Translated by Rhea

Summary

- dYdX, the Ethereum Layer 2-based perpetual futures exchange, announced the launch of its own blockchain, the “dYdX Chain.”

- Its standalone chain launch seems to be aimed at: 1) supplementing the shortcomings of its tokenomics, 2) possibly avoiding regulations on security tokens, and 3) betting on the multi-chain narrative.

- For the dYdX Chain to succeed, the project needs to prevent attrition of Ethereum users, gain sufficient trust in its standalone chain, and build infrastructure including bridges.

- As a DEX with a declared ambition of becoming the largest global cryptocurrency exchange, dYdX taking such a drastic step as above will serve as the guidance for other project teams developing blockchain services in deciding their directions in the future.

Announcing the “dYdX Chain,” Its Standalone Blockchain

Another big news broke out in the DeFi ecosystem following Uniswap’s acquisition of Genie last June 22. dYdX, the number one derivatives exchange based on Ethereum Layer 2 (L2), has announced that it will launch its own chain called the “dYdX Chain” as it moves its blockchain to Cosmos. All eyes are on dYdX to find out what was behind such an unusual move since it is very rare for a project to move out of Ethereum L2 and into other blockchains, while many have migrated from other blockchains to Ethereum L2.

dYdX is a perpetual futures exchange taking up the second largest market share among decentralized exchanges (DEX) by accumulated transaction volume. It used the ZK rollup solution of StarkWare in Ethereum’s layer 2 to build an orderbook-based derivatives exchange requiring much scalability. Having successfully provided a transaction environment rivaling even the centralized exchanges, dYdX grew in love and support of many DeFi users to reach $615 billion in the accumulated transaction for the past year. Despite being a late starter, only having launched in April 2021, dYdX was able to quickly catch up with the transaction volume of Uniswap, launched in 2018, and established itself as one of the major DEXs.

Because dYdX was on such a solid path to success, the market was surprised to hear the news about the launch of its standalone Cosmos blockchain and became curious about what was behind such a decision. dYdX has detailed the following reasons on its blog and Twitter account:

- dYdX V4 will be launched based on its standalone blockchain, the “dYdX Chain.”

- The “dYdX Chain” will be using Cosmos SDK and Tendermint Proof-of-Stake consensus protocol.

- Existing dYdX tokens will function as the dYdX Chain’s L1 token.

- With V4, dYdX will transform into a fully decentralized off-chain orderbook perpetual futures exchange, not run by dYdX Trading Inc.

- No blockchain gas fees are charged for transactions but only trading fees, which would accrue to validators and their stakers.

- Whether the operation of V3 on StarkWare L2 will be stopped remains to be determined.

Even with the above reasons provided, it is still not exactly convincing that dYdX, which was only inches away from taking over the number one DEX title from Uniswap, would switch its mainnet. Why would dYdX really make a choice to launch a Cosmos-based standalone chain?

Hidden Reasons Behind Standalone Chain Launch

1. Supplementing Shortfalls of Existing Tokenomics

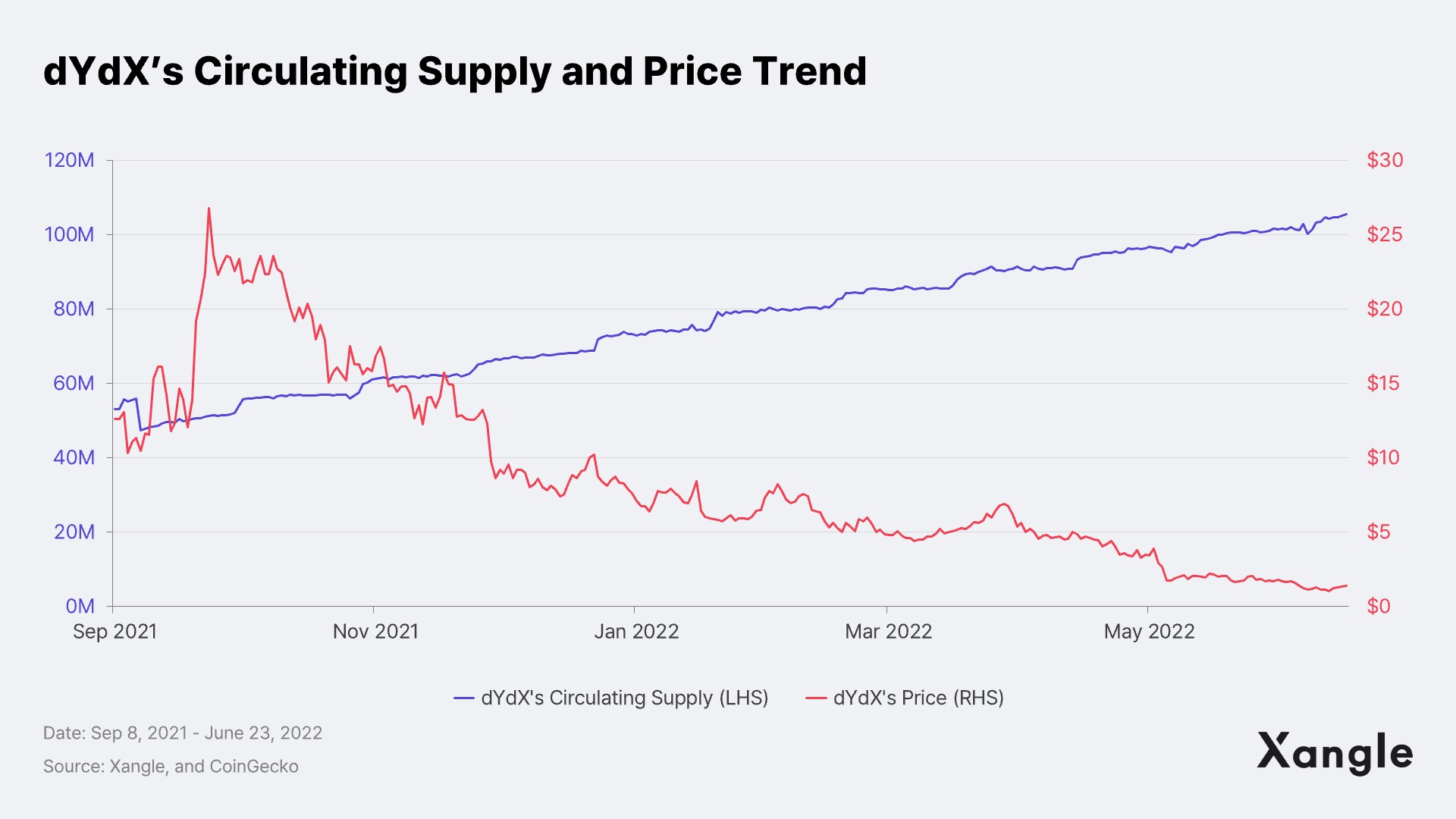

One of the key factors for dYdX’s success was its tokenomics, designed to allow users to receive a significant amount of dYdX token distribution for trading on dYdX. However, such tokenomics led to high inflation of 18% on an annual average. Like many other DeFi tokens, the value of the dYdX token dropped, with the circulating supply pouring in, to about 1/20 of its previous peak. (Refer to the graph below.) It was the actualization of the overhang risk suspected of the dYdX tokens as they possess no real value other than the governance voting rights. (Refer to the "Token Economics" section of the Xangle Crypto Rating.)

The new tokenomics involving the switch from dYdX to L1 as per this announcement is expected to relax the existing overhang risk to a certain degree. This is because validator staking is required to run the PoS consensus, which the dYdX Chain chose to adopt. On top of that, since the project has stated that the entire trading fee incurred on dYdX will be distributed across the community, the holders now have good reasons to HODL onto their dYdX. With dYdX’s fully diluted valuation (FDV) at $1.4 billion and the accumulated revenue for the past one year at $500 million, it seems that the actual token value will be significantly improved if this amount were to be distributed among the holders. (Refer to the graph below.) The project has displayed its efforts to improve the tokenomics in V4 with the announcement of two solid utilities compared to previously rather superficial tokenomics, which basically only stated that “[these tokens] can be used for governance votes.”

2. Potentially Avoiding Regulations on Security Tokens

The word dYdX mentioned the most in its announcement of the V4 launch was “decentralization.” According to the Howey Test, the most widely used method to determine whether a token is a security token, tokens from fully decentralized projects are highly likely to be categorized as non-security tokens. In fact, a few officials at the U.S. Securities and Exchange Commission (SEC) have stated that Ethereum would not be deemed a security token because 1) a long time has passed since its initial coin offering (ICO), 2) the network’s operation is broadly dispersed with no specific operating entity, and 3) the price of Ethereum would not rise solely by the efforts of the Ethereum Foundation. (Refer to the Reuter article)

It seems that dYdX has made a judgment call that its regulatory risk can be mitigated by launching its own chain to secure a large number of validators and building a decentralized service not run by dYdX Trading Inc. In particular, it is worth pointing out that the part about its tokenomics involving a 100% return of the trading fees as mentioned above could be considered the same as “dividends” for stocks, increasing the chance of dYdX being categorized as a security token which “provides its investors a contracted portion of its profit.” Its announcement that the profit would be given out not in the form of dividends but as rewards for PoS staking could also be understood in the same context. As the role theory for regulators is gaining traction and the discussions about regulations on crypto assets are becoming full-blown as of late, dYdX’s launch of a standalone chain can be interpreted as a smart move in reducing its regulatory risk.

3. Betting on the Multi-chain Narrative

On the topic of the future of smart contract platforms, the current blockchain industry is deeply divided into two sides: 1) Ethereum’s modular blockchain to rule them all, or 2) the multi-chain narrative based on various monolithic L1s. (Refer to the Xangle article, “Blueprint of Ethereum 2.0: Modular Blockchain.”) With many projects opting for Ethereum L2 since the Terra incident, it looked like the former would gain dominance. However, it seems that the future with a multi-chain ecosystem will gain more support again with this announcement of dYdX.

The benefits dYdX can enjoy by choosing Cosmos app-chain over Ethereum’s ZK rollup are as follows:

- Building a new L1 token economics from scratch → Existing dYdX to be switched to L1 token

- Lower fee than Ethereum → Gas fee to be free of charge (but trading fees will still be incurred)

- Higher level of decentralization than ZK Rollup solution → Decentralized form of governance planned for V4

However, leaving Ethereum means leaving a blockchain ecosystem that has abundant liquidity and is used and verified by numerous users. As such, dYdX is tasked with having to solve various challenges such as 1) preventing attrition of existing Ethereum users, 2) gaining sufficient trust in its standalone chain, and 3) building infrastructures, including bridges. In fact, the growth of the Cosmos ecosystem, which had been stagnant since the Terra incident, will have to be accompanied in order for dYdX to maintain the same level of performance in the Cosmos DeFi ecosystem, which is a mere 1/100 of the entire Ethereum ecosystem.

Will This Be a DEX Market Game-Changer?

Due to the reasons mentioned above, some people in the industry have questioned dYdX’s launch of its own mainnet, pointing out the possibility that dYdX DEX will lose its competitive edge when it fails to secure a sufficient number of users after abandoning a much larger ecosystem of Ethereum and moving to Cosmos. AntonioJuliano, the founder of dYdX, shut this allegation down on his Twitter account, emphasizing that what really matters for a project is what products it builds rather than how many users are on a specific blockchain. He also added that the project would not only launch the standalone chain but also be equipped with infrastructures needed to use its V4 service, such as Cosmos wallet and bridges.

For now, it is hard to tell the kind of impact dYdX’s move to the Cosmos ecosystem will have on the DEX ecosystem. dYdX may be able to maintain its momentum of growth as it was close to outperforming Uniswap, Ethereum’s major AMM-based DEX, by transaction volume. Or, it may lose its Ethereum users and shrink down to the scale of Osmosis, for example, another Cosmos DEX. Whether all the promises Antonio Juliano made, such as multi-chain infrastructure and seamless chain transition, will come true will also influence how the users behave. However, it is clear that Osmosis, which had enjoyed unrivaled dominance in Cosmos as the representative DEX, will likely lose a significant portion of its market share as such a powerful competitor enters the scene.

Results from the New Experiment to Be the Guideline for Other Late Starters

On its blog, the dYdX team has shared their philosophy of “Think 10x Bigger,” signifying that they think bigger and seek to take on bigger challenges. They also declared that their goal is not to be the top DEX in the boundary of a specific chain but to be the largest exchange in the entire exchange ecosystem. In order to reach its goal, dYdX took a stab at this bold new experiment of launching its own chain. How its future unfolds is likely to have a significant implication for the blockchain industry as a whole as we move forward. In particular, it will serve as a guideline for other project teams seeking to develop blockchain-based services when they try to decide which direction they should take, such as launching on the Ethereum L2, a monolithic blockchain, or a standalone blockchain. Of course, it would be difficult to predict the implications of dYdX’s choice. However, it is undisputedly clear that various experiments are underway even in this bear market and that efforts are continuously being made to create value in the industry, even as we speak now.