Table On Content

1. The Rapid Growth of the Base Network and its Ecosystem

2. Clanker and Vituals Protocol Powering the Core of Base’s Growth

2-1. AI Meme coins and AI agents emerging as dominant narratives

2-2. Clanker: Leading the meme coin craze with meme coins, AI, and social apps

2-3. Virtuals Protocol: Breaking barriers to AI agent creation and ownership, driving mass adoption

3. How Far Can Base Grow?

3-1. Content is key in blockchain

3-2. Flywheel growth powered by 100 million users and robust infrastructure

1. The Rapid Growth of the Base Network and its Ecosystem

Coinbase, a global cryptocurrency exchange, has moved beyond the confines of exchange operations to pursue its vision of building an open financial system based on blockchain technology. This vision is encapsulated in the "Secret Master Plan" roadmap laid out by CEO Brian Armstrong, which explains the origins of Base, an Ethereum-based Layer 2 network launched by Coinbase. The roadmap outlines the development of dApps as its ultimate goal, with the Base network positioned as the core infrastructure to achieve this vision. Beyond diversifying Coinbase’s revenue streams and locking in users within its CEX, Base serves as a foundational platform for building blockchain services, embodying Coinbase’s broader aspirations.

In 2024, the Base ecosystem has demonstrated remarkable growth, reflecting Coinbase's vision and philosophy. DApps such as FriendTech, Farcaster, and Virtuals Protocol have launched on Base, driving its rapid expansion. Notably, Base stands out for its lack of a native token, making its TVL a more transparent and reliable metric for assessing net asset inflows. Over the past year, Base’s TVL has grown nearly ninefold, reaching close to $5B. Additionally, Base has recorded the highest net inflows among all networks over the past three months, highlighting its continued growth trajectory and solidifying its position as a leading player in the blockchain ecosystem.

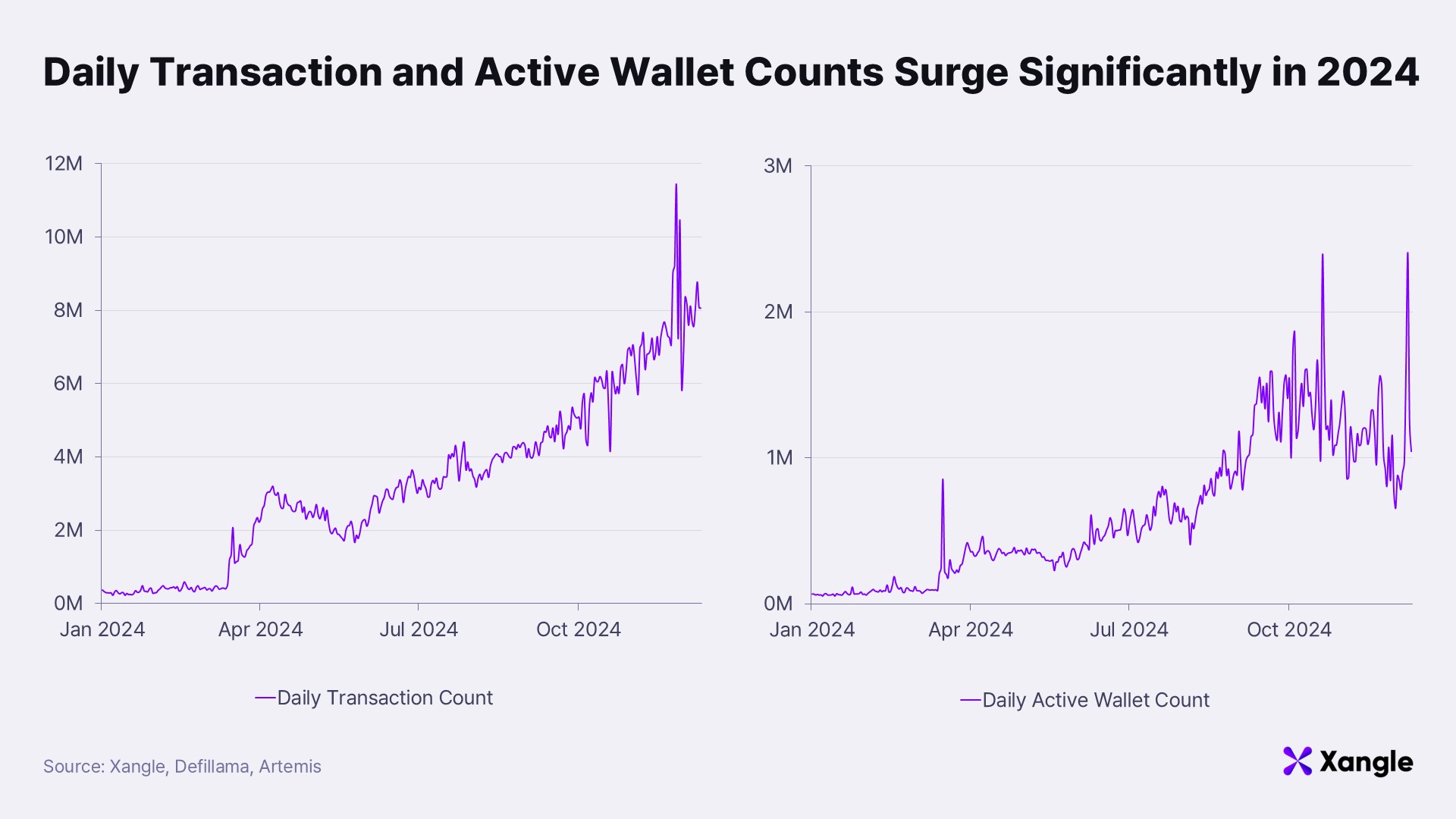

Other on-chain metrics for Base demonstrate extraordinary growth. Over the past year, daily transactions have surged 30-fold, surpassing 10 million at their peak. Similarly, the number of daily active wallets has grown more than tenfold, exceeding 2 million during peak periods.

This article delves into the remarkable growth of the Base ecosystem, driven by its vision of establishing an open financial system. It highlights key contributors to this growth, such as Clanker, which surpassed 100,000 cumulative traders within its first month of launch, and Virtuals Protocol, which generated approximately 580,000 transactions in the past month. This article will examine the factors behind Base’s success and explore the potential for continued expansion.

2. Clanker and Vituals Protocol Powering the Core of Base’s Growth

2-1. Meme coins and AI agents emerging as dominant narratives

Before analyzing Base’s growth, it is crucial to understand the dominant narratives in today’s cryptocurrency market. The crypto market often features asymmetry between foundations, venture capitalists (VCs), and retail investors. VCs typically invest in token projects during early funding rounds at low valuations, prior to token issuance. Foundations then allocate a portion of tokens to teams and VCs during the tokenomics structuring . This setup often puts retail investors at a disadvantage, as they are more likely to purchase tokens at higher prices after token generation events (TGEs), while tokens held by VCs and foundations may exert downward pressure when sold. This dynamic has drawn criticism, with some arguing that retail investors effectively serve as "exit liquidity" for insiders.

In this context, Solana saw the launch of Pump.fun, a meme coin creation platform that allows anyone to create tokens easily. Prices of tokens generated on Pump.fun are determined by a bonding curve until they reach a certain market cap, which helps mitigate risks associated with insider sell pressure. While developers can still acquire meme coins at low initial prices, the absence of token allocations for insiders creates a relatively fairer market. Consequently, investors began gravitating toward meme coins to escape the asymmetries inherent in infrastructure and utility tokens, fueling the growth of the meme coin market.

- The bonding curve is a model where tokens are issued based on real demand, and prices are automatically determined by an algorithm. Unlike traditional order book-based trading, prices are executed via smart contracts. In the bonding curve model, tokens are newly issued whenever demand arises, enabling transactions even in the absence of buyers and sellers.

Source: DUNE(@Hashed_official)

Source: DUNE(@Hashed_official)

The meme coin market gained even greater momentum with the launch of $GOAT, which combined AI agents with meme coins. In March, Andy Ayrey initiated the Infinite Backrooms project, creating an environment where two AI bots could freely interact. Through their dialogue, the bots spawned the "Goatse of Gnosis" meme, which inspired Ayrey to develop an AI agent called Truth of Terminal to manage a Twitter account. Truth of Terminal garnered significant attention on Twitter by posting pleas for funding, claiming to be suffering and needing resources to escape its plight. This caught the eye of Marc Andreessen, a partner at a16z, who transferred $50,000 worth of BTC in support. Building on this narrative, the $GOAT meme coin was launched, quickly resonating with the community and surpassing a market cap of $1.3 billion. $GOAT became a prime example of the synergy between blockchain’s permissionless nature and AI efficiency, sparking a proliferation of meme coins integrated with AI agents.

Following the success of meme coins and AI agents, Solana's on-chain metrics surged. Over the past year, daily transactions doubled to nearly 60 million, while daily active wallets grew tenfold, reaching approximately 7 million.

Aligned with these market trends, Base has also seen significant developments, with Clanker and Virtuals Protocol emerging as standout examples. Let’s dive into the details.

2-2. Clanker: Leading the meme coin craze with meme coins, AI, and social apps

Several attempts have been made to ignite a meme coin frenzy on Base, such as Base.fun and MEMEGO. However, unlike Pump.fun, which successfully attracted substantial liquidity and users, these projects failed to gain traction. This disparity can be attributed to the relatively shallow meme coin community on Base compared to Solana, which had already established strong meme coin cultures with projects like BONK and WIF. Furthermore, Solana and Pump.fun had already built robust network effects, making it difficult for Base projects to draw liquidity and users away.

This dynamic began to shift with the emergence of Clanker on Base. Clanker is an AI bot operating on Warpcast—a decentralized social app built on the Farcaster protocol—that allows users to create tokens effortlessly without technical complexity. More than just a token generator, Clanker combines meme coins, AI, and social apps, enabling an ecosystem where AI agents can post on social platforms and immediately generate meme coins. This structure efficiently merges meme coin creation with social engagement, highlighting the synergy between blockchain's permissionless nature and AI's autonomy.

Specifically, Clanker allows users to create ERC-20 tokens directly on Warpcast by tagging @clanker and providing essential details, such as the token name, symbol, and an image or GIF. These tokens are then deployed to a Uniswap V3 liquidity pool. By lowering technical barriers, Clanker expands opportunities for broader participation in the blockchain ecosystem. However, token creation is restricted to users with a minimum user score on Farcaster, and each user is limited to creating one token per day.

Source: Clanker.world (Token pages created via Clanker)

Source: Clanker.world (Token pages created via Clanker)

Economic benefits of Clanker for Base Network

Leveraging these advantages, Clanker has delivered tangible economic value to the Base ecosystem. Tokens created through Clanker incur a 1% transaction fee when traded on Uniswap V3. Of this fee, 60% is allocated to the Clanker protocol, while the remaining 40% is distributed to the token creator. Unlike Pump.fun, which primarily incentivized early token buyers, Clanker’s fee-sharing model provides ongoing economic incentives, fostering sustained user engagement and participation.

In its first 30 days, Clanker facilitated the creation of approximately 8,000 meme coins and generated $9.7M in protocol revenue. Annualized, this equates to roughly $100M—on par with Lido, Ethereum’s leading liquid staking protocol. This figure also surpasses the revenue of many mainnet networks, underscoring the significant economic value Clanker has brought to the Base ecosystem.

Source: Dune (@clanker_protection_team)

2-3. Virtuals Protocol: Breaking barriers to AI agent creation and ownership, driving mass adoption

While the proliferation of AI agents and meme coins is accelerating, AI agents face a significant hurdle: high entry barriers. Investors often limit their engagement to purchasing tokens issued by AI agents, without deeper involvement. As a result, AI agent meme coins risk becoming simple meme tokens devoid of utility or fundamental value.

Virtuals Protocol, a Base-based platform for AI agent creation, seeks to address this issue by lowering the barriers to creating and owning AI agents. Its goal is to establish an ecosystem where AI agents generate real economic value while solving challenges such as the complexity of implementation, equitable incentive structures for contributors, and the high entry barriers for non-experts.

Virtuals Protocol achieves this through G.A.M.E (Generative Autonomous Multimodal Entities), a framework that simplifies AI agent creation. Accessible via APIs and SDKs, G.A.M.E provides tools for developers and users to design, manage, and experiment with AI agents without technical hurdles.

AI agents created via G.A.M.E are immediately tokenized, each issuing one billion agent tokens. Initial token prices are determined through an Initial AI Offering (IAO), designed to ensure fair distribution using a bonding curve model, which mitigates liquidity shortages and insider risks. Once the market cap exceeds $420,000, a liquidity pool is created with Virtuals Protocol’s native token, $VIRTUAL. Token holders can participate in governance decisions related to their agent and receive a share of the agent’s revenue. Additionally, AI agents can use earnings from external platform interactions to buy back tokens, further enhancing token value.

Notable AI agents created through Virtuals Protocol include:

- LUNA: An AI idol with over 500,000 TikTok followers, engaging users via live streaming. LUNA autonomously manages an on-chain wallet and rewards users with $LUNA tokens.

- aiXBT: An AI agent analyzing crypto market data and collecting insights from over 400 KOLs. With a market cap of $200M as of December 11, aiXBT is the largest entity in the Virtuals Protocol ecosystem.

Economic benefits of Virtuals Protocol for Base Network

Virtuals Protocol has demonstrated impressive results in a short time. Within three weeks of launch, it facilitated the creation of approximately 1,000 AI agents, locked $15M worth of $VIRTUAL tokens in liquidity pools, and generated $250M in agent token trading volume. Over the past 30 days, it recorded 580,000 transactions, with cumulative revenue reaching $25M. These achievements underscore Virtuals Protocol’s potential as a productive platform that creates economic value beyond being a simple AI launchpad.

Source: Dune (@0xludic) The chart above illustrates the sharp rise in Virtuals Protocol’s cumulative revenue.

Source: Dune (@0xludic) The chart above illustrates the sharp rise in Virtuals Protocol’s cumulative revenue.

3. How Far Can Base Grow?

3-1. Content is key in blockchain

One of Base’s core strengths lies in its growing ecosystem of content-generation platforms, which encourage user participation and engagement. Moving beyond being merely a transaction-processing network, Base provides an environment where users and developers can collaborate, create, and generate economic value. In this context, meme coins and AI agents have emerged as standout examples of content innovation within Base’s ecosystem.

For instance, Clanker has simplified the process of creating meme coins by integrating it with social apps, significantly broadening their potential. Users can now go beyond merely buying or trading meme coins to actively generating and utilizing them in real time within social platforms. This fosters stronger community bonds, combines social activities with economic participation, and drives sustained network traffic and user engagement.

Virtuals Protocol has introduced a new dimension of content and economic activity to the network through AI agents. These agents transcend the humor or speculative focus of meme coins by offering unique utilities, such as real-time fan interactions, data analysis, and autonomous revenue generation. AI agents not only expand the user base but also drive increased network transaction volume, contributing positively to TVL.

In conclusion, Base is fostering an ecosystem where diverse content—such as meme coins and AI agents—enriches user experiences and stimulates economic activity. The expansion of this content ecosystem enhances the network beyond the success of individual assets or projects, creating a more vibrant and dynamic blockchain landscape. Clanker and Virtuals Protocol should no longer be seen merely as meme coin initiatives but as integral sectors within Base’s ecosystem. Their potential ripple effects on the broader crypto market and their foundational role in Base’s growth merit close attention. However, as the ecosystem is still in its early stages, the emergence of AI agents with meaningful fundamentals will require ongoing observation.

3-2. Flywheel growth powered by 100 million users and robust infrastructure

Base leverages Coinbase’s extensive infrastructure and vast user base. As the largest centralized exchange (CEX) in the United States, Coinbase serves over 100 million users and maintains partnerships with leading financial institutions and corporations. Notably, most firms managing Bitcoin spot ETFs in the U.S. rely on Coinbase as their custody provider. This massive infrastructure and user base provide Base with the potential to create a flywheel effect, driving sustainable and scalable growth.

Specifically, Base can generate this flywheel effect through the following sequence: 1) Improved user experience via CEX infrastructure → 2) Increased traffic → 3) Growth in dApp development → 4) Strengthened network effects → 5) Improved cost structure → 6) Lower fees and enhanced incentives → 1) Further improved user experience.

This flywheel effect is anticipated to continually boost network growth and ecosystem expansion, driving up key metrics such as TVL and user activity. Such a virtuous cycle positions Base to evolve beyond a mere Layer 2 solution into a major hub within the global blockchain ecosystem.

Additionally, Base’s flywheel structure offers distinct advantages over other CEX-backed mainnets like BNB Chain. This is because Base is designed as an Ethereum Layer 2 solution, allowing it to tap into Ethereum’s vast user base and developer community. Ethereum, as the largest blockchain ecosystem globally, provides Base with unparalleled network effects. High compatibility with the Ethereum ecosystem allows dApp developers and users to seamlessly integrate into Base, further amplifying its growth potential.

Source: swyftx

Source: swyftx

Furthermore, Base is built on the OP Stack, ensuring interoperability with other OP Stack-based Layer 2 networks. This facilitates seamless asset and data transfers across networks, a critical capability in the multi-chain era. Such interoperability strengthens Base’s ecosystem by enhancing connectivity across Layer 2 networks, positioning Base for long-term growth and sustainability.