*This article was co-authored by Xangle and Republic Crypto

Table of Contents

1. Introduction

2. The Golden Age of Rollups

2-1. Growth Drivers at the Infrastructure Level: A Look into EIP4844, ERC4337, RaaS

2-2. Notable Performance Among Rollups (feat. Optimism & Base)

3. Despite the Success of Rollups, Investment Perspectives in Rollup Governance Tokens May Differ

3-1. Bear Case Scenario: Limited Upside

3-2. Bull Case Scenario: Growth Stock Narrative

4. Conclusion

1. Introduction

Rollups are solidifying their standing amidst fierce competition within the blockchain infrastructure space. Taking into account the rapid advancements in rollup infrastructure, the growth trajectory of its ecosystem, and the emerging trend of modular stacks,very few would dispute the potential of rollups. I, too, am bullish about the future of rollups, projecting their market share to expand notably in the coming year. Yet, when we pivot to an investment perspective, the valuation of rollup tokens remains a gray area.

Venturing to assess the value of digital assets is inherently risky. The crypto market observed over the past few years defies valuation norms typically applied in traditional financial markets. There have been numerous instances of investors who, in discussing 'intrinsic value', have shorted meme coins like $DOGE, $SHIBA, and $PEPE, only to vanish without a trace. It sometimes raises the question of whether discussing token valuation even holds relevance.

Nevertheless, the motive behind this report is to offer readers diverse and objective viewpoints concerning rollup tokens. While a definitive valuation methodology and framework for digital assets remain elusive, many investors tend to equate network growth directly with the appreciation of its token's value, which isn't always the case.

The <Rollup Investment Guide> series is structured in two parts. The first delves into the future of rollups and their main growth catalysts. Using Optimism as an example, the report delves into rollup tokenomics and value capture mechanisms, painting a bull/bear case scenario for rollup governance tokens. The second report propose various tokenomics improvements that can enhance the value of l2 governance tokens.

2. The Golden Age of Rollups

2-1. Growth Drivers at the Infrastructure Level: A Look into EIP4844, ERC4337, RaaS

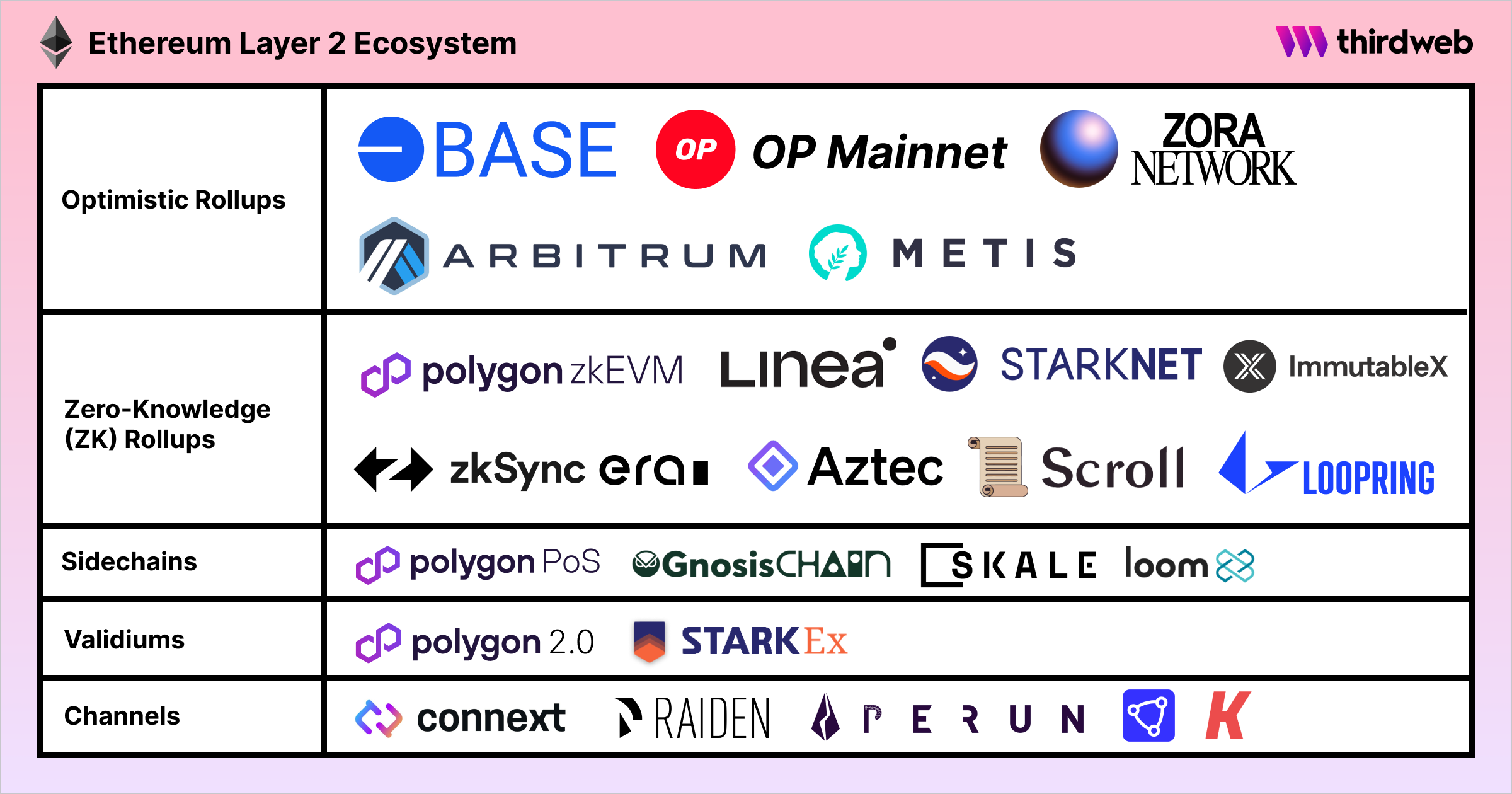

In recent years, the progress of rollups has been nothing short of spectacular. Since the inception of a tangible concept around rollups in 2018, R&D among great talents in the blockchain industry has led to the emergence of EVM equivalent rollups, fraud/validity-proof-based bridges, advancement in batch data compression techniques, rollup SDKs, and etc. Numerous rollup solutions, including notable ones like Optimism, zkSync, Arbitrum, and StarkNet, have emerged and are already making a mark in the blockchain market.

Source: ThirdWeb

The rollup ecosystem's growth is anticipated to accelerate from next year, largely revolving around three pivotal developments: EIP4844, ERC4337, and RaaS (Rollup-as-a-Service).

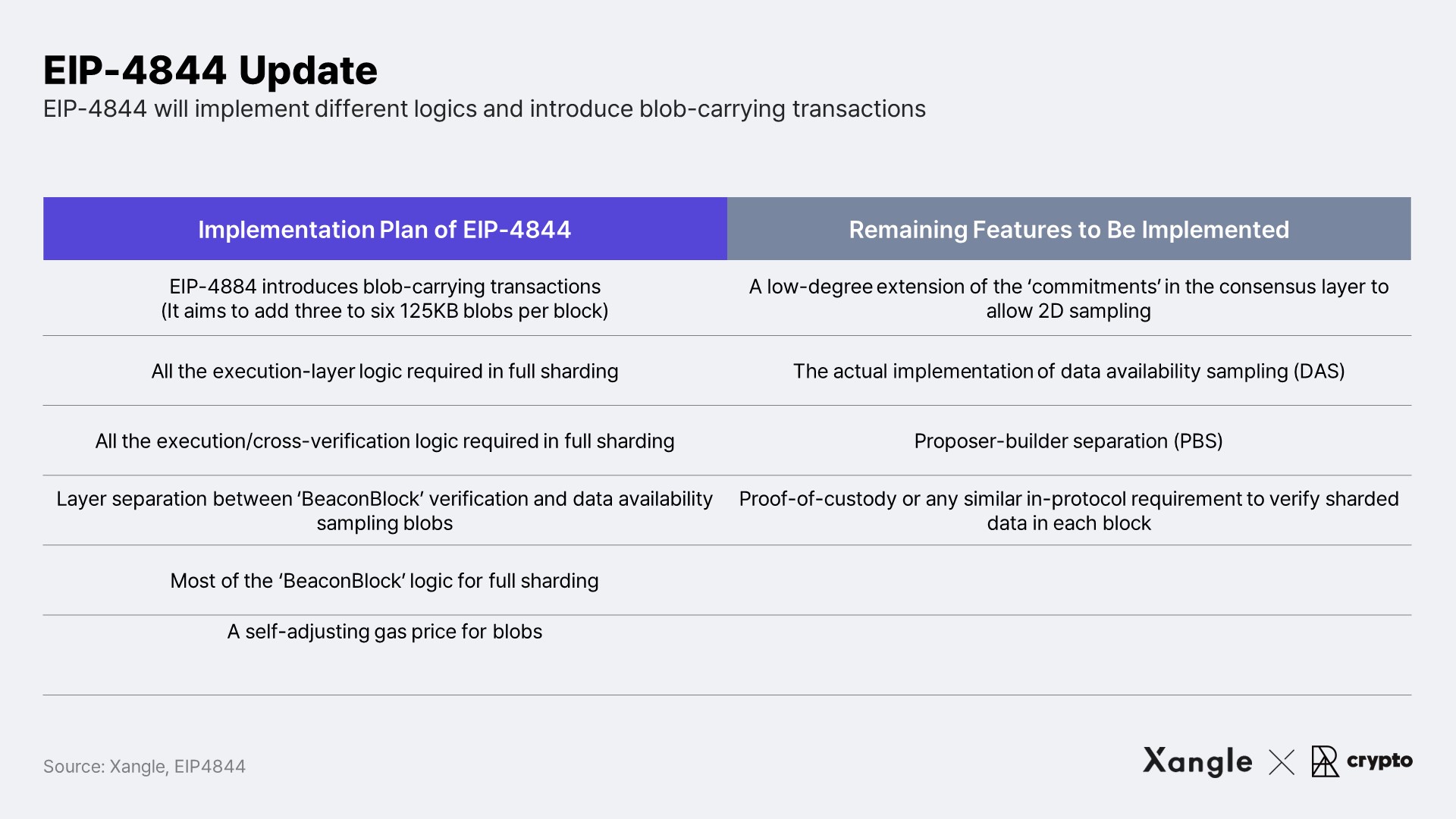

The first driver, EIP4844 (a.k.a proto-danksharding), is an upgrade proposal aimed to 1) pre-introduce the execution logic required for a smooth transition of the protocol architecture to Danksharding, and 2) introduce blob carrying transactions. The reason EIP4844 is perceived as a growth catalyst for rollups is due to the potential significant reduction in DA (L1 publication) costs when replacing the previously utilized calldata with a new data type called blobs. In specific terms, rollup’s DA costs are projected to be practically zero until blob demand reaches its target level (based on 250KB per block), which is estimated to take about 1-2 years. (Refer to the 'EIP4844 and Its Impact on Rollup Economics' report).

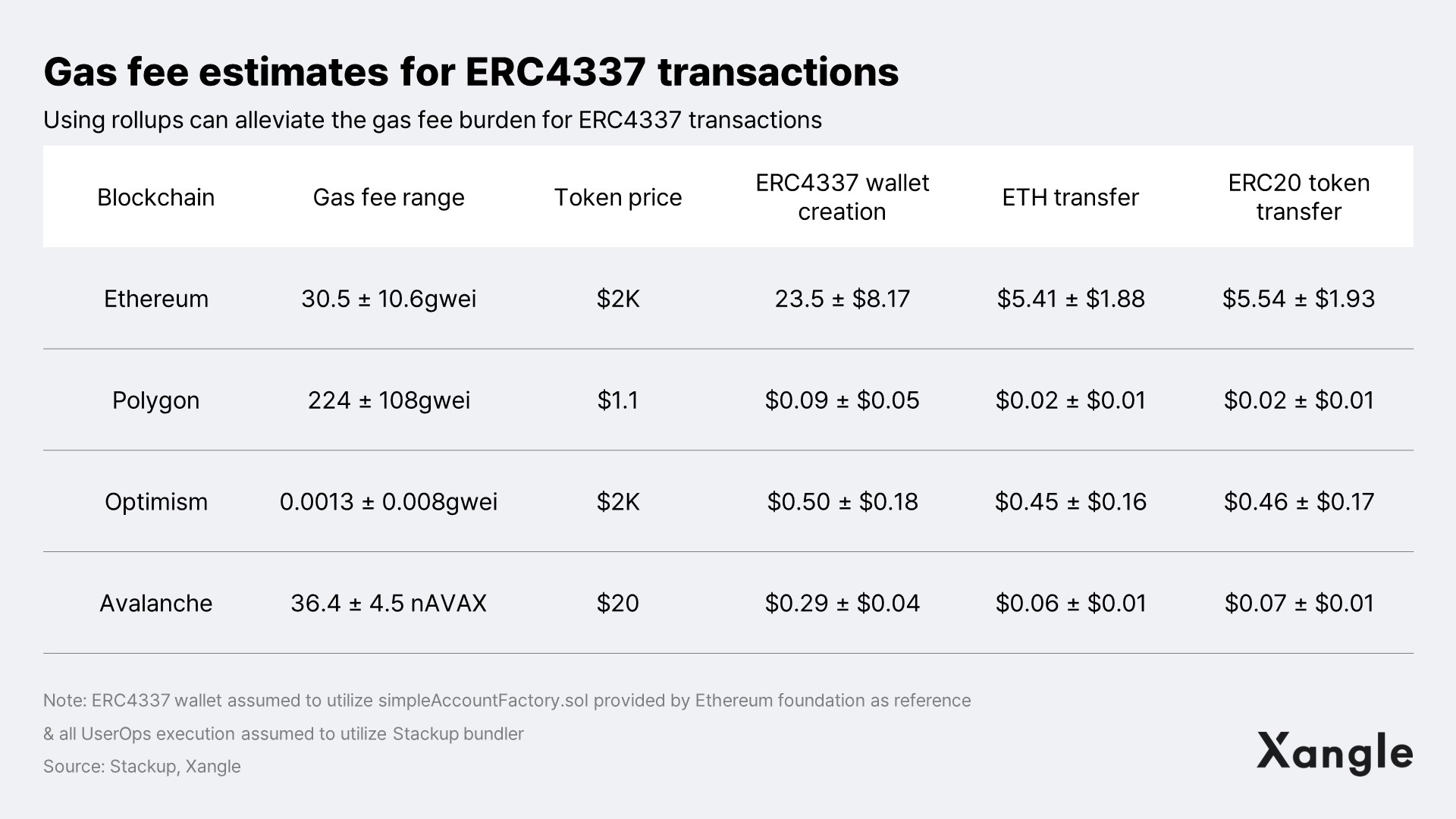

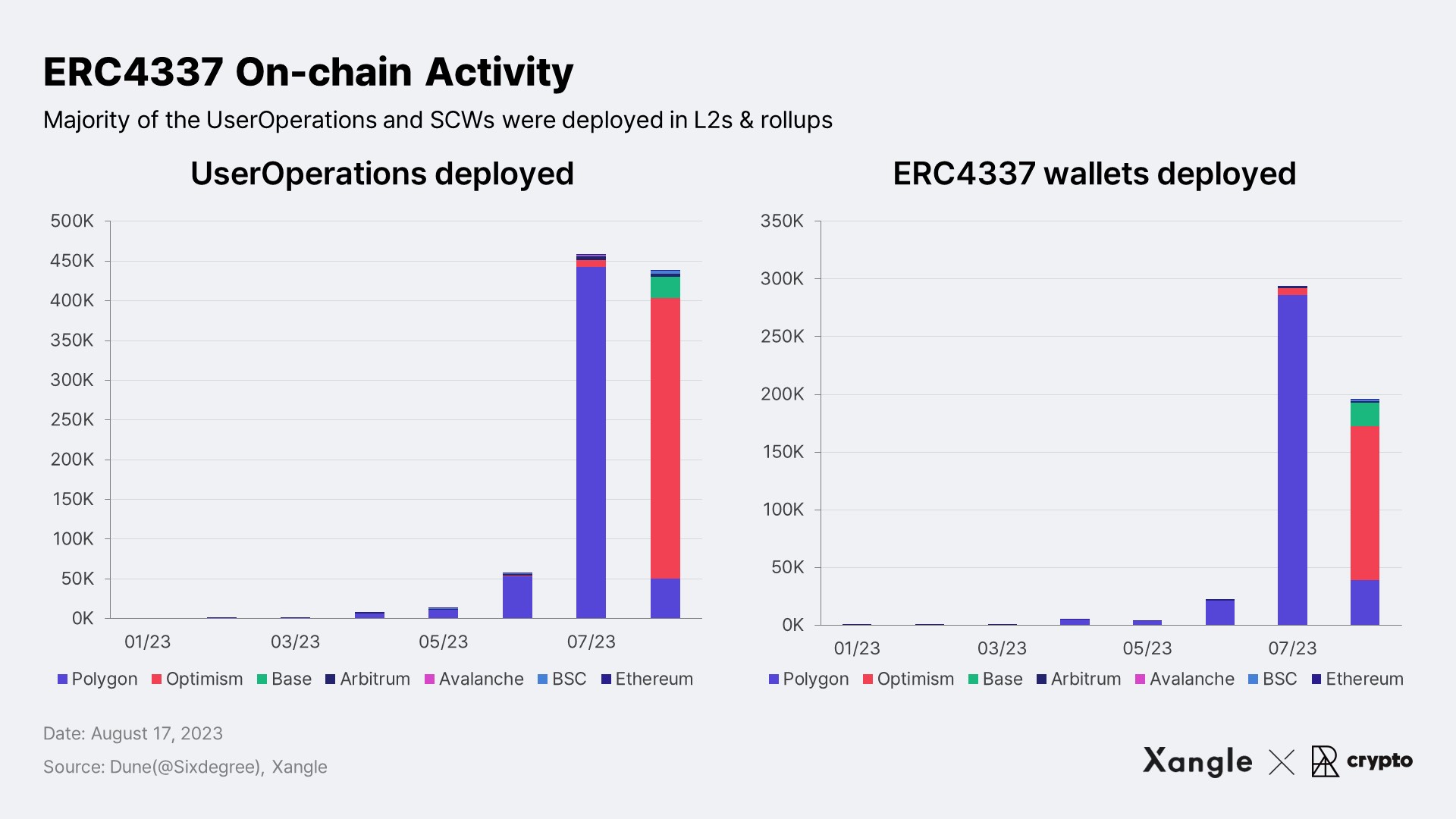

The second trigger is ERC4337, an improvement proposal allowing AA(Account Abstraction) without modifying the consensus layer protocol, or the need for a hard fork. Instead of altering the bottom-layer transaction type and adding new protocol features, ERC4337 introduces a higher-level pseudo-transaction object called UserOperation. Once implemented, ERC4337 is expected to significantly improve Ethereum’s UX and the associated overheads of self-custody (refer to the 'ERC4337, the Epicenter of UX Innovation' report). A notable downside of ERC4337 is its structural implication of higher transaction gas fees. However, this isn't much of a concern in a rollup environment where gas fees are substantially lower. Demonstrating this, the ERC4337-type transactions, UserOperations, currently exhibit the highest activity in rollups. From this perspective, it's anticipated that the blockchain UX will rapidly improve in the future, with rollups leading the way.

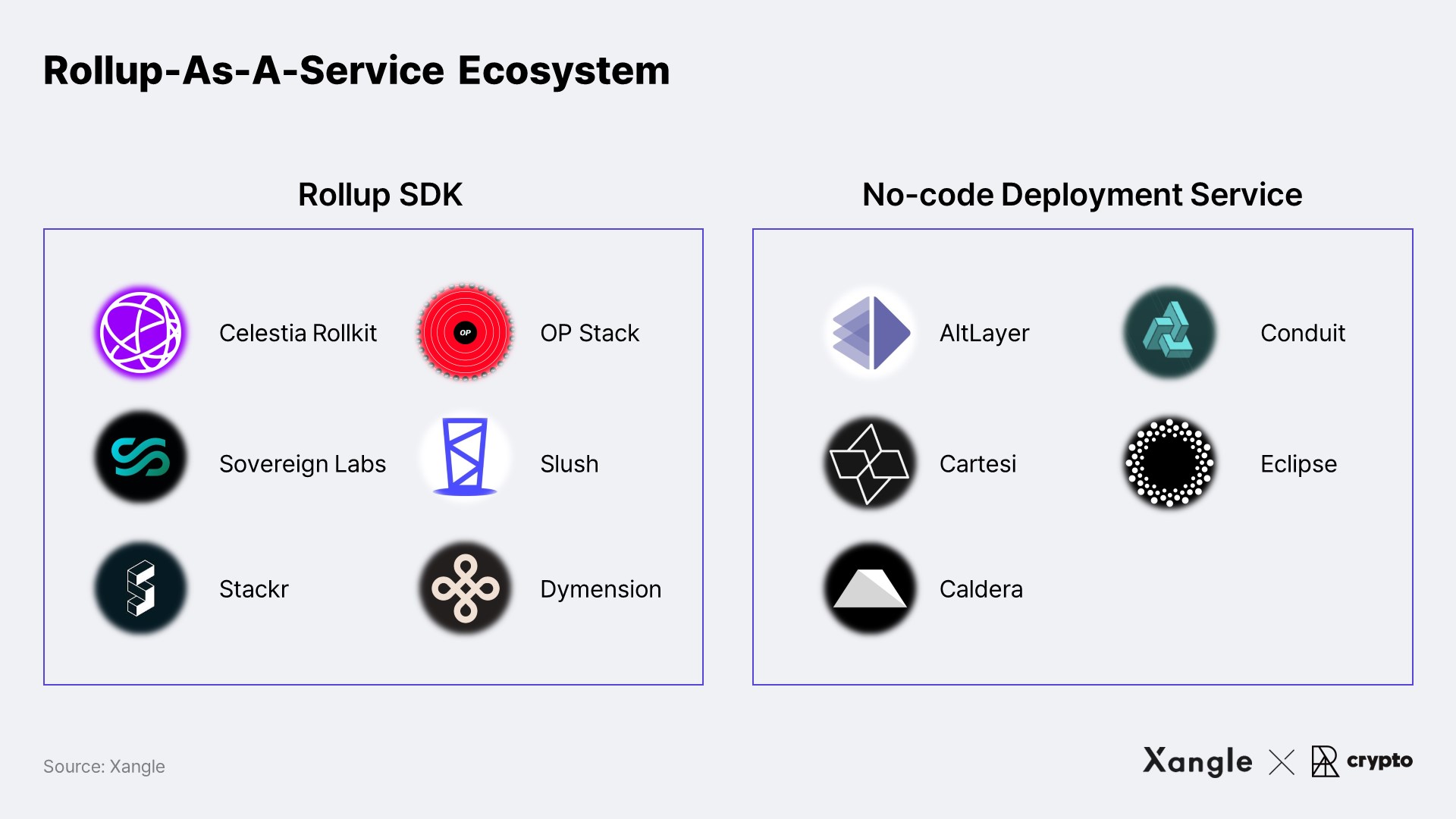

Lastly but not least is the rise of RaaS (Rollup-as-a-Service). RaaS provides a service that streamlines the deployment, maintenance, and management of custom rollups, eliminating the technical challenges developers face during mainnet development, and allowing them to concentrate solely on application layer development. By "custom", it means that developers can not only choose their desired protocols for the execution environment, settlement layer, and DA layer, but also have flexibility in aspects such as sequencer structure, network fees, tokenomics, and overall network design.

The RaaS (Rollup-as-a-Service) ecosystem consists of SDK and no-code rollup deployment services. SDKs, serving as development frameworks for rollup deployment, include notable options such as OP Stack, Arbitrum Orbit, Celestia Rollkit, and the Dymension RollApp Development Kit (RDK). On the other hand, no-code rollup deployment services enable the deployment of rollups without requiring coding expertise. Solutions like Eclipse, Cartesi, Constellation, Alt Layer, Saga, and Conduit belong to this category.

Although the current market landscape remains subdued with lower-than-expected demand for custom rollup creations, it is anticipated that as macro environments improve and product-market fit becomes clearer, hundreds to thousands of rollups will emerge utilizing RaaS. This evolution could possibly make the Ethereum L2 ecosystem resemble the Cosmos AppChain ecosystem. This is likely why the Ethereum community has recently started referring to such rollups as AppRollups.

2-2. Notable Performance of Rollups (feat. Optimism & Base)

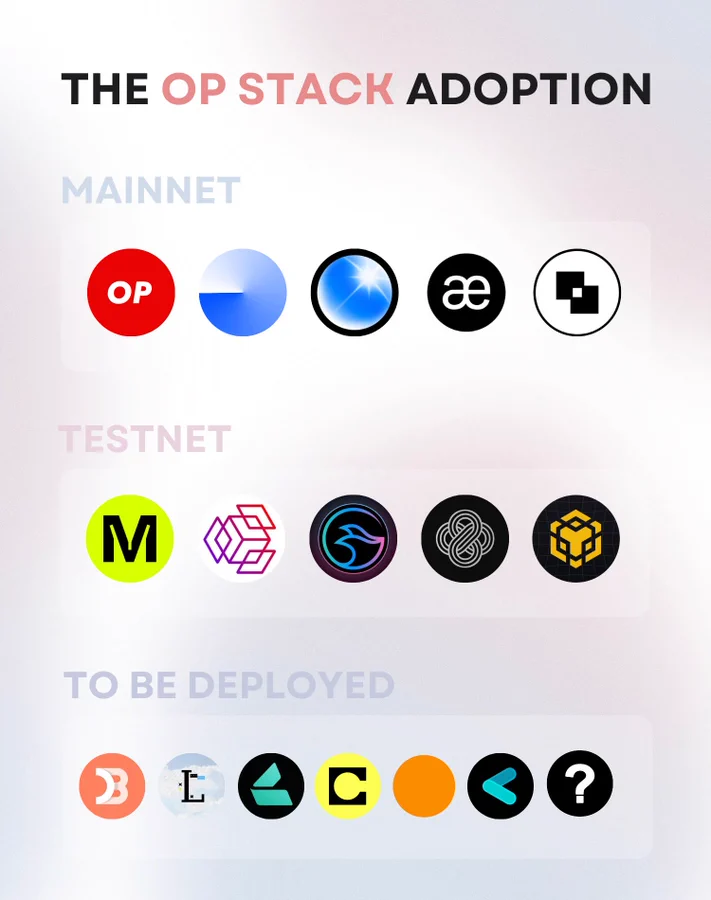

Optimism’s ecosystem growth rate stands out, independent of the advancement of Ethereum's L2 infrastructure. Since launching the OP Stack in 2022 October, Optimism has rapidly secured various OP Chain use cases. Most of these will likely join the Superchain* ecosystem, fueling Optimism's growth. As of August 17, there are over 15 OP Chains utilizing the OP Stack. Notable OP Chains include Optimism, Base, Zora, Aevo, and PGN, while prominent projects in the testnet/development stage include Farcaster, Celo, opBNB, Debank, Lattice, and Lyra Finance.

*Superchain - Superchain is an open-source rollup platform based on the OP Stack developed by OptimismPBC. Characteristics of OP Chains within Superchain include: 1) heightened interoperability and composability, 2) shared security through a common sequencer set, and 3) excellent connectivity due to a unified cross-chain messaging protocol. All OP Chains within the Superchain adhere to the Law of Chains governance principle.

Source: Twitter(@Stacy Muur)

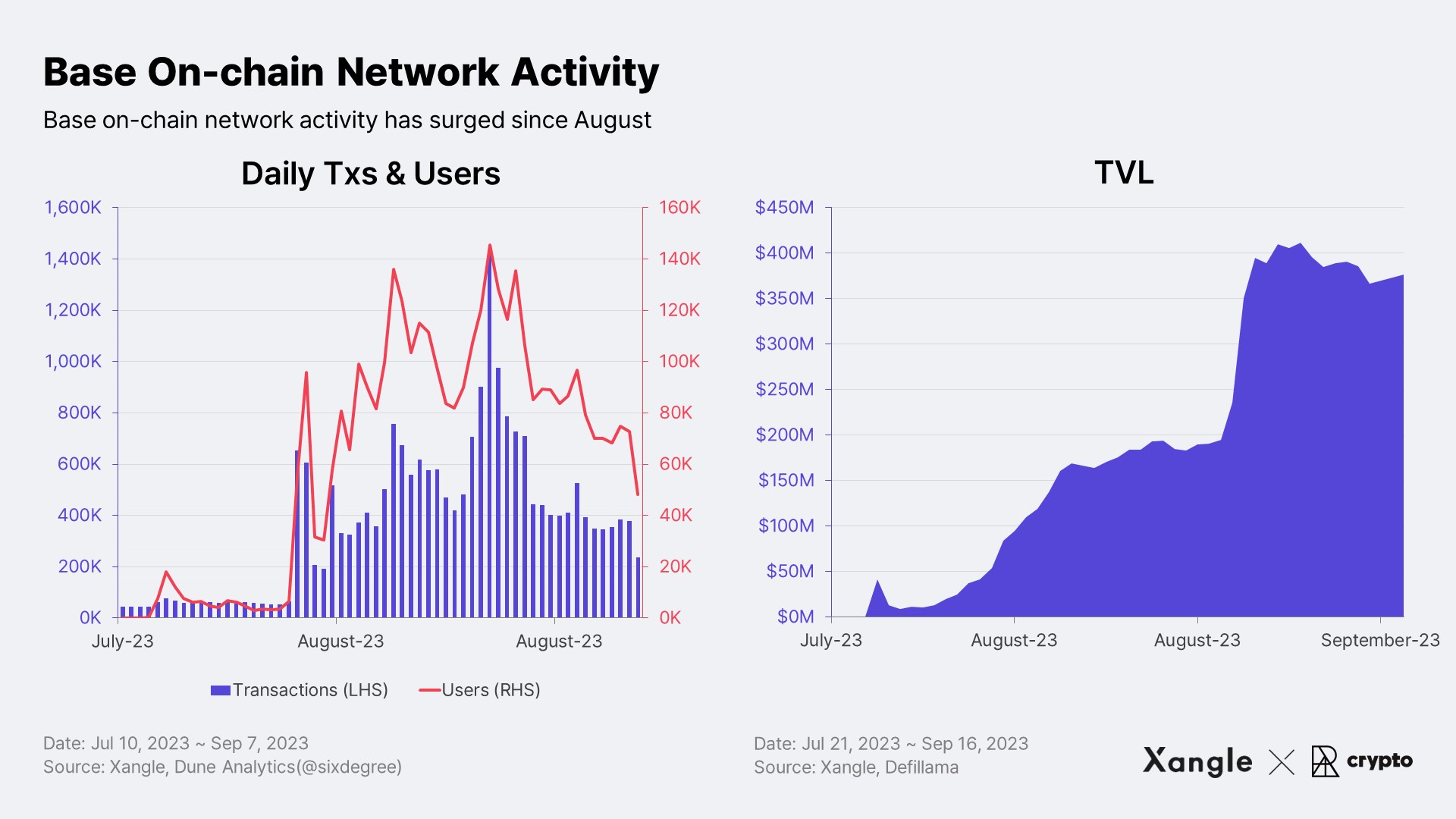

The performance displayed by Base is particularly noteworthy. Base, developed by Coinbase (the largest US cryptocurrency exchange recording 110M users, an asset volume of $80B, and annual trade volume of $830B in 2022), succeeded in onboarding over 150 projects despite its mainnet launch on August 9 of this year. Some of the most popular projects on Base include $BALD (turned out to be a rugpull project) and friend.tech, both of which had their moment of market limelight.

Source: OptimismDaily

Thanks to these initiatives, Base's network activity has been rapidly growing. In August, Base achieved 555K transactions and 96K users, and as of September 16, its Total Value Locked (TVL) exceeded $350M. According to the partnership announced on August 25, Base will distribute 2.5% of sequencer revenues or 15% of net profits to the Optimism treasury. Thus, the rise in Base's activity will directly contribute to the growth of the Optimism chain.

However, in exchange for sharing these economic rewards, Optimism will supply Base with approximately 118M $OP over six years through RPGF (Retroactive Public Goods Funding). It remains to be seen if this partnership will ultimately benefit the Optimism chain, especially considering the value of $OP at $1.5, amounting to $177M. As of August 31, Base achieved a total revenue of $3.3M through sequencer fees, of which 2.5% (around $83K) will be allocated to Optimism, constituting 0.04% of the promised $OP value. It's anticipated that the Optimism treasury funds, akin to sequencer revenues, will be utilized for initiatives like RPGF.

3. Despite the Success of Rollups, Investment Perspectives in Rollup Governance Tokens May Differ

In summary, Optimism seems poised to maintain its position as a major player in the blockchain market, thanks to advancements in rollup infrastructure (EIP4844, ERC4337, RaaS) and the expansion of Superchain via OP Stack. It is anticipated that Ethereum base layer users and developers will mostly migrate to promising rollup solutions like Optimism, and that numerous OP chains will emerge. However, the value of $OP from an investment perspective remains ambiguous, irrespective of the success of the Optimism ecosystem. As the ecosystem evolves, I expect that $OP could likely follow one of the following two narratives:

3-1. Bear Case Scenario: Limited Upside

In traditional financial markets, shareholders are legally entitled to specific rights such as dividends (claim on profits), voting rights, residual asset claims, preemptive rights to new shares, access to financial statements, various litigation rights, and etc. Depending on the class of shares, such as common or preferred stock, the priority or subordination of these rights can differ. However, the inherent value in stocks arises from the guarantee of these rights across all share classes.

In contrast, $OP does not guarantee any rights beyond protocol governance (voting). Sequencer revenue generated via transaction fees are not distributed to token holders, which means that the growth of the network does not directly translate to a rise in token value. This is the very reason many institutional investors cast doubts over the value proposition of rollup tokens (Rollup tokens like $POL and $STRK, serving respectively as the native currencies for Polygon and StarkNet, and utilized for network fee payments, fall outside this category. Notably, there are clear trade-offs associated with such structures, which will be elaborated upon in part 2).

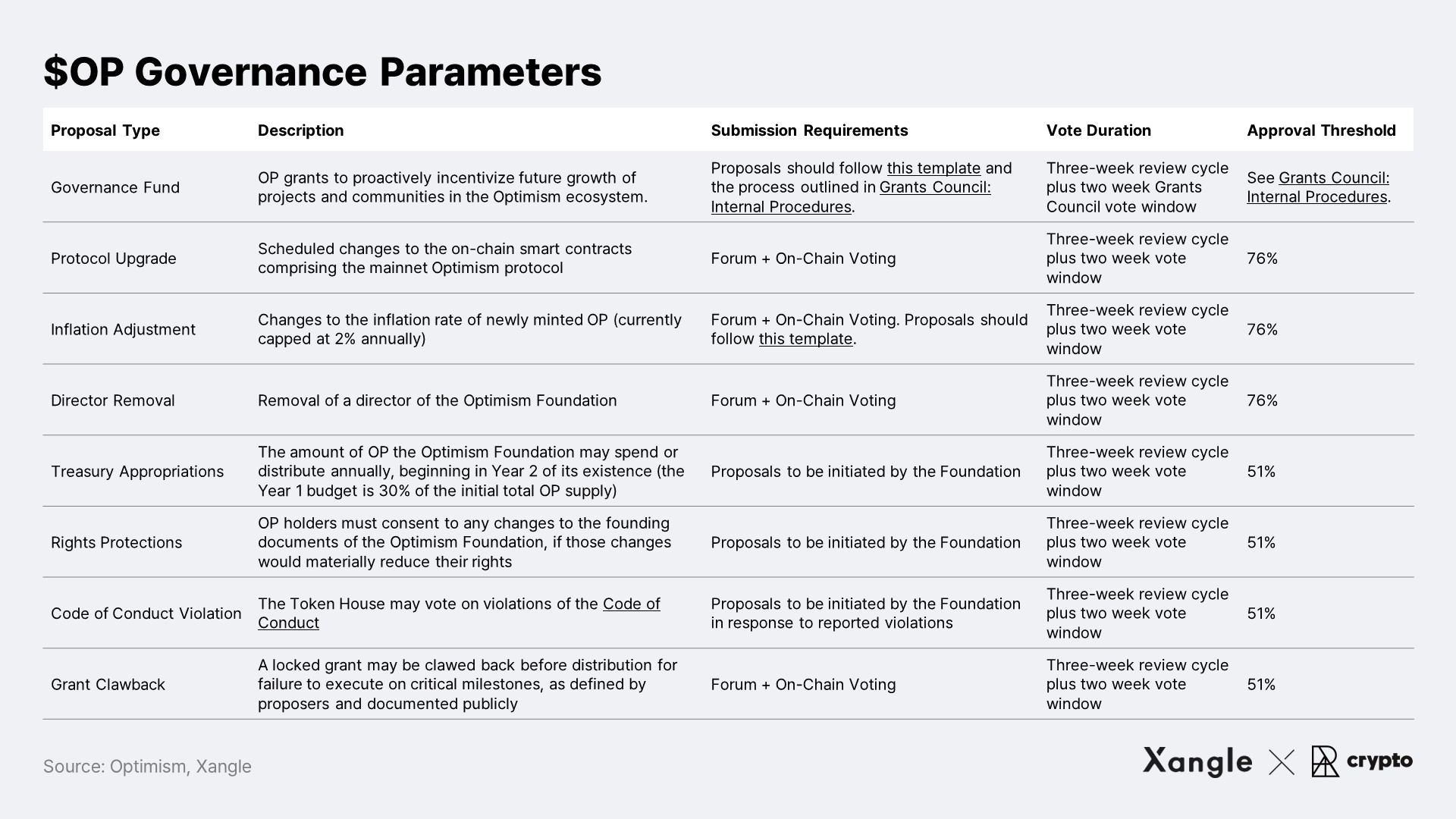

Certainly, governance rights alone can establish a certain level of value. Governance parameters vary per project, but in the case of Optimism, it grants token holders voting rights proportional to their holdings on virtually all matters related to the protocol. This includes contract upgrades, treasury management, governance fund operations, director removal, and adjustments to $OP inflation (refer to the figure below). These issues are akin to the strategic direction decisions a corporation's board would vote on. Thus, holding the token grants influence and control over such decisions, imbuing $OP with a significant intangible value. Especially for major stakeholders of Optimism, there may even be a willingness to pay a premium for voting rights on the protocol. However, for most investors, whether a governance token that does not pay dividends represents an attractive investment remains questionable. It's also worth pondering whether its utility justifies a market capitalization of $1B.

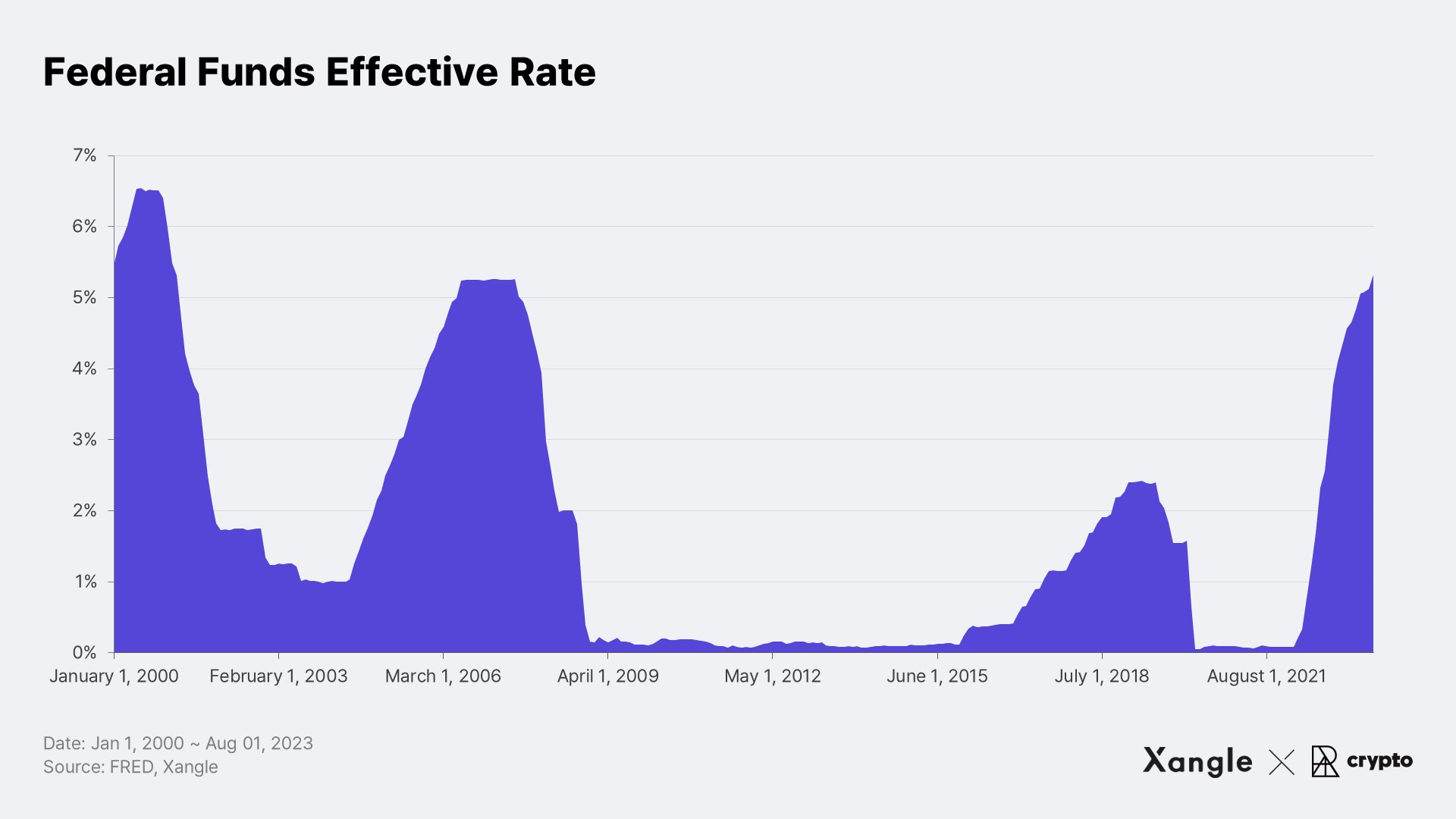

Furthermore, as explained by Nathan, assets like $OP, which don't offer a real yield, are less attractive in today's high-interest rate environment. As interest rates climb, the cost of capital increases, and the opportunity cost of investment choices amplifies. Now more than ever, investors need to be discerning in their selection. From this perspective, tokens that don't generate cash flows could be overlooked, especially by large institutions. Thus, regardless of the growth of Optimism's ecosystem, conservative investors may not find $OP alluring. I anticipate risk-averse investors, keen on betting on the success of rollups, might lean more towards $ETH since it provides a stable staking return while fully capitalizing on the benefits accompanying the growth of rollups.

3-2. Bull Case Scenario: Growth Stock Narrative

In financial markets, the value of a company is not solely determined by its net profit or dividends. Especially when investing in growth stocks, the company's reinvestment and expansion strategies and long-term growth potential hold much greater significance. In this context, one might perceive investing in rollup governance tokens like $OP with a logic similar to that of investing in traditional growth stocks.

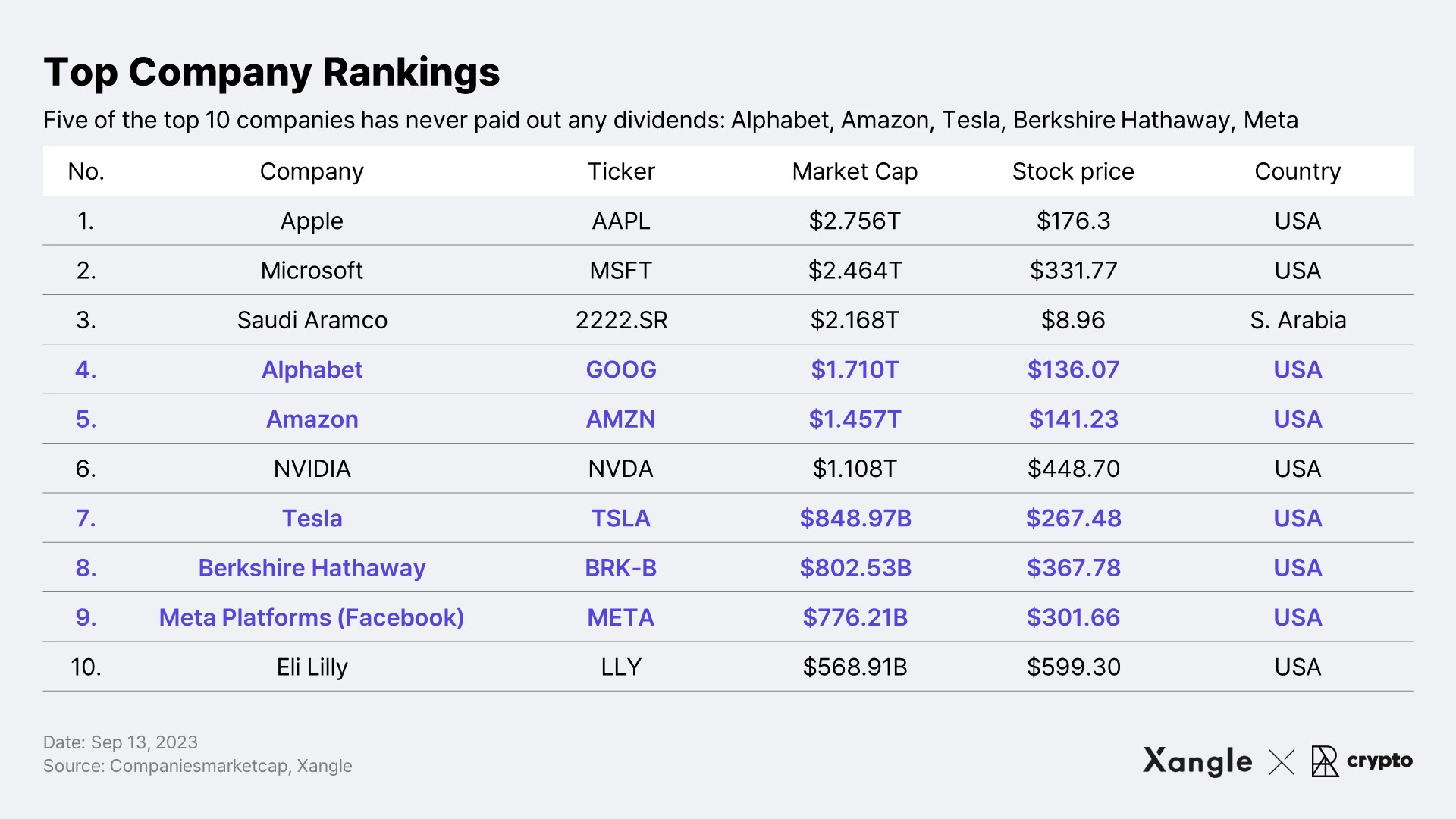

Even in traditional financial markets, many companies opt not to distribute dividends to shareholders in pursuit of growth. This list includes some of the world's highest market cap companies like Alphabet (Google), Amazon, Tesla, Berkshire Hathaway, Meta (formerly Facebook), and Netflix. These corporations have consistently chosen to reinvest their profits into the growth of the company rather than pay dividends.

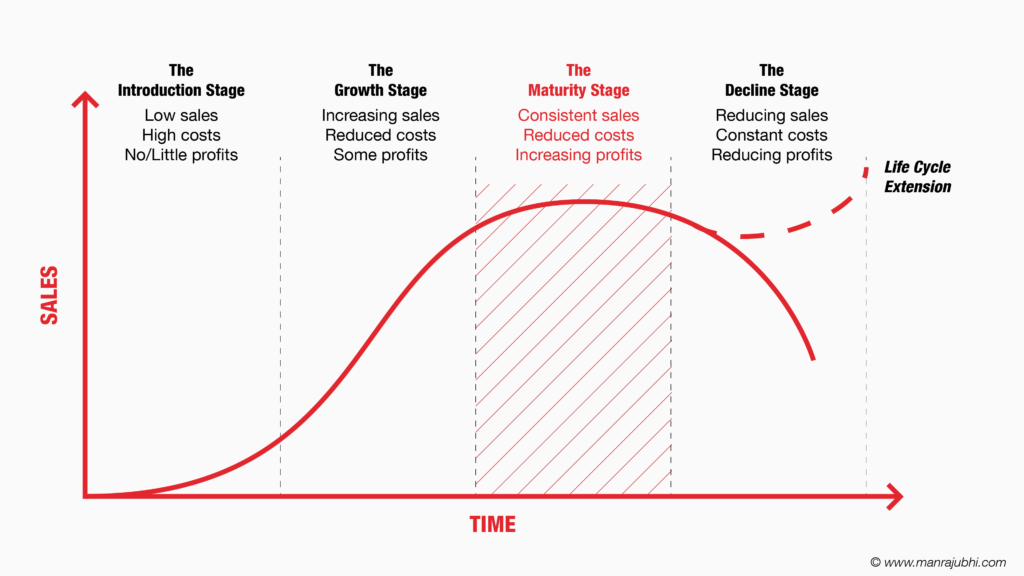

The ways in which a company can utilize its profits are 1) Paying dividends, 2) Stock buybacks, 3) Debt payoffs, and 4) Reinvestment. The choice among these mainly depends on the company's growth cycle along with a myriad of strategic factors such as the company’s current cash flow, stock valuation, and leadership principles. Usually, companies in the mature phase, with high revenues but slowing growth, often undertake dividend distribution, stock buybacks, or debt reduction to enhance shareholder value. In contrast, companies in the growth phase predominantly engage in profit reinvestment strategies.

Source: Manrajubhi

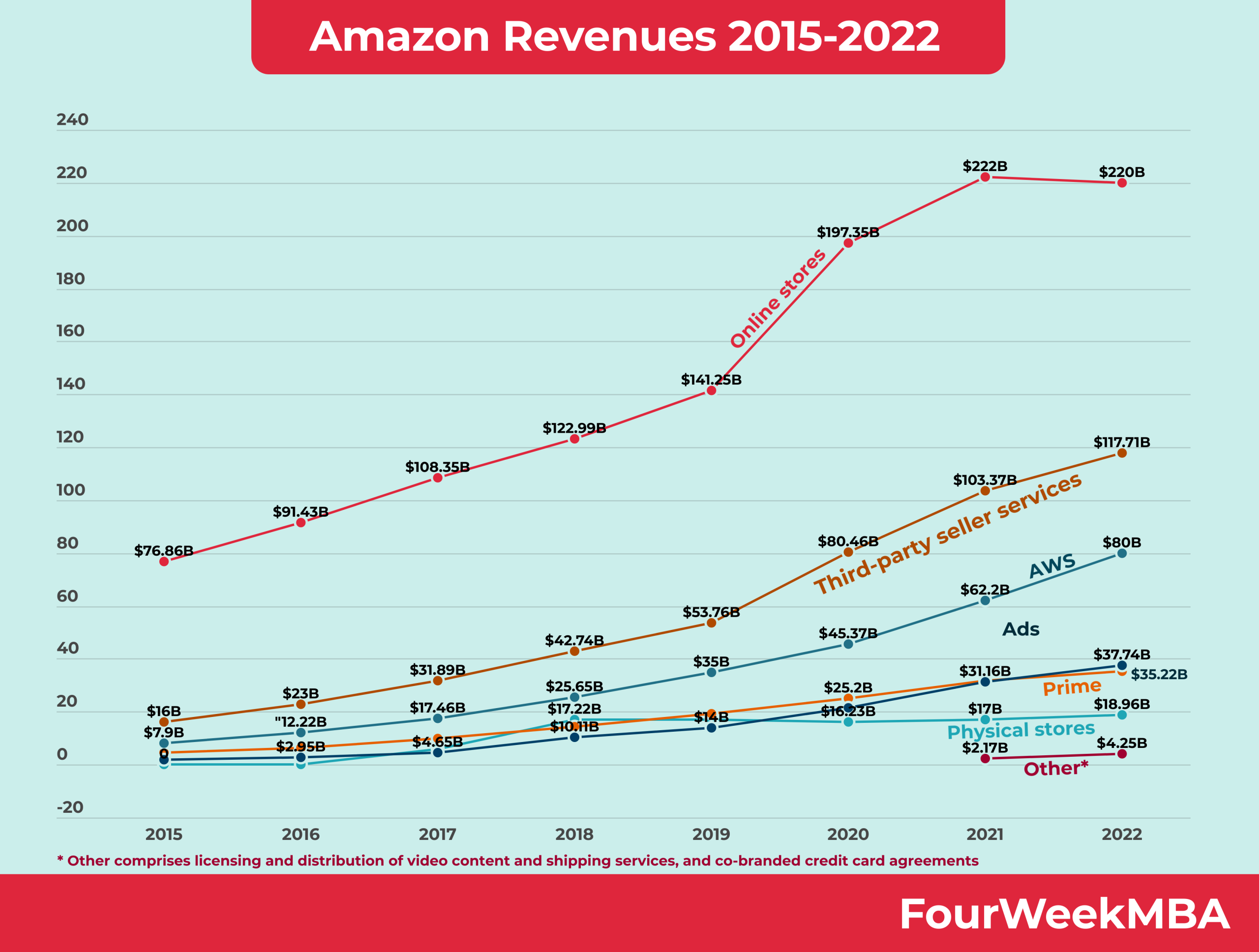

For instance, Amazon, which started as an online bookstore, chose not to distribute dividends but instead invested those funds into cloud services, media & entertainment, e-commerce, healthcare, fulfillment, and more, successfully expanding its business domains. This strategic decision enabled Amazon to become the second company in history to achieve a market cap of 1 trillion dollars. Notably, investors showed no discontent regarding the absence of dividend payments.

Source: FourWeekMBA

Source: SMB Compass

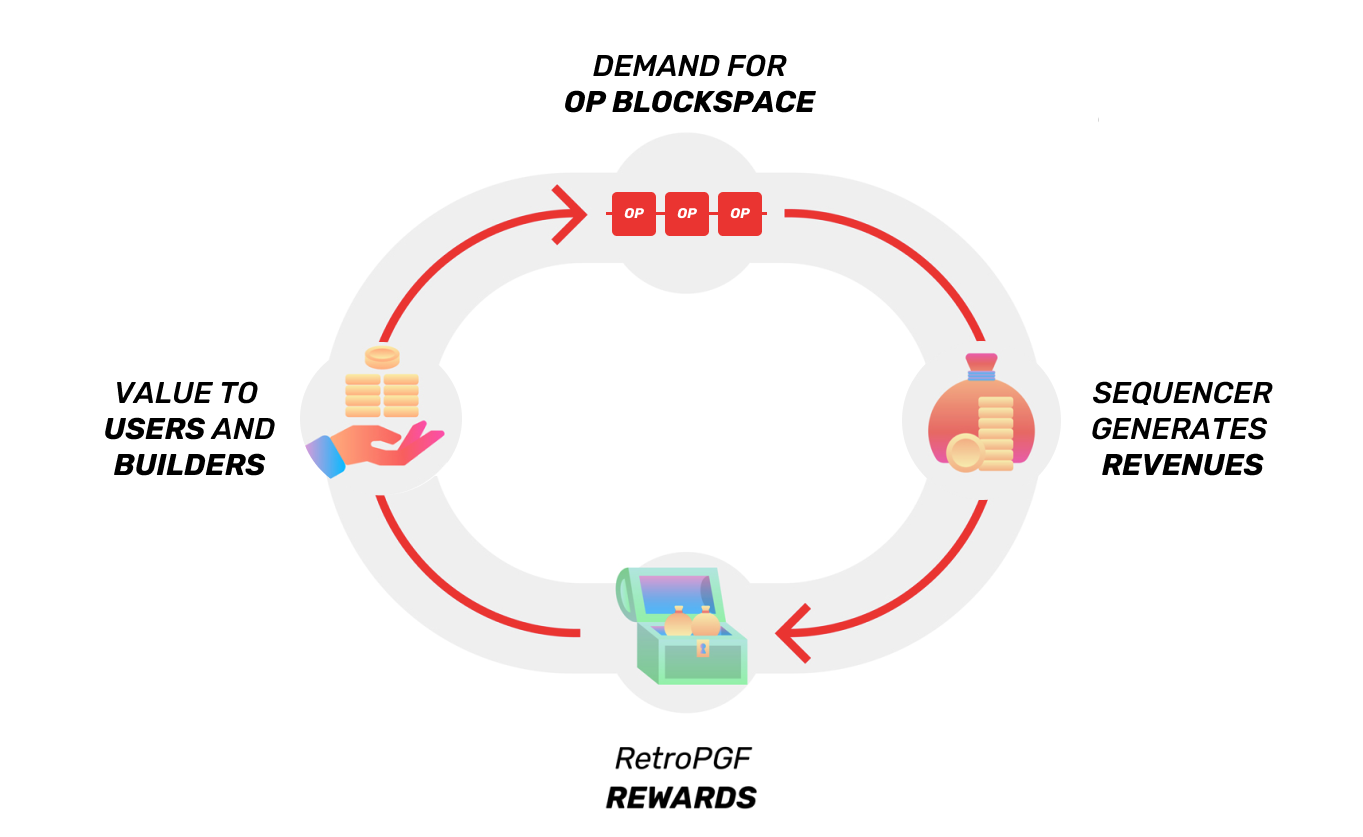

From this perspective, investing in governance tokens like $OP can be approached with a rationale akin to investing in non-dividend growth stocks. Optimism, prioritizing user satisfaction, has committed to reinvesting all revenues from sequencers and treasury funds* towards ecosystem growth (RPGF, attracting new OP chains, granting, etc.). Through this, Optimism aims to create a flywheel structure of <Increased blockspace demand → Increased sequencer revenue → Increased RPGF → Increased value to users and builders>. Additionally, as more OP chains like Base join the Superchain, the revenues and network effects garnered by Optimism are expected to surge exponentially. While cryptocurrencies and stocks differ in structure, principles, and market dynamics, the fundamental investment logic and principles can be commonly applied.

4. Conclusion

In a mid to long term perspective, it is anticipated that the rise of EIP4844, ERC4337, and RaaS (comprising of SDK and no-code rollup deployment services) will spearhead the proliferation of rollups, potentially leading to the birth of thousands or even tens of thousands of AppRollups. In such a scenario, Ethereum’s L2 ecosystem might evolve in a direction reminiscent of the AppChain vision originally conceived by Cosmos. Nonetheless, the way investors perceive governance tokens like $OP might differ. Rollup governance tokens might either face limited upside due to the absence of value capture mechanisms and a high-interest rate environment, or be viewed similar to non-dividend growth stocks like Google, Amazon, and Tesla, subsequently justifying higher valuations. The forthcoming article will explore strategies and improvement measures to optimize the value of rollup tokens.