Table of Contents

Intro

1. Status of the Subnet Ecosystem (feat. Xangle Analytics)

1-1. Rapid Growth in the Number of Subnets

1-2. DFK Maintains its Status as the Most Active Subnet

2. Time to Renew Focus on Subnet Ecosystem Growth

2-1. Avalanche Subnet: A New Option for Global Web2 Companies

2-2. Standout Subnets: GREE, SK Planet (UPTN), and Gunzilla Games (gunzilla)

2-3. Anticipating Major Subnet Adoption Announcements in 2H 2023

3. Subnet Expansion Strategy and Future Outlook

3-1. Customized Evergreen Subnet: Catering to Enterprise Needs

3-2. Accelerating Subnet Deployments, but Early Stage for Rapid Service Onboarding

3-3. Leveraging Web2 Enterprise References as a Competitive Advantage

4. Subnet Ecosystem Growth and its Impact on Avalanche Stakeholders

4-1. Enabling Long-Term Value for $AVAX

4-2. Avalanche Network Security Improves as the Cost of Attack Increases

Closing

Intro

"Visualizing the Vision of Avalanche - 1," we delved into the competitive advantages of Avalanche, specifically its blockchain design architecture, and determined that Avalanche possesses the necessary technical foundation to fulfill its vision. Building upon this strong technical advantage, the next step is to expand the subnet ecosystem. In this article, we will provide an overview of the current state of the Avalanche ecosystem, with a particular emphasis on on-chain data. Additionally, we will explore Avalanche’s subnet expansion strategy while providing insights into the upcoming subnets that are set to contribute to Avalanche’s continued development.

1. Status of the Subnet Ecosystem (feat. Xangle Analytics)

1-1. Rapid Growth in the Number of Subnets

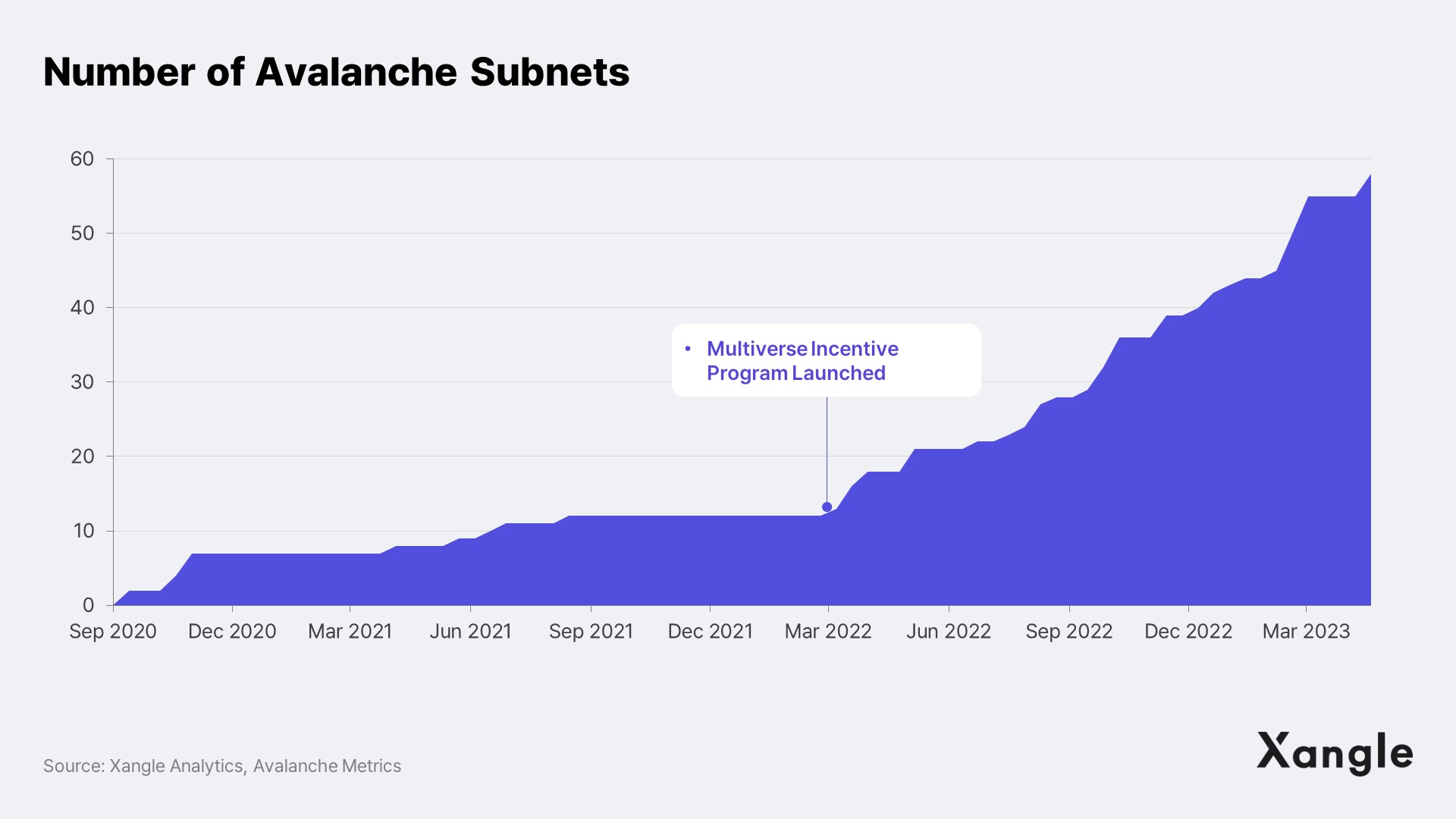

Since the introduction of Multiverse in March 2022, there has been a significant surge in subnet creation, with a total of 58 subnets being created as of May 10. This remarkable growth can be attributed to the implementation of the $290M incentive program aimed at fostering subnet expansion and advancement.

Specifically, among the 58 subnets, 23 (40%) are currently operational with at least one validator, while the remaining 35 (60%) have ceased operations. Out of the 11 subnets for which on-chain data is available, 6 (10%) exhibit substantial levels of transactions and active addresses. These notable subnets include DFK (DeFi Kingdoms), StepNetwork, WrapTag, Dexalot, XANA, and XPLUS (excluding Swimmer Network, which recently announced plans to discontinue operations).

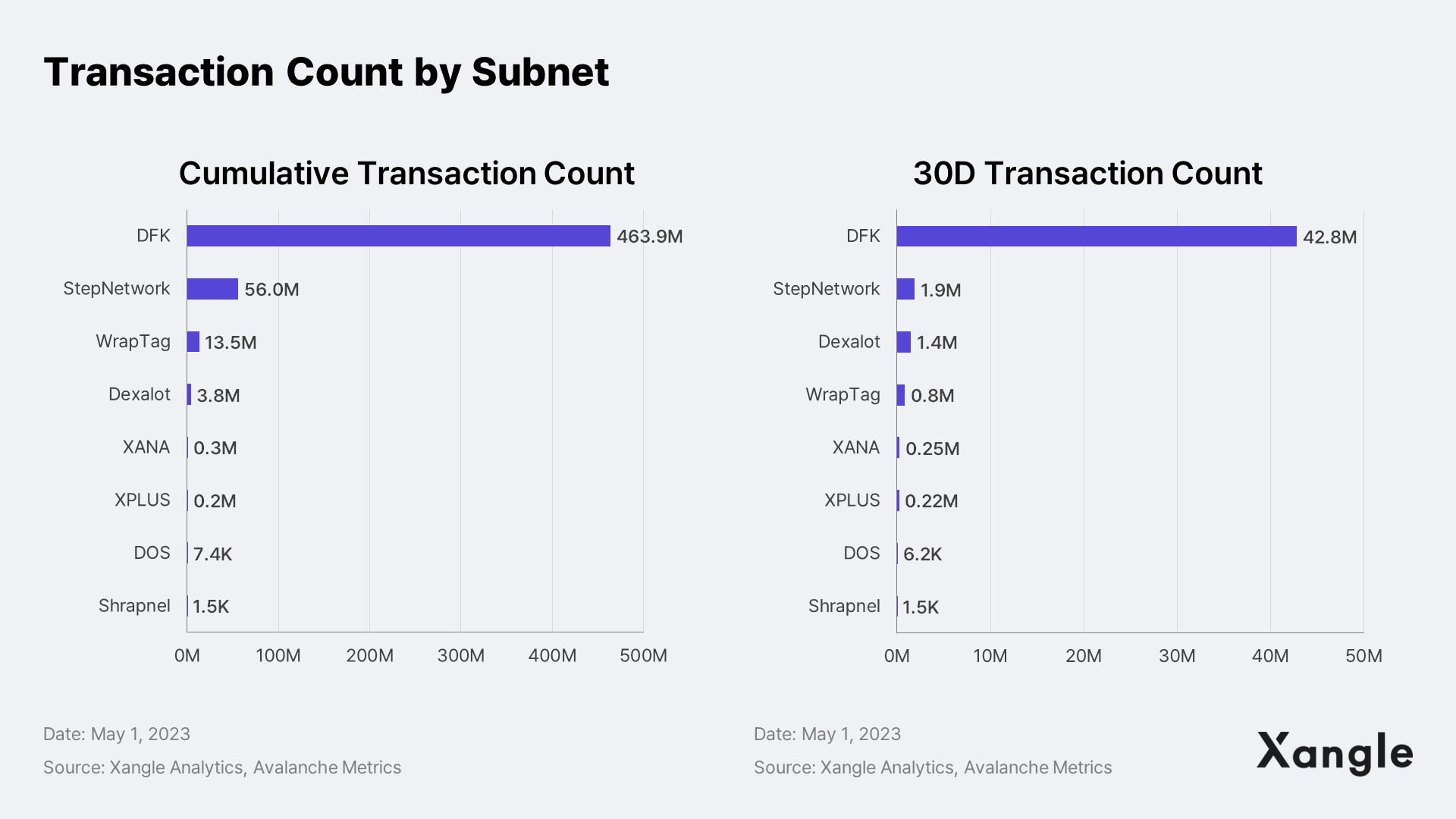

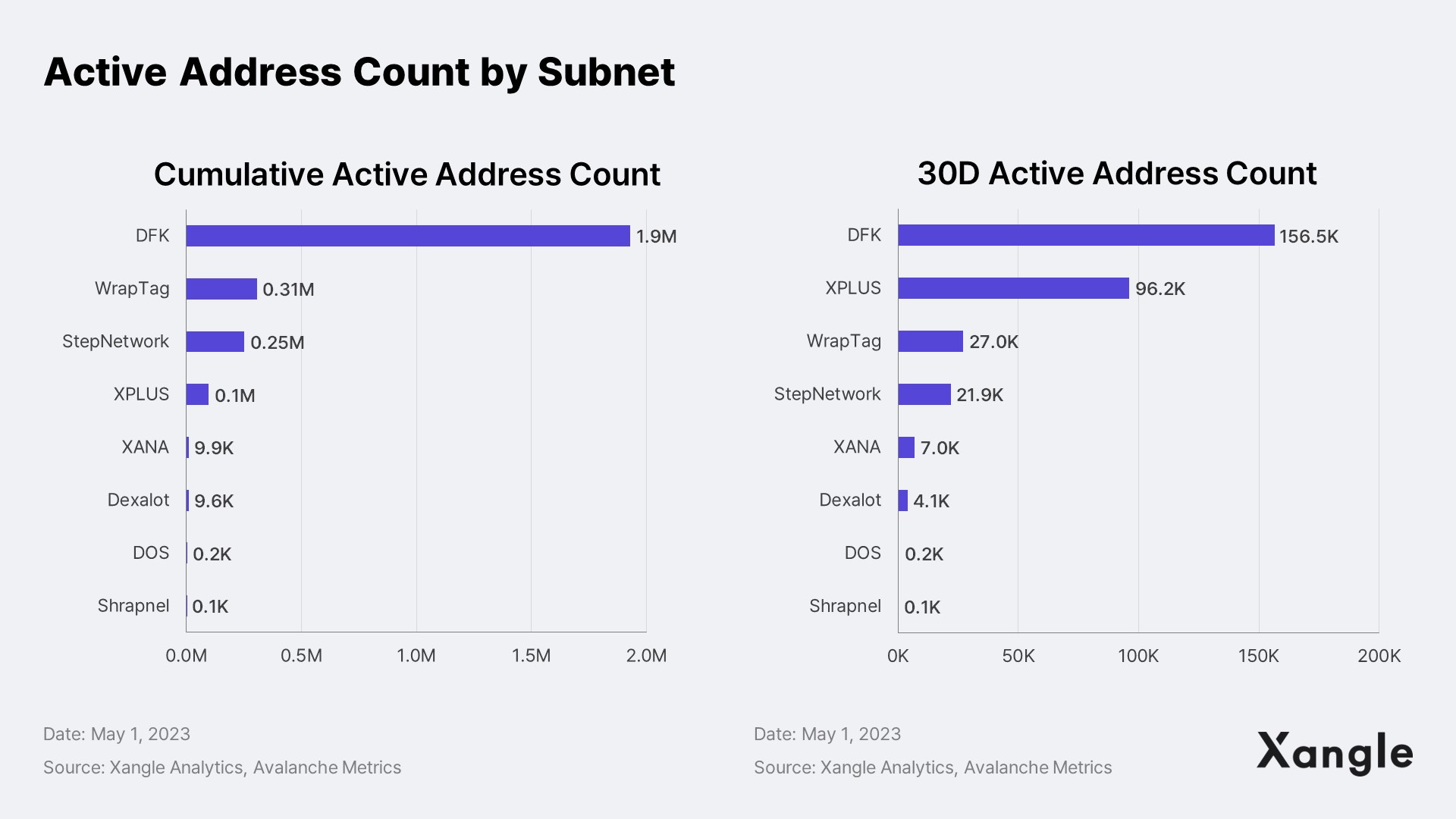

Among the various subnets in the Avalanche ecosystem, DFK has emerged as the clear leader in terms of transaction volume and active addresses. It has consistently maintained its position at the top, followed closely by StepNetwork, WrapTag, and XPLUS, which also exhibit significant transactional activity and user engagement. In the subsequent sections, we will delve into a comprehensive analysis of individual subnet metrics, providing a more in-depth understanding of their respective performance.

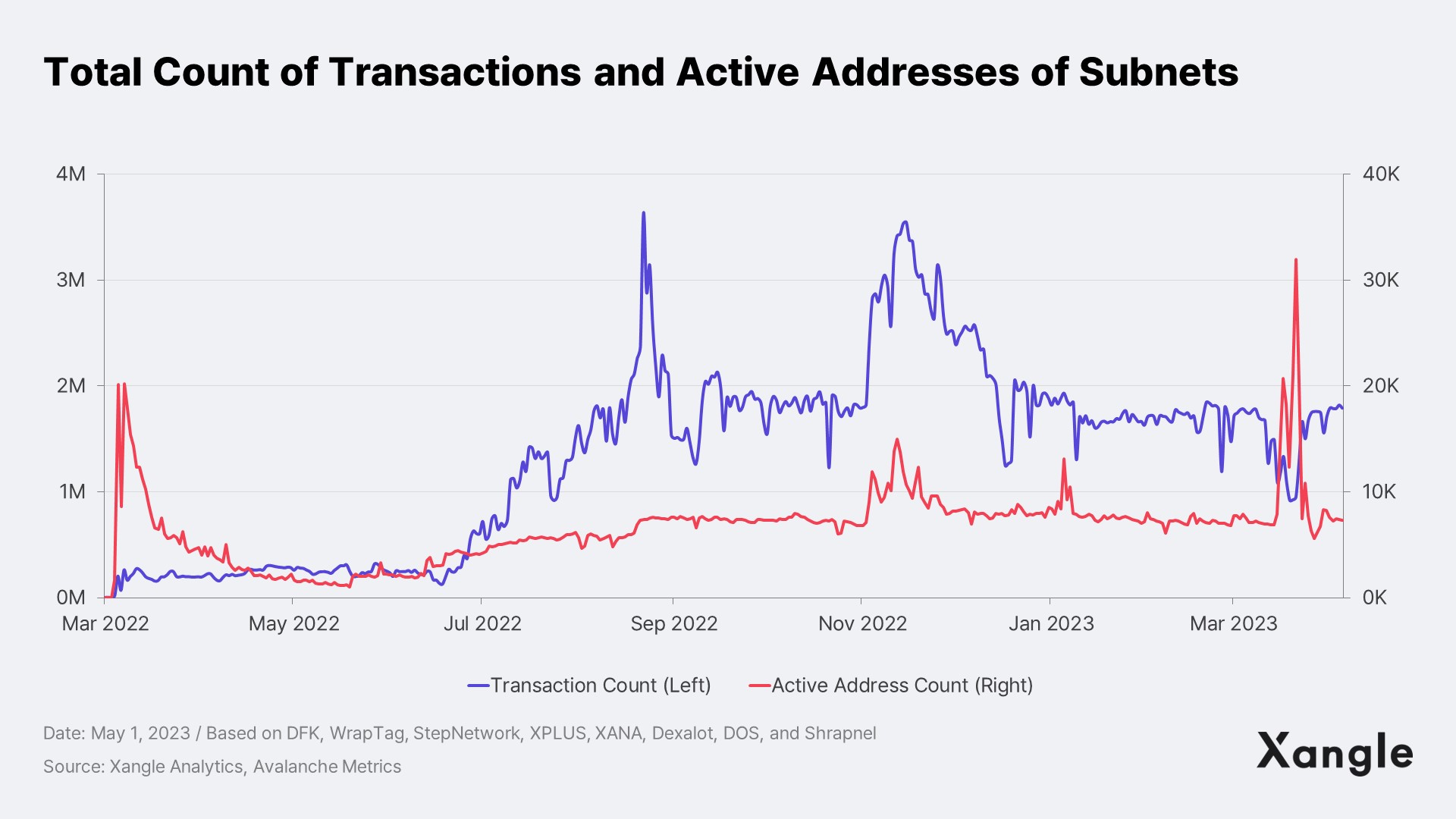

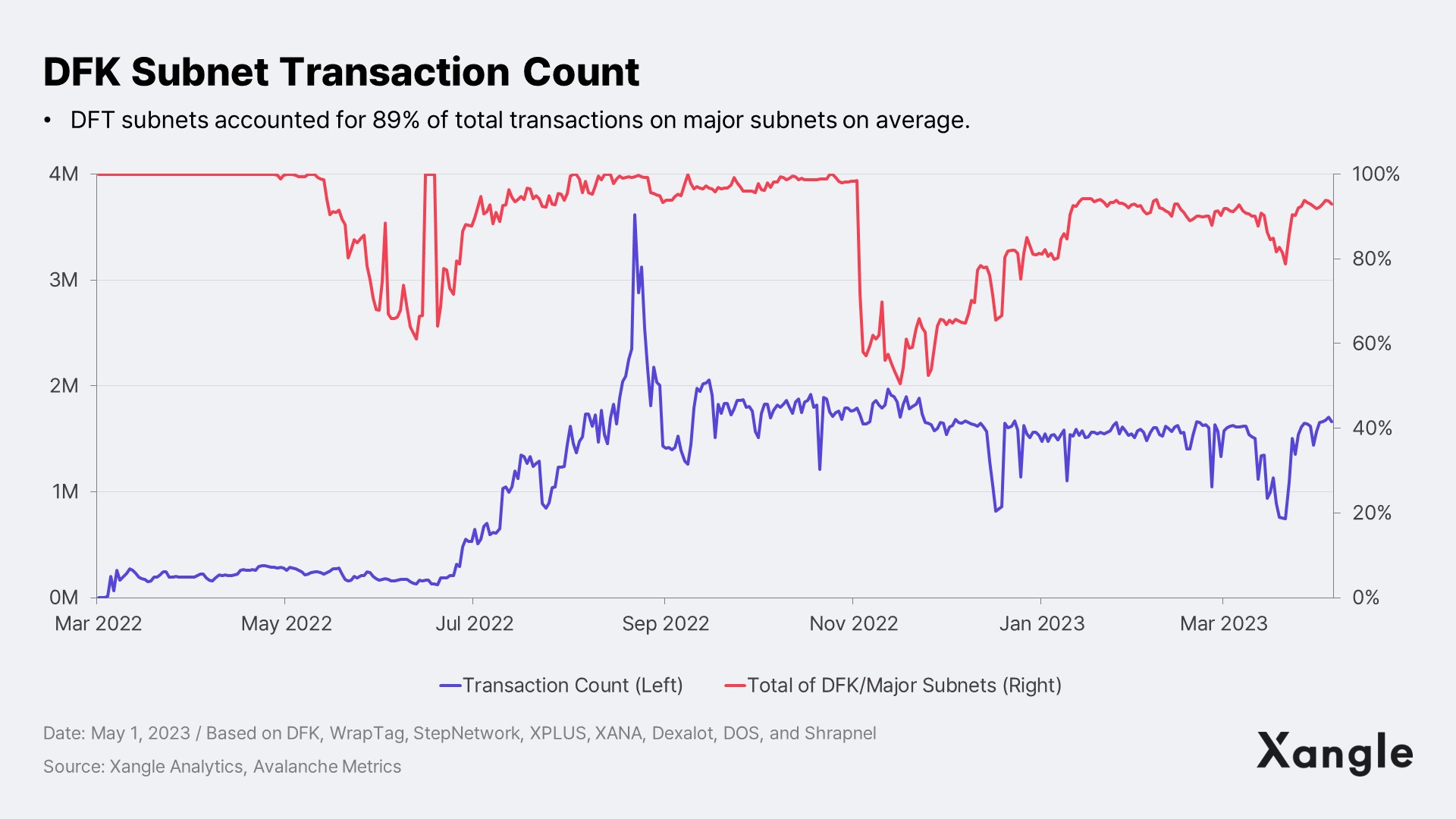

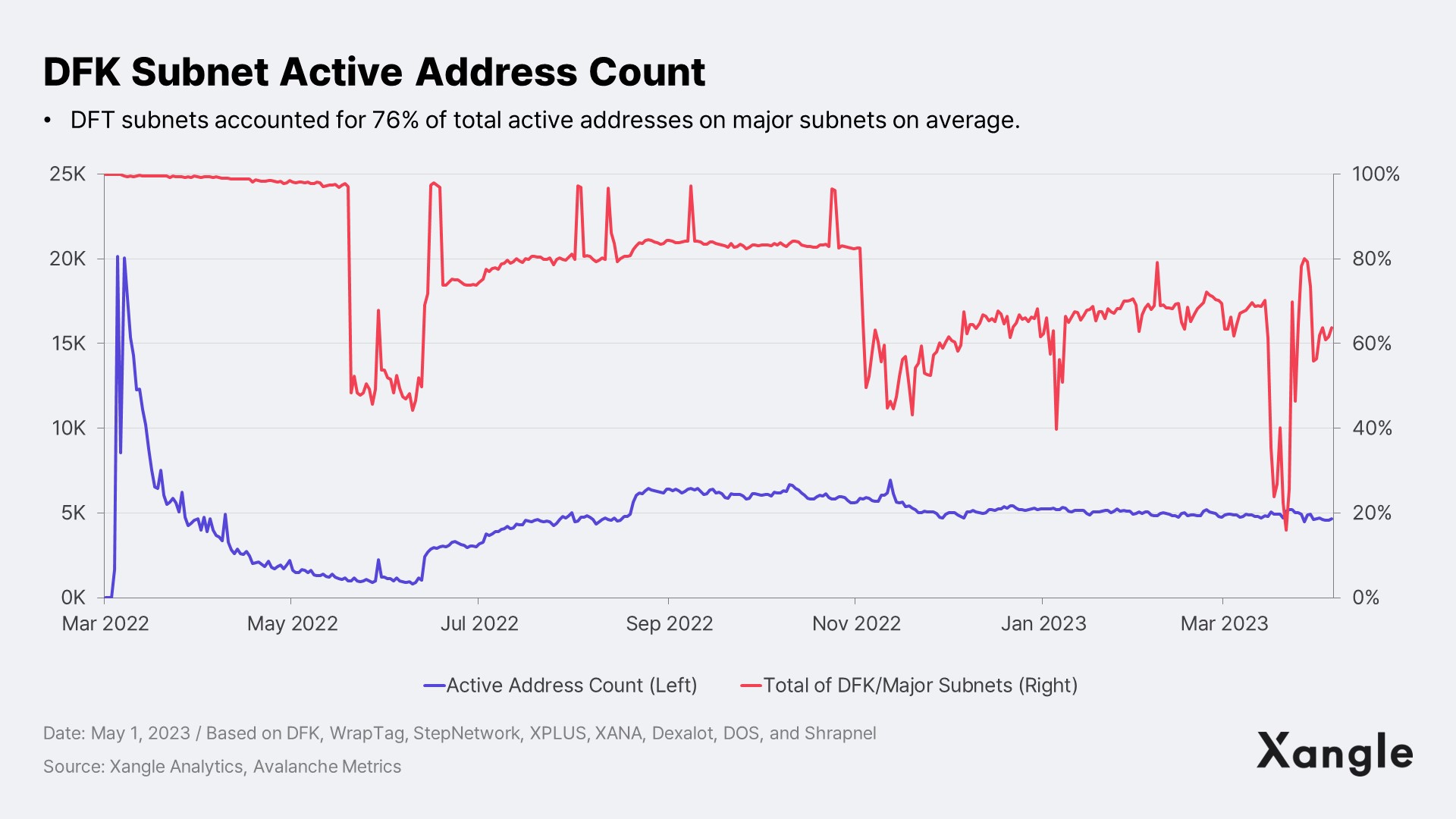

Apart from a temporary surge following the full activation of the DFK subnet in July 2022, the overall transaction count has remained relatively steady at approximately 2M, with active addresses hovering around 10,000. These figures have not seen proportional growth in correlation with the expanding number of subnets, indicating that a majority of transactions and active addresses are concentrated within a limited number of subnets. This dominance of DFK subnets can be observed in the chart provided above.

1-2. DFK Maintains its Status as the Most Active Subnet

DFK stands out as the undisputed leader among the subnets in the Avalanche ecosystem, boasting an impressive number of transactions and active addresses that surpass those of other subnets by a significant margin. Since its introduction in late March 2022, DFK has consistently commanded a substantial portion of the ecosystem's activity, accounting for an astounding 89% of total transactions and 76% of total active addresses. Although there may be occasional fluctuations in DFK's dominance when new apps are launched or events like token airdrops capture temporary user attention, it continues to maintain its stronghold as the primary and most influential subnet within the Avalanche network.

2. Time to Renew Focus on Subnet Ecosystem Growth

2-1. Avalanche Subnet: A New Option for Global Web2 Companies

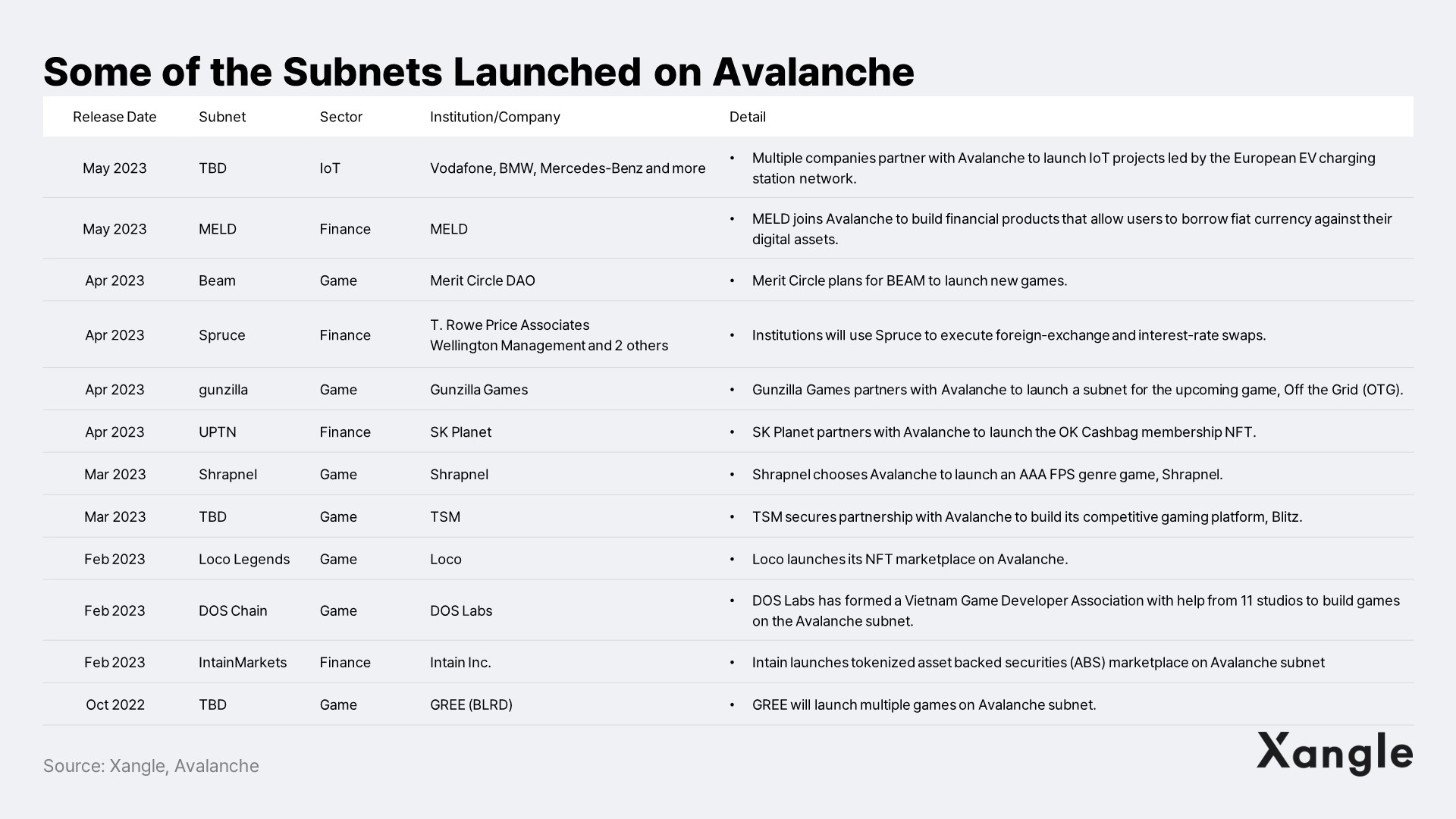

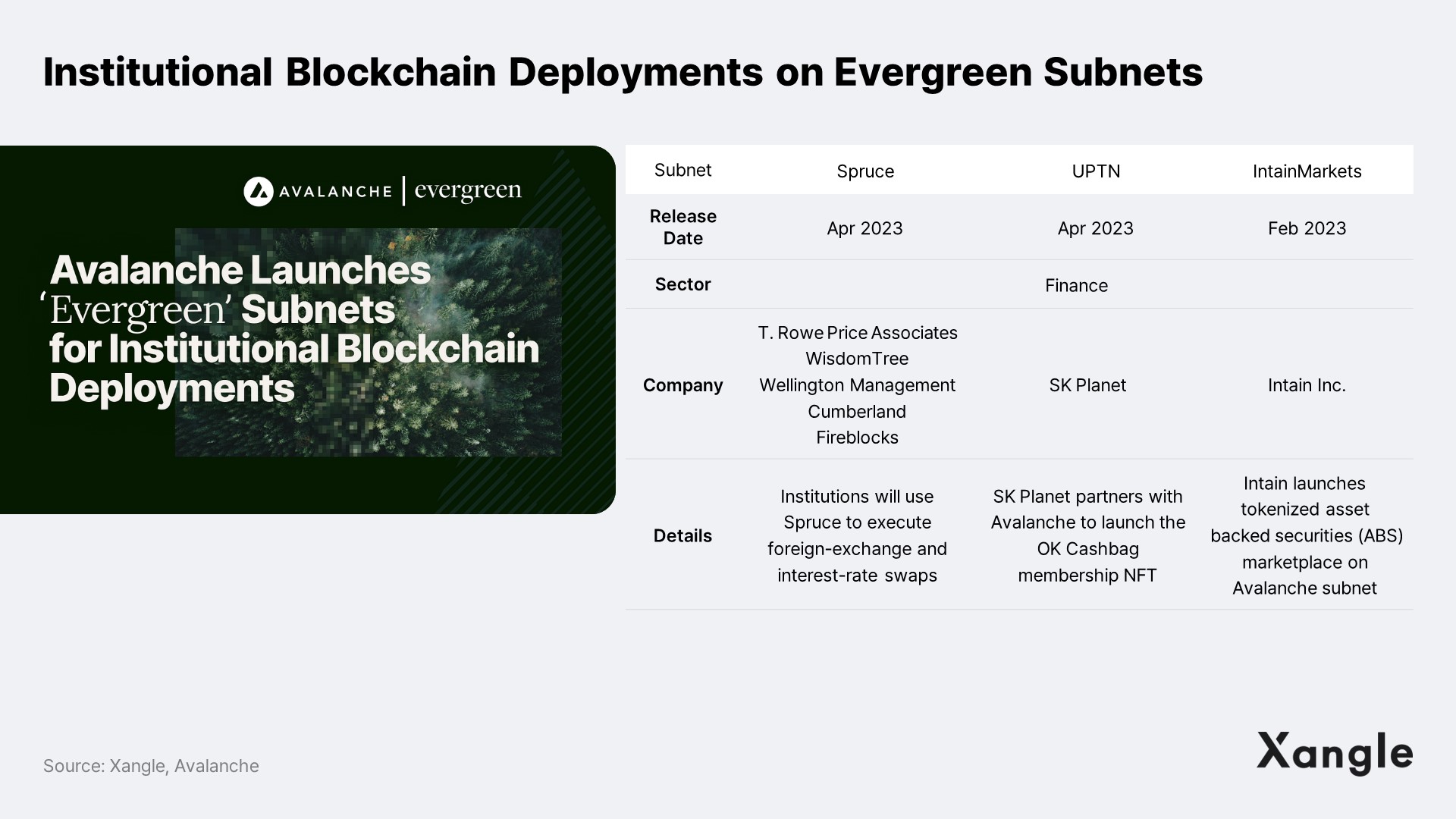

As demonstrated in Section 1, it is evident that DFK stands as the sole activated subnet out of the 58 subnets created thus far. While the relatively slower pace of subnet activations may have dampened market interest in Avalanche, we believe that 1) the recent adoption of subnets by global Web2 enterprises and 2) the promising array of upcoming subnets justify a renewed emphasis on Avalanche. Alongside SK Planet, whose plans to operate its own subnet garnered substantial attention in Korea in April 2023, numerous notable domestic and international companies have already announced their intentions to embrace subnets since the start of this year (refer to the chart below).

Based on the data presented in the table above, it is evident that Subnet has garnered significant popularity, particularly within the gaming and financial sectors. This can be attributed to Subnet's exceptional performance, making it an optimal choice for these industries.Their exceptional performance makes them well-suited for gaming, which demands swift data processing for a substantial user base, as well as for finance, where rapid transaction execution is crucial to providing users with a seamless gaming and financial services experience.

2-2. Standout Subnets: GREE, SK Planet (UPTN), and Gunzilla Games (gunzilla)

One of the most highly anticipated subnets in the gaming realm is GREE's subnet (subnet name to be determined). GREE is a significant Japanese mobile game company listed on the Tokyo Stock Exchange, recognized for popular titles such as Heaven Burns Red and One Punch Man. With a monthly active user base (MAU) of 30M, GREE's revenue is comparable in scale to South Korea's Com2uS for the most recent fiscal year. The company has unveiled plans to launch an NFT-centric blockchain game on its dedicated subnet within the upcoming year. While specific details have yet to be disclosed, the activation of this subnet for future game releases seems highly likely, given GREE's global IP portfolio, development expertise, and expansive user base.

In the financial sector, one particularly notable subnet is SK Planet's UPTN subnet. This subnet will be responsible for issuing NFTs for SK Planet's integrated mileage service, OK Cashbag. Although OK Cashbag's member base is currently limited to Korea, it already encompasses a substantial 20M members. We believe that the service holds significant expansion potential, especially considering its ability to collaborate with domestic and international partners, as well as group companies, to onboard diverse content and services in the future.

Additionally, Gunzilla Games' highly anticipated cyberpunk battle royale game, Off The Grid, scheduled for release this year, is expected to be a AAA title. The game features Neill Blomkamp, renowned director of District 9 and Elysium, as the screenwriter. Built on the powerful Unreal Engine 5, it offers a gaming experience of exceptional quality that rivals leading Web2 games in the industry.

Off The Grid Gameplay | Source: Off The Grid

Furthermore, a notable consortium of prominent U.S. asset management companies, such as T. Rowe Price Associates, Wellington Management, and WisdomTree, has established the Spruce subnet within the Avalanche network. The primary objective of the Spruce subnet is to facilitate on-chain trading of diverse assets, starting with foreign exchange and interest rate swaps. As the subnet matures, it plans to expand its offerings to encompass tokenized equity and debt issuance, trading, and fund management. Although currently in the early stages of operation within a testnet environment, the adoption of the Avalanche subnet by traditional financial institutions for on-chain financial transactions is highly significant. This development highlights the growing interest and recognition of Avalanche as a reliable platform for secure and efficient asset trading and management.

2-3. Anticipating Major Subnet Adoption Announcements in 2H 2023

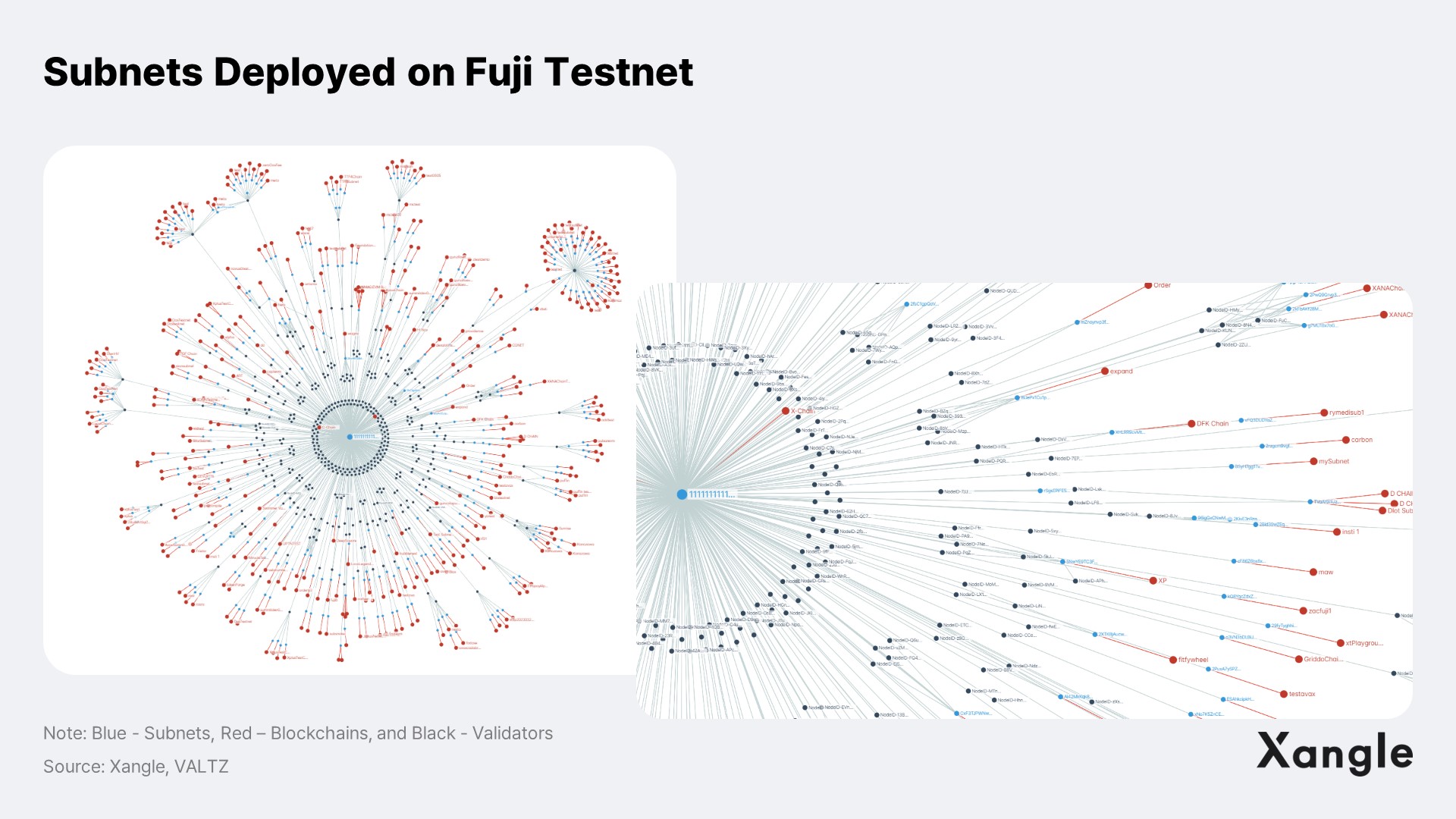

In addition to the growing adoption of subnets by major domestic and international companies, a substantial number of subnets are scheduled to be launched, indicating an imminent expansion of the subnet ecosystem. Presently, a total of 1,783 subnets have been deployed and are undergoing testing on the Fuji Testnet. Many of these subnets are expected to transition to the mainnet in due course. Out of the deployed subnets on the Fuji Testnet, 395 (22%) have validators, showcasing the progress and engagement within the subnet deployment process.

Supporting this outlook, John Wu, President of Ava Labs, previously stated this year that a minimum of 100 additional subnets are anticipated to be publicly launched by year-end. With approximately 10 subnets already introduced thus far, it is highly probable that dozens more will emerge during the remaining months. Notably, the launched subnets thus far have been associated with significant Web2 companies or Web3 projects as operators, indicating a likelihood for similarly sized entities to operate the upcoming subnets.

Furthermore, Olivia Song, BD of Ava Labs Korea, expressed earlier this year that "several substantial domestic partnerships are progressing, with the intention of announcing them in the first half of the year." She emphasized that the disclosed partnerships would showcase advancements in technology and business beyond mere written Memorandum of Understanding (MOU). The recent announcement of SK Planet's subnet and OK Cashbag NFT issuance in April 2023 aligns with this expectation. It is worth highlighting that news regarding the adoption of subnets by Korean companies on par with SK Planet is anticipated in the near future.

3. Subnet Expansion Strategy and Future Outlook

3-1. Customized Evergreen Subnet: Catering to Enterprise Needs

Examining the current state of the Avalanche Subnet, we observe several noteworthy aspects. Notably, subnet operators are predominantly traditional Web2 companies rather than Web3 native projects, particularly within the gaming and financial sectors. High-performance subnets hold significant appeal for Web2 companies that are accustomed to centralized systems as they are particularly drawn to the level of control they can have over their services. Additionally, given the time-sensitive nature of gaming financial services, Web2 companies would find subnets’ high performance appealing.

With the growing trend of Web2 companies adopting subnets, Avalanche has been diligently enhancing its features, including HyperSDK and AWM, to facilitate convenience and efficiency. Undoubtedly, these advancements significantly improve development ease, service safety, and operational efficiency. However, for Web2 companies lacking expertise in blockchain and related fields, the task of designing, building, operating, and maintaining a subnet can still be daunting. This significant undertaking can pose a substantial entry barrier for Web2 companies contemplating subnet adoption.

In April, Avalanche introduced the Evergreen Subnet in direct response to the requirements of Web2 enterprises. Designed specifically for enterprise use, Evergreen functions as a comprehensive cloud service that encompasses all aspects of subnet operation, ranging from design and construction to ongoing management. Its primary objective is to facilitate the deployment of tailored subnets that align with the unique needs of each enterprise. While there may not be significant variations at the protocol level compared to existing subnets, Evergreen provides essential solutions and management services essential for constructing a chain with parameters customized to meet each company's specific requirements. For instance, if a company faces regulatory restrictions that hinder the issuance of its own token, the Evergreen Subnet can integrate Avalanche's solution, enabling transaction processing without gas fees, with the management aspect handled by Avalanche. This empowers companies to concentrate on developing and operating their services without the need for additional investments in chain design and management resources.

3-2. Accelerating Subnet Deployments, but Early Stage for Rapid Service Onboarding

We anticipate Avalanche will effortlessly draw new customers from diverse industries, thanks to its impressive track record with major domestic and international Web2 companies. Noteworthy references from industry leaders like GREE, SK Planet, T. Rowe Price Associates, Wellington Management, BMW, IBM, and others will undoubtedly expedite the expansion of the subnet ecosystem. These partnerships will contribute to the expedited rollout of subnets. Given the substantial user base and content capabilities of Web2 companies, the services they introduce possess considerable growth potential. As more subnets, driven by Web2 enterprises, emerge, we anticipate witnessing an expansion of the Avalanche ecosystem beyond DFK, with numerous subnets actively supporting its development.

However, it is important to note that the process of onboarding and activating services on subnets will require a considerable amount of time. Many of the launched subnets are focused on gaming, a sector that typically necessitates two to three years of development before reaching fruition. Shrapnel, renowned for its high-quality AAA games, is presently in Phase 1 of its five-phase development roadmap. GREE and Gunzilla Games are also targeting a release later this year, but specific launch dates have yet to be confirmed. Given the anticipated prominence of gaming-focused subnets in the future, it is premature to expect rapid service onboarding that aligns with immediate expectations. Similarly, the financial sector is currently in the testing phase of integrating blockchain technology into its services. It will take some time before these services are available to the public and commercially viable.

3-3. Leveraging Web2 Enterprise References as a Competitive AdvantageAvalanche's continuous efforts to cultivate its Web2 enterprise references offer a distinct competitive advantage. For Web2 companies, minimizing market entry risks is of utmost importance, often requiring them to select blockchains with robust use cases unless a clear technical advantage is evident. The accumulation of these references has played a pivotal role in Avalanche's recent expansion beyond its existing customer base in the gaming and financial sectors, extending into traditional industries like automotive (BMW, Mercedes-Benz), defense (Thales), and semiconductors (IBM). Notably, recent developments such as Mastercard partnering with Avalanche to establish cross-border digital asset transfer standards and Alibaba Cloud launching an enterprise metaverse platform on the Avalanche blockchain can be attributed to these references. Drawing inspiration from Polygon's success in diversifying its customer base with brands like Nike, Meta, and Nexon, primarily driven by its early collaborations with Disney and Starbucks, we anticipate that Avalanche will be increasingly favored by companies spanning various industries in the future.

The accelerated mass adoption of Web3 will be driven by the entry of Web2 companies armed with significant capital, loyal user bases, and established services and operational expertise. In the forthcoming landscape, the market is expected to reconfigure itself around blockchains that have successfully onboarded Web2 enterprise clients, specifically those few blockchains that were quick to capture customers during the Web2-to-Web3 transition and rapidly expand their customer base. These leading blockchains may maintain their dominance for a considerable period until a disruptive technology ushers in a transformative industry shift. In this regard, Avalanche's ability to establish references across diverse industries and amass a large customer base positions it as a potential competitive advantage in the future.

4. Subnet Ecosystem Growth and its Impact on Avalanche Stakeholders

4-1. Enabling Long-Term Value for $AVAX

How does the expansion of the Subnet ecosystem contribute to the interests of various stakeholders within the Avalanche network? It may be argued that the growth of subnets does not directly impact the value of $AVAX since subnets can utilize their native tokens for transaction fees instead of $AVAX. Notably, subnets such as DFK, StepNetwork, and the soon-to-be discontinued Swimmer Network utilize their respective tokens for gas fees, rather than relying on $AVAX. Consequently, regardless of the number of subnets created, the demand for $AVAX is unlikely to experience significant changes unless $AVAX is actively employed as a gas fee currency.

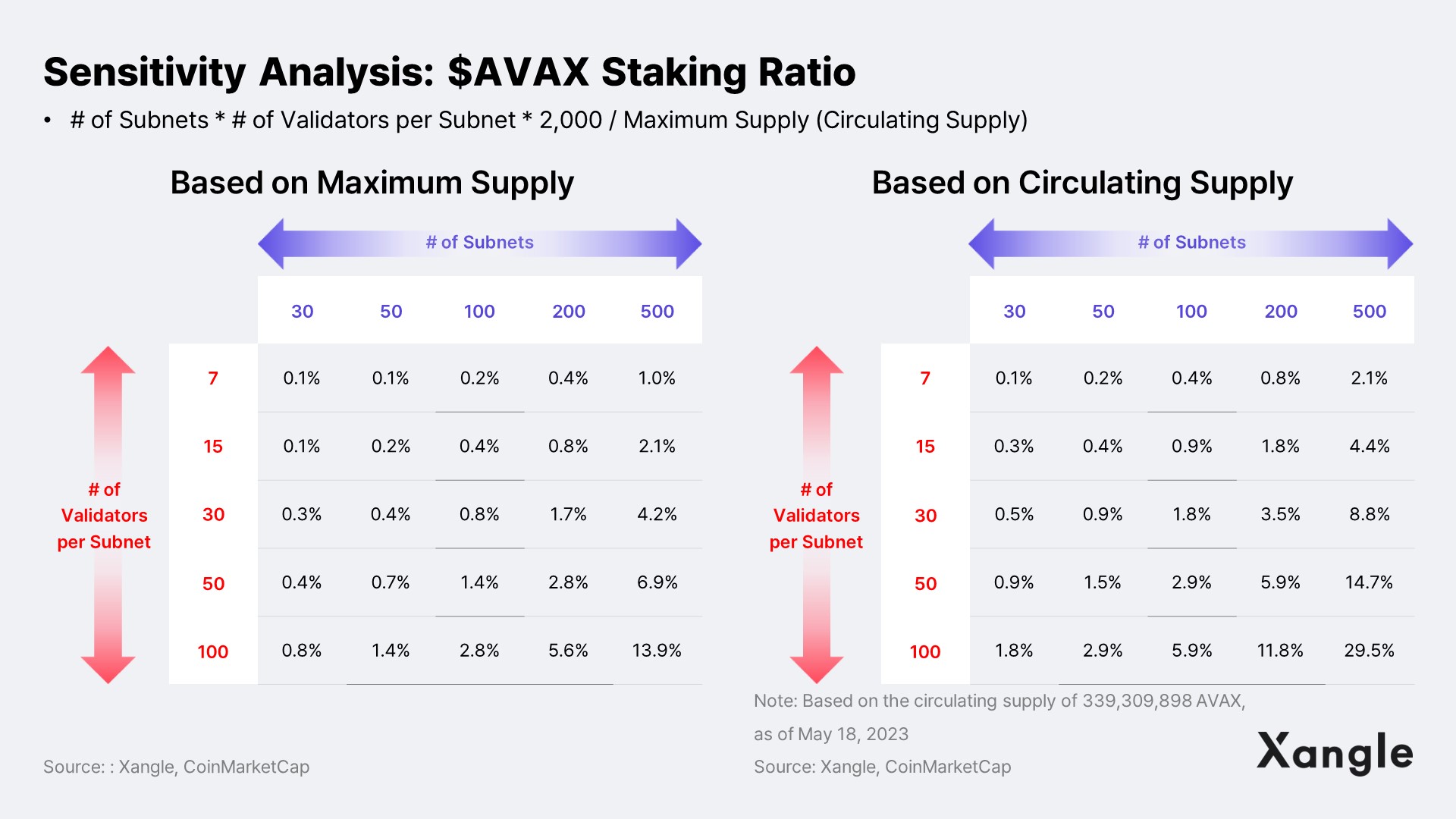

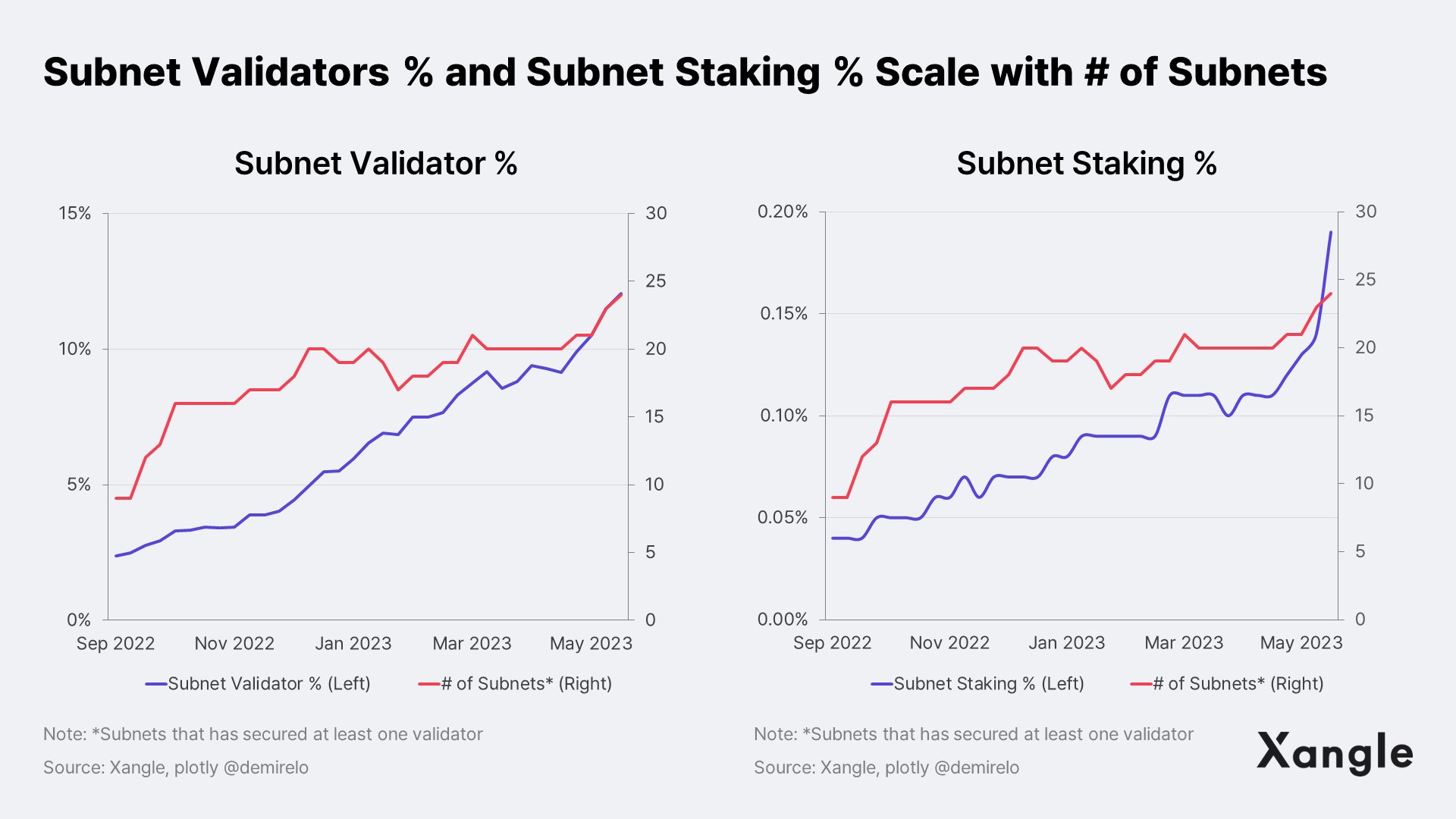

However, it is important to note that subnets require validators, and each validator must stake a minimum of 2,000 $AVAX. The analysis in the chart below examines the impact of changes in the number of subnets and the number of validators per subnet on the $AVAX staking rate. Currently, the staking volume of subnet validators represents less than 0.1% of the circulating supply and maximum supply. Even with the launch of 100 subnets in line with the roadmap within the year, assuming an average of 7* validators per subnet, the staking rate would only increase to 0.4% of the circulating supply and 0.2% of the maximum supply. In the short term, the staking volume of subnet validators has a minimal effect on the value of $AVAX. However, looking ahead, as the number of subnets increases and the number of validators per subnet rises with the transition from the current permissioned structure to the permissionless structure of Elastic Subnet, the staking rate can see significant growth. For instance, if 500 subnets were created in the future, each with 100 validators, the staking rate would reach 29.5% of the current circulating supply and 13.9% of the maximum supply. While $AVAX may not necessarily be used for gas, the expansion of the subnet ecosystem to such an extent could lead to a reduction in $AVAX circulation and potentially drive an increase in token value.

* Average number of validators on operating subnets

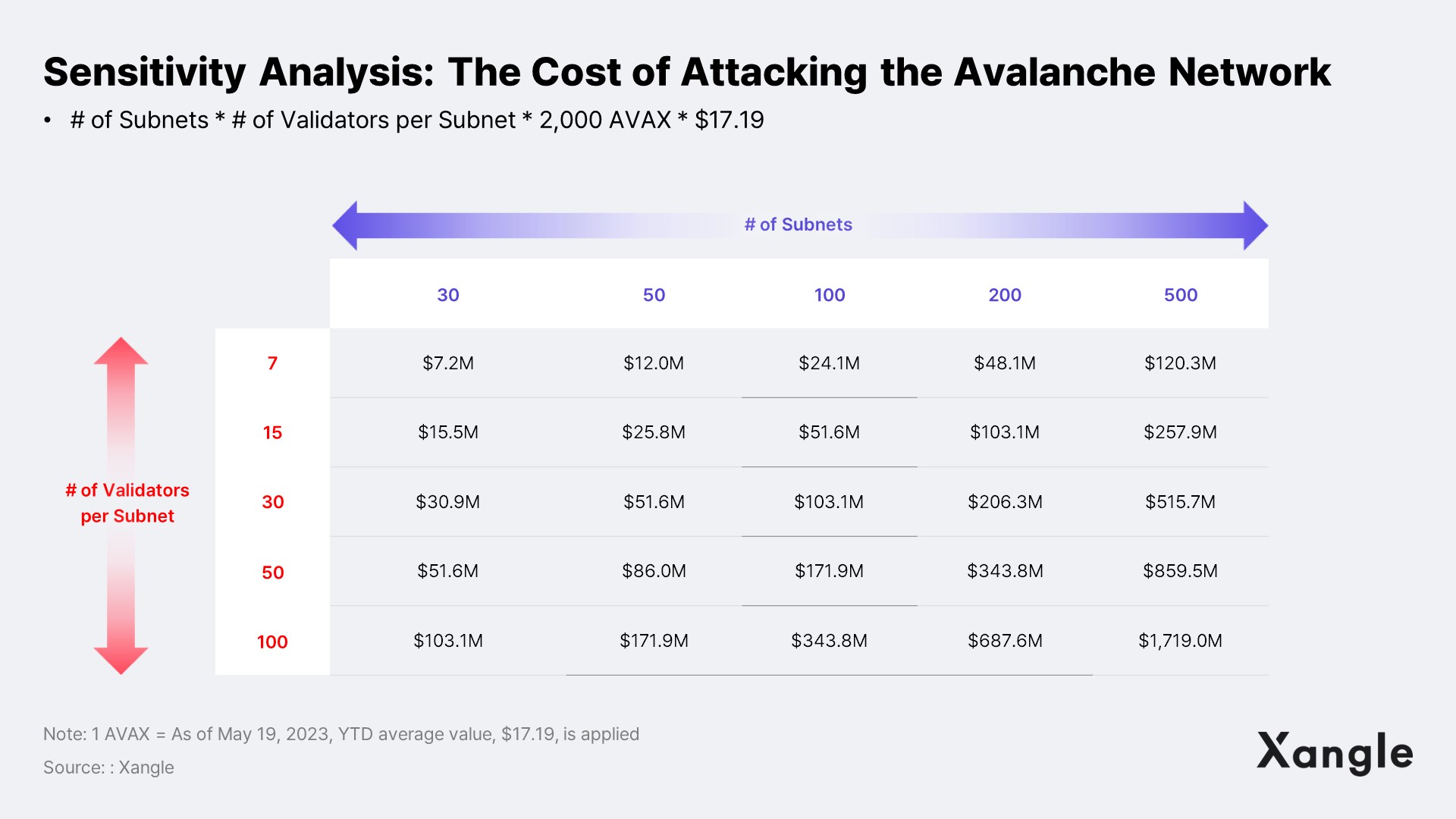

4-2. Avalanche Network Security Improves as the Cost of Attack Increases

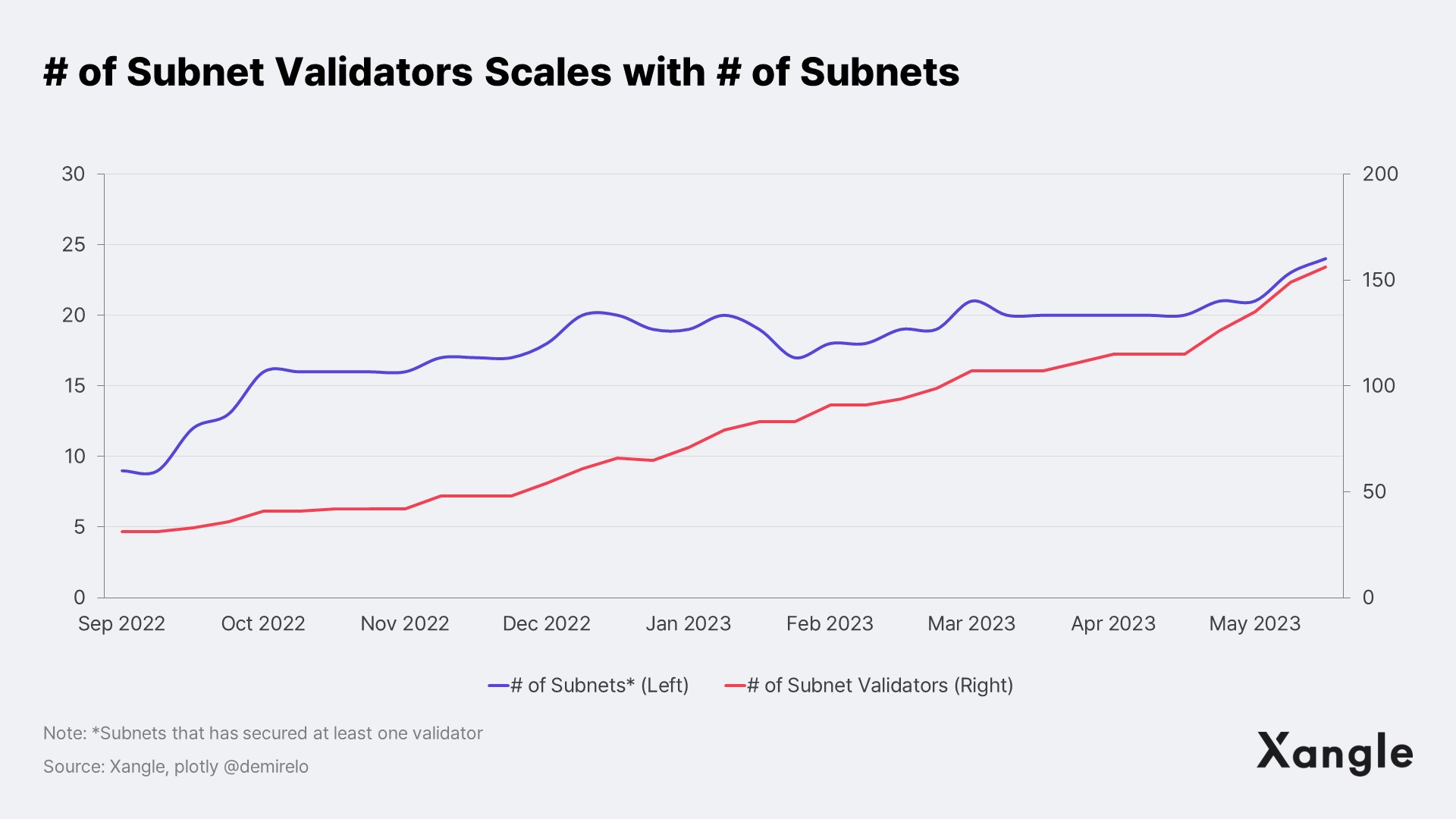

The expansion of the subnet ecosystem can lead to improved security within the Avalanche network. Subnet validators play a crucial role in safeguarding both the subnets and the primary networks (P-chain, X-chain, C-chain). As the number of subnets increases, so does the number of validators and the amount of $AVAX staked, resulting in heightened security measures for the entire Avalanche network.

The chart provided below examines how changes in the number of subnets and the number of validators per subnet impact the cost of attacking the Avalanche Network. Based on the analysis, with 7* validators per subnet and the release of 100 subnets within the year as per the roadmap, the additional attack cost would amount to $24.1M. Looking ahead, in the long term, as the number of subnets and validators per subnet continues to increase, the cost of launching an attack grows exponentially. For instance, if there are 500 subnets with 100 validators per subnet, the added cost of attacking the Avalanche network would soar to a staggering $1.72B. This underscores the importance of the expanding subnet ecosystem, which contributes to the enhanced security of the network, benefiting all participants within the Avalanche ecosystem.

* Average number of validators on operating subnets

** The $AVAX price per unit used to calculate the cost of attacking the Avalanche network is the YTD average value of $17.19 as of May 19, 2023, but is subject to change based on market conditions.

Closing

Despite the slower-than-expected pace of subnet activations, Avalanche is gaining traction as a viable option for global Web2 enterprises. The upcoming months hold significant potential for widespread subnet adoption. Leveraging its Web2-oriented references, Avalanche is well-positioned to attract customers from diverse industries, giving it a competitive edge as Web2 companies venture into the Web3 market and mass adoption gains momentum. It is crucial to shift our focus towards nurturing the growth of the subnet ecosystem, as it is projected to maintain dominance in the industry for the foreseeable future, barring any disruptive technological advancements.