Written by stella@footprint.network

Data Source: NFT Research - Footprint Analytics

January 2024 marked a pivotal moment for the crypto and NFT markets, highlighted by the debut of spot Bitcoin ETFs in the US, a milestone in financial integration that attracted significant investor attention. Meanwhile, the NFT sector experienced remarkable growth, with trading volumes and user engagement reaching new highs. The month also revealed shifts in blockchain preferences, with Polygon's surge and the rise of platforms like Mooar and culturally rich projects like TinFun. In contrast, OpenSea expressed openness to acquisition discussions amid NFT market shifts.

This report is based on data sourced from Footprint Analytics' NFT research page, a comprehensive and user-friendly dashboard. It provides up-to-date statistics and metrics essential for grasping the pulse of the NFT industry, covering trades, projects, funding, and more.

Key Points

Crypto Macro Overview

-

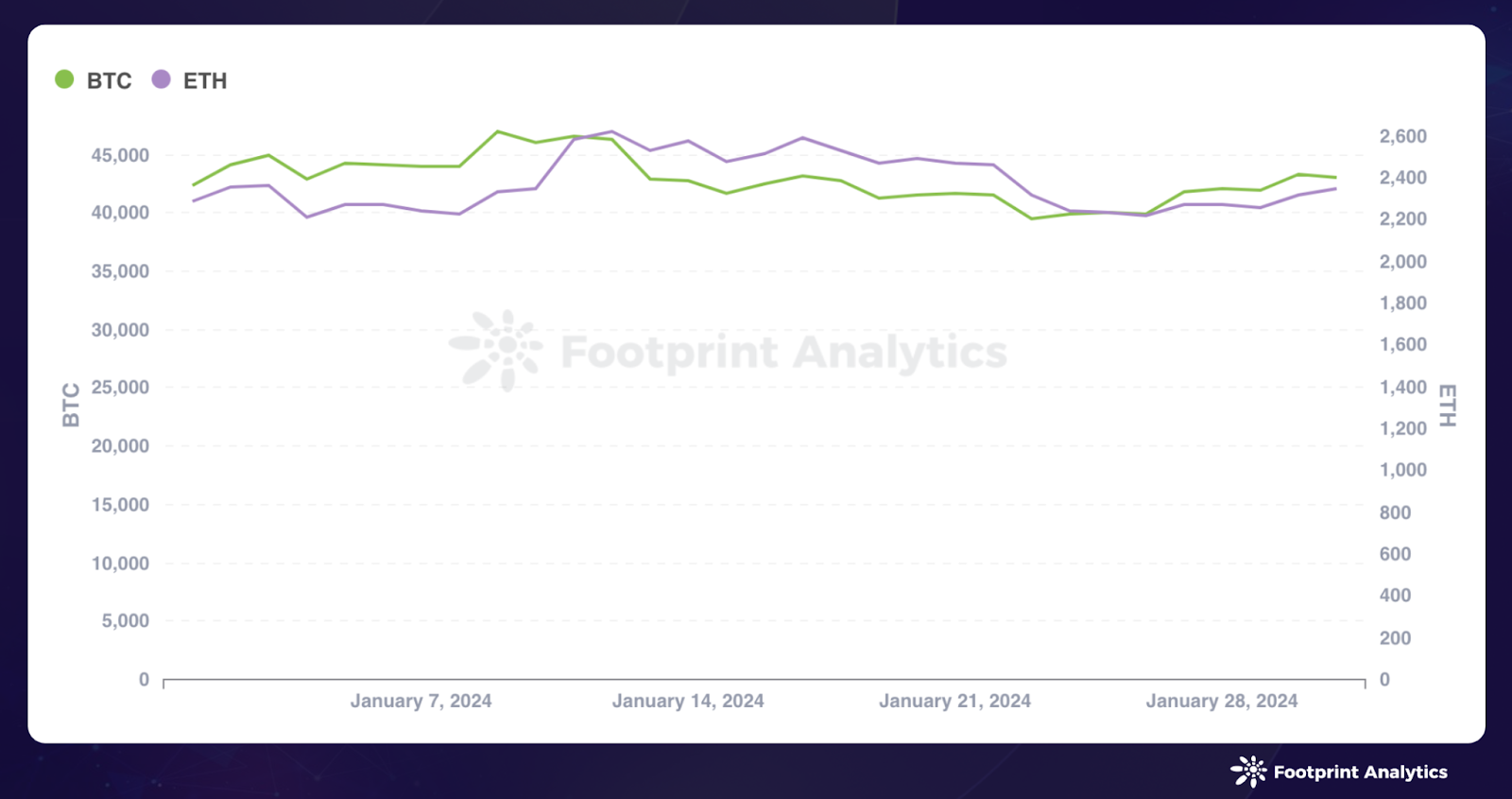

Bitcoin modestly climbed by 1.65% from an opening of $42,303 to close at $43,001, while Ethereum saw a 2.77% increase, starting at $2,283 and ending at $2,346.

-

The broader crypto market shifted towards exploring crypto-AI synergies and observing a steady rise in the stablecoin market cap, against a backdrop of the Federal Reserve's decision to hold interest rates steady.

NFT Market Overview

-

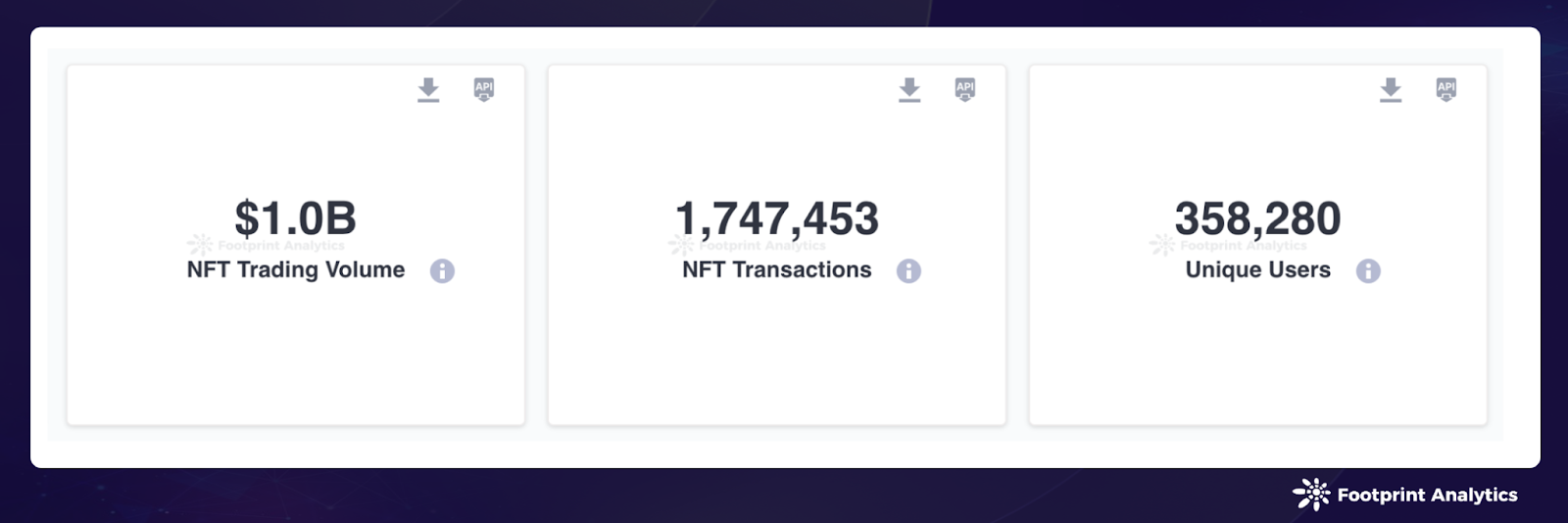

In January 2024, the NFT market grew robustly, with trading volume hitting $1.0 billion, up 17.3% from December.

-

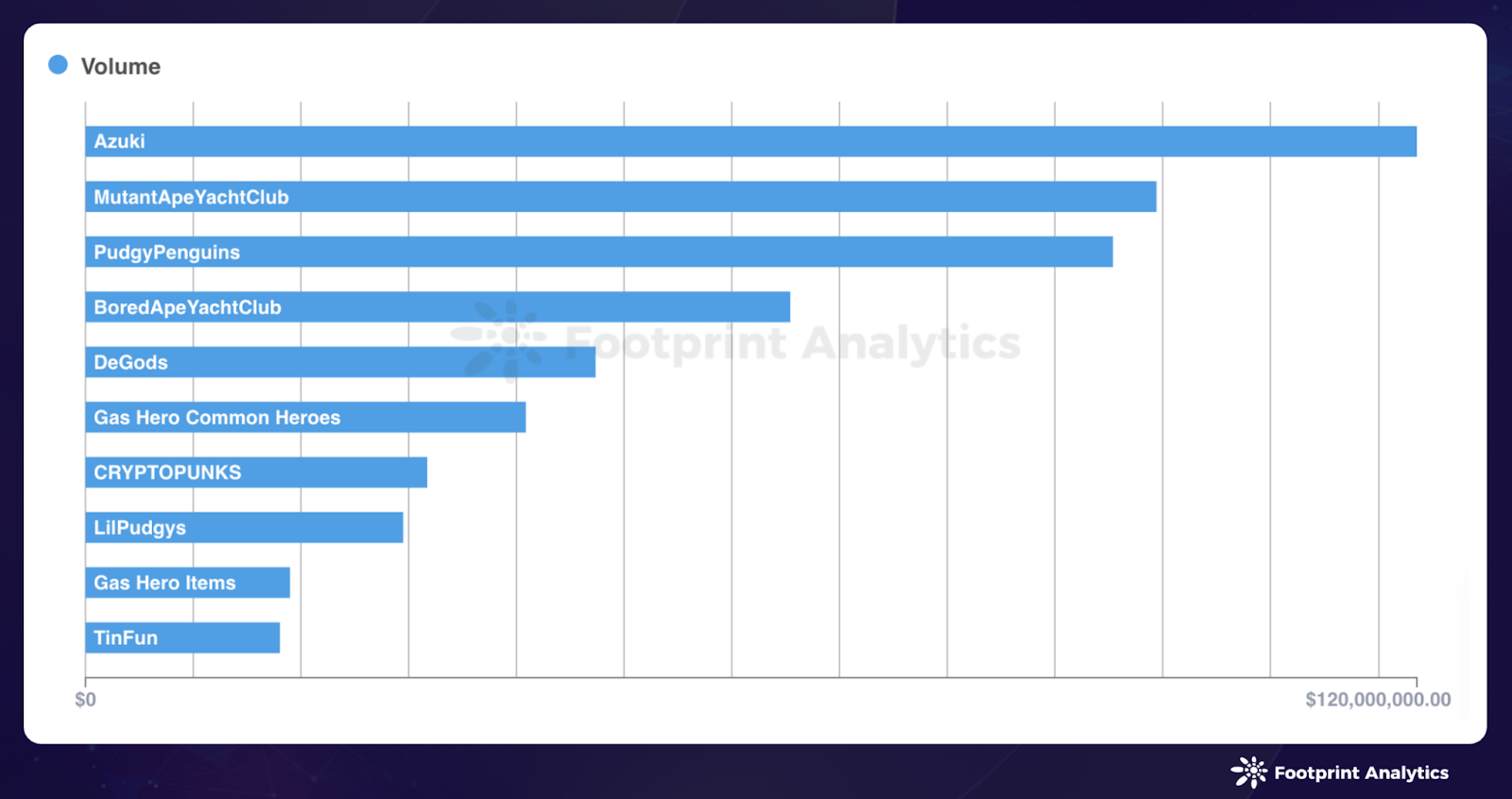

Pudgy Penguins maintained its appeal, securing the third spot in the top 10 collections by trading volume, while its sister project, Lil Pudgys, came in at eighth.

-

Gas Hero NFTs, especially the Common Heros and Items collections, saw significant trading volume spikes, ranking them among the top 10 collections by trading volume in January.

-

TinFun achieved the 10th position in trading volume following its debut in January 2024.

Chains & Marketplaces for NFTs

-

Ethereum led the NFT market with a trading volume of $904.9 million, accounting for 89.1% of all transactions, marking its lowest market share since 2021.

-

January saw a remarkable increase in Polygon's trading activity, with its volume reaching $106.0 million, a 97.2% rise from the previous month.

-

OpenSea saw a continued decline in market share, falling from 20.8% to 16.6%, alongside a trading volume decrease of 10.1% to $168.1 million.

-

The surge in popularity of the Web3 game Gas Hero significantly contributed to the increase in trading volume for both Mooar and Polygon in January.

NFT Investment & Funding

-

In January, the NFT market remained steady with five funding rounds totaling $26.4 million.

What’s New?

-

OpenSea introduces wallet creation using email, making NFT onboarding easier.

-

Binance Labs Invests in MEME, the Native Token of Memeland from the Creators of 9GAG

-

Hedera-Based Tune.FM Raises $20M for Artist-Friendly Web3 Music Platform.

-

OpenSea is open for acquisition amid NFT market shifts.

Crypto Macro Overview

In January 2024, Bitcoin and Ethereum continued their upward trajectory, although at a slower pace. Bitcoin modestly climbed by 1.65% from an opening of $42,303 to close at $43,001, while Ethereum saw a 2.77% increase, starting at $2,283 and ending at $2,346.

Source: BTC Price & ETH Price - Footprint Analytics

Source: BTC Price & ETH Price - Footprint Analytics

The debut of spot Bitcoin ETFs in the US in January 2024 marked a pivotal moment for the crypto market, with these ETFs quickly capturing investor attention through daily trading volumes of $2.1 billion. This significant interest reflects a deeper cryptocurrency integration into the traditional financial ecosystem. Despite the excitement around ETFs, Bitcoin and Ethereum prices remained relatively stable, indicating cautious trading post-launch. Meanwhile, the broader crypto market shifted towards exploring crypto-AI synergies and observing a steady rise in the stablecoin market cap, against a backdrop of the Federal Reserve's decision to hold interest rates steady. This period signifies a nuanced evolution in the crypto landscape, balancing between institutional embrace, through ETFs, and the ongoing anticipation of macroeconomic and technological developments.

NFT Market Overview

In January 2024, the NFT market grew robustly, with trading volume hitting $1.0 billion, up 17.3% from December. Transactions surged by 26.2%, reaching 1,747,453, and the number of unique users grew by 20.5% to 358,280. These statistics underscore a significant upward trend in both market activity and user engagement, highlighting the enduring appeal and expanding footprint of NFTs.

Source: NFT Market Overview - Footprint Analytics

Source: NFT Market Overview - Footprint Analytics

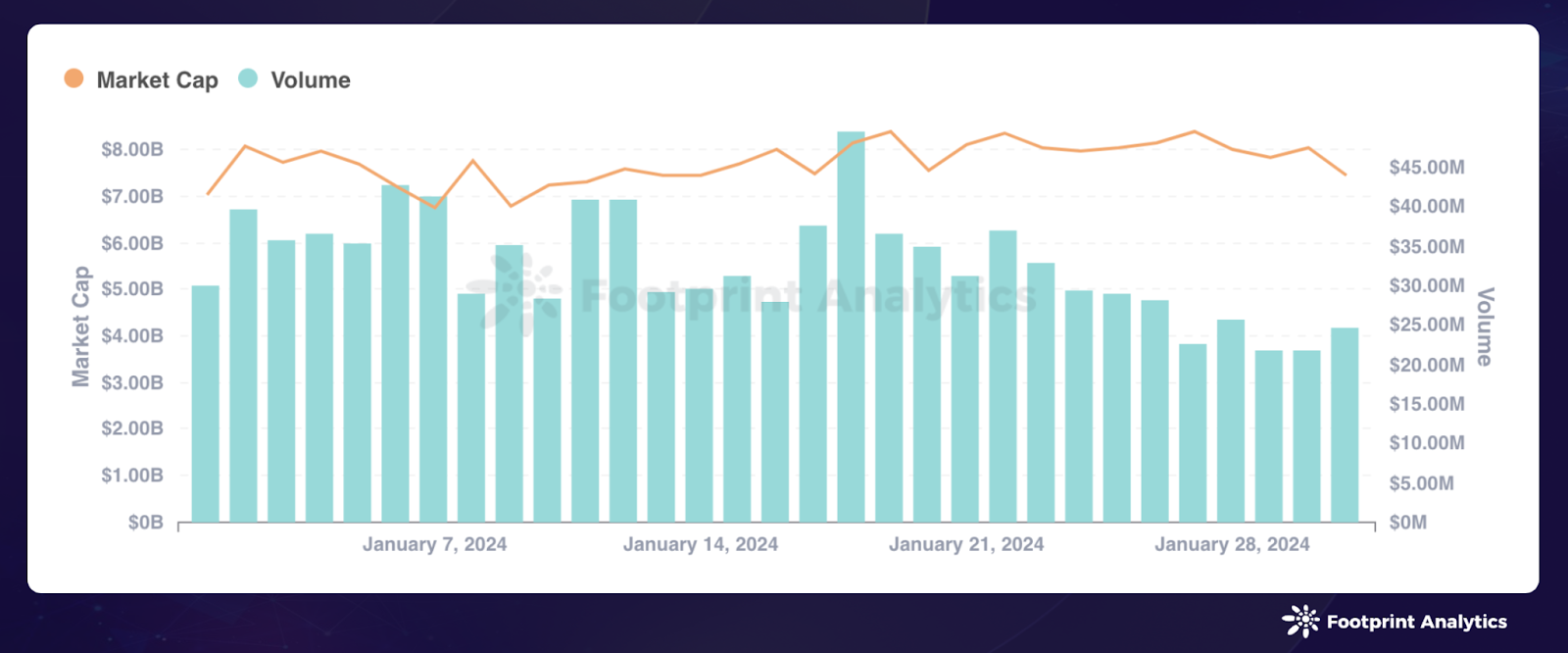

The NFT market cap started at approximately $7.02 billion and experienced a growth of 5.83% to close at around $7.43 billion.

Source: NFT Market Cap & Volume - Footprint Analytics

Source: NFT Market Cap & Volume - Footprint Analytics

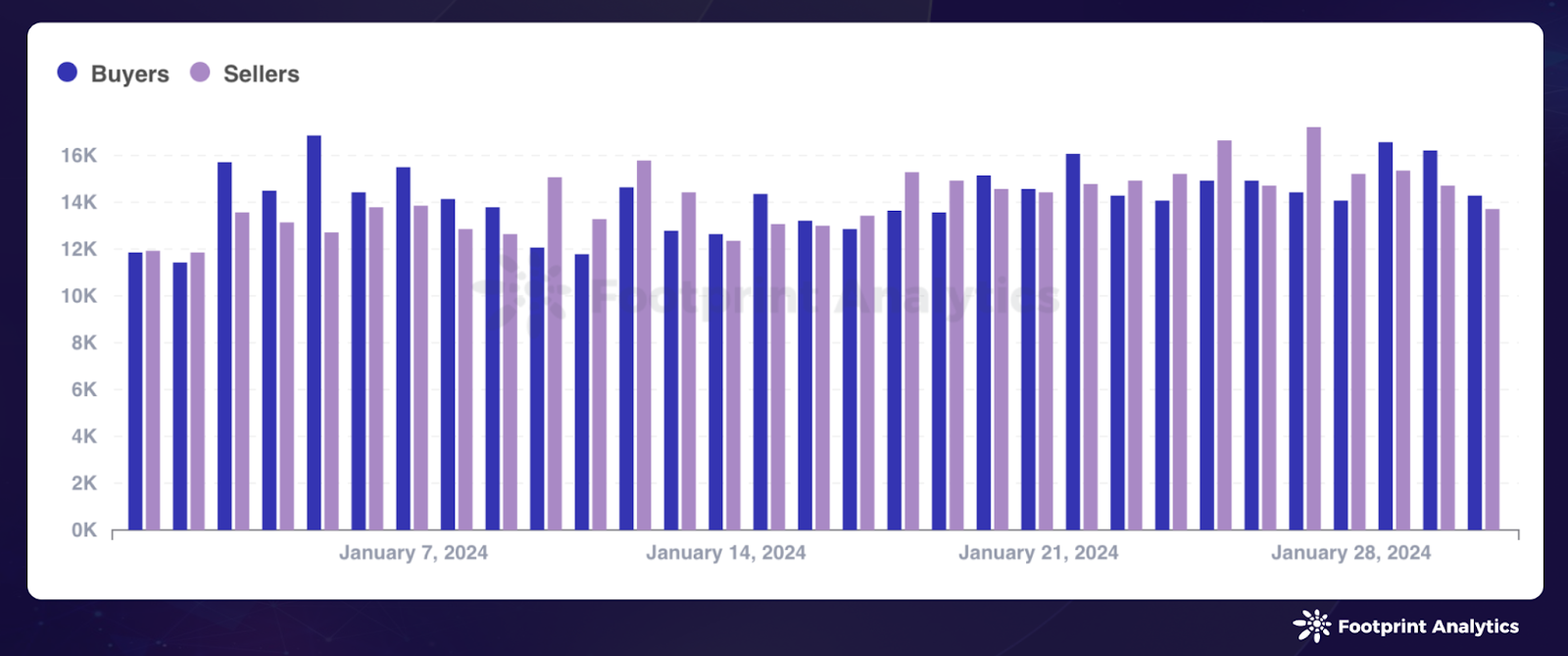

The NFT market's buyer-to-seller ratio improved to 118.6%, with buyers increasing to 228,509, up 26.8% from December, and sellers reaching 192,718, up 9.1%. This shift underscores a growing buyer interest, outpacing the rise in sellers.

Source: Daily Buyers & Sellers - Footprint Analytics

Source: Daily Buyers & Sellers - Footprint Analytics

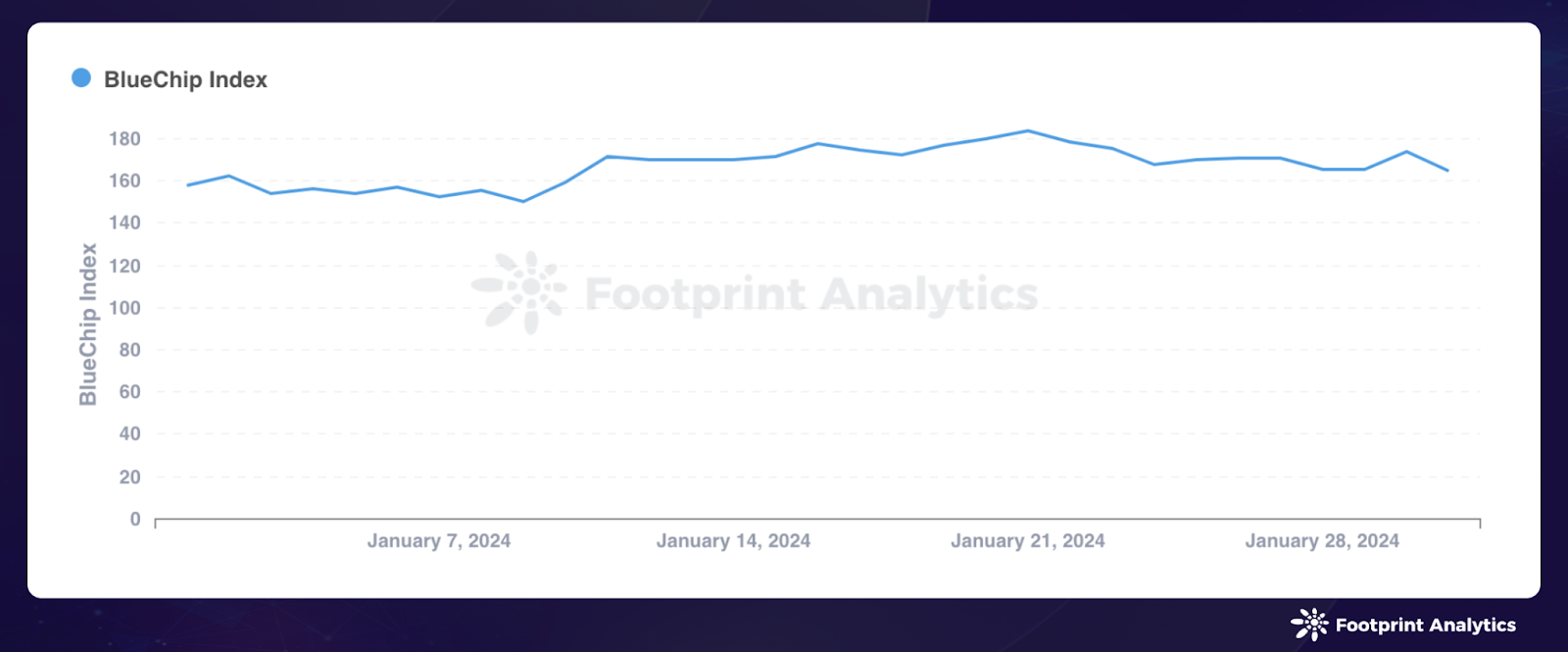

The Blue Chip Index experienced a slight increase of 4.4%, with fluctuations throughout January.

Source: BlueChip Index - Footprint Analytics

Source: BlueChip Index - Footprint Analytics

In January, Pudgy Penguins maintained its appeal, securing the third spot in the top 10 collections by trading volume, while its sister project, Lil Pudgys, came in at eighth.

Source: Top 10 Collection Volume - Footprint Analytics

Source: Top 10 Collection Volume - Footprint Analytics

Gas Hero, a Web3 interactive strategy game known for its focus on social interaction, debuted on January 3 and quickly gained widespread attention. It operates within the Find Satoshi Lab ecosystem, utilizing the native GMT token, the same as StepN. The game offers players the opportunity to collect, customize, and enhance Hero NFTs with an array of weapons and pets, encouraging them to undertake quests for gathering in-game assets. Notably, the game's NFTs, especially the Common Heros and Items collections, saw significant trading volume spikes, ranking them among the top 10 collections by trading volume in January.

Gas Hero Common Heroes NFT Collection

Gas Hero Common Heroes NFT Collection

TinFun, a notable NFT initiative, achieved the 10th position in trading volume following its debut in January 2024. The project seeks to honor Eastern cultural traditions through the integration of premium artwork and innovative blockchain technology, offering a deep dive into Eastern aesthetics, narratives, and games. The project is led by “BitCloutCat”, the founder of LaserCat NFT, and supported by a team with experience at major companies such as Tencent, OKX, and Riot Games. The successful launch of TinFun has raised expectations around its ability to keep up the pace through continued user engagement and to extend the practical utility of its NFT collection beyond the hype.

TinFun

TinFun

Chains & Marketplaces for NFTs

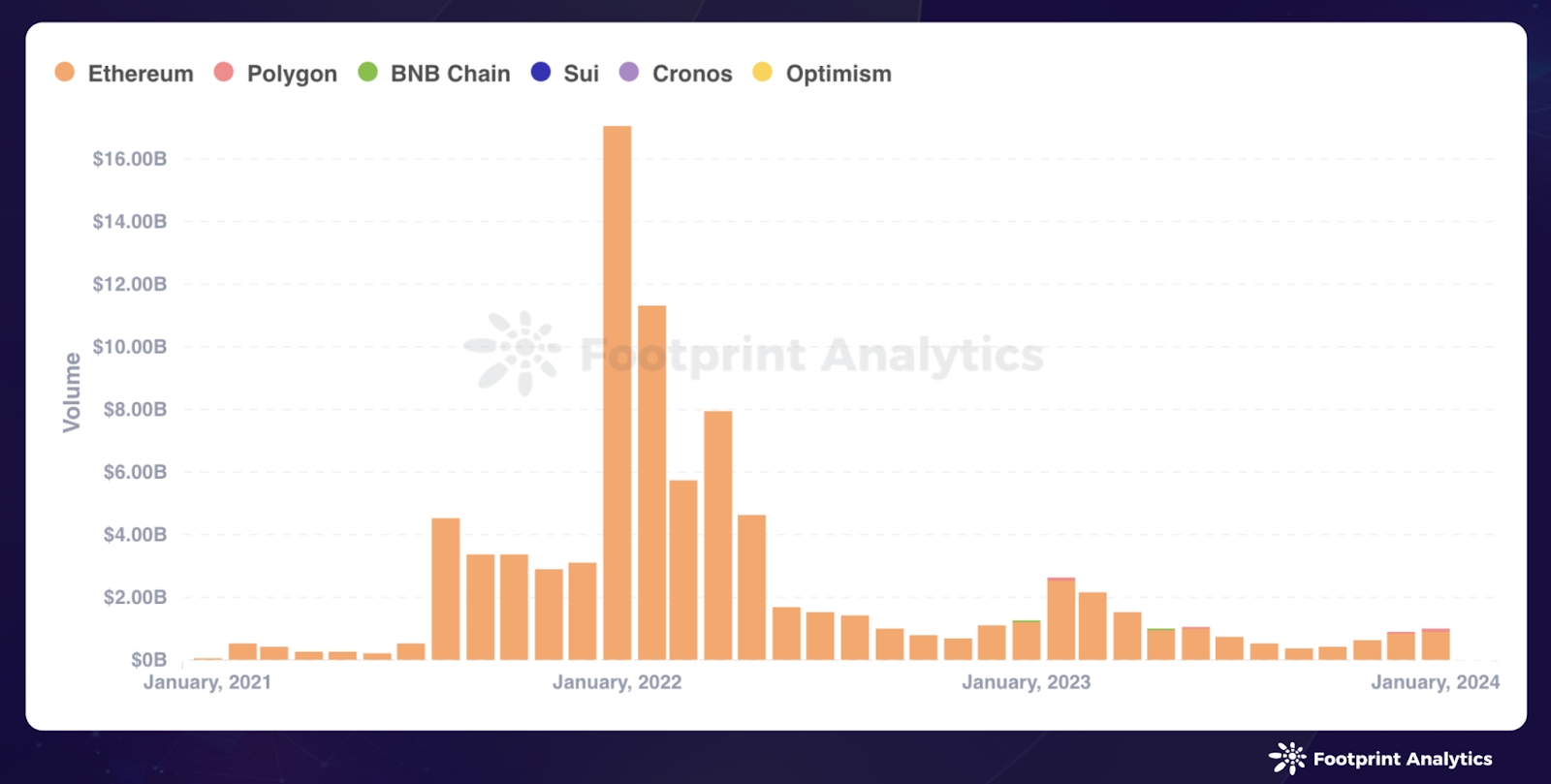

In January, Ethereum led the NFT market with a trading volume of $904.9 million, accounting for 89.1% of all transactions, marking its lowest market share since 2021. Conversely, January saw a remarkable increase in Polygon's trading activity, with its volume reaching $106.0 million, a 97.2% rise from the previous month. This surge boosted Polygon's market share to 10.4%, nearly doubling from December's 6.0%.

Source: Monthly Volume by Chain - Footprint Analytics

Source: Monthly Volume by Chain - Footprint Analytics

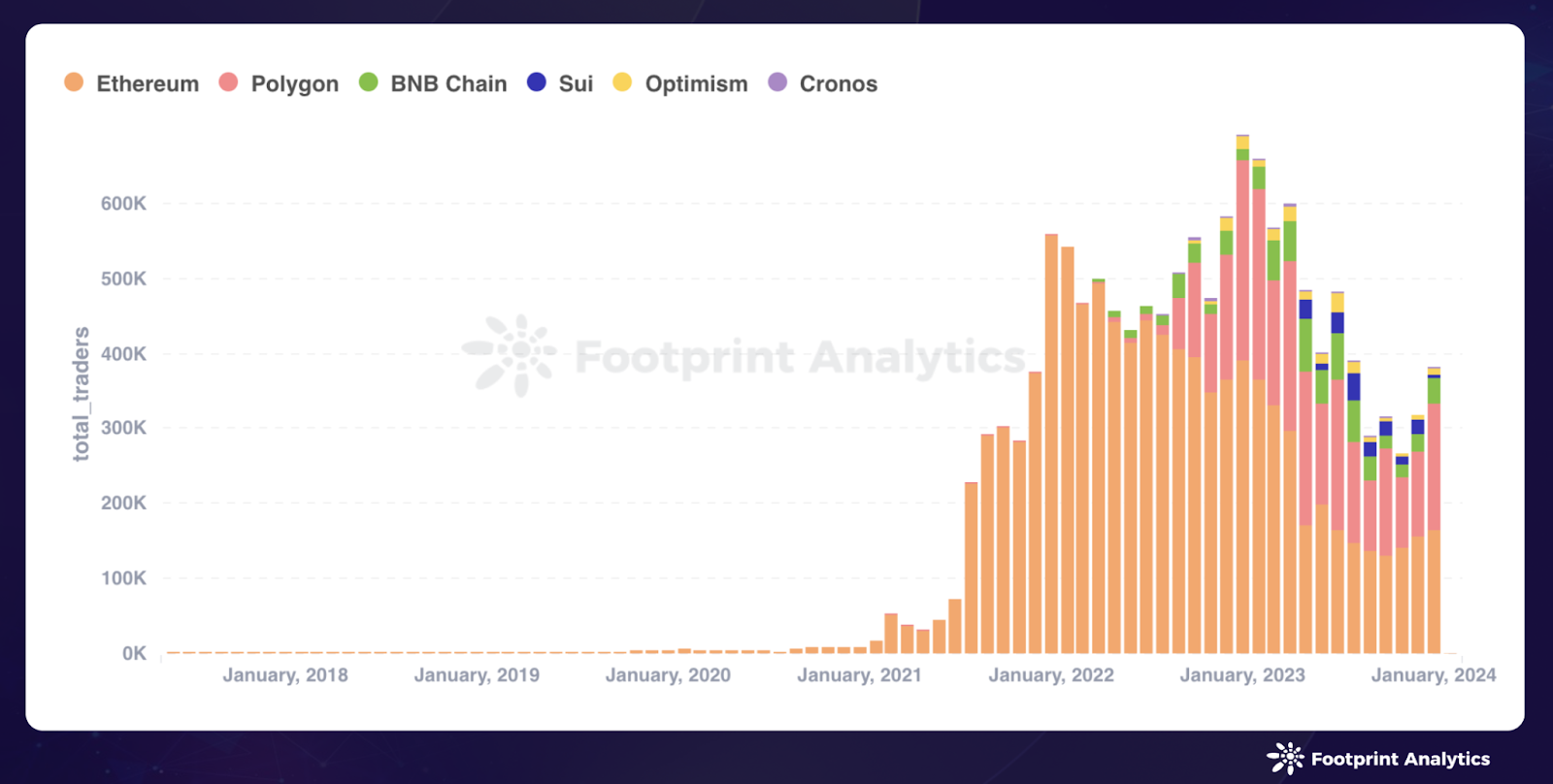

Ethereum maintained its growth trajectory in unique user count, reaching 163.3K, a 4.9% gain from December, yet its market share dipped to 42.7% from 49.0%. In contrast, Polygon experienced a significant uptick in its user base, surging 50.5% to 170.0K and elevating its market share from 35.5% to 44.5%, thereby securing the largest user base in January. Meanwhile, BNB Chain saw a modest rise in user share, moving up from 7.5% to 8.6%.

Source: Monthly Unique Users by Chain - Footprint Analytics

Source: Monthly Unique Users by Chain - Footprint Analytics

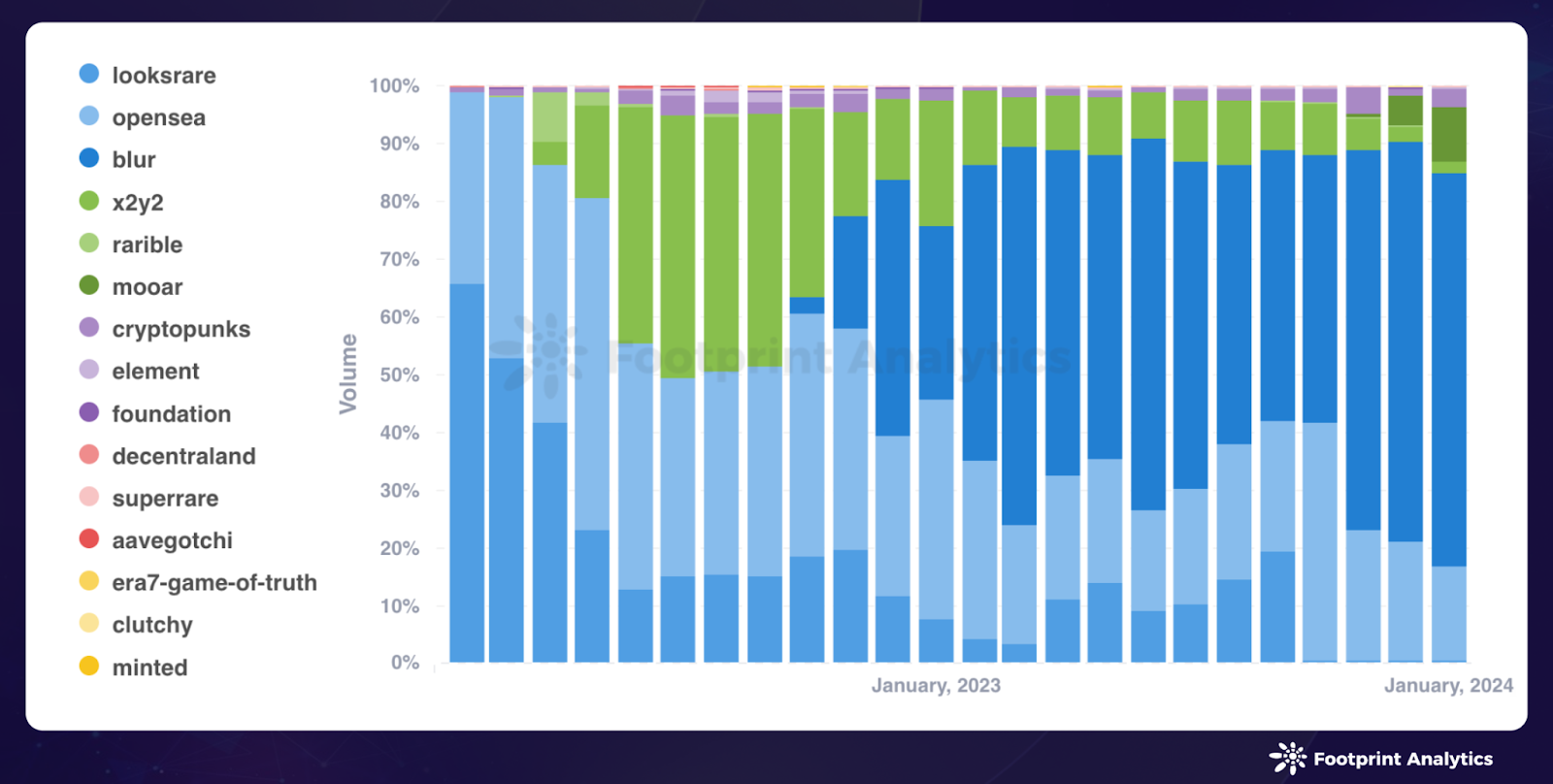

When it comes to NFT marketplaces, Blur witnessed an 11.7% increase in trading volume to $693.2 million, though its market share dipped slightly to 68.3% from December's 69.2%. OpenSea saw a continued decline in market share, falling from 20.8% to 16.6%, alongside a trading volume decrease of 10.1% to $168.1 million. Conversely, Mooar emerged as a prominent contender, experiencing a remarkable 112.1% surge in trading volume, with its market share growing from 5.0% to 9.5%.

Source: Monthly Volume Distribution by Marketplace - Footprint Analytics

Source: Monthly Volume Distribution by Marketplace - Footprint Analytics

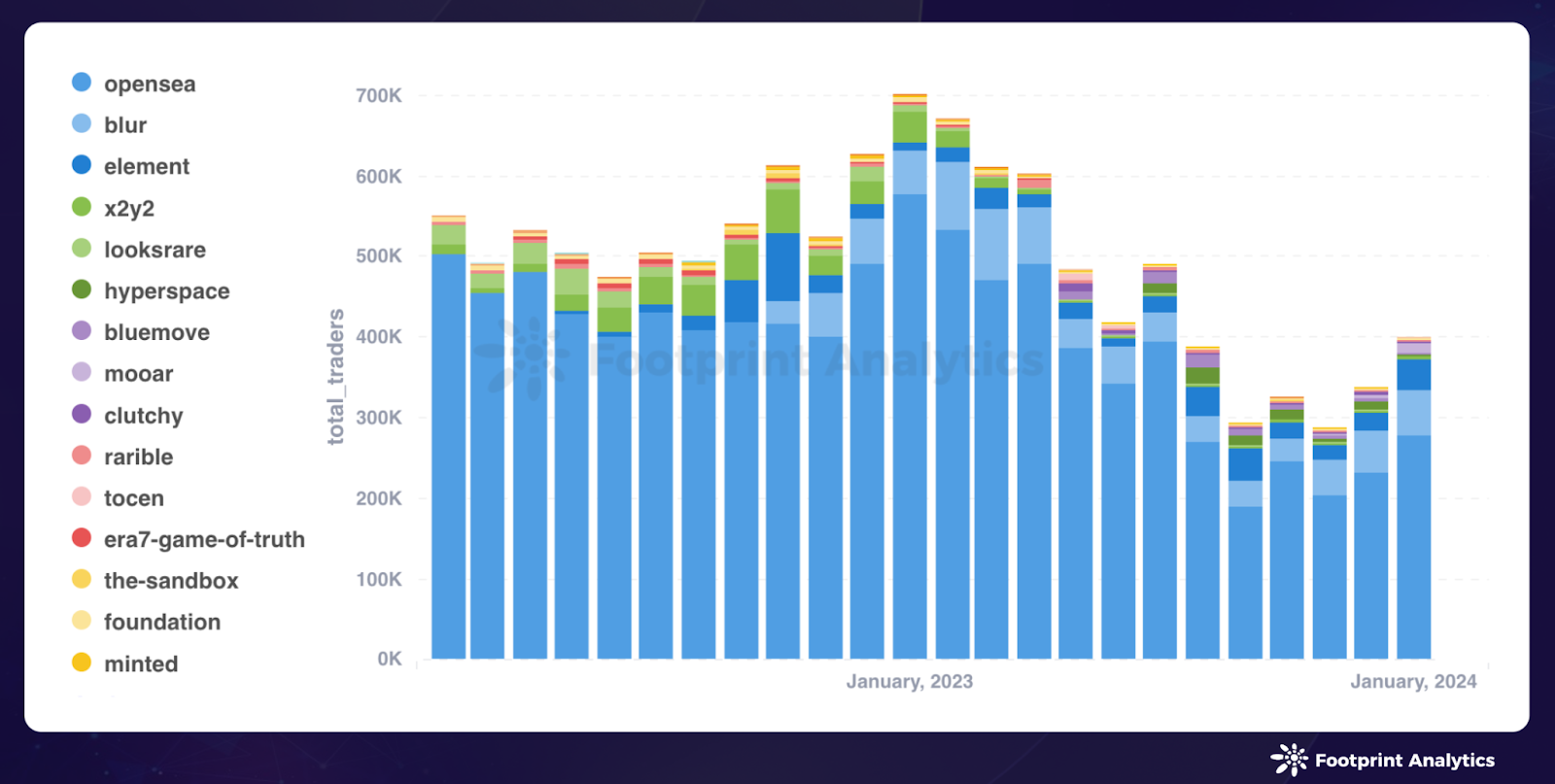

Furthermore, OpenSea, Blur, and Element garnered the highest number of unique users in January, recording user counts of 278.9K, 54.7K, and 39.5K, respectively.

Source: Monthly Volume Users by Marketplace - Footprint Analytics

Source: Monthly Volume Users by Marketplace - Footprint Analytics

The surge in popularity of the Web3 game Gas Hero significantly contributed to the increase in trading volume for both Mooar and Polygon in January, highlighting the game's impact on market dynamics.

In contrast, OpenSea has struggled to justify its former valuation of $13.3 billion amid NFT market shifts. On January 27, CEO Devin Finzer disclosed that OpenSea has attracted acquisition interest, though he did not detail the timing or potential acquirers. Finzer mentioned to the press that the company is open to the possibility of being acquired. Once the leading force in the NFT market, OpenSea has seen its competitors gain ground more rapidly since the second half of 2023.

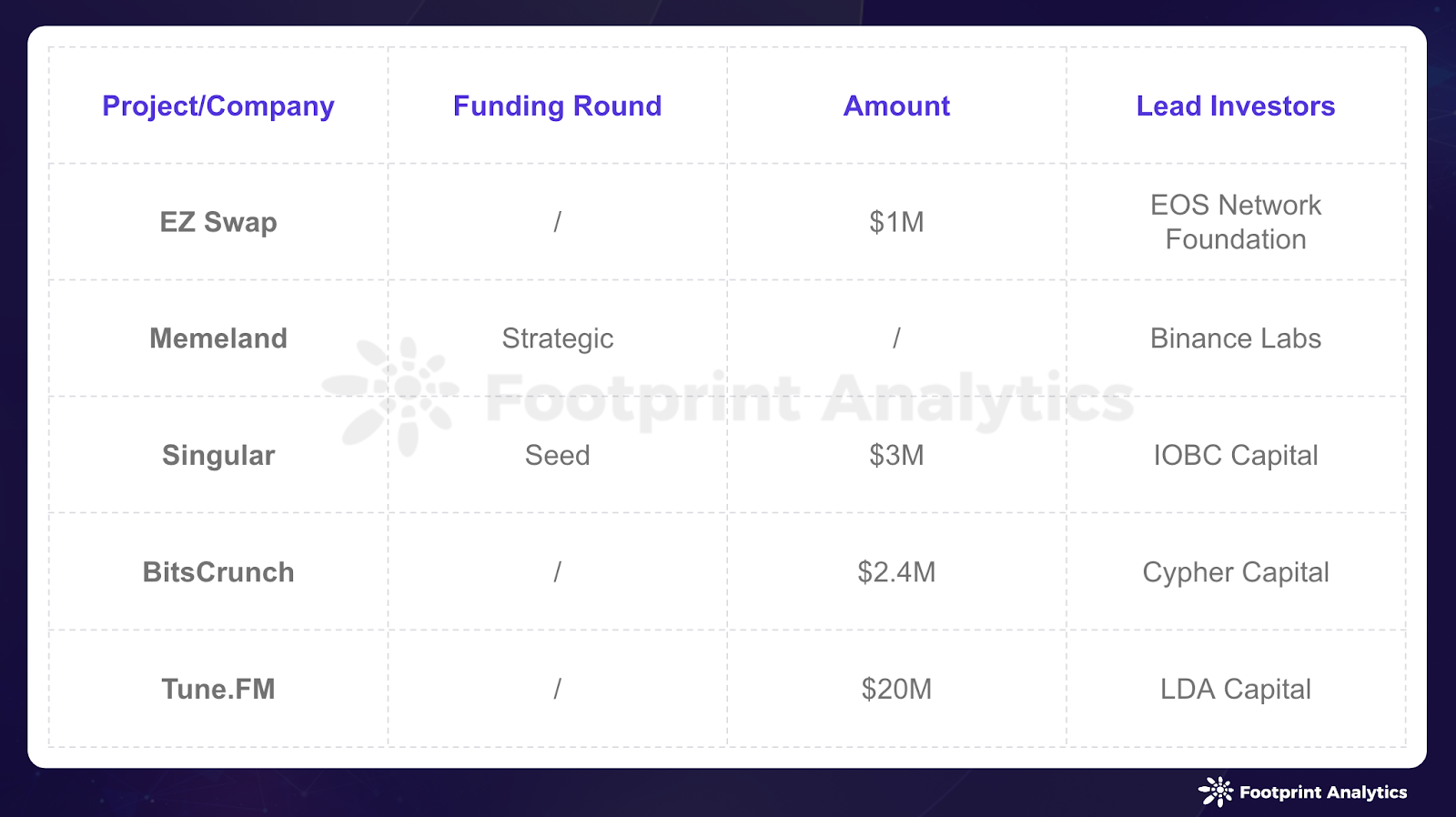

NFT Investment & Funding

In January, the NFT market remained steady with five funding rounds totaling $26.4 million.

NFT Funding Rounds In January 2024

NFT Funding Rounds In January 2024

Binance Labs, the investment arm of Binance, has strategically invested in Memecoin (MEME), the native token of Memeland, an independent Web3 venture studio birthed by the creators of 9GAG. Memeland is dedicated to fostering the SocialFi and creator economies, aiming to bridge creators and communities by leveraging the power of meme culture through its MEME token and NFTs (The Captainz, The Potatoz, and YOU THE REAL MVP). This investment demonstrates Binance Labs' commitment to supporting innovative projects that strengthen the connection between digital content creators and their audiences in the evolving Web3 ecosystem.

Tune.FM, a Web3 music platform, has successfully raised $20 million from LDA Capital, an alternative investment group, to further its mission of empowering musicians to earn a more substantial share of royalties from their work. Utilizing the advanced Hedera Hashgraph blockchain technology, Tune.FM offers artists a unique opportunity to earn micropayments for streams in its native JAM token and to mint NFTs for their digital music and collectibles.

Data includes:

-

Blockchains: Ethereum, Polygon, BNB Chain, Cronos, Optimism, Sui

-

Marketplaces: OpenSea, LooksRare, Blur, X2Y2, Cryptopunks, Rarible, SuperRare, Foundation, Decentraland, Aavegotchi, Element, Era7, the Sandbox, Minted, Clutchy, BlueMove, Hyperspace, Tocen, Keepsake, Mooar.