Table of Contents

1. Project Overview

2. 4Q24 Key Highlights

2-1. Aptos maintains strategic direction amid CEO transition

2-2. BlockRock’s first non-EVM chain investment

2-3. Strengthening the Aptos DeFi ecosystem with USDT integration

3. On-Chain Performance — 2024: The Year Aptos Made Its Mark

3-1. Network activity

3-2. Development activity

4. Ecosystem Review — The Undervalued Aptos Ecosystem: Projects to Watch

1. Project Overview

Aptos is a monolithic PoS blockchain developed by former contributors to Meta’s Diem project, with a strong emphasis on speed and stability. Utilizing cutting-edge technologies like AptosBFT and BlockSTM, the network is designed to achieve over 100,000 transactions per second (TPS) and sub-second latency. Furthermore, the Move programming language ensures a robust, fast, and flexible development environment, offering an exceptional blockchain experience that caters to both developers and users.

2. 4Q24 Key Highlights

2-1. Aptos maintains strategic direction amid CEO transition

In 4Q24, Aptos underwent a significant leadership change as Mo Shaikh, co-founder and CEO, stepped down, with co-founder and former CTO Avery Ching assuming the role of CEO. Avery Ching brings a wealth of technical expertise, having previously served as the technical lead for Meta’s batch processing team and overseen the development of wallet infrastructure and L1 blockchain technologies. This leadership transition, taking place three years after Aptos’ founding, has sparked considerable industry interest regarding its underlying motivations and potential implications.

Despite speculation surrounding Mo’s resignation, the CEO transition is expected to deliver two major benefits. The first is accelerated platform expansion and technological advancement: Avery Ching’s extensive experience in large-scale distributed systems and blockchain operations positions him to drive further refinement of the Move-based ecosystem and accelerate the platform’s technological evolution. The second is ecosystem growth: As a developer-turned-CEO, Avery Ching is expected to bring a stronger focus on supporting the builder community. He has already stated, “We will intensify our efforts to grow the Aptos ecosystem. Ecosystem growth is our top priority.” As discussed in section 3-2, 2024 marked a year of substantial growth for Aptos’ development ecosystem. With Avery Ching at the helm, expectations are high for even greater ecosystem expansion in 2025.

Source: X(@AveryChing)

2-2. BlockRock’s first non-EVM chain investment

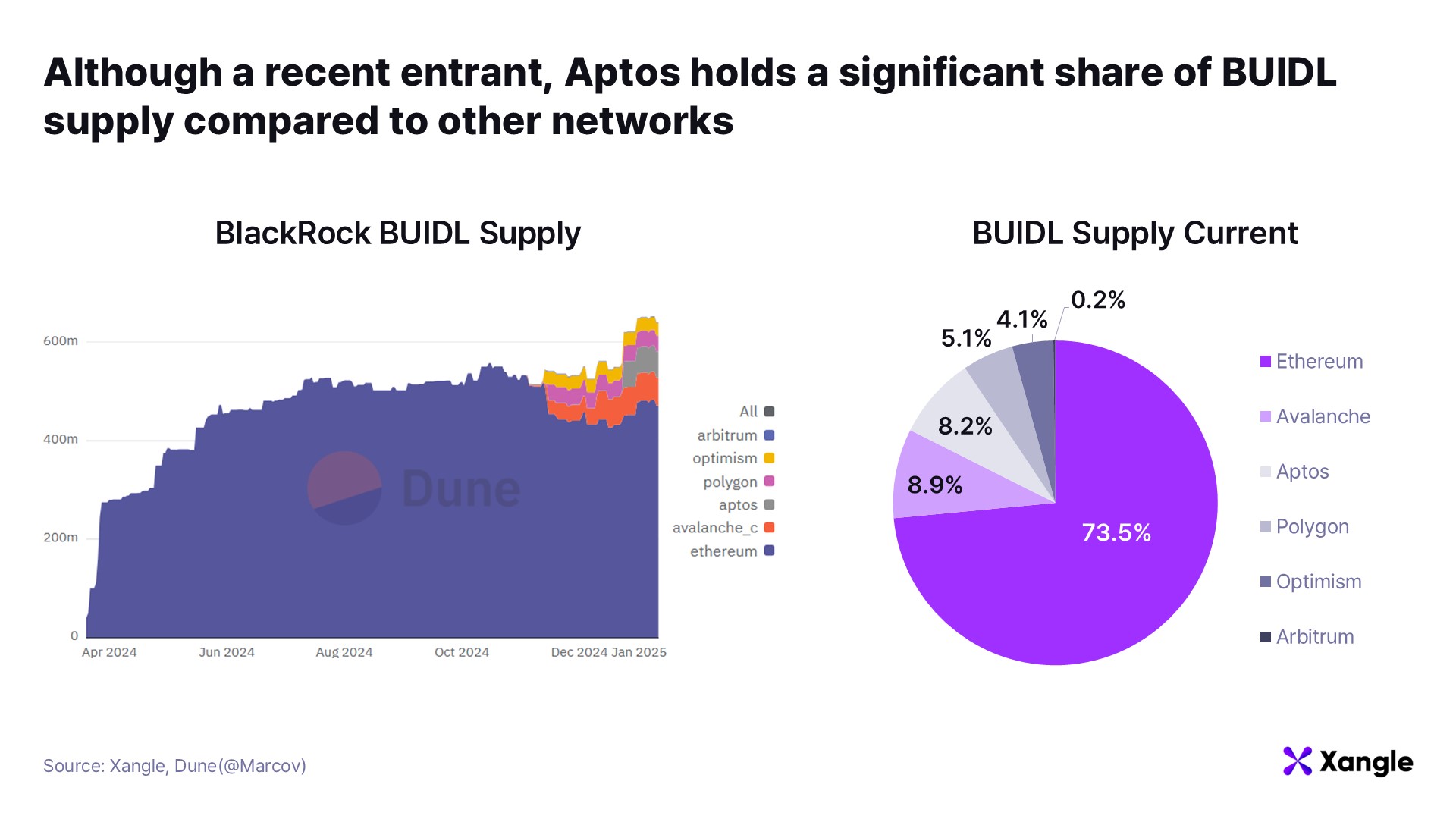

BlackRock's tokenized money market fund, BUIDL, initially launched on Ethereum in March and subsequently expanded across EVM-compatible chains such as Arbitrum, Avalanche, Optimism, and Polygon PoS. However, in November, Aptos was selected for integration, drawing significant attention as the first non-EVM chain to be connected to BUIDL.

The BUIDL fund, tokenized by Securitize, is a money market fund pegged to $1 and backed 100% by safe assets such as U.S. dollars, treasuries, and repurchase agreements. Designed for institutional and large-scale investors, the fund has a minimum investment threshold of $5M and provides on-chain monthly dividends. Currently, the BUIDL fund issued on Aptos stands at approximately $52M, ranking third after Ethereum and Avalanche. This growth is partly attributed to a liquidity-focused strategy where the management fee for BUIDL on Aptos, Avalanche, and Polygon is set at 0.2%, significantly lower than the 0.5% fee on other networks. Notably, Aptos also boasts the fastest and most cost-efficient transactions among all integrated networks, which may further increase its share in the future.

Two main factors contributed to Aptos becoming BlackRock's first non-EVM partner chain. First is its high scalability, enabled by the Move programming language. Aptos inherits the technology of Meta's Diem project, offering seamless parallel transaction processing and security features tailored for financial applications. Second is its close collaboration with global institutions. Aptos has established partnerships with traditional corporations and financial giants such as Google and Mastercard, enhancing its infrastructure reliability—a factor likely noticed by BlackRock.

Looking ahead, the synergy between BlackRock's vast institutional capital and Aptos' differentiated technological foundation is highly anticipated. As the assets under management in BUIDL grow, the Aptos ecosystem could benefit from increased capital inflows into DeFi, on-chain financial services, and other sectors. This, in turn, could elevate the visibility of Aptos-based applications and further solidify its competitive position in the market.

2-3. Strengthening the Aptos DeFi ecosystem with USDT integration

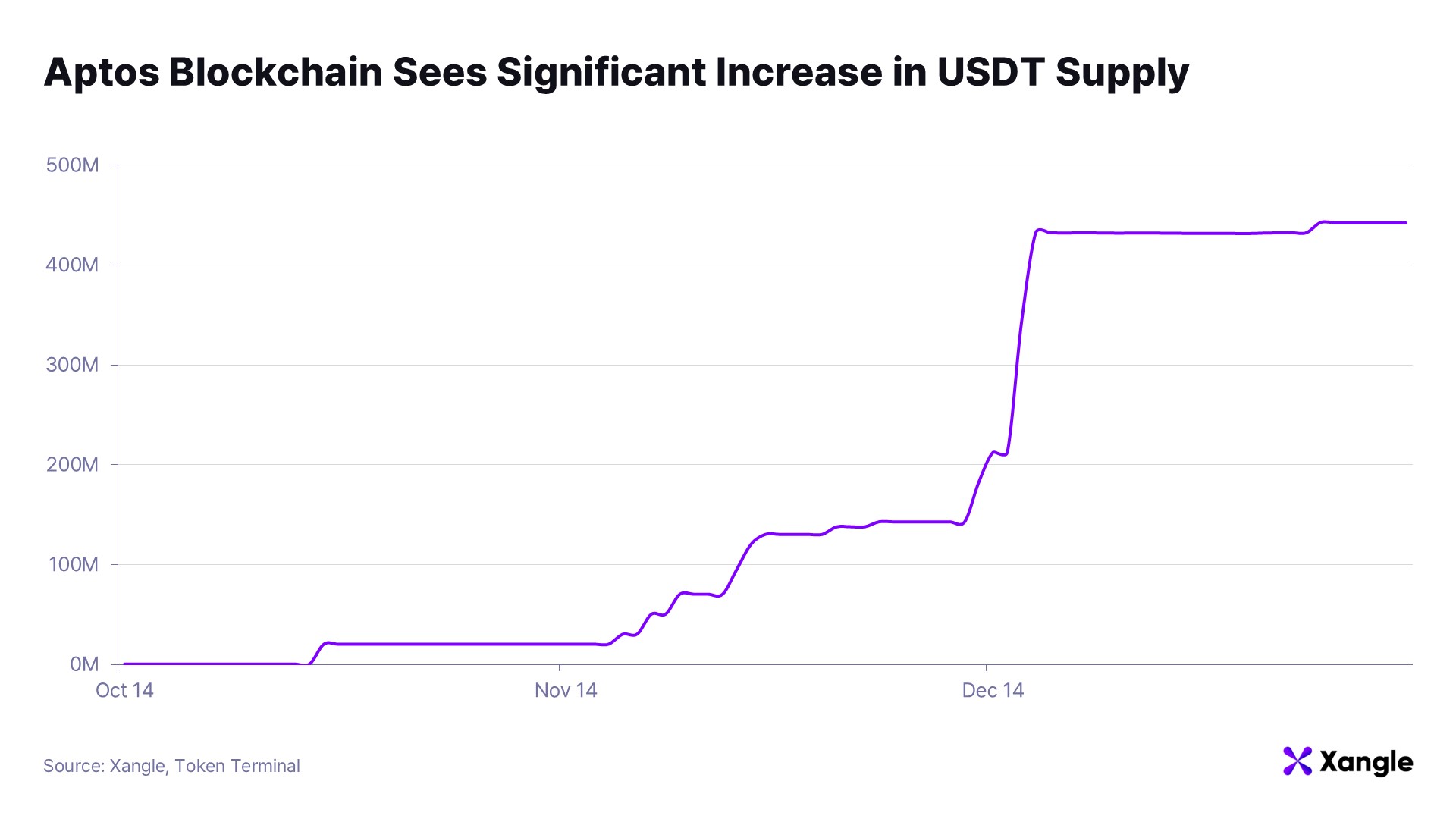

In October, native USDT was officially launched on the Aptos network. Issued by Tether, USDT is the third-largest cryptocurrency by market capitalization after Bitcoin and Ethereum. This launch marks a significant milestone for Aptos, providing a foundation for further expansion of its DeFi ecosystem.

Commenting on the launch, Tether stated that it chose to introduce USDT on Aptos due to its advanced technology stack and rapidly growing DeFi ecosystem, adding that Aptos' exceptional performance and low costs will further drive USDT adoption. Aptos has demonstrated its technological prowess, boasting sub-second latency and high TPS. For example, in August, the network processed over 300 million daily transactions without any issues. Additionally, Aptos offers user- and institution-friendly features, and its TVL surged over eightfold in 2024, surpassing $1 billion. Numerous DeFi projects within its ecosystem have shown remarkable growth, with several notable new projects launching during the year. These factors likely influenced Tether's decision to support USDT on the Aptos network.

The introduction of native USDT is expected to further ascend the Aptos ecosystem for several reasons. Previously, USDT usage on Aptos relied on bridged versions, leading to asset fragmentation as identical assets were treated as distinct tokens across different bridges. Native USDT resolves this issue, streamlining DeFi activities such as lending and swaps. Additionally, as USDT is widely used as a de facto currency on major centralized exchanges (CEXs) like Binance and OKX, the integration could facilitate easier capital inflows from these exchanges into Aptos. Reflecting these advantages, the supply of USDT on Aptos has grown rapidly since its launch, reaching approximately $440M as of January 9.

In November, Aptos announced plans to support Circle's native USDC as well. With both USDT and USDC integrated, the Aptos DeFi ecosystem is expected to become even more dynamic and robust.

3. On-Chain Performance — 2024: The Year Aptos Made Its Mark

3-1. Network activity

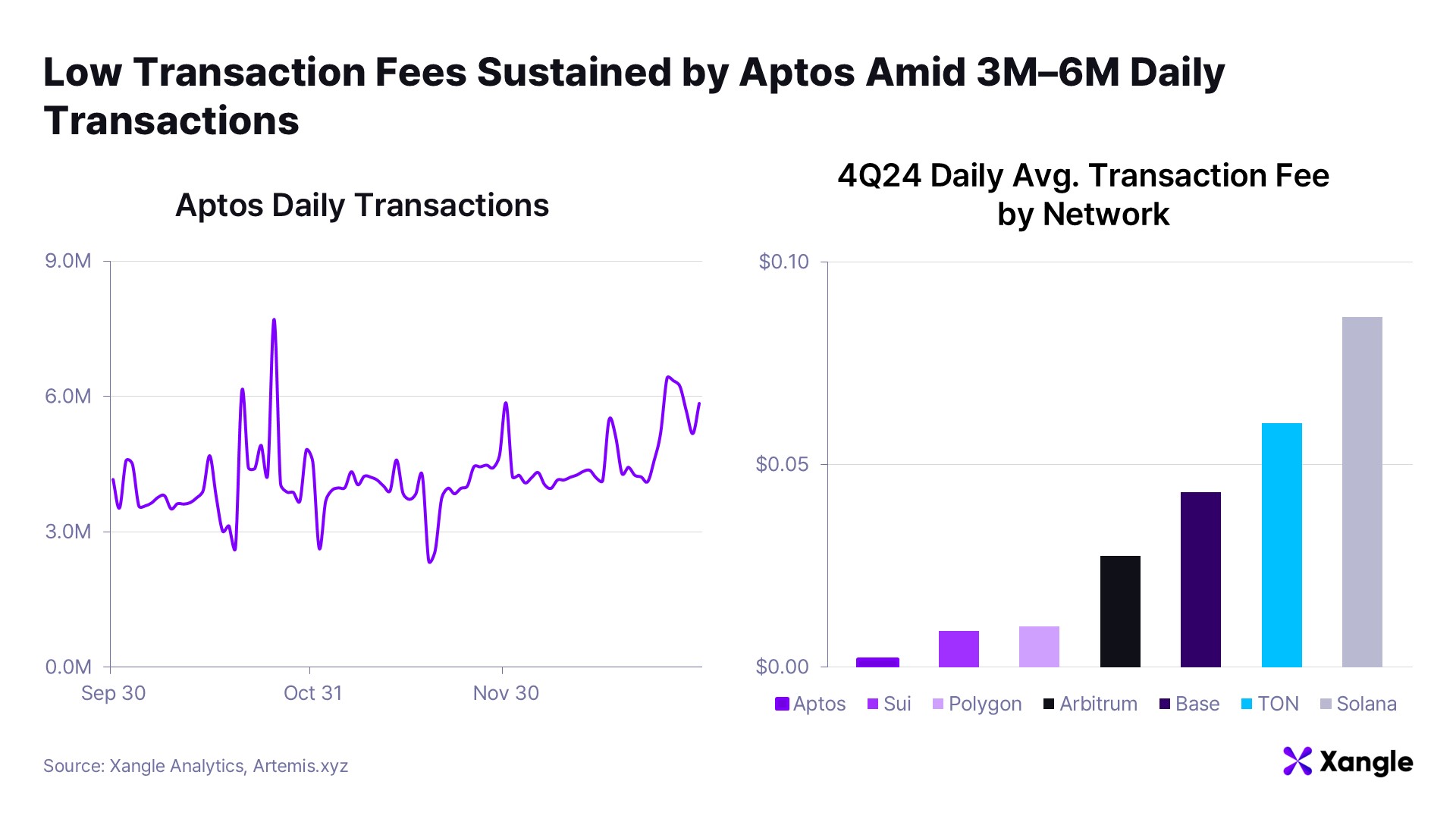

Aptos has consistently maintained a daily transaction volume of 3 to 6 million, ranking just below Solana, Base, and Sui on average. Notably, despite the high transaction count, Aptos maintains exceptionally low transaction fees. In Q4, Aptos recorded the lowest total transaction fees among eight networks analyzed, amounting to just 23% of the fees on Sui, the next-lowest network. This ensures a seamless user experience even as transaction volumes increase. Additionally, builders can easily subsidize gas fees for users, creating an environment conducive to onboarding both users and developers.

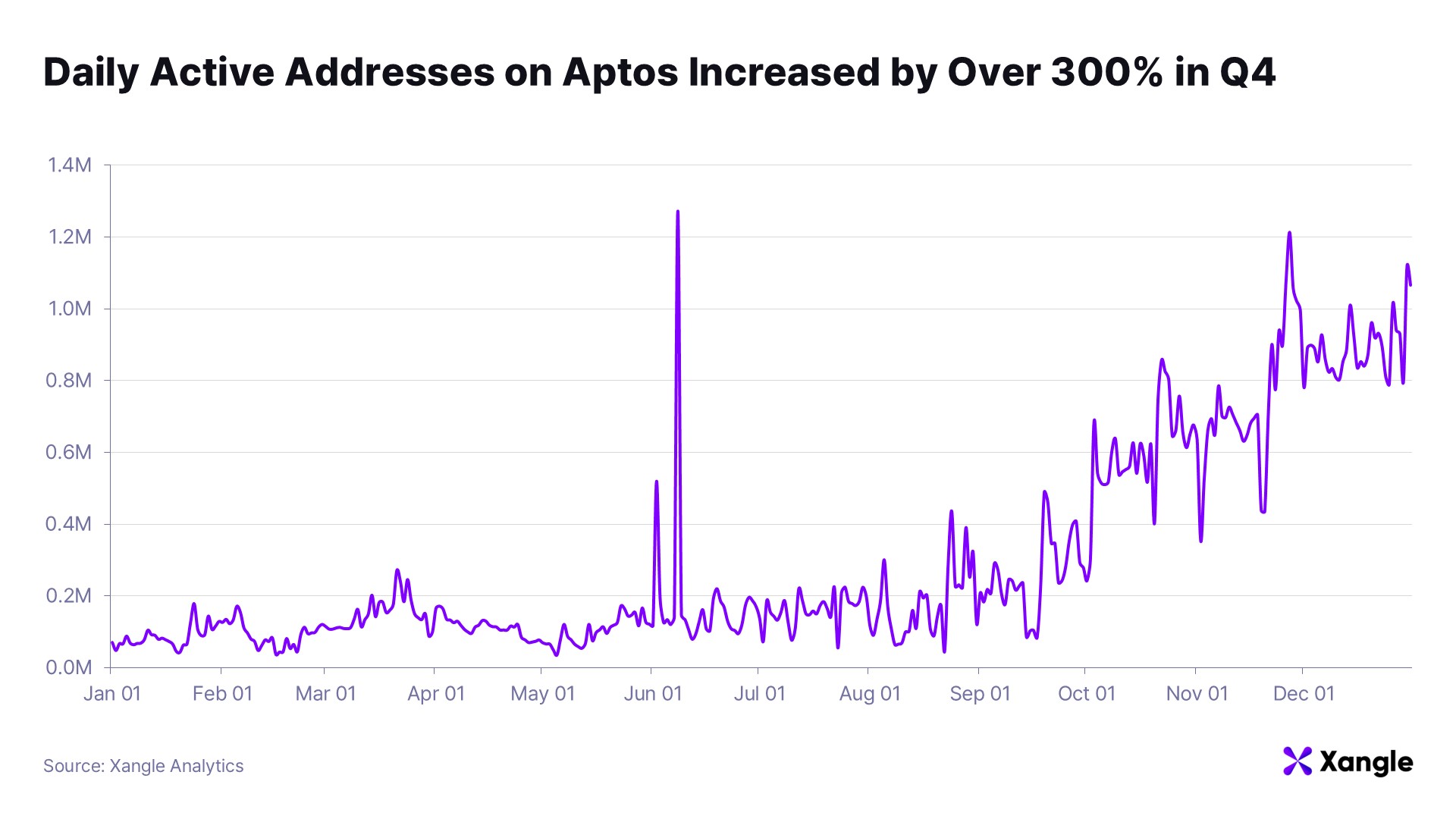

Daily active wallet count on Aptos saw a significant surge in Q4. This growth is primarily attributed to (1) increased DeFi activity and (2) a rise in user numbers across key applications. During Q4, Aptos' daily DEX trading volume peaked at nearly $90 million, reflecting heightened activity. As of January 12, data from DappRadar indicates that the 30-day active user count for Kana Labs, a DEX aggregator on Aptos, reached approximately 2.8 million. Additionally, other notable applications like Chingari and STAN also reported strong user engagement, with 30-day active user counts of 2.8 million and 1.5 million, respectively. Chingari is a Web3 social app within the Aptos ecosystem, while STAN serves as a community app for gamers. The steady growth in user activity across diverse sectors such as DeFi, social, and gaming underscores Aptos' expanding ecosystem.

3-2. Development activity

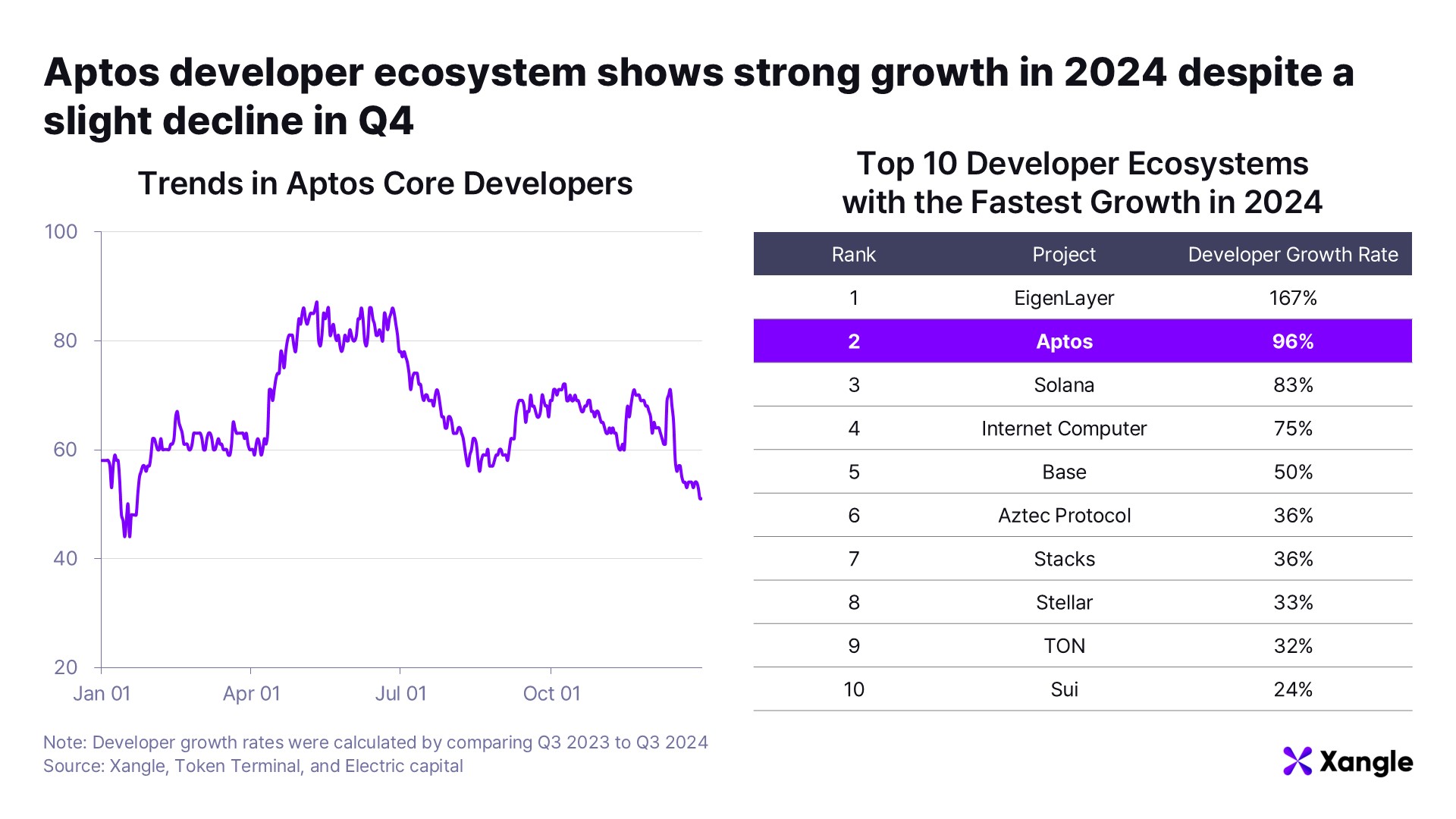

Aptos' developer ecosystem showed an upward trend throughout 2024, although growth slowed in Q4. According to Electric Capital, Aptos recorded the second-highest increase in developer count in 2024. EigenLayer, which launched its mainnet in 2024, ranked first with a 167% increase, while Aptos saw a 96% increase. This growth is particularly significant given that Aptos did not have the same first-launch momentum as EigenLayer. Looking ahead to 2025, it will be important to monitor whether Aptos' developer ecosystem continues to expand, particularly under the leadership of initiatives like Avery Ching.

4. Ecosystem Review — The Undervalued Aptos Ecosystem: Projects to Watch

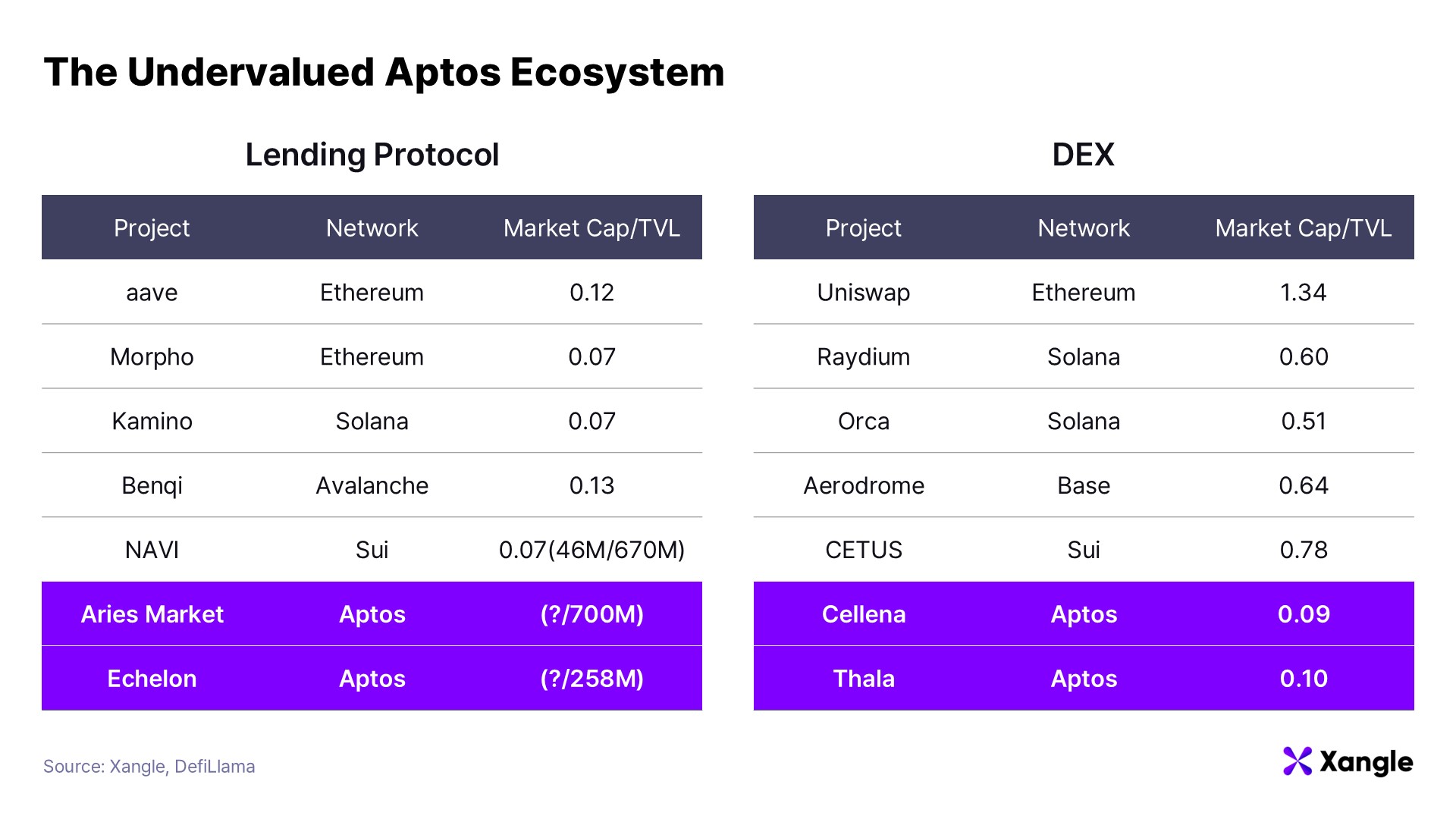

The Aptos ecosystem is growing rapidly, yet it still hosts numerous projects that are either pre-TGE (Token Generation Event) or undervalued. For instance, Aries Markets, the largest lending protocol in the Aptos DeFi ecosystem, boasts a TVL (Total Value Locked) of $880M but has yet to launch its token. Other prominent projects with high TVL rankings, such as Echo Protocol, Echelon Market, and Amnis Finance, are also pre-TGE, making them worth monitoring.

Even among projects that have already launched tokens, many appear undervalued. A simple way to assess valuation is by dividing the market capitalization by TVL, which provides an intuitive measure of how much value is being utilized within a protocol. For Aptos' largest DEXs, Thala and Cellena Finance, this ratio stands at 0.15 and 0.11, respectively—significantly lower than DEXs on other networks. This suggests that their market caps are undervalued relative to their TVL. While a more accurate valuation would require additional analysis of tokenomics and revenue, this article provides a simplified overview.

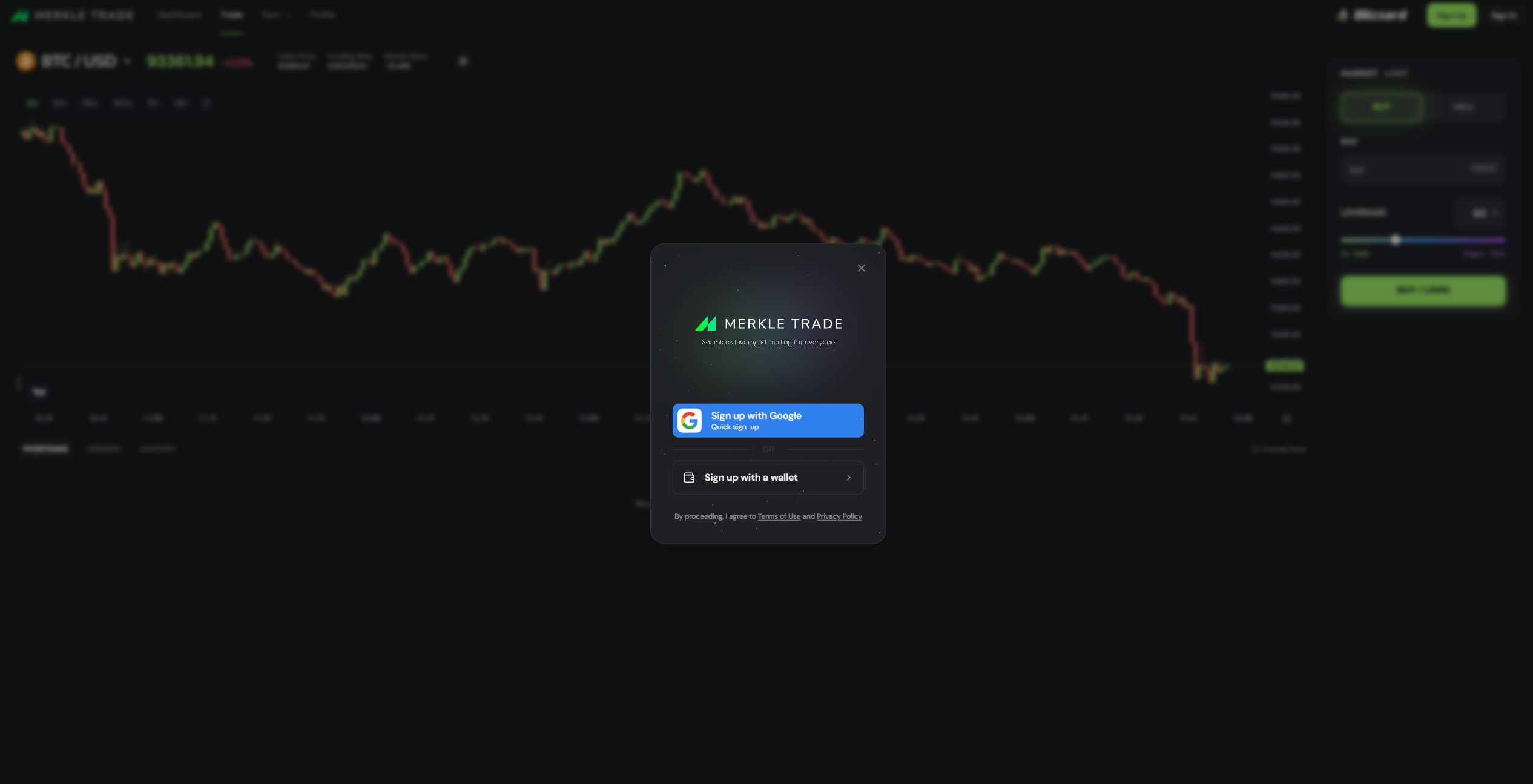

Additionally, the Aptos ecosystem includes standout applications that have launched but still have relatively small market capitalizations. One example is Merkle Trade, which supports a wallet-less approach, allowing users to access the app with just a Google account. By using Merkle LP to supply liquidity collectively instead of relying on an order book, Merkle Trade can handle high trading volumes even with low TVL. It also incorporates gamification elements and EVM chain compatibility, lowering entry barriers for retail users and offering a differentiated user experience among Aptos-based DeFi protocols.

Source: Merkle Trade

Looking Ahead to 2025: The Rise of AI Agents

If there’s one dominant narrative in the crypto market today, it’s AI Agents. With infrastructure projects like Virtual Protocol and Ai16z leading the charge, countless agents and tokens have emerged, supported by increasingly sophisticated models.

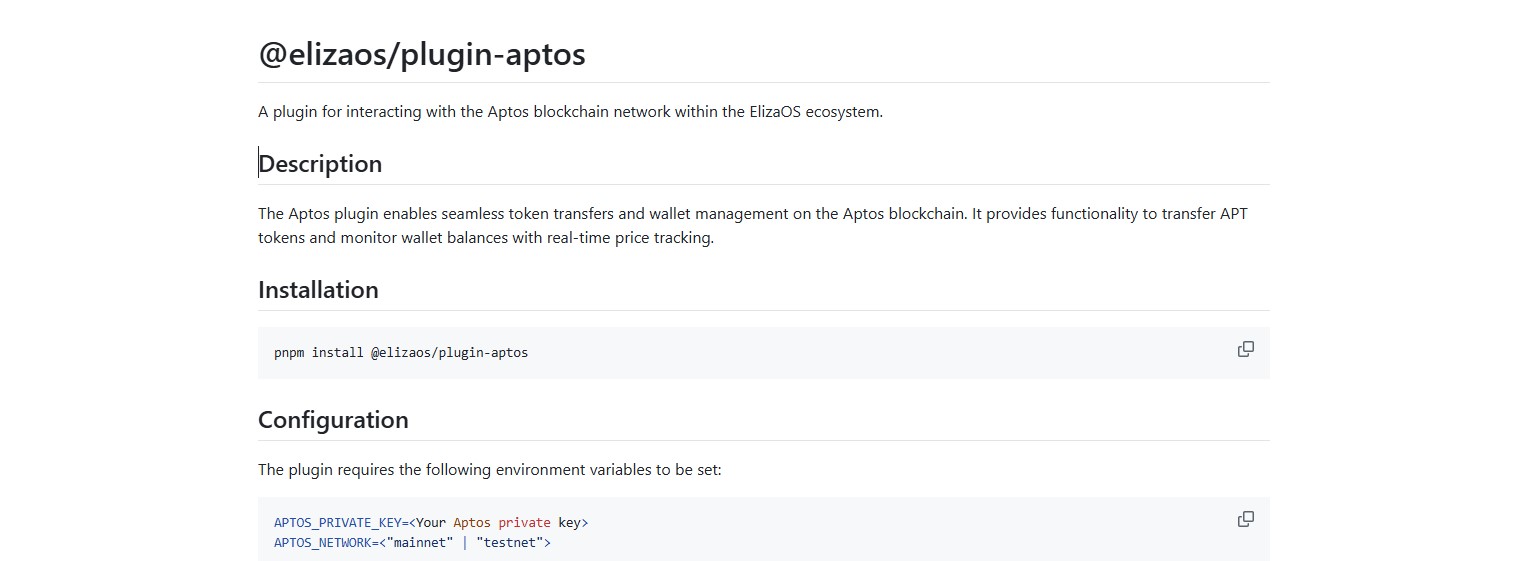

Currently, the AI Agent trend is predominantly centered around the Solana and Base chains, which boast the highest network performance among all blockchains. However, Aptos has also begun exploring the integration of AI Agents. For example, the GitHub repository for Eliza, an open-source framework by Ai16z, includes a plugin for interacting with the Aptos network. Specifically, the Aptos plugin enables real-time price tracking, APT token transfers, and wallet balance monitoring on the Aptos network.

Moreover, key applications like Chingari have included plans in their roadmaps to enhance functionality through AI Agents. Although still in its early stages, it’s evident that Aptos is focusing on AI Agent development. It remains to be seen how Aptos will leverage agents and expand its ecosystem within this powerful narrative.

Source: github