Table of Contents

1. The Rise of DEXs and Solana at the Core

2. How Saros Establishes Its Edge in the Solana DEX Ecosystem

2-1. A unified liquidity and trading layer across spot and perpetuals

2-1-1. A spot DEX based on DLMM: High capital efficiency and customizable liquidity

2-1-2. A perpetual futures DEX powered by Orderly: 100+ listed pairs and CEX-level liquidity

2-2. $BERRY as the core incentive of the Saros ecosystem

3. Saros’ Expansion Strategy

3-1. Opportunities and potential in Asia, and Saros’ strategic advantage

3-2. Agile ecosystem expansion through broad partnerships

3-3. Securing scalability and sustainability through aggressive buybacks

4. Closing Statement – Can Saros Become the Future of Solana DeFi?

1. The Rise of DEXs and Solana at the Core

In traditional Web2 financial markets, centralized exchanges (CEXs) confined users to the role of simple buyers and sellers. Liquidity provision and price discovery were handled exclusively by market makers and the exchanges themselves, who monopolized both spread revenue and trading fees. As a result, ordinary users remained mere consumers of services, with no participation in the structural distribution of market profits.

Web3 exchanges particularly decentralized exchanges (DEXs) fundamentally transformed this paradigm. Smart contracts and automated market maker (AMM) mechanisms created an open environment where anyone can supply liquidity, and participants who deposit assets into liquidity pools earn a share of transaction fees whenever trades occur. With no centralized intermediary involved, the entire process of trading, settlement, and revenue distribution is executed on-chain, ensuring transparency and censorship resistance. This shift goes beyond technical progress; it represents a redesign of market roles and incentive structures.

On the strength of these structural advantages, the DEX sector has continued to grow rapidly. Over the past year, trading volumes on DEXs increased by 62% compared to CEXs.

At the center of this momentum is the Solana ecosystem. Solana is a high performance Layer 1 blockchain capable of processing up to 50,000 transactions per second, with sub second block finality and extremely low fees. Its speed and scalability make it an ideal environment for large scale on chain trading. This has sparked a wave of activity, from meme coin launchpads to real world asset (RWA) initiatives, while fueling highly active token trading among its growing user base.

As of August 2025, Solana’s total value locked (TVL) stands at approximately $11 billion, second only to Ethereum. In October 2024, its daily active users surpassed 9 million, and over the past year its average daily DEX trading volume has consistently exceeded $3 billion. These figures highlight that Solana has evolved far beyond being just a fast network; it has established itself as a global hub of DeFi liquidity.

This report begins with an overview of DEXs and the Solana ecosystem because Saros is positioning itself to become a core DeFi platform within Solana’s DEX market. Saros has emerged as a fast-rising protocol in the ecosystem. Founded in 2021 by Coin98 Labs, it has attracted strategic investments from the Solana Foundation and leading blockchain investors across Asia. In January 2024, Saros secured $3.75 million in private funding from Solana Ventures, Hashed, and Spartan Capital, accelerating its pace of development and expansion.

In the following sections, we will examine in detail how Saros intends to establish itself as the liquidity layer of Solana’s DEX market, and the strategic direction underpinning its growth.

2. How Saros Establishes Its Edge in the Solana DEX Ecosystem

2-1. A unified liquidity and trading layer across spot and perpetuals

Saros seeks to establish an integrated liquidity layer within the Solana ecosystem by delivering multiple DeFi services under a single umbrella. The vision extends beyond offering isolated products: the aim is to provide a seamless user experience where both spot and perpetual markets coexist within one platform.

Traditionally, DeFi users had to operate across fragmented venues, an AMM based DEX for spot trades and a separate perpetual futures exchange for leveraged positions. Saros eliminates this fragmentation by combining Saros Swap (spot DEX) and Saros Perps (perpetuals DEX) in one application. With a single wallet connection, users can access both markets, enabling frictionless on-chain activity across spot swaps, liquidity provision, staking, and leveraged trading.

Importantly, Saros’ vision is not limited to functional integration. The protocol is designed so that spot and perpetual markets reinforce one another, driving greater trading efficiency and optimizing liquidity utilization across the Solana ecosystem. For users, this means simplicity and capital efficiency; for the protocol, it delivers deeper liquidity and stronger network effects. The following sections detail the mechanics of Saros Swap and Saros Perps.

2-1-1. A spot DEX based on DLMM: High capital efficiency and customizable liquidity

At the core of Saros Swap lies the DLMM (Dynamic Liquidity Market Maker). Originating from Trader Joe’s Liquidity Book model and adapted for Solana, DLMM builds on the strengths of both AMMs and CLMMs (Concentrated Liquidity Market Makers), while overcoming their inherent limitations.

Conventional AMMs distribute liquidity evenly across the entire price curve, lowering barriers for LP participation but scattering capital inefficiently across wide ranges. CLMMs improved on this by allowing liquidity concentration within selected price ranges, raising efficiency but their reliance on continuous curve structures still exposes LPs to slippage during large trades and adds complexity to liquidity management.

DLMM resolves these structural weaknesses by dividing price ranges into discrete bins, with liquidity allocated directly into each. Trades executed within a single bin incur zero slippage, with prices only adjusting stepwise when crossing into the next bin. This design reduces price impact even on large volume trades, while enabling LPs to concentrate capital in specific bins to create deeper order books with the same liquidity. The result is simultaneously higher capital efficiency and stronger fee generation potential.

Visualization of DLMM structure (Source: Saros)

DLMM also features a dynamic fee mechanism that adjusts AMM fees automatically based on market volatility. During high volatility, fees rise, rewarding LPs more generously and dampening short term speculative trades that might otherwise drive extreme price swings. This mechanism reduces the risk of prices breaking beyond concentrated liquidity bands, mitigating the risk of LP capital becoming inactive or withdrawn.

In practice, LPs can allocate liquidity precisely to their chosen bins, enabling the formation of deep order books even with limited capital. The dynamic fee structure further ensures profitability in volatile markets while sustaining market stability. Beyond improving capital efficiency, DLMM introduces a customizable market participation model that empowers LPs to manage liquidity strategically. These characteristics give Saros’ DLMM a differentiated edge over conventional AMM and CLMM designs.

2-1-2. A perpetual futures DEX powered by Orderly: 100+ listed pairs and CEX-level liquidity

Saros has implemented an orderbook based perpetual futures DEX by leveraging the Orderly Network. Whereas many perpetual DEXs rely on vAMM or oracle driven models, Saros utilizes Orderly’s high performance Central Limit Order Book (CLOB) and matching engine. This combination delivers execution quality comparable to centralized exchanges while retaining the non custodial foundation of DeFi.

Orderly is a protocol that supplies builders with white-label infrastructure for perpetual trading, including order matching, settlement layers, and liquidity rails. By integrating this framework into the Solana environment, Saros is able to maintain its own UI/UX and community identity while simultaneously absorbing Orderly’s pre bootstrapped global liquidity and matching engine. As a result, Saros Perps differentiated itself from launch with more than 100 trading pairs, leverage of up to 50x, and rapid listing of new markets.

The Orderly architecture consists of three layers: asset layer – engine layer – settlement layer.

- The asset layer is composed of non custodial vaults on each chain, where deposits and withdrawals remain fully on chain. In Saros’ case, user assets are held in Solana based vaults, then reflected into Orderly’s unified liquidity pool via a messaging protocol.

- Once a user executes a trade, the engine layer comprising the CLOB, matching engine, and risk engine processes the transaction.

- All trade execution data is then finalized and settled within the settlement layer on Orderly’s L2, which is built on the OP Stack.

This architecture enables a unified orderbook across multiple chains while keeping assets in their native token standards. As a result, liquidity is able to interoperate across ecosystems without bridges, delivering three core benefits simultaneously: deep consolidated liquidity, transparent on chain records, and full self custody of assets.

2-2. $BERRY as the core incentive of the Saros ecosystem

The Saros ecosystem is underpinned by a dual track incentive structure combining the $SAROS token and $BERRY points. $SAROS serves as the governance token, with a total supply of 10 billion, conferring governance rights and participation privileges within the ecosystem. In contrast, $BERRY functions as a non transferable incentive point, designed not for speculative trading but for fostering long-term engagement and loyalty.

$BERRY is earned through Saros Garden, the staking program. Users who stake $SAROS accumulate $BERRY continuously in proportion to both the amount and duration of their stake the longer the lock up, the greater the rewards. Early unstaking results in the forfeiture of a substantial portion of accrued $BERRY, effectively discouraging short-term behavior and rewarding sustained contribution. This mechanism channels rewards toward committed participants rather than short term arbitrageurs.

The core utility of $BERRY lies in granting priority access within the Saros ecosystem. Future benefits for $BERRY holders are expected to include: (i) priority allocations in new project token presales and airdrops, (ii) xclusive participation rights in platform launchpads. These features dovetail with Saros’ partnership-driven expansion strategy outlined in Section 3-2. With Saros actively collaborating with launchpad platforms, $BERRY is poised to become a central mechanism for channeling liquidity into new tokens and rewarding early adopters anchoring its role as a key driver of ecosystem growth.

In sum, the combined $SAROS–$BERRY framework provides the foundation for Saros’ sustainable growth engine. $SAROS delivers immediate, tradable value as a liquid medium of exchange, while $BERRY creates a lock in effect by aligning long term participation with future reward potential. This balanced tokenomics design equips Saros with a critical edge in cultivating community loyalty and outpacing rival DeFi platforms.

3. Saros’ Expansion Strategy

3-1. Opportunities and potential in Asia, and Saros’ strategic advantage

Saros is part of the Ninety Eight ecosystem and was developed by Coin98 Labs, a Vietnam based blockchain pioneer. Ninety Eight operates both as a Web3 incubator and an investment platform, backing a wide range of projects including Coin98 Super Wallet, Viction, Ramper, Baryon, and Saros. Among them, Coin98 Super Wallet is Ninety Eight’s flagship product and the largest multi chain crypto wallet service in Southeast Asia. By 2024, it had secured over 10 million users worldwide, with roughly half located in Southeast Asia. Saros is now leveraging this established user base and community network to rapidly expand its footprint across regional markets.

Southeast Asia presents fertile ground for expansion, being both crypto friendly and rapidly scaling. According to Chainalysis (2025), Vietnam has ranked within the global top five of the Crypto Adoption Index for four consecutive years. As of 2024, approximately 21.2 million Vietnamese had either owned or used cryptocurrencies, with annual crypto transaction volumes projected to surpass $100 billion.

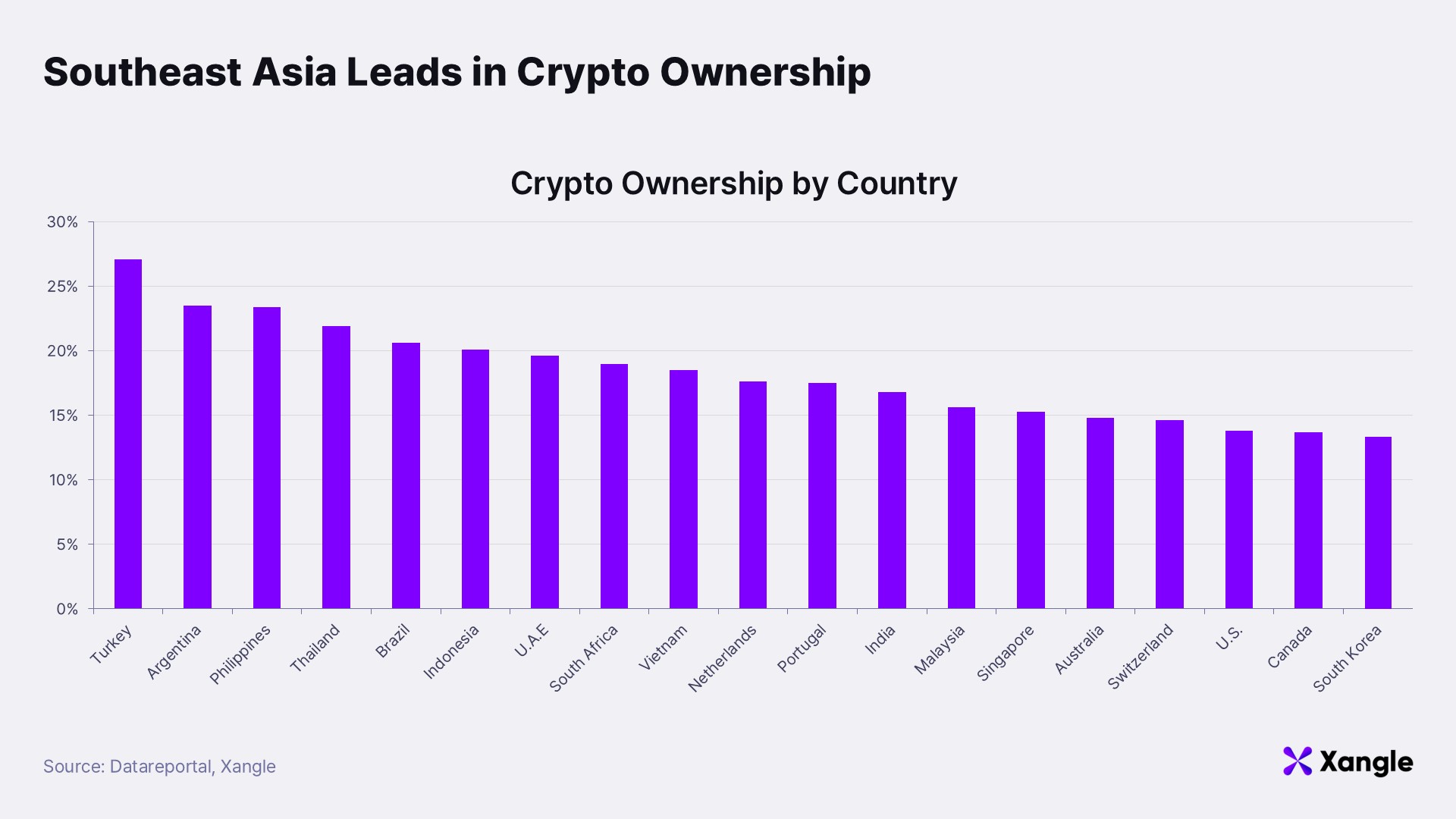

Other Southeast Asian markets also demonstrate strong affinity for crypto adoption. Datareportal’s survey of national crypto ownership rates places the Philippines 3rd globally at 23.4%, Thailand 4th at 21.9%, and Indonesia 6th at 20.1%.

From a regulatory standpoint, Saros benefits from clear advantages in the region. Thailand has already established a relatively mature framework. Platforms offering Thai Baht denominated trading must obtain an SEC license, while unlicensed foreign exchanges are prohibited from operating fiat markets. In June 2025, the government went further, blocking access to platforms such as Bybit, OKX, and CoinEx. Only a handful of licensed operators including Bitkub, Satang Pro, Upbit Thailand, and KuCoin Thailand (formerly ERX) remain authorized to provide fiat on/off-ramps. In effect, Thailand has shifted toward an environment where only licensed exchanges are recognized a regulatory reset that directly favors projects like Saros with strong local presence and partnerships.

Vietnam, by contrast, remains in the early stages of regulatory development. The central bank does not recognize digital assets as legal tender, and no fully licensed fiat-linked exchanges exist. At present, P2P platforms such as Binance P2Pand Remitano, alongside OTC markets, serve as the primary gateways. Still, the government has formed a dedicated research committee to study crypto regulation, laying the groundwork for eventual legalization. Once a regulatory framework is introduced, Vietnam’s vast crypto user base could be served through compliant on/off-ramp markets, translating into significant opportunities for Saros to capture both users and liquidity.

In short, Saros holds a strategic local advantage built on Ninety Eight and Coin98’s entrenched networks, brand strength, and substantial user base in Southeast Asia. These localized assets position Saros to maximize opportunities and preempt latent demand across the region. As regulatory frameworks mature and markets expand, this foothold will serve as a decisive competitive edge for Saros in its bid to become the leading Solana based DeFi hub in Southeast Asia’s fast accelerating crypto economy.

3-2. Agile ecosystem expansion through broad partnerships

Saros is not limiting itself to protocol development alone; it is pursuing an aggressive, multi-pronged partnership strategy to rapidly scale liquidity infrastructure across the Solana ecosystem. Within just two months, Saros announced more than 15 new partnerships, making it one of the most aggressive movers in the space over that period. These collaborations span the full spectrum of the ecosystem, including stablecoin issuers, cross-chain bridges, trading tools, analytics platforms, and aggregator DEXs.

A notable example is Saros’ partnership with R2Yield, issuer of the RWA backed stablecoin R2USD, collateralized by U.S. Treasuries and private credit. The collaboration opens a gateway for yield bearing real world assets to flow into Solana DeFi. Saros has also integrated Wormhole’s cross chain infrastructure to bring in external chain assets and liquidity, while connections with major aggregator DEXs such as OKX Swap, Titan Exchange, and Dex3 ensure that Saros liquidity pools sit at the center of multiple trading pathways.

Saros is equally active in enhancing data accessibility. Through integrations with CoinGecko, GeckoTerminal, Birdeye, and DefiLlama, Saros now provides real time public data on TVL, trading volumes, and pool compositions across its AMM and DLMM pools, empowering traders and LPs to make more informed decisions. In addition, Saros partnered with Debut, a Solana based token launch platform, enabling newly launched community tokens to be instantly listed and paired with liquidity on Saros. While Debut remains in an early stage in terms of liquidity and volumes, the collaboration lays the groundwork for potential market activation and expanded trading opportunities.

The fact that Saros secured more than 15 partnerships in just two months underscores the project’s determination to seize as many growth opportunities as possible in the short term. Each collaboration brings concrete benefits: new liquidity inflows, broader asset accessibility, and enhanced data transparency, directly driving ecosystem-wide trading activity and user acquisition. Looking ahead, Saros is also exploring additional partnerships with genesis launch protocols, which would further diversify the range of new tokens available for trading on the platform.

3-3. Securing scalability and sustainability through aggressive buybacks

Since the start of 2025, the price of $SAROS has skyrocketed by over 2,600%. Driving this extraordinary rise has been Saros’ aggressive buyback strategy. In August 2025, the Saros Foundation formalized a quarterly buyback program and disclosed that it had already repurchased 100 million $SAROS (worth approximately $38 million) from the open market. According to the Foundation, the program represents both “an investment in the protocol’s future growth and a signal of confidence to the community.” By directly channeling protocol revenues into $SAROS buybacks, Saros has taken a bold approach to reinforcing intrinsic token value and strengthening investor trust.

Crucially, the buyback program is not a one-off event but is designed to be sustainable. The Foundation plans to allocate up to 20% of quarterly revenues toward repurchasing $SAROS on a regular basis. The repurchased tokens will either be burned or re-staked to regulate circulating supply. In doing so, Saros has established a direct link between its economic performance and token value, aligning platform growth with the appreciation of user-held assets.

Saros’ buyback strategy ultimately targets two objectives simultaneously: in the short term, supporting price stability and reinforcing investor confidence; in the long term, building a sustainable token economy where revenues are consistently recycled into value accrual. The sustainability of this model, however, depends on Saros’ ability to generate stable and recurring revenues. To this end, the protocol is prioritizing trading volume growth and market share expansion. Given the rapid momentum of the Solana DeFi ecosystem and Saros’ own accelerated trajectory, this flywheel effect appears likely to persist. Still, its long-term viability will hinge on Saros’ capacity to secure a broader user base and deepen transaction activity critical factors that warrant close monitoring as the project scales.

4. Closing Statement – Can Saros Become the Future of Solana DeFi?

As highlighted at the outset, the Solana ecosystem has established itself at the heart of blockchain DeFi, delivering performance so strong that it is often described as the sector’s current epicenter. The explosive rise of DEX activity has been fueled in large part by launchpad platforms such as Pump.fun and Let’s Bonk, amplified by Solana’s network speed, low fees, vibrant community, and the steady rollout of new launchpad applications.

Against this backdrop of rapid growth, securing a durable competitive edge is no easy task. Established DeFi protocols such as Raydium, Jupiter, and Meteora already command strong user bases and hold firm positions within their respective domains. Even so, as the overall market continues to expand, capturing even a modest share can represent a meaningful outcome.

Saros is navigating this environment with focus and agility. The team is regarded as possessing both the potential and execution capability to deliver on its vision. With an established network and brand presence across Southeast Asia, Saros has rapidly forged partnerships with a wide spectrum of DeFi protocols and infrastructure providers to accelerate ecosystem expansion. In parallel, the project has been proactive in stablecoins and RWAs, positioning itself to channel new liquidity flows into Solana.

The journey ahead remains long, but Saros has already demonstrated a clear strategy, scalable partnerships, and strong localization advantages, giving it significant growth potential. Whether Saros will ultimately emerge as a central hub within the Solana DeFi ecosystem remains to be seen but it is undoubtedly a project worth watching as Solana DeFi continues to evolve.