[Xangle Originals]

Written by TraceØ

Translated by elcreto

Content

1. Introduction

2. Reshuffle in South Korea’s Crypto Exchange Market Since the introduction of the Act on Reporting and Using Specified Financial Transaction Information

3. Upbit and Layer 1: An Exchange with the Overwhelmingly Largest Trading Volume and the Most Prevailing Blockchain Sector

3-1. Winning the Largest Pie of the Market: Upbit’s Convenient UI/UX and Successful Customer Onboarding

3-2. Trading Volume by Sector: Layer 1 Recording the Largest Volume

4. Act on Reporting and Using Specified Financial Transaction Information: Changes It Has Brought to South Korea’s Crypto Exchange Market

4-1. Fewer listed tokens in South Korea’s Crypto Exchanges

4-2. Enforcement of FSC Registration Resulting in Mass Delisting

4-3. None Delisted: Korbit’s Conservative Listing Process

4-4. DeFi & P2E Increasingly Attracting Attention

5. South Korean Crypto Projects Still a Force to Be Reckoned With

5-1. Heavy Trading Volume of Altcoins: Altcoins Seen as the Answer

5-2. South Korean Projects Representing 20% of the Entire Trading Volume

5-3. The Ongoing Controversy over Substandard Projects

6. South Korean Crypto Exchanges Going Against Global Trends

6-1. Projects Targeting Overseas Market Vs. Crypto Exchanges Focusing on Domestic Market

6-2. The Listing Practice Decoupled from the Global Trend

6-3. CEXs’ Trading Volume Significantly Outperforming DEXs’

7. Conclusion

1. Introduction

An analogy is often drawn between the great tulip bulb bubble in the 1600s and the crypto craze in 2017. One of the countries at the epicenter of the fever was South Korea. Although there were times when investment slowed after a slump in the price of Bitcoin that had started at the beginning of 2018, crypto investment boomed again in 2020, and the growth of the market has been exponential to date.

As the market's growth accelerates, the number of cryptocurrencies listed on the crypto exchanges is steadily on the rise, along with the trading volume growing dramatically from KRW 100T in 2Q 2020 to KRW 1,500T in 2Q 2021. In 2H 2021, the average daily trading volume of the crypto market in South Korea hit KRW 11T, which outstrips KRW 7.4B of KONEX and is on a par with KRW 11T of KOSDAQ.

Looking at its market share, South Korea is already a force to be reckoned with in the global crypto market. As of 1Q 2022, the trading volume of the South Korean exchanges represents 5% of the global crypto transactions. In terms of Bitcoin’s trading volume, which gives us an indirect estimation of the traded value of cryptocurrencies, South Korea (3.7%) ranks third after the U.S. (84.4%) and Japan (6.9%) (Source: Coinhillls), demonstrating its presence.

As a follow-up to the November 2020 analysis, Xangle analyzed South Korea’s crypto market as of May 2022, focusing on the trading volume. With the introduction of the Act on Reporting and Using Specified Financial Transaction Information (hereinafter “the Act”) and the Travel Rule, South Korea’s crypto market has been in a sense more formally included in the system, putting the market at a watershed between progress and regress.

Based on the analysis of the traded value from 1Q 2021 to 1Q 2022 of the top 4 crypto exchanges in South Korea, we will first discuss how South Korea’s crypto trading patterns stand apart from the global trend and move on to crypto regulations and the most widely known projects in South Korea.

2. Birth of Big 4: How the Act Solidified Their Status

In Sep 2021 when the Act on Reporting and Using Specified Financial Transaction Information came into effect, most of the crypto exchanges in Korea that failed to obtain real-name bank accounts suspended buy/sell trades of assets in KRW, further solidifying the dominance of the top 4 crypto exchanges—Upbit, Bithumb, Coinone, and Korbit.

Of the 63 crypto exchanges in South Korea, only 23 managed to register their business with the authority, while even among the 23, only four were able to obtain the Information Security Management System (ISMS) certification to allow assets to be traded in KRW. Recently, GOPAX has opened the KRW market after it entered a partnership with Jeonbuk Bank to secure real-name bank accounts, but the trading volume has not come in big numbers.

The ”coin market” exchanges where assets are traded in pairs (i.e., BTC/ETH) are significantly less competitive than the “KRW market” exchanges, making it virtually impossible for the coin market exchanges to survive. The 2H 2021 Survey Results of Virtual Asset Service Providers published by the Financial Services Commission (hereinafter, “the FSC”) reaffirmed that as of 2H 2021, South Korea’s crypto market is split into KRW- and coin-based markets in an overwhelming ratio of 95-to-5 percent ratio, with the daily traded value standing at KRW 10.7T and KRW 0.6T, respectively.

Given that transaction fees are the source of income for crypto exchanges, the traded values are directly linked to their revenue. So it is only natural that the KRW-based market grew exponentially in almost all aspects, including revenue, operating profit, and net income while the coin-based market waned. The big four are looking set to grow further this year, propelled by the oligopoly they could build on the foundation of law.

Meanwhile, Korbit reported a net operating loss of KRW 2.7B, which was in contrast to the burgeoning surplus of Upbit, Bithumb, and Coinone. As of 2021, more than 95% of the crypto trades are taking place in Upbit and Bithumb, giving latecomer Korbit no other choice but to come up with a strategy to secure enough transactions.

3. Upbit and Layer 1: An Exchange with the Overwhelmingly Largest Trading Volume and the Most Prevailing Blockchain Sector

3-1. Winning the Largest Pie of the Market: Upbit’s Convenient UI/UX and Successful Customer Onboarding

The introduction of the Act reshuffled the market landscape in 2021, until which year the market was pretty much split by the big four exchanges. Unlike until 2019, when Bithumb had remained the overwhelmingly predominant player in the market, Bithumb’s trading volume topped Upbit’s by a narrow margin between Jun and Sep 2020, virtually dividing up the market into two.

The year 2021 was different though. Upbit took over more than 75% of the traded value, tightening its grip on the market. The primary drivers behind it are considered to be: i) easy-to-use UI/UX, ii) lower KRW transaction fees, iii) partnership with K Bank in Jun 2020 and subsequent new customer onboarding. Dunamu, the operator of Upbit, used to run brokerage service app “Stock Plus” for many years, which became the foundation that allowed Upbit to speed up the process of introducing high-demand features and services and building a user-friendly UI/UX.

Upbit’s phenomenal growth is well illustrated by the growth of its partner, K Bank. Since the partnership with Upbit in Jun 2020, the number of K Bank’s customers grew exponentially from 2.19M as of end-2020 to 4.8M in 11 months and hit 7M in Dec 2021. Aside from the staggering 3-fold growth within less than a year, the bank’s net interest income soared from KRW 46B in 2020 to 198B in 2021. Subsequently, the results were translated into the bank’s first-ever quarterly net income in 2Q 2021, which was an achievement in just about four years since its inception.

Yet, it may be premature to conclude that Upbit will keep its grip on the market. As of 2021, Upbit’s domestic market share is over 75%, indicating its dominant position in South Korea’s crypto trading market. The Fair Trade Act in South Korea regards a business entity that holds a market share of more than 50%, or two or three entities that hold a combined market share of more than 75% as a “market-dominant business entity.” Since monopoly/oligopoly has constantly been an issue in the industry, the steady influx of latecomers is likely to change the landscape of the crypto exchange market.

3-2. Trading Volume by Sector: Layer 1 Recording the Largest Volume

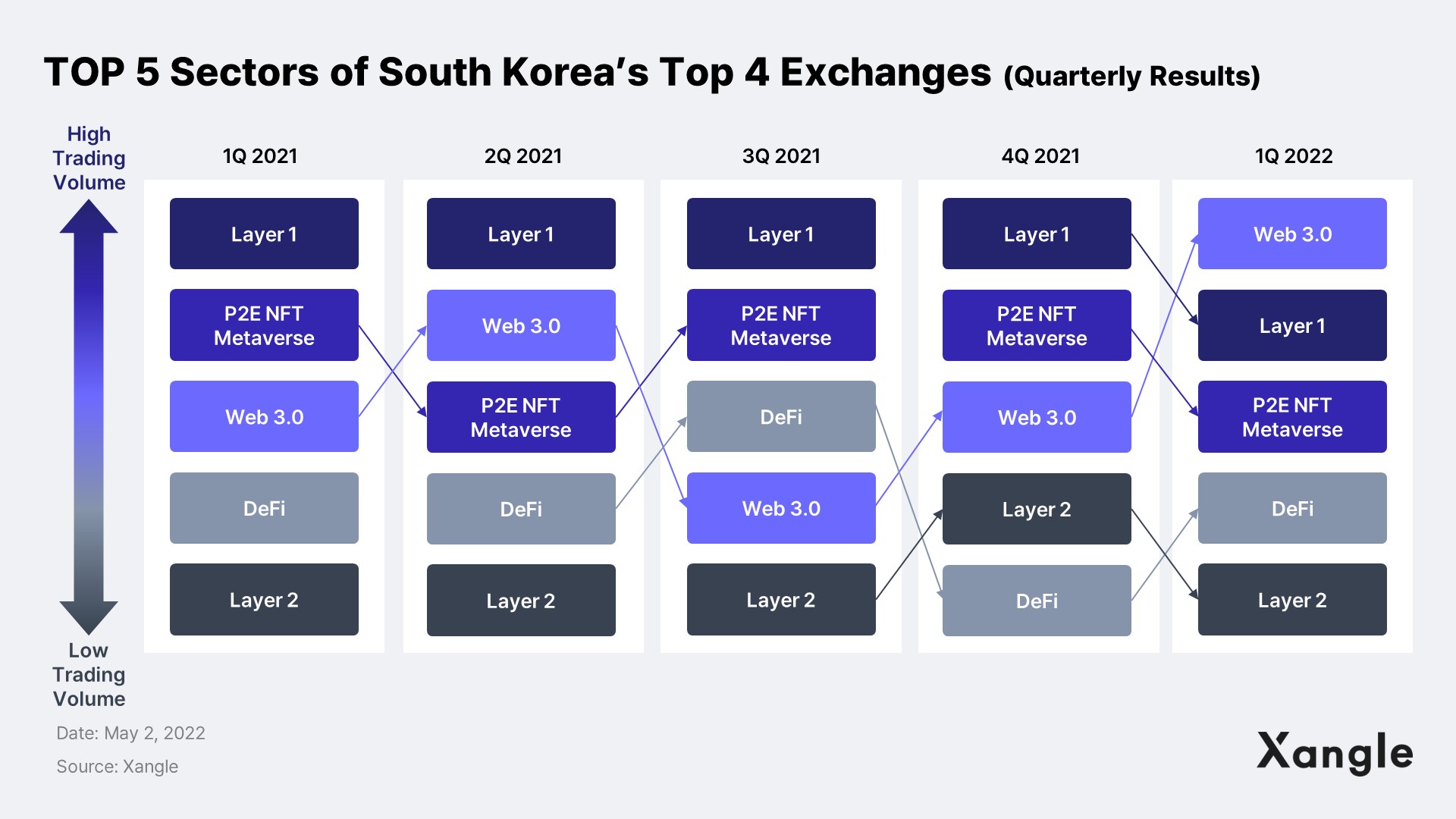

To find out which sector has the most heavily traded projects in South Korea’s crypto exchanges, we divided the sectors of the listed projects into six categories: Layer 1, Layer 2, DeFi, P2E/NFT/Metaverse, Web 3.0, and others.

- Layer 1: BTC, ETH, SOL, KLAY, etc.

- Layer 2: MATIC, RON, LRC, BOBA, etc.

- DeFi: AAVE, COMP, SNX, SRM, etc.

- P2E/NFT/Metaverse: AXS, MANA, SAND, WEMIX, etc.

- Web 3.0: BTT, GRT, FIL, THETA, etc.

- Others: DOGE, XRP, MVL, ASM, etc.

We analyzed the trading volume of the projects listed on South Korea’s crypto exchanges and found that the most frequently traded projects were Layer 1 projects. A significant number of Layer 1 projects made it into CoinMarketCap’s top 100 market cap list. It turned out that South Korea was no exception to the worldwide popularity of the two largest market cap projects, Bitcoin and Ethereum. Meanwhile, Web 3.0 projects turned out to be heavily traded in Upbit in 1Q 2022. This was due to the relatively higher volume of trades involving BitTorrent (BTT), which took place during a prolonged slump in the global crypto market.

It is interesting that XRP is more popular in South Korea than almost anywhere else. XRP not only makes it into the top 5 most heavily-traded crypto assets every quarter, but its traded value also represents over 5% of the entire crypto market in South Korea. It indicates that XRP is more frequently traded in South Korea than in other countries, given that XRP represents less than 1% of the traded value of the global crypto market.

4. Act on Reporting and Using Specified Financial Transaction Information: Changes It Has Brought to South Korea’s Crypto Exchange Market

4-1. Fewer listed tokens in South Korea’s Crypto Exchanges

As has been discussed already, South Korea is a force to be reckoned with, with its traded value raking third in the world after the U.S. and Japan. According to CoinMarketCap, Upbit’s 24-hour trading volume hit KRW 11T on Sep 1, 2021, earning it the second spot among the 398 exchanges.

Korean exchanges, however, offer around 200 cryptocurrencies, which is fewer than the number of assets offered by global exchanges, such as Binance (500+ listed tokens) and Huobi Global (400+ listed tokens).

4-2. Enforcement of FSC Registration Resulting in Mass Delisting

South Korea’s crypto exchanges had carried out a large-scale delisting in the runup to the enforcement of registration of cryptocurrency business that took effect in Sep 2021. In Korea, registering as a KRW-based crypto exchange requires real-name bank accounts since the Korea Federation of Banks views crypto exchanges with a large number of listed tokens as more prone to money laundering.

CoinDesk’s survey of all listed coins from Jan 2020 to Aug 2021 found that the number of trading pairs listed on the four largest crypto exchanges rose from 476 to 749 in just 19 months, up 57%. As the larger the number of tradable tokens, the more likely the users are to be onboarded, the cumulative number of customers and traded value of the big four also skyrocketed during the same period.

The number of trading pairs, however, has been trending down since Jun 2021. It seems that the exchanges delisted a significant number of tokens to secure real name bank accounts just ahead of the registration with the authority. In 2Q 2021, 25 tokens were delisted, the highest in five quarters.

4-3. None Delisted: Korbit’s Conservative Listing Process

In terms of the number of tokens delisted in 2021, Upbit delisted the most tokens, followed by Bithumb and Coinone. Korbit, on the other hand, went completely opposite to the other three: none was delisted from Kobit in 2021. It appears that Korbit’s relatively stricter listing policy led to such result.

Currently, 101 tokens are available for trades on Korbit, which is almost 50% of the number of tradable tokens listed on other exchanges. Since the number of tradable tokens is directly linked to the revenue of an exchange, revenue comes in relatively lower for Korbit than for other exchanges. Yet, the fact that the exchange did not have to let go of any of its listed tokens is coming into light, increasingly positioning it as a safe haven for investors.

4-4. DeFi & P2E Increasingly Attracting Attention

Even after the mass delisting in 2Q and 3Q 2021 that followed the introduction of the Act, the crypto exchanges did not cease to list new tokens. The big four were found to have listed more than 30 tokens per quarter for the previous five months.

Bithumb, in particular, has listed 99 tokens since 2021, the highest among exchanges. Korbit is also on the offensive, increasing the number of listed tokens to grow its portfolio.

Portfolio was where the sea change took place. Nearly 50% of almost 50 tokens delisted from the four largest exchanges were South Korean projects. They replaced home-grown projects with DeFi and P2E projects, making a significant shift in their portfolio composition.

As of 2021, DeFi topped the list in terms of the number of projects listed on the four exchanges with 48 projects, followed by 40 P2E/NFT/Metaverse projects and 35 Layer 1 projects, 29 Web3.0 projects, and 7 Layer 2 projects. Driven by the hype over DeFi and the success of Axie Infinity, DeFi and P2E have drawn more attention than other sectors. Crypto exchanges in South Korea appeared to have wanted to secure enough trading volume by listing tokens of DeFi and P2E projects.

On a quarterly basis, the sectors that listed the most projects were DeFi in 1H 2021 and P2E/NFT/Metaverse in 1Q 2022. Looking at the listed projects in each sector, South Korea’s crypto market is increasingly on a similar trajectory to the global market.

5. South Korean Crypto Projects Still a Force to Be Reckoned With

5-1. Heavy Trading Volume of Altcoins: Altcoins Seen as the Answer

The analysis of the traded value of the four largest crypto exchanges in South Korea found that altcoins are still a popular choice for many Korean investors. Except for 1Q 2021, when a radical spike in the price of Bitcoin led the bull market, trading of Bitcoin has taken up about 10% in South Korea, which is lower than in other countries.

According to CoinMarketCap, Bitcoin trades represented 26% in 2Q 2020 but make up only 15.3% in South Korea’s big four crypto exchanges, indicating that altcoins are relatively more frequently traded and still a popular investment option in the country.

5-2. South Korean Projects Representing 20% of the Entire Trading Volume

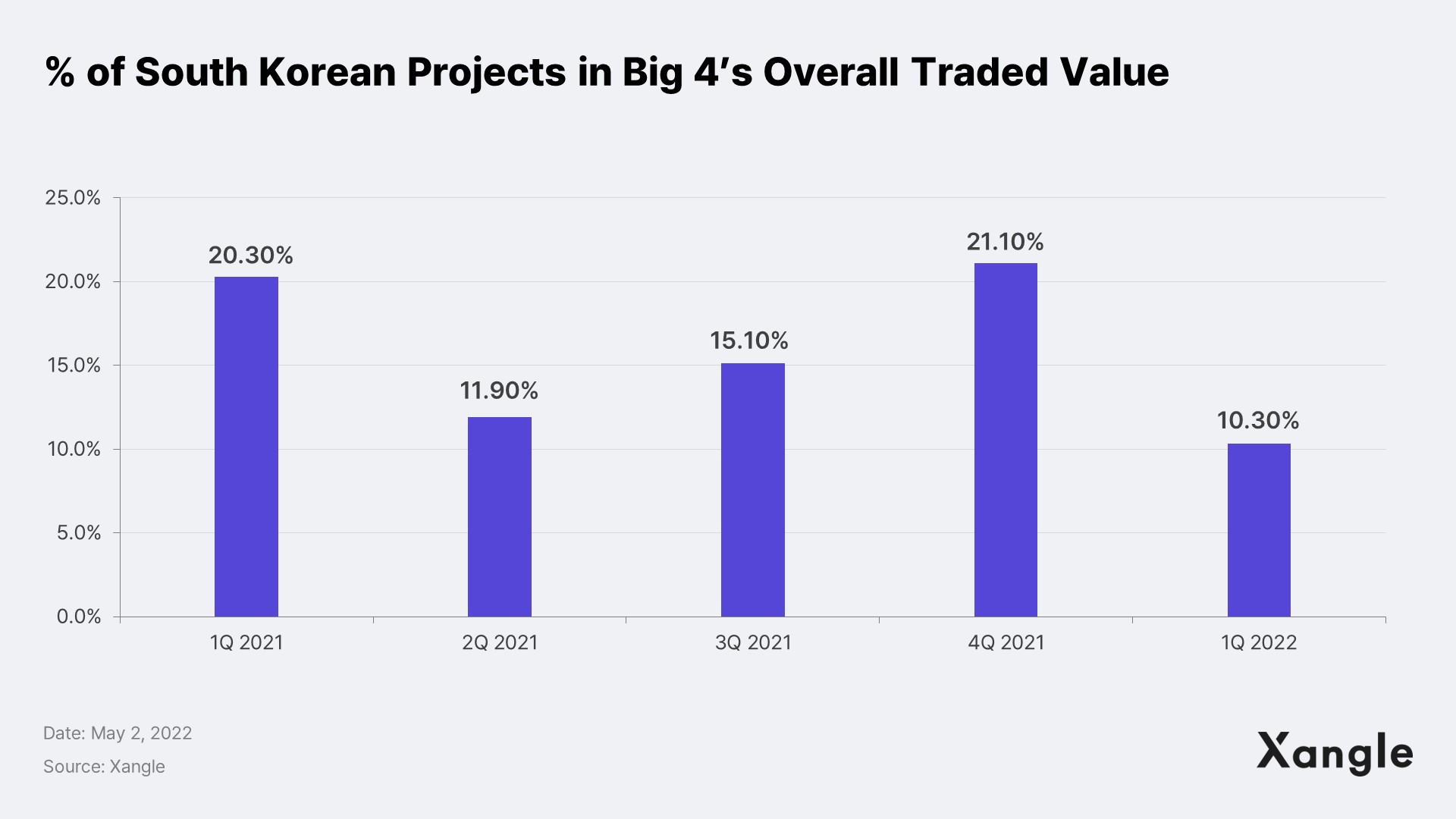

The most popular among the altcoins were the so-called “Kimchi projects,” which are virtually South Korea-based projects. The traded value of the Kimchi projects accounted for 20% of the traded value of the entire market over the previous five quarters, steadily attracting the market’s attention.

Spearheaded by Bitcoin, the price of many cryptocurrencies took off, and South Korean projects were not an exception to this until early Apr 2021. The price of health data platform MediBloc soared 115.38% in just one day on Apr 1, 2021, and the price of logistics platform dKargo 70% on Mar 14, 2021. Attracted by the stellar performance of South Korean projects, many investors started to invest in the market. Crypto exchanges saw a significant increase in the cumulative number of users, hitting 5.71M, which is a 50% growth in just one month.

Clearly, crypto exchanges benefited from the hype over the Kimchi coins. Transaction fees are the source of revenue for crypto exchanges, and as of the end of Apr 2022, there were 126 Kimchi projects, representing 33% of all the projects listed on the big four. The figure is the sum of the numbers of projects located in South Korea or run by Korean CEOs, meaning that the number is even exclusive of projects that mint cryptocurrencies overseas but are disguised as non-Korean. As for the number of South Korea-based projects listed on the crypto exchanges, there are 84 projects on Coinone, 59 on Bithumb, 29 on Upbit, and 7 on Korbit.

Some of the most heavily traded projects up until 1H 2021 were platform and payment Korean projects, such as SOMESING (SSX), Metadium (META), and dKargo (DKA), more than 90% of which are traded on crypto exchanges in South Korea. This stands in comparison to overseas markets where trading of DeFi projects was most significant.

Since 2H 2021, Kimchi projects started to make it into the top five in the P2E/NFT/Metaverse fields—the industries that became conspicuous globally. The largest driver of such rapid growth of South Korea’s crypto projects was the killer applications that South Korea’s P2E businesses, like the widely known Wemix, have launched.

Besides Wemix, there are many other P2E services launched by prominent game developers in South Korea. Top game companies with all the necessary resources from funds, publication to development, such as Kakao Games, Netmarble, Com2uS, and NEOPIN, are set to launch their own services. The difference with the existing crypto-centered P2E games will be the fun aspects, which the companies are putting a greater weight on.

Unlike previous Kimchi projects that have not been able to achieve notable success in the DeFi space, Nexon, NCSOFT, and Netmarble—which had already been successful in the global gaming market—were able to jump on the P2E wagon by maximizing the abundance of their intellectual properties (IPs) that became the primary source of their killer applications. Yet, no company other than Wemix has actually launched a P2E game, and there are regulations associated with P2E games within South Korea, such as the Game Industry Promotion Act. As such, we need to keep track and see if South Korean projects continue to stay ahead of the pack, or even move significantly in line with global trends.

5-3. The Ongoing Controversy over Substandard Projects

Most Korean projects are small caps and traded locally, making it more susceptible to severe volatility and frequent price swings. During the unprecedented bull market in 1H 2021, when Bitcoin and many other crypto assets exhibited an exponential price rise, a massive amount of funds flowed in, and Kimchi projects were the go-to option for beginners to blockchain investment. The thing is, though, many of the projects were projects that added blockchain to their already existing business, lacking technological advantages. Since crypto exchanges in South Korea started to delist projects for which the development and business progress of the foundation are hard to verify, token purchasers are increasingly burdened by the aftermath of delisting.

Since such is the case, Korean projects are seeking to make over the image. For instance, Bora Network announced the BORA 2.0 renewal blueprint, laying out major structural changes to technology and tokenomics, and Metadium announced Metadium 2.0 aimed at a new vision and roadmap, signaling a shift in its focus on DeFi and Web3. More and more eyes are on whether such improvements to Korean projects will lead to tangible results just like other successful projects abroad.

6. South Korean Crypto Exchanges Going Against Global Trends

6-1. Projects Targeting Overseas Market Vs. Crypto Exchanges Focusing on Domestic Market

Blockchain projects based in South Korea have started to realize the limitations in the domestic market and are increasingly targeting overseas markets, mainly because of the difficulty in propping up a high market cap only with South Korea’s crypto market alone. Wemix launched Mir4 Global in some other countries, rather than in Korea, and the game turned out to be a huge success, pushing Wemix’s market capitalization significantly higher. Inspired by some of the most successful home-grown projects, projects based in South Korea are increasingly eyeing the global market.

Crypto exchanges, on the other hand, are going the opposite direction: the Act is virtually forcing South Korean exchanges to let go of foreign investors. Further, the FATF (Financial Transaction Reports Act) travel rule that took effect in Mar 2021 may cast a chill across the entire exchanges and projects in South Korea. With around 400 projects listed on the largest crypto exchanges in South Korea, the number of listed projects is distinctly smaller compared to crypto exchanges in some other countries, and this may have also caused a capital outflow.

6-2. The Listing Practice Decoupled from the Global Trend

For the crypto exchanges, the higher the transaction fees, the higher the profitability. Crypto exchanges in South Korea failed to list promising tokens earlier on and are in that sense at a disadvantage in terms of trading volume and profitability.

South Korean exchanges have listed DeFi tokens in 1H 2021 and P2E/Metaverse/NFT tokens in 1Q 2022, moving in line with the global trends. Yet, they have hardly listed trending tokens like GMT and STG. This draws a contrast with overseas crypto exchanges with a high volume of global trades, such as Binance, Coinbase, and FTX, which have been quick to list such much-coveted tokens and absorb liquidity in the market.

Today, South Korean exchanges are making different moves. APE and ENS were listed by Korbit lately, followed by GMT by Bithumb, and ENS and GMT by Upbit on May 4, 2022, suggesting that the major exchanges are now moving faster in adopting trending tokens than in the past. Although the idea of the more the merrier does not always hold true, it remains to be seen whether such speedier adoption of trending tokens can help prevent outflow of liquidity.

6-3. CEXs’ Trading Volume Significantly Outperforming DEXs’

Compared to the proportion of trades that take place in DEXs in the global market, trades in South Korea are much more heavily biased towards CEXs. While a DEX records buy and sell trades in the blockchain, a CEX has a central system that consolidates data and processes transactions. In South Korea, only 2% of the trading is done in DEXs, which makes a stark contrast to global market’s 11%. This indicates that most of the trading in South Korea is done in the big four CEXs. Some argue that local investors in South Korea will eventually depart for DEXs en masse, in a bid to dodge restrictions and that existing exchanges, such as Upbit, Bithumb, Coinone, and Korbit, will end up being currency exchange services.

7. Conclusion

In this report, we discussed the key characteristics of South Korea’s crypto market with a focus on the traded value of the four largest crypto exchanges in Korea. South Korean exchanges are moving towards the right direction, governing management of their portfolio of listed cryptocurrencies. Yet, there aren’t as many tradable tokens as in international exchanges. With a series of relevant regulations being introduced, South Korea’s crypto market appears to be undergoing an array of changes. In our next report in this series, we will be discussing regulations on cryptocurrencies in South Korea.