Context

In order to introduce Truflation’s value proposition, it is key to briefly cover 3 key axes on the current financial landscape: financial data access, tokenisation of real-world assets, and the advances in decentralised finances.

Currently, financial data is oftentimes inaccessible, non-standardised, very costly, and gate-kept by a few centralised corporations that don’t make it available on-chain. As a consequence, high quality data is siloed, with non-transparent sourcing and vulnerable to manipulation. A clear example of this problem is inflation metrics such as the Consumer Price Index (CPI) which serves as the basis for a 3.3T bond industry and guides the decision-making of institutions like the US Federal Reserve. More details on this problem can be found at https://whitepaper.truflation.com/background/problem.

In regards to the second axis, it is worth highlighting the traction achieved by the blockchain technology to serve as rails to secure and settle real-world assets (including traditional assets like ETFs, stocks, bonds, real-state and others), with over $1B of TVL increase in the first 3 quarters of 2023 for non-stablecoin tokenised RWA. Additionally, experts in the field expect an outstanding growth of the space predicting the tokenisation market to achieve a $16T size by 2030.

Furthermore, as a third key element, the impact of RWA financial data will not only have major effects on the tokenisation of the aforementioned assets, but also on the availability of on-chain derivatives and synthetics markets; allowing any trader exposure to the price change of underlying assets.

Below, we share how Truflation's decentralised data stream network marks a pivotal shift by consistently sourcing, authenticating, and integrating data from a multitude of channels, all while upholding clear and accountable methodologies. This will ensure the flow of unadulterated information, with Truflation poised to become a foundational pillar for both the current and future landscape of traditional and decentralised financial industries.

Project Overview

Solutions

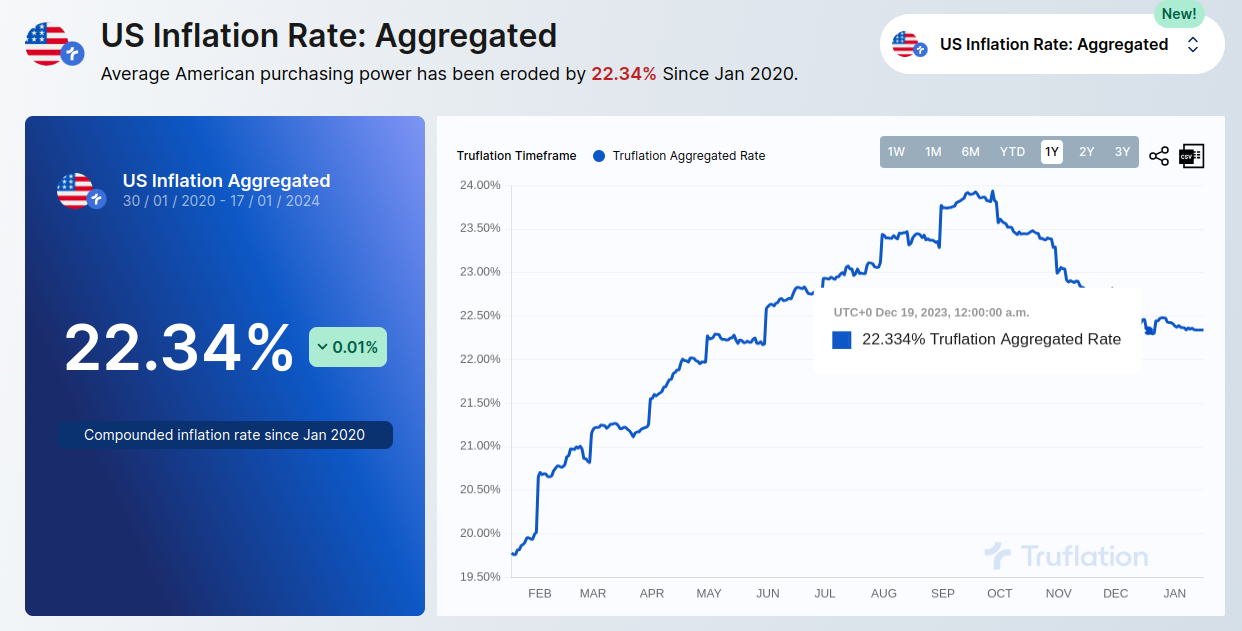

Truflation Dashboards

Data visualisation tools connected to the Truflation index API that calculates the most current US inflation rate and price indexes for various inflation categories like food or housing.

Truflation dashboards are offered using a freemium model.

Truflation API Data Access

Truflation enables data stream access through direct APIs including pricing data within categories such as equities, currencies, metals, ETFs, agriculture, commodities, utilities, and housing among others.

Truflation can potentially provide direct access to over 18M data streams that are currently sourced and curated for the aggregation of the inflation indexes.

Truflation RWA Oracle

The Truflation data streams available through Truflation’s API are also pushed on-chain by leveraging Chainlink’s technology. In this way, the Truflation Oracle constitutes an an on-chain feed of the financial data streams processed by the Truflation Stream Network.

The Truflation RWA Oracle is bringing real-world financial data to empower the next wave of financial products in the following key sectors:

- Flatcoins tracking US CPI index,

- Real-World Assets, by enabling the composability of tokenised representations of this type of assets and supporting activities as minting, trading, and lending.

- Synthetics representation and derivatives markets for RWA.

It is worth highlighting that Truflation data streams will massively expand the coverage (in terms of assets and price feeds tracked) of Chainlink’s network to mantain it’s leadership in the RWA space.

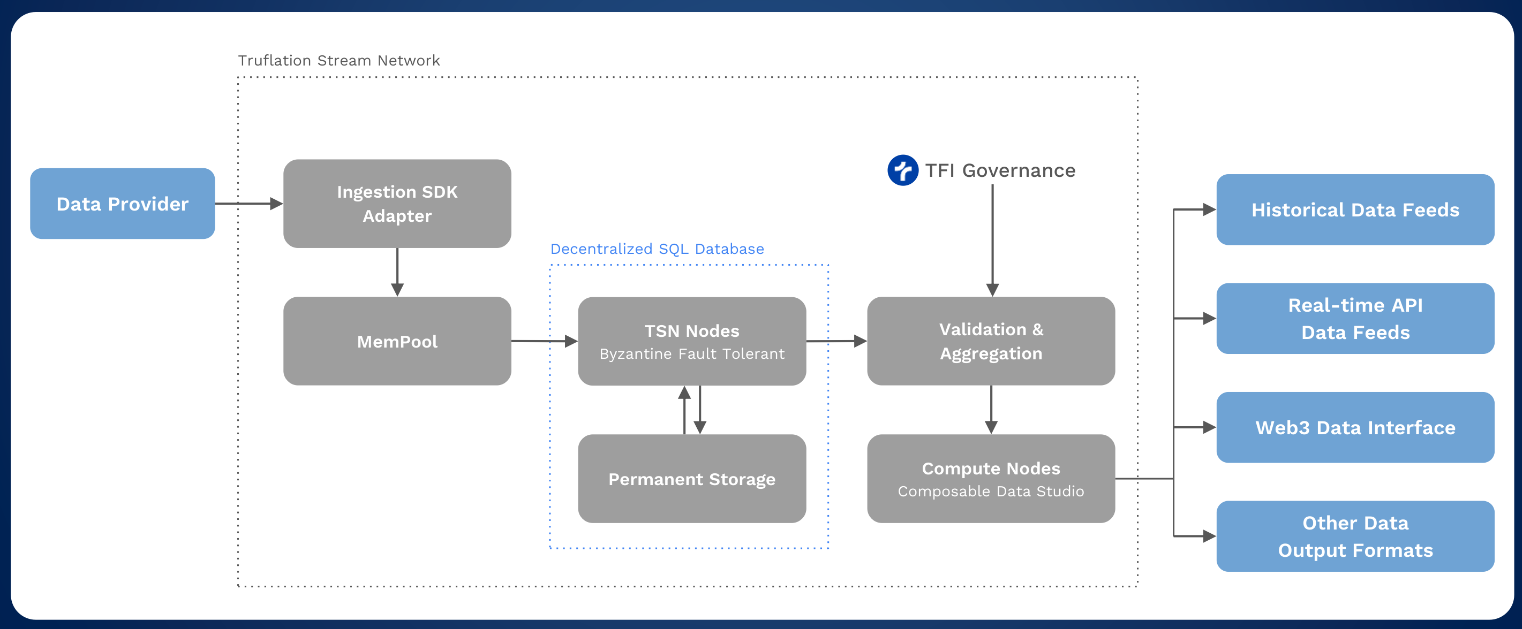

Truflation Stream Network (TSN)

The Truflation Stream Network, a decentralised data network for the sourcing, curation and distribution of financial data streams. The network processes and achieves consensus among the contributions of different data providers to record, compute, standardize and aggregate each relevant data stream and index.

The network is formed by data providers and validators that currently process over 18M+ data streams from over 50 different sources, serving data consumers that operate both off-chain and on-chain.

The Truflation Stream Network (TSN) also processes consumer payments, contributor rewards and will integrate staking/slashing mechanisms to ensure participants in the network are incentivised to provide transparent and unbiased data.

The Truflation Stream Network (TSN) is Byzantine Fault Tolerant (BFT) app-chain, designed to efficiently process, store, and disseminate data across a decentralised network.

The TSN is formed by a committee of consensus-driven nodes that collect and process real-world data for distribution in the form of data streams to various programmable environments. The main characteristics of the TSN are:

- Sufficiently decentralised and governable

- Composable

- Fast

The TSN is available and synchronised across various Layer 1’s and EVM-compatible blockchains such as: Ethereum, Base, Avalanche, Arbitrum, BSC, Polygon, Fantom + other EVM chains.

Core Components

The TSN is comprised of four core components, each serving a distinct but interconnected function within the system:

- Adapters: These are modular, on-chain program components akin to smart contracts. Adapters perform deterministic operations, serving as interfaces within the TSN to facilitate various tasks such as aggregating events from storage, responding to queries, verifying and parsing incoming data before committing it to storage, and more. They are configured to read events from relevant categories and can communicate with other Adapters to extend TSN's functionality, encompassing analytics, encryption, and creating indexes among other capabilities.

- Data Streams: Designed for the continuous broadcast of processed data, Data Streams make information available to external consumers. These streams are updated when a consensus is reached among nodes, ensuring that data is replicated identically across the network. Data Streams require Adapters for creation, leveraging past and newly ingested data. This setup enables efficient data querying and analysis by syncing aggregated events and post-processed data across nodes, comparable to traditional ETL (Extract-Transform-Load) mechanisms.

- Index: This component utilises the architecture of Data Streams and Adapters to aggregate data, perform computations, and create new datasets within the TSN. An Index tracks the performance of underlying assets in a standardised manner, similar to indexes in traditional finance, but with the added robustness of decentralised data feeds. For instance, the TSN can construct a Consumer Price Index for a country by combining data on various expenses over time.

- Events Context: Acting as a persistent and decentralised data store, the Events Context records events processed and signed by TSN Adapters. It maintains data integrity by storing events in sequence without allowing deletions or alterations. This ledger forms a structured dataset that represents the TSN’s valuation state across various categories, enabling comprehensive query and analysis capabilities and allowing for complete system rebuilds within the context of a foreign database.

Data Security & Authenticity

The TSN implements mechanisms allowing Adapters to filter data to ensure only information with verified authenticity and quality, or from reputable sources, is included. This selective process allows developers and consumers to access secure data, balancing programmatic trust with the utility of more nascent or exotic data.

The TSN also ensures data authenticity through cryptographic signatures and node technology, enabling data verification before storage. Cryptographic proofs, like Provenance and Integrity proofs (via ECDSA) and Authenticity proofs (via MPC-TLS), ensure data's genuineness and tamper-resistance from off-chain sources.

Moreover, TSN Adapters employ a quality control protocol to eliminate fraudulent data, including checks for data consistency, deviation, and presence. Cryptographic verification further enhances data quality control, with real-time or delayed verification processes adaptable to specific business logic.

Lastly, the TSN uses a deterministic process to manage and assess the reputation of Data Providers based on consumer engagement, data quality, and feedback. This reputation system influences the data's perceived reliability and is crucial for determining the trust level in data sets from different providers.

To join the network, Data Providers must stake TRUF tokens in the Governance Portal, receiving veTRUF tokens in return, enabling them to participate in governance. Instead of gas fees, they pay a chain access fee for service and data commitment to the TSN, leading to whitelisting and data storage across the network, making new data sources available to participants.

Data providers' trustworthiness is assessed based on:

- Primary Purpose and Data Provenance: Their main function should be data provision, sourcing data directly.

- Value Correlation: The entity’s data quality must directly impact the value of their service.

- Capitalisation and Incentives: They must be well-capitalised to ensure data accuracy incentives outweigh falsification risks.

Business Model

The TSN allows data consumption through APIs for off-chain and Oracles for on-chain use, with some entities having direct database access.

Truflation will monetise the data services via 3 different revenue streams:

- SaaS model for dashboard data consumers (target users: individual traders / retail).

- SaaS model for API access to historic and live data streams (target users: enterprise/institutional data consumers, developers building web2 and web3 apps).

- Oracle services for on-chain applications (paid either using subscription models, micropayments, or protocol revenue share)

The API ensures data verifiability with cryptographic proofs, while Oracles bridge the gap for smart contracts to access off-chain data, limited by blockchain compatibility. Consumers can include institutions, companies, and blockchain-based entities, all supported by the TSN's flexible architecture and verified through Web3 access.

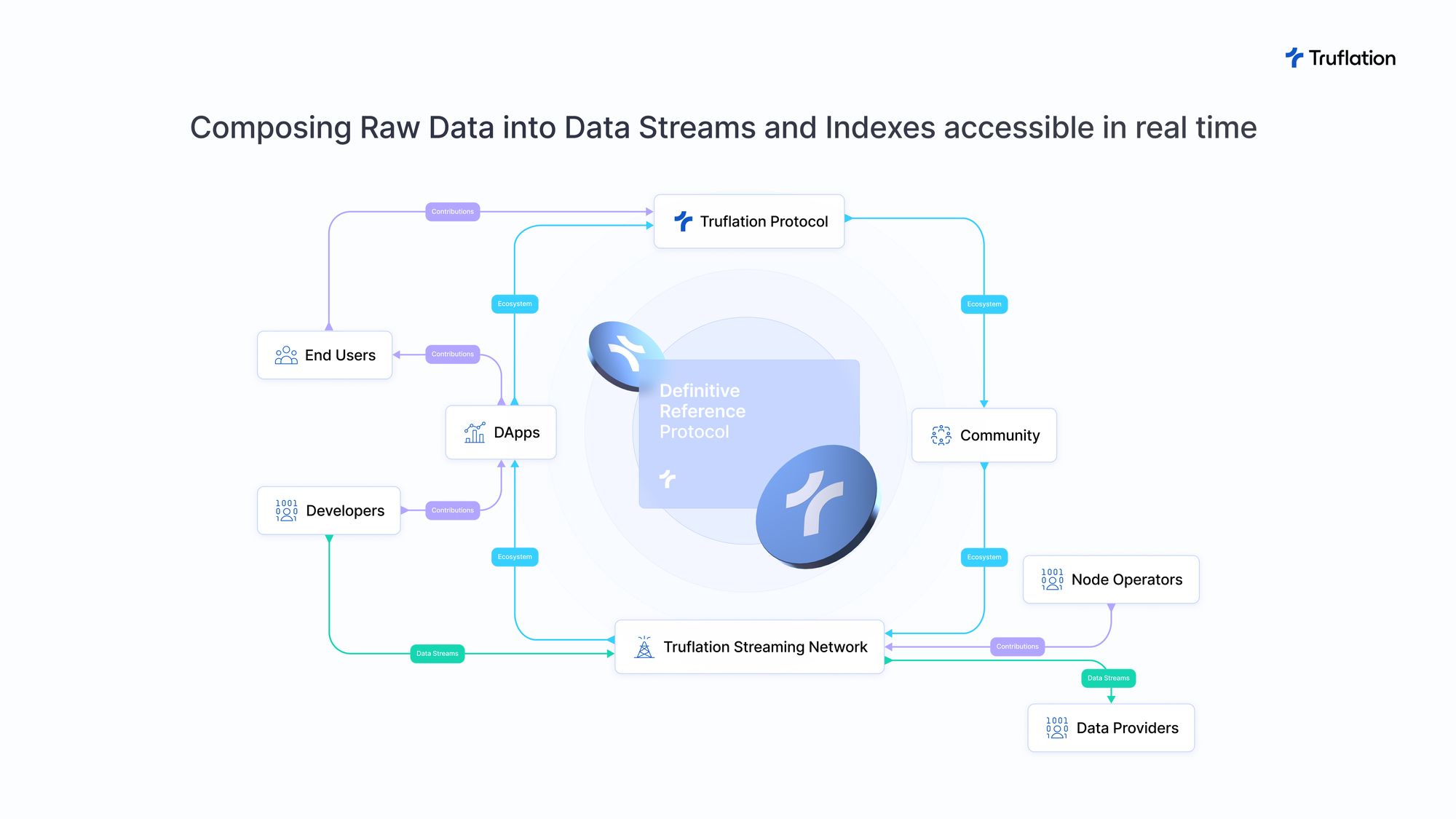

TRUF Token Utility

TRUF tokenomic mechanisms are put in place to align the incentives of key participants in the network: node operators (data providers and curators), validators, token holders, and data consumers.

Planned token utilities at launch include

- Node operators: The node operator ensures availability of the data by maintaining the necessary infrastructure and updating the TSN software stack.

- Data consumers: DeFi, TradFi and B2B customers pay for Truflation data streams using TRUF tokens, or in some cases pay in stable coins.

- Governance Staking: users can lock their TRUF in return for time-based yield, and to receive veTRUF tokens, which grant holders voting rights in the Governance decisions related to token distributions and rewards, data category selections, market strategies, and much more. Additionally, veTRUF token holders are awarded a portion of the protocol fees for their active participation, as well as slashing rewards.

The following image displays the value-flows within the ecosystem around the Truflation Protocol.

More information in this link.

Roadmap

Q1 2024

- TSN: mainnet launch, decentralising CPI Index

- Data providers / aggregators: SDK release

- Indexing coverage: CPI indexes for 2 new countries

- RWA Oracle: fully automated and self-serve

Q2 2024

- TSN: key feature release for composability of data streams

- Data providers / aggregators: Acquisition of 3 data aggregators

- Indexing coverage: Development of at least 1 new economic index

- RWA Oracle: Injective DEX release

Q3 2024

- TSN: monetisation of data streams

- Data providers / aggregators: AI enabled data-studio

- Indexing coverage: CPI Indexes for two new countries

- RWA Oracle: AI-powered quality control

Q4 2024

- TSN: expansion of node operators, phase 2

- Indexing coverage: Development of at least 1 new economic index

- RWA Oracle: AI-powered quality control

Q1-Q2 2025

- TSN: node operator network publicly open.

- Indexing coverage: continued development based on market demand.

Traction

- Currently compiling over 18M data streams in real time, aggregating over 50 different sources. This makes Truflation the oracle service with widest coverage in the market.

- Key differentiator with oracles in the market: widest coverage, highest quality of data sourcing and curation, making it valuable for off-chain consumers and not just on-chain data distribution.

- 3x growth in website visits from March 2023 to Jan 2024, reaching nearly 500k monthly visitors.

- Over 140 developers building on top of Truflation Stream Network,

- DeFi protocols building on economic data include Frax, Ostium, Ampleforth, Overlay, Fortunity, Lendr, Nuon, Helix (Injective).

- Initial onboarding of TradFi customers across Derivative Swap Traders, Asset managers and financial advisors ongoing; targeting 10 institutional users by EOY.

- Truflation is working on distribution partnerships with Factset, BNYM, TheTie, Tiingo and others.

- Investment received from key players in the space: Coinbase Ventures, Chainlink Labs, Balaji Srinivasan, C² Ventures, Abra, Fundamental Labs, and others.

- Partnering with Base and Injective to public data on their chain and foster the creation of new and efficient inflation-resistant products.

- Increasing awareness in both traditional and decentralised finance spheres:

- Cathie Woods: https://www.youtube.com/watch?v=SpRJeWKbE5Q&t=615s&ab_channel=ARKInvest

- NYT reference by Paul Krugman: https://www.nytimes.com/2023/10/23/opinion/columnists/american-economy-success.html

- Pompliano https://twitter.com/apompliano/status/1744372591324742115?s=46

- All-in Podcast https://www.youtube.com/watch?v=JD-b-Zl7yso&t=1897s&ab_channel=All-InPodcast

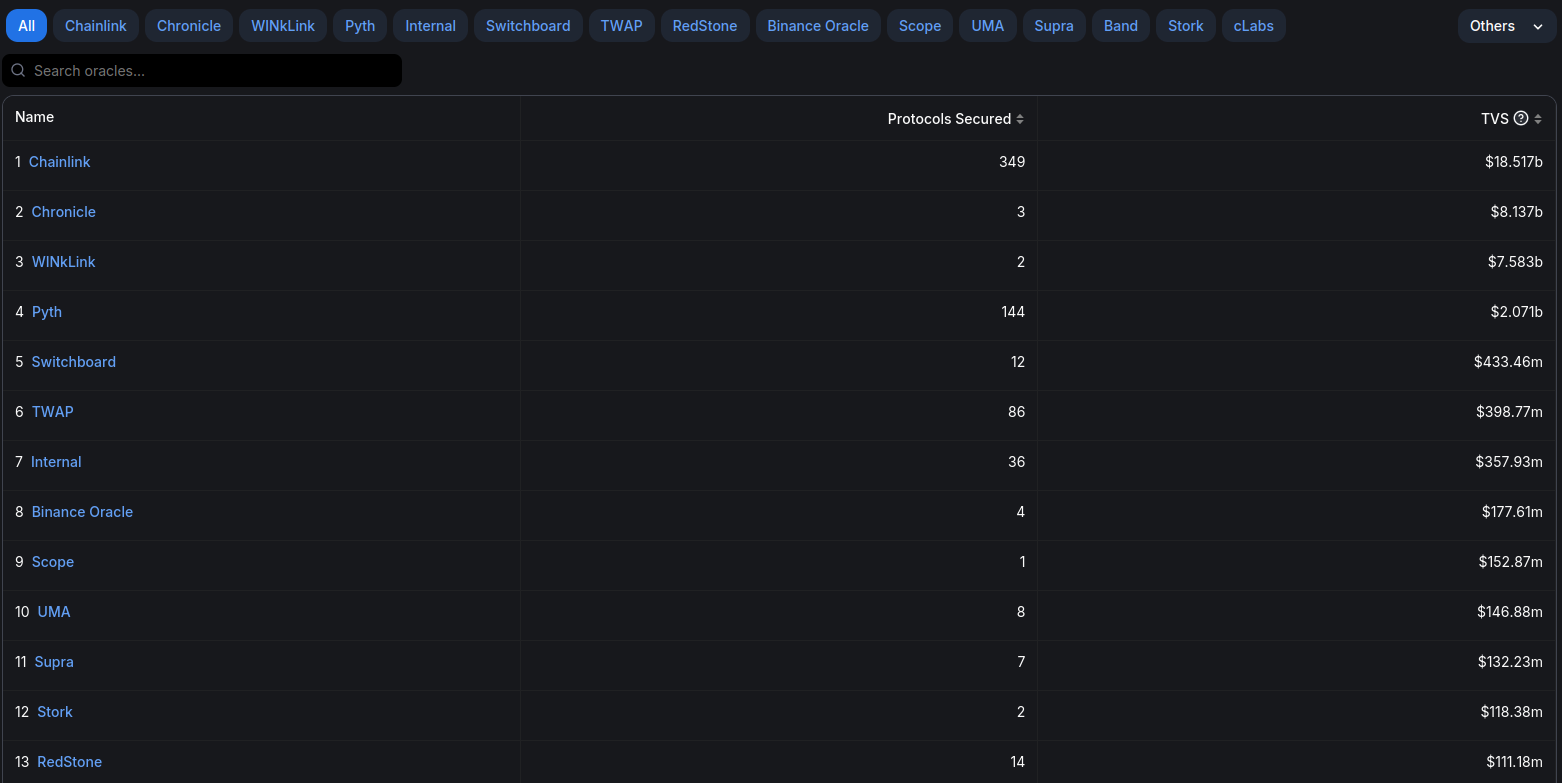

Competitive Landscape

As observed in the image below, the oracle space is dominated by Chainlink as a major key actor, with over $18Bn Total Value Secured (TVS) by Chainlink’s services, followed by Chronicle Labs ($8 Bn TVS, mostly from MakerDAO protocol), WinkLink ($7.5Bn TVS, leader in the Tron ecosystem), and Pyth (+$2Bn TVS).

As Chainlink’s partner and portfolio company, Truflation is looking to expand Chainlink’s coverage and market dominance in the RWA sector, which is poised to growth significantly in the upcoming years as reported by numerous professional sources.

In this context it is worth to highlight some comparable metrics of Chainlink and upcoming competitors in the space.

Competitors with token trading in the open market:

| Protocol | Valuation (Market Cap.) |

|---|---|

| Chainlink | $11.5B |

| Pyth | $1.45B |

| Band | $315 M |

| Truflation | $7.1 M (estimated listing market cap) |

Competitors with tokens not trading in open market:

| Protocol | Funds raised |

|---|---|

| Redstone | $7 M (announced Q3 2022) |

| Supra Oracles | $24 M (announced Q3 2023) |

Additionally, within the space of processing and off-chain distribution of financial data the following companies can be cited:

- Bloomberg

- BLS

- Equifax

- LiveRamp

Team

Highlighting the founding team:

- Stefan Rust (CEO): 20+ years in entrepreneurial experience, former CEO of bitcoin.com, responsible for scaling up to 20M wallets, early China mobile technology pioneer, experience scaling infrastructure at Sun Microsystems, Co-founder of Hi, neobank with crypto payments, Founder of Laguna DeFi, Founder of Trusted Node, Founder of Nuon Finance.

- Joseph Wang (CDO). Former JP Morgan, Bitmex, Web3 developer & entrepreneur.

- Oliver Rust (Head of Data). Formerly at Citi, HSBC, Visa, Nielsen.

- Cameron Lee (Product Lead) Formerly at Solomon Pierce Holdings

- Vadim Zolotokrylin (Lead Engineering) Formerly at Clearpool , Amplify Protocol MIQ

Token Distribution

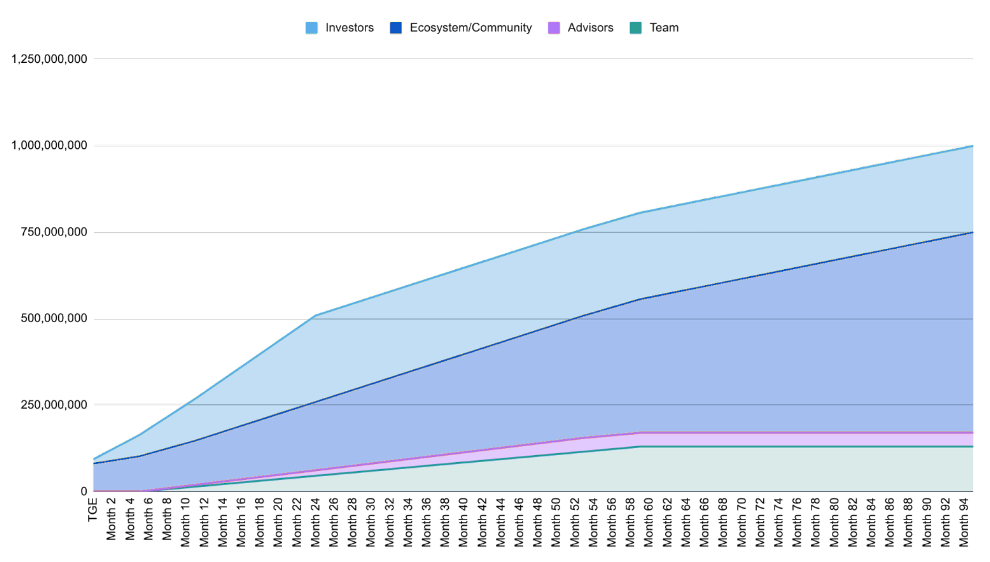

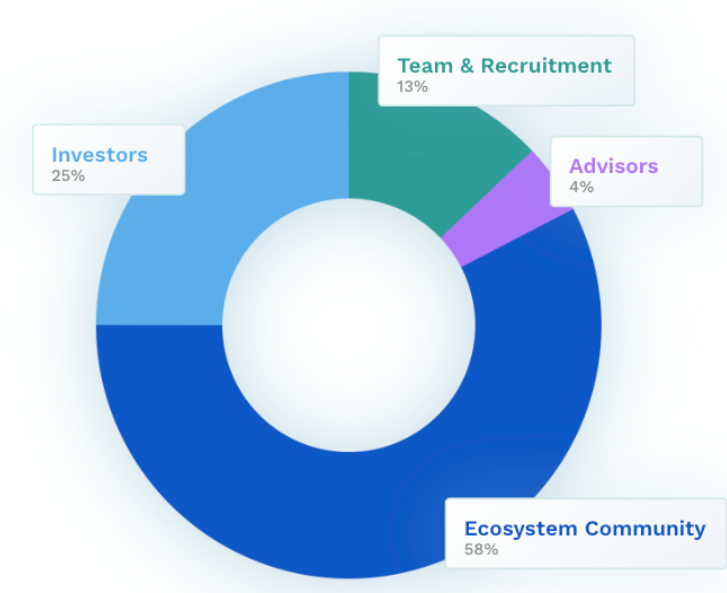

The following charts display the token distribution for $TRUF. It is worth highlighting that vesting schedules have been designed to avoid inflation to exceed 2% monthly rate at any point in time after the initial listing event.

| Token Allocation | % of allocation | Vesting |

|---|---|---|

| Team & Recruitment | 13.00% | 6 month cliff, then daily linear over 48 months |

| Advisors | 4.00% | 6 month cliff, then daily linear over 48 months |

| Investors | 25.00% | 5% at TGE then daily release over 24 months |

| Ecosystem community | 58.00% | 5% at TGE, 12 month cliff, then daily linear release over 84 months. * Within this portion are included public sale and liquidity. |

| Total | 100.00% |

Risk Evaluation

Decentralisation-Related Risks: Truflation operates on a decentralized oracle network, which inherently carries the risk of collusion among node operators. Such collusion could compromise data integrity. There's also the risk of a 51% attack, where if a majority of the network's computing power were to be dominated by a single entity, it could lead to potential data manipulation.

Mitigation: The economic viability of a 51% attack is very remote since the amount of capital required for a malicious actor to manipulate the network would be greater than the potential extractable value through DeFi

Operator Risks: Node operators within Truflation's network are exposed to slashing risks. Should operators experience downtime or be found guilty of misreporting, they could face penalties. This not only affects the operators but can also impact the service's credibility and the reliability of the data provided.

Mitigation: The distributed nature of the validator set is what shields Truflation against outages, while economic incentives are aligned to keep the vast majority of network participants well-behaved.

Smart contract risks: smart-contract related risks are always inherent in web3 protocols.

Mitigation: Truflation smart contracts have been audited by Hacken & Sherlock. Bug-bounty programs will also be implemented to ensure continued monitoring.

Investment Thesis

Based on the information presented in this report, Truflation’s TRUF is an attractive investment opportunity, displaying:

- An extremely attractive valuation, with large upside opportunity based in the size of the addressable market and validated by the benchmarking against competitors in the space.

- A visionary and serial-entrepeneur founder, supported by a talented team with experience in relevant fields as traditional finances, distributed systems, data science and blockchain development.

- A solid infrastructure for the sourcing, curation and distribution of over 18M+ data streams.

- Truflation CPI Index: a fully-developed flagship product with the potential of disrupting a 3T+ market.

- Wide coverage oracle for RWA data: a comprehensive service designed for a sector poised to grow exponentially over this decade.

- Proven demand for the developed products, evidenced by the adoption of general users, traditional finance institutions and DeFi builders.

• 500k monthly website visitors,

• 10+ traditional finance customers onboarded,

• 140+ web3 builders, - 10+ Defi protocols integrations in the pipeline ready to go live (or already live).

- A strong network of supporters, contributors and adopters; including Coinbase Ventures, Chainlink, Injective, BNY Mellon, Fineco, and others.

Relevant Links

Website: https://truflation.com/

X: https://x.com/truflation

Telegram: https://t.me/truflation

Reference materials used for this research report include:

- Truflation’s public whitepaper

- Truflation’s deck for private fundraising

- Truflation’s internal business development pipeline

- Direct discussions with Truflation team

The information herein provided is updated up to March 16th 2024.