Translated by Rhea

Table of Contents

1. All Roads Lead to Binance

2. Binance: The Infrastructure Connecting the Real and the Blockchain Worlds

2-1. Three Strategies to Keep Its Network Effect

3. BNB Chain: Expanding into the Blockchain Ecosystem

3-1. Behind BNB Chain's Launch: Early Move into DEX Market and Product Diversification Strategy

3-2. Behind BNB Chain's Growth: High Ethereum-Compatibility and Leverage on Binance

3-3. BNB Chain Still Going Strong in 2Q 2022

4. Roadmap for Regulatory Compliance and Blockchain Mass Adoption

4-1. A Shift in Strategy with Regulations Introduced: Binance's Localization Strategy and Improving BNB Chain's Decentralization

4-2. Efforts for Blockchain Mass Adoption: Expanding Investments for Binance and Improving BNB Chain's Scalability

5. The Binance Empire to Continue Standing Firm in 2023

5-1. Binance: To Continue Enjoying Its Unrivaled Dominance as the Number One Centralized Exchange

5-2. BNB Chain: To Secure an Upper Hand with Its Many Users and Connection with Binance

1. All Roads Lead to Binance

On last October 6, the BNB chain was exploited. It was a hacking incident at such a monumental scale that it counts as the second-largest blockchain hack of 2022 in terms of the amount stolen, with 2 million BNB tokens (worth USD 570 million) taken from the BSC token hub. Binance stopped the operation of the chain in a day to minimize damage from the hack, a decision that limited the damage down to USD 100 million.

Perhaps it was because the exploits last year mostly took the anonymity of the projects as their leverage. When yet another similar hacking incident hit the BNB Chain this time around, its TVL did not so much as flinch even after concerns were raised about the chain’s safety and security. The difference? The BNB Chain has a clear entity backing the blockchain: Binance. In fact, this incident served as an opportunity to confirm the crypto market participants’ confidence in Binance. Since its launch in 2017, Binance has been maintaining its policy to prioritize its customers first, and has already proven itself by protecting all its customer deposits when it lost 7,000 BTC in a hack in 2019.

Binance has been enjoying its position as the number one in the global cryptocurrency market by trade volume since 2018. It has attracted many users based on its large trade volume and liquidity, and remains the go-to exchange for those new to the crypto world as the first exchange they need to install as they take the first step into their crypto journey. Then, why is Binance, already comfortably seated in a leading position and generating a heap of revenue from transaction fees, finding itself stuck in the middle of the turmoil of centralization scandal in the world of blockchain, where decentralization is the crown jewel, by launching the BNB Chain?

It seems that Binance is looking to construct an empire that encompasses the cryptocurrency market in its entirety by launching the BNB Chain. This article will take a closer look at the backdrop against which BNB Chain was launched, how Binance has been building its empire, and whether it will be able to maintain the grandeur it has built.

2. Binance: The Infrastructure Connecting the Real and the Blockchain Worlds

Centralized exchanges are an essential infrastructure for any users to make spot trades on their crypto assets. Binance is an unrivaled leader by volume among such centralized exchanges. The difference between Binance and other exchanges forms such a huge chasm that Binance’s trade volume accounts for over 50% of the total volume handled by the top 15 exchanges (USD 812 billion).

<Source: CryptoCompare>

High liquidity is a great asset, especially for exchanges where smooth trades and low slippage are significant advantages. In other words, the network effect holds more importance in this business model since a small gap in liquidity begets more and more liquidity. This is where Binance greatly benefited. Thanks to the network effect, Binance was able to attract many users based on high liquidity and transaction amount, and naturally led to becoming the exchange with the most traffic. Binance has been making a lot of efforts to maintain such a network effect from the start. Even now, when the introduction of regulations is materializing, it is deploying different strategies than before in an attempt to grab hold of the market advantage.

2-1. Three Strategies to Keep Its Network Effect

Binance is a global cryptocurrency exchange that opened in July 2017, which puts it among the late starters. It is six years behind Bitstamp and Kraken, launched in 2011, and three years behind Huobi and OKEx.

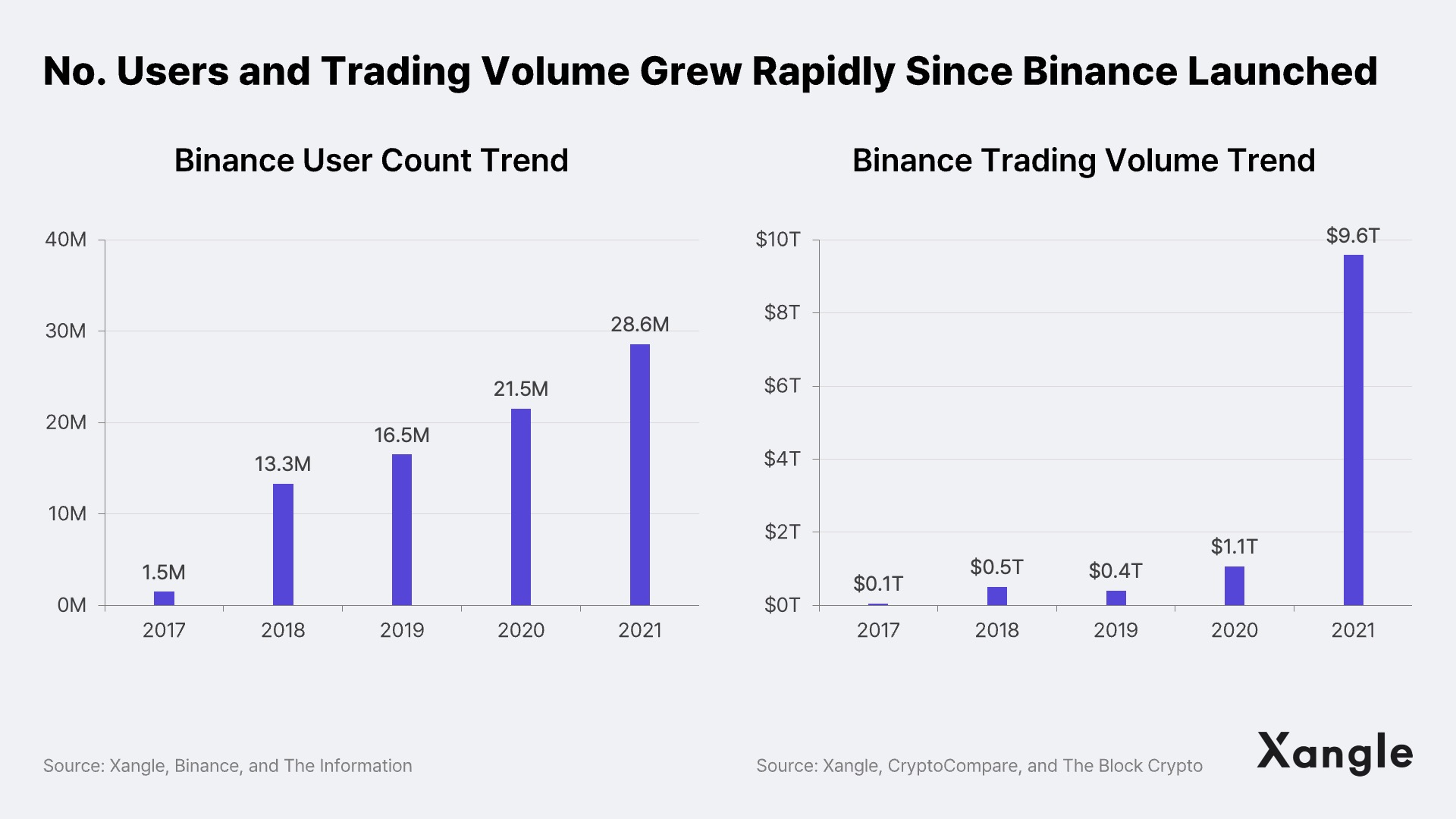

Though Binance may have been slow to start, its transaction volume growth was nothing but slow. Its transaction volume grew 9-fold from USD 1.1 trillion in 2020 to USD 9.6 trillion in 2021, and the number of Binance users is also showing about 30% CAGR since 2018 after its launch in 2017.

Binance was able to reach relatively rapid growth because it successfully read the industry trends and operated businesses that fit such trends accordingly. It was able to secure a leading role in the spot market by launching a wide variety of products and cross-selling them on a single platform. Unlike other exchanges, Binance maintained a decentralized organization, allowing it to be relatively free from regulations to expand its share in the market.

On top of these factors, the market was ripe for the picking when Binance entered the scene. When Binance launched its exchange in 2017, there was no single exchange that stood out to dominate the market, and people were skeptical of the security of exchanges due to a series of hacking incidences. Such major exploits include 850,000 Bitcoins stolen from Mt. Gox in 2011 and about USD 72 million from Bitfinex in 2016.

A) Strategy for Prompt Listing

Exchanges generate revenue through transaction fees. This means a larger transaction amount leads to a higher profit. Binance speedily secured its portion of the pie in the exchange market by actively listing new assets than its peers. At the time of its launch, Binance only supported five tokens – BTC, ETH, LTC, NEO, and BNB. However, over the next 18-month period, Binance listed a total of 435 trading pairs, including 164 tokens and 7 basic pairs, swiftly taking transactions over from other exchanges. This is quite a contrast to how Coinbase supported only four cryptocurrencies (source available in Korean) on its platform back in 2017.

Even now, Binance remains the exchange with the most trading pairs supported. It is also making various efforts to continue to maintain its advantageous position in the spot trade market, such as making advanced listings for promising tokens with prospective for large transaction amounts.

B) Strategy to Launch Various Product Groups and to Provide Them All on a Single Platform

Binance facilitated transactions for a wide variety of crypto assets, and the number of users for the exchange also grew rapidly to 3 million (source available in Korean). However, the listing strategy was something other exchanges could copy. Binance tried to hinder user attrition by offering benefits they could enjoy only when using the Binance platform. A few such efforts materialized as 1) various services on the platform and 2) the launch of the BNB token.

Binance started providing a wide variety of different services, including margin and derivatives, based on its abundant liquidity as the number one exchange by transaction amount. Along with the high liquidity pool, the fact that users can enjoy various services on a single interface acted as an advantage that eventually led Binance to keep its position as number one by the transaction amount.

Moreover, Binance launched the BNB token as a part of its efforts to provide exclusive benefits users can enjoy only when using the Binance platform. Along with discounts for transaction fees using BNB tokens, Binance introduces a series of services and products that incorporates BNB tokens, such as Binance Launchpad. Binance Launchpad allowed users to purchase new cryptocurrencies of promising projects via IEO (Initial Exchange Offering; raising funds through exchanges) with BNB tokens. As the price of new projects’ tokens purchased as such spiking up, it became another means for Binance to retain its user base. The average return of Binance Launchpad is 2,209%, which is much higher than other exchanges.

BNB is more than just an exchange token that provides discounts for transaction fees but is also used as the base layer token for BNB Chain, creating a strong network effect.

C) Strategy to Obtain Regulatory Arbitrage as Decentralized Autonomous Company

Binance is a decentralized organization that does not have any headquarters. Since it is not clear under which jurisdiction Binance falls and where Binance’s servers are located, it is impossible for a single regulatory institution to ban the operation of the exchange. This allowed Binance to go unscathed even when the Chinese government put a blanket ban on cryptocurrency exchanges in 2017 (source available in Korean). This paints a starkly different picture compared to how things went down with Huobi and OKEx, whose token price plummeted upon the news of the Chinese regulation in September 2021, due to their continued amicable relationship with Beijing.

3. BNB Chain: Expanding into the Blockchain Ecosystem

3-1. Behind BNB Chain’s Launch: Early Move into DEX Market and Product Diversification Strategy

As mentioned earlier, Binance is not stopping at running an exchange business and has entered the blockchain market by launching the Binance Chain and the Binance Smart Chain in April 2019 and September 2020, respectively. So, what is the reason behind such a move by Binance, which was already raking in revenue from its exchange, to launch its own blockchains? The answer to this curiosity can be found in the Binance Coin Whitepaper published in 2018 and Binance’s strategy for launching new products.

A) Binance’s Ambition to Move into DEX Market Early

Binance had originally planned to launch a DEX. This is apparent in its whitepaper published in 2017, which states the BNB token’s utility as below:

Decentralized Exchange

In the future, Binance will build a decentralized exchange, where BNB will be used as one of the key base assets as well as gas to be spent.

As he mentioned in his interview with Bankless, Changpeng Zhao believes the center of blockchain exchange market will move from centralized exchanges (CEXs) to decentralized exchanges (DEXs) in 5 to 10 years’ time. It seems that is why Binance sought to launch its own chain and secure its first-mover position in the DEX market it enjoys now.

B) Diversifying Core Products and Means to Raise Funds

Binance’s launch of its own chain could also be seen as just another one of its exchange products added to the list. As the cryptocurrency market that soared up in 2017 turned bearish in 2018, the total amount of transactions itself plummeted, making a huge dent in exchanges that rely on transaction fees as revenue. Exchanges further diversified and differentiated their core products to deal with this issue, and launching their own chains was one such product. Since exchanges launching their own chain can be the bases for issuing other assets, such as launching exchange tokens, and an opportunity and momentum to raise funds, it is highly sought after not only by Binance but other exchanges as well. In fact, many exchanges announced the launch of their own public chains.

3-2. Behind BNB Chain’s Growth: High Ethereum-Compatibility and Leverage on Binance

A) High Ethereum-Compatibility

The single biggest contributing factor to the growth of BNB Chain would be, bar none, its high compatibility with Ethereum. In early 2021, the growth of Ethereum-based DeFi services raised the number of transactions, which raised the Ethereum gas fee and caused a surge in demand for alternative platforms. The first chain to benefit from the Ethereum gas fee increase was BNB Chain.

BNB Chain rapidly scaled up its user base with the advantage that 1) it supports EVM and enables easy transfer of dApps from Ethereum, 2) it lowers the entry barrier for Ethereum users with its compatibility with MetaMask, and 3) it launched a yield farming protocol with a very high token incentive.

BNB Chain’s growth in the early phase was centered around DeFi projects. BNB Chain copied major Ethereum-based DeFi projects, Uniswap and Compound, to launch its own, PancakeSwap and Venus, which currently still enjoy over 50% DeFi TVL and maintain a dominant position within the BNB Chain DeFi ecosystem.

B) Mainnet Taking Off on the Back of Binance

One cannot talk about BNB Chain without talking about Binance. Though Binance is said to have only lent BNB Chain its brand, the chain was able to grow rapidly by leveraging Binance’s funding resources and traffic since Binance was a contributor to the ecosystem.

BNB Chain Project Listed on Binance Exchange

Even now, Binance is an exchange with the most transaction amount in the world, which causes a token price to sway upward upon the news of the said token being listed on Binance. The price of recently listed GMX, for example, likewise skyrocketed over 50% from its initially listed price of about USD 40 to about USD 67. Since there were no blockchain products actually in use, with most of the projects still in their development phase back in 2019, the so-called “price pumping” due to exchange listing was more prominent. This led many projects to wish to be listed on the Binance Exchange.

In June 2019, Binance announced that it would make a monthly selection of at least one from the various projects on Binance DEX, which meets specified qualifications, such as its transaction volume and community size, to be listed (BEP2 Community Listing Program). Since then, Binance has carried out the Listing Program initiative a total of nine times until June 2020.

Such momentum was maintained even after Binance launched its smart contract platform, Binance Smart Chain, by listing four BSC DeFi projects (BAKE, BURGER, CAKE, and SPARTAN) in September alone since the launch of the Innovation Zone (a separate listing category for promising yet still in the development phase projects) on September 21, 2021. Since then, promising projects from many mainnets, such as Ethereum and Solana, have been listed within the Innovation Zone.

As mentioned earlier, being listed on Binance means a surge in the token price in the short term, and a leg up for the project’s growth with additional liquidity and transaction volume in the long run. Binance expanded its ecosystem by allowing projects who wish to be listed on Binance to be onboarded on the chain by listing projects on Binance DEX and Binance Smart Chain.

Binance Ecosystem Fund and Accelerator Program

From the early days of the BNB Chain launch, Binance has been expanding its ecosystem by forming large-scale ecosystem funds and operating accelerator programs. Since the launch of Binance Smart Chain in April 2020, Binance launched a USD 100 million BSC Accelerator Fund and even formed the largest fund ever at the time (USD 1 billion) in 2021. Ecosystem funds were provided to projects building services based on the respective mainnets in the form of 1) liquidity, 2) investments, and 3) accelerator programs. This influenced the growth of BNB Chain’s major DeFi platforms, PancakeSwap (a DEX) and Venus (a lending platform), both directly and indirectly.

Even now, Binance continues to provide financial support for the projects using the ecosystem fund and further expanding its ecosystem with its accelerator program titled “Most Valuable Builder Program.”

3-3. BNB Chain Still Going Strong in 2Q 2022

A) Holding Down the Fort as Top 3 by TVL Against New Competitors

As explained earlier, the year 2021 was littered with fierce battles among numerous mainnets to take the lead of the market as the substitute for Ethereum that it is even dubbed the “Layer 1 War.” This led BNB Chain’s TVL to decline compared to the total TVL of all the chains between 4Q 2021 to 1Q 2022.

The 2Q 2022 was another story. As an impact of the Terra and Celsius incidents in April 2022, the entire DeFi ecosystem shrunk overall, and the prices of crypto assets continuously fell, decreasing the total DeFi TVL. However, the drop in BNB Chain’s TVL was lower than the Top 10 mainnets, ensuring BNB Chain maintains its Top 3 ranking. The reasons for such a phenomenon are 1) a relatively small fall in the price of BNB token – the base token for BNB Chain – compared to other mainnets, and 2) BNB Chain having absorbed the DeFi protocols of Terra blockchain.

B) Growth Engine Built on NFTs and Gaming

BNB Chain is reigning number one by market share among all the chains in the GameFi sector, with a 36.85% market share as of July 2022. Moreover, BNB Chain is also the most selected chain by the new GameFi projects.

<Market Share by Chain; Source: Footprint GameFi Industry Report 2022>

Perhaps this is how BNB Chain is able to enjoy rapid growth in the GameFi and NFT sectors, unlike the DeFi sector, which hit a bit of a speed bump. When we look at the NFT trade volume on BNB Chain, while the total amount of transactions may have dropped due to the fall of BNB price, the transaction amount increased by 670% YoY and the number of transactions by 878%.

Binance plans to continue its expansion in the metaverse and DeFi sectors. At the time of its rebranding as BNB Chain last February, BNB Chain stated that it would scale up its ecosystem with a focus on MetaFi (a comprehensive concept including metaverse, DeFi, GameFi, SocialFi, Web3, and NFT).

4. Roadmap for Regulatory Compliance and Blockchain Mass Adoption

4-1. A Shift in Strategy With Regulations Introduced: Binance’s Localization Strategy and Improving BNB Chain’s Decentralization

A) Binance: Targeting Localization

As mentioned earlier, Binance enjoys the advantage of not being tied to a specific set of regulations as a decentralized organization without any earth-bound headquarters. However, as more and more crypto asset trade-related regulations are put in place, Binance is getting banned from operating its business in one jurisdiction after another.

Binance is currently under investigation by the U.S. authorities for the suspicion of money laundering since May 2021 and was banned by the U.K. financial authorities from operating its business on June 25, 2021. On July 25, Barclays, a large British bank, suspended deposits to and withdrawals from their bank accounts as well as all credit and debit card payments to Binance.

Binance is tackling this issue by building separate local exchanges. Its strategy is two-pronged: establishing its own exchanges (e.g., Binance US in the United States) and acquiring local companies (e.g., for South East Asian countries). Its original approach for making its way into different countries was to forge partnerships with local companies to build their own exchanges. However, as regulatory compliance and other factors make it difficult to pursue that approach, Binance has shifted its focus to acquiring companies that have already been licensed.

B) BNB Chain: Improving Decentralization

CEO of Binance, Changpeng “CZ” Zhao, has maintained that Binance has merely lent its brand to BNB Chain and is not involved in the chain’s operation itself. However, the Binance exchange token, BNB, has the potential risk of being considered an unregistered security in the eyes of the U.S. Securities and Exchange Commission since Binance has been using 20% of its profit on burning BNB tokens on a quarterly basis.

The controversy over whether the token should be considered a bearer security would be resolved as Binance and BNB Chain become decentralized. Last February, the chain rebranded itself as the “Build N’ Build” chain as a part of its ongoing effort to cut ties from Binance and become decentralized. BNB Chain is seeking to 1) become decoupled from Binance by changing its quarterly token burn mechanism to an automatic one and 2) raise the decentralization level of the chain itself by increasing the number of its validators (to 41 active validators out of 80 to 100 validators in total).

Despite such efforts, some still believe that the chain centralization issue persists in the light of the BNB Chain shutdown that took place last October 6, after only a day to resolve the BSC token hub exploit. Binance CEO CZ stated that they were able to contact every one of their validators and stop the chain, which could only be made possible in such a short period of time because the chain currently has a limited number of validators of 26. This incident showed the world that it is possible for Binance to arbitrarily shut down the BNB Chain if it so chooses and that BNB Chain needs to work harder on its decentralization.

4-2. Efforts for Blockchain Mass Adoption: Expanding Investments for Binance and Improving BNB Chain’s Scalability

A) Binance: Expanding Investments

Binance is continuing its investment in TradiFi companies. It executed a USD 200 million strategic investment in Forbes last February and stated that it is "interested in taking stakes in traditional e-commerce and gaming companies in the future."

Binance’s investments in blockchain projects are also continuing. According to CoinDesk, Binance has invested USD 325 million into 67 projects as of October 8, 2022, which is more than double in terms of investment amount alone compared to 2021 (with USD 140 million invested in 73 projects).

B) BNB Chain: Making Technological Updates for Scalability Improvements

BNB Chain is expanding its horizon into multi-chain and cross-chain to overcome limitations of how much a single chain can handle and improve scalability. Currently, BNB Chain sees a maximum of 2 million daily active users (DAU), with a single GameFi accounting for 1 million DAU, which signifies that the chain needs to scale up its computing resources in order to onboard more users. BSC Application Subchain (BAS) was introduced last June to this end, and various game projects such as MetaApe have been onboarded and are in operation.

Last September, the BNB Chain presented the zkBNB testnet and disclosed the code as an open-source, as the consensus mechanism for Binance sub-chains will be developed as a Proof-of-Stake mechanism for the first phase, then as a ZK-rollup (SNARK-based) for the second phase. BNB Chain’s roadmap shows that the BNB ZK-rollup will be announced within the year 2022. Once this technology is launched, BNB Chain will take on a modular blockchain structure, much like Ethereum, and be able to secure further scalability to onboard more users.

5. The Binance Empire to Continue Standing Firm in 2023

5-1. Binance: To Continue Enjoying Its Unrivaled Dominance as the Number One Centralized Exchange Based on Trust

What we could confirm more than anything with the recent hacking incident was the market’s confidence in Binance. Whether the operating body can be trusted is a critical part of what makes or breaks a centralized exchange. The recent exploit might have even been a blessing in disguise: How proactively Binance responded to the incident served as momentum and an opportunity to reiterate to its users the advantages only centralized operation can offer. Such a strong brand power will act as the driving force for the empire that is Binance to continue to grow well into next year.

Furthermore, Binance is likely to continue to enjoy its advantageous position in the crypto exchange market by maintaining its massive transaction amount and low transaction fee policy. As mentioned earlier, the network effect is vital to the exchange business. The high transaction amount and liquidity Binance has already secured are expected to bring in even more users.

Binance does have a certain risk lingering since it has been banned from operating business due to the uncertain location of its headquarters weighing it down as crypto regulations are introduced. However, Binance is not alone in such a struggle. Any and all centralized exchanges, and their businesses, are destined to be impacted by regulations no matter where their jurisdictions are. For example, FTX is also taking measures against the introduction of regulations by launching FTX US in the US and acquiring exchanges in Asia.

In the midst of such turmoil, Binance is focusing on taking a cooperative stance with the regulatory authorities worldwide, such as establishing a Global Advisory Board (GAB) and partnering with Binance.US in the States. Just as it maintained the level of its transaction amount even in the crypto bear market in 2018 by launching a wide variety of services, Binance is expected to adapt quickly to the changing environment. The regulatory issue is not likely to negatively impact the solo run Binance is dashing in the short term.

5-2. BNB Chain: To Secure an Upper Hand With Its Many Users and Connection With Binance

BNB Chain currently leverages its massive user count and the Binance platform to expand its ecosystem. BNB Chain’s UAWs (Unique Active Wallets) reaches about 1.8 million, which is over 3-folds larger than Ethereum (with 480,000 as of October 14, 2022) and Avalanche (57,000 as of October 14, 2022), and Solana (694,000 as of October 14, 2022). In the case of Binance NFT Marketplace, it offers the project the benefit of taping access to the 28.6 million Binance Exchange user base (as of 2021) by participating in various events such as IGOs (Initial Gaming Offering). Due to such an advantage, many projects tend to flock to BNB Chain with an eye for a better marketing position.

While expectations are high on P2E games and GameFi to lead blockchain to mass adoption, BNB Chain’s massive user number and connection with Binance is expected to lay the foundation to continuously attract killer dApps and build their growth engine.

Binance is not stopping at operating a centralized exchange business and furthering its presence in the blockchain ecosystem by launching the BNB Chain. BNB Chain is leveraging the Binance Exchange’s traffic, built its growth engine through NFTs and GameFi, and is fortifying its position in the market and maintaining its Top 3 ranking by TVL against new contenders in the competition. BNB Chain is expected to continue attracting killer dApps and grow its ecosystem based on the high user number and the Binance NFT Marketplace. Binance has made a successful marriage between the centralized exchange and BNB Chain-based decentralized ecosystem, a couple that could very likely cannibalize themselves with just a single wrong step. Now, Binance is well on its way to building an empire that any crypto market users will necessarily have to stop by, and such an ambitious take on the challenge will surely continue in the year 2023.

Other Related Research Articles

- What Constitutes a Mainnet? An In-Depth Look Inside the Building Blocks

- Fat Protocols vs. Fat Applications