Translated by Lyne Choi

Table of Contents

1. Intro

2. Limitations of the Current Ethereum Structure in Terms of Security and Cost: Key Players and Issues

3. EigenLayer: Enabling Decentralized Trust Trading via Restaking

4. Highly Anticipated Flagship Service EigenDA to Launch in 2023

5. Closing

1. Intro

In anticipation of Ethereum's upcoming Shanghai/Capella upgrade, Liquid Staking Derivatives (LSD) protocols, including Lido ($stETH), Coinbase ($cbETH), and Rocket Pool ($rETH), are experiencing a surge in popularity. This trend is partly attributable to the release of EigenLayer's whitepaper, which is being touted as an evolved iteration of LSD. In this article, we will explore the creation of EigenLayer and its potential implications for the Ethereum network ahead of its launch on the mainnet.

2. Limitations of the Current Ethereum Structure in Terms of Security and Cost: Key Players and Issues

As Ethereum's consensus algorithm transitions to PoS, network security has become reliant on the amount of ETH staked rather than hash power. This is a significant advancement as it enhances network decentralization and security while reducing the energy consumption of mining activities. Nevertheless, staked ETH is locked up by a smart contract, rendering it unusable as collateral or tradable assets.

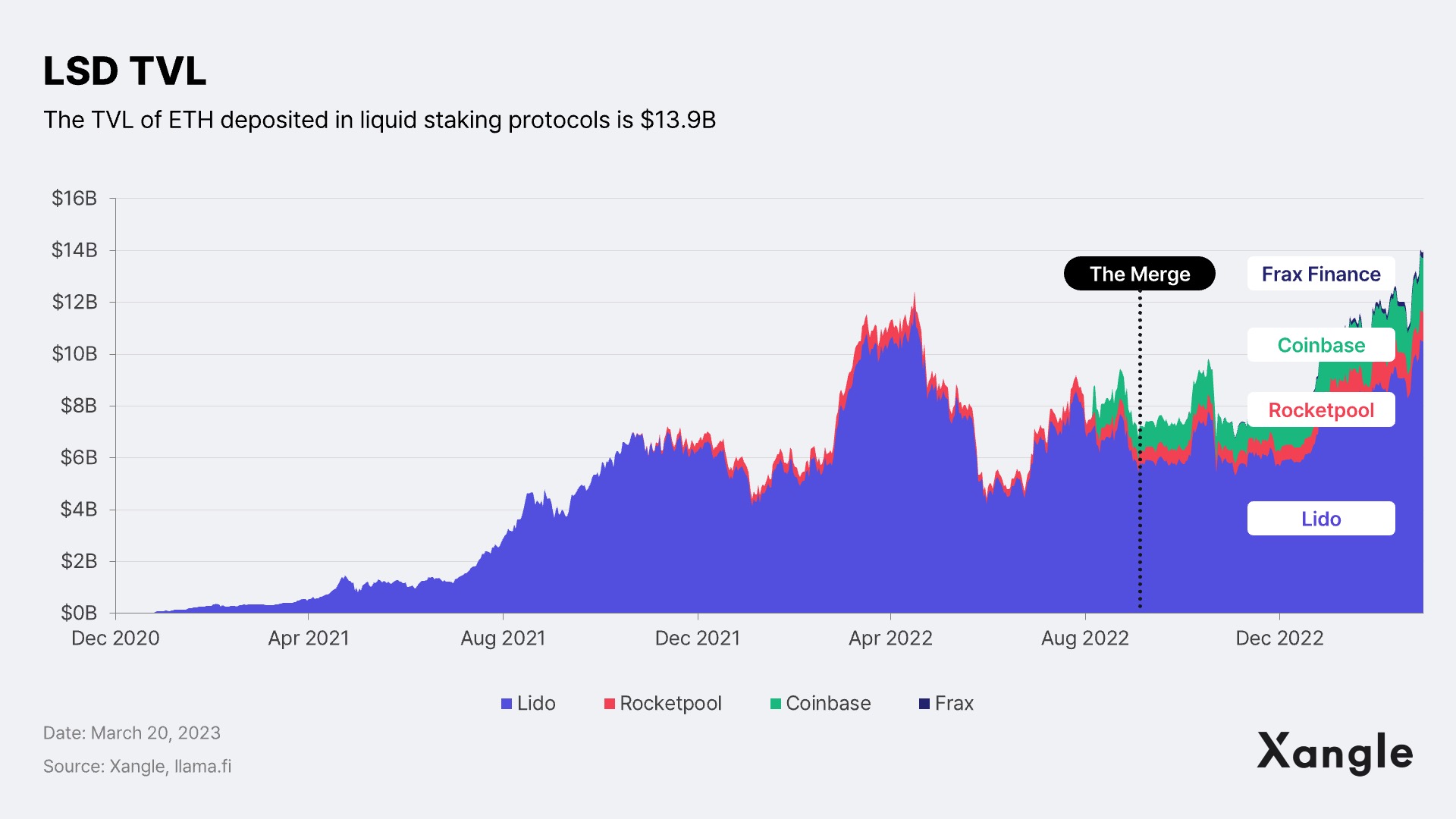

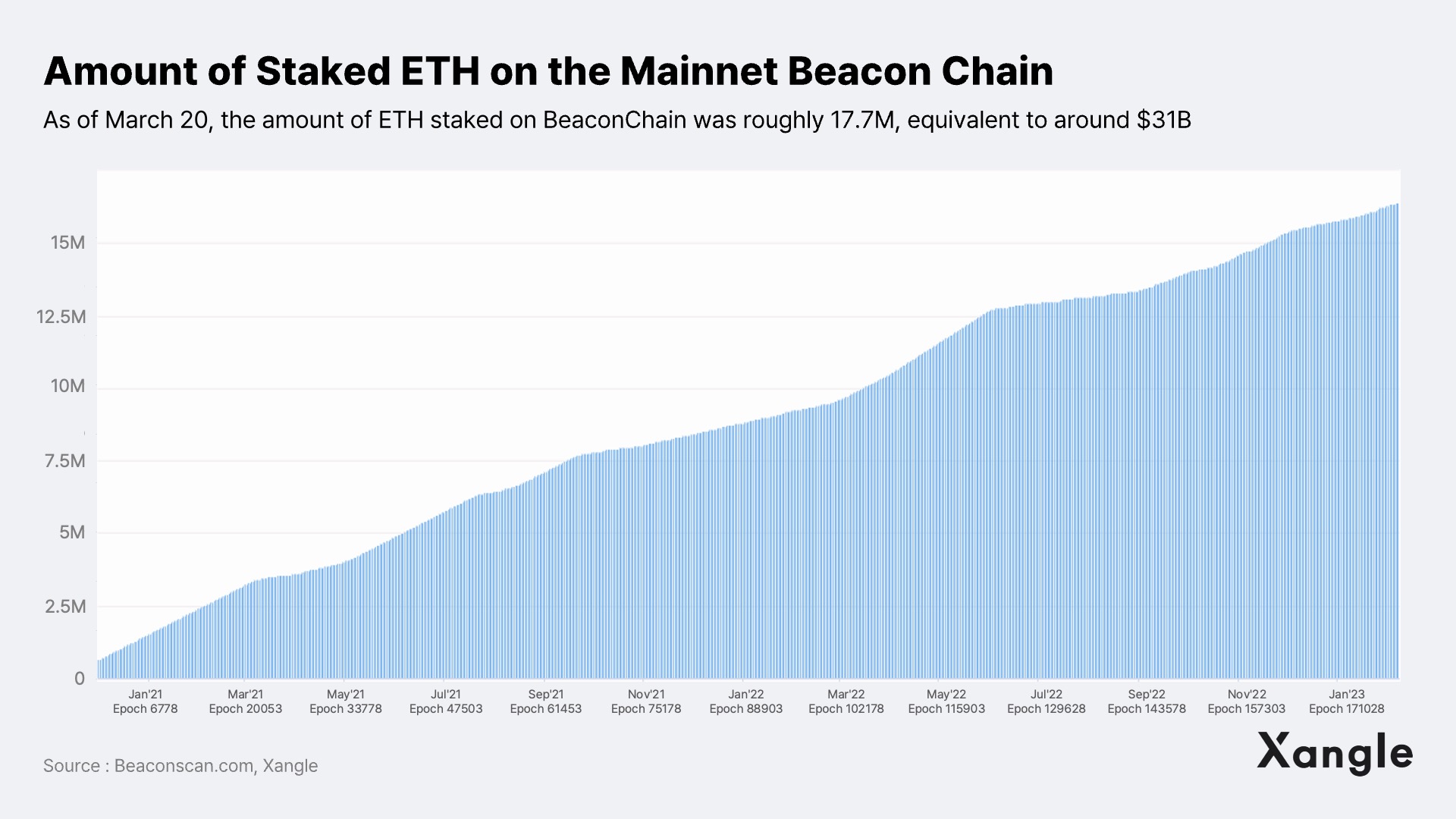

LSD initiatives, which convert staked ETH into liquid assets, have arisen as a solution to these inefficiencies and have gained momentum since Ethereum's PoS transition. As of March 20th, the total value locked (TVL) in LSD projects was over $13.9 billion, corresponding to roughly 7.8 million ETH or about 43% of the total ETH deposited on Beacon Chain (17.6 million ETH).

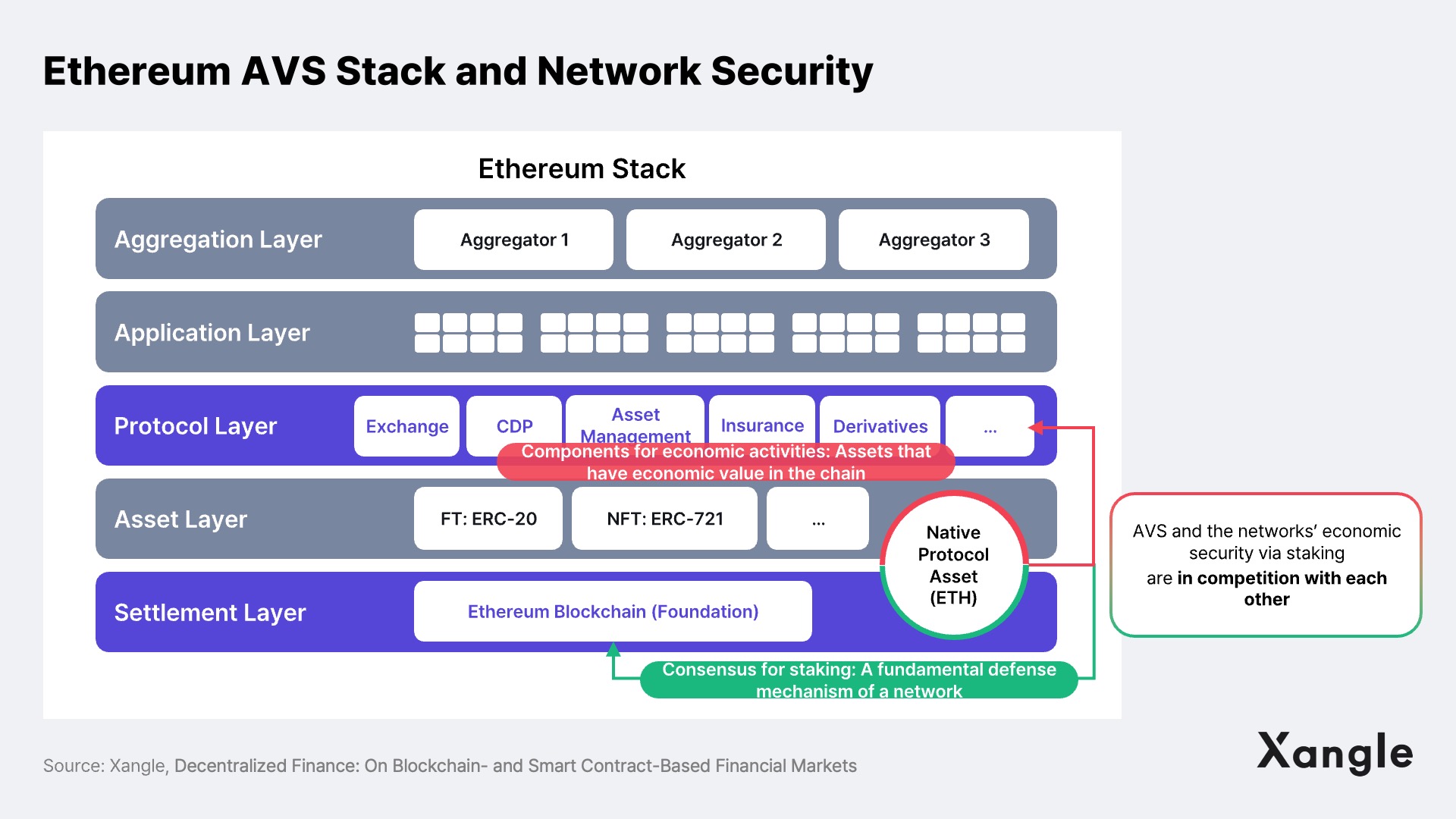

Nonetheless, LSD tokens are predominantly utilized in the DeFi realm and are unable to participate in the validation of Actively Validated Services (AVS) or Ethereum-based middleware and infrastructure, such as sidechains, DA-layers, new VMs, keeper networks, oracles, storage, bridges, and TEEs, each of which has its own trust network. Consequently, even with the emergence of LSD, AVSs must still establish their own trust networks, which are typically achieved through either 1) token issuance or 2) a permissioned structure. In this scenario, token issuance raises the following concerns:

2-1. The Burden of Capital Cost

To secure the necessary funding for constructing their own trust networks, AVSs that pose a greater risk than Ethereum PoS staking must provide staking yields that correspondingly exceed those of Ethereum PoS staking APR (averaging at 4-5%). This implies that AVSs must offer higher yields, particularly for new and riskier protocols, to raise funds smoothly. This framework heightens the cost burden on AVS and ultimately triggers competition between AVS and L1 in terms of crypto-economic security, as elaborated in the Xangle research article, "Exploring Liquid Staking: A Comprehensive Guide to Understanding the Concept." In other words, in the event that an AVS presents a high APR, stakers will naturally prefer to stake on that platform instead of L1, resulting in a lower L1 staking rate, which increases the potential cost of attack relative to a higher Total Value Locked (TVL), ultimately compromising the security of the Ethereum network.

2-2. Fragmented Security

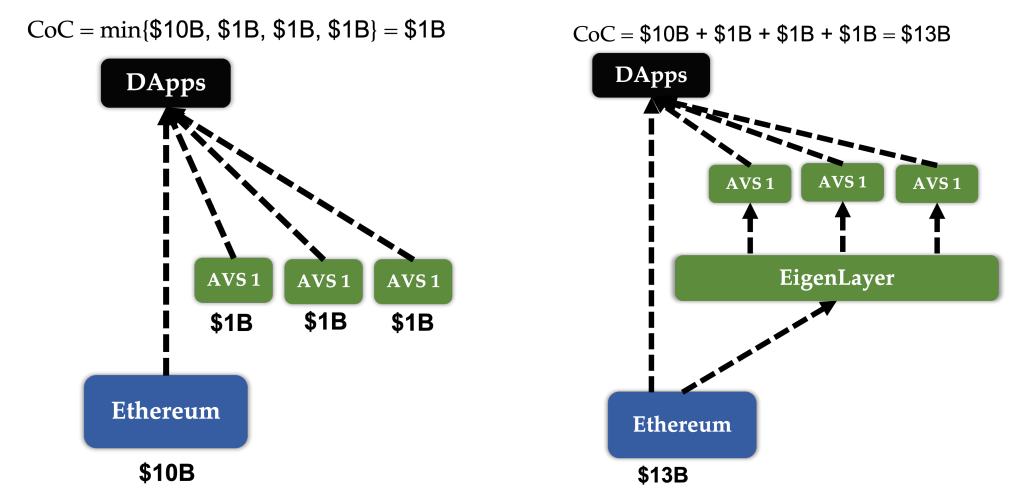

The security of the Ethereum network and the security of the AVS and the underlying dApps are distinct from one another. In other words, even if Ethereum is considered secure with a market cap of $31B (as of March 20, 2023), if the AVS is secure only up to $1B, the dApps depend on it are also only as secure as the AVS. This is because dApps rely on the security of the AVS, as demonstrated by the numerous projects that have failed due to bridge hacks and oracle issues.

Consequently, even if a project has excellent ideas and capabilities, it will ultimately fail if it cannot bootstrap a new AVS on Ethereum. Ultimately, the fragmented security structure of Ethereum can also impede innovation and growth.

3. EigenLayer: Enabling Decentralized Trust Trading via Restaking

3-1. What is EigenLayer?

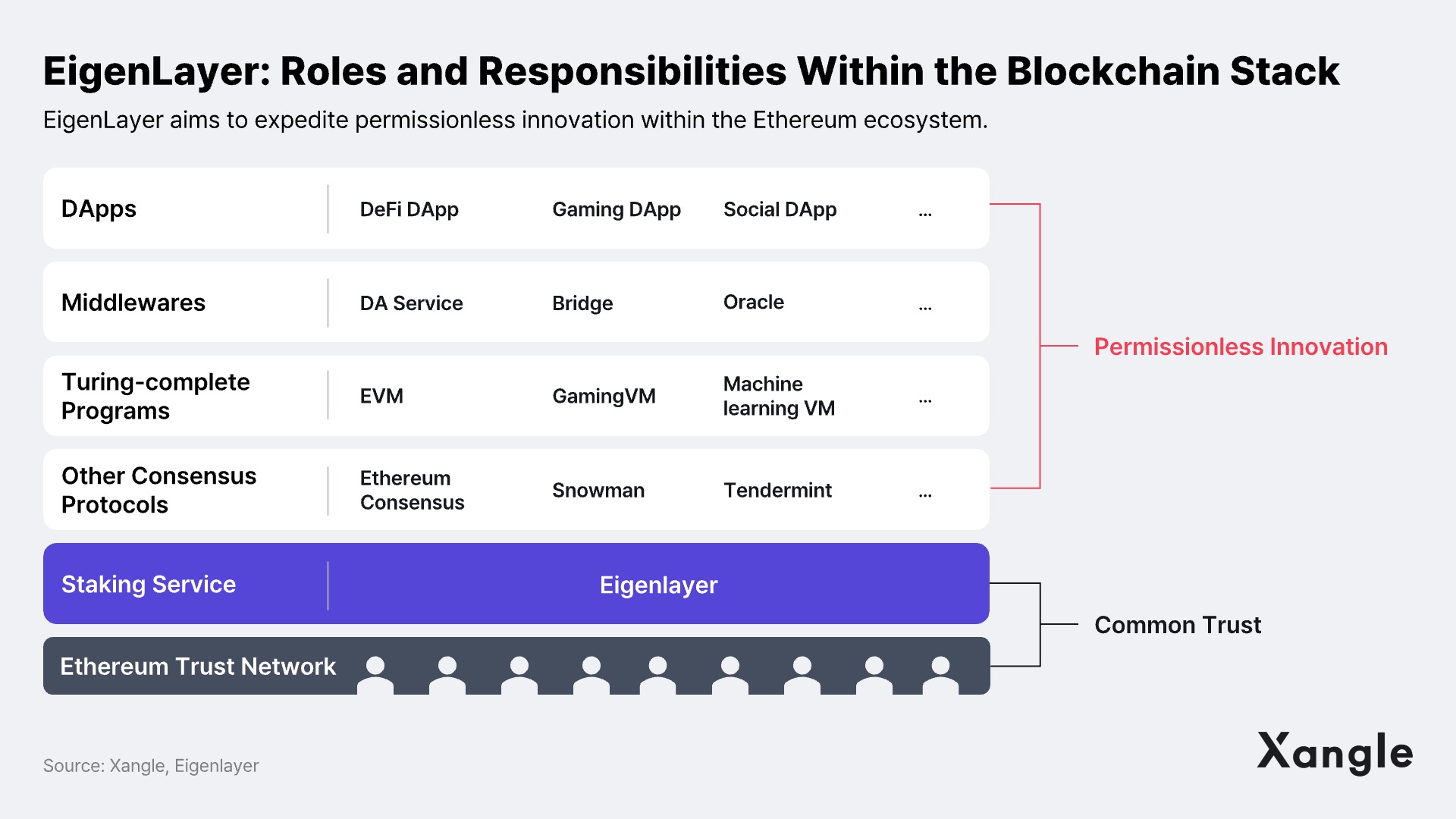

EigenLayer is a set of smart contracts that allows cryptographic security to be shared between L1 and AVS. Simply put, it supports the security of AVS services through ETH staked on the Ethereum network. The main idea behind it is to provide ETH stakers with the ability to opt into the AVS trust network, which can be compared to the consensus structure allowing Avalanche validators to act as subnet validators or the Interchain Security (ICS) concept of Cosmos. ICS allows appchains to incentivize Cosmos validators to participate in validation by offering them block rewards. ICS is particularly appealing to newly established appchains, as it provides security to Cosmos from the very beginning. EigenLayer aims to transform Cosmos into a security-sharing network by introducing 1) a restaking mechanism and 2) free-market governance.

Restaking: This concept involves restaking ETH that has already been staked on the Ethereum PoS chain. Ethereum validators can download and run the node software, and validate both the Ethereum PoS chain and AVS simultaneously, provided they use the EigenLayer contract. ETH stakers can also participate in restaking, which will be further discussed in sections 3-4.

Free-market governance: EigenLayer creates an environment where validators can freely participate in the AVS validation process based on risk/reward preferences. This is similar to how early-stage startups and VCs bootstrap their investors in the early days. Validators can maximize their returns by staking in the AVSs they want to support, while AVSs can build a stable network of trust early on.

3-2. EigenLayer's Solution to Ethereum's Challenges

EigenLayer addresses the structural issues of Ethereum, including the lack of trust and security for AVSs, by establishing an open marketplace for decentralized security. This solution addresses the issues mentioned above, including:

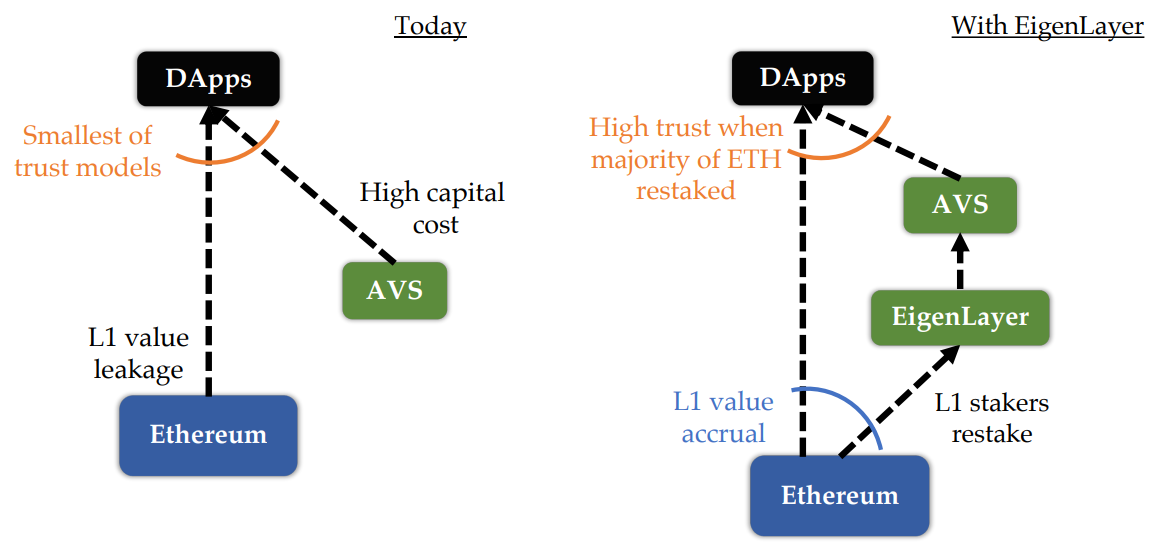

Capital Cost: One of the benefits of EigenLayer's solution is that it helps to mitigate capital costs. Instead of Ethereum L1 and AVS competing for limited capital, they can now cooperate and share resources. ETH stakers can now stake on both the Beacon chain and the AVS, doubling their profits. Additionally, AVS no longer needs to offer an aggressive staking pool during the initial bootstrapping phase, which reduces the cost burden.

Fragmented Security: EigenLayer provides a new mechanism for pooled security. The figure below shows that $13B is injected into the Ethereum ecosystem in both the left and right scenarios. However, in the left scenario where EigenLayer is not implemented, the cost of corruption (CoC) of AVS is $1B, whereas, in the right scenario with EigenLayer, the CoC is reduced to $13B due to the improved security mechanisms.

As of March 20, the total amount of ETH staked on the Beacon Chain was 17.6M, which equates to approximately $31M. With the implementation of EigenLayer, AVS will have access to this significant sum, resulting in a substantial increase in the level of security.

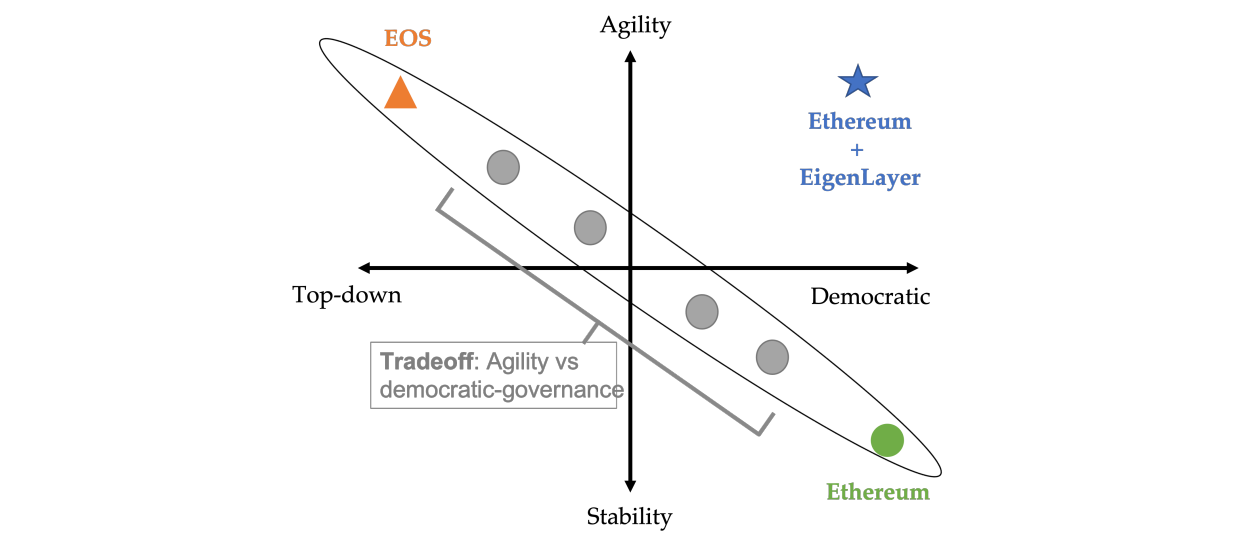

The Ethereum protocol is upgraded through a democratic mode of off-chain governance that is robust and, consequently, necessarily slow-moving. Competing protocols such as Binance Smart Chain (BSC) have sought to achieve faster decision making and updates by adopting a more top-down, corporate type of governance. All protocols today end up making some trade-off between democratic governance and the rate of innovation. The emergence of EigenLayer challenges the existence of any trade-off between democratic governance and agile innovation. EigenLayer allows agile innovation to be built on top of the Ethereum trust network. The structure allows projects to bypass the bootstrapping process for security and fosters change and innovation at the dApps and middleware layers while leaving the core of Ethereum alone to continue upgrading in a cautious and stable manner. The below figure shows that with the addition of EigenLayer, Ethereum can enjoy the best of both worlds: democratic governance with agility in innovation.

Source: Eigenlayer whitepaper

3-3. What are the Differences between Restaking, LSD, and Superfluid Staking?

LSD: Liquid staking services such as Lido and Rocket Pool allow users to deposit their ETH to a staking pool and receive a liquid staking derivative token that represents a claim on their ETH and its staking yield. The LSD protocol delegates the ETH in the staking pool to validators, and users' LSD tokens represent their staking position and their claim to staking revenue. LSD tokens can also be traded in the DeFi ecosystem via exchanges like Uniswap, Curve, and Aave.

Superfluid Staking: Developed by Osmosis, Cosmos' flagship DEX, which enables LP tokens to be utilized for Ethereum PoS staking.

Restaking: Restaking differs from LSD and Superfluid staking in two main ways: 1) Restaking allows for AVS validation and staking participation, and 2) the order of stacking. In EigenLayer, there can be several modalities of restaking.

- LSD Restaking: Validators can restake by staking their LSDs by transferring their LSDs into the EigenLayer smart contracts. This is equivalent to DeFi → EigenLayer yield stacking

- ETH LP Restaking: Validators stake the LP token of a pair which includes ETH. This is equivalent to DeFi → EigenLayer yield stacking.

- LSD LP restaking: Validators stake the LP token of a pair which includes a liquid staking ETH token, such as Curve’s stETH-ETH LP token, thus taking the L1 → DeFi → EL yield stacking route.

3-4. Engaging Passive Restakers via Delegation in EigenLayer

Many EigenLayer restakers holding ETH or LSDs may be interested in participating in EigenLayer, but may not want to act as EigenLayer operators themselves. EigenLayer provides an avenue for these restakers to delegate their ETH or LSDs to other entities that are running EigenLayer operator nodes. These operators receive fees from both the Ethereum beacon chain and the modules they are participating in via EigenLayer. They keep a fraction of those fees and send the remainder to the delegators. While restakers have the benefit of participating in EigenLayer without running operator nodes, there is the risk of ETH of restakers getting slashed if the nodes are not carefully managed. Each operator node has different conditions, including delegation fees and fee distribution methods, and the operators will provide these details directly to the stakers.

3-5. EigenLayer vs Merged Mining: The Option of Slashing

The restaking concept of EigenLayer is similar to the notion of merged mining, which was used for Namecoin in 2011. Merged mining is a cryptographic mining operation where proof of work and hash rate is submitted to multiple blockchain networks simultaneously, intending to maximize profits and amortize the cost of mining. While merged mining has been used for Bitcoin/Namecoin, Bitcoin/Elastos, Bitcoin/RSK, and Litecoin/Dogecoin, the primary reason for its failure was due to security vulnerabilities. Miners were not penalized for failing to mine sub-blockchains, creating security vulnerabilities for the sub-blockchain network. This meant miners were only interested in mining BTC, and neglecting to run their sub-blockchain (e.g., Namecoin) nodes correctly did not affect their ability to receive BTC rewards. To address vulnerabilities in merged mining, EigenLayer implemented a slashing mechanism for restaking and did not issue a fungible token representing restaked positions. Slashing describes the process whereby other network participants forcibly eject an offending validator, such as failing to produce blocks for an extended period of time or double signing, and their deposited ETH stake will be subject to slashing.

3-6. The Primary Concern is Security Risks

Due to the LSD protocol's Total Value Locked (TVL) and revenue potential, many validators are expected to utilize EigenLayer's service upon its launch. Nevertheless, as the amount of ETH deposited into EigenLayer's contracts rises, there is a greater possibility of the following issues arising:

Operator collusion: Operators may collude to steal funds from a set of AVSs. Consider an AVS which is secured by $8B of restaked ETH and which contains a total locked value of $2B. With a quorum of 50% required to capture the $2B of locked value, the application appears to be secure since a successful attack would result in at least $4B of the attacker's stake being slashed. However, this may not be the case if the same set of stakers is also restaking in other AVSs. In the simplest case, the same set of restakers participates in 10 other AVSs, each of which has $2B locked. Thus the total profit from corrupting this group of restakers is $20B, thus making the system crypto economically insecure. To avoid such a scenario, the EigenLayer team has stated that they have taken the following measures: 1) constructing a mechanism to anticipate the likelihood of collusion among operators and 2) allowing AVS to add parameters related to hacking prevention. However, the particular countermeasures will be closely monitored after the service is launched.

Unintended slashing: One risk is the case in which an AVS is created with an unintentional slashing vulnerability, such as a programming bug, which causes a loss of funds to honest users. The EigenLayer team proposes two measures to prevent such situations: 1) Establish a multisig veto committee comprised of prominent members of the Ethereum and EigenLayer community, which has the ability to veto slashing decisions via a multisig.

Malicious attacks: As EigenLayer's TVL increases, the risk of hacking attempts also rises significantly. The potential danger is that, unlike typical applications or bridges, hacking an EigenLayer smart contract can result in the loss of the capital that supports Ethereum's security. The larger the EigenLayer TVL and the greater the number of protocols utilizing restaking, the more significant the consequences of a security breach.

4. Highly Anticipated Flagship Service EigenDA to Launch in 2023

The EigenLayer team recently announced the upcoming launch of its flagship service, EigenDA, which is set to release this year in tandem with the EigenLayer service. EigenDA will serve as the mainnet counterpart to the Data Availability (DA) layer in the modular blockchain structure, with a focus on securely and accurately storing transaction data. The DA layer's core function is to record transaction data completely and accurately while ensuring accessibility, verifiability, and usability without data availability issues. While no official DA layer has been released yet, Celestia, Polygon Avail, and EigenDA are currently considered promising in the DA market. EigenDA is highly anticipated as it can leverage restaked ETH instead of its token to secure the network, and Mantle, a rollup solution developed by BitDAO, one of the largest DAOs in existence, has also selected EigenDA as its DA layer.

5. Closing

EigenLayer aims to address Ethereum's fragmented security and capital inefficiencies by introducing restaking. Unlike typical AVS or DApps, EigenLayer utilizes ETH staked directly on the beacon chain. However, the security risks of EigenLayer are a concern, as operator collusion, accidental slashing, and hacking can weaken the security of Ethereum. Nonetheless, EigenLayer has significant growth potential by providing additional revenue to ETH stakers and strong Ethereum security to AVS. Moreover, it has numerous use cases, such as decentralizing L2 sequencers, verifying bridge data, smoothing MEVs, and increasing the scale of PoS chain security. Therefore, if the security issues are well-addressed, EigenLayer can become a core infrastructure that elevates Ethereum to the next level.