Product guy who does research from time to time

Translated by LC

Table of Contents

1. Transition from PoW to PoS Leads to Increase in Demand for Liquid Staking Services

2. The Significance of PoS Staking Rewards

3. Nevertheless, PoS is Not Perfect

4. Liquid Staking Emerges as Solution to Address PoS Related Challenges

5. Closing Thoughts: Importance of Distinguishing Liquid Staking from CEX Staking

1. Transition from PoW to PoS Leads to Increase in Demand for Liquid Staking Services

The Ethereum network underwent a major change on Sep 15, 2022, when it transitioned from Proof-of-Work (PoW) to Proof-of-Stake (PoS) consensus mechanism via the Merge. The transition represents a shift towards a more sustainable and energy-efficient blockchain as PoS mechanism rewards token holders for creating blocks, making it a more holder-friendly blockchain compared to PoW.

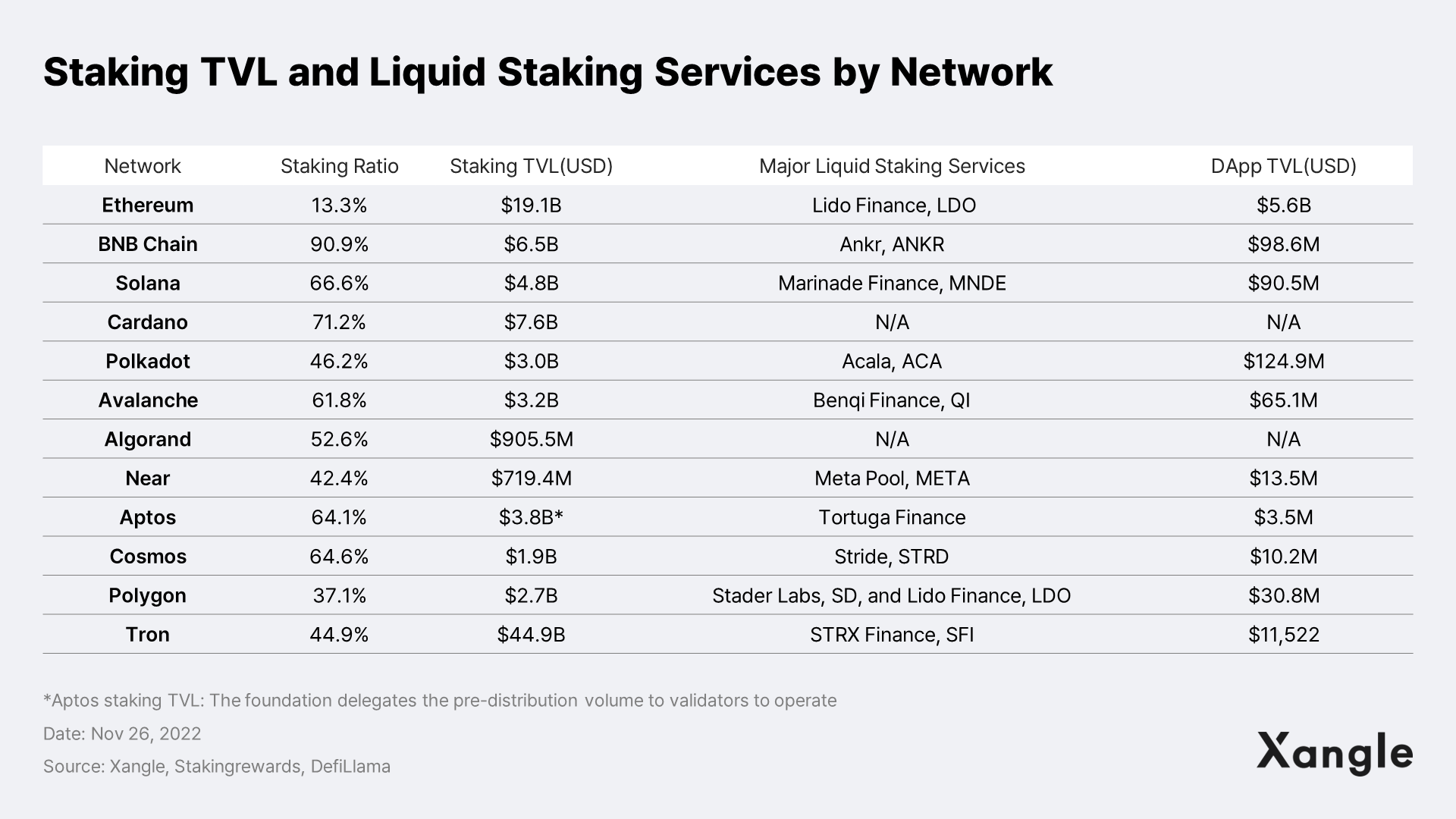

The advent of Proof-of-Stake (PoS) consensus mechanism has necessitated the development of infrastructure to facilitate its implementation. This has given rise to liquid staking services, which not only support token staking but also offer securitization options. Securitization in this context refers to the provision of xxETH tokens to the staker as soon as ETH is staked. Early projects in this space include Lido (LDO) and Rocket Pool (RPL). In recent times, there has been a growing interest in liquid staking platforms, with established players such as Coinbase and Frax Finance (FXS) launching their offerings, such as cbETH and frxETH, respectively. The following graph illustrates this trend.

But what is the actual value of these liquid staking services? Are they mostly used for leveraging like most DeFi dApps? This article delves into the background and implementation of liquid staking, which was developed to increase the capital efficiency of PoS staking, and provides insights into the genuine value of liquid staking.

2. The Significance of PoS Staking Rewards

2-1. PoS Staking Reward for Contributing to the Network’s Security

PoS, a proof-of-stake consensus method, incentivizes users with staking rewards. PoS staking reward is often understood as an “incentive earned by contributing to the network’s security,” but in this article, we will explore the staking mechanism in more detail as it is related to the fundamental value of liquid staking services.

In a blockchain, a block producer uploads the transaction data to the blockchain upon validation. In a PoW blockchain system, such as Bitcoin, miners usually form mining pools to compete with other mining pools to have higher hash rate, and the winning miner is allowed to add the next block to the blockchain. Whereas in a PoS blockchain, cryptocurrency owners validate block transactions based on the number of staked coins. In contrast, Proof-of-Stake (PoS) blockchains employ a different mechanism for block generation that is based on stake. In PoS, the right to generate a block is randomly distributed among the stakeholders in proportion to the amount of the network's native token they hold.

In a PoS consensus mechanism, as illustrated above, there is a cohort of validators who are responsible for validating transactions and generating blocks. These validators require an economic incentive to sustain the infrastructure and operations necessary to maintain the network, including the storage of data and the processing of requested transactions. This incentive is provided in the form of a Staking Reward, which is compensated to the validator nodes as a reward for their participation in the PoS consensus mechanism.

2-2. Validators and Token Holders to Benefit from Staking Rewards

To comprehend the motivation behind the creation of liquid staking, it is important to examine the various stakeholders in a Proof-of-Stake (PoS) network and their interests as defined by the staking rewards. In the context of staking rewards, the members of a Proof-of-Stake (PoS) network can be divided into three groups: 1) the network, 2) validators, and 3) token holders. The interests of each group with respect to the rewards can be summarized as follows:

- Decentralized Network (Network)

A decentralized blockchain network that operates on a PoS consensus mechanism. The network aims to maintain a minimum staking ratio in order to enhance resistance against protocol-level attacks, such as Sybil Attacks and Long-range Attacks. - Validator

Validators validate transactions on the network and receive fees and block rewards for participating. In a PoS system, the more tokens that are staked on a validator's node, the greater the expected profits from operating the node. As a result, validators aim to secure more staking volume while maximizing their returns. - Token Holders

Token holders are ecosystem participants who play the role of investors. Their primary objective is to increase the token price and secure more tokens. To achieve this goal, they engage in various productive activities within the network, including controlling the circulating supply, burning tokens, participating in governance, distributing tokens through airdrops, and establishing Decentralized Autonomous Organizations (DAOs).

3. Nevertheless, PoS is Not Perfect

Having examined the members of a blockchain economy driven by staking rewards, it is evident that although PoS may seem like a well-established economic system, it still faces certain challenges, such as i) high barriers to entry for participants, both economically and technically, ii) hidden costs associated with Miner Extractable Value (MEV), and iii) lack of liquidity due to token lockups.

1) Major hurdles of PoS: The high deposit and technical barriers required to become a validator

In an effort to maintain an efficient composition of validators within the network, most blockchains impose certain restrictions on the accessibility of node operations. For instance, Ethereum has implemented a staking deposit limit of 32 ETH to limit the number of validators who can participate with significant economic incentives, while Solana has a set the threshold is based on the cost of infrastructure and technology required to build fast-performing validator nodes. These barriers to entry, both financial and technical, can effectively exclude the average token holders from participating in staking and earning staking rewards.

2) Untraceable Rewards

The issue of invisible Maximum Extractable Value (MEV) is a growing concern in the PoS-based blockchain ecosystem – rewards derived from manipulating the network's consensus or exploiting its security vulnerabilities. With $685 million in traceable rewards, it is expected that the actual MEV is much higher. The exclusive control of MEV rewards by validators, who are often a small group of large token holders, means that the average token holder is often unaware of the MEV rewards they can receive from their holdings. The recent shift of Ethereum to PoS has further highlighted the importance of MEV rewards, as evidenced by the distribution of over $60 million in MEV rewards (in ETH) in the last three months.

Given the significance of MEV rewards, it is crucial to increase awareness and transparency around this issue. If you are interested in learning more about MEV, we recommend reading Xangle’s recent publication on MEV.

3) Opportunity Costs and Risks Arising from Token Lock-up Period

The recent de-pegging of Terra's UST token (LUNA) on May 9, 2022, serves as a prime example. At the time, many stakers had locked up their LUNA tokens to earn 8% annualized staking rewards, but due to the 21-day unbonding period, they were unable to access their assets in response to the sudden plummet of LUNA from $64 to $0.01 within a three-day period. As a result, these stakers suffered a total loss of their locked-up assets, highlighting the potential risks posed by the lock-up period. The situation underscores the interplay between network protocol design and the behavior of stakers and highlights the importance of considering potential liquidity risks when participating in staking.

4. Liquid Staking Emerges as Solution to Address PoS Related Challenges

1) What is Liquid Staking?

Liquid staking is a solution aimed at addressing the limitations of existing Proof-of-Stake (PoS) systems. It is a decentralized protocol that operates as a custodian for token holders, issuing liquidation tokens in exchange for their assets. The process is straightforward: 1) An Ethereum holder deposits ETH into a liquid staking service. 2) The service issues liquidation tokens to the holder. 3) The service acts as a validator and generates and verifies blocks. 4) The service provides staking rewards to the holder in exchange for a limited fee.

Liquid staking presents an innovative solution to the liquidity limitations inherent in existing staking mechanisms by providing tokens as xxETH backed by locked-up ETH upon deposit. This solution addresses the liquidity concerns experienced by token holders. In addition to its liquidity features, liquid staking encompasses five key characteristics that tackle various issues previously encountered in PoS mechanisms.

In addition to liquidity and accessibility, liquid staking incorporates other key characteristics to optimize staking in PoS systems. Liquid staking may also be categorized as either native, operating directly at the network protocol level, or non-native, operated by entities other than the network protocol (refer to Appendix 1 located at the bottom of this article for a detailed explanation). Currently, the non-native approach is the most prominent, with several active projects, including Lido (LDO), Rocket Pool (RPL), Ankr (ANKR), Marinade (MNDE), and Stader (SD), among others.

2) Liquid Staking to Lower High Deposit and Remove Technical Barriers

Another benefit of liquid staking is the ability to mitigate some of the challenges associated with PoS. For example, with liquid staking, Ethereum holders can participate in staking with a minimum deposit of 0.11 ETH, and without the need to have the required hardware to run a node, thereby removing deposit and technical barriers. Additionally, both holders and validators can deposit additional staking assets into the node infrastructure to earn more fees.

Naturally, it is important to note that holders who use liquid staking services are exposed to the smart contract risks of the service itself, as well as non-protocol risks like slippage in securitization. Additionally, validators are subject to penalties such as the slashing of their staking stake.

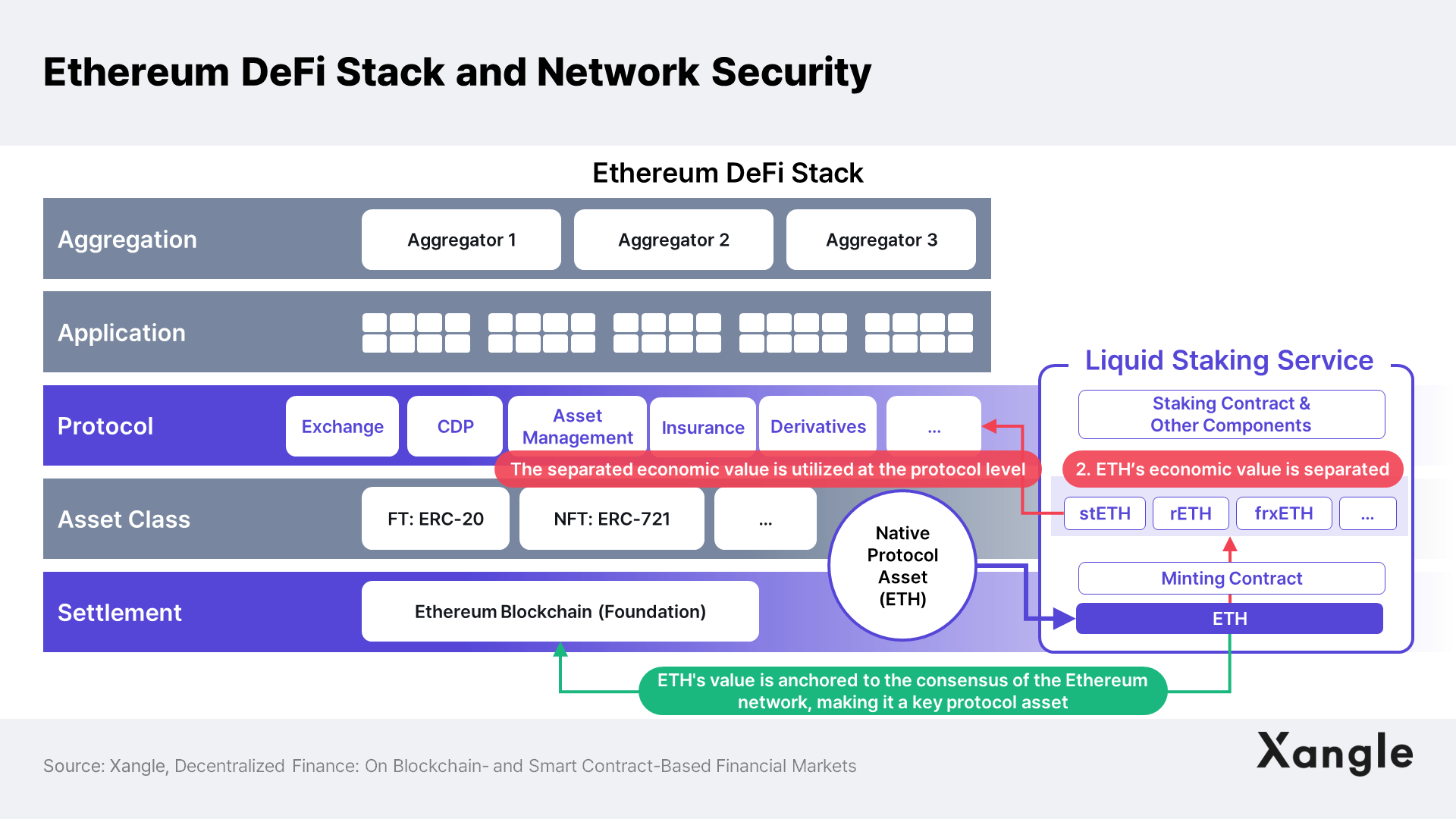

3) Two-in-One Solution: Ensure Network Security and Expansion of DeFi Ecosystem

The intrinsic value of liquid staking that Xangle focuses on is the network perspective value of liquid staking. If there were no liquid staking platform available on Ethereum, the economic value of staking would be reduced compared to high-interest DeFi products, resulting in a lower staking rate. As a result, the network would have a low attack cost for a high total value locked (TVL), which would compromise the network's security and expose it to potential threats such as hacks and Sybil attacks.

Staking assets, such as Ethereum, possess characteristics that make them valuable for consensus and network security. However, they cannot be utilized independently. Liquid staking services resolve the potential conflict between DeFi ecosystems and network security by transforming the relationship into a symbiotic and cooperative one. As a result, liquid staking can be considered a vital component of the network economy, facilitating seamless economic activity within PoS-based networks and providing the necessary security to sustain the ecosystem.

Liquid staking services provide a solution to decouple the trade-off between network security and capital efficiency, making the network both secure and capital efficient. The value of a liquid staking platform in underpinning the economic scaling of a network is undeniable. If you're interested in staking, you can consider using the staking services offered by centralized exchanges (CEX) as a starting point. However, it's important to note the lack of transparency in the CEX staking service and the benefits of "self-custody" in asset management.

5. Closing Thoughts: Importance of Distinguishing Liquid Staking from CEX Staking

The reason we are covering both exchange staking and liquid staking is because they compete for the same benefit for token holders: access to staking rewards. While liquid staking services offer the value of decentralization, transparency, and low fees, exchange staking services provide superior accessibility, a user-friendly Web2 UX, and often higher yields. This advantage over liquid staking platforms is significant for the average user, even if it comes at the cost of transparency.

However, this tradeoff comes with potential risks. CEX staking is a "black box" in which the exchange's database manages the customer's custodial asset information, making it difficult to track whether staked assets are actually participating in the network unless the exchange transparently discloses the assets staked through CEX directly.

CEX staking, however, offers a fixed rate to customers, incentivizing exchanges to invest the remaining assets in instruments with higher expected returns. In essence, CEX staking services operate similarly to traditional banking systems. The lack of transparency in these services was a direct and indirect factor in the recent FTX bank run, highlighting the potential risks associated with CEXs. It is important for cryptocurrency holders to be vigilant and aware of the potential dangers of CEXs.

Blockchain networks rely on staking to promote consensus and economic stability, with the aim of achieving a decentralized and secure system. However, exchange staking services that operate opaquely and lack transparency could potentially pose risks for token holders, turning them into non-transparent crypto-custodial mutual funds. The core value of cryptocurrencies is rooted in transparency, trustlessness, and self-custody, where individuals have complete control over their assets. Therefore, it is crucial that users opt for staking or liquid staking services through their personal wallets, or at least choose exchanges that disclose their circulating supply and collateralization to ensure transparency and accountability.

Appendix

1. Two Categories of Liquid Staking Services: Native and Non-Native

1) Native – Network inherent liquid staking

In the case of native liquid staking, the network itself supports the liquidity of staking assets at the protocol level. Staking asset holders do not have to lock up their tokens or bear the risk of illiquidity.

One prominent example is Tezos, which implements a Liquid Proof-of-Stake (LPoS) consensus mechanism that delegates assets to validators when staking while retaining ownership. In this scenario, the network provides a liquid staking option whereby owners of Tezos' native staking asset, the XTZ token, can earn staking rewards as well as maintain the liquidity of the asset.

This includes some of the features of the "Liquid Staking Hub" that were proposed in Cosmos 2.0's Proposal 82. Although the proposal was ultimately rejected, the concept of liquid staking can be understood as embedded liquid staking as it leverages the Inter-Blockchain Communication (IBC) protocol for cross-chain asset transfers.

2) Non-Native: Liquid Staking by Other Entities on On-Chain

Non-native staking is a type of liquid staking service in which an on-chain smart contract is entrusted with staking assets and issues liquidity tokens for assets under management and custody. This approach is widely adopted by major PoS-based blockchains, including Ethereum, Solana, Polygon, Avalanche, Polkadot, and Near, which offer dApps to facilitate the use of this type of liquid staking service.

Other Related Research Articles