Translated by Lani Oh

Table of Contents

Introduction

1. Where Stablecoins Headed After Terra-Luna Crash

2. Fiat-collateralized Stablecoins

2-1. USDT: Growing stability of USDT absorbs the BUSD demand

2-2. USDC: Circle poised to expand infrastructure with CCTP while rising from the fallout of SVB bankruptcy

2-3. BUSD: Issuance suspended by NY financial authorities, unlikely turnaround

2-4. TUSD: Emerging as Binance's new stablecoin

3. Crypto-backed stablecoins

3-1. DAI: A decentralization plan “Endgame” to be free from regulatory headwinds

3-2. FRAX: An algorithmic stablecoin that maintains its presence

3-3. GHO: Aave poised to expand the utility of its native coin AAVE and generate additional revenue streams

3-4. CRV: Recouping liquidity and trading volume after Terra-Luna crash

4. Will CBDCs replace stablecoins?

4-1. Most regulatory frameworks may acknowledge only fiat-backed stablecoins

4-2. Will CBDCs replace stablecoins?

Closing Thoughts

Introduction

Over a year on since the Terra-Luna fiasco ravaged the crypto space in 2022, the stablecoin market is still reeling from the fallout. Given a boost by the rise of DeFi, stablecoin issuance poured into the market in its glory days since June 2020. The memory may seem distant now with an over 30% drop from a market cap peak of $189B to $128B as of June 27, 2023. The plunge was accelerated by a series of developments, such as U.S. regulatory crackdown on cryptocurrencies, instability in the banks that used to underpin the crypto ecosystem, and the aftermath of the November 2022 FTX bankruptcy.

Despite all these, stablecoins are still commanding attention primarily because of the stability of their prices unlike Bitcoin and Ethereum, which allows them to be used in real life, including payments. Indeed, the demand for stablecoins as portfolio assets has rather trended upwards after the bearish spell continued to persist in the crypto market since the end of 2022.

So what are the changes stablecoins have gone through in the aftermath of the Terra-Luna crash? In this article, we'll take a look at how stablecoin projects are adopting different survival strategies after the downfall of UST.

1. Where Stablecoins Headed After Terra-Luna Crash

Stablecoins can be classified into three types: fiat-collateralized, cryptocurrency- collateralized, and algorithmic, with different price stabilization mechanisms. (For more information, see Xangle Research A Complete Summary of Stablecoins: Who Will Claim the Throne?) However, they do share some similarities in that 1) the value of the coin is pegged to one of the most widely accepted real-world assets, the dollar, 2) the supply of coins put into circulation can be controlled, and 3) they employ specific mechanisms to peg the price to the U.S. dollar.

Since the Terra meltdown, existing stablecoin projects have been trying to improve the quality of their collateral assets to enhance price stability and broaden usage. One thing is that, after the UST crash, there has been a general distrust of algorithmic stablecoins. They were once among the three pillars of stablecoin, representing more than 10% of the market share, but are now becoming less and less viable.

Another notable development in the aftermath was the arrival of new stablecoins such as 1) Aave’s $GHO and 2) Curve’s $crvUSD. Typically, they hit the market with new stablecoin models that emphasize enhanced utility and stability compared to existing models—decentralizing token issuing and burning entities, introducing new mechanisms like soft liquidation, and adding highly practical utility functions to the stablecoins.

2. Fiat-collateralized Stablecoins

2-1. USDT: Growing stability of USDT absorbs the BUSD demand

Having emerged in 2015, Tether (USDT) is the first real-world asset-backed off-chain stablecoin that currently has the largest market cap among stablecoins. After Terra's algorithmic stablecoin UST crumbled, USDT also suffered a decline in TVL as risks associated with its collateral and lack of transparency in information caused it to de-peg from the dollar. Later, it managed to roar back as it improved the quality of collateral asset while competing stablecoins USDC and BUSD were battered by regulations and SVB’s bankruptcy. USDT absorbed all the stray liquidity and made a significant increase in market cap. This year alone, the market cap has risen 25.8%, reaching $83.3B on June 30, and continues to set new all-time highs every day. (See the chart above for stablecoin market cap) As USDT's market cap approaches the highest peak ever reached, investors are flocking to the highly liquid asset class. Tether, the USDT issuer, is now earning over 5% on their U.S. Treasury investments, generating $1.5 billion worth of net income in Q1 2023 alone. It has grown to rake in more than major U.S. financial firms, with USDT revenues expected to hit $6 billion this year—even larger than the $5.5 billion expected from global asset manager BlackRock.

USDT is shifting its collateral to safer assets to ensure price stability. Tether has completely replaced relatively riskier corporate debt instruments with U.S. Treasuries. It also announced its intention to buy and hold $200 million of Bitcoin to stabilize USDT, when it is already known to hold $1.5 billion worth of Bitcoin as of March 2023. In addition to Bitcoin, Tether also holds gold, which is estimated to be worth $3.4 billion as of March 2023.

2-2. USDC: Circle poised to expand infrastructure with CCTP while rising from the fallout of SVB bankruptcy

USDC is essentially a collateralized stablecoin like USDT, but, unlike USDT, it is regulated by the U.S. financial authorities. It backed by relatively safe assets such as U.S. dollar cash and short-term U.S. Treasuries. Recently, USDC’s market cap plunged 34% due to the fact that 8% of its reserves were deposited with the bankrupt Silicon Valley Bank (SVB).

Currently, USDC is trying to leverage the launch of the Cross-Chain Transfer Protocol (CCTP) to increase its usage, which supports transfers between multiple chains. Most bridges use the lock-and-mint mechanism to move assets, which is structurally more susceptible to loss of funds and 51% attacks. What renders a fiat-backed stablecoin worth $1 is that it can be exchanged for $1 of the underlying asset at any time. Yet, a wrapped stablecoin is virtually worthless if the native assets locked are hacked. Moreover, different bridges offer different synthetic assets, meaning that the same stablecoin can have dozens of different wrapped assets depending on the bridge used. This fragments liquidity in the DeFi ecosystem and hinders the user experience.

Circle's CCTP offers a solution to the common issue found in conventional lock-and-mint bridges. Instead of locking up the tokens sent to the contract, CCTP burns the tokens and issues new ones. This allows users to send USDC to multiple chains and deposit the newly minted USDC into decentralized finance protocols to earn profits. It also enhances user experience and helps consolidate liquidity across chains by allowing native USDCs issued on multiple chains to be safely and easily transferred to other chains.

Following the launch of the first CCTP between Ethereum and Avalanche on April 27, the crosschain transfer protocol will be deployed to Arbitrum on June 27, 2023. Since the launch of the CCTP, USDC’s market share on Avalanche has edged upwards. Potentially, the share of USDC is likely to grow over time as the number of supported chains increases. Given USDC's high usage in DeFi services, e.g., decentralized exchanges (DEXs), lending protocols, and staking, the introduction of CCTP is expected to facilitate a wider adoption of USDC.

USDC is also working to expand its use by increasing support for native tokens of each blockchain. It recently announced that it will support the Cosmos chain, as 1) there has been no native Cosmos stablecoin since the May 2022 Terra-Luna collapse, and 2) dYdX, the top perpetual futures DEX by volume, plans to migrate from Ethereum to Cosmos later this year.

Currently, the most popular stablecoin replacing Terra’s UST in the Cosmos ecosystem is wrapped USDC, a synthetic version of USDC issued on the Ethereum blockchain. USDC accounts for 84.18% of the TVL on Osmosis, the largest DEX in Cosmos. Additionally, dYdX is already one of the largest users of USDC, with perpetual swaps and future contracts all held in USDC until they are executed. All these point to an upside potential for USDC's market cap that may begin to manifest once its support for the Cosmos ecosystem begins.

Source: DeFiLlama

Circle plans to launch a Cosmos-based USDC through crypto startup Noble. Noble is an appchain built for native asset issuance, with industry-standard features that allow both multiple entities to mint and burn tokens and asset issuers to freeze and blacklist addresses on the Noble chain. As the first phase of the mainnet launch, Noble will launch a Proof-of-Authority chain with the Cosmos Hub’s validators. With Noble's native USDC issuance, over 50 appchains on Cosmos will be able to use USDC through the IBC. Noble will support the issuance of standard, fungible versions of USDC for all blockchains as it anticipates the future growth of the Cosmos ecosystem. In addition, it plans to support turnkey institutional-grade asset issuance and provide a reliable issuance and distribution channel for both users and appchains connected to the IBC. Going forward, Noble will support all digital assets entering the IBC ecosystem, including stablecoins, and is expected to play a major role within the Cosmos ecosystem.

2-3. BUSD: Issuance suspended by NY financial authorities, unlikely turnaround

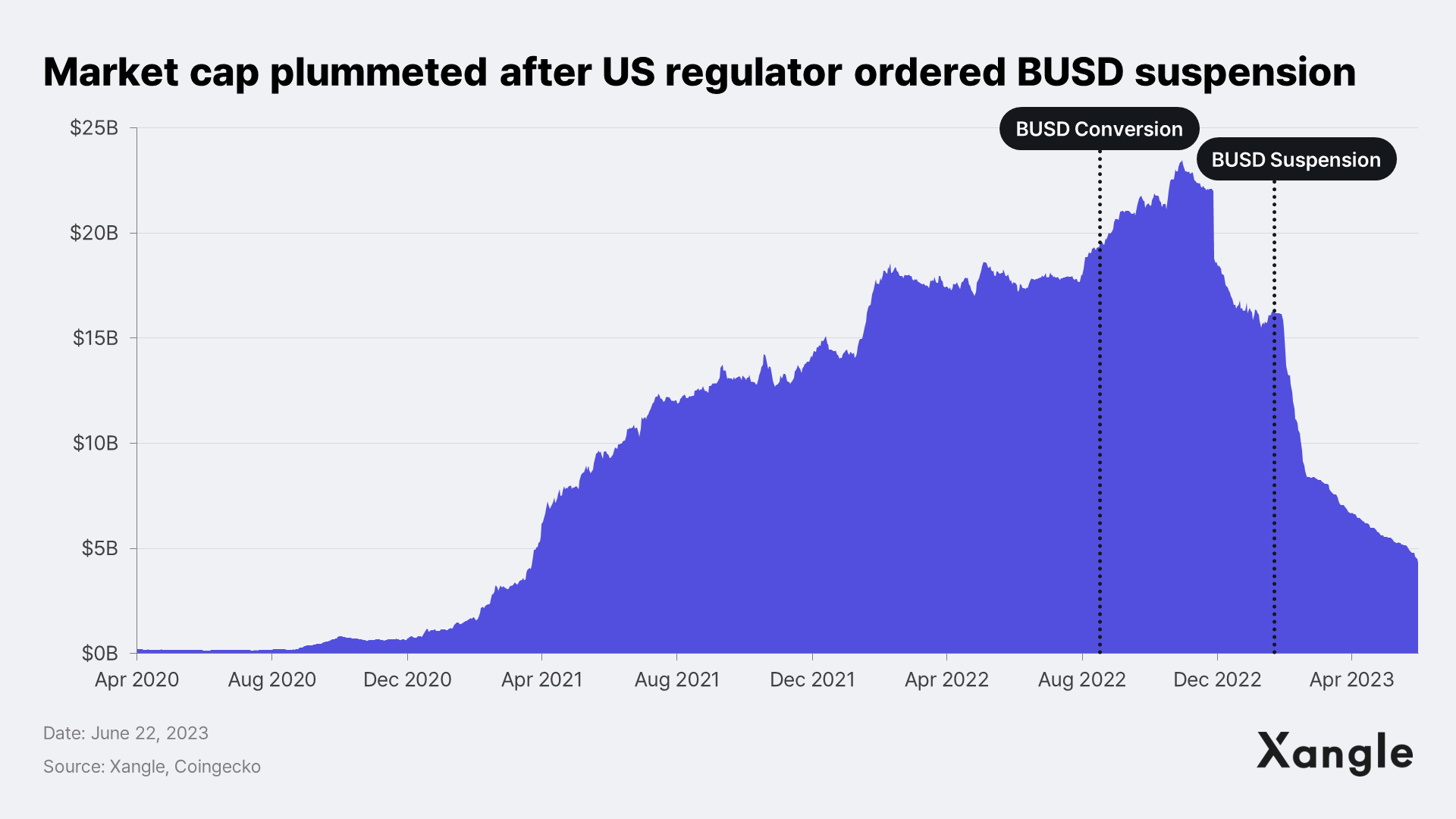

BUSD is a stablecoin developed by the world's largest exchange Binance and stablecoin issuer Paxos. It has garnered attention as a stablecoin known for its relative stability, backed by reserves consisting of U.S. Treasuries and cash. In September 2022, Binance announced that it would automatically convert all USDC, USDP, and TUSD balances to BUSD, which led to a significant spike in market cap. However, in February there year, the New York State Department of Financial Services (NYDFS) ordered Paxos to cease minting BUSD due to "several unresolved issues related to Paxos' oversight of its relationship with Binance." This triggered a precipitous fall in BUSD’s market cap from $23 billion to $4 billion between November 2022 and June this year.

As of February 21, 2023, Paxos ceased issuance of new BUSD tokens, but stated in its official announcement that BUSD would still remain supported and redeemable until at least February 2024.

2-4. TUSD: Emerging as Binance's new stablecoin

TUSD is a stablecoin developed by the TrustToken platform. After the complete suspension of BUSD issuance, Binance looked for an alternative stablecoin to meet the demand for stablecoins on the exchange. It chose TrustToken, its partner since June 2019. Binance announced that the zero-fee promotion for trades between major stablecoins and BUSD would now be applied to TUSD instead, effectively replacing the exchange's base currency with TUSD. As a result, TUSD's market cap soared, emerging as the fifth largest stablecoin after BUSD. Indeed, Binance issued about 118 million TUSD between February 16-24, and the number of TUSD and trading volumes are continuing to rise.

3. Crypto-backed stablecoins

3-1. DAI: A decentralization plan “Endgame” to be free from regulatory headwinds

MakerDAO primarily issues Ethereum-based stablecoins in a decentralized manner using cryptocurrencies as collateral. The price of DAI has been relatively stable compared to algorithmic stablecoins as DAI’s peg to the dollar has been tested and proven over a long period since its launch in December 2017. Still, DAI has not been immune to the issues that plagued the crypto market, and some argue that it will not be able to stay free from regulatory scrutiny, especially considering that USDC and GUSD constitute 60% of its collateral composition.

In response, MakerDAO announced a major overhaul called “Endgame” in November 2022, which aims to achieve the full decentralization of DAI. The ultimate goal of this initiative is to bring MakerDAO to an endgame state, which is characterized as a self-sustaining condition where it can minimize the influence of external factors and maintain the ability to recover under any circumstances.

In addition, MakerDAO is diversifying the asset pool to ensure the stability of the DAI stablecoin. While USD-based stablecoins (USDC, USDP, GUSD) account for 60% of DAI's collateral, DAI's reliance on USDC has been steadily decreasing with the recent approval of key governance protocols. Meanwhile, DAI's real world asset (RWA) collateralization has continued to grow and now amounts to 41.0% of total collateralized assets. To enhance the stability of DAI and project returns, MakerDAO has increased its holdings to USD 1.2 billion by purchasing USD 700 million worth of U.S. Treasuries. The move aims to augment the portion of less risky and more liquid traditional assets within the project.

Also on May 8, MakerDAO launched the Spark Protocol, a DeFi lending solution for DAI users, in an effort to expand the use of DAI. The platform is designed specifically for DAI and aims to provide users with competitive interest rates.

As a result of such endeavors, DAI's market cap has climbed and has recently reclaimed the third spot on the list of stablecoins after the former third-place stablecoin, BUSD, ceased to mint new coins.

3-2. FRAX: An algorithmic stablecoin that maintains its presence

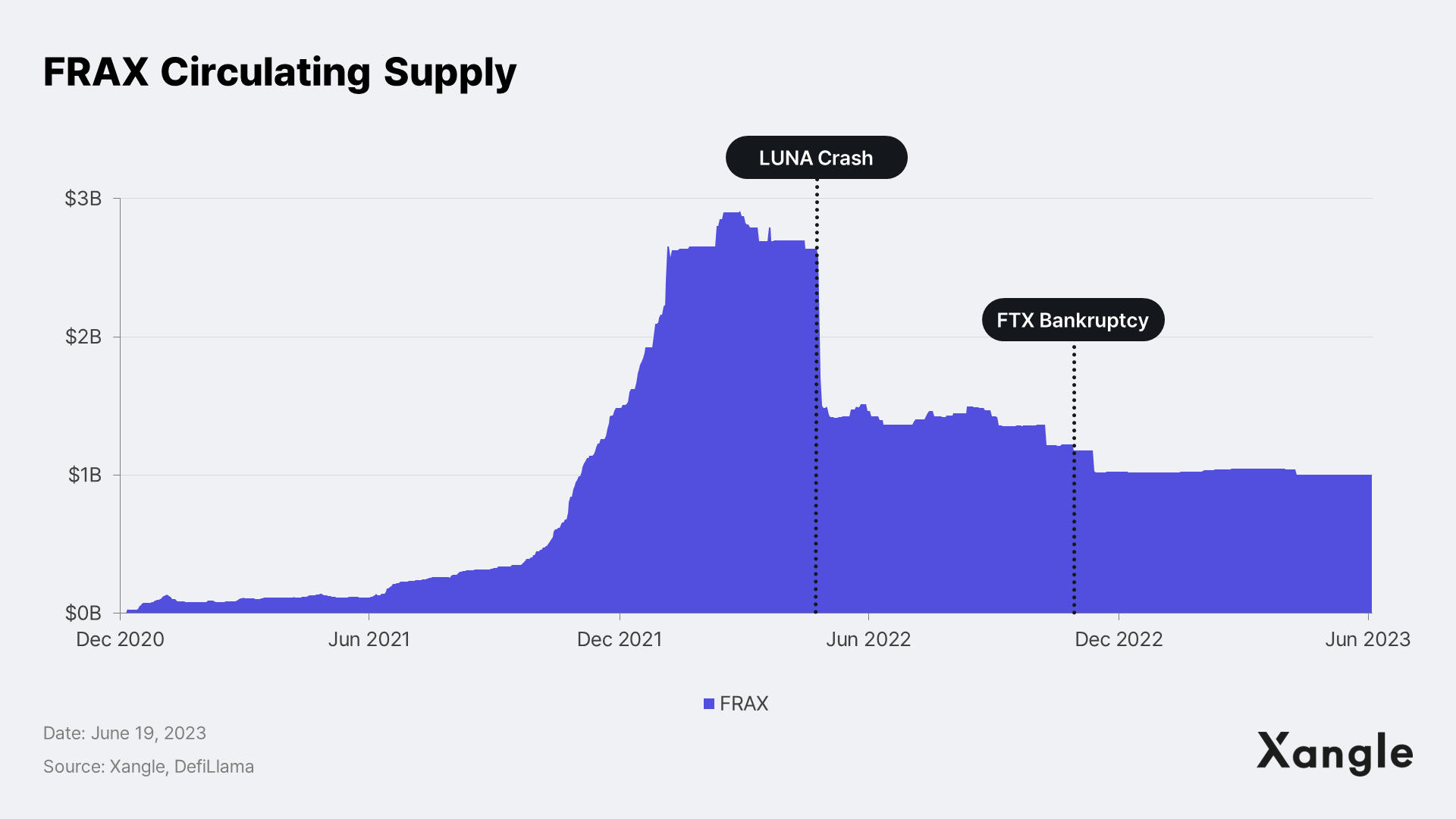

FRAX is a partially algorithmic stablecoin based on its own stablecoin, FXS, and USDC. It adopts a partially algorithmic design that blends both asset-collateralized and algorithmic stablecoin models as a compromise to solve the problems of reduced capital efficiency in traditional asset-backed stablecoins and the price stability issues often associated with algorithmic stablecoins. The spread of distrust in algorithmic stablecoins following the Terra-Luna crash sent FRAX’s market cap tumbling, but it is one of the few stablecoins that has managed to retain its position. In this regard, the mechanism itself is judged to be valid in that the price has remained stable other than the USDC de-peg.

3-3. GHO: Aave poised to expand the utility of its native coin AAVE and generate additional revenue streams

Aave decided to introduce a new decentralized stablecoin, GHO, through a governance vote in July 2022 to address the sharp decline in liquidity of wBTC and stETH following the Terra-Luna crash and subsequent plunge in TVL. GHO is issued in an over-collateralized manner like DAI and notably features Facilitators, which allow various entities to issue GHO instead of solely relying on Aave as the issuing entity. Considering that Aave is a leading lending protocol with the third largest TVL among all DeFi protocols, GHO is believed to have already secured strong use cases.

However, Aave GHO is currently being tested in a testnet environment, and it is premature to evaluate its impact until it is deployed on the mainnet. The project recently announced that the mainnet launch is imminent, and voting on initial parameters, Facilitator onboarding procedure, and liquidity pool composition is currently underway via SnapShot.

3-4. CRV: Recouping liquidity and trading volume after Terra-Luna crash

Shortly after Aave’s GHO launch, Curve Finance's move towards its own stablecoin became evident. Curve released the official codes and whitepaper for its own stablecoin, crvUSD, on November 22, 2022, and subsequently launched the crvUSD stablecoin on May 17, 2023. Curve is a DEX specializes in stablecoin trading. After the Terra-Luna meltdown took a toll on its TVL, Curve appears to have decided to launch a stablecoin in attempts to 1) secure liquidity, 2) increase trading volume, and 3) encourage CRV token lockups.

Basically, the crvUSD stablecoin is issued in the form of an over-collateralized stablecoin like Maker's DAI. It notably features the Liquid-Lending AMM Algorithm (LLAMMA), addressing the risks of the existing stablecoin liquidation mechanism.

Currently, crvUSD can be issued using four assets as collateral: wstETH, sfrxETH, wBTC, and ETH. It has demonstrated a steady uptrend since its launch, sitting at $42.5 million as of June 26. However, since the collateral to the stablecoin is mainly composed of liquid assets, such as sfrxETH and wstETH, the stability assessment requires a conservative approach.

4. Will CBDCs replace stablecoins?

While various stablecoin projects keep trying to achieve price stability and broader acceptance in the aftermath of the Terra implosion, fiat-backed stablecoins still reign. USDT and USDC account for more than 85% of the total market cap of stablecoins. As the regulatory frameworks also center on fiat-backed stablecoins, the dominance of fiat-backed stablecoins is likely to continue.

Meanwhile, with the evident emergence of CBDC issuance, stablecoins might experience a partial retreat. However, it is improbable for CBDCs to completely replace stablecoins given their distinct utility and purpose.

4-1. Most regulatory frameworks may acknowledge only fiat-backed stablecoins

The biggest reason for the dominance of fiat stablecoins is that most regulatory frameworks only recognize stablecoins that are 100% or more backed by fiat. Countries across the world recognize that the stablecoin and CBDC markets will likely make a quantum leap in the coming years and are establishing regulatory measures and frameworks for stablecoins, which has become a potential means of payment. A primary objective of national regulations is to prevent money laundering and terrorist financing, and projects without fiat backing like algorithmic stablecoins are virtually restricted.

In February 2023, the third-largest stablecoin by market cap, BUSD, was suspended by U.S. regulators due to heightened scrutiny of the crypto market and the SEC's classification of BUSD as an unregistered security. This resulted in a 43% plunge in the BUSD market cap. In the end, stablecoin issuers that fail to adhere to regulatory guidelines would lose ground in the market, and only those stablecoins, even among the fiat-backed ones, that operate in a regulatory-friendly manner are likely to survive.

4-2. Will CBDCs replace stablecoins?

The emergence of blockchain-based digital currencies has been one of the most-talked about issues in the financial world. Since the COVID-19 pandemic, there has been a surge in online transactions and a slide in the use of cash. This fueled the discussion of CBDC around the world. In particular, emerging and developing countries are introducing CBDCs faster than developed countries in order to include the financially marginalized in the relatively scarce financial infrastructure. According to the CBDC Tracker, 89 projects are in the research phase, 24 are in the Proof-of-Concept phase, and 14 are in the pilot phase. Emerging countries, such as Nigeria, Bahamas, and Jamaica, have launched CBDCs already. China also appears to be seriously considering CBDC adoption, with the digital yuan already being tested in 20 cities: As of the end of 2022, about 82.7 million wallets have been created, and over 600 million transactions have taken place, with a cumulative transaction value of 635.8 billion yuan.

<Source: CBDC tracker>

Unlike existing physical currencies, CBDCs are currencies whose value is stored electronically, and payments are made between users through the fund transfer function. CBDCs are similar to stablecoins in terms of low price volatility, but the primary difference is that CBDCs are issued by the central banks of each country. As concerns have been raised that stablecoins’ price stability may be hindered by issues surrounding reserves and regulations, some began to see CBDCs as an alternative to stablecoins and raised the possibility that CBDCs, once launched, will drive out stablecoins.

Issued by central banks, CBDCs outperform stablecoins in terms of price stability and payment reliability. Issued on private chains, on the other hand, CBDCs underperform stablecoins in terms of interoperability with other digital assets. In addition, retail CBDCs, which are currently being discussed in several developed countries, are limited to domestic use as the central bank is ultimately responsible for transaction finality. Making CBDCs a cross-border transaction vehicle requires a common CBDC trading platform to be built in each country, but this is unlikely given the difficulty of creating such platform. Stablecoins, on the other hand, have the advantage of universal acceptance and consistent value across jurisdictions, making them an ideal medium of exchange between cryptocurrencies. This is why a complete replacement of stablecoins by CBDCs is unlikely. With that said, as stablecoins continue to grow exponentially and regulations are tightening to control them, only those that comply are expected to survive.

Closing Thoughts

While the high volatility of cryptocurrencies such as Bitcoin and Ethereum limits their potential to be used as real-world currencies, stablecoins are an asset class whose price tends to be stable, making them a good fit for realizing the potential of blockchain. Stablecoins had primarily been used as trading pairs in crypto exchanges due to their price stability until June 2020, when decentralized finance started to grow exponentially. Since then, their use has expanded and market cap has surged.

On the other hand, after the Terra-Luna fiasco, the market cap of stablecoins nosedived and is still reeling from the fallout to this day. As a result, funds are flowing in to more stable fiat-backed stablecoins, particularly to USDT, which has been working to improve reserve quality and transparency. Indeed, USDT has been stealing much of the spotlight by renewing its market cap highs every day. MakerDAO also reclaimed the third place in market cap after the suspension of the BUSD issuance by incorporating U.S. Treasury securities and improving the utility of DAI with the Spark protocol. In the case of FRAX, the market cap that once fell due to the widespread distrust in algorithmic stablecoins triggered by the Terra implosion is holding up strong among algorithmic stablecoins. The validity of the mechanism, in particular, has been evidenced by the stability of the price that has consistently maintained its 1:1 dollar peg other than during the USDC depeg incident.

Stablecoins have become an essential part of blockchain infrastructure. The significant growth of stablecoins that has come alongside the explosive growth of the cryptocurrency market is now prompting active discussions on the need for regulations to protect investors. While the discourse surrounding CBDCs is also gaining traction, it appears unlikely for CBDCs to fully replace stablecoins due to their issuance on private chains, limited interoperability, and their probable confinement to domestic payments. The introduction of regulations and guidelines is anticipated to yield more confidence among investors and participants in the cryptocurrency market, which will in turn build momentum for the growth of the stablecoin market.