All research is powered by Kaiko data.

Trend of the Week

TUSD DEPEGS AFTER LOSING TOP USE CASE.

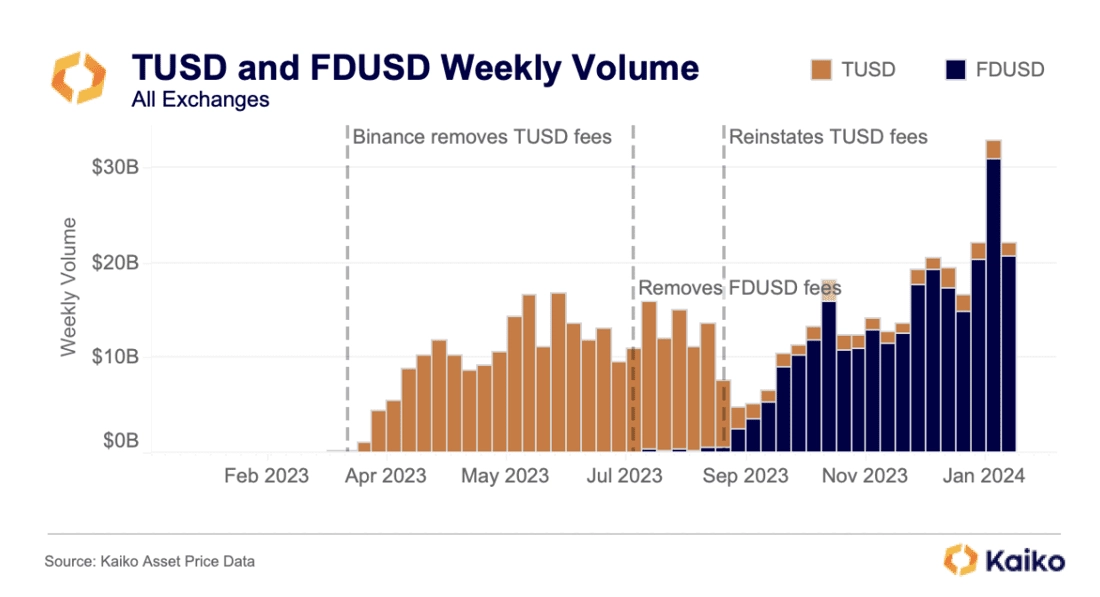

As the world’s largest exchange, Binance has long been able to pull different levers and create wide-ranging ripple effects on the entire ecosystem. This was most obvious last year, when the exchange reinstated fees for its BTC-USDT pair and removed them for much smaller stablecoins, first TUSD, then FDUSD, causing volumes to whipsaw.

While the chart below includes all exchanges in Kaiko’s coverage, it would look indistinguishable if it was only Binance, which consistently accounts for over 99% of the stablecoins’ volume. Despite high volumes for FDUSD, both stablecoins have largely failed to catch on for use beyond Binance’s zero-fee pairs.

This has made Binance’s Launchpool – which allows users to stake tokens to receive rewards in the form of newly launched tokens – an increasingly important lever.

Until last week, Launchpool had offered staking of BNB, FDUSD, and TUSD. There were regularly over $1bn TUSD staked, representing over half of its market cap. For unclear reasons, Binance’s two Launchpools last week only offered staking of BNB and FDUSD, kicking out TUSD.

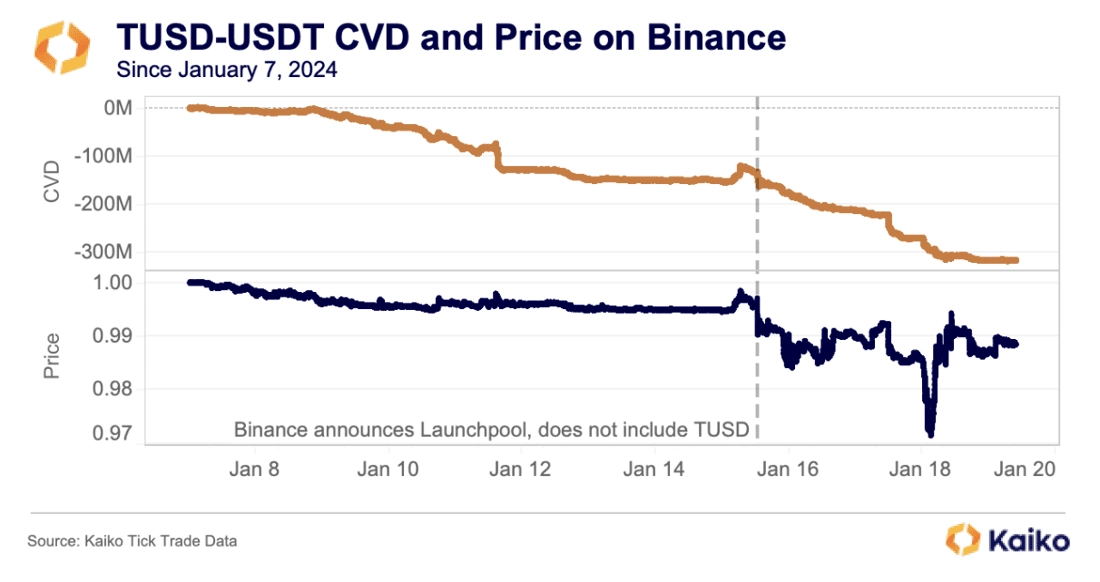

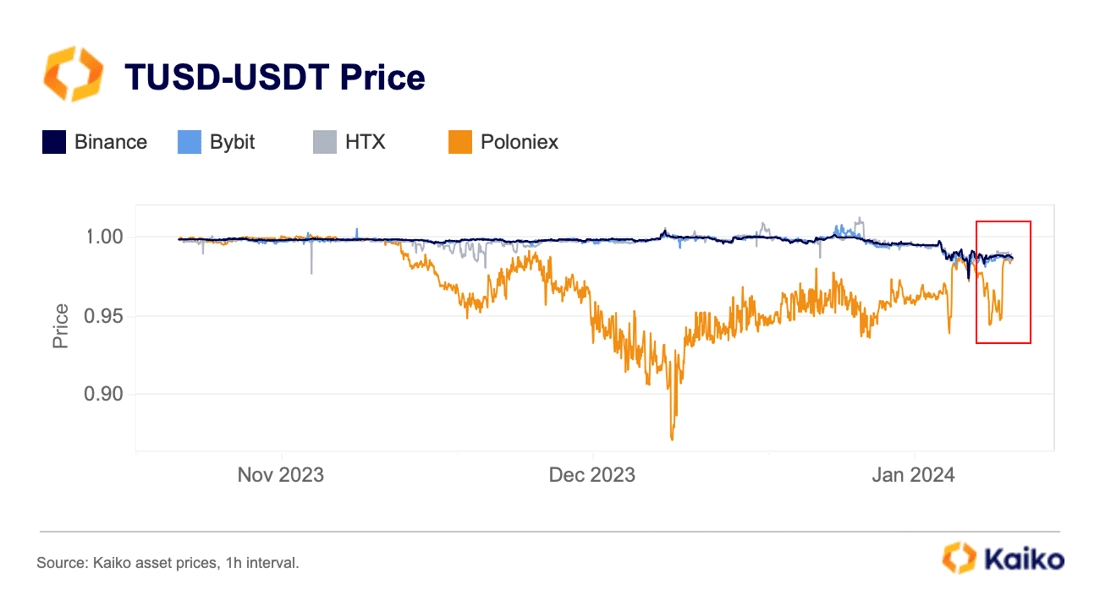

There had been about $150mn of net TUSD selling, as measured by Cumulative Volume Delta (CVD), in the week leading up to the announcement, leading to a fairly common TUSD depeg. However, this escalated as soon as users realized that TUSD’s top use case had vanished.

As of this writing, a net of over 200mn TUSD has been sold for USDT on Binance. Note that we didn’t write $200mn TUSD; this selling led to a depeg that caused the stablecoin to hit a low of just over 0.97 USDT on January 18. However, CVD has since levelled off, helping TUSD approach – but not reach – parity with USDT.

Data Points

WILL ETF HYPE FUEL ETH’S COMEBACK?

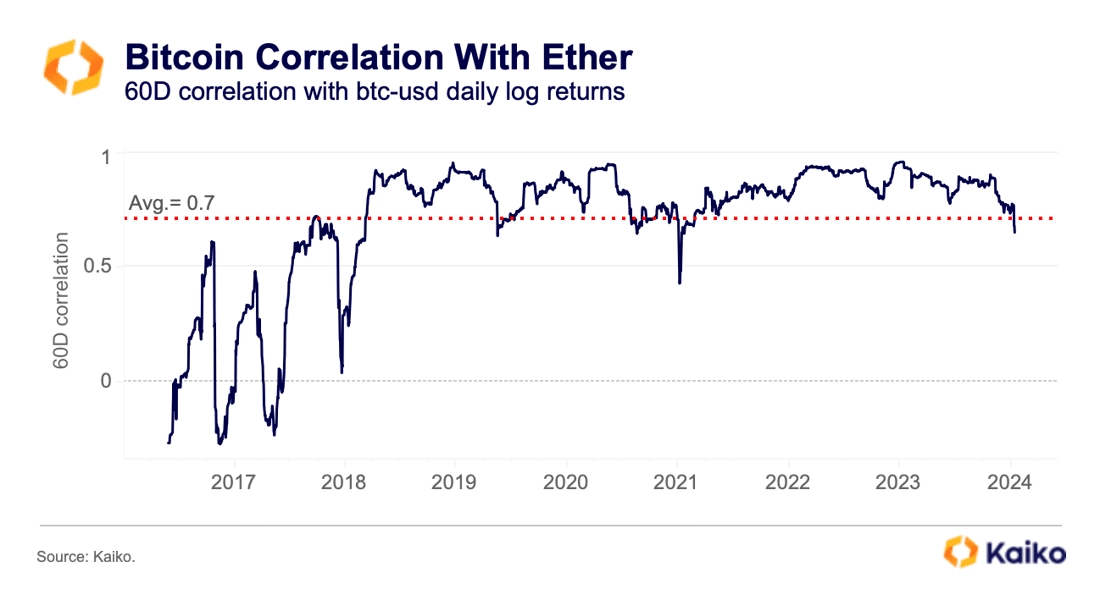

For the first time since 2021, the BTC:ETH correlation dropped below its all time average of 0.71. It is no coincidence that this occurred on the day that the bitcoin spot ETFs started trading. For months, the two crypto assets have been diverging in price activity as BTC benefited from ETF hype and speculation while ETH experienced a relatively sluggish rally. In our latest Deep Dive, we try and understand the impact of a possible ETH spot ETF and if it could lead to a rally ahead of its decision date in May.

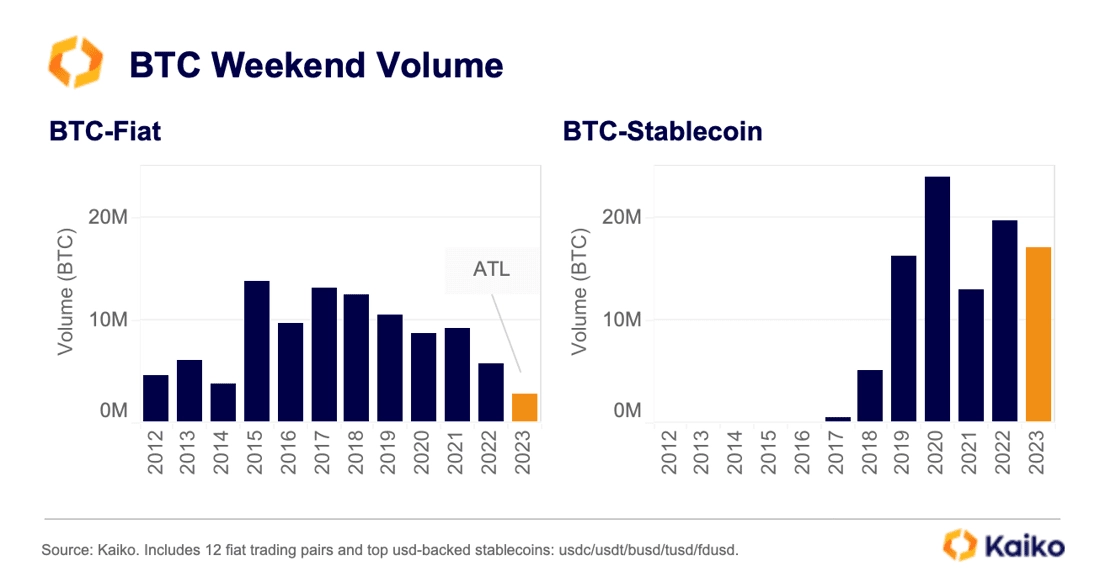

WEEKEND TRADE VOLUME HITS ALL-TIME LOW.

Weekend trade volume for fiat currency-quoted bitcoin markets hit an all-time low in 2023. BTC-fiat trade volume includes all markets that incorporate a fiat currency such as the dollar, euro or pound. In contrast, BTC-stablecoin weekend volume has experienced a less extreme drop, and remained close to its 2021 levels.

The trend suggests that crypto markets have become less 24/7 following the collapse of two crypto friendly banks in the U.S. back in March 2023. In addition, fiat on- and off-ramp services have been increasingly disrupted for offshore exchanges such as Binance, which faced issues with several of its banking partners last year.

The launch of 11 spot ETFs could also impact BTC market structure, causing the weekend/weekday gap to widen.

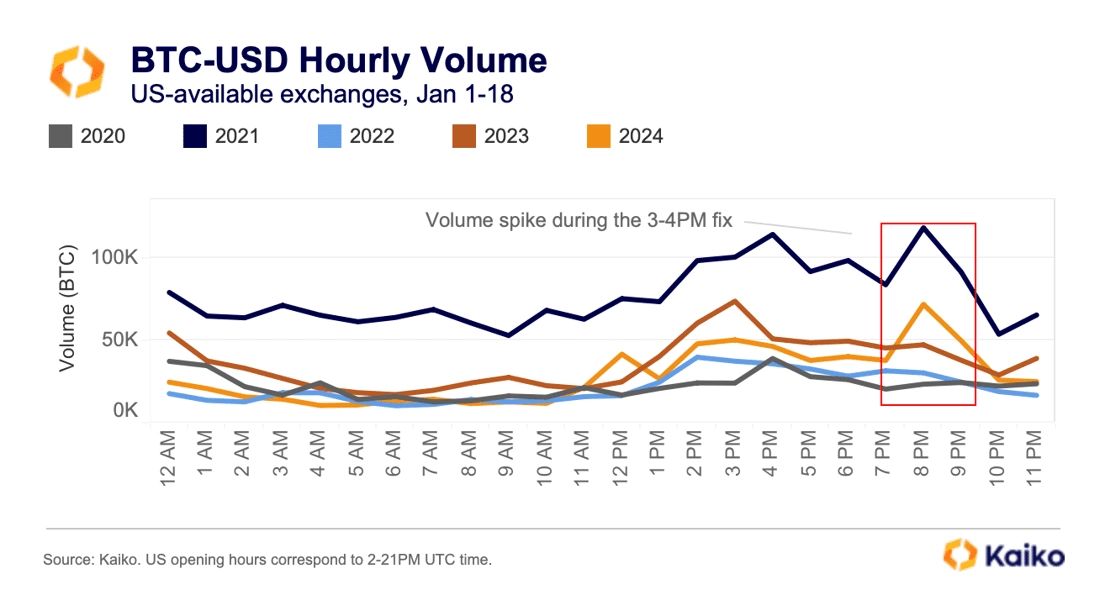

We already observe some changes in BTC trading patterns on U.S.-available platforms in the aftermath of the spot approvals. Hourly BTC-USD trade volume spiked around 8-9PM UTC time, which corresponds to the daily close on U.S. markets (3-4PM EST).

Overall, lower weekend liquidity is likely to exacerbate volatility and keep risk-averse traders and market makers away from the market outside traditional opening hours.

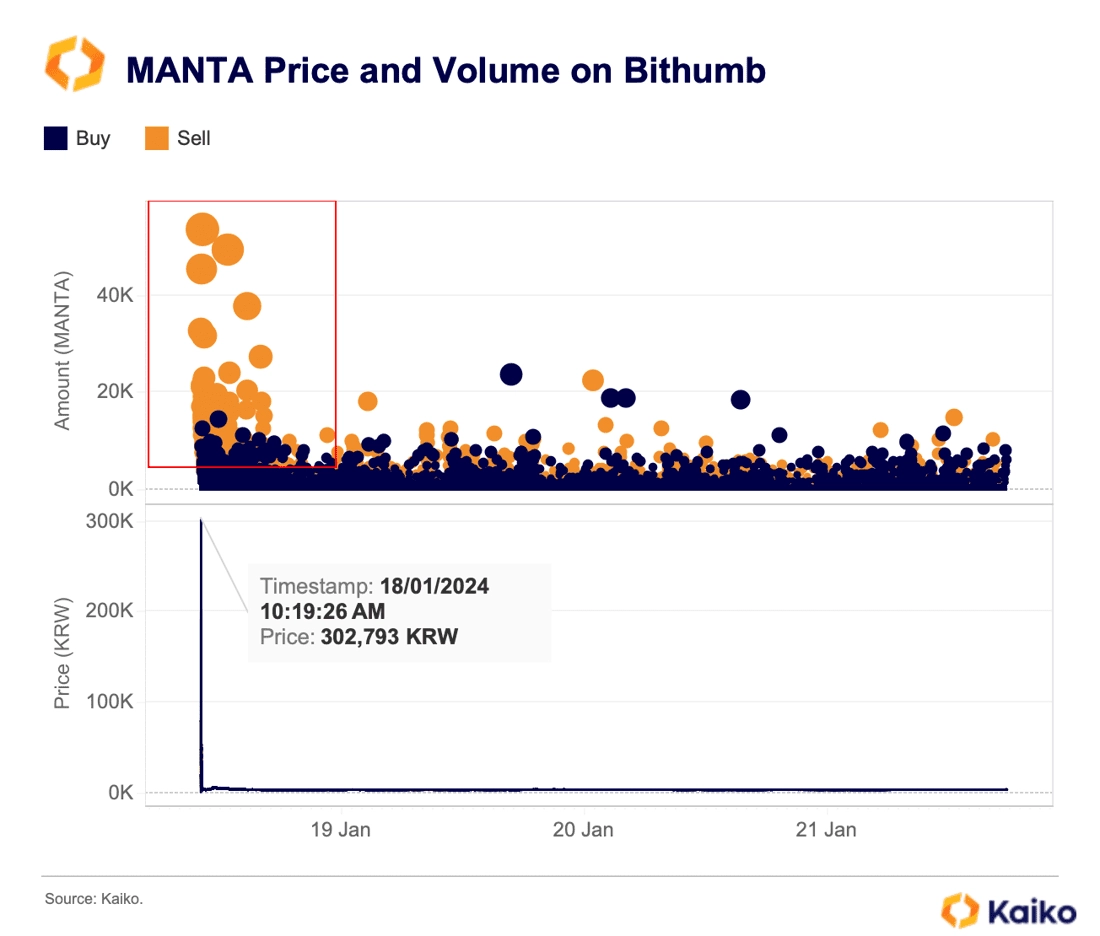

MANTA TOKEN’S LAUNCH ON BITHUMB MARKED BY VOLATILITY.

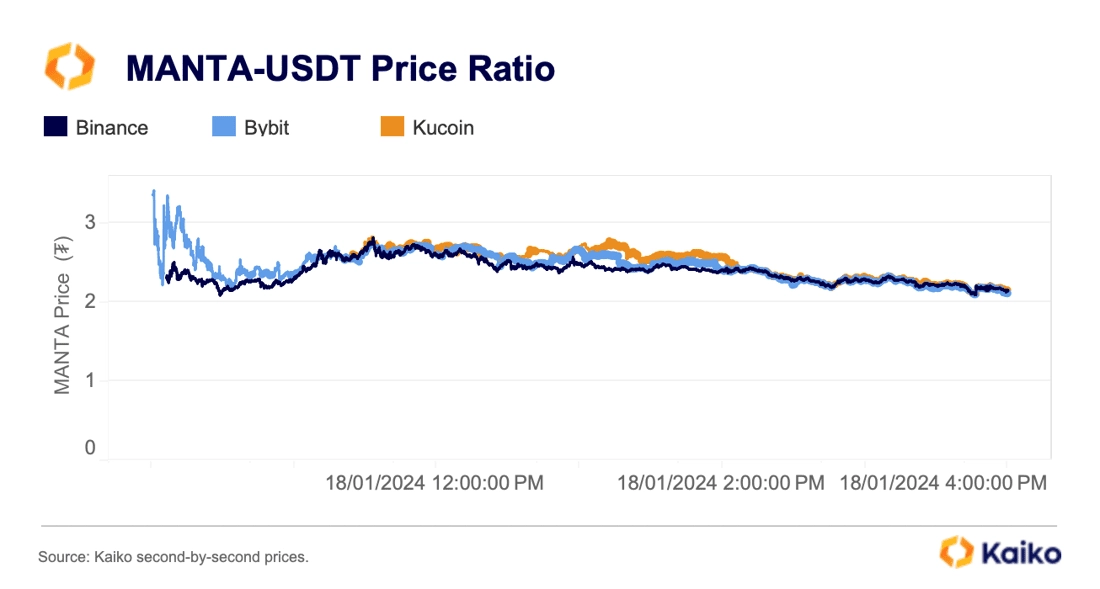

The Manta Network protocol, backed by Binance’s launchpool, faced accusations of money laundering following its listing on the second largest Korean exchange Bithumb. Manta network also experienced a denial-of-service (DDoS) attack on its launch day.

The protocol’s native MANTA token started trading on multiple exchanges on January 18. However, it saw significant volatility on Bithumb just minutes after its launch.

Prices surged from near zero to as high as $220 (330K KRW) before dropping back below $1 after massive selling pressure. This led to speculation of suspicious trading activity involving MANTA insiders. MANTA prices varied significantly less on other exchanges.

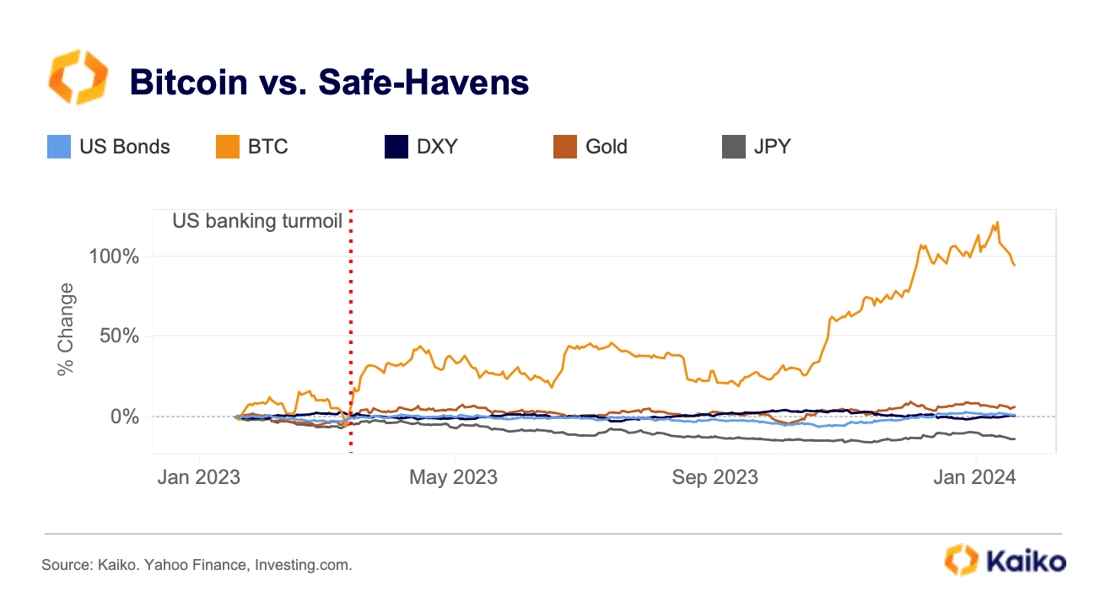

BITCOIN OUTPERFORMS TRADITIONAL SAFE HAVENS.

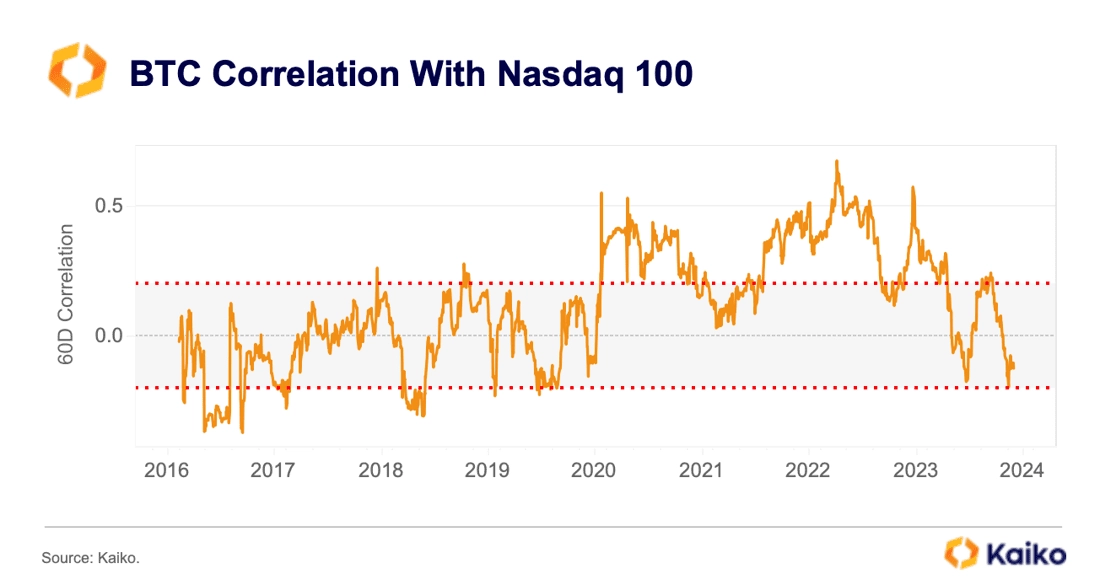

Large institutional players such as BlackRock and ARK have increasingly been praising BTC’s safe-haven characteristics. A safe haven is an asset that is uncorrelated with equities during times of market turmoil.

BTC’s 60-day correlation with the Nasdaq 100 has indeed declined significantly over the past year. It has been close to zero on average since June of 2023 as BTC price movements have been driven by the hype around spot U.S. ETFs. Typically, a correlation between -0.2 and 0.2 is regarded as very weak.

Overall, however, BTC offers significantly higher returns than other traditional safe-havens such as gold, U.S. bonds or the dollar. It has notably outperformed, attracting safe-haven flows during the U.S. banking crisis last year.

Its asymmetric returns and low correlation could provide solid support for the nine newborn spot ETFs which have already seen strong demand with more than $2bn in net inflow since their launch on Jan 11.