1. Introduction: Differentiation as the Key to Survival in the Competitive L2 Space

2. Building the Safest L2 for DeFi

2-1. Achieving security at the sequencer level via SLS

2-2. ZK proofs designed for continuous upgrades via Modular Provers Design

3. Zircuit’s Efforts to Build a DeFi Ecosystem

4. Final Remarks: Post-TGE Strategies Essential for Ecosystem Growth

1. Introduction: Differentiation as the Key to Survival in the Competitive L2 Space

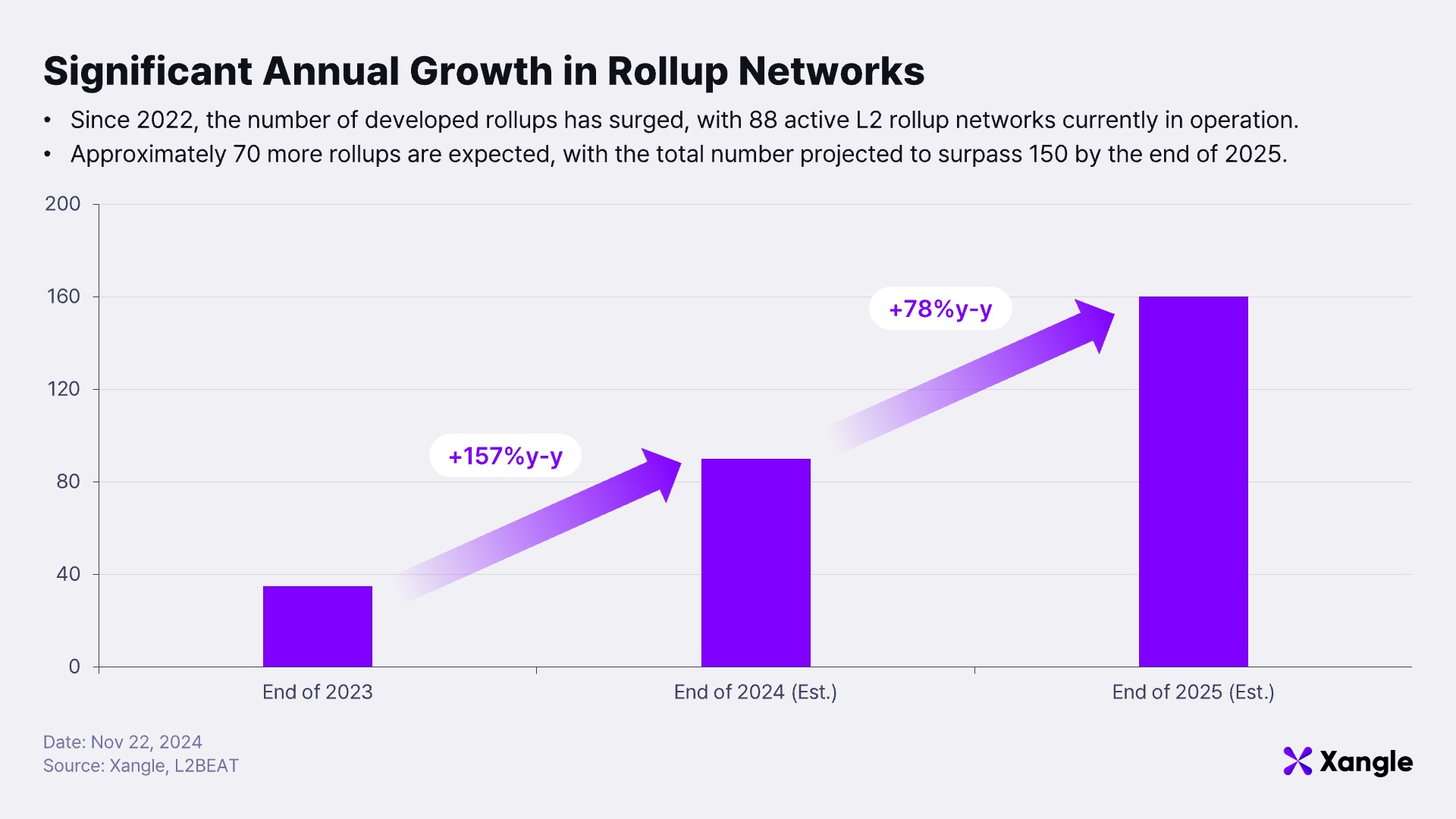

Layer 2 (L2) rollup technology emerged to address Ethereum’s scalability challenges. Due to advancements in infrastructure and a decrease in setup costs, entry barriers for L2 rollups have significantly lowered. Consequently, 2024 has seen a surge in L2 rollup projects, intensifying market competition. According to data from the rollup tracking platform L2BEAT, dozens of new rollups have launched this year, bringing the total to over 80 projects. This trend is likely to continue, with around 80 additional projects—including major players like the centralized exchange Kraken and Uniswap, Ethereum’s largest decentralized exchange—expected to launch their own rollups, heralding a signaling the beginning of an L2 war among projects.

In this intensified L2 space, projects need not only technical differentiation but also strategies to build ecosystems that attract both users and developers. Zircuit is one such project, making various efforts to stand out amid the crowded rollup space. By using AI technology to bolster sequencer security, adopting a hybrid rollup model that combines OP Stack with ZK proofs, and launching staking programs to attract users, Zircuit has secured grants from the Ethereum Foundation and Zcash (a pioneer in ZK roll-ups), as well as investments from notable VCs. Let’s examine how Zircuit is carving out a differentiated L2 solution.

2. Building the Safest L2 for DeFi

Since Ethereum’s launch, blockchain networks and DeFi services have emerged rapidly, offering users new financial possibilities but also exposing them to various on-chain threats. Today, approximately $92 billion in assets are actively traded on-chain, yet these assets remain vulnerable to risks like smart contract vulnerabilities and bridge exploits. The rise of liquid staking and re-staking services, especially following Ethereum’s transition to Proof-of-Stake (PoS), has funneled substantial assets into liquidity staking tokens (LSTs) and restaking tokens (LRTs), which are also susceptible to hacking threats. According to DeFiLlama, the total value of assets lost to DeFi and bridge service hacks has reached around $9 billion. Zircuit is dedicated to building the most secure Layer 2 network to protect both user and protocol assets from these malicious on-chain attacks.

2-1. Achieving security at the sequencer level via SLS

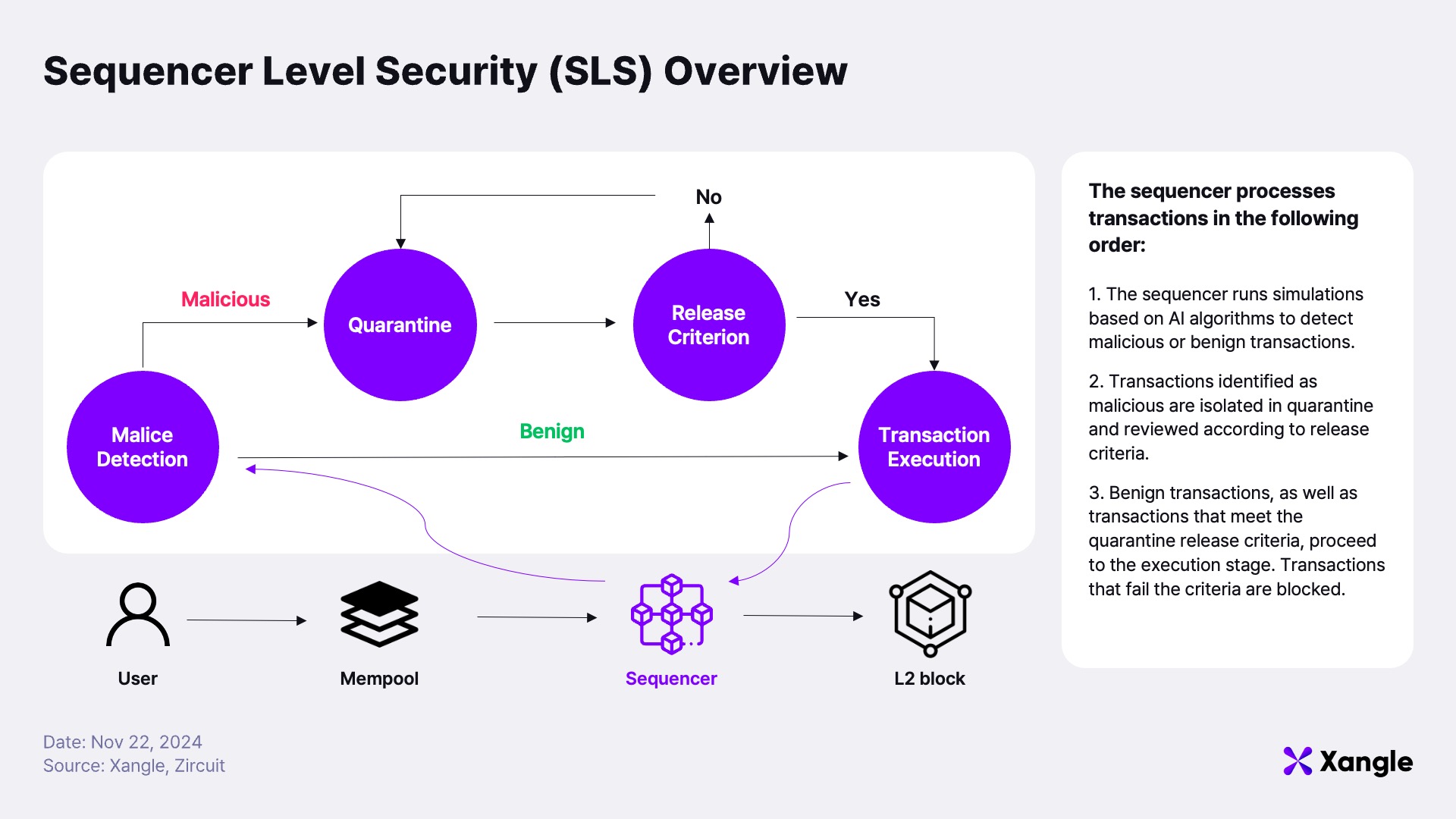

To protect user assets, Zircuit is strengthening security at the network level, going beyond the protections typically provided at the smart contract or dApp level. As part of this effort, it introduces Sequencer Level Security (SLS), a new security layer that leverages AI at the sequencer level. SLS enables the sequencer to examine the mempool for signs of malicious intent before transactions are included in an L2 block. If any suspicious transactions are identified, they are detected early and quarantined, ensuring that they do not execute immediately.

(1) Malice Detection

The sequencer selects a list of transactions for potential inclusion in the upcoming block from the mempool. Parallel simulations are then conducted to predict how each transaction would execute if included in the latest state of the blockchain. Using an algorithm that combines AI-driven program analysis and machine learning, the system identifies transactions as benign or malicious. The AI system is trained on billions of transactions from other EVM-compatible chains over the past two years, allowing it to accurately detect malicious intent even when transactions do not originate from Zircuit.

(2) Quarantine-Release Criterion

Transactions flagged as potentially malicious are processed according to quarantine-release criterion. Suspicious transactions are initially not included and held in the mempool until specific conditions are met. Later, these transactions are reviewed against release criteria; those meeting the criteria are released for execution, while others are removed from the mempool.

(3) Transaction Execution

Transactions identified as benign, or those meeting the quarantine-release criterion, proceed to the execution phase. At this stage, the sequencer processes these transactions for inclusion in a block.

Through this process, Zircuit monitors all transactions on its network, preventing malicious transactions from entering blocks. In the SLS analysis process, transaction handling takes just tens to hundreds of milliseconds, imposing minimal overhead on the sequencer and resulting in negligible impact on end-user experience. This approach allows Zircuit to create a chain that is safe for both users and developers at minimal cost.

2-2. ZK proofs designed for continuous upgrades via Modular Provers Design

As a ZK (zero-knowledge proof) rollup, Zircuit adopts a hybrid architecture that combines zkEVM compatibility with the widely used and proven OP Stack, achieving high Ethereum compatibility. The transaction structure on L2 resembles that of standard rollups; however, Zircuit leverages Halo2 Proof technology to parallelize proof generation, producing multiple proofs simultaneously and compressing them into a single proof. This approach enables Zircuit to optimize both speed and cost efficiency.

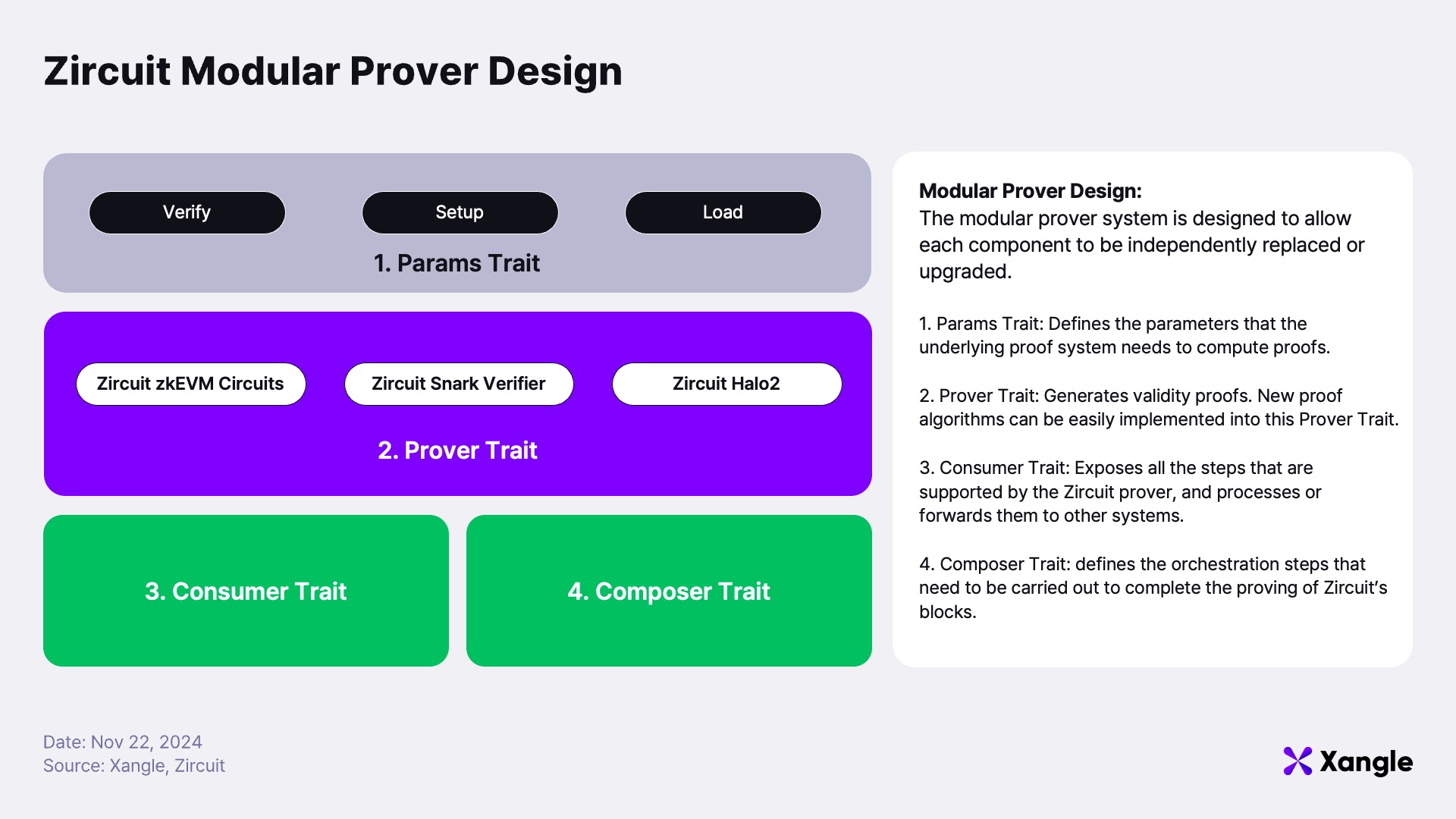

However, this approach is a temporary workaround, as a fully efficient and rapid zk rollup remains challenging to achieve with current technology. Zircuit differentiates itself from other rollups by introducing a Modular Prover Design, allowing swift adoption of more cost-effective and performant proof technologies as they become available.

The Modular Prover Design enables Zircuit to replace proof systems, circuits, and other components with ease, without requiring major redesigns in the future. This design categorizes proof parameters (Params), provers, consumers, and composers as distinct traits, allowing each module to function consistently within its specific trait. With this approach, Zircuit can upgrade or replace individual components of the proof system without impacting the rest. For instance, if the community develops a faster and cheaper zkEVM circuit, Zircuit can integrate it into the system with minimal cost and effort under the Modular Prover Design.

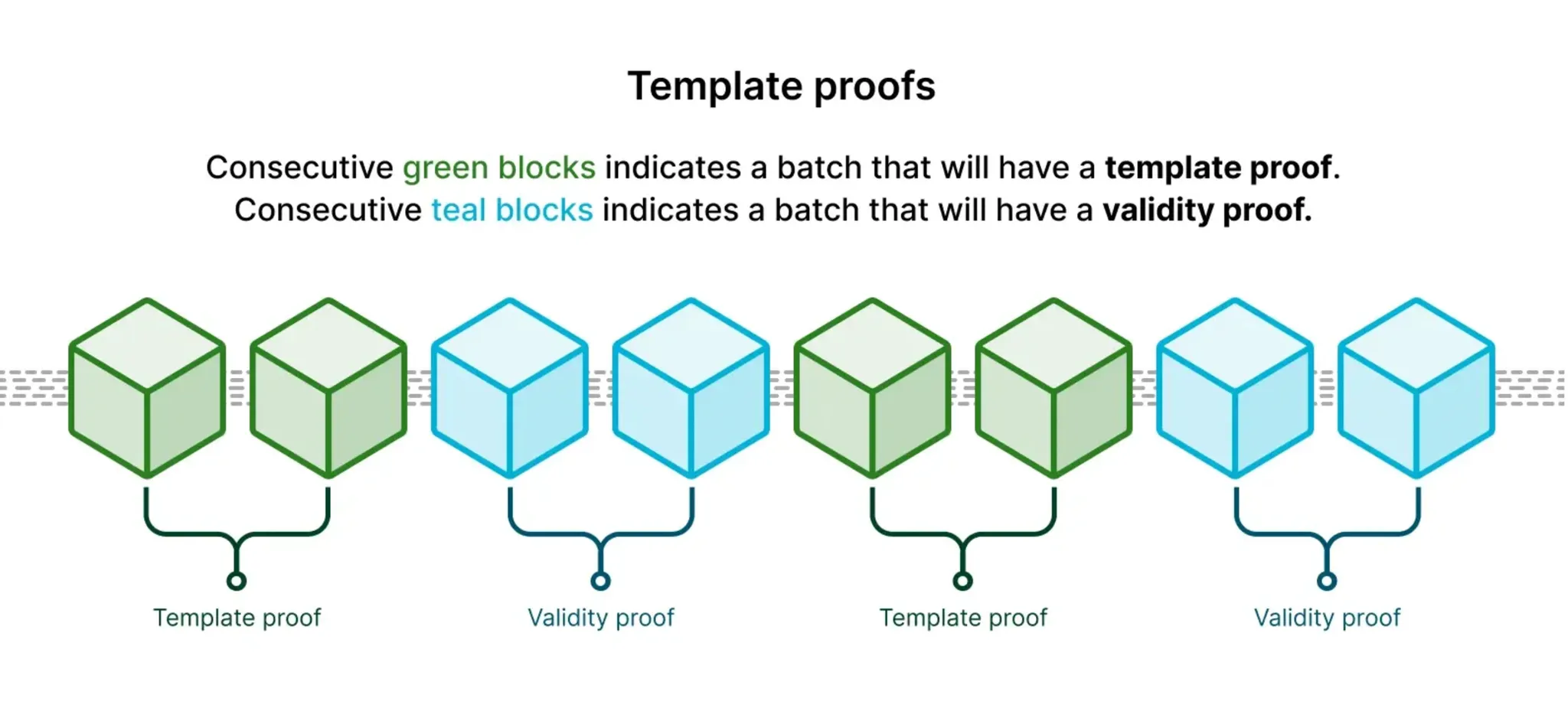

As noted, Zircuit pursues efficiency by parallelizing proof generation with the Halo2 method. Yet, proof generation remains resource- and time-intensive. Given L2’s block generation speed and proof creation rate, rapid proof processing requires multiple machines, which increases costs. To manage these costs effectively, Zircuit uses Template Proof, compressing consecutive blocks into batches when there are no available provers for validity proofs.

Source: Zircuit Docs

During times when all available provers are actively generating validity proofs, consecutive blocks are grouped into batches and processed as Template Proofs. This approach allows Zircuit to continuously reflect L2’s state on L1, even when not every block can be assigned a validity proof in real-time. Like validity proofs, Template Proofs undergo verification by Zircuit’s verifier deployed on L1. Since July of this year, a validity proof has been generated approximately every 20 minutes, during which time around 200 blocks are processed together in the form of Template Proofs.

This batching of blocks is a temporary solution, necessitated by current technical limitations, with the goal of achieving full validity proof generation for each block by early 2025. Zircuit is actively working to improve its proof system in pursuit of a fully-fledged zk rollup, starting with the Zircuit 1.5 upgrade. This upgrade enhances the transaction batching mechanism, enabling more transactions to be processed in parallel and allowing for validity proofs to be generated for every block.

3. Zircuit’s Efforts to Build a DeFi Ecosystem

Initial funding secured through airdrop, though further efforts to attract dApps are essential for building a DeFi ecosystem

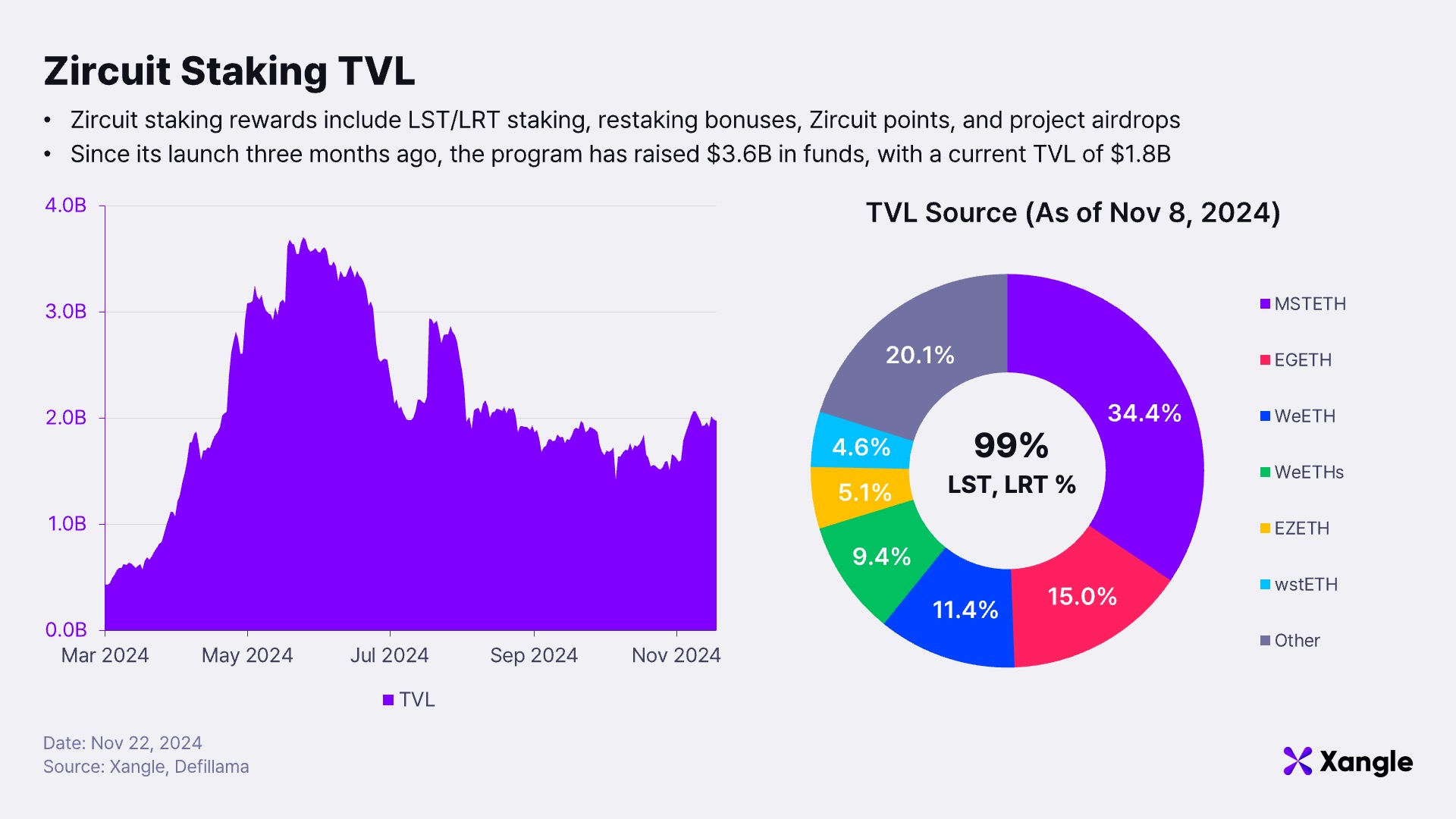

Ahead of its mainnet launch, Zircuit joined the 2024 restaking wave—one of the biggest trends in blockchain this year—by introducing a staking program to secure initial liquidity and users. By staking LRT in Zircuit’s program, users receive staking rewards, restaking rewards, and additional Zircuit points along with their LRT points, effectively drawing significant restaking funds. Since the staking program’s release, $3.6 billion in LST and LRT assets have been accumulated in about three months, with approximately $2.1 billion still staked as of November 22.

In August, following the launch of Mainnet Phase 1, Zircuit introduced the Liquidity Hub, an all-in-one airdrop and staking asset hub for its mainnet. The Liquidity Hub incentivizes users to migrate assets staked on Ethereum’s mainnet to Zircuit’s mainnet. By staking in the Liquidity Hub, users not only receive standard staking rewards but also airdrops from key dApps within the ecosystem. Through this setup, Zircuit aims to increase assets staked on its network and provide liquidity to dApps in the ecosystem, fostering a win-win structure that locks in liquidity on the Zircuit network. Furthermore, Zircuit plans to support the integration of staking assets like LST, LRT, and staked BTC through ongoing partnerships, establishing itself as a secure and efficient liquidity hub within the Ethereum ecosystem.

However, the Liquidity Hub strategy alone is not enough to secure Zircuit’s position in the intensely competitive L2 market, akin to a "warring states" period. As Zircuit envisions a secure network for DeFi services, expanding its foundational DeFi ecosystem will require the presence of utility and dApps that attract users beyond staking platforms. Currently, Base, the L2 market leader, drew users and capital by capitalizing on the meme coin trend earlier this year and leveraging its native DEX, Aerodrome. Unlike other L2s that struggled to retain users and TVL post-launch, Base continues to experience steady growth in both user engagement and TVL, showcasing the highest TVL among L2 projects by leveraging these utilities and core dApps.

At present, Circuit, Elara, Ocelex, and three other dApps are part of the ecosystem offering airdrop rewards through the Liquidity Hub. However, only $185 million out of the total $2.1 billion in assets staked in Zircuit staking have been migrated from Ethereum to Zircuit’s network, indicating that the Zircuit ecosystem still lacks the compelling dApps needed to drive user adoption. Securing "killer dApps" to attract users will be crucial for Zircuit’s journey toward building a complete DeFi ecosystem and establishing itself as a liquidity hub for staking.

$ZRC Tokenomics

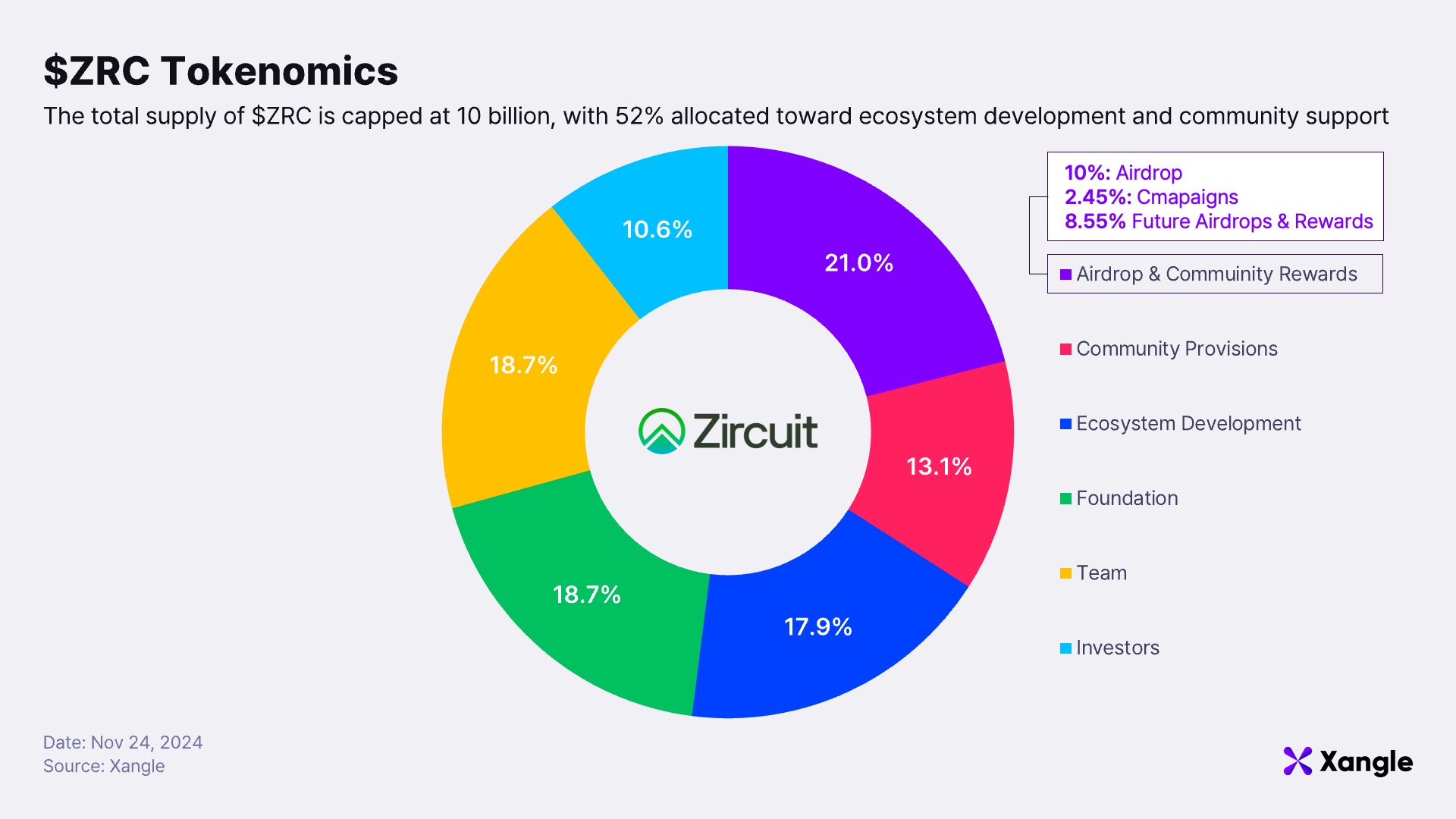

Zircuit has announced the upcoming launch of its $ZRC token on November 25, alongside the detailed unveiling of its tokenomics. With $ZRC, Zircuit aims to incentivize both developers and users, fostering participation and driving sustained innovation within the ecosystem. The total supply of $ZRC is set at 10 billion tokens. Of this, 17.9% is allocated to ecosystem development, while 34.1% is designated for airdrops and community support initiatives. Notably, more than half of the total token supply has been strategically allocated to facilitate network expansion, supporting continuous upgrades to zero-knowledge proofs and ecosystem growth.

4. Final Remarks: Post-TGE Strategies Essential for Ecosystem Growth

In 2024, a year of numerous L2 launches, Zircuit aims to position itself as the safest DeFi-focused L2 network through its TGE. Before the mainnet launch, Zircuit raised $2.1 billion in staked assets by actively marketing airdrops and joining the restaking trend. These assets will be locked into the chain, forming a liquidity hub where diverse staking assets can be utilized safely and efficiently. To this end, Zircuit strengthens network security at the sequencer level via Secure Layer Sequencing (SLS), continually upgrades its zero-knowledge proofs through a modular prover design, and aims to foster trust and a sustainable ecosystem for DeFi users and developers alike.

Numerous L2s, including ZKsync, Blast, Taiko, Scroll, and Kroma, launched networks and conducted TGEs this year but have found it challenging to sustain initial hype without defined use cases. L2s that fail to capture use cases may fade from relevance, joining the ranks of numerous forgotten networks. If Zircuit is to establish itself in the crowded and intensely competitive L2 DeFi space, it will need more than a liquidity hub focused on staking. Active partnerships to secure more staking assets and the acquisition of killer dApps that attract users will be vital. As the competition among L2s intensifies, Zircuit’s strategy for DeFi ecosystem development will be one to watch closely.