Translated by elcreto

Content

1. What Are P2E Games?

2. P2E Market Landscape

2-1. Traditional Gaming Market: How Big Is It?

2-2. Blockchain Gaming Market: Where It Stands

2-3. On-Chain Indicators: How the Numbers Have Moved

2-4. Key Investors and Investing Trends

2-5. Major Global Players

2-6. South Korean Game Developers: Where They Are Headed

3. Problems with P2E Games

3-1. High Entry Barriers

3-2. Game Distribution Channels Occupied by Web2 Players

3-3. An Ecosystem Disrupted by Gaming Bots

3-4. Tighter Policy Expectations

3-5. The Biggest Problem: Lack of Cool Stuff

4. Web 2.0 Game Developers Set to Lead the P2E Market

4-1. Why Should Web 2.0 Companies Shed the old Models and Stick to P2E

4-2. Building a Tokenomics: The First Step to Developing a P2E game

5. Conclusion

Introduction

After the DeFi summer in 2020 and NFT boom in 2021, P2E games are widely considered the next big thing in the market. As P2E games are increasingly considered a potential driver that can stage a turnaround in the current crypto winter, this article will discuss the present, challenges, and future of the P2E market.

1. What Are P2E Games?

The term P2E (Play-to-Earn) means that users can make profits (i.e., tokens and resources) from their gameplay by participating in economic activities to create an added value within the game. P2E, along with metaverse, is much anticipated to introduce a new paradigm in the gaming industry.

From the pay-per-use model (1980s) of console and arcade games that started to emerge in the 1970s to the subscription (2000s), DLC (Downloadable contents), and partially paid models (2010s), games so far have charged you in any way. P2E, on the other hand, uses token economics as its foundation to allow users to earn profits by playing games.

The Two Pillars to P2E Games: i) Blockchain-Enabled Open Economy and ii) NFTs

- Open economy: Key currencies (cryptocurrency), items, and resources can be freely and transparently traded within games without having to involve an intermediary (i.e., game developers, publishers, or platforms), thanks to L1 blockchain infrastructures like Ethereum.

- NFTs: The digital ownership of all the assets in games is vested in users. There is no risk of damage or loss to users’ assets.

Surely, P2E games would be better off leaving decisions to their DAOs so anyone can freely participate in the decision-making process on matters, including development and direction of the games. This, however, is possible only after a community matures enough to run on their own.

P2E illustrates what Web 3.0 envisions in the sense that it hands over the sovereignty to users as the users are the contributors to the game’s ecosystem and growth. Unlike previous games, where users used to spend money and time to have fun, P2E is empowering users to: i) be the owner of in-game assets and ii) engage in economic activities within the game. These actually explain much of the growth potential of P2E games.

2. P2E Market Landscape

2-1. Traditional Gaming Market: How Big Is It?

On average, the size of the global video game market has climbed 12.9% per annum, growing from $196B in 2021 to an estimated $405B in 2027. The blockchain gaming market in 2021 draws a stark contrast, standing at around $3B. Given that P2E games are in the pipeline of many game developers, the P2E gaming sector is projected to grow exponentially by 26-fold by 2027, if it manages to take up 20% of the entire gaming market by the time.

2-2. Blockchain Gaming Market: Where It Stands

Backed by the broader theme of metaverse, P2E started to gain popularity in 2H 2021, and its popularity peaked later at the end of 2021. Global IBs, such as Goldman Sachs and Morgan Stanley, forecast that the size of the metaverse market would hit as high as $8T, much of which, they predicted, would be accounted for by the P2E market.

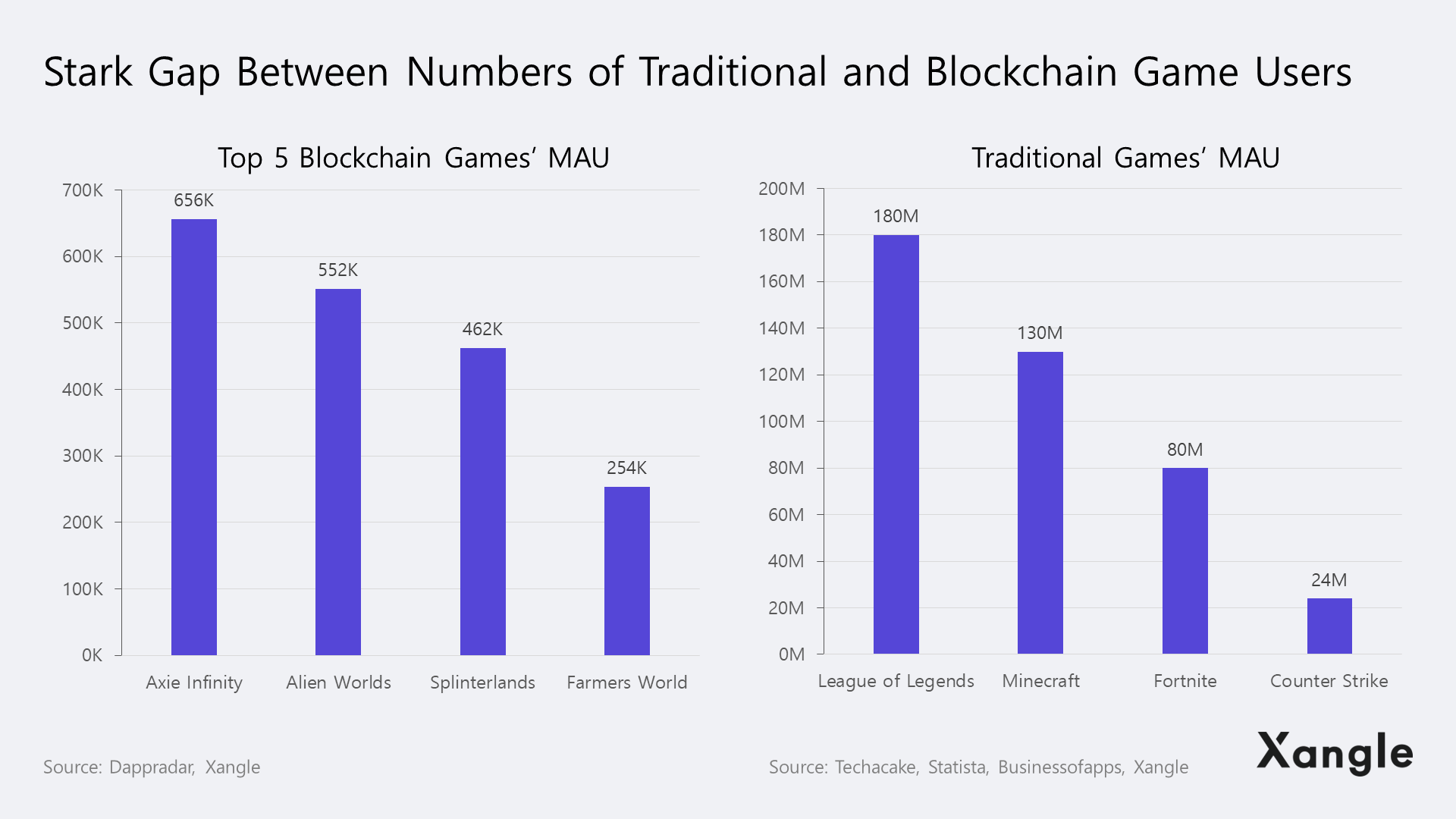

The percentage held by blockchain games in the entire gaming industry has been marginal though. As of Jun 29, 2022, there are only 881 blockchain games out there, revealing a striking gap with mobile, PC and console games.

The numbers of users of the games are also illustrative of the explicit gap. At the end of 2021, Axie Infinity, a blockchain game acclaimed as one of the most prominent projects in the crypto market, hit 656,000 users—which is about 0.3% of the MAU of 180M of League of Legends.

2-3. On-Chain Indicators: How the Numbers Have Moved

There still has not been a clear sign of growth for the on-chain performance indicators of the blockchain gaming sector. The number of transactions on the blockchain gaming dapps is on the rise but with a downtrend in the unique active wallet that started at the end of 2021 remains persistent. One thing that still bodes well for the sector is the number of users that grew 100% compared to the previous year—from 3M to 6M.

2-4. Key Investors and Investing Trends

Nevertheless, there is a steady stream of investment into the blockchain gaming sector. In 1Q 2022 alone, the sector landed a $2.5B investment, and FTX launched a $2B venture fund, much to the market’s surprise. Andreessen Horowitz (a16z)’s May launch of a $600M P2E fund also signifies its unfaltering anticipation for the blockchain games amidst the recent downtrend. In just a month, Immutable X also launched a $500M Web 3.0 gaming fund in Jun, searching for games to go live on the IMX platform. As illustrated, numerous P2E games are being developed and launched right at this moment.

2-5. Major Web 3.0 Players

Some of the leading players in the blockchain gaming market are: Forte, Sorare, Animoca Brands, Immutable, Mythical Games, and Sky Mavis, the developer of Axie Infinity. One of the developers that has gained the most prominence recently is Immutable, which is equipped with an L2 solution dedicated to games, its own studio with a freshly updated lineup of games (i.e., Gods Unchained, Guild of Guardians, Ember Swords), and a $500M P2E fund.

2-6. South Korean Game Developers: Where They Are Headed

Unlike large game developers in other countries that have remained neutral to P2E games, a growing number of large enterprises in South Korea, such as Wemade, Com2uS, Kakao Games, Netmarble, and Neowiz, are announcing their entrance into the P2E market.

3. Emerging Problems with P2E Games

But the market may have been overly enthusiastic about P2E: the surfacing of problems and limitations inherent to P2E games have soon sapped the high-flying anticipation, shortly turning it into a disappointment. As a result, the price of P2E-related tokens has plummeted and is not showing much sign of recovery at this point. Here are the challenges facing P2E games.

3-1. High Entry Barriers

Unlike traditional games where all they need to do is to access the PC client or mobile app, P2E games have high entry barriers and distractions that disturb the user experience. For instance, users are asked to create and connect their MetaMask wallets, sign transactions in the middle of gameplay, and use a bridge and wallet-to-wallet transfer of assets. At a time when most games are free to play, some P2E games even require users to purchase expensive NFTs, making it even more unaffordable for potential users.

3-2. Game Distribution Channels Occupied by Web2 Players

Currently, game distribution is dominated by Web 2.0 companies. Over 99% of the mobile games are distributed via Google Play Store and Apple App Store, which charge a 30% fee on the revenue in exchange for registering the games to the stores. This makes it even more difficult for P2E game developers to enter the market. Steam Games is another distribution channel but announced that it had ruled out support for crypto-related games.

3-3. An Ecosystem Disrupted by Gaming Bots

Bots have become a significant threat to a thriving gaming ecosystem: they fraudulently rake in monies and items and deplete resources and content, destroying the balance in the game. Recognizing the harms to both users and developers, there have been a series of strong measures to clamp down on bots—which have not turned out very successful so far. When the existing games are already having a headache over bots, the tokens convertible to cash in P2E games are almost bound to lure a throng of bot players—even more so than the non-blockchain games. Even League of Kingdoms, one of South Korea’s most well-known P2E games, once lamented that bots are the biggest disturbance to its business, stating that it had invested a sizable amount of time and resources to troubleshoot the issue.

3-4. Tighter Policy Expectations

a. Tokens as a Class of Securities

The SEC stated that all relevant laws regarding issuance and distribution of securities, including restrictions on public offering and a ban on unfair trade practices, will be applicable to tokens satisfying the conditions of the Securities Act of 1933 required for a security. The “Howey Test” that determines whether a transaction qualifies as an investment contract will likely be put in place to examine if the token is considered a security. Tokens of P2E games will be classified as either utility or security tokens accordingly.

Once a project launches an ICO, the first three out of four requirements of the “Howey Test” are met. Most disputes arise from the fourth requirement, which expects profits to be derived from efforts of a third party. This is key to determining if a token is a security because unlike an equity, the existence of a third party to a cryptocurrency depends on the level of decentralization. In fact, William Hinman, the Director of SEC’s Corporate Finance division, opined that Bitcoin and Ethereum were “sufficiently decentralized” to avoid regulation under the U.S. federal securities laws and thus was not considered an investment contract.

* Note

a. Token Safe Harbor That Reflects Key Characteristics of Cryptocurrency

:The Token Safe Harbor Proposal was proposed by SEC Commissioner Hester Peirce to determine whether a cryptocurrency can be considered a security. The underlying idea of the proposal is to provide a three-year grace period under certain conditions, given that building a blockchain into a decentralized network takes time. Although the SEC was mostly critical of the proposal, it is still encouraging to see the first-ever regulatory proposal that seems to understand the characteristics of cryptocurrencies.

b. South Korean Market: Regulation on Speculative Activities

South Korea’s Game Rating and Administration Committee governs the rating process of games and has the authority to reject or revoke the rating classification of a game that violates relevant laws, including the Game Industry Promotion Act. The problems is that the Committee is refusing to administer a rating on grounds that the tokens in P2E games breach Article 28 (2)—which state that “he or she shall neither have others gamble or do other speculative acts by making use of game products nor leave them to do such things” and Article 32 (1) 7—which prohibits “making a business of converting into money or intermediating such conversion or repurchase of tangible and intangible results obtained through the use of game products by anyone.

As such, issues of possible regulatory breaches surrounding alleged speculative nature or speculative activities associated with tokens will override the issue of whether tokens can be considered securities. In May 2022, the Committee decided to revoke the rating of 32 South Korean games that had P2E and NFT elements. Darksteel, the in-game resource of Wemade’s globally popular Mir4 and $DST, the in-game currency of the NOD Games’ League of Kingdoms that have hundreds of thousands of users are providing users with profits, allowing users to convert them into cash. The local law virtually deems this a violation of law.

3-5. The Biggest Problem: Lack of Play

More crucially though, the primary cause that plagues the P2E games is Web 3.0 game developers' focus on “earn” rather than “play.” Obviously, games are all about fun and P2E games are not an exception.

P2E games so far have significantly lagged traditional games in terms of quality and level of sophistication, including graphics, content, control system, and storyline. Lacking fun, P2E games have shifted their focus to the earn part of the games. The strategy turned out to be a failure because, instead of dedicated aficionados, it lured users whose sole interest was money-making opportunities.

The biggest risk to this is the very high likelihood of falling into the trap of ponzinomics. Ponzinomics has a zero-sum structure as it is constantly in need of new investors and their money and the lack of it or a bank run is bound to trigger a collapse of the price of the token.

In other words, under ponzinomics, the price of tokens climbs until there is a significant influx of new investors and users but a cutoff in the flow of new investments on concern of extreme overvaluation triggers a death spiral. A diminishing demand usually intensifies selling pressure and crashes the token price, hurting profitability and accelerating the churn. Again, a declining user base indicates a looming decline in valuation, creating a vicious cycle of reducing investors’ appetite and demand for the token. Normally, the demand from game enthusiasts stabilizes the price after a slump but this is not true for games with a weak user base. Such games usually take the brunt, as well illustrated by the examples of Axie Infinity, which has recently suffered a radical user churn and STEPN, whose token price took a nosedive.

4. Large Enterprises Set to Lead the P2E Market

Be it P2E or not, fun is what makes games sustainable. On average, however, the development of an AAA-level, high-quality fun game usually takes more than three years and costs a whopping $80-$100M. It is a tough decision even for top publishers like Nintendo, Blizzard, and EA. As for P2E games, there are additional considerations, such as blockchain user experience (i.e., wallet connection, transaction signing, and use of bridge), NFT, and tokenomics design. In this sense, it may be too far-fetched to expect high-quality P2E games from small crypto-native game companies that have started taking baby steps only recently.

Moreover, compared to the speed of a Web 3.0 game company that secures resources on its own, development of an AAA-level game is unequivocally faster when a large company acquires a small Web 3.0 game developer or builds blockchain and crypto knowledge through its own R&D. Apparently, large Web 2.0 game companies are considered highly likely to lead the market, given their ample resources, abundance of IP, and development knowhow. Already, having noticed P2E’s potential much earlier on, large game developers in South Korea, including Wemade, Com2uS, and Netmarble, are releasing games that employ P2E elements, harnessing their in-depth knowledge in the gaming industry and blockchains.

4-1. Why Should Web 2.0 Companies Shed the old Models and Stick to P2E

The is another way of asking if the P2E model creates new values that have not existed so far. The gaming industry has been smooth sailing, having never been in need of blockchain technology or cryptocurrency. Just look at Lineage. It raised KRW1.8T in 2021 alone. Because P2E games would get game developers to share their ownership and profits with users, there seems absolutely no reason for them to get down to the business unless they went crazy. If a game company chooses the difficult path nonetheless, the following would be what they are after.

a) Expanding Business Model

Game studios that only engage in development, just like Wemade, can enter other businesses, including game publisher (L1 blockchain), distribution platform, and NFT exchange. One of the most illustrative examples is Axie Infinity, which launched its own sidechain and DEX. Likewise, all the companies entering the P2E market seem to be looking for an opportunity to monopolize the value chain.

For instance, if a game company launches an NFT exchange, profits arise from fees in secondary sales, which is something that has never even been thought of. Generally, fees charges on NFTs are more or less 5% (2.5% for transaction + 2.5% for royalty). This may be eclipsed by the percentage charged as a fee by Web 2.0 companies but the revenue is handsome: BAYC raised KRW50B in revenue solely from its 2.5-percent royalty.

b) Global Reach (Greater Total Addressable Market)

Based on blockchain, tokens are borderless, quick, cheap, freely tradable, and readily cashable, compared to in-game currencies and points. While tokens can easily be encashed in any countries, converting in-game currencies and points into cash is virtually impossible in countries that do not support the service. When cashing in MapleStory’s mesos is difficult enough, converting them into dollars would be in no way close to an easy process. This is where tokenomics can offer scalability to games as well as incentives to global users.

Also, the “earn” part of P2E games and ownership distribution of in-game assets can act as a strong incentive for a greater user base. After all, while P2E may lower the profits from fees, it can also maximize a user base to generate greater revenue—similarly to Walmart and Coupang’s High Volume, Low Margin strategy.

c) Power to Mint Currency (Seigniorage Effect)

Once a game company starts to mint currency in a game, it serves as a central bank and can profit from the difference between the face value and the production costs of the currency. From there, it can raise funds and start securing the capital required to grow its ecosystem—which, of course, does not remain the same as the game becomes more and more decentralized.

4-2. Building a Tokenomics: The First Step to Developing a P2E game

The first thing to do to start the process of developing an P2E game is to design token economics. Tokenomics is essential to the sustainability of a P2E game, but at the same time, it is a very challenging topic since the designs distinctly vary, and there has not been a glaring success.

a) Dual Token Economy

Largely, the most plausible and applicable tokenomics is believed to be a dual token economy, which splits up governance tokens and utility tokens provided as incentives (soft currency). Under the duel token economy, i) governance tokens are issued to entitle users to make decisions and ii) utility tokens replace the existing in-games currencies. Here, finding the right inflation rate will remain the crucial part of the design considerations.

Then Why the Dual Token Economy?

Largely, there are three reasons why the most-known examples like Axie Infinity, STEPN, and League of Kingdoms chose a dual token economy over a single token economy.

First of all, they wanted to separate gamers who simply want to play games and who are also investors wishing to participate in the governance.

Second, they also wanted to prevent a slump in the price of the governance token from triggering a collapse of the game’s ecosystem. Any user who bets on a long-term growth would never wish to see the price of their governance tokens being swayed neither by their fundamentals nor by external circumstances.

Third, a dual token economy allows them to set inflation rates differently for each token—which is, in fact, the primary reason for choosing it over a single token economy. Ideally, I believe, a tokenomics is better off when the supply of governance tokens is fixed and the supply of utility tokens is not restricted. While governance tokens cannot be issued limitlessly, a robust economy that is ruled by supply and demand requires utility tokens, the in-game currencies, to be flexibly controlled, reflecting the demand.

Example) League of Kingdoms

Take League of Kingdoms, which has been a massively popular P2E game with a dual token economy. The game offers governance token $LOKA and utility token $DST.

$LOKA supply has a hard cap and its primary use is to participate in the decision-making process on how the council vault, or the DAO treasury, should be managed. After 2024, by which all vesting schedules will have ended, the token holders will be able to participate in decisions not only on the treasury but also on changes in the protocol or roadmap.

$DST is an in-game currency of League of Kingdoms that does not have a hard cap, meaning that there is no limit to the supply. $DST can not be bought through an exchange and can only be acquired through gameplay. The $DST obtained is used to upgrade gamers’ ability.

b) Mechanisms to Keep or Raise the Token Value

For now, the only way to pump up the value of tokens is burn (buyback). Or, a staking mechanism can be put in place for the revenue to be distributed, once the issue over whether tokens can be considered securities is cleared and relevant regulations are set. Upon the announcement of the launch of its own chain, dydx decided to return 100% of the fee revenue to the community. Sharing profits from the protocol with the holders of governance tokens is expected to have a significantly positive impact on the token’s value.

Bluntly put, utility tokens are like mud cookies: the value of the tokens is completely reliant on the fun of the game. But fun is the mantra that can create a demand even for a mud cookie, win them game enthusiasts, and build downward rigidity. This is why the in-games currencies of the most widely-known long running games like WoW (World of Warcraft), Lineage, Diablo, and Maplestory, have not faltered, but rather seen a steady stream of demand despite the high inflation in the value.

You may wonder why not fiat- or crypto-collateralized stablecoins instead of mud cookies. The answer is yes and no. Stablecoins seem to be a plausible alternative yet with a catch since game companies will have to disclose its treasury to the users on a real-time basis to placate the solvency concerns and also face the scalability issue, which one the stablecoin trilemma.

c) Crucial Part of the Design: Finding the Right Inflation Rate

Tokenomics in a game works similarly to the real-world economy. It means balanced monetary policies, including control of quantity of money and economic incentives, is paramount to the stability of the game. Especially important is building the right “Faucet and Sink” mechanism.

- Faucet: Inflationary elements, i.e. field drop, quest rewards, and event rewards.

- Sink: Deflationary elements, i.e., shops, dungeon entry feed, and loss of game items during a failed quest.

The absence of the sink is the reason so many games, including WoW, are suffering excessive inflation. The substantial difficulty of striking the right balance is well illustrated by EVE Online, which hired as many as three PhD economists to come up with the right faucet and sink mechanism.

Over time, the importance and elusiveness of token economics have led to creation of a new post—token economists. A long-running game has always been a holy grail—a holy grail rarely achieved but most coveted by every game company. The focus should be placed on the economic ecosystem of the game—many deliberations before and constant modifications after the release.

5. Conclusion

Driven by the high hopes for the coming of a new paradigm, P2E games have risen to stardom since late last year. As the industry is in a fledgling stage, however, it has yet to navigate many challenges, including regulatory issues, user experience, and the size of the market, which is by far smaller than that of traditional games. Many are pointing out that most P2E games are disproportionately focused on the earn rather than the play part of the game, suggesting that large companies with sufficient knowhow and capacity to publish AAA-level games will lead the spread of P2E games. Although this article discussed the dual token economy, where governance and utility tokens are set apart, having the launch of NFTs precede the launch of games may be another way to pull this off, given the burden of regulatory issues and tokenomics.

Despite all such challenges, the future of P2E is still promising. P2E is much likely to win the hearts of users with tis open ecosystem and ownership of in-games monies and items. After all, users will prefer their ownership and multiple universes to game companies’ ownership and a single universe. So far, many blockchain games have failed due to lack of sophistication, policy risks, and tokenomics that have yet to be tested further. At some point in the future, however, it may be unimaginable to think of games without blockchain.