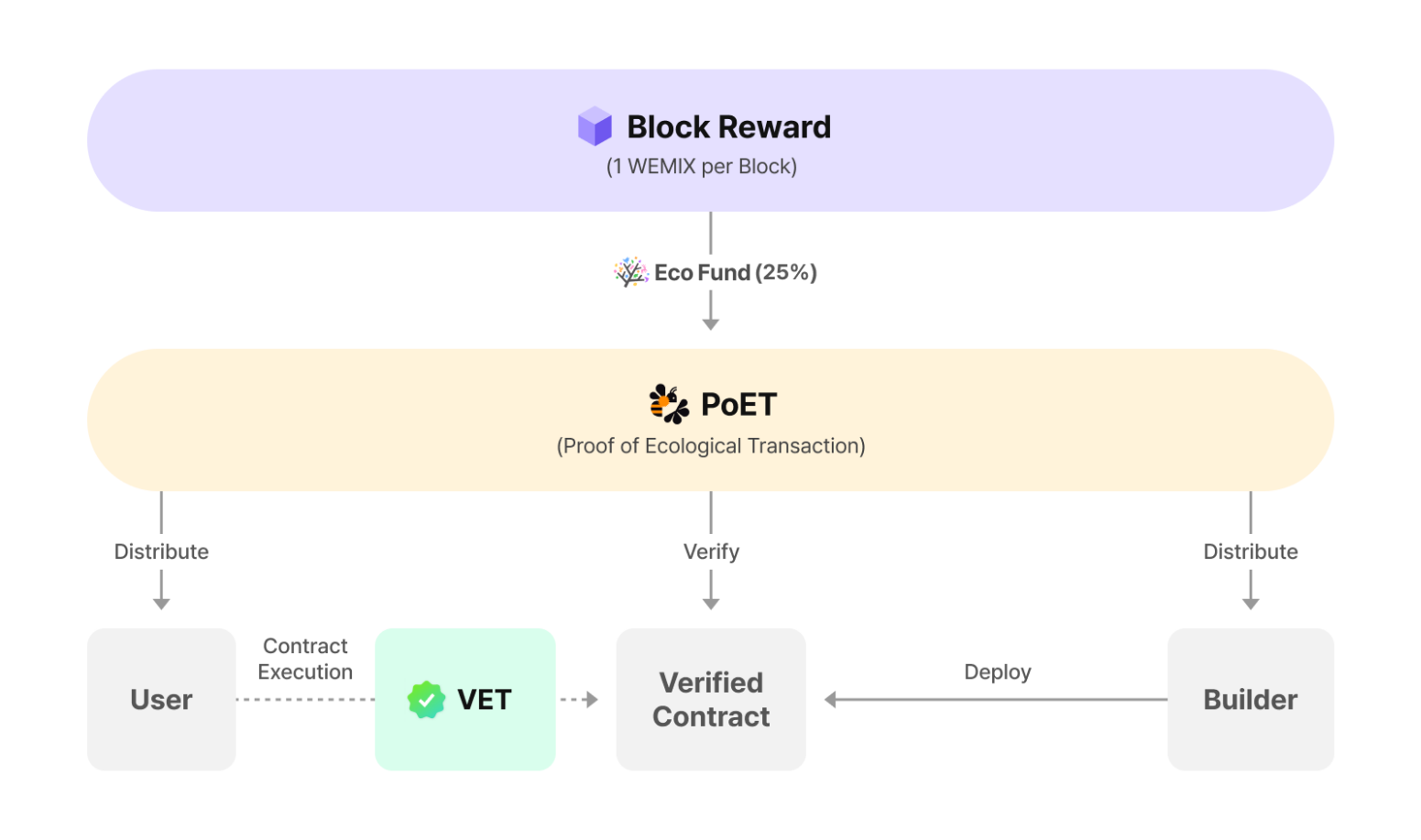

This idea closely resembles the Proof of Ecological Transaction (PoET) system introduced by WEMIX. PoET incentivizes users and service providers in the WEMIX ecosystem with $WEMIX tokens for their contributions to its development. Those who make significant contributions to the ecosystem receive a higher number of tokens as rewards. Importantly, although the PoET system isn't limited to game mods but extends to developers creating dApps within the WEMIX ecosystem, it still shares some similarities with mods.

* For more information on PoET, please refer to the WEMIX Docs.

<WEMIX PoET system, Source: WEMIX>

Gamers: All about the fun!

Looking at it from a gamer's perspective, there's every reason to dive into blockchain games. When blockchain enters the scene, it brings a swift supply of high-quality content, elevating the gaming experience. Gamers get to dive into creatively tweaked original games and find the ones that perfectly suit their tastes. While game companies focus on profit and create games for the masses, modders, unburdened by development costs and profit pressures, can offer games customized for specific niche audiences. Moreover, mods, which can easily adapt to gamer feedback, are exceptionally popular among gamers. The introduction of blockchain takes the joy of gaming up a notch, naturally drawing gamers in.

The potential of mods in blockchain gaming

Providing gamers with the opportunity to create and monetize secondary creations through mods can create a win-win situation for game companies, modders, and gamers alike. However, questions arise such as 1) Modding is not a unique feature of blockchain games. What makes blockchain games different? 2) Will Web2 game companies move away from their current closed mentality and allow full modding? As mentioned earlier, unrestricted modding comes with various side effects.

The answer to the first question lies in the unique aspects of blockchain games, primarily interoperability and transparency. In traditional games, each mod often operates within its isolated world, with distinct lore, rules, and economic systems, essentially making them separate games in the eyes of gamers. Consequently, transitioning from one mod to another comes with significant switching costs. However, when mods built on the same blockchain can share in-game assets and economic systems, gamers no longer need to worry about such costs. They can invest equivalent time, effort, and resources to enjoy a more immersive gaming experience.

However, this can lead to a significant issue: it might disrupt the balance between early gamers and latecomers. Most traditional games achieve equality among all gamers by either separating servers or introducing a seasonal approach, ensuring everyone competes from a level playing field. This provides latecomers with the motivation to enjoy the game, prevents their departure, and simultaneously extends the game's lifespan by attracting new gamers.

Nonetheless, if characters and in-game assets can be used limitlessly across all mods, narrowing the gap between early gamers and latecomers becomes challenging. Of course, the decision of whether to build a larger user base to enhance the game's sustainability or to maximize profits by favoring the core gamer segment, even if it deepens the imbalance, depends on each game company or mod creator's judgment. However, considering potential measures to prevent a scenario where only a few gamers continuously dominate, thus avoiding an imbalanced situation, is essential.

Another advantage of blockchain games is transparent profit sharing. In existing platforms that adopt revenue-sharing models, like YouTube or Roblox, it's often difficult to determine the criteria for profit distribution, and information on whether profits are actually settled according to these criteria is unclear. However, by using blockchain, profits are automatically distributed based on smart contracts, and all settlement records are transparently accessible. This increases gamers' trust in game companies, contributing to the vitality of the gaming ecosystem.

Let's tackle the second question. It's only natural that we shouldn't expect game companies to fully open up their game resources and development rights right from the start. Allowing extensive modding can lead to problems like altering the original purpose or violating intangible assets. Nevertheless, some game companies are exploring this path and conducting partial experiments, with Nexon as a notable example.

MOD N, a component of the MapleStory Universe ecosystem, serves as a blockchain game development platform that leverages Nexon's NFTs and those from external games. Nexon intends to evaluate contributions to the ecosystem based on the popularity of games created with MOD N and provide corresponding rewards. Nexon's MapleStory Universe stands as a testing ground to verify the impacts and potential of blockchain integration in this way.

* For more information on Nexon’s initiative, please refer to “[Debrief] The NFT/Blockchain Gaming Conference in Korea“ and “ADOPTION 2023 Part 3: Gaming.”

4. Closing Thoughts

This article set out to address fundamental questions about blockchain gaming and offer insights to help navigate the direction of the blockchain gaming market. The perspectives shared here are those of one individual and do not claim to offer definitive solutions. Nevertheless, we hope that it will prove valuable to those interested in understanding the direction of the blockchain gaming market.

Anticipation is mounting for games to play a central role in driving the widespread adoption of blockchain technology. This excitement is amplified, particularly with major global game companies announcing their foray into this field. However, it's crucial to acknowledge that the blockchain gaming market is still in its early stages. We advise taking a step back and approaching the growth potential of blockchain games with a more medium to long-term perspective.

Looking ahead, we have our sights set on WEMADE's "Night Crows Global" as a short-term point of interest. Given its proven success in the domestic market, we believe it has the potential for global recognition, akin to the achievement of "MIR4." We anticipate that the success of "Night Crows Global" will inspire more game companies to venture into the blockchain gaming market and enhance gamers' perception of blockchain games.

Additionally, we emphasize the importance of thoughtfully and carefully integrating blockchain into games. Relying solely on existing intellectual property (IP) without careful game design, a model adopted by many major game companies, can be a challenging path to success. Instead, games should offer a familiar gaming experience for current gamers while delivering a distinctive blockchain gaming experience. We firmly believe that blockchain's most significant potential lies in granting gamers the freedom to create and monetize secondary content.