Table of Contents

1. Babylon, Opening the BTCFi Era

2. Phase 2: Launch of the Babylon Genesis Chain and the $BABY Token

2-1. Babylon Genesis Chain is set to become the central hub of BTCFi

2-2. Enhanced protocol security backed by multiple mechanisms 2-3. The long-awaited launch of the $BABY token and its tokenomics

3. Phase 3: Expanding the BSN Chain Lineup and Strengthening the DeFi Ecosystem

3-1. BSN Chains, securing the future revenues of bitcoin staking

3-2. The blossoming DeFi ecosystem of the Babylon Chain

4. Closing Thoughts

1. Babylon, Opening the BTCFi Era

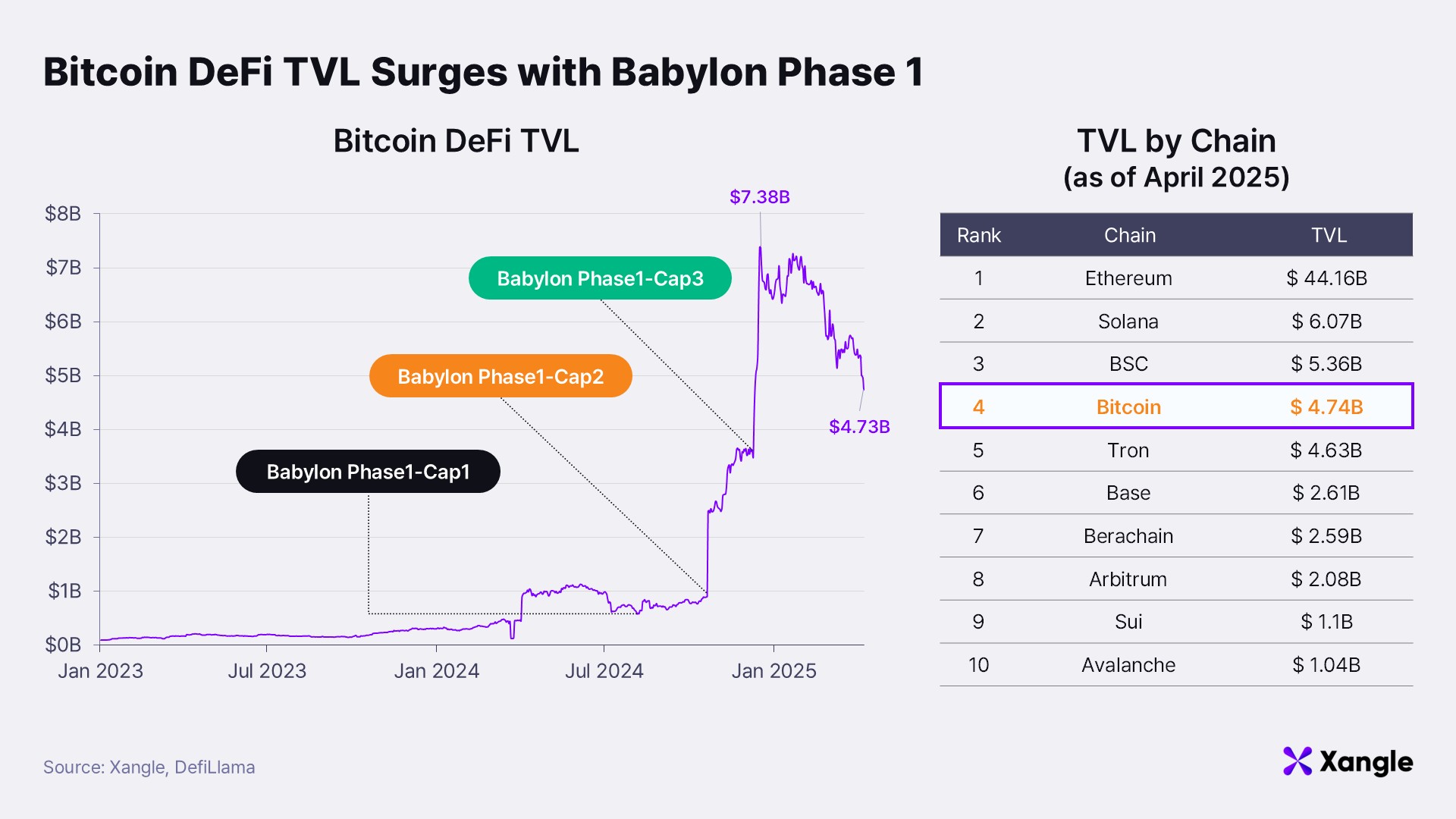

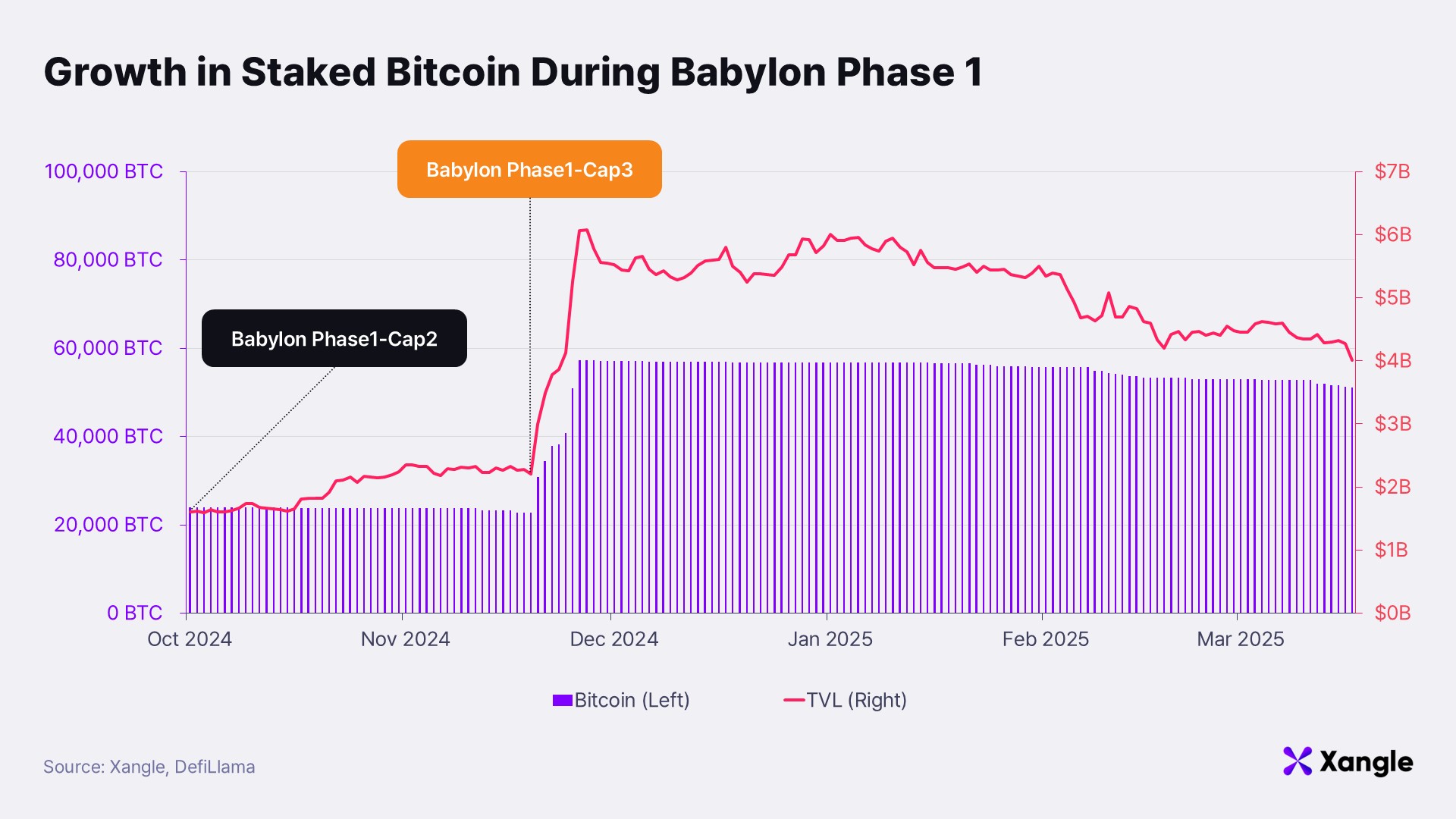

2024 is widely regarded as the year Bitcoin truly entered the world of decentralized finance (DeFi). This perception arose from the exponential growth in Bitcoin-based DeFi total value locked (TVL), which surged from just $300 million at the start of the year to approximately $6.5 billion by year-end—a more than 20-fold increase—strongly imprinting on users the potential of Bitcoin staking.

At the heart of Bitcoin DeFi (BTCFi), which rapidly climbed to become the fourth-largest segment of the overall DeFi market, stood Babylon. Babylon's three-round approach to BTC staking successfully attracted approximately $6.4 billion (equivalent to about 57,000 BTC) by the end of 2024, significantly driving BTCFi ecosystem growth. As a result, Babylon staking protocol currently accounts for over 80% of the total Bitcoin DeFi TVL, effectively equating "BTCFi" with "Babylon" in the market's perception.

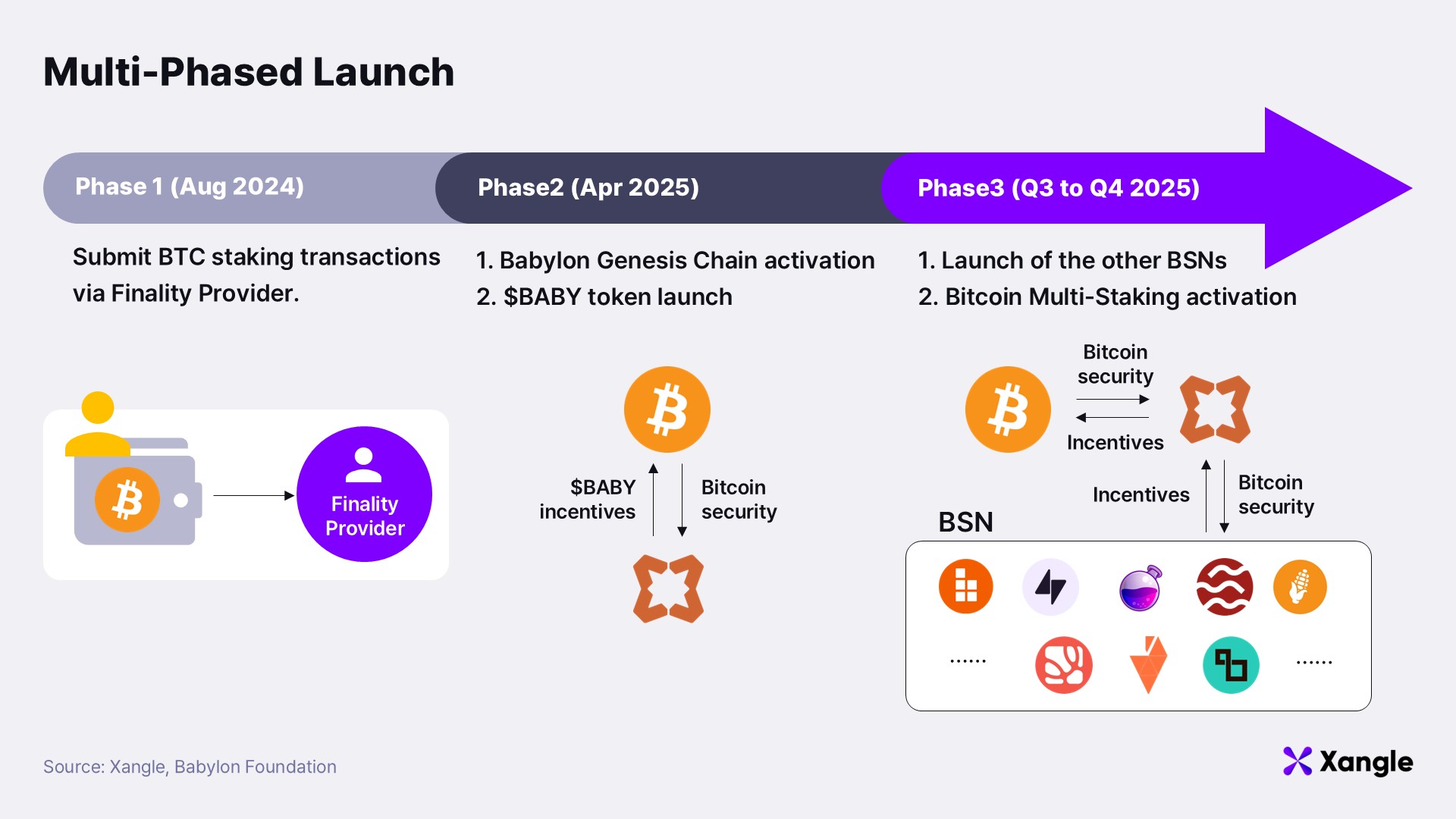

Previously, in August last year, Xangle Research explained in detail why Bitcoin staking should occur through Babylon, how staking interest is generated, and the precise structure of the Babylon protocol. (Refer to Xangle Research, "Babylon's Bitcoin Staking Revolution: Overcoming Bitcoin's Limitations") Building upon the successful conclusion of Phase 1, this report first examines Babylon’s roadmap for Phases 2 and 3—highlighting how it has elevated Bitcoin from merely being a store of value to becoming an essential source of security for PoS chains. Subsequently, we focus on (1) the efforts taken to sustain staking yields and (2) the implementation of safer staking protocol mechanisms.

2. Phase 2: Launch of the Babylon Genesis Chain and the $BABY Token

Having successfully concluded Phase 1 with the goal of attracting Bitcoin staking in 2024 and initiating the BTCFi era, Babylon is now gearing up for Phase 2. A significant milestone of Phase 2 will be the launch of the Babylon Genesis Chain. Starting its testnet operations last January, the Babylon Genesis Chain is expected to play a crucial role by enhancing the security of various Proof-of-Stake (PoS) chains through the staked Bitcoin, thereby generating substantial returns for stakers. Unlike other Layer 1 chains that pursue broad goals, such as building extensive dApp ecosystems, Babylon Chain’s objective remains straightforward and clear: maximizing the yield from staked Bitcoin.

The name "Babylon" originates from the ancient city at the heart of Mesopotamian civilization and the capital of the Babylonian Empire. We anticipate that the Babylon Genesis Chain will similarly serve as the "capital" of the BTCFi ecosystem, enhancing the security of its partner PoS chains while offering attractive yields to Bitcoin stakers.

2-1. Babylon Genesis Chain is set to become the central hub of BTCFi

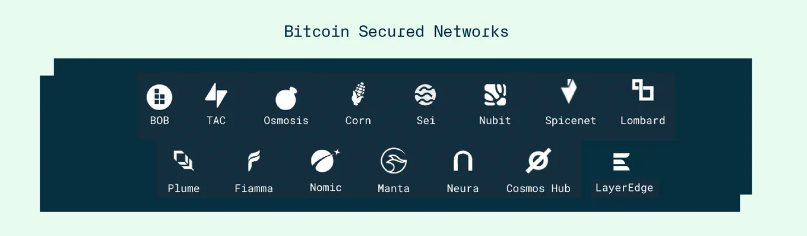

The Babylon Genesis Chain will leverage the Bitcoin secured in Phase 1 to reinforce the security of various partner PoS chains. In exchange, these PoS chains will provide their own native tokens as rewards, which will then be distributed to stakers. These participating PoS chains will form the Bitcoin Secured Network (BSN), becoming key stakeholders driving profitability within the Babylon protocol.

Source: Babylon Blog

Source: Babylon Blog

Given the pivotal role of Bitcoin staking, the Babylon Genesis Chain has distinct features setting it apart from other blockchains:

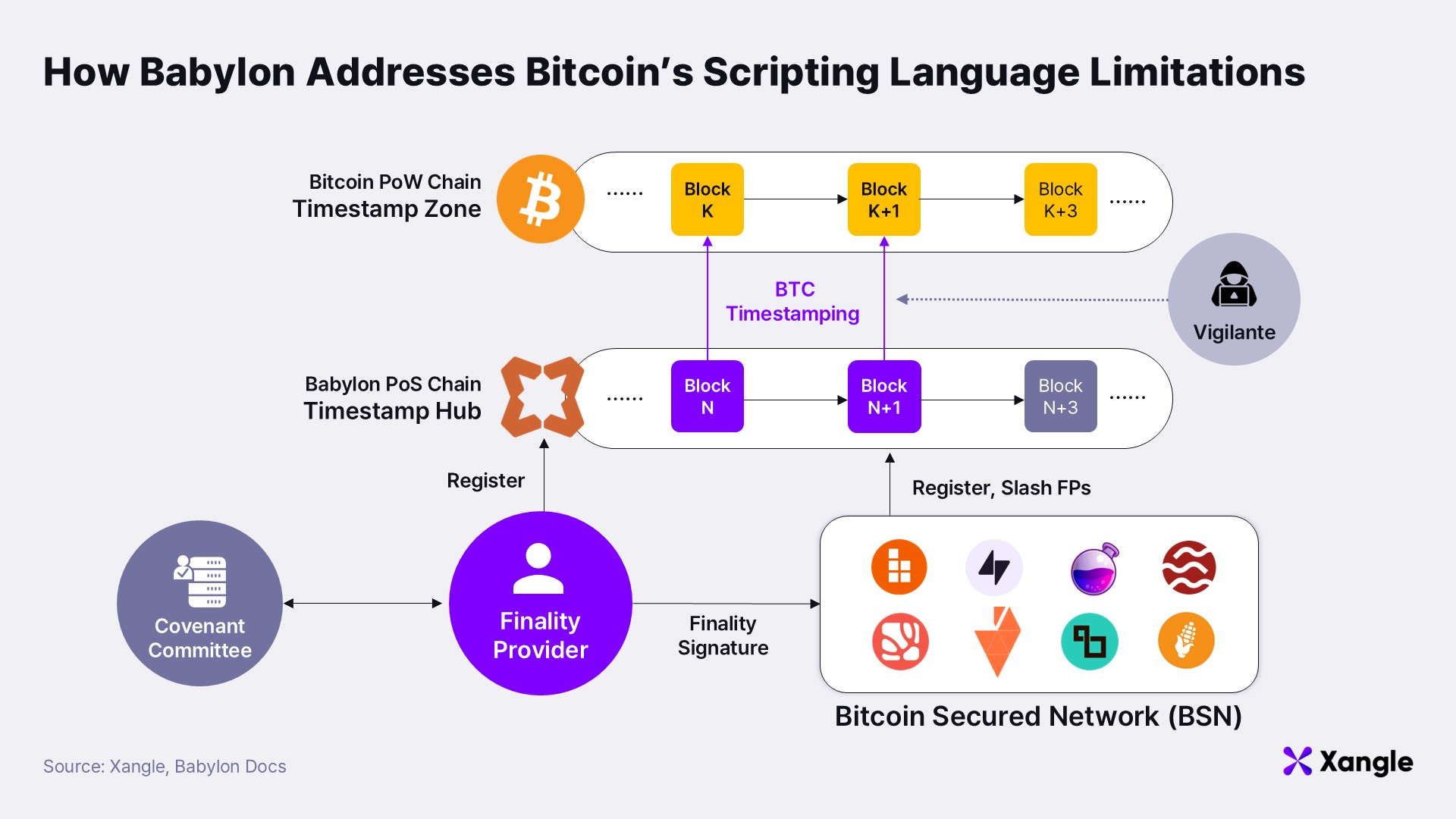

Firstly, the Babylon Genesis Chain is unique as the very first blockchain that directly inherits Bitcoin’s security model. There have been past attempts to integrate Bitcoin’s security with other chains, yet these attempts often failed. They were mostly limited to chains employing energy-intensive Proof-of-Work (PoW) systems or carried significant security vulnerabilities. Babylon, however, overcame these limitations by using Bitcoin as collateral and incorporating internal safeguards like slashing mechanisms to counteract malicious activities. This ensures secure reinforcement of BSN chain security. Babylon's approach is actualized through a combination of 100 CometBFT chain validators and 60 Bitcoin-based Finality Providers, enabling Babylon to achieve an industry-leading security standard, despite utilizing only around 0.27% of the total circulating Bitcoin for staking.

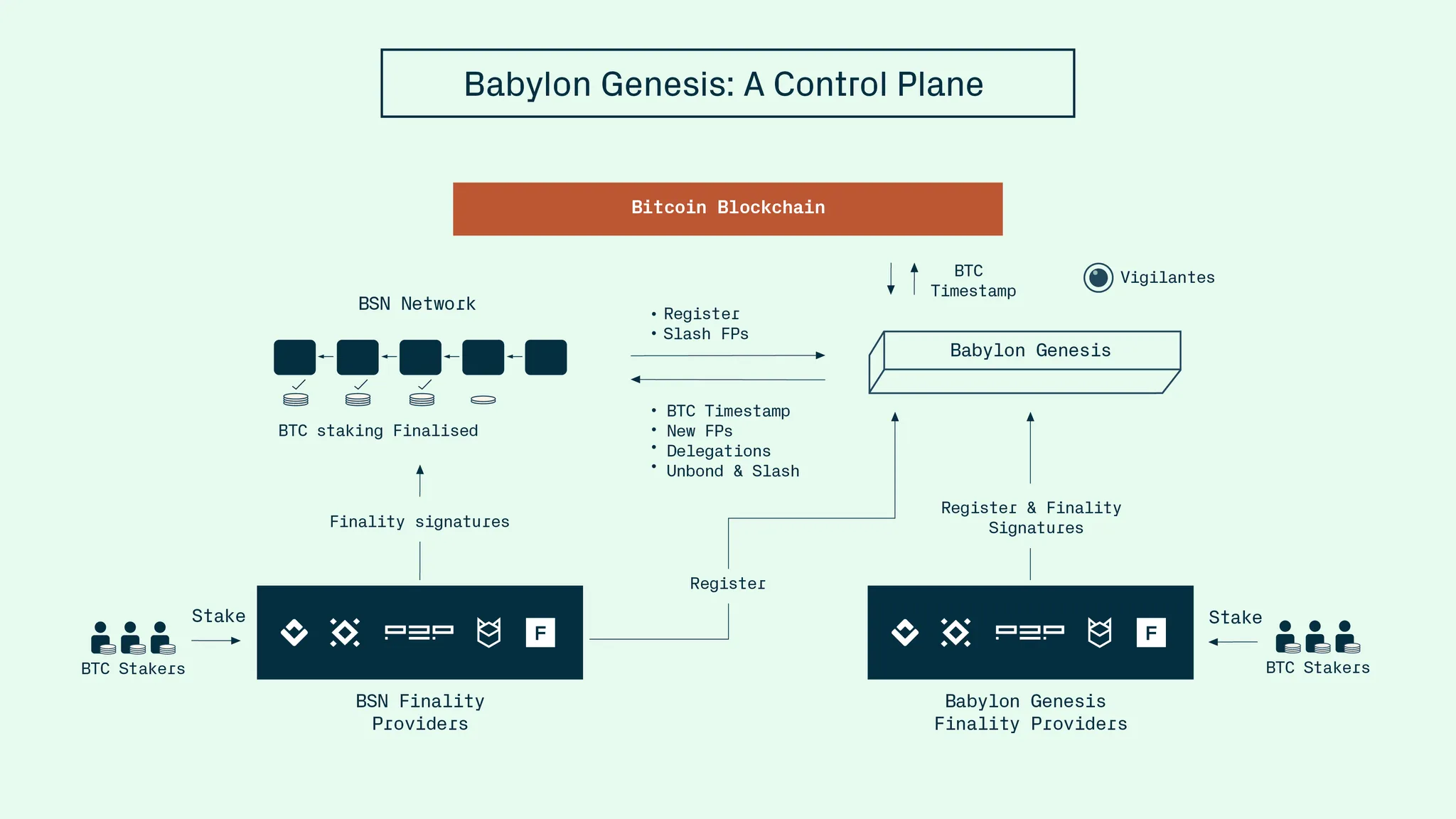

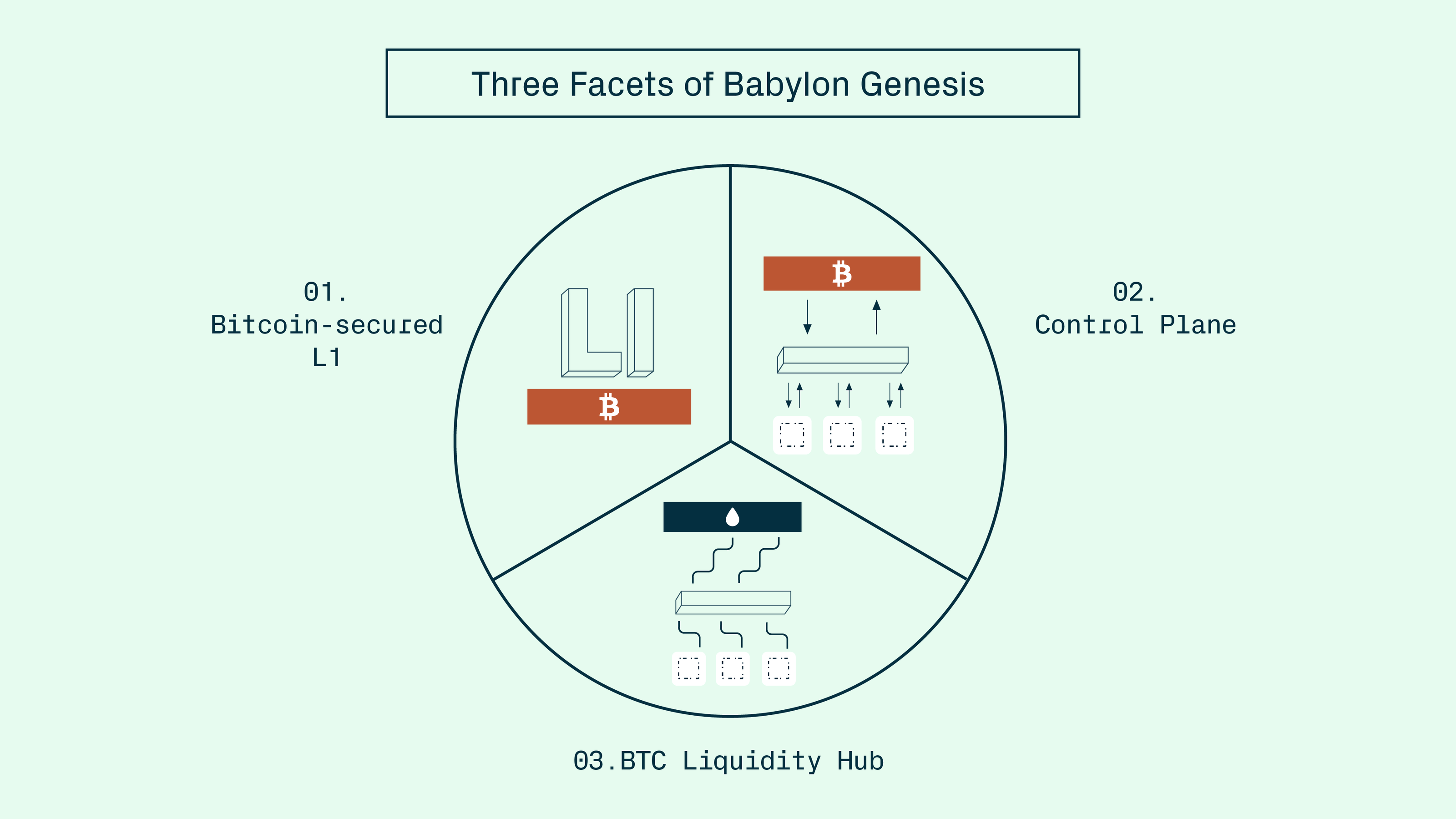

Furthermore, the Babylon Genesis Chain functions beyond just another blockchain; it acts as a "Control Plane" linking other blockchain networks to Bitcoin. In other words, other BSN chains can effortlessly access Bitcoin’s security and timestamping features simply by connecting to Babylon, eliminating the need for complex individual system development. Babylon synchronizes staking information and block finality states across these chains, automatically distributing generated revenues to validators and stakers in the process.

Lastly, the Babylon Chain aims to become the liquidity hub of Bitcoin DeFi. Various teams are currently developing DeFi services—including DEXs, Liquid Staking Tokens (LSTs), Lending platforms, and Vaults—directly on the Babylon Chain. Prior to the Genesis Chain launch, services built on other blockchains required bridges for access (e.g., for LST services), but now these can be directly implemented on the Babylon Chain itself. This approach not only mitigates the hacking risks associated with bridge usage but also consolidates fragmented liquidity into a single, cohesive ecosystem.

Source: Babylon Blog

Source: Babylon Blog

In summary, Babylon Chain will become the first-ever Layer 1 chain intrinsically secured by the Bitcoin network. It will play a pivotal role by enhancing the security of various BSN chains and capturing returns from them to distribute back to Bitcoin stakers. Moreover, as an independent blockchain, it is expected to host diverse DeFi services and thus function as the capital of the emerging BTCFi empire.

2-2. Enhanced protocol security backed by multiple mechanisms

At its core, the Babylon protocol essentially operates like a financial service—receiving deposits and paying interest. Therefore, it is imperative that Babylon continuously demonstrates robust safety measures against risks such as hacking, in order to maintain the trust of its customers (Bitcoin holders). Several technical upgrades planned for Phase 2 are expected to significantly bolster protocol security. The key initiatives include: (1) implementation of a slashing mechanism, and (2) development of a Bitcoin ↔ Genesis bridge.

1) Introduction of the Slashing Mechanism

Slashing on a blockchain is a security mechanism that imposes financial penalties on participants who violate network rules or engage in malicious activities. This method encourages participants to behave correctly, thus maintaining network safety and reliability. Babylon has introduced a slashing mechanism to prevent malicious behaviors from both CometBFT validators who validate blocks on the Babylon Chain and the Finality Providers (FP) who handle block finality for BSN chains. This mechanism will become operational starting from Phase 2.

Take, for instance, the FPs, who are responsible for enhancing the security of various BSN chains using delegated BTC. These FPs earn rewards by serving as validators on BSN chains. However, if they maliciously compromise chain security or fail to promptly implement technical updates, their deposited BTC will be penalized via slashing. Unlike typical PoS chains, which enforce slashing through smart contracts, Babylon—built on Bitcoin script—implements this mechanism using its proprietary technology known as EOTS. Since this mechanism will be introduced starting from Phase 2, BTC stakers are expected to carefully delegate their BTC to reliable FPs with a lower risk of slashing.

(Specific slashing conditions and rates will be announced at a later date. Due to the critical impact slashing mechanisms have on network security and economic models, this report will be updated upon release of these details.)

2) Development of Bitcoin ↔ Genesis Bridge

For Babylon Chain to firmly establish itself as the liquidity hub of the Bitcoin ecosystem in Phase 2, the key challenge is whether reliable infrastructure has been established. While Babylon Genesis Chain already provides robust security through its native BTC staking and timestamping functions, it has historically relied on multi-sig bridges for bringing BTC liquidity from external sources, such as LST protocols.

To address this, Babylon is developing a “trust-minimized Bitcoin-Genesis bridge.” Beyond simply enhancing Babylon Chain's security, this bridge will serve as universal infrastructure, allowing other BSN chains to securely leverage BTC liquidity. Consequently, it will enable various applications such as trustless LST issuance, BTC staking for dApp security, and liquidity sharing among BSN chains.

Babylon is constructing the Genesis Bridge based on a unique BitVM2-derived architecture, developing a new type of lightweight client capable of securely verifying the state of the Bitcoin blockchain. Furthermore, an economic penalty structure is implemented to slash pre-staked Bitcoin if bridge operators engage in malicious activities, thus ensuring stable bridge operation independent of any single entity’s trustworthiness. Through these technological foundations, Babylon aims to redefine Bitcoin—not merely as a storage asset but as the key security and liquidity asset within decentralized finance.

2-3. The long-awaited launch of the $BABY token and its tokenomics

Alongside the launch of the Babylon Genesis Chain, the tokenomics of $BABY—scheduled for listing on Binance—has been unveiled. The reason the $BABY token is expected to play a particularly significant role compared to other chains lies in the fact that early-stage Bitcoin staking returns depend heavily on $BABY token airdrops. (As Babylon Chain begins earning revenue by providing security to BSN chains in the future, the structure of Bitcoin staking rewards will diversify.)

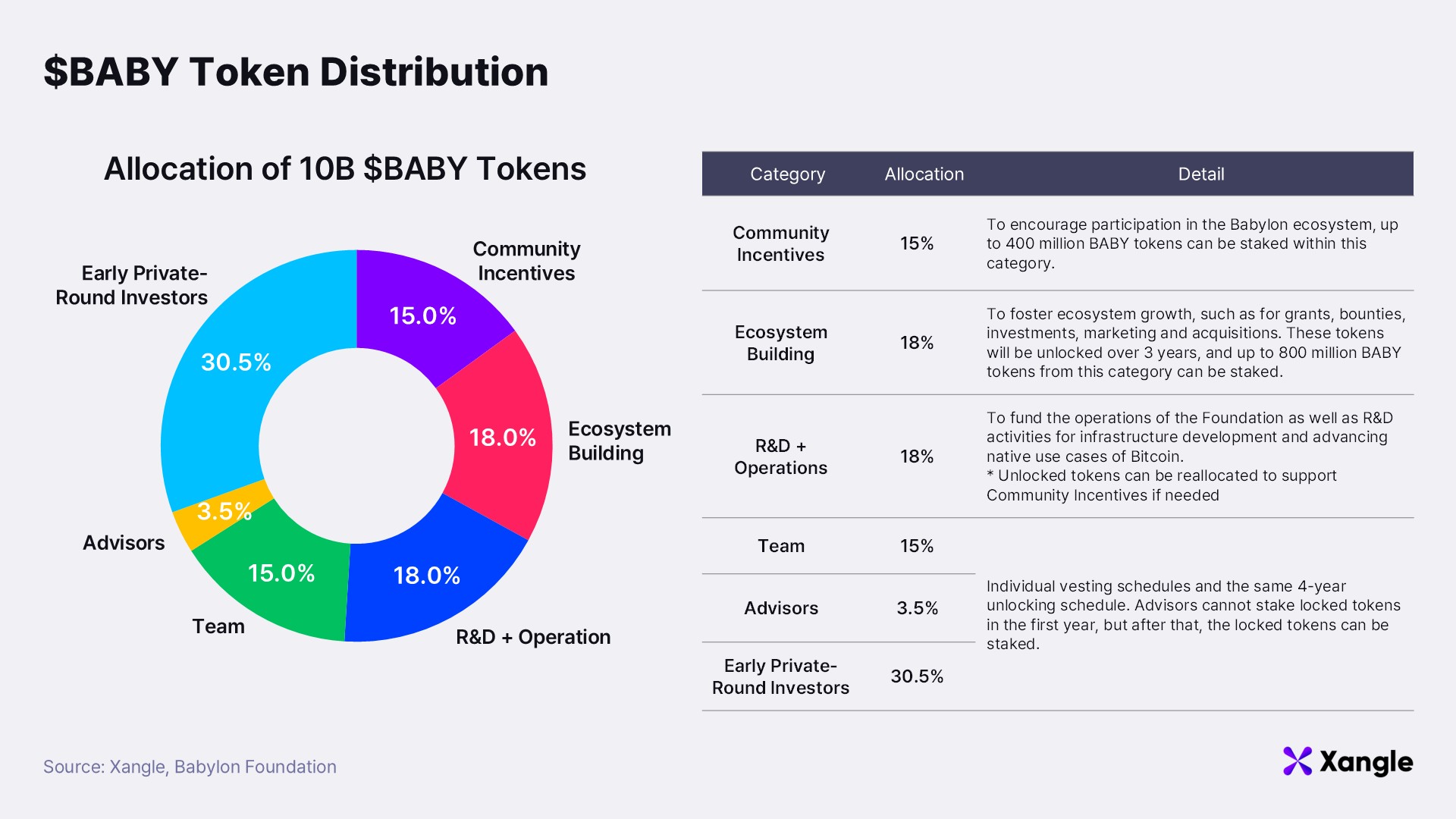

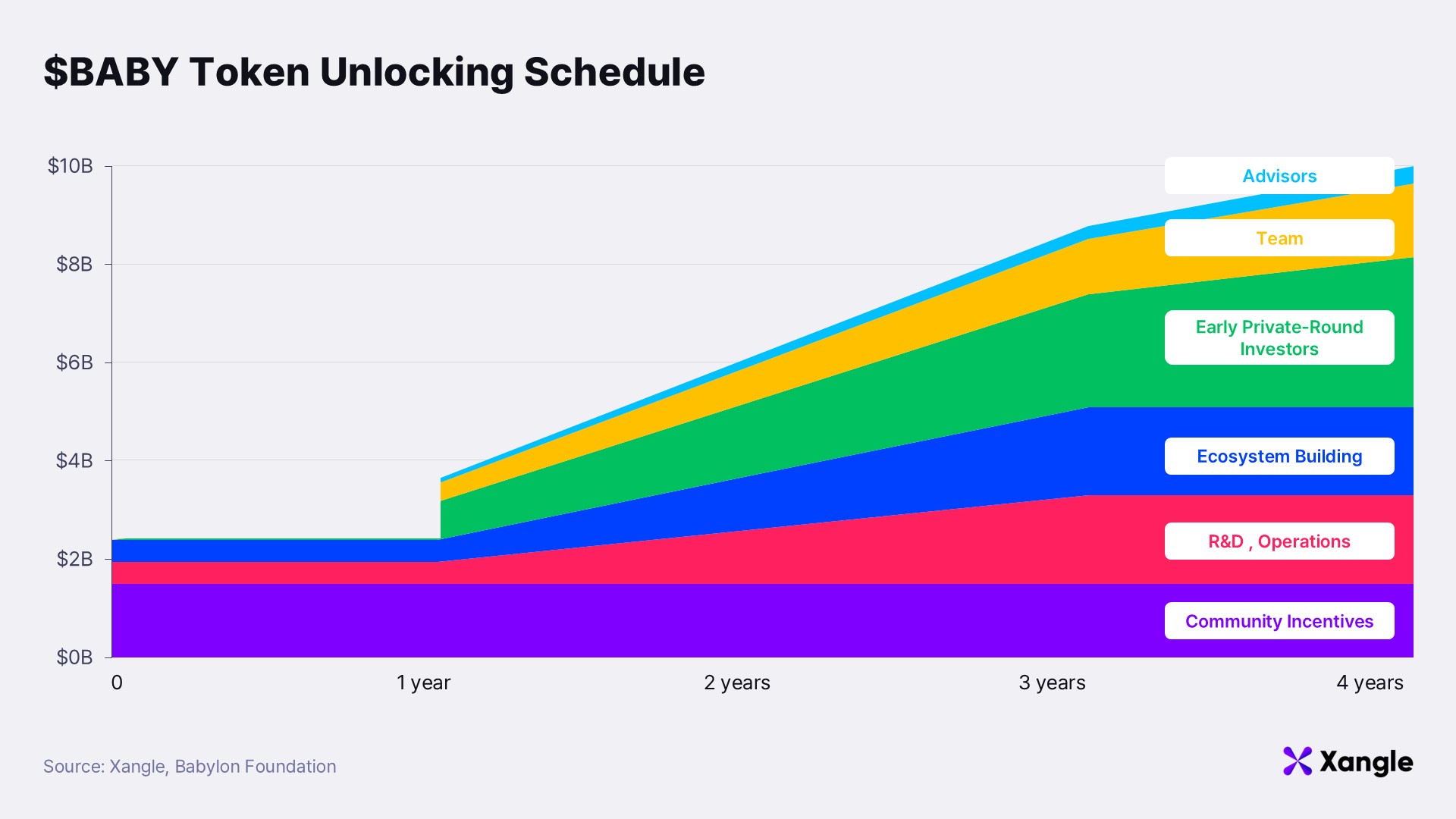

In the current tokenomics, a total of 10 billion $BABY tokens will be issued, featuring inflation, and will be distributed as shown below.

It’s viewed positively that Bitcoin stakers will receive an immediate 15% reward. If the fully diluted valuation (FDV) of the $BABY token exceeds $1 billion, $150 million worth of tokens would initially be distributed, yielding about 3% return against the current total BTC staked (approximately $4.7 billion). Considering Bitcoin traditionally offers no yield as a PoW-based asset, a 3% yield could be quite attractive.

Additionally, the community appreciates that VC and team allocations will be vested over up to four years and locked tokens will not be eligible for staking. This structure appears intentionally designed, reflecting lessons learned from projects like Celestia and EigenLayer, where VC entities previously staked locked tokens and subsequently sold rewards on the open market, negatively impacting token prices.

Source: X

Source: X

However, with 24% of tokens unlocked immediately upon Token Generation Event (TGE) and the entire supply (100%) unlocking over the next four years, annual inflation could reach 43%, potentially creating significant selling pressure after the first year. Given that the ecosystem is still in early stages, the limited initial utility of the $BABY token—mainly transaction fees and staking—also points to the need for improvement. Efforts to build a native DeFi ecosystem on Babylon Chain will be essential to expanding token use cases.

The highly anticipated $BABY airdrop, eagerly awaited by Bitcoin holders staking with Babylon, is now a publicly revealed card. Following the initial 15% reward at TGE, stakers will subsequently receive tokens with annual inflation at a lower rate of around 4%. Thus, ongoing efforts to enhance staking yields will be crucial. BSN chains are expected to play a central role in increasing these yields.

3. Phase 3: Expanding the BSN Chain Lineup and Strengthening the DeFi Ecosystem

3-1. BSN Chains, securing the future revenues of bitcoin staking

One of the critical factors behind Babylon’s success in attracting substantial BTC deposits from Bitcoin holders was the anticipated $BABY token airdrop. With the $BABY airdrop soon approaching, rewards from the BSN chains are expected to become the key incentive moving forward. According to Babylon’s roadmap, the completion of a structure enabling the "activation of Bitcoin multi-staking," where Bitcoin stakers delegate their staked BTC to BSN chains and receive corresponding rewards, is planned for Phase 3 by late 2025. (The exact timeline for Phase 3 has yet to be disclosed.)

Once Phase 3 becomes reality, BTC stakers will be able to simultaneously stake their Bitcoin across multiple BSN chains and collect staking rewards from various sources. At that point, Babylon Chain will fully perform its aforementioned role as a Control Plane, facilitating cross-chain synchronization and enhanced security.

Of course, the critical factor for Phase 3 is whether the BSN chains will provide sufficiently attractive revenue-generating opportunities. The primary concern expressed by the community at present revolves around whether these BSN chains can indeed offer meaningful rewards considering the significant volume of Bitcoin staked. The Babylon team understands these concerns deeply and is actively working to secure attractive BSN chain partnerships, recently expanding the BSN partner list accordingly.

Source: Babylon Blog

Source: Babylon Blog

If Babylon successfully achieves its Phase 3 milestones as it has with Phases 1 and 2, it could represent a significant turning point for PoS chains and the broader Bitcoin ecosystem. Bitcoin, traditionally limited to a Buy & Hold strategy solely as a store-of-value asset, could then be utilized across diverse chains beyond the Bitcoin network itself, offering new opportunities to BTC holders. Moreover, BSN chains, typically lacking users and liquidity, may greatly benefit by attracting the enormous user base and liquidity pool from the Bitcoin ecosystem.

However, concerns regarding Phase 3 remain. Issues such as the complexity of staking Bitcoin across multiple chains with diverse staking structures, potential security risks, and low profitability represent challenges that Babylon will need to thoroughly validate and overcome in the future.

3-2. The blossoming DeFi ecosystem of the Babylon Chain

The DeFi ecosystem of Babylon is expected to flourish alongside the launch of the Babylon Genesis Chain. Initially, as Babylon Chain primarily prioritized Bitcoin staking, its liquid staking token (LST) ecosystem has developed much faster than on other Layer 1 chains (where typically DEX and lending services appeared before LST solutions).

LST projects issue stBTC as liquid staking tokens representing staked Bitcoin. Prominent Babylon-based LST projects include:

- Lombard (TVL $1.5B)

- Specializing in institutional staking solutions, Lombard has driven liquidity of Babylon-based BTC through LBTC. It serves as a strategic partner offering robust DeFi integration and stability.

- Solv (TVL $600M)

- Backed by Binance Labs and Blockchain Capital, Solv offers optimized re-staking strategies and yield-generation structures using SolvBTC.

- Bedrock (TVL $100M)

- Supports easy one-click re-staking via uniBTC for WBTC and BTC holders, distinguished by its user-friendly interface and strong interoperability.

During Phase 1, many Bitcoin holders chose to stake BTC through LST services rather than directly through Babylon. This approach maximized yield, enabling simultaneous receipt of airdrops from both the LST protocols and Babylon itself. Recently, beyond LST protocols, lending platforms such as Avalon Labs, Euler, and Union Protocol have announced their support for the Babylon Chain. Additionally, Vault platforms like Veda have joined the Babylon ecosystem, actively contributing to its growing DeFi landscape.

Following the launch of the Babylon Genesis Chain, the onboarding of additional DeFi services is highly anticipated. From the perspective of DeFi teams, Babylon Chain presents an attractive option as vast BTC liquidity could flow directly into their services. Furthermore, from the Babylon Foundation's viewpoint, developing a robust DeFi ecosystem is urgent for enhancing $BABY token utility and generating transaction fee revenues. Incentive policies to attract strong teams and builders are therefore likely to emerge, funded from the allocated 18% ecosystem support budget.

4. Closing Thoughts

In 2024, Babylon demonstrated the potential for Bitcoin to serve roles beyond merely being a store of value. It emerged as a pivotal player ushering in the era of BTCFi. Looking forward, Babylon’s 2025 roadmap is anticipated to bring this potential into clearer reality. With the launch of the Babylon Genesis Chain, the introduction of various security mechanisms—including slashing—and the Bitcoin ↔ Genesis Bridge technology, the project aims not merely to maximize staking yields but also to foster safer and more efficient liquidity sharing and enhanced security through integration with diverse PoS chains. Furthermore, the $BABY token’s airdrop and tokenomics structure establish an immediate reward system for Bitcoin holders, while also serving a crucial role in managing long-term inflation and expanding token utility within the ecosystem.

The "Bitcoin multi-staking activation" and collaborative efforts among BSN chains slated for implementation in Phase 3 have the potential to surpass the existing single-chain staking model of Babylon, potentially establishing itself as an innovative financial infrastructure capable of bolstering security across numerous blockchain networks. Of course, considerable challenges remain, such as the complexity inherent in operating across various chains, security risks, and the relatively high inflation rate of the token. Ensuring that rewards from BSN chains remain sufficiently attractive to Bitcoin stakers will also be a significant hurdle. Yet, given Babylon’s proven track record of innovation and execution, there is optimism that these challenges will be gradually overcome.

Ultimately, Babylon is redefining Bitcoin—not merely as a digital asset but as a central pillar of a broader financial ecosystem spanning multiple DeFi services and PoS chains. Babylon’s ambition to surpass traditional limitations of Bitcoin staking, and to create new revenue and security models through interaction with diverse chains, marks an important turning point likely to catalyze a new chapter in the convergence between traditional finance and blockchain technology.