[Xangle Original]

Written by KP

Translated by LC

[Xangle Valuation Series] ① Bitcoin

The Benefits of Crypto Valuation

The price of Bitcoin and other cryptocurrencies is fluctuating yet again following the recent changes in the macro-environment. Experts cite various reasons (e.g., excessive leverage) as to why the prices are more volatile for cryptocurrencies than the traditional investments such as stocks and bonds. Fundamentally, the question lies in the intrinsic value of cryptocurrencies. Bitcoin, which initially launched as P2P electronic cash and has recently begun to be recognized as digital gold, Ethereum, which has emerged as a web3 internet infrastructure, DeFi, and NFTs are examples of the countless digital assets that have been created over the past years. And this overwhelming number of digital assets has made it difficult for investors to determine each asset’s value. Consequently, investors were driven by narrative-based investing instead of numbers, creating hype about cryptocurrencies. Furthermore, cryptocurrencies have no valuation methods to measure the rock bottom, such as PER and PBR, which are commonly used in the stock market, resulting in investors blindly rushing toward either extreme of buying or selling digital assets.

Do cryptocurrencies, including Bitcoin, really have no intrinsic value? Valuation tools such as PER and DCF, commonly used in the stock market, are not yet available in the cryptocurrency market. However, various attempts are being made to evaluate cryptocurrencies based on different perspectives, and prices fluctuate according to specific indicators. To that end, the [Xangle Valuation Series] was prepared to examine which indicators affect the cryptocurrency prices and from what perspective should these newly emerged assets be viewed. Bitcoin is the first runner of the series especially focusing on various valuation methods.

What Is Bitcoin? How Does It Work?

It is challenging to define Bitcoin in a single sentence. While it was adopted as legal tender in El Salvador, global institutional investors define Bitcoin as “digital gold,” and it has been increasing in institutional investment portfolios. Determining the value of Bitcoin requires a certain amount of regulation and an effort to evaluate its value within that framework. I can personally relate to the narrative, “Bitcoin is like a mirror,” as anyone who looks into it sees some reflection of themselves or what they want from Bitcoin. This article will search into traditional assets, including fiat currency, gold, Bitcoin from a portfolio point of view, and numbers.

1. Bitcoin as Payment Method

Governors of the Central Banks around the world have declared that Bitcoin will not be regarded as currency. While this would be a feasible statement in countries with an advanced financial system, it is not the same case for developing countries like El Salvador and Venezuela, where the fiat currency is unstable, and Bitcoin is regarded as legal tender in those countries. A Venezuelan engineer Alejandro said, “I’m helping to feed my family with groceries purchased from Walmart.com with bitcoins.”

Then what would be the potential value of Bitcoin when those countries with unstable fiat currency adopt the digital currency as a legal tender? To answer this question, the Index of Monetary Freedom published by the Heritage Foundation was studied, specifically referring to the currency of 35 countries with low monetary freedom scores.

The total money supply of these countries (based on M2) is about $3.4 trillion, about five times the market capitalization of Bitcoin at $0.7 trillion (as of Mar 10, 2022, 18:00). Although, of course, not all fiat currencies of the entire 35 countries will be replaced, and Bitcoin is likely to be used as an alternative solution. Still, it is by no means small. Let's take a moment here and imagine Bitcoin replacing a portion of the G20 countries’ combined currency of $110 trillion, though it is hardly possible. In that case, the scale of Bitcoin used as legal tender could be much larger.

This perspective is meaningful in that the number of payments using Bitcoin has recently increased in countries such as El Salvador. After El Salvador adopted Bitcoin as legal tender, the country is now where people could live only using Bitcoin. The story of an Italian couple who traveled around El Salvador for 45 days using only Bitcoin has certainly generated media interest. Currently, over 2 million El Salvadorians have downloaded the Chivo Wallet, a crypto wallet for citizens to facilitate transactions in Bitcoin, and are using it daily. (Refer to the dashboard below)

With the recent introduction of the Lightning Network, Bitcoin’s costly transaction fees when used for payments decreased, creating meaningful use cases in some countries. Recently, a rumor has been circulating that Bitcoin could be declared legal tender in Mexico, as El Salvador did in 2021.

2. Bitcoin Emergence as Digital Gold

The anonymous Satoshi published his famous whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” in 2008, and the Bitcoin network has since witnessed a meteoric rise over the course of a decade. Along the way, “digital gold” has become the new narrative of Bitcoin, going beyond electronic cash. This suggests that Bitcoin has started to be recognized as a “store of value.” Gold has been an asset that has held value for thousands of years because of i) its scarcity and ii) its immutability. Thus, it didn’t take long for people to realize that Bitcoin also possesses the two key attributes of physical gold. The network has i) a limited supply of only 21 million bitcoins (= scarcity) and has proven itself robust against hacking attacks (= immutability), and these attributes have earned Bitcoin the title of the new digital gold. Bitcoin is superior to gold in some respects as a single bitcoin can be divided into 100 million pieces called satoshis, and it can be used as a payment method.

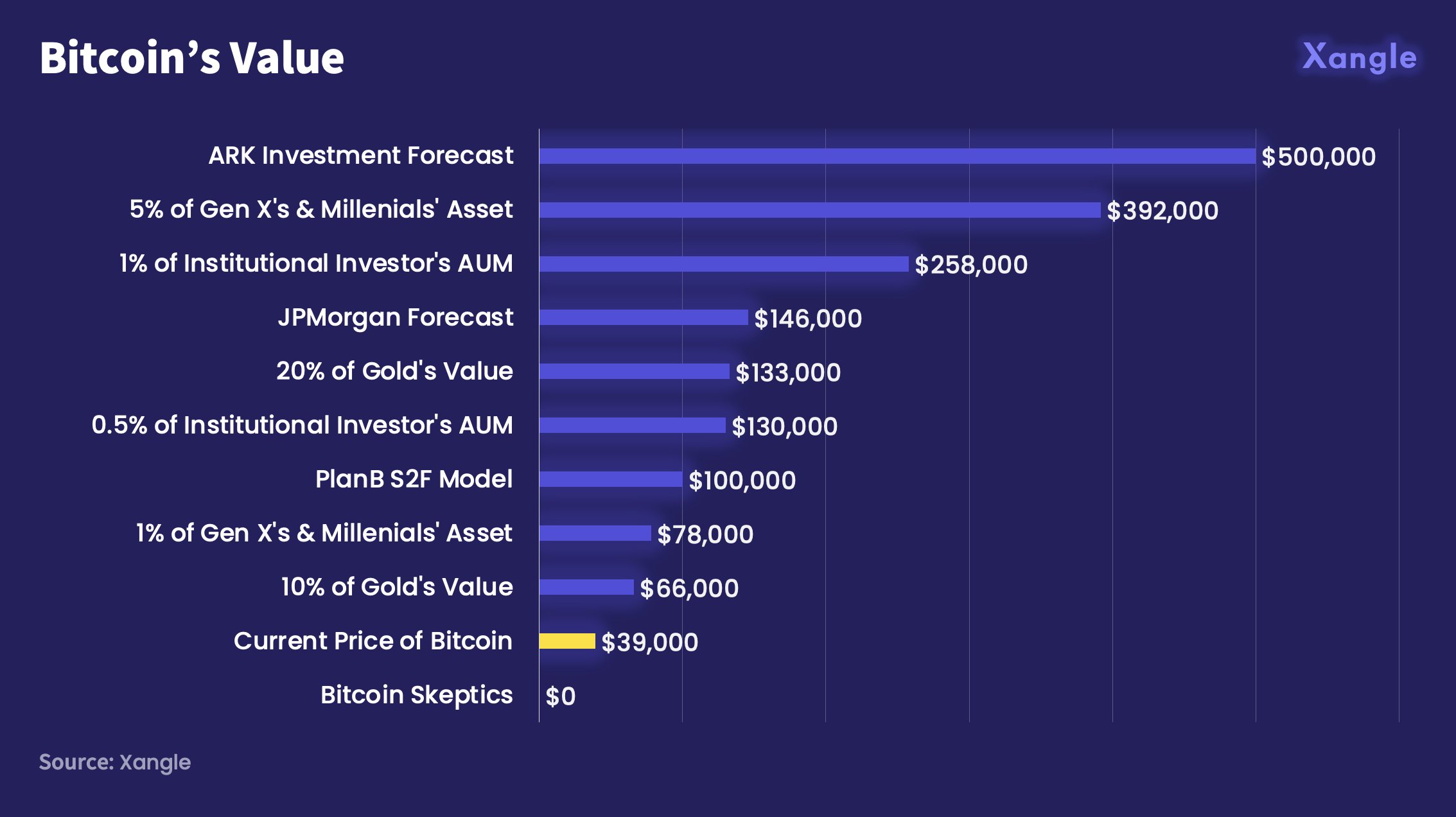

Bitcoin will eventually earn the title of digital gold as more people start to recognize Bitcoin as the new shining gold. Then what value would Bitcoin bring when it gets recognized as digital gold? The answer can be found in the current market capitalization of gold. At present, the market capitalization of gold is roughly $12.5 trillion, which is 18 times the market capitalization of Bitcoin of $0.7 trillion. In other words, Bitcoin has an 18-fold upside potential (note: JP Morgan predicted that Bitcoin could rise to $146,000 and compete with gold if the market cap increases the private sector’s investment in gold by $2.7 trillion).

3. Bitcoin and Portfolio Diversification

Will Bitcoin become a better store of value than gold? There are quite a few people who own Bitcoin but do not invest in gold, and the millennials’ preference for Bitcoin is especially significant. Assuming that Generation X and millennials worldwide include 5% of bitcoin in their portfolio, the potential value per bitcoin would be about $393,000, which is 10 times the current level (roughly $786,000 assuming 1%).

The fact that an increasing number of retail and institutional investors are investing in Bitcoin is worth considering. In 2020, prominent Wall Street investors and major companies had begun incorporating Bitcoin into their portfolios. Meanwhile, billionaire Wall Street investors, including Ray Dalio, Paul Tudor Jones, Stanley Druckenmiller, and even Cathie Wood, believed Bitcoin, with its limited supply, could serve as hedge against inflation. Furthermore, institutions like Tesla, MicroStrategy, Square, and Nexon have all incorporated Bitcoin into their balance sheets, indicating that institutional players saw Bitcoin could be a valuable hedge against the upcoming inflation.

If global institutional investors who manage $145 trillion start including Bitcoin in their portfolios, the impact will be enormous. The Fidelity survey showed that 91% of institutional investors would invest in digital assets within 5 years. If institutional investors allocate 0.5% of their global AUM (Assets Under Management) to Bitcoin, their potential value could reach $130,000. From that point of view, Cathie Wood, CEO of Ark Investment Management, predicted that Bitcoin will be worth $1 million in 2030, signaling that more institutional investors will have no choice but to include Bitcoin to diversify portfolios in the future.

4. Other Valuation Models

Acknowledging Bitcoin as a currency and digital gold provides a standard against which to estimate the size of the market share that Bitcoin may be able to take over. However, the above method is helpful in estimating the potential value of the future, but it is difficult to determine whether Bitcoin is currently undervalued or overvalued. In this section, the value of Bitcoin will be evaluated from a technical point of view while determining whether Bitcoin is undervalued or overvalued.

1) PlanB's Stock-to-Flow(S2F) Model

S2F is a Bitcoin valuation model widely used in the digital asset industry. The S2F model indicates the total supply of scarce resources such as gold divided by the number of resources produced annually. This model assumes that the scarcity of a specific resource increases its value.

In the case of Bitcoin, its scarcity increases with each halving that occurs every 3 to 4 years, and this is the basic premise of the S2F model, that the price will rise following each halving. Bitcoin's S2F is similar to gold today, but having gone through the halving every four years and reduced supply, Bitcoin is anticipated to become more scarce than gold by 2025.

PlanB is the creator of the bitcoin S2F model. According to the current S2F model, Bitcoin’s price is about $100,000, considering the current Bitcoin supply. Although PlanB was heavily criticized after his model failed to predict the November closing price in 2021, past data on the Bitcoin price has been in line with the S2F model to some extent. According to this model, the price of Bitcoin is currently undervalued.

2) Market Value / Realized Value (MV/RV)

MVRV (Market Value to Realized Value) ratio is defined as an asset’s market capitalization divided by realized capitalization, which is useful for spotting market tops and bottoms. Market Value refers to the market capitalization currently in circulation, that is, the market capitalization of Bitcoin. Realized Value is a metric created by Coin Metrics that is calculated by valuing each unit of supply at the price it last moved on-chain. It is a concept of market capitalization calculated by applying the market price at the time to the circulation volume that has moved for a certain period of time.

MVRV is very intuitive and useful when checking whether Bitcoin is undervalued or overvalued. Recently, Messari mentioned MVRV as one of the indicators to check Bitcoin sentiment, recommending that whenever MVRV hits 3 tends to be a good time to take gains and that a historically good time to buy has been when the same ratio hits 1. The MVRV ratio has provided a reasonable standard for identifying highs or lows over the past decade, but it now appears to be at a neutral level, neither overheating nor panicking.

Bitcoin Demonstrates Its Intrinsic Value To The World

The above text refers to a headline in Forbes published on Mar 1, 2022. The article contains stories of the people who have turned to Bitcoin as a solution to their differing problems, introducing Ukrainian refugees forced to rely on Bitcoin as banks closed, the Russians withdrawing the Ruble so they could spend it to buy Bitcoin to avoid losing more value, and the Canadians resorting to Bitcoin after millions worth of donations got frozen. Forbes cited that Bitcoin has demonstrated its intrinsic value in the recent global events, providing ready solutions to different people facing different challenges.

The [Xangle Valuation Series] ① Bitcoin delved into the intrinsic value of Bitcoin based on a number of cases in which Bitcoin was used, examining its value as i) currency, ii) digital gold, iii) investment portfolio and others. It is unclear whether this valuation model will remain valid in the future since the digital asset market has only been around 10 years. Moreover, given that new valuation methods have always emerged over the last hundred years of the stock market history, it is likely to be replaced by a better alternative model. Nevertheless, I hope the Xangle Valuation Series on Bitcoin proves helpful for those seeking to invest in Bitcoin. Although the headwinds in the market may have put the price of Bitcoin on a wild ride, a rise in the intrinsic value of Bitcoin may be inevitable.