Table of Contents

Introduction: Uncovering the Blind Spots of Traditional Finance

Creditcoin: The Birth of On-Chain Credit Infrastructure

Expanding Across Chains with Universal Smart Contracts

Inside the Creditcoin Ecosystem

Spacecoin: Bridging Finance and Connectivity

Conclusion: Can Creditcoin Establish Itself as Global Financial Infrastructure?

Introduction: Uncovering the Blind Spots of Traditional Finance

Why does cryptocurrency have the power to drive real financial innovation? The answer lies in its permissionless design. Public blockchains such as Ethereum and Solana allow anyone, without institutional approval or identity verification, to participate directly and build financial protocols atop open networks. This property enables the creation of financial products and payment systems independent of banks or legacy payment rails. By removing temporal and geographical barriers, permissionless networks make financial access truly borderless. In essence, Web3 transforms structural inefficiencies born of physical and spatial limitations into opportunities for innovation.

Yet this advantage resonates less in developed economies. Financial products are already mature, and banks and card networks operate within near-perfect infrastructure. As a result, the ability to build financial services without licensing or payment integrations, once seen as revolutionary, loses much of its appeal. In regions where physical bank branches are ubiquitous and payments are frictionless through credit cards and mobile systems, the “innovation” promised by Web3 often feels abstract and unnecessary.

Conditions are entirely different in developing countries. According to the World Bank, as of 2021, 57% of Africa’s population lacks access to a traditional bank account. In such environments—where financial infrastructure is either incomplete or non-existent—the permissionless nature of crypto becomes a powerful equalizer. Regions untouched by formal banking are precisely where Web3’s mass adoption is most likely to take root.

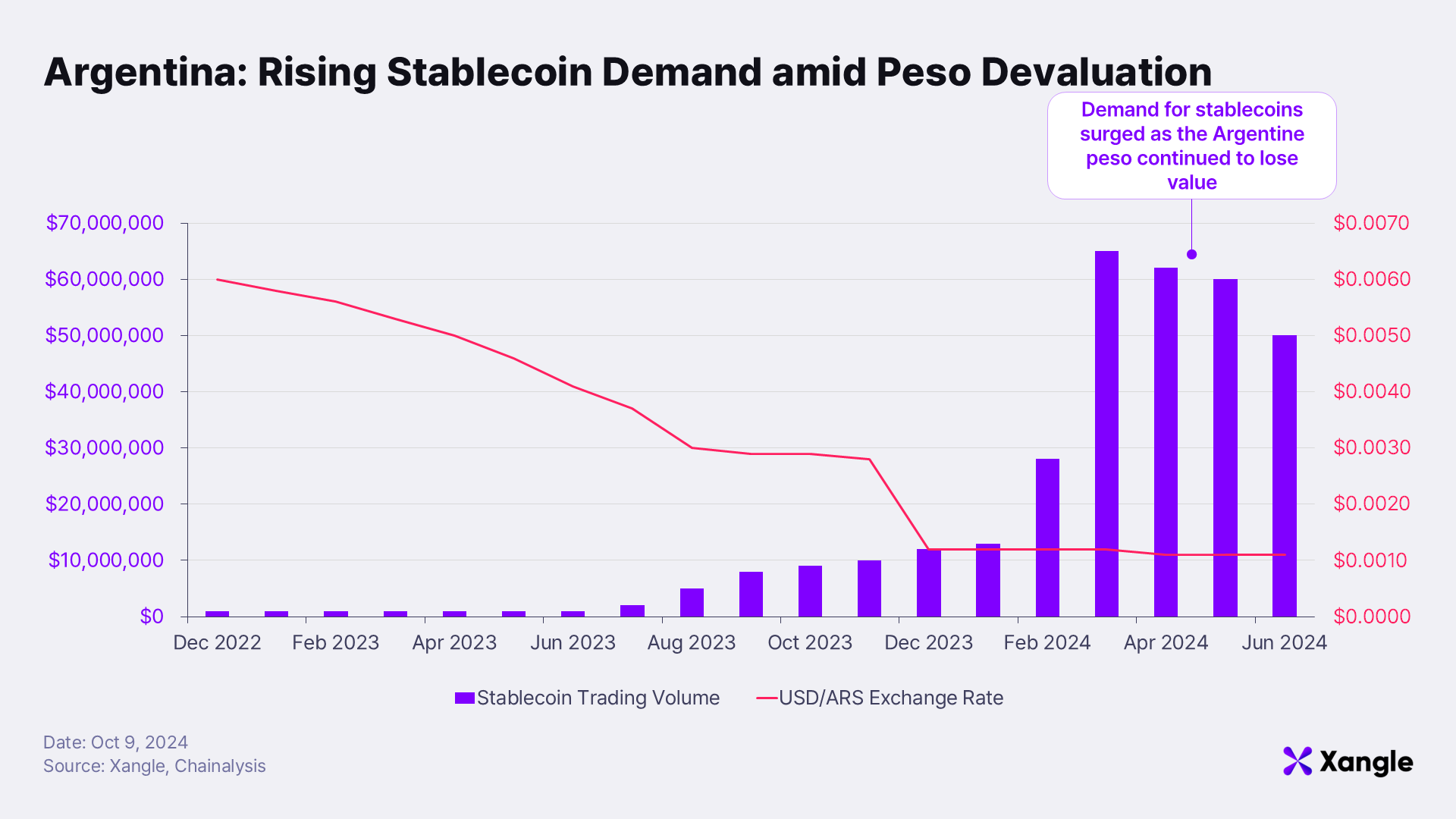

A tangible example can be found in Argentina’s stablecoin market, which grew rapidly amid the nation’s debt crisis. There, the ability to access financial and remittance systems without relying on government-regulated exchanges or banks directly met the needs of local users. Countries with unstable political systems and limited banking access are not only where Web3 is most urgently needed but also where demand potential is greatest.

Credit, however, the backbone of modern finance, presents a far deeper challenge. Credit expansion fuels not only financial growth but also the broader economy itself. Yet, as banks have monopolized credit creation and guarantees, those lacking access to formal institutions are often shut out of borrowing altogether, even when they possess both the ability and willingness to repay. With no alternative, they turn to informal, unregulated lending markets plagued by inefficiency and exploitation. In emerging economies, the physical and institutional frictions inherent to traditional finance translate into real-world barriers to lending.

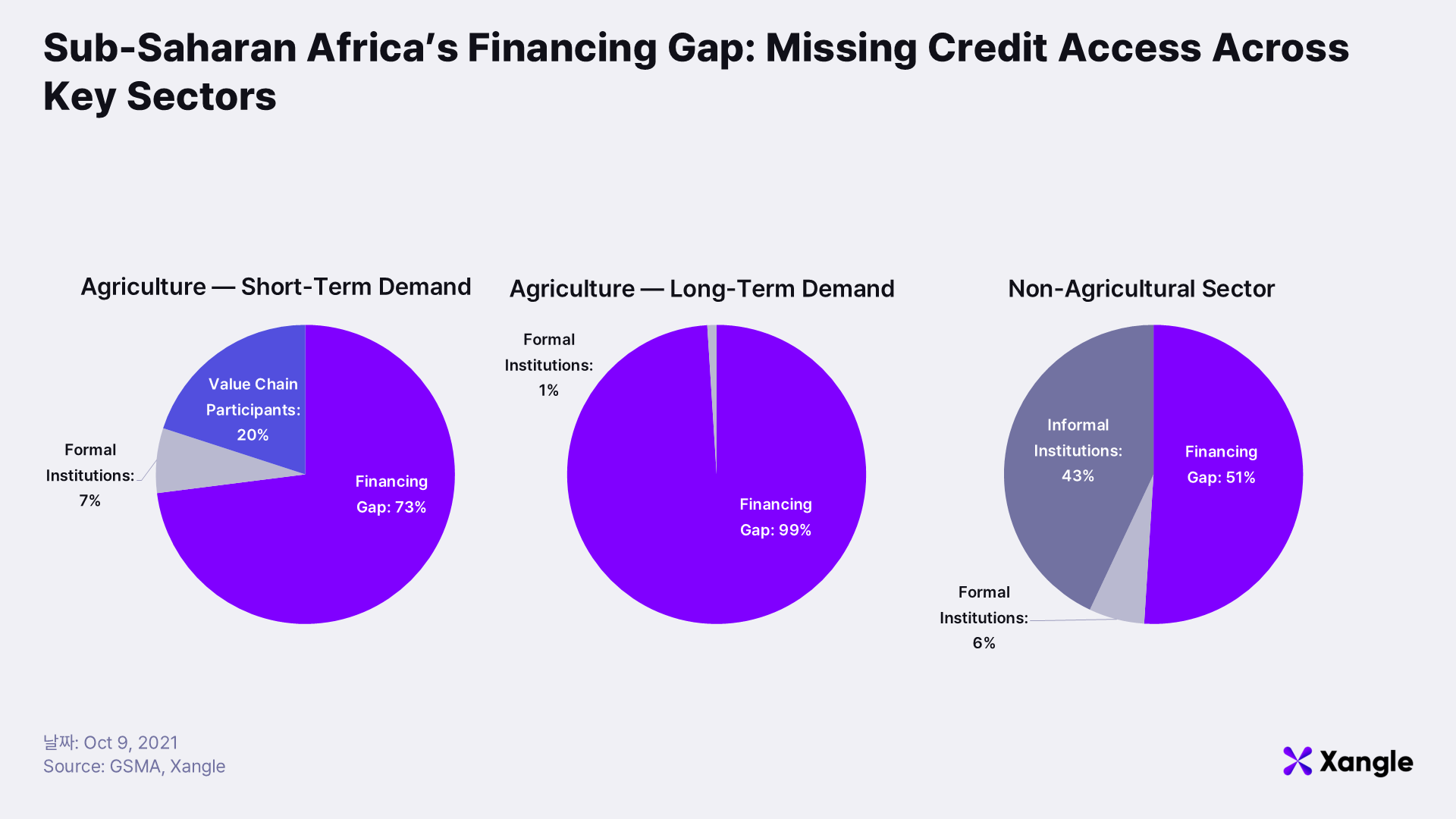

countries such as Nigeria, Kenya, and Bangladesh, small-scale entrepreneurs and individuals are frequently denied credit simply because they cannot post collateral. In Sub-Saharan Africa, smallholder farmers—who collectively drive a substantial share of the regional economy—face a significant *financing gap. According to GSMA, formal institutions cover only 7% of short-term financing demand and a mere 1% of long-term demand in agriculture. Many of these borrowers demonstrate consistent repayment behavior and trustworthy transaction histories, yet they lack the infrastructure to prove it. As a result, they are not merely excluded from finance—they are denied the very opportunities for economic and social mobility that credit should enable.

Financing Gap: A shortfall that occurs when viable businesses or individuals cannot access capital due to information asymmetry or structural inefficiencies, despite having sound fundamentals or repayment capacity.

Creditcoin directly addresses this problem. Beyond enabling payments via cryptocurrency, the network seeks to redefine credit accessibility by recording credit data on-chain and making it verifiable to all participants. Even without a bank account or collateral, users can prove their creditworthiness based on on-chain repayment and transaction histories. In essence, Creditcoin aims to solve the credit inequality left unresolved by traditional finance—leveraging blockchain as the foundation for a more open and auditable credit system.

Creditcoin: The Birth of On-Chain Credit Infrastructure

How, then, does Creditcoin address the problem? Delivering loans to those who need them while keeping the experience practical and safe hinges on two pillars: ease of access and risk management. Excessive documentation and cumbersome verification suppress access even when credit is available; relax the checks too far and default risk compounds, undermining recoveries and the integrity of the lending market.

Traditional institutions have tried to improve access with online lending and denser branch networks, while managing risk with income verification and collateral-based underwriting. Such approaches work in developed markets where branches are plentiful and records are organized and accessible. In regions with few branches, scarce paperwork, and unclear property rights, the same procedures harden into invisible barriers that block lending. Creditcoin targets that bottleneck with a blockchain-native approach.

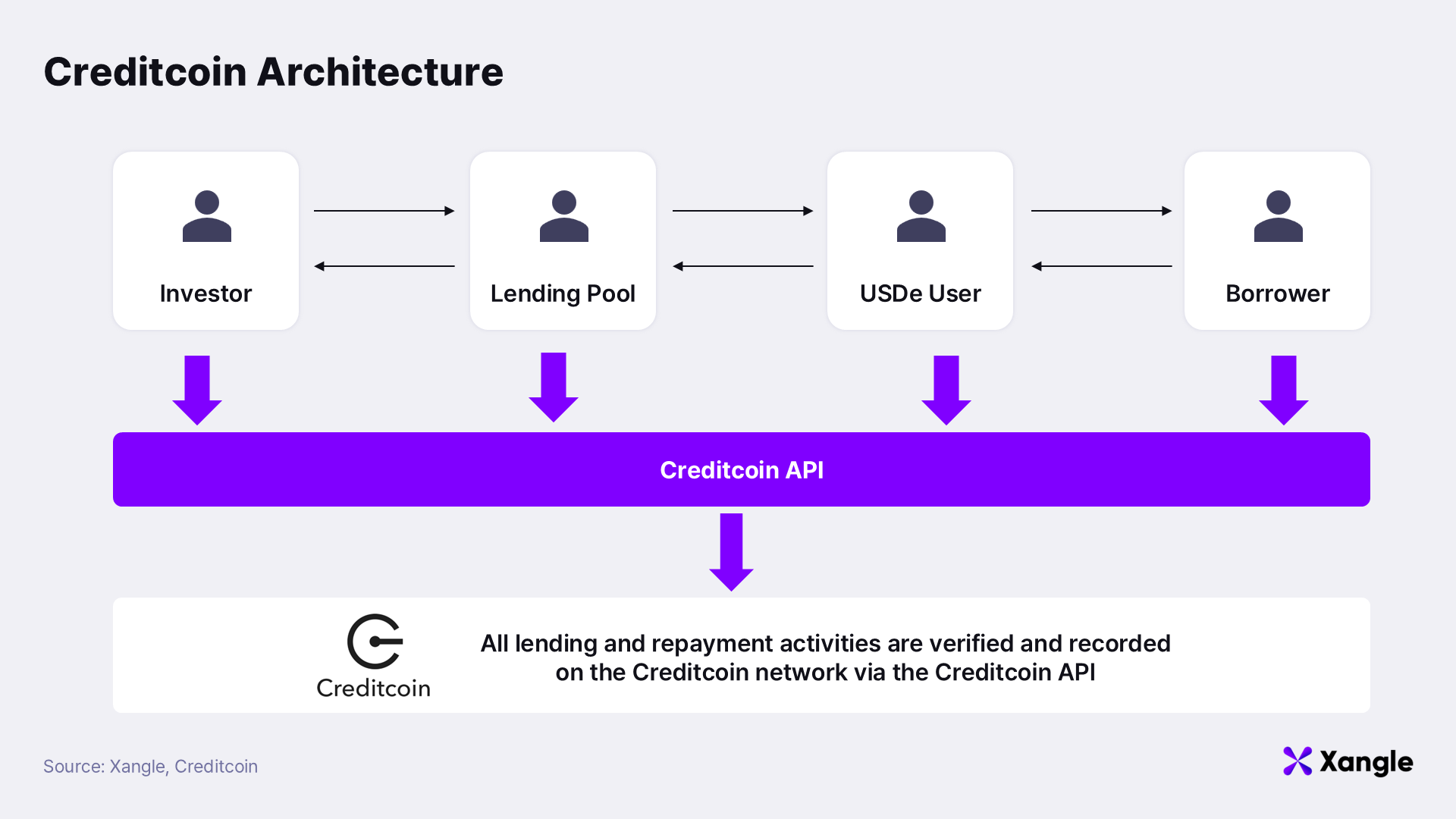

Creditcoin is a credit-specialized blockchain designed to migrate core borrowing and lending mechanics on-chain. Investors and borrowers propose terms and match in a decentralized marketplace, and outcomes are recorded immutably on-chain. Principal and interest still move on external networks such as Bitcoin or Ethereum, while Creditcoin verifies the corresponding transaction IDs to attest to settlement. The result is a decentralized gateway that stitches credit transactions across chains without anchoring the system to any single network.

Put differently, remittances occur on external chains while Creditcoin operates as the credit layer. The network’s sole mandate is to record, evaluate, and verify creditworthiness. Users no longer need to supply thick stacks of documents or income statements; on-chain histories serve as proof. Lenders and financial institutions can, in turn, assess borrower risk objectively against transparent data. The model enables credit-based lending even where legacy rails fail to function.

The architecture furnishes users with a publicly auditable credit record. Every loan and repayment sits immutably on the Creditcoin chain for open inspection. Investors can underwrite against observed behavior and calibrate risk models; borrowers who repay consistently graduate into better terms. Unlike closed, centralized credit bureaus, Creditcoin forms a distributed, non-monopolizable credit ledger; aligning incentives on both sides of the market.

At the center of the ecosystem is the CTC token, which powers network activity end-to-end: validator rewards, transaction fees, and EVM-based smart-contract interactions. Two derivative forms circulate on external networks: G-CRE, an exchange-listed ERC-20 widely traded, and wCTC, a wrapped ERC-20 with liquidity on Uniswap. Users can move between them via the SwapCTC tool, positioning Creditcoin as both an on-chain credit network and a multi-chain financial asset hub.

On the technical roadmap, Phase 1 transitions the network to an EVM-compatible Layer-1; Phase 2 introduces Universal Smart Contracts. Current mainnet EVM compatibility lets developers ship on Creditcoin with the same languages and tooling used on Ethereum, opening the door to a broader set of dApps and protocols. The Universal Smart Contract phase will let Creditcoin natively reference events from external chains—such as Bitcoin or Ethereum—to make multi-chain applications simpler and safer to build.

What, then, becomes achievable with this design? Creditcoin can address the long-tail market*—the underserved blind spots beyond incumbent financial networks. That market includes small businesses and individuals who fail traditional credit screens yet can be offered opportunities for economic growth that are transparently guaranteed on-chain.

Long-tail market: In the classical Pareto curve, the bottom 80% of demand historically considered less significant. It is the counterpoint to a world where a handful of core products dominate total sales; advances in IT have elevated the aggregate importance of these previously niche segments.

In practical terms, advancing financial inclusion*, using credit to improve quality of life and support economic self-reliance for those excluded from formal finance, can remove entrenched inefficiencies and unlock growth in regions constrained by structure, not potential. The opportunity is not merely humanitarian; financial institutions gain a new revenue line by onboarding vast populations previously unbankable due to missing credit data. With transparent, on-chain credit records, Creditcoin opens the gates to this substantial, untapped market.

*Financial inclusion: An environment where individuals and businesses can reliably and safely access useful, affordable financial products and services—transactions, payments, savings, credit, and insurance.

Creditcoin’s vision of blockchain-enabled inclusion is already taking shape in the field, most prominently through collaboration with the Government of Nigeria. Gluwa, the project’s developer, partners with the Central Bank of Nigeria (CBN) on the eNaira initiative to help the financially excluded build blockchain-based credit profiles. The partnership spans broader national programs as well—introducing blockchain to cultural and creative industries, providing blockchain education, and developing digital financial infrastructure. The work shows Creditcoin advancing beyond technical experiment into a component of national digital finance strategy, and it serves as an early proving ground for global scalability and institutional integration.

Expanding Across Chains with Universal Smart Contracts

Creditcoin’s ambitions extend far beyond serving as a credit layer for a handful of interconnected blockchains. The protocol ultimately aims to evolve into a comprehensive financial layer—an omnichain infrastructure capable of unifying countless blockchains into a single interoperable network. Within this envisioned architecture, Creditcoin seeks to record and verify every transaction across diverse ecosystems, from general-purpose blockchains such as Ethereum and Solana to digital assets in gaming economies and metaverse environments. By enabling such a foundation, the network could support entirely new forms of credit markets, where even in-game items or virtual properties become viable collateral across chains.

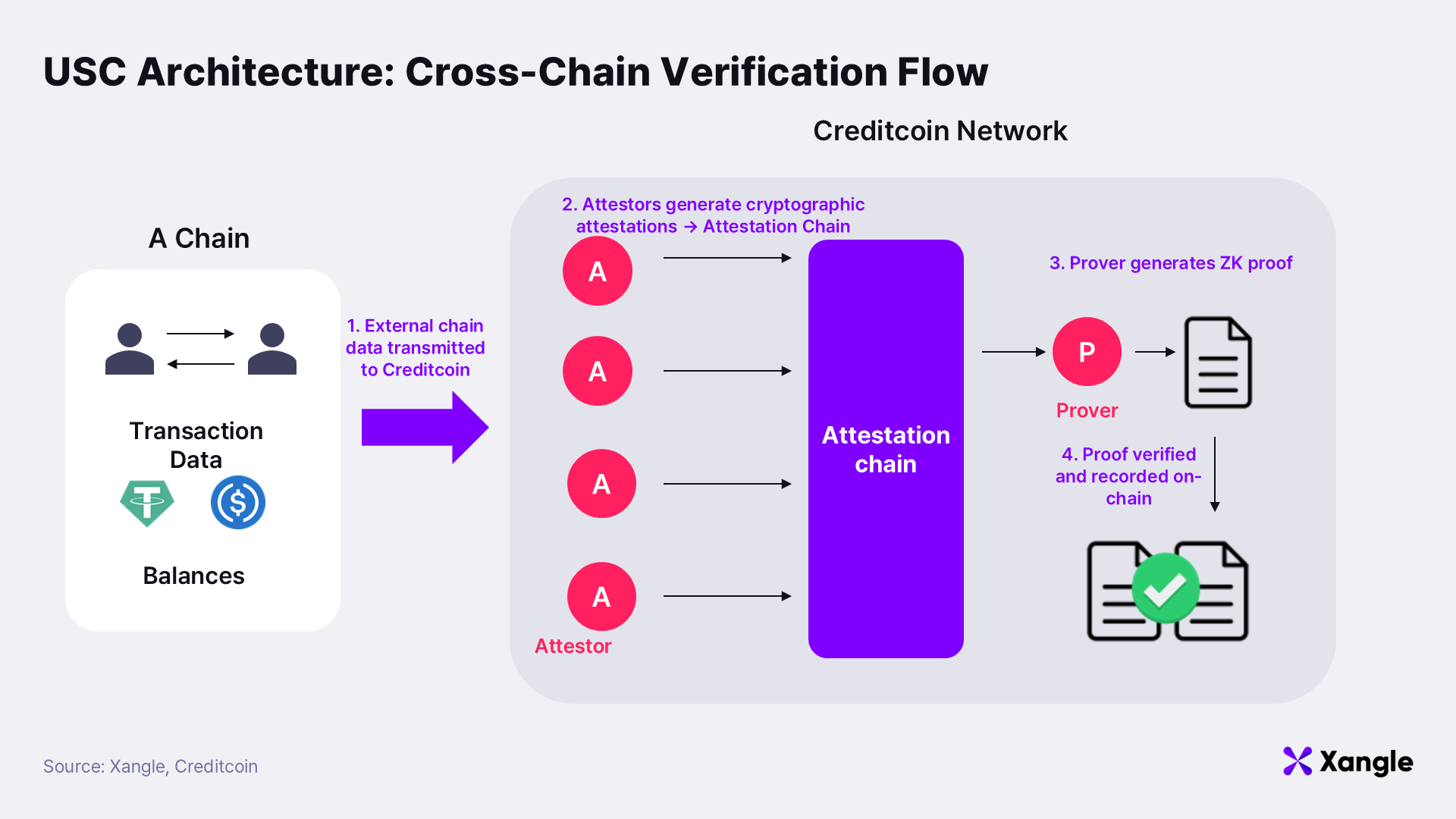

Achieving this vision requires a bridge architecture that connects multiple blockchains as seamlessly as if they were one. The most common solutions to date have relied on centralized oracles and bridges, but these approaches compromise the very principles that make blockchain trustworthy. Relying on a single oracle operator exposes institutions and users to a single point of failure, leaving them vulnerable to hacks, data manipulation, and fund theft. To address these structural flaws, Creditcoin introduces a new cryptographic framework known as the Universal Smart Contract (USC).

The USC is designed to overcome the inherent limitations of cross-chain data access. Currently live on testnet and preparing for mainnet deployment, it replaces trust-based bridge models with Zero-Knowledge (ZK) cryptography, specifically STARK-based proofs. Conventional cross-chain protocols depend on external oracles or bridge validators to attest to events occurring on other chains, a model that has repeatedly led to security breaches and scalability constraints. Creditcoin’s USC reimagines this paradigm through cryptographic attestation and mathematical verification, removing the need for trust in third parties.

USC’s design operates on two structural pillars. First, a network of Attestors reaches consensus on the transaction history of an external blockchain, producing a cryptographic summary known as the Attestation Chain. Next, a Provergenerates a STARK proof of a specific event—such as “a user repaid a loan on Ethereum.” The USC deployed on the Creditcoin network verifies this proof and recognizes it as mathematically validated truth. Rather than simply transferring data between chains, the USC brings cross-chain credit activity into a cryptographically provable statewithin the Creditcoin network itself.

This architecture holds significant practical value for financial use cases. When a borrower repays a loan on Ethereum, the USC generates a ZK proof validating the repayment, and Creditcoin subsequently mints a repayment NFT. This NFT functions as an immutable on-chain record of the borrower’s repayment performance. Over time, such verifiable records can underpin improved lending terms, algorithmic credit scoring, and access to multi-chain lending protocols. What were once isolated financial activities across separate chains can now be consolidated into a single, continuous credit history.

Several other projects, including LayerZero and ZetaChain, also pursue cross-chain interoperability, but their primary focus lies in messaging and bridging functions. Creditcoin’s USC takes a different approach—it establishes a ZK-verified, trust-minimized credit data layer. Instead of facilitating mere asset transfers, it extends the fundamental mechanics of credit—repayment, verification, and reputation—across multiple chains in a provably secure, cryptographic manner. This represents a shift from cross-chain communication to cross-chain finance infrastructure, embedding trustless credit verification directly into the multi-chain landscape.

Ultimately, the Universal Smart Contract forms the core engine of Creditcoin’s omnichain financial layer: the key component that synchronizes disparate blockchains into a unified economic environment. In this architecture, all assets and credit activities can be managed seamlessly across chains, transforming Creditcoin into a cohesive and transparent financial infrastructure that bridges the world’s fragmented blockchain economies.

Inside the Creditcoin Ecosystem

Creditcoin’s vision to build a financial layer atop an omnichain infrastructure is deeply aligned with the massive financial demand emerging from developing markets. Yet realizing that vision requires more than constructing the underlying network itself. The ecosystem must host an active suite of decentralized applications (dApps) that deliver tangible financial services, particularly lending and investment, on-chain.

For such applications to emerge organically, developers need compelling incentives. The most effective driver is a growing user base that creates natural demand for dApps built on the network. To that end, Creditcoin has placed strong emphasis on ecosystem expansion, with PenguinBase standing out as a central initiative. PenguinBase functions as both an accelerator of network growth and a foundational hub that makes it easier for developers to build, and for users to engage with, the Creditcoin ecosystem.

PenguinBase serves as an all-in-one portal for every dApp operating on the Creditcoin Layer-1 blockchain. It aims to become both the entry point and the primary destination for user interaction across the ecosystem. The platform is designed to streamline the developer experience and provide users with a unified, intuitive interface for exploring on-chain applications. Its development follows a clearly defined four-phase roadmap designed to gradually onboard and familiarize users with the broader Creditcoin ecosystem.

Phase 1: Preflight (Live)

The “Preflight” stage focuses on onboarding users and lowering the entry barrier into the Creditcoin ecosystem. This phase launched with an airdrop campaign and the first ecosystem game, offering a simple and accessible preview of on-chain experiences. The phase also introduced a unified dashboard presenting all available Creditcoin dApps at a glance, establishing a clean and convenient starting point for user exploration.

Phase 2: Takeoff (Upcoming)

The “Takeoff” phase emphasizes deepening user engagement. It will introduce new games developed by Mini and Studio Aitken, as well as a personalized “My Page” dashboard that tracks user activity and progress across the platform—creating a more interactive and tailored experience.

Phase 3: Boost Phase

The “Boost” stage focuses on full ecosystem integration and scalability. It will deliver a unified interface connecting games, dApps, and ecosystem tools while allowing users to manage their CTC (Creditcoin) directly within PenguinBase. Continuous additions of new games and dApps will ensure ongoing ecosystem expansion and sustained user activity.

Phase 4: Global Decentralized Infrastructure (Vision)

PenguinBase’s long-term vision is to evolve into a global decentralized infrastructure, serving as a universal gateway for users around the world to play, explore, and build credit. This goal reflects an ambition to go beyond a simple crypto portal—to become an indispensable layer of decentralized infrastructure redefining how users access and interact with digital life in the Web3 era.

Beyond PenguinBase, the Creditcoin network operates PenguinSwap, a decentralized exchange (DEX), and CreditWallet, the ecosystem’s official wallet solution. CreditWallet enhances accessibility by allowing users to manage multiple blockchains connected to Creditcoin through a single interface—eliminating the friction of handling assets spread across different networks. This design not only simplifies user participation but also strengthens overall ecosystem engagement.

All dApps built atop Creditcoin contribute to growing demand for the network’s native token, CTC, stimulating on-chain activity and reinforcing the broader token economy. As usage expands, this creates self-sustaining incentives for developers to build on Creditcoin, accelerating its evolution into a full-fledged financial layer. Among the various ecosystem initiatives driving this growth, the project drawing the most attention today is Spacecoin—the next major milestone in Creditcoin’s expansion trajectory.

Spacecoin: Bridging Finance and Connectivity

Creditcoin began as a protocol designed to build on-chain credit infrastructure. Over time, however, it has evolved into a broader ecosystem where multiple utility-driven projects grow symbiotically on top of the network. Among the diverse applications emerging across decentralized communications, real-world infrastructure, and dApp development, Spacecoinstands out as the most notable and rapidly advancing initiative.

Spacecoin is the world’s first satellite-based decentralized physical infrastructure network (DePIN) project, aiming to provide global 5G internet coverage through a constellation of low Earth orbit (LEO) satellites. Around the world, approximately 2.6 billion people still remain unconnected to the internet. Spacecoin seeks to deliver universal blockchain-based internet access to these populations, enabling them to participate in the Web3 economy. This represents more than just an advancement in telecommunications; it is an infrastructure revolution that removes physical connectivity barriers and expands digital financial accessibility to previously excluded regions.

The system’s architecture is elegantly simple. Each LEO satellite functions as a network node, while users connect via compatible ground devices. Data transmitted between satellites and ground stations is recorded immutably on-chain, and all network access and service payments are processed using Spacecoin tokens. Unlike traditional networks that depend on centralized telecom operators or state-controlled infrastructure, Spacecoin operates through a distributed mesh of satellites and blockchain nodes, ensuring three fundamental properties: censorship resistance, global coverage, and trustless connectivity.

This narrative integrates naturally with the broader Creditcoin ecosystem. Creditcoin’s growth to date has centered on building on-chain credit profiles for financially underserved populations, most notably in Nigeria, but the scalability of that model is limited by the need for institutional and governmental cooperation. Telecommunications infrastructure, on the other hand, faces fewer cross-border regulatory constraints, and the universal demand for internet access allows adoption to spread rapidly across regions. As such, Spacecoin introduces a new growth vector for the Creditcoin network, addressing the scalability limits of its financial focus and extending its reach into the communication layer of the global economy.

Because the Spacecoin network is built directly on the Creditcoin blockchain, every user connecting to the internet via satellite contributes to on-chain activity that generates demand for the CTC token. As users access the network through Spacecoin, all transactional and credit-related data flow back to the Creditcoin chain. This creates a flywheel effect: expansion of communication infrastructure → increase in user base → activation of the Creditcoin network → growth in CTC token demand.

Conclusion: Can Creditcoin Establish Itself as Global Financial Infrastructure?

Creditcoin has defined its product–market fit (PMF) around building blockchain-based credit infrastructure for developing economies and underbanked populations long neglected by traditional finance. Its recognition as a key partner of the Central Bank of Nigeria (CBN), and its role in enabling financially excluded individuals to establish on-chain credit profiles, illustrate how a technological vision can translate into tangible, real-world impact. The partnership marks one of the first instances where blockchain-based credit systems have been integrated into a national financial framework, demonstrating that decentralized infrastructure can serve as a genuine instrument for inclusion.

Still, a further leap is required for Creditcoin to evolve into truly global financial infrastructure. The progress achieved in Nigeria is an important proof point, but without broader geographic and functional adoption, Creditcoin risks remaining a regionally specialized network. Sustained global expansion will depend on the successful deployment of complementary application-layer projects that enhance its core credit architecture. Among these, Spacecoin and other decentralized communication initiatives represent a key strategic axis for network growth. Telecommunications, by addressing the universal demand for connectivity, can scale across borders far more rapidly than credit-based systems, while simultaneously creating additional on-chain demand for the CTC token.

The trajectory of Creditcoin’s future thus hinges on how quickly it can transcend its identity as a pure credit protocol and evolve into a multi-layered ecosystem. The pace at which application projects like Spacecoin mature will determine how effectively the network can amplify its ecosystem-wide network effects. As credit data, communication infrastructure, and decentralized applications converge into a single interoperable framework, Creditcoin stands positioned to move beyond the blind spots of traditional finance and emerge as a global financial backbone—an infrastructure capable of sustaining inclusive, multi-dimensional economic growth in the Web3 era.