Table of Contents

1. Table of Contents

2. 2Q25 Key Highlights

2-1. Securing both speed and scalability with the “Lightning Upgrade”

2-2. BTC On-chain utility expands with Bitcoin-collaterlized stablecoins

2-3. Omnichain reach extends to Avalanche and Arbitrum

2-4. Expanding accessibility through Coinbase on-ramp integration

3. On Chain Performance – Rising Adoption and Application Usage

4. Closing Summary – A Breakthrough Quarter for Ecosystem Growth and Technical Maturity

1. Project Overview

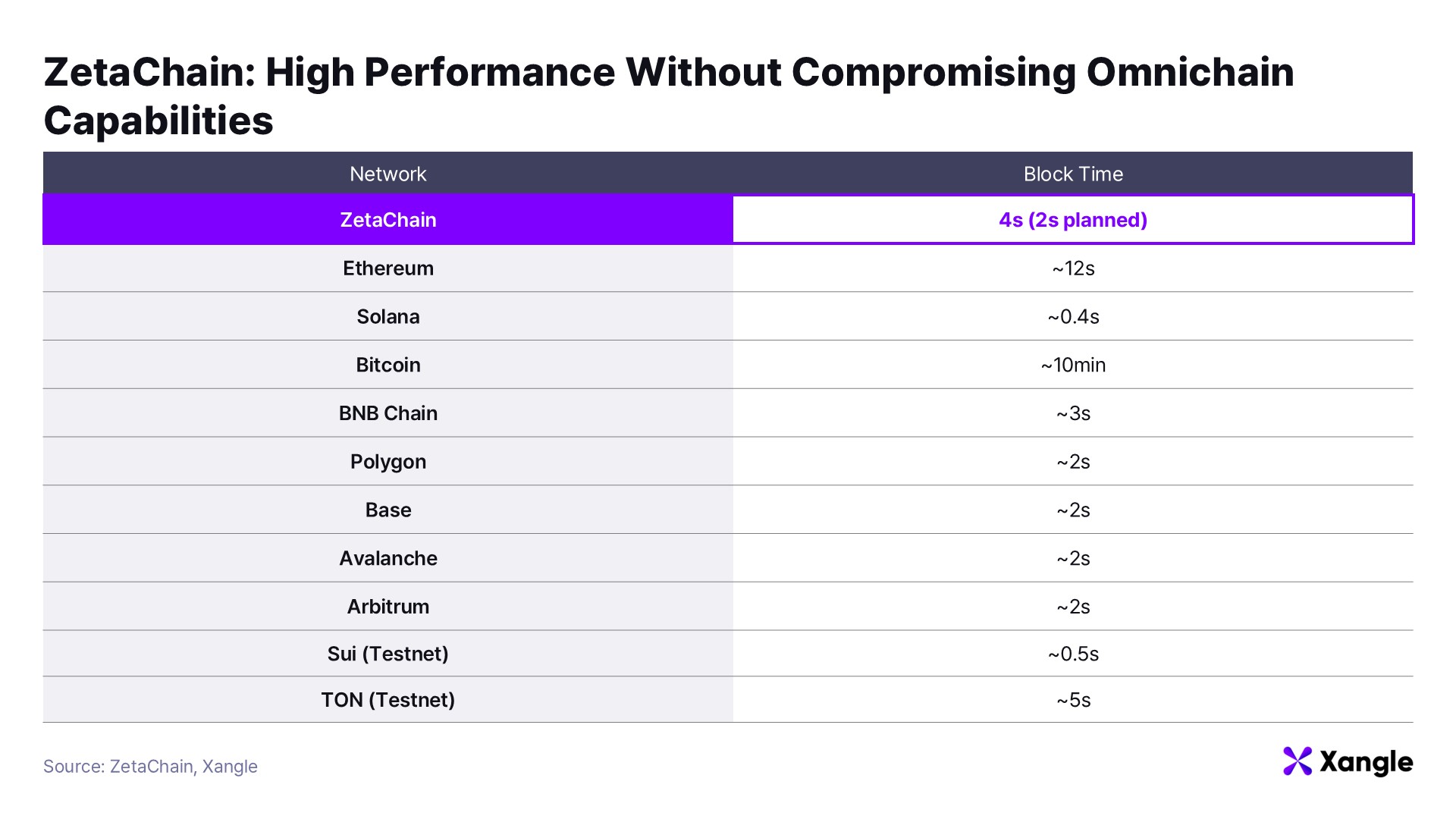

ZetaChain is a Proof-of-Stake (PoS) blockchain network built on the Cosmos SDK and the Tendermint PBFT consensus algorithm. It offers fast block generation times under five seconds and guarantees instant finality.

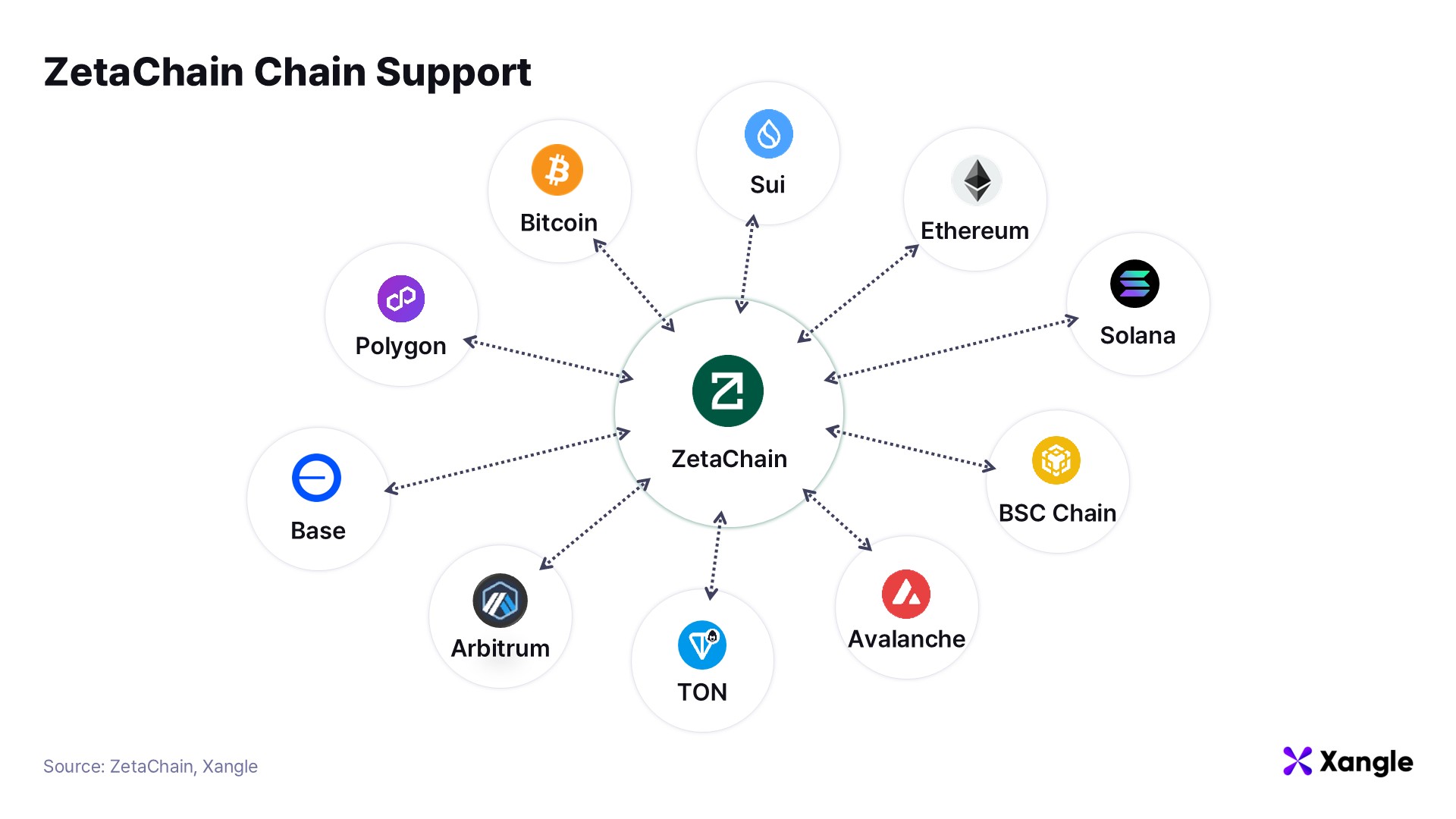

As an omnichain network, ZetaChain is purpose built to support seamless interactions across multiple blockchains. At its core is the proprietary execution layer, zEVM, equipped with native omnichain smart contract functionality. This architecture enables the development of innovative cross-chain applications by directly connecting disparate blockchain environments. For a deeper exploration of ZetaChain’s design, see Xangle’s report, “ZetaChain: Navigating Chain Abstraction with Native Bitcoin.”

2. 2Q25 Key Highlights

2-1. Securing both speed and scalability with the “Lightning Upgrade”

In June 2025, ZetaChain implemented the “ZetaChain Lightning (V31)” upgrade, significantly enhancing block production speed and improving the network’s overall throughput particularly in terms of universal app chain call capabilities. More than a routine performance enhancement, this release marked a pivotal technical advancement, laying the foundation for near real-time execution of decentralized applications across multiple blockchains.

The block time was reduced from six seconds to four, with further optimizations planned to lower it to around two seconds. These gains were realized without resorting to centralized sequencers or delegated consensus mechanisms. Instead, ZetaChain maintained its fully decentralized validator infrastructure setting it apart from traditional dPoS networks, Layer 2 solutions, and sidechains that often rely on centralized intermediaries.

This upgrade directly benefited ZetaChain’s core offering Cross Chain Transactions (CCTX). Users can now perform cross-chain operations more efficiently and reliably, such as leveraging native Bitcoin to access Ethereum-based dApps or calling Solana applications from an EVM compatible wallet.

Of particular note is the expanded universal app compatibility with Solana and TON, enabling users to interact with applications across diverse chains from within a single interface. For example, users can now purchase Solana tokens using ETH or USDC directly, or call Ethereum based applications from a TON wallet all without the need for bridges or manual network switching. This level of interoperability offers a meaningful leap in user experience, reinforcing ZetaChain’s commitment to delivering a truly seamless omnichain environment.

2-2. BTC On-chain utility expands with Bitcoin-collaterlized stablecoins

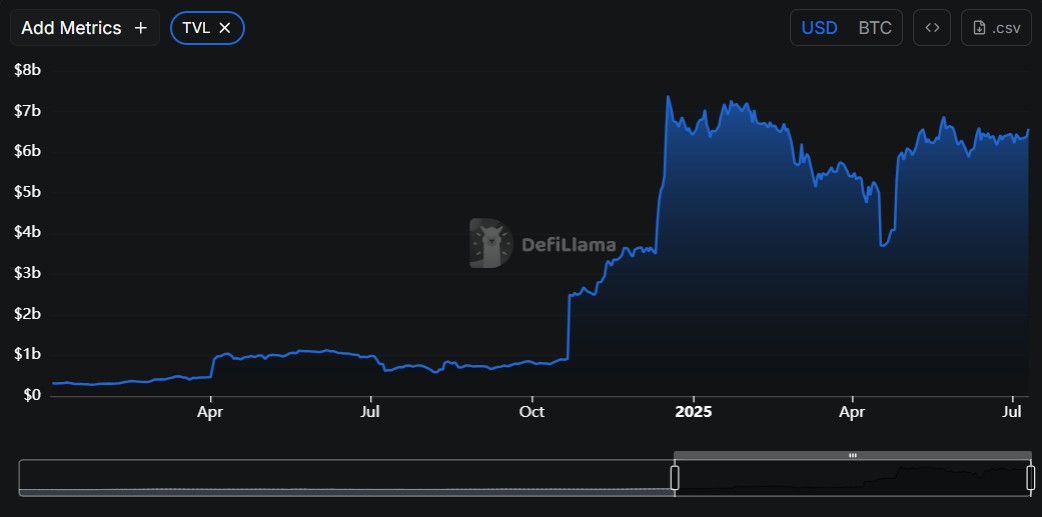

Efforts to move Bitcoin beyond a passive store of value into active utility within DeFi have accelerated markedly in recent months. The total value of Bitcoin locked in DeFi protocols has surged from approximately $300 million at the start of 2024 to $6.6 billion as of July 2025, a more than 20 fold increase. This growth underscores the rising demand for real world utility of Bitcoin assets.

Amid this momentum, a pivotal upgrade was introduced in May 2025: Bitcoin Core the reference client that operates the Bitcoin network officially removed the 80 byte data size limit on the OP_RETURN field. This change represents a foundational step in expanding Bitcoin’s native on chain capabilities and marks a turning point in its evolution toward becoming a programmable, cross chain integrated asset.

Value of Bitcoin deposited in DeFi (Source: DeFiLlama)

Value of Bitcoin deposited in DeFi (Source: DeFiLlama)

ZetaChain had already anticipated this shift. Prior to the protocol change, the network had implemented a Taproot and Tapscript-based structure that allowed Bitcoin transactions to embed EVM-compatible addresses, metadata, and cross chain call information all without relying on OP_RETURN. This enabled native Bitcoin transactions to directly invoke smart contracts on other chains, eliminating the need for bridges or wrapped assets. Bitcoin, traditionally viewed as a static holding asset, could now be used dynamically across decentralized applications in real time.

One of the most notable manifestations of this capability is bitUSD, a Bitcoin collateralized stablecoin launched by bitSmiley on ZetaChain. By depositing native BTC, users can mint bitUSD, which can be freely utilized across ecosystems such as Ethereum, Arbitrum, and Solana thanks to ZetaChain’s omnichain infrastructure. This development marks a major milestone: for the first time, Bitcoin is delivering real utility across the broader DeFi landscape.

bitUSD is not simply a new stablecoin; it represents a paradigm shift in Bitcoin’s role. What was once a collateral asset is now programmable. ZetaChain’s architecture makes bridgeless cross chain interoperability, trust minimized collateralization, and multi chain utility not only possible, but practical. These capabilities pave the way for Bitcoin to play a foundational role in DeFi, payments, and the next generation of stablecoin applications.

2-3. Omnichain reach extends to Avalanche and Arbitrum

In Q2 2025, ZetaChain completed mainnet integrations with Avalanche and Arbitrum, significantly broadening its omnichain coverage, particularly across EVM compatible ecosystems. This expansion builds on earlier integrations with Bitcoin, Ethereum, Solana, Sui, and TON, and now encompasses high-performance Layer 1 and Layer 2 networks with strong throughput and scalability. As a result, the functional reach of universal applications has expanded meaningfully.

Avalanche is a high-performance Layer 1 blockchain distinguished by its custom consensus mechanism and flexible subnet architecture. With its integration into ZetaChain’s Universal EVM, developers can now build applications that seamlessly span Bitcoin, Ethereum, Solana, and Avalanche all from a single smart contract. Beam DEX has already capitalized on this capability, launching a universal app that enables AVAX-BTC swaps without any bridging layer, setting a new benchmark for user friendly, cross chain asset transfer.

Arbitrum, a leading Ethereum based rollup Layer 2 network, has fostered a thriving dApp ecosystem through its low fees and high throughput. Its integration into ZetaChain allows over 50 million Arbitrum users to access universal apps natively interacting directly with applications across various chains without requiring bridges or manual network switching.

2-4. Expanding accessibility through Coinbase on-ramp integration

In Q2 2025, ZetaChain officially integrated Coinbase’s on ramp service, a globally recognized onboarding hub, substantially lowering the entry barrier for new users. One of the most persistent obstacles in the Web3 onboarding journey is acquiring initial tokens. New users often face a fragmented process: purchasing assets on centralized exchanges and then transferring them to self custodial wallets before interacting with decentralized applications. This complexity has long been a deterrent to mainstream adoption.

Coinbase On-Ramp addresses this pain point by enabling fiat to ZETA conversions in over 100 countries via credit cards, bank transfers, and other localized payment methods. Users can now acquire and use ZETA directly within an app interface, while developers can integrate this capability into their Universal Apps with only a few lines of code.

This integration is more than a convenience feature as it introduces strategic infrastructure that bridges fiat and crypto within ZetaChain’s omnichain architecture. By layering Coinbase’s fiat conversion mechanism onto ZetaChain’s Universal EVM execution layer, a single application can now serve as a unified entry point spanning both blockchain ecosystems and fiat rails. This positions ZetaChain to evolve into a truly user friendly “mainstream blockchain,” encompassing the entire journey from onboarding to cross-chain interaction within one seamless experience.

3. On Chain Performance – Rising Adoption and Application Usage

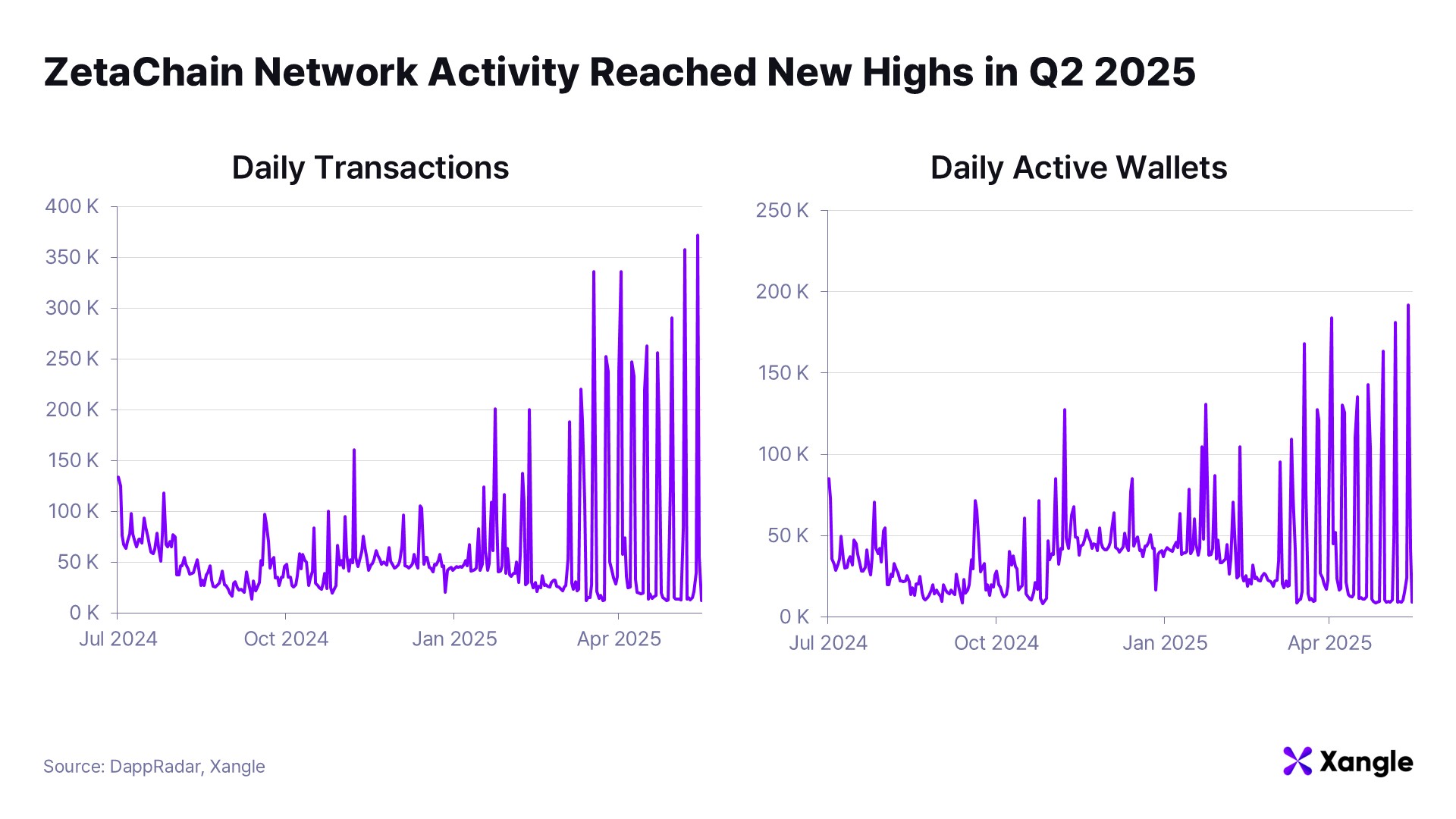

ZetaChain’s on chain metrics exhibited a clear upward trend in the second quarter of 2025. The average transaction count rose by 26% quarter-over-quarter, while daily active users increased by 7%, signaling a balanced uptick in network activity. This sustained growth throughout the quarter was largely attributed to a series of newly launched user campaigns.

Two major campaigns served as key drivers behind the improvement: Coinbase Learning Rewards and ZetaChain Summer ’25. The Learning Rewards initiative introduced ZETA and the Universal App concept through a simplified educational program, offering incentives to participants. With hundreds of thousands of users engaging, the campaign successfully facilitated new wallet creation and onboarding into ZetaChain’s on chain ecosystem. ZetaChain Summer ’25 was structured to stimulate universal app usage, with dedicated support for both users and developers. This initiative led to the launch of a series of impactful applications, including Pitch Lucy, Beam, and Random Meme. By combining quests, token rewards, and community driven missions under a Learn & Earn framework, the campaign fostered organic user engagement and real utility adoption.

More importantly, this quarter’s performance is not viewed as a one off surge. The on chain growth reflects foundational momentum tied to the structural expansion of the Universal App ecosystem. As Q3 begins, all eyes will be on whether this positive trend can be sustained through the continuous launch of new applications and the extension of campaign programs.

4. Closing Summary – A Breakthrough Quarter for Ecosystem Growth and Technical Maturity

The second quarter of 2025 marked a pivotal moment for ZetaChain, as the project simultaneously advanced on both technological and ecosystem fronts. The Lightning Upgrade significantly improved block generation speeds and boosted the performance of Cross Chain Transactions (CCTX), while also enabling technical integrations with non EVM chains such as Solana and TON. These developments expanded ZetaChain’s omnichain coverage, which now also includes high performance EVM chains like Avalanche and Arbitrum, substantially widening the operational scope of Universal Apps.

Beyond the technical achievements, the quarter marked a structural turning point in ZetaChain’s ecosystem, long viewed as lagging behind its technical capabilities. Key initiatives such as the Coinbase on ramp integration, Learning Rewards program, and the ZetaChain Summer ’25 campaign drove meaningful inflows of both users and developers. This surge translated directly into improved on chain metrics and the launch of multiple Universal Apps. The network is no longer a venue for theoretical demos; real applications are now actively operating atop a live Universal Blockchain.

ZetaChain has begun to establish a full ecosystem flywheel, onboarding → usage → expansion, laying the groundwork for sustainable growth. While metrics such as TVL and top-tier dApp traction still present room for improvement, the network now exhibits both a clear trajectory and tangible results. As Q3 unfolds, the focus will be on whether this momentum can be sustained, and how rapidly the Universal App ecosystem will mature and embed itself within the broader multichain landscape.