Table of Contents

1. What If You Could Borrow the Entire Ethereum Network?

2. The Blockspace Problem of Ethereum

3. EthGas’s Approach and Expected Impact

4. Partnerships & Tokenomics

5. Closing Remarks: ETHGas as Ethereum’s Execution Engine

1. What If You Could Borrow the Entire Ethereum Network?

What would become possible if the entire Ethereum network could be borrowed for ten minutes? On Ethereum, ten minutes corresponds to the production of roughly fifty blocks. Control over that window would mean deciding which transactions are included in those blocks—and in what order. It would also mean retaining the option to include no transactions at all.

Consider a scenario involving time-sensitive events such as first-come-first-served token sales, NFT mints, or deposit campaigns. Under such conditions, guaranteed priority execution becomes possible: transactions would settle first, deterministically, without exposure to gas auctions or execution failure. If an NFT mint were scheduled for 10:00 a.m., borrowing Ethereum from 10:00 to 10:10 would allow the blockspace between 10:00 and 10:05 to be reserved exclusively for transactions originating from a single wallet, executed sequentially and without contention.

Arbitrage provides another illustrative case. Suppose that during the same ten-minute interval, Ethereum prices rise sharply on centralized exchanges while on-chain prices have not yet adjusted. Such a temporal mismatch would allow Ethereum to be acquired on-chain at a relatively lower price, creating a clear arbitrage opportunity.

Assume Ethereum is borrowed from 10:00 to 10:10. During this interval, only pre-approved transactions are permitted on the network, effectively freezing DEX pricing at its 10:00 state. Centralized exchanges, by contrast, continue trading uninterrupted, with prices updating in real time. If Ethereum trades at $3,000 at 10:00 and rises by 10% to $3,300 on centralized venues by 10:05, the position becomes straightforward: Ethereum can be purchased on-chain at $3,000, transferred off-chain, and sold at $3,300—capturing the spread created by execution asymmetry.

The same mechanism extends beyond traders to builders. An NFT project, for instance, could conduct a mint during a predefined window and restrict all blocks in that interval exclusively to minting transactions. Gas fee competition disappears; transaction failures are eliminated; the minting experience becomes smooth, predictable, and controlled.

EthGas is the project designed to operationalize this hypothetical construct. Temporary control over Ethereum’s blockspace enables more than isolated use cases: perceived confirmation latency can be compressed toward the 50-millisecond range, supporting near-real-time execution while also laying the groundwork for mass adoption in which users no longer need to actively consider gas fees. This report examines how EthGas makes such a structure feasible and how it could meaningfully alter Ethereum’s execution model at the system level.

2. The Blockspace Problem of Ethereum

2-1. Blockspace as the Source of Blockchain Value

The Role of Ethereum Blocks: https://ethereum.org/ko/developers/docs/blocks/

The Role of Ethereum Blocks: https://ethereum.org/ko/developers/docs/blocks/

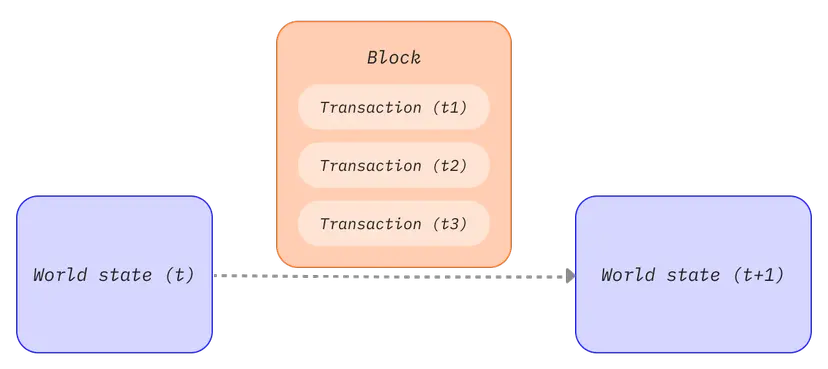

A blockchain aggregates transactions created by users into blocks and processes the transactions within each block sequentially. In doing so, it updates the full state managed by the network, including account balances and smart contract data, commonly referred to as the World State. The limited capacity available within a single block constitutes blockspace.

Nodes receive token rewards in exchange for producing and validating blocks, while users pay fees to ensure their transactions are included within this constrained blockspace. Viewed in its simplest form, a blockchain can be described as a system that produces blockspace and supplies it to a market. From this perspective, the fundamental value of a blockchain does not originate from the token itself, but from the blockspace transacted via that token.

Under this framing, Ethereum functions as a network that produces and sells blockspace, which represents its core role. Owing to its high level of security and reliability, as well as the largest concentration of users and application demand, Ethereum offers blockspace that is more valuable and more sought after than that of other blockchains. If blockspace did not exist and participants were unable to record transactions, Ethereum would have no intrinsic value, and all assets and services built on top of it would lose their meaning. Blockspace therefore serves as the foundation that sustains the entire Ethereum ecosystem.

Despite its importance, blockspace has not historically been traded as an independent asset nor subjected to clear price discovery. Access to blockspace has been mediated exclusively through gas fees, a mechanism that remains highly opaque. As a result, users have limited visibility into when transactions are actually confirmed, while structural advantages accrue to a small subset of participants with superior information or technical capabilities.

Separating blockspace and allowing it to trade as a standalone asset materially alters this structure. Risks borne by validators selling blockspace and by users or protocols purchasing it are reduced, while transparency around confirmation timing and execution conditions improves. Informal and closed allocation mechanisms can give way to a more competitive and more neutral market structure.

ETHGas begins from the premise that Ethereum’s current blockspace model is constrained by these structural limitations. By reconstituting blockspace as an asset that can be pre-confirmed and traded in advance, ETHGas aims to improve both Ethereum’s practical usability and its economic value. The ultimate objective is to form a new market explicitly centered on blockspace itself.

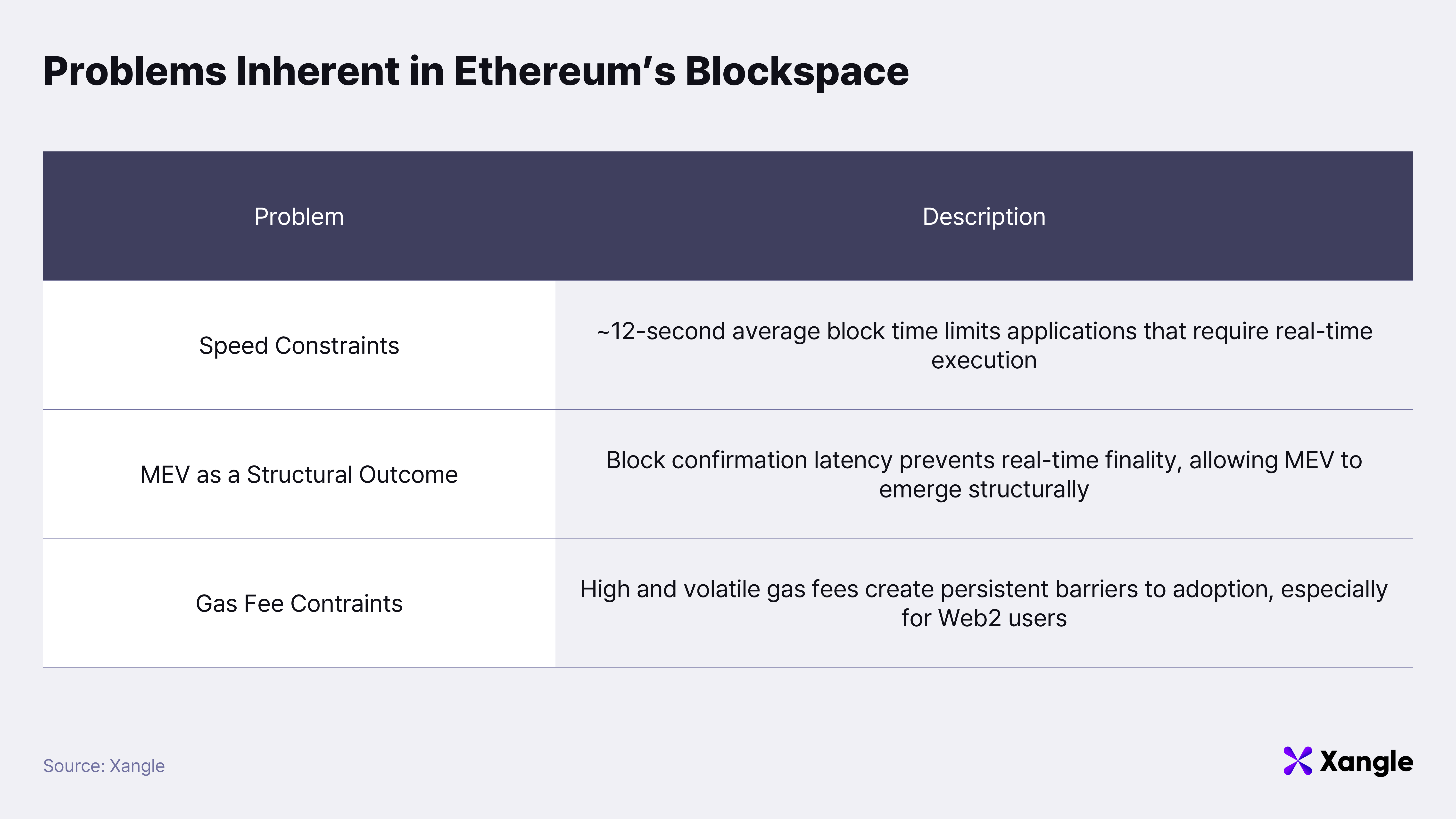

2-2. Problems Inherent in Ethereum’s Blockspace

Ethereum is an extremely decentralized and secure blockchain, with roughly one million validators participating in the network. That same design choice, however, comes with clear trade-offs: slower throughput and higher usage costs. Despite continuous upgrades that have improved performance over time, these structural constraints continue to impose burdens on users and applications, most notably in the form of confirmation latency, the structural emergence of MEV, and high, volatile gas fees.

Speed constraints:

Ethereum’s average block time is approximately 12 seconds. At a minimum, users must wait one block—around 12 seconds—for a transaction to be confirmed, and roughly 13 minutes, equivalent to two epochs (64 blocks), to reach full finality. Such latency may be acceptable for transactions that do not require immediacy, such as simple transfers; however, it becomes a meaningful limitation for use cases that depend on real-time responsiveness, including trading and gaming.

MEV as a structural outcome:

This latency-driven confirmation model gives rise to MEV (Maximal Extractable Value) as a structural phenomenon. Because transactions are not finalized in real time, block proposers and builders can reorder transactions sitting in the mempool, or selectively prioritize and delay specific transactions, to extract additional value. While this MEV accrues as revenue for validators and specialized operators, the associated costs are borne by ordinary users in the form of increased slippage, unfavorable execution, and liquidation losses. MEV, in this sense, is not merely a technical artifact, but a structural cost rooted in insufficient speed and finality.

Gas fee constraints:

Beyond latency, Ethereum also faces persistent challenges related to gas fees. These issues can be grouped into three categories.

-

1. Gas fees as a barrier to entry:

For Web3-native users, gas fees may feel familiar; for typical Web2 users, they represent a foreign and significant barrier to service usage. There is little intuitive reason why users should need to understand a blockchain’s fee mechanics and explicitly pay for them simply to access an application. The experience is analogous to paying a fee every time a video is played or uploaded on YouTube. Moreover, gas fees must be paid in the network’s native token, which requires users to acquire the token via an exchange and transfer it to a personal wallet—an additional layer of friction.

-

2. High absolute gas costs:

Ethereum’s gas fees are also expensive in absolute terms. When transaction demand spikes, fees can rise sharply, with single transactions at times costing tens or even hundreds of dollars. Although the Dencun upgrade in 2025 significantly reduced average gas fees to around 0.75 gwei, fee levels remain volatile during periods of network congestion.

-

3. Unpredictable gas fee volatility:

Beyond cost, volatility itself presents a major obstacle to mass adoption. Gas fees exhibit extreme variability: while Bitcoin’s price volatility is roughly 55% and Ethereum’s price volatility around 70%, Ethereum gas fees have at times fluctuated by more than 3,000%. Such instability poses a serious challenge for real-world usage and adoption. Predictable gas pricing would allow service operators to incorporate fees into product design and would materially improve usability from the end-user perspective.

Layer 2 solutions and alternative Layer 1 chains have emerged in response to these challenges. ETHGas, however, does not pursue a strategy of replacing Ethereum. Instead, it adopts an approach focused on preserving Ethereum itself while restructuring how blockspace is allocated and consumed. This path allows existing dApps, liquidity, and network effects to be retained, while targeting structural resolution of the core constraints around speed, MEV, and gas fees.

3. EthGas’s Approach and Expected Impact

ETHGas addresses Ethereum’s existing limitations by introducing a marketplace for advance blockspace trading and by operating the Open Gas Initiative in collaboration with a broad set of Ethereum-native protocols.

3-1. Solution Design

Blockspace Trading Marketplace

ETHGas operates a marketplace that allows future blockspace to be purchased and traded in advance directly from validators. By separating blockspace into a distinct, tradable asset, the model opens a structural path toward mitigating long-standing issues around execution latency and gas fee volatility on Ethereum.

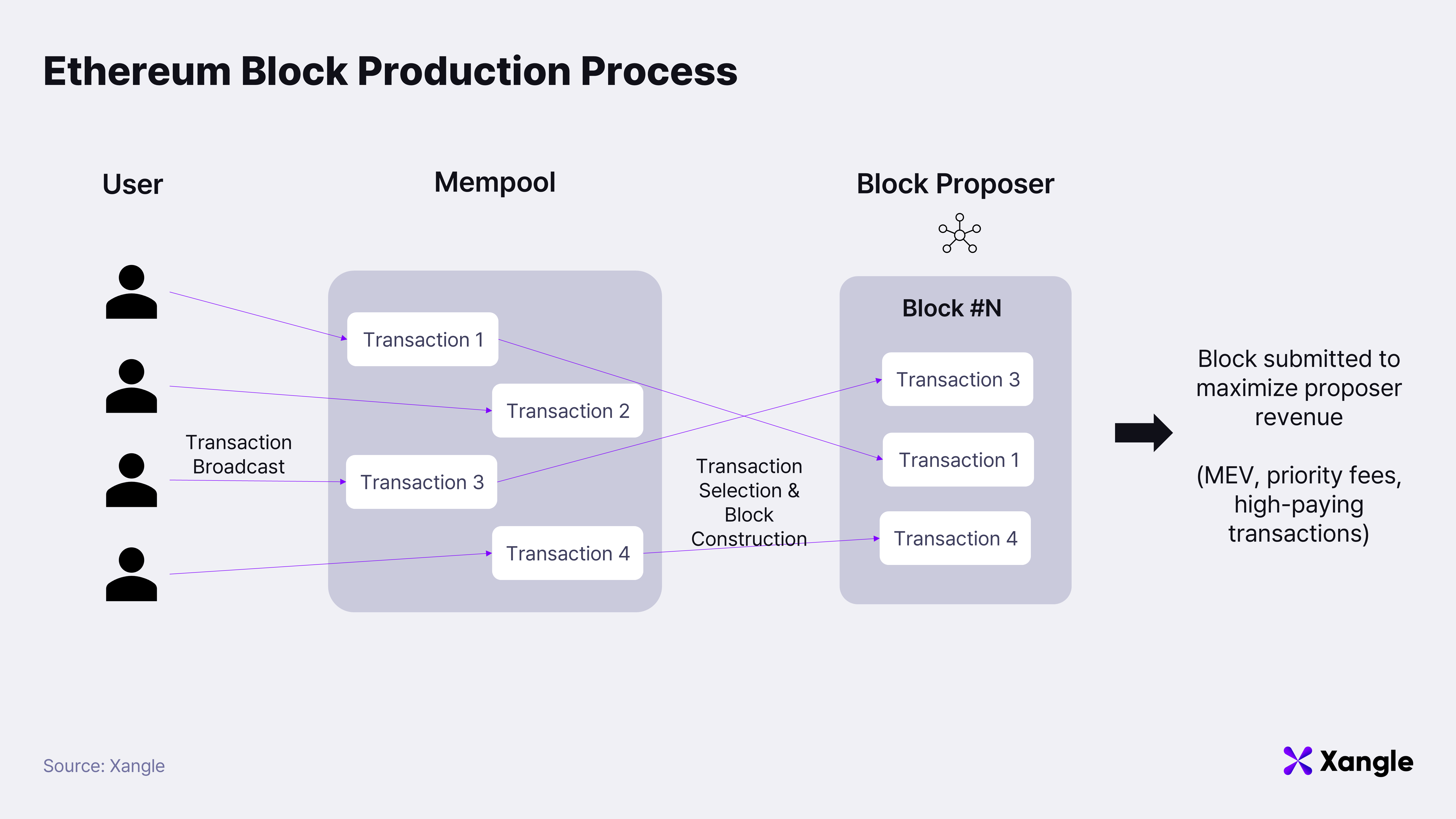

Under Ethereum’s current design, the validator selected as block proposer for a given slot constructs the block by selecting the most profitable transactions from the mempool. Priority is given to transactions offering higher gas fees, while block composition is optimized to maximize MEV. During periods of congestion, this dynamic intensifies gas fee competition and leaves users unable to predict when—or in what order—their transactions will be processed.

The introduction of ETHGas creates an alternative option for validators. Instead of capturing gas fees and MEV through direct block construction, validators can sell block construction rights in advance. When revenue from blockspace sales exceeds the expected value of gas fees and MEV, selling those rights becomes economically rational. Control over block composition, in turn, shifts to the purchaser of that blockspace.

- Existing validator revenue: gas fees (priority fees) + MEV revenue + block rewards

- Validator revenue via blockspace sales: blockspace sale revenue + block rewards

Once a block is purchased, the buyer determines how it will be used or redistributed. In practice, blockspace utilization follows three primary patterns.

- 1. Direct block construction, generating value in excess of the purchase price through MEV or arbitrage

- 2. Partial block usage, combined with resale of the remaining blockspace

- 3. Full subdivision of the block, followed by resale of all segments

Under the first model, the blockspace purchaser effectively assumes the role of block proposer for that slot. Transaction composition and ordering are set directly by the purchaser, and any arbitrage or MEV generated during execution can be captured accordingly. Revenue that would otherwise accrue to validators is internalized by the blockspace buyer.

The second model applies when guaranteed inclusion of specific transactions is the primary objective. A purchaser may reserve part of the block to ensure execution of critical transactions, while reselling unused blockspace back to the market. This approach allows execution certainty to be maintained while offsetting costs or generating incremental returns.

The third model involves dividing the entire block into multiple segments and reselling them to multiple counterparties. In this configuration, blockspace itself functions as a tradable asset, enabling price discovery and arbitrage across time and demand.

Blocks acquired through ETHGas are therefore not consumed as indivisible units. Internally, each block can be subdivided into finer time slices and utilized sequentially. This structure allows transactions to be included immediately after submission, without waiting for block production to complete.

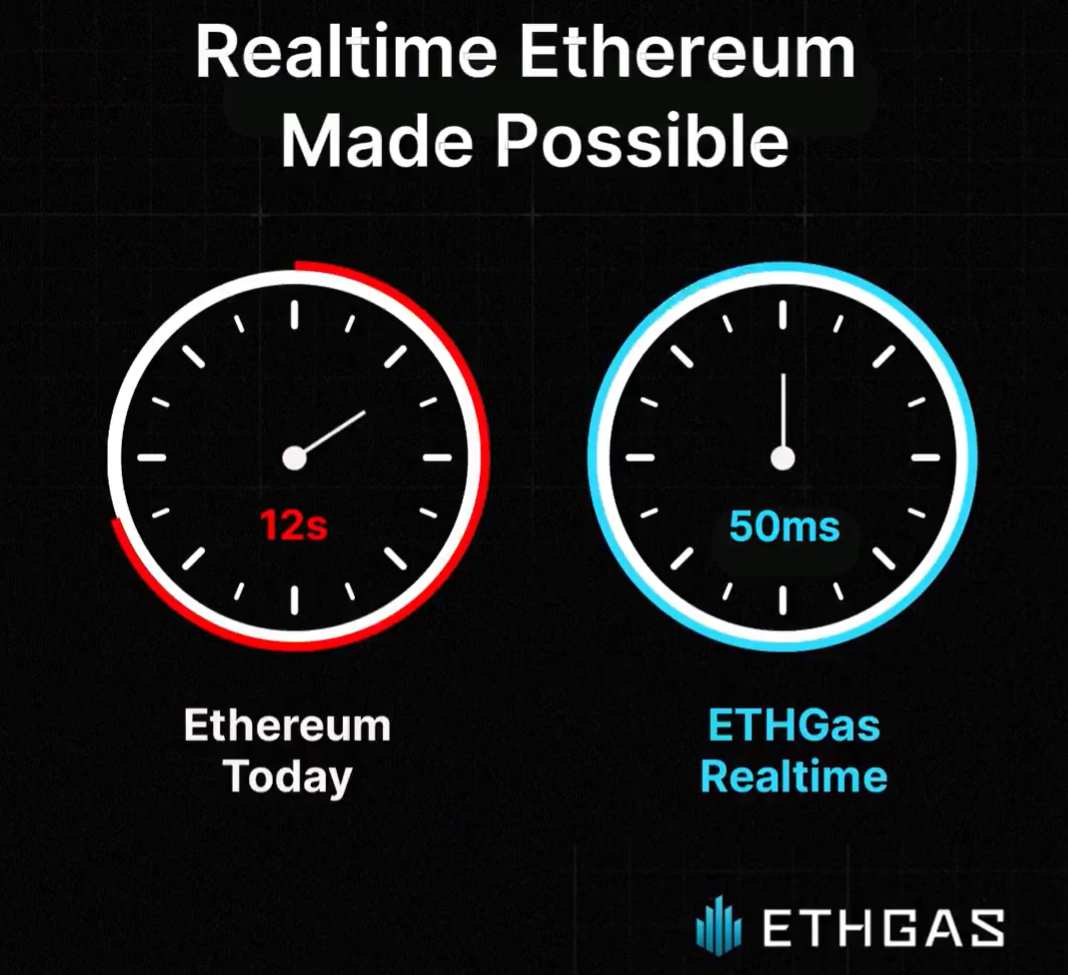

In parallel, confirmation of transaction inclusion is propagated in real time. Users are able to treat execution order and inclusion as pre-confirmed information, compressing perceived wait times that previously averaged around 12 seconds into an experience that feels near-instantaneous. At a system level, ETHGas divides a single block into 240 intervals of approximately 50 milliseconds each, delivering an effective 240-fold improvement in perceived execution speed from the user’s perspective.

https://x.com/ETHGasOfficial/status/2005625080626422033?s=20

https://x.com/ETHGasOfficial/status/2005625080626422033?s=20

It should be noted that this information is provided prior to final block confirmation. However, it is not merely informational in nature; it functions more like an economically backed commitment. If a pre-confirmed transaction is not ultimately included in the block, responsibility rests with the block proposer that sold the blockspace. In such cases, the validator’s posted collateral is slashed and paid out as compensation to the blockspace purchaser.

Under this structure, the underlying block time remains unchanged. However, execution inclusion and ordering are fixed in advance, which structurally removes the long waiting times and uncertainty that previously characterized the user experience. ETHGas therefore addresses Ethereum’s limitations in perceived speed and predictability without modifying the consensus mechanism itself. A more detailed explanation of the technical implementation follows in Section 3-2.

Open Gas Initiative

Gas fee pressure can be partially mitigated through blockspace trading. Securing blockspace in advance during periods of anticipated demand allows users and protocols to avoid sudden fee spikes and design more stable cost structures. That approach alone, however, is insufficient to fully eliminate the gas fee burden as perceived by users. For this reason, ETHGas operates the Open Gas Initiative in parallel with blockspace trading.

The Open Gas Initiative is a program that enables dApps and protocols to easily design flows in which gas fees are either sponsored directly or refunded after transaction execution. As a result, users can interact on-chain without having to calculate or pay gas fees themselves, leading to a more intuitive and seamless experience. Several protocols have already joined the initiative voluntarily, delivering near-gasless user experiences in which gas fees are barely noticeable.

In the short term, this model introduces an explicit cost for protocols, as they bear gas fees on behalf of users. Over time, however, reduced transaction failures, lower churn, and improved user experience can drive higher user acquisition and activity. For these reasons, the Open Gas Initiative is not positioned as a simple subsidy program, but rather as a strategic lever for strengthening protocol competitiveness.

The Open Gas Initiative is structured not as a single feature, but as a three-stage roadmap designed to progressively abstract gas fees and convert them into a manageable component of the user experience. Each stage increases technical sophistication incrementally while delivering immediately observable benefits to both protocols and users.

-

Stage 1: Curation Protocols selectively subsidize gas fees for core user actions. dApps estimate per-action gas costs via a dashboard and provide aggregated ETH rebates on a monthly basis for high-priority actions such as deposits and swaps. Users are included automatically, without any opt-in process.

-

Stage 2: Programmatic

Gas fee incentives are defined in a conditional and autonomous manner. Protocols can specify custom rules, such as rewarding users for specific actions, and continuously optimize incentive structures using on-chain and behavioral data across activities like swaps, holding, and quests.

-

Stage 3: Full Automation

Gas fees disappear entirely from the user-facing transaction flow. Gas costs are handled automatically at the protocol level, allowing users to execute on-chain actions without gas calculations or approvals. This stage targets native-level integration through future account abstraction standards, including EIP-7702.

ETHGas is currently executing Stage 1 of this roadmap and is actively expanding the set of partner projects participating in the Open Gas Initiative. Projects such as ether.fi, Pendle Finance, EigenLayer, and Velvet Capital have already committed to participation. Together, these integrations are gradually shaping an Ethereum environment in which gas fees no longer function as a primary barrier to user experience.

3-2. Technical Mechanism

Blockspace Trading Flow

The blockspace pre-purchase model described above is implemented atop auxiliary infrastructure that makes block construction rights tradable, while leaving Ethereum’s underlying consensus mechanism unchanged.

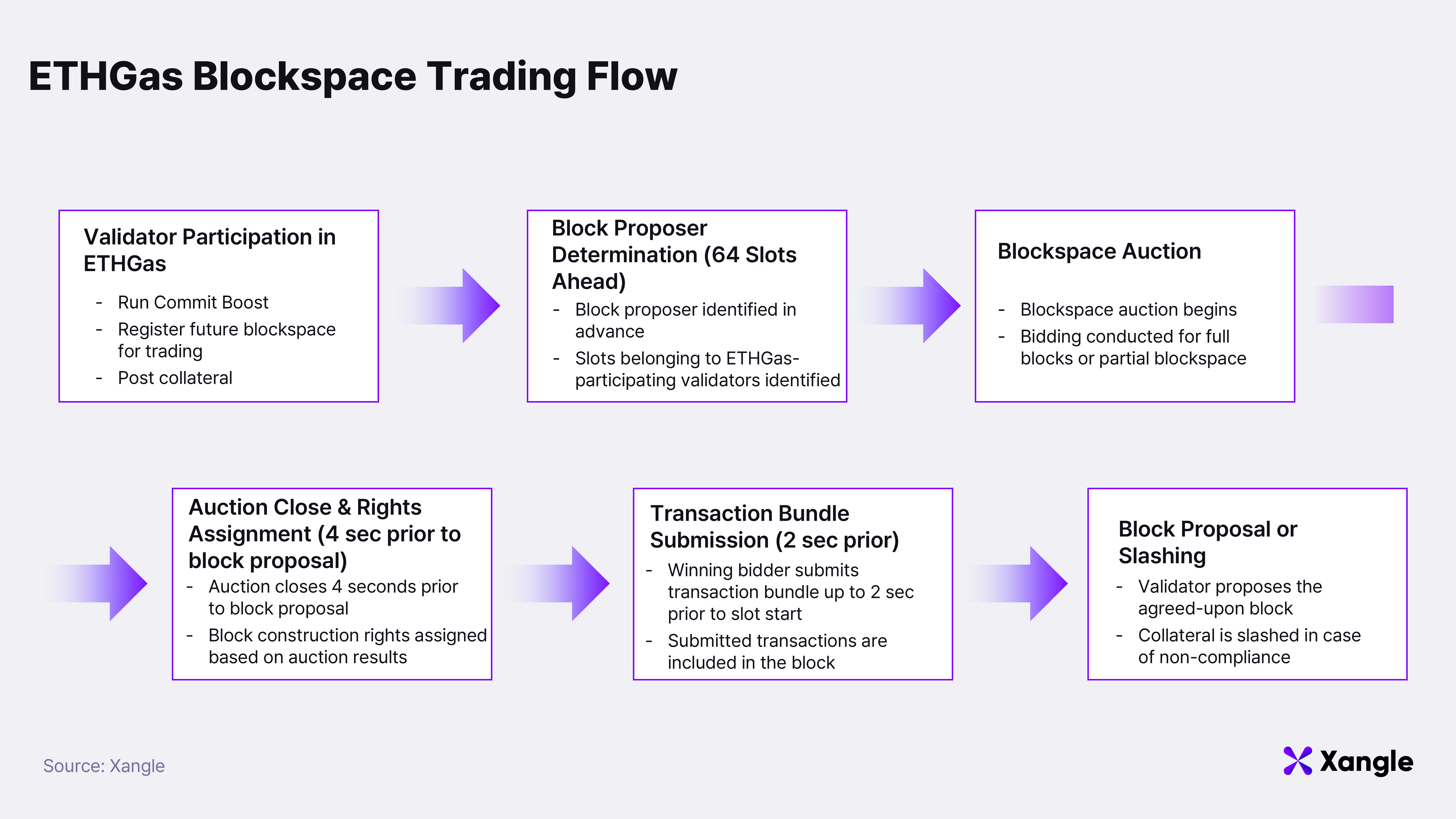

Validators that wish to participate in the ETHGas ecosystem first signal intent by running the Commit Boost module. Commit Boost is an auxiliary module that allows a validator to publish an advance commitment regarding future blocks it will propose: the validator commits that those blocks will be delegated for use under specified conditions. Running the module enables block construction rights to be made tradable via ETHGas; collateral is posted alongside the commitment, establishing economic accountability.

On Ethereum, block proposers are selected randomly with probabilities proportional to stake. The identity of the proposer for a given slot becomes predictable roughly two epochs in advance (64 slots, approximately 12.8 minutes). ETHGas leverages this property to enable trading only for blocks proposed by validators that have opted into ETHGas, and only for future slots that can be identified ahead of time. Not all blocks are listed; only blocks from pre-consenting validators enter the ETHGas market.

For registered slots, trading opens 32–64 slots in advance, and bids are placed for the blockspace of the relevant slot. Products covering entire blocks (Whole Block Commitments) can be traded at this stage, as can inclusion-guarantee products for partial blockspace (Inclusion Preconfirmations). The auction closes four seconds before the block proposal time; the outcome determines who holds block construction rights for that slot.

After the auction clears, the bundle of transactions that must be included in the block must be submitted no later than two seconds before the slot begins. The validator is obligated to include the submitted transactions verbatim when proposing the block; failure to comply triggers slashing of the collateral posted in advance. Validators post a minimum of 1 ETH as collateral; in a slashing event, the collateral is transferred as compensation to the entity that purchased blockspace via ETHGas, thereby anchoring preconfirmation in economic credibility.

ETHGas offers four blockspace products on top of this structure.

-

Whole Block Commitments

A product that sells sequencing rights for an entire block in a specific slot. The buyer directly controls transaction ordering and composition within the block; the block can also be subdivided for resale or used only in part.

-

Inclusion Preconfirmations

A product that guarantees a specific transaction will be included for a defined unit of block gas (e.g., 200,000 gas). The guarantee applies to inclusion, not to the execution result.

-

Execution Preconfirmations

A product that extends Inclusion Preconfirmations by additionally guaranteeing that the transaction reaches a specified execution outcome or state. It provides stronger certainty; it currently remains at the testnet stage.

-

Base Fee Futures

A derivatives product designed to allow gas fee volatility itself to be traded or hedged, using the base fee of a specific slot as the underlying asset.

Following the mainnet launch on June 18, 2025, Whole Block Commitments and Inclusion Preconfirmations are available for use on mainnet. Execution Preconfirmations and Base Fee Futures are scheduled for release in Q1 2026. Users can currently access these products in a testnet environment; mainnet availability will expand gradually over time.

Real-Time Ethereum

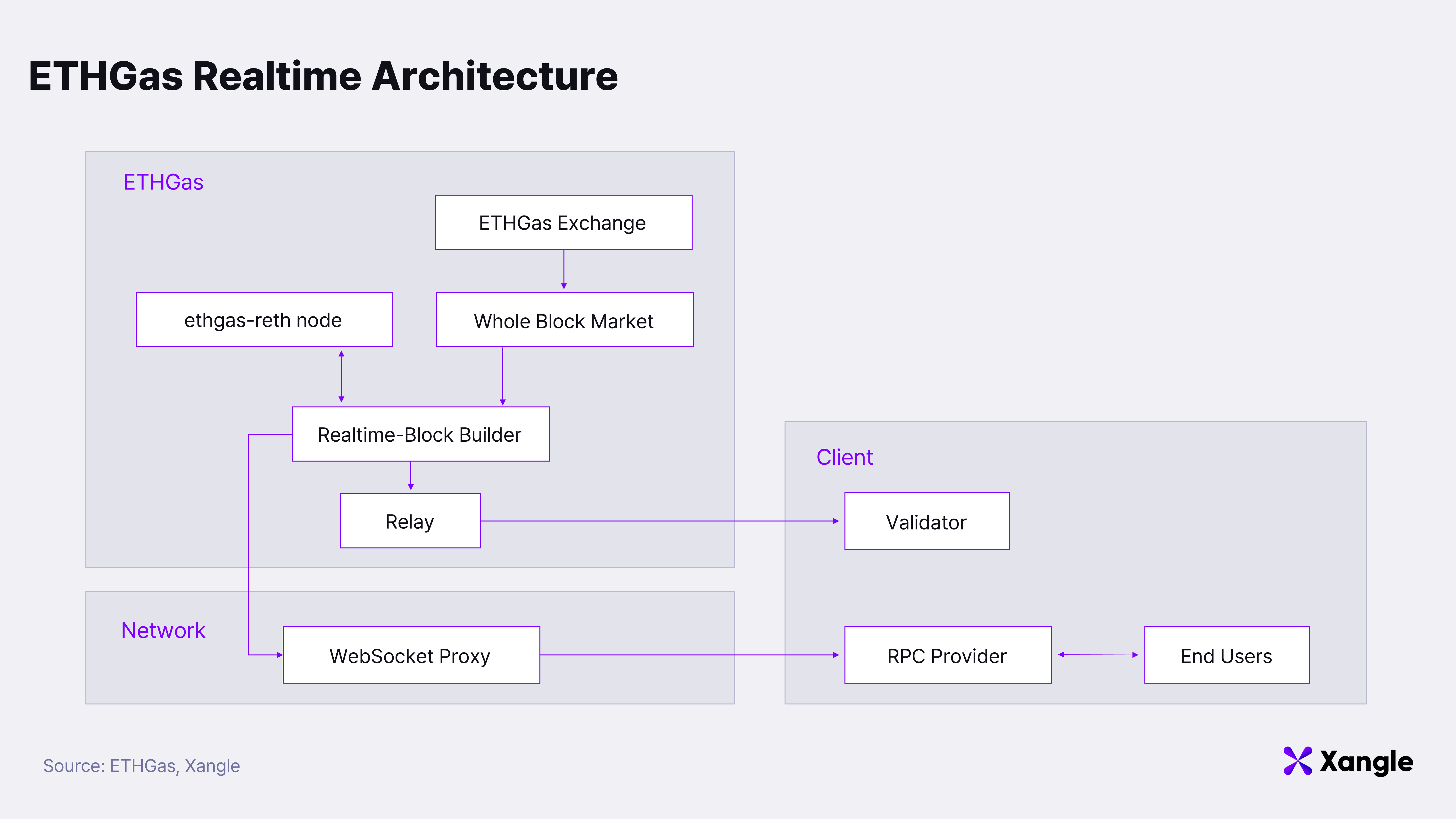

Alongside blockspace trading and preconfirmation, ETHGas provides the ETHGas Realtime architecture, which reconfigures the block production process to be near real time. ETHGas Realtime preserves Ethereum’s existing block cadence and consensus security, while externally streaming the transactions that will be included in a block before the block is finalized.

On Ethereum, blocks are produced roughly every 12 seconds; users submit a transaction and then wait for the block to complete to observe the result. ETHGas Realtime does not treat the 12-second block as a single unit. Instead, it processes the block internally as a sequence of very short intervals: each time a transaction executes, the cumulative execution results up to that point are aggregated and transmitted externally, repeating at roughly 50–100 ms intervals.

Realtime blocks delivered at each point in time include the transactions processed so far, along with the resulting balance changes and contract state updates. dApps and RPC providers can consume this data via the ETHGas Realtime RPC, allowing interfaces or application logic to update as if execution results were already finalized, even before the final block is produced.

Real-time propagation becomes feasible because the Commit Boost–based preconfirmation structure reduces uncertainty during block construction. A validator delegates block construction rights for a specific slot to ETHGas, and a distinct entity holds the sequencing authority for that slot; as a result, the probability of mid-process changes to block construction declines. Under this setup, the Realtime Block Builder constructs the block while broadcasting incremental progress via a WebSocket Proxy; the same information is relayed to the block proposer (validator), which then submits the final block.

The WebSocket Proxy distributes Realtime blocks and preconfirmation data to multiple RPC providers at low latency; RPC providers then serve the same information to users and dApps. Users can therefore perceive execution results as effectively confirmed even before the transaction is written into the canonical block, experiencing responsiveness on the order of tens of milliseconds.

As a result, ETHGas can compress the perceived confirmation experience of Ethereum blocks from roughly 12 seconds to an experience that is up to 240× faster.

3-3. Implementation Examples

ETHGas’s blockspace pre-trading, preconfirmation, and Realtime architecture remain early-stage; nevertheless, they enable application-level implementations that were structurally infeasible under the existing Ethereum execution model. The examples below illustrate how these shifts can surface in practice.

1) Real-time on-chain trading

Executing a swap on a decentralized exchange (DEX) such as Uniswap exposes two fundamental frictions under the current model. First, users must pay gas fees directly each time they submit a transaction. Second, confirmation latency leaves transactions exposed in the mempool until inclusion, creating a window in which MEV strategies can be applied. In high-volatility regimes, that latency often translates directly into wider slippage or systematically worse execution.

Under an ETHGas-enabled environment, execution order is fixed at the moment of submission via preconfirmation. Transactions no longer compete in an open mempool for ordering; instead, they are processed according to a pre-confirmed temporal sequence, materially reducing the surface area for MEV intervention. The result is a more predictable and stable on-chain trading environment, with the effect most visible for latency-sensitive flows such as large swaps and high-frequency execution strategies.

Pairing this with the Open Gas Initiative allows protocols to design gas refund schemes, or, over time, to directly sponsor gas on behalf of users. Users can therefore execute swaps while barely perceiving gas costs, lowering friction even for participants accustomed to centralized exchanges (CEXs). As execution becomes smoother, trading frequency tends to increase; deeper liquidity and improved fee efficiency follow, benefiting LPs, traders, and DEX venues simultaneously.

https://x.com/ETHGasOfficial/status/1990033090333266216?s=20

https://x.com/ETHGasOfficial/status/1990033090333266216?s=20

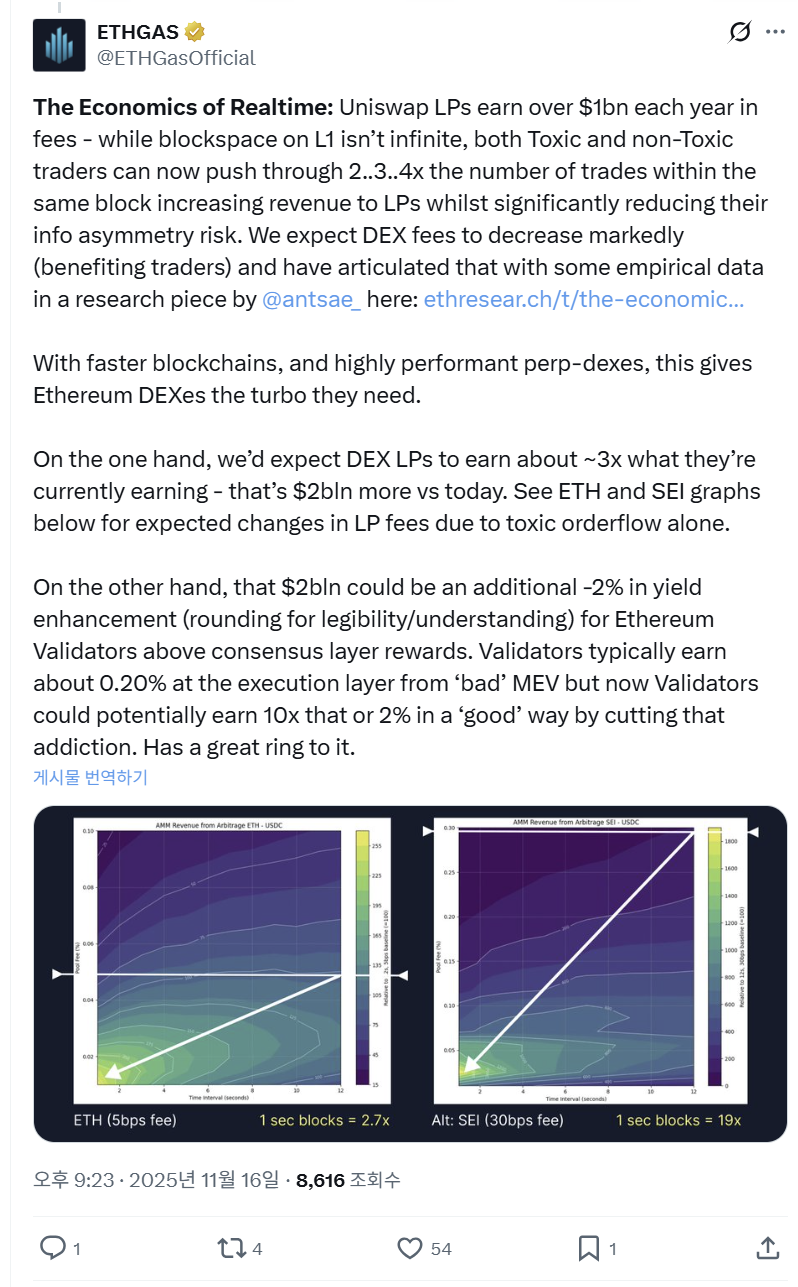

ETHGas has also published analysis suggesting that applying a real-time trading structure to Uniswap could increase LP revenue by up to roughly 3× versus current levels, corresponding to more than $2 billion in additional annual revenue. The study is grounded in empirical analysis using observed on-chain data; further details are available in the ETH Research publication: https://ethresear.ch/t/the-economics-of-instant-an-exploration-of-real-time-ethereum/23156

2) Fast and secure liquidations for lending protocols

Liquidation speed is a core determinant of stability in lending systems. Consider a protocol such as Aave: when a user borrows USDC against ETH collateral, liquidation should occur immediately once collateral value falls and the LTV breaches a defined threshold. Under Ethereum’s current confirmation latency, however, finality can take up to roughly 12 seconds, leaving room for additional adverse price movement between threshold breach and actual liquidation execution.

Such delays introduce risk on both sides. In fast drawdowns, collateral can become insufficient by the time liquidation executes, forcing protocols to absorb losses as bad debt. Borrowers also face the opposite failure mode: excessive price movement can eliminate remaining collateral and create losses beyond what would be necessary under tighter execution timing.

ETHGas’s preconfirmation and Realtime architecture compresses this window materially. Liquidation can be triggered almost immediately when the collateral ratio reaches the threshold; even before the canonical block is finalized, execution order and outcomes are effectively fixed, allowing liquidation to complete before further price deterioration occurs. The net effect is a structural reduction in lending-protocol risk and improved operational stability under sharp market moves.

3) First-come-first-served events such as token sales and NFT minting

Token sales and NFT mints are representative cases of transaction demand converging at a single point in time. Under the current Ethereum model, the result is often severe gas fee competition; failed participation remains common even for users willing to pay elevated fees. Bots and automated strategies also tend to dominate ordering, creating persistent concerns around fairness for ordinary participants.

ETHGas enables project teams to secure blockspace in advance for the sale or mint window. Blocks acquired in advance can be configured to include only participant transactions under predefined rules, ensuring that all participants are processed under the same conditions and ordering. Gas auctions are removed from the equation, and uncertainty around failed inclusion declines materially.

NFT minting offers a particularly clear illustration. A project can dedicate the acquired blockspace exclusively to mint transactions to ensure stable throughput. Users can participate in a predictable environment without paying excessive gas or repeatedly failing; for projects, the outcome is higher user trust and lower operational friction, including reduced confusion and overhead during execution.

Taken together, these examples indicate that ETHGas is not merely a mechanism for making blocks “faster.” It is infrastructure that changes how on-chain execution is organized: near real-time certainty and predictable blockspace reduce Ethereum’s existing constraints across trading, lending, and sales, enabling a more stable and fair on-chain environment.

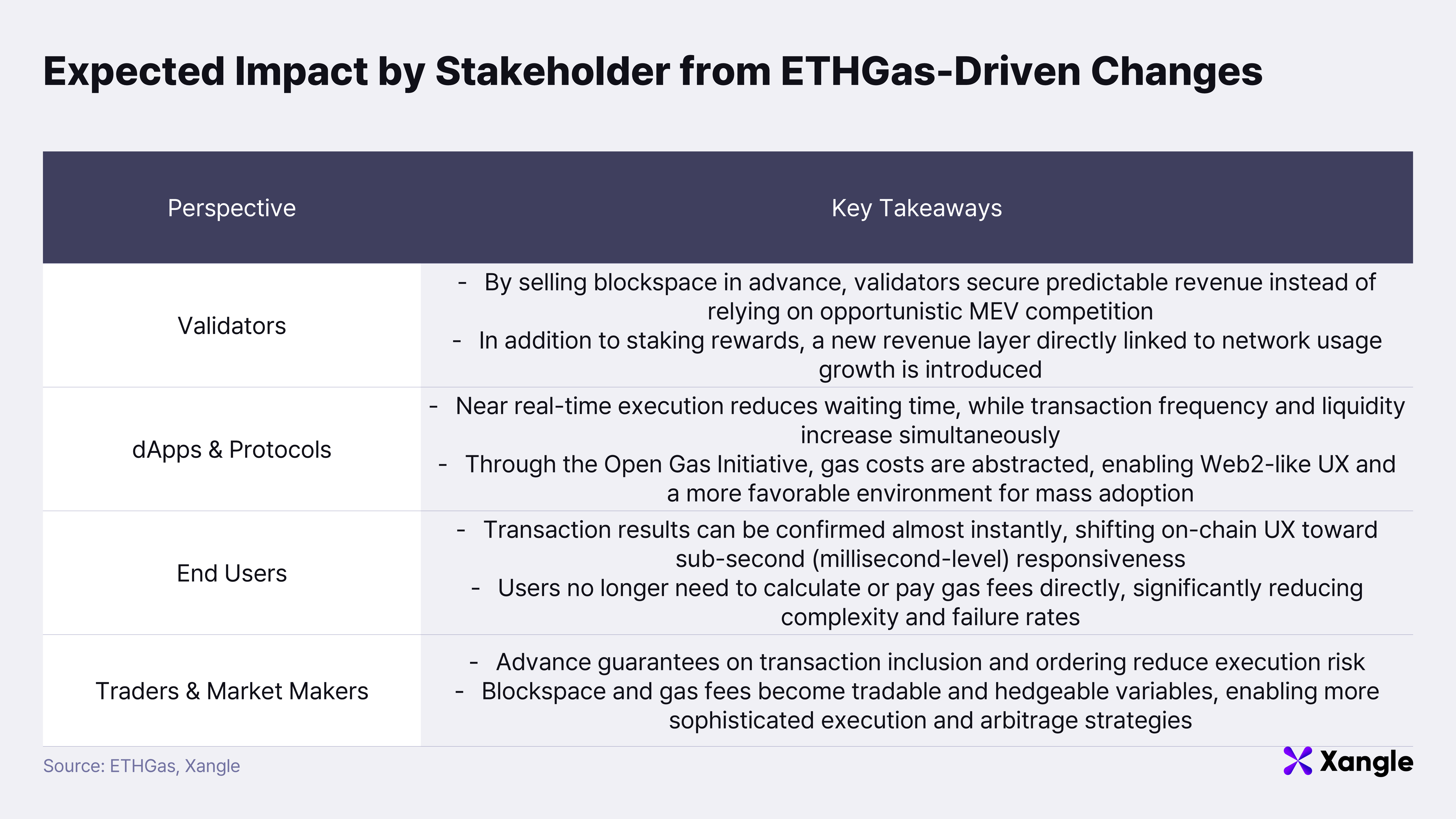

3-4. Stakeholder-Level Impact

1) Validators & Staking Operators

Under Ethereum’s current validator economics, revenue has been driven primarily by base staking rewards and a highly volatile stream of MEV income. Even when network usage expands, converting that growth into stable, planable cash flows at the validator level has remained difficult.

Participation in ETHGas reframes validator blockspace as a tradable asset. By selling block construction rights for specific slots in advance, validators can replace opportunistic, slot-by-slot MEV competition with a more predictable and repeatable revenue stream. This functions as incremental yield alongside baseline staking rewards, while differing in character: revenue is tied directly to on-chain economic activity rather than to stochastic extraction opportunities at block time.

Quantitatively, Ethereum validators earn an average annual yield of roughly 3% relative to staked assets, with MEV contributing only around ~0.2% of that total. By contrast, as discussed earlier, a real-time block structure could generate more than $2 billion in incremental annual market value from Uniswap alone. ETHGas estimates that approximately one-third of the incremental on-chain revenue attributable to real-time execution could be distributed to ETHGas and participating validators as blockspace compensation; with sufficient network scale, annualized proceeds are projected to reach roughly $1.0–$1.2 billion.

In effect, ETHGas positions itself as more than an MEV optimization layer for validators. A new revenue layer emerges around blockspace itself, improving the stability profile of staking returns while more directly linking validator incentives to Ethereum’s network-level growth.

2) Protocols & dApps

A shift toward near real-time on-chain execution alters the operating environment for protocols and dApps at a fundamental level. Shorter confirmation delays reduce failure rates and waiting time, which naturally increases transaction frequency. Higher activity deepens liquidity; under the same fee structures, cost efficiency per unit of volume improves. These dynamics strengthen on-chain venues’ ability to compete with centralized exchanges (CEXs) on user experience.

A real-time execution environment also affects demand composition, not only the behavior of existing users. As perceived speed and execution certainty improve, adoption from users who were previously unfamiliar with on-chain trading becomes more likely. Protocols can therefore expect growth in both volume and the active user base, translating directly into revenue expansion.

Gas fees, however, remain the dominant driver of churn for many applications. The burden is not limited to cost: gas introduces uncertainty around failure risk and outcome predictability, amplifying UX instability. For new users in particular, gas has functioned as the primary barrier to using on-chain services.

ETHGas’s Open Gas Initiative structurally alleviates this friction. Protocols can abstract gas by sponsoring it directly or refunding it post-transaction without implementing complex bespoke logic. Users can execute transactions while barely perceiving gas costs; the resulting experience is closer to Web2 conventions, supporting mass adoption of on-chain applications.

3) End Users

For end users, the most immediate change under ETHGas is a shift in perceived latency and in how costs are experienced. On Ethereum mainnet today, waiting several seconds to tens of seconds after submission has been normalized, and gas is treated as a parameter users must compute and pay directly. The result is an on-chain experience that feels slow and complex, raising the barrier to entry for new participants.

Within an ETHGas environment, preconfirmation effectively fixes inclusion and ordering at submission, while ETHGas Realtime propagates outcomes on a near real-time basis. Execution results become observable before canonical finalization, with responsiveness on the order of ~50 ms. The comparison is meaningful: Solana, architected for speed, has an average slot time of roughly ~400 ms; achieving ~50 ms responsiveness on Ethereum mainnet implies an approximately 8× faster perceived response.

Coupling this with the Open Gas Initiative removes the need for users to calculate or pay gas directly. Protocol-level sponsorship or refunding reduces failure modes tied to wallet configuration errors or insufficient gas. On-chain activity can therefore shift toward an immediate, intuitive experience closer to Web2 patterns, creating the conditions for broader mainstream adoption.

4) Traders & Market Makers

From a trading perspective, blockspace has historically been opaque and difficult to access. Inclusion and ordering are shaped by competitive mempool dynamics, making advance certainty over execution outcomes nearly unattainable.

ETHGas separates blockspace into standardized, tradable products, effectively turning it into a financial asset. Traders can use Inclusion Preconfirmations to secure advance guarantees that specific transactions will be included in a given block; the advantage is material for latency-sensitive strategies and trades exposed to front-running risk.

Base Fee Futures, once introduced, provide a mechanism to hedge gas fee volatility. Gas becomes less of an unpredictable cost and more of a manageable variable. Blockspace, treated as a new asset class, can then be incorporated into more sophisticated arbitrage, hedging, and execution strategies.

4. Partnerships & Tokenomics

4-1. Key Partnerships

ETHGas has adopted a strategy of scaling its structure through collaborations with specialized partners to build a real-time Ethereum blockspace market. Core components—gas abstraction, validator participation, block construction, and economic security—operate less as isolated modules and more as an integrated system built around each partner’s comparative strengths. This partnership-driven approach underpins ETHGas’s core value propositions: preconfirmation, near real-time execution, and gas fee abstraction.

-

Open Gas Initiative – Gas Abstraction Partnership

The Open Gas Initiative is ETHGas’s core gas abstraction program, designed to allow dApps and protocols to directly sponsor or refund user gas fees. Gas rebates can be delivered without modifying existing smart contracts, enabling a UX in which gas is barely perceived. The initial mainnet cohort includes ether.fi, Pendle Finance, EigenLayer, and Velvet Capital; these integrations illustrate a shift in gas from a pure cost item to a lever for user acquisition and retention.

-

Brevis Network – ZK Verification Partnership

Brevis Network is a protocol that uses zero-knowledge proofs (ZK) to make on-chain activity verifiable in a trust-minimized manner. Put simply, Brevis functions as a “trustless verification layer” that mathematically proves whether specific actions or outcomes actually occurred on-chain. The partnership with Brevis addresses trust issues that can arise within the Open Gas Initiative at a cryptographic level. Brevis verifies, without relying on a centralized operator, who is eligible for rebates, whether refund amounts are correct, and whether abuse or duplicate participation has occurred; the result is a gas sponsorship model that can scale while preserving security and transparency.

-

EigenLayer Vision AVS – Economic Security Partnership

EigenLayer is a restaking protocol that reuses Ethereum-staked assets to extend economic security to external services. The partnership with EigenLayer Vision AVS ties economic collateral to ETHGas’s preconfirmation mechanism. Under this structure, validators post collateral alongside selling blockspace and face slashing if commitments are not honored. Preconfirmation therefore functions not as a soft promise, but as an economically backed contract tied to real capital, providing execution guarantees without centralized arbitration.

-

Infrastructure and Ecosystem Partnerships

In addition to core functional partnerships, ETHGas collaborates with infrastructure and ecosystem participants to support mainnet distribution and operational robustness. Kraken applies the ETHGas structure to part of its Ethereum validator operations; cooperation with major staking and restaking protocols such as EtherFi, Swell, and Renzo supports a stable validator supply base. Partnerships with Blockdaemon, P2P, Stakefish, and Korea-based DSRV further reinforce an open architecture that is not dependent on any single operator, while enabling ETHGas to build the real-time blockspace market as an additional layer on Ethereum in a stable manner.

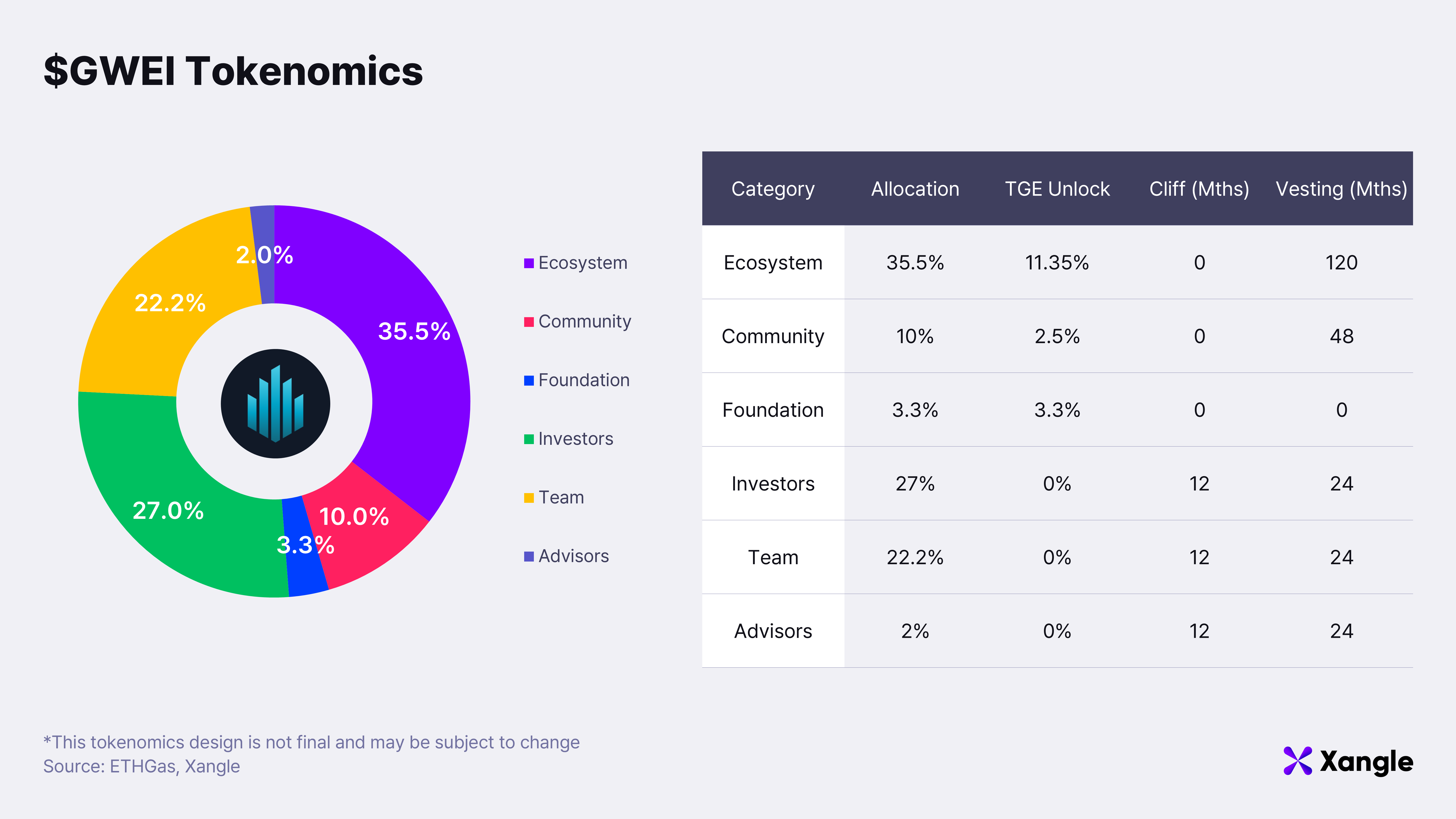

4-2. $GWEI Tokenomics

- Total Supply: 10,000,000,000 (10B) $GWEI

- Token Allocation

- Ecosystem: 35.5% / 240-month vesting (no cliff)

- Community: 10.0% / 48-month vesting (no cliff)

- Foundation: 3.3% / immediately unlocked (no cliff)

- Investors: 27.0% / 12-month cliff (10% unlocked) + 24-month vesting (90% unlocked)

- Team: 22.2% / 12-month cliff (10% unlocked) + 24-month vesting (90% unlocked)

- Advisors: 2.0% / 12-month cliff (10% unlocked) + 24-month vesting (90% unlocked)

- Token Utility

- Governance: Staking $GWEI mints the voting token $veGWEI, enabling participation in decisions around fee, incentive, and collateral parameters; whether to execute Buy-back & Burn; the direction of protocol upgrades; and treasury fund allocation

- Voting Power Structure: Voting power scales with both stake size and lock-up duration; vote delegation is supported

- Indirect Value Accrual: Protocol revenue is not distributed directly to token holders; token value may be affected indirectly if governance elects to execute Buy-back & Burn

* This tokenomics design is not yet final and is subject to change.

5. Closing Remarks: ETHGas as Ethereum’s Execution Engine

The market ETHGas targets extends well beyond incremental feature improvements. The objective is not to add another dApp or middleware layer, but to rethink how Ethereum itself consumes and executes blocks. If blockspace can be converted into a pre-confirmed, tradable asset and connected to real-time execution and gas abstraction, ETHGas functions not as a tool layered on top of applications, but as a core engine that drives Ethereum’s execution flow at the system level. If this model takes hold, the result would be an infrastructure-level shift that improves both network efficiency and user experience across the ecosystem.

Clear challenges remain. Excessive concentration of block purchases among a small set of actors could introduce risks, including increased latency or abnormal network behavior. In addition, stable operation depends on broader validator participation: at present, roughly 5% of Ethereum validators participate in the ETHGas structure. Without wider adoption, the market’s ability to reach a robust, self-correcting equilibrium remains constrained.

Even so, early signals are encouraging. Within approximately six months of mainnet launch, around 5% of Ethereum validators have already opted into the ETHGas framework. From a validator’s perspective, the presence of a clear and incremental revenue stream materially lowers the barrier to participation. The trajectory resembles the early adoption pattern observed with MEV-Boost, where validator incentives drove rapid uptake. ETHGas operates under the same assumption: structural issues are more effectively resolved through market-driven incentives than through centralized or forced intervention.

At the same time, ETHGas has not treated these risks as theoretical. Ongoing engagement with key stakeholders, including the Ethereum Foundation, reflects an effort to anticipate and mitigate potential side effects as the system evolves. Given the project’s early stage, unexpected variables may still emerge. However, continued iteration alongside a broad set of ecosystem participants increases the likelihood that ETHGas can mature into a core engine for Ethereum—one that supports near real-time execution and a network experience in which users no longer need to actively consider gas.