Table of Contents

1. Introduction of the Act on the Protection of Virtual Asset Users

2. Relevant Regulations for Virtual Asset Projects

2-1. The Act of the Protection of Virtual Assets Users

2-2. Best Practices for Supporting Virtual Asset Transactions

3. Projects Response to the Introduction of Regulations

3-1. Periodic information disclosure via the information disclosure platform is required

3-2. Establishing a continuous support and verification system for on-chain data, including circulating supply

4. Closing Summary

1. Introduction of the Act on the Protection of Virtual Asset Users

On July 19, 2024, the Act on the Protection of Virtual Asset Users (the “Act”) was enacted, ending a long regulatory gap. This Act aims to protect users' assets and regulate unfair transactions. It primarily addresses the responsibilities of virtual asset service providers (mainly exchanges) as key market entry points. Additionally, projects that operate tokens in South Korea are subject to certain regulations under this Act, even if not classified as virtual asset service providers. They may be considered issuers or operators and must comply with specific rules. Thus, understanding these regulations and their potential impact is crucial for appropriate action. Xangle will examine the sections of the Act and DAXA's self-regulatory guidelines that might affect projects, identifying necessary measures for seamless operations.

2. Relevant Regulations for Virtual Asset Projects

For projects that issue tokens and operate services, the critical areas within the Virtual Asset User Protection Act include the regulation of unfair trading practices and DAXA's “Best Practices for Supporting Virtual Asset Transactions.” Xangle identifies the disclosure of significant information as a crucial area for projects to address.

2-1. The Act of the Protection of Virtual Asset Users

Projects must focus on the regulation of unfair trading practices. Article 10 prohibits such practices and broadly defines insiders with access to undisclosed important information, restricting their insider trading and collusion.

2-2. Best Practices for Supporting Virtual Asset Transactions

To ensure smooth operations in the South Korean market, it is essential for projects to have their issued virtual assets listed on local exchanges, making them accessible to users. Therefore, DAXA's “Best Practices for Supporting Virtual Asset Transactions,” as revealed in their press release, are crucial guidelines for projects to pay attention to. These best practices, implemented concurrently with the Act, include details on listing and delisting processes, review procedures, and information disclosure. While most of these best practices set standards for exchanges to follow, the “Listing Review Requirements” establish minimum criteria that all South Korean exchanges must adhere to. Consequently, all projects with tokens listed on South Korean exchanges need to pay close attention to these key aspects.

Listing Review Requirements

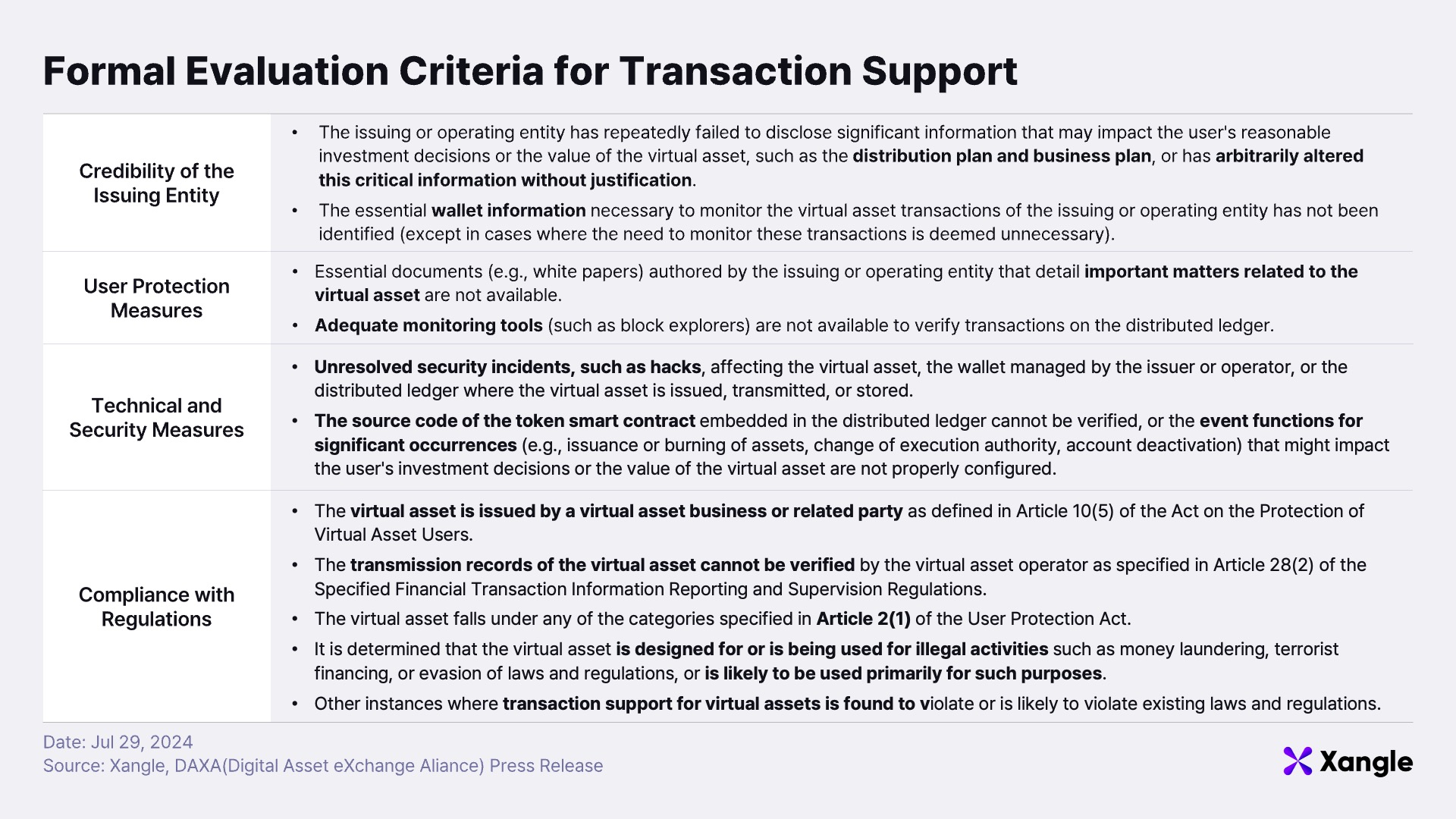

When listing new virtual assets, exchanges will consider both formal review requirements and qualitative review criteria. However, DAXA has only disclosed the formal review requirements, which focus on disqualification criteria to prevent market abuse. The formal review requirements are as follows:

In addition to these formal requirements, there are qualitative review criteria that DAXA has not disclosed. Although the exact criteria are unknown, they are expected to include several elements based on the regulatory guidelines.

3. Project Response to the Introduction of Regulations

We have outlined how the Act and the Best Practices for Supporting Virtual Asset Transactions apply to projects. Given that the Act primarily targets virtual asset operators, projects classified as issuers and operators must pay special attention to the Best Practices for Virtual Asset Transaction Support, which are essential for listing on South Korean exchanges. What specific areas of these best practices should projects focus on, and what measures should be taken to comply?

3-1. Periodic information disclosure via the information disclosure platform is required

The most crucial area for projects to address, in light of the Act and the DAXA Best Practices Regulation, is the transparent and regular disclosure of significant information to investors in Korean. The Act prohibits the sale and trading of virtual assets by projects possessing undisclosed information, and DAXA Best Practices may impose significant disadvantages in listing reviews if material disclosures are omitted.

The Act of the Protection of Virtual Asset Users, Article 10 (Prohibition of Unfair Trade Practices)

- None of the persons issuing virtual assets shall use any material non-public information relating to virtual assets for trading in the relevant virtual assets or engaging in other transactions or allow other persons to use such information.

The issuing project (corporations), shareholders, employees, related parties, and those who received the information, are all considered insiders. Therefore, it is necessary to systematically establish internal processes to prevent these insiders from using undisclosed material information. If material information is disclosed internally within the project but not externally, and transactions are made based on that information, it constitutes a violation of the law.

The Enforcement Decree of the Act, Article 15 (Standards on distinguishing material nonpublic information from publicly available information)

- The "means prescribed by presidential decree" for disclosing material information includes dissemination through newspapers, over-the-air broadcasting, Yonhap News Agency, virtual asset exchanges, websites, or electronic communication media.

Projects must ensure that their information disclosures adhere to the standards established under the Act on the Protection of Users of Virtual Assets. Although Article 15 outlines several means for disclosing material information, in practice, projects should focus on using virtual asset exchanges, websites, or electronic communication media. As will be detailed later, exchanges are expected to update key project information quarterly to ensure its currency. Therefore, it is essential to disclose information via platforms accessible to an unspecified number of individuals and that have consistently published information with a significant impact on the value of the virtual asset over the past six months.

DAXA Best Practice Guidelines 1. Credibility of the Issuing Entity

- Entities that repeatedly fail to disclose critical information impacting users' investment judgments or the value of the virtual asset—such as total issuance volume, distribution plans, and business plans—or that make arbitrary changes without justifiable reasons, will be subject to scrutiny under these guidelines.

According to the transaction support screening requirements, the credibility of the issuing entity is paramount. "Important matters that may materially affect a user's reasonable investment judgment or the value of the virtual asset" include total issuance volume, distribution plans, and business strategies, though these are minimal examples. It is anticipated that more diverse activities will be included as important matters. These could include significant changes in insider holdings of the crypto or the trading of the operating entity's crypto on the market. Any matter deemed critical to a reasonable investor's judgment or potentially impacting the cryptocurrency's value should be actively disclosed.

To prevent "repeated acts of non-disclosure or arbitrary changes without justification," it is imperative to establish a systematic information disclosure process and secure dedicated staff responsible for this task to ensure that important information is neither omitted nor arbitrarily altered. Additionally, since most users of domestic exchanges are Korean investors, disclosing information without a Korean translation may not be recognized as an appropriate way of providing information. Therefore, it is advisable to disclose the Korean translation of the information along with the original text.

DAXA Best Practice Guidelines 1. User Protection Measures

- If the issuing or operating entity lacks essential materials (e.g., white papers) explaining critical aspects of the virtual asset, or if there are inadequate surveillance tools (e.g., block explorers) to verify transactions on the distributed ledger.

One of the key formal screening requirements for transaction support is ensuring User Protection Measures, which states, “If no material written by the issuer or operating entity explaining key matters related to the virtual asset is identified," trading support is not available. Consequently, white papers must be provided in both the original English and Korean translations to the exchange. Additionally, any updates to the white paper must be promptly communicated to users via the project's website, authoritative platforms, or media channels.

According to the exchange's information disclosure section, it is incumbent upon the exchange to compile and provide the necessary information to users. This includes disclosing the original white paper, updated quarterly, a Korean text explaining the key points of the white paper, a detailed description of the virtual asset (using a common format), and links to the main publication media of the issuing or operating entity before the commencement of trading support.

It is, therefore, crucial for projects to communicate important information in Korean to facilitate the practical understanding of Korean investors. The exchange is expected to publish only the white paper and the virtual asset description directly, while other significant information will be made available through links to major public media. This information should be published on an "authoritative and representative platform" to ensure easy access and recognition by Korean investors, thereby facilitating integrated communication.

DAXA Best Practice Guidelines 4. Information Disclosure on Exchanges

- The original white paper, along with Korean materials explaining its main content, virtual asset documentation (using a common format), and links to the main disclosure platforms of the issuing or operating entity, should be disclosed before the start of trading support. These materials will be reviewed quarterly to ensure they remain up-to-date.

Since the exchange plans to "review the data once a quarter and keep it as up-to-date as possible," projects must ensure that the exchange can seamlessly disclose the latest data. Therefore, projects need to implement internal mechanisms to consistently disclose and disseminate information, thereby demonstrating a track record of protecting investors.

These best practices for crypto trading support became effective immediately with the enactment of the Act on July 19. As a result, these requirements apply to all new crypto assets listed on or after this date. For assets already supported for trading, a six-month re-examination period has been provided because of the challenges in collecting and reviewing data and issuer information simultaneously. During this period, projects must actively protect investors and prepare sufficient data to demonstrate compliance to maintain trading support. All Korean exchanges have implemented this process since July 19, and proving compliance will be difficult if delayed until after the six-month re-examination period begins.

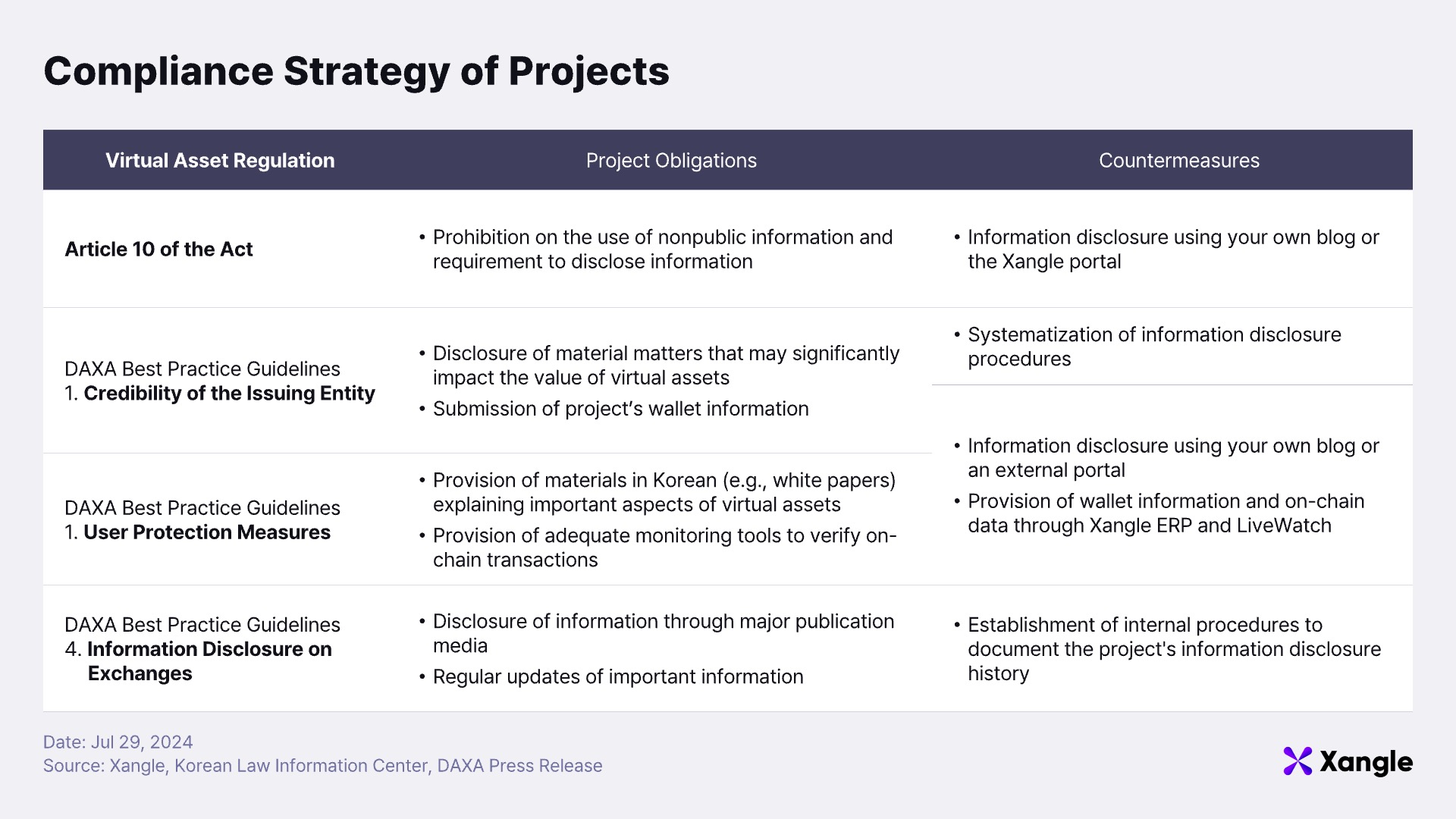

Compliance strategy of projects

a. Disclosing Information on the Project's Official Website and Blog

Projects should prioritize disclosing information through official platforms, which can include both exchanges and internet homepages or electronic communication media that 1) are accessible to an unspecified number of people and 2) have continuously posted information that can significantly affect reasonable investment judgment or the value of virtual assets for at least the last six months. Official websites and blogs operated by the project itself can serve as effective information disclosure platforms. However, it is recommended that projects, whether domestic or foreign, disclose important information in Korean. Disclosing information "in Korean" and "publicly" on platforms not sufficiently representative of Korean investors may risk non-compliance with investor protection obligations. Therefore, it is crucial to upload Korean-language materials on platforms that are easily accessible to a broad audience.

b. Disclosing Information Utilizing External Portals

Another viable option for disclosing information is to utilize an external portal. As explained earlier, if the information is disclosed solely "in Korean" or through a medium that lacks sufficient public representation, it may not satisfy the disclosure requirements. Utilizing an external information disclosure portal that aggregates information from multiple projects, rather than an individual project's homepage or blog, may be a more effective approach. One such platform is Xangle, which meets the criteria for providing important information to investors as defined by the Act. Xangle provided disclosure services to Korean investors from 2018 to 2023. Even after discontinuing the disclosure service in 2023, some functions were integrated into the Xangle event service. Notably, information disclosed on Xangle is also accessible through Naver, Korea's leading portal, and is provided to major Korean exchanges such as Gopax, ensuring the information reaches a broad audience.

3-2. Establishing a continuous support and verification system for on-chain data, including circulating supply

DAXA Best Practice Guidelines 1. Credibility of the Issuing Entity

- The asset may be not be listed or delisted if the essential wallet information necessary to monitor the virtual asset transactions of the issuing or operating entity is not confirmed, except where monitoring is deemed unnecessary.

Under the Credibility of the Issuing Entity criteria, transaction support may be denied if “the essential wallet information required to monitor the issuing or operating entity’s virtual asset transactions is not verified.” Consequently, projects must provide wallet information to exchanges to facilitate the monitoring of their cryptocurrency transactions. Additionally, projects might consider directly disclosing their wallet information to investors to demonstrate more transparent operations. As the disclosure of cryptocurrency information becomes more prevalent in Korea, it will be increasingly challenging to keep a project’s wallet private due to the inherent transparency of blockchain technology. Important transactions will inevitably be disclosed, making it easier for investors to infer the project's wallet from the disclosed transactions. Thus, a project's proactive wallet disclosure can be viewed as part of its efforts to protect investors by ensuring transparency.

DAXA Best Practice Guidelines 1. User Protection Measures

- The asset may not be listed or delisted if there is no documentation (e.g., white paper) explaining critical aspects of the virtual asset, or if there is no adequate monitoring tool (e.g., block explorer) to verify transactions on the distributed ledger.

Regarding User Protection Measures, it is essential that block explorers are available to investors for direct verification and validation of on-chain data. Transaction support cannot be provided if "adequate surveillance tools (such as block explorers) do not exist to verify transactions on the distributed ledger." Providing comprehensive support to process, curate, and deliver a range of on-chain information—such as circulating supply, on-chain transaction volume, transaction count, TVL, and burnt supply—demonstrates the project’s commitment to equipping investors with the necessary information to make informed decisions, thereby highlighting its dedication to investor protection.

Compliance strategy of projects

a. Token Unlocks

Token Unlocks is a specialized distribution service that offers comprehensive information on token distribution plans and volumes. It visualizes off-chain data, such as initial token allocations and vesting schedules, and provides real-time information on the actual volumes claimed or distributed on-chain. By registering their distribution plans on Token Unlocks and presenting them through visualized charts, projects can offer investors detailed insights. However, Token Unlocks may not fully meet the criteria for a disclosure platform as defined by the proposed regulation. Currently, the Token Unlocks dashboard does not facilitate the disclosure of material matters by issuers and only provides aggregate distribution volumes without detailed breakdowns, such as initial distributions and plans. This limitation makes it challenging for projects to use Token Unlocks to fully comply with regulatory requirements for disclosing all virtual asset information.

b. Xangle ERP - Tokenomics

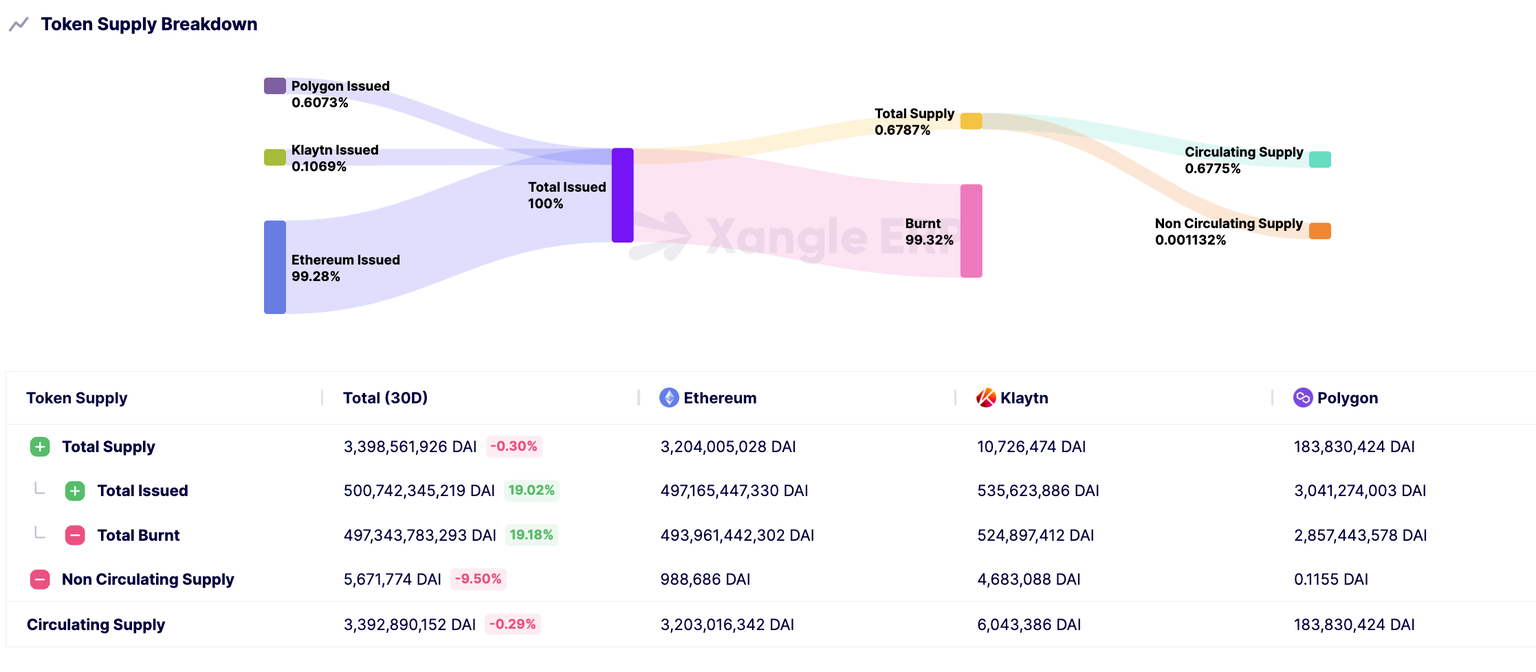

Xangle ERP is an ERP program designed for Web3 that helps both established companies and startups comply with government regulations, achieve community-level transparency, and make data-driven decisions. Tokenomics, one of Xangle ERP's key features, aids projects in managing their circulating supply and mitigating compliance risks. Currently, Xangle ERP supports six blockchain networks, including Ethereum, BNB, Polygon, and Klaytn, with plans to support additional networks in the future. Projects issuing tokens on these networks can easily calculate complex on-chain circulating supply in multi-chain environments by registering their non-circulating wallets. Additionally, the Xangle ERP’s publishing feature enables projects to display their distribution plans on the Xangle website at no cost. This function allows projects to visually present and communicate their distribution strategies to investors via the “Circulating Supply” tab and transparently disclosing distribution volumes based on on-chain data.

Xangle ERP - Multi-chain Circulating Supply calculated by Tokenomics (example)

C. Xangle LiveWatch

Xangle LiveWatch is an advanced circulating supply monitoring service that provides real-time tracking and visualization of circulation plans. While dApp projects can manage their circulating supply leveraging Xangle ERP’s Tokenomics feature, LiveWatch offers a more comprehensive monitoring solution. It supports both native tokens on the mainnet and tokens issued on various general mainnets, with customizable features for each project and API endpoints. LiveWatch performs cross-validation of blockchain data and distribution plans, detecting risks associated with the circulating supply by comparing published plans with actual on-chain data in real-time.

Integrating LiveWatch allows projects to enhance the reliability and transparency of their token supply management through independent third-party verification. The service has been pivotal in monitoring tokens suspended from trading due to circulating supply issues, thereby improving investor access to crucial information on issued and circulating supply. For projects aiming to mitigate circulating supply risks in the Korean market, Xangle's upcoming compliance advisory service offers a valuable solution. Currently under development, this service is designed to support global projects in navigating the Korean market effectively, with its launch expected in the near future.

4. Closing Summary

The enactment of the Act on the Protection of Virtual Asset Users represents a significant step forward in safeguarding virtual asset investors. As the Act primarily targets virtual asset operators, particularly exchanges, its immediate impact on projects not directly involved in virtual asset operations may be less apparent. This is partly due to the six-month grace period provided for assets currently supported by exchanges. As a result, projects not undergoing new support evaluations might not perceive substantial changes right away. However, without proactive measures to enhance investor protection over the next six months, projects could face challenges during future re-evaluations. Preparing thoroughly and addressing potential regulatory impacts proactively will be essential for navigating the evolving regulatory landscape effectively.