PalaSquare Throws Its Hat in the Klaytn NFT Ring

Translated by Rhea

Summary

- Contracts generated in the Klaytn ecosystem are heavily weighted towards NFTs, with 97% of new smart contracts generated on Klaytn written in KIP17 as of August 8.

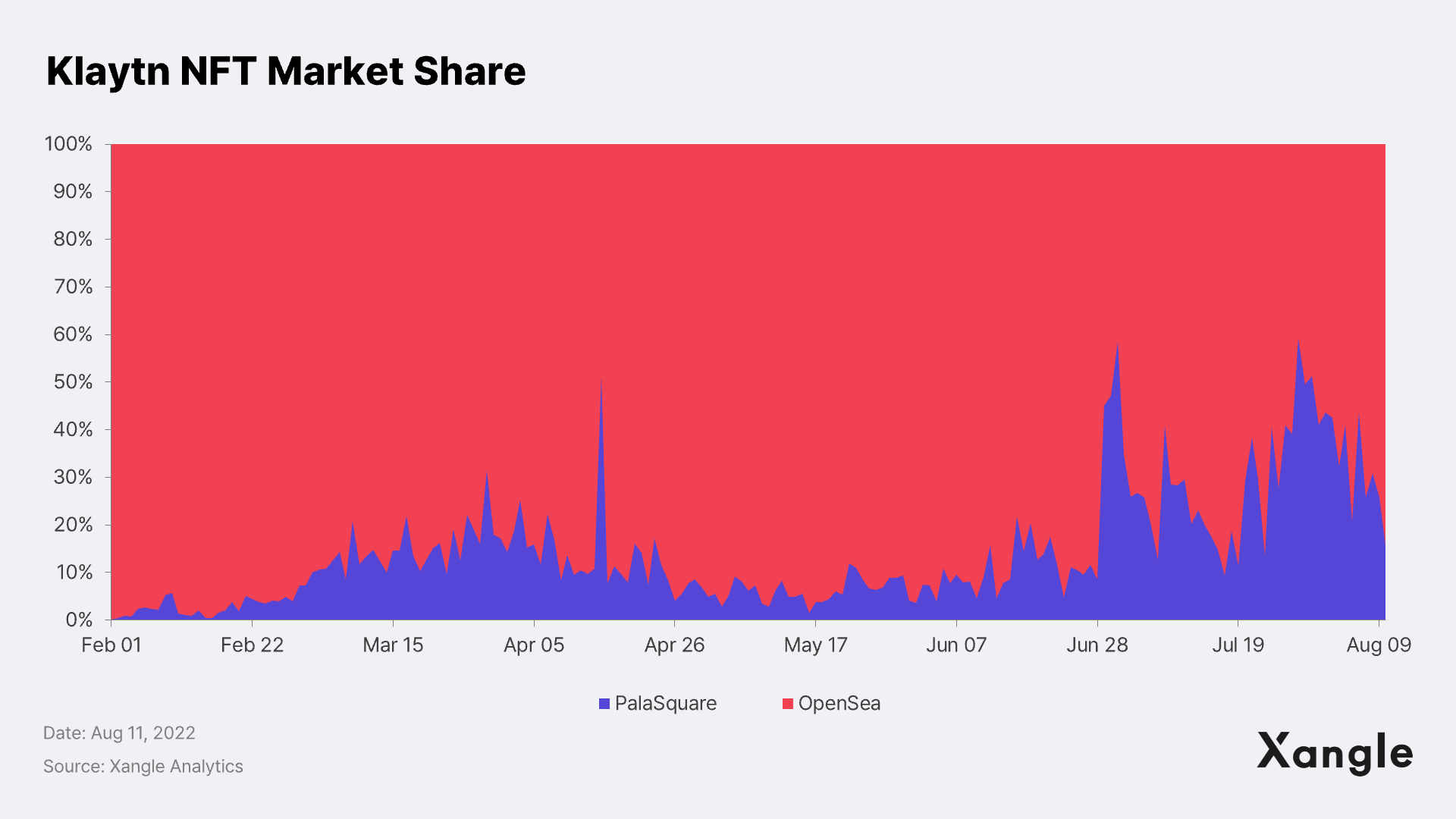

- PalaSquare is PALA’s NTF marketplace building a Klaytn-based DeFi ecosystem and challenging the Klaytn NFT market, which had been de facto monopolized by OpenSea, steadily increasing its share of the market.

- Presumed to owe its growth momentum to its 0% transaction fee and collaboration with Korean projects through its Trade Grant Program, PalaSquare is even showing higher transactions than OpenSea at times.

- Given how LooksRare, which gained fame with a similar reward system, had been engulfed controversy regarding to wash trading, Xangle Analytics also investigated the scale of wash trading on PalaSquare. Results showed its wash trading volume to be minimal, consisting of only 0.06% of the total transaction.

- As of August 10, PalaSquare’s share of the Klaytn NFT market is at 18% and steadily growing.

A New Wave on the Klaytn NFT Market

NFT contracts are taking up an overwhelming majority of the Klaytn ecosystem. As of August 8, about 97% of smart contracts generated on Klaytn are in written in the KIP17 standard, making NFTs essentially the core content of the Klaytn ecosystem. As such, most of the transactions incurred on Klaytn are concentrated on NFTs, with many of their transactions taking place on OpenSea, the only NFT exchange where Klaytn NFT trading is enabled.

The problem was that OpenSea practically had a monopoly over such transactions. Then, early this year, the Klaytn NFT ecosystem saw a slight shift in its landscape. Pala had declared its launch of “PalaSquare,” its own Klaytn NFT marketplace.

PalaSquare Marches On

PalaSquare launched its Beta service in January this year. Since the launch, PalaSquare quickly caught up with OpenSea in terms of transaction volume and is growing into a bona fide core application of the Klaytn NFT ecosystem. (Please refer to Xangle Analytics.)

PalaSquare’s market share rapidly grew to take on 30-40% of the Klaytn NFT market, a warp speed growth given how it initially fell even short of 20% in its early days. Its growth has been incredibly fast, sometimes even exceeding 50% in daily transactions.

How was it that PalaSquare was able to ramp up its presence in the NFT marketplace so much in such a short period of time? Xangle’s analysis determined that it was led by two major factors: 1) low transaction fees and 2) various events via its partnerships.

1) Low Transaction Fees

PalaSquare currently takes a 1% transaction fee, which is de facto 0% with its buyback program. This figure is considerably lower than OpenSea’s 2.5% and acted as a clear vantage point in attracting traders. PalaSquare’s buyback program puts the same amount of pKLAY as the transaction fee incurred into the buyback wallets to be swapped later with PALA tokens held by the team. Pala stated in its Medium post that “since this promotion is targeted at vitalizing activity in the Klaytn NFT ecosystem, the Pala team would be burning all of their PALA tokens corresponding to the entire sum of sales transaction fees incurred during the event period.”

2) Various Events Via Its Partnerships

After a look into PalaSquare’s transactions by collection, SuperWalk came on top as the project with the most share. In particular, for the two days of July 28 and 29, when the SuperWalk coupon NFTs were airdropped and the open beta test was announced, the transactions incurred amounted to an overwhelming 480,000 KLAY, taking up 77% of the total transactions.

In comparison, when the same NFT data was analyzed not by collections but by holders, it showed that the top 10% of sellers were responsible for generating 41% of total transactions, and about half of that top 10% of sellers generated a huge portion of the transactions by selling over 10 NFTs. Such data tells us that whales chose to conduct their NFT deals via PalaSquare instead of OpenSea.

This trend seems to be somewhat influenced by the grant program that airdropped PALA to top holders by accumulated transactions. Given that the projects subject to the grant program had much more transactions on PalaSquare than OpenSea, it can be inferred that the promotional programs and events held in connection with partnerships had a positive impact on the transaction volume on PalaSquare.

Projects subject to the grant program: SuperWalk, KlayCity, SNKRZ, and KLAYDICE, among others.

Of course, some see the impact from Pala’s tokenomics and grants mentioned above as a one-off event caused by wash trading, as had been with LooksRare. Could this increase in PalaSquare’s transactions be mere short-term trades seeking to exploit the incentive structure?

Xangle Analytics Rules Out Wash Trading as the Cause

In the beginning of this year, LookRare and its policy that gives back transaction fees to the users had won the attention of many, generating transaction volume rivaling that of OpenSea. However, LooksRare’s transactions were accused of being overly inflated with wash trading that abused the system, which was soon discovered to be true. In response, a wash trading filter was developed to make an objective evaluation of LooksRare’s abnormal transactions.

Due to the fact that PalaSquare airdrops tokens to wallets with the most transaction per NFT collection and that its transaction fee is 0%, PalaSquare is not free from wash trading allegations. Although it is structured to only reward a few wallets, the environment does foster enough incentives for wash trading. As such, Xangle Analytics also dug into the matter and devised an index that applies the filter to capture transactions suspected of being wash trading.

The algorithm dubbed the “wash trading filter” is derived by applying an SQL query developed by a data analyst, @hildobby, and eliminates trades made between two different addresses to buy and sell the same NFTs. For example, the records of the address “A” selling the NFT “#0000” to address “B,” and the address “B” selling the same NFT back to address “A” are excluded from the transaction volume.

Contrary to popular belief, Xangle Analytics’ analysis revealed that only a very small volume of trades could be considered wash trading.

- Between February 22 and August 10, 2022, about 42.7 million KLAY transactions took place on PalaSquare.

- During the abovementioned period, transactions that fit the criteria for wash trading amounted in 111 transactions in total, which translates into about 28,000 KLAY, or 0.06%, of total transactions being wash trading.

- Most of the transactions considered to be wash trading involved sales of NFTs with low prices of about 1 to 4 KLAY in value. Notably, one SheepFarm NFT, #116030, had been traded 56 times between two addresses of 0xe149 and 0xcff7.

- On March 6, wash trading of 14,002 KLAY in value was incurred from transactions of a single SYLTARE NFT #3780 between two wallets (0xeb8b and 0x7217) selling and reselling at the same price (7,001 KLAY). This figure amounted to 50% of total wash trading.

Another curious series of transactions was discovered during Xangle Analytic’s investigation into the wash trading. MOKSHA NFTs #717 and #281 were traded between three addresses (0x8869, 0xa7c1, and 0xe3e2), generating transactions in a total of 5,450 KLAY. Their transactions showed a very different pattern in many aspects, such as how one address bought NFTs from the other two addresses and resold them to the same two addresses after about a month, how they did not inflate the price of the NFTs over the average price to incur the maximum transaction, how the NFTs were traded at prices not much different from the average price, and how the NFTs were resold at a price lower than their purchase price. Moreover, since MOKSHA NFTs are not subject to Pala’s Trade Grant Program, providing little incentive for wash trading.

To sum up, Xangle Analytics found that even transactions identified as wash trading cannot definitively be considered to have set out to target the airdrop rewards with their wash trading, and that most of the wash trading incurred on PalaSquare were very small in their scale.

PalaSquare to Show the Power of Locals

Much like Klaytn, which sought to expand its ecosystem headed by a herd of Korean companies, PalaSquare is forging collaborative relationships with many Korean projects as it makes its way into the Klaytn NFT market currently under the exclusive hold of the OpenSea. However, the Klaytn NFT market is in an unprecedented recession right now. As of August 9, 2022, the combined Klaytn NFT transactions between PalaSquare and OpenSea was 230,638 KLAY, marking the lowest this year. It was only about 1.2% of the transaction on February 16 when the volume peaked (at 18,539,979 KLAY). Things are getting even more dire as large NFT projects move on to other chains, such as Ethereum, to attract non-Korean users.

However, opportunities are also borne in times of crisis. In this unrivaled recession, PalaSquare is slowly gaining its share of the Klaytn NFT market, and even introducing DeFi protocols such as Vault and PalaDEX, providing NFT tokenization and DeFi services. Although its liquidity is very small compared to its competition, KLAYswap, they are expected to make a play to expand its market share in the DeFi sector as well as they have been doing in the NFT marketplace lately. Another aspect that is heightening anticipation for its potential is that it is operated by Snow, a NAVER subsidiary, and is in collaboration with various Korean companies. It remains to be seen whether PalaSquare will grow through the hardship of the current market environment to become Klaytn’s number one application, and endure the Crypto Winter.

Other Research Articles

- The Klaytn Ecosystem Needs Time (featuring Xangle Analytics)

- Why Do MZers Increasingly Choose NFTs Over Cars?