1. Introduction: Why BTCfi Matters Now

Bitcoin has firmly consolidated its position as digital gold. Harvard University’s endowment has allocated capital to Bitcoin ETFs; JPMorgan has launched Bitcoin-based structured products; and in the United States, regulatory pathways now allow exposure to Bitcoin through 401(k) retirement accounts. Collectively, these developments place Bitcoin squarely within the domain of institutional finance.

Institutional recognition, however, does not equate to functional completeness. Despite its overwhelming market capitalization, the volume of capital actively deployed for financial activity within the Bitcoin ecosystem—measured by total value locked (TVL)—remains materially lower than that of other major blockchains. The discrepancy highlights a core structural reality: Bitcoin has matured as a store of value, yet remains constrained in its utility as a financial asset.

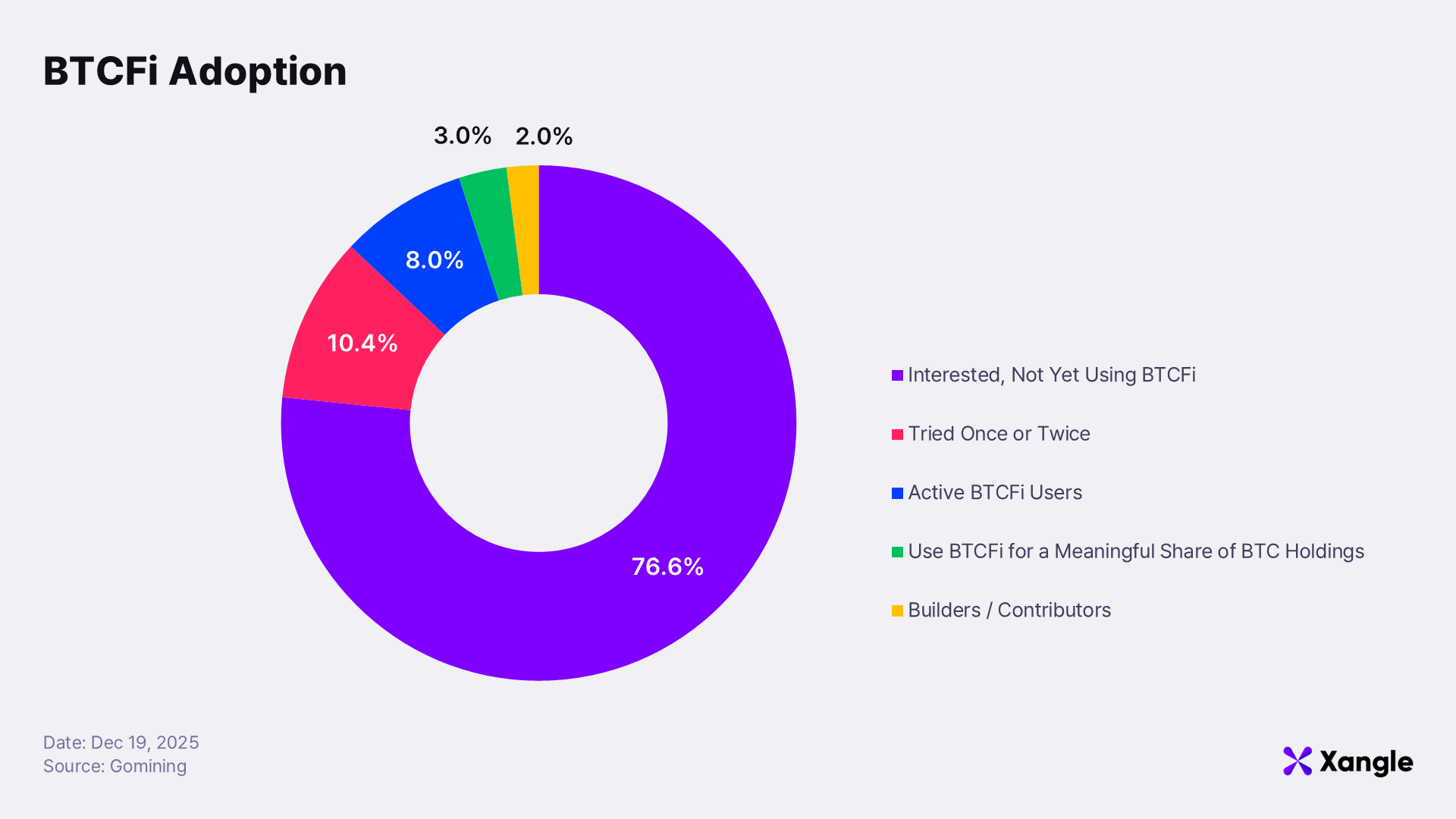

Adoption data reinforces this assessment. According to a GoMining survey conducted in October 2025 among 730 Bitcoin holders across North America and Europe, 77% of respondents reported having never used BTCfi (Bitcoin DeFi). The result provides quantitative evidence that BTCfi has not yet entered the practical usage domain of the majority of Bitcoin holders.

Several structural factors explain this limited participation. Trust considerations represent the most significant constraint: risks embedded in wrapped BTC and custodial architectures remain a persistent concern, while Bitcoin holders who prioritize security and asset sovereignty exhibit strong resistance toward third-party bridges and wrapping mechanisms. User experience further compounds the issue. Onchain interaction patterns modeled after Ethereum-centric DeFi diverge meaningfully from the expectations of conservative Bitcoin holders. Historical incidents involving wrapped BTC, including security breaches and depegging events, have reinforced risk aversion and deepened skepticism toward structures that do not allow for direct use of native BTC.

From a quantitative perspective, BTCfi remains structurally nascent. DefiLlama data places total value locked across Bitcoin-based BTCfi at approximately $165M, accounting for less than 0.1% of aggregate DeFi TVL, estimated at roughly $119B. While some reports indicate that BTCfi TVL reached $6B to $10B during late 2024 to early 2025, subsequent market corrections in the second half of 2025 appear to have partially reversed that expansion. By comparison, Ethereum DeFi continues to sustain over $50B in TVL and captures 50% to 60% of the broader DeFi market, underscoring BTCfi’s early-stage positioning.

The same gap also signals latent upside. Even limited deployment of Bitcoin’s $1.8T+ market capitalization into onchain financial primitives could drive nonlinear expansion in TVL. Demand for conservative, yield-oriented strategies, particularly among institutions and long-term holders, is gradually emerging, suggesting that BTCfi’s medium- to long-term trajectory will depend on how effectively its structural frictions are resolved.

As Bitcoin’s integration into the global financial asset universe deepens, incentives to actively utilize held capital are likely to strengthen. Beyond price appreciation, Bitcoin is increasingly expected to generate stable cash flows. A clear illustration can be found in Strategy (formerly MicroStrategy). As of September 2025, the firm incurred approximately $50 million in interest expenses on a nine-month YTD basis while maintaining its large-scale Bitcoin holding strategy, underscoring the operational importance of sustainable cash-flow generation.

The implication is straightforward: Bitcoin can no longer remain solely a passive asset. Sustaining the digital gold narrative over the long term requires parallel pathways that enable productive, yield-generating use cases. Within this context, Bitcoin-native financial infrastructure and BTC-collateralized yield mechanisms are becoming increasingly central.

BOB emerges at precisely this inflection point. By preserving Bitcoin’s security and asset sovereignty while enabling onchain financial activity, BOB positions itself as an execution layer designed to balance usability and yield, addressing two requirements that define Bitcoin’s next phase as a financial asset.

2. BOB Technical Architecture

BOB (Build on Bitcoin) is a hybrid Layer-2 solution that combines Bitcoin’s security with Ethereum’s execution environment. While adopting an OP Stack–based rollup architecture, BOB differentiates itself from conventional Ethereum L2s by anchoring final settlement and the root of trust to the Bitcoin network. The core objective extends beyond scalability; BOB aims to provide an execution layer that enables Bitcoin holders to access DeFi environments without relying on Ethereum assets or complex onchain interactions.

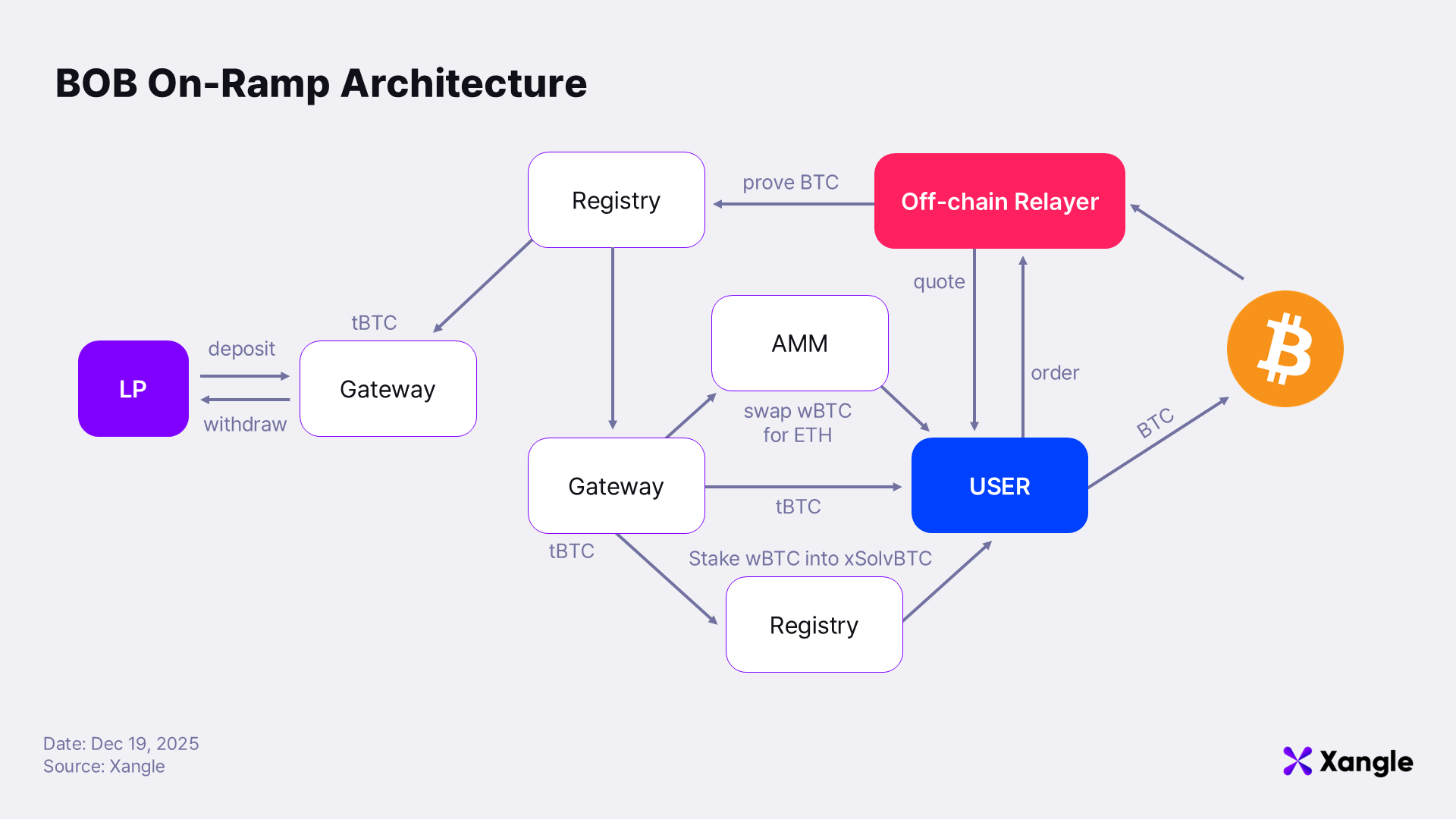

The center of this architecture is the BOB Gateway. Unlike traditional bridges, the Gateway is designed as an onboarding layer that abstracts user actions at the level of intent. Users are not required to hold ETH or ERC-20 assets in advance; a single Bitcoin transaction is sufficient to execute compound operations such as BTC bridging, staking, and token swaps. Structural differentiation arises from the Gateway’s validation model: user intent is verified using OP_RETURN data embedded directly within the Bitcoin transaction, without reliance on external oracles.

Within the Gateway’s onramp structure, defined as the process of bringing externally held assets into a blockchain-based execution environment, liquidity providers deposit wrapped Bitcoin assets such as WBTC, tBTC, and FBTC into smart contracts deployed on the BOB chain. Prior to executing the bridge, users reserve the required liquidity through an offchain relayer that pre-holds liquidity ahead of execution, after which BTC is transferred on the Bitcoin mainnet. During this process, the user generates a hash containing their BOB EVM address and transaction intent, for example bridging or staking, and embeds it into the OP_RETURN field of the Bitcoin transaction. This information enables subsequent onchain verification and execution of the intended action. The relayer monitors the transaction and submits a corresponding proof to the Bitcoin Light Client deployed on the BOB chain. Once verified, the Gateway contract releases the wrapped BTC deposited by the liquidity provider to the user; in staking scenarios, the contract mints and transfers an LST or LRT backed by the deposited assets. The critical property of this design is that the Bitcoin transaction itself serves as the cryptographic proof of user intent.

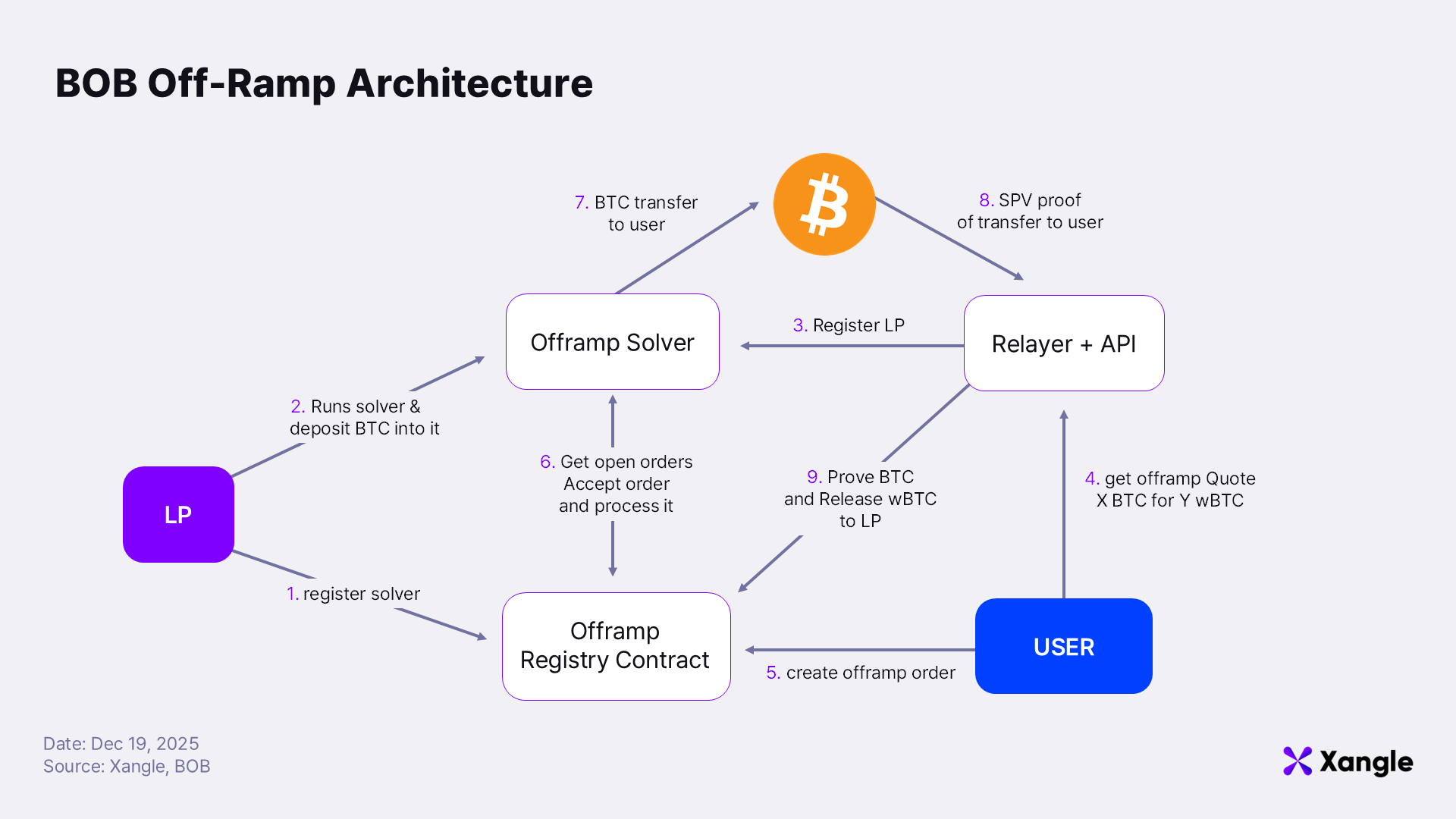

The offramp structure, which returns assets operated within the onchain environment back into native external assets, follows a similar principle. When a user deposits wrapped BTC into the OfframpRegistry contract on the BOB chain and specifies a Bitcoin address, a liquidity provider acting as a solver accepts the order and generates the corresponding Bitcoin transaction. Order identification data is embedded in the OP_RETURN field, and the relayer submits the transaction’s Merkle proof onchain to finalize settlement. If the order is not executed within a predefined time window, the user may either increase the fee or reclaim the assets after a delay period.

Gateway-level security is enforced through the Bitcoin Light Client. At present, a light client configuration is used to verify whether submitted block headers satisfy current or previous difficulty thresholds. This model relies on SPV assumptions and does not validate full transaction correctness, and therefore does not constitute a fully validating client. BOB nonetheless argues for the practical effectiveness of this design from an economic security perspective. Based on calculations as of December 2024, a successful attack on the relayer would require computational power equivalent to approximately 0.14% of the total Bitcoin hash rate, corresponding to roughly $12 million in hardware costs. As long as the value of assets secured by the Gateway remains below this threshold, economic incentives for attack are considered limited. Over the longer term, BOB has announced a planned transition to a full client model that submits all Bitcoin block headers.

Even under this operating model, a fundamental limitation common to existing BTCfi architectures remains: guaranteeing full trustlessness is difficult. BOB therefore frames the Gateway not as a terminal solution, but as an intermediate step. The longer-term direction centers on constructing a Bitcoin-native trust environment using BitVM. Through this approach, BOB seeks to minimize reliance on custodial or centralized intermediaries and to implement BTCfi directly on top of Bitcoin’s native verification model.

3. BitVM-Based Trustless Bridge Architecture

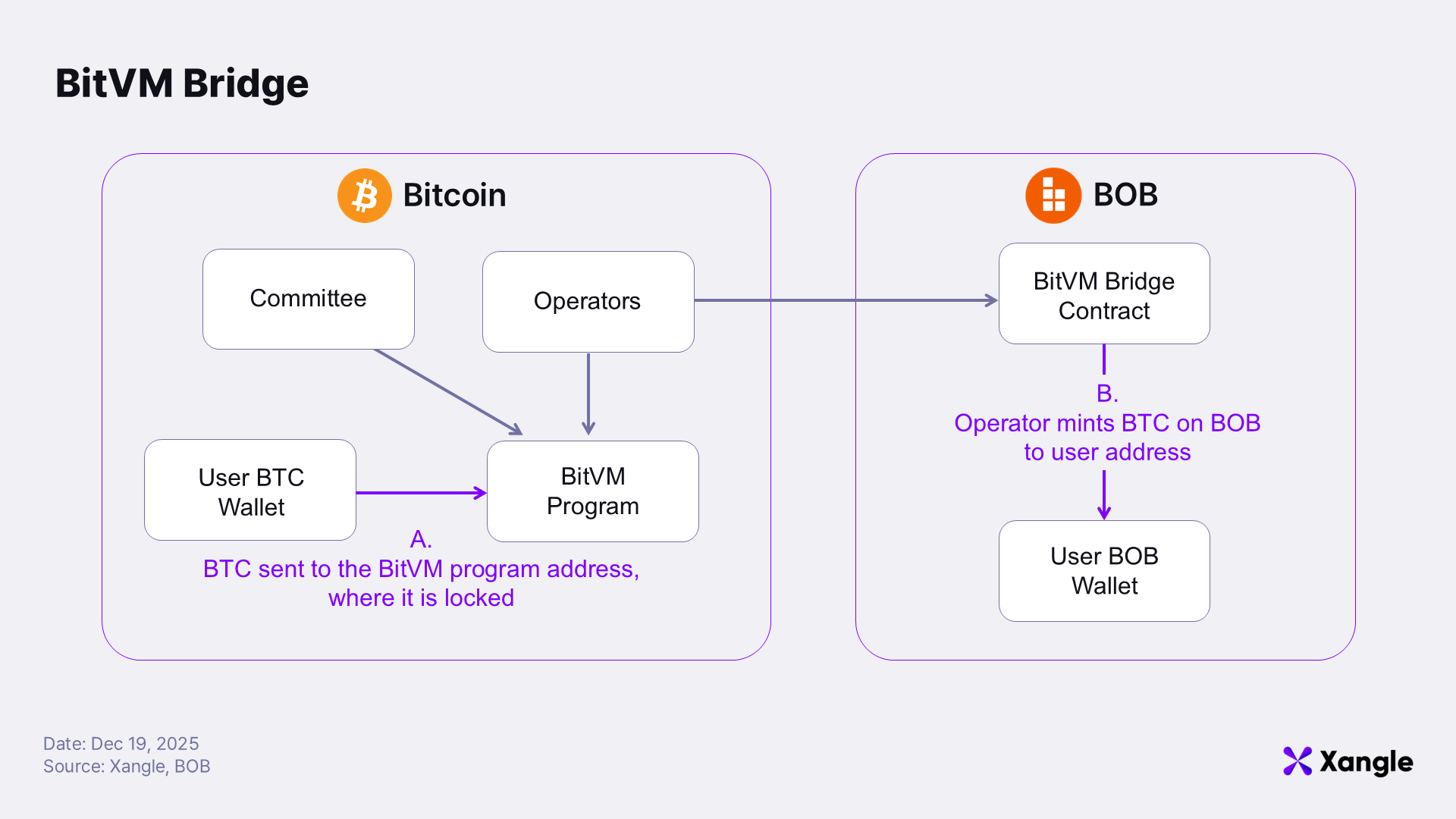

BitVM is widely viewed as an offchain verification paradigm that overcomes the expressive limitations of Bitcoin Script and enables computation that is effectively Turing-complete. The central idea is to avoid executing complex computations onchain. Instead, computation is performed offchain, and only when disputes arise is a fraud proof verified onchain. This design allows advanced financial logic to be implemented without modifying Bitcoin’s security model or its consensus rules.

A defining feature of this architecture is the ability to use native Bitcoin directly, without reliance on wrapped BTC. Financial activities collateralized by BTC on the Bitcoin mainnet become possible without transferring assets into separate wrapping tokens or custodial bridge structures. This capability gives rise to the concept commonly referred to as the Bitcoin Vault. In this framework, BTC is locked in a trust-minimized manner and serves as the foundation for advanced DeFi primitives, including lending, stablecoin issuance, perpetual DEXs, and prediction markets.

Rather than concentrating BitVM functionality into a single bridge, BOB has structured its approach around a dual-bridge strategy described as “Two bridges, one vision.” The objective remains consistent: transforming BTC into a productive asset. The implementation, however, offers differentiated trust and performance trade-offs tailored to distinct user profiles and operational requirements.

The BOB Gateway currently serves as a high-speed bridge optimized for retail users. Its intent-based design allows users to execute compound operations such as bridging, staking, and swapping with a single Bitcoin transaction. The Gateway is already live on mainnet. While it does not achieve full trustlessness, the design prioritizes fast execution and a simplified user experience to ensure practical usability.

The BitVM Bridge, by contrast, is positioned as a high-security bridge designed primarily for institutions and large pools of capital. Its architecture combines a BitVM-based verification model with SNARK-enabled fraud proofs, with the explicit goal of minimizing trust assumptions at the bridge layer. Prototype testing was completed successfully in early 2025, followed by a testnet release in February. As of December 2025, the testnet remains operational. A mainnet launch is targeted for late 2025 to early 2026, pending additional security audits and partner integrations. In this design, institutional-grade security and verifiability take precedence over user experience or execution speed.

Operating both bridges in parallel represents a pragmatic approach to scaling BTCFi rather than a purely technical experiment. The BitVM Bridge satisfies the trust requirements necessary for large-scale institutional capital flows, while the Gateway supports day-to-day DeFi access and liquidity circulation. Together, these components create a structure capable of absorbing both institutional and retail capital within a unified ecosystem.

BOB expects this architecture to improve capital efficiency by more than 50 percent in high-frequency, high-complexity applications such as decentralized exchanges and prediction markets. The underlying rationale is that combining BitVM-enabled native BTC utilization with LST and LRT structures allows the same BTC collateral to be used simultaneously for security, liquidity provision, and yield generation, thereby accelerating overall TVL growth. These projections, however, remain subject to validation based on real-world adoption and usage patterns once deployed on mainnet.

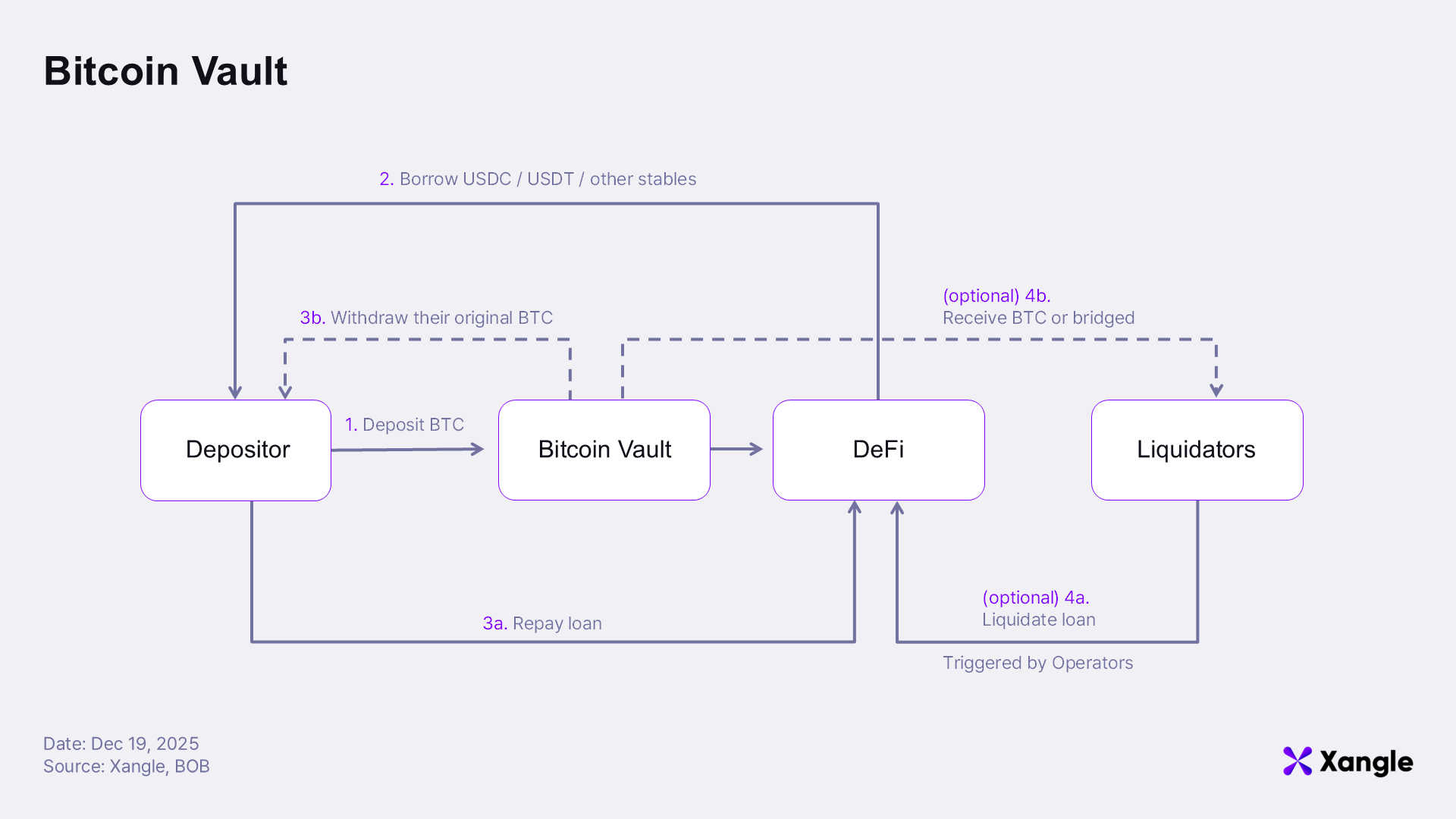

BOB has extended this approach further with the announcement of a BitVM-based native Bitcoin vault on December 17, 2025. The core premise of the native Bitcoin vault is the ability to use BTC as DeFi collateral and enable automated liquidation while keeping Bitcoin unwrapped and locked directly on the Bitcoin network. Implementation relies on a combination of covenant emulation using predefined transactions and timelocks, a BitVM-based dispute resolution framework, and the EVM logic of the BOB chain. Depositors lock BTC into the vault, borrow stablecoins, or manage DeFi positions, and upon repayment retrieve the same BTC unchanged. If collateralization thresholds are breached, permissionless liquidators may execute partial liquidations. In dispute scenarios, final enforcement is handled through multisig mechanisms or a BitVM-based Tribunal. This modular design allows configurations ranging from institution-friendly security settings to fully cryptographic verification, with the broader objective of aligning Bitcoin’s asset sovereignty with DeFi-level capital efficiency.

The integration of BitVM represents more than a feature addition. It is increasingly viewed as a structural inflection point for BTCFi as a whole. By making native Bitcoin-based yield generation technically viable and accessible to both institutional and retail participants, BitVM has emerged as one of the most important technical pillars underpinning BOB’s long-term vision.

4. BOB Ecosystem

BOB’s long-term vision centers on moving Bitcoin beyond its role as a simple store of value and repositioning it as a productive, yield-generating asset. To support this transition, BOB is progressively building infrastructure that allows Bitcoin holders to participate in onchain financial activity without compromising Bitcoin’s security guarantees or asset sovereignty.

A primary component of this strategy is the reinforcement of BOB’s role as a multichain gateway. Integrations with major cross-chain infrastructures, including LayerZero, enable Bitcoin capital to move efficiently across more than ten external chains and DeFi environments rather than remaining confined to a single network. This design positions BOB as a liquidity hub anchored around Bitcoin-native capital.

Alongside this effort, BOB has identified the expansion of BTC-collateralized financial products as a core priority, with institutional demand explicitly in focus. BTC-backed lending, stablecoins, and BTC-based LSTs and LRTs are structured not as experimental DeFi applications, but as financial primitives designed to meet the stability, transparency, and predictable yield requirements of large-scale BTC holders. This approach clearly differentiates BOB from retail-oriented DeFi ecosystems characterized by higher risk and volatility.

In 2025, the BOB ecosystem entered a phase of gradual expansion. The number of onchain projects increased by more than 25 percent year over year, while total value locked surpassed $200 million. Although the absolute scale remains modest, this development can be viewed as an early signal of the potential for idle capital, representing hundreds of thousands to millions of BTC across the broader Bitcoin ecosystem, to migrate onchain over time.

Beyond protocol growth metrics, BOB has advanced its ecosystem design by introducing an incentive framework that spans holders, developers, and investors. The objective extends beyond short-term inflows; the structure is intended to encourage sustained participation and contribution, allowing network growth and utilization to reinforce one another over time.

The incentive model is deliberately broad in scope. Rather than targeting a single participant group, it encompasses token holders, developers, and capital providers simultaneously, emphasizing network-wide engagement over transient liquidity incentives.

For $BOB token holders, staking provides access to both network rewards and governance participation. This design enables indirect involvement in protocol upgrades and key parameter changes, moving beyond passive token ownership. The BOB Earn platform further expands available options by offering BTC-based yield strategies, including staking and lending, for holders seeking long-term utilization of their Bitcoin assets.

From a developer perspective, BOB presents a relatively low barrier to entry. Full EVM compatibility with Ethereum is maintained, while BitVM-based primitives are introduced incrementally to enable application designs that directly leverage Bitcoin’s security model. This environment preserves familiar Ethereum development workflows while encouraging experimentation with financial and application primitives built around Bitcoin-native assets.

For investors, ecosystem growth itself represents the primary variable of interest. Beyond short-term price movements of the $BOB token, factors such as aggregate TVL expansion, the mainnet deployment of BitVM-based bridges, and the breadth of institutional partnerships play a central role in shaping medium- to long-term value dynamics. Leadership in TVL within the Bitcoin L2 and BTCFi landscape, combined with the development of institution-friendly infrastructure, supports durable network value formation rather than event-driven speculation.

BOB’s incentive architecture reflects a participation-driven approach to ecosystem expansion, with the explicit goal of increasing the productive deployment of Bitcoin capital. Its ability to generate sustained usage, developer engagement, and capital inflows will depend on continued progress in BitVM integration and the structural evolution of BTCFi.

5. Closing Analysis: The Future of BTCfi and BOB

e volume of capital actively deployed onchain remains limited, indicating that BTCfi has yet to fully resolve its structural constraints. Persistent trust concerns, complex user experience, and limitations around native BTC utilization have collectively constrained Bitcoin’s progression beyond digital gold toward a productive asset.

BOB emerges directly from this set of structural challenges. Its OP Stack–based hybrid L2 architecture, intent-based Gateway designed for practical onboarding, and the introduction of a Bitcoin-native trust model centered on BitVM reflect an effort to redesign the BTCfi stack rather than compete on performance alone. The dual-bridge strategy that operates both the Gateway and the BitVM Bridge represents a pragmatic attempt to accommodate distinct demand profiles, spanning retail accessibility and institution-grade security.

BOB’s approach also extends beyond technical architecture. By implementing an incentive framework that encompasses holders, developers, and investors, the project aims to support organic ecosystem expansion. Governance and reward mechanisms built around the $BOB token, an EVM-compatible development environment, and BTC-collateralized financial primitives designed with institutional requirements in mind constitute core building blocks for BTCfi to evolve beyond a short-term narrative and toward sustainable financial infrastructure. BOB’s trajectory reflects a deliberate effort to translate this vision into an operational reality.