Table of contents

1. Why Aptos Ecosystem Deserves Your Attention

2. DeFi

2-1. Aries Market

2-2. Echelon

2-3. Echo

2-4. Hyperion

2-5. Merkle Trade

2-6. Kana Labs

2-7. Noctra

2-8. Fliq

3. Game

3-1. KGEN

4. Infra

4-1. Rewardy Wallet

1. Why Aptos Ecosystem Deserves Your Attention

The era of launching massive token sales through ICOs is behind us. Today, the dominant marketing strategy for Token Generation Events (TGEs) centers on accumulating points through trading volume, asset deposits, and social activity—and then using those points for airdrops. This point-based airdrop approach accelerates both user acquisition and liquidity inflows, driving on-chain activity. Consequently, recent mainnets have seen surges in network activity and rising token values that coincide with the TGEs of major projects.

A prime example is seen in Solana and SUI. Toward the end of 2023, after key projects like Jupiter and Jito conducted consecutive TGEs, the Solana network experienced significant activation. Similarly, SUI saw dramatic growth during Q4 2024 following TGEs by core projects such as Suilend and DeepBook, which amplified market hype. The TGEs of major DeFi projects drove users to deposit SOL and SUI into liquidity pools and use these tokens for network fees while trading—and this, in turn, directly impacted token prices. However, market conditions vary: In Solana’s case, trigger events like Jupiter and Jito reactivated a tepid network, drawing in users and capital; in SUI’s case, the market’s keen interest was further fueled by the TGEs of Suilend and DeepBook.

This cycle is expected to repeat on Aptos.

Aptos began as Meta’s Diem project and evolved into a Layer 1 blockchain built on its native smart contract language, Move. Aptos is well known for its technical strengths, including its Block-STM parallel execution engine, ultra-low latency consensus protocol (Raptr), and low fee structure. Yet, the recent attention on Aptos is driven not only by its technology but also by the simultaneous onset of ecosystem expansion and a wave of TGEs.

Throughout 2024, the Aptos ecosystem experienced rapid expansion with the emergence of various DeFi protocols and applications. During this period, TVL increased more than 13-fold, at one point surpassing $2.1 billion. What is particularly interesting is that most of these projects have not yet conducted their TGEs. Many are either preparing for their TGEs or are in the product-building phase—which increases the likelihood of even more capital and users flowing into Aptos. The current direction set by Aptos Labs and the foundation is clearly aimed at expanding the ecosystem. Aptos CEO Avery Ching stated, “Ecosystem growth is everything and our top priority.” and has initiated ecosystem fund operations and dedicated TGE support tracks (LFM) to fully support Aptos ecosystem growth.

Despite current global market challenges brought on by intensifying trade wars and economic uncertainty, there is an expectation that once the market regains upward momentum, the growth wave in the Aptos ecosystem will also begin. In this context, this article explores the key projects growing within the Aptos ecosystem and examines the opportunities and potential inherent in Aptos.

Disclaimer

This content is intended solely to provide information about the point-accumulation structures and utilization methods used by projects in the Aptos ecosystem and does not constitute an endorsement or recommendation for any specific investment. In particular, the strategy described herein represents only one of many approaches for using DeFi, and excessive leverage carries significant risks—including the risk of liquidation. Readers should exercise caution and assume full responsibility for their own decisions.

2. DeFi

2-1. Aries Markets - The all-in-one DeFi hub

Aries Markets Strategy 🪄

-

Currently pre-token issuance, Aries Markets is running a point-based program to provide user incentives (likely with an airdrop at the TGE).

-

Users receive 1 point per $1 deposited for assets and 3 points per $1 when borrowing.

-

With leverage, the APY on stablecoin loans can reach up to 14.9% and users can earn up to 37 points per $1. The method for generating leverage is as follows:

-

Deposit USDC as liquidity

-

Borrow USDT

-

Re-deposit the borrowed USDT

-

Borrow USDC again

-

Repeat steps 1–4(This strategy is called Looping)

-

⚠ Note: Leverage investments carry the risk of liquidation if USDC or USDT depeg beyond certain thresholds.

About Aries Markets

Aries Markets is the largest DeFi platform on Aptos, offering an integrated protocol for margin trading, lending/borrowing, and swaps on a single platform. It launched with the Aptos mainnet in 2022 and currently holds a TVL of approximately $700 million(include borrowed coin in lending protocol), ranking first within the Aptos ecosystem and within the top 12 global lending protocols.

From a technical perspective, Aries is based on its own lending infrastructure. Users can deposit assets to earn interest, and they can also pledge collateral to borrow funds; this process is fully automated via Move-based smart contracts. Notably, Aries provides a structure that allows both lending and swapping to be executed in a single transaction, enabling swaps without the need for asset borrowing. This unified interface streamlines the user experience by seamlessly integrating leveraged exposure into the trading process.

Screenshot of executing swaps without asset borrowing on Aries Markets (Source: Aries Markets)

Screenshot of executing swaps without asset borrowing on Aries Markets (Source: Aries Markets)

Aries Markets is not just a standalone success story—it serves as a core infrastructure driving the growth of the Aptos DeFi ecosystem. By integrating lending and trading functions into one platform, it delivers both capital efficiency and ease of use. Additionally, the real-world application of its high-performance modules provides developers with valuable technical insights. Aries Markets demonstrates that Aptos is capable of implementing sophisticated on-chain financial services, thereby paving the way for institutional capital and professional traders to enter the market.

2-2. Echelon - A high-efficiency lending protocol

Echelon Strategy 🪄

-

Echelon’s structure enables looped deposits and borrowing on the same asset, allowing for leverage strategies with high LTV (up to 93%).

-

A point-based program is currently in place (with an anticipated airdrop at the TGE).

-

Major stable assets such as USDC, USDT, and sUSDe can be leveraged up to 14.3× through a -Looping strategy.

-

USDC Strategy:

- Achieves up to 14.3× leverage with an APY of 19.9% + points; provides stable, asset-backed operation with moderate yields.

-

USDT Strategy:

- Achieves up to 14.3× leverage with an APY of 9.2% + points; offers lower yields but enables diversified asset strategies.

-

sUSDe Strategy:

- Achieves up to 14.3× leverage with an APY of 67.4% + points; the high APY is driven by an Ethena-based reward structure (refer to this link for details).

⚠ Note: With leverage investments, there is a risk of liquidation if USDC, USDT, or sUSDe depeg beyond acceptable thresholds. Current APY figures include protocol incentives and may decline in the future.

About Echelon

Echelon is a decentralized lending protocol on Aptos designed to maximize capital efficiency by optimizing liquidity and borrowing efficiency for assets on the Move blockchain. Since its launch on the Aptos mainnet in Q1 2024, it has grown rapidly and currently holds a TVL of around $333 million(include borrowed coin).

The core technology of Echelon leverages the high price correlation among assets in the same category to enable ultra-efficient borrowing. For instance, due to the strong price correlation between stablecoins—or between LSD-original token pairs like stAPT and APT—Echelon can apply much higher LTVs compared to conventional lending models. The protocol refers to this as "Efficiency Mode" (i.e., high-borrowing mode), aiming to offer up to 95% LTV for select asset categories. Additionally, Echelon employs an advanced liquidation mechanism to prevent risk propagation during market volatility, and it operates a stable framework for allowing deposits and borrowing of identical assets, enabling a so-called “Looping” strategy that can achieve up to 20× leverage.

Echelon’s lending pool list; notice the increased LTV in Efficiency Mode (Source: Echelon)

Echelon’s lending pool list; notice the increased LTV in Efficiency Mode (Source: Echelon)

Echelon stands as a prime example of capital efficiency innovation within Aptos DeFi. By implementing a decentralized high-leverage model similar to the prime brokerage found in traditional finance, Echelon enables users to harness more assets against the same collateral. This approach provides substantial benefits for traders, DeFi users, and institutional borrowers alike, driving the movement of liquidity into Aptos.

2-3. Echo Protocol - The Bitcoin bridge and liquid staking protocol

Echo Protocol Strategy 🪄

-

Users who deposit BTC receive aBTC on a 1:1 basis, and the platform provides lending and liquid staking services. This dual functionality creates multiple revenue streams along with point farming opportunities.

-

The Echo Points program is currently active alongside a campaign offering up to 5× rewards (likely tied to the TGE airdrop).

-

Strategy on Echo:

-

Deposit BTC on Echo for an APY of 7.7% + points

-

Deposit the generated aBTC into Echo Lend for an APY of 12% + points

-

-

Strategies Combining Other Protocols:

-

Stake APT on Trufin (7% APY)

-

Deposit the liquidity token TruAPT into Echelon (6.99% APY + Echelon points)

-

Borrow aBTC on Echelon (plus 0.06% interest with additional Echelon points)

-

Redeploy aBTC back on Echo (12% APY + points)

-

⚠ Note: Leverage investments carry liquidation risks if prices fall significantly. The APYs include protocol incentives and are subject to change.

About Echo Protocol

Echo Protocol is the first Bitcoin bridge and liquid staking platform in the Aptos and Move ecosystem, offering yield farming opportunities for both BTC and APT. Through Echo, users can transfer BTC onto Aptos, earning an annual yield of 7.7% simply by depositing. Currently, Echo’s aBTC market share accounts for approximately 34% of Aptos’s total bridged assets, with a total TVL of about $220 million.

Echo’s structure revolves around aBTC (a liquidity token bridged on a 1:1 basis from BTC) and eAPT (a liquid staking token generated through staking APT or aBTC). aBTC can be used in lending, deposits, and derivatives trading on Aptos, while also qualifying for various rewards. eAPT serves as a restaking asset not only on Aptos but also across other Move-based chains.

The Bitcoin bridge supported by Echo Protocol (Source: Echo Protocol)

The Bitcoin bridge supported by Echo Protocol (Source: Echo Protocol)

Screenshot of liquid staking on Echo Protocol (Source: Echo Protocol)

Echo Protocol goes beyond a simple bridge by attracting Bitcoin liquidity to Aptos. Its structure, which enhances both user profitability and network security through aBTC and eAPT, has allowed Aptos to take another step toward establishing a multi-chain DeFi network. Echo is recognized as a core platform growing into a cross-chain asset liquidity hub.

2-4. Hyperion – A High-Performance Hybrid DEX

Hyperion Strategy 🪄

- Currently running a point-based program named "Drips" where users earn points based on their activity (likely with an airdrop at the TGE).

- When providing liquidity, users earn 5 Drips per $100 deposited, and during trading, they accumulate between 1–10 Drips per $100 based on the fee rate.

- Hyperion’s key advantage is its limited number of current participants—the early mover advantage!

- Example Strategy for the APT-USDC Pool:

- Depositing $500 into a pool with a 0.05% fee yields 25 Drips per day.

- Executing $1,000 in trades adds an extra 50 Drips.

- This pool currently offers an APR of 196.9%, delivering very high returns from fee revenue.

⚠ Note: The current APR includes Hyperion’s incentive rewards, so figures are subject to change in the future.

About Hyperion

Hyperion is a hybrid DEX developed on Aptos that combines an order-book with an AMM model to deliver an optimized trading environment for both everyday users and professional traders. Leveraging Aptos’s speed and technical capabilities, Hyperion aims to recreate the user experience typical of centralized exchanges entirely on-chain.

At its core, Hyperion integrates an order-book based trading system with a pool-based AMM liquidity structure. This synergy enables traders to achieve precise executions and rapid order book updates, while liquidity providers benefit from continuous revenue generation. This hybrid approach has been acclaimed for simultaneously addressing slippage and liquidity shortcomings that have hindered traditional DEXs.

Swapping on Hyperion (Source: Hyperion)

Swapping on Hyperion (Source: Hyperion)

Since its launch, Hyperion has rapidly attracted both users and trading volume, firmly establishing itself as one of the leading DEXs within the Aptos ecosystem. As of April 8, daily trading volume has reached approximately $18 million—a significant figure achieved in a short period. TVL has also risen rapidly, exceeding $7 million within just four months of launch.

The emergence of Hyperion marks a major milestone in enhancing the on-chain trading infrastructure of the Aptos ecosystem. Although still in its early stages—and with additional liquidity and user acquisition needed—its performance is impressive given its short time on the market. Hyperion successfully translates Aptos’s technical excellence into a tangible user experience, creating strong expectations that it will help establish Aptos as a cornerstone of the DeFi space.

2-5. Merkle Trade - A perpetual futures exchange that maximizes user experience

Merkle Trade Strategy 🪄

-

Merkle Trade employs a structure combining skill (trading returns), luck (raffles), and contribution (lock-up), enabling not only top traders but also consistently active users to farm APT rewards and points.

-

It operates in seasons; in Season 34, a total reward pool of 17,000 APT is being offered (Duration: April 3–17).

-

Reward Breakdown:

- Racing Royale (3,000 APT): Competition based on trading returns

- Raffle Pool (4,000 APT): Participate in APT or MKL raffles using points

- Lock & Earn (10,000 APT): Lock points to receive rewards proportionate to the amount locked

-

How to Participate in Racing Royale:

-

Build up your Degen Score through trading; if you rank among the top 20, you are crowned “Degen King.”

-

If you become King, a survival challenge begins—each day, the bottom two ranked are eliminated.

-

Otherwise, if you are not King, you become a “Peasant” and can bet your accumulated Chips on promising Kings to earn rewards.

-

-

Point Utilization Strategies:

- Lock & Earn: Lock your points until the end of the season to earn rewards proportional to MKL tokens.

- Raffle Pool: Use 10 or more points to participate in raffles for APT or MKL.

About Merkle Trade

Merkle Trade is an on-chain perpetual futures exchange built on Aptos that supports up to 150× leverage across more than 50 assets. It operates on a single liquidity pool model using USDC, where liquidity providers earn returns in MKLP tokens and traders open long/short positions against the pool. All transactions are processed on-chain in real time, ensuring rapid and precise trade execution.

Merkle Trade’s standout strength lies in its utilization of Aptos’s high-speed processing capabilities and keyless wallet functionality, which allow entry using only email or social logins. This provides a user experience that enables even Web2 users to participate naturally in trading without the complexity of managing a traditional wallet, thereby lowering the entry barriers for Aptos-based DeFi.

Merkle Trade can be easily accessed via Google login (Source: Merkle Trade).

Merkle Trade can be easily accessed via Google login (Source: Merkle Trade).

In addition, Merkle integrates gaming elements into trading, delivering an experience that includes character progression, NFT rewards, and leaderboard competitions. This design not only fosters repeated engagement and community-driven activity but also boosts user retention and organic sharing beyond simple profit-driven motives. Merkle Trade is considered Aptos’s flagship trading protocol—blending exceptional UX, speed, and entertainment—and is emerging as a new benchmark for Web3 trading.

Merkle Trade Leaderboards (Source: Merkle Trade)

Merkle Trade Leaderboards (Source: Merkle Trade)

2-6. Kana Labs - The all-in-one DeFi app

Kana Labs is a Web3 super app built on Aptos that offers cross-chain bridging, a DEX aggregator, and perpetual futures trading. Thanks to its intuitive UI and low fee structure—designed to be accessible even to Web2 users—the platform is growing rapidly. According to DAppRadar, Kana Labs ranks as the second most active wallet provider on Aptos and holds the top spot among DeFi projects.

The most critical feature of Kana Labs is its AMM-based DEX aggregator swap, which automatically finds the best swap route by connecting over nine different chains. Users simply need to select their desired chain and token; efficient exchanges are facilitated by Panora and the platform’s proprietary algorithm. Key information such as slippage and received amounts is transparently provided, and on Aptos, Kana Labs also supports gasless swaps via a Paymaster.

Cross-chain swaps available on Kana Labs (Source: Kana Labs)

Cross-chain swaps available on Kana Labs (Source: Kana Labs)

Kana Labs isn’t just another DeFi application—it serves as a core gateway that lowers the entry barriers to the Aptos ecosystem. In particular, users accustomed to EVM chains can access Aptos-based assets via cross-chain swaps, effectively driving adoption for Move-based chains that aren’t EVM-compatible. At the same time, Kana Labs integrates liquidity from various chains and DEXs, functioning as a powerful aggregator that enables easy and efficient swaps. In this way, Kana Labs aims to be a Web3 DeFi super app that enhances both usability and connectivity, playing a key role in expanding Aptos into a mainstream DeFi platform.

2-7. Noctra - The DeFAI infrastructure for effortless DeFi development

Noctra is Aptos’s first AI-driven DeFi automation platform (DeFAI), providing an AI agent infrastructure that spans everything from developing investment strategies and executing trades to generating content. Noctra’s core strength lies in enabling anyone to create and customize an AI agent tailored to their needs, thereby automating the often complex processes of DeFi. While its concept is similar to Base’s Virtual Protocol or Solana’s ai16Z, Noctra distinguishes itself by focusing exclusively on DeFi.

List of AI agents launched on the Noctra platform (Source: Noctra)

List of AI agents launched on the Noctra platform (Source: Noctra)

Within the Noctra platform, a range of AI agents have already been launched (Source: Noctra). These AI agents perform various functions, including ▲ executing trades, ▲ analyzing market data, and ▲ creating content. Depending on a user’s risk profile and objectives, these agents can automatically conduct tasks such as swaps, deposits, analyses, and even tweet generation. They integrate directly with major Aptos DeFi protocols like Aries, Echo, and Thala, enabling even complex operations to be automated with a single configuration.

By unifying diverse DeFi activities under one AI infrastructure, Noctra aims to lower the high entry barriers of traditional DeFi so that anyone can participate with ease. When combined with Aptos’s high-performance network, Noctra’s agent-based automation system offers a new user experience, allowing users to maximize profits without being burdened by the complexities of DeFi.

2-8. Fliq - on-chain prediction market where you can trade everything

Fliq is an on-chain prediction market platform built on Aptos that supports decentralized betting and opinion trading on various topics such as sports, cryptocurrencies, and politics. Operating under the motto “Bet on Everything,” Fliq enables anyone to create and participate in prediction markets, garnering attention as an information-driven DeFi platform within the Web3 space.

Users can create a prediction market by inputting a question, determining judgment criteria, and setting an end time; approved markets are then formally listed. Trades are structured around Yes/No prediction tokens, where winning tokens converge to 1 and losing tokens to 0, based on the outcome. In the near future, a decentralized settlement and dispute resolution system is also expected to be introduced. Fliq supports both market orders (instant execution with a 0.05% fee) and limit orders (price-specified with no fee), allowing for sophisticated participation strategies.

Screenshot of a limit order on Fliq (Source: Fliq)

Screenshot of a limit order on Fliq (Source: Fliq)

Fliq is currently under development with a target mainnet launch in 2025. By introducing the new category of prediction markets into the Aptos ecosystem, Fliq demonstrates the potential to expand beyond simple betting into areas such as public opinion surveys, policy simulation, risk hedging, and community-based participation mechanisms. With its design intended to capture not only Web3-native users but also general users interested in event-based financial participation, Fliq is poised to add depth to both the scalability and practical utility of the Aptos ecosystem.

3. Gaming

3-1. KGeN - A decentralized game publisher platform ensuring data sovereignty

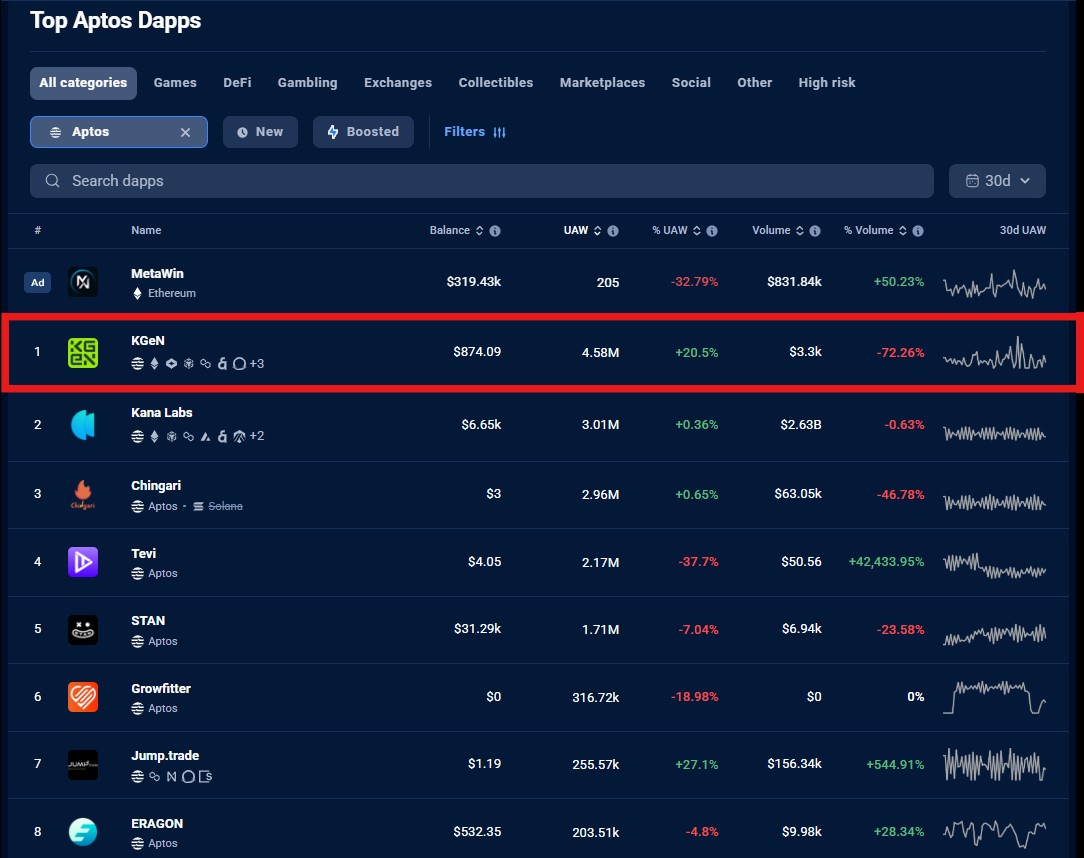

KGeN is a distributed gamer network platform built on Aptos. It operates around a “Proof of Gamer (POG)” system that records gamers’ activity data on-chain and uses this data to provide rewards and reputation scores. Currently, KGeN has secured over 4.5 million active monthly users—primarily in emerging markets such as India, Brazil, and Nigeria—making it the DApp with the largest user base on Aptos.

KGeN’s technical architecture is built on two main pillars. The first is the POG (Proof-of-Gamer) engine, which measures real user activity data. The second is a dedicated LLM model named POG-E that learns from this extensive dataset to generate AI-based agents. The POG engine calculates a reputation score, known as K-Points, by monitoring over 93 behavioral indicators such as playtime, achievement completion, PvP performance, and community contributions, and records these scores on-chain. Beyond simple analysis, POG-E leverages this data to generate intelligent AI agents that make real-time decisions in-game, propose strategies, or respond adaptively to user behavior. For instance, POG-E can suggest trading strategies, provide guidance to new users, or analyze community reactions to specific games or projects to deliver actionable insights.

Users can utilize their K-Points profile as a sort of resume across various games, with high scorers receiving NFT rewards, airdrops, and early access benefits in new games. Conversely, game developers can leverage this vast dataset to enable user segmentation targeting, optimize retention strategies, and potentially reduce customer acquisition costs (CAC) by up to 60%. Notably, this data can be reused not only within a single game but also across cross-game and cross-chain environments, enhancing its value as a form of digital identity.

KGeN is a project that aims to realize long-discussed ideals in Web3 regarding data sovereignty and user-centric economies—returning data ownership and revenue structures back to gamers. Moreover, gamers’ reputation data can be repurposed in other Aptos protocols, such as DeFi, NFTs, and DAOs, further boosting overall ecosystem scalability and synergy.

For more detailed insights about KGeN, please read Xangle’s “KGeN: Leading the Next Wave of Web3 Game Publishing.”

4. Wallet

4-1. Rewardy Wallet - The social wallet delivering quest-to-earn

Rewardy Wallet is a reward wallet service that converts everyday activities—such as listening to music, gaming, and watching advertisements—into Web3 rewards. Users can create a wallet with just a social login, enabling them to perform on-chain actions naturally within the app without needing to use a seed phrase or pay gas fees. Centered around a "Quest-to-Earn" structure, users earn points by engaging in various activities, and these points are automatically converted in real time into RWD tokens via Rewardy’s core P2T (Point-to-Token) system. This entire conversion process operates seamlessly in the background, providing an instant reward experience.

Rewardy has already proven its value in the Web2 space, with 1 million downloads, hundreds of thousands of monthly active users, and over 170,000 reviews averaging 4.3 stars. Following its partnership with Aptos, a pilot campaign converting points into Aptos-based NFTs attracted tens of thousands of participants. In 2025, Rewardy plans to launch its Aptos mainnet DApp, which will deliver full on-chain functionalities for point accumulation, tracking, and asset conversion. Additionally, in collaboration with the Aptos Foundation, a large-scale onboarding campaign is underway in Web2-centric regions such as Korea, Japan, and Southeast Asia, aimed at converting hundreds of thousands of users into Aptos wallet holders.