Translated by LC

Table of Contents

1. 19 DeFi Exchange-Related Tokens Listed on Major Korean Exchanges

2. Major DeFi Exchange Tokens

3. DeFi Exchange XCR Rating Scale

A Guide for Cryptocurrency Enthusiasts on Navigating the Web3 Universe

The growth of Korea's crypto exchanges has been remarkable, with the top five exchanges in Korea listing and trading around 400 coins as of the end of 2022. Coins, including representative cryptocurrencies such as Bitcoin and Ethereum, are traded daily with transactions ranging from tens of millions to hundreds of billions of Korean won. However, it is crucial to consider how many investors truly understand the purpose and utility of each asset, as well as how to trade them effectively. Moreover, rumors often drive the prices of coins that are poorly managed or underutilized.

Xangle is dedicated to evaluating the sustainability and potential mass adoption of various blockchain projects and cryptocurrencies by analyzing their whitepapers and project information. Our process involves assessing the coins' utility and usability continually. We strive to make this information available to investors in Korea and contribute to the maturation of the cryptocurrency market.

As part of our ongoing mission, Xangle will be launching a series of "A Guide to Cryptocurrencies Listed on Korean Exchange Platforms." This guide will categorize coins listed on major exchanges in Korea based on their utility and showcase their goals and current status. Our primary goal is to encourage investors in Korea to invest in these crypto assets based on their true potential and actual value rather than being swayed by rumors and speculation. The Xangle platform aims to provide easy access to information and real value related to cryptocurrencies.

A Map of Cryptocurrencies Listed on Korean Exchange Platforms 2. Decentralized Exchange

In the blockchain ecosystem, there are various projects that offer financial services, including the Decentralized Exchange (DEX) which functions as a marketplace for buying and selling cryptocurrencies. DEXs serve as the backbone of the asset exchange infrastructure in the blockchain ecosystem and are usually the first service to be introduced on mainnets.

DEXs have seen explosive growth alongside the DeFi (Decentralized Finance) boom that began in June 2020. Trading volumes on DEXs have also increased significantly, with $149.5B in 2021, up more than tenfold from the previous year. While trading volumes decreased in 2022 due to macroeconomic instability and various issues, trading volumes in January 2023 still reached $61B, indicating that transactions on DEXs remain robust.

1. 19 DeFi Exchange-Related Tokens Listed on Major Korean Exchanges

As DeFi services have gained mainstream adoption in the cryptocurrency market, there are several DEX-related tokens listed on the five major Korean exchanges - Upbit, Bithumb, Coinone, Korbit, and Gopax. Among them, the majority of the tokens (15 out of 19) are Automated Market Maker (AMM) projects, while two are order book projects and two are aggregators. This is because AMM projects are currently the mainstream in DEXs.

Furthermore, it is worth noting that most DeFi services were initially developed on Ethereum. As a result, more than half of the listed projects (12 out of 19) are Ethereum-based DEXs, including those built on Ethereum Layer 2 solutions.

The Advantages and Disadvantages of DEXs

One significant advantage of DEXs is their transparency, which is achieved through the use of open-source technology known as smart contracts. All transactions are recorded on the blockchain, providing a public ledger accessible to anyone. Additionally, DEXs support peer-to-peer (P2P) transactions without intermediaries, enabling users to conduct transactions directly from their personal wallets without the need to trust third parties with their funds. These characteristics make DEXs particularly appealing to investors seeking greater transparency and control over their assets, as centralized exchanges have faced issues related to customer holdings and transaction history transparency.

In contrast, DEXs have some drawbacks compared to centralized exchanges. Because transactions on DEXs are recorded on the blockchain, they may experience slower transaction speeds and higher transaction fees than centralized exchanges that rely on a central server. Additionally, centralized exchanges often provide user interfaces that resemble those of traditional financial institutions, making them more familiar and accessible to investors. In contrast, DEXs may offer a less user-friendly experience. Moreover, while centralized exchanges allow digital assets to be traded against fiat currencies, converting fiat currencies on DEXs is not as straightforward.

Different Utilities of DEX Tokens

1) Incentivizing Liquidity Providers

Decentralized exchange tokens have several utilities, one of which is rewarding users for providing liquidity. Liquidity is critical for an exchange to operate smoothly and maintain low slippage rates, making it a key priority. Moreover, liquidity attracts more liquidity, creating a positive network effect. To encourage users to provide liquidity, DEXs offer a decentralized exchange token as a reward in addition to trading fees.

2) Allowing Token Holders to Participate in Platform Governance and Vote on Important Decisions

Another utility of decentralized exchange tokens is the ability for token holders to participate in governance and vote on key decisions that impact the platform's direction and ecosystem. Typically, token holders with larger holdings have more voting power.

Additionally, DEXs are expanding the token utility by incentivizing users to stake their tokens on the platform. This process reduces the available supply of tokens in circulation while also providing additional liquidity rewards. For instance, Curve allows CRV token holders to lock up their tokens, resulting in up to a 2.5x increase in CRV rewards for providing liquidity.

Types of DEXs

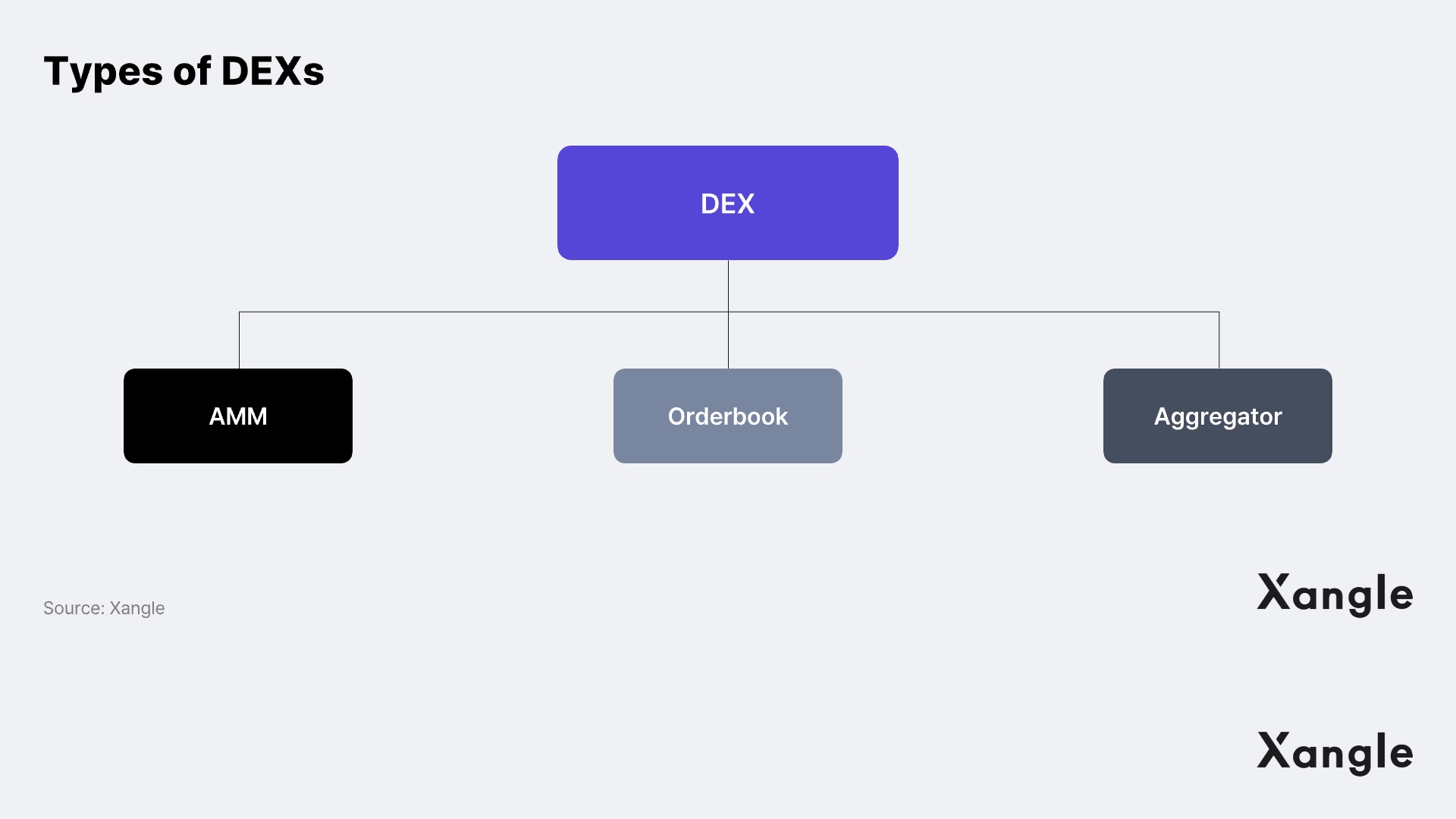

DEXs are categorized into two main types: Automated Market Makers (AMMs) and Order books. AMMs operate differently from Order books, and both have their unique benefits and drawbacks. Moreover, there are aggregators that combine trading conditions from multiple DEXs to provide optimal trading opportunities.

1) Automated Market Maker (AMM)

AMM is a trading method that relies on mathematical algorithms to compute asset prices automatically. Instead of engaging in trades between traders or market makers, users exchange assets by means of a smart contract that draws on a liquidity pool consisting of a token pair (e.g., USDC-ETH). In this context, a liquidity pool is a pool of digital assets that are tied to a smart contract. Usually, projects allocate a portion of the transaction fees to a liquidity provider to ensure a sufficient liquidity pool, which is also known as liquidity mining.

When a trade order is placed, the AMM computes the trade price and automatically exchanges the desired asset from the liquidity pool based on the smart contract. On DEXs that rely on AMM, the price is determined by the proportion of tokens in the liquidity pool, which enables buyers to purchase tokens even when liquidity is low. However, this can result in a slippage problem where buyers pay a higher price than the market price due to insufficient liquidity.

AMMs typically function as either CPMM (Constant Product Market Maker) or CSMM (Constant Sum Market Maker). In the case of CPMM, assets are exchanged when the equation x * y = k (where k is a constant) is satisfied, while in the case of CSMM, assets are exchanged when the equation x + y = k is satisfied. Popular DEXs that employ the CPMM function include Uniswap, SushiSwap, and PancakeSwap. Curve, on the other hand, optimizes the advantages of both CPMM and CSMM models to cater to stablecoin trading.

AMMs have some associated risks, such as impermanent loss. This happens when the price of an asset changes after it's deposited into the liquidity pool, causing its dollar value to decrease when withdrawn compared to its initial deposit value. This can lead to losses compared to simply holding onto the asset. Technological upgrades are being developed to reduce the risks of slippage and impermanent losses, making AMM exchanges safer for traders.

2) Order Books

Order book trading is a traditional method used on centralized exchanges, where buyers and sellers specify their desired price and quantity in real-time, and a trade is executed when a match is found. In contrast, DEXs that use AMMs rely on the AMM function to determine the market price. On order book exchanges, the market price is determined by the most recently executed price. While the order book method allows for precise buying and selling at the desired price, eliminating slippage, it can be challenging to execute trades for less liquid assets. In contrast, AMMs can provide liquidity for assets with lower trading volumes.

There are two main types of order books: on-chain and off-chain. On-chain order books record both buy/sell orders and trade executions on the blockchain, while off-chain order books only record trade executions on the blockchain. In an off-chain order book, orders are processed through a third party broker. While on-chain order books offer increased transparency since all transactions are stored on the blockchain, they also have some disadvantages, such as high transaction fees due to the need to pay fees for every transaction, and the high computing power required for fast transaction processing. As a result, the dYdX exchange, which currently has the highest trading volume among decentralized order book exchanges, uses an off-chain order book method.

3) Aggregator

Aggregators are exchanges that compile trading conditions from multiple DEXs, offering investors a range of options that minimize gas fees and slippage. Since liquidity for a given token pair can vary widely between DEXs, investors may struggle to determine which exchange offers the best price for their desired tokens. Aggregators simplify this process by allowing investors to access multiple trading pools through a single dashboard, presenting the best options for a particular token swap across all connected exchanges.

2. Major DEX Tokens

Xangle utilizes XCR to evaluate the whitepapers, roadmaps, and token economics of various decentralized exchange projects.

1) Uniswap (UNI)

Uniswap was the first decentralized exchange built on Ethereum to implement the AMM model proposed by Ethereum founder Vitalik Buterin, using the CPMM algorithm. Uniswap has released three versions to date, with V1 in 2018, V2 in 2020, and V3 in 2021. Each version has aimed to address the shortcomings of existing DEXs and introduce new features. Notably, V3 significantly increased capital efficiency by introducing concentrated liquidity technology to address the inherent inefficiencies of the CPMM model. As a result, Uniswap now holds a 74.9% market share among Ethereum-based DEXs, far ahead of second place SushiSwap. In fact, it is the only decentralized exchange ranked among the top 10 exchanges globally in terms of 30-day spot trading volume. Going forward, Uniswap plans to expand its market share by leveraging Ethereum-based Layer 2 solutions and exploring opportunities on other mainnets.

As of January 2022, there were 627M UNI tokens in circulation, with a maximum supply of 1B UNI. The expected average annual inflation rate is 10%, but it will decrease to 2% after 2024. While the absolute inflation rate is low, there is a risk of overhang as 400M tokens are held by teams and investors without a lock-up requirement.

2) SushiSwap (SUSHI)

SushiSwap is a decentralized exchange built on the Uniswap code. As a community-driven project, SushiSwap responds quickly to market needs, and it is rapidly evolving into an integrated DeFi platform that includes not only an exchange but also a lending protocol. SushiSwap initially gained momentum through a "vampire attack" strategy, which involved absorbing liquidity from Uniswap. Since then, it has continued to attract holders with favorable tokenomics that distribute revenue to token holders. In 2021, SushiSwap generated $523M in revenue, which was distributed to liquidity providers and SUSHI token holders.

The maximum supply of SUSHI tokens that can be issued is 250M, with an annual inflation rate of 3% until 2026. No new SUSHI tokens will be minted after 2026. With high token diversification and a low inflation rate, overhang risk is expected to be limited.

3) Curve DAO (CRV)

Curve is a decentralized exchange (DEX) that operates on the StableSwap model, allowing for stablecoin exchanges with almost zero slippage. In addition, it also functions as a yield farming platform and utilizes the CRV token for boosting capabilities. In June 2021, Curve launched Curve V2 to improve its capital efficiency and support non-pegged assets, increasing its competitiveness in the DEX market. However, despite these efforts, Curve's market share in the Ethereum-based DEX market is significantly lower than that of Uniswap, which is currently the market leader. Curve operates as a stablecoin-based liquidity pool, and its total value locked (TVL) reached $24B in January 2021. However, the TVL has decreased sharply due to a series of stablecoin depegging events, resulting in a similar TVL to that of Uniswap. To counteract this trend, Curve released a whitepaper for its own stablecoin, crvUSD, in October 2022 and plans to launch it in Q1 2023.

As of January 2023, the circulating supply of CRV tokens is 1.39B, and the maximum supply that can be issued is 3.03B. However, to utilize the boosting features on Curve, CRV tokens must be locked up, which means that the actual circulating supply is approximately 630M CRV. In 2024, an additional 386M tokens are expected to enter circulation, resulting in a low inflation rate. Additionally, the percentage of locked CRV in circulation is gradually increasing, minimizing the risk of overhang.

4) PancakeSwap (CAKE)

PancakeSwap is a DEX and a fork of SushiSwap. It currently holds the number one market share in terms of liquidity, trading volume, and users within the BNB Chain ecosystem. Its rapid growth can be attributed to BNB Chain’s low fees and fast transaction speeds, as well as PancakeSwap's low protocol fees and high annual percentage rate (APR) compared to earlier Ethereum-based DEXs. PancakeSwap's goal is to offer a comprehensive token investment platform by introducing various services rather than simply upgrading the DEX itself. CAKE token holders can use their tokens for various services on the platform, including yield farming, single token staking, lottery services, and an NFT marketplace.

As of January 2022, there are 258M CAKE tokens in circulation, and there is no maximum supply of tokens that can be minted. However, the current rate of inflation is high, with an annualized rate of approximately 52% when factoring in the tokens minted and burned each day. This high inflation rate poses a risk of overhang. Despite this risk, token burn has been primarily used as a marketing tool and a strategy to attract the community with high annual percentage rates (APRs). In the past, governance proposals have increased the number of tokens burned per block generation from 20 to 25. In the future, more aggressive burning and reduced APRs could be implemented to address the high inflation rate and maintain the long-term sustainability of the PancakeSwap ecosystem.

5) dYdX (DYDX)

dYdX is a decentralized futures exchange that utilizes an off-chain order book and operates on the L2 blockchain. The platform has established a competitive advantage by attracting market makers to provide liquidity and offering a variety of trading strategies such as limit buy and stop loss. Since August 2021, dYdX has experienced a significant increase in users and trading volume due to its reward mechanism, which pays out dYdX tokens based on trading fees and open interest size. This has led to dYdX becoming the only decentralized exchange to achieve $1B in open interest. Despite its impressive growth, it is important to note that the increase in trading volume does not necessarily translate into a growth in token value. Currently, all trading fees from perpetual futures contracts go to dYdX Trading Inc. Furthermore, other DEXs are introducing or preparing to introduce L2-based perpetual contract services, which may increase competition for dYdX's offerings.

6) 1inch Network (1INCH)

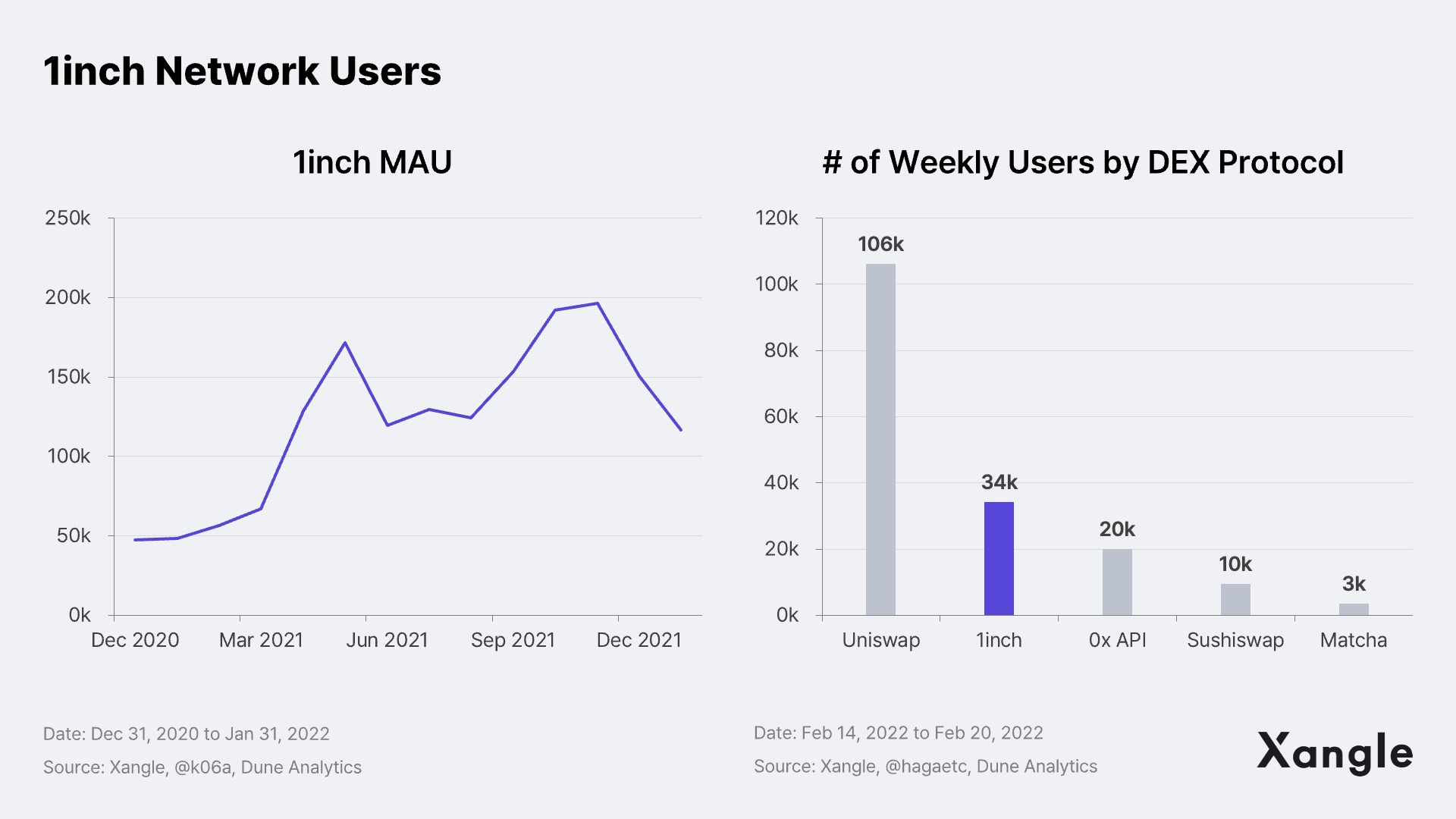

1inch Network is a multi-chain decentralized exchange (DEX) aggregator that launched in May 2019. It aggregates trading conditions from various DEXs, providing investors with options that minimize gas and slippage, ultimately maximizing the cost-benefit ratio when trading. On the Ethereum network, 1inch Network holds a significant market share compared to its competitors, boasting over 100,000 monthly active users, which ranks it second among all DEX-related protocols. Over $10B in monthly transaction volume passes through the 1inch Network aggregator service. In addition to its aggregator service, 1inch Network also supports liquidity protocols. However, unlike aggregators, liquidity on liquidity protocols has dropped considerably after the conclusion of most liquidity mining programs, making them less competitive.

As of February 2022, the circulating supply of 1INCH tokens is 4.15B, with a maximum supply of 1.51B tokens. It is expected that all 1.5B 1INCH tokens will be in circulation by December 2024, which could lead to a high risk of overhang. However, the token distribution plan is determined by the governance of the 1inch DAO, so there is a possibility that the plan may change in the future.

7) Balancer (BAL)

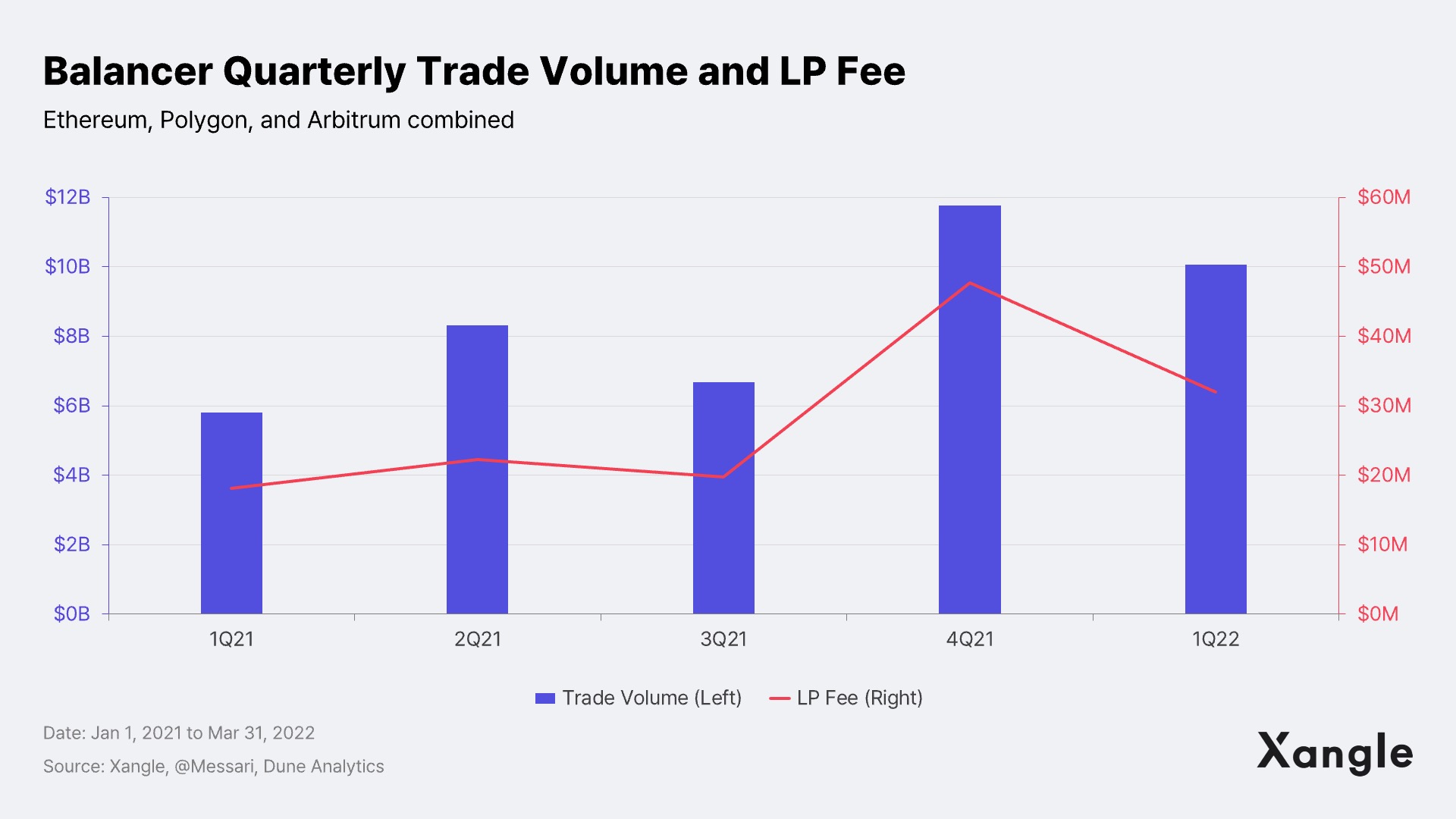

Balancer is a decentralized exchange based on AMMs that offers customizable liquidity pools. Unlike traditional DEXs that provide 50:50 liquidity pools, Balancer enables liquidity pool creators to customize the number of assets (up to eight), ratios, and trading fees. As of May 2022, Balancer's quarterly trading volume and TVL have remained stable at $8.5B and $2.5B, respectively, and have been relatively unaffected by market ups and downs. This can be attributed to the BAL tokenomics, which distributes 100% of fees to liquidity providers (LPs) and focuses on LPs’ rights.

Balancer plans to launch veBAL, which can be earned by staking BAL tokens. After the launch of veBAL, token holders will not only be able to directly distribute profits, but also benefit from the reduced circulating supply due to long-term lockups.

As of May 2022, the circulating supply of BAL is 6.9M, which accounts for only 6.9% of the maximum supply. The annualized inflation rate for 2023 is 16.1%, which is not high. The majority of BAL tokens are distributed as incentives to LPs, which is expected to reduce the risk of overhang as the incentive decreases annually, halving every four years.

8) Bancor (BNT)

Bancor (BNT) is the first AMM-based decentralized exchange launched in June 2017. The platform seeks to protect liquidity providers from impermanent losses that can occur in AMMs by ensuring that every trading pair in the liquidity pool is backed by its own token, BNT. The exchange rate within the liquidity pool is determined through a mechanism of issuing and burning BNT tokens. Bancor's V2 version, which offers loss protection, saw a monthly trading volume of $5.3B in May 2021. However, the platform has experienced a significant decline in both revenue and users due to competing DEXs like Uniswap. Additionally, the platform suffered two hacks in 2018 and 2020, resulting in the theft of approximately $24M in funds, raising concerns about the security and trust in decentralized platforms.

Bancor's supply fluctuates through the minting and burning of BNT tokens, with no tokens allocated for foundation or investors. Therefore, there is no increase in circulation upon unlocking. As of March 2022, the total supply is 256M BNT, with no limit on the maximum token supply that can be minted. However, in the six-month period from September 1, 2021, to March 1, 2022, BNT issuance increased by 12.9%, indicating an expected annual inflation rate of 27% if the trend continues. Nevertheless, Bancor anticipates that inflation will ease in the future if the amount of burned tokens increases due to increased usage after the V3 upgrade.

9) PERP Protocol (PERP)

Perpetual Protocol (PERP) is an Ethereum Layer 2 xDAI-based perpetual futures exchange that uses a virtual automated market-making (vAMM) method similar to Uniswap's asset-backed price AMM method. The platform allows users to deposit USDC into the Vault and trade perpetual futures based on it. Unlike traditional AMMs, vAMM eliminates the need for liquidity pools and providers, and there are no impermanent losses associated with it.

Currently, PERP ranks second in terms of turnover among decentralized futures exchanges. However, the platform faces technical limitations of vAMM compared to dYdX, which is an order book-based exchange, and the competitive gap created by dYdX's Epoch airdrop. As of November 2021, PERP's turnover is 1/30th of dYdX's.

As of January 2022, the total circulating supply of PERP is 68.7M, with a maximum supply of 150M. Under the token vesting period, most team-owned tokens will be unlocked after three months and one year, resulting in high inflation rates. Additionally, 5.8% and 31.8% of tokens will be distributed compared to the circulating supply as of January 2022, respectively, further increasing the inflation rate. Ecosystems & Rewards, which accounts for more than 50% of the token allocation, are not included in the token vesting period, meaning there is a high risk of an overhang, given that 150K PERP is distributed as rewards every week.

10) Sun (SUN)

Sun (SUN) is a decentralized exchange (DEX) platform built on the Tron blockchain. It offers two main services: Sun.io, which facilitates stablecoin swaps, and SunSwap, an AMM DEX that allows users to swap various tokens, excluding stablecoins. The platform has a significant total value locked (TVL) within the Tron ecosystem, with 45% of the TVL coming from stablecoin-based liquidity pools, providing some stability in the face of price volatility and room for steady growth. Although Sun currently only supports the Tron chain, the team aims to expand support to other blockchains in the future.

As of June 2022, there are 10.51B SUN tokens in circulation, with a maximum supply of 19.9B tokens that can be issued. One positive aspect of Sun is that there was no initial venture capital or private equity funding, pre-mining, or team allocation, which helps limit overhang risk. Additionally, the platform has a buyback and burn mechanism in place to reduce the inflation rate. However, the allocation of the remaining 47.2% of tokens has not been determined yet, leaving some uncertainty about the future token distribution.

3. DEX XCR Rating Scale

This article should not be taken as an approval or recommendation of any specific cryptocurrencies or projects regarding their social or monetary value or sustainability. It also contains no predictions of cryptocurrency prices, investment advice, or suggestions to buy, sell, or hold cryptocurrencies.

Other Related Research Articles

- A Guide for Cryptocurrency Enthusiasts on Navigating the Web3 Universe 1. Blokchain Game

- Economic Moats and NFT Marketplaces (feat. Blur vs OpenSea)