Table of Contents

1. Robinhood’s Structural Experiment and the Changing Dynamics of the Web3 Perpetual Futures Market

2. How Variational is Building Its Edge in the Perpetual Futures Market

2-1. A zero-fee exchange powered by its own vertically integrated market maker and Oracle model

2-2. Securing sustainability and scalability by sharing market-making profits with users

2-3. Agile listing strategy delivering coverage of over 500 tradable assets

3. What’s Next in Variational’s Expansion Strategy?

3-1. Expanding into an OTC exchange to meet the growing on-chain trading demand from institutions

4. Final Thoughts – Variational Driving Fresh Momentum to the Perpetual Futures Market

1. Robinhood’s Structural Experiment and the Changing Dynamics of the Web3 Perpetual Futures Market

Robinhood is one of the most notable examples of a company that upended the U.S. stock brokerage industry with a groundbreaking decision to eliminate trading commissions entirely. In the traditional brokerage model, charging a fixed commission per trade was an unquestioned norm. Robinhood broke that convention with a simple yet powerful proposition: “Trading should be free.” The message resonated strongly with U.S. retail investors, enabling the platform to rapidly capture market share. The results were extraordinary. As of 2025, Robinhood had 25.9 million funded accounts and approximately $279 billion in assets under custody. By 2024, it commanded roughly 50% market share, leaving major competitors far behind.

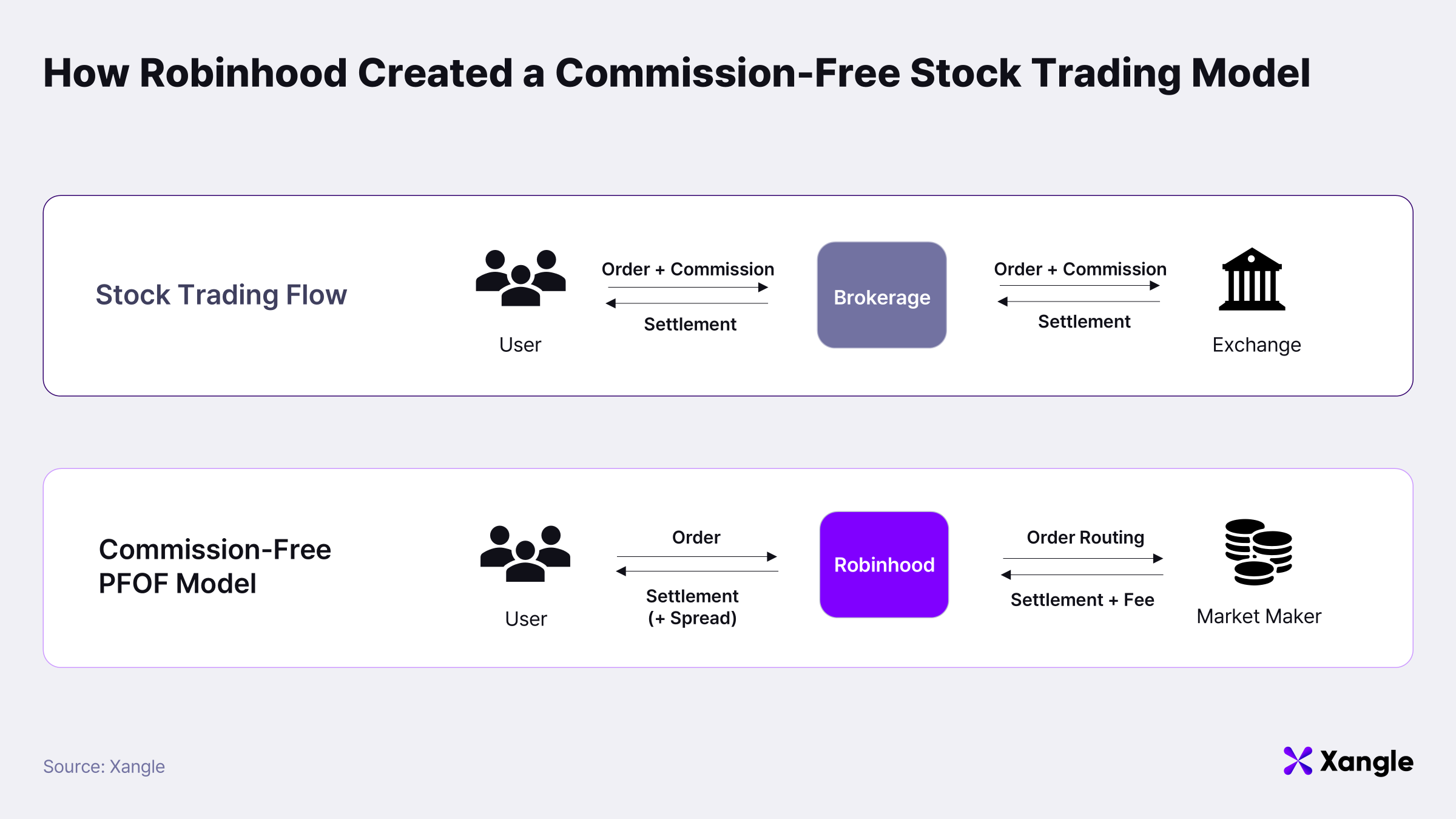

How did Robinhood build a commission-free trading model?

The answer lies in its adoption of a dealer-based execution framework combined with a Payment for Order Flow (PFOF) structure. Traditionally, securities platforms routed user orders to exchanges for execution and charged an explicit commission in return. Robinhood reengineered this process from the ground up. Instead of executing orders itself or sending them to an exchange, it directed them to institutional market makers. These market makers, in exchange for access to Robinhood’s order flow, paid the company a fixed fee per share traded—this is the essence of PFOF. This allowed Robinhood to remove visible fees for users while securing a hidden revenue stream from market makers. The shift represented more than a price cut—it was a structural innovation that lowered perceived trading costs while redesigning the platform’s economic foundation.

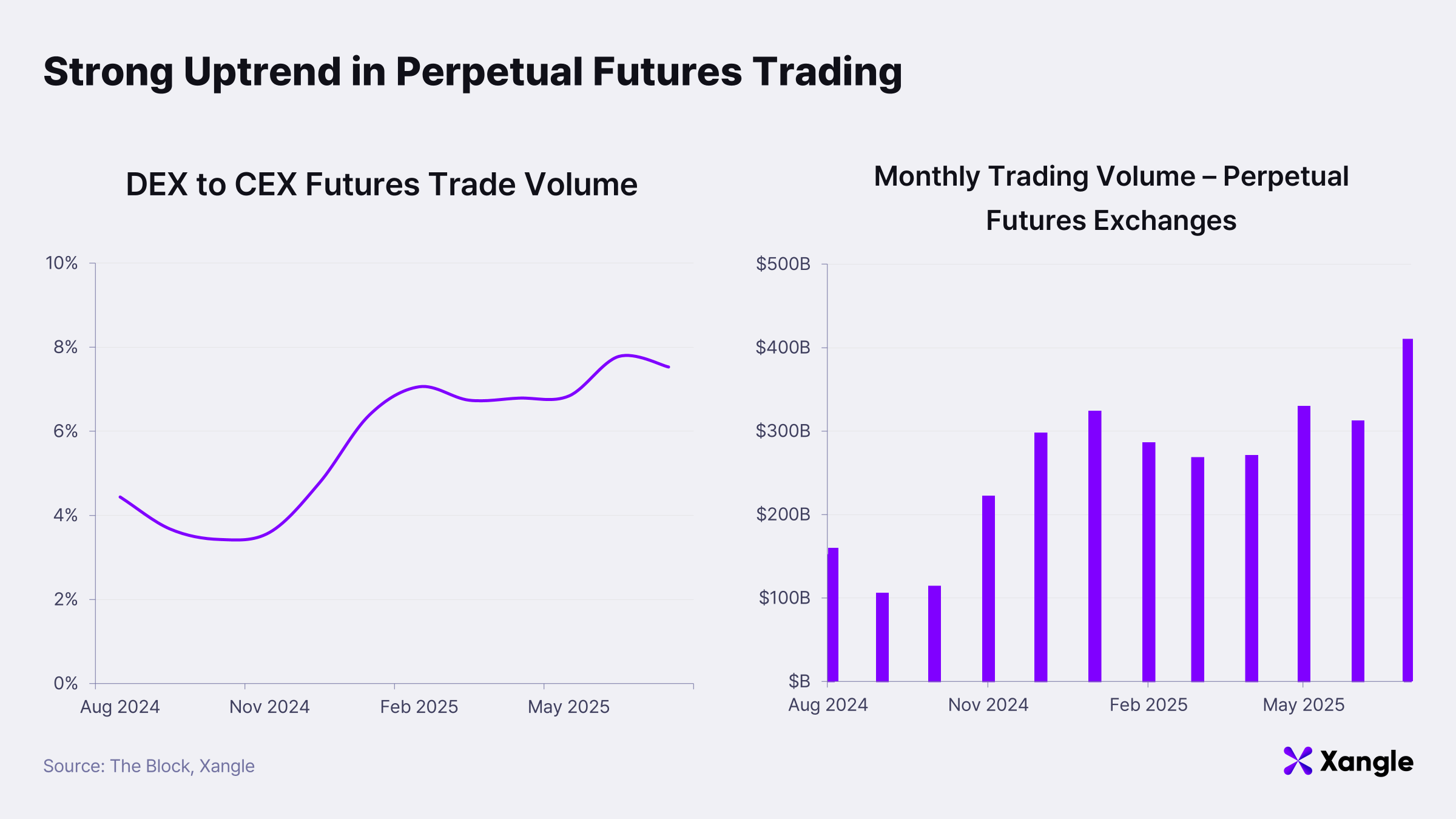

The Robinhood example is relevant here because a similar structural experiment is taking shape in the Web3 perpetual futures (Perpetual DEX) market. Over the past year, perpetual futures have become one of the fastest-growing on-chain sectors. As of July 2025, trading volume in the segment reached $400 billion up 177% year on year signaling rapidly expanding demand. According to The Block, by August 2025, on-chain perpetual futures volume is projected to reach approximately 12% of centralized exchange (CEX) futures volume.

It is in this context that Variational is seeking to redefine the structural foundations of the perpetual futures market. Centering its model on one of the industry’s rare 0% trading fee policies—and building the technical architecture to make that possible—Variational offers a user experience and revenue framework fundamentally distinct from conventional perpetual futures exchanges.

This report examines how Variational has engineered a model that generates revenue without imposing trading fees, as well as the competitive advantages it brings in risk management, liquidity deployment, and user experience. From there, we evaluate the differentiated positioning the project is establishing within the perpetual futures market and the growth potential it holds.

2. How Variational is Building Its Edge in the Perpetual Futures Market

Variational is an on-chain derivatives infrastructure protocol founded by entrepreneurs with deep expertise in quantitative trading and market making. Co-founders Lucas Schuermann and Edward Yu previously launched the hedge fund Qu Capital, which was later acquired by Digital Currency Group (DCG). At DCG, Lucas served as Vice President of Engineering at Genesis Trading, while Edward was Head of Quantitative Research. The two later founded the market-making firm Variational Research, supplying liquidity to major CEXs and DEXs, and amassing extensive market experience across both on-chain and off-chain venues.

Rather than operating as a single application, Variational is designed as a general-purpose framework capable of hosting a wide range of derivatives trading services. It is currently deployed on Arbitrum. The perpetual futures exchange examined in this report, Omni, is the first retail-focused application launched on the Variational protocol. Omni enables commission-free trading across hundreds of tokens. Backed by its structural innovations and growth potential, Variational has raised $10.3 million in seed funding from Bain Capital Crypto, Coinbase Ventures, and Dragonfly Capital.

2-1. A zero-fee exchange powered by its own vertically integrated market maker and Oracle model

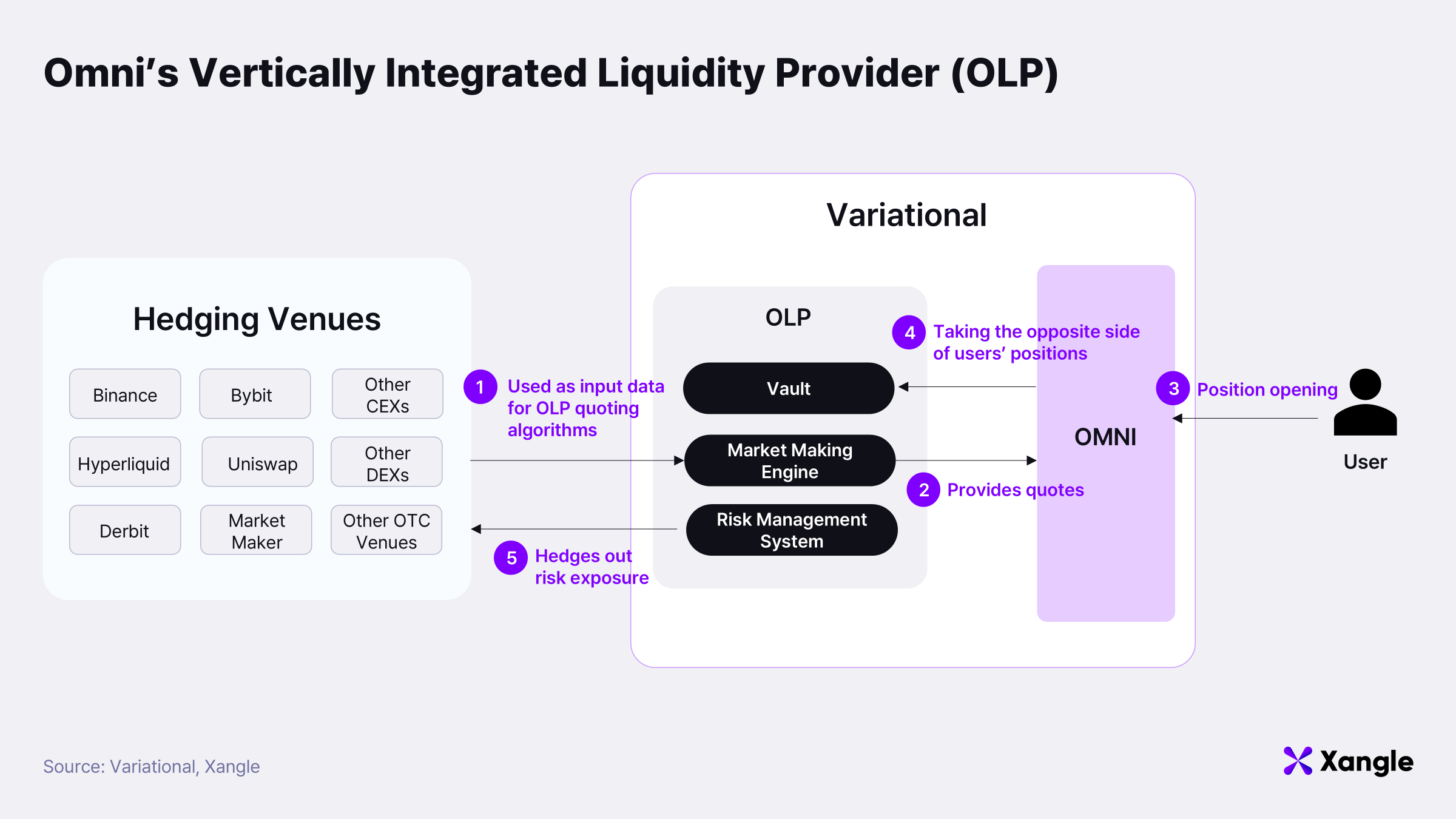

Omni positions itself as a “0% fee” exchange, yet is built on a unique architecture that allows it to generate stable, recurring revenue without reliance on external market makers. In a typical futures exchange, external market makers quote prices and fill user orders, capturing the resulting spread profits; profits the exchange itself cannot easily retain.

Omni adopts a different approach. It employs a oracle model where the counterparty to every trade is a single internal entity, the Omni Liquidity Provider (OLP). The platform sources external price data through oracles, then uses the Request for Quote (RFQ) system to generate real-time quotes. Once a trade is executed, the OLP automatically takes the opposite position. This design ensures that all spread revenue remains within the platform rather than leaking to outside participants.

Since the liquidity pool automatically takes the opposite side of user trades, it inherently carries liquidation risk. To mitigate this, Omni hedges a portion of its positions on external CEXs or DEXs.

The advantages of this architecture are clear: the OLP captures all spread revenue, which flows directly into platform earnings. This allows Omni to prominently deliver a “commission-free trading” experience, akin to Robinhood, while maintaining profitability. Crucially, this is not a marketing gimmick but a structural advantage grounded in economic design.

Another fundamental strength of Omni’s model is that it has no need to sell user order flow to external market makers. In the Web2 paradigm, brokers like Robinhood remove trading commissions but monetize by routing user orders to outside dealers in exchange for rebates. While this can reduce visible costs for users, it has long been criticized for degrading execution quality, introducing conflicts of interest, and reducing transparency.

Omni sidesteps these structural pitfalls entirely by keeping the counterparty in-house via its liquidity pool. As a result, while the “zero-fee trading” label might appear similar to Web2 models, the underlying revenue engine is entirely different. This is a Web3-native design innovation—one that achieves both user protection and platform profitability within a single, coherent framework.

2-2. Securing sustainability and scalability by sharing market-making profits with users

One of Omni’s defining strengths is that the spread revenue generated by its internal market maker (OLP) is not simply funneled into protocol operations, it is actively redistributed to the community. Whereas most platforms treat fee revenue or points-based rewards as short-lived marketing levers, Omni embeds rewards as a structural mechanism within its core design.

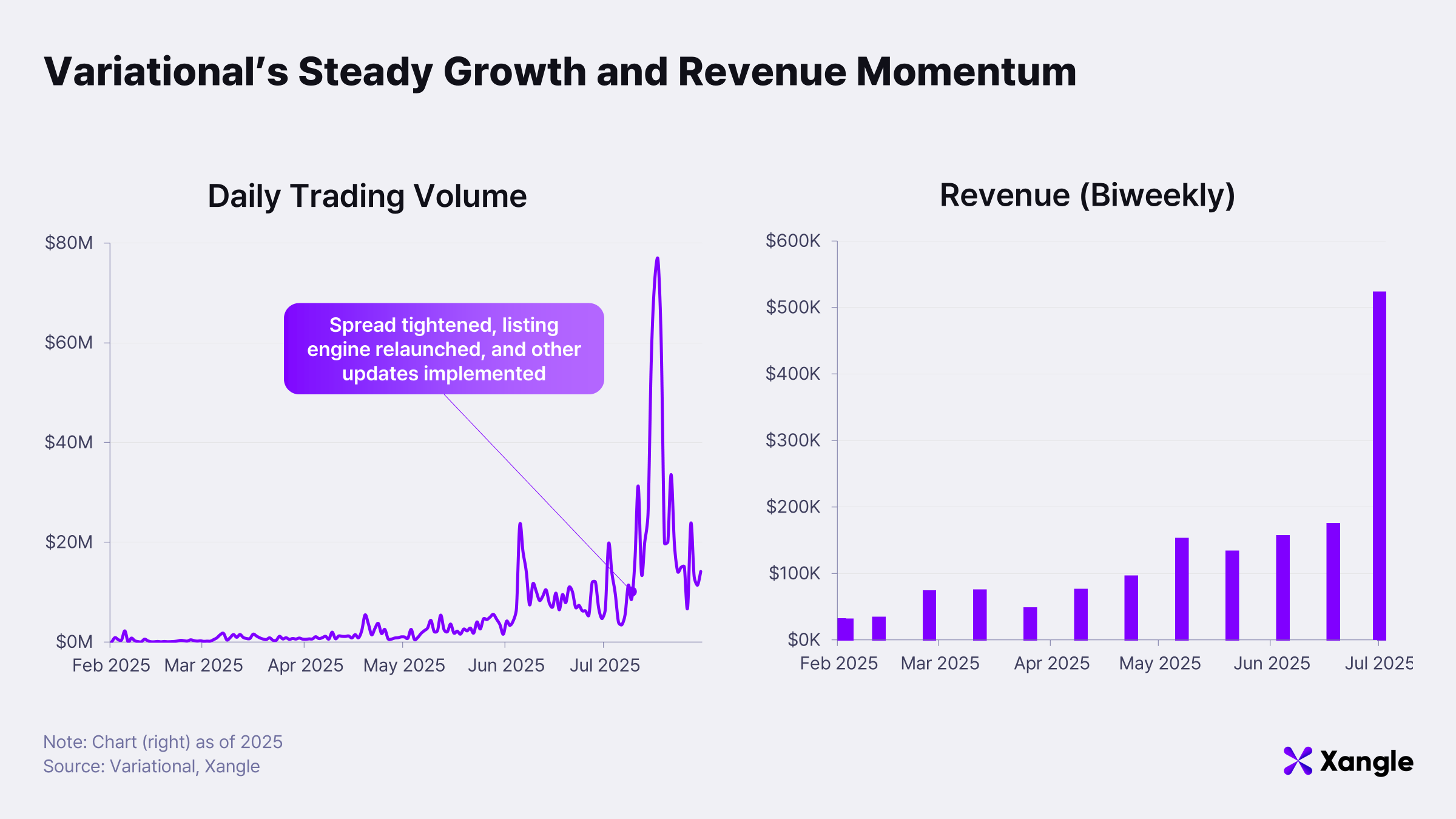

In July, Omni’s daily trading volume peaked at approximately $80 million and has recently stabilized in the $10–20 million range. This sustained volume has translated into steady revenue growth. Between February and July 25, cumulative revenue reached around $1.5 million, with annualized revenue projected at $3.5 million. Given that the platform is still in private beta with a limited user base, these figures are expected to scale significantly once access opens.

All profits flow back to users through a variety of reward programs. This is not a margin-extraction model; it is a framework in which protocol-level earnings are systematically shared with participants, a major point of differentiation.

A prime example is the Loss Refund program. Using the spread revenue retained within the platform, Omni refunds traders a portion of their losses in USDC. The maximum refund rate is set to increase to 80%, and unlike one-off point airdrops or time-limited campaigns, this operates as a permanent, sustainable incentive mechanism.

Additional reward programs include:

- Cumulative Volume-Based Cashback: When aggregate trading volume reaches set milestones, tens of thousands of dollars in USDC are distributed to participating users, directly aligning ecosystem growth objectives with tangible user rewards.

- Twitter PnL Card Sharing Events: Traders who share performance snapshots receive rewards, simultaneously boosting platform visibility and retention.

- Tier-Based Spread Discounts: Users can receive up to a 25% discount on spread costs based on trading activity and volume.

From the user’s perspective, these mechanisms maximize cost efficiency. Comparing trading costs makes the advantage clear:

- On Hyperliquid, opening a Bitcoin long position incurs a 0.045% fee.

- On Jupiter, the same position costs 0.06%.

- On Omni, there is no trading fee—only a 0.03% slippage cost, much of which is effectively rebated through reward programs.

By internalizing market making, Omni eliminates revenue leakage to external entities and channels those savings directly into user benefits. This structure serves as a powerful incentive mechanism for ecosystem growth as lower trading costs accelerate both user acquisition and trading activity, while competitive OLP APYs drive liquidity provision.

2-3. Agile listing strategy delivering coverage of over 500 tradable assets

Futures trading demand in Web3 consistently gravitates toward high-volatility assets, particularly meme coins and newly launched tokens, where rapid price movements make leverage and hedging especially valuable. In such circumstances, the ability to list new assets rapidly and provide smooth trading conditions is not just a convenience; it is a core determinant of a platform’s competitive edge.

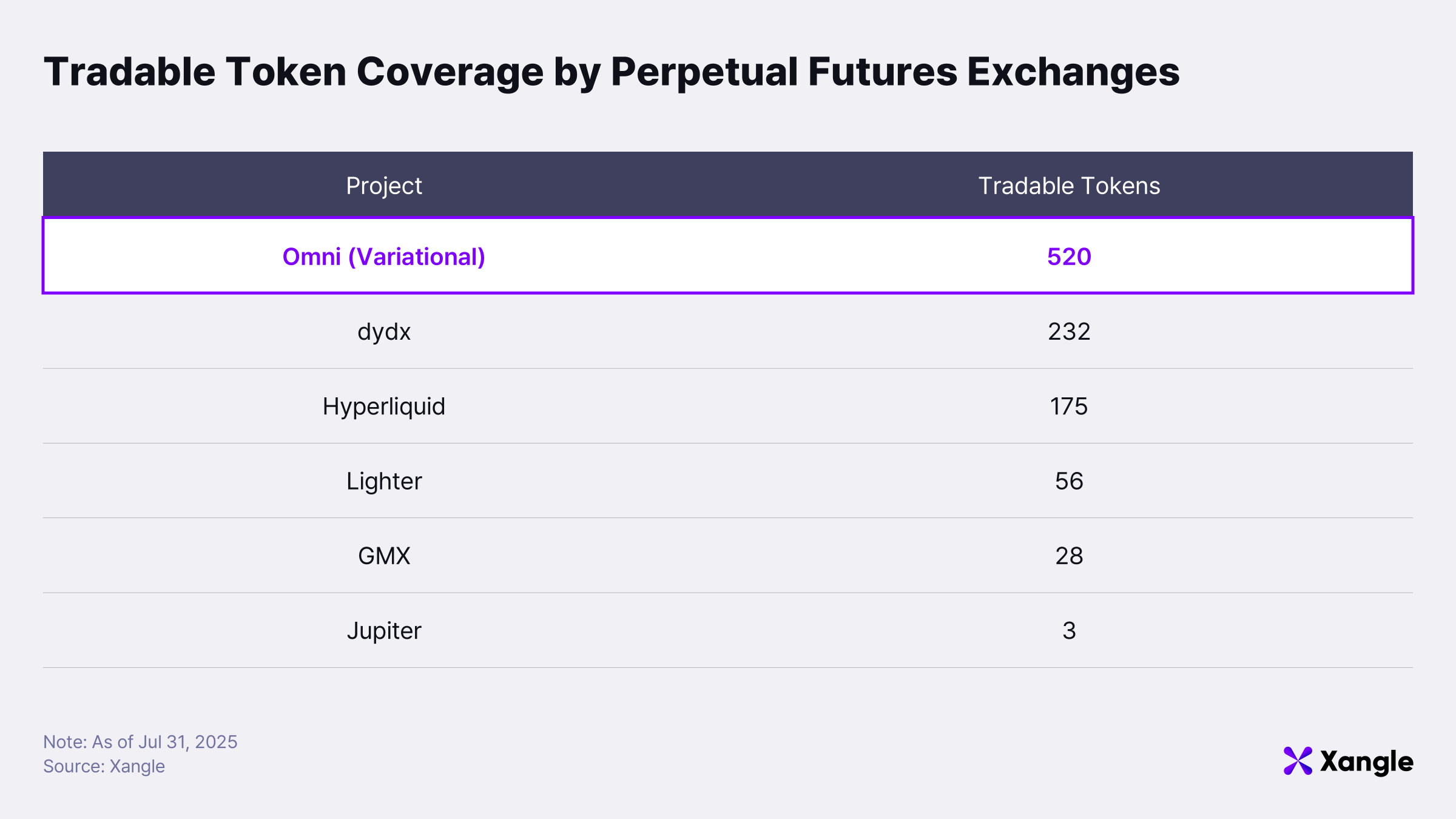

Within this context, Omni has secured a leading position. As of July 31, 2025, the platform already supports trading for 520 tokens, far surpassing Hyperliquid (175), GMX (28), and Jupiter (3). And it’s not only about the breadth of coverage; the speed of listings is equally noteworthy. For example, Eclipse ($ES), which held its TGE on July 16, began trading on Omni just three hours after launch. However, as is often the case in the initial stages of trading, spreads can be relatively wide, so traders should exercise appropriate caution.

This agility is rooted in Omni’s architecture. With no reliance on external market makers and the OLP serving as the counterparty for all trades, new markets can go live instantly as soon as price data from oracles is integrated, and no separate liquidity sourcing required.

The listing process is fully automated: once certain criteria are met, trading is activated without manual review. The requirements are:

- Oracle Price Feed Availability: Adequate liquidity across both CEXs and DEXs.

- Market Activity Thresholds: Minimum market cap, 24-hour volume, and holder count.

- Decentralized Token Distribution: No excessive concentration of supply in a single wallet or small group.

- Smart Contract Security Check: No malicious code such as honeypots or transfer restrictions.

Assets that meet these conditions are listed automatically, with the OLP providing liquidity from day one. During this process, Omni uses the na Oracle that aggregates CEX and DEX data to determine a fair value, ensuring pricing stability.

In effect, Omni offers an infrastructure capable of listing assets rapidly, securely, and at scale. Being the first to bring a broad range of assets into the perpetual futures market is not just part of its strategy—it is one of its most potent competitive weapons.

3. What’s Next in Variational’s Expansion Strategy?

3-1. Expanding into an OTC exchange to meet the growing on-chain trading demand from institutions

Beyond its retail-focused exchange, Variational is also preparing to launch Variational Pro, an OTC exchange designed for institutional investors. This move reflects a strategic effort to establish differentiated competitiveness in step with the accelerating institutional adoption of crypto—driven in part by recent regulatory easing.

Although Variational Pro has not yet gone live, its architecture is being developed around the following core capabilities:

-

On-Chain Automation of the Institutional OTC Derivatives Workflow:

The multi-trillion-dollar institutional OTC derivatives market still operates through cumbersome off-chain processes—Telegram chats, email negotiations, legal review, and bank wire transfers. Variational Pro aims to fully on-chain this workflow, enabling real-time clearing and settlement, automated margin management, and a transparent, competitive pricing environment.

-

Structural Safeguards Against Counterparty Default Risk:

Counterparty credit risk remains a central concern in institutional trading. Variational Pro mitigates this risk by holding assets in secure, escrow-based smart contracts. Per-trade margin requirements and liquidation rules can be customized, providing built-in protection against counterparty failure.

-

Trading for Pre-Listing Tokens and Custom Derivatives:

Institutions will not be limited to listed assets—they can trade pre-listing tokens and bespoke derivatives unavailable on conventional exchanges. With the ability to define trade structures and request liquidity via RFQ, institutions can execute complex options and futures strategies entirely on-chain.

-

Fully P2P, Non-Custodial Operation:

Variational Pro will function as a fully peer-to-peer, non-custodial platform. Institutions transact directly with one another without third-party intermediaries, while collateral is held in segregated settlement pools—eliminating risks from platform insolvency or unauthorized external access.

In practical terms, Variational Pro’s goal is to bring the multi-trillion-dollar traditional OTC derivatives market on-chain, addressing the inefficiencies, opacity, and counterparty risks that have long defined institutional trading. The combination of deep RFQ-based liquidity, automated margin and liquidation management via smart contracts, and extensive customizability is designed to make OTC trading faster, safer, and more flexible. If delivered as planned, these capabilities could establish Variational as a full-stack derivatives infrastructure providerspanning both retail and institutional markets. However, with the platform still in pre-launch, its eventual performance, stability, and real-world adoption will need to be closely monitored as it comes online.

4. Final Thoughts – Variational Driving Fresh Momentum to the Perpetual Futures Market

Variational is building a differentiated position in the perpetual futures market through a retail-first structural design. Its fee-free trading environment, paired with a model that channels internal revenue back to both the protocol and the community, extends far beyond user convenience, forming the basis for a sustainable and scalable ecosystem. Steadily rising trading volumes and consistent revenue generation indicate that this model is already proving effective in practice.

The platform’s strategic direction is clearly laid out in its roadmap: launching with the Loss Refund program, followed by a UI overhaul, the introduction of a read-only API, and ultimately a trading API. In contrast to most exchanges, which prioritize attracting high-frequency and algorithmic traders, Variational is deliberately prioritizing a retail-centric trading experience and reward architecture from the outset. This approach reflects its core design philosophy: ensuring that value created on the platform remains within the protocol and its users, rather than flowing to external market makers.

Its listing strategy further highlights this competitive edge. Supported by an oracle-driven automated system, Variational already offers trading for hundreds of assets, with the capability to list new tokens within hours of their TGE. In a market where meme coins and new projects emerge at a rapid pace, a futures exchange that can deliver both speed and breadth of coverage offers users tangible opportunities and a clear market advantage.

That said, there is an important caveat: newly listed assets may initially have limited liquidity, leading to temporarily high slippage. Variational addresses this by using its in-house oracle system to aggregate pricing from trusted venues such as Binance and Uniswap, producing reliable fair values. Looking ahead, it plans to introduce a user liquidity deposit feature to further enhance trading stability.

Ultimately, Variational is more than another perpetual DEX—it is an experimental platform aiming to deliver a structural alternative to the Web3 derivatives market. Just as Robinhood reshaped the standard for user experience in Web2 with commission-free trading, Variational is reengineering that model for Web3 in a more transparent and sustainable form. While still in its growth stage, its structural experiment has the potential to establish a new benchmark for the perpetual futures market.