Table of Contents

1. Why Finance Needs ZK Technology

2. Prividium, ZKsync’s Strategic Weapon for Institutional DeFi

2-1. An institutional-focused chain balancing privacy and regulatory compliance

2-2. Second only to Ethereum in RWA market share

2-3. The two pillars of institutional capital inflows: Stablecoins and custody

3. ZK Is Already Here—and You’re Using It

3-1. Real-world expansion from finance to social and gaming

3-2. Emerging markets matter: Asia, Latin America, and beyond

3-3. The infrastructure behind it all: Elastic Network and technical architecture

4. $ZK Fundamentals: The Build Has Just Begun

4-1. Why token fundamentals matter

4-2. ZKnomics: A proposed overhaul of the $ZK tokenomics model

4-3. L1-L2 Token value feedback loops: Key use cases and experiments

5. The Path to a Self-Sustaining On-Chain Economy

1. Why Finance Needs ZK Technology

Since 2024, the approval of Bitcoin spot ETFs, a global shift toward regulatory easing, and supportive government policies have collectively accelerated the adoption of blockchain technology by traditional financial institutions. Despite this positive momentum, substantial obstacles remain before asset management can fully transition to on-chain infrastructures. Chief among these barriers are privacy protection and regulatory compliance—core requirements of traditional finance that frequently conflict with the transparency inherent to public blockchain systems. Protecting client identities, transaction records, proprietary strategies, and large-position confidentiality are more than technical requirements; they represent fundamental legal and operational standards. Public blockchains, where every action is inherently transparent, have struggled to meet these stringent conditions. Consequently, institutional entry into blockchain has remained limited.

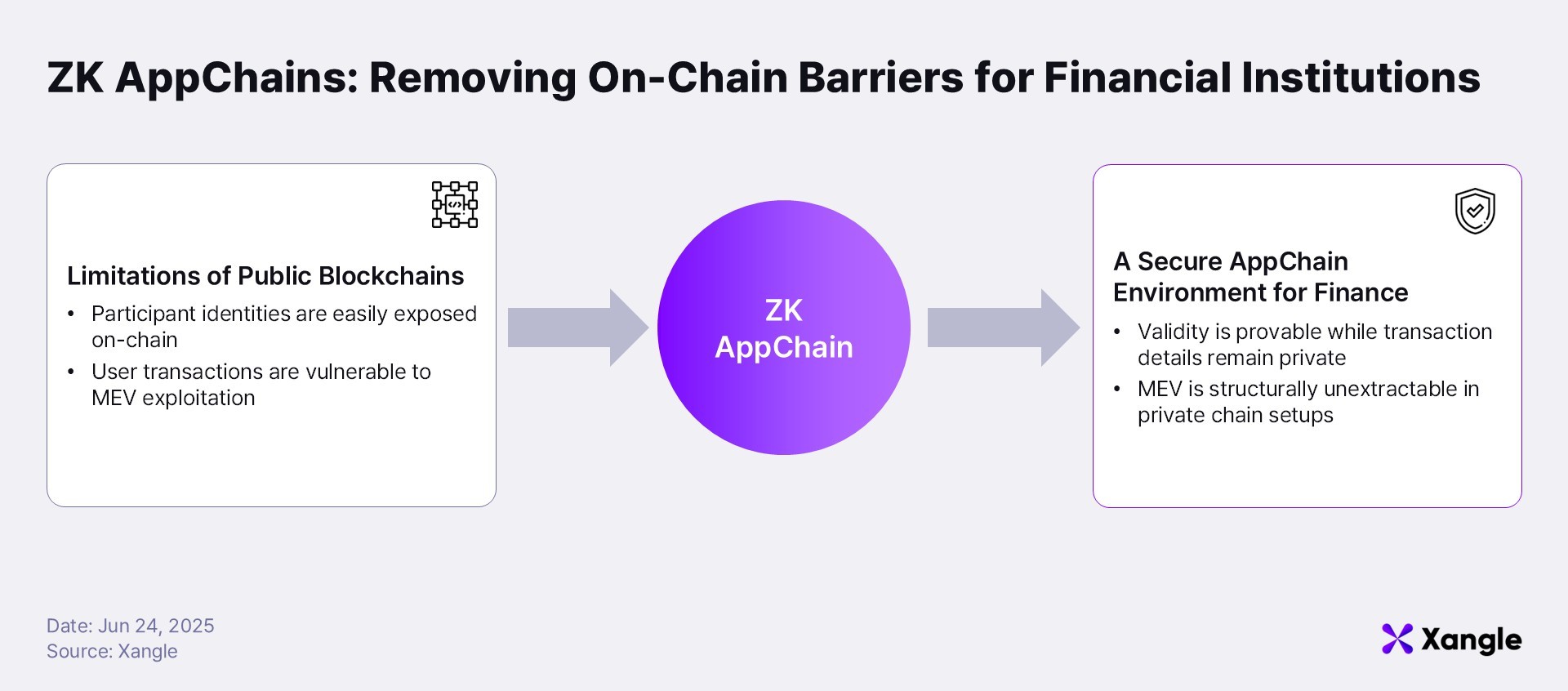

A compelling and increasingly practical solution is emerging through the integration of Zero-Knowledge (ZK) technology and AppChain architecture. Web3 infrastructure is rapidly shifting from general-purpose mainchains toward AppChains—highly customizable chains that allow flexible adjustments of block sizes, fee structures, and data visibility tailored to specific application requirements. When combined with ZK technology, AppChains can provide selective transparency, high-performance computation, and robust data privacy simultaneously. These attributes significantly enhance the usability of blockchain in industries that handle sensitive data, including finance, identity verification, and real-world asset (RWA) management. For example, ZK technology enables institutional investors to cryptographically verify their investment positions without revealing detailed holdings publicly. Due to these capabilities, ZK-based AppChains are gaining traction as ideal infrastructure for financial institutions that must adhere to both privacy and regulatory mandates. In response, various ZK Layer 2 projects have started providing specialized SDKs tailored explicitly for institutional adoption, aiming to strategically expand their user base among financial entities.

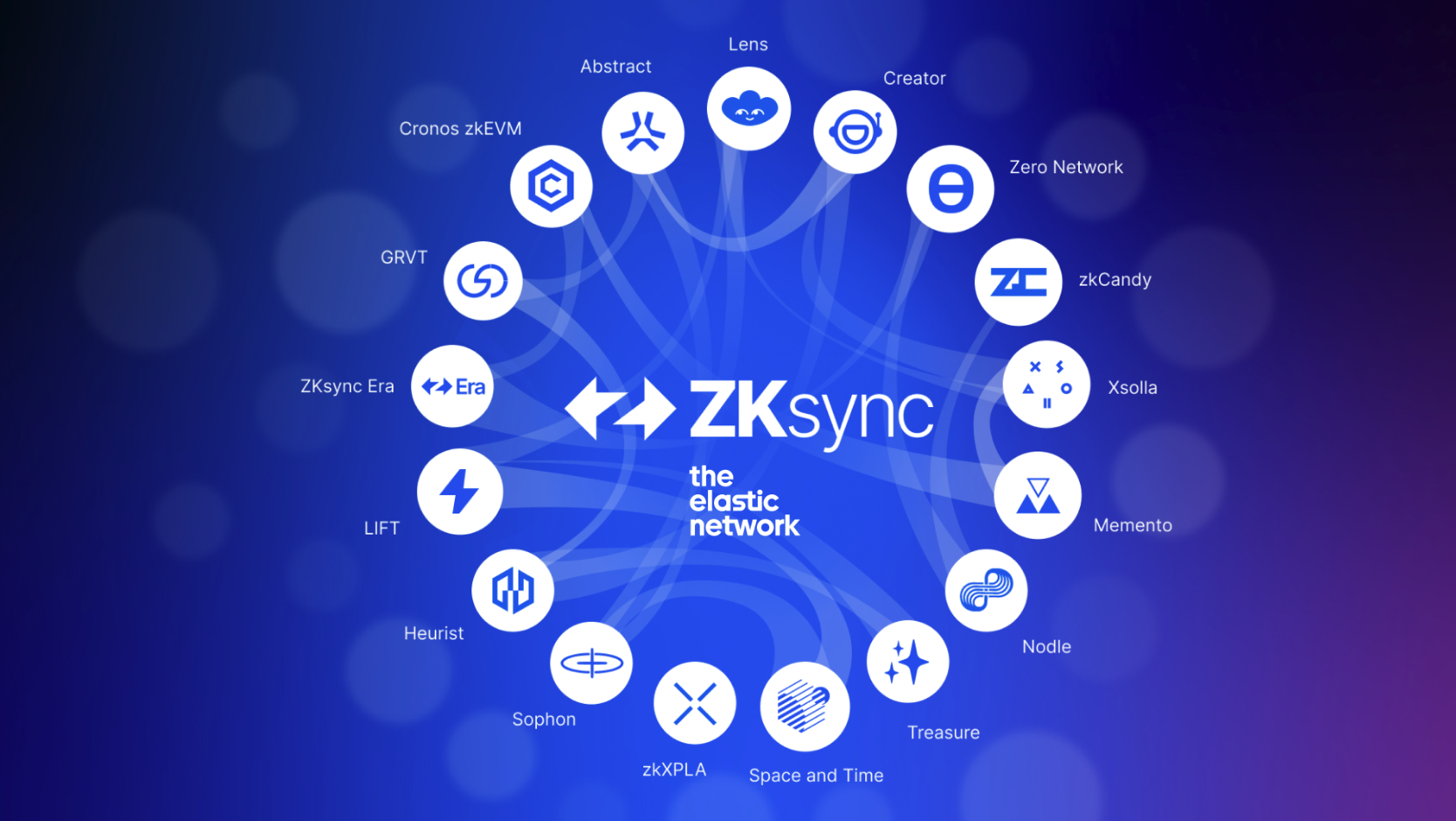

Within this rapidly evolving ecosystem, ZKsync stands out as a leading project preparing for the emerging era of ZK-based AppChains. Originally starting with ZKsync 1.0—which provided simple payment functionality—it advanced to ZKsync 2.0, adding full smart contract support and EVM compatibility. In June 2024, ZKsync evolved further with the launch of ZKsync 3.0 (Elastic Network), prioritizing multi-chain architectures and enhanced interoperability. Recognizing that a single, general-purpose Layer 2 chain would be insufficient to accommodate the diverse needs of various applications, ZKsync has repositioned itself as a network of interconnected, specialized ZK AppChains. Recently, this strategic evolution led to the launch of Prividium, a dedicated privacy-focused chain tailored explicitly for traditional financial institutions.

2. Prividium, ZKsync’s Strategic Weapon for Institutional DeFi

2-1. An institutional-focused chain balancing privacy and regulatory compliance

Prividium is a customizable private blockchain infrastructure developed within the ZKsync ecosystem, specifically designed to meet the regulatory compliance and privacy requirements of traditional financial institutions. While built on the ZKsync Stack—the same foundation as ZKsync’s Elastic Network—it operates in a separate environment, allowing institutions to deploy independent private chains tailored to their specific needs. Unlike typical public chains, transaction data within Prividium is processed privately off-chain. Zero-Knowledge (ZK) proofs ensure data integrity and validity, enabling selective data disclosure to regulatory authorities when necessary.

Prividium is engineered with native integration capabilities for KYC/AML systems, privacy-centric wallets, and identity management solutions. It includes essential institutional features such as internal auditing capabilities, access control, and regulatory reporting functionalities. Key enterprise integrations further differentiate Prividium, notably with widely adopted authentication systems such as Azure AD and Okta. It also supports private block explorers and on-chain identity-based permissioning frameworks. Such robust feature sets position Prividium ideally for regulated financial use cases—including private financial transactions, tokenized asset distribution, and on-chain securities management. Moreover, it establishes a versatile foundation capable of supporting future expansions into Central Bank Digital Currencies (CBDCs), Security Token Offerings (STOs), and global asset settlement processes. The ability to build customized ZK rollup chains tailored to the needs of traditional financial institutions with strict regulatory and compliance requirements is a key value proposition of Prividium.

The real-world practicality and viability of Prividium are currently being demonstrated through the launch of the Memento ZK Chain. Developed collaboratively by Deutsche Bank as part of the Monetary Authority of Singapore’s (MAS) Project Guardian and Project DAMA, Memento Chain provides comprehensive institutional functionality, including digital fund creation, investor onboarding, KYC-based access control, on-chain identity management, and multi-chain accounting integration. Though still at an early developmental stage, Memento’s adoption of a Validium architecture exemplifies how institutional-grade privacy and scalability can coexist effectively, underscoring the promise of a regulatory-compliant on-chain financial infrastructure. All transactions are verified through ZK proofs and ultimately finalized on Ethereum, ensuring transaction integrity and interoperability with public ecosystems.

Looking ahead, additional Prividium-based chains like Memento are expected to emerge independently but remain flexibly interconnected with the Elastic Network, Ethereum mainnet, and other ZKsync Stack-based chains. This strategic integration positions Prividium as a critical bridge between public blockchain ecosystems and private institutional financial infrastructure. Aligned with MAS’s vision outlined in Project DAMA, Prividium’s scope could potentially broaden beyond digital fund management to encompass recurring payments, multi-asset bridging, and cross-chain settlements, showcasing a transformative shift toward comprehensive institutional on-chain finance. Though still considered an early experiment, ZKsync clearly intends for Prividium to serve as an essential proving ground for regulated, institutional blockchain adoption. Its ongoing development may soon position the entire ecosystem as a vital intersection, seamlessly linking public with private blockchain systems, and bridging traditional finance with decentralized infrastructures.

2-2. Second only to Ethereum in RWA market share

As of Q1 2025, ZKsync has secured its position as the second-largest blockchain network for Real-World Assets (RWA), accumulating a total on-chain asset value exceeding $2 billion—second only to Ethereum. This milestone underscores the accelerating pace at which traditional financial institutions have adopted and experimented with tokenizing tangible assets on ZKsync. One notable example is UBS, Switzerland’s largest bank, which conducted a proof of concept (PoC) for a “Tokenized Gold” system that would allow its clients to purchase and manage rights to physical gold. This PoC involved deploying a smart contract on ZKsync’s Validium architecture, aiming to test how ZKsync’s privacy-preserving and scalable infrastructure could perform in real-world financial environments that require both confidentiality and off-chain data integration. The experiment highlighted the potential of ZKsync for tokenized asset adoption within regulated financial institutions.

The RWA ecosystem growth on ZKsync has been further accelerated by Tradable, a platform specializing in private credit assets. Working closely with institutional giants such as Victory Park Capital, Janus Henderson, and ParaFi Capital, Tradable successfully tokenized and deployed a $1.7 billion private credit portfolio directly onto ZKsync Era. Spanning over 30 distinct asset positions, Tradable’s portfolio achieves liquidity provisioning, real-time settlement, and full regulatory compliance simultaneously. Acting as an entry gateway for traditional financial institutions entering Web3, Tradable has rapidly expanded in scale based on institutional confidence in ZKSync’s underlying infrastructure. The platform’s success highlights ZKSsync’s transition from a mere technical layer into foundational infrastructure for tokenizing traditional financial assets.

Venture capital funds are also increasingly migrating to ZKsync’s infrastructure. Blockchain-based VC fund management offers automated dividends via smart contracts, lower fees, global investor participation, and increased liquidity—emerging as a compelling alternative to the complexity and inefficiencies of traditional venture finance. A prime example is Blockchain Capital (BCAP), a crypto-native investment firm that has fully migrated its first tokenized VC fund to ZKsync and begun paying out dividends to investors. This upgrade was made possible through collaboration with portfolio companies such as Securitize, Circle, and Matter Labs, and leverages ZKsync’s scalability and low fees to distribute $0.25 in USDC per token—a 25% return on the 2017 issuance price of $1. This illustrates a more efficient, open venture capital structure, overcoming the cost and speed limitations of Ethereum.

2-3. The two pillars of institutional capital inflows: Stablecoins and custody

In parallel with the growing adoption from financial institutions, ZKsync’s stablecoin-centric liquidity ecosystem has rapidly expanded. In Q1 2025, stablecoin balances across the Elastic Network increased 101.1% quarter-over-quarter, reaching a total of $129.1 million. Within this ecosystem, USDC maintained a dominant market position, representing 88.2% market share with $113.7 million. Meanwhile, USN, a newly launched stablecoin by Noon, gained rapid traction, swiftly reaching $7.4 million in circulation. Conversely, USDT showed a notable decline, reflecting a concentration of user trust toward specific stablecoins. The explosive growth of the USDC ecosystem can be largely attributed to Elastic Netorks such as Sophon and Abstract, which natively implemented Circle’s Bridged USDC Standard, effectively driving deeper integration across the broader ZKsync ecosystem.

Anchorage Capital Custody x ZKsync

Another key factor facilitating institutional inflow into ZKsync is the partnership with Anchorage Digital. As the only federally chartered crypto bank in the U.S., Anchorage Digital recently collaborated with the ZKsync Foundation to provide institutional-grade custody for the $ZK token, facilitate active governance participation, and offer seamless integration with its proprietary custody wallet, Porto. Institutions can now securely manage assets on ZKsync through Anchorage Digital Bank N.A. or its Singapore branch, creating essential infrastructure for traditional finance to confidently enter the ZKsync ecosystem. Given Anchorage’s stellar reputation in regulatory compliance and security infrastructure, its partnership significantly enhances institutional trust and adoption. Amid rising global interest in ZK technology, this institutional-grade custody and governance capability further positions ZKsync as a credible, robust blockchain network ready for wider adoption across traditional financial markets.

3. ZK Is Already Here—and You’re Using It

3-1. Real-world expansion from finance to social and gaming

As previously highlighted, ZKsync is transitioning away from a single-layer-2 structure, evolving instead into the Elastic Network—a network comprising various specialized ZK Chains interconnected organically. This modular architecture resolves the limitations in transaction throughput and user experience associated with monolithic chains, fostering a flexible ecosystem where individual chains serve unique purposes while remaining seamlessly interoperable. Crucially, this approach conceals the complexity of Zero-Knowledge (ZK) technology, providing users with intuitive experiences on par with familiar Web2 interfaces. This significantly lowers entry barriers, allowing retail users with minimal blockchain familiarity to effortlessly adopt Web3 services. Financially specialized AppChains built upon this foundation are progressively migrating traditional Web2 services to Web3, simultaneously enhancing decentralized finance (DeFi) user experiences and regulatory compliance within on-chain financial infrastructures. Notable projects exemplifying this shift include:

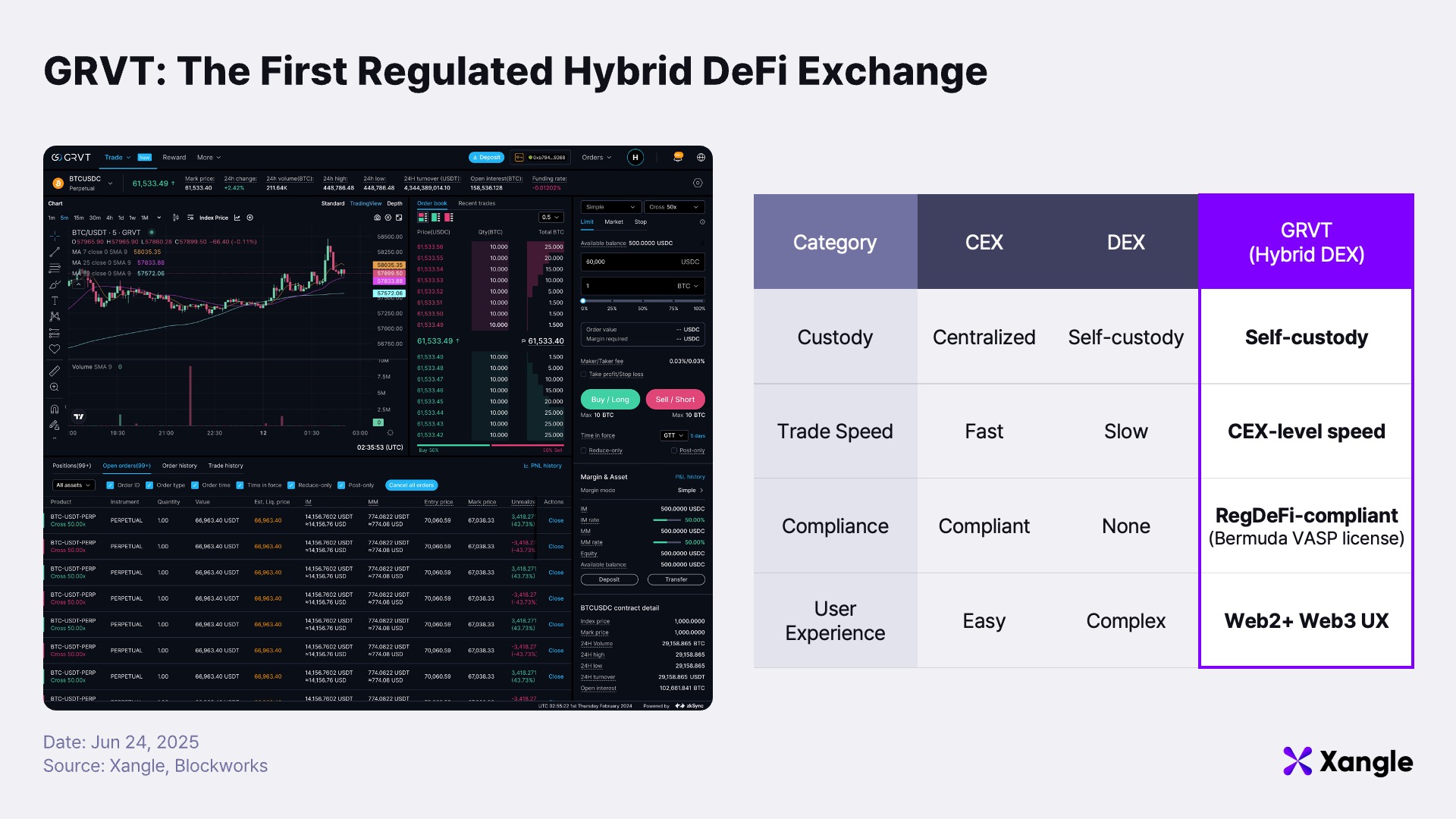

- GRVT: Built on Matter Labs' ZKsync Stack, is a hybrid self-custodial derivatives exchange designed to meet institutional-level requirements for speed and privacy. Users experience intuitive, Robinhood-like interfaces while maintaining direct custody of their assets, contributing to daily trading volumes exceeding $30 million. Utilizing a private Hyperchain architecture, GRVT facilitates rapid settlement, data obfuscation, and robust market maker integration—delivering a centralized finance (CeFi)-grade experience in a decentralized context. Remarkably, GRVT recently secured regulatory licensing from Bermuda’s financial authorities, becoming the world’s first regulated DEX, with cumulative trading volume surpassing $6 billion as of May 2025.

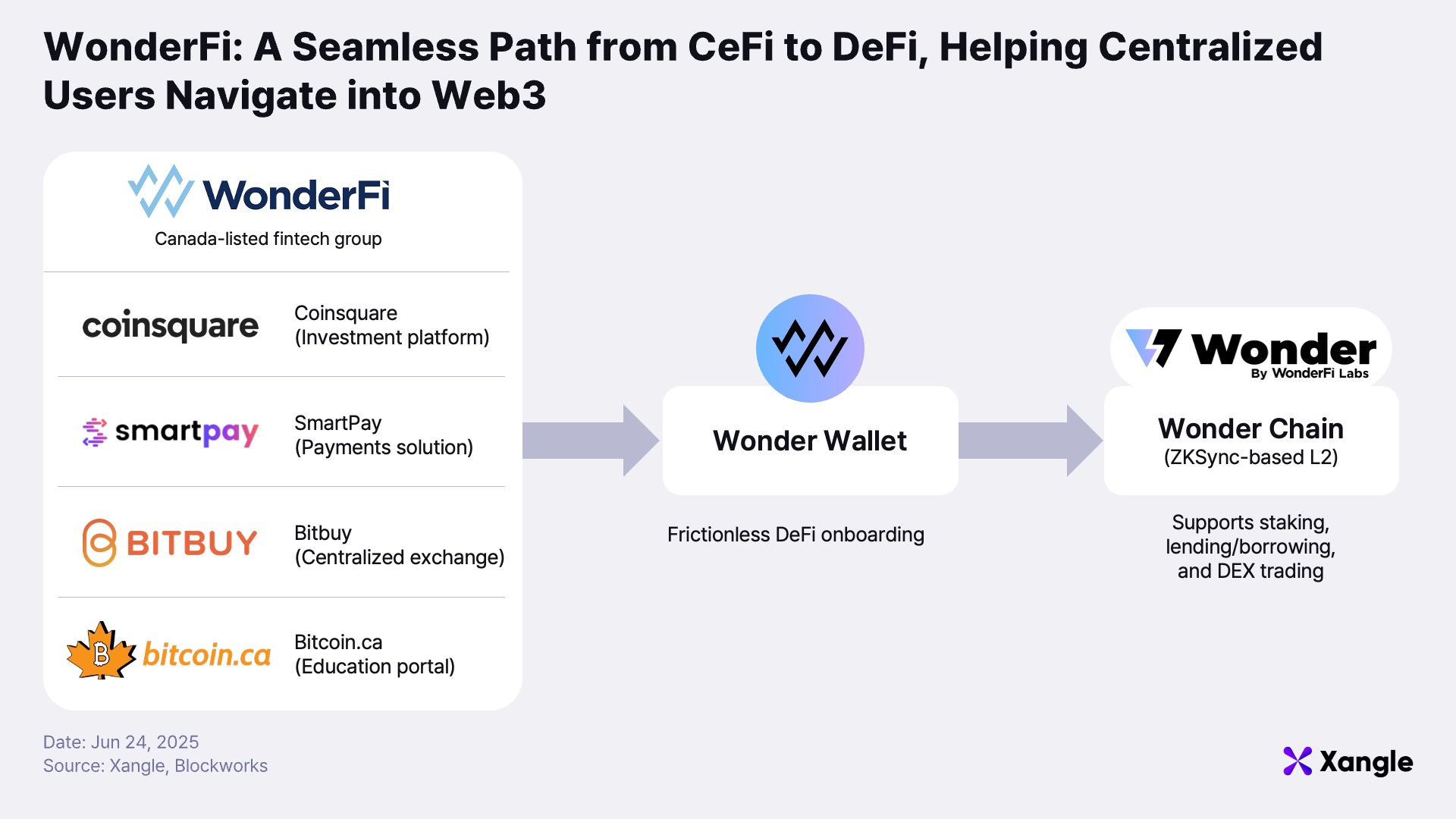

- WonderFi: Operator of prominent Canadian centralized exchanges like Bitbuy and Coinsquare, has launched a gasless wallet and dedicated L2 chain built on ZKsync. Designed to bridge its existing Web2 user base into Web3 seamlessly, WonderFi provides frictionless onboarding, enabling wallet creation through simple login procedures and fee-free access to staking, lending, and decentralized exchange (DEX) services. Leveraging its extensive user pool, WonderFi aims to become a leading financial hub on the Elastic Network.

- Cronos zkEVM: Developed collaboratively by Crypto.com, Matter Labs, and VVS, represents the first independent ZK Chain built on ZKsync. Functioning as a new L2 expansion to Cronos’ existing EVM and PoS chains, users pay transaction fees using the zkCRO token while enjoying user-friendly Web2-equivalent features such as FaceID-enabled onboarding, gasless transactions, and seamless bridging between L1 and L2. Cronos aims to convert its extensive user base of over 100 million into active participants within its DeFi, gaming, and NFT ecosystems through a triple-revenue model combining staking, DeFi yields, and royalty-based rewards.

Beyond financial infrastructures, the Elastic Network is rapidly establishing practical utility across retail, content, and social-focused chains. These AppChains, characterized by high-frequency usage and extensive transactional activity, are driving substantial increases in overall network transactions and fee revenues. Since the emergence of key retail-oriented AppChains, metrics like total transactions and total value locked (TVL) have experienced exponential growth compared to the earlier single-chain Era. This trend demonstrates ZK technology’s seamless integration into everyday user experiences.

- Abstract: Simplifies wallet creation through its email-based Abstract Global Wallet (AGW), issuing over 1.4 million wallets and driving more than 17 million transactions via its creator-centric reward model. Abstract exemplifies how ZK infrastructure can underpin mainstream-friendly Web3 experiences, allowing ordinary users to access blockchain-based content without encountering technological complexities.

- Sophon: An AppChain integrating AI, gaming, and social functionalities, has onboarded more than 27 million wallets through strategic partnerships with Mirai Labs and Anomaly. Leveraging gasless user experiences, automatic account creation, and AI-driven content frameworks, Sophon dramatically lowers barriers to entry, showcasing the mass-market potential of user-focused ZK infrastructure.

- Lens: Having migrated from Polygon to ZKsync’s Elastic Network, transferred approximately 125GB of extensive on-chain social data. Users were seamlessly transitioned to the SocialFi service without needing specialized technical knowledge, effectively demonstrating ZK technology’s ability to protect individual privacy while enabling efficient social data utilization on-chain.

While the full network effects within the Elastic Network ecosystem have yet to materialize completely, the rapid emergence of finance, gaming, and social-oriented AppChains has already significantly boosted ecosystem-wide metrics—including transaction volumes, fee revenues, and user counts—relative to the single-layer-2 Era period. Users now naturally engage with ZK technology in their daily interactions, whether creating wallets, gaming, or consuming social content. With ZK technology deeply embedded within intuitive user experiences, ZKsync’s Elastic Network is actively catalyzing the expansion of a Web3 economy rooted firmly in practical, real-world adoption.

3-2. Emerging markets matter: Asia, Latin America, and beyond

While ZKsync continues to accelerate its global sector-driven adoption strategy—especially through RWAs and stablecoins—it is simultaneously pursuing targeted expansion in emerging markets. Regions such as Latin America and Southeast Asia, facing persistent inflation, inadequate financial infrastructure, and high remittance fees, increasingly see blockchain not merely as an investment avenue but as a practical tool to resolve everyday issues. Recognizing that Zero-Knowledge technology offers a realistic solution capable of simultaneously ensuring transparency and privacy, ZKsync has prioritized the growth of use-case driven ecosystems within these markets.

A prime example is QuarkID, a project implemented in Buenos Aires, Argentina, utilizing ZKsync Era. The municipal government has begun recording citizen birth certificates, marriage records, income data, and educational credentials on-chain, enabling approximately 3.6 million citizens to securely manage personal data and easily access governmental services. QuarkID marks the first concrete demonstration of ZK technology effectively balancing privacy protection with public administrative efficiency. Furthermore, through integration with Argentina’s National ID system, the project has secured legal recognition for on-chain issued documents. This initiative is led by a consortium involving Extrimian, ZKsync (Matter Labs), the Buenos Aires city government, and BID Lab, and will soon expand across Latin America through the Latam ID Alliance.

In Southeast Asia, Singapore-based Union Fintech has launched the Union Chain, a new Layer-2 built on ZKsync infrastructure, bridging traditional finance (TradFi) with crypto-native platforms. Union Chain collaborates with key licensed exchanges and RWA platforms throughout the region—including Coinhako, Indodax, Coins.ph, Coins.co.th, InvestaX, and IX Swap—to facilitate comprehensive RWA processes ranging from asset structuring and issuance to distribution, remittance, and fiat on/off-ramp services. Connecting over 20 million KYC-verified users to a market exceeding 600 million people in Southeast Asia, Union Chain delivers practical financial solutions backed by robust regulatory licenses, regional fiat-backed stablecoins, and compliance-ready frameworks. Additionally, the chain prioritizes delivering faster, cheaper remittance services and improving SME financial access in major markets such as Indonesia, the Philippines, and Thailand.

3-3. The infrastructure behind it all: Elastic Network and technical architecture

The Elastic Network proposed by ZKsync is a modular, multi-chain network built upon the ZKsync Stack, a comprehensive framework designed specifically for AppChain development. Supporting this ecosystem are two critical infrastructure components: ZK Gateway and ZK Router. ZK Gateway ensures rapid finality and low transaction costs by efficiently cross-verifying and compressing states across multiple chains. Meanwhile, ZK Router enhances user experience by enabling seamless movement between different chains using just a single address and keypair, minimizing friction in user interactions. This architecture provides developers the flexibility to build Rollup and Validium chains tailored uniquely to diverse application needs, each featuring customizable fee models, account structures, and onboarding experiences.

A combination of user-friendly UX infrastructure and powerful interoperability strategies has driven the Elastic Network’s rapid adoption. For instance, Abstract leverages Native Account Abstraction (NAA) to simplify user onboarding—eliminating the need for standalone wallet installations by supporting logins through common social accounts like Google. Similarly, Sophon employs Paymaster functionality to subsidize user gas fees automatically, significantly reducing transaction-related barriers. Additionally, ZKsync has integrated Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to automate asset transfers and payments across the Elastic Network, laying a robust foundation for seamless, multi-chain asset management and complex transaction execution.

On the developer experience (DX) front, ZKsync has established a complete toolkit essential for building real-world chains. Following full EVM bytecode compatibility in late 2024, ZKsync rapidly improved its LLVM-based compiler and completed integrations with essential Ethereum developer tools such as Foundry, Remix, and Viem. The recent launches of the ZKsync Stack CLI and Hardhat plugins have further simplified local testing and deployment workflows. These infrastructure advancements directly facilitated the accelerated deployment of diverse AppChains and services on the Elastic Network.

ZKsync continues to invest heavily in both performance enhancement and decentralization. Its latest technological milestone, the Airbender zkVM, is the world's fastest open-source zkVM based on RISC-V architecture. Capable of generating Ethereum block proofs in just 35 seconds on a single GPU—approximately four to six times faster than previous models—Airbender achieves a base-layer proving performance of 21.8 million constraints per second (cps). Additionally, the cost of proof generation has drastically dropped to about $0.0001 per transaction, making Airbender over ten times cheaper than the previous Boojum technology. This significant improvement has dramatically increased the operational efficiency and scalability of the entire Elastic Network.

Looking ahead to 2025, ZKsync plans to deploy the ChonkyBFT consensus algorithm, delivering single-slot finality. Concurrently, it is collaborating with projects such as Lagrange and Fermah to decentralize its proving process, with plans to delegate over 75% of proof generation to external provers. A subset of these external provers will operate using Trusted Execution Environment (TEE)-based multi-prover structures, ensuring both scalability and security. ZKsync’s future roadmap also includes the gradual introduction of advanced infrastructure elements such as Smart SSO, a native smart wallet SDK, private Validium chains, and enterprise-grade wallet solutions. These forthcoming developments position ZKsync as a holistic blockchain infrastructure capable of seamlessly integrating performance, user experience, privacy, and interoperability into one cohesive platform.

4. $ZK Fundamentals: The Build Has Just Begun

4-1. Why token fundamentals matter

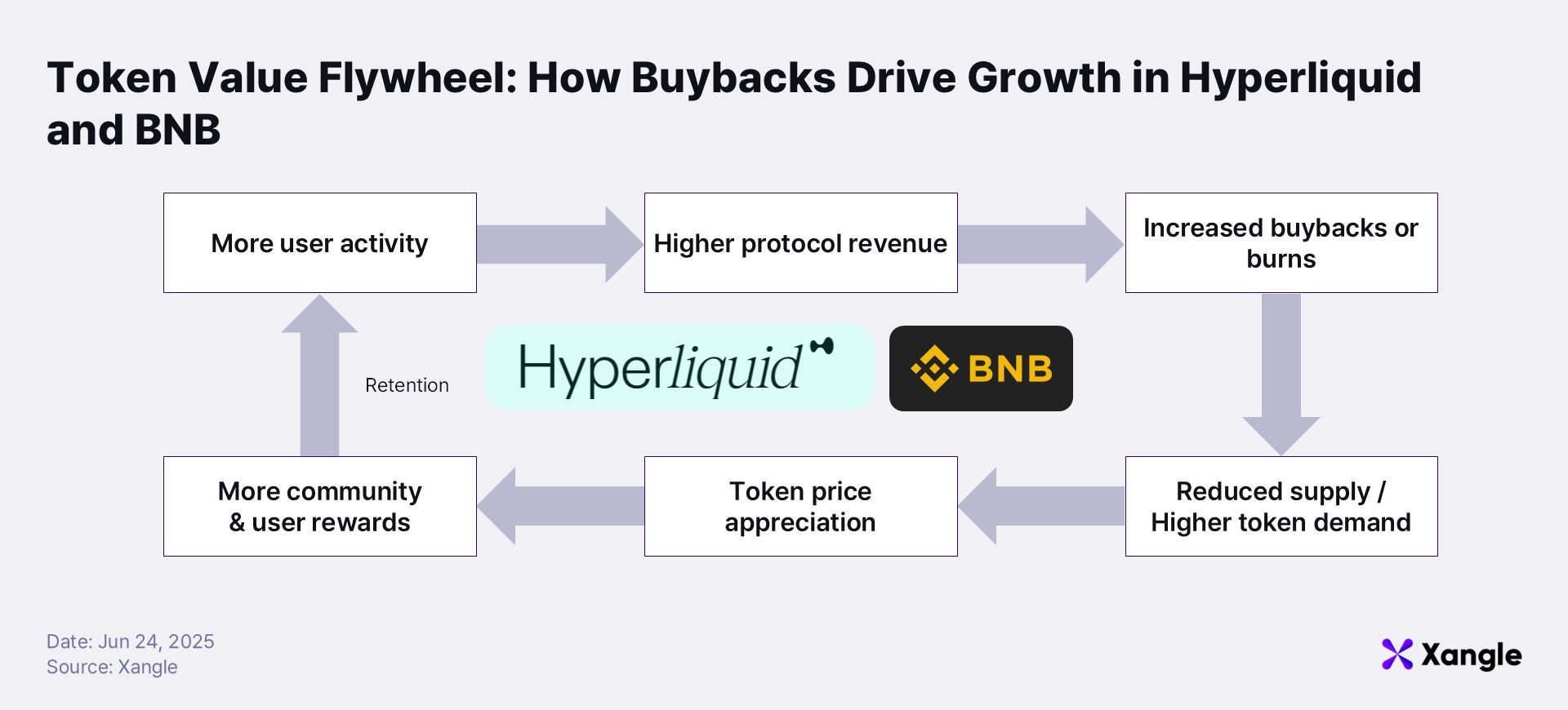

The early wave of L2 tokens was primarily designed with a focus on governance functionality. However, this approach has increasingly been criticized for its inability to generate sustainable, long-term value. When increased network activity fails to translate into direct token value accrual, investor and user interest inevitably diminishes. In contrast, projects that have recently received positive market recognition clearly link protocol revenues directly back to token holders and their communities. Binance's BNB, for example, consistently burns tokens quarterly based on its exchange profits, and Hyperliquid employs derivatives trading fees to buy back and burn its $HYPE tokens, effectively controlling circulating supply.

These revenue-linked token models go beyond mere price support mechanisms. They are essential to establishing tokens as genuinely valuable assets within their ecosystems. Revenue-sharing token designs do more than simply enhance utility—they actively build community trust and incentivize broader ecosystem participation. The $ZK token must similarly evolve beyond mere governance functions. Given the recent surge in on-chain activity driven by the proliferation of AppChains, private chains, and Real-World Asset (RWA) integrations, failing to integrate these activities with $ZK would render the token an empty shell existing outside its ecosystem. Ultimately, ZKsync must create a structure in which all economic activity occurring across its network directly impacts token supply and demand. Only then can ZKsync mature into a genuinely self-sustaining economic environment.

4-2. ZKnomics: A proposed overhaul of the $ZK tokenomics model

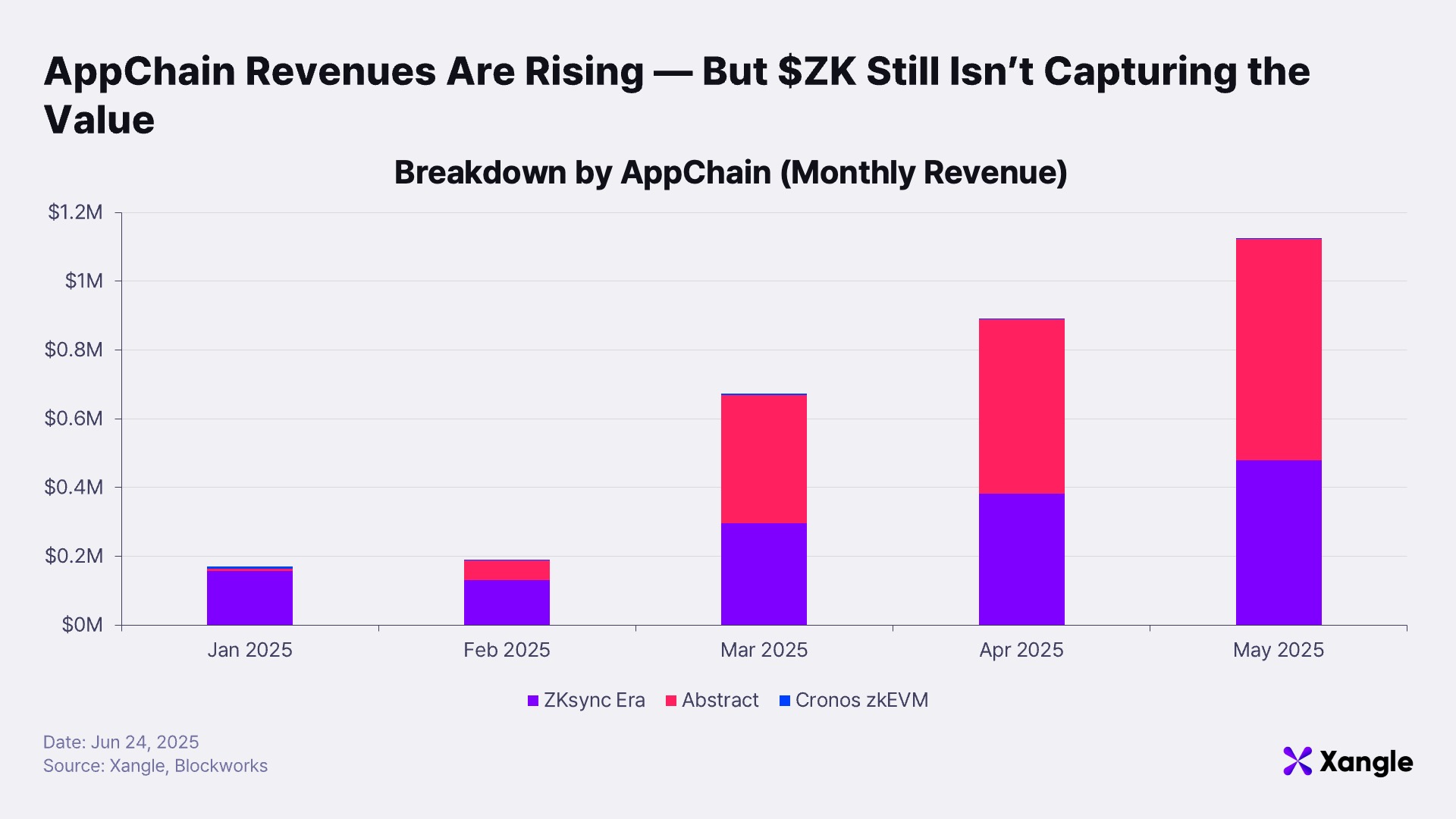

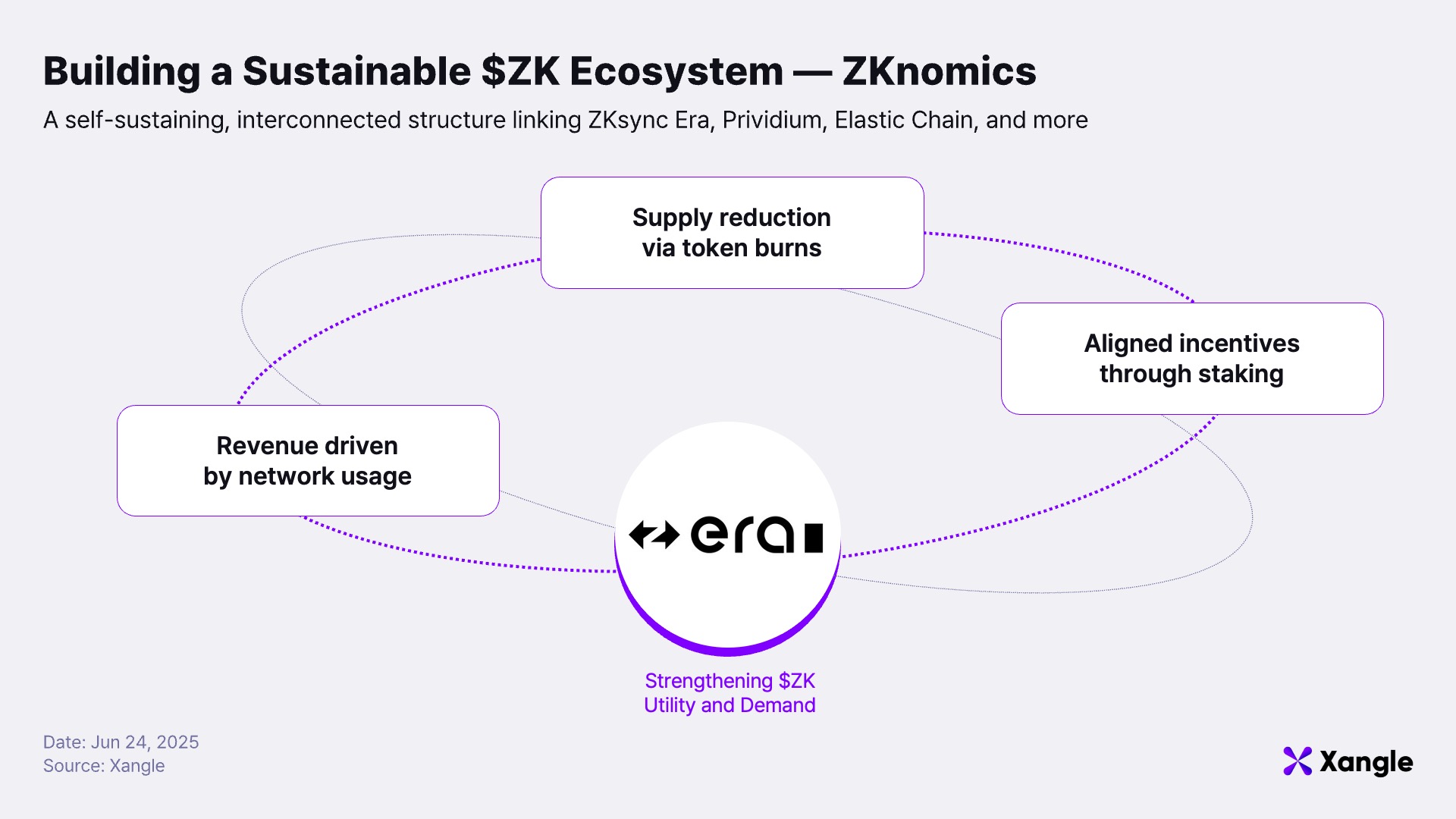

Despite the rapid expansion and rising usage of the Elastic Network ecosystem, the $ZK token has thus far been confined mainly to governance purposes, prompting ongoing discussions about its limited connection to real-world usage. In response, a new community-driven proposal, known as "ZKnomics," aims to fundamentally reshape the network’s revenue flows, establishing a direct linkage between network activity and token value (proposal link). Specifically, ZKnomics introduces an automated mechanism whereby transaction fees derived from network usage trigger token burns and staking rewards, all governed flexibly by decentralized governance structures. More than merely expanding the utility of the token, ZKnomics strategically positions ZKsync as the central settlement hub and economic core for on-chain activities.

Importantly, the ZKnomics initiative aligns seamlessly with ZKsync’s recent infrastructure developments, significantly increasing the protocol’s potential to evolve into a self-sufficient economic ecosystem. Until now, increased network utilization—such as AppChain proliferation, heightened transaction volumes, and RWA adoption—has failed to meaningfully convert into direct $ZK demand or revenue. ZKnomics seeks to rectify this by converting all network activity into tangible revenue streams, subsequently driving token demand and reducing circulating supply through systematic burns. For example, if Elastic Network-based AppChains begin to settle transactions in $ZK or implement fee structures that include token burns, ecosystem growth and token value would become organically interconnected. Although currently in the community proposal stage, the successful implementation of ZKnomics could transform ZKsync from a technical infrastructure layer into a robust, economically sustainable on-chain ecosystem.

4-3. L1-L2 Token value feedback loops: Key use cases and experiments

Even L1 blockchains, increasingly constrained by declining transaction fees, are actively exploring ways to align their ecosystems' value directly with token demand through innovative tokenomics models. Particularly in multi-chain and modular blockchain environments, sophisticated revenue-to-token value feedback mechanisms have become essential. Historically, ecosystems like Cosmos and Polkadot—which center around independent, flexible AppChains—faced persistent difficulties sustaining demand for their native tokens, despite technological strengths. The fundamental reason was straightforward: economic activities on these chains rarely translated directly into native token demand. Interoperability solutions such as Cosmos' Inter-Blockchain Communication (IBC) and Polkadot’s shared security via relay chains provided technical advantages but did not inherently address the critical challenge of token value capture.

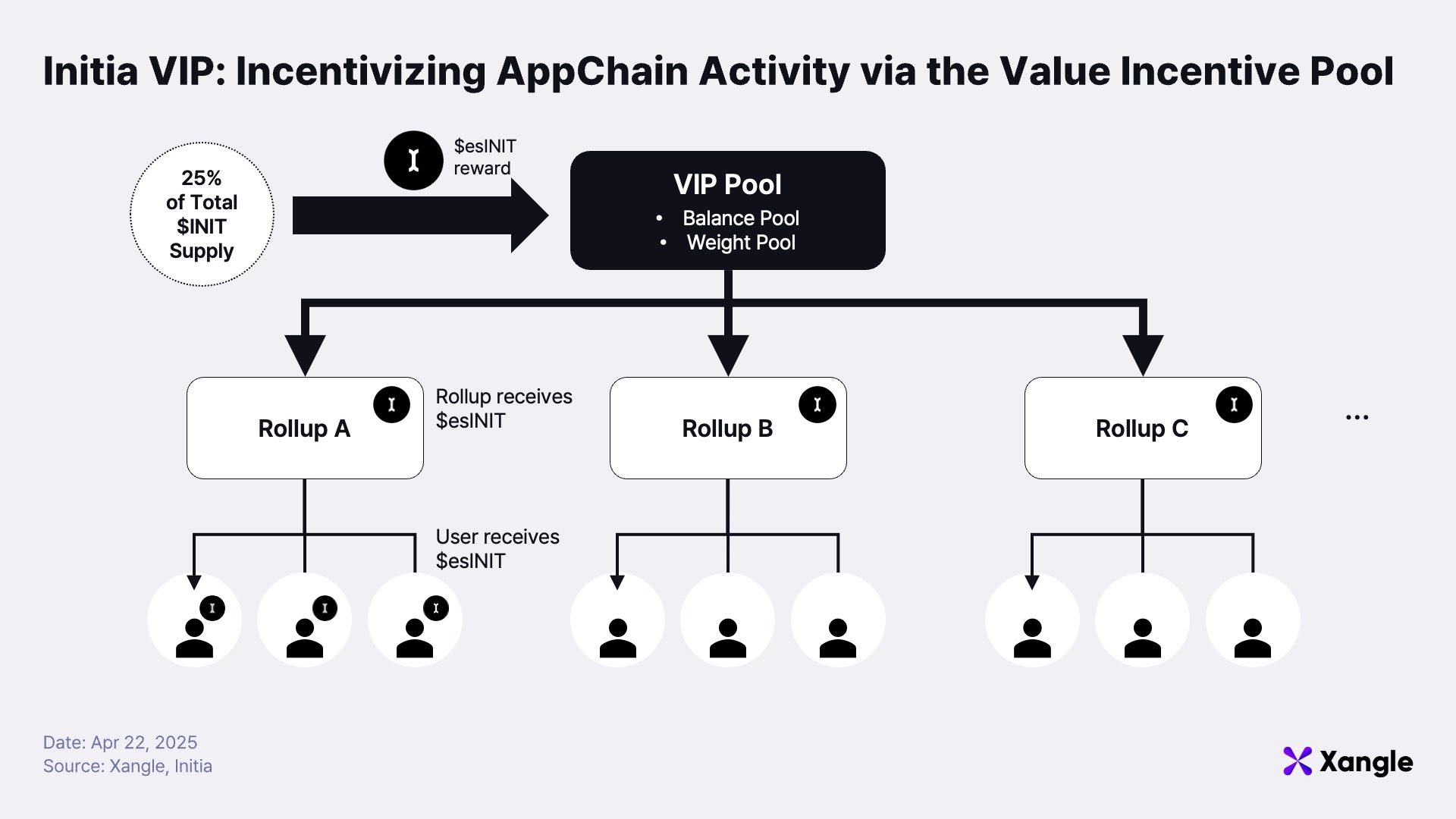

Recently, projects have begun directly confronting this issue. A notable example is Initia, which introduced a Value Incentive Pool (VIP) model designed to organically link AppChain activities directly to its native token, $INIT. Under this framework, each AppChain earns $INIT token rewards proportionate to its level of activity, subsequently redistributing these tokens to users or incorporating them into their revenue models. This structure creates a virtuous cycle where token demand at the L1 level is amplified by the contributions of each AppChain. Crucially, this model avoids scenarios where L1 chains monopolize revenue or AppChains operate in economic isolation. Instead, it fosters an interconnected, symbiotic relationship where L1 and L2 ecosystems collectively drive token demand.

ZKsync should similarly consider strategies within its Elastic Network framework to aggregate the value generated by ZKsync Stack–based chains back into its native token, $ZK. While preserving the independence and flexibility of each AppChain, ZKsync’s design must strategically ensure that network usage, revenues, and economic demand directly and naturally feed into the $ZK token’s value. Without evolving beyond a mere collection of Layer 2 environments into an integrated financial infrastructure with a cohesive token economy, $ZK will continue to struggle to realize genuine utility beyond governance. Therefore, the critical task is no longer merely token design but strategic network-wide planning to systematically stimulate token demand. While ZKnomics may lay the foundational structure, it should be complemented by more advanced mechanisms—such as specific AppChain incentives, revenue-sharing from bridge fees, and stablecoin or RWA-driven token demand models—to ensure long-term economic sustainability and robust token value accrual.

5. The Path to a Self-Sustaining On-Chain Economy

ZKsync’s journey has represented a critical test of whether Zero-Knowledge technology can move beyond a mere scalability solution to become robust infrastructure tailored for real-world applications—particularly in the financial sector. By focusing strategically on four foundational pillars—privacy protection, regulatory compatibility, flexible chain design, and modular interoperability—ZKsync has emerged as the most pragmatic solution bridging public blockchain ecosystems with traditional financial institutions. In particular, finance-specific use cases such as Prividium, Tradable, and Memento are steadily proving that ZK technology can serve as a viable, real-world solution even under the stringent regulatory and operational constraints of traditional finance. These implementations have moved beyond mere technical demonstrations, providing concrete evidence that ZK infrastructure can practically support sensitive financial applications at scale.

However, the core challenge for ZKsync goes far beyond merely launching numerous AppChains. The ultimate objective is to consolidate the entire Elastic Network ecosystem into a unified economic system, firmly centered around the $ZK token. Achieving this vision requires strategic infrastructure: transaction demand must directly drive $ZK demand; ecosystem revenues must flow consistently back into the $ZK token economy; and clear incentive structures must simultaneously attract both AppChain operators and users. The recently proposed ZKnomics framework embodies this strategic vision, seeking to position ZKsync not merely as a Layer-2 rollup infrastructure, but as the central settlement hub for Web3 activity and the core engine powering governance and economic circulation.

Ultimately, ZKsync’s long-term success hinges on precisely aligning its tokenomics model with network architecture. When effectively implemented, the envisioned structure ensures AppChain transaction activities naturally fuel $ZK token utilization and demand, seamlessly integrates RWAs and stablecoin-based assets with on-chain liquidity, and organically connects public and private chains within a single, cohesive token economy. The question facing ZK technology is no longer simply whether it can technically operate within financial systems; rather, it now involves proving sustainable network economics and self-sufficiency at scale. In this context, 2025 could very well become the defining year in which ZKsync successfully provides compelling answers to these critical challenges.