Translated by elcreto

Content

Why Does Web3 Warrant Financial Institutions’ Attention?

- Blockchain Infrastructure Optimized for Financial Services

- Continuity with Existing Business Models

- Exponential Growth of Crypto Markets and High-Flying Returns of Crypto Projects

State of Web3 Adoption: TradFi

- Global Financial Institutions

- Financial Institutions in South Korea

Web3: What Is the Way Forward for Financial Companies?

- Monitoring Regulatory Landscape

- Building & Upgrading Infrastructure

Why Does Web3 Warrant Financial Institutions’ Attention?

A Crypto Market Turmoil Sparked by FTX Implosion

FTX, the world’s second largest crypto exchange, declared bankruptcy. The flywheel of leverage that had once enabled FTX’s rapid rise has boomeranged in a liquidity crunch, adding up to the sudden demise of a high-profile exchange.

At the epicenter of such exorbitant leverage and subsequent lightspeed downfall lie an absence of internal control and risk management. “Never in my career have I seen such a complete failure,” FTX’s newly appointed CEO John J. Ray III, who has over 40 years of legal and restructuring experience including supervising situations involving Enron, states in a bankruptcy filing, adding “This situation is unprecedented.”

FTX was, in a sense, an unusually secluded empire that commanded numerous subsidiaries, including FTX US and Alameda Research. FTX’s bankruptcy filing revealed that customer deposits had not been recorded as liabilities in the financial statements of both FTX US and FTX Intl. Worse, such fraudulent accounting practices lasted all along without proper audit, indicating the level of prevalence of such irregularities. (Here’s the link to the document).

Fears are rampant that the FTX fiasco could ripple through and shake the foundation of the entire industry. At the moment, all eyes are on the impact on crypto lender Genesis and its fallout. Genesis’ parent company DCG (Digital Currency Group) has prominent subsidiaries such as crypto fund manager Grayscale and media outlet Coindesk and is one of the initial investors in the Nasdaq-listed crypto exchange, Coinbase. As of Nov 22,

GBTC (Grayscale Bitcoin Trust), one of Grayscale’s investment trust funds, trades at a record discount of 45%. Though the possibility of Genesis’ liquidity shortage resulting in GBTC’s insolvency is deemed less likely given the independence of GBTC from Genesis, seeing that Genesis put a halt on customer redemption and sought emergency injection, jitters have obviously gripped the market. (See Genesis & DCG Caught Up in FTX Contagion for more details)

Paving the Way for TradiFi to Venture Into the Crypto Space

When the unraveling of blockchain protocol Terra Luna and venture capital 3AC had already spoken volumes for the need for regulatory frameworks, the crypto industry looks further besieged by the FTX conundrum since more than 1 million individual retail customers may not be able to recover their money. In response, government authorities will ramp up their effort to regulate the market, limiting risky investment activities and dictating stronger internal risk control (See Genesis & DCG Caught Up in FTX Contagion for more details). Moreover, given the headwinds at play in the macroeconomic environment, a downturn in the crypto market seems inevitable. Conversely for TradFi, the downfall of the scandal-ridden crypto exchange and its aftermath may serve as a springboard for entry. Since traditional finance has not been short of drama, risk management has long been an essential part of its system.

Some liken the FTX collapse to the 2008 financial crisis triggered by the subprime mortgage meltdown in the sense that it, too, is an insolvency problem driven by excessive leverage. Back then, the case in point that illustrates the tighter post-crisis regulatory landscape was the Dodd-Frank Act's Volcker Rule:

- Volcker Rule: Enacted in July 2010, the rule aims to prevent banks from making certain types of speculative investments that contributed to the 2008 financial crisis. Most notably, it:

- Prohibits banks from conducting certain investment activities with their own accounts unless they are part of their customer operations.

- Limits banks’ investment in and management of hedge funds and private equity funds to 3% of the bank’s Tier 1 capital.

- Mandates the introduction of compliance monitoring and regulatory reporting requirements.

As the focus of the rule was prohibition on banks’ risky investment activities, it is only natural that the soundness of the banks compliant with the rule has improved. South Korea is no exception. For long, it has governed matters relating to banks’ financial soundness with regulations—the most prominent example of which is the BIS (Bank for International Settlements) capital adequacy ratio, the ratio of a bank's capital in relation to its risk weighted assets. Despite the implementation of the BIS capital adequacy ratio in 1993 and obligation to keep the ratio at 8% or higher in 1995, South Korean banks’ botched management of risky assets sent the entire country tumbling into a financial crisis in 1997. The efforts of the banks to improve their capital adequacy ratio since 2000 have translated into higher numbers, which have consistently stayed above 10% and recently peaked at as high as 16.5% in and around 2020.

A growing consensus in the financial market for enhanced transparency and investor protection has led to the amendment of the EU’s Markets in financial instruments directive (MiFID II), under which brokerage firms are regulated.

- MiFID II: Enacted in 2014, MiFID II is a financial instruments directive that became effective as of Jan 2018. Reflecting the post-crisis changes in the financial environment, it instituted an array of measures, including enhanced investor protection.

- The directive requires EU member states to allow authorities to enforce investor protection measures, including an order to cease the sale of financial products.

- Keeping up with new electronic trading techniques, new regulatory frameworks were adopted to govern matters relating to automated high-frequency trading (HFT).

- Financial products that had not been captured under the previous regulatory framework, the organized multilateral trading facilities, became subject to newly established rules governing the new market.

- The amendment also introduced enhanced disclosure requirements aiming to achieve greater transparency, i.e., pre- and post-trade disclosure of bid/ask quotes, prices, and volumes.

- New regulations introduced by MiFID II also include restrictions on commodity derivatives, i.e., limits on positions.

A series of new rules, including regulations on HFT, and a broader range of applicable products would have undeniably posed a daunting task for financial institutions striving to catch up with the fast-evolving regulatory landscape. All in all, the increasingly stricter regulatory climate is making it more and more plausible that financial institutions, backed by the long-established regulatory architecture, start gaining traction to enter the crypto space and reshuffle the market.

TradFi’s Interest in Crypto Is Not New

Even long before the FTX crisis, global financial heavyweights, such as BlackRock, Goldman Sachs, Fidelity, and JP Morgan, had offered cryptocurrency-linked products or explored opportunities to collaborate with Web3 companies. Then, why the interest?

1. With Blockchain and Cryptocurrencies at the core, Web3 Best Fits in With Financial Infrastructure

(1) Payment & Remittance

Blockchain technology came into the spotlight as a potential solution to inefficiency associated with electronic transactions, such as payment and money transfer. Bitcoin creator Satoshi Nakamoto believed that the process of centralized organizations securing and guaranteeing transaction participants’ trust increased the social and economic costs of electronic transactions. The ultimate goal of Bitcoin, he argued, was to enhance cost-efficiency and stability of electronic transactions by eliminating the involvement of intermediaries and allowing people to transact with electronic currencies in a decentralized manner. For more details, please see the link below:

Bitcoin has some way to go to establish itself as a payment vehicle and has been plagued with technological limitations and a lack of infrastructure as well as high volatility. Despite such hurdles, numerous crypto projects keep pushing ahead with experiments and payment services. The very first real-world crypto transaction took place when Laszlo Hanyecz paid 10,000 BTC for two Papa John's pizzas, and the crypto community has celebrated May 22 as Bitcoin Pizza Day. 10 years on, big tech is driving the evolution of utility.

- Nov 2020: PayPal launches a new service that allows accountholders to buy, sell, store, and pay with cryptocurrency.

- Mar 2021: Elon Musk tweets that Tesla cars can be bought with Bitcoin. Although he backtracked and suspended the plan two months later, the potential of Bitcoin becoming a payment vehicle kept pushing up the price of Bitcoin.

- Sep 2021: Twitter rolls out Bitcoin tipping service available in certain countries.

- Sep 2022: Spain’s largest telecom company Telefónica begins to accept seven cryptocurrencies including Bitcoin as payment.

- Oct 2022: Google announces its plan to start accepting cryptocurrency payments for its cloud services.

One of the recent developments that brought significant attention to the remittance aspect was the Ukrainian Government’s crypto fundraising. After the war broke out, Ukraine’s government tweeted on Feb 26, 2022 that it would accept cryptocurrency donations and raised over $20M in a single day. This demonstrated blockchain’s prowess in fund transfer, which turned out to be much faster than that of traditional financial institutions.

Ripple, currently the 7th largest cryptocurrency with a $18B market cap, is one of the pioneering projects specializing in remittance. It is actively engaging in partnerships with institutions in search of business opportunities.

*Note: A legal battle between the U.S. SEC and Ripple Labs is underway on the matter of the security status of XRP. Court’s ruling is expected in 1H 2023.

(2) Decentralized Finance (DeFi)

The arrival of Ethereum marks the beginning of the age of smart contracts. The Ethereum network has enabled a wide array of blockchain-based financial services as follows:

- Lending Protocols: Provide collateralized loans without the involvement of credit or intermediaries

- Stablecoins: Aim to maintain a highly stable price to allow them to be used in various financial services

- Decentralized Exchanges: Support swaps between assets without the involvement of centralized intermediaries

- Derivatives: Support futures and margin trading based on their underlying crypto assets

- Yield Aggregators: Provide on-chain asset management services

- Other Types of Services: Include insurance, index, and bridge

Most of these services have already resided in the financial market, so it was like moving them to the Web3 space. Because the services are run based on smart contracts on the blockchain, they can not only eliminate the involvement of intermediaries but can theoretically expect greater efficiency. Yet, absence of risk control system and technological limitations have so far resulted in a bumpy ride for the market.

If running these services in a fully decentralized manner is accompanied by many challenges as such, trustworthy centralized service providers might gain traction to roll out a hybrid type of Web3 financial services. It will be worth watching how traditional financial institutions reshape their offerings on the blockchain.

2. Continuity with Existing Business Models

For financial institutions, an increase in the number of institutional or individual investors who see cryptocurrencies as new investment assets and want them to be included in their portfolio means greater business continuity with existing services. After all, they already have the basic infrastructure and similar experience key to running those services.

Already, some institutions have included Bitcoin in their portfolio, regarding it as a hedge against inflation or highly volatile investment asset.

Most likely, the trend will lead them to build services dedicated to institutional clients. One good example is the mandatory use of an institutional-grade custodial service. Institutional investors are legally bound to use authorized institutional-grade custodians for the safekeeping of customer assets. Despite the difference that crypto custody services store encrypted private keys, the links and similarities between traditional and crypto custody services would grab the attention of TradFi companies on the lookout for new business opportunities. And indeed, already, not only crypto exchanges but also traditional financial institutions have announced that they are either providing or preparing for custody services.

Individual investors’ interest in crypto is high, and there is even a survey that found millennials preferred Bitcoin to gold. For traditional financial companies, crypto-related services will gradually become an essential part of the offerings rather than an option.

Once the Financial Investment Services and Capital Markets Act (FSCMA) is made applicable to Security Token Offering (STO), existing crypto exchanges will not be able to provide security tokens. This will give a tremendous edge to financial companies that have long been executing securities trades.

KB Financial Group’s Research Center has recently published a report on traditional finance’s perspective of crypto exchanges and custody wallets, covering the differences with TradFi services in extensive details. Going forward, the research center plans to release crypto-related reports in a series of editions, hinting at the level of its intention to enter the market.

Such interest, however, has not translated into products primarily because of the absence of clear guidelines on the security status of tokens. The Financial Supervisory Service of South Korea said during a policy seminar in Sep 2022 that it would formulate guidelines on security tokens by the end of this year. Having already been at the center of the debate surrounding the Terra Luna crash in May 2022 and the on-going legal battle between Ripple and the SEC, the security status of a token is one of the overarching topics that can alter the landscape of the crypto market. This explains why stakeholders are biting their nails to see how South Korean regulatory bodies conclude.

3. Exponential Growth of Crypto Markets and High-Flying Returns of Crypto Projects

There is another reason traditional financial institutions are interested in Web3. Similarly to other industries, the competition is heating up within the financial industry amongst the existing financial services. Particularly, as the recent market dynamics have morphed into the platform economy, big techs that currently or potentially can operate a platform have expanded their territory into financial services. The prime examples are Internet banking and payment services of each platform. There are three online-only banks in South Korea, which differentiate themselves with varied products and services. The key characteristic they share is the convenient non-face-to-face account opening and cost efficiency.

- K Bank: A South Korean online-only bank established in Apr 2017 that continues to forge partnerships with various companies, including crypto exchange Upbit and Mirae Asset Securities, in pursuit of a digital finance platform.

- KakaoBank: Established in Jul 2017, KakaoBank is the first online-only bank that had an IPO. The two pillars of its business are platform (e.g., delegated securities account opening and advertising platform) and banking (e.g., deposits and loans).

- Toss Bank: Established in Oct 2021, Toss Bank is the last company among the three to make a foray into online-only banking. It seeks to differentiate itself with unprecedented services and products, such as daily deposit interest offering and lending service for individual entrepreneurs.

Driven by Upbit’s phenomenal growth, K Bank saw the number of customers and net interest income skyrocket. K Bank customers, which used to be 2.19 million as of end-2020, surged by 4.8 million to hit 7 million as of Dec 2021. Likewise, the bank’s net interest income, which used to be KRW 46B in 2020, multiplied to KRW 198B in 2021, allowing the bank to post a net income for the first time since its establishment.

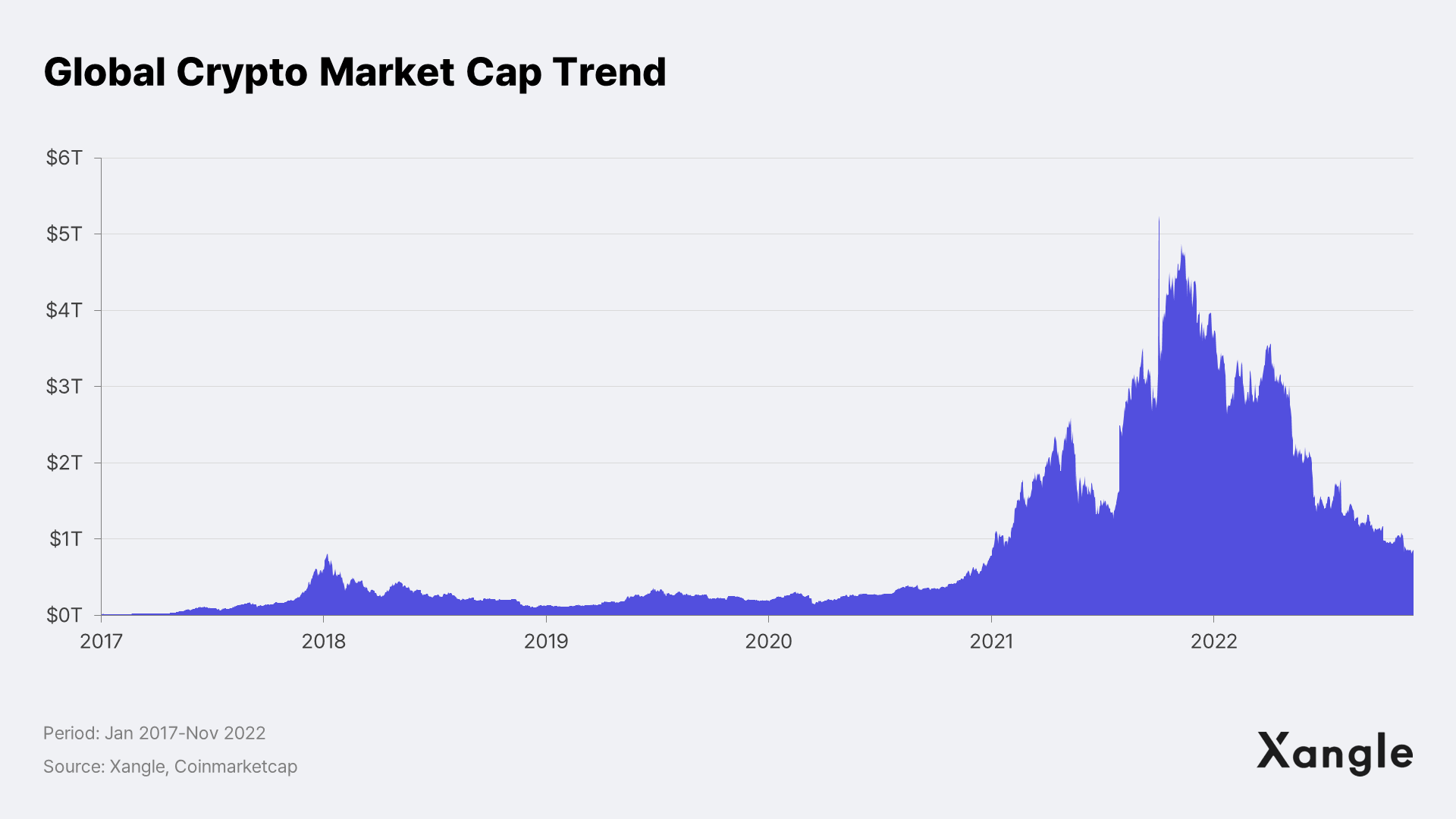

Although the size of the return of online-only banks’ crypto businesses is dwarfed by traditional banks’ profit numbers, the exponential growth of the crypto project is certainly not being overlooked by banks and other traditional financial institutions. Looking at what the industry has achieved in just a few years’ time span, crypto’s growth has certainly been jaw-dropping, soaring from $200B in early-2020 to $2.96T at its peak in Nov 2021. Even when the number is currently brought down to $857B by the persistent winter in the crypto space that has been plagued by both internal and external factors, the industry still carries the potential for further growth.

Apart from the market cap, we consider that the added value of cryptocurrencies, such as NFT services (trading, custody, collateralized lending), and anticipation for STO, can open up a promising new territory of business for financial companies. The crypto-related services have already been proven to be fast-growing and highly profitable.

Crypto Exchanges

Along with the meteoric rise of the crypto market, South Korean crypto exchanges posted stellar performance numbers. The daily trading volume of the top 5 biggest crypto exchanges in South Korea hovered around a staggering KRW 13.3T in 1H 2021, surpassing the KOSPI and KOSDAQ markets. Moving into 2022, the hype has cooled along with the downturn across the economy and heavy headwinds within the industry, bringing the daily trading volume down to KRW 5T as of Sep 2022. Although the number is half the daily trading volume of the KOSPI, KRW 10.4T, over the same period, it signifies that crypto trading is holding up well against the turbulence in the market.

South Korea’s two largest crypto exchange Dunamu (Upbit) and Bithumb Korea reported KRW 3.27T and KRW 782.1B in operating income, posting an operating margin of as much as 88% and 77%.

This stands in stark contrast to the average operating margin of the top 5 securities companies in South Korea, namely Mirae Asset, Korea Investment, Samsung Securities, NH Investment & Securities, and Kiwoom Securities) and of the largest banks in the country, which stand at 13% and 34% respectively.

Even when the crypto market was well into its winter, crypto exchanges’ operating margin for 1H22 remained higher than that of other financial institutions.

Most likely, the drivers behind such high operating margins are: i) 24-hour trading that boosted fees revenue and ii) digital-only trading that eliminated fixed costs like a branch setup. Currently, only the licensed companies can act as an intermediary for the trading of cryptocurrencies. But once the legislators pass the pending bills on digital assets and amendment of the Financial Investment Services and Capital Markets Act (FSCMA), brokerage firms will take over the role of trading intermediary for security tokens.

DeFi’s growth, in particular, has shot up since 2021, proving the potential of blockchain technology being incorporated into financial services. A series of crashes, including Terra Luna, Celsius, and FTX, have obviously dealt a blow to the confidence in the crypto market. Technically speaking, however, the cause of their downfall was the absence of risk management and internal control in which DeFi was leveraged as a tool to line the pockets of a few individuals, rather than the DeFi system itself.

That said, DeFi protocols surely have shortcomings. As interest rate hikes and subsequent liquidity squeeze continue, DeFi has increasingly become a less appealing investment primarily due to difficulties in coming up with a product that offers more-than-satisfactory yields against the risks involved. The higher barrier to DeFi’s mass adoption, though, is the concerns over the security of bridges key to multichain expansion and the absence of a risk management system.

Nonetheless, under the Web3 paradigm, where ownership is conferred not to intermediaries but to individuals, DeFi is expected to emerge again as a viable option for customers. Given the growth potential and profit margin of the market, existing financial institutions may find DeFi adoption worth considering.

The table above compares the interest rate spreads (lending rate minus deposit rate) of DeFi lending protocols and banks. It shows that the spreads vary depending on crypto and lending protocols while the spread of stablecoin USDC is on par with that of South Korea’s commercial banks.

In a report published by the IMF, DeFi was viewed as a highly efficient but significantly riskier service in that it provides attractive offerings with lower margin in the absence of regulations (IMF, Global Financial Stability Report, April 2022). When economies of scale, regulatory protection, and operational stability are considered, DeFi protocols bear higher risks. The financial sector may still be eyeing the potential and start adopting blockchain features and even moving towards Web3, seeing that smart contract has enabled existing banking services, and DeFi has offered services that can compete with commercial banks—all at a lower operational cost.

Big or small, investment banks have been trying new things in the DeFi ecosystem until very lately. JPMorgan participated in a pilot program led by Singapore’s central bank and executed FX and cross border trades on a public blockchain, Polygon, via a liquidity pool comprised of Singapore and Japanese government bonds and SGD and JPY. Singapore’s largest bank DBS, after Goldman Sachs (GS) and BNP Paribas (EPA), became the first Asian bank to use JPMorgan’s blockchain-based fixed income trading network Onyx. In the meantime, stablecoin issuer MakerDAO approved to provide Huntingdon Valley Bank with DAI loan in exchange for real-world assets as collateral. These initiatives highlight global investment banks are making various attempts to connect real-world assets with the DeFi ecosystem and leverage blockchain in enhancing financial infrastructure and products.

TradFi’s State of Web3 Adoption

Global

As was illustrated by the DeFi segment, many of the global financial companies will or have already started to incorporate Web3 into their business. Despite the uncertainties that may be getting in their way—most notably, regulatory issues and legal status of cryptocurrencies—the world’s largest financial giants are setting the stepping stones as follows to ready themselves for the market once regulatory risks are resolved:

- Blackrock launched a spot Bitcoin trust and teamed up with Coinbase to provide its customers with crypto trading, custody, and prime brokerage starting Aug 4, 2022, and its EU customers with blockchain ETF starting Sep 29, 2022.

- Fidelity launched crypto and metaverse ETF on Apr 12, 2022 and allowed customers to add Bitcoin to their retirement savings plan 401(k) on Apr 17, 2022. Further, it launched an index fund on Oct 5, 2022, allowed institutional investors to trade ETH on Oct 28, 2022, and announced on Sep 13, 2022 that it would tie up with Charles Schwab and Citadel Securities to launch a new crypto exchange, EDXM.

- Goldman Sachs offers high-value customers an ether fund issued by Galaxy Digital, starting Mar 9, 2022.

- Morgan Stanley offers the Galaxy Bitcoin Fund to high-value customers and institutional investors, starting Mar 18, 2022.

- JP Morgan launches Onyx, a business unit focused on blockchain technology.

- BNY Mellon rolled out a custody service on Oct 11, 2022. It won the approval of New York’s financial regulator to manage certain customers’ BTC and ETH. It is allowed to i) hold customers’ private keys on their behalf and ii) provide services that used to be offered to fund managers.

Financial companies in South Korea, although more conservative than their global counterparts, are also said to be in preparation for Web3 adoption.

Brokerage Firms & Securities Companies

Already, five securities companies, including Mirae Asset and NH, have included cryptocurrencies in their research coverage. It ranges from a weekly report focused on market intelligence to a more in-depth report, while some research houses have analysts dedicated to digital assets.

The Web3 initiatives that South Korea’s leading securities companies have unveiled so far include the following:

- Samsung Securities recruited new hires for STO (Security Token Offering) consulting and professional services in 2H 2021. The digital asset section of its app allows users to view crypto prices and comprehensive investment information.

- KB Securities made an equity investment in Korea Digital Asset Co. (KODA), signed an MOU with SK C&C to develop a digital asset platform, and has finished developing and testing key features of an STO platform.

- Shinhan Securities has crypto custody service under consideration.

- NH Investment & Securities’s Namuh Securities mobile app offers crypto prices.

- SK Securities sealed a partnership with Peertec, the operator of GDAC exchange, for crypto custody service and signed an MOU with Funble, an operator of a digital real estate beneficiary securities platform. It also made an equity investment in a digital asset custody platform, Infinite Block.

- Kiwoom Securities is pushing a digital token service jointly with Funble and entered MOUs with real estate, artwork, and music copyright fractional investment firms KASA, Tessa, and Music Cow.

- Hanwha Investment & Securities made an equity investment in Dunamu (Upbit exchange).

Banks

Banks can link the accounts to their partner crypto exchanges in South Korea and support KRW-denominated transactions.

Since the passing of the Act on Reporting and Using Specified Financial Transaction Information, currently there are five crypto exchanges that are allowed to offer KRW-denominated trades, with each supported by NH, Shinhan, Kakao, Jeonbuk, and K banks.

Besides such transactional support, banks look set to add cryptocurrencies to their existing deposit, loan, and payment services. And indeed, some of them are doing the groundwork, launching or investing in a custody service provider.

- KB Bank launched crypto custody provider KODA, in partnership with Hatch Labs and Hashed. The My Data service on KB’s Star Banking app offers crypto valuation and gain/loss on investment.

- Shinhan Bank is partnering with Korbit exchange and allows its account holders to buy and sell cryptocurrencies in KRW. It made an equity investment along with Korbit and Blocko in crypto custody provider KDAC and invested in crypto data intelligence platform Xangle.

- Hana Bank signed an MOU with Uprise, the operator of crypto investment service Heybit.

- Woori Bank teamed up with Coinplug to set up crypto custody service provider DiCustody.

- NH Bank is partnering with Bithumb exchange and allows its account holders to buy and sell cryptocurrencies in KRW. It made an equity investment along with Hexlant and KICC in crypto custody service provider Cardo

- K Bank is partnering with Upbit exchange and allows its account holders to buy and sell cryptocurrencies in KRW.

- Kakao Bank is partnering with Coinone exchange and allows its account holders to buy and sell cryptocurrencies in KRW.

- Jeonbuk Bank: is partnering with Gopax exchange and allows its account holders to buy and sell cryptocurrencies in KRW.

Web3: What Is the Way Forward for Financial Companies?

As has been covered in this report, many of the international and South Korean financial companies have made inroads into the Web3 space already, be it directly or indirectly. Even if the traits of cryptocurrencies are put aside, having once had to go through tumultuous changes during the transition from Web1 to Web2—specifically in the area of B2C in particular—the financial sector is staying more agile and attentive to these changes than any other sector. Not only does Web3 mean a new crypto business or business expansion in a narrow sense, but also a blockchain-based overhaul of the financial infrastructure in a broader sense. Blockchain technology will continue to evolve in a way that further i) cuts costs, ii) ensures stability, and iii) gains confidence through transparency, positioning Web3 as a viable option for institutional and individual investors.

The dilemma facing financial institutions is the fact that they will have to pull two plows together. To start with, they need to build and upgrade their infrastructure. Like many of those companies have done, deploying human resources or organizing a dedicated team will serve as the first step—which should then be followed up by an internal process of fostering professionals. As multiple facets of Web3 keep evolving, the competencies of a company will ultimately be determined by the company’s network and talent pool that can translate technological innovations into services. Secondly, but at the same time, they need to be prepared for regulatory risks. The financial market is one of the most regulated markets and having an in-depth knowledge of the regulations is a prerequisite for business continuity.

As mentioned earlier, the Financial Supervisory Service of South Korea is expected to provide guidelines on security tokens by the end of this year, and the court decision on the SEC-Ripple case is expected in 1H 2023, very likely speeding up the process of determining security status of tokens. In addition, amid heightened awareness sparked by developments surrounding WEMIX, guidelines on supporting digital asset’s accounting process will also be released by the end of this year. Satisfying two not just different but sometimes conflicting requirements may be daunting. But, once the Web3 paradigm shift sets in, gaining an upper hand when the hegemony is in the hands of others will be harder. It is worth noting that, just like Web2 has rendered a life without the Internet and smartphones unimaginable, Web3 may be another disruptive upheaval that not only determines competency but survival. This crypto winter may be harsher and longer than expected, but those staying attentive to the market and prepared for opportunities will reign in the spring.