Table of Contents

1. DuckChain’s Multi-Chain Leap with AI, leveraging TON

2. Strategies to Supercharge Early Network Effects

2-1. Mass adoption strategy targeting 1 billion Telegram users

2-2. Boosting developer adoption with the Arbitrum Orbit Stack

2-3. Tangible results from the initial strategy

3. Quack AI – The Integrated Agent Platform Bridging Users and Multi-Chains

3-1. Streamlining DAO governance with AI agents

3-2. Expanding DeFi and ecosystem growth with real-time data

3-3. The ultimate goal: A unified multi-chain agent service

3-4. Strategic partnerships to fuel the AI agent roadmap

4. Community-First Tokenomics for DuckChain

5. Lowering Web3 Barriers and Driving Multi-Chain Expansion with AI

1. DuckChain’s Multi-Chain Leap with AI, Leveraging TON

Meet the cool, sunglasses-wearing duck—the bold symbol of DuckChain. Far from just a mascot, this friendly, rubber-duck-inspired character captures attention and has become a fan favorite across the Web3 community, representing the open, fun, and user-friendly experience DuckChain is all about.

Another element behind DuckChain is the TON (The Open Network) chain. Born from Telegram’s blockchain team, TON has experienced explosive growth since 2023, fueled by its strategic bond with Telegram. According to DappRadar (as of September 2024), TON hit an all-time high with 810,000 daily active wallets, reached 10 million monthly active wallets, and processed 25.72 million transactions.

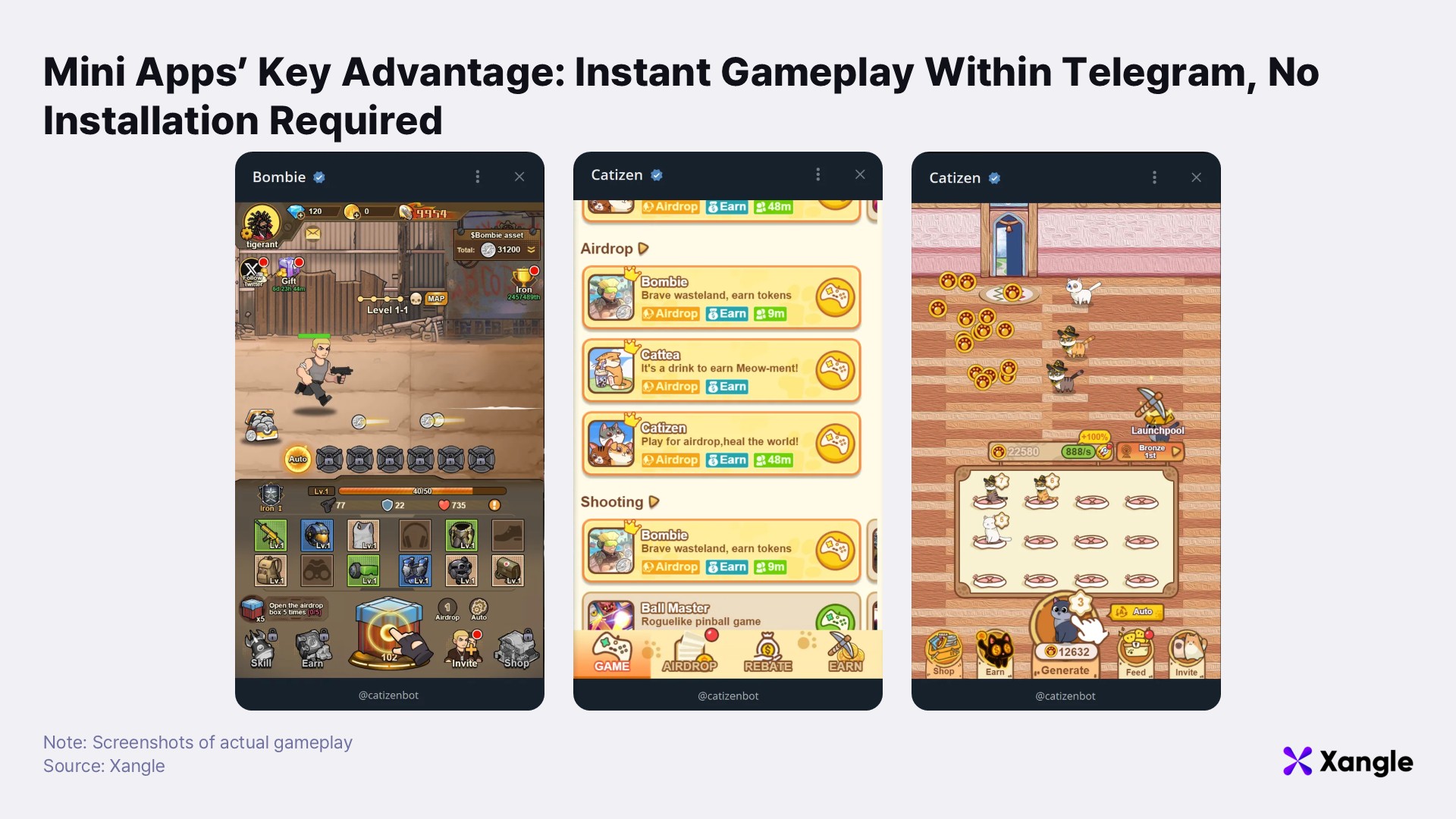

A key driver behind TON’s rapid rise was the overwhelming success of Telegram Mini Apps. These lightweight apps run right inside Telegram—no extra installation needed—and are fully integrated with the TON blockchain to make access a breeze. Since their launch in 2023, mini apps have turbocharged user adoption in gaming, social, and DeFi sectors. For example, Notcoin combined a simple, click-based game with token rewards to attract over 35 million Telegram users by early 2024, while game-centric mini apps like Catizen boast impressive engagement, with players spending over 10 minutes per session.

Following TON’s lead, DuckChain has smartly adopted the mini app strategy to rapidly build its user base. By embracing an EVM-compatible development environment, DuckChain has dramatically lowered the barriers for Ethereum developers around the world and expanded its reach by integrating with multiple blockchains beyond TON.

Now, DuckChain is set to deliver “valuable experiences” to its users with its next-level AI agent system, Quack AI. The goal? To simplify complex blockchain operations—optimizing DeFi services and automating DAO governance—while paving the way for automated, fast, and secure cross-chain asset transfers among Ethereum, Bitcoin, and more. DuckChain envisions a future where multi-chain DAO governance drives widespread participation and a truly sustainable ecosystem.

This report dives into how DuckChain, which began its journey on the TON chain, is elevating the user experience with AI and expanding into a vibrant multi-chain network.

2. Strategies to Supercharge Early Network Effects

As TON’s growth began to plateau in the latter half of last year, DuckChain emerged with a bold plan to harness the power of Telegram’s massive user base and TON’s technical prowess. Rather than simply patching TON’s limitations, DuckChain has injected fresh energy into the ecosystem by appealing to both users and developers. Its strategy rests on three pillars: targeting Telegram’s 1 billion users for mass adoption, driving developer engagement through Arbitrum Orbit, and proving its execution capabilities from the get-go.

2-1. Mass adoption strategy targeting 1 billion Telegram users

DuckChain rolled out the DuckChain Mini App so that anyone who creates a TON wallet in Telegram can instantly dive into DuckChain services—no complicated setups required. Far beyond a simple gaming gimmick, this mini app packs features like airdrops, DeFi, and bridging, making it effortless for users to jump into Web3. Its in-app airdrop point system not only sparks initial excitement but also keeps users coming back for more.

Moreover, the DuckChain Mini App makes it super easy for users to access DeFi protocols—no wallet switching or steep learning curves. This approach has laid out a clear plan to seamlessly integrate over 200 million mini app users from Telegram into the DuckChain ecosystem. With the ever-charming, sunglasses-wearing duck reinforcing its brand, DuckChain has boosted its profile within TON. By March 2025, around 7.87 million unique accounts were live on DuckChain, thanks to its Telegram integration, rewarding user system, and engaging marketing tactics.

DuckChain’s mass adoption strategy is built on implementing airdrops, DeFi, and bridging functionalities via the DuckChain Mini App, with a focus on activating TON wallets within Telegram so that users can easily access Web3 services.

2-2. Boosting developer adoption with the Arbitrum Orbit Stack

From the start, TON’s proprietary smart contract languages (Fift, FunC, Tact, etc.) have posed significant hurdles for developers. One dApp team reported that Solidity developers required nearly six months just to learn these new languages, which significantly delayed project development. To lower these language barriers and tap into the vast pool of Solidity talent, DuckChain adopted Arbitrum Orbit. Arbitrum Orbit is a flexible blockchain stack built on Ethereum’s Layer 2 solution, Arbitrum, and it brings EVM compatibility to TON—allowing Solidity developers to enter the TON ecosystem effortlessly.

Here’s how DuckChain dApps interact with the TON chain using this setup:

-

Transaction Generation and Execution

When a user kicks off a transaction—be it an asset transfer or a smart contract call—via a DuckChain dApp, the request is sent to the Execution Layer. Powered by Arbitrum Orbit, this layer processes transactions at high speed with rapid finality within an EVM environment

-

Transaction Aggregation and State Root Generation

Transactions from the Execution Layer are then consolidated in the Aggregation Layer, which compiles the results to create a state root that reflects the network’s latest status.

-

State Root Publication and Verification

The state root is published to the TON chain via the Decentralized Oracle Layer (DOL). TON continuously verifies transaction outcomes and data integrity using this state root, ensuring everything remains accurate and stable through multisig and other security measures.

-

Cross-Chain Synchronization and Asset Transfer

Once recorded on TON, both chains synchronize in real time. Additionally, if necessary, the Decentralized Asset Verification Layer (DAVL) securely manages asset transfers and cross-chain operations between TON and DuckChain.

This architecture lets transactions generated on DuckChain dApps be swiftly aggregated, verified, and synchronized with the TON chain via Arbitrum Orbit. As a result, Solidity developers can build dApps on DuckChain without long retraining periods, and transaction data is reliably logged on TON. Plus, this seamless TON integration means Telegram users can easily access DuckChain dApps—further driving ecosystem growth.

2-3. Tangible results from the initial strategy

From the start, DuckChain executed a clear strategy to massively attract Telegram users and expand its developer ecosystem. By January 2025, it achieved a daily unique active wallet count of 410,000 (an all-time high), and by March, it had secured a user base of 7.87 million. Despite challenging market conditions, DuckChain reached a Total Value Locked (TVL) of $14 million within just two months of launch, and today more than 50 projects have joined forces around its vision.

Furthermore, DuckChain continuously synchronizes the transaction states processed on its EVM with the TON blockchain in real time through its Decentralized Oracle Layer (DOL) and Aggregation Layer, ensuring a stable supply of external data (such as price feeds). Technically, DuckChain has demonstrated on its testnet that it can process over 50 million transactions for 2 million users—and it continues to operate seamlessly on the mainnet without any network disruptions.

However, amid the stagnation in the TON ecosystem, DuckChain itself has recently entered a growth plateau and is actively seeking new breakthroughs. To enhance convenience for its existing 7.87 million users, it has introduced an AI agent system. In addition, DuckChain plans to expand its ecosystem beyond TON to other chains. With AI agents and multi-chain connectivity emerging as promising new drivers, DuckChain is poised to reenergize its growth.

3. Quack AI – The Integrated Agent Platform Bridging Users and Multi-Chains

After its initial success, DuckChain is now overcoming its growth plateau by developing the Quack AI Agent. First unveiled in January 2025 as part of the DuckChain AI DAO Genesis Member Program, Quack AI acts as an “AI Agent” that seamlessly connects users with the ecosystem.

3-1. Streamlining DAO governance with AI agents

Quack AI equips each user with a personalized AI agent to facilitate efficient decision-making. By automating the entire governance process—proposal review, voting, and reward distribution—users can participate in essential decision-making even if they’re offline or new to DAO operations. For example, if a user pre-sets a preference for “infrastructure investment proposals,” the AI agent will automatically analyze the proposal’s value and risk according to that criterion and cast votes on the user’s behalf.

Moreover, the AI agents go beyond mere vote delegation. After a proposal passes, Quack AI automatically executes the budget specified in the smart contract and monitors milestone achievements, adjusting rewards or payment scales as needed. This real-time reward mechanism minimizes managerial overhead and significantly reduces delays or errors in the governance process.

3-2. Expanding DeFi and ecosystem growth with real-time data

The real-time data feed provided by Quack AI plays a pivotal role in driving DuckChain’s ecosystem expansion. For instance, by leveraging on-chain data from DuckSwap—a leading DeFi protocol—Quack AI automates liquidity pool adjustments and asset portfolio management. It also provides comprehensive analyses, not just of price indicators, but also of cross-chain activity and transaction trends between user accounts. For example, if trading volume suddenly spikes on the TON network, DuckSwap receives a real-time alert from Quack AI, prompting it to expand cross-deposits between liquidity pools or adjust reward ratios for specific assets to mitigate volatility risks. This enables DeFi protocols within DuckChain to respond swiftly to market fluctuations while maintaining stable revenue structures.

3-3. The ultimate goal: A unified multi-chain agent service

Quack AI is designed not to confine DuckChain to a single blockchain, but to build automated cross-chain connections across diverse blockchains—including TON, Ethereum, and Bitcoin—so that users can transfer assets without the need for separate bridge services. For example, when transferring TON-based assets to Ethereum, the Quack AI agent automatically selects the most efficient route by considering network fees and confirmation times, while proactively detecting potential bridging risks to enhance security.

Furthermore, Quack AI seamlessly integrates DAO governance with multi-chain functionality, aiming to ease decision-making processes that tend to favor large token holders and create an inclusive environment for users of all sizes. Since budget execution and reward distribution are automated across multiple chains, overall on-chain management is significantly streamlined. Looking ahead to post-2025, Quack AI plans to launch APIs and SDKs to encourage even more dApp projects to leverage DuckChain’s cross-chain capabilities and governance modules. Through these initiatives, DuckChain aspires to establish itself as a multi-chain hub—enabling sustainable long-term user growth and efficient DAO operations across TON and other blockchain networks.

That said, for the value delivered by Quack AI to translate into genuine user convenience and transformative DeFi UI/UX improvements, further enhancement of agent functionalities is critical. By securing tailored features and an intuitive interface to meet a diverse range of user needs, satisfaction can be boosted across the spectrum—from beginners to advanced users. While the current roadmap outlines these ambitions, if executed as planned, Quack AI is poised to become the core engine driving DuckChain’s continued growth and multi-chain expansion.

3-4. Strategic partnerships to fuel the AI agent roadmap

DuckChain’s Telegram AI Chain envisions providing an environment where anyone can effortlessly access DeFi, DAO, and other services through AI, targeting Telegram’s potential 1 billion users. To realize this vision, DuckChain has forged strategic alliances with various AI and blockchain projects.

On the data acquisition front, Sahara is connecting DuckChain with a user base of over 20 million to build a large-scale data ecosystem, ensuring that AI agents have access to rich and reliable information. To further enhance the AI models, DuckChain has established an AI agent training system tailored to the Telegram environment via Flock.io, which provides a user-friendly interface and robust training infrastructure, while Allora’s self-learning AI network continuously improves the performance of DeFi agents.

To ensure not only performance but also a secure and trustworthy operational environment, DuckChain applies Phala Network’s TEE (Trusted Execution Environment) technology to handle sensitive data safely in a decentralized manner, and leverages Mind Network’s Fully Homomorphic Encryption (FHE) technology to protect governance vote data and maintain transparent DAO operations.

Finally, in its approach to AI-driven content, DuckChain has partnered with Virtuals Protocol to support AI agent management and tokenization of applications, enabling the easy development and distribution of diverse services and content. Additionally, MyShell’s AI-based meme agent content is designed to drive user engagement and spark creative meme generation.

Building on the collaboratively developed agent system through these partnerships, DuckChain plans to launch an AI-powered governance DAO and provide every $DUCK holder with a personalized AI agent. This initiative envisions DuckChain evolving into a multi-chain hub—where Telegram users can enjoy instant guidance and financial services, and seamlessly manage asset transfers and governance procedures across various blockchains.

However, for these partnerships and roadmap to deliver tangible user value, ongoing and concrete collaboration between all involved projects is essential. How DuckChain develops these collaborations will be crucial; it is expected that such progress will significantly accelerate the mass adoption of blockchain via AI agents and the creation of a robust multi-chain ecosystem.

4. Community-First Tokenomics for DuckChain

Source: DuckChain Docs

Source: DuckChain Docs

DuckChain is laser-focused on building a community-driven economic model, a principle clearly reflected in the design of the $DUCK token. $DUCK is used for on-chain governance, staking, DeFi liquidity provision, and transaction fee payments, and is engineered to operate organically across a multi-chain environment (TON, DuckChain, Arbitrum, Base).

A standout feature is that 77% of the token allocation is dedicated to community and ecosystem growth. Notably, 50% of the total supply is directly airdropped to users, encouraging those who contribute to the DuckChain ecosystem to naturally become part of the network. By rewarding early mini app users, on-chain governance participants, AI DAO Genesis Members, and other active contributors, DuckChain aims to foster a self-sustaining culture of community participation. An additional 20% is reserved for ecosystem development grants and dApp support, ensuring that projects operating on DuckChain can continue to grow.

Ultimately, DuckChain’s tokenomics are designed to build a long-term, community-centric network. Rather than focusing on short-term price spikes or investment gimmicks, the structure creates a virtuous cycle where genuine user contributions are rewarded—a design whose true value will become even clearer as the community grows and the role of the $DUCK token within the network evolves.

Meanwhile, the $DUCK token is actively traded on several major international exchanges—including Kraken, OKX, Gate.io, Bitget, KuCoin, MEXC, and HashKey—even though it has yet to be officially listed on Korean exchanges. This global trading activity underscores its international appeal and hints at the potential for future Korean market entry.

5. Lowering Web3 Barriers and Driving Multi-Chain Expansion with AI

DuckChain has already lowered entry barriers by leveraging EVM compatibility, enabling developers familiar with Ethereum smart contract languages to build dApps on DuckChain without extra training. Now, it’s taking things a step further by harnessing AI agents to revolutionize the user experience and create a resilient system capable of rapid recovery—even in the face of market stagnation. In particular, Quack AI automates governance decision-making and cross-chain transactions, drastically reducing the complexity of on-chain operations. Integrated with Telegram-based mini apps and AI chat agents, Quack AI provides an environment where even blockchain newcomers can easily get started. This strategy not only aims to attract traditional Web3 users but also to bring in an entirely new user base.

Of course, for AI-based automation to deliver long-term impact, several challenges need to be addressed. Key among these are ensuring the influence and reliability of AI in governance decisions, improving security and fee structures in cross-chain transactions, and refining the economic model and incentive structures to support sustainable ecosystem growth.

If DuckChain can successfully implement its AI services with an eye toward multi-chain expansion, it will offer substantial value to both users and developers. This would pave the way for DuckChain to establish itself as a multi-chain hub—not only within TON but across diverse blockchain ecosystems. Moreover, as an intuitive and efficient on-chain experience powered by AI takes root, it could set a new standard for Web3 across the board. Keep an eye on DuckChain as it leverages AI to build a broad, interconnected multi-chain ecosystem and deliver a sustainable, user-centric experience.