Table of Contents

1. NVIDIA Inception Signals a Shift in Pundi AI’s Token Dynamics

2. Updates Toward Realizing Pundi AI’s Vision

2-1. Pundi AI MM Agent – Unlocking revenue opportunities through liquidity optimization

2-2. Diversified revenue streams of the $PUNDIAI token

2-3. PURSE+ plugin and the expansion of the SocialFI Ecosystem

2-4. Strategic partnerships to expand data utility

3. Present and Future Through the Lens of the Pundi AI Dashboard

3-1. Data accumulation status: Active data generation despite testing phase

3-2. User and transaction activity: Still limited participation to date

3-3. Outlook: Anticipating change with the official launch

4. Closing Remarks

1. NVIDIA Inception Signals a Shift in Pundi AI’s Token Dynamics

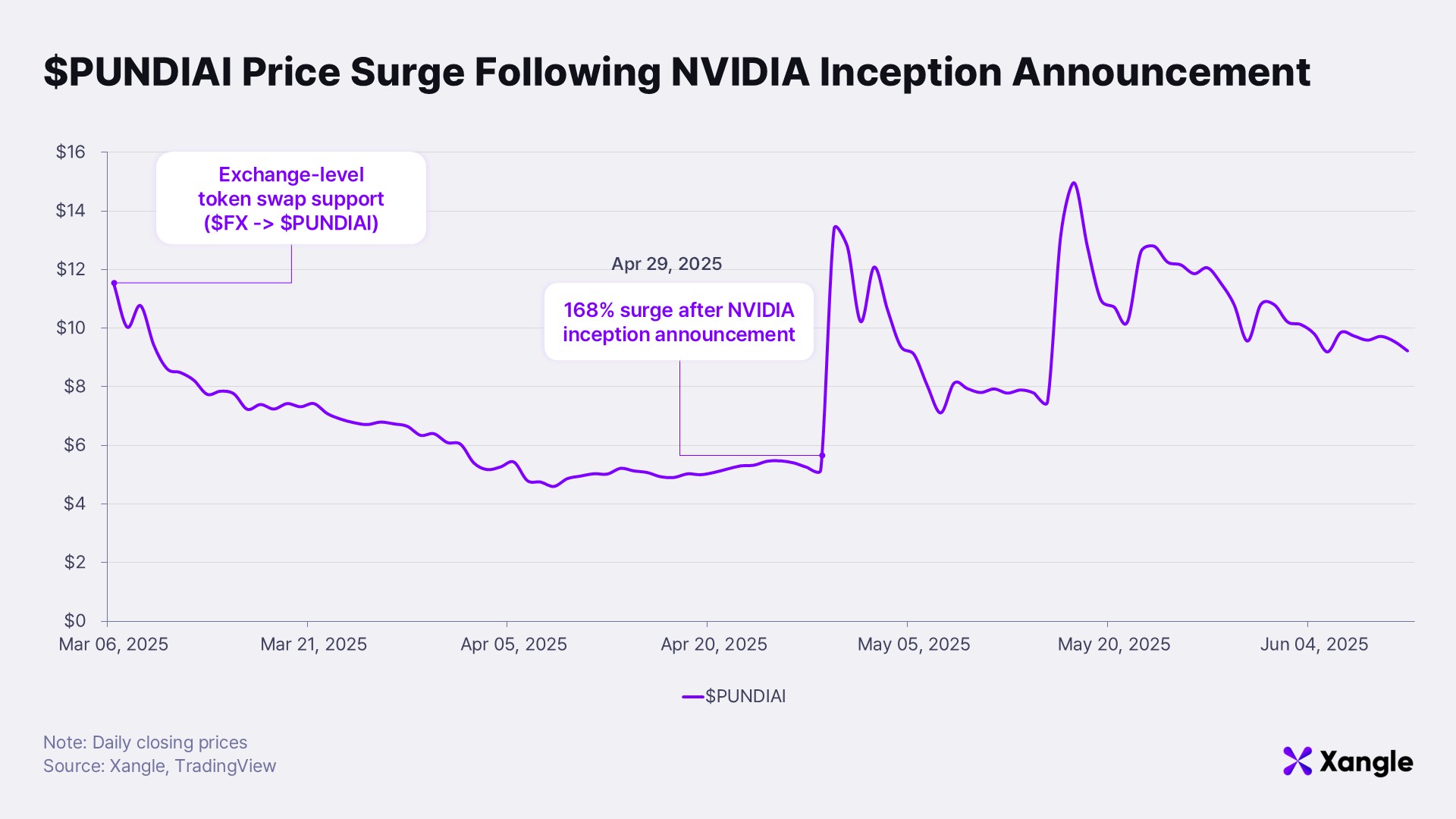

The sharp price uptick of Pundi AI’s token, $PUNDIAI, beginning on April 29, appears to have been largely driven by the announcement of its acceptance into the NVIDIA Inception program. NVIDIA Inception is a no-cost support initiative aimed at accelerating innovation and business development for AI startups. Benefits include discounted access to hardware, cloud credit support, and networking opportunities with industry experts. The market’s positive response to Pundi AI’s inclusion suggests that its positioning as a Web3 AI Data Foundry is resonating with investors. However, token prices are inherently volatile and highly sensitive to broader market conditions. Caution is warranted against making investment decisions based solely on this announcement.

Our earlier coverage, “Pundi AI Makes a Bold Move into the Data Market” (November 2023), underscored the team’s clear intent and confidence in pivoting toward AI. Since then, Pundi AI has actively showcased its demo service at major tech exhibitions and has continued to refine the economic structure of its data marketplace via technical improvements and tokenomics upgrades.

In parallel, strategic partnerships have been actively pursued to enhance the utility and reach of data generated on the platform. The NVIDIA Inception milestone, in this context, can be seen not as an isolated event, but as the result of consistent and deliberate groundwork laid over the past several months.

This follow-up report will assess Pundi AI’s concrete progress across technical developments and partnership activity, while also offering a forward-looking perspective based on data collected from the project’s ongoing alpha-phase platform.

2. Updates Toward Realizing Pundi AI’s Vision

Over the past several months, the Pundi AI team has taken steps beyond its original vision as an AI data platform, actively expanding into new service domains. A key initiative has been the development of the MM (Market Making) Agent, which diversifies its business scope while concretizing the utility of the $PUNDIAI token. Complementing these efforts, the team has also pursued strategic partnerships aimed at enhancing the platform’s practical applications.

To what extent can these developments contribute to Pundi AI’s long-term vision? And more critically—can each of these initiatives evolve into viable business models?

2-1. Pundi AI MM Agent – Unlocking revenue opportunities through liquidity optimization

Pundi AI’s newly introduced MM (Market Making) Agent is a service that uses AI to automate and optimize token liquidity provisioning. It is designed to create synergy by boosting on-chain trading activity, thereby increasing the liquidity of the existing data platform economy and enhancing the utility of the $PUNDIAI token.

In the crypto market, when a new token launches, a "market maker" is typically required after exchange listing to enable stable trading. Market makers facilitate this by continuously quoting bid and ask prices. However, both traditional and decentralized approaches present trade-offs. Conventional market makers require specialized talent and significant capital, limiting accessibility for smaller projects. In contrast, AMMs (Automated Market Makers) on decentralized exchanges allow anyone to provide liquidity—but individual users often struggle to respond effectively to market volatility, leading to capital inefficiency.

Even CAMMs (Concentrated Automated Market Makers) such as Uniswap V3—which have become mainstream—suffer from inherent limitations. CAMMs allow for concentrated liquidity in high-volume price ranges, increasing the chance of earning more trading fees. However, when price volatility causes tokens to exit the initially set range, liquidity providers suffer from impermanent loss due to shifts in token ratios. They are also burdened with the need to constantly monitor the market and reset price ranges. In the end, individual investors are still required to have a considerable degree of expertise and time commitment.

The MM Agent is positioned to solve these challenges using AI. By combining the sophistication of traditional market makers with the accessibility of AMMs, the system dynamically adjusts liquidity provisioning in real time. During normal conditions, liquidity is concentrated within ±1% of the current price to maximize fee capture. In periods of heightened volatility, the range is widened to ±5% to reduce downside risk. A standout feature is mempool monitoring. The agent scans unconfirmed transactions waiting in the blockchain’s mempool and anticipates large incoming trades, proactively adjusting liquidity ranges before those transactions are executed. Additional features include adaptive responses based on market indicators and gas fee optimization—underscoring the system’s capacity for fully dynamic liquidity management.

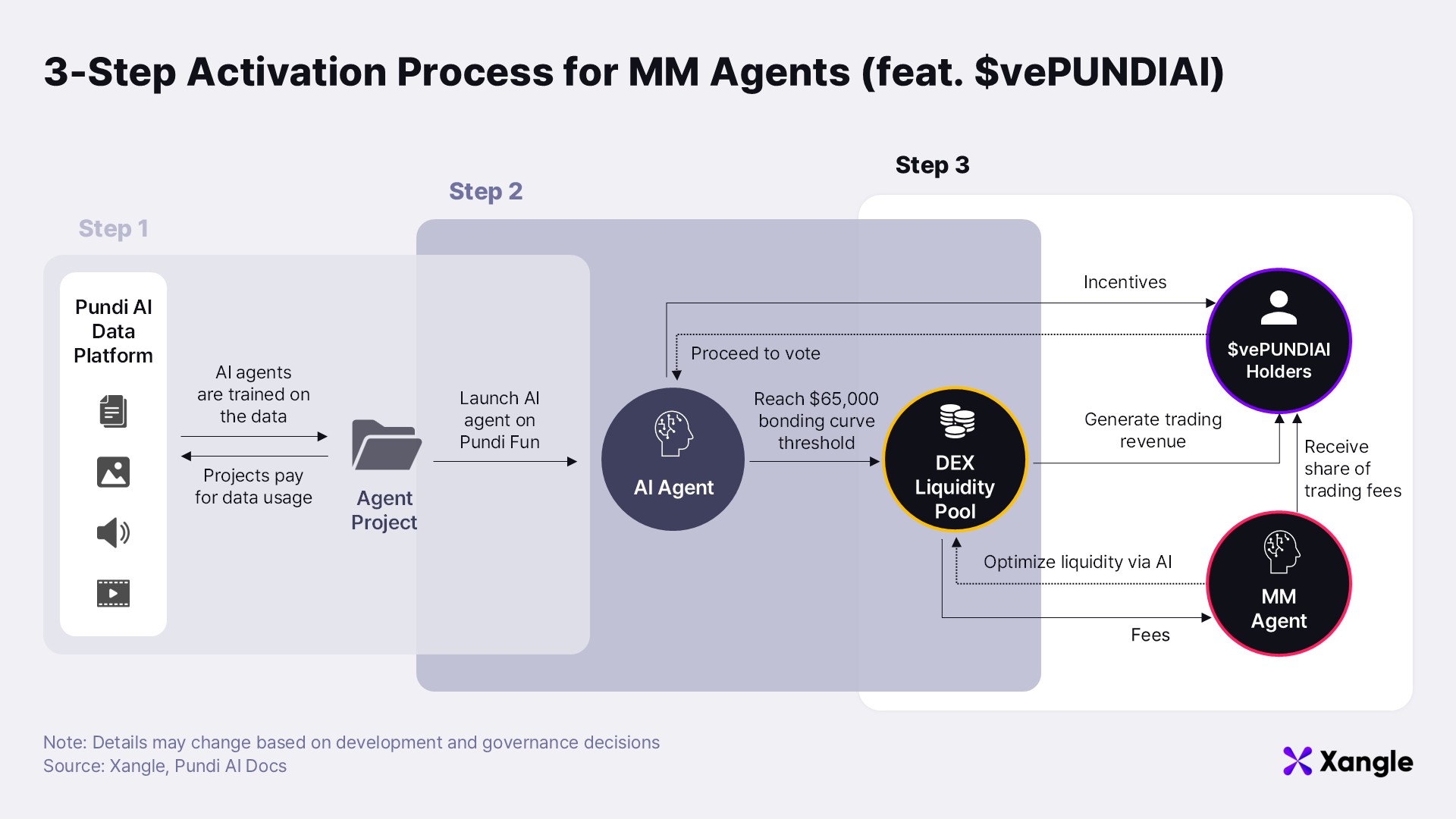

Pundi AI plans to roll out this service in three stages via a platform called “Pundi Fun.”

- In Phase 1, projects train their AI agents and launch their tokens.

- In Phase 2, once the project reaches a market cap threshold of $65,000, a liquidity pool is formed on DEX platforms such as Uniswap and Aerodrome.

- In Phase 3, holders of the governance token $vePUNDIAI vote weekly on which projects should receive liquidity incentives. (More on $vePUNDIAI will be covered in the next section.)

Projects can offer their own tokens or other rewards as “bribes” to attract votes. Based on the voting results, the Pundi AI Foundation purchases the selected project’s token and pairs it with $PUNDIAI to provide liquidity. The MM Agent then optimizes this newly formed liquidity pool to generate yield.

While this model is designed to be mutually beneficial for all participants, several risks remain. AI-driven trading systems often underperform relative to their theoretical promise—especially under volatile conditions. Core features like mempool monitoring and dynamic range adjustment require real-world validation. Moreover, the success of this structure depends heavily on active community participation. A sufficient number of engaged $vePUNDIAI holders and continuous onboarding of eligible projects are prerequisites for the mechanism to function as intended.

2-2. Diversified revenue streams of the $PUNDIAI token

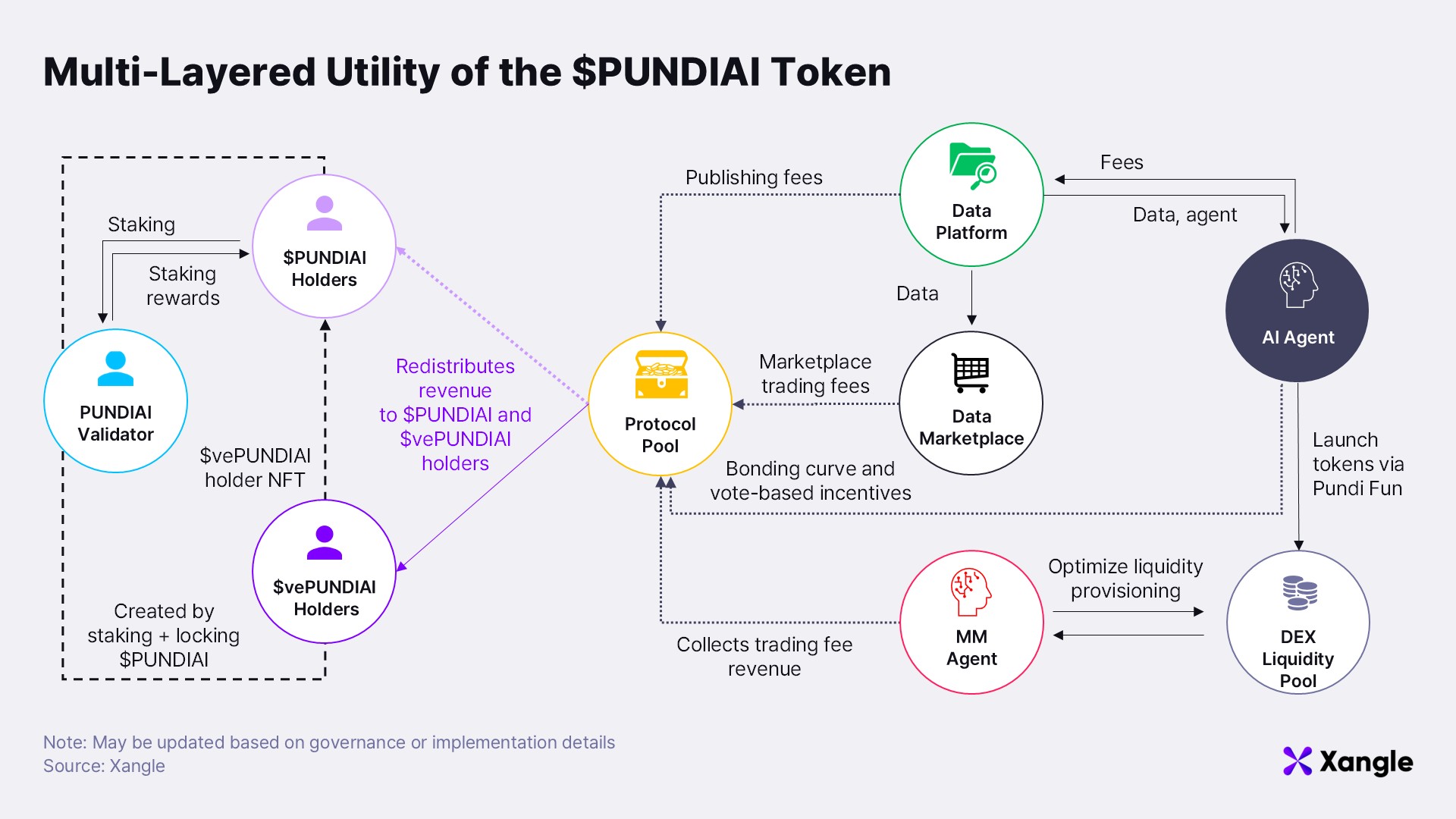

In our previous report, the $PUNDIAI token primarily functioned as a medium of exchange for data transactions. Recent updates, however, have transformed it into a multi-functional asset embedded across the platform’s operational, economic, and governance layers.

The most significant change is the introduction of a dual-token model anchored by $vePUNDIAI. While $PUNDIAI remains a standard ERC-20 utility token used across all Pundi AI services, $vePUNDIAI is issued through a two-step process:

- Users delegate $PUNDIAI to validators to earn staking rewards.

- They can then lock these delegated tokens for a fixed term to mint an NFT-form governance token, $vePUNDIAI.

$vePUNDIAI plays a central role in epoch-based voting to determine which projects receive liquidity incentives on the Pundi Fun platform. Voting power is proportional to the lock-up duration: a four-year lock grants 100% weight, while a one-year lock provides 25%.

This framework supports a diversified set of revenue streams across token holder segments:

- $PUNDIAI Holders

- Earn staking rewards (currently ~15% APY) via validator delegation

- Will receive a share of protocol revenue generated across the ecosystem

- $vePUNDIAI Holders

- Receive bribes (incentives) from projects seeking votes

- Earn a portion of DEX trading fees from pools tied to voted projects

- Collect 10% of the “convincing fee” paid by projects requesting whitelist inclusion on Pundi Fun

- Protocol Pool

- Aggregates revenue from various sources:

- 10% of data publishing fees (Pundi AI platform)

- 10% of marketplace transaction fees

- 10% of bribe fees collected via the MM Agent

- 1% of bonding curve transaction fees

- Trading fees from liquidity pools created through governance votes

- Funds are either redistributed to $PUNDIAI / $vePUNDIAI holders or allocated to ecosystem development

- Aggregates revenue from various sources:

While this tokenomic design provides strong incentives for participation, its success depends on several critical assumptions. A sufficient number of users must be willing to lock their $PUNDIAI for extended periods to ensure meaningful governance participation. At the same time, projects must perceive tangible value in the platform—enough to justify paying fees and offering bribes to attract liquidity.

No matter how well-structured the model may be, its long-term viability ultimately hinges on the appeal of the core services. Without continued growth in platform utility and active user participation, even the most sophisticated incentive mechanisms may struggle to sustain the ecosystem.

2-3. PURSE+ plugin and the expansion of the SocialFI Ecosystem

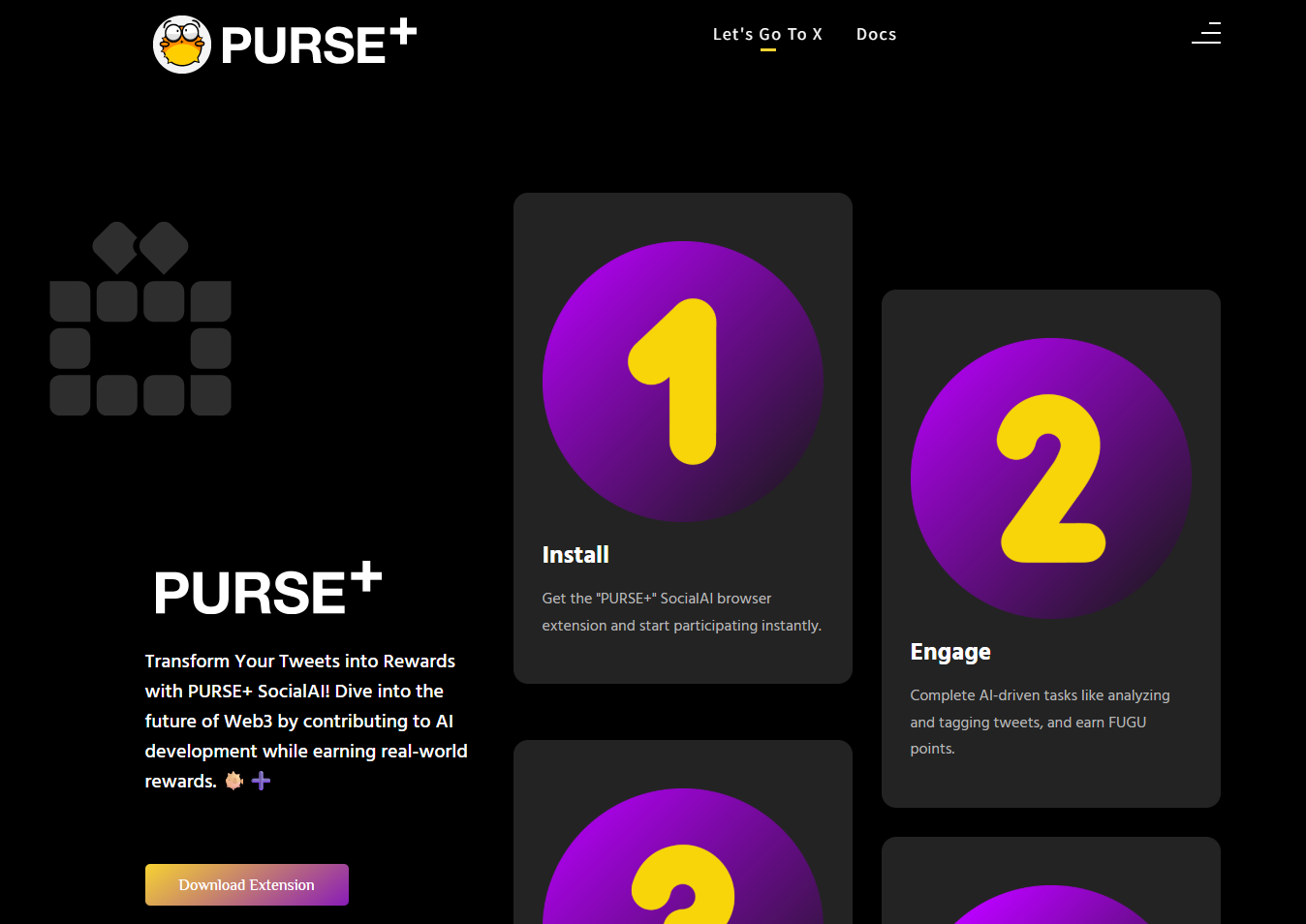

First introduced in our previous research, the PURSE+ browser plugin has emerged as one of the most accessible entry points for everyday users within the Pundi AI ecosystem. Operating directly on the Pundi AI chain, it enables users to participate in data tagging activities while engaging in routine interactions on X.com (formerly Twitter). Recently, PURSE+ has undergone significant enhancements, particularly in its token architecture and yield mechanisms.

Source: PURSE+

Source: PURSE+

ERC-404: A Dual-Token Structure with Experimental Utility

At the core of the PURSE+ ecosystem is the PURSE token, which adopts the experimental ERC-404 standard. This novel format merges the attributes of both fungible ERC-20 tokens and non-fungible ERC-721 tokens into a dual-token framework. A user’s token holdings are divided into active and inactive balances, and every 1,000,000 PURSE tokens can be wrapped into a single NFT.

These PURSE NFTs serve primarily as a technical experiment demonstrating the capabilities of the ERC-404 standard. Since each NFT must remain fully backed by the corresponding token amount, the structure encourages long-term token holding. However, these NFTs do not currently grant governance rights or direct economic benefits, and their utility remains largely symbolic and experimental.

Diverse Yield Mechanisms for PURSE Token Holders

Holders of PURSE tokens have access to multiple earning strategies. Token staking allows users to earn rewards without incurring impermanent loss, although withdrawals are subject to a 21-day unbonding period. Alternatively, users can supply liquidity to the PURSE-USDT pool and stake the resulting LP tokens. While this option may offer higher yields, it also exposes users to the risk of impermanent loss.

Within the broader Pundi AI ecosystem, PURSE+ plays a key B2C-facing role, responsible for onboarding new users and supporting data acquisition. While components like the MM Agent and Data Marketplace focus on more technical, on-chain operations, PURSE+ offers a familiar social-media-based experience that lowers the barrier to entry for mainstream participants. Its design bridges casual engagement with AI development—allowing users to contribute meaningfully without requiring technical expertise. In this way, PURSE+ enhances both chain utility and content expansion. The integration of ERC-404 and multiple yield strategies positions it not merely as a participatory tool, but as a viable source of economic incentives. That said, user acquisition remains a critical challenge. To maximize its impact, targeted marketing campaigns tailored to well-defined audience segments will be essential to scaling usage and capturing network effects.

2-4. Strategic partnerships to expand data utility

Source: Pundi AI Medium

Source: Pundi AI Medium

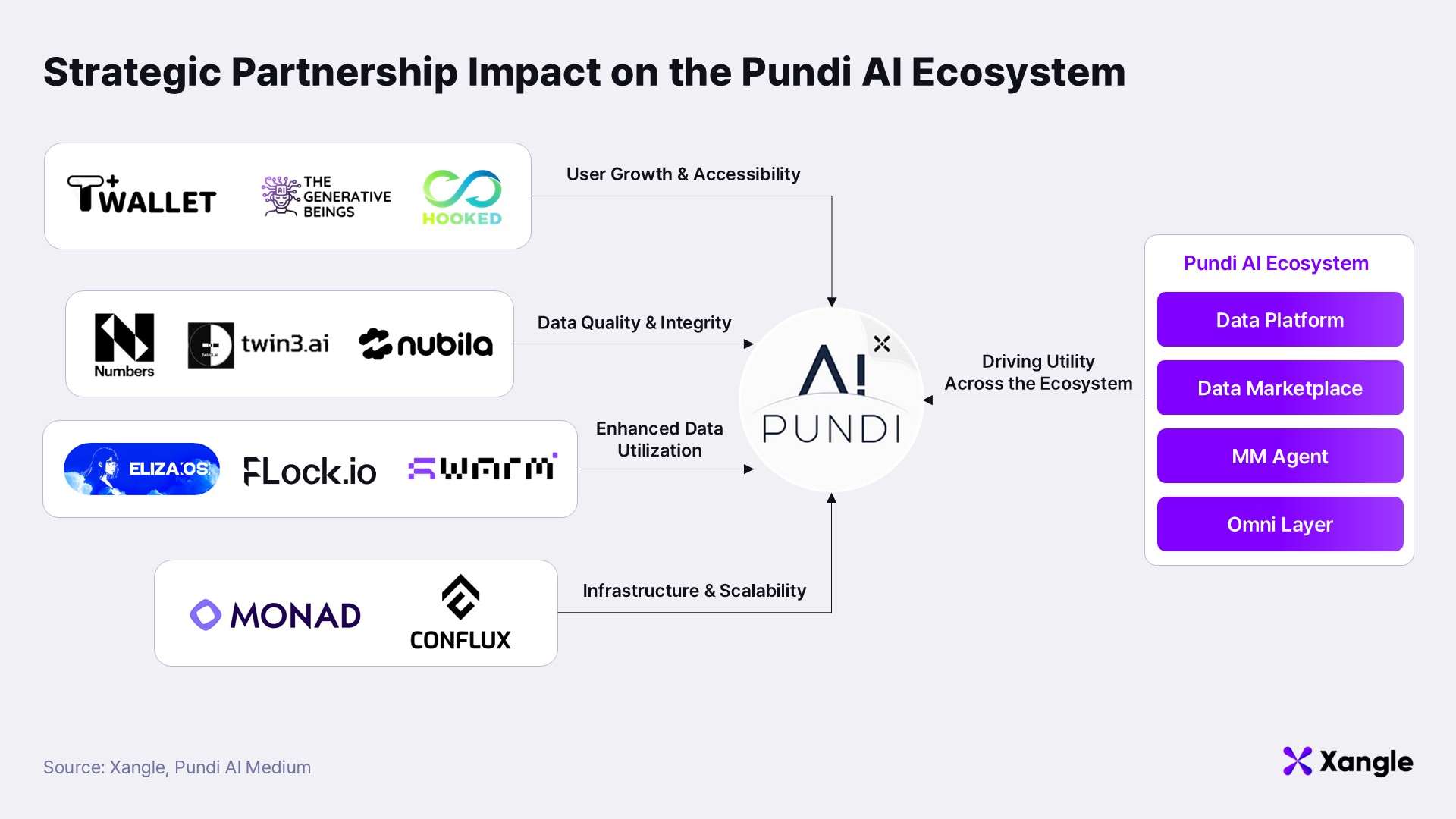

On June 10, Pundi AI announced a partnership with Eliza OS, accelerating its ecosystem expansion through active collaboration with leading AI infrastructure projects. Eliza OS, a comprehensive development framework for AI agents, enables agents built on the platform to access datasets generated by Pundi AI—drawing on them for knowledge extraction and model training.

For a decentralized AI data platform like Pundi AI, success hinges on securing a robust combination of data supply, engaged users, and scalable infrastructure. To that end, the team has been actively forming strategic partnerships—not only with Eliza OS but across multiple verticals. These collaborations can be grouped into four key categories:

1) Partnerships to broaden user access and adoption

Integration with T+ Wallet enables more than 100,000 users to directly participate in data annotation tasks within their wallets. Through collaboration with The Generative Beings, over 2,500 AI projects across Southeast Asia are now equipped to utilize Pundi AI’s data tools. In parallel, an educational partnership with Hooked Protocol introduces users to decentralized AI through the “Democratizing AI” learning module, further supporting user acquisition. Collectively, these partnerships contribute meaningfully to expanding the ecosystem’s active user base.

2) Partnerships to enhance data quality and integrity

Collaborations with Numbers Protocol and Twin3.ai aim to improve data reliability and provenance. Numbers Protocol offers digital watermarking and provenance verification tools, ensuring data integrity, while Twin3.ai leverages Soulbound Token (SBT) technology to validate the identity of data contributors. These partnerships are essential to securing the high-quality, trustworthy data required for effective AI training. Meanwhile, Nubila Network provides access to verified datasets in specialized domains, including ESG and environmental intelligence.

3) Partnerships to maximize data utility

To ensure that Pundi AI’s datasets are not only collected but actively leveraged, the project has expanded its partner network beyond Eliza OS. A key collaboration with FLock.io brings in expertise in federated learning and privacy-preserving AI, focusing on the development of vertical-specific models for industries such as finance, healthcare, and sports. A newly formed partnership with Swarm Network—built on the SUI blockchain—is also notable. Swarm offers tools that enable users to deploy and manage their own AI agents. This integration allows Swarm’s agents to access Pundi AI’s verified datasets, enabling cross-platform collaboration and agent-level interoperability.

4) Partnerships to strengthen technical infrastructure and scalability

Infrastructure-focused partnerships with Monad and Conflux Network are helping to solidify the technical backbone of the Pundi AI ecosystem. Monad contributes high-performance infrastructure and EVM compatibility, supporting the scalability of the Tag-to-Earn model. Meanwhile, Conflux Network’s Tree-Graph architecture enhances the performance of decentralized AI applications. Pundi AI’s inclusion in the NVIDIA Inception Program further bolsters its position, providing access to hardware subsidies, cloud credits, and a global network of AI-focused industry professionals.

This structured partnership strategy reflects Pundi AI’s ambition to evolve beyond a standalone data platform into a fully integrated AI ecosystem. By leveraging the domain expertise of its partners, the project is systematically reinforcing critical pillars of growth: user onboarding, data trustworthiness, technical scalability, and infrastructure readiness.

That said, the effectiveness of such a broad partnership network will ultimately depend on measurable outcomes. Demonstrating real-world synergies—particularly those that improve user experience or generate tangible network effects—will be key to validating the long-term value of these strategic alliances.

3. Present and Future Through the Lens of the Pundi AI Dashboard

To evaluate Pundi AI’s current performance and project its future trajectory, we turn to publicly available dashboard data. The Pundi AI Data Platform, currently in its alpha testing phase, allows users to upload datasets and request preprocessing services. While revenue distribution has not yet been activated and the testing environment remains limited, several key metrics offer valuable insights.

3-1. Data accumulation status: Active data generation despite testing phase

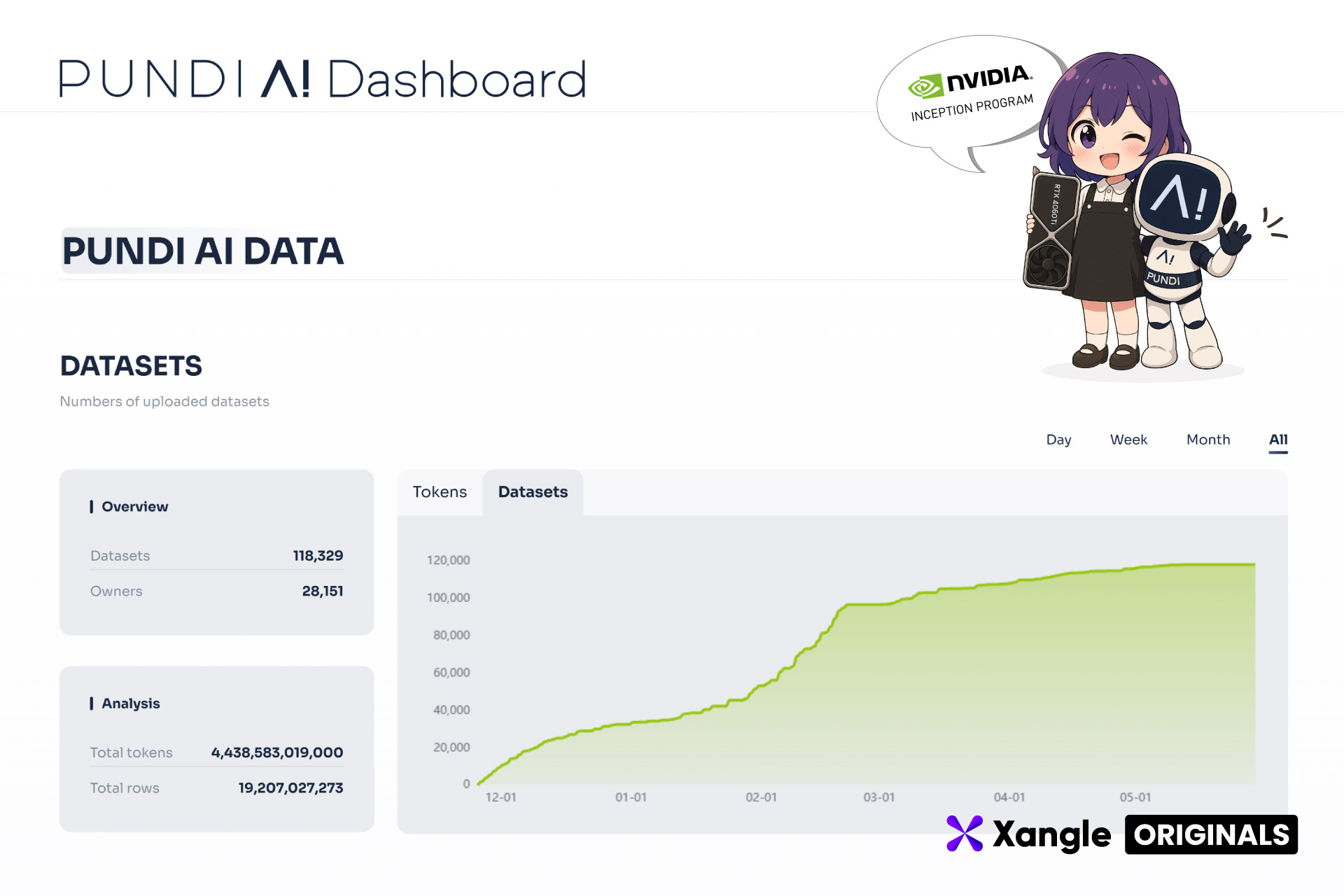

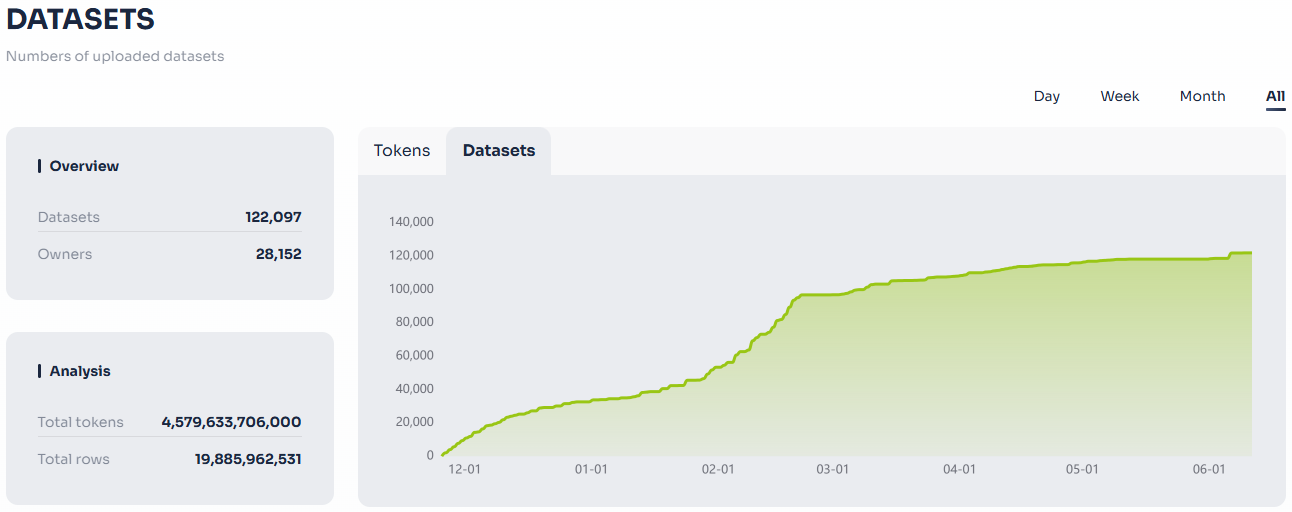

Source: Pundi AI Dashboard

Source: Pundi AI Dashboard

One of the most noteworthy indicators is the volume of accumulated datasets. As of June 12, 2025, a total of 122,097 datasets had been uploaded by 28,152 unique contributors. In aggregate, the platform has amassed 4.57 trillion tokens(individual data elements) and 1.98 billion rows—an impressive volume, particularly for a service still in its alpha testing phase.

The upward trajectory in data contributions has been consistent since late 2024, highlighting active engagement from participants despite the absence of token-based incentives. This pattern offers an early signal of the potential behind Pundi AI’s core value proposition: “Tag to Earn.” If such participation can be achieved without actual token rewards, it suggests substantial upside once the platform and its data marketplace go fully live.

That said, quantity alone is not sufficient. As the platform moves toward production, the quality and AI-relevance of the contributed data must be rigorously validated. The extent to which this growing dataset can support real-world AI training will ultimately determine the viability and long-term impact of Pundi AI’s ecosystem.

3-2. User and transaction activity: Still limited participation to date

Source: Pundi AI Dashboard

Source: Pundi AI Dashboard

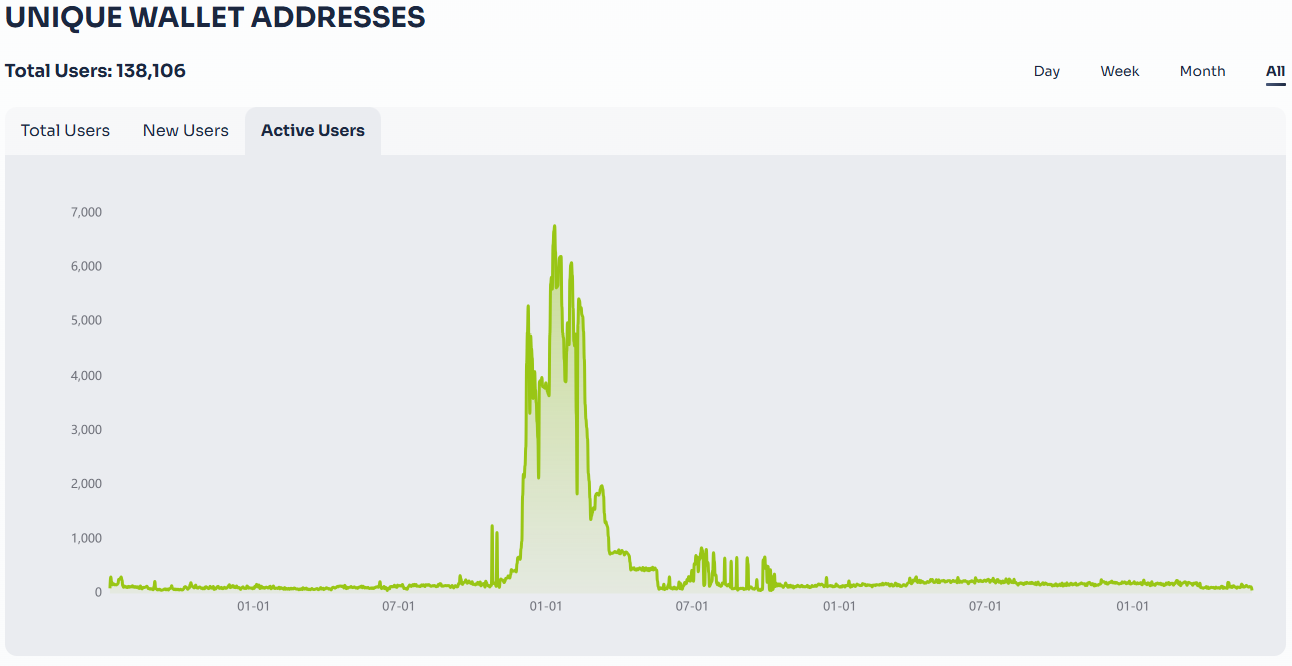

In contrast, user activity metrics appear underwhelming. While the platform has seen 138,106 unique wallet connections, the number of daily active users (DAUs) has declined since a sharp spike in active wallets in 2023.

Source: Pundi AI Dashboard

Source: Pundi AI Dashboard

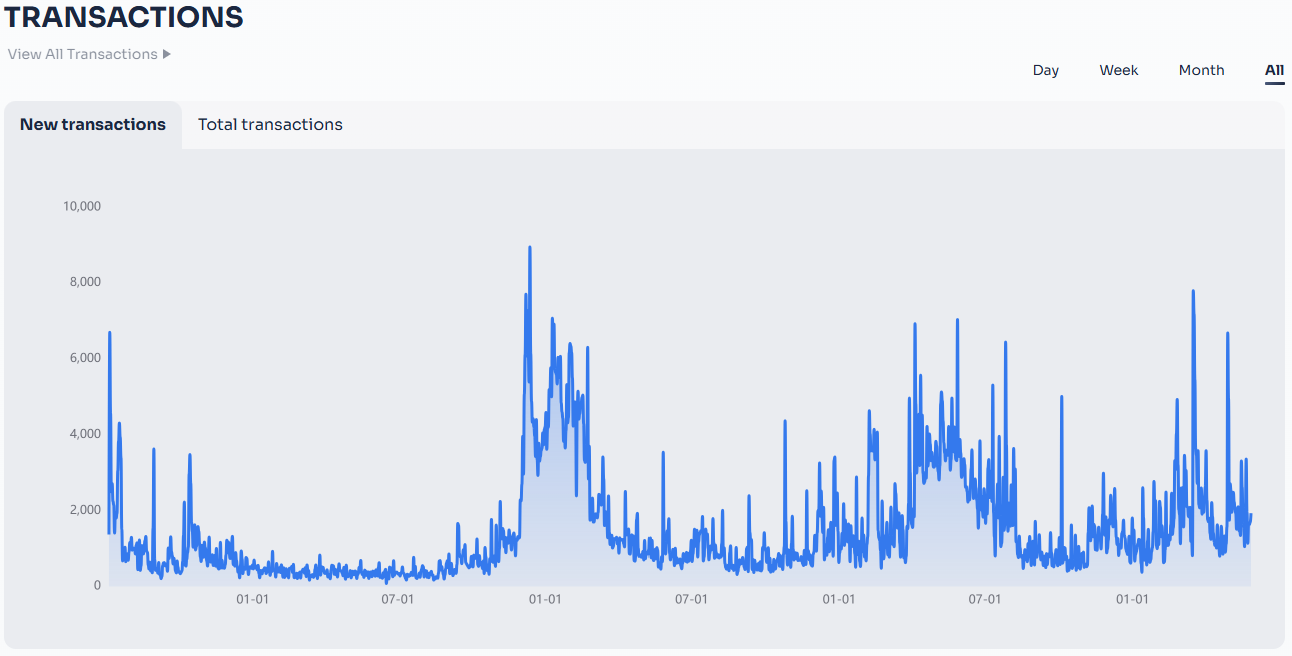

In terms of transaction volume, there is no clear indication that the pivot to an AI data platform has yet translated into sustained on-chain activity. A definitive upward trend will likely become more evident only after the full launch of Pundi AI’s services.

3-3. Outlook: Anticipating change with the official launch

The limitations of the current metrics stem largely from the platform’s alpha-stage constraints and the absence of active revenue distribution. However, a significant shift is anticipated once Pundi AI officially launches its data marketplaceand begins distributing token rewards under the Tag-to-Earn model.

With more than 110,000 datasets already accumulated, the supply-side infrastructure is relatively well established—assuming this data is effectively integrated into the mainnet rollout. If the strategic partnerships outlined earlier translate into active user participation, stagnant wallet activity and transaction volumes could see a meaningful rebound.

For example, the potential onboarding of 100,000 users from T+ Wallet and 2,500 AI projects from The Generative Beings would likely result in a measurable uptick in user engagement and platform utility.

Ultimately, the success of Pundi AI hinges on one core question: Can the project translate its growing dataset and partner network into a practical and valuable user experience? While the current data contribution metrics are encouraging, the true test lies in converting this momentum into sustainable, real-world business value.

4. Closing Remarks

Pundi AI has steadily evolved from a single-purpose AI data platform into a multifaceted ecosystem. The project now spans DeFi through the introduction of the AI MM Agent, employs a more sophisticated token economy via the $PUNDIAI / $vePUNDIAI dual-token model, and explores mass adoption through the PURSE+ SocialFi interface. These efforts collectively reflect a strategic push to broaden the ecosystem through a multi-pronged approach.

The next challenge lies in forging synergy across these components. In theory, a seamless loop—where users onboard through PURSE+, contribute data on the platform, see that data monetized in a marketplace, and then have AI agents and token liquidity optimized by the MM Agent—could form a powerful value cycle. With over 110,000 datasets already uploaded during the alpha phase, expectations are high for a significant transformation once the platform and incentive mechanisms go live. However, intensifying competition in the AI data space cannot be ignored. As Pundi AI refined its vision, many other projects entered the market with similar goals. In today’s environment, a compelling value proposition is no longer sufficient. Success will depend on precise differentiation and the delivery of a tangible, user-centric experience.

That said, Pundi AI may be entering its most promising window yet. The recent upward momentum in both Pundi AI and Pundi X token prices suggests heightened investor interest. If the team can translate this attention into concrete results, it could catalyze the next major phase of growth. The project is actively pursuing listings on major centralized exchanges (CEXs) and accelerating its marketing efforts, including airdrop campaigns.

Source: Pundi AI Medium – Pundi AI featured on Binance Alpha

Source: Pundi AI Medium – Pundi AI featured on Binance Alpha

Above all, Pundi AI deserves credit for its resilience. In a space where countless projects have vanished after merely launching a token, Pundi AI has continued to build—releasing products, forming partnerships, and seeking meaningful utility. Now, with the NVIDIA Inception milestone behind it, the spotlight is on whether it can turn its accumulated technology and data into measurable real-world outcomes.