Translated by LC

Table of Contents

Intro

1. The Emergence of Blur, the First NFT Exchange to Make OpenSea Sweat

1-1. Blur Overtakes OpenSea in Trading Volume

1-2. Blur Quickly Expands its Market Share Through 0% Fee Policy and Airdrop Structure

2. OpenSea's Strategic Response: What Lies Ahead?

2-1. OpenSea’s Aggressive Competition Strategy and Potential Airdrop

2-2. Can Blur Effectively Defend Itself Against OpenSea?

3. The Future of NFT Exchanges and Future Growth Strategies

3-1. Can NFT Exchanges Establish Competitive Advantages?

3-2. Case Analysis 1: Coinbase – Expanding Beyond the Exchange

3-3. Case Analysis 2: Robinhood’s Survival Strategy

Closing

Intro

The NFT market is currently experiencing a significant shift in dynamics.

Previously, OpenSea was the dominant platform for buying, selling, and trading NFTs, with most NFTs flowing through their marketplace. However, in 2022, several challengers, including LooksRare, X2Y2, Gem.xyz, and Sudoswap, attempted to challenge OpenSea's monopoly by offering airdrops, fee reductions, automated market makers (AMMs), and lower gas fees but were unable to dethrone OpenSea. However, a new player, Blur (Blur.io), has entered the scene and disrupted everyone's expectations. With the listing of their native token $BLUR, and the distribution of their Season 1 airdrop on the 15th, Blur.io has quickly gained traction in the NFT market, capturing a significant share of the pie once dominated by OpenSea. This unexpected development has sparked excitement and speculation about the future of the NFT market as Blur.io continues to vie for the top spot against OpenSea. As the NFT market undergoes this tectonic shift, it remains to be seen how Blur's entry will impact the overall landscape.

1. The Emergence of Blur, the First NFT Exchange to Make OpenSea Sweat

1-1. Blur Overtakes OpenSea in Trading Volume

Blur is an NFT exchange and aggregator that introduced its beta service on Oct 19, 2022. It positions itself as an NFT exchange designed specifically for professional traders. The company is led by Pacman, an MIT dropout and former Y Combinator member, who is known for his connections to Paradigm. There are rumors that Blur has received a valuation of $1 billion from notable investors such as Paradigm, eGirl Capital, and 0xMaki, who is also the co-founder of SushiSwap. However, it is intriguing how Blur achieved unicorn status within just four months of its launch.

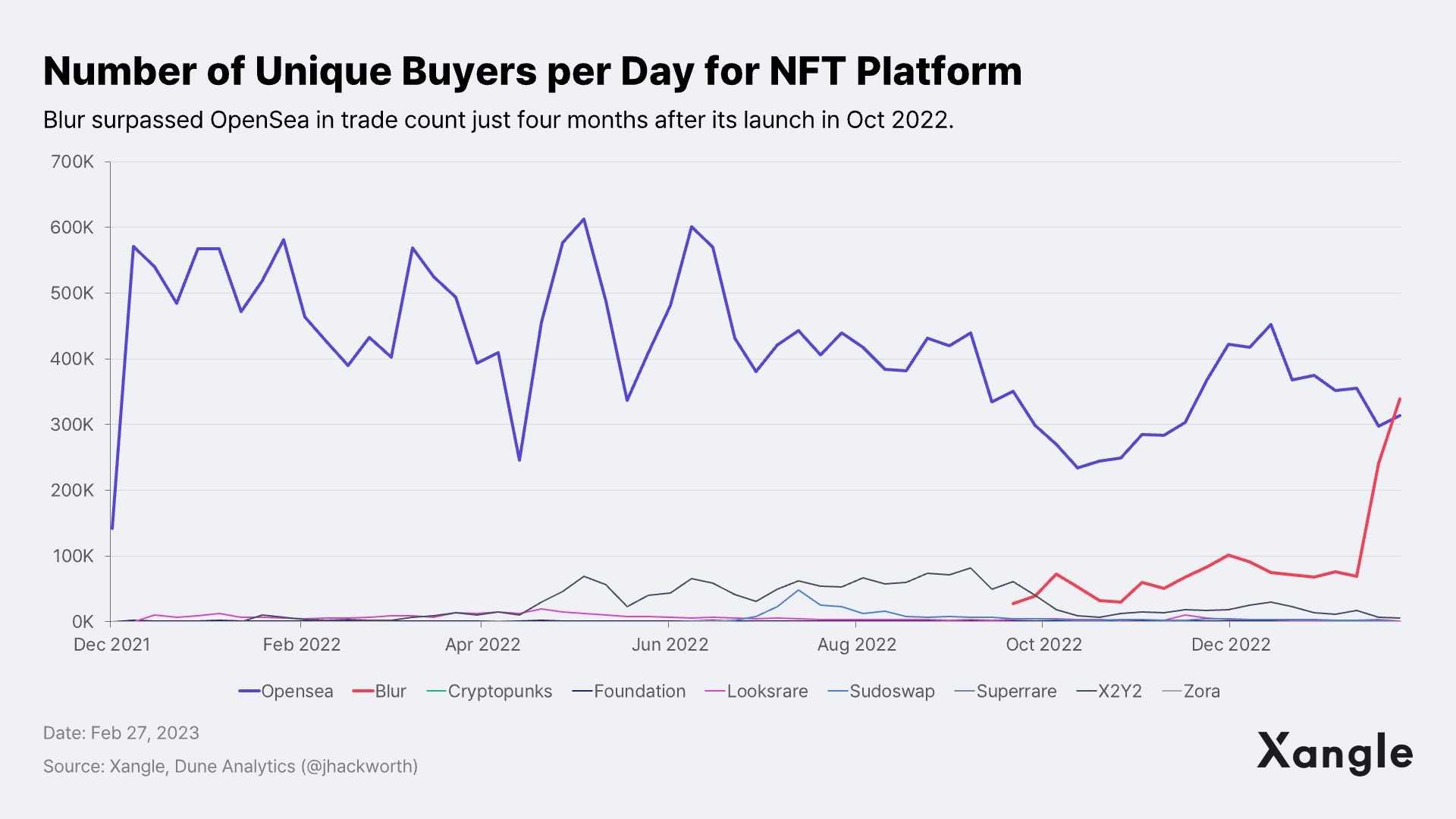

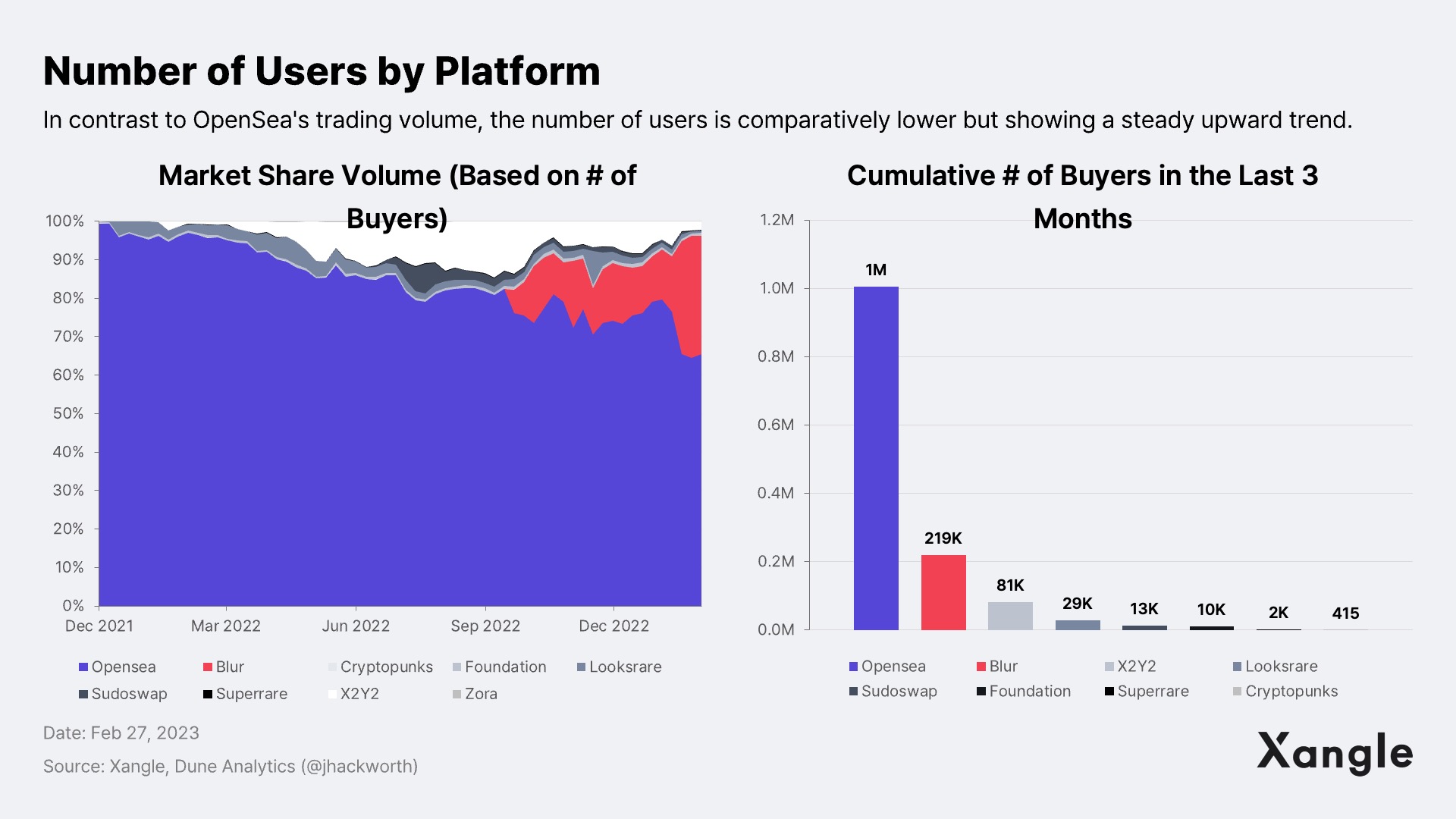

The key to Blur's rapid rise to unicorn status can be attributed to its impressive growth rate. Since its launch, Blur has consistently shown strong on-chain performance, particularly in terms of transaction volume. In just a month and a half after its launch, Blur surpassed OpenSea's transaction volume, and as of Feb 20, it had captured a 60% market share. Additionally, when comparing cumulative three-month trading volumes among exchanges, Blur has overtaken OpenSea, which had a volume of $1.8B, to claim the top spot. Furthermore, Blur's NFT transaction count has also exceeded OpenSea's, with 338K transactions compared to OpenSea's 314K, marking a significant milestone for Blur.

1-2. Blur Quickly Expands its Market Share Through 0% Fee Policy and Airdrop Structure

Low transaction fees have been a major driving force behind Blur's rapid growth, attracting users seeking cost-effective NFT trading options. Additionally, Blur's unique airdrop structure, which provides users with native tokens as rewards, has incentivized participation and engagement on the platform. Furthermore, Blur initially differentiated itself by offering additional features such as faster NFT snipe and sweep. However, as these features have become more commonplace among NFT exchanges, Blur's competitive advantage has diminished.

Low Transaction Fees

NFT transaction fees typically encompass two components: 1) fees imposed by the exchange and 2) creator royalties. Blur's total transaction fee is 0.5%, consisting of a 0% exchange fee and a minimum royalty of 0.5%. This fee structure is among the lowest in the market, comparable to the decentralized NFT exchange Sudoswap, which follows the automated market maker (AMM) model, and has garnered attention among NFT traders. It's worth mentioning that OpenSea has recently reduced its fees significantly in response to competition from Blur, but this will be discussed in further detail later.

Airdrop Mechanism

In both the NFT market and DeFi space, there have been instances of vampire attacks that leverage airdrops and high APRs, such as LooksRare and X2Y2, in early 2022. The strategy behind these attacks involved 1) airdropping their own tokens to OpenSea users to attract them to their platform and 2) offering their tokens as incentives for every NFT traded on their platform to discourage user churn. However, these types of airdrops were susceptible to wash trading, and ultimately the vampire attacks failed to achieve their intended outcome.

As a response to the vulnerabilities observed in previous vampire attacks, Blur has implemented a reward system that focuses on three key aspects: 1) listing, 2) bidding, and 3) loyalty, rather than solely relying on transaction volume. Blur utilizes a combination of variables to calculate each user's airdrop payout, with a primary emphasis on the liquidity they provide to the platform. This strategic approach helps prevent OpenSea from monopolizing the market, considering that liquidity is one of OpenSea's significant competitive advantages. Blur has effectively attracted users and ensured a more reliable and sustainable liquidity pool by prioritizing liquidity as a key factor in its reward system. The current Total Value Locked (TVL) for the Blur Bidding pool stands at approximately $144M as of March 1. This substantial amount is more than sufficient to support a blue-chip NFT collection equipped with a robust bidding wall capable of processing sizable trades instantly and without slippage (refer to the figure below).An interesting example of this efficiency was witnessed on Feb 22 when Mando sold 71 Bored Ape Yacht Club (BAYC) NFTs at market price without any slippage. Although some may criticize Blur's bidding pool for being an exit liquidity for whales, it is noteworthy that bidding pools play a crucial role in providing liquidity in the NFT market.

2. OpenSea’s Strategic Response: What Lies Ahead?

OpenSea, which remained relatively quiet amidst competition from rivals such as LooksRare, X2Y2, and Sudoswap, has finally broken its silence and announced a strategic counterattack. This decision comes as OpenSea has observed a decline in its market share, which was once over 99% just a year ago, now reduced to 65%, due to customer attrition towards Blur. In the NFT market, where customer acquisition costs (CAC) are notably high, losing customers could pose a substantial financial burden for OpenSea. Notably, as of Feb 27, Blur's user share has risen to 31%, indicating a noteworthy increase in market presence.

2-1. OpenSea’s Aggressive Competition Strategy and Potential Airdrop

On Feb 18, OpenSea made a significant announcement outlining their strategy to recapture customers, which includes 1) temporarily eliminating transaction fees (2.5 → 0%), moving to optional creator earnings (0.5% minimum) for all collections, and 3) no longer blocking marketplaces with operator filters. Essentially, OpenSea is initiating a bleeding competition by matching Blur's transaction fee of 0.5%. It's worth noting that Blur has operated without transaction fees since its inception, relying solely on investment ($11M Seed round) and $BLUR team equity for funding. This aggressive approach by OpenSea appears to be a calculated move to compete head-on. While specific financial details of OpenSea are not publicly available, OpenSea CEO Devin Finzer mentioned in a Techcrunch article in July 2022 that OpenSea's runway was estimated to be around five years.

It's also possible that OpenSea could launch its own token and airdrop it to customers, as the company has stated that it is "exploring ways to provide appropriate incentives and rewards to our customers." So far, OpenSea has been planning an IPO instead of launching its own token, but that was before Blur came along. If OpenSea's management and shareholders believe that not launching a token would cause a serious crisis, there's no reason why OpenSea couldn't implement an incentive program similar to Blur's. I believe OpenSea could potentially reclaim the top spot with a combination of fee cuts and an airdrop to customers.

2-2. Can Blur effectively defend itself against OpenSea?

As OpenSea declares chicken game, Blur must brace themselves for a defensive battle. Retaining control may prove to be more challenging than seizing it in the first place. Not only is OpenSea putting up a fight, but there are also two key reasons why Blur's victory may not come easily.

Heavy Reliance on Whales and Questions about Long-Term Sustainability

Despite rapid user growth, Blur's success is only partial, with OpenSea maintaining over 60% of the user base. Moreover, a significant portion of the trading volume on Blur is dominated by a few prominent whales, such as machibigbrother, franklinisbored, and mrghostmintfun. The top 15 NFT traders alone account for 17% of the total volume, while the top 100 account for 46%. This heavy reliance on a small number of traders raises concerns about the sustainability of Blur's performance. It's unclear what motivates these whales, but it's suspected that they may be consolidating their holdings in anticipation of Airdrop Season 2, indicating that Blur's current success may not be sustainable in the long run (see below). Once the airdrop season ends or other exchanges offer more lucrative incentives, there may be little incentive for these traders to remain on Blur.

Limited Effectiveness of Airdrops

Previous attempts by NFT exchanges, such as LooksRare and X2Y2, to target OpenSea with airdrops in the NFT market have ended in failure. While they initially succeeded in capturing market share from OpenSea in the early stages of their services, the effectiveness of their airdrops diminished over time, resulting in increased customer churn and substantial losses. For instance, when LooksRare and X2Y2 were launched in early 2022, 80% and 50% of total users received airdrops, respectively. However, by the end of February 2023, these figures had dropped below 20%. Additionally, a significant percentage of $LOOKS and $X2Y2 holders, approximately 60% and 86%, respectively, sold all of their holdings immediately after receiving the airdrops. These statistics indicate that the impact of the airdrops was short-lived and did not result in long-term retention of users or value for the platforms.

Consequently, LooksRare and X2Y2 are currently reporting significant protocol losses, with -$76M and -$41M, respectively, primarily attributed to the exponential increase in CAC resulting from aggressive airdrop campaigns.

In this regard, Blur, like LooksRare and X2Y2, may experience a loss in market share and a sharp decline in profitability once the Season 2 airdrop ends. Furthermore, the ease with which NFT traders shift to other exchanges after the airdrop raises concerns about the long-term sustainability of NFT exchanges.

3. The Future of NFT Exchanges and Future Growth Strategies

3-1. Can NFT Exchanges Establish Competitive Advantages?

Unlike e-commerce giants such as Amazon, Alibaba, and Coupang, which can achieve competitiveness through cost-effective and speedy product delivery to their own logistics centers, NFT exchanges dealing with data do not have a "cheap and fast" strategy. Many NFT exchanges already offer near-zero transaction fees due to the automation of trading with smart contracts, resulting in relatively low labor costs. Additionally, the transaction processing speed of NFT exchanges is not within their control, as it is determined by the blockchain's TPS (Transactions Per Second) and latency. Furthermore, compared to other markets, the Web3 ecosystem has a low lock-in effect as customers do not need to sign up or log in; they simply connect their wallets. Additionally, incentivizing users with token airdrops often makes users frequently switch between platforms. This makes it inherently challenging for NFT exchanges to establish a competitive advantage or build a moat in such an environment.

It's difficult to argue that Blur has built a sustainable competitive advantage, similar to OpenSea, which has leveraged low transaction fees and airdrops for growth. Blur may garner temporary attention, but its long-term sustainability is questionable. If OpenSea were to follow up its fee cut with a token airdrop, it would likely regain its dominance, leaving Blur in a challenging position (in fact, given OpenSea's Tweet on Feb 18, a token launch seems plausible). Blur's lack of revenue generation means that if it loses market share, which currently sustains the business through investments and $BLUR team supply, the token price could decline due to weakened fundamentals, posing a significant risk to Blur's runway. Additionally, it's worth noting that gem, an NFT aggregator acquired by OpenSea last year, is already working on a strategy of token airdrops for users who pay royalties, further highlighting the competitive advantage of established platforms.

How can Blur respond to OpenSea's counterattack? And what strategies should NFT exchanges adopt to ensure sustainability in an environment where 0% transaction fees are becoming the norm? Drawing insights from the growth strategies of US financial platforms like Robinhood and Coinbase, let's explore how NFT exchanges can expand their businesses.

3-2. Case Analysis 1: Coinbase – Expanding Beyond the Exchange

Coinbase has recently revealed its plans to launch BASE, an Ethereum Layer 2 (L2) solution, as part of its strategy to expand beyond mainnet operations and venture into DeFi, NFTs, and other on-chain services. BASE will be based on the Optimistic (OP) stack and will eventually join Optimistic's Superchain. The launch of BASE Stage1 mainnet is planned for late 2023, with Stage2 mainnet set for 2024.

Coinbase plans to leverage its exchange as a gateway to the blockchain ecosystem, aiming to onboard more than a billion users into the crypto economy. With a user base of over 110M and over $80B in deposited assets, we see significant potential in building an ecosystem that seamlessly connects the exchange, wallet, bridge, and dapp layers. The vision is to create a self-sustaining ecosystem that goes beyond a traditional exchange, with transaction fees from sequencer operations and on-chain services potentially surpassing exchange fees in the long run. This approach allows for building a wide and deep moat around the ecosystem. Arbitrum and Optimism, two leading ORs, currently generate annual revenues of $5M and $4.4M, respectively.

OpenSea and Blur could explore the possibility of launching a dedicated mainnet/wallet specifically for NFTs, leveraging their existing exchange platforms as a springboard for business expansion. In particular, following the example of BASE, building an NFT-specific Layer 2 (L2) solution connected to a superchain using OP Stack could offer several advantages, including: 1) securing an initial sequencer, 2) reducing mainnet development time through OP Stack, and 3) immediately leveraging the ecosystem of the superchain. This strategic approach could enable OpenSea and Blur to tap into the growing NFT market and enhance their offerings.

3-3. Case Analysis 2: Robinhood’s Survival Strategy

Robinhood, known for the GME and AMC scandals, is a prominent North American financial platform that has experienced rapid growth during COVID-19. Named after the legendary character Robin Hood, the platform aims to "democratize finance for all." It offers features targeted toward retail investors, including 0% trading fees, decimal stock trading, and a gamified UX/UI. As a result, a significant portion of its customer base, with 57% of its 23 million users, according to Morgan Stanley, consists of Gen MZ.

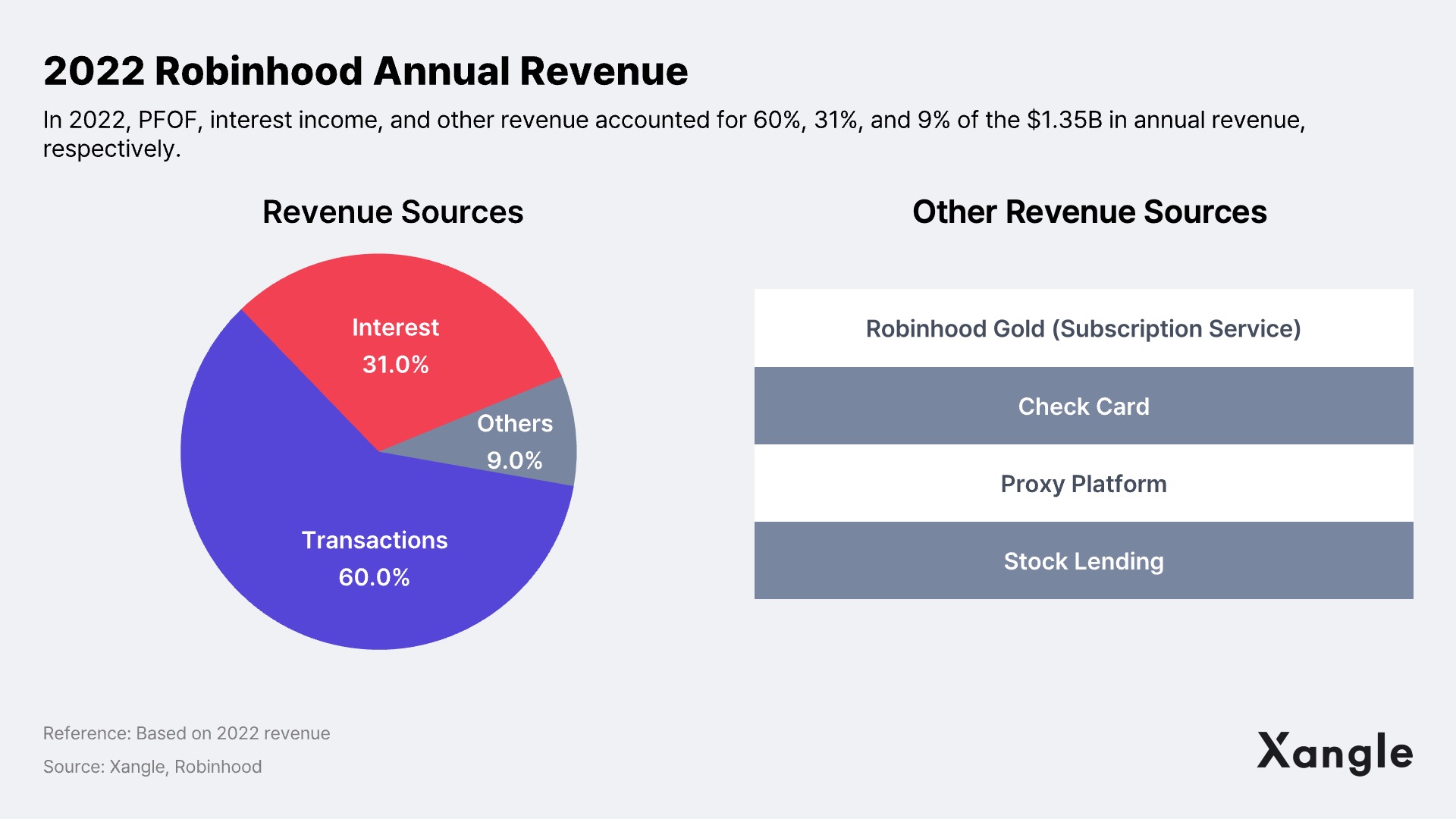

As mentioned earlier, Robinhood generated a significant revenue of $1.35B in 2022 alone, despite not charging transaction fees like OpenSea, Blur, and Sudoswap. A closer look at Robinhood's revenue structure reveals that 60% of the $1.35B in revenue comes from Payment for Order Flow (PFOF), 31% from interest, and approximately 9% from other revenue sources. PFOF refers to Robinhood's rebate revenue from selling real-time transaction data from its clients to market makers who provide liquidity through ultra-short order trading. Interest revenue represents the interest earned on client deposits, while another revenue is derived from various services such as the Robinhood Gold subscription service, securities lending, and debit card fees.

Since NFTs have a limited quantity and trading is largely based on self custody, it is unlikely that NFT exchanges would be able to generate revenue from Payment for Order Flow (PFOF) and interest, similar to Robinhood. Therefore, other revenue streams, such as subscriptions and landing services, are more likely for NFT exchanges. Although Robinhood's other revenues only account for 9% of its total revenue, given that OpenSea's revenue for 4Q 2022 was $24M, an annual amount of $120M is not unreasonable in comparison.

- Subscription service: Robinhood Gold is a monthly subscription service priced at $5, offering access to NASDAQ Level 2 market data, Morningstar research reports, increased direct deposit limits, margin trading discounts, and other investment-related benefits. Similarly, NFT exchanges can explore subscription services with various benefits, such as access to advanced analytics tools, MEV protection, NFT research reports, and participation in their launchpad.

- Launching NFT-related DApp services: Taking inspiration from Robinhood's monetization of securities landing, NFT exchanges can do the same by launching NFT Bridge or NFTfi DApp services, such as NFT landings, fractional investments, derivatives, BNPL, and sentiment analysis, to diversify their revenue streams and expand their business. The cumulative landing volume of NFTs is approximately $802M as of March 6, indicating a substantial market. Moreover, we believe there is potential for maximizing the synergy between the two businesses by integrating these services on top of the previously mentioned L2/wallet launch.

Closing

Blur has successfully gained market share from OpenSea by leveraging its low fees and airdrops as a competitive advantage. Blur has recently demonstrated its ambitions by launching a loyalty program incentivizing users with additional airdrop points for exclusive NFT listings on its platform. However, even in the decentralized finance (DeFi) market, including platforms like LooksRare, X2Y2, or SushiSwap, there have been no instances of successfully attaining the top position through vampire attacks. In the Web3 ecosystem, where lock-in effects are comparatively low compared to other industries, the position gained through chicken games and airdrops can be easily lost in a similar manner. As Blur continues to defend its position, OpenSea is also fighting back, leveraging its brand awareness and user base. The true battle will likely commence once the $SEA token is released.

As the macro environment remains challenging and fees trend toward 0%, NFT exchanges must focus on survival and sustainability. Diversifying their business and building a competitive advantage is crucial to achieving this. One strategy is to create their own ecosystem and offer subscription services, which can be achieved through the launch of L2, wallet, and NFTfi DApp services. This approach can help NFT exchanges build a moat and ensure long-term viability in the evolving NFT market.