Translated by LC, elcreto

※ The report was published on Dec 2, 2022, by CMC Research.

Table of Contents

1. Introduction

2. Trading Volume

A. Market Size

B. Cryptocurrency Exchanges in Korea

C. Listed Assets

D. Korea's Crypto Exchanges Are Expected to Grow Further in 2023

3. State of Blockchain Adoption

A. Web3 Adoption in South Korea

B. Web3 Adoption by Sector

4. Regulations

A. Governing Laws and Regulations in South Korea

B. Accounting Standard for Cryptocurrencies

C. Crypto Regulations: What's to Come in the Coming Years

5. Closing Thoughts

1. Introduction

Korea Blockchain Week (KBW) 2022, a premier blockchain event held in August, brought mass attention during the two-day event, which had about 130 speakers sharing their knowledge and experience with over 8,700 attendees. Aside from the main event, some 90 projects held side events prior to and after KBW2022, featuring networking opportunities. KBW2022 is said to have established itself as a global blockchain event beyond Asia.

The Korean crypto market has been attracting attention for being at the top of the global market in terms of transaction amount, but the atmosphere of the Korean crypto scene seemed different this time around. KBW clearly demonstrated that major domestic listed companies already leading the traditional industry are highly interested in Web 3.

The ADOPTION 2022 conference, hosted by a crypto data analytics platform Xangle during KBW, was also organized to achieve integration of Web 2 and Web 3. A myriad of Web 2 companies from different industries participated in this year's event, evidencing that the crypto market in Korea is developing into an optimal destination for creating practical use cases for cryptocurrencies leveraging blockchain technology.

In this report, the Xangle Research team takes a deeper dive into the Korean cryptocurrency market, which has matured in many ways. We will explore the size of Korea's crypto market, how regulations are progressing, and for what purpose companies in each sector are keen to adopt blockchain technology.

2. Trading Volume

A. Market Size

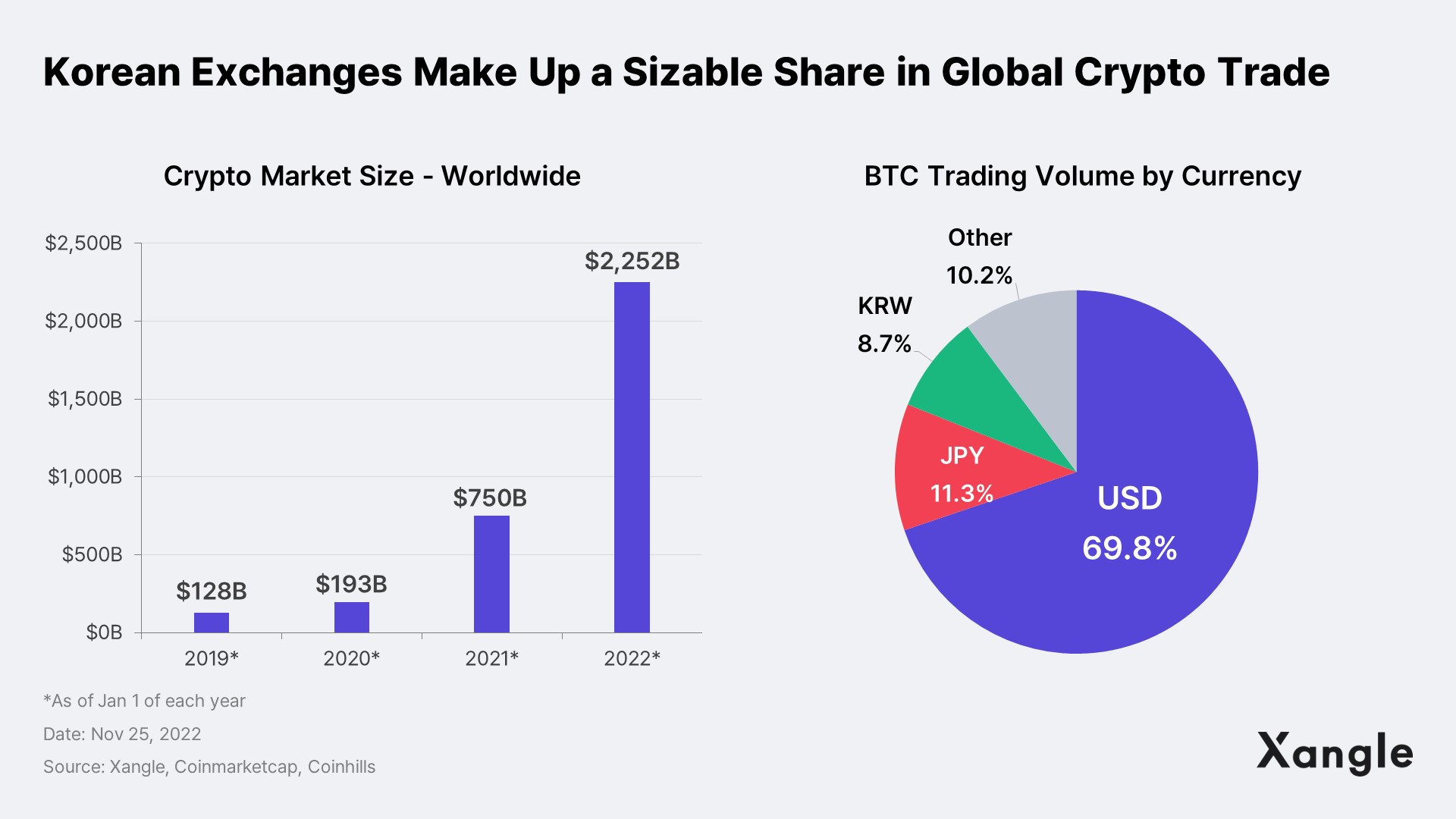

The global crypto market has been growing steadily over the past three years, which was worth $129B in early 2019, $193B in early 2020 (YoY +50%), $750B in early 2021 (YoY +289%), and $2,252B in early 2022 (YoY +200%).

In line with the global crypto market, the Korean crypto market has seen rapid growth over the past few years. As of writing, Korea (8.7%) ranks third in terms of Bitcoin trading volume after the U.S. (69.8%) and Japan (11.3%), making up a sizable share of the global cryptocurrency market.

Recently, the crypto market began to catch up to equities in terms of trading volumes. As of 2H 2022, the average daily transaction amount* was KRW 11.3 trillion, similar to the KOSPI transaction amount of KRW 12.8 trillion (source: Korea Exchange) and the KOSDAQ transaction amount of KRW 11.7 trillion during the same period. Considering that the market capitalization of crypto assets was about 5% of that of KOSPI and KOSDAQ toward the end of 2021, it can be seen that cryptocurrency is popular in Korea with high trading activity.

* The transaction amount = Sum of Number of trades per crypto asset x daily closing price of the crypto asset

The overall transaction volume has been on the decline due to continued unfavorable market conditions domestically and globally following the cryptocurrency market crash and economic contraction since the beginning of 2022. However, the number of crypto assets increased from 1,257 to 1,371, a 9% increase from 1H 2022, and the number of traders was 6.9M, up 24% from 1H 2022 (5.58M).

Although the number of individual user accounts decreased by 20% compared to 1H 2022, the number of institutional investor accounts rose by 24%, indicating that the deployment of crypto regulations is driving institutional adoption.

B. Cryptocurrency Exchanges in Korea

1) Transaction Volume of Top 5 Crypto Exchanges in Korea

Upbit continues to run a monopoly, handling over 75% of the total trading volume

In Sep 2021, when the Act on Reporting and Using Specified Financial Transaction Information came into effect, most of the crypto exchanges in Korea that failed to obtain real-name bank accounts suspended buy/sell trades of assets in KRW, further solidifying the dominance of the top five crypto exchanges—Upbit, Bithumb, Coinone, Korbit, and Gopax.

Of the top five exchanges, Upbit continues to solidify its monopolistic status in 2022, recording a cumulative transaction amount of about KRW1,400T as of Oct 2022 and accounting for 82.7% of the entire cryptocurrency market in Korea.

Partnerships with internet-only banks are key to the growth of domestic virtual asset exchanges

The crypto regulations in Korea restrict cryptocurrency trading to real-name bank accounts, which indicates that a trader must create a real-name account with the bank supported by the exchange, and both the bank and the exchange must verify the trader's identity. Deciding which bank to partner with is important because users would want to trade on exchanges partnered with banks that would allow them to open an account without a brick-and-mortar presence.

For this reason, many crypto exchanges prefer partnering with internet-only banks rather than commercial banks. By offering services primarily through the internet without face-to-face interactions, internet-only banks can onboard new customers fast, and improved customer convenience and easy accessibility will allow exchanges to attract more traders.

Currently, there are three internet-only banks in Korea, each offering a diversified range of financial services and products.

- K Bank: Launched in Apr 2017, K Bank aims to grow as a digital financial platform through partnerships with various industries, including Upbit and Mirae Asset Securities.

- KakaoBank: Established in Jul 2017, KakaoBank is Korea’s first digital bank to go public (IPO), mainly operating as a digital platform (for opening security accounts and posting advertisements) and banking service provider (deposit and loan services).

- Toss Bank: A latecomer compared to the previous two, Toss Bank was launched in Oct 2021. The internet-only lender takes a differentiated approach by offering daily deposit interest services and loan services to private business owners.

1) Upbit Becomes the Largest Crypto Exchange in Korea Backed by K Bank Partnership

Upbit was not always the largest crypto exchange in Korea in terms of transaction amount. Until 1H 2020, Upbit and Bithumb accounted for about 35% of the crypto exchange market but starting in June 2020, Upbit secured an overwhelming market share by partnering with K Bank for real-name verification.

Along with Upbit’s overwhelming growth, K Bank’s customers and net interest income increased significantly. It said the number of its customers reached 7M in Dec 2021, up from 2.19M at the end of 2020. The net interest income increased from KRW 46B in 2020 to about KRW 198B in 2021, and the increased earnings enabled the online lender to net its first black in 2Q 2021, which marked the first quarterly profit since its inception four years ago.

Upbit is also dominating in Korea because of its convenient UX and intuitive UI compared to other exchanges. Dunamu, the operator of Upbit, has experience operating the stock investment app “Stock Plus” for several years and based on this, it was able to quickly introduce features and services that users wanted.

Above all, Upbit’s low trading fee in KRW has, in fact, helped the exchange solidify its dominant position. Launched relatively late compared to other exchanges in Korea (Bithumb – Launched in Jan 2013, Coinone – Launched in Apr 2016). Upbit was able to quickly increase its market share by offering the lowest trading fee among major exchanges in Korea.

2) Coinone-KakaoBank Partnership: Will Coinone Achieve Outstanding Growth Following the Deal with KakaoBank?

However, it is difficult to affirm whether Upbit will retain its position as the nation’s dominant exchange operator with the largest market share as Coinone is seeking a breakthrough in a partnership with KakaoBank. Under the partnership, KakaoBank will provide verified real-name deposit and withdrawal account services. KakaoBank is the biggest internet-only bank backed by massive traffic volume – with over 18M users and 15M monthly unique users. Looking at how the partnership between exchanges and internet-only banks has affected the influx of new users, as in the case of the K Bank and Upbit partnership, a fresh synergy brought by the Coinone-KakaoBank deal could possibly enable Coinone to increase its share in the Korean crypto market.

2) Token Listings of Korea’s Crypto Exchanges

Domestic Exchanges Achieved Rapid Growth by Listing As Many Projects As Possible

When the bullish crypto market began in earnest in late 2020, domestic crypto exchanges began aggressively listing token projects, rapidly increasing their transaction volume. Since exchanges generate revenue by collecting transaction fees, the more transactions on a particular exchange, the more money they earn. The Big 5 exchanges had over 150 trading pairs listed in the first half of 2021 alone, and the cumulative number of users and transaction volume also exploded during the same period.

In particular, Bithumb and Coinone stepped up their games in the first half of 2021 by listing 64 and 39 token projects, respectively. Although efforts were made to tap into a niche market by listing the Binance coin (BNB) and Klaytn (KLAY), the two coins which were not listed on Korea’s largest exchange by trading volume, Upbit, Bithumb, and Coinone failed to deliver meaningful results. This is because Upbit already had high liquidity and the trading volume for major tokens, including Bitcoin and Ethereum, and listing BNB and KLAY would not have been able to increase the market share of Bithumb and Coinone.

Domestic Exchanges have Fewer Tokens Listed than Global Exchanges, but Transaction Amount Remains High

Ahead of the regulatory overhaul, major exchanges in Korea have switched from a listing rush to scrapping coins in delisting dumps. In Sep 2021, Korean crypto exchanges suddenly began terminating token projects as they were preparing to register with the Financial Intelligence Unit (FIU). Exchanges must secure a bank partnership in order to qualify for FIU registration, as the Korea Federation of Banks (KFB) stated concerns over money laundering risks of local crypto exchanges that had too many token projects that the KFB considers fishy. The timing of domestic exchanges’ delisting aligns with the FIU registration deadline for securing partnerships with domestic banks, and a total of 26 tokens were delisted in 2H 2021.

Meanwhile, 32 tokens were delisted in 2Q 2022. The decisions from the exchanges came in the wake of the Luna and Terra crash in May 2022, causing the Top 5 exchanges to temporarily delist the tokens related to the Terra ecosystem. (LUNA-related stablecoins)

In addition, newly listed token projects began to be delisted after Korea’s top 5 crypto exchanges launched a joint consultative body called the Digital Asset eXchange Alliance (DAXA) on Jun 22, 2022, in response to the crypto debacle surrounding the Terra and Luna coins. The alliance released a draft version of the crypto listing guideline in July to conduct a risk assessment of listed digital assets and began running the consultative group on a trial basis as per the guideline starting in August.

As a result, crypto project listings have generally decreased while the investment caution list increased. According to the Financial Services Commission’s press release, trading support for new projects in 2Q 2022 after the LUNA incident decreased from 95 assets in 1Q to 59 assets in 2Q, while the number of delisting increased from 62 assets to 85 assets, and the number of tokens in the investment caution list increased from 92 to 114.

However, Korea’s crypto exchanges currently support about 200 tokens, which is relatively less than global exchanges such as Binance (500+ tokens listed) and Huobi Global (400+ tokens listed).

Nevertheless, as mentioned earlier, the Korean virtual asset market is the third-largest global market after the United States and Japan in terms of transaction amount. According to CoinMarketCap (as of Nov 15, 2022), Upbit showed a trading volume of $2.6B (24-hour trading volume) and ranked 8th out of 248 total exchanges.

3) Performance of Domestic Exchanges

Crypto Winter Takes Toll on Korean Exchanges’ Trading Volume

The overall transaction volume of crypto exchanges decreased in 2022 following a prolonged bout of macro-induced volatility, including the Russia-Ukraine war and interest rate hikes, causing economic contraction. The global crypto scene also has suffered from major incidents, such as the Luna-Terra debacle in May and the Chapter 11 bankruptcy of Celcius and FTX in June and November, respectively, shaking crypto investors’ confidence more broadly.

As a result, the total transaction amount of the crypto exchange also decreased, and the performance is also deteriorating significantly. The short-term net profit of Upbit and Bithumb in 1H 2022, which accounts for more than 95% of the market share of the domestic exchange, fell more than 90% YoY to KRW 172.8B and KRW 7.4B, respectively.

Meanwhile, most of the profits from Korea’s crypto exchanges depend on transaction fees. In 2021, 99% of Dunamu (Upbit)’s and 100% of Bithumb Korea’s revenues were generated from exchange fees, and revenues naturally decreased as the transaction amount decreased. According to the Financial Services Commission (FSC), there is a substantial decline in operating profit as all 24 exchanges except for two posted operating losses in 2Q 2022.

Trading fees have been the primary revenue source for exchange platforms all around the world, leaving them highly reliant on trading volume – a problem that global exchanges, including Korea, need to solve collectively. For Coinbase, the vast majority of revenues are also from trading tokens, and 90% of its revenue in 1H 2021 came from trading fees. To curb reliance on trading fees, Coinbase shifted away from its trading fee revenue model to a subscription-based one (the service includes a waiver of Coinbase trading fees and a dedicated customer support line available 24/7). Coinbase’s effort to diversify revenue streams paid off as the subscription and services revenues went up from 4% in 1H 2021 to 15% in 1H 2022.

Domestic Exchanges Seek Ways to Diversify Revenue Streams by Starting NFT Business

Major crypto exchanges in Korea, including Upbit, Bithumb, and Korbit are taking steps to diversify and grow their non-transaction revenue streams, and they are seeking ways to maintain profitability by starting NFT businesses.

Dunamu launched the “Upbit NFT” beta service in Nov 2021. It offers “Drops,” where users buy NFTs through auctions, and “Marketplace,” where users trade NFTs. Dunamu and HYBE, the music label managing K-pop superstar group BTS, established a joint venture named “Levvels” to launch an NFT-trading platform targeting the global fans of HYBE artists.

Bithumb and Korbit are also seeking ways to maintain profitability by leveraging NFTs. Bithumb Meta, the metaverse subsidiary of Bithumb, is also scheduled to launch its NFT marketplace called “Naemo World.” Korbit launched Korea’s first NFT marketplace in April, introducing an NFT using the IP of popular dramas in collaboration with Studio Dragon. Korbit is currently working on “Korbit NFT 2.0,” an NFT upgrade to improve the existing NFT marketplace, scheduled to launch this year.

C. Listed Assets

1) Trading Volume: Korean Won Market vs Coin Market

High Entry Barrier Makes the Coin Market Less Competitive than the Korean Won Market

In Sep 2021, the polarization of cryptocurrency exchanges in Korea intensified upon enacting the revised version of the Specific Financial Information Act, under which securing bank partnerships to provide real-name verified accounts is included as a reporting requirement for domestic exchanges.

The five major exchanges that have secured partnerships with commercial banks in the traditional financial sector and continued to operate in the Korean won market logged a trading volume of KRW 5.2 trillion, accounting for 99.4% of the total trading volume in the Korean crypto market. In contrast, the transaction amount of the exchanges that operate the coin market (an exchange where BTC/ETH tokens are traded in pairs) is KRW 3B, only 0.6% of the total transaction amount. As for the coin market (exchanges where tokens are traded in pairs, such as BTC/ETH), there is an entry barrier where users have to purchase tokens in Korean won or use outside services to convert the purchased tokens to Korean won.

In addition, when comparing the listed cryptocurrencies, the coin market has 1) fewer listings of major crypto assets compared to the Korean won market and 2) a higher share of transactions of non-mainstream and single-listed crypto assets. According to the FSC’s investigation, the top 10 crypto assets traded in the coin market were all single-listed crypto assets that support trading only on one exchange. Single-listed crypto assets usually have low market capitalization with low distribution volume, indicating that investors will face great risks in case of sudden price fluctuations and insufficient liquidity. On the other hand, most of the top 10 trading projects in the Korean won market in 1H 2022 were similar to the top 10 global trading projects except for dollar-based stablecoins.

As a result, the coin market is not generating meaningful profits due to the low trading volume, and the operating profit of the entire coin market exchange in 1H 2022 is -KRW32.7B (source: FSC). Against this backdrop, it seems difficult for the coin market to continue its operation in Korea as its competitiveness is significantly lower than the Korean won market exchange.

2) Listed Assets by Sector

Many tokens were delisted when the Specified Financial Transaction Act came into effect in Sep 2021, but that did not mean that the exchanges had completely suspended listing. Even after the Luna-Terra Crash, the top five domestic exchanges listed 14 tokens during the 3Q 2022.

Then which crypto projects, or, to be specific, sectors, were listed the most by the domestic exchanges? To answer this question, the Xangle Research team segregated the sectors of listed projects into six categories – Layer 1, Layer 2, DeFi, NFT/Game/Metaverse, Web 3.0, and others. Projects included in each sector are the following.

- Layer 1: BTC, ETH, SOL, KLAY

- Layer 2: MATIC, RON, LRC, BOBA

- DeFi: AAVE, COMP, SNX, SRM

- P2E/NFT/Metaverse: AXS, MANA, SAND, WEMIX

- Web 3.0: BTT, GRT, FIL, THETA

- Other: DOGE, XRP, MVL, ASM

DeFi and P2E Projects were Listed the Most Since 2021

The Xangle Research found that DeFi-related projects, with 599, had the most listed on the top four domestic exchanges after 2021, followed by P2E/NFT/Metaverse with 53, Layer 1 with 37, and Web 3.0 with 30, and Layer 2 with 11. The DeFi and P2E sectors have been receiving relatively more attention from the market following the DeFi craze that began in 2020 and the P2E trend triggered by the success of Axie Infinity. Thus, it seems that Korea’s crypto exchanges listed many token projects in the two sectors to increase trading volume.

Though the Number of Listings Decreased, the Listing of Projects in DeFi and P2E Sectors Has Been Maintained in 2022

The number of new listings has decreased following the enactment of the Specific Financial Information Act in Sep 2021 and the Luna-Terra incident in May 2022. Ahead of the regulatory overhaul, major exchanges in Korea began scrapping coins in delisting dumps as they had to secure a bank partnership in order to qualify for FIU registration as the KFB stated concerns of money laundering risks of local crypto exchanges that had too many token projects that the KFB considers fishy. As a result, the number of listed coins in 1H 2021 was 156, but the number of listed coins in 2H 2021 dropped significantly by more than 50% to 71.

The top five domestic exchanges strengthened their listing standards as the need for investor protection measures increased after the Luna-Terra incident. The number of listed coins in 3Q 2022 was 14, dropping more than 70% QoQ.

Although the overall listing activity decreased, the listing of projects in the DeFi and P2E sectors has been maintained. 47 P2E/NFT/metaverse sector projects were listed in 2022, an increase from the previous year. Projects listed during that period include Wemix and PlayDapp, the two major P2E projects in Korea.

3) Trading Volume by Sector

Layer 1 Projects Record Highest Trading Volume in All Quarters across Domestic Exchanges

Which sector is traded the most on Korea’s crypto exchanges? The trading volume of Layer 1 related projects was the highest in all quarters across domestic exchanges. However, the trading volume of Web 3.0 related tokens was very high in 1Q 2022 because BTT trading volume (45% of Upbit trading volume as of 1Q 2022) was relatively high on Upbit, which recorded more than 87% out of the total transaction amount in Korea in 1Q.

P2E Sector Draws Mass Attention

The P2E sector is drawing mass attention in Korea as domestic game companies announced plans to enter the P2E market combined with NFT after seeing the success of WeMade's Mir 4. Korea's game development/publishing companies with financial strength, such as Kakao Games, Netmarble, Com2us, and Neopin, plan to release P2E games focusing on fun over function, unlike crypto-born P2E. The quarterly trading volume also indicates that P2E/NFT/metaverse trading was always high, except for 1Q 2022 when the BTT trading volume was higher.

The Trading Volume of Major P2E Projects in Korea Continues to Increase

Projects worthy of attention in the P2E/NFT/Metaverse sector are Korean P2E projects represented by Wemix, Bora, and PlayDapp. Korean P2E projects are actively traded in Korea, accounting for 22% of the total P2E/NFT/Metaverse sector trading volume as of 3Q 2022. Furthermore, the proportion of Korea's P2E projects is also increasing in the total trading volume.

Korea's game development/publishing companies with financial strength, such as Kakao Games, Netmarble, Com2us, and Neopin, are releasing various P2E games. As Korea's major game companies are already leading the way in the global gaming industry, they are expected to bring killer services in the P2E sector backed by their popular game IPs.

D. Korea’s Crypto Exchanges Are Expected to Grow Further in 2023

We explored the characteristics of the Korean cryptocurrency market, focusing on the trading volume of the five major exchanges in Korea. Korea's crypto market seems to be undergoing various changes; with the establishment of toughened crypto regulations, domestic exchanges are now closely monitoring their asset portfolios.

Meanwhile, Korea's top five exchanges' transaction amount is expected to continue to grow. The market share of global cryptocurrency transactions has also been increasing since 2017, and the crypto market is still in the early stages of development, considering the number of traders.

1) The ratio of actual users of domestic exchanges is 12.8% of the total population, meaning that the number of users, which is small compared to the total population, could grow down the road. 2) Moreover, the number of tokens listed on domestic exchanges is still smaller than that of global exchanges, and if exchanges begin to list more projects again after regulations take root, the transaction amount is likely to increase as well. 3) Lastly, Korea’s crypto exchanges operate strictly in line with the crypto regulations for investors’ protection, which indicates that it is relatively safe to trade on domestic exchanges.

And above all, Korea’s crypto exchanges are expected to grow further in 2023 as the crypto trading market could be revived if Web 2 companies can drive growth by creating various use cases, such as creating new P2E games.

3. State of Blockchain Adoption

A. Web3 Adoption in South Korea

Crypto data intelligence platform Xangle hosted a conference for Web2 companies, including prominent listed companies. The conference revolved around themes, such as defining and preparing for Web3, and provided the audience with real examples of Web3 initiatives.

According to our survey, more than half of the industries that had attended the conference expressed their interest in Web3 products and services.

It is important to note that the seemingly less related sectors, such as non-tech or non-financial companies, are taking Web3 seriously. Apparently, game, IT, and financial companies’ pursuit of Web3 adoption seems only natural given that blockchain technology and infrastructure are the building blocks of Web3. But what the findings of the survey suggested was something else as it indicated that entertainment, distribution, and manufacturing sectors were also having Web3 products and services included in their pipelines.

It indicated that top-performing companies in South Korea see blockchain-based Web3 as a potential catalyst for a seismic shift in paradigm—similar to what the Internet did to the landscape of commerce—rather than a storm in a teacup that would affect only a handful of industries. This is why many prominent blockchain projects often see the South Korean market as a significant opportunity for a tangible outcome. As will soon be discussed in the following section, companies in traditional industries in South Korea have already been distinctly proactive in moving towards Web3 adoption.

B. Web3 Adoption by Sector

1) Games

The mega success of WEMADE’s MIR4 Global (an MMORPG-based P2E game) was quickly met with a throng of game companies in South Korea vying for blockchain business. The most significant merits that caught their attention were the geographical coverage of the user base that can be extended to other countries besides South Korea and the product-market fit of MMORPG, which is not only South Korean game companies’ strong suit but also a genre best suited for blockchain games.

Leveraging such benefits, South Korean game companies have increasingly thrown down the gauntlet since 2H 2021. For the most part, they are tapping their existing IPs, rather than developing blockchain games from scratch. Announcements of the launch of blockchain gaming platforms have so far been made by five game companies listed below, but there are also other game companies positive about introducing NFTs into their games.

Blockchain Gaming Platforms

Netmarble (Market cap of KRW 4.35 trillion, 70th largest in the KOSPI as of Nov 15, 2022 | KRX: 251270)

Netmarble is taking a two-pronged approach to blockchain business, running Klaytn-based gaming platform MarbleX and BSC-based entertainment content platform CUBE (formerly ITAM CUBE). It has launched P2E games by adding blockchain technology to existing games. After incorporating blockchain into A3: Still Alive and Ni no Kuni: Cross Worlds, Netmarble saw a significant increase in noteworthy performance numbers, including revenue from in-app purchases and MAU. Unlike its competitors, however, Netmarble has not been able to come up with a breakout title. Currently, it is partnering with content and entertainment companies to source mega IPs in an attempt to bolster IP competitiveness.

Com2uS (Market cap of KRW 832.5 billion, 60th largest in the KOSDAQ as of Nov 15, 2022 | KOSDAQ: 078340)

Veering from its Initial intent of building its mainnet on Terra in the wake of the May collapse, Com2uS launched Cosmos SDK-based mainnet XPLA. One of the biggest benefits of XPLA is its ability to leverage Cosmos IBC to enable collaboration with other mainnet projects in the Cosmos ecosystem. Migration of the previously released five games to the new mainnet will be followed by the launch of a blockchain version of its flagship game, Summoners War: Chronicles. In addition, XPLA will continue to push the boundaries into the entertainment business, including music, TV series, and movies. It will also collaborate with Com2Verse, an open Web3 metaverse, to build a blockchain ecosystem home to a wide variety of content.

Kakao Games (Market cap of KRW 3.69 trillion, 5th largest in the KOSDAQ as of Nov 15, 2022 | KOSDAQ: 293490)

Since the launch of ArcheWorld and Birdie Shot, Kakao Games’ blockchain platform BORA has grown into a sizable ecosystem. Last September, ArcheWorld was so hyped that it topped OpenSea’s list of top NFTs by trading volume on Klaytn. After KaKao’s other subsidiaries and affiliates, including Kakao Entertainment and Kakao Enterprise, announced to join the BORA ecosystem along with Kakao Games, anticipation is growing over the prospect of the platform as to its powerful IPs and possible large user base and lock-in effect.

WEMADE (Market cap of KRW 1.96 trillion, 14th largest in the KOSDAQ as of Nov 15, 2022 | KOSDAQ: 112040)

The stellar performance of MIR4 Global has won it a broad user base. Last October, it went on to migrate from Klaytn to its own mainnet, WEMIX 3.0. WEMIX 3.0 is set to drive the expansion of its ecosystem with its three flagship platforms—blockchain gaming platform WEMIX PLAY, DAO & NFT platform NILE, and DeFi service WEMIX.Fi. WEMIX has onboarded 17 games so far and has 32 more games to come aboard. Quite contrary to MIR4 Global’s deceleration in the growth rate, lackluster performance of new games, and subsequent downtrend of the on-chain indicators, performance numbers are expected to stage a turnaround upon the Q4 release of the Anipang series and MIR M Global.

Neowiz (Market cap of KRW 816.3 billion, 62nd in the KOSDAQ as of Nov 15, 2022 | KOSDAQ: 095660)

Klaytn-based DeFi platform NEOPIN and Polygon-based gaming platform Intella X are the two key pillars of Neowiz’s blockchain business. Intella X will exclusively onboard Neowiz’s game lineup, including social casino game A.V.A, Crypto Golf Impact, and Brave Nine. Neowiz seems more committed to the multichain strategy than any other projects, making it more likely that both NEOPIN and Intella X will build a multichain platform connected to multiple mainnets.

Game Companies Set to Introduce NFT Technology

Nexon (Nexon Games, market cap of KRW 1.23 trillion, 45th largest in the KOSDAQ as of Nov 15, 2022 | KOSDAQ: 225570)

Nexon is planning to create an NFT ecosystem based on its foremost IP, MapleStory. Apart from providing services like NFTs, decentralized communities, and dapps, the company will be joining a decentralized ecosystem, MapleStory Universe, as a creator. Once MapleStory Universe gains enough traction, other game IPs will be put at play in the decentralized ecosystem.

NCSOFT (Market cap of KRW 10.14 trillion, 35th largest in the KOSPI as of Nov 15, 2022 | KRX: 036570)

NCSOFT is the developer/publisher of the trailblazing money-making game, Lineage. Leveraging the ownership of such a powerful IP, it has grown significantly knowledgeable about running an in-game economy. While the launch of NFTs in Lineage W is slated for Q4 2022, the company is seeking to figure out ways to maintain the existing business model and economy. The company does not appear to have a particular interest in the play-to-earn business model and is projected to move ahead with a greater focus on providing value to game players rather than to token investors.

2) Finance

With the unprecedented growth of the crypto market, an increasing number of institutions are adding cryptocurrencies as investment asset. In response, traditional finance companies are going further than just adding new asset classes to existing investment portfolio—they are actually attempting to make inroads into the blockchain business itself. Given the crypto industry’s exponential growth and high returns, their blockchain initiatives may, too, turn out well.

Brokerage Firms

At the moment, most brokerage firms in South Korea appear to be sitting on the sidelines, citing reasons such as a prolonged crypto winter and lack of regulatory framework. Still, various plans are under review and they seem to be preparing themselves to stay agile once a cloud of risks is cleared in the market. We’ll discuss this more in detail, breaking it down by type of business, rather than by company.

Security Token Offerings (STO)

Security tokens that are deemed securities under the Financial Investment Services and Capital Markets Act will very likely be issued and distributed by brokerage firms or securities companies. As such, many South Korean securities companies are said to be proceeding with preparations for Security Token Offerings (STO). One of those is KB Securities Co., Ltd. It has recently announced that it had just completed development and testing of the key features of its in-development STO platform. Once guidelines are instituted and functionality testing, involving token issuance, wallet distribution, and transactions using smart contract, etc., is complete, KB Securities will be quick to release the service. Kiwoom Securities Co., Ltd. is another good example. It announced that it will collaborate with an issuer of real estate-backed securities in digital form, Funble, on such business. Kiwoom also announced that it had signed an MOU with a real estate securities trading service provider, Kasa Korea, signaling a collaboration aimed at a blockchain-based platform business.

Crypto Exchange Service

It appears that brokerage firms and securities companies in South Korea are also mulling a crypto exchange service. The Korea Financial Investment Association and South Korea’s seven largest securities companies (KB, NH, MiraeAsset, Samsung, Shinhan, Kiwoom, Korea Investment & Securities) are currently doing the groundwork for the founding of the Korea Alternative Trading System (KATS). As tradable assets on KATS will include listed stocks and depositary receipts, security tokens will also be made available. The Korea Financial Investment Association added that, in addition to security tokens, it had plans to make non-security tokens regulated by the upcoming Digital Assets Basic Act available at alternative exchanges. Once alternative exchanges are allowed to include non-security tokens as their tradable assets, they will be able to cover the full spectrum of cryptocurrencies that have been exclusively provided by existing crypto exchanges.

Banks

With the rise of the crypto economy, which was followed by a string of legislative and regulatory moves, many South Korean banks are considering entering the blockchain space. Currently, banks are not allowed to do crypto business under South Korea’s Banking Act. In response, big banks in the country are taking alternative approaches to the digital assets business, i.e., setting up joint ventures or holding shares.

Crypto Custody

The exponential growth of the crypto market has prompted many companies and institutions to add cryptocurrencies to their portfolio. Banks in South Korea began providing custody services where the banks get to buy cryptocurrencies and safeguard private keys on behalf of institutional investors. KB Kookmin Bank, in collaboration with Hashed and Haechi Labs, set up Korea Digital Asset Co., Ltd. (KODA), through which it offers crypto custody and management services. Woori Bank is also offering crypto custody through DiCustody, a joint venture the bank set up in partnership with Coinplug. Shinhan and NongHyup Banks, too, are setting foot in, each making investments in crypto custodians, Korea Digital Asset Custody (KDAC), and Cardo.

3) Entertainment

South Korean entertainment companies, on the other hand, are seeking ways to increase their value by turning their intangible resources, IPs, into digital assets. When it comes to valuation, determining and recognizing the value of their celebrities and the phenomenal fandom for the celebrities have long been a headache for the companies. Even apart from Hybe’s BTS, many of the IPs of South Korean entertainment companies are already capturing worldwide attention. This explains why these companies see this as an opportunity for business expansion and scramble for Web3 adoption.

Hybe Co., Ltd. (Market cap of KRW 5.85 trillion, 55th largest in the KOSPI as of Nov 15, 2022 | KRX: 352820)

Hybe formed a joint venture, Levvels, with Dunamu Inc. in Santa Monica, California to start an NFT business. Hybe is projected to create and sell NFTs of their artists, such as BTS and SEVENTEEN. NFTs using powerful IPs of the artists will likely offer a new type of fan experience, hence fueling fandom even further. Considering its announcement of a plan to launch an NFT marketplace of its own by year’s end, it remains to be seen if Hybe succeeds in assigning a meaningful market value to its IPs by allowing fans to freely engage in buy and sell trades of the NFTs.

SM Entertainment Co., Ltd. (Market cap of KRW 1.68 trillion, 20th largest in the KOSDAQ as of Nov 15, 2022 | KOSDAQ: 041510)

Unlike the debuts of K-Pop idols prior to this girl group, SM Entertainment used its own metaverse to unveil Aespa to the public, becoming the first entertainment company to do so. The company linked real-life members of a girl group to their corresponding virtual counterparts, allowing fans to interact with the K-pop stars in a unique and unprecedented way and to transcend time and space to participate in fandom activities. Furthermore, the company is planning to issue Aespa NFTs and set up infrastructure to have them used in SM’s metaverse. Its continued pursuit of collaborating with offshore crypto big names like Binance and The Sandbox also demonstrates its commitment to the P2C (Play to Create) ecosystem and SMTOWN Land metaverse.

Cube Entertainment Inc. (Market cap of KRW 269.2 billion, 271st in the KOSDAQ as of Nov 15, 2022 | KOSDAQ: 182360)

Its entry into the NFT market has become officialized after a series of announcements of partnership with The Sandbox, Animoca Brands, and Neowiz. In particular, an airdrop of video NFTs using footages of artists of Anicube—a joint venture between Cube and Animoca Brands—created massive hype, attracting 2.3 million applicants.

4) Consumer Products: Cosmetics, Fashion & Distribution

A brand is an important asset for any consumer product companies, including cosmetics and fashion businesses. Like many global brands, South Korea’s consumer goods industry has seen various attempts of leveraging NFTs to increase brand strength among millennials or in the metaverse.

Cosmetics

As revenue from Chinese shoppers in the cosmetics market has been seriously on the wane since the pandemic, South Korean beauty brands are exploring ways to leverage Web3 to usher in a boom once again.

LG Household & Health Care (Market cap of KRW 10.50 trillion, 32nd largest in the KOSPI as of Nov 15, 2022 | KRW: 051900)

LG H&H is the largest cosmetics and household goods company in South Korea. It has focused on building a storytelling universe that communicates brand philosophy to raise its appeal to millennials and Gen Z. In particular, belif, one of LG H&H’s most popular brands among millennials, minted NFTs using the brand’s own character and universe and offered various membership features. Building on the success of belif, it went on to link NFT to the actual products of its anti hair loss brand, Dr. Groot—the hype of which was so high that 2,000 tokens were sold out in just one day.

Shinsegae International (Market cap of KRW 897.9 billion, 230th in the KOSPI as of Nov 15, 2022 | KRX: 031430)

In collaboration with popular NFT project Meta Kongz, Shinsegae International launched NFT wearables, using newly released clothes of its brand, MAN ON THE BOON. Much like the way LG H&H did with Dr. Groot, Shinsegae leveraged its brand that sells primarily to men in their 20s to 40s.

Fashion

Virtually, incorporating NFTs in brand development strategies has allowed fashion brands to dissect their existing customers into subgroups, making target market more relevant and specific. Hazzys, at the beginning of this year, and Kolon Sport, at the end of last year, launched their NFT projects as part of their unequivocal efforts to rev up the appeal to millennials and Gen Z. Quite clearly, their NFT initiatives seem to be aimed at brand repositioning.

Hazzys (Unlisted)

South Korean clothing brand Hazzys rolled out its plan to sell 3D virtual characters Hazzys Friends on Feb 28, 2022, and threw a raffle dishing out 365 NFTs of virtual influencer Haesu on May 3, 2022.

Kolon Sport (Kolon, market cap of KRW 307.5 billion, 448th in the KOSPI as of Nov 15, 2022 | KRX: 002020)

Exclusively for Origin Red products (limited edition) of its flagship lineup, Antarctica, Kolon Sport provided an NFT-based digital warranty through Kakao Klip on Nov 12, 2021. Later, on Jun 16, 2022, it announced a collaboration with NFT brand Shy Ghost Squad.

Distribution

For department stores in search of demand for luxury goods, NFTs may yield opportunities to strengthen their brands and attract millennials, who will mostly become a key customer group for the companies.

Shinsegae Department Store (Shinsegae, market cap of 2.12 trillion, 134th in the KOSPI as of Nov 15, 2022 | KRX: 004170)

Shinsegae is the first conglomerate that minted PFP NFTs, using its signature character Puuvilla. The six levels of Puuvilla NFTs were designed to offer a variety of benefits, which became so popular that 10,000 tokens, split into three rounds of offering, were all sold out immediately upon issuance. After the sale of the NFTs, Shinsegae followed it up with an offline NFT festival, creating a positive cycle of promoting not only Puuvilla NFTs but Shinsegae’s brand as well.

Launching services targeting younger generations, home shopping networks are exploring repositioning opportunities for their brands to expand their customer base.

Lotte Home Shopping Inc. (Unlisted)

Similarly to Shinsegae, Lotte Home Shopping minted 10,000 NFTs using its signature character Bellygom and added membership benefits to the NFTs. Even before the NFT offering, Bellygom’s 1.1 million fanbase has led to social media fandom. The public sale of 3,500 NFTs, all of which were sold out immediately upon issuance, once again speaks to its great popularity. This home shopping network, too, created a positive cycle of raising awareness of both Lotte Home Shopping’s brand and Bellygom by displaying a giant Bellygom at Lotte World Tower.

Aside from such growing adoption, however, there seem to be gaps to be filled for the existing Web2 companies, including listed companies, to further advance into the market. Given that business involving crypto will highly likely be subject to laws and regulations, we’ll now walk you through the current state of South Korea’s regulatory environment.

4. Regulations

A. Governing Laws and Regulations in South Korea

The unraveling of a series of debacles, most notably the collapses of Terra Luna, Celsius, and FTX, has dealt a blow to the trust and confidence in the crypto industry—leading to a heightened awareness of the direction of regulatory frameworks among the market participants.

By no means is South Korea immune to the broiling regulatory debates. This past September, the regulatory authorities in South Korea shared their approaches and direction of digital assets regulations at the Security Token Policy Seminar and Digital Asset Legislation Seminar hosted by the Financial Services Commission and Korea Capital Market Institute.

The two seminars gave a glimpse into how far the progress of the regulatory deliberations has come—which, at that moment, was at the stage of formulation of guidelines that sought to split digital assets into security and non-security tokens and regulate each with the Financial Investment Services and Capital Markets Act and Digital Assets Act. Let’s take a look at the possible regulations that may be imposed on exchanges and issuers—the top stakeholders in South Korea’s crypto market—once the bills tabled at the National Assembly are passed.

1) Virtual Asset Service Providers (VASPs)

The regulatory authorities in South Korea voiced their concerns about the similar problems that it had already encountered during the inception of the capital market, stressing the need to apply laws and regulations governing securities, such as disclosure obligation and regulations on unfair trade practices and service providers. As such, even if cryptocurrencies are classified into security and non-security tokens, the securities provisions of the Financial Investment Services and Capital Markets Act will be applicable to Virtual Asset Service Provider (hereinafter, VASPs).

a) Disclosure Obligation

On grounds that the issuers of digital assets are positioned to collect funds and in a superior position regarding information, the regulations will likely limit the eligibility of an issuer to onshore/offshore corporate entities and mandate disclosure. The legislation will seek to oblige issuers to submit and disclose their digital asset business plans that should provide more granularity than their whitepapers in order to inform investors. Once issued, the assets will be subject to mandatory ad-hoc public disclosure, where the issuer should report details about the circulating supply.

b) Regulations on Unfair Trade Practices

Although most market participants make investment decisions based on data, i.e., price and trading volume, it still isn’t easy to discern truth and facts from wrongful practices skewing the data, such as rumors, fraudulent information, and wash trading—and even more so to pursue fraud charges. As such, the authorities placed emphasis on handling such cases with regulations on unfair trade practices. To this end, provisions of the Financial Investment Services and Capital Markets Act, such as: i) Article 174 (Prohibition on Use of Material Nonpublic Information), ii) Article 176 (Prohibition on Market Price Manipulation), and iii) Article 178 (Prohibition on Unfair Trading), will likely be put in place.

c) Regulations on Service Providers

In pursuit of investor protection and healthier market dynamics, the authorities are also expected to set up a barrier to entry by granting licenses only to select providers. Protection of the interest of users, in particular, will very likely be expressly prescribed in the law, given the exponential growth of the crypto market and the subsequent risk associated with VASPs abusing their dominance in terms of expertise, information, and financial firepower. So, as for regulating service providers, i) fiduciary duty, ii) duty of safekeeping of digital assets, iii) prevention of misselling, and iv) prevention of conflict of interest will likely be added.

2) Exchanges

As discussed earlier, the Act on Reporting and Using Specified Financial Transaction Information mandates crypto exchanges in South Korea to obtain authorizations and permits from the Financial Services Commission to perform crypto business. So far, five exchanges have obtained such permits and are allowed to have their users set up real-name bank accounts. The five exchanges perform KYC and anti-money laundering processes in compliance with travel rule requirements. Regulations on exchanges are likely to include the following mandates.

a) Disclosure Requirements for Issuance & Circulation

Exchanges, just like issuers, will be obligated to disclose their financial and business results. In the case of highly decentralized digital assets like Bitcoin, for which issuers are hardly identifiable, the duty of disclosure imposed on the issuer will be transferred to trading intermediaries of the assets. The regulatory authorities are expected to entitle exchanges to impose the duty of disclosure on issuers and make the information publicly available.

b) Mandatory Market Monitoring System

Since the task of monitoring and examining every crypto transaction in real-time entails many challenges, the authorities will collaborate with exchanges to have anomalous transaction detection embedded in their systems.

The new regulations will mandate exchanges to set up a market monitoring system to detect abnormal transactions that distort price and trading volume and to report such transactions to investigation agencies.

c) Launch of the Digital Asset Industry Association

With fair trading environment, effective investor protection, and sustainable growth of the industry in mind, the regulatory authorities are mulling the launch of an association comprising VASPs to tap into their expertise. Seemingly, they are seeking to address the absence of regulations before the bills at the National Assembly are passed and brought into effect with the association’s voluntary regulations and guidelines on compliance with regulations on service providers. Naturally, the role of exchanges will become even more important since the Digital Asset eXchange Alliance (DAXA), consisting of South Korea’s five largest exchanges, will be central to the association.

B. Accounting Standard for Cryptocurrencies

Over time, the growing institutional interest in cryptocurrencies has surfaced issues involved in accounting standards. The International Accounting Standards Board (IASB) has added accounting standard-setting agenda for holders but has yet to establish accounting standards for cryptocurrency companies that issue crypto assets. The Korea Accounting Standards Board (KASB), which complies with international accounting standards, also provides accounting standards for holders but not for crypto companies and projects, and the lack of regulatory clarity is creating confusion among companies that issue cryptocurrencies. The international accounting standards currently applicable here in South Korea will be shortly discussed in the following paragraph.

While the accounting process remains a matter of further discussion, the following are examples of how accounting transactions are being recorded in leading crypto issuers and exchanges in South Korea.

1) Virtual Asset Service Providers (VASPs)

WEMADE

- WEMIX tokens are issued by WEMIX PTE. LTD., a subsidiary of WeMade, incorporated in Singapore.

- WEMIX tokens are not accounted as assets as it cannot be guaranteed that the issued tokens would accrue financial benefits to WeMade.

- Selling the issued WEMIX tokens is recognized as **unearned revenue (contract liabilities)**, and the platform fee is recognized as revenue when the user pays WEMIX tokens to use services and features on the WEMIX network.

- A holding of other cryptocurrency is considered an intangible asset to which a cost model is applied to assess the impairment loss.

In the case of WEMADE, the WEMIX tokens sold are recognized as unearned revenue (liability), and revenue is accrued when a customer pays for goods and services on the WEMIX platform with the tokens as platform fees recognized as revenue. Accordingly, KRW 146.1B had been recognized as unearned revenue, from which KRW 2.4B was subtracted later on when the platform accrued revenue of KRW 2.4B. While the sale of tokens recognized as unearned revenue was included in other current liabilities, changes in unearned revenue were disclosed in notes as follows:

Ground X Corp.

Kakao issues KLAY through Krust Universe, for which Kakao is like a great grandparent company. Ground X is a South Korean company that studies and develops technology to supply to its parent company, Krust, and receives KLAY in return.

Ground X’s accounting transactions are booked as follows:

- With KLAY issuer Krust being a Singapore-based company, the accounting process regarding the issuance of KLAY is not available.

- Ground X receives KLAY in exchange for services supplied to KLAY issuer Krust.

- Revenue from KLAY is recognized in proportion to progress of contract performance and recorded as contract assets.

- Using the cost model, crypto holdings other than the above are classified as intangible assets, for which impairment loss is recognized.

2) Exchanges

Dunamu Inc. (Upbit Crypto Exchange)

- Dunamu breaks their crypto holdings into inventory and intangible assets.

- Changes in the fair value less the cost of disposal of cryptocurrencies classified as inventory are recognized as gain or loss for the applicable period.

- Using the revaluation model, gain or loss on valuation of crypto holdings classified as intangible assets comes under the category of gain or loss from digital assets and is booked as non-operating income.

- Since customers’ assets held for safekeeping are not controlled by the group of consolidated entities and thus, are not deemed to generate the inflow of future economic benefits for the company, Dunamu does not recognize them as assets as the assets it considers do not satisfy the definition and accounting requirements for recognition.

South Korea’s leading crypto exchange, Upbit, split their crypto holdings into inventory and intangible assets. It reflects changes in the fair value less costs to sell of the cryptocurrencies classified as inventory for the period of the change. Unlike other companies using the cost model, Upbit uses the revaluation model and books gains or losses on valuation of cryptocurrencies classified as intangible assets under the category of gain (loss) on digital assets. According to the IFRS definition, an “active market” exists for a particular cryptocurrency when identical assets are traded, willing buyers and sellers are readily available at all times, and pricing information is provided on an ongoing basis in the market. Dunamu seemed to have deemed their cryptocurrencies classified as intangible assets to meet the requirements for an active market and adopted the revaluation model. The company does not regard such assets held for safekeeping as meeting the definition and accounting requirements for recognition and does not recognize them as assets on grounds that the assets are not controlled by the company and do not yield future economic benefits for the company.

C. Crypto Regulations: What’s to Come in the Coming Years

Then, what might the future regulatory landscape look like? Starting off with the latest developments in South Korea, after WEMADE’s WEMIX token was flagged with an investment warning by the Digital Asset Exchange Association (DAXA) on Oct 27, 2022, the big four crypto exchanges in South Korea, Bithumb, Coinone, Upbit, and Korbit, eventually decided to delist the token on Nov 24, 2022.

Initially, the DAXA issued an investment warning on grounds of the discrepancy between the distribution plan and the circulating supply of WEMIX tokens. This last July, WEMADE submitted its plan to crypto exchanges, including Upbit, that it would complete the release of 246 million tokens by the end of Oct. Upon its mainnet launch, however, the circulating supply WEMADE disclosed on CoinMarketCap for the first time since Sep 2021 was 318 million—exhibiting a difference from both WEMIX’s 3Q22 quarterly report and numbers submitted to the DAXA. This means that part of the tokens was put into circulation undisclosed. Although WEMIX appeared to have made an all-out effort to address the issue, i.e., redeeming WEMIX tokens used as collateral, the DAXA concluded it be delisted given the inaccuracy of the information submitted during the period of explanation and damage to trust. WEMIX announced that it would file for an injunction against the delisting decision of the four exchanges and went on to hold a press conference on Nov 25, 2022 to give further explanation. With AML having been the primary focus of legislation so far, the crypto market in South Korea relies quite heavily on self-regulatory measures introduced by consultative bodies in the private sector. The lack of clear rules and standards may get in the way of the ruling process involved in a specific incident.

In the meantime, crypto exchanges are leading a great deal of such discussion, which is primarily geared towards investor protection at the moment. The key areas of collaboration discussed include: i) an independent third-party assessment prior to CEX listing, ii) on-chain monitoring of circulating supply, and iii) cooperation with crypto disclosure service providers. Currently, South Korea’s private sector, including crypto data intelligence platform Xangle, is providing an array of related services. Over time, regulatory authorities and government agencies, such as the Financial Services Commission, are expected to take over the conversation and lead the efforts to formulate and institute regulatory guidelines.

5. Closing Thoughts

In this report, we explored the size of the trading volume in Korea's crypto market, how regulations are progressing, and for what purpose companies in each sector are keen to adopt blockchain technology. Xangle co-founder Junwoo Kim stressed, "the next bull market will arrive as players from gaming and content sectors enter the market in earnest." He added, "While major L1 projects are also expected to focus on onboarding killer dApps to build use cases, the Korean crypto market will become an attractive destination as a wide user pool and active participation from institutional investors back it." We look forward to witnessing Korea withstanding this brutal crypto winter and thriving to become a key player in the global crypto scene.