BD by trade, research by curiosity

Table of Contents

1. CZ’s Return and Renewed Spotlight on BNB with TST and Broccoli

2. BNB’s 2025 Roadmap: Shaping the Future with Purpose-Driven Infrastructure

3. Which Sector in the BNB Ecosystem Deserves the Most Attention?

3-1. Proven user retention in the gaming sector on opBNB

3-2. The BNB Chain’s DeFi power sustains top-tier TVL

4. Will BNB Stage a Major Comeback?

1. CZ’s Return and Renewed Spotlight on BNB with TST and Broccoli

Changpeng Zhao (CZ) had long been an iconic figure in the global cryptocurrency industry. However, in April last year he was sentenced to prison on charges of violating anti-money laundering laws, leading to his resignation as Binance’s CEO. With CZ’s incarceration reducing his public presence—and aggressive marketing by competing exchanges—the symbolic power of Binance weakened, and community interest in BNB appeared to wane for a period.

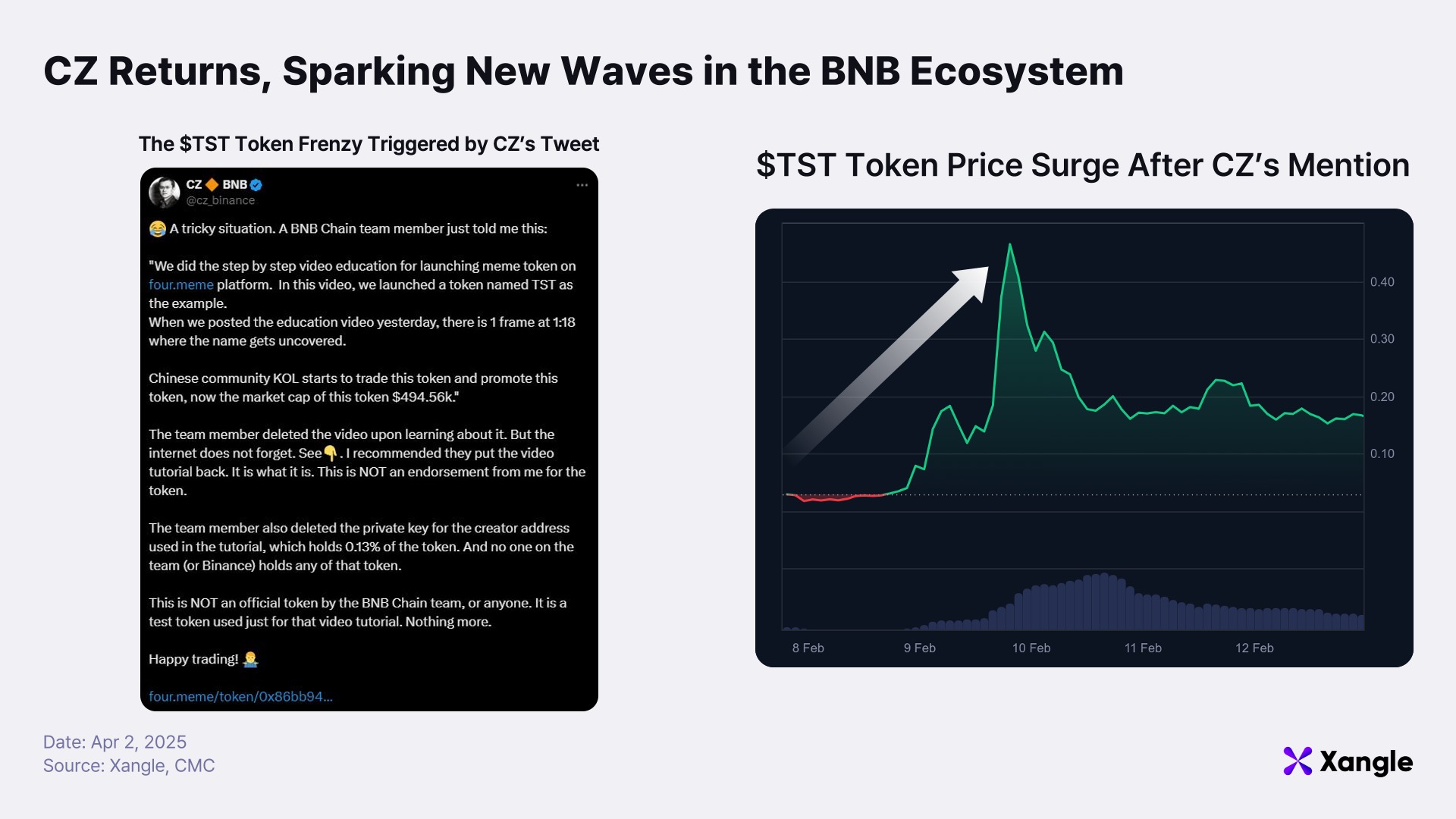

Yet the atmosphere changed dramatically when CZ, after completing his sentence, resumed activity on Twitter (now X). Although he stated that he had stepped away from Binance’s management, he restarted social media engagement surrounding the BNB Chain and its ecosystem. The community reacted immediately, reviving interest in BNB. A clear example of this renewed attention was the $TST incident in February this year.

Originally, TST was merely a simple test token featured in BNB Chain tutorials. But almost immediately after CZ mentioned it in a tweet, the community embraced it like a meme coin—and it spread rapidly. A token that initially had no real value or utility was quickly listed on multiple exchanges, and following its Binance listing its market capitalization once surpassed $500 million, with some forecasts even suggesting it could reach $1 billion.

Adding to this overheated atmosphere was CZ’s pet dog, “Broccoli.” As soon as he revealed his dog’s name, meme coins bearing that name began appearing in droves on both the Solana and BNB Chains. In one striking case, a Broccoli meme coin on Solana reached a market cap of $1.5 billion. Meanwhile, the BNB Chain’s Four.Meme platform emerged as a new hub for community-driven issuance and distribution of meme coins.

These events clearly demonstrate that CZ still wields tremendous influence and can directly shift market trends. In fact, after a period when BNB’s market cap was once overshadowed by Solana’s, it reversed course—and the community, galvanized by CZ’s tweets, has been generating new memes and narratives that inject fresh, positive energy into the ecosystem. This report examines, in a comprehensive manner, how the BNB ecosystem might evolve in light of these changes, focusing on recent technical and strategic developments and key sectors to watch.

2. BNB’s 2025 Roadmap: Shaping the Future with Purpose-Driven Infrastructure

Recently, the BNB infrastructure has evolved to consist of three major products, each defined by its functional role and technical purpose: BNB Smart Chain (BSC), opBNB, and BNB Greenfield. The rationale for operating these diverse solutions together is to allow projects within the ecosystem to select the most suitable technical infrastructure based on their specific characteristics and objectives. This multi-layered architecture overcomes the limitations of a single chain focused on one function, significantly enhancing overall network scalability and flexibility.

- BNB Smart Chain(BSC): A high-performance, EVM-compatible Layer 1 blockchain that serves as the backbone of the BNB ecosystem. BSC hosts a wide array of Web3 applications, including DeFi, NFTs, and meme coins. With lower gas fees (averaging around $0.1) and fast block times (approximately 3 seconds), BSC enables Ethereum developers to easily scale their projects, while users can operate with familiar wallets like MetaMask. Its close integration with Binance (e.g., fee-free chain transfers and potential exchange listings) is another major advantage.

- opBNB: A Layer 2 scaling solution for BSC based on Optimism’s OP Stack. By processing transactions off-chain and summarizing the results on BSC, opBNB increases throughput while reducing fees. As of 2024, it can achieve speeds of up to 5,000 TPS and is particularly well-suited for applications in gaming, social interactions, and microtransactions. opBNB is designed to overcome the limitations of BSC and offers an optimized infrastructure for projects that require high-frequency transactions.

- BNB Greenfield: A dedicated storage chain focused on decentralized data storage, providing an environment where users can store, share, trade, and monetize their data. Unlike traditional Web2 cloud services, Greenfield manages data ownership and access on-chain and, when combined with DeFi, enables a data-driven economic model. It is applicable for personalized dataset storage and monetization for AI training, RWA-based file storage, and NFT-integrated file services.

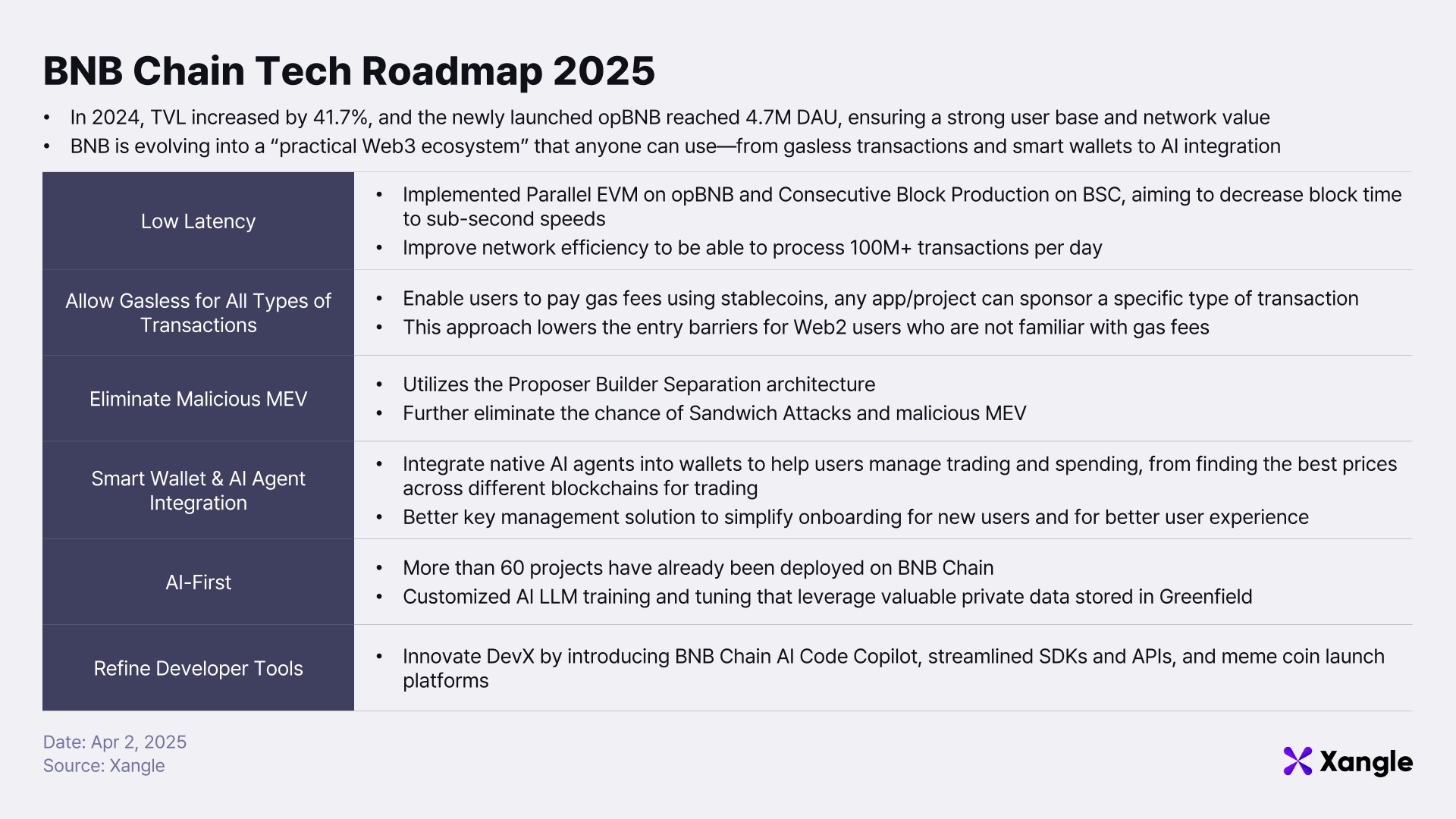

The technical roadmap for the BNB Chain, announced in early 2025, outlines the innovation strategy for the entire ecosystem based on these three products. Broadly, the roadmap is divided into three pillars: i) Scaling to handle over 100 million transactions per day, ii) the adoption of AI Agents, and iii) the implementation of Account Abstraction. These initiatives aim to build a Web3 ecosystem that anyone can easily access and use.

Thus, the BNB Chain roadmap delivers a diverse array of infrastructures—integrating multiple technologies beyond a single Layer 1—to provide the performance and superior developer experience that projects and builders demand. In addition to features that facilitate the onboarding of users unfamiliar with Web3 (through Binance’s user base), the ecosystem is also advancing the AI sector by hosting large-scale online hackathons such as “BNB AI Hack.”

3. Which Sector in the BNB Ecosystem Deserves the Most Attention?

3-1. Proven user retention in the gaming sector on opBNB

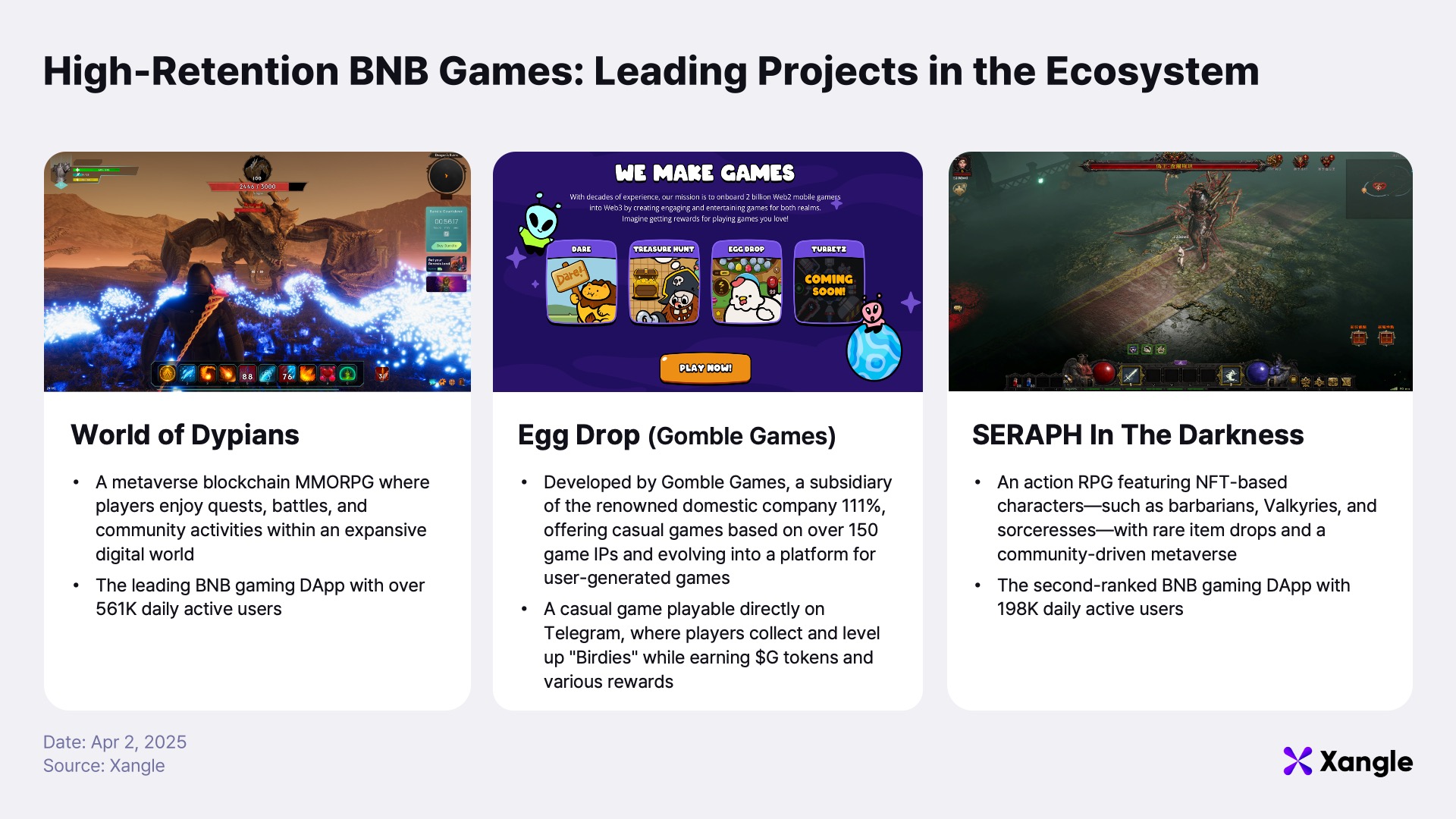

In Web3, games have long been recognized as a key driver for user acquisition and on-chain transaction activity. However, few projects have delivered sustained performance in terms of actual user experience and retention. Many projects rely on short-term airdrop events or token rewards, which often fail to maintain continuous user engagement. In this context, the BNB Chain ecosystem stands out by hosting projects that are genuinely in use—where real users visit daily to play and transact.

For example, “World of Dypians” records 560,000 daily active users, “SERAPH” about 200,000, and “Egg Drop” over 70,000, thereby quantitatively proving high retention. Notably, opBNB—a Layer 2 solution built on the OP Stack—has been particularly impressive: as of April 2025, it recorded a total of 2.07 million unique active wallets (UAW) and processed an average of over 2.3 million transactions per day, ranking among the top global gaming chains. In fact, according to DAppRadar’s gaming category rankings, opBNB sits at 3rd, and the main chain, BNB Smart Chain, boasts the highest number of DApps (5,671) among all blockchains.

opBNB not only offers higher TPS and lower fees compared to its main chain, BSC, but also benefits from Binance’s robust infrastructure, EVM compatibility, and a flexible onboarding system that lowers entry barriers for both users and developers. BNB has built a gaming ecosystem that is driven by actual usage and retention—demonstrating that Web3 games can evolve into sustainable models without solely relying on token rewards or airdrops. It is expected that various genres of games will continue to be actively developed on the BNB Chain.

3-2. The BNB Chain’s DeFi power sustains top-tier TVL

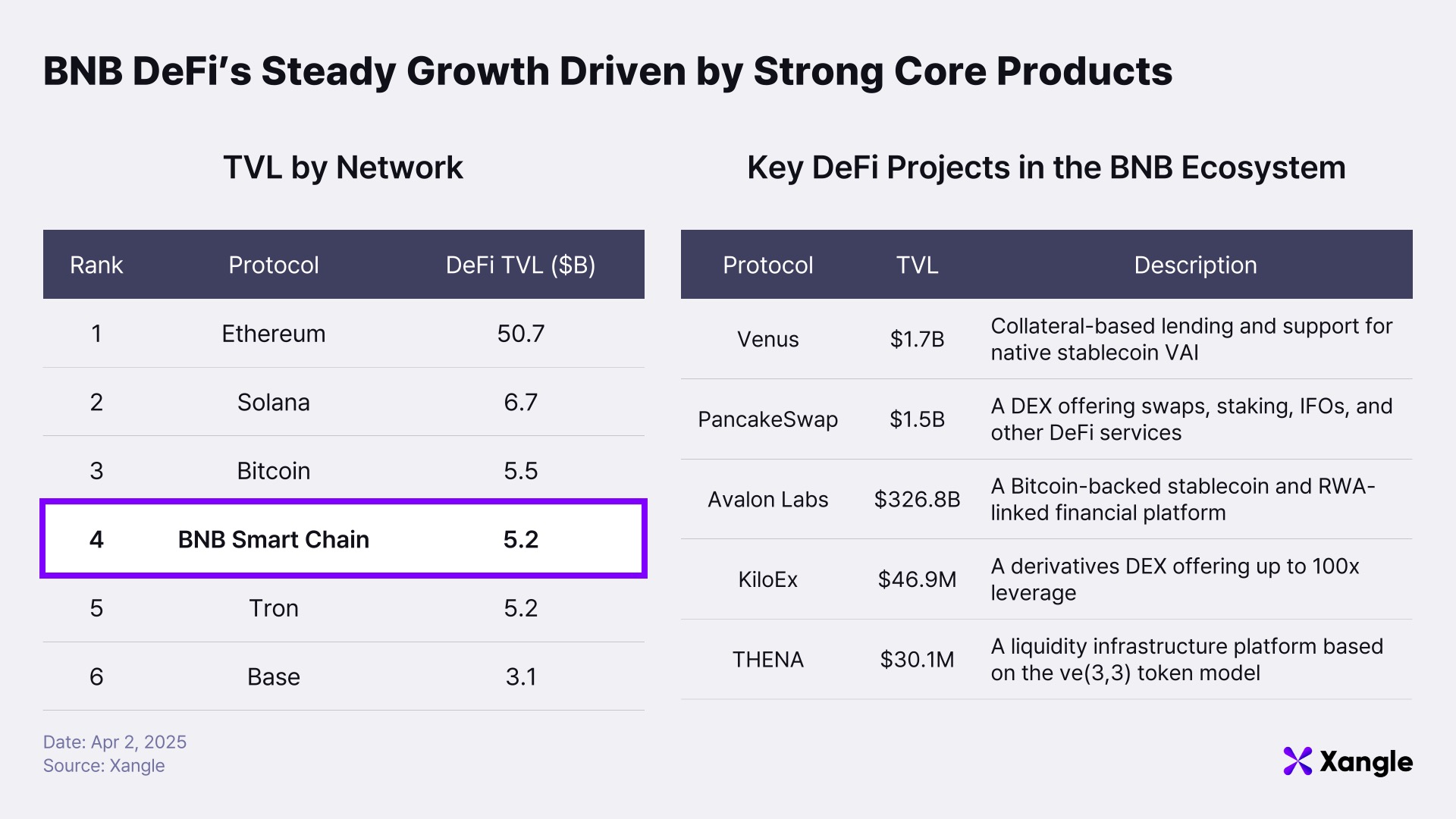

As of 2025, the BNB Smart Chain has recorded approximately $5.3 billion in DeFi TVL, ranking 4th among all blockchain networks. This achievement is not merely the result of technological factors but is also attributable to Binance’s strong support and strategic backing. BSC offers low gas fees (averaging around $0.1) and fast block generation (roughly 3 seconds), which are now within reach of most EVM-compatible chains. More importantly, the structure that naturally onboard Binance users to the BNB Chain—combined with Binance’s business support, strategic initiatives for project attraction, and liquidity provisioning—has created an environment optimized for the transition from CEX to DEX.

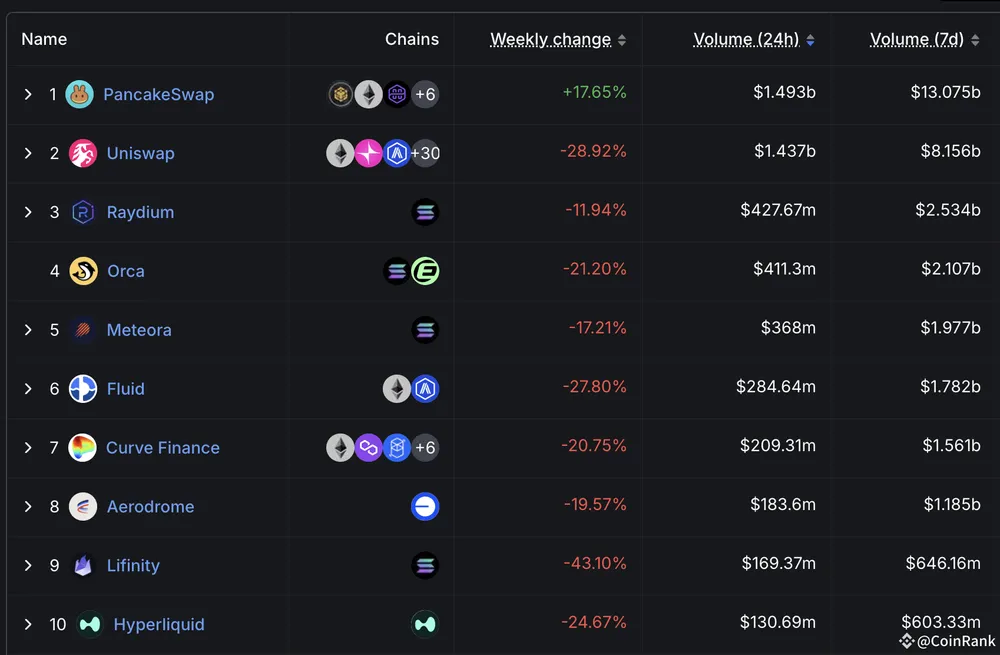

For example, PancakeSwap, a leading DEX on BSC, is an all-in-one platform that integrates swapping, yield farming, staking, IFO, and NFT trading. Its TVL currently stands at around $1.6 billion, and on March 25 it recorded a daily trading volume of $1.5 billion, surpassing Uniswap to claim the top spot in overall DEX trading volume. This success is due to its intuitive UI, which makes it accessible even to beginners, a low-cost structure, and consistent upgrades that maintain high user satisfaction.

DeFiLlama DEX Daily Trading Volume Rankings, March 25

Recently proposed upgrades in version 4 plan to modularize the AMM and introduce Flash Accounting to maximize gas fee efficiency. With various liquidity pools such as CLAMM and LBAMM and flexible Hooks functionality, developers can design their preferred order structures or fee strategies, while external developers can also earn revenue through Hooks. This has laid the foundation for PancakeSwap to evolve into an infrastructure-oriented DeFi platform. If Ethereum’s Uniswap has firmly established its position as the AMM DEX, then on BSC, PancakeSwap has secured its place.

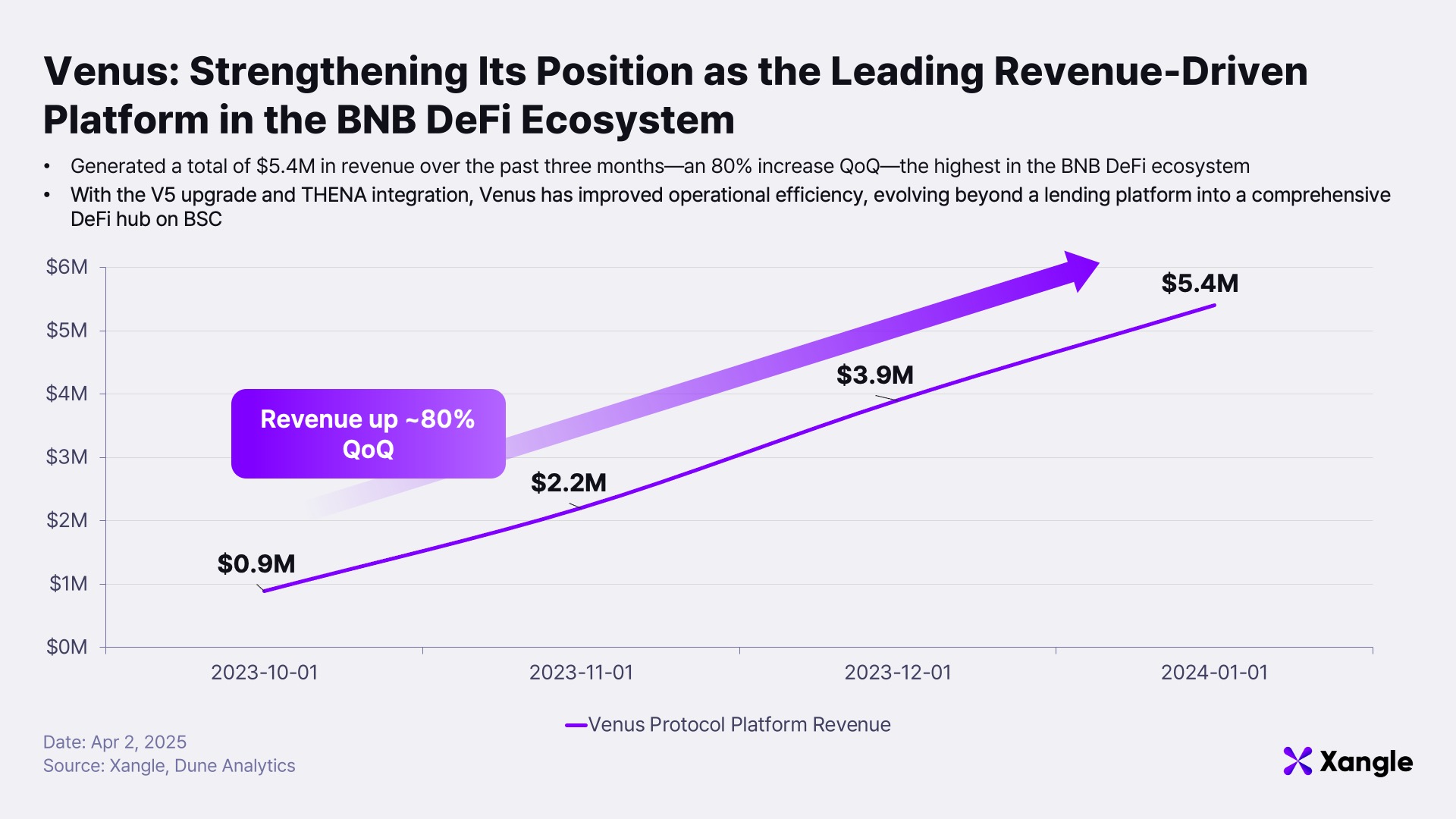

Venus Protocol, the largest lending and borrowing platform on the BNB Chain, has built its own financial ecosystem through the issuance of its stablecoin VAI. Based on a hybrid structure that combines elements of Compound and MakerDAO, Venus allows users to perform lending, borrowing, and stablecoin issuance through a single interface. Moreover, by integrating with PancakeSwap, it enables simultaneous lending and swapping, thereby enhancing asset management efficiency. Venus has also seen significant growth, achieving around $5.4 million in revenue between October 2024 and January 2025—a nearly 80% increase compared to the previous 90 days.

Venus Prime enables staking 1,000 XVS to grant users preferential interest and loan rates, and the upcoming V5 upgrade is expected to feature interface improvements, enhanced risk parameters, and a restructured liquidity separation. Venus is also planning to evolve into a super app via integration with THENA. Based on the ve(3,3) model, THENA supports effective liquidity collection and distribution for various DeFi protocols, further enhancing Venus’s scalability and liquidity management efficiency.

Avalon Labs is expanding the BTCFi sector by offering Bitcoin-collateralized loans and issuing the Bitcoin-based stablecoin USDa, focusing on linking on-chain real-world assets (RWA) in a manner accessible even to Web2 users. Meanwhile, KiloEx—a derivatives-focused DEX built on opBNB—is set to offer advanced features including up to 125x leverage, a wide range of asset trades, and sophisticated copy trading, all while capturing a broad user base with its fast transaction processing and intuitive UI.

Overall, the DeFi ecosystem on the BNB Chain is more than just a collection of independent protocols; these protocols are organically interconnected, creating synergies. The close integration among major protocols like PancakeSwap, Venus, and THENA not only enhances asset flow efficiency but also promotes capital circulation within the chain. In particular, the seamless connection between key financial functions—such as liquidity gathering, trading, lending, and derivatives—creates a structure that minimizes user churn and boosts cross-utilization among services. This ultimately forms the foundation for a sustainable, usage-driven DeFi growth model that can persist for years.

4. Will BNB Stage a Major Comeback?

Recent rebounds in the BNB ecosystem have transcended a mere “meme coin boom” and have successfully rekindled market interest that had been waning. In fact, daily user numbers and transaction volumes have remained consistently above a certain threshold, while a variety of practical applications in gaming, DeFi, and social platforms are actively operating—demonstrating strong potential for sustained momentum.

The multi-infrastructure approach, comprised of BNB Smart Chain (BSC), opBNB, and BNB Greenfield, is designed to cater to different use cases. This structure allows projects to select the most suitable chain based on diverse needs—ranging from DeFi and gaming to AI and data storage—clearly underscoring the flexibility and versatility of the BNB ecosystem. Notably, opBNB, as a high-performance Layer 2, plays a critical role in driving real user adoption in gaming and social sectors, while Greenfield is primed to capture emerging demand for RWA and AI data bridging between Web2 and Web3. Moreover, robust backing from Binance—the global leader in trading volume—provides a solid foundation for the stable growth of the BNB ecosystem.

Ultimately, whether BNB can rise beyond the role of a fast follower to lead the industry depends on how its narrative is crafted and sustained. The market buzz generated by CZ’s return needs to evolve into a trend where more users actively engage with its infrastructure. BNB boasts a strong technical foundation, a solid user base, and unwavering support from Binance. The remaining challenge is to harmonize these elements into a long-term vision that resonates with the market. With effective execution, BNB could not only mark the comeback of a traditional powerhouse but also become a driving force in creating a new cycle in the industry.