1. The Domain Market: Growth Without Structural Efficiency

Domains have become foundational infrastructure for the internet—serving as the primary means by which companies, institutions, and individuals establish digital presence and deliver services online. The Domain Name Service (DNS) market has expanded steadily over the past decade, supported by accelerating global digital transformation, the proliferation of online businesses, and the rapid growth of SaaS and mobile services.

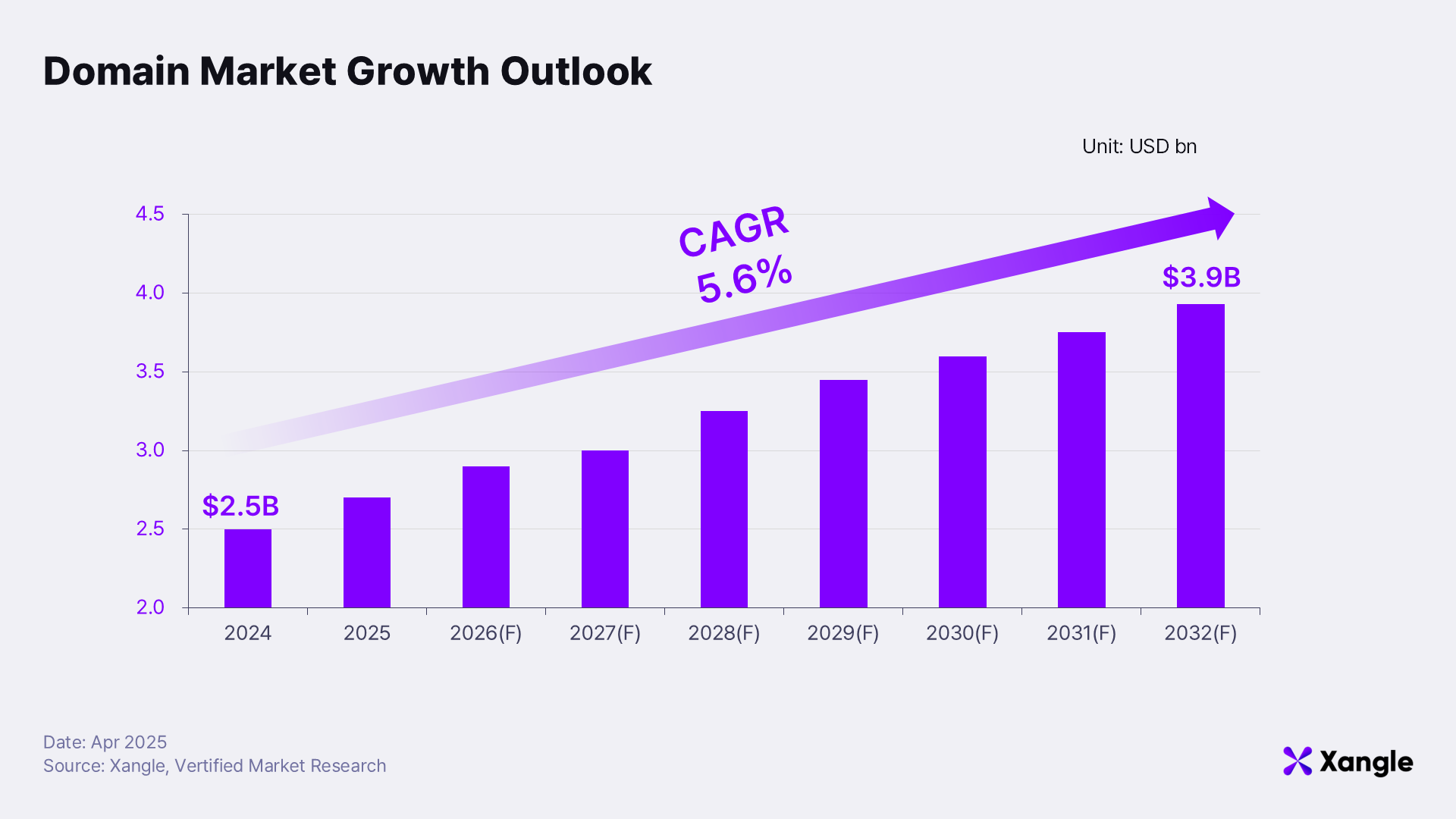

The post-COVID period further intensified this trajectory: the widespread adoption of e-commerce, content platforms, and remote work reinforced demand for unique online identifiers among both enterprises and creators. As a result, domain registrations increased sharply, while the market value of premium domains rose in parallel. Collectively, these dynamics have pushed total market size to approximately USD 2.5 billion, with projections suggesting a rise toward USD 4 billion by 2032.

Market growth, however, has not translated into structural efficiency. The domain industry remains constrained by persistent inefficiencies, most notably an ownership model that functions closer to a lease than true asset ownership. Domain holders remain subject to the rules of specific registrars* and registries**, are required to pay recurring annual renewal fees, and may face limitations on effective usage rights due to policy changes or enforcement actions by governing bodies. Even for enterprises, domains represent strategically critical digital assets over which full control is difficult to secure.

Secondary-market liquidity represents another persistent bottleneck. Domain transactions continue to rely heavily on brokers, escrow services, and manual verification processes; execution is slow, counterparty risk remains elevated, and settlement timelines are extended. Price discovery under such conditions is inherently inefficient, limiting domains’ usability as financial assets and preventing their economic value from being fully realized.

Regulatory and intellectual property considerations further complicate the landscape. Domains operate within overlapping frameworks that include international internet governance bodies such as ICANN, trademark law, and country-specific registration regimes, each imposing distinct requirements. Dispute resolution processes are often lengthy and costly, creating significant barriers for companies pursuing global expansion.

Despite sustained headline growth, the domain market has remained constrained by structural bottlenecks: ambiguous ownership frameworks, inefficient transaction mechanics, distorted pricing dynamics, regulatory fragmentation, and elevated operating costs. These limitations have prompted renewed interest in reframing domains as liquid, tokenized assets that can be freely traded within open markets. This shift in perspective forms the foundation of what is now referred to as DomainFi.

*Registrar: An entity that directly operates and manages top-level domain (TLD) structures.

**Registry: An intermediary service provider through which end users access, register, and purchase domains.

2. DomainFi: From Domain Names to Financial Primitives

DomainFi reframes the traditional domain industry by addressing its structural inefficiencies and redefining domains as liquid, on-chain assets. According to the VeriSign Q2 2025 report and the Sedo Global Domain Report 2025, the global domain market comprises more than 370 million registered domains, yet annual sell-through remains below 3%. Transaction settlement typically requires 45 to 90 days, while brokerage fees range from 10% to 20%, underscoring the extent of inefficiency embedded in current market structures.

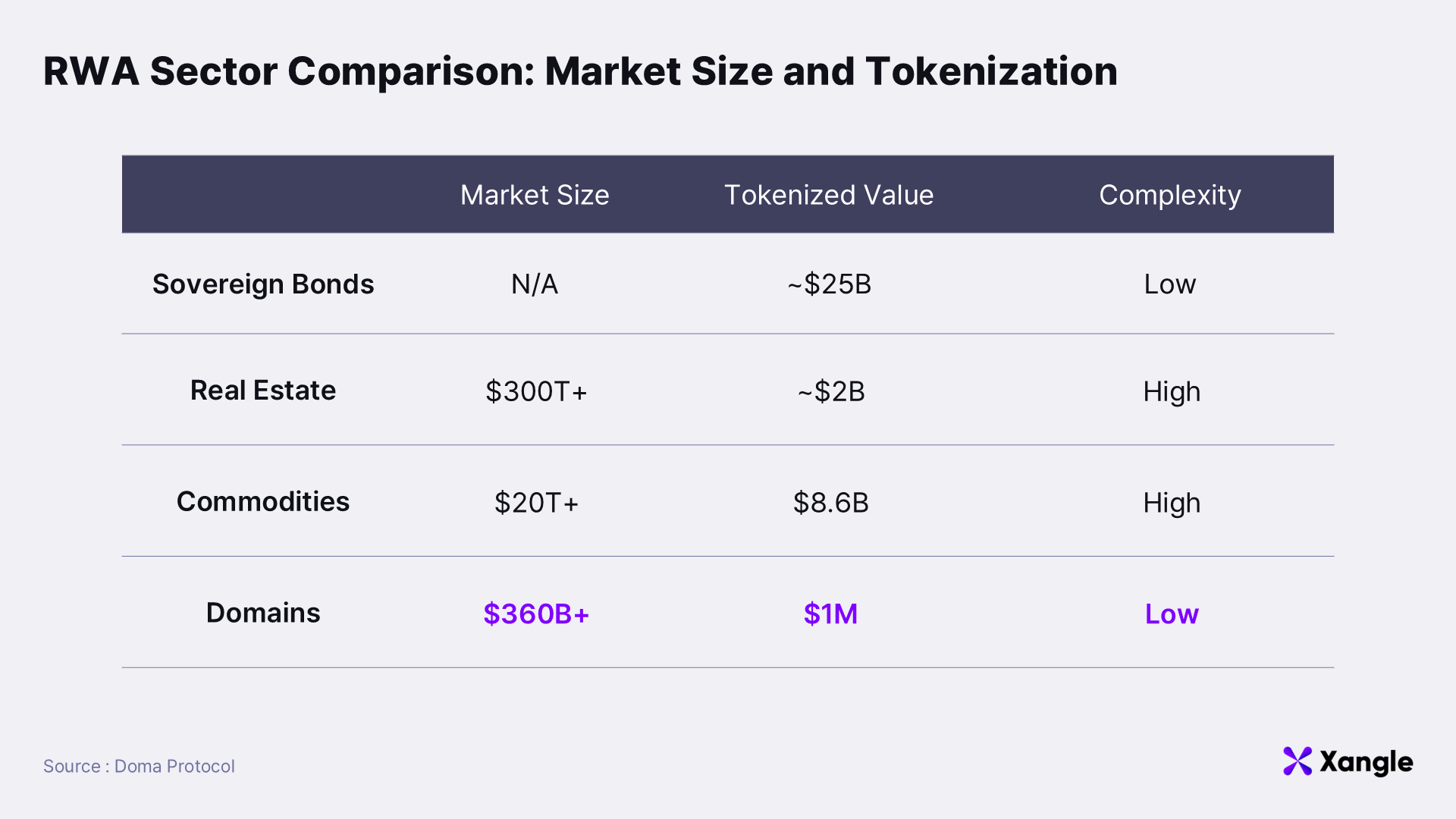

Once domains are tokenized, market dynamics shift materially. Unlike conventional real-world assets, domains are digital-native RWAs (Real-World Assets) that originated within the internet itself. Even so, the cumulative value of tokenized domains to date remains below USD 1 million, a level that appears markedly undervalued relative to market size and accessibility. Doma Protocol projects that, as the domain market enters a phase of full-scale growth, the emergence of an entirely new market could expand total addressable value to as much as USD 360 billion.

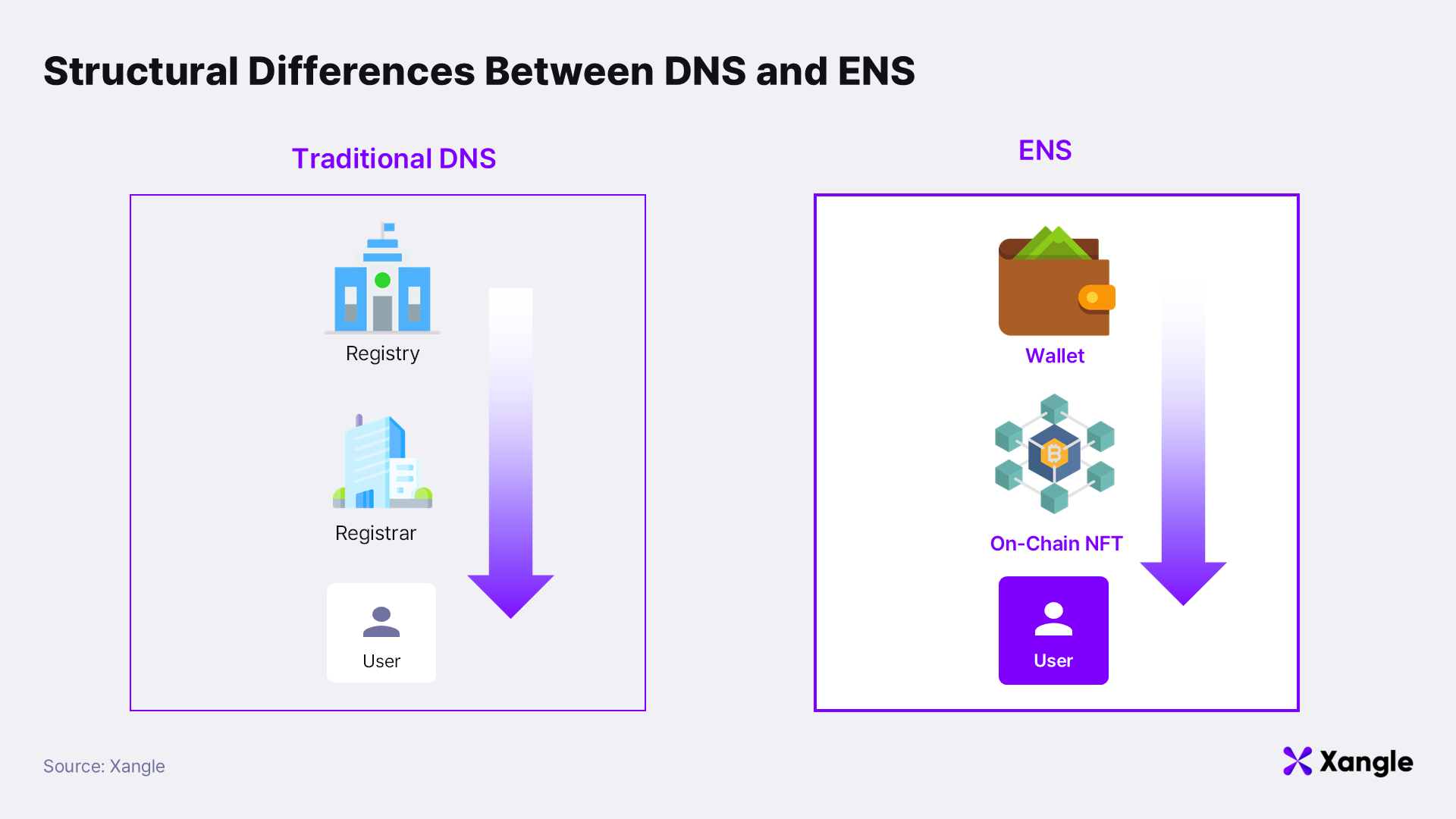

Within Web3, concrete efforts have already emerged to restructure the inefficient legacy domain market and establish DomainFi as a new vertical. The most prominent example is ENS (Ethereum Name Service). ENS departs from the centralized registrar–registry model maintained by traditional DNS and instead implements domain ownership directly as smart contract–based NFTs. Under the existing DNS framework, nominal domain “ownership” leaves effective control with registrars and registries, while users receive limited usage rights in exchange for recurring renewal fees. ENS, by contrast, issues each name as an ERC-721 NFT; the wallet holding the NFT becomes the absolute on-chain owner of that name. Ownership is therefore assigned directly to the user rather than mediated by intermediaries, eliminating the risk of arbitrary revocation or restriction driven by centralized institutions or policy changes.

ENS has consequently gained attention as an alternative model capable of mitigating multiple bottlenecks inherent in the traditional domain market, including centralization risk, low liquidity, inefficient transaction structures, and regulatory complexity. Clear ownership semantics, transparent on-chain transactions, and programmability together point toward a structural reconfiguration of how domains are treated as assets.

Web3-based naming systems, however, are not without limitations. ENS offers the advantages of an on-chain name service, yet native compatibility with traditional internet infrastructure—such as browsers, email clients, and operating systems—remains limited in many cases. As a result, Web2 DNS and Web3 ENS largely operate in parallel domains, with potential exposure to name collision risks. Fragmentation at this layer ultimately constrains real-world usability.

D3 introduced a fundamentally different approach to address this structural bottleneck. Rather than replacing the existing DNS framework, the model preserves the current registrar–registry structure and ICANN governance while adding a financial and utility layer that enables domain tokenization. Legal and technical foundations remain intact; Web3 functionality is layered on top, allowing registrars and registries to offer blockchain-based ownership and liquidity without undermining regulatory compliance. The Layer 2 network developed by D3 to implement this model is Doma Protocol.

3. Doma Protocol: A Layered Architecture for DNS Tokenization

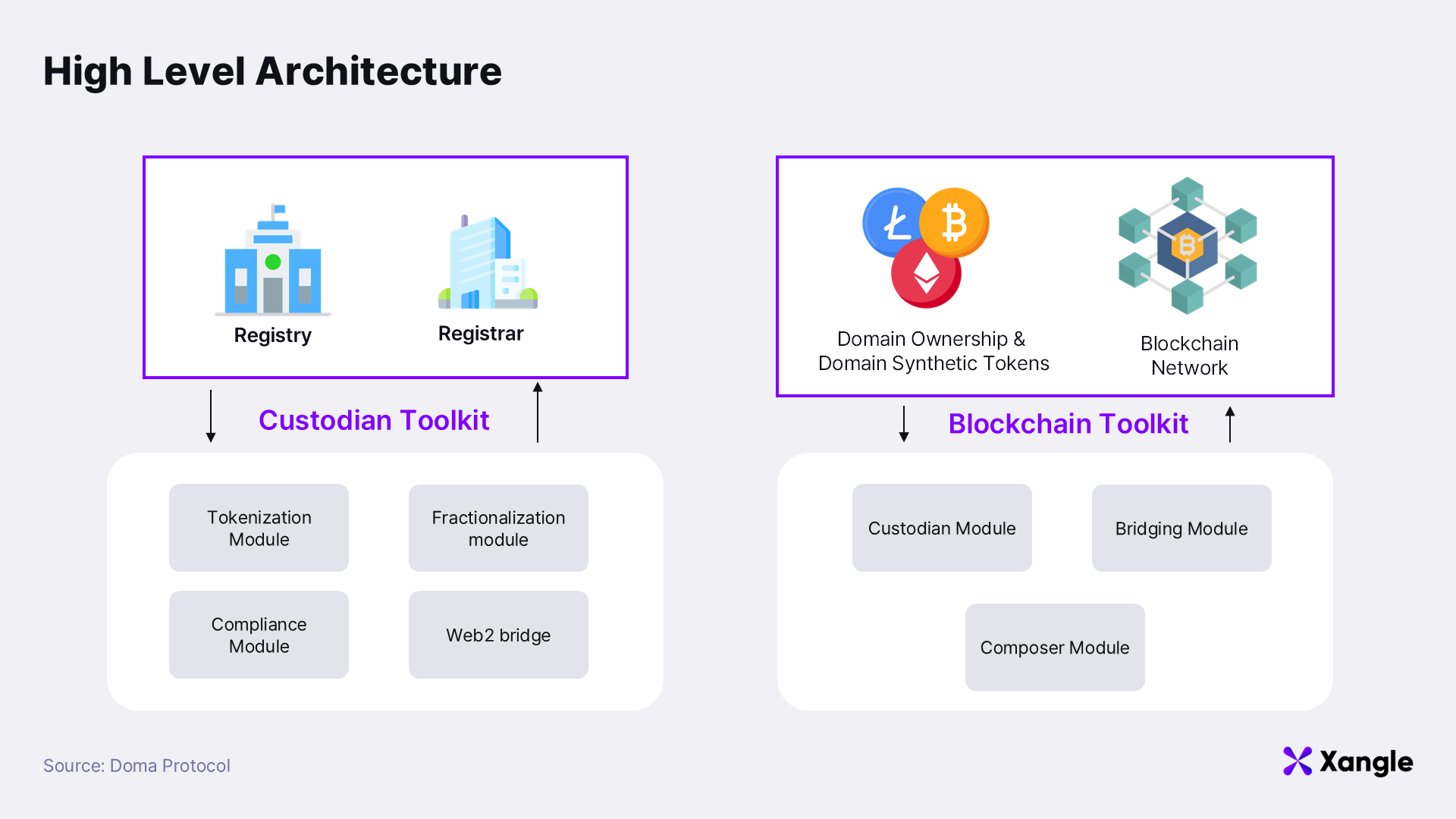

Doma Protocol is a Layer 2 network designed to convert traditional domains into on-chain assets and enable their tokenization. The protocol is structured around a simple but consequential idea: just as ENS issues domains as on-chain NFTs, existing DNS-based domains can be treated in an equivalent manner on blockchain infrastructure. Web2 domains previously managed by registrars and registries are tokenized and made interoperable with smart contracts, allowing them to be traded and utilized as on-chain name services in the same way as ENS domains.

DNS-based domains, however, differ fundamentally from blockchain-native naming systems in both complexity and legal responsibility. Domains are not merely strings of text; they represent a distinct asset class shaped by national regulations, ICANN policies, relationships with registrars and registries, ownership disputes, and formal transfer procedures. Addressing these constraints requires more than simple token issuance. Doma Protocol therefore integrates a set of core modules into a unified architecture capable of handling the entire domain lifecycle on-chain, including tokenization, permission decomposition, regulatory compliance, bridging, custody, and synthetic token creation. Together, these modules reinterpret domains as liquid and composable digital assets while combining the strengths of the existing DNS system with those of Web3 naming infrastructure.

Doma Protocol adopts a modular architecture to support the conversion of traditional domains into on-chain assets. The domain partitioning module enables tokenized domains to be split into fungible tokens, allowing fractional investment and trading while providing liquidity without requiring the sale of the underlying domain. The compliance module supports UDRP* dispute resolution processes; transfers can be immediately suspended during investigations, and, when necessary, domain tokens may be burned across all chains to return ownership to the registrar through an enforcement mechanism. The bridging module allows both domain ownership tokens and synthetic tokens to move across multiple L1 and L2 networks, enabling interaction with a broad range of dApps.

*UDRP: An official international arbitration system that resolves domain name disputes without proceeding to court.

The custody module connects domain registration with on-chain tokenization in accordance with ICANN regulations. When a token transfer occurs between wallets, the registrar detects the change and temporarily places the domain under the custody of a “Doma proxy registrant.” Once the new owner submits the required off-chain registration information, ownership is transferred to the final registrant. The composer module further decomposes ownership tokens into multiple synthetic tokens, such as DNS management rights, transforming domains into programmable, permission-based asset units. These synthetic tokens may be traded independently or deployed within dApps, and can later be recombined to restore the original ownership token. This structure allows domains to be reconstituted as fully on-chain ownership assets, supporting a wide range of use cases including investment, trading, rights separation, and synthetic asset utilization.

Doma Protocol structures its architecture around modular components that remain aligned with ICANN regulations, UDRP procedures, and on-chain asset standards. This design minimizes legal and institutional friction during domain tokenization, allowing blockchain-based ownership to be layered safely on top of the existing DNS system without undermining its legal or operational foundations. At this intersection, the market Doma Protocol ultimately seeks to establish begins to take shape: DomainFi, a financial layer in which domain names are directly linked to on-chain ownership, identity, access rights, and economic value. Domains are no longer treated solely as internet addresses, but as premium RWAs capable of being fractionalized, collateralized, leased, and traded.

4. ENS Integration: Establishing Domains as On-Chain Identity Assets

On October 21, 2025, Doma Protocol announced its integration with ENS, marking a meaningful inflection point in the convergence of Web2 and Web3 intellectual property systems. As a result of this integration, existing DNS domains tokenized via Doma Protocol can now be recognized and used as native ENS names across Ethereum wallets, dApps, and a broad range of identity infrastructure.

The implications of this integration extend beyond a purely technical connection between ENS and Doma Protocol. The collaboration signals the early formation of a new domain finance system in which names function simultaneously as ownership primitives and financial assets. ENS expanded naming systems into on-chain identity; Doma Protocol builds on that foundation by attaching explicit ownership, value, liquidity, and financial utility, elevating domain names into a distinct on-chain asset layer under the DomainFi framework.

A central objective of the ENS integration lies in removing the technical barriers that historically prevented traditional domain holders from adopting ENS. Under prior approaches, linking a DNS name to an ENS profile required complex and manual DNS configuration. Doma Protocol’s on-chain integration replaces this process with a native on-chain user experience that can be completed with minimal interaction. Domain owners tokenize their domains, hold them in NFT form, and gain full ENS connectivity without modifying underlying DNS settings.

The integration also represents a potential starting point for the DomainFi market envisioned by Doma Protocol. ENS is no longer limited to a Web3-native user base; global domain holders can now be absorbed as potential participants, positioning ENS closer to a de facto standard for on-chain identity. At the same time, tokenized DNS domains can enter Ethereum as structurally simple and regulation-friendly RWAs, enabling faster adoption than more complex real-world assets such as real estate or fixed-income instruments. Domain owners can deploy tokenized domains as ENS-based identities and, when required, utilize them directly as collateral within DeFi protocols.

From the perspective of registrars, the integration carries equal significance. Rather than displacing the existing DNS industry, Web3 functionality becomes an incremental service layer that registrars can offer to customers, opening additional revenue streams. Participation by established industry players such as InterNetX/IONOS indicates that the traditional domain ecosystem is prepared to engage with this emerging standard.

Over the long term, ENS integration is expected to play a foundational role in shaping the DomainFi ecosystem. ENS’s strong brand recognition and integration across more than 800 applications provide immediate distribution and real-world usage pathways for tokenized domains. Early adoption at this layer serves as an initial proof point for DomainFi’s scalability and practical viability, marking an important milestone in the emergence of the market Doma Protocol seeks to establish.

5. Closing Remarks: Domains as a New Class of Tokenized RWAs

Despite a market size exceeding USD 300 billion and a well-established base of real-world use cases, the traditional domain market has long remained constrained, with much of its potential left unrealized. Domain registration and management are fragmented across multiple layers—including ICANN, registries, registrars, and intermediaries—while procedures vary significantly across jurisdictions. Structural inefficiencies have therefore become deeply entrenched. Domain transactions continue to rely on brokers, escrow services, and manual transfer processes, resulting in extremely low liquidity. As a result, domains, despite their clear value as digital assets, have persisted as an atypical and underutilized asset class within financial and investment markets.

Doma Protocol introduces a fundamental intervention by enabling domains to be directly tokenized on blockchain infrastructure. Tokenized domains are issued as on-chain NFTs, establishing clear ownership semantics and an on-chain standard capable of replacing legacy operational processes. This approach addresses the structural inefficiencies of traditional DNS at a technical level and opens a pathway for domains to be redefined as first-class digital assets.

ENS integration further extends this transformation. Existing DNS domains gain the ability to function in the same manner as ENS names, allowing domain names to carry ownership while simultaneously supporting financial utility. Domains have always exhibited core asset characteristics, including scarcity, brand value, and demand-driven fundamentals. Once on-chain primitives such as fractionalization, collateralization, lending, and leasing become available, domains transition into an entirely new asset category.

At this convergence point, Doma Protocol establishes the foundation of DomainFi: a market in which names become identity, identity becomes on-chain ownership, and ownership connects directly to financial systems. In doing so, Doma Protocol positions itself as a leading model capable of converting the latent potential of the existing domain market into sustained and measurable value flows.