Translated by elcreto

Content

1. FTX Filing for Bankruptcy

2. The Fall That Surfaced Moral Hazards Prevalent in the Top Management

3. FTX Users and VCs Are Hit the Hardest

4. Genesis Falling Prey to FTX Contagion

5. Seemingly Limited Risk for Grayscale, One of DCG’s Key Subsidiaries

6. A Major Fumble by FTX, Not by Web3

1. FTX Filing for Bankruptcy

FTX, the world’s second largest crypto exchange, ended up filing for Chapter 11 bankruptcy. This came just two days after Binance had pulled out of a deal to acquire the troubled exchange on grounds of issues that surfaced during a due diligence review of FTX’s financials (See FTX News Recap for more details). While it only took 24 hours for the world’s largest crypto exchange to walk away, Binance CEO Changpeng Zhao, commonly known as CZ, cited in a tweet that issues were beyond its control or ability to help, hinting at the magnitude of the issues. Chapter 11 of the United States Bankruptcy Code governs the legal proceedings involving reorganization and aims to allow the business to reemerge as a going concern through debt restructuring or funding. To this end, restructuring expert John J. Ray III was appointed the CEO of the FTX, taking over the decision making function. All 134 FTX affiliates and subsidiaries, including FTX Intl., FTX US, and Alameda Research, filed for bankruptcy, revealing that even FTX US, which had been considered to be in a relatively better condition, turned out to be no exception. In a devastating turn of events, it transpired that the state of insolvency of the entire FTX empire was made official.

*For the convenience of the reader, we will label FTX entities with the following four categories:

- WRS Silo: the FTX US exchange and its subsidiaries in Delaware

- Alameda Silo: Alameda Research and its investment and trading arms worldwide

- Ventures Silo: FTX Ventures and its affiliated venture capital firms

- Dotcom Silo: FTX.com (International) and its subsidiaries in the Bahamas and across the world

2. The Fall That Surfaced Moral Hazards Prevalent in the Top Management

Six days after FTX filed for Chapter 11 bankruptcy, fillings submitted to the Delaware bankruptcy court were made public on Nov 17, 2022. “Never in my career have I seen such a complete failure,” John J. Ray, who has over 40 years of legal and restructuring experience, including supervising situations involving Enron, states in the document. “This situation is unprecedented,” he added, pointing out the absence of internal control, trustworthy financial information, and regulatory oversight, as opposed to the concentration of control in the hands of a very small group of inexperienced individuals. The filing has laid bare how the empire was built on sand.

1) Accounting Fraud

The shocking revelations have uncovered appalling defects in the balance sheets of all the once-considered mainstays of the FTX empire, FTX.com, FTX US, and Alameda Research. According to the consolidated financial statements of 134 FTX entities, FTX’s assets and liabilities sit at $19B and $7.9B as of end-3Q22. But the newly appointed executives of FTX said that they had identified situations that might amount to material accounting manipulations, the most notable example of which was customer deposits on its platform not being recognized as a liability. This stands in contrast to the practices of South Korean crypto exchanges, where customers’ funds deposited in the platform are counted as other current liabilities (or deposit liabilities) or deposits due to customers. Although the exact number has yet to be identified, the investigation will very likely turn up a staggering multi-billion dollar debt, given that millions of customers are the creditors of the troubled exchange. Quite literally, however, such colossal numbers are wiped out of existence in FTX’s balance sheet.

2) Top Executives’ Embezzlement

FTX top management’s moral hazards went far beyond accounting manipulations. It turned out that Samuel Bankman-Fried, commonly known as SBF, had received a personal loan from one of the four silo companies and employees in the Bahamas had used corporate funds to purchase personal homes. It appears that, after SBF lent $2.3B worth of cash to his paper company, he took out another $1B loan under his own name. In addition, $121 million dollars’ worth of real estate properties were reportedly bought with corporate funds. What’s even more striking is the fact that zero internal control was in place to hold him in check, including the board of directors that was supposed to do just that.

3. FTX Users and VCs Are Hit the Hardest

FTX took the heaviest toll on customers and investors. When the bank run took place, FTX halted withdrawals on Nov 8, 2022, and customers have so far been left unable to access their funds. As discussed earlier, FTX did not count customer deposits as liabilities in its balance sheet and misappropriated the entrusted funds for their personal use. This obviously does not bode well for the customers as it is highly likely, if not 100% certain, that their deposits may not be returned. The cash and cash equivalents recorded on the financial statement of FTX entities as of 3Q22 are $1.2B—or $2.4B, if $1.2B worth of USD stablecoins are added. With the stated amount of liabilities alone standing at a staggering $8B, the exact amount of liabilities will snowball once it starts to reflect customer deposits that have not been recognized as liabilities due to accounting malpractices.

Except for the cash and cash equivalents and stablecoins, FTX’s assets are mostly comprised of Alameda and Ventures Silo’s investments, meaning that a significant reduction in value is expected. As for Alameda Silo, the specified assets are $4B of investments, $4.1B of loans and receivables, and $4.1B of digital assets estimated based on the fair value less cost to sell. And as for Ventures Silo, it holds $1.9B of investments. Unfortunately, FTT and other cryptocurrencies comprise much of the investments and digital assets, making loss on valuation inevitable. Of the $4B loans and receivables, SBF, his paper company, and Nishad Singh owe $1B, $2.3B, and $0.5B, clouding the outlook for repayment. This is an indication that $14B out of $19B worth of assets stated in the balance sheet are materially impaired.

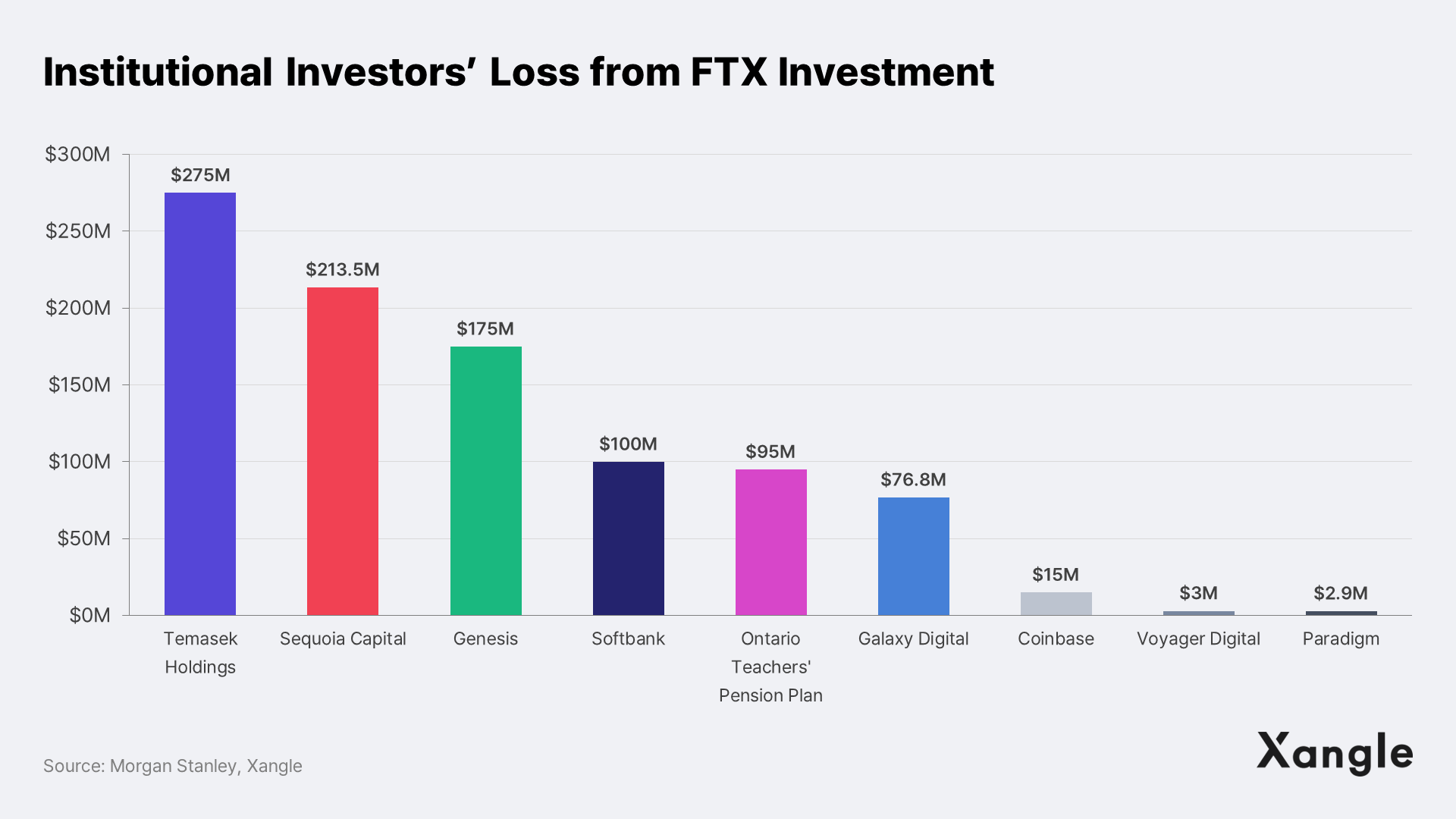

These shocking revelations about FTX’s financials have left many investors with little choice but to regard all their investments in FTX as loss. Apparently, they saw almost zero possibility of revival for the troubled exchange. Notably, Singapore's sovereign wealth fund Temasek, Sequoia Capital, and Softbank have written off $205M, $214M, and $100M, respectively. Yet, because their investments in FTX comprised a minor portion of their portfolio, the write-off did not trigger a significant issue right away.

The real concern lies with the funds of the already financially stretched crypto VCs and brokerage firms locked in FTX. In particular, Genesis, having $175M locked in FTX, suspended customer withdrawals from the Earn program, shoving the scandal towards the much-dreaded state of ecosystem contagion.

4. Genesis Falling Prey to FTX Contagion

Genesis is a crypto broker owned by the Digital Currency Group (DCG) located in the U.S. Similarly to Goldman Sachs in traditional finance, it offers brokerage, trading, and over-the-counter (OTC) services to exchanges and institutional investors. As of 3Q 2022, with YTD spot and derivatives trading standing at $38B and $73B, Genesis is undoubtedly a heavyweight in the crypto space. It also runs a lending service called Genesis Earn, where it profits from an interest spread between short-term deposits and long-term lending. The YTD amount of loan disbursed by its lending unit was a whopping $93B, and the remaining balance at the moment is as high as $2.8B.

In the course of this turmoil, Genesis Earn became an epicenter for the company as it had been juggling deposits and loans with different maturities. The FTX scandal was followed by a flood of withdrawal requests from individuals who had deposits with CeFi lending services, and the CeFi lending services, in turn, made withdrawal requests to Genesis. This eventually resulted in a sudden liquidity risk for the company. It all started with a bank run on an exchange, which began to spread to lending services. Genesis, with much of its funds locked in long-term loans, ended up halting withdrawals and new loan origination. As a result, South Korean crypto exchange GOPAX also suspended redemptions on its crypto deposit service linked to the Genesis Earn program, GOFi.

It turned out that Genesis had been suffering some brutal losses even before the FTX collapse. After Genesis received UST in a BTC/UST swap with the Luna Foundation on May 6 this year, the price of UST went into freefall, plummeting 98%. Then came the bankruptcy filing of Three Arrows Capital (3AC), further hurting Genesis’ solvency. Surely, when its fundamentals were already significantly eroded by crises like Terra Luna and 3AC, FTX fiasco and subsequent bank run must have been a hard bone to swallow. In an effort to rescue Genesis, its parent company DCG stepped in and offered a $140M capital infusion. Yet, the move stopped short of preventing a halt in withdrawals, and Genesis is currently on the lookout for a $500M-$1B investment.

5. Seemingly Limited Risk for Grayscale, One of DCG’s Key Subsidiaries

After Genesis’ investor notice of potential bankruptcy and $1B fundraising target were made public, concerns are mounting over the potential contagion of risk that may spread even to its parent company, DCG. Seeing that DCG’s $140M emergency injection failed to stop a bank run on Genesis’s lending service, rumors started to go around that DCG’s other key subsidiary Grayscale might also be at risk. Apparently, it was a signal that DCG, the largest of all the digital asset financial service providers worldwide, might also be teetering on the brink in the aftermath of FTX’s downfall.

Grayscale is a DCG subsidiary that offers crypto investment trust products, i.e. GBTC (Grayscale BTC) and ETHE (Grayscale ETH). The underlying mechanism of this product is that when funds are transferred to GBTC, the fund will purchase and add the corresponding amount of BTC so that the price of GBTC moves in tandem with BTC’s price. Giving exposure to the price movement of bitcoin, GBTC was quick to gain a lot of traction among companies unable to directly hold cryptocurrencies and institutional investors looking for bitcoin portion in their portfolio. Growing into a gigantic investment vehicle, the fund’s AUM (Assets Under Management) sits at above $10B at the moment.

But GBTC’s discount to the value of the underlying bitcoin is widening, reflective of the prevalent fears in the market that Grayscale may follow in the footsteps of Genesis. The GBTC discount, which used to hover around -20% at the beginning of this year, grew to -35% prior to the FTX crisis and peaked at 45% before it inched up to currently stand at around -40%. Then, what are the risks involved in GBTC?

Two of the foremost concerns about GBTC are the possibilities of Grayscale’s voluntary liquidation of GBTC in an attempt to aid Genesis and the crash of the highly-leveraged GBTC AUM. The two scenarios, however, look less likely for several reasons.

For Grayscale, in the first place, GBTC and investment trust are too profitable a business to relinquish voluntarily. The fees income from GBTC is 2% of the AUM, which hit as much as $470M in 2021 and $210M in Oct 2022 YTD (Source: Marketwatch). Potentially, DCG may prefer to forgo crisis-ridden Genesis rather than one of its best performing businesses. In addition, the articles of incorporation of the fund prescribe that the payment to the customers upon liquidation be made in cash, implying that more than 600,000 bitcoins will pour into the market. The volume represents 3.4% of the total BTC supply, and it would be a botched assumption to think Grayscale is not sufficiently aware of the impact of unleashing a flash flood in the market.

The other concern was initially sparked by DataFinnovation in July this year. DataFinnovation argued that Grayscale used GBTC as leverage to balloon the AUM (See below for diagram): 3AC borrows BTC from Genesis (①,②), deposits BTC with Grayscale to GBTC issued (③,④), uses profits from the premium on GBTC as collateral to borrow more BTC and issue GBTC (⑤,⑥). Back in the days when GBTC had always traded at a premium, it served as a flywheel for Grayscale to increase the amount of BTC under management and enable higher fee income proportionally. Now that its winning streak is snapped and GBTC trades at a significant discount to BTC, 3AC and Genesis have found themselves in a liquidity crunch, stoking much speculation about GBTC. Worse yet, the situation went into a downward spiral after Grayscale refused to disclose proof of reserves or wallet addresses, which investors had demanded for more transparency.

Despite a swarm of doubts and suspicions surrounding GBTC, the risk involved in GBTC is projected to have a limited impact on Grayscale. For starters, GBTC is a fund registered with the SEC and is thus obliged to submit quarterly reports to the agency. The U.S. tends to seek very heavy penalties for false disclosure, and Grayscale is not expected to take too big a risk. Moreover, after Grayscale said that all the collateral assets backing its products were kept in Coinbase’s custody, Coinbase custody backed the statement by disclosing Grayscale’s bitcoin holdings of 635,235 BTC as of Sep 30. For such reasons as there being two gatekeepers, the SEC and Coinbase, in this investment trust, the possibility of GBTC’s insolvency is considered less likely.

6. A Major Fumble by FTX, Not by Web3

It’s been less than a month since Coindesk sounded the alarm about Alameda’s balance sheet. The warning was followed by CZ’s announcement of Binance's FTT selloff, a subsequent bank run, and eventually the fall of a scandal-ridden crypto exchange. The fallout is rippling through the crypto ecosystem: Genesis, having much of their funds locked in FTX, is hurled into a near-bankruptcy and the shockwave is spreading to reach its parent company DCG and sister company Grayscale. Looming out there seems to be the dark cloud of a possible domino collapse. In its scathing article Let Crypto Burn, the Financial Times lashed out at the crypto industry. But really, is there any glimmer of hope for the Web3 industry?

We see the unraveling of FTX and Genesis as a financial accident caused by moral hazard and excessive leverage, where a line needs to be drawn to separate the mess from what actually constitutes Web3. At the core of Web3 lies a fundamental shift in the structure of ownership. Contrary to the notion of ownership where companies get to own services and data by way of shares, Web3 seeks a digital ecosystem where both builders and users own the service protocol. To build such ecosystem, Web3 requires a scalable, decentralized database blockchain as well as a digital asset that allows a user to have complete ownership and a tokenomics design that can attract and incentivize builders and users.

Ethereum layer 2 solutions and fast and affordable alternate layer 1s have demonstrated the promising potential of a scalable blockchain. Currently, the world’s largest companies like Starbucks and Nike are building their services on these blockchain networks. Since the arrival of NFT that marked the inception of the notion of digital asset ownership, NFTs have evolved from a portrait of an ape to find its place in in-game items, IDs, and many more. In search of a larger base of builders and users, tokenomics is also treading the path of evolution, i.e., paying out profits from the protocol in the form of dividends. Such seemingly small achievements have actually brought about breakthroughs in shaping of the blockchain ecosystem. This is why the FTX fiasco and its aftermath involving Genesis may slow but cannot turn the Web3 tide.