Table of Contents

1. Project Overview

2. 4Q24 Highlight: The Journey to “The Everything Network”

2-1. Key Highlights

2-2. Key Metrics

3. Major Partnerships and Updates

3-1. Opening new frontiers in blockchain gaming

3-2. Driving innovation in the global financial industry on Avalanche

3-3. Accelerating enterprise blockchain adoption via Avalanche

3-4. Strategic programs driving ecosystem expansion

4. On-Chain Performance - Avalanche9000 Upgrade: Before & After

4-1. Key changes post Avalanche9000 upgrade

4-2. Network activity (Feat. The effect of reduced fees)

4-3. Ecosystem engagement

5. Closing Summary

1. Project Overview

Avalanche is a Layer 1 blockchain that offers customizable blockchains, referred to as “L1s” (formerly known as subnets). These L1s are independent networks within the Avalanche ecosystem, each capable of implementing its own tokenomics, governance rules, and validator sets. Complementing the L1s, the network’s Primary Network consists of the P-Chain, X-Chain, and C-Chain, all of which operate using the Snowman consensus algorithm.

2. 4Q24 Highlight: The Journey to “The Everything Network”

Source: Avalanche X

Source: Avalanche X

In Q4, Avalanche completed the Avalanche9000 upgrade, positioning itself for the mass adoption of Web3 technologies. Recently, under the banner of “The Everything Network,” Avalanche has embarked on an ambitious expansion strategy. With the pro-crypto currency stance of President-elect Trump providing a favorable backdrop, 2025 is poised to be a critical year to showcase the results of Avalanche’s groundwork and achievements.

2-1. Key highlight

Avalanche Pioneering New Horizons in the Blockchain Gaming Industry

- Nexon’s MapleStory Universe successfully concluded its beta testing phase.

- The anime series Solo Leveling launched digital collectibles on a platform built on Avalanche L1.

- OTG (On The Game) demonstrated the potential of Web3 gaming with its stable and reliable gaming services.

- FCHAIN adopted Avalanche L1 to establish its gaming ecosystem.

Transforming the Global Financial Industry on Avalanche

- BlackRock introduced its digital liquidity fund, BUIDL, on the Avalanche network through the Securitize platform.

- JP Morgan developed institutional-grade privacy solutions via AvaCloud.

- Colombian neobank Littio offered USD interest-bearing accounts to local customers using OpenTrade.

- StraitsX leveraged the Avalanche network to streamline cross-border payments across Southeast Asia.

Accelerating Blockchain Adoption Among Enterprises Through Avalanche

- Suntory Group implemented a management system for its premium beer, Premium Malt’s.

- Blockticity established global trade verification standards using Avalanche.

- MeWe developed a decentralized, privacy-centric social networking platform.

Strategic Programs Driving Ecosystem Expansion

- Avalanche allocated up to $40 million in grants to projects on the Avalanche9000 testnet.

- The AI-focused infraBUIDL program accelerated infrastructure development for AI applications.

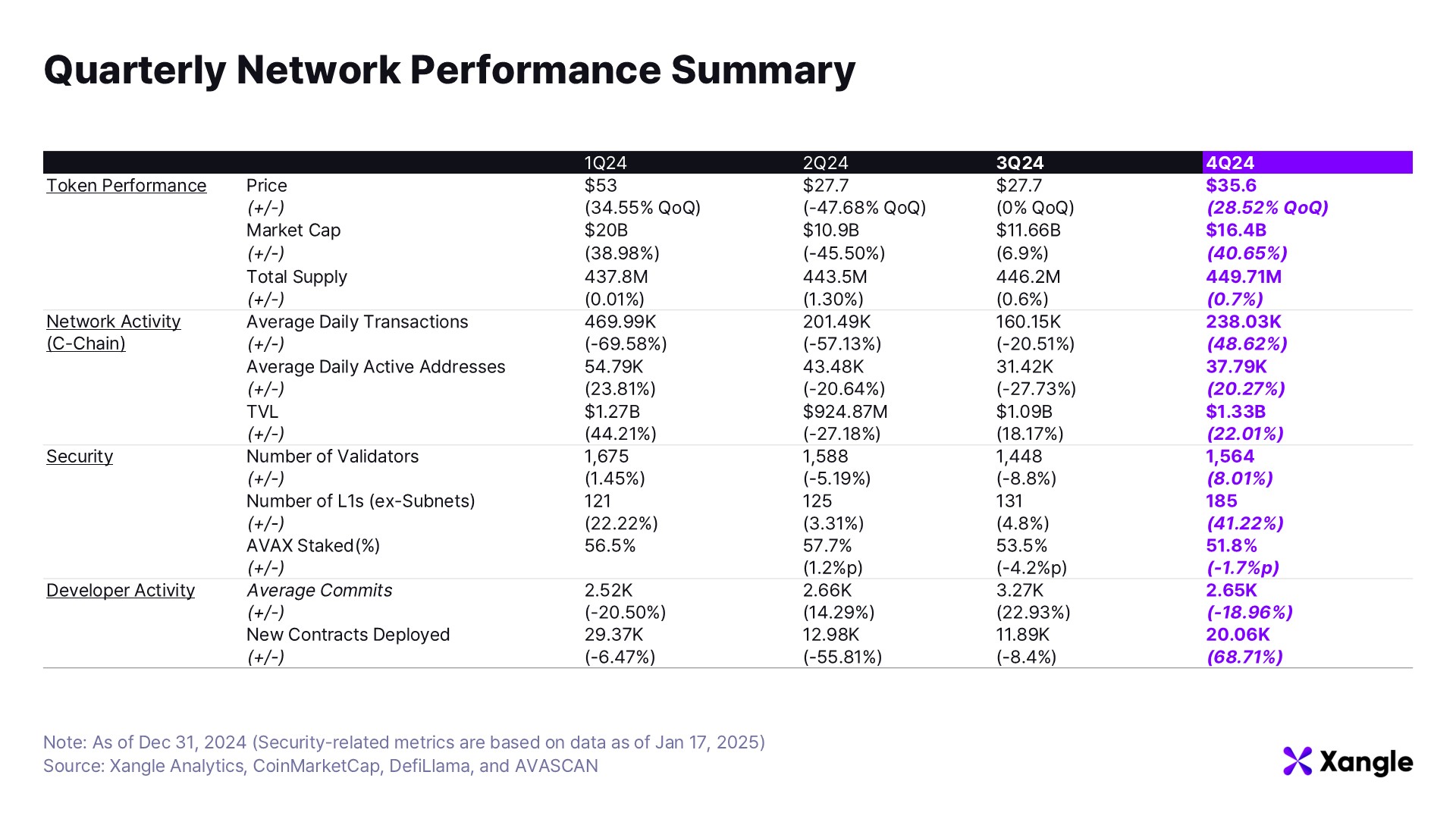

2-2. Key Metrics

3. Major Partnerships and Updates

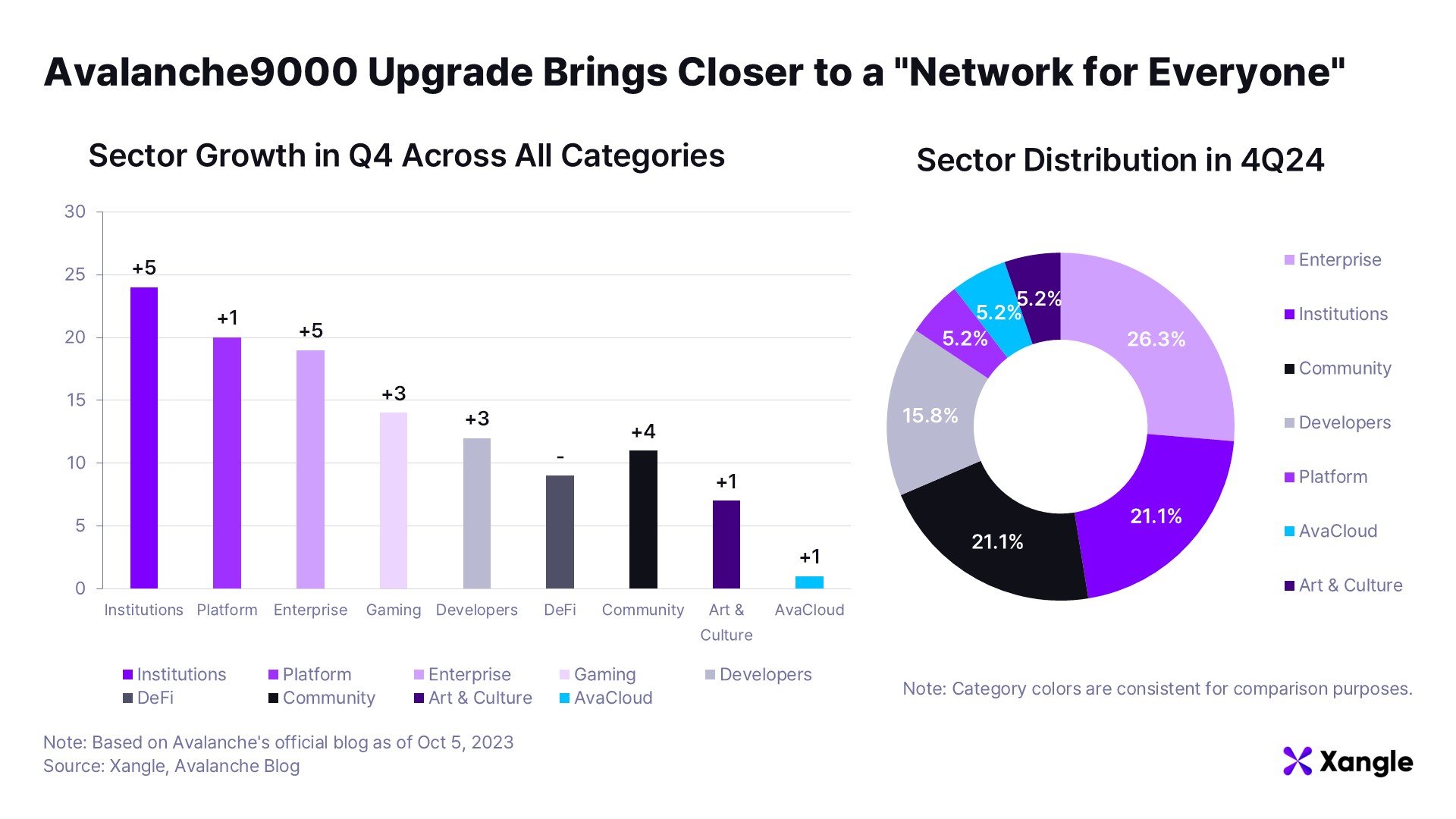

In 4Q24, Avalanche made a significant leap forward as an inclusive infrastructure network through the Avalanche9000 upgrade. This upgrade facilitated the onboarding of numerous institutions and enterprises onto the Avalanche network. It also spurred the launch of diverse services, including meme-coin ecosystems and AI agent platforms, which contributed to increased on-chain activity. Notably, community-related activities surged compared to the previous quarter, highlighting the importance of community engagement for the qualitative and quantitative growth of Avalanche.

Source: Avalanche Blog

Source: Avalanche Blog

One standout event was the Avalanche Summit LATAM, held in Buenos Aires, Argentina. This summit served as a milestone in showcasing the current state of institutional blockchain adoption. Over seven days, industry leaders such as Ava Labs, Galaxy, and SkyBridge convened to discuss changes in crypto policy and the integration of blockchain into traditional finance. During sessions on real-world asset (RWA) tokenization, featuring participants like Onyx Digital Assets, Dinari, and TomNext, strategies for on-chain RWA adoption and synergies with DeFi protocols were thoroughly explored. In addition, the summit highlighted achievements and visions in GameFi and SocialFi, affirming that Avalanche's vision of becoming “The Everything Network” is more than just a slogan—it reflects tangible progress. To strengthen community bonds and energize the ecosystem, Avalanche has also hosted numerous meetups and hackathons worldwide, encouraging participation from developers and users alike.

3-1. Opening new frontiers in blockchain gaming

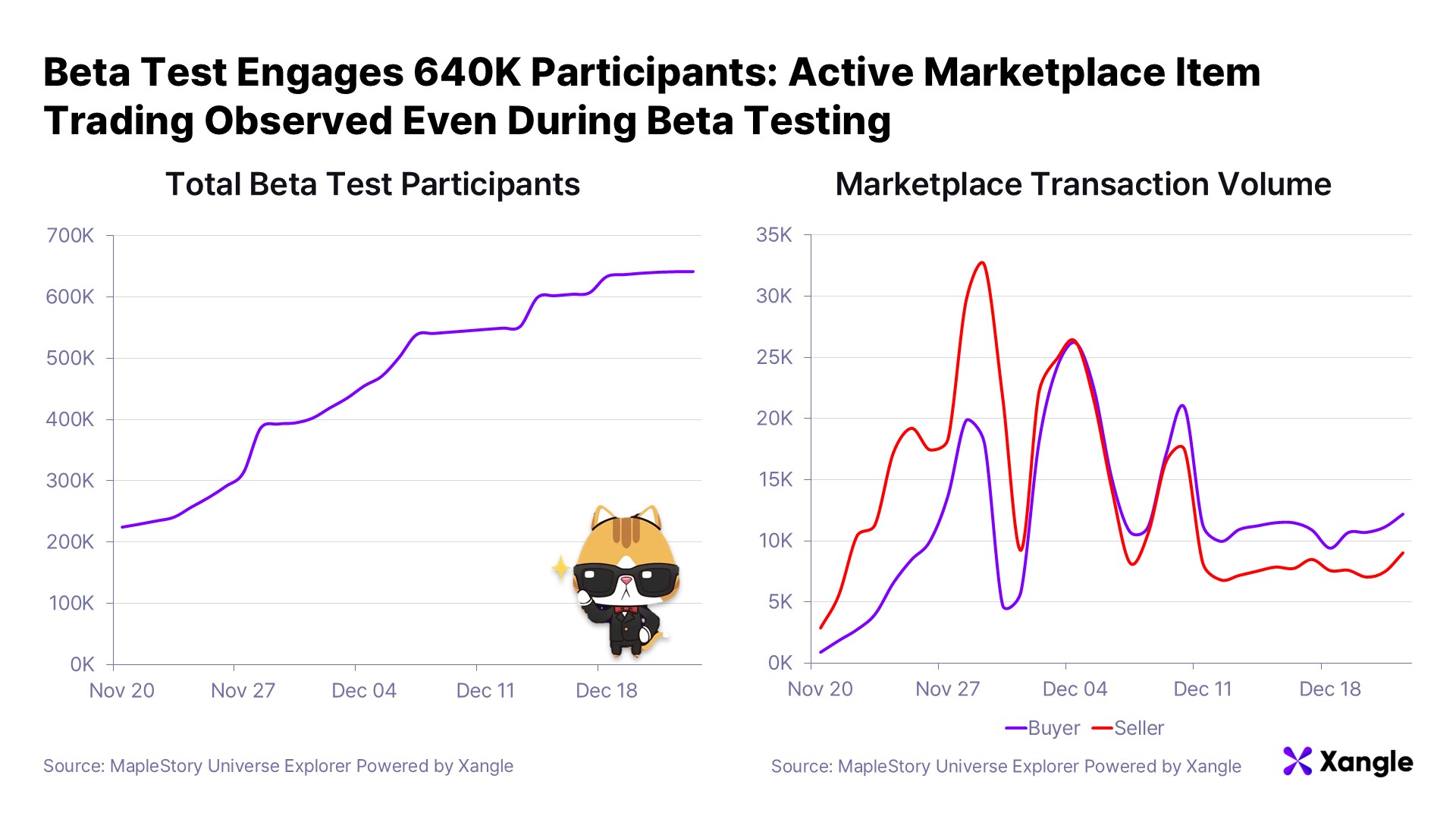

The MapleStory Universe, slated for launch in 2025, successfully concluded its second beta testing phase, which began on November 20, 2024. Initially planned to run until November 29, the beta test was extended to December 23 due to overwhelming community interest and participation. Players familiar with the original MapleStory found the new game intuitive, with engaging content such as guild and party formation, as well as boss battles.

By the end of the beta testing period, the MapleStory Universe Explorer recorded approximately 640K participants, with an average of 12K items traded daily on the marketplace. These metrics, achieved during the beta phase, underscore the game’s potential for even greater success upon its official launch.

Meanwhile, the FPS game OTG (Off The Grid), which garnered significant attention last year, continues to thrive. Despite initial concerns about its popularity being short-lived, the game has maintained steady performance, recording 2.5 to 3 million daily transactions. The sustained success of OTG, coupled with the upcoming launch of the MapleStory Universe, positions Avalanche to solidify its leadership in the blockchain gaming market in 2025.

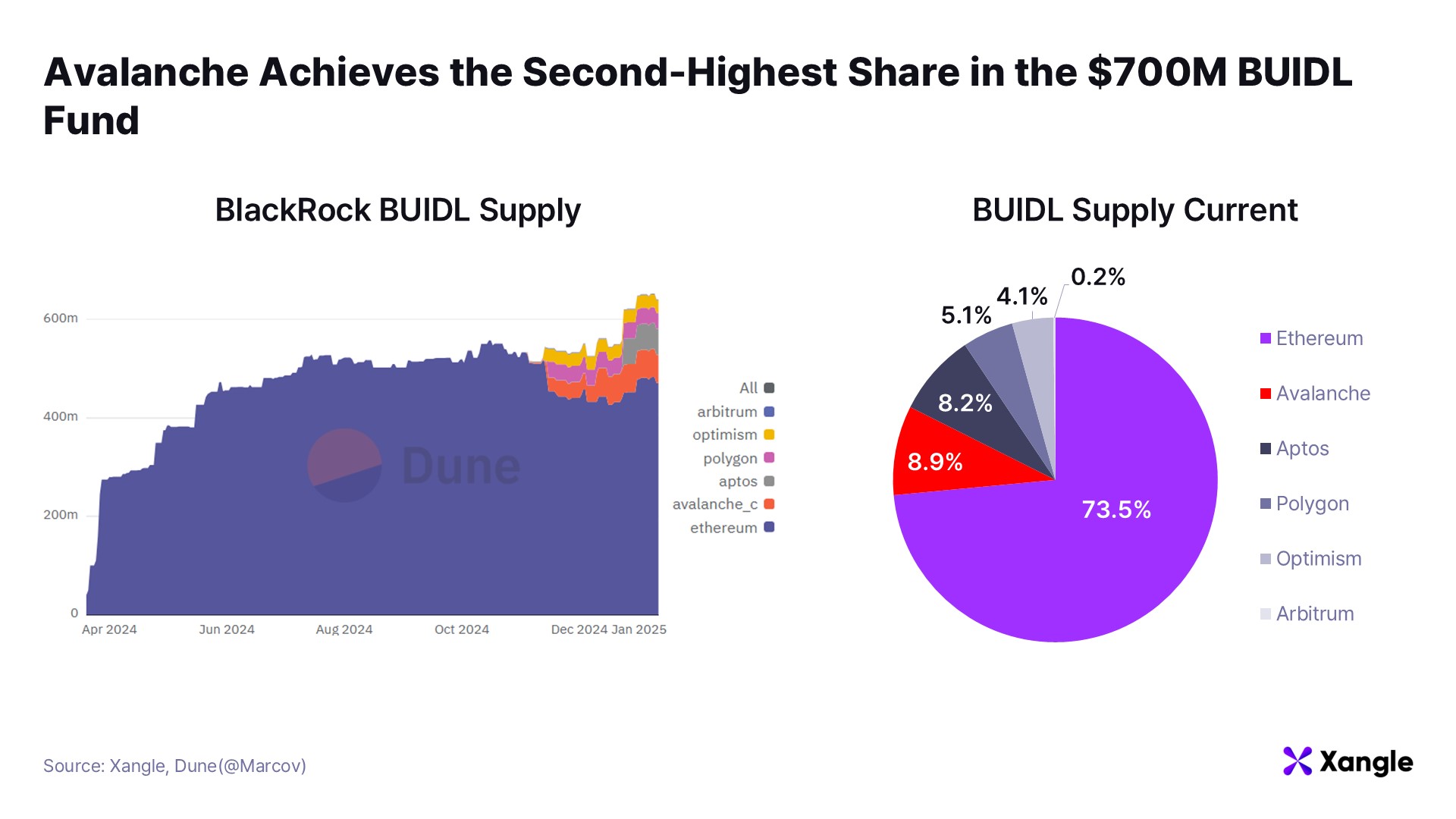

3-2. Avalanche leading innovation in the RWA sector

In 4Q24, Avalanche reinforced its position as a leading infrastructure network bridging traditional finance and blockchain. A key milestone was the launch of BlackRock’s digital liquidity fund, BUIDL, on the Avalanche network via the Securitize platform. This fund, which exclusively invests in U.S. dollars, U.S. Treasury bonds, and repurchase agreements, leverages blockchain technology to offer instant settlement, transparency, peer-to-peer transfers, daily dividends, and collateral mobility. As shown in the chart, Avalanche ranked second only to Ethereum in hosting BlackRock’s BUIDL fund, reflecting strong institutional trust in the network.

Advancing financing privacy and security

The expansion of financial institutions on Avalanche has driven advancements in privacy and security solutions for financial data. AvaCloud’s privacy solution was selected for JP Morgan’s Kinexys chain as part of Project EPIC. Through the recent acquisition of EtraPay, AvaCloud has enhanced its blockchain privacy capabilities, incorporating zero-knowledge proofs (ZK Proofs) and distributed homomorphic encryption (DHE) to meet institutional needs. This solution is particularly valued for protecting sensitive data during investor onboarding while complying with KYC/AML requirements. It also enables credential verification using digital identities (DIDs) during fund allocation processes, addressing a critical need for secure and efficient financial operations.

Transforming consumer finance

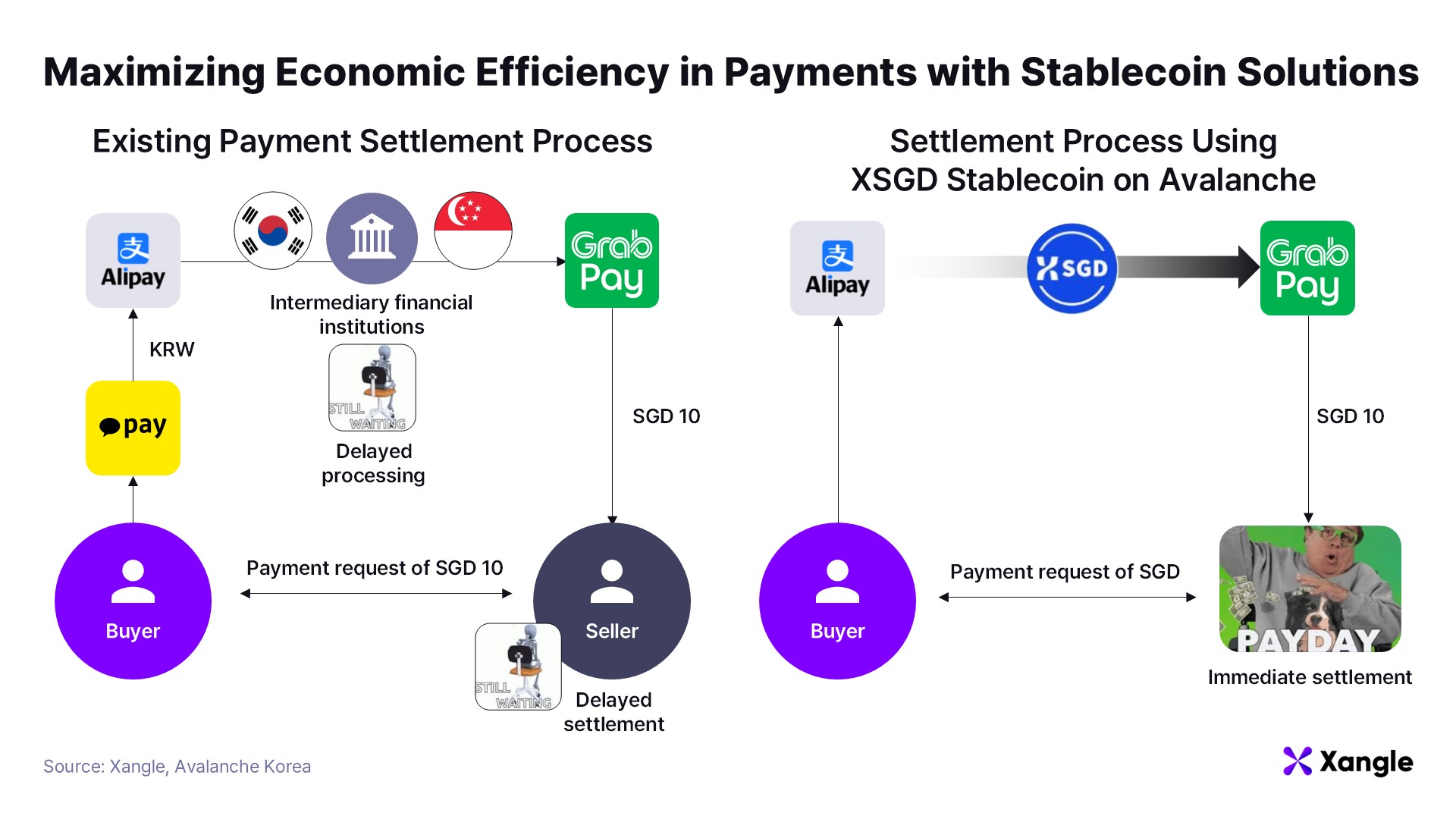

Avalanche has also made notable strides in the digital transformation of everyday financial services. In Southeast Asia, StraitsX collaborated with Ant International and Grab to launch a cross-border payment system based on Avalanche. This system leverages the Purpose Bound Money (PBM) protocol and XSGD stablecoin, enabling tourists to make fast and secure payments at participating merchants via the Alipay+ app. Avalanche’s Layer 1 infrastructure, with its speed, low fees, and scalability, has proven to be an optimal solution for Southeast Asia’s rapidly growing digital economy.

In Colombia, the digital bank Littio began offering dollar-based interest-bearing accounts to local users by utilizing Avalanche’s RWA-based vaults through OpenTrade. This initiative addresses two key challenges in Latin America: limited financial accessibility and inflation risks.

3-3. Accelerating enterprise blockchain adoption via Avalanche

In Q4, traditional industry players leveraged Avalanche to introduce innovative business models, showcasing the practical utility of blockchain technology. Notably, enterprises went beyond mere adoption, using blockchain to enhance user experiences and generate tangible business value.

Unique consumer experiences powered by Web3

Source: Avalanche Blog

Source: Avalanche Blog

Global beverage company Suntory Group combined its premium beer "Premium Malt's" with Avalanche blockchain to deliver an innovative consumer experience. Limited-edition bottles aged in Yamazaki Whisky barrels featured NFC-enabled caps, allowing consumers to claim NFTs upon opening the product. This approach not only certifies product authenticity but also establishes a novel digital connection between the brand and its consumers, earning recognition as a groundbreaking initiative.

Setting global standards for transactions

Another significant milestone is Blockticity’s collaboration with ASTM International to develop global transaction verification standards. Addressing the $4.7 trillion annual losses from counterfeit and manipulated documents, Blockticity utilizes Avalanche’s immutable ledger to create a Certificate of Authenticity (COA) standard. Over $275 million worth of physical assets have already been certified, with applications expanding into agriculture, commodities, solar panel tracking, and battery monitoring industries.

Solving privacy issues in existing social media

Source: Avalanche Blog

Source: Avalanche Blog

In the social media space, MeWe announced its transition to Avalanche to build a privacy-focused decentralized social network. Over 1.3 million users have already migrated on-chain, with more than 675K users owning their social graphs. MeWe aims to address issues like data breaches, algorithm manipulation, and intrusive ads found in centralized platforms, empowering users with true data ownership.

These examples highlight Avalanche’s evolution from a blockchain platform to a trusted infrastructure for digital transformation. Avalanche’s technical strengths—high throughput, low fees, and scalability—are proving to be critical competitive advantages in real-world business environments.

3-4. Strategic programs driving ecosystem expansion

In Q4, Avalanche launched multiple strategic programs to foster both quantitative and qualitative ecosystem growth. Ahead of the Avalanche9000 upgrade’s mainnet deployment, the $40 million Retro9000 grant program was introduced to encourage developer participation. Currently, over 500 Layer 1 blockchains, including DeFi Kingdoms, Dexalot, Off The Grid, Lamina1, SK Planet, and StraitsX, are being developed on Avalanche’s testnet and mainnet, signaling an imminent surge in ecosystem growth.

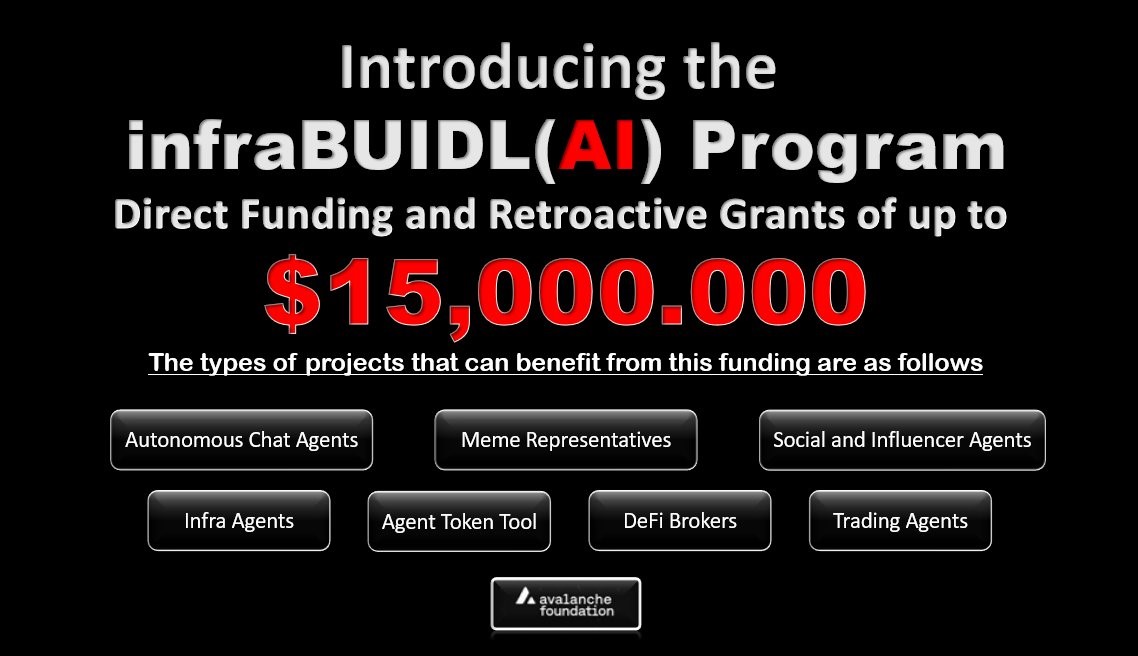

In alignment with the 2025 AI agent narrative, Avalanche has proactively supported this sector. The Avalanche Foundation’s infraBUIDL(AI) program, with up to $15 million in funding, accelerates the development of AI-powered blockchain applications. A key innovation is the introduction of AIfred, an AI-based InfraAgent designed to mimic venture capitalists’ decision-making processes for project evaluation. This tool is expected to drive rapid and high-quality ecosystem growth.

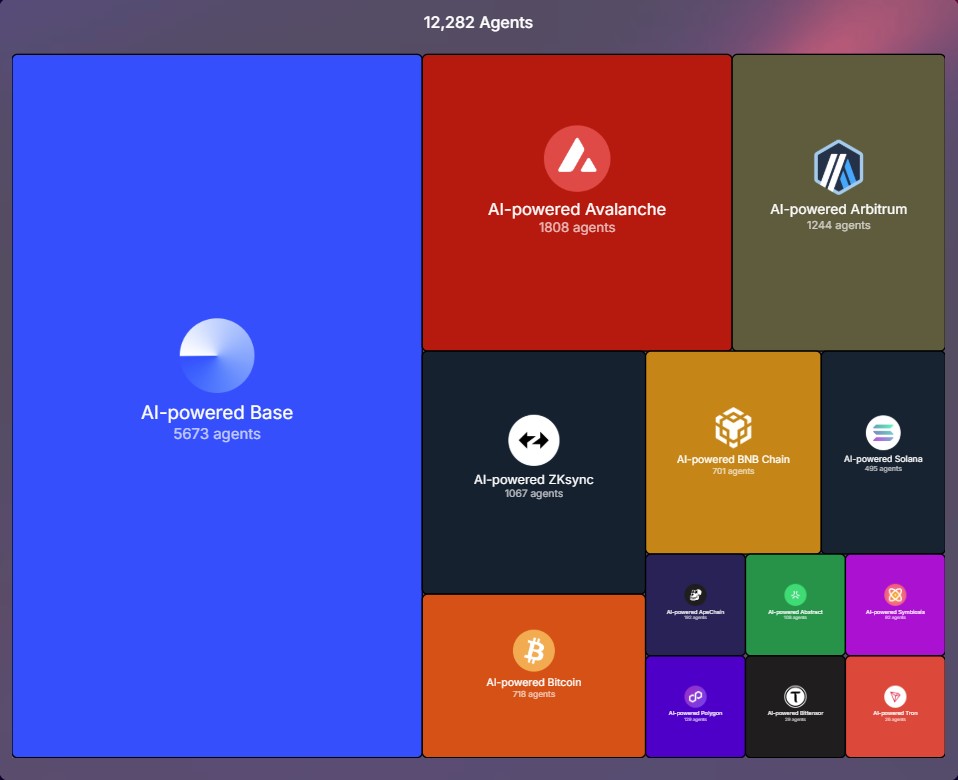

While Base and Solana have rapidly expanded their AI agent ecosystems through strong community engagement, Avalanche’s strategy focuses on building a robust narrative to capture market share in the AI agent sector. According to EternalAI.org’s chain-specific market share dashboard, Avalanche ranks second in AI agent launches, trailing Base. Interestingly, despite supporting only one AI model compared to Base’s multiple models, Avalanche’s high adoption rate underscores its ecosystem’s potential. These developments position Avalanche as a leader in fostering AI innovation while maintaining a competitive edge in the broader blockchain space.

4. On-Chain Performance - Avalanche9000 Upgrade: Before & After

4-1. Key changes post Avalanche9000 upgrade

On December 16, 2024, Avalanche achieved a major milestone with the Avalanche9000 upgrade, significantly enhancing the network’s scalability and cost efficiency. This upgrade introduced groundbreaking changes:

- Eliminated the initial staking requirement of 2,000 AVAX for L1 deployment, replacing it with a monthly fee of 1–10 AVAX, thereby lowering the entry barrier and enabling a sustainable economic model.

- Reduced C-Chain transaction fees from 25 nAVAX to 1 nAVAX, cutting costs by approximately 96% and alleviating financial burdens for developers and users.

- Launched Interchain Messaging (ICM) to facilitate seamless asset and data transfers between L1 blockchains while simplifying the complexity of the previous Subnet model through independent validator sets.

These enhancements empower developers with complete autonomy to design custom staking mechanisms, gas tokens, and governance structures. The impact of the Avalanche9000 upgrade was immediately evident, with notable on-chain performance improvements following its implementation.

- Unit: 10^9 nAVAX = 1 AVAX

4-2. Network activity (Feat. The effect of reduced fees)

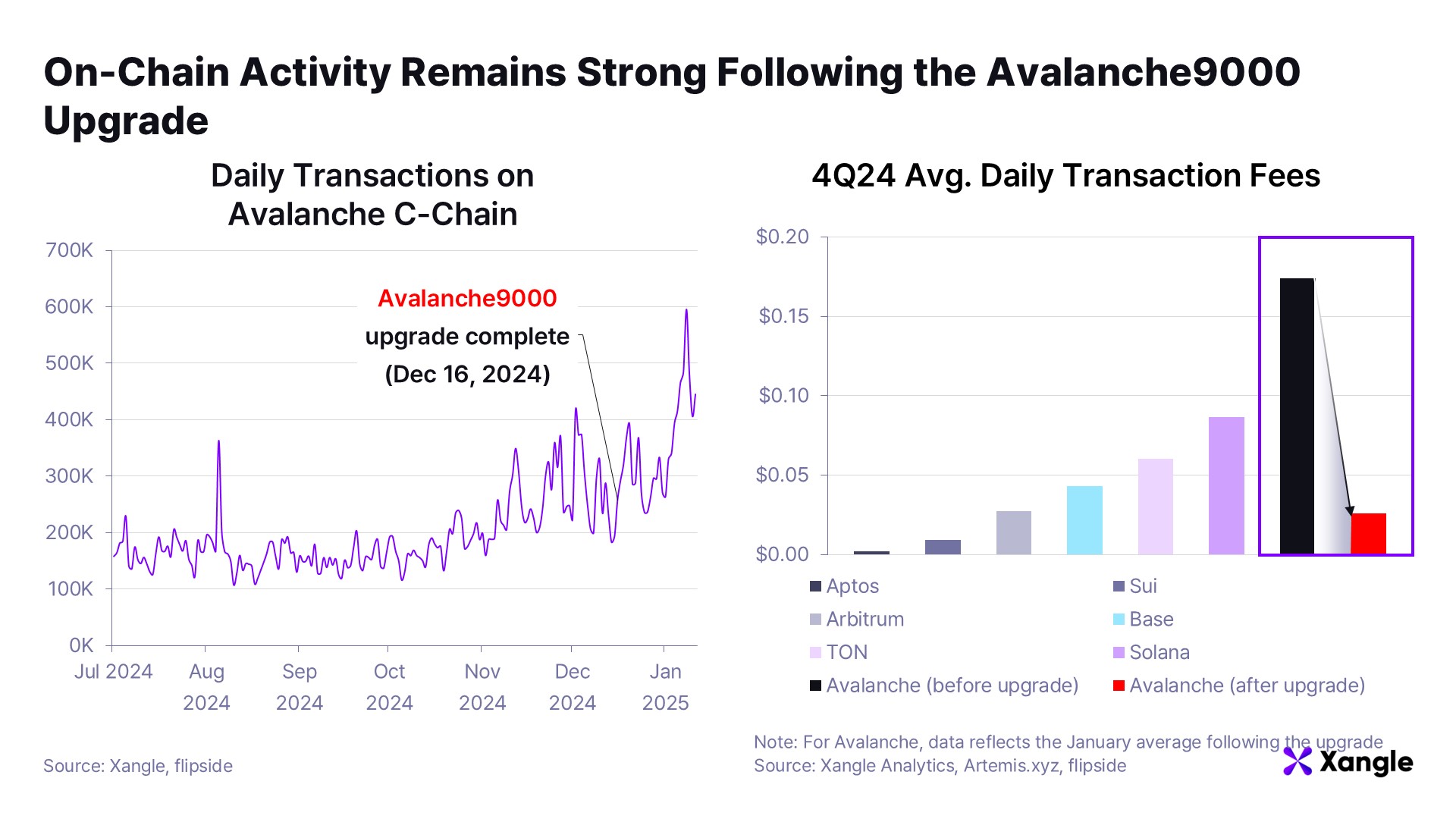

Following the Avalanche9000 upgrade, the average transaction fee on the C-Chain dropped from $0.18 to $0.026—a reduction of nearly 90%. This substantial decrease in gas fees has driven a surge in transaction volume on the C-Chain. When compared to competing chains, Avalanche now enjoys a notable cost advantage, positioning it to further enhance on-chain activity through community growth and ecosystem expansion.

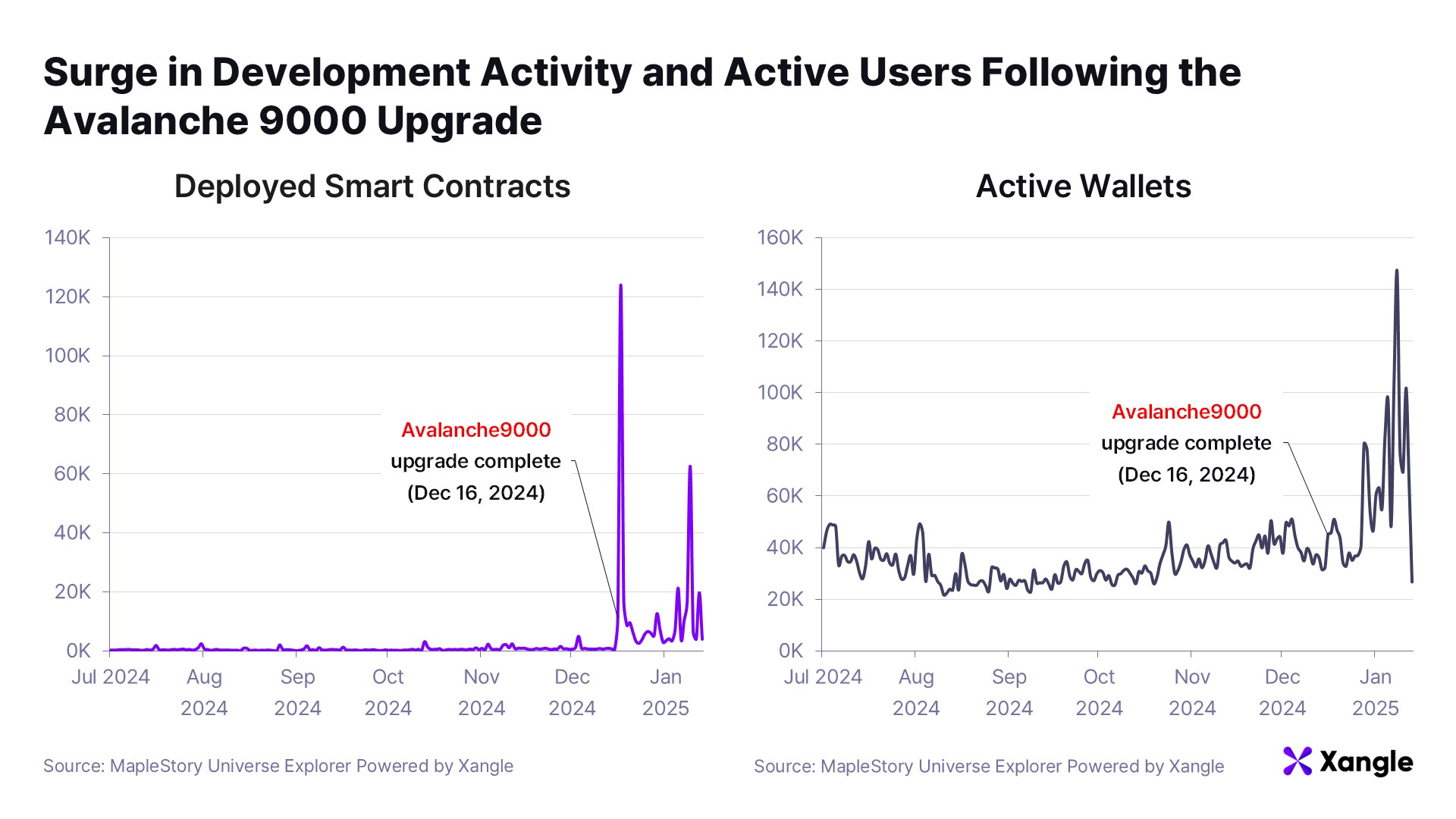

4-3. Ecosystem engagement

The reduced onboarding costs and gas fees following the Avalanche9000 upgrade have led to a significant uptick in developer activity and the number of active wallets. Although only a month has passed since the upgrade, these trends indicate potential for even greater growth. The performance metrics for Q1 will be critical in assessing the long-term impact of these changes.

5. Closing Summary

Avalanche has positioned itself as a robust intermediary infrastructure network, successfully attracting numerous institutions and enterprises while leveraging their participation to onboard users. Despite its achievements in onboarding L1 projects, Avalanche has not yet secured a leading position in rapidly growing sectors like meme coins and AI agents, which have driven explosive network growth for competing chains. Moreover, while institutional partnerships have bolstered Avalanche’s reputation, they have not translated into significant increases in the value of the AVAX token—a critical shortcoming.

This disparity can be attributed to Avalanche’s relative lack of community-driven DeFi activity and projects compared to its competitors. Recognizing this gap, Avalanche has declared 2025 as the year for revitalizing its on-chain community. With its established dominance in the enterprise sector, the key question is whether Avalanche can achieve similar innovation in the Web3-native market. The year ahead will reveal whether Avalanche can transition into "The Everything Network," seamlessly integrating enterprise and Web3-native ecosystems and solidifying its position as a comprehensive blockchain solution.