Table of Content

1. Introduction

2. Magic Eden, Journey to the #1 NFT Marketplace

3. Magic Eden's Strategy for Ecosystem Expansion and Building Network Effects

3-1. Opportunities discovered in the Bitcoin ecosystem: The beginning of DEX expansion

3-2. Magic Eden Wallet: Maximizing UX and achieving user lock-In

4. $ME Tokenomics: The Key to Ecosystem Expansion

5. Bottom Line - The Amazon of Web3: All Assets, All Chains in One App

1. Introduction

Magic Eden stands as one of the leading consumer dApps in the crypto industry, having amassed over $6B in total trading volume and 3 million wallets in just three years. It currently ranks as the #1 NFT marketplace and the #1 Bitcoin DEX. Magic Eden envisions becoming an on-chain super app, where retail users can easily onramp into crypto and trade digital assets across all chains with a retail-friendly UX. To achieve this, Magic Eden is developing a cross-chain trading app available on both desktop and mobile. This app, which will enable token and NFT trading on all chains, aims to make crypto more accessible to everyone.

Magic Eden's official token, $ME, is set to represent one of the largest cross-chain communities. Users can stake the $ME token to trade digital assets on Magic Eden and earn $ME as rewards. Once staked, $ME holders will have the opportunity to participate in key governance proposals and impact the protocols that power Magic Eden.

2. Magic Eden, Journey to the #1 NFT Marketplace

Compared to other blockchain sectors, NFT marketplaces lack diverse or complex technical features. Most marketplaces provide similar functionalities, making it difficult to differentiate significantly in terms of transaction fees, user interface, or collection management. Consequently, there is no strong technical moat or user-driven network effect. Users easily move to platforms that offer benefits such as airdrops or reduced fees, and the market share of the platform changes rapidly accordingly. As a result, NFT marketplaces are fiercely competing for the leading position without a permanent winner.

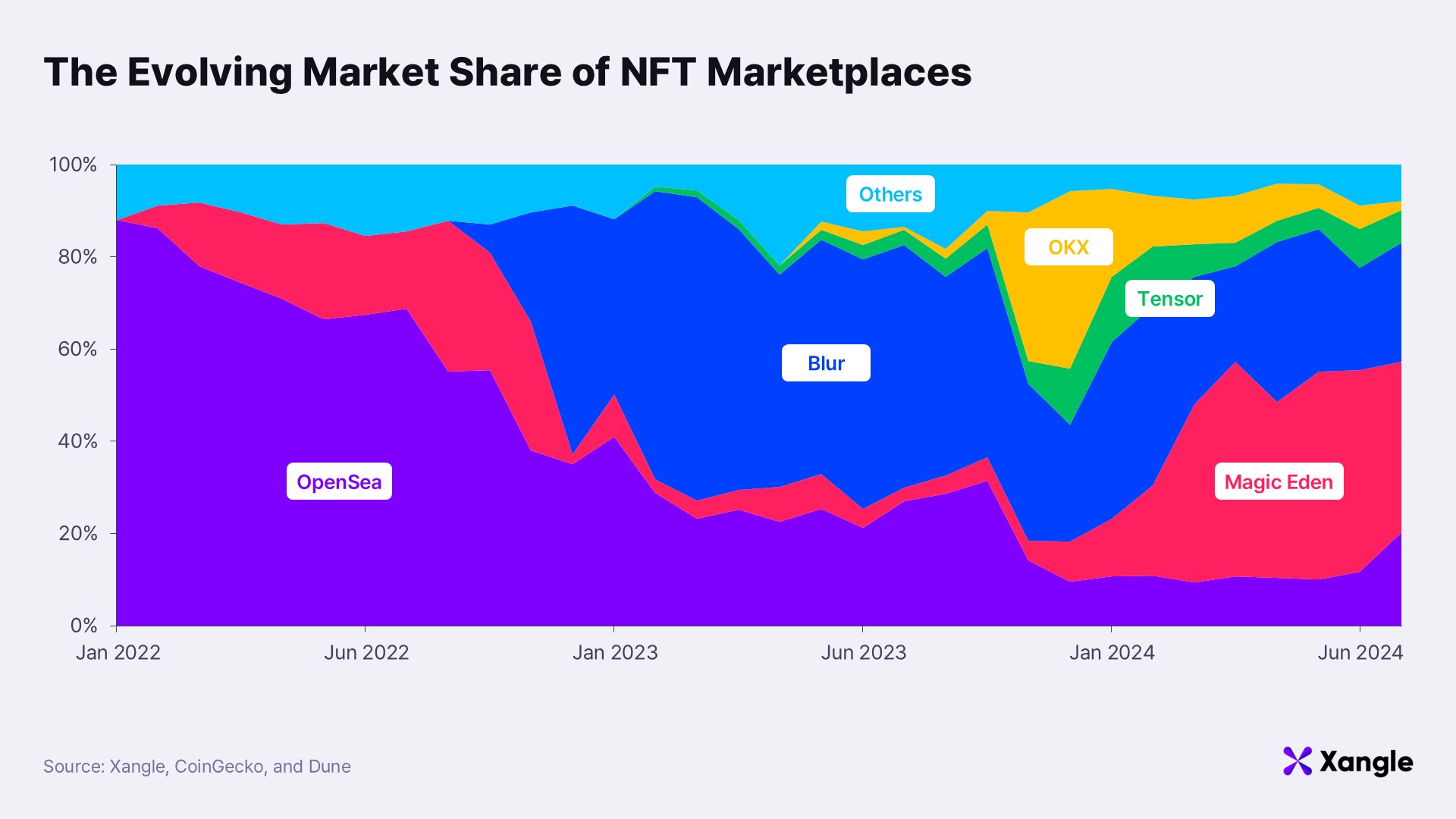

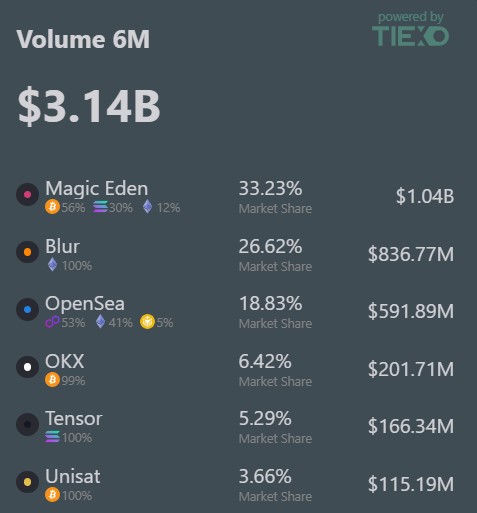

As the NFT marketplace chart below illustrates, these market dynamics are evident. For example, OpenSea’s market share was close to 90% in early 2021 but has steadily declined with the emergence of competing marketplaces. Blur’s share surged significantly after launching its point program and fee reduction policy, but it dropped following the program’s end. Similarly, Tensor’s market share expanded briefly with the point program but later declined.

Various marketplaces have attempted to expand their market share through short-term strategies. However, the inherent characteristics of the NFT market have limited their ability to establish sustainable network effects. Amid this competitive landscape, Magic Eden has emerged as the market leader and is attracting significant attention. Over the past year, it has captured 60% of all NFT revenue across chains and engaged 29% of all users. This article will explore the distictive strategies Magic Eden employs to sustain its position as the leading NFT marketplace.

Magic Eden is expanding its ecosystem with agile multi-chain support, leveraging its own wallet to ensure a seamless multi-chain experience for users. In addition to NFTs, its long-term goal is to become a comprehensive platform enabling the trading of various assets, including tokens and Ordinals (Bitcoin-equivalent NFTs). Will this strategy be effective for Magic Eden in building strong network effects? Can it successfully expand its ecosystem and secure sustainability? Let’s delve deeper into these questions in this article.

3. Magic Eden's Strategy for Ecosystem Expansion and Building Network Effects

3-1. Opportunities discovered in the Bitcoin ecosystem: The beginning of DEX expansion

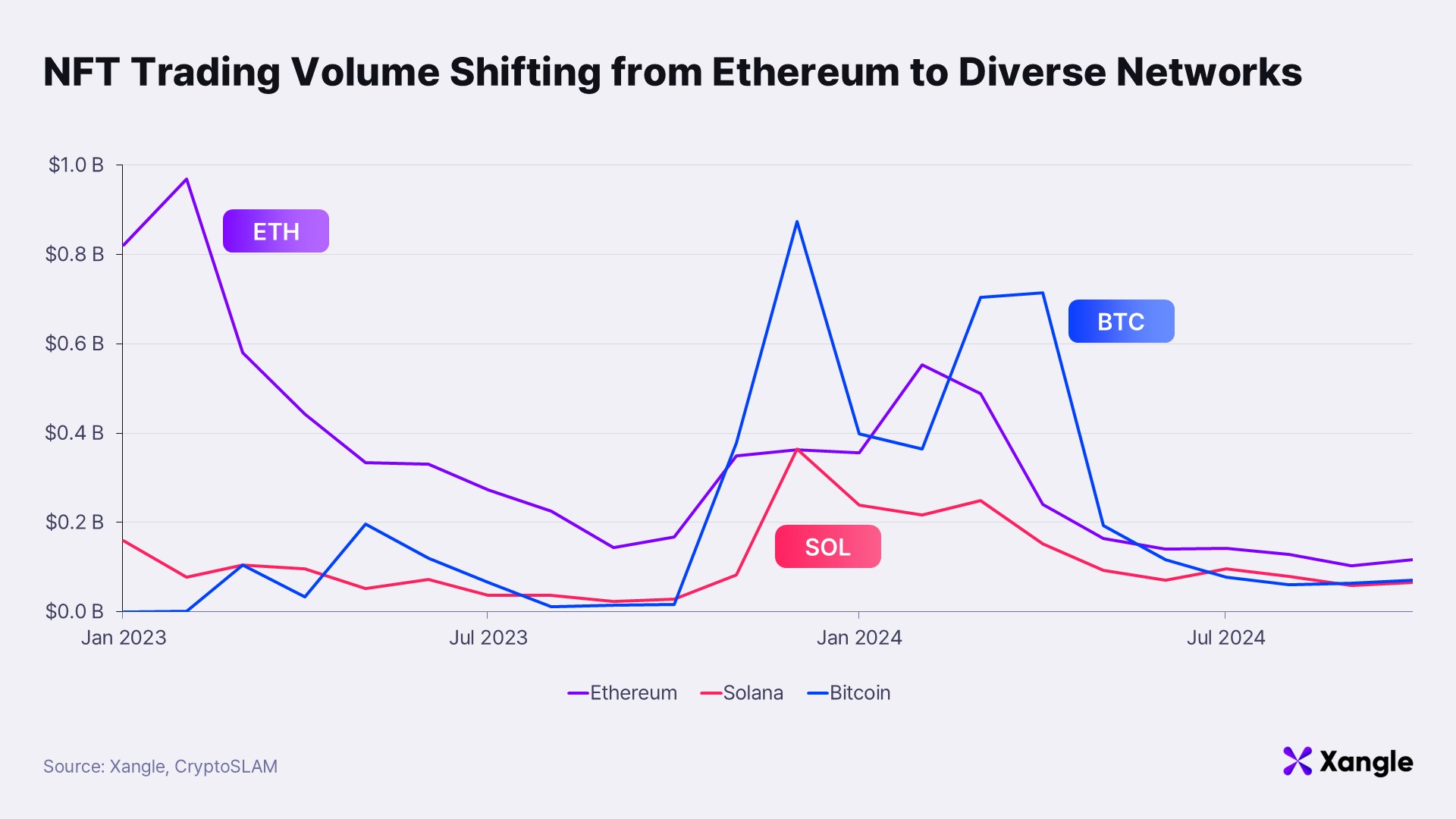

As blockchain networks continue to evolve technologically, NFT transaction volumes are no longer concentrated solely on Ethereum but are increasingly dispersed across various networks. Bitcoin and Solana are emerging as key NFT transaction networks, with platforms like Base and Berachain also drawing attention.

The surge in Bitcoin NFT trading volumes is particularly noteworthy. As illustrated in the chart above, Bitcoin’s NFT trading volumes experienced two significant spikes, surpassing Ethereum’s in late 2023 and early 2024. This growth is attributed to the newfound ability to issue and trade NFTs and tokens on the Bitcoin network. Historically regarded as "digital gold" and primarily a store of value, Bitcoin is now being explored for broader applications. Two notable examples are Ordinals and the BRC-20 standard. Ordinals enable the creation of assets similar to NFTs by assigning unique identifiers to individual satoshis—the smallest unit of the Bitcoin blockchain—allowing data such as images, text, and videos to be inscribed. Meanwhile, the BRC-20 standard leverages the Ordinals structure to enable the issuance of tokens on the Bitcoin network, opening up the possibility of issuing various tokenized assets on Bitcoin.

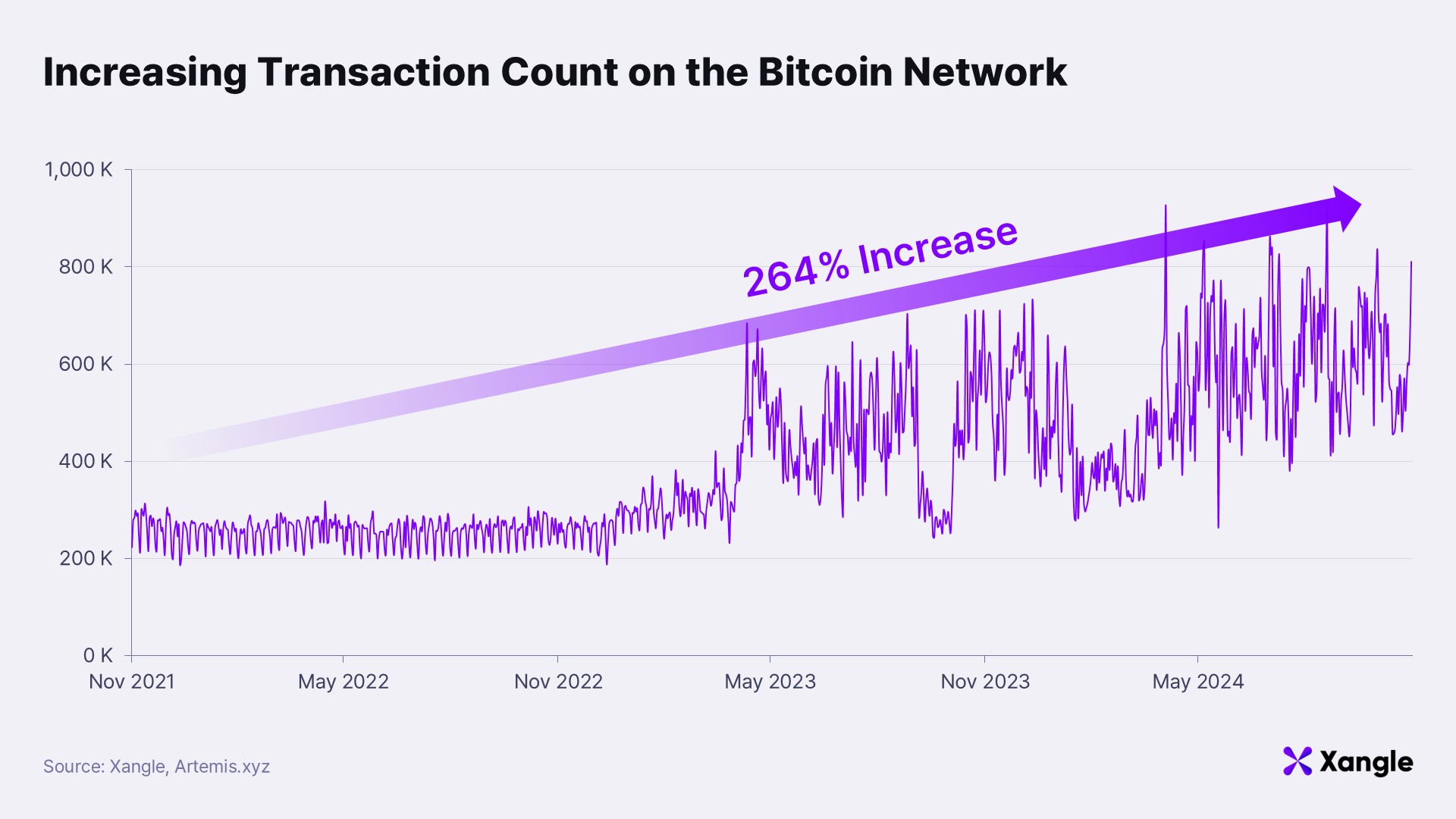

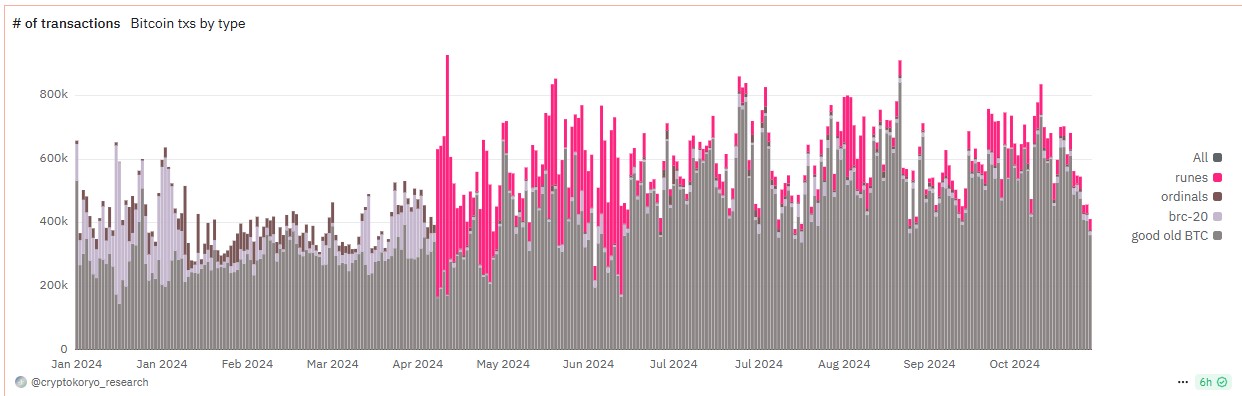

The expansion of the Bitcoin ecosystem gained further momentum in 2024 with the introduction of Runes, which has now established itself as a dominant Bitcoin token standard. Runes utilizes Bitcoin’s Unspent Transaction Output (UTXO) model to efficiently create and manage tokens, addressing inefficiencies in utilizing blockchain space and high fees—limitations of the earlier BRC-20 standard. Since its launch, Runes has driven a significant increase in Bitcoin transaction activity, recording the highest transaction count among Bitcoin token standards.

Source: Dune

Source: Dune

As shown above, the development of Bitcoin-based NFTs and tokens has transformed Bitcoin from a mere store of value into a platform supporting diverse digital assets. Amidst these changes, Magic Eden is actively embracing the Bitcoin ecosystem by enabling Bitcoin-based asset transactions. Through services supporting assets built on Ordinals and Runes, Magic Eden is attracting a new user base and expanding its offerings beyond existing NFT transactions to include tokens, thereby strengthening its position as a comprehensive digital asset marketplace. Over the past six months, Magic Eden has consistently ranked as the top NFT marketplace by trading volume, with Bitcoin accounting for 56% of its total trading volume during this period. In fact, Magic Eden has 70% of the Runes market share.

This highlights the significance of its efforts to expand its product offerings beyond the NFT marketplace, as the continued growth of the Bitcoin ecosystem is expected to further bolster Magic Eden's own ecosystem.

Source: TIEXO

Source: TIEXO

Magic Eden is also actively developing features to support Bitcoin token transactions. In the past, Runes transactions were conducted by individually purchasing listed Runes, which is similar to NFT transactions. This approach stemmed from the technical limitations of Bitcoin’s UTXO-based model and the absence of smart contracts, which made implementing efficient DEXs challenging. Runes assign metadata to individual UTXOs to manage tokenized assets, making it difficult to support an AMM-based DEX model.

However, on November 22, Magic Eden launched the Runes Swap function, significantly enhancing the UX for transactions. By abstracting the process, the feature allows users to seamlessly exchange Runes through a more intuitive and streamlined interface, moving away from the existing individual transaction methods. This agile expansion and development efforts provide the foundation for Magic Eden's ability to secure a leading position within the Bitcoin ecosystem.

With the rapid growth of Bitcoin-based NFT and token transactions, Magic Eden’s continuous innovation has the potential to set new standards across the blockchain ecosystem. It remains to be seen whether Magic Eden can overcome ongoing technical challenges and take the lead in the evolving Bitcoin ecosystem.

Source: Magic Eden (Runes Swap Interface)

Source: Magic Eden (Runes Swap Interface)

3-2. Magic Eden Wallet: Maximizing UX and achieving user lock-In

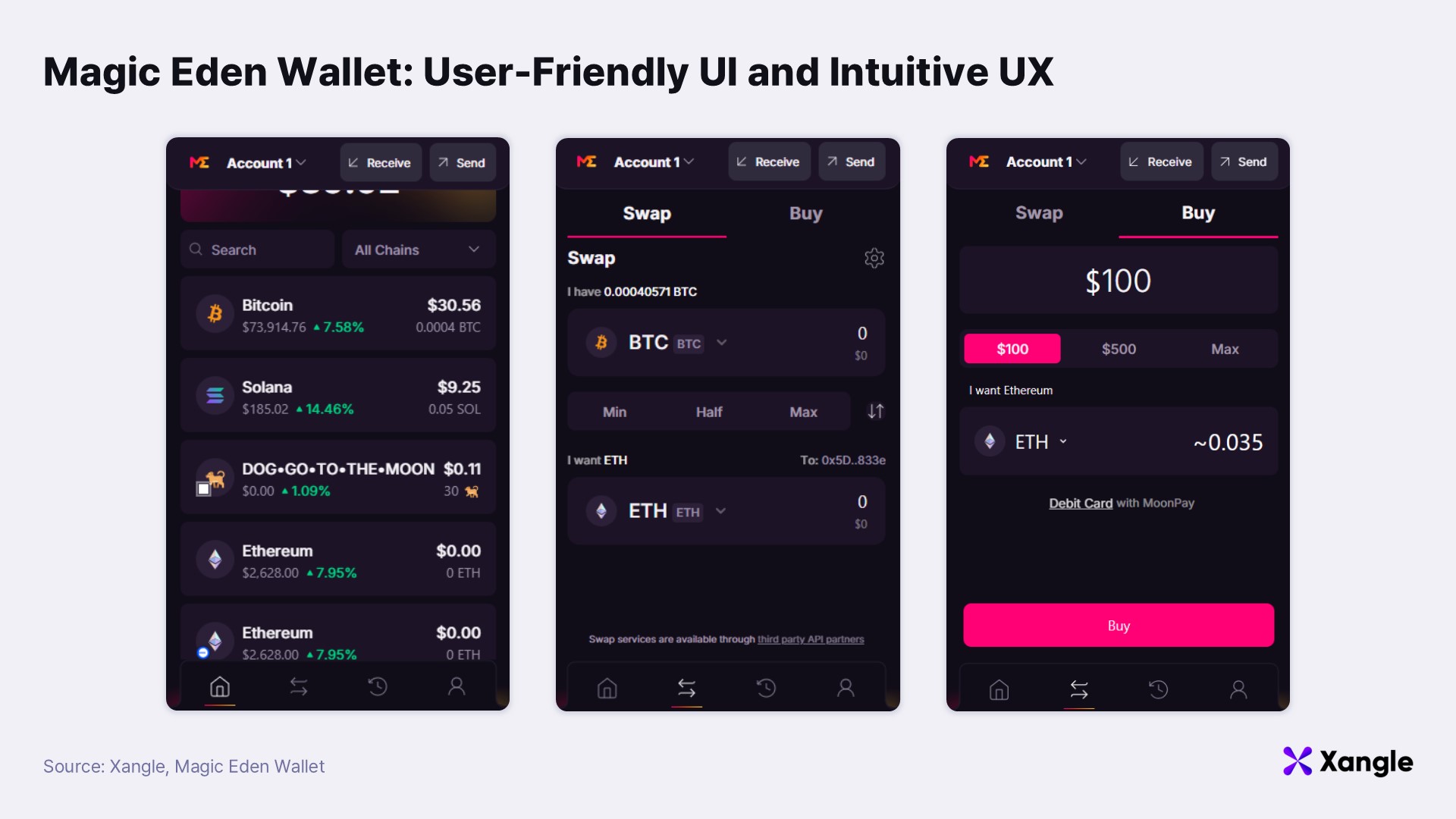

Magic Eden Wallet, the platform's proprietary multi-chain wallet, goes beyond being a mere asset management tool and serves as a core hub for Magic Eden to expand its NFT and token transactions. Currently, Magic Eden Wallet boasts an impressive 300,000 MAU.

Typically, multi-chain expansion increases the complexity of asset management, often hindering the UX. However, Magic Eden has successfully overcome this challenge through its wallet by providing seamless multi-chain management functionality. With Magic Eden Wallet, users enjoy the convenience of managing assets across multiple blockchains as though they were held in a single wallet, enabling seamless interoperability between assets.

In addition, Magic Eden Wallet supports cross-chain swaps and fiat-based cryptocurrency purchases, further enhancing the UX. Cross-chain swaps are implemented using APIs from cryptocurrency exchanges such as Jupiter, AeroSwap, Uniswap, Changelly and ChangeHero, allowing users to easily exchange BTC on the Bitcoin network for ETH on the Ethereum network without relying on a CEX. Meanwhile, the fiat-based cryptocurrency purchase function, powered by MoonPay’s API, eliminates the complex exchange transfer process, offering users an intuitive and efficient experience. These features position Magic Eden Wallet as a leader in providing an excellent UX in multi-chain environments while enhancing the scalability and competitiveness of the Magic Eden ecosystem. Furthermore, by enabling users to seamlessly purchase and swap Bitcoin, the wallet is expected to generate significant synergies with the expanding Bitcoin ecosystem.

Can Magic Eden Wallet be competitive?

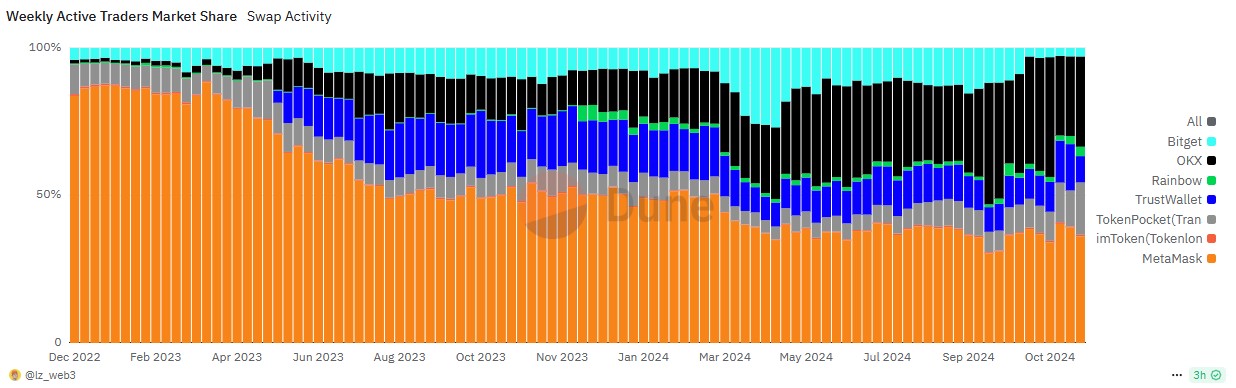

The success of wallet services can be attributed to two primary strategies. The first is early ecosystem preemption. If a user of Wallet A decides to switch to Wallet B, they must transfer all their tokens and NFTs, which imposes a significant cost barrier to switching. Wallet services that secure early dominance in their ecosystems can thus enjoy a strong user lock-in effect. For example, Phantom and MetaMask have leveraged this strategy effectively, rapidly gaining substantial market shares by establishing themselves as the dominant wallets in the Solana and Ethereum ecosystems, respectively.

The second strategy focuses on leveraging growth through proprietary platforms. Examples include wallet services launched by CEXs, such as OKX Wallet and Bitget Wallet. This strategy allows platforms to seamlessly channel their existing user traffic into wallet services. Users can integrate their exchange accounts with these wallets without signing up for new platforms or dealing with complex setups, enabling simple and fast asset transfers. Furthermore, since wallet services are supplementary to their primary business models, these platforms can adopt aggressive fee reduction policies. As a result, proprietary wallet services have been steadily increasing their market share.

Source: Dune

Source: Dune

While both strategies remain viable today, growth strategies based on proprietary platforms are anticipated to become more effective as the industry matures. As technological differentiation becomes harder to achieve and switching costs decrease, users will gravitate toward services that offer affordable, seamless experiences. Additionally, platforms with proprietary wallets can use them as a foundation to expand their ecosystems. For instance, CEXs that have launched proprietary wallets, such as OKX and Binance, are simultaneously expanding their ecosystems by introducing their own blockchain networks. A similar trend is evident in the gaming industry. MapleStory Universe, for example, which boasts a loyal user base anchored by strong intellectual property, is expected to launch a proprietary wallet as part of its efforts to lay the groundwork for ecosystem expansion.

As shown in the chart above, MetaMask initially captured significant market share by securing an early foothold in the ecosystem. However, as wallets backed by major platforms, such as OKX and Binance, entered the market, MetaMask has gradually seen its market share eroded.

From this perspective, the future of Magic Eden Wallet and the broader Magic Eden platform looks promising. Magic Eden Wallet can seamlessly attract existing users from its NFT marketplace, leveraging the platform’s traffic to onboard users naturally. By doing so, Magic Eden can lock in users and further expand its ecosystem. Magic Eden Wallet is expected to go beyond being a tool for improving UX evolving into a strategic hub for ecosystem expansion.

4. $ME Tokenomics: The Key to Ecosystem Expansion

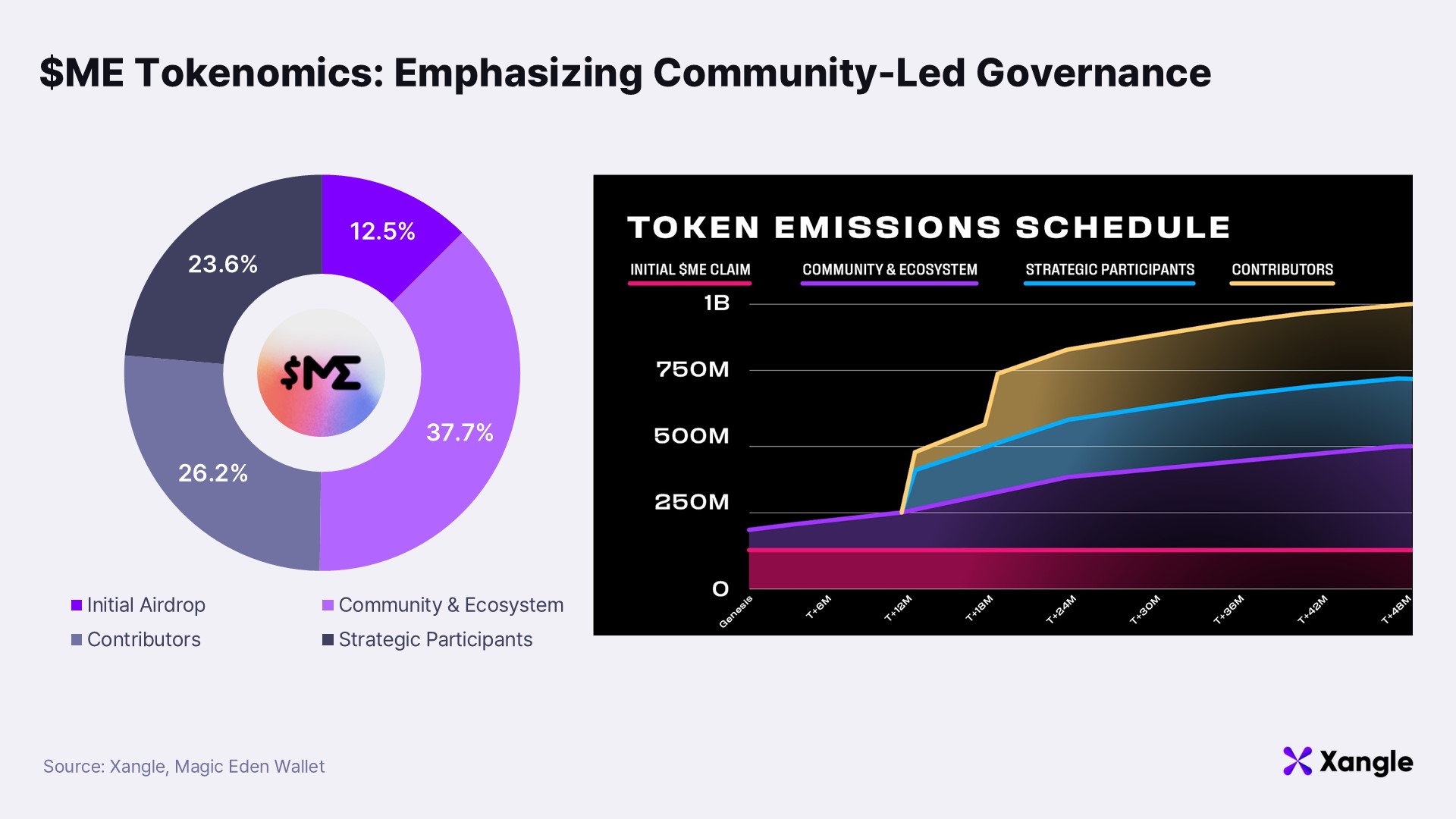

On November 19, the ME Foundation unveiled $ME Tokenomics, designed with a community-first approach to support long-term ecosystem growth. Of the total issuance of 1 billion tokens, 37.7% is allocated to the community and ecosystem, with 12.5% set aside for an airdrop to attract early users. Allocating nearly half of the tokens to the community underscores Magic Eden’s clear commitment to building a community-driven ecosystem. The remaining 26.2% is allocated to ecosystem contributors, and 23.6% to strategic participants, with token distribution scheduled to occur over four years.

Within the Magic Eden ecosystem, $ME will be distributed as an incentive to users who trade NFTs and tokens. Additionally, $ME holders will have the opportunity to stake their tokens and earn additional rewards, starting on the day of the Token Generation Event (TGE). Specific details regarding staking and incentive programs are expected to be disclosed after the TGE. This tokenomics structure is designed to promote user retention on the platform while encouraging active participation in governance.

Nevertheless, the tokenomics framework presents challenges regarding long-term sustainability. While the high allocation to the ecosystem may effectively attract early users, a slowdown in user acquisition and activity is possible as token rewards decrease over time. As the performance of leading DEXs such as dydx and Uniswap have also seen a gradual decline in performance as incentives have been reduced, Magic Eden needs to take additional measures to ensure that the ecosystem continues to grow after the token unlock. To address this, Magic Eden will need to focus on building a network effect centered on the Magic Eden Wallet and platform while exploring strategies to retain users beyond the vesting period.

In conclusion, while specific measures are needed to ensure sustainability, Magic Eden holds a strategic advantage through its proprietary platform and wallet. $ME is expected to become a cornerstone of the Magic Eden ecosystem, bolstering the platform’s competitiveness and driving the growth of its on-chain economy.

5. Bottom Line - The Amazon of Web3: All Assets, All Chains in One App

Magic Eden aims to transcend its role as a mere NFT marketplace by evolving into a comprehensive cross-chain platform encompassing all assets and chains. This strategy can be likened to Amazon’s “everything store” approach in retail. By supporting a wide range of tokens and NFTs, as well as long-tail assets, Magic Eden is expanding its user base beyond any single ecosystem or asset class. This strategy is already evident in Magic Eden’s quick adaptation to the rapid growth of the Bitcoin ecosystem, where it now supports Bitcoin-based NFT and token transactions. This move has not only secured a new user base but also enhanced service offerings for existing users. Furthermore, as Magic Eden continues its close collaborations with emerging chains like Monad and Berachain, the introduction of new chains is expected to fuel its growth further.

Magic Eden’s plan to support over 15 blockchain networks serves as a significant differentiator, offering users unparalleled value. Within this framework, Magic Eden Wallet and $ME play pivotal roles in realizing the platform’s strategic objectives. Magic Eden Wallet enhances the user experience by providing seamless multi-chain functionality and features like cross-chain swaps and fiat-based cryptocurrency purchases. Meanwhile, $ME serves as a key tool for driving user acquisition and ecosystem growth, offering robust incentives to support the development of a community-centric ecosystem. Together, $ME and Magic Eden Wallet are expected to secure users while fostering engagement and retention through seamless functionality.

However, Magic Eden still faces significant challenges. While the platform has enhanced the UX through its Runes swap function, fundamental technical limitations remain unresolved. Specifically, Bitcoin’s UTXO model and the lack of smart contract support pose substantial obstacles to implementing Runes as a fully DEX. Overcoming these technical barriers is crucial for creating a truly decentralized trading environment. Furthermore, competing protocols like Bitflow and Arch Network are making strides toward developing their own Bitcoin-based DEXs. This intensifies the need for Magic Eden to establish clear differentiation through technical innovation in the coming months. As previously mentioned, another pressing task for Magic Eden is to devise concrete strategies to sustain ecosystem growth following the unlock of the $ME token.

The anticipation is that Magic Eden, with its innovative DNA, will secure a leading position in the Bitcoin DEX market and evolve into a single app for all assets and chains.