Table of Contents

1. Mantle Network: Layer 2 Scaling Solution Fueled by BitDAO

2. The First Modular Rollup Utilizing EigenDA as a Data Availability Layer

3. What’s Next for Mantle Network?

4. Technical Specifications and Mantle Governance: Competitive Advantage Moving Forward

5. Closing Thoughts

1. Mantle Network: Layer 2 Scaling Solution Fueled by BitDAO

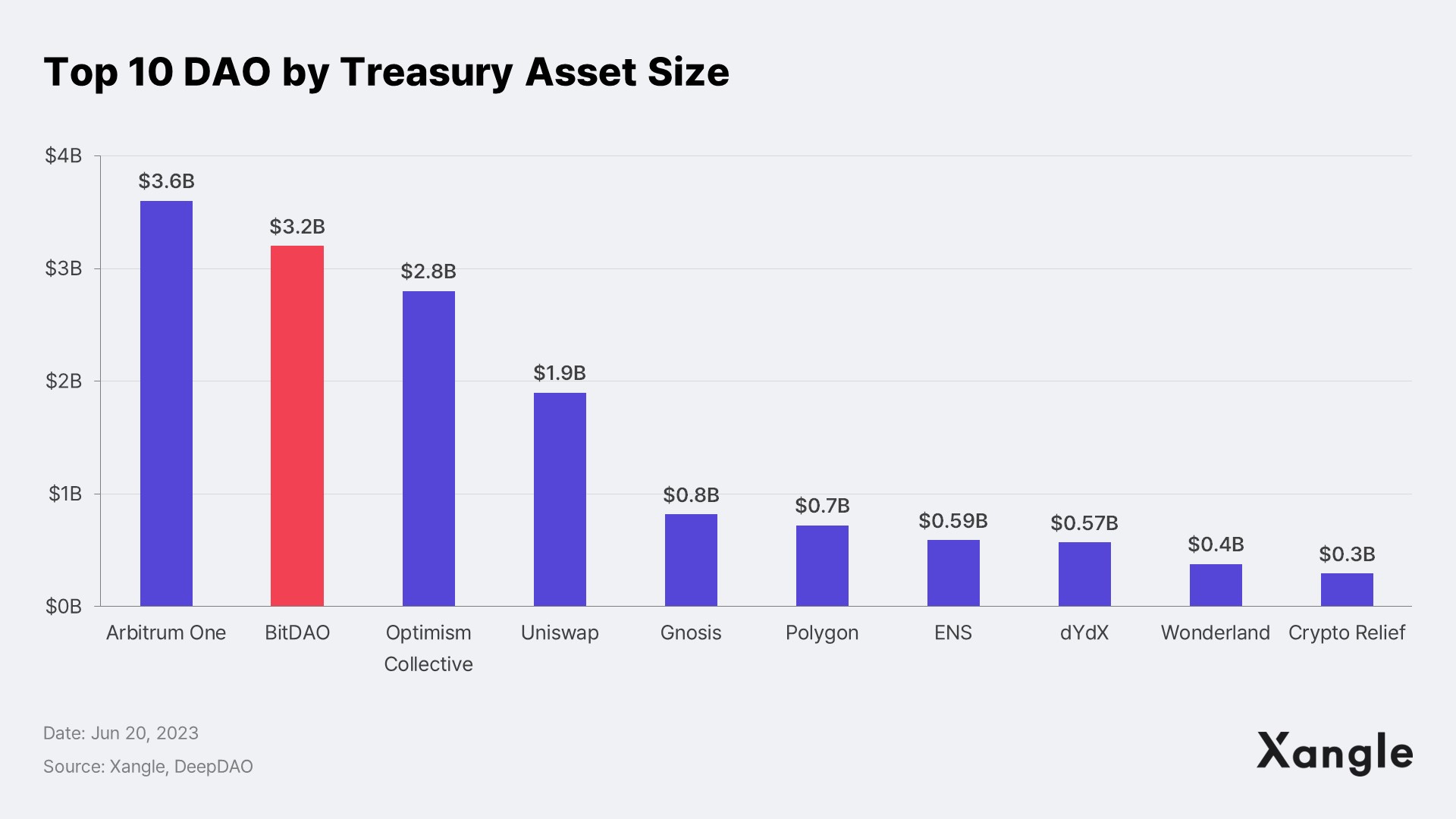

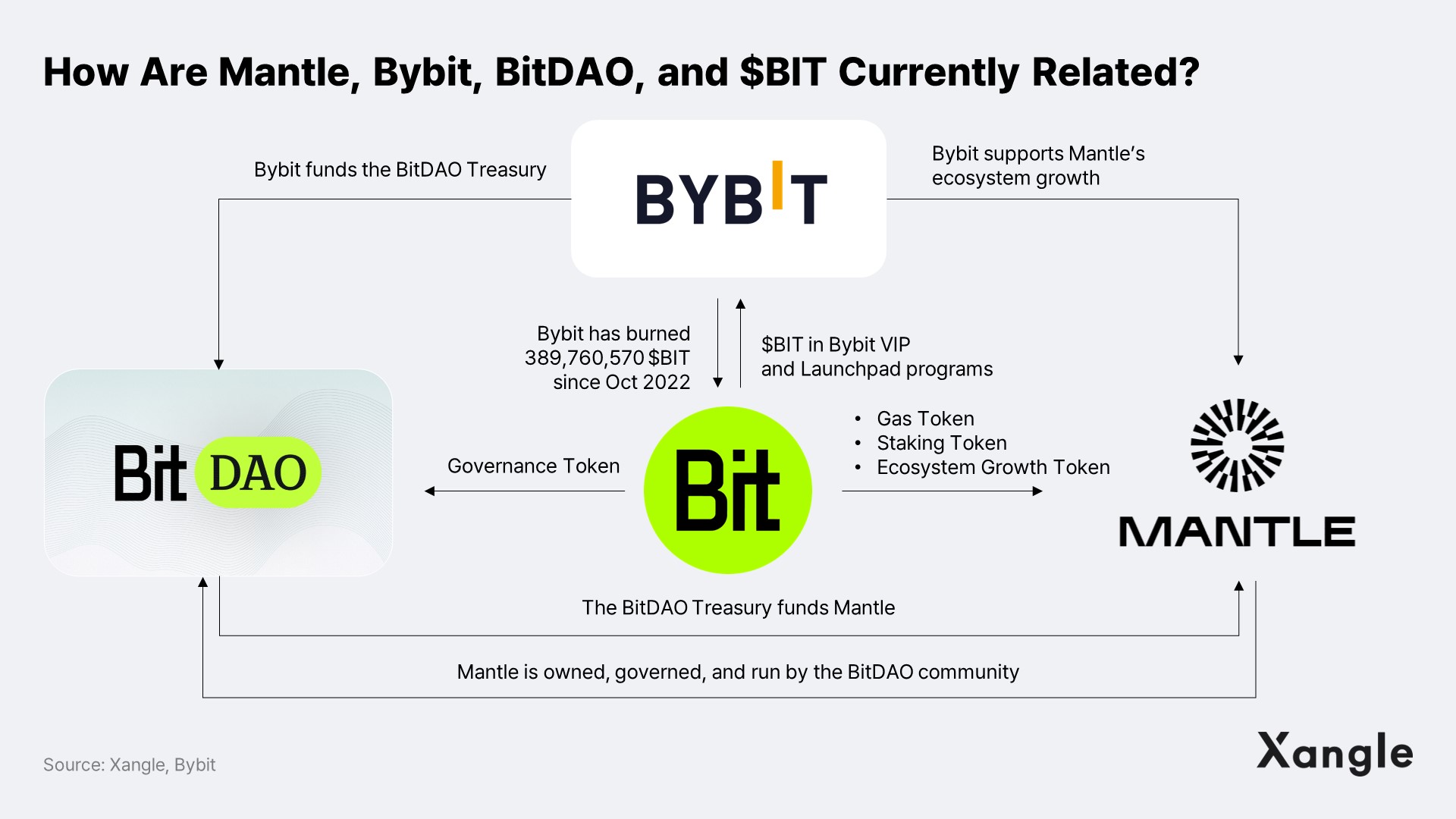

Mantle Network is a Layer 2 Optimistic rollup, and Bybit, a contributor to the BitDAO treasury, serves as one of the strong backups for Mantle. BitDAO receives funding from Bybit, the cryptocurrency exchange sponsor, which contributes to the development and operation of Mantle Network. Initially, Bybit contributed funds to the BitDAO treasury based on a percentage (0.025%) of the futures trading volume on their platform until February 2023. However, with the introduction of BIP-20: Adjustments to Bybit Contributions to the BitDAO Treasury (shortened title), Bybit has committed to supporting BitDAO with 2.7B $BIT (valued at $1.05B as of June 28, 2023) over the next 48 months. This shift aims to reduce BitDAO's reliance on Bybit. Currently, the treasury holds $3.2B, making BitDAO one of the largest DAO organizations. The growth of Mantle Network is backed by this substantial support. Mantle Network testnet was launched in January 2023, and the mainnet release is planned for later this year.

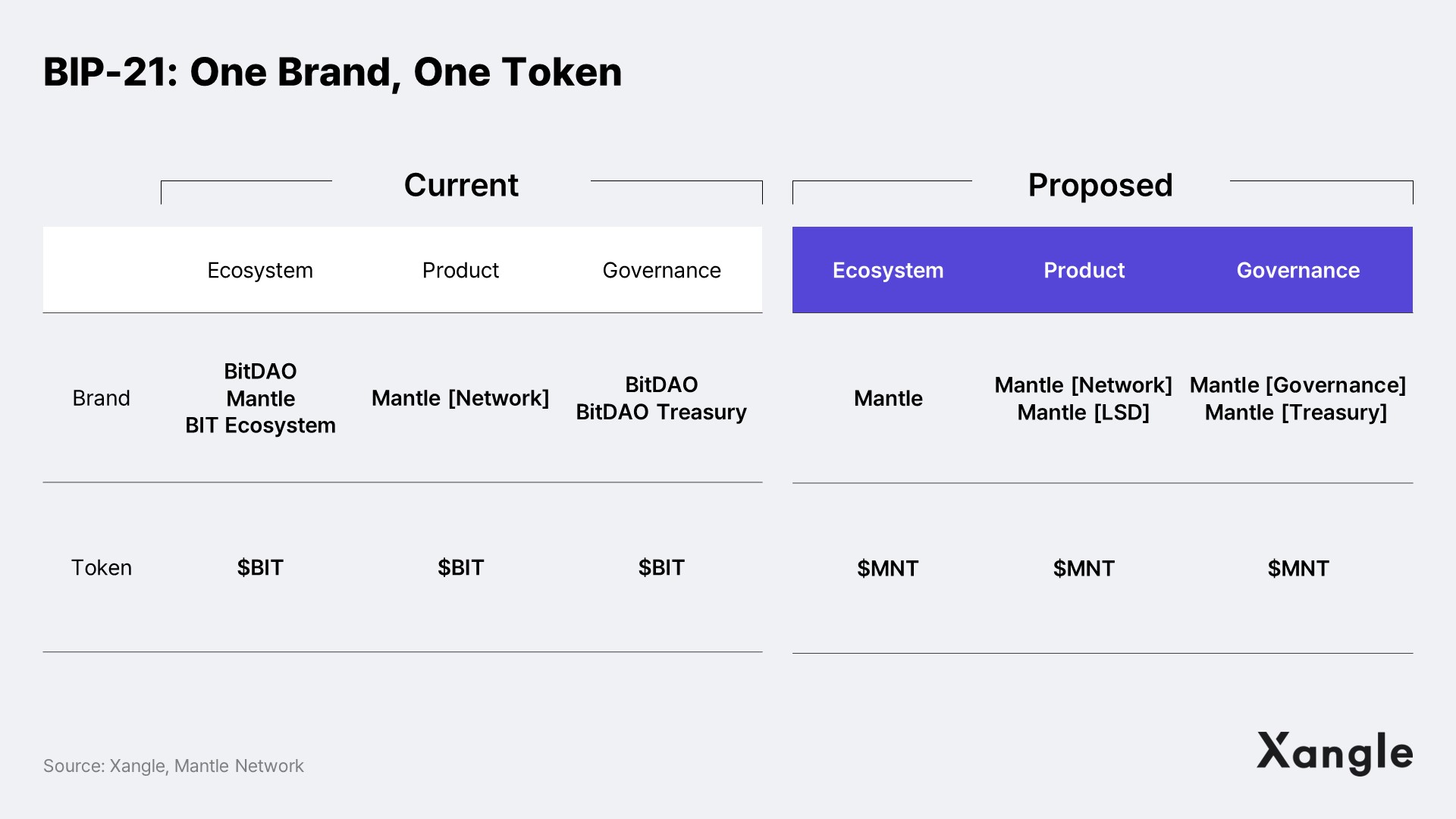

Currently, Bybit, BitDAO, and Mantle Network are interconnected through the utilization of $BIT. Both BitDAO and Mantle Network employ $BIT as their governance and native token, respectively. To maintain the token’s price stability, Bybit has taken measures, including token burn events prior to BIP-20 and reducing the circulating supply of $BIT after the introduction of BIP-20. However, this structure is expected to undergo significant changes following the recent adoption of BIP-21: Optimization of Brand, Token, and Tokenomics. BIP-21 proposes the integration of the existing fragmented structure of Bybit, BitDAO, and Mantle Network into a unified Mantle ecosystem. Further details regarding this integration plan will be provided at a later stage.

2. The First Modular Rollup Utilizing EigenDA as a Data Availability Layer

2-1. Limitations of Existing Rollups: High Transaction Data Publication Costs

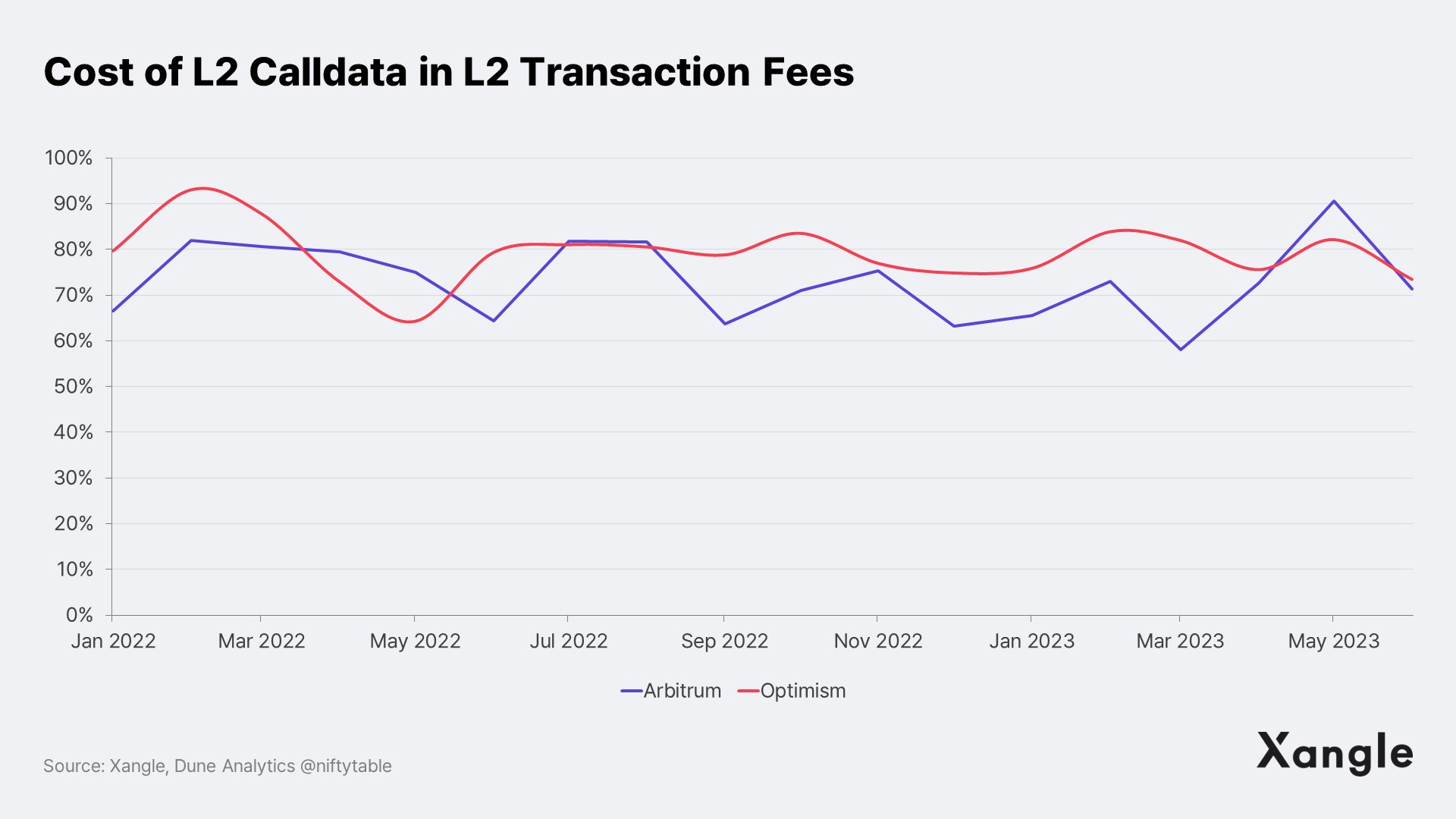

Rollups offer the advantage of recording transaction data on Ethereum, ensuring data availability (DA), and benefiting from Ethereum's security. However, they also come with certain limitations, particularly the high costs associated with publishing transaction data to Ethereum. These costs can be divided into two main components: 1) the cost of executing the transaction (L2 gas fee) and 2) the cost of publishing the transactions to Ethereum (L1 data publication fee). The latter, in particular, is a significant factor, as evidenced by examples like Arbitrum and Optimism. On average, the cost of publishing transactions to Ethereum accounts for approximately 73% and 79% of the total transaction fees incurred by Arbitrum and Optimism, respectively. These figures can rise above 90% when the Ethereum network experiences congestion (as shown in the figure below). In essence, rollups entail significant transaction data publication costs due to the inherent trade-off between security and cost.

2-2. Mantle Network: Leveraging EigenDA as a Data Availability Layer to Address Security and Cost Concerns

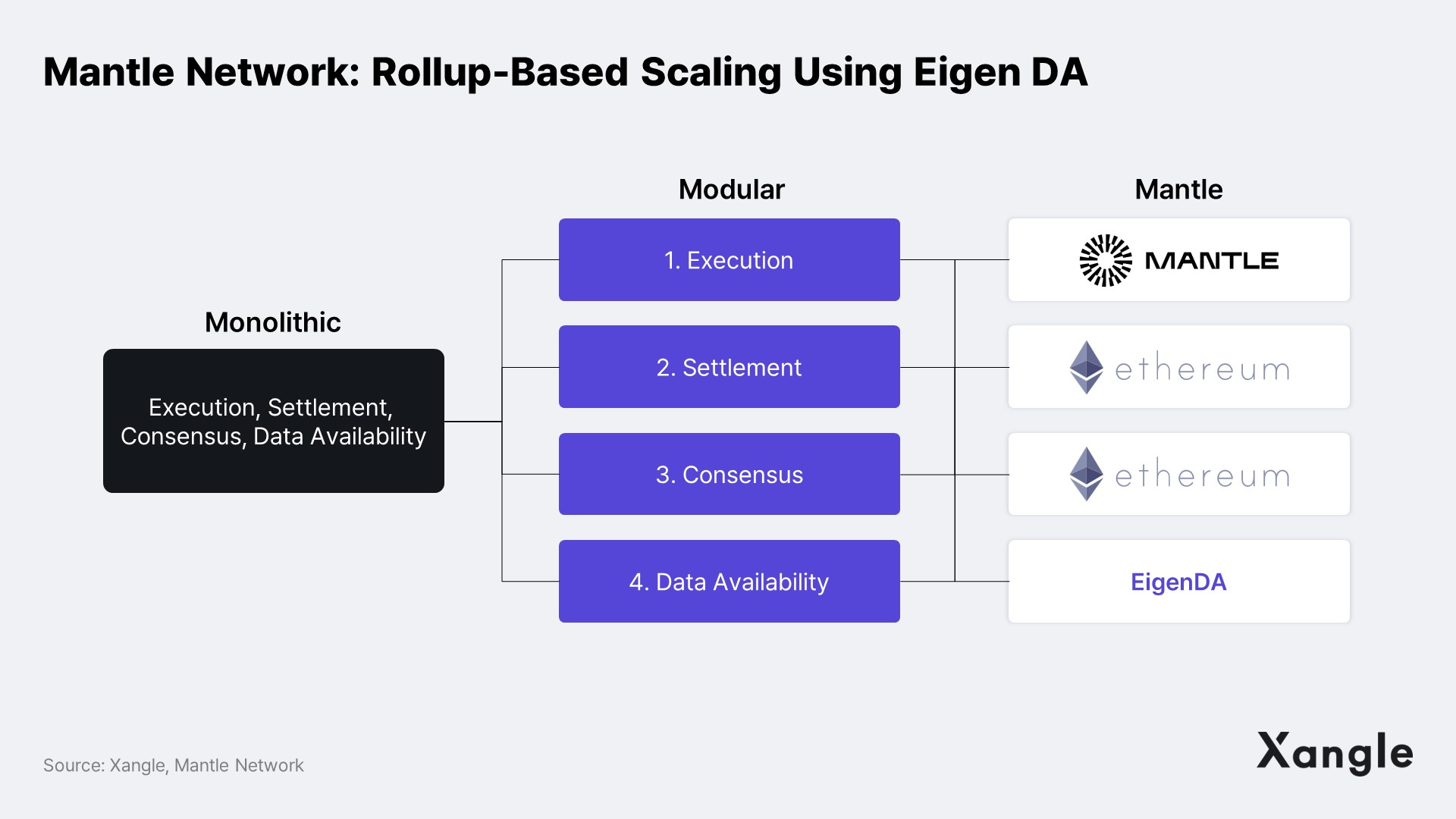

To tackle the limitations of existing rollups, Mantle Network has made the strategic decision to delegate data availability to EigenDA. In this approach, out of the four roles of blockchain, Mantle Network carries out execution while leveraging Ethereum’s settlement and consensus and EigenLayer’s EigenDA for data availability.

By leveraging EigenDA, Mantle Network benefits from the security offered by the Ethereum network while significantly reducing transaction costs. EigenLayer acts as a smart contract that enables the sharing of security between Ethereum and various Ethereum-based middleware and infrastructure. It achieves this by backing the security of these services with ETH staked on the Ethereum network (for more details, refer to the Xangle Original article, "EigenLayer: An Open Marketplace for Decentralized Trust"). Ethereum Validators are not limited to the existing Ethereum Proof-of-Stake (PoS) chain and can simultaneously validate multiple services. By leveraging the mechanisms of EigenLayer, EigenDA empowers the Mantle Network to utilize existing Ethereum validators, thereby enjoying the robust security provided by the Ethereum network.

EigenDA also provides significant cost advantages compared to the Ethereum network. Operator nodes in EigenDA only store a portion of the transaction data and do not maintain a separate ledger. Instead, they record DA commitments on Ethereum, serving as proof that the data is stored on the DA layer. This enables Mantle Network to mitigate the high costs associated with existing rollups' transactions publication and the network aims to reduce transaction costs by nearly 80%. Despite individual operators only having access to a portion of the data, data availability is improved as the complete dataset can be reconstructed by aggregating data from multiple operators. With EigenDA, Mantle Network addresses the security and cost challenges inherent in existing rollups, while ensuring robust data availability.

2-3. Accelerating Withdrawal Times with MPC Implementation is Another Differentiating Factor

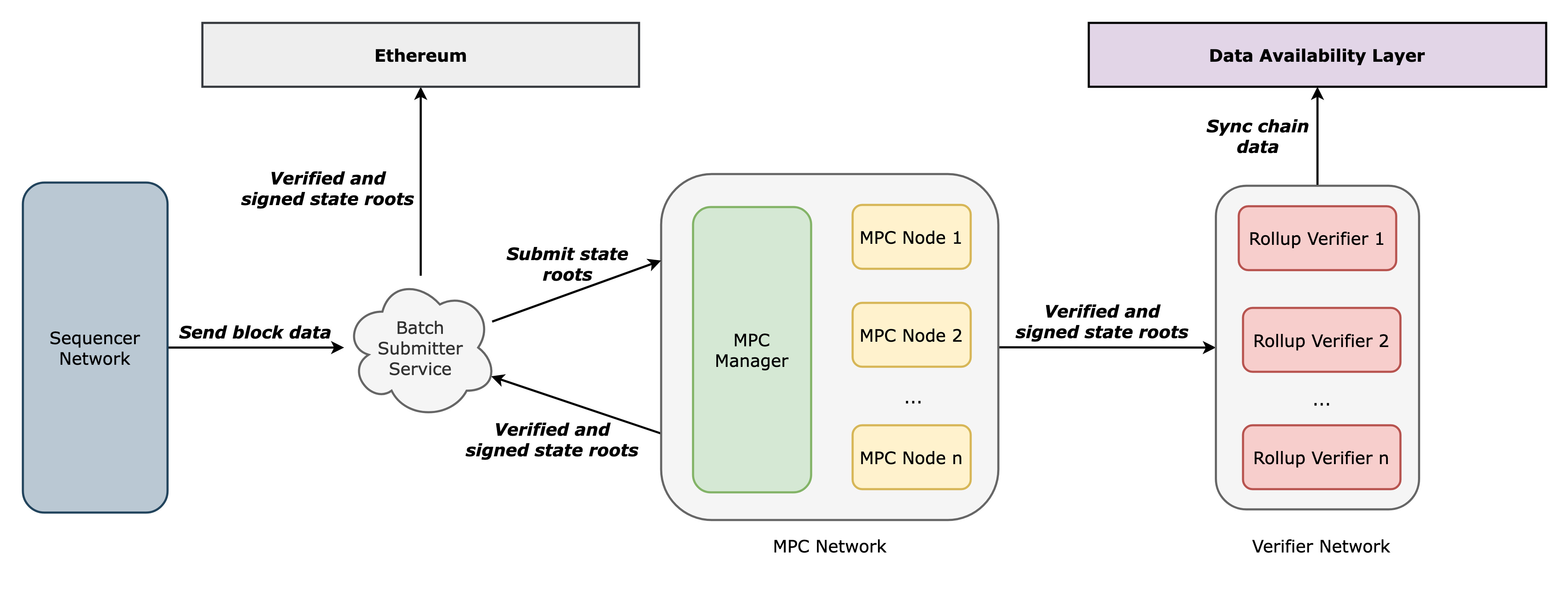

Mantle Network stands out among other rollups for its unique features. Not only does it pioneer the delegation of data availability to the DA layer as a modular rollup, but it also differentiates itself through the introduction of Multi-Party Computation (MPC) to reduce withdrawal times. The current withdrawal process in the Optimistic Bridge involves a 7-day challenge period following a transaction, which can hinder user experience when trying to retrieve assets back to the Ethereum network. To address this, Mantle Network aims to reduce the challenge period significantly using MPC.

Introducing the concept of TSS (Threshold Signature Scheme) nodes, which are used to validate blocks in rollups, Mantle affirms the validity of blocks. These nodes will need to 1) stake a fixed amount of $MNT* on Ethereum, and 2) undergo an evaluation by the Mantle core team to validate blocks produced by the sequencer. TSS nodes will independently compute state roots from transaction data and provide a signature for valid state transitions. As more nodes sign the block, collective confidence in block validity increases. By pre-validating transaction data at the rollup level, this approach presents a promising solution for reducing the challenge period, which could potentially be reduced to as low as 1-2 days, according to Mantle.

To ensure the integrity of the system, the staked $MNT will be slashed in case any malicious behaviors are detected, and all slashed $MNT will be distributed among other functioning TSS nodes. This incentivizes nodes to behave honestly, reducing the likelihood of malicious actions and minimizing the chances of failure. While the Mantle core team currently selects the TSS nodes, they will be selected through Mantle governance in the future, thereby mitigating certain centralization concerns.

* Token rebranded from $BIT as part of BIP-21

<TSS Data Flow, Image Source: Mantle Network>

3. What’s Next for Mantle Network?

3-1. Positioning Mantle as Unified Ecosystem Brand

Mantle Network has a roadmap in place for the upcoming months, with plans to launch its mainnet in late Q2 or early Q3, following the implementation of BIP-21: Optimization of Brand, Token, and Tokenomics upgrade. The primary objective of BIP-21 is to establish a more cohesive and user-friendly ecosystem by consolidating the currently separate components, including Mantle Network, BitDAO, and the BIT Ecosystem, under a unified brand called Mantle. New product lines will use the naming convention Mantle [Name] as default (e.g., Mantle Network, Mantle LSD, and so on), while the existing governance and treasury will be referred to as Mantle Governance and Mantle Treasury, and the overall ecosystem will be called Mantle. To create a recognizable brand presence and deliver essential functions for an L2 token before the mainnet launch, $BIT will be converted to $MNT. Consequently, all future activities, including investments, bootstrapping, and partnerships, will be carried out within the "Mantle" framework.

3-2. Introducing $MNT as an L2 Token Prior to the Mainnet Launch

As $BIT was initially designed solely as the governance token for BitDAO and not specifically tailored for L2 network use, all $BIT will be converted to $MNT before Mantle’s mainnet launch, encompassing all the functions essential for an L2 token. On June 9, the Mantle core team deployed a new token contract for $MNT on the Goerli testnet, on which $BIT can be converted to $MNT on a 1:1 basis.

The conversion from $BIT to $MNT will not result in material changes to existing governance processes, while $MNT will be used for gas payments and staking on the Mantle L2 network. Modeling after major L2 tokens such as $ARB and $OP, $MNT will have the “upgradability” and “mint and burn” functions. Such enhancements will enable $MNT to adapt and incorporate necessary functionalities for upcoming products and governance proposals, eliminating the need for token migrations and allowing for the minting and burning of additional $MNT tokens to support the long-term growth and development of the ecosystem. For a comprehensive understanding of the token design, conversion parameters, and asset handling, please refer to MIP-22: Mantle Token Design, Conversion Parameters, and Asset Handling.

3-3. Testnet Phase 2 "Ringwood"

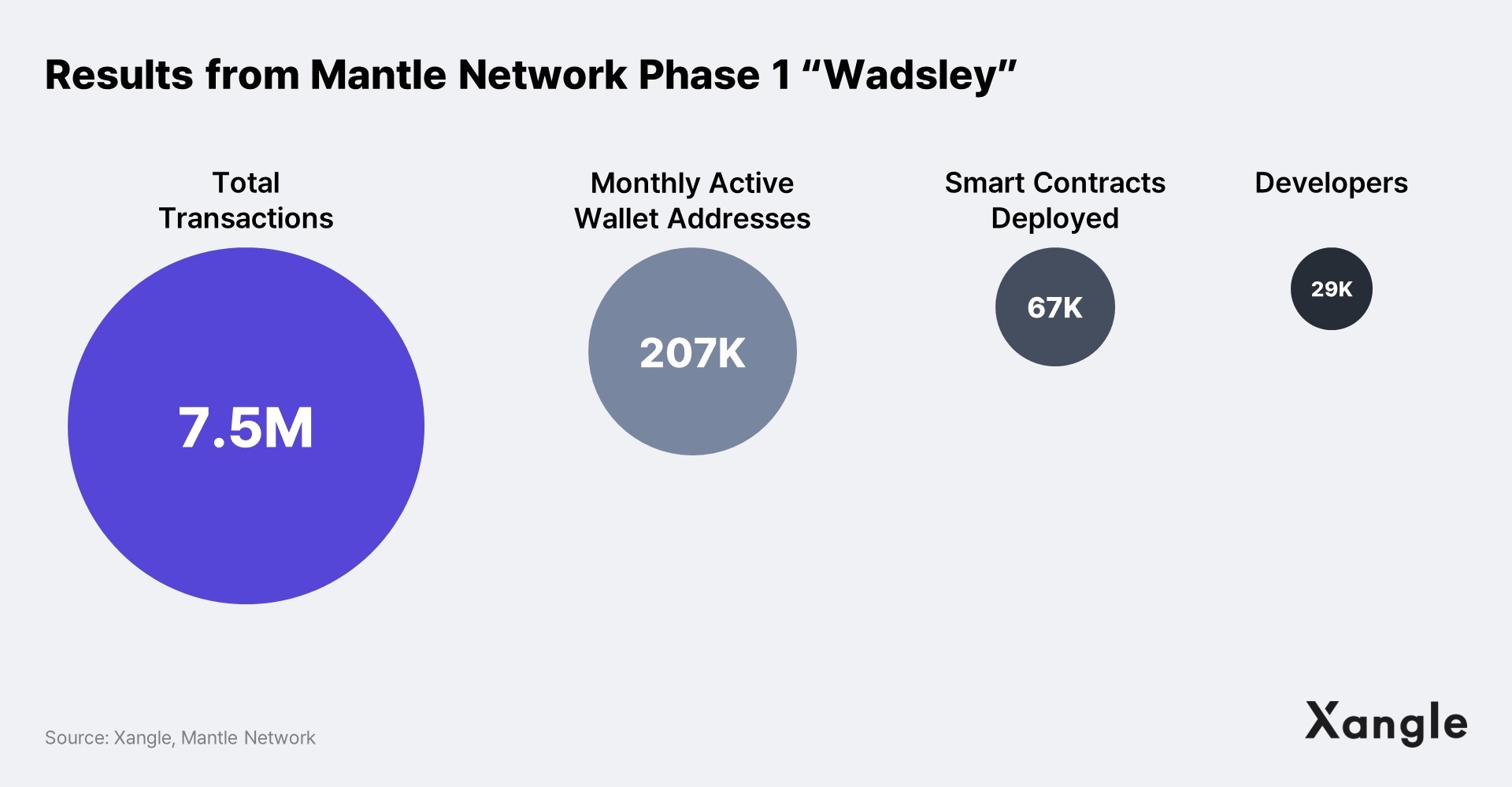

After launching Mantle network testnet phase 1 “Wadsley” on Jan 10, 2023, the testnet entered its second phase called “Ringwood” on May 23, 2023. During phase 1 Wadsley, the network witnessed a 7.5M total transactions, 207K monthly active wallet addresses, and 67K smart contracts deployed.

What’s to look forward to with the Ringwood testnet are: 1) complete integration of EigenDA, 2) successful onboarding of TSS and DA nodes*, and 3) fraud proofs integration. With the completion of the EigenDA integration, the transaction data rollup to CTC has been fully switched to EigenDA. The Mantle team highlighted that the amount of data sent to L1 has been reduced, thereby significantly lowering gas fees for L2 transactions by up to 70%. Mantle successfully commenced with the onboarding of TSS and DA nodes, and as a result, the network becomes increasingly secure and decentralized. As for the fraud proof mechanism, the Mantle team collaborated with Specular, a company focused on EVM-Native optimistic rollups, to develop a fraud proof mechanism. This mechanism compiles and executes fraud proof logic with EVM-level instructions, which means Ethereum clients such as Geth, Besu, and Eragon can interact with Mantle’s fraud proof system natively, minimizing trust assumptions between validators, clients, and compilers compared to Optimistic rollups that rely on a separate EVM. For a comprehensive understanding of fraud proofs, please refer to Fraud Proofs. As mentioned earlier, the mainnet is expected to launch in late Q2 or early Q3 after the testnet phase 2.

* Nodes that store calldata

4. Technical Specifications and Mantle Governance: Competitive Advantage Moving Forward

Following the mainnet launch, Mantle Network has set its sights on adoption by partnering with major players in both the Web2 and Web3 industries. The appeal of Mantle Network to these industry leaders can be attributed to two key factors: its robust technical specifications and the capitalization provided by Mantle governance.

Mantle Network's technical specifications make it an attractive option, especially within the Web3 industry. By significantly reducing transaction fees by 70-80% while leveraging the security of Ethereum, Mantle addresses the limitations of existing rollups. However, in an increasingly competitive rollup ecosystem, Mantle must demonstrate that the network is capable of delivering high-level security at low fees in a mainnet environment.

When it comes to onboarding major Web2 players, advanced technical features alone are not enough. Web2 companies are focused on minimizing the risks associated with entering new markets, especially considering the challenges faced by certain Web3 players like Luna, 3AC, and FTX. To mitigate these risks, Web2 companies prioritize partnering with trusted entities that possess industry references, successful use cases, industry experts, and sufficient funding, in addition to robust technical specifications.

This is where Mantle governance becomes instrumental. In the absence of a clear business model, many Web3 projects often struggle to sustain their operations due to aggressive talent acquisition, marketing expenses, and funding. Unsustainable project operations can jeopardize the underlying blockchain infrastructure, which would be disastrous for Web2 companies relying on such services. With Mantle Governance, however, concerns about funding runway are mitigated, as the project has already secured $3.2B in funding and a commitment of an additional $1.05B (based on the closing price, Jun 28, 2023) over the next 48 months through Bybit's pledge. With this financial backing, Mantle can ensure the project's ongoing operations, attract talented experts, and secure partnerships.

5. Closing Thoughts

Mantle Network is the first rollup that introduces a modular structure and leverages EigenDA for data availability. While it is currently in the testnet stage, making it premature to fully assess its competitiveness, we anticipate that Mantle Network will make a significant impact on the market upon its mainnet launch. It offers compelling solutions to the limitations of existing rollups, such as reduced transaction costs, and faster withdrawal times. Moreover, the robust capitalization of Mantle's governance provides a strong foundation to attract major partners, further enhancing the network's competitive position. The ability to leverage this financial backing, combined with its technical advancements, positions Mantle Network as a potential disruptor in the existing rollup ecosystem.