[Xangle Originals]

By Debussy

Translated by LC

Summary

- ALEX is the first-ever Stacks-based full-service DeFi platform that primarily leverages the vast amount of capital of the Bitcoin network to attract institutional investors.

- It launched a service that allowed for “lending/borrowing BTC at a fixed rate without risk of liquidation” for the first time, using Automated Market Maker (AMM) and Collateral Rebalancing Pool (CRP).

- Stacks-based IDO platform “ALEX Launchpad” is expected to attract many new Stacks-based tokens and drive up $ALEX price and TVL.

- ALEX DEX will have AMM and order book functions embedded and start offering various types of Bitcoin-leverage trading.

At last, ALEX, the first-ever full-service DeFi platform on Bitcoin is about to launch its mainnet on Stacks on Jan 10, 2021. Stacks-based dApps carry weight as it leverages the massive capital of the Bitcoin network and focuses on services for institutional investors, the so-called “moguls” of the traditional financial market. In the blockchain ecosystem, the DeFi protocol consolidates each network’s capital, acting as a key vehicle for strengthening the fundamentals of the mainnet and driving up TVL. It is in this context that ALEX’s initial investor a41 Ventures said that investing in ALEX is like an index investing in the Stacks ecosystem.

The majority of Bitcoin whales simply want to store BTCs in their wallets or use them as collateral to earn more on central exchanges (CEXs) like Binance and Bitfinex. Leverage trading that exclusively relies on BTC as collateral, of course, has an advantage in terms of high return. Yet, attracting the Bitcoin whales (institutional investors) that tend to take a more conservative approach requires alternative options to hedge the risks associated with liquidation and interest rates. With its target set on institutional investors, ALEX envisions just that as it launches the first-ever service that allows for lending/borrowing BTC at a fixed rate without risk of liquidation. More specifically, ALEX is hedging both interest rate and liquidation risks through the financial engineering model of the traditional financial market and Collateral Rebalancing Pool (CRP). Let's find out more about how ALEX is achieving the goal and what other services it is planning to launch.

ALEX Launchpad to Drive $ALEX Price and TVL higher

.png)

The first feature ALEX will be showcasing on Jan 10, 2021 is the launchpad. Crypto launchpads are platforms that give qualified users earlier access to initially-offered crypto assets. Users can have an opportunity to purchase tokens before they are available in the market. Such type of trading is known to return a higher profit as the investors can seize the chance to profit from a price spike. Among centralized exchanges, Binance Launchpad is the industry-leading launchpad that conducts IEOs (Initial Exchange Offerings) through which tokens that survive Binance’s screening are listed and put up for sale.

As a decentralized exchange (DEX), ALEX executes an IDO (Initial DEX Offering) for listing and sale of tokens, allowing P2P trading without the need of a central operator or server. Generally, Crypto assets listed through an IDO have significantly easier access to DeFi services. Since ALEX is the first Stacks-based, full-service DeFi protocol, most of the new Stacks-based tokens will likely use the ALEX launchpad in the future. In terms of TVL, Uniswap and Serum are the largest platforms that provide a launchpad. If the probability of securing IDO tokens increases proportionally to the amount of ALEX held, the launchpad will surely contribute to the rise of the $ALEX price and TVL of the protocol.

- ALEX mainnet & Launchpad release (Link)

ALEX DEX: AMM, Order Book, and Bitcoin Leverage

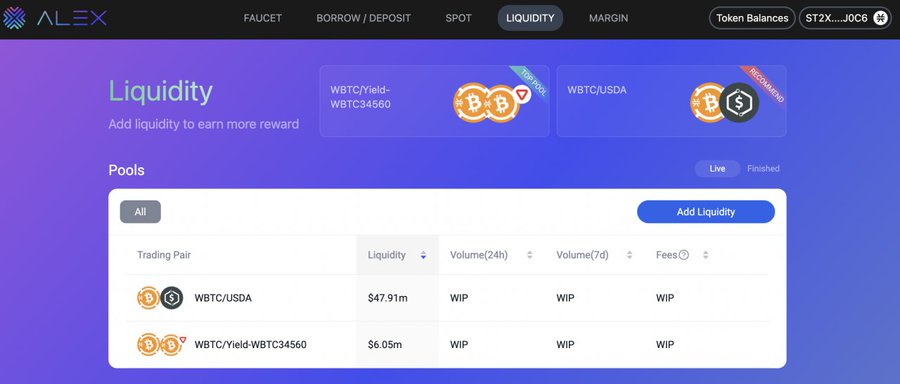

ALEX stands for Automated Liquidity Exchange. It is literally a high-performance decentralized exchange (DEX) equipped with Automated Market Maker (AMM). It is planning to provide various leveraged products, such as fixed-rate borrowing/lending services without risk of liquidation, Bitcoin margin trading, and yield farming, aiming to tap into the enormous capital and liquidity of the Bitcoin network. In theory, ALEX is a model that combines the strengths of the traditional stronghold of a decentralized exchange, Uniswap, and the emerging power, dYdX. The goal is to maximize the advantages of both platforms by combining Uniswap's AMM and dYdX's order book and leverage features. To put it simply, an order book is a type of a book that records all bid/ask quotes placed by buyers and sellers. Among the highest TVL DEXs, Serum is the only platform that properly implements the order book. The order book feature is key to increasing the convenience of trading. Therefore, once all ALEX enables all these features the future, they will surely propel the rise of TVL and growth of its ecosystem.

Arkadiko, a Stacks-based self-repaying loan platform, demonstrated an explosive growth in Nov 2021, achieving a TVL of over $30M on the first day of its release. If we infer from Arkadiko ALEX’s margin trading model, users will be able to borrow decentralized stablecoin USDA, using STX tokens as collateral. By doing so, the pledged STX tokens can be stacked to secure an average annual return of 11 to 13%. At the same time, users will be able to buy Bitcoins with borrowed USDA and deposit them with ALEX to secure an interest rate that is equivalent to a fixed interest rate. This means users can stably earn compounding interest. We would have to wait and see until its official launch to make any judgments, but if properly implemented, it is anticipated to be the new powerhouse in the DEX industry in 2022.

ALEX Lending Protocol: The First-Ever Fixed-Rate BTC Leverage Service Without Liquidation Risk

As the saying goes, leverage is one of the beauties of capitalism, and it is no exaggeration to say that the core of the DeFi market is lending. This is because lending can create a money multiplier that can significantly increase liquidity in the market. However, most of the lending protocols, except for ALEX, have been providing variable interest rates only. Ethereum-based loan protocols Compound and MakerDAO also support variable interest rates. In addition, all of the highest TVL loan protocols either only support variable interest rates or provide restrictive fixed rate products. Variable interest rates have clear advantages in terms of maximizing the interest income. Yet, a fixed-rate lending that can hedge the interest rate risk is essential to attracting institutional investors who are the powerful players of the traditional financial market. Meanwhile, ALEX pioneered the blue ocean by providing for the first time lending and borrowing service at a fixed rate and also in BTC without the risk of liquidation.

1) Incorporating TradFi’s Zero-Coupon Bond: Improving Stability, Timeliness, and Predictability

ALEX applied to DeFi the concept of a zero-coupon bond, which is one of the ways the traditional financial market issues bonds. In the traditional financial market, a zero-coupon bond is a debt security issued at a discount equal to the interest receivable in replacement of the due interest payable upon maturity. Despite the fact that interests are not paid regularly, the merits of a zero-coupon bond are stability, timeliness, and predictability as the creditor can redeem a predictable amount upon maturity. With a fixed interest rate and loan maturity, borrowers can predict when and how much interest they will need to pay while lenders (liquidity providers) can build portfolios and manage crypto assets in a more stable way.

2) AMM and Bond Tokens (ayToken) to Enable Fixed Interest Rates

Unlike traditional financial markets, the DeFi lending market does not provide a credit line. Instead, it all comes in the form of token-collateralized loans. Therefore, rather than simply issuing a debt security, DeFi borrowers provide their tokens as collateral and borrow in the form of tokens payable that can be exchanged for a certain value upon maturity. ALEX employed Automated Market Maker (AMM) and Collateral Rebalancing Pool (CRP) that are based on highly sophisticated financial engineering models, and built a mechanism that allows both parties to lend and borrow at a fixed rate without the risk of liquidation for a set period of time. In the end, if you pay a small fixed interest, you can leverage Bitcoin without any significant risks. The specific logic behind this is elaborated in the diagram below.

3) CRP to Hedge Both Interest Rate and Liquidation Risks

Another point to note is the minimized liquidation risk. A loan secured against crypto assets means borrowing crypto assets up to a certain percentage of the asset pledged as collateral. However, there is a fatal weakness: there is always a risk of liquidation if the value of the collateral plummets depending on the market condition. In such cases, posting additional collateral to prevent liquidation may actually increase the risk. In this sense, ALEX is taking a leap forward as a game-changer in the DeFi platform by minimizing the risk of liquidation posed to Bitcoin whales.

DeFi’s existing collateral loan protocols have been based on a single crypto asset collateral that reflects the risk preference of the borrower. Simply put, it is a way of margin trading based on a single collateral pool made up of only BTC or ETH. This type of trading is suitable for high-risk, high-return investors, and the leverage may earn you significantly more while you are more likely to face liquidation if your position and the market situation change. In this context, ALEX developed the Collateral Rebalancing Pool (CRP) mechanism by applying the Black-Scholes model, one of the prominent models of financial engineering, to eliminate liquidation risk. The delta value, the core of the Black-Scholes model, refers to the degree of position change in response to changes in the underlying asset price and is mainly used to minimize the volatility of the position.

CRP is a pair of pools consisting of risky assets and risk-free assets. This is similar to portfolios with equities and government bonds, where the former represents a risky asset while the latter represents a risk-free asset. ALEX applied a delta value to automatically rebalance the ratio of risky assets and risk-free assets based on the market condition to minimize liquidation risk. During a market boom, for instance, the weight is placed on risky assets so that the collateral pool can absorb any increase in value. Conversely, the weight is placed on risk-free assets to avoid liquidation risk during a market downturn. This mechanism is allowing ALEX to simultaneously hedge both interest rate and liquidation risks. Plus, the protocol allows for a more aggressive loan-to-value (LTV) ratio compared to other DeFi protocols and better preparedness with higher loan loss reserve for any black swan event (like an unpredictable sharp decline).

- ALEX whitepaper – Protocol mechanism (Link)

On Jan 10, 2022, along with the release of its launchpad, ALEX will hold its IDO (Initial DEX Offering) of its native token $ALEX. According to ALEX’s TOKEnomics, which was released on Dec 30, 2021, ALEX tokens will act as a medium for exchanging time value and risk preference within the ecosystem. ALEX will provide liquidity to the DEX and be provided as a reward for participating in staking. In particular, it is worth noting that 50% of the initial token supply will be rewarded to users who lock up ALEX or liquidity tokens. ALEX will also be used to make proposals in key governance agenda, such as the direction of the protocol development, staking policy, and ALEX token supply policy.

At this point, you might wonder, is ALEX really safe enough to handle the big bucks?

ALEX has already completed a smart contract audit through CoinFabrik, a leading blockchain smart contract coding and security auditing firm. The audit was conducted on ALEX’s smart contracts, liquidity pools, yield farming, and the aforementioned financial engineering modeling, and all of the minor issues found in the process are fixed. In addition, it is jointly running a bug bounty program with Immunefi, a leading DeFi security platform, in a steady effort to minimize security defects. ALEX is the only full-service DeFi protocol that indirectly utilizes the Bitcoin network, ensuring both security and stability.

Although ALEX has not released any official features yet, there are a few issues to consider. First, it should be monitored how ALEX would improve the transaction processing speed, which has been a chronic issue for Stacks-based dApps, and whether it can win the heart of large BTC investors enough to tolerate the slow speed. Also, it remains to be seen how many various types of crypto assets will be included in the risky and risk-free asset classes and how effective the hedging strategy will be. Crypto traders who trade on margin are high-risk and high-return investors who are not afraid to take risks. When specific weight setting methodology is put aside, rebalancing a pool of asset pairs may not as effective as a single collateral pool to maximize the leverage effect.

Will ALEX be able to tackle these issues? We’ll stay on the lookout to see if it will ultimately be able to maximize the merits of the architecture and massive capital of Bitcoin to usher in the era of Bitcoin DeFi.